eScore

adobe.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Adobe demonstrates a world-class digital presence, commanding immense domain authority and dominating branded and high-intent non-branded search queries. Its multi-channel presence is exceptionally consistent, leveraging its vast content ecosystem (tutorials, Behance community) to align with user intent at every stage of the customer journey. While already a leader, its specific optimization for conversational voice search could be more pronounced, though its strong featured snippet presence provides a solid foundation.

Unparalleled content authority driven by a massive ecosystem of tutorials, user-generated content (Behance), and thought leadership, which captures a vast range of search intents.

Proactively create and optimize content specifically for conversational, long-tail voice search queries, focusing on 'how-to,' 'what-is,' and 'best-for' formats to capture more answer engine results.

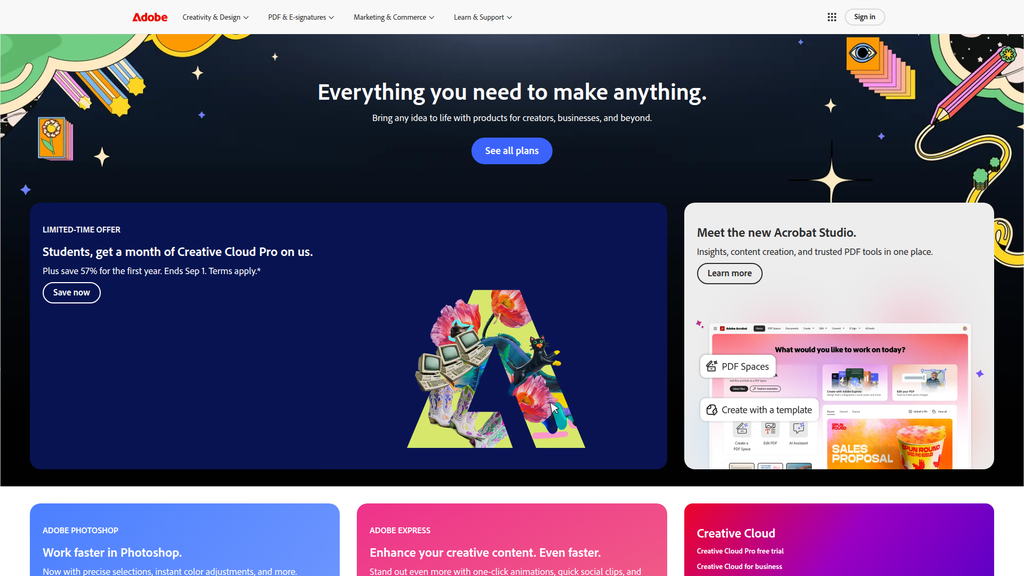

Adobe's brand messaging is masterful at inspiring its core audience of creative professionals with an empowering and innovative voice. The messaging for different user segments like students and individuals is clear and effective. However, the communication hierarchy on the homepage heavily favors individual creators, potentially leaving high-value business and enterprise customers feeling underserved until they navigate deeper into the site.

A strong, aspirational core message ('Everything you need to make anything') that effectively captures the brand's empowering essence and resonates deeply with its creative audience.

Revise the homepage message architecture to create a more prominent and distinct entry point for business/enterprise audiences, immediately showcasing the value proposition beyond individual creative tools.

The on-site conversion experience for signing up for trials and purchasing plans is visually clear, with a low cognitive load and excellent cross-device consistency. However, the overall score is significantly penalized by the subscription cancellation process, which is the subject of an FTC lawsuit for being intentionally burdensome. This major friction point in the post-conversion journey severely undermines user trust and the overall experience.

A visually intuitive and streamlined user flow for initial trial sign-ups and plan purchases, with clear calls-to-action and logical information architecture.

Radically overhaul the subscription cancellation process to be transparent and user-friendly, making it as easy to cancel as it is to sign up, thereby resolving the core issue of the FTC lawsuit and rebuilding customer trust.

Adobe's credibility is a story of contrasts; it has immense brand authority, robust data security (SOC 2, ISO 27001), and strong third-party validation as the industry standard. However, this is severely undermined by the high-risk FTC lawsuit alleging deceptive subscription practices, which has created significant reputational damage. While Adobe has made positive strides in transparency regarding AI data usage, the ongoing lawsuit remains a major unresolved credibility issue.

Proactive and clear policy on AI ethics, explicitly stating that user content is not used for training generative AI models, which builds significant trust in a high-stakes emerging technology.

Urgently resolve the FTC lawsuit concerning subscription practices. This is the most significant legal and reputational risk, and its resolution is paramount to restoring full credibility with consumers.

Adobe's competitive moat is exceptionally strong and sustainable, built on the trifecta of a deeply integrated product ecosystem, its status as the ubiquitous industry standard, and powerful network effects from its massive user community. Switching costs for professionals and enterprises are extremely high due to entrenched workflows and proprietary file formats. The rapid integration of its proprietary, commercially-safe Firefly AI across the entire suite has created a new, powerful layer of differentiation that standalone competitors struggle to match.

The deeply integrated three-cloud ecosystem (Creative, Document, Experience) creates a seamless workflow and high switching costs that point-solution competitors cannot replicate.

Accelerate the development of cloud-native, collaboration-first versions of core applications to neutralize the primary architectural advantage of competitors like Figma and future-proof its ecosystem.

Adobe's SaaS business model is highly scalable, boasting impressive gross margins and strong operational leverage. The company shows clear expansion potential by targeting the large SMB and creator economy markets with Adobe Express and developing new revenue streams from generative AI. While its core professional market is maturing, leading to slower overall growth (around 10-11% YoY), these new expansion vectors and AI monetization present significant future potential.

A highly scalable SaaS model with over 80% gross margins and a massive, predictable recurring revenue base, providing substantial free cash flow to reinvest in new growth areas like AI.

Establish a dedicated, agile business unit with a product-led growth (PLG) focus to more effectively penetrate the high-volume, low-spend SMB and creator economy markets currently dominated by Canva.

Adobe's subscription-based revenue model is highly optimized and profitable, with a clear focus on its three core clouds. The company demonstrates strong strategic focus by deeply integrating its key innovation (Firefly AI) across the entire product portfolio. However, the business model's coherence is weakened by a misalignment between its aggressive annual subscription terms (with early termination fees) and consumer protection standards, as highlighted by the FTC lawsuit.

A successful and highly profitable transition to a subscription model that generates over 94% of its revenue as predictable, recurring income, fueling continuous innovation.

Re-evaluate and simplify the subscription terms, particularly the 'annual, paid monthly' plan, to ensure crystal-clear transparency and fairness regarding early termination fees, aligning the model with customer trust.

Adobe wields immense market power, holding a dominant market share in the professional creative software industry and functioning as the definitive industry standard. This position grants it significant pricing power and the ability to influence market direction, as seen with its push into generative AI. While facing strong competition in niche segments (like UI/UX design from Figma), its comprehensive ecosystem and brand equity create a formidable barrier to entry, ensuring a stable and leading market share trajectory.

Dominant market share (~58%) and status as the entrenched 'industry standard,' which creates powerful network effects in hiring, education, and collaboration, continuously reinforcing its market leadership.

Develop and market a clearer competitive narrative for the Experience Cloud that emphasizes the unique value of its integration with Creative Cloud, better leveraging its market power in creation to win against marketing-only competitors like Salesforce.

Business Overview

Business Classification

Software as a Service (SaaS)

Platform & Ecosystem

Software

Sub Verticals

- •

Creative & Design Software

- •

Digital Marketing & Experience Management

- •

Document Management Solutions

Mature

Maturity Indicators

- •

Dominant market share in core professional segments.

- •

Highly predictable, subscription-based recurring revenue model.

- •

Global brand recognition and industry-standard product status.

- •

Consistent profitability and strong free cash flow.

- •

Strategic shift from product-led to platform-led growth, focusing on AI and ecosystem lock-in.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Creative Cloud Subscriptions

Description:Subscription fees for access to a suite of software for graphic design, video editing, web development, photography, and more. Key products include Photoshop, Illustrator, Premiere Pro, and After Effects.

Estimated Importance:Primary

Customer Segment:Creative Professionals, Businesses (All sizes), Students & Educators

Estimated Margin:High

- Stream Name:

Experience Cloud Subscriptions

Description:Subscription fees for a suite of products for marketing, analytics, advertising, and commerce. Helps businesses manage, personalize, and optimize customer experiences.

Estimated Importance:Primary

Customer Segment:Medium to Large Enterprises, Marketing & E-commerce Teams

Estimated Margin:High

- Stream Name:

Document Cloud Subscriptions

Description:Subscription fees for products like Adobe Acrobat Pro DC, Adobe Sign, and Scan, which allow users to create, edit, sign, and manage PDF documents.

Estimated Importance:Secondary

Customer Segment:Business Professionals, Consumers, Enterprises

Estimated Margin:High

Recurring Revenue Components

- •

Monthly & Annual Subscriptions (Creative, Experience, Document Clouds)

- •

Enterprise Term License Agreements (ETLAs)

- •

Consumption-based pricing for AI features (e.g., Generative Credits for Firefly).

Pricing Strategy

Tiered Subscription

Premium

Transparent

Pricing Psychology

- •

Tiered Pricing (e.g., Single App, All Apps, Creative Cloud Pro).

- •

Bundling (Creative Cloud suite offers more value than single apps).

- •

Promotional Pricing (Student and teacher discounts).

- •

Decoy Effect (A mid-tier plan can make the premium plan look more attractive).

Monetization Assessment

Strengths

- •

Extremely high percentage of revenue is recurring and predictable.

- •

Strong pricing power due to industry-standard status and deep integration into workflows.

- •

Successful transition from perpetual licenses to a subscription model.

- •

New AI-driven monetization vector through generative credits and premium-tier subscriptions.

Weaknesses

- •

High price point can be a barrier for individuals and SMBs, creating an opening for lower-cost competitors.

- •

Dependence on the subscription model creates vulnerability to 'subscription fatigue'.

- •

Complexity in enterprise licensing can be a friction point.

Opportunities

- •

Upselling existing customers to higher 'Pro' tiers with advanced AI capabilities.

- •

Expanding consumption-based pricing for compute-intensive AI tasks (video, 3D).

- •

Penetrating the non-professional/casual creator market with more accessible tools like Adobe Express.

- •

Deeper integration of creative tools into the enterprise-focused Experience Cloud to drive bundle adoption.

Threats

- •

Aggressive competition from more accessible and lower-cost tools like Canva and Figma, particularly in the non-professional segment.

- •

Disruption from AI-native startups that could build more efficient, specialized creative tools from the ground up.

- •

Potential for market saturation in core creative professional segments.

- •

Economic downturns leading to reduced software spending by businesses and freelancers.

Market Positioning

Industry Standard & Premium Technology Leader

Dominant in professional creative software; Strong challenger in digital experience and document management.

Target Segments

- Segment Name:

Creative & Marketing Professionals

Description:Individuals and teams whose primary job function involves creating digital content. This includes graphic designers, video editors, web designers, UX/UI designers, photographers, and enterprise marketing teams.

Demographic Factors

- •

Professionals aged 25-55

- •

Higher education in arts, design, or marketing

- •

Employed by agencies, corporations, or as high-value freelancers

Psychographic Factors

- •

Value quality, precision, and control over their tools.

- •

Perceive Adobe products as the professional standard.

- •

Career and reputation are tied to proficiency with Adobe software.

- •

Seek efficiency and seamless workflows.

Behavioral Factors

- •

Deeply integrated into the Adobe ecosystem.

- •

High willingness to pay for tools that improve productivity and output quality.

- •

Actively follow industry trends and software updates.

Pain Points

- •

Pressure to produce high-quality content faster.

- •

Need for seamless collaboration with team members and clients.

- •

Keeping up with new tools, features, and technologies like AI.

- •

Managing complex, multi-application workflows.

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Business Professionals & Consumers

Description:A broad segment including knowledge workers, small business owners, and general consumers who need to create, edit, and sign documents, or produce simple marketing materials without professional design skills.

Demographic Factors

Wide age range

Various professional roles outside of creative industries

Psychographic Factors

- •

Value simplicity, speed, and ease-of-use.

- •

Often price-sensitive.

- •

Task-oriented; looking for a tool to solve an immediate problem (e.g., sign a PDF, create a flyer).

Behavioral Factors

- •

Less brand-loyal; may use a variety of tools (e.g., Canva, DocuSign).

- •

Lower engagement and usage frequency compared to professionals.

- •

Influenced by freemium models and accessibility.

Pain Points

- •

Professional design tools are too complex and expensive.

- •

Lack of time and skill to create professional-looking content.

- •

Difficulty with document compatibility and security.

Fit Assessment:Good

Segment Potential:High

- Segment Name:

Students & Educators

Description:Individuals and institutions in the education sector who use creative and document tools for learning, teaching, and academic projects.

Demographic Factors

Aged 13-25 (students) and 30-65 (educators).

Enrolled in or employed by educational institutions.

Psychographic Factors

- •

Highly price-sensitive.

- •

Motivated by learning and skill development.

- •

Seek to learn industry-standard tools to improve future career prospects.

Behavioral Factors

Acquisition is driven by heavily discounted educational pricing.

High potential for future conversion to full-priced plans upon graduation.

Pain Points

- •

Affordability of professional tools on a limited budget.

- •

Steep learning curve for complex software.

- •

Need for access to tools for coursework and portfolio building.

Fit Assessment:Excellent

Segment Potential:High

Market Differentiation

- Factor:

Integrated Ecosystem (Creative, Document, Experience Clouds)

Strength:Strong

Sustainability:Sustainable

- Factor:

Proprietary AI Models (Firefly & Sensei)

Strength:Strong

Sustainability:Sustainable

- Factor:

Industry Standard Status & Brand Equity

Strength:Strong

Sustainability:Sustainable

- Factor:

Vast User Base and Community (e.g., Behance)

Strength:Moderate

Sustainability:Sustainable

- Factor:

Enterprise-grade Security and Commercial Indemnification for AI

Strength:Strong

Sustainability:Sustainable

Value Proposition

An integrated ecosystem of industry-standard applications and services for digital content creation, marketing, and document management, supercharged with generative AI to enhance creativity and productivity for everyone from students to global enterprises.

Excellent

Key Benefits

- Benefit:

Professional-Grade Creative Tools

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Decades of use as the industry standard in creative fields.

Vast feature sets in flagship products like Photoshop and Premiere Pro.

- Benefit:

Seamless Workflow Integration

Importance:Critical

Differentiation:Unique

Proof Elements

Interoperability between Creative Cloud applications (e.g., Photoshop files in After Effects).

Centralized asset management via Creative Cloud Libraries.

- Benefit:

AI-Powered Efficiency and Creativity

Importance:Important

Differentiation:Unique

Proof Elements

- •

Generative Fill in Photoshop powered by Firefly.

- •

Acrobat AI Assistant for document summaries and insights.

- •

Commercially safe AI models trained on licensed content.

- Benefit:

Scalable Enterprise Solutions

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Comprehensive Experience Cloud platform for marketing and analytics.

Enterprise-level security, administration, and support.

Unique Selling Points

- Usp:

The only company offering a deeply integrated, end-to-end solution spanning content creation (Creative Cloud), customer experience management (Experience Cloud), and document workflows (Document Cloud).

Sustainability:Long-term

Defensibility:Strong

- Usp:

Adobe Firefly, a family of commercially safe generative AI models, natively integrated into core creative workflows, providing IP indemnification for generated content.

Sustainability:Medium-term

Defensibility:Strong

- Usp:

Ownership of the PDF format and the industry-standard Acrobat toolset, now enhanced with AI capabilities.

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Creating high-quality, professional digital content is complex and time-consuming.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Managing and delivering consistent, personalized customer experiences at scale is difficult.

Severity:Critical

Solution Effectiveness:Partial

- Problem:

Ensuring seamless collaboration and asset management across creative and marketing teams.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Securely creating, sharing, and getting signatures on digital documents.

Severity:Major

Solution Effectiveness:Complete

Value Alignment Assessment

High

Adobe's products are deeply aligned with the market's ongoing digital transformation, the increasing demand for digital content, and the strategic importance of customer experience management.

High

For its core audience of creative professionals, Adobe's value proposition is exceptionally well-aligned, providing the industry-standard tools they require. Alignment is improving for the business/consumer segment through offerings like Adobe Express.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Hardware Manufacturers (Apple, Microsoft, NVIDIA)

- •

Cloud Infrastructure Providers (Amazon Web Services, Microsoft Azure).

- •

Technology Partners (OpenAI, Google, Meta).

- •

Solution & Channel Partners (Consulting firms, resellers, agencies like Publicis Groupe).

- •

Educational Institutions.

Key Activities

- •

Research & Development (especially in AI and cloud technologies).

- •

Software Development & Engineering.

- •

Sales & Global Marketing.

- •

Customer Support & Success.

- •

Strategic Acquisitions & Partnerships.

Key Resources

- •

Extensive Intellectual Property Portfolio (Patents, Trademarks).

- •

Global Brand Equity & Reputation.

- •

Large, loyal customer base and developer ecosystem.

- •

Vast datasets for training AI models.

- •

Highly skilled workforce in engineering and design.

Cost Structure

- •

Research & Development Expenses.

- •

Sales and Marketing Costs.

- •

General and Administrative Expenses.

- •

Cloud Infrastructure Hosting Costs.

- •

Employee Salaries and Benefits.

Swot Analysis

Strengths

- •

Dominant market leadership in the professional creative software segment.

- •

Highly defensible ecosystem with strong user lock-in.

- •

Robust, predictable recurring revenue from a mature subscription model.

- •

Strong brand recognition and reputation for quality.

- •

Advanced, proprietary AI capabilities (Firefly) integrated directly into workflows.

Weaknesses

- •

Premium pricing may limit adoption among casual users and emerging markets.

- •

Perception of product complexity and steep learning curves for non-professionals.

- •

Slowing revenue growth compared to previous years, indicating market maturation.

- •

Historically slower to adapt to web-first, collaborative models compared to newer entrants.

Opportunities

- •

Monetizing generative AI through new subscription tiers, add-ons, and consumption-based models.

- •

Expanding the more accessible Adobe Express to capture the casual creator market from competitors like Canva.

- •

Driving growth in the enterprise segment through the Experience Cloud and GenStudio.

- •

Leveraging AI to create new product categories and workflows (e.g., video and 3D generation).

- •

Expanding into new geographic markets with tailored offerings.

Threats

- •

Intensifying competition from accessible, web-native, and often lower-cost tools like Canva and Figma.

- •

Disruption from agile, AI-native startups that could leapfrog legacy workflows.

- •

General 'subscription fatigue' among consumers and businesses.

- •

Potential antitrust and regulatory scrutiny due to market dominance.

- •

Software piracy, particularly in developing markets.

Recommendations

Priority Improvements

- Area:

Market Penetration (SMB & Consumer)

Recommendation:Aggressively enhance and market Adobe Express as a direct, user-friendly competitor to Canva, focusing on seamless integration with the professional Creative Cloud suite as a key differentiator. Simplify the entry-level user experience.

Expected Impact:High

- Area:

AI Monetization Strategy

Recommendation:Develop and clearly communicate a flexible, hybrid monetization model for AI that combines tier-based access (unlimited standard features in Pro plans) with a transparent consumption-based model (pay-per-use for high-compute tasks like video generation). This caters to both power users and occasional users.

Expected Impact:High

- Area:

Product Innovation

Recommendation:Prioritize R&D in agentic AI capabilities to automate complex, multi-step workflows across applications (e.g., 'Create a marketing campaign for product X using our brand assets'). This would transform Adobe from a tool provider to a true creative and marketing co-pilot, solidifying its moat.

Expected Impact:High

Business Model Innovation

- •

Introduce a 'Workflow-as-a-Service' model for enterprises, offering automated, AI-driven solutions for specific business outcomes (e.g., 'on-brand social media content generation') rather than just access to tools.

- •

Explore a marketplace model where third-party developers can build and sell AI-powered plugins and actions directly within Adobe applications, creating a network effect and fostering innovation.

- •

Develop a modular subscription offering that allows users to build custom tool bundles, appealing to specialized professionals who don't need the entire 'All Apps' plan but require more than one tool.

Revenue Diversification

- •

Expand Adobe Stock to include AI-generated assets, 3D models, and video templates, with a clear compensation model for creators whose work helps train the AI models.

- •

Offer premium consulting and implementation services for the Experience Cloud and GenStudio, helping enterprises maximize their investment in Adobe's marketing technology stack.

- •

Launch a certified education and talent platform, connecting businesses with Adobe-proficient freelancers and agencies, and taking a commission on projects.

Adobe's business model is a masterclass in strategic evolution, having successfully transitioned from a perpetual license model to a highly profitable and predictable SaaS subscription powerhouse. Its primary strength lies in its deeply entrenched and integrated three-cloud ecosystem (Creative, Experience, Document), which creates a formidable competitive moat and significant customer lock-in. The company's status as the 'industry standard' in the creative professional market has afforded it strong pricing power and brand loyalty. The current strategic imperative is the integration of generative AI. Adobe Firefly is not merely a feature addition; it is a fundamental evolution of the core value proposition, designed to enhance productivity and creativity while simultaneously introducing a powerful new monetization layer through generative credits and premium subscription tiers. This positions Adobe to capture additional value from its existing user base and defend against disruption.

However, Adobe faces significant challenges. Its mature core market is experiencing slower growth, and the rise of more accessible, collaborative, and often cheaper competitors like Canva and Figma poses a serious threat, particularly in the non-professional and SMB segments. The primary strategic risk is being outmaneuvered by more agile, AI-native startups that are not encumbered by legacy architecture. To secure future growth, Adobe must execute a dual strategy: 1) Defend its professional core by deepening its AI integration and workflow automation to a level competitors cannot replicate, and 2) Aggressively attack the high-growth casual creator market with a simplified and compelling offering in Adobe Express. The evolution from a 'tool provider' to an 'AI-powered system for digital creation and experience' will be critical for sustaining its market leadership and growth trajectory in the coming years.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Ecosystem Lock-In & High Switching Costs

Impact:High

- Barrier:

Brand Reputation & Industry Standard Status

Impact:High

- Barrier:

High R&D Investment for Professional-Grade Tools

Impact:High

- Barrier:

Extensive Intellectual Property Portfolio

Impact:Medium

Industry Trends

- Trend:

Generative AI Integration

Impact On Business:Fundamental shift in content creation, necessitating rapid innovation (e.g., Firefly) to maintain leadership and creating opportunities for new, AI-native competitors.

Timeline:Immediate

- Trend:

Demand for Simplified, Web-Based Tools

Impact On Business:Drives competition from players like Canva and Figma, forcing Adobe to invest in and promote simpler applications like Adobe Express to capture the mass-market segment.

Timeline:Immediate

- Trend:

Cloud-Based Collaboration

Impact On Business:Increases pressure to enhance real-time collaboration features across the Creative Cloud suite to compete with natively collaborative platforms like Figma.

Timeline:Near-term

- Trend:

Subscription Model Fatigue

Impact On Business:Potential for customer churn and price sensitivity, especially among freelancers and small businesses, creating an opening for competitors with perpetual licenses or more flexible pricing.

Timeline:Near-term

Direct Competitors

- →

Canva

Market Share Estimate:Significant and growing, particularly in the non-professional/SMB segment.

Target Audience Overlap:High

Competitive Positioning:The easy-to-use design platform for everyone, from individuals to enterprise teams.

Strengths

- •

Superior ease of use and intuitive interface for non-designers.

- •

Vast library of templates and assets, especially in the free and lower-priced tiers.

- •

Strong brand recognition among marketers, educators, and SMBs.

- •

Effective freemium model that drives user acquisition.

- •

Generous cloud storage on paid plans.

Weaknesses

- •

Less powerful and precise than Adobe's professional tools for complex design tasks.

- •

Limited integration with professional creative workflows (e.g., video, 3D).

- •

AI feature transparency can be less clear compared to Adobe's Firefly.

- •

Perceived as less 'professional' in traditional design agencies.

Differentiators

- •

Simplicity-first design philosophy.

- •

Template-driven workflow.

- •

Focus on team collaboration for marketing and business assets.

- →

Figma

Market Share Estimate:Dominant in the UI/UX design and product prototyping space.

Target Audience Overlap:Medium

Competitive Positioning:The collaborative interface design tool for teams.

Strengths

- •

Best-in-class real-time collaboration features.

- •

Web-based accessibility across all platforms.

- •

Strong community and extensive plugin ecosystem.

- •

Streamlined workflow from design to development (Dev Mode).

- •

Powerful AI-powered features for automating design tasks.

Weaknesses

- •

Niche focus on UI/UX, lacks the broad creative suite of Adobe.

- •

Less capable for complex vector illustration or photo manipulation compared to Illustrator/Photoshop.

- •

Offline capabilities are more limited than desktop-native applications.

Differentiators

- •

Collaboration-native architecture.

- •

Browser-first approach.

- •

Unified platform for design, prototyping, and developer handoff.

- →

Blackmagic Design (DaVinci Resolve)

Market Share Estimate:Growing, estimated around 15% of the video editing market, challenging Premiere Pro.

Target Audience Overlap:Medium

Competitive Positioning:The all-in-one solution for professional video editing, color correction, visual effects, and audio post-production.

Strengths

- •

Extremely powerful free version with professional-grade features.

- •

Industry-leading color grading capabilities.

- •

Integrated workflow (editing, color, VFX, audio) in a single application.

- •

One-time purchase for the 'Studio' version (no subscription).

Weaknesses

- •

Steeper learning curve compared to Premiere Pro for basic editing.

- •

Less seamless integration with graphic design and motion graphics tools (unlike Premiere Pro with Photoshop/After Effects).

- •

The user base, while passionate, is smaller than Adobe's.

Differentiators

- •

All-in-one post-production workflow.

- •

Legendary color science.

- •

Disruptive pricing model (powerful free tier and perpetual license).

- →

Salesforce

Market Share Estimate:Market leader in CRM, with a strong position in marketing automation, holding a slightly larger market share than Adobe in some campaign management segments.

Target Audience Overlap:High

Competitive Positioning:The #1 AI CRM for connecting with customers.

Strengths

- •

Dominant position in the CRM market provides a massive existing customer base.

- •

Strong AI capabilities (Einstein) integrated into workflows.

- •

Extensive ecosystem of third-party apps (AppExchange).

- •

Perceived as highly effective for B2C use cases.

Weaknesses

- •

Lacks the integrated content creation tools that Adobe Experience Cloud offers.

- •

Can require significant technical IT support to run effectively.

- •

Considered to have a steeper learning curve than some competitors.

- •

Complex and often higher pricing.

Differentiators

- •

CRM-centric approach to marketing.

- •

Unified customer data platform (Data Cloud).

- •

Strong focus on sales and service cloud integrations.

- →

DocuSign

Market Share Estimate:Market leader in the e-signature space.

Target Audience Overlap:High

Competitive Positioning:The trusted way to agree, with a focus on the entire agreement workflow.

Strengths

- •

Strong brand recognition and market leadership in e-signatures.

- •

Extensive library of over 400 integrations with other business systems.

- •

Focus on the entire contract lifecycle management, not just signatures.

- •

Perceived to have more advanced workflow automation than Adobe Sign.

Weaknesses

- •

Core focus is narrower than Adobe Document Cloud, which includes robust PDF editing.

- •

Pricing can be higher, with advanced integrations often requiring more expensive tiers.

- •

Less seamless integration with creative and marketing document workflows.

Differentiators

- •

Specialization and depth in e-signature and agreement automation.

- •

Broadest integration ecosystem for business processes.

- •

'Agreement Cloud' platform vision.

Indirect Competitors

- →

Generative AI Startups (e.g., Midjourney, Runway, ElevenLabs)

Description:Companies offering powerful, standalone, AI-native tools for specific creative tasks like image generation, video editing, and voice synthesis.

Threat Level:High

Potential For Direct Competition:High, as they could bundle services to create a competing creative suite.

- →

Open Source Software (e.g., Blender, GIMP, Krita)

Description:Free, community-developed software that provides powerful alternatives to Adobe's products, especially in 3D modeling (Blender) and image editing (GIMP).

Threat Level:Medium

Potential For Direct Competition:Low, they compete on price but lack the cohesive ecosystem, support, and enterprise focus of Adobe.

- →

Microsoft

Description:Microsoft competes indirectly through Office 365 (PowerPoint, Word), which serves basic design and document needs for businesses, and through its Azure cloud platform, which competes on an infrastructure level.

Threat Level:Medium

Potential For Direct Competition:Medium, especially if they more deeply integrate their AI Designer tools into the Office suite and Teams.

- →

Google

Description:Google competes with its Workspace suite (Docs, Slides) for document collaboration and with Google Analytics and Google Ads in the digital marketing space.

Threat Level:Medium

Potential For Direct Competition:Low in creative tools, but remains a major competitor in marketing analytics and advertising.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Integrated Ecosystem (Creative, Document, Experience Clouds)

Sustainability Assessment:Highly sustainable due to deep integration, established workflows, and high switching costs for professionals and enterprises.

Competitor Replication Difficulty:Hard

- Advantage:

Industry Standard Status & Brand Equity

Sustainability Assessment:Highly sustainable; file formats (.psd, .ai, .pdf) and product names (Photoshop) are industry vernacular, creating a powerful network effect.

Competitor Replication Difficulty:Hard

- Advantage:

Large, Loyal Professional User Base & Community

Sustainability Assessment:Sustainable, as this community provides extensive tutorials, plugins, and a hiring pool skilled in Adobe products, reinforcing its incumbent position.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'First-Mover Advantage in Deeply Integrated Generative AI (Firefly)', 'estimated_duration': '12-24 months'}

Disadvantages

- Disadvantage:

High Subscription Cost & Perceived 'Subscription Fatigue'

Impact:Major

Addressability:Moderately

- Disadvantage:

Product Complexity & Steep Learning Curve for Core Applications

Impact:Major

Addressability:Difficult

- Disadvantage:

Software Performance & 'Bloat'

Impact:Minor

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Launch aggressive marketing campaigns for Adobe Express targeting Canva's core user base, highlighting AI features and Creative Cloud integration.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Simplify Creative Cloud pricing tiers to reduce confusion and better showcase value for different user segments.

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Double down on AI-driven workflow automation, not just content generation, to significantly increase user productivity within the suite.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Develop a 'Creative Cloud Lite' subscription tier that bundles key simplified apps (Express, Rush, Photoshop on iPad) to better compete with Canva's pricing.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Acquire niche AI startups with unique technology that can be integrated into the core product suite to accelerate the innovation roadmap.

Expected Impact:High

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Invest in building a new, cloud-native, collaboration-first suite of professional tools to future-proof against competitors like Figma.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Expand the 'GenStudio' concept to create AI-powered, end-to-end solutions for specific enterprise verticals (e.g., pharmaceuticals, manufacturing) beyond marketing.

Expected Impact:High

Implementation Difficulty:Difficult

Position Adobe as the indispensable, AI-powered platform for professionals and enterprises, where serious creative and business outcomes are achieved through an integrated, end-to-end workflow.

Differentiate through the seamless integration of best-in-class, professional-grade applications with ethically sourced, production-ready generative AI, creating a powerful, defensible ecosystem that simpler tools cannot replicate.

Whitespace Opportunities

- Opportunity:

AI-Powered Creative Project Management

Competitive Gap:No existing platform effectively integrates project management with a deep understanding of creative assets. A tool could analyze assets, automate versioning, suggest workflows, and generate client-ready reports.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Simplified, Collaborative 3D for Marketing Teams

Competitive Gap:A gap exists between complex 3D tools (like Substance 3D) and simple 2D design tools (like Canva). An offering for marketers to easily create and customize 3D product mockups for campaigns is needed.

Feasibility:High

Potential Impact:Medium

- Opportunity:

Interactive Content Creation Suite for Education

Competitive Gap:While Canva is strong in education, there is an opportunity for a suite focused on creating interactive learning materials, leveraging Adobe's capabilities in animation, video, and PDF forms.

Feasibility:Medium

Potential Impact:Medium

Adobe operates from a position of immense strength, anchored by a mature, oligopolistic market in professional creative software. Its primary competitive advantage is a deeply integrated ecosystem spanning creation (Creative Cloud), documents (Document Cloud), and marketing (Experience Cloud), which creates high switching costs and reinforces its status as the industry standard. However, the competitive landscape is being reshaped by two powerful forces: the demand for simplicity and the rise of generative AI.

Direct competitors like Canva and Figma are effectively 'unbundling' the creative suite, capturing large user segments with more accessible, collaborative, and often more affordable web-based tools. Canva poses a significant threat to Adobe's growth in the SMB and non-professional creator market, while Figma has become the dominant force in the high-value UI/UX design space. In video, Blackmagic Design's DaVinci Resolve presents a disruptive challenge with its powerful free version and perpetual license model, directly attacking Premiere Pro's subscription revenue. In the enterprise space, Adobe faces stiff competition from giants like Salesforce, who leverage their CRM dominance to offer compelling marketing automation platforms.

The primary disruptive threat comes from a new wave of AI-native startups. These agile competitors are building tools from the ground up around generative AI, potentially leapfrogging Adobe's capabilities in specific areas. Adobe's strategic response, Firefly, has been strong, integrating generative AI directly into its existing, dominant applications. This is a powerful defensive move, leveraging its ecosystem as a key differentiator.

Adobe's key disadvantages are its high price point and the complexity of its professional software, which created the market gap that competitors like Canva have exploited. Future success will depend on a dual strategy: first, defending its professional core by continuing to integrate cutting-edge AI and enhancing collaborative workflows; and second, aggressively competing for the mass market by simplifying its offerings and effectively marketing its accessible tools like Adobe Express. The primary strategic whitespace lies in bridging the gap between simple content creation and complex professional workflows, particularly through AI-powered automation and specialized tools for enterprise verticals.

Messaging

Message Architecture

Key Messages

- Message:

Everything you need to make anything.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero

- Message:

Bring any idea to life with products for creators, businesses, and beyond.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Sub-headline

- Message:

Start your Creative Cloud free trial.

Prominence:Secondary

Clarity Score:High

Location:Creative Cloud Page Hero

- Message:

20+ creative apps. Infinite possibilities.

Prominence:Secondary

Clarity Score:High

Location:Creative Cloud Page

- Message:

Students, get a month of Creative Cloud Pro on us.

Prominence:Tertiary

Clarity Score:High

Location:Homepage Promotional Banner

- Message:

Empower marketing teams. Generate high-performing on-brand campaign content.

Prominence:Tertiary

Clarity Score:Medium

Location:Homepage - GenStudio Section

The message hierarchy is effective but heavily skewed towards the individual creator. The primary message, 'Everything you need to make anything,' is broad and aspirational, successfully capturing the brand's core mission. This is supported by funneling users into specific product categories (Creative Cloud, Acrobat) and audience segments (Students). However, messages for business and enterprise customers are tertiary and appear much further down the page, potentially causing these high-value segments to feel underserved by the initial impression.

Messaging is highly consistent within the 'creator' and 'individual user' funnels. The aspirational and empowering language of the homepage is carried through to the Creative Cloud page, which logically breaks down the 'anything' into tangible apps and possibilities. There's a slight disconnect between the all-encompassing 'make anything' message and the very specific, solution-oriented message for 'Performance Marketing,' suggesting a different messaging strategy is employed for B2B products.

Brand Voice

Voice Attributes

- Attribute:

Empowering

Strength:Strong

Examples

- •

Bring any idea to life...

- •

Amazing apps. Endless possibilities.

- •

Empower marketing teams.

- Attribute:

Innovative

Strength:Strong

Examples

- •

Your all-in one AI content creation app.

- •

Create beautiful images in just a few words.

- •

Now with precise selections, instant color adjustments, and more.

- Attribute:

Accessible

Strength:Moderate

Examples

- •

Start your Creative Cloud free trial.

- •

See plans for students and teachers...

- •

Online PDF tools

- Attribute:

Professional

Strength:Strong

Examples

- •

Creative Cloud for business

- •

Work faster in Photoshop.

- •

Trusted PDF tools in one place.

Tone Analysis

Inspirational

Secondary Tones

- •

Promotional

- •

Educational

- •

Action-Oriented

Tone Shifts

- •

Shifts from broad, inspirational language in headlines ('Endless possibilities') to more direct, benefit-driven language in product descriptions ('Work faster...').

- •

Adopts a promotional and urgent tone for specific offers ('LIMITED-TIME OFFER... Ends Sep 1.').

- •

Becomes more functional and educational in the FAQ and 'More than great apps' sections.

Voice Consistency Rating

Good

Consistency Issues

The voice is highly consistent for the Creative Cloud and Document Cloud offerings targeting individuals and creative professionals. The tone for enterprise-level products like 'GenStudio' feels more corporate and less inspirational, which is appropriate for the audience but creates a slight voice fragmentation on the homepage.

Value Proposition Assessment

Adobe provides an integrated, industry-standard ecosystem of creative and digital document tools, supercharged by AI, that empowers everyone from individual creators to global enterprises to bring any digital experience to life.

Value Proposition Components

- Component:

Comprehensive Suite of Tools

Clarity:Clear

Uniqueness:Unique

Examples

20+ creative apps. Infinite possibilities.

- Component:

AI-Powered Innovation

Clarity:Clear

Uniqueness:Somewhat Unique

Examples

Adobe Firefly creative AI for images, video, and audio.

Your all-in one AI content creation app.

- Component:

Industry Standard & Professional Grade

Clarity:Clear

Uniqueness:Unique

Examples

Work faster in Photoshop.

Trusted PDF tools...

- Component:

Cross-Device & Cloud Integration

Clarity:Somewhat Clear

Uniqueness:Somewhat Unique

Examples

Get the complete toolkit for creativity...

Creative ways to collaborate

- Component:

Community & Learning Resources

Clarity:Clear

Uniqueness:Somewhat Unique

Examples

Membership perks include tutorials, fonts, templates, and more.

Behance — Show your stuff and see what others are doing

Adobe's primary differentiation lies in its comprehensive, integrated ecosystem of professional-grade tools. While competitors like Canva focus on simplicity or Affinity on a one-time purchase model, Adobe's value is in being the all-in-one, industry-standard solution where different powerful apps work together. The recent aggressive integration of generative AI (Firefly) is a key new differentiator, positioning Adobe not just as a tool provider but as an innovative partner in the creative process.

The messaging positions Adobe as the undisputed market leader and the gold standard for creative professionals. It simultaneously works to democratize creativity through accessible tools like Adobe Express and student pricing, addressing competition from more user-friendly platforms. The enterprise messaging for GenStudio positions Adobe as a strategic partner for business growth, moving beyond just creative tools to content supply chain optimization.

Audience Messaging

Target Personas

- Persona:

Students & Educators

Tailored Messages

- •

Students, get a month of Creative Cloud Pro on us.

- •

Plus save 57% for the first year.

- •

See plans for students and teachers

Effectiveness:Effective

- Persona:

Individual Creators (Photographers, Designers, etc.)

Tailored Messages

- •

Everything you need to make anything.

- •

20+ creative apps. Infinite possibilities.

- •

Combine, retouch, and remix your pics.

Effectiveness:Effective

- Persona:

Small & Medium Businesses (SMBs)

Tailored Messages

Creative Cloud for business

See plans for... small and medium businesses.

Effectiveness:Somewhat

- Persona:

Enterprise Marketing Teams

Tailored Messages

- •

Adobe GenStudio for Performance Marketing

- •

Empower marketing teams.

- •

Generate high-performing on-brand campaign content.

Effectiveness:Somewhat

Audience Pain Points Addressed

- •

Need for a wide range of powerful, professional tools

- •

Pressure to create high-quality content quickly ('Work faster', 'Even faster')

- •

Managing complex document workflows ('Create, edit, review, and sign PDFs')

- •

Budget constraints for students and individuals ('LIMITED-TIME OFFER', 'Student pricing')

Audience Aspirations Addressed

- •

Bringing creative ideas to life ('Bring any idea to life')

- •

Achieving professional results ('Create something beautiful')

- •

Boosting productivity

- •

Gaining recognition within a creative community ('Show your stuff')

Persuasion Elements

Emotional Appeals

- Appeal Type:

Aspiration & Empowerment

Effectiveness:High

Examples

- •

Everything you need to make anything.

- •

Endless possibilities.

- •

Bring any idea to life.

- Appeal Type:

Curiosity & Innovation

Effectiveness:Medium

Examples

Meet the new Acrobat Studio.

Create beautiful images in just a few words.

Social Proof Elements

- Proof Type:

Media Mentions / Authority

Impact:Moderate

Examples

'In the news' section highlighting new product launches and partnerships.

- Proof Type:

Community

Impact:Strong

Examples

Mentions of Behance, Adobe Live, and Adobe MAX create a sense of a large, active user community.

Trust Indicators

- •

Strong, globally recognized brand name

- •

Clear links to pricing and terms ('See terms', 'View plans and pricing')

- •

Showcasing partnerships with major companies like Meta

Scarcity Urgency Tactics

LIMITED-TIME OFFER

Ends Sep 1.

Calls To Action

Primary Ctas

- Text:

See all plans

Location:Homepage Hero

Clarity:Clear

- Text:

Save now

Location:Homepage Student Offer

Clarity:Clear

- Text:

Learn more

Location:Multiple Product Sections

Clarity:Clear

- Text:

Try now

Location:Adobe Express Section

Clarity:Clear

- Text:

Buy now

Location:Creative Cloud Pricing Section

Clarity:Clear

- Text:

Register now

Location:Adobe MAX Section

Clarity:Clear

The CTAs are highly effective. They are clear, concise, and use a strong action verb. There is a good mix of low-commitment CTAs ('Learn more') and high-commitment CTAs ('Buy now', 'Save now'), guiding users through the funnel appropriately. The design and placement of the CTAs give them high visibility.

Messaging Gaps Analysis

Critical Gaps

The homepage lacks a clear, prominent entry point for business/enterprise customers. The value proposition for Adobe's other major divisions, like the Experience Cloud, is not represented in the primary messaging.

The message of synergy between the different product clouds (e.g., how Creative Cloud assets seamlessly flow into Experience Manager for marketing campaigns) is a major missed opportunity on the homepage.

Contradiction Points

There's a subtle tension between the 'for everyone' message ('make anything') and the clear positioning as the 'professional standard'. While managed through product segmentation (e.g., Express vs. Photoshop), the initial message might be too broad to resonate strongly with high-end enterprise buyers looking for specific solutions.

Underdeveloped Areas

Storytelling is underdeveloped on the homepage. While it mentions creating things, it doesn't show compelling customer success stories or case studies that would bring the 'make anything' promise to life.

Messaging around the value of the subscription model itself (continuous updates, access to new features like AI, cloud services) could be more explicit, especially on the Creative Cloud page, to counter competitors with one-time purchase models.

Messaging Quality

Strengths

- •

Strong, aspirational, and empowering core message that captures the essence of creativity.

- •

Clear segmentation of products and plans for individuals, especially within the Creative Cloud page.

- •

Effective use of benefit-oriented headlines for specific products ('Work faster in Photoshop').

- •

Excellent brand voice that is both professional and inspiring.

Weaknesses

- •

Over-emphasis on the creative/individual user on the main homepage, potentially alienating large business and enterprise visitors.

- •

Lack of clear narrative connecting the different parts of the Adobe ecosystem.

- •

Relies heavily on brand recognition rather than explicitly stating competitive advantages like ecosystem integration.

Opportunities

- •

Create distinct homepage journeys or prominent navigation paths for different core audiences (Individual, SMB, Enterprise) to deliver more relevant messaging upfront.

- •

Develop a stronger narrative around the 'Content Supply Chain', showing how Adobe is the only company that can manage the entire lifecycle of digital content from creation to delivery and analytics.

- •

Integrate more customer storytelling and visual case studies to provide concrete proof of the value proposition.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Audience Segmentation

Recommendation:Implement a clear navigational choice or distinct content blocks near the top of the homepage for 'Individuals/Creators', 'Business', and 'Enterprise' audiences to guide them to relevant value propositions and products immediately.

Expected Impact:High

- Area:

Ecosystem Value Proposition

Recommendation:Craft and feature a key message and visual that explains the power of the integrated Adobe ecosystem. For example: 'From first spark to final sale, one seamless platform for your entire content workflow.'

Expected Impact:High

- Area:

Customer Storytelling

Recommendation:Replace one of the generic product feature blocks on the homepage with a dynamic customer success story module, showcasing incredible work created with Adobe tools, with links to a more detailed case study.

Expected Impact:Medium

Quick Wins

- •

Add a 'For Business' link directly in the hero section of the homepage.

- •

A/B test the main headline 'Everything you need to make anything' against a more benefit-focused alternative, such as 'The future of creativity is here. And you're in control.'

- •

Make the 'Creative Cloud for business' CTA more prominent.

Long Term Recommendations

- •

Develop a unified messaging framework that clearly articulates the value proposition of each Cloud (Creative, Document, Experience) and how they work together to power digital business.

- •

Invest in creating more persona-based content journeys that guide different users (e.g., a marketing manager vs. a video editor) through a curated experience on the site.

- •

Shift from a product-centric to a solution-centric messaging approach, especially for business audiences, focusing on outcomes like 'Accelerate Content Velocity' or 'Deliver Personalization at Scale'.

Adobe's strategic messaging is masterful in capturing the spirit of creativity and empowering its core audience of individuals and creative professionals. The primary message, 'Everything you need to make anything,' is broad, aspirational, and effectively positions the Creative Cloud as the ultimate toolkit. The brand voice is consistent, inspiring, and professional, building on decades of market leadership. Persuasion techniques are well-executed, with clear CTAs, trust indicators, and effective use of promotional offers for specific segments like students.

The primary weakness in the current strategy is its homepage's heavy skew towards the individual creator. This focus risks undervaluing and potentially alienating the equally important business and enterprise segments, whose needs and buying criteria are fundamentally different. While Adobe has powerful offerings for these audiences, such as Experience Cloud and GenStudio , their value propositions are relegated to secondary or tertiary positions. This creates a messaging gap where the full, integrated power of the Adobe ecosystem—its most significant competitive advantage —is not clearly articulated. The website communicates the strength of its individual products but misses the larger, more powerful story of how these products connect to form a singular platform for digital transformation. To optimize, Adobe should evolve its homepage messaging to create clearer pathways for its key audience segments and elevate the narrative to focus on the unique, integrated power of its entire ecosystem.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Dominant market share in core creative professional segments (e.g., Photoshop, Premiere Pro).

- •

Revenue of $22.60 billion in the last twelve months, with consistent ~11% year-over-year growth, indicating strong, ongoing demand.

- •

Transitioned a massive user base from perpetual licenses to a recurring revenue subscription model (SaaS), which now accounts for over 94% of revenue.

- •

Industry-standard file formats (.PSD, .AI, .PDF) create high switching costs and network effects.

- •

Large, active user community and third-party ecosystem (e.g., Behance, plugins, tutorials) that reinforces its market position.

Improvement Areas

- •

Simplify user experience for entry-level and SMB users to better compete with challengers like Canva.

- •

Enhance web-based and collaborative features to counter the appeal of cloud-native competitors like Figma.

- •

Improve monetization and value proposition of generative AI (Firefly) to justify premium pricing and drive upgrades.

Market Dynamics

Digital Content Creation Market: ~13-14% CAGR. Digital Experience Platform (DXP) Market: ~11-13% CAGR.

Mature

Market Trends

- Trend:

Generative AI Integration

Business Impact:Massive opportunity to create a new competitive moat and drive upgrades; also a threat as AI-native startups emerge. Adobe's Firefly is a strategic response.

- Trend:

Rise of the Creator Economy & SMBs

Business Impact:Expands the total addressable market beyond creative professionals but requires simpler, more accessible tools (e.g., Adobe Express) to capture.

- Trend:

Demand for Personalized Digital Experiences

Business Impact:Drives growth for the Adobe Experience Cloud, putting it in competition with Salesforce, Oracle, and others in the enterprise DXP space.

- Trend:

Shift to Cloud-Native and Collaborative Workflows

Business Impact:Creates pressure to re-architect legacy desktop applications for the web and improve real-time collaboration features across the suite.

Critical. The generative AI wave represents both the single largest growth opportunity and a significant disruptive threat. Adobe's market leadership depends on its ability to successfully integrate AI across its product ecosystem faster and more effectively than competitors.

Business Model Scalability

High

Highly scalable SaaS model with high gross margins (consistently over 80%). The cost of serving an additional customer is minimal.

Strong. As a mature software company, Adobe has significant operational leverage. Revenue growth from subscriptions directly impacts profitability with minimal incremental operational cost.

Scalability Constraints

- •

Market saturation in core professional segments, leading to decelerating revenue growth from ~20%+ to 10-12% YoY.

- •

Complexity of managing a vast, and sometimes fragmented, product portfolio.

- •

High price points for the full Creative Cloud suite can be a barrier for individuals and small businesses, limiting penetration in high-growth, lower-spend segments.

Team Readiness

Very Strong. Experienced leadership team that has successfully navigated the massive shift from perpetual licenses to a cloud-based subscription model.

Mature but complex. The organization is structured around its three core clouds (Creative, Document, Experience). The key challenge is fostering cross-cloud innovation and agility to respond to nimble competitors.

Key Capability Gaps

- •

Agility in product development to rapidly iterate on web-first, simplified products for the creator economy.

- •

Deepening expertise in vertical-specific enterprise solutions to compete more effectively with players like Salesforce in the Experience Cloud market.

- •

Talent acquisition in the hyper-competitive generative AI research and engineering space.

Growth Engine

Acquisition Channels

- Channel:

Direct & Organic Search

Effectiveness:High

Optimization Potential:Medium

Recommendation:Leverage strong brand equity to create more content targeting long-tail keywords related to generative AI use cases and competitor comparisons (e.g., 'Adobe Firefly vs. Midjourney').

- Channel:

Freemium & Free Trials

Effectiveness:High

Optimization Potential:High

Recommendation:Optimize the user journey from free tools like Adobe Express and Acrobat Reader to paid single-app or full Creative Cloud subscriptions. Focus on showcasing AI-powered features as a key upgrade incentive.

- Channel:

Enterprise Sales

Effectiveness:High

Optimization Potential:Medium

Recommendation:Focus on cross-selling and bundling Creative Cloud, Document Cloud, and Experience Cloud solutions for large enterprise customers to increase deal size and create a more integrated platform offering.

- Channel:

Paid Advertising

Effectiveness:Medium

Optimization Potential:High

Recommendation:Shift budget towards campaigns targeting non-professional creators and SMBs, emphasizing the simplicity and AI power of Adobe Express to compete with Canva.

Customer Journey

Well-defined multi-path journey: Free trials for pro tools, freemium access via Adobe Express and Acrobat, and enterprise sales motions. Clear up-sell and cross-sell paths are in place.

Friction Points

- •

The complexity and perceived steep learning curve of professional applications like Photoshop and Premiere Pro can deter new users.

- •

Price sensitivity, especially for the full Creative Cloud Pro subscription, for individual creators and small businesses.

- •

Navigating the vast ecosystem of different apps and services can be overwhelming for newcomers.

Journey Enhancement Priorities

{'area': 'Onboarding', 'recommendation': 'Develop highly personalized, AI-driven onboarding flows that guide new users based on their stated goals and skill level, especially for those starting with free trials.'}

{'area': 'Freemium-to-Paid Conversion', 'recommendation': 'Embed more compelling AI features from premium apps into the free versions (with usage limits) to clearly demonstrate the value of upgrading.'}

Retention Mechanisms

- Mechanism:

High Switching Costs

Effectiveness:High

Improvement Opportunity:Continue to build out cloud-based asset libraries and collaborative features that lock users and teams into the Adobe ecosystem, making it harder to migrate projects and workflows elsewhere.

- Mechanism:

Ecosystem & Network Effects

Effectiveness:High

Improvement Opportunity:Further integrate Behance and Frame.io into core creative workflows to strengthen the community and collaborative feedback loops, increasing the platform's stickiness.

- Mechanism:

Continuous Innovation

Effectiveness:High

Improvement Opportunity:Maintain a rapid pace of innovation, especially in generative AI. The integration of Firefly across the suite is the single most important retention driver currently.

Revenue Economics

Very Strong. The SaaS model with high gross margins ensures excellent per-customer profitability. A significant portion of revenue is recurring and predictable.

Estimated to be very high for its core professional user base due to high retention, strong pricing power, and mature, efficient acquisition channels.

High. Adobe demonstrates strong revenue generation relative to its operational costs, evidenced by its robust operating margins and cash flow.

Optimization Recommendations

- •

Develop tiered pricing for generative AI features (e.g., generative credit packs) to increase Average Revenue Per User (ARPU).

- •

Drive adoption of the new, higher-priced 'Creative Cloud Pro' plan by highlighting exclusive AI and collaboration features.

- •

Create bundled offerings for SMBs that combine elements of Creative, Document, and Experience Clouds at an accessible price point.

Scale Barriers

Technical Limitations

- Limitation:

Legacy Desktop-First Architecture

Impact:Medium

Solution Approach:Continue investing heavily in re-architecting core applications for web-first, collaborative environments to match the user experience of cloud-native competitors.

- Limitation:

Seamless Cross-Cloud Integration

Impact:Medium

Solution Approach:Deepen the technical integration between Creative Cloud, Document Cloud, and Experience Cloud to deliver on the promise of a unified content supply chain for enterprise customers.

Operational Bottlenecks

- Bottleneck:

Organizational Silos

Growth Impact:Can slow down the consistent implementation of strategic initiatives, like generative AI, across the entire product portfolio.

Resolution Strategy:Empower cross-functional, mission-oriented teams (e.g., an 'AI Growth Team') with the authority to drive initiatives horizontally across the organization.

- Bottleneck:

Go-to-Market for New Segments

Growth Impact:The existing sales and marketing engine, optimized for creative professionals and enterprises, may not be suited to efficiently capture the high-volume, low-spend creator economy.

Resolution Strategy:Build out a dedicated, product-led growth (PLG) team focused exclusively on the Adobe Express user base and the SMB market.

Market Penetration Challenges

- Challenge:

Intensifying Competition in Simplified Creative Tools

Severity:Critical

Mitigation Strategy:Aggressively invest in Adobe Express, focusing on ease of use, AI-powered workflows, and freemium acquisition funnels to directly challenge Canva's market position.

- Challenge:

Market Saturation in Core Professional Markets

Severity:Major

Mitigation Strategy:Focus on increasing ARPU through new AI-powered services and higher-tier plans rather than solely on new user acquisition. Drive expansion into adjacent professional domains like 3D and immersive design.

- Challenge:

Enterprise DXP Competition

Severity:Major

Mitigation Strategy:Leverage Adobe's unique advantage in content creation (Creative Cloud) as a key differentiator for its Experience Cloud offering, providing an end-to-end solution from creation to personalization that competitors like Salesforce cannot match.

Resource Limitations

Talent Gaps

- •

Top-tier AI/ML research scientists and engineers.

- •

Product managers with deep experience in product-led growth (PLG) models.

- •

Enterprise sales executives with expertise in specific verticals (e.g., healthcare, finance) for the Experience Cloud.

Low. The company generates substantial free cash flow ($8.06 billion in FY24) and does not have significant capital constraints for organic growth initiatives.

Infrastructure Needs

Continued investment in scalable cloud infrastructure to power compute-intensive generative AI models.

Expansion of data center capacity in emerging markets to support global growth and ensure low-latency performance.

Growth Opportunities

Market Expansion

- Expansion Vector:

Small and Medium Businesses (SMBs)

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Create tailored subscription bundles that combine Adobe Express, Acrobat, and light versions of professional tools with simple administration and billing.

- Expansion Vector:

The Creator Economy (Social Media Creators, Influencers)

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Lead with a mobile-first strategy for Adobe Express and Premiere Rush, integrating features that streamline social media content creation, scheduling, and publishing.

- Expansion Vector:

Geographic Expansion in Asia-Pacific

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Develop localized pricing, marketing campaigns, and product features. Establish strategic partnerships with regional tech companies and educational institutions.

Product Opportunities

- Opportunity:

Generative Video and Audio (Firefly)

Market Demand Evidence:Explosive interest in generative AI for multimedia content creation, driven by platforms like OpenAI's Sora and RunwayML.

Strategic Fit:High. A natural extension of Adobe's dominance in video (Premiere Pro) and audio (Audition) editing.

Development Recommendation:Accelerate R&D and integrate Firefly-powered video/audio generation and editing features directly into Premiere Pro and Adobe Express.

- Opportunity:

AI-Powered Enterprise Content Supply Chain

Market Demand Evidence:Enterprises struggle to create on-brand content at the scale required for personalized marketing.

Strategic Fit:High. Connects the value propositions of Creative Cloud, Document Cloud, and Experience Cloud.

Development Recommendation:Launch an integrated 'GenStudio' offering that allows marketing teams to generate, manage, and deploy on-brand content at scale, using Firefly trained on their own brand assets.

- Opportunity:

Immersive and 3D Design Tools

Market Demand Evidence:Growing demand for 3D content for gaming, e-commerce, and the metaverse. The partnership with Meta for Substance 3D Reviewer is a key indicator.

Strategic Fit:High. Leverages the existing Substance 3D product line and integrates with Photoshop and Illustrator.

Development Recommendation:Deepen integrations between 2D and 3D workflows and build simpler tools for non-experts to create and use 3D assets.

Channel Diversification

- Channel:

Embedded/API-first Offering

Fit Assessment:High

Implementation Strategy:Offer Firefly and core editing capabilities as APIs that other platforms (e.g., e-commerce sites, marketing automation tools) can embed, creating a new B2B revenue stream.

- Channel:

Hardware Bundling

Fit Assessment:Medium

Implementation Strategy:Expand partnerships with OEMs like Microsoft, Apple, and Nvidia to pre-install or offer bundled subscriptions to Creative Cloud on devices targeted at creative professionals.

Strategic Partnerships

- Partnership Type:

AI & Cloud Infrastructure

Potential Partners

- •

Nvidia

- •

Microsoft Azure

- •

Google Cloud

Expected Benefits:Ensure access to state-of-the-art GPU infrastructure for training and running AI models. Co-marketing opportunities to enterprise customers.

- Partnership Type:

Platform Integration

Potential Partners

- •

Microsoft (Teams, Office 365)

- •

Google (Workspace)

- •

Salesforce

Expected Benefits:Embed Adobe's creative and document workflows directly into the productivity and CRM platforms where business users spend their time, increasing usage and stickiness.

- Partnership Type:

Vertical-Specific Software

Potential Partners

- •

Veeva (Life Sciences)

- •

Shopify (E-commerce)

- •

Autodesk (AEC & Manufacturing)

Expected Benefits:Create integrated solutions for specific industries, using Adobe's tools as the creative engine within specialized vertical platforms.

Growth Strategy

North Star Metric

Weekly Active Creators using AI Features

This metric shifts focus from simply acquiring/retaining subscribers to driving deep, valuable engagement with Adobe's most strategic technology (Generative AI). It measures adoption of the key differentiator, correlates with perceived value, and acts as a leading indicator for retention and upgrades.

Increase by 50% over the next 12 months.

Growth Model

Hybrid: Product-Led Growth (PLG) + Sales-Led Growth (SLG)

Key Drivers

- •

PLG: Freemium offerings (Adobe Express), free trials, and self-serve upgrades for individuals and SMBs.

- •

SLG: Enterprise sales teams driving large, multi-year deals for integrated cloud solutions.

- •

Innovation Flywheel: New AI features drive user engagement, which generates data to improve the AI, which creates better features, reinforcing the cycle.

Invest in a dedicated PLG organization to optimize the freemium funnel, while simultaneously equipping the enterprise sales team with training and collateral to sell the integrated 'Content Supply Chain' vision.

Prioritized Initiatives

- Initiative:

Accelerate Adobe Express as a 'Canva Killer'

Expected Impact:High

Implementation Effort:High

Timeframe:12-18 months

First Steps:Launch an aggressive performance marketing campaign focused on SMBs and creators. Double the R&D team for Express, with a mandate to simplify workflows and integrate best-in-class AI features.

- Initiative:

Monetize Firefly with Enterprise-Grade Features

Expected Impact:High

Implementation Effort:Medium

Timeframe:6-9 months

First Steps:Launch 'Firefly for Business' allowing enterprises to train the model on their own brand assets for commercially safe, on-brand content generation. Price this as a premium add-on to Creative Cloud for Business.

- Initiative:

Launch Vertical-Specific Solution Bundles

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:9-12 months

First Steps:Create a bundled solution for e-commerce retailers that combines Photoshop, Adobe Express (for social content), Substance 3D (for product visuals), and Adobe Experience Manager (for site content).

Experimentation Plan

High Leverage Tests

- Test Name:

AI Credit vs. Unlimited Tiers

Hypothesis:A consumption-based model for generative AI credits will drive higher ARPU than a flat 'unlimited' tier for heavy users.

Area:Pricing & Packaging

- Test Name:

Simplified UI for Photoshop

Hypothesis:An optional, simplified user interface for Photoshop targeted at casual users will increase activation and retention for single-app subscribers.

Area:Product/Onboarding

- Test Name:

Cross-Cloud Upsell Prompts

Hypothesis:Triggering in-app prompts in Creative Cloud about Experience Cloud analytics when a user exports marketing assets will increase qualified enterprise leads.

Area:Cross-Sell

Utilize a standard framework (e.g., A/B testing platform) to measure impact on key metrics: conversion rate, ARPU, feature adoption rate, and churn.

Run concurrent experiments across product, marketing, and sales teams on a bi-weekly sprint cycle.

Growth Team

A hybrid model: A central 'Growth Strategy' team that sets the North Star and identifies macro opportunities, alongside embedded 'Growth Pods' within each major product line (e.g., Express, Photoshop, Experience Cloud) responsible for execution and experimentation.

Key Roles

- •