eScore

53.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Fifth Third Bank demonstrates a strong digital presence, particularly in its core regional markets and through its award-winning mobile app. The SEO analysis reveals effective targeting of bottom-of-funnel, product-related keywords, but a significant weakness in attracting top-of-funnel traffic through educational or thought leadership content. While its multi-channel presence is solid for core banking, its content authority is underdeveloped, limiting its reach against national competitors who invest heavily in financial wellness hubs.

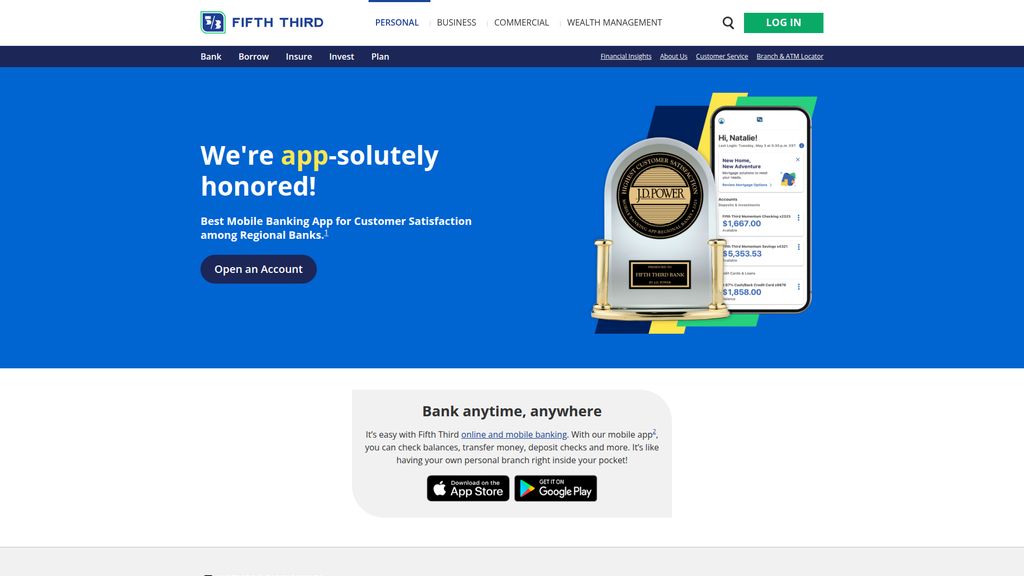

The bank's digital strategy is effectively centered around its award-winning mobile app, which serves as a powerful tool for both customer acquisition and retention.

Develop a comprehensive 'Financial Insights' or 'Small Business Resource Center' content hub to attract users earlier in their journey, build brand authority, and compete for non-branded, informational search queries.

The bank's brand communication is sharp and consistent, effectively leveraging the third-party validation of its mobile app as a key differentiator. The brand voice is approachable and clever, setting it apart from more traditional banking tones. However, the messaging is overly focused on digital self-service, creating a significant gap by failing to communicate the value of its human advisors and physical branches, which could alienate customers seeking an omnichannel experience.

The messaging hierarchy is highly effective, prioritizing the most compelling differentiator—the J.D. Power award for the mobile app—to immediately establish credibility and capture user attention.

Integrate messaging that highlights the availability and expertise of human bankers as a crucial complement to the bank's powerful digital tools, creating a more holistic 'human-centric digital bank' positioning.

The website benefits from a logical information architecture that clearly segments audiences, making navigation intuitive. However, the conversion experience is hindered by notable friction points identified in the visual analysis, including inconsistent CTA design and an understated primary 'Open an Account' button that lacks visual prominence. While the mobile experience is generally good, dense text blocks increase cognitive load, potentially causing users to miss key information and abandon their journey.

The website's information architecture is logically structured around clear customer segments (Personal, Business, Commercial), allowing users to quickly self-identify and find relevant pathways.

Redesign and A/B test the primary 'Open an Account' call-to-action to give it significantly more visual contrast and prominence, making it the undeniable focal point for new customer acquisition on the homepage.

Fifth Third Bank has established a robust and mature framework for credibility and risk mitigation, anchored in thorough adherence to core banking regulations like the GLBA. Its public-facing commitment to ADA compliance and web accessibility is a significant differentiator that builds trust and reduces legal risk. The prominent display of third-party validation, such as the J.D. Power award and its status as one of the World's Most Ethical Companies, strongly reinforces its credibility.

A dedicated and detailed ADA Compliance statement that references WCAG standards provides strong third-party validation of its commitment to accessibility, mitigating legal risk and expanding market reach.

Update the online privacy policy to include a specific section for California residents, clarifying the GLBA exemption and providing clear mechanisms for exercising rights over any non-exempt personal information to address CCPA/CPRA ambiguity.

The bank's competitive advantages are rooted in sustainable factors like established brand trust, a physical branch network, and high customer switching costs typical of the banking industry. Its diversified business model provides resilience against economic shifts. However, its most heavily marketed advantage—the award-winning app—is temporary, as competitors are also investing heavily in digital experiences, and the bank is vulnerable to more agile fintech disruptors.

The combination of brand trust built since 1858, a physical branch network, and a full suite of diversified products creates a significant competitive moat that is difficult for new digital-only entrants to replicate.

Accelerate the modernization of the core banking platform to enhance agility, enabling faster product development and better integration with fintech partners to counter the innovation speed of digital-native competitors.

Fifth Third has a clear, well-defined, and data-driven strategy for growth, focused on aggressive expansion into high-growth Southeast markets. This strategy is funded by optimizing its legacy Midwest footprint, demonstrating high capital efficiency. While the physical branch network presents scalability constraints, the bank's strong digital platform provides a scalable engine for customer acquisition and servicing in these new markets, indicating high overall expansion potential.

A data-driven, disciplined strategy for geographic expansion into the U.S. Southeast, supported by proprietary analytics for site selection, is the company's primary and most potent growth engine.

Develop a digitally-native, branch-light expansion model to test new metropolitan areas outside the core footprint, allowing for faster market entry and lower initial capital outlay compared to traditional branch-first expansion.

Fifth Third operates a highly coherent and resilient business model, balancing revenue between net interest income and a growing base of fee-based noninterest income. The strategic focus is clear: leverage digital innovation to drive consumer banking while expanding high-margin commercial and wealth management services. Investments in technology and geographic expansion are well-aligned with its goal of becoming a top-performing regional bank, demonstrating strong resource allocation and stakeholder alignment.

The diversified business model, with strong segments in Commercial Banking, Consumer Banking, and Wealth Management, provides multiple, counter-cyclical revenue streams that ensure stability and resilience through various economic conditions.

Enhance the small business banking proposition with a fintech-grade digital onboarding and lending platform to fully capitalize on this high-potential segment and better align it with the bank's overall digital-first strategy.

As a top-tier super-regional bank, Fifth Third wields significant market power and has a strong market share trajectory in its core and expansion geographies. Its brand recognition and diversified offerings give it moderate pricing power. However, it operates in a hyper-competitive oligopoly, facing intense pressure from larger national banks like JPMorgan Chase and U.S. Bank, as well as a growing number of agile fintechs, which constrains its ability to unilaterally influence market direction.

Fifth Third holds a dominant market position within its core Midwest footprint and is rapidly gaining share in the Southeast, demonstrating a successful strategy of regional concentration and targeted expansion.

Increase investment in R&D and fintech acquisitions, particularly in areas like AI-driven personalization and embedded finance, to move from being a market follower to a market shaper in digital banking innovation.

Business Overview

Business Classification

Diversified Financial Services

Regional Banking

Financial Services

Sub Verticals

- •

Commercial Banking

- •

Consumer and Small Business Banking

- •

Wealth & Asset Management

- •

Payments & Treasury Management

Mature

Maturity Indicators

- •

Established in 1858, indicating a long history and deep market presence.

- •

Consistent dividend payments for over 50 years, demonstrating financial stability.

- •

Large-scale operations with over $200 billion in assets and approximately 20,000 employees.

- •

Focus on operational efficiency, digital transformation, and strategic acquisitions rather than foundational market entry.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Net Interest Income (NII)

Description:The primary driver of revenue, representing the difference between interest earned on assets (such as loans to consumers and businesses) and interest paid on liabilities (such as customer deposits).

Estimated Importance:Primary

Customer Segment:All Segments

Estimated Margin:Medium

- Stream Name:

Noninterest Income

Description:Diverse fee-based income generated from various banking services. Key components include service charges on deposits, wealth and asset management fees, commercial banking revenue (e.g., corporate bond fees, treasury management), mortgage banking, and card/processing fees.

Estimated Importance:Primary

Customer Segment:All Segments

Estimated Margin:High

Recurring Revenue Components

- •

Interest income from loan portfolios

- •

Account maintenance and service fees

- •

Wealth and asset management advisory fees

- •

Treasury and cash management service fees for commercial clients

Pricing Strategy

Service-Based & Interest Spread

Mid-range

Semi-transparent

Pricing Psychology

- •

Tiered Offerings (e.g., different checking account levels with varying benefits)

- •

Relationship Pricing (e.g., fee waivers for maintaining minimum balances or multiple accounts)

- •

Fee-Based Add-ons

Monetization Assessment

Strengths

- •

Diversified revenue streams across multiple business lines (Commercial, Consumer, Wealth) reduce dependency on any single source.

- •

Strong growth in fee-based noninterest income, particularly from wealth management and commercial payments, provides a cushion against interest rate fluctuations.

- •

Strategic focus on high-growth areas like the Southeast U.S. and specialized industries (e.g., healthcare) is driving new deposit and loan growth.

Weaknesses

- •

High sensitivity of Net Interest Income to macroeconomic interest rate changes.

- •

Traditional revenue sources like overdraft fees face regulatory pressure and negative public perception.

- •

Competition from fintechs and neobanks can compress margins on payment processing and consumer lending products.

Opportunities

- •

Expand embedded finance solutions through its 'Newline' platform by partnering with more tech companies.

- •

Leverage recent acquisitions like DTS Connex to deepen penetration in the B2B commercial payments and cash management ecosystem.

- •

Grow sustainable finance offerings to attract environmentally and socially conscious clients.

Threats

- •

Prolonged periods of low interest rates can significantly compress Net Interest Margin (NIM).

- •

Intensifying competition from national banks (JPMorgan Chase, Bank of America), other super-regionals (PNC, U.S. Bank), and digital-only banks.

- •

Increased regulatory scrutiny and capital requirements for regional banks.

Market Positioning

A leading super-regional bank blending a strong physical presence in the Midwest and Southeast U.S. with an award-winning digital banking experience.

Top-tier regional bank in its core operating footprint; a notable, but not dominant, player on the national scale. It is a top commercial payments provider.

Target Segments

- Segment Name:

Consumer & Small Business Banking

Description:Individuals and families requiring standard banking services, and small businesses seeking deposit accounts, loans, and basic cash management.

Demographic Factors

- •

Middle-to-upper-middle income households

- •

All age groups, with a growing focus on tech-savvy millennials and Gen Z.

- •

Geographically concentrated in the Midwest and Southeast U.S.

Psychographic Factors

- •

Value convenience and digital access

- •

Seek a trusted, long-term financial partner

- •

Appreciate both digital tools and the availability of physical branches

Behavioral Factors

Heavy users of mobile and online banking for daily transactions.

Likely to bundle multiple products (checking, savings, mortgage, credit card) with one institution.

Pain Points

- •

Complex banking processes

- •

Lack of personalized financial guidance

- •

Security concerns with digital banking

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Commercial Banking

Description:Middle-market companies and large corporations requiring sophisticated financial solutions.

Demographic Factors

Companies with significant revenue, primarily located in the bank's geographic footprint.

Specific industry focuses include retail, healthcare, restaurants, and agribusiness.

Psychographic Factors

Value industry expertise and relationship management

Seek efficiency in treasury and cash management operations

Behavioral Factors

Require customized credit and capital markets solutions

High utilization of treasury management and payment platforms

Pain Points

- •

Inefficient cash flow and liquidity management

- •

Access to capital for growth and operations

- •

Managing financial risk (interest rate, foreign exchange)

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Wealth & Asset Management

Description:High-net-worth individuals, families, and institutions seeking investment management, financial planning, and trust services.

Demographic Factors

- •

Affluent and high-net-worth individuals

- •

Business owners and corporate executives

- •

Not-for-profit organizations and foundations

Psychographic Factors

- •

Focused on wealth preservation and growth

- •

Desire personalized, high-touch service

- •

Value expertise and a long-term advisory relationship

Behavioral Factors

Delegate investment decision-making to trusted advisors

Often have complex financial needs, including estate and tax planning

Pain Points

- •

Navigating complex investment markets

- •

Planning for intergenerational wealth transfer

- •

Lack of a holistic view of their financial life

Fit Assessment:Good

Segment Potential:High

Market Differentiation

- Factor:

Digital Customer Experience

Strength:Strong

Sustainability:Sustainable

- Factor:

Commercial Payments & Treasury Management

Strength:Strong

Sustainability:Sustainable

- Factor:

Regional Focus and Community Presence

Strength:Moderate

Sustainability:Sustainable

Value Proposition

Fifth Third Bank provides a comprehensive suite of financial services for individuals and businesses, combining the convenience and innovation of a top-tier digital banking platform with the trust and personalized support of an established regional bank.

Good

Key Benefits

- Benefit:

Convenient Anytime, Anywhere Banking

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Awarded 'Best Mobile Banking App for Customer Satisfaction among Regional Banks'.

Features like mobile check deposit, Zelle transfers, and cardless ATM access.

- Benefit:

Comprehensive Financial Solutions

Importance:Critical

Differentiation:Common

Proof Elements

Wide range of products spanning personal, small business, commercial, and wealth management lines.

- Benefit:

Advanced Security & Support

Importance:Critical

Differentiation:Common

Proof Elements

- •

Account alerts for suspicious activity.

- •

In-app security tools like SmartShield.

- •

24/7 message support via 'Jeanie' virtual assistant.

Unique Selling Points

- Usp:

Integrated Fintech-Driven Commercial Solutions

Sustainability:Long-term

Defensibility:Strong

- Usp:

Award-Winning Mobile App User Experience

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Managing daily finances efficiently

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Accessing capital for personal or business needs

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Optimizing complex cash flow for businesses

Severity:Major

Solution Effectiveness:Complete

Value Alignment Assessment

High

The bank's focus on digital transformation aligns perfectly with the market's shift towards digital-first banking, while its diversified model addresses the needs of a wide economic base.

High

For consumers, the emphasis on a user-friendly mobile experience is a direct match. For commercial clients, the investment in advanced payments and treasury solutions solves key operational pain points.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Fintech Companies (e.g., Zelle, AvidXchange, Stripe).

- •

Technology Providers (e.g., Amazon Web Services for cloud infrastructure).

- •

Payment Networks (Visa, Mastercard)

- •

Correspondent Banks

- •

Community Organizations

Key Activities

- •

Deposit & Loan Servicing

- •

Digital Platform Development & Maintenance

- •

Wealth & Asset Management

- •

Treasury & Payment Solutions

- •

Risk Management & Regulatory Compliance

Key Resources

- •

FDIC-Insured Deposit Base

- •

Brand Reputation & Trust

- •

Physical Branch Network

- •

Proprietary Digital Technology (Mobile App, Newline Platform)

- •

Skilled Workforce (Relationship Managers, Financial Advisors)

Cost Structure

- •

Employee Compensation & Benefits

- •

Interest Expense on Deposits

- •

Technology & Infrastructure Costs

- •

Physical Branch Operations & Maintenance

- •

Marketing & Customer Acquisition

- •

Provision for Credit Losses

Swot Analysis

Strengths

- •

Strong brand recognition and long history in core markets.

- •

Diversified business model providing stable, resilient revenue streams.

- •

Proven leadership in digital banking innovation and customer experience.

- •

Strong position in the lucrative commercial payments market.

Weaknesses

- •

Geographic concentration makes it more vulnerable to regional economic downturns compared to national competitors.

- •

Higher efficiency ratio (cost-to-income) than some larger national peers.

- •

Perception as a 'regional' player may limit appeal to the largest national and multinational corporations.

Opportunities

- •

Continued geographic expansion into high-growth markets like the Southeast.

- •

Scale fintech acquisitions and partnerships to create new B2B revenue streams.

- •

Leverage AI and data analytics to offer hyper-personalized customer experiences and improve underwriting.

- •

Capture market share from smaller banks that lack the resources to invest in digital transformation.

Threats

- •

Intense competition from larger money-center banks, agile fintechs, and other super-regional banks.

- •

Evolving cybersecurity threats targeting financial institutions.

- •

Unfavorable shifts in interest rate policy impacting profitability.

- •

Increasingly stringent regulatory and compliance burdens.

Recommendations

Priority Improvements

- Area:

Operational Efficiency

Recommendation:Accelerate the use of AI and automation in back-office processes (e.g., loan processing, compliance checks) to lower the efficiency ratio and improve scalability.

Expected Impact:High

- Area:

Market Penetration

Recommendation:Develop a digitally-native, branch-light expansion strategy for new high-growth metropolitan areas outside the current core footprint to capture new customers without the high cost of traditional branch expansion.

Expected Impact:High

- Area:

Small Business Segment

Recommendation:Enhance the digital onboarding and lending platform for small businesses, leveraging fintech partnerships to offer a faster, more seamless experience that rivals competitors like Stripe and Square.

Expected Impact:Medium

Business Model Innovation

- •

Launch a 'Banking-as-a-Service' (BaaS) offering, leveraging the Newline API platform to enable non-financial companies to embed Fifth Third banking products (e.g., accounts, payments, lending) directly into their own applications.

- •

Develop a subscription-based premium service for small businesses that bundles advanced treasury tools, dedicated advisory services, and preferential pricing.

- •

Create a data-driven financial wellness platform that uses AI to provide proactive advice and automated savings tools for retail customers, moving beyond traditional banking transactions to holistic financial partnership.

Revenue Diversification

- •

Expand the scope of Fifth Third Ventures to invest in and acquire fintechs in adjacent areas like insurance (Insurtech) or specialized lending, creating new fee-based income opportunities.

- •

Build out a more robust suite of ESG (Environmental, Social, Governance) investment products and sustainable finance solutions for both wealth management and commercial clients.

- •

Monetize proprietary data through anonymized analytics and benchmarking services for commercial clients, helping them understand industry trends and their own performance.

Fifth Third Bank has successfully evolved from a traditional regional bank into a digitally-forward financial services leader. Its business model is robust, balanced, and strategically positioned to capitalize on the industry's digital transformation. The primary strength lies in its diversified revenue streams, which provide resilience against economic cycles. The bank's significant investments in its mobile platform and digital customer experience have yielded a clear competitive advantage in the regional banking space, as evidenced by customer satisfaction awards. Furthermore, its strategic acquisitions and partnerships in the fintech space, particularly in commercial payments with its Newline platform, demonstrate a forward-thinking approach to capturing high-margin, scalable B2B revenue.

The primary challenge for Fifth Third is navigating the competitive landscape, which includes both resource-rich national banks and agile fintech disruptors. While its digital offerings are strong, maintaining a leadership position requires continuous and substantial investment. Moreover, its operational efficiency, while improving, can be a drag on profitability compared to larger or digital-native competitors. The bank's future success will hinge on its ability to continue executing its dual strategy: leveraging its strong regional presence and brand trust while aggressively scaling its technology-driven services. The key opportunities for strategic evolution involve moving beyond traditional banking products to become an integrated financial ecosystem provider, primarily through the expansion of its Banking-as-a-Service (BaaS) capabilities and deeper integration of AI across all business lines to enhance personalization and efficiency.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Regulatory Compliance and Licensing

Impact:High

- Barrier:

High Capital Requirements

Impact:High

- Barrier:

Brand Trust and Customer Acquisition Cost

Impact:High

- Barrier:

Legacy Technology Integration

Impact:Medium

- Barrier:

Access to Payment Networks (e.g., FedNow)

Impact:Medium

Industry Trends

- Trend:

Digital Transformation and AI Integration

Impact On Business:Fifth Third must continuously invest in its digital platform to meet customer expectations for seamless, personalized experiences and operational efficiency, as highlighted by competitors' focus on AI and digital tools.

Timeline:Immediate

- Trend:

Competition from Fintech and Neobanks

Impact On Business:Indirect competitors like Chime and SoFi are eroding market share by offering low-fee, mobile-first products, forcing Fifth Third to innovate and emphasize its value proposition beyond basic banking.

Timeline:Immediate

- Trend:

Emphasis on Customer Experience (CX)

Impact On Business:Competitors like U.S. Bank are lauded for their mobile app experience, creating a high benchmark. Fifth Third's focus on its award-winning app is a direct response to this trend.

Timeline:Immediate

- Trend:

Market Consolidation (M&A Activity)

Impact On Business:The trend of M&A in the banking sector presents both an opportunity for growth through acquisition and a threat from larger, more scaled competitors like PNC, which grew significantly after acquiring BBVA USA.

Timeline:Near-term

- Trend:

Evolving Regulatory Environment

Impact On Business:Potential changes in capital requirements, stress testing, and consumer protection laws require constant vigilance and investment in compliance, affecting profitability.

Timeline:Long-term

Direct Competitors

- →

PNC Financial Services

Market Share Estimate:Significant regional and national competitor with a larger asset base.

Target Audience Overlap:High

Competitive Positioning:Positions as a large, stable institution with a diversified portfolio across retail, corporate, and asset management, increasingly focused on digital innovation.

Strengths

- •

Extensive branch network and national presence.

- •

Strong brand recognition and reputation.

- •

Diversified revenue streams (retail, corporate, wealth management).

- •

Aggressive investment in digital capabilities, such as the Virtual Wallet and PNC Direct Deposit.

Weaknesses

- •

May be perceived as less agile than smaller regional banks.

- •

Customer service can be inconsistent across its large network.

- •

Vulnerable to broad economic downturns due to its scale.

Differentiators

- •

"Virtual Wallet" product suite offers integrated digital money management tools.

- •

Strong focus on corporate and institutional banking.

- •

Significant investment in community initiatives through the PNC Foundation.

- →

U.S. Bank (U.S. Bancorp)

Market Share Estimate:One of the largest banks in the U.S. by assets, with a significant national footprint.

Target Audience Overlap:High

Competitive Positioning:Positions as a technology-forward incumbent, leveraging its scale to offer a leading digital experience combined with a full suite of traditional banking products.

Strengths

- •

Award-winning mobile app and digital banking platform, often ranked #1.

- •

Strong emphasis on integrating human and digital service (e.g., cobrowsing feature).

- •

Comprehensive product offerings for individuals, small businesses, and corporations.

- •

Extensive national branch and ATM network.

Weaknesses

- •

Can be slower to innovate on core product features compared to fintechs.

- •

Like other large banks, can be perceived as impersonal.

- •

Faces significant competition in every market it serves.

Differentiators

- •

Market-leading mobile app functionality and user experience.

- •

"Cobrowse" feature effectively merges digital convenience with human support.

- •

Strong position in payment services.

- →

KeyBank

Market Share Estimate:Major regional bank with a strong presence in the Midwest and other select states.

Target Audience Overlap:High

Competitive Positioning:Focuses on relationship banking for individuals and small to middle-market businesses, with specialized expertise in specific industries.

Strengths

- •

Strong focus on specific commercial sectors (e.g., healthcare, energy, technology).

- •

Emphasis on building long-term client relationships.

- •

National digital lending business (Laurel Road) targeting healthcare professionals.

- •

Solid branch network within its 15-state footprint.

Weaknesses

- •

Geographically less diverse than national competitors.

- •

Brand recognition is lower outside of its primary operating regions.

- •

Digital offerings are solid but not typically seen as industry-leading compared to U.S. Bank.

Differentiators

- •

Industry-specific expertise in its commercial banking division.

- •

Laurel Road provides a unique national digital presence in a high-value niche (healthcare).

- •

Positioning as a "Main Street" bank focused on community and middle-market clients.

- →

Huntington Bancshares

Market Share Estimate:Prominent regional bank with a dense network, particularly in the Midwest.

Target Audience Overlap:High

Competitive Positioning:Positions itself as a customer-centric bank focused on looking out for people and businesses, with a friendly and approachable brand image.

Strengths

- •

Strong reputation for customer service and a community-focused approach.

- •

High branch density in its core markets.

- •

Innovative consumer-friendly features like "The Huntington National Bank® 24-Hour Grace®".

- •

Strong small business banking services.

Weaknesses

- •

Limited geographic footprint outside the Midwest.

- •

Smaller scale compared to competitors like PNC and U.S. Bank.

- •

May not have the same breadth of complex corporate and investment banking services.

Differentiators

- •

Emphasis on a "Welcome" brand philosophy and customer advocacy.

- •

Unique, trademarked product features designed to be fair and transparent.

- •

Deep integration into local communities.

Indirect Competitors

- →

Chime

Description:A digital-only neobank offering fee-free checking and savings accounts, early direct deposit, and a credit-builder product, primarily via a mobile app.

Threat Level:High

Potential For Direct Competition:Increasingly a direct competitor for primary checking accounts, especially among younger, digitally-native demographics who do not require branch services.

- →

Ally Bank

Description:A leading online-only bank known for high-yield savings accounts, auto financing, and a full suite of digital banking and investment products.

Threat Level:High

Potential For Direct Competition:Already a direct competitor in deposits, personal loans, and mortgages. Its lack of physical branches is its main differentiator from Fifth Third.

- →

SoFi

Description:A digital financial services company that started with student loan refinancing and has expanded into a comprehensive one-stop-shop for loans, investing, banking, and credit cards.

Threat Level:Medium

Potential For Direct Competition:High. By obtaining a bank charter, SoFi is directly competing for deposits and loans, leveraging a tech-forward platform to cross-sell a wide array of financial products.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Established Brand and Trust

Sustainability Assessment:Highly sustainable. Building trust in financial services takes decades and is a significant moat against new entrants.

Competitor Replication Difficulty:Hard

- Advantage:

Physical Branch Network

Sustainability Assessment:Moderately sustainable. While less critical for daily transactions, branches remain important for complex advice, problem resolution, and serving certain customer segments.

Competitor Replication Difficulty:Hard

- Advantage:

Diversified Product Portfolio

Sustainability Assessment:Highly sustainable. Offers a full suite of services (commercial, wealth management, mortgage) that fintechs struggle to replicate comprehensively.

Competitor Replication Difficulty:Medium

- Advantage:

Regulatory Expertise

Sustainability Assessment:Highly sustainable. Deep experience in navigating complex banking regulations is a significant operational advantage and barrier to entry.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'Award-Winning Mobile App', 'estimated_duration': '1-2 years. Competitors like U.S. Bank and PNC are also investing heavily in digital, making it a continuous race to maintain a leadership position.'}

{'advantage': 'Specific Promotional Interest Rates/Offers', 'estimated_duration': '3-6 months. These are easily matched by competitors and are short-term tactics for customer acquisition.'}

Disadvantages

- Disadvantage:

Perception of Being Less Innovative than Fintechs

Impact:Major

Addressability:Moderately

- Disadvantage:

Legacy Core Technology Infrastructure

Impact:Major

Addressability:Difficult

- Disadvantage:

Geographic Concentration

Impact:Minor

Addressability:Difficult

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted marketing campaigns highlighting the award-winning mobile app and specific features (like Cardless ATM) that outperform fintechs.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Simplify the digital account opening process to be on par with leading neobanks, reducing friction for new customers.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Promote human-digital integration features, similar to U.S. Bank's cobrowse, to showcase the value of having both physical and digital access.

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Invest in AI-driven personalization to provide proactive financial advice and customized product recommendations through the mobile app.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Develop and market specialized banking solutions for underserved, high-growth niches (e.g., gig economy workers, small e-commerce businesses).

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Expand partnerships with fintechs to integrate innovative point solutions (e.g., advanced budgeting tools, subscription management) into the Fifth Third ecosystem.

Expected Impact:Medium

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Execute a phased modernization of the core banking platform to improve agility, reduce operational costs, and enable faster product development.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Strategically expand the bank's geographic footprint, either digitally or through targeted M&A, into high-growth markets in the Southeast.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Build out a comprehensive financial wellness platform that goes beyond traditional banking to offer education, planning tools, and advisory services as a key differentiator.

Expected Impact:Medium

Implementation Difficulty:Difficult

Position Fifth Third as the premier 'human-centric digital bank,' combining the trust and comprehensive services of an established institution with a best-in-class, intuitive, and personalized digital experience that rivals top fintechs.

Differentiate on the seamless integration of digital convenience and accessible human expertise. While competitors have one or the other, Fifth Third's strategy should be to prove it is the best at delivering both in a cohesive, customer-first manner.

Whitespace Opportunities

- Opportunity:

Integrated Financial Planning for the Mass Affluent

Competitive Gap:Many competitors offer either high-touch wealth management for the wealthy or basic robo-advisors. There is a gap for a digitally-delivered, yet human-supported, holistic financial planning service for customers with $100k-$1M in assets.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Banking-as-a-Service (BaaS) for Small Businesses

Competitive Gap:While some fintechs play in this space, few regional banks offer a robust BaaS platform that allows small businesses to embed financial products (e.g., payments, lending) directly into their own software and workflows.

Feasibility:Low

Potential Impact:High

- Opportunity:

Proactive Financial Wellness and Debt Management Tools

Competitive Gap:Most banks offer reactive tools (low balance alerts). An opportunity exists to use AI to proactively analyze spending and cash flow to offer predictive advice, savings recommendations, and personalized debt reduction plans, competing directly with fintech apps like Chime.

Feasibility:Medium

Potential Impact:Medium

Fifth Third Bank operates in the mature and highly competitive U.S. regional banking industry, which is dominated by a few national players and strong regional institutions. The market is an oligopoly where barriers to entry, such as regulatory hurdles and capital requirements, are exceptionally high for new traditional banks.

Fifth Third's primary direct competitors are other large regional banks like PNC, U.S. Bank, KeyBank, and Huntington, all of whom vie for the same customer base with similar product suites. The key battleground has shifted decisively to digital capabilities and customer experience. Competitors like U.S. Bank have set a high bar with award-winning mobile applications, while PNC is aggressively investing in its digital ecosystem. Fifth Third's stated focus on its own mobile app excellence is a necessary strategic response to maintain parity and relevance.

The most significant disruptive threat comes from indirect competitors, specifically well-funded fintech companies and neobanks like Chime, Ally, and SoFi. These digital-native firms excel at customer acquisition through frictionless onboarding, low-to-no fees, and superior mobile-first design, effectively unbundling traditional banking services and capturing significant market share among younger demographics.

Fifth Third's sustainable competitive advantages are its established brand trust, extensive physical branch network, and a comprehensive, diversified product portfolio that fintechs cannot easily replicate. However, these advantages are slowly being eroded by the convenience and user-centric design of digital-first challengers. The bank's website content correctly identifies its digital platform as a core asset, a crucial point of defense and a potential source of differentiation.

Strategic whitespace exists for Fifth Third in more effectively blending its digital and human channels. While competitors also work on this, an opportunity remains to create a truly seamless, 'phygital' experience that fintechs cannot offer and that larger banks struggle to execute with a personal touch. Focusing on underserved niches, such as specialized services for the growing gig economy or offering proactive, AI-driven financial wellness tools, could create new revenue streams and deepen customer relationships. Ultimately, Fifth Third's future success will depend on its ability to accelerate its technological innovation to match the agility of fintechs while leveraging its traditional strengths of trust, personal advice, and a full-service product menu.

Messaging

Message Architecture

Key Messages

- Message:

Fifth Third has the Best Mobile Banking App for Customer Satisfaction among Regional Banks.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Section

- Message:

Bank anytime, anywhere with convenient and easy-to-use online and mobile banking tools.

Prominence:Secondary

Clarity Score:High

Location:Homepage, Online and Mobile Banking Page

- Message:

Our digital banking platform offers a comprehensive suite of features, including mobile check deposit, bill pay, alerts, and 24/7 support.

Prominence:Tertiary

Clarity Score:High

Location:Online and Mobile Banking Page

The messaging hierarchy is logical and effective. It correctly prioritizes the most compelling differentiator—the award for customer satisfaction with the mobile app—on the homepage to capture attention. This is supported by secondary messages about the general convenience of digital banking, with the specific features detailed further on a dedicated page for users seeking more information.

Messaging is highly consistent across the provided pages. The central theme of empowerment through convenient, powerful digital banking tools is reinforced by headlines, subheadings, and feature descriptions. The phrase 'It’s like having your own personal branch right inside your pocket!' is used on both pages, creating a strong, consistent narrative.

Brand Voice

Voice Attributes

- Attribute:

Convenient

Strength:Strong

Examples

- •

Bank anytime, anywhere

- •

Everything you need—right at your fingertips.

- •

Convenient, Digital Banking for Your Busy Life

- Attribute:

Clever/Playful

Strength:Moderate

Examples

We're app-solutely honored!

Online and Mobile Banking—Now 166.7% Better.

- Attribute:

Reassuring

Strength:Moderate

Examples

- •

Always know what’s happening with your account.

- •

Pay Bills Without the Hassle

- •

24/7 Message Support: Because Questions Aren’t Just 9-5

Tone Analysis

Helpful and Empowering

Secondary Tones

Tech-savvy

Approachable

Tone Shifts

The tone shifts from celebratory and slightly playful on the homepage ('app-solutely honored!') to more feature-focused and instructional on the online banking page.

Voice Consistency Rating

Good

Consistency Issues

The clever wordplay ('166.7% Better', a pun on 5/3) is a strong, unique brand voice element but is not explained. This may confuse some users and represents a missed opportunity to reinforce the brand's unique identity.

Value Proposition Assessment

Fifth Third provides an award-winning digital banking experience that offers superior convenience and control, allowing you to manage your finances easily and securely from anywhere.

Value Proposition Components

- Component:

Award-Winning Mobile App

Clarity:Clear

Uniqueness:Unique

- Component:

Comprehensive Digital Features

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

24/7 Accessibility and Support

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Security and Control

Clarity:Somewhat Clear

Uniqueness:Common

The primary differentiator is the third-party validation: 'Best Mobile Banking App for Customer Satisfaction among Regional Banks.' This is a powerful claim that sets them apart from competitors who can only self-proclaim their app's quality. The clever brand voice ('166.7% Better') also serves as a memorable, if subtle, differentiator. While other banks offer similar features, Fifth Third's messaging effectively packages them under the umbrella of an award-winning experience.

The messaging positions Fifth Third as a technology-first regional bank that rivals the digital capabilities of larger national banks (like Chase or Bank of America) while emphasizing a focus on customer satisfaction, a trait often associated with smaller community banks. This 'best of both worlds' positioning is strategic for attracting customers who want modern convenience without feeling like just another number.

Audience Messaging

Target Personas

- Persona:

The Digitally Native Consumer

Tailored Messages

- •

We're app-solutely honored!

- •

Bank anytime, anywhere

- •

Everything you need—right at your fingertips.

Effectiveness:Effective

- Persona:

The Busy Professional / Parent

Tailored Messages

- •

Convenient, Digital Banking for Your Busy Life

- •

Deposit checks with a tap

- •

24/7 Message Support: Because Questions Aren’t Just 9-5

Effectiveness:Effective

Audience Pain Points Addressed

- •

Lack of time to visit a physical bank branch.

- •

Difficulty managing finances on the go.

- •

Frustration with clunky or limited banking apps.

- •

Concerns about missing important account activity or potential fraud.

- •

Needing customer support outside of standard business hours.

Audience Aspirations Addressed

- •

To have effortless control over their financial life.

- •

To feel secure and informed about their money.

- •

To simplify daily tasks and save time.

- •

To use modern, efficient technology.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Relief & Empowerment

Effectiveness:High

Examples

Pay Bills Without the Hassle

It’s like having your own personal branch right inside your pocket!

- Appeal Type:

Trust & Security

Effectiveness:Medium

Examples

Get alerts for suspicious activity, low balances, upcoming payments, and more.

Securely pay all of your bills from one place

Social Proof Elements

- Proof Type:

Awards / Third-Party Validation

Impact:Strong

Examples

Best Mobile Banking App for Customer Satisfaction among Regional Banks.

Trust Indicators

- •

Prominent display of the satisfaction award.

- •

Clear disclaimers when leaving the Fifth Third website.

- •

Offering educational content on topics like security and strong passwords.

- •

Mention of specific security features like account alerts.

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

Open an Account

Location:Homepage Hero Section

Clarity:Clear

- Text:

Download the Fifth Third Mobile App

Location:Online and Mobile Banking Page

Clarity:Clear

The CTAs are generally clear and direct. The primary acquisition CTA ('Open an Account') is well-placed but could be more compelling by linking it to the value proposition (e.g., 'Open an Account and See Why Our App Is #1'). The secondary CTAs ('Download the App', 'See How', 'Activate Alerts') are effective for guiding users to specific actions and deepening engagement.

Messaging Gaps Analysis

Critical Gaps

- •

Lack of 'Human Touch' Messaging: The content is heavily focused on digital self-service. There is no mention of in-person branch services, personal bankers, or wealth advisors. This could alienate customers who value an omnichannel experience or need more complex financial advice.

- •

Weak Connection to Brand Mission: The corporate mission to 'make life a Fifth Third Better' is not explicitly connected to the features. The messaging explains what the tools do, but not how they contribute to the customer's overall financial well-being.

- •

Absence of Customer Stories: The site lacks testimonials or case studies showing real customers benefiting from the app, which would add a powerful layer of social proof and emotional connection.

Contradiction Points

No itemsUnderdeveloped Areas

Value Proposition Beyond the App: The messaging is so focused on the mobile app that it fails to communicate the value of the bank's core products (like checking accounts) or its broader relationship benefits.

Explanation of '166.7% Better': This unique and clever brand slogan is presented without context, which can cause confusion and reduces its potential impact as a memorable brand asset.

Messaging Quality

Strengths

- •

Clear Focus on a Key Differentiator: The messaging consistently highlights the award-winning mobile app, creating a sharp competitive edge.

- •

Distinctive Brand Voice: The use of clever wordplay ('app-solutely', '166.7% Better') creates a memorable and approachable personality.

- •

Effective Use of Social Proof: Leading with a customer satisfaction award is a powerful and credible way to build trust.

- •

Strong Feature-Benefit Translation: The content does a good job of explaining how features like alerts and mobile deposit benefit the user (e.g., 'Always know what’s happening', 'Pay Bills Without the Hassle').

Weaknesses

- •

Over-reliance on Digital Channels: The messaging may unintentionally signal that the bank doesn't prioritize in-person service, potentially deterring certain customer segments.

- •

Lack of Emotional Storytelling: The messaging is very functional and feature-driven, missing opportunities to connect on an emotional level through customer narratives.

- •

Disconnected from Broader Brand Promise: The 'why' behind the bank—its mission and values—is absent from the product-level messaging.

Opportunities

- •

Integrate the 'Human Element': Add messaging that highlights the availability and expertise of human bankers as a complement to the powerful digital tools.

- •

Build a Narrative Around 'A Fifth Third Better': Create content that explicitly connects how using the mobile app and other tools helps customers improve their financial well-being, thus making their lives 'a Fifth Third Better'.

- •

Leverage Customer Testimonials: Feature short video or text testimonials from satisfied customers to bring the benefits of the mobile app to life.

Optimization Roadmap

Priority Improvements

- Area:

Value Proposition

Recommendation:Expand the value proposition to be 'The Best Digital Banking Experience, Backed by People Who Care.' Introduce a module on key pages that briefly showcases access to human experts via phone or in-branch.

Expected Impact:High

- Area:

Brand Narrative

Recommendation:Develop a central messaging pillar around the '166.7% Better' concept. Explain it as a commitment to going above and beyond, and link specific features (like 24/7 support or Cardless ATM) as proof points.

Expected Impact:High

- Area:

Social Proof

Recommendation:Incorporate customer quotes and testimonials directly on the Online and Mobile Banking page to add authenticity and support the award claim.

Expected Impact:Medium

Quick Wins

- •

A/B test the homepage CTA: Change 'Open an Account' to 'Get Our Award-Winning App' or 'Open an Account & Bank Better'.

- •

Add a small, dismissible tooltip or a short sentence on the Online Banking page that explains the '166.7% Better' pun to share the brand's personality.

- •

Re-title the 'The More You Know' section to something more benefit-oriented like 'Master Your Money' or 'Your Guide to Financial Well-being'.

Long Term Recommendations

- •

Develop a content marketing strategy that tells customer stories, showing how Fifth Third's tools have tangibly improved their financial lives.

- •

Create a more robust 'Security Center' section on the website to build deeper trust and more thoroughly address a key customer concern.

- •

Segment email marketing campaigns to deliver messaging tailored to user behavior, differentiating between digitally-active users and those who primarily use branches.

Fifth Third Bank's strategic messaging on its website is sharp, consistent, and effectively built around a powerful differentiator: its award-winning mobile application. The brand voice is distinct and approachable, with clever copy that sets it apart in a typically conservative industry. The message architecture is logical, successfully funneling users from a high-level, award-based claim on the homepage to detailed feature-benefits on interior pages.

The primary strength of the strategy is its laser focus on the digital experience, which directly addresses the modern consumer's demand for convenience and control. However, this strength is also its main weakness. By concentrating almost exclusively on self-service technology, the messaging creates a significant gap, failing to address the value of human interaction and in-person banking. This could alienate customers who prefer an omnichannel approach or require more complex financial guidance, positioning Fifth Third as a 'digital-only' bank in perception, even if not in reality.

To elevate its market position, Fifth Third should evolve its messaging from 'the best banking app' to 'the best banking experience,' which seamlessly integrates best-in-class technology with accessible human expertise. The optimization roadmap should focus on closing the 'human touch' gap, better integrating the overarching 'Fifth Third Better' brand promise into the product narrative, and leveraging customer stories to add a crucial layer of emotional resonance and authenticity.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Established position as a major US regional bank with a diversified financial services model.

- •

Consistent revenue generation and a large, established customer base across multiple states.

- •

Award-winning mobile app, indicating strong adoption and satisfaction with digital offerings, a key growth area.

- •

Strategic focus on high-growth segments like wealth management and treasury services, suggesting alignment with profitable market needs.

Improvement Areas

- •

Enhance digital onboarding to reduce friction for new customers and compete with fintechs.

- •

Increase personalization within the mobile app using AI to move from transactional support to proactive financial guidance.

- •

Deepen integration between consumer banking, small business, and wealth management to increase customer lifetime value.

Market Dynamics

Modest (Low single-digit %)

Mature

Market Trends

- Trend:

Digital Transformation and AI Adoption

Business Impact:Shift in customer interaction from physical branches to digital channels is accelerating. Investment in AI, cloud, and data analytics is critical for operational efficiency, personalization, and fraud detection.

- Trend:

Intensified Competition

Business Impact:Facing pressure from larger national banks (Chase, BofA), other super-regionals (PNC, U.S. Bank), and agile fintech/neobank startups.

- Trend:

Geographic Market Shift

Business Impact:High-growth markets are concentrated in the Southeastern US, creating a strategic imperative for geographic expansion.

- Trend:

Evolving Regulatory Landscape

Business Impact:Ongoing changes to capital and liquidity requirements necessitate prudent balance sheet management and can influence growth capacity.

Excellent for digital-led growth and geographic expansion. The market rewards banks that can efficiently scale digital services while strategically entering high-growth regions.

Business Model Scalability

Medium

High fixed costs associated with branch network, compliance, and legacy technology. Digital channels offer a more scalable, lower variable cost model. The key challenge is managing this hybrid cost structure.

Moderate. Digital transformation and branch optimization are key levers. Migrating routine transactions to digital channels frees up high-cost human resources for value-added relationship management.

Scalability Constraints

- •

Legacy core banking systems hindering rapid product development.

- •

Regulatory compliance overhead, which increases with scale.

- •

Dependence on a physical branch network for customer acquisition and high-value services in certain markets.

- •

Integrating acquisitions, which is a common growth vector for regional banks.

Team Readiness

Experienced leadership team with a clear strategy focused on stability, profitability, and growth. Strong focus on digital transformation is evident.

Traditional banking structure with four main segments. May face challenges with agility and cross-functional collaboration required for rapid growth experimentation.

Key Capability Gaps

- •

Advanced Data Science and AI/ML talent to drive hyper-personalization.

- •

Agile Product Management to accelerate the digital product roadmap.

- •

Digital Marketing expertise beyond traditional channels, focusing on performance marketing and SEO.

Growth Engine

Acquisition Channels

- Channel:

Digital Marketing (Paid Search/SEO)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Aggressively optimize for high-intent keywords like 'open checking account online'. Develop a robust content marketing strategy around financial literacy to drive organic traffic and build trust.

- Channel:

Branch Network

Effectiveness:High

Optimization Potential:Medium

Recommendation:Continue the strategy of optimizing the Midwest network to fund expansion into high-growth Southeast markets. Evolve the branch role from transactional hub to advisory center for complex financial needs.

- Channel:

Referral Programs

Effectiveness:Low

Optimization Potential:High

Recommendation:Implement a seamless, digitally-enabled referral program with compelling incentives for both the referrer and the new customer to lower acquisition costs.

- Channel:

Commercial & Small Business Banking

Effectiveness:High

Optimization Potential:Medium

Recommendation:Strengthen cross-sell initiatives to capture the personal banking needs of business owners and their employees.

Customer Journey

The website funnels users toward 'Open an Account' and mobile app downloads. The primary focus is clearly on digital channel adoption.

Friction Points

- •

Potentially lengthy and complex online account opening applications.

- •

Lack of seamless transition between digital application and human assistance if needed.

- •

Onboarding process may not sufficiently drive adoption of key value-added digital features.

Journey Enhancement Priorities

{'area': 'Digital Account Opening', 'recommendation': 'Develop a best-in-class, mobile-first account opening process that can be completed in under 5 minutes, leveraging technology for identity verification.'}

{'area': 'New Customer Onboarding', 'recommendation': 'Create a multi-touch, automated onboarding sequence (email, SMS, in-app messages) that educates new customers on key features like mobile deposit, bill pay, and Zelle to drive engagement and stickiness.'}

Retention Mechanisms

- Mechanism:

Product Bundling & High Switching Costs

Effectiveness:High

Improvement Opportunity:Use data analytics to proactively offer tailored product bundles (e.g., mortgage, auto loan, credit card) at key life moments, rather than waiting for customer inquiries.

- Mechanism:

Digital Engagement

Effectiveness:Medium

Improvement Opportunity:Move beyond transactional features in the mobile app. Integrate budgeting tools, savings goals, and personalized financial health scores to become an indispensable financial partner.

- Mechanism:

Customer Service

Effectiveness:Medium

Improvement Opportunity:Further enhance AI-powered tools like the 'Jeanie' virtual assistant to handle a wider range of queries instantly, while ensuring a smooth handoff to human agents for complex issues.

Revenue Economics

As a large bank, unit economics are generally positive, driven by Net Interest Margin (NIM) and fee income. The strategic focus is on increasing non-interest income to build resilience against interest rate fluctuations.

Not publicly determinable, but for a primary banking relationship, LTV is typically very high. The goal is to lower CAC through digital acquisition and increase LTV through effective cross-selling.

Good, with a stated focus on disciplined expense management and improving operational efficiency.

Optimization Recommendations

- •

Shift customer acquisition mix towards lower-cost digital channels.

- •

Increase the cross-sell attachment rate of fee-generating products (wealth management, treasury services) to new and existing customers.

- •

Automate manual back-office processes to reduce operational costs and improve margins.

Scale Barriers

Technical Limitations

- Limitation:

Legacy Core Banking Platform

Impact:High

Solution Approach:Continue the strategy of modernizing the core through a combination of cloud adoption (AWS) and microservices architecture. This allows for faster innovation and easier integration with third-party fintechs.

- Limitation:

Data Silos

Impact:Medium

Solution Approach:Invest in a unified data platform that provides a single view of the customer across all business lines (retail, commercial, wealth) to enable true personalization and effective cross-selling.

Operational Bottlenecks

- Bottleneck:

Manual Underwriting and Loan Processing

Growth Impact:Slows loan origination, increases costs, and can lead to a poor customer experience.

Resolution Strategy:Implement AI and machine learning models to automate decision-making for standard loan applications, freeing up underwriters to focus on complex cases.

- Bottleneck:

Regulatory and Compliance Reporting

Growth Impact:Consumes significant resources and can slow down the launch of new products and entry into new markets.

Resolution Strategy:Invest in RegTech (Regulatory Technology) solutions to automate compliance monitoring and reporting, reducing manual effort and risk.

Market Penetration Challenges

- Challenge:

Intense Competition in Growth Markets

Severity:Critical

Mitigation Strategy:Compete through a combination of data-driven branch placement and a superior, differentiated digital customer experience. Focus on specific customer segments underserved by larger national competitors.

- Challenge:

Customer Inertia and High Switching Costs

Severity:Major

Mitigation Strategy:Offer compelling sign-up bonuses and digitally-enabled tools that simplify switching direct deposits and automatic payments, directly addressing the primary friction points for customers considering a new bank.

Resource Limitations

Talent Gaps

- •

Cloud Engineers and Architects (specifically AWS)

- •

Data Scientists with experience in financial services

- •

Cybersecurity specialists

Capital is generally strong (CET1 ratio of 10.44%), but expansion (both organic and M&A) and technology investments will require continuous capital allocation planning.

Infrastructure Needs

- •

Continued investment in cloud infrastructure to support modernization efforts.

- •

Upgrades to branch technology to support the shift to an advisory model.

- •

Enhanced cybersecurity infrastructure to counter evolving threats.

Growth Opportunities

Market Expansion

- Expansion Vector:

Geographic Expansion in the U.S. Southeast

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Continue the current, successful strategy of opening 50-60 new branches annually in high-growth Southeastern markets, funded by optimizing the Midwest footprint. This is the primary growth engine for the bank.

- Expansion Vector:

Demographic Targeting of Young Professionals/Affluent Millennials

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Develop tailored digital product bundles (e.g., high-yield savings, investment starter-packs, premium credit cards) and market them through targeted social media and content campaigns.

Product Opportunities

- Opportunity:

Expanded Wealth Management Offerings

Market Demand Evidence:Growing demand for wealth and asset management services is a key driver of non-interest income for banks.

Strategic Fit:High

Development Recommendation:Develop a hybrid 'robo-advisor' service for mass-affluent customers, combining automated investing with access to human advisors, to serve a broader client base more efficiently.

- Opportunity:

Banking as a Service (BaaS) / Embedded Finance

Market Demand Evidence:Non-financial companies are increasingly looking to embed financial products (e.g., loans, payments) into their platforms.

Strategic Fit:Medium

Development Recommendation:Start with a pilot program by partnering with a few established tech companies or platforms to offer white-labeled banking services, leveraging the modern technology stack being built.

Channel Diversification

- Channel:

Affiliate & Influencer Marketing

Fit Assessment:Good for reaching younger demographics.

Implementation Strategy:Partner with reputable personal finance bloggers, podcasters, and influencers to promote digital banking products. Track performance meticulously to ensure positive ROI.

- Channel:

Content Marketing Hub

Fit Assessment:Excellent for building brand authority and driving organic traffic.

Implementation Strategy:Create a comprehensive online resource center ('Financial Insights' section) with articles, videos, and tools covering topics like home buying, investing, and small business management to attract and engage potential customers early in their financial journey.

Strategic Partnerships

- Partnership Type:

Fintech Integration

Potential Partners

Plaid (for easy account linking)

FinTechs specializing in automated budgeting or micro-investing

Expected Benefits:Accelerate product innovation without building every feature in-house. Enhance the customer value proposition by integrating best-in-class tools directly into the mobile banking app.

- Partnership Type:

Community and Local Business Alliances

Potential Partners

Local real estate agencies

Chambers of Commerce in new expansion markets

Expected Benefits:Deepen community engagement and create embedded referral channels for mortgage and small business lending.

Growth Strategy

North Star Metric

Number of Digitally Active Primary Customers

This metric aligns the entire organization around attracting valuable, engaged customers. 'Primary' indicates a deep relationship (e.g., direct deposit), 'Digitally Active' ensures engagement on the most scalable channel, and 'Number' drives top-line growth.

Increase by 15% annually through a combination of new acquisition and deeper engagement of existing customers.

Growth Model

Digitally-Led, Relationship-Driven Growth

Key Drivers

- •

Digital customer acquisition conversion rate.

- •

New branch performance in Southeast markets.

- •

Cross-sell rate of additional products per household.

- •

Monthly active usage of the mobile app.

Use digital channels for broad top-of-funnel acquisition and efficient self-service. Leverage the physical branch network and relationship managers for high-value, complex needs (e.g., mortgages, wealth management, business loans), creating a hybrid model that maximizes efficiency and value.

Prioritized Initiatives

- Initiative:

Accelerate Southeast Branch Expansion

Expected Impact:High

Implementation Effort:High

Timeframe:Ongoing (3-5 years)

First Steps:Secure regulatory approvals for the next batch of branch locations and finalize staffing plans for the 50-60 new branches planned for the next year.

- Initiative:

Launch Hyper-Personalized In-App Nudges

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:9-12 months

First Steps:Form a cross-functional team of data scientists, product managers, and marketers. Identify 3-5 initial use cases for personalized offers or advice (e.g., pre-approved credit limit increase, recommendation to consolidate debt).

- Initiative:

Streamline Digital Account Opening to <5 Minutes

Expected Impact:High

Implementation Effort:High

Timeframe:12-18 months

First Steps:Map the current end-to-end customer journey to identify all friction points. Evaluate third-party technology vendors for identity verification and data pre-fill capabilities.

Experimentation Plan

High Leverage Tests

- Area:

Acquisition

Experiment:A/B test different welcome bonus offers (e.g., cash bonus vs. high-yield introductory APY) on digital ad campaigns.

- Area:

Engagement

Experiment:Test different in-app prompts and notifications to encourage the setup of recurring transfers to a savings account.

- Area:

Retention

Experiment:Pilot a proactive outreach program to customers with high balances but low engagement, offering a complimentary financial review.

Utilize an A/B testing platform to track key metrics for each experiment, including conversion rate, cost per acquisition, feature adoption rate, and customer churn. Ensure statistical significance before rolling out changes.

Establish a bi-weekly 'Growth Sprint' where new experiments are launched and results from previous tests are reviewed.

Growth Team

A centralized 'Growth Center of Excellence' that supports product-aligned growth pods. The central team owns data infrastructure, experimentation frameworks, and channel expertise. Pods are cross-functional teams embedded within business lines (e.g., Consumer, Business) to drive specific KPIs.

Key Roles

- •

Head of Growth

- •

Data Scientist/Analyst

- •

Product Marketing Manager

- •

Conversion Rate Optimization (CRO) Specialist

- •

Lifecycle Marketing Manager

Invest in training for product and marketing teams on agile methodologies and experimentation. Hire external talent with experience in high-growth tech or fintech companies to inject new skills and perspectives.

Fifth Third Bank is in a strong position to accelerate growth, built on a solid foundation of a well-recognized brand, a diversified business model, and a clear commitment to digital transformation. The company has correctly identified its primary growth vector: aggressive, data-driven expansion into the high-growth Southeastern U.S. markets, funded by the optimization of its legacy Midwest footprint. This strategy is sound and already showing positive results in deposit growth.

The bank's biggest asset in this pursuit is its award-winning digital platform, which serves as a scalable engine for customer acquisition and engagement. However, the competitive landscape is fierce, with pressure from larger national banks and nimble fintechs. To win, Fifth Third must transition from merely providing excellent digital tools to becoming an indispensable, personalized financial partner for its customers.

The primary barriers to scaling are not capital, but technological and organizational. The ongoing modernization of the core banking platform is critical and must be accelerated to enable faster innovation. Organizationally, the bank must continue to break down silos and embed a culture of rapid experimentation and data-driven decision-making.

Recommended Strategic Imperatives:

1. Double Down on the Southeast: Aggressively execute the geographic expansion plan, as this is the most significant and proven growth driver.

2. Win on Digital Experience: The next frontier is moving beyond transactional convenience to hyper-personalization. Leveraging AI and a unified customer data view to provide proactive advice and tailored offers will be a key differentiator.

3. Build a Growth Machine: Formalize a growth team and experimentation process to systematically optimize the entire customer lifecycle, from acquisition and onboarding to retention and cross-selling. This will increase the ROI on both marketing spend and technology investment.

By focusing on these imperatives, Fifth Third can successfully navigate the mature banking market, capture disproportionate share in its target growth regions, and build a sustainable competitive advantage based on a superior, digitally-powered customer relationship model.

Legal Compliance

Fifth Third Bank provides a comprehensive set of privacy documents that are easily accessible through a 'Privacy & Security' link in the website footer. The primary privacy notice is structured to comply with the Gramm-Leach-Bliley Act (GLBA), clearly outlining what personal information is collected, the reasons for sharing it, and whether customers can limit this sharing. It specifies that data is collected from applications, transactions, and credit bureaus. The policy distinguishes between sharing for everyday business purposes, marketing, and with affiliates, providing opt-out instructions via a toll-free number or by visiting a banking center. An 'Online Privacy Policy' specifically addresses data collected through the website, including automatic data collection via cookies and web beacons, and clarifies its application to online interactions. This policy is separate from the main GLBA notice and covers website-specific data practices. The bank appropriately notes that information collected under GLBA may be exempt from state laws like the CCPA/CPRA, which is a correct interpretation of the law. However, the online policy does not explicitly mention CCPA/CPRA rights like 'Do Not Sell or Share My Personal Information', relying on the GLBA exemption. While legally sound for GLBA-covered data, this could be a gap for data collected outside a direct financial product context, such as general website marketing.

The website's legal framework is governed by multiple agreements, primarily the 'Digital Services User Agreement,' which is presented to users upon enrolling in online banking. This agreement covers online and mobile banking, bill pay, and electronic communication disclosures. It clearly states that by using the services, customers agree to be bound by its terms, as well as other account rules and regulations. The agreement establishes that electronic requests and communications have the same legal authority as a signed written request. Other key documents like the 'Deposit Account Rules & Regulations' and 'Debit Card Agreement' are also available online and govern specific products. These documents define terms, outline user responsibilities, detail transaction limits, and explain the bank's right to change or close accounts. The terms are comprehensive and typical for the banking industry, establishing a clear, enforceable legal framework for the bank's digital offerings.

Upon visiting 53.com, a cookie consent banner appears at the bottom of the page. It informs the user that the site uses cookies to deliver the best experience and provides two options: 'Accept All Cookies' and 'Cookie Settings'. This mechanism provides users with a degree of control over non-essential cookies. The 'Online Privacy Policy' discloses the use of cookies, web beacons, and other tracking technologies for website statistics and advertising purposes. It also mentions that third parties may use tracking technologies to collect information about online activities over time and across different websites. The policy provides general information on how to set a browser to refuse cookies, which is a standard but less direct opt-out method. The approach is compliant with the U.S. standard 'opt-out' model but may not meet the stricter 'opt-in' requirements of regulations like GDPR if the bank were actively targeting European customers.

As a financial institution, Fifth Third Bank's data protection measures are primarily governed by the GLBA Safeguards Rule. The bank's main privacy notice states that they use security measures that comply with federal law to protect personal information from unauthorized access, including 'computer safeguards and secured files and buildings'. The website features a 'Privacy & Security' section that highlights their 'SmartShield' security suite, covering fraud protection, secure access with two-factor authentication, and monitoring. They also provide educational articles on topics like creating strong passwords and securing data during digital banking, demonstrating a commitment to customer security education. The bank's disclosure about the non-guaranteed security of internet transmissions is a standard and prudent disclaimer. This multi-layered approach of combining regulatory compliance, technological safeguards, and customer education represents a strong data protection posture.