eScore

aflac.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Aflac's digital presence is anchored by immense brand authority and recognition, making its branded search performance nearly absolute. The website effectively segments users and provides clear pathways for its core audiences. However, its overall intelligence is moderated by underdeveloped top-of-funnel content, leading to weaker performance in non-branded, problem-aware search queries where it faces intense competition.

Exceptional brand authority driven by the iconic Aflac Duck mascot results in dominant branded search visibility and high baseline traffic.

Develop a robust content strategy around broader financial wellness topics to capture users at the awareness stage of their journey, improving non-branded organic search performance.

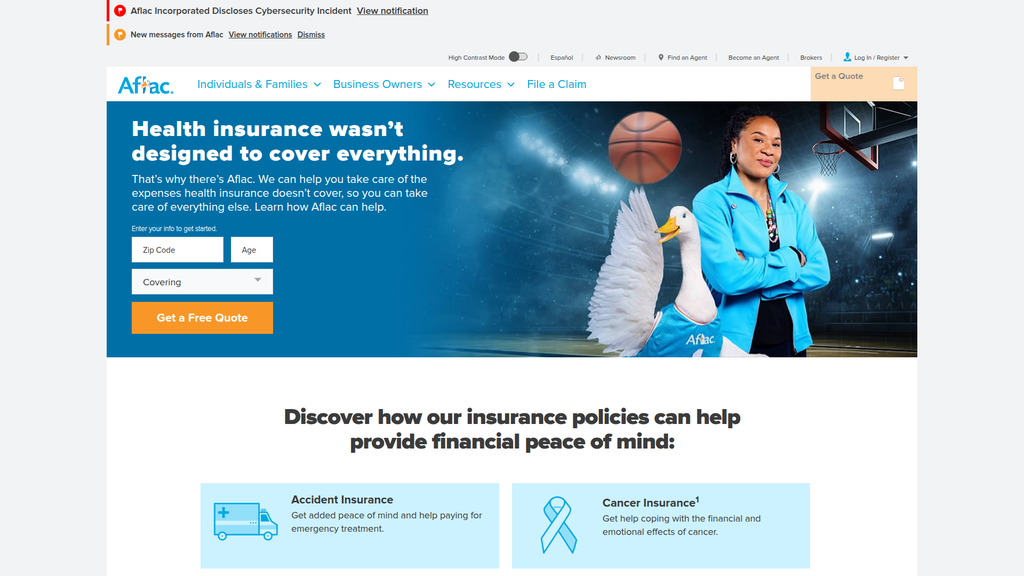

The core value proposition—'Health insurance doesn’t cover everything'—is communicated with exceptional clarity and consistency. The brand voice is consistently empathetic and caring, reinforced by purpose-driven marketing like the 'Check for Cancer' campaign. Effectiveness is slightly diminished by a flawed homepage message hierarchy, where policyholder notifications often obscure the primary marketing message for new visitors.

The core value proposition is remarkably clear, simple, and effectively addresses a key customer pain point regarding gaps in primary health insurance.

Redesign the homepage notification system to be less intrusive, such as a single, dismissible banner, to ensure the primary value proposition and conversion CTAs are the first elements a new visitor sees.

The website provides a solid foundation with excellent mobile responsiveness, clear navigation, and effective audience segmentation through CTAs. However, the conversion experience is hampered by clear friction points, including inconsistent CTA designs, moderate cognitive load from text-heavy pages, and ambiguous UI patterns on key forms. These issues indicate a design system that is still developing and not fully optimized for a seamless user journey.

The site's excellent mobile responsiveness ensures a seamless and intuitive experience for users on smartphones and tablets, which is critical for on-the-go research and interaction.

Standardize the entire Call-to-Action (CTA) component system with a clear visual hierarchy (e.g., Primary, Secondary, Tertiary styles) and apply it consistently to reduce user cognitive load and improve conversion path clarity.

Aflac has historically strong credibility from its brand longevity, social responsibility initiatives, and proactive accessibility compliance. However, the recent disclosure of a significant cybersecurity incident severely undermines this trust, exposing a critical gap between stated data security policies and their effective implementation. While the company's transparent disclosure is a positive step, the breach itself introduces high-severity risks related to data security, regulatory scrutiny, and brand reputation, heavily weighing down the score.

A strong, visible commitment to web accessibility (WCAG/ADA compliance) broadens market access and mitigates legal risk while enhancing the brand's reputation for inclusivity.

Execute a comprehensive, third-party cybersecurity audit and launch a proactive public relations campaign focused on rebuilding trust by clearly communicating the remediation steps taken and enhanced security measures implemented.

Aflac's competitive advantage is exceptionally strong and sustainable, forming a deep moat around its business. This is built on the trifecta of unparalleled brand recognition from the Aflac Duck, a vast and deeply entrenched worksite distribution network of agents, and significant economies of scale as a market leader. These advantages are extremely difficult and costly for competitors to replicate, giving Aflac a durable position of market power.

The iconic Aflac Duck mascot has created unparalleled brand recognition (over 90%), which serves as a massive and highly sustainable competitive advantage in a crowded market.

Address the primary disadvantage of over-reliance on the traditional agent-based sales model by investing in and scaling a robust direct-to-consumer (DTC) digital sales channel to counter insurtech disruptors.

As a mature market leader, Aflac's business model is proven and profitable, but its scalability is constrained by a partial reliance on a high-touch agent network. Significant expansion potential exists in untapped digital channels and underserved markets like the gig economy. However, realizing this potential is hampered by operational bottlenecks such as legacy IT infrastructure and potential channel conflict, which must be addressed to unlock faster growth.

The core insurance product and back-end administrative functions are inherently scalable, supported by a strong financial position that allows for investment in new growth initiatives.

Develop and aggressively market a suite of flexible, portable insurance products specifically designed for the growing gig economy and self-employed workforce, accessible through a fully digital purchasing process.

Aflac's business model is exceptionally coherent and time-tested, with a clear value proposition that directly aligns with its target segments' needs. Its dual revenue streams of premiums and investment income are stable and highly effective. The strategic focus on the worksite sales channel has been historically successful, though a slower adaptation to digital-first trends represents a minor weakness in market timing.

The worksite distribution model, which utilizes payroll deduction, is a highly effective and coherent strategy that enhances premium collection efficiency and increases policyholder retention.

Accelerate investment in the direct-to-consumer (DTC) channel to better align with the market trend of consumers seeking self-service and digital purchasing options, thus improving market timing.

Aflac wields significant market power as the dominant leader in the U.S. supplemental insurance market and a major player in Japan. This leadership, combined with immense brand recognition, grants the company considerable pricing power and influence over industry trends. While revenue growth has been steady rather than spectacular, its market share is stable and defensible, though it faces increasing competition from both large insurers and agile insurtech startups.

Dominant market share in its core supplemental insurance category provides significant economies of scale, extensive underwriting data, and substantial influence within the employee benefits industry.

Mitigate customer dependency risk by diversifying revenue streams more aggressively into the direct-to-consumer market, reducing over-reliance on the employer-based worksite channel.

Business Overview

Business Classification

Insurance Provider

Financial Services

Insurance

Sub Verticals

- •

Supplemental Health Insurance

- •

Life Insurance

- •

Worksite/Voluntary Benefits

Mature

Maturity Indicators

- •

Established in 1955, demonstrating a long and stable operating history.

- •

Iconic brand recognition (Aflac Duck) in primary markets (U.S. and Japan).

- •

Consistent payment of dividends, often referred to as a 'dividend aristocrat'.

- •

Large-scale operations with over 50 million people insured worldwide.

- •

Ranked 137th on the Fortune 500 list, indicating significant revenue and market presence.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Insurance Premiums

Description:The primary revenue source, generated from recurring premium payments by policyholders for a diverse range of supplemental insurance products (e.g., accident, cancer, critical illness, dental, life). These are sold to both individuals and groups.

Estimated Importance:Primary

Customer Segment:Individuals and Businesses (via worksite)

Estimated Margin:Medium

- Stream Name:

Investment Income

Description:Significant revenue is generated by investing the 'float' – the premiums collected from policyholders that have not yet been paid out as claims. This capital is invested in various financial instruments to generate returns.

Estimated Importance:Secondary

Customer Segment:N/A (Internal financial operation)

Estimated Margin:High

Recurring Revenue Components

Monthly/Quarterly/Annual policy premiums

Pricing Strategy

Actuarial-Based Premium

Mid-range

Opaque

Pricing Psychology

- •

Peace of mind

- •

Loss aversion (protecting against large, unexpected costs)

- •

Affordability (framing costs as small, manageable payments)

Monetization Assessment

Strengths

- •

Highly stable and predictable recurring revenue from premiums.

- •

Dual income from underwriting (premiums) and investments.

- •

Worksite payroll deduction model enhances premium collection efficiency and policy persistency.

Weaknesses

- •

High dependency on the U.S. and Japan markets.

- •

Profitability is sensitive to economic downturns which can impact employment and policy sales.

- •

Revenue growth is steady but slow, characteristic of a mature market player.

Opportunities

- •

Expansion of direct-to-consumer digital channels to capture a wider audience.

- •

Growth in the underpenetrated pet insurance market through its partnership with Trupanion.

- •

Diversification into adjacent services for employers, such as absence management and HR services.

Threats

- •

Intense competition from traditional insurers (MetLife, Cigna) and agile insurtech startups.

- •

Significant regulatory changes in healthcare (like the ACA) could alter the market landscape.

- •

Cybersecurity incidents, as disclosed on their website, can lead to financial loss and reputational damage.

Market Positioning

Market leader in supplemental insurance, positioned as a financial safety net that pays cash benefits to help with expenses major medical doesn't cover.

Market Leader (U.S. Supplemental Health)

Target Segments

- Segment Name:

Employees via Worksite (B2B2C)

Description:Individuals and families who purchase supplemental insurance through their employer's benefits program, often via payroll deduction. This is Aflac's core and largest segment.

Demographic Factors

Working adults aged 25-55.

Middle-income households.

Psychographic Factors

- •

Seek financial security and peace of mind.

- •

Value comprehensive benefits packages from employers.

- •

Often risk-averse.

Behavioral Factors

Enroll in benefits during open enrollment periods.

Often have high-deductible primary health plans.

Pain Points

- •

High out-of-pocket costs from deductibles and co-pays.

- •

Potential loss of income if unable to work due to illness or injury.

- •

Worry about covering non-medical bills (mortgage, groceries) during a health event.

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Small & Medium Businesses (Employers)

Description:Businesses, typically with fewer than 100 employees, that want to offer competitive benefits to attract and retain talent without incurring direct costs, as policies are employee-paid.

Demographic Factors

Varies by industry.

Psychographic Factors

Value employee well-being and loyalty.

Often budget-conscious regarding benefits.

Behavioral Factors

Seek easy-to-administer benefits solutions.

Pain Points

- •

Inability to afford employer-paid ancillary benefits.

- •

Competition for talent with larger companies.

- •

Administrative burden of managing complex benefits.

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Brokers and Large Employers

Description:Insurance brokers who serve mid-to-large case markets (100+ employees) and the large employers themselves, who require more complex group products like disability and life insurance.

Demographic Factors

Established companies with dedicated HR departments.

Psychographic Factors

Focus on comprehensive risk management and employee productivity.

Behavioral Factors

Engage in formal RFP processes for benefits.

Require integrated solutions for benefits administration.

Pain Points

- •

Managing employee absences and leave laws.

- •

Need for a diverse benefits portfolio to satisfy a varied workforce.

- •

Integrating multiple benefit providers.

Fit Assessment:Good

Segment Potential:Medium

Market Differentiation

- Factor:

Brand Recognition & Marketing

Strength:Strong

Sustainability:Sustainable

- Factor:

Worksite Distribution Model

Strength:Strong

Sustainability:Sustainable

- Factor:

Cash Benefit Payouts

Strength:Moderate

Sustainability:Sustainable

- Factor:

Pioneering History in Cancer Insurance

Strength:Moderate

Sustainability:Temporary

Value Proposition

Aflac provides supplemental insurance that pays cash benefits directly to policyholders to help with the expenses that major medical health insurance doesn't cover, ensuring financial security and peace of mind during unexpected health events.

Excellent

Key Benefits

- Benefit:

Direct Cash Payouts

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Core marketing message emphasizes cash benefits.

Policy descriptions detail payment structures.

- Benefit:

Financial Security & Peace of Mind

Importance:Critical

Differentiation:Common

Proof Elements

Website messaging: 'Health insurance wasn’t designed to cover everything.'

Customer testimonials and stories.

- Benefit:

Affordable Premiums

Importance:Important

Differentiation:Common

Proof Elements

Emphasis on worksite payroll deduction makes payments feel small and manageable.

Quote-based system implies tailored, affordable pricing.

Unique Selling Points

- Usp:

The Aflac Duck: An iconic and highly recognizable brand mascot that creates instant brand recall and trust.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Extensive Agent & Broker Network: A deeply entrenched, nationwide worksite sales force provides a powerful distribution channel that is difficult for new entrants to replicate.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Dominant Market Leadership in Japan: Aflac holds a commanding position in Japan's third-sector (cancer and medical) insurance market, providing significant and stable revenue.

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Financial gap from high-deductible health plans

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Loss of income while out of work for illness/injury

Severity:Major

Solution Effectiveness:Partial

- Problem:

Inability to pay for non-medical living expenses during a health crisis

Severity:Critical

Solution Effectiveness:Complete

Value Alignment Assessment

High

The value proposition directly addresses the growing market trend of rising healthcare costs and the prevalence of high-deductible plans, which leave consumers financially exposed.

High

The proposition of financial security and peace of mind through affordable payments strongly resonates with the core target audience of working families who are often budget-conscious and risk-averse.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Independent sales agents and insurance brokers

- •

Employers (for worksite distribution)

- •

Strategic partners (e.g., Trupanion for pet insurance, American Cancer Society for CSR/Marketing)

- •

Technology providers

- •

Distribution partners in Japan (e.g., Japan Post Group, banks)

Key Activities

- •

Sales and Distribution Management (Agent/Broker Network)

- •

Marketing and Brand Building

- •

Insurance Underwriting and Actuarial Analysis

- •

Claims Processing and Customer Service

- •

Investment Portfolio Management

- •

Product Development

Key Resources

- •

Strong Brand Equity (The Aflac Duck)

- •

Extensive Distribution Network (Agents & Brokers)

- •

Statutory Capital and Investment Portfolio

- •

Regulatory Licenses to Operate in the U.S. and Japan

- •

Large Policyholder Database

Cost Structure

- •

Agent/Broker Commissions and Sales Expenses

- •

Benefit Payouts (Claims)

- •

Marketing and Advertising Spend

- •

Employee Salaries and Administrative Costs

- •

Technology and Infrastructure Costs

Swot Analysis

Strengths

- •

Dominant brand recognition and trust.

- •

Market leadership in the U.S. supplemental and Japanese cancer/medical insurance markets.

- •

Vast and deeply entrenched worksite sales and distribution network.

- •

Strong financial position and consistent profitability.

Weaknesses

- •

Over-reliance on agent-based, worksite sales model may be slow to adapt to digital-first consumers.

- •

Heavy concentration in two markets: the U.S. and Japan.

- •

Attracting younger customers is a stated challenge, particularly in mature markets like Japan.

Opportunities

- •

Accelerate digital transformation to improve direct-to-consumer sales and claims processing.

- •

Expand product offerings in high-growth areas like dental, vision, and pet insurance.

- •

Leverage data analytics to create more personalized products and pricing.

- •

Target the growing gig economy and self-employed workforce who lack traditional employer benefits.

Threats

- •

Disruption from insurtech startups with more agile, technology-driven business models.

- •

Economic downturns leading to higher unemployment and reduced participation in worksite benefits.

- •

Evolving healthcare regulations that could impact the supplemental insurance market.

- •

Increased competition from major medical and life insurance carriers entering the supplemental market.

Recommendations

Priority Improvements

- Area:

Digital Transformation & Customer Experience

Recommendation:Invest heavily in creating a seamless, transparent, and fully-online quote-to-purchase journey for individuals. This would reduce friction for digitally native consumers and capture the growing direct-to-consumer market segment.

Expected Impact:High

- Area:

Product Innovation for New Demographics

Recommendation:Develop flexible, modular insurance products tailored to the needs of gig economy workers, freelancers, and younger demographics. These products could offer shorter terms or be bundled with services relevant to self-employment.

Expected Impact:Medium

- Area:

Data Analytics Integration

Recommendation:Leverage policyholder data to proactively identify opportunities for cross-selling, improve underwriting accuracy, and personalize marketing communications to increase customer lifetime value.

Expected Impact:High

Business Model Innovation

- •

Transition from a purely reactive claims-based model to a proactive wellness ecosystem. Integrate insurance products with health and wellness platforms, offering premium discounts or rewards for preventative care and healthy behaviors.

- •

Develop a 'Benefits-as-a-Service' platform for SMBs, bundling Aflac's products with other HR tech and payroll solutions to become a more integrated partner for small businesses.

- •

Explore embedded insurance partnerships with financial wellness apps, payroll providers, or professional associations to reach customers at their point of need.

Revenue Diversification

- •

Aggressively scale the Aflac Group division to capture more market share in the large employer segment with products like group disability, life, and absence management services.

- •

Further penetrate the direct-to-consumer market, reducing reliance on the traditional worksite channel.

- •

Strategically explore new, underserved international markets for supplemental insurance, leveraging the operational expertise gained in the U.S. and Japan.

Aflac's business model is a masterclass in building a mature, highly profitable, and defensible enterprise. Its foundation rests on a powerful trifecta: an iconic brand, a deeply entrenched worksite distribution model, and a dual-engine revenue stream of premiums and investment income. The company has successfully positioned itself as an essential financial safety net in an era of rising healthcare costs and high-deductible plans, a value proposition with high market alignment. The business demonstrates exceptional maturity, characterized by its steady growth, market leadership in the U.S. and Japan, and consistent shareholder returns.

The primary strategic challenge and opportunity for Aflac is evolution. Its traditional, agent-centric worksite model, while a formidable strength, risks being outpaced by digital-first competitors and changing consumer buying habits. The future of its growth trajectory depends on its ability to embrace digital transformation—not just as a supplementary channel, but as a core component of its business. This involves creating a seamless direct-to-consumer experience, leveraging data analytics for personalization, and innovating products for non-traditional workforces like the gig economy. The expansion into pet insurance via the Trupanion partnership and the focus on Aflac Group for larger employers are positive steps toward diversification. To ensure long-term, sustainable growth, Aflac must strategically invest in technological evolution and product innovation to complement its existing market dominance, transforming itself to meet the needs of the next generation of policyholders while retaining the trust and stability that define its brand.

Competitors

Competitive Landscape

Mature

Moderately concentrated

Barriers To Entry

- Barrier:

Regulatory Compliance and Licensing

Impact:High

- Barrier:

Brand Recognition and Trust

Impact:High

- Barrier:

Distribution Network (Agents/Brokers)

Impact:High

- Barrier:

Capital Requirements

Impact:Medium

Industry Trends

- Trend:

Digital Transformation

Impact On Business:Increased pressure to digitize sales, claims processing, and customer service to meet consumer expectations and improve efficiency. This requires significant investment in technology.

Timeline:Immediate

- Trend:

Demand for Voluntary Benefits

Impact On Business:Growing opportunity as employers shift more healthcare costs to employees, increasing the need for supplemental coverage to fill gaps in major medical plans.

Timeline:Immediate

- Trend:

Personalization and Data Analytics

Impact On Business:Opportunity to leverage data for creating customized products and targeted marketing, but also a threat if competitors are more adept at using technology.

Timeline:Near-term

- Trend:

Focus on Employee Financial Wellness

Impact On Business:Supplemental insurance is increasingly seen as a key component of an employee's overall financial health, creating opportunities to integrate offerings into broader wellness platforms.

Timeline:Near-term

- Trend:

Insurtech Disruption

Impact On Business:Emergence of tech-savvy startups creates pressure to innovate, improve customer experience, and streamline operations. They can be potential partners or new competitors.

Timeline:Long-term

Direct Competitors

- →

Unum

Market Share Estimate:Leading competitor

Target Audience Overlap:High

Competitive Positioning:A leading provider of disability, life, and supplemental health insurance, primarily focused on the employer-sponsored benefits market.

Strengths

- •

Strong market presence in disability and life insurance.

- •

Well-established relationships with brokers and large employers.

- •

Offers a broad suite of products including dental, vision, and leave management services.

- •

Positive customer reviews on support during claims.

Weaknesses

- •

Customer complaints regarding claims processing delays.

- •

Primarily accessible through employer groups, limiting direct-to-consumer reach.

- •

Negative reviews concerning customer service accessibility.

Differentiators

- •

Market leader in disability insurance.

- •

Integrated leave management solutions for employers.

- •

Parent company of Colonial Life, providing a multi-brand strategy.

- →

Colonial Life (an Unum subsidiary)

Market Share Estimate:Significant

Target Audience Overlap:High

Competitive Positioning:Specializes in voluntary, worksite-marketed benefits, offering a similar product suite to Aflac and targeting both individuals and businesses.

Strengths

- •

Strong focus on the worksite sales model with a large agent network.

- •

Recognized as an industry leader in sales for certain products like cancer insurance.

- •

Offers customizable plans and focuses on workplace education.

- •

Financially backed by parent company, Unum Group.

Weaknesses

- •

Mixed customer reviews, with a notable number of complaints filed with the BBB.

- •

Perceived as having high costs by some customers.

- •

Website can be difficult to navigate for information.

Differentiators

Specialization in one-on-one benefits counseling at the worksite.

Strong brand presence in the voluntary benefits space.

- →

MetLife

Market Share Estimate:Major competitor

Target Audience Overlap:High

Competitive Positioning:A global insurance giant with a significant presence in employee benefits, offering a comprehensive portfolio including dental, vision, life, disability, and supplemental health products.

Strengths

- •

Strong global brand recognition and financial stability.

- •

Extensive and diverse product portfolio beyond just supplemental health.

- •

Large distribution network and established relationships with multinational corporations.

- •

Offers a wide range of voluntary benefits including pet and legal insurance.

Weaknesses

- •

Can be perceived as less specialized in supplemental health compared to Aflac.

- •

Large company structure may lead to less personalized service.

- •

Some customer complaints regarding poor communication.

Differentiators

- •

Ability to bundle a wide array of insurance products for large employers.

- •

Strong presence in dental and vision insurance markets.

- •

Global reach and experience.

- →

Principal Financial Group

Market Share Estimate:Niche competitor

Target Audience Overlap:Medium

Competitive Positioning:Offers a suite of group benefits including disability, life, dental, vision, and supplemental health (accident, critical illness, hospital indemnity) as part of a broader financial services and retirement solutions portfolio.

Strengths

- •

Integrates benefits with retirement and other financial services.

- •

Strong offerings in dental and disability insurance.

- •

Focus on providing comprehensive solutions for businesses.

- •

Offers unique programs like a Cancer Treatment Oral Health Program.

Weaknesses

- •

Less brand recognition specifically for supplemental health compared to Aflac.

- •

Supplemental health is part of a larger portfolio, not the primary focus.

- •

May primarily target businesses already using their retirement or other services.

Differentiators

Holistic approach combining insurance with retirement and investment services.

Strong focus on the business market with tools to customize benefit packages.

- →

Guardian Life

Market Share Estimate:Niche competitor

Target Audience Overlap:Medium

Competitive Positioning:A mutual insurer with a strong reputation, providing a range of employee benefits including dental, life, disability, and voluntary supplemental health products.

Strengths

- •

Strong reputation as a mutual insurance company (policyholder-owned).

- •

Well-regarded for its dental and disability insurance products.

- •

Offers portability on many of its voluntary benefits, allowing employees to keep coverage after leaving a job.

- •

Focus on permanent life insurance options through the workplace.

Weaknesses

- •

Smaller market share in the supplemental health space compared to Aflac.

- •

Less aggressive marketing and brand visibility than Aflac.

- •

Policies may have numerous limitations and exclusions that require careful review.

Differentiators

Mutual company structure can be appealing to some customers.

Innovative offerings like voluntary permanent life insurance that builds cash value.

Indirect Competitors

- →

High-Deductible Health Plans (HDHPs) with HSAs/FSAs

Description:Health insurance plans with lower premiums and higher deductibles, often paired with tax-advantaged savings accounts (Health Savings Accounts or Flexible Spending Accounts) that individuals use to pay for out-of-pocket medical costs.

Threat Level:High

Potential For Direct Competition:N/A - This is a market trend that Aflac's products are designed to complement, but a consumer might choose to self-insure through an HSA rather than buy supplemental coverage.

- →

Insurtech Startups (e.g., Breeze, Sidecar Health)

Description:Technology-focused companies offering streamlined, often direct-to-consumer, insurance products. They compete by simplifying the application and claims process and often target niche markets or specific products like disability or critical illness insurance.

Threat Level:Medium

Potential For Direct Competition:High, as they scale and broaden their product offerings, they could challenge the traditional agent-based model.

- →

Major Medical Insurers (e.g., UnitedHealth, Cigna, Anthem)

Description:While many also offer supplemental products (making them direct competitors in that regard), their core major medical plans can be seen as an indirect competitor. A consumer might opt for a more expensive, comprehensive major medical plan with lower out-of-pocket costs, reducing the perceived need for supplemental insurance.

Threat Level:Medium

Potential For Direct Competition:Already direct competitors in many cases, but their strategic focus on major medical can indirectly impact the demand for Aflac's core products.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Brand Recognition

Sustainability Assessment:Highly sustainable due to decades of consistent, high-spend advertising featuring the Aflac Duck, creating unparalleled brand recall in the supplemental insurance category.

Competitor Replication Difficulty:Hard

- Advantage:

Large, Established Distribution Network

Sustainability Assessment:Sustainable due to the deep relationships and established infrastructure of its agent and broker network, which is difficult and time-consuming for new entrants to build.

Competitor Replication Difficulty:Hard

- Advantage:

Market Leadership and Scale

Sustainability Assessment:Sustainable, as its position as a market leader provides economies of scale, extensive claims data for underwriting, and significant influence in the worksite benefits market.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'Specific Product Features or Riders', 'estimated_duration': '1-2 years'}

{'advantage': 'Promotional Campaigns and Partnerships', 'estimated_duration': 'Less than 1 year'}

Disadvantages

- Disadvantage:

Dependence on Traditional Agent-Based Sales Model

Impact:Major

Addressability:Moderately

- Disadvantage:

Perception of a Complex Claims Process

Impact:Major

Addressability:Moderately

- Disadvantage:

Potentially Higher Premiums on Some Products

Impact:Minor

Addressability:Easily

Strategic Recommendations

Quick Wins

- Recommendation:

Launch a targeted digital campaign highlighting the simplicity of the online claims process with video testimonials.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Optimize website landing pages for specific products with clear calls-to-action for 'Quote & Apply Online' to capture more direct-to-consumer leads.

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Promote the 'Check for Cancer' campaign more heavily across all digital channels to reinforce brand purpose and drive engagement.

Expected Impact:High

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Invest in a unified digital platform for agents and brokers that simplifies quoting, enrollment, and client management to enhance channel loyalty.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Develop and market 'gig worker' benefit bundles that are portable and flexible, addressing a growing and underserved market segment.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Partner with leading HR tech and payroll platforms (e.g., Workday, ADP) to embed Aflac's voluntary benefits offerings directly into their ecosystems.

Expected Impact:High

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Build out a robust direct-to-consumer (DTC) sales channel to complement the agent network, capturing individuals who prefer self-service.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Leverage AI and machine learning to analyze claims data for product innovation and create hyper-personalized coverage recommendations.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Explore acquisitions of smaller insurtech companies to quickly integrate innovative technology and digital talent.

Expected Impact:High

Implementation Difficulty:Difficult

Reinforce Aflac's position as the most trusted and accessible supplemental insurance provider by pairing its dominant brand with a superior, user-friendly digital experience for policyholders, agents, and employers.

Focus on 'Simplicity and Speed.' Differentiate by making every interaction, from getting a quote to filing a claim, the fastest and most transparent in the industry, leveraging technology to automate processes and provide real-time updates to policyholders.

Whitespace Opportunities

- Opportunity:

Develop supplemental insurance products tailored to mental wellness.

Competitive Gap:While disability insurance may cover mental health, there is a lack of specific supplemental products that provide cash benefits for therapy, wellness apps, or other mental health treatments not fully covered by major medical.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Create an integrated financial wellness platform for SMBs.

Competitive Gap:Competitors offer benefits, but few provide a holistic platform for Small and Medium-Sized Businesses (SMBs) that combines supplemental insurance with financial planning tools, HSA management, and educational resources for employees.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Targeted products for specific chronic illnesses beyond cancer.

Competitive Gap:While critical illness policies are common, there is an opportunity to create more nuanced products for specific, prevalent chronic conditions (e.g., diabetes, heart disease) that provide benefits for ongoing expenses like supplies, specialized diets, and health coaching.

Feasibility:High

Potential Impact:Medium

Aflac operates in the mature and moderately concentrated supplemental health insurance industry. Its primary competitive advantage is its unparalleled brand recognition, built over decades of memorable advertising, which creates a significant barrier to entry for competitors. This is supported by a vast and deeply entrenched network of independent agents and brokers, making its distribution model a formidable asset.

The competitive landscape is dominated by a few key players. Unum and its subsidiary, Colonial Life, represent the most direct threat, with a similar focus on worksite marketing and voluntary benefits. MetLife poses a challenge through its scale, comprehensive product suite, and strong relationships with large corporate clients. Other players like Principal and Guardian compete effectively in niche areas, often by integrating supplemental benefits into broader financial wellness and retirement offerings.

The industry is undergoing significant transformation, driven by digitalization and a growing demand for voluntary benefits as employers shift healthcare costs to employees. Aflac's reliance on a traditional, agent-driven sales model is both a strength and a potential vulnerability. While this network provides a powerful sales engine, it is threatened by the rise of direct-to-consumer models and insurtech startups that prioritize a seamless digital customer experience.

Key strategic opportunities for Aflac lie in leveraging its brand strength to build a best-in-class digital platform. This involves not only improving the direct-to-consumer quoting and application process but also empowering its agent network with superior digital tools. There is significant whitespace in developing products for underserved markets, such as gig economy workers, and addressing emerging needs like mental wellness and chronic care management.

Emerging threats include agile insurtech firms that can innovate faster and major medical carriers expanding more aggressively into the supplemental space to protect their margins. To maintain its leadership, Aflac must pivot from being a marketing-led company to a technology-enabled one, focusing on simplifying the customer journey, from enrollment to claims, to defend its market share and capture future growth.

Messaging

Message Architecture

Key Messages

- Message:

Health insurance wasn’t designed to cover everything. That’s why there’s Aflac.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Section

- Message:

We can help you take care of the expenses health insurance doesn’t cover, so you can take care of everything else.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Section

- Message:

We care about Aflac’s policyholders affected by...

Prominence:Primary

Clarity Score:High

Location:Homepage Notifications Banner

- Message:

Discover how our insurance policies can help provide financial peace of mind.

Prominence:Secondary

Clarity Score:High

Location:Homepage - Product Section Intro

- Message:

Check for Cancer.

Prominence:Tertiary

Clarity Score:High

Location:Check for Cancer Campaign Page

Poor. The homepage's primary marketing message, which clearly defines Aflac's role as a supplemental insurer, is severely undermined by the overwhelming number of disaster relief notifications. While demonstrating care, these alerts dominate the user's initial experience, pushing the core value proposition and acquisition-focused content far down the page. This creates a disjointed experience, making the site feel more like a current policyholder service bulletin than a tool for attracting new customers.

Good. The core message of providing a financial safety net for things health insurance doesn't cover is consistent. This theme of 'care' and 'support' is echoed in both the product descriptions and the prominent policyholder notifications, as well as the 'Check for Cancer' social good campaign. The language is consistently focused on help, relief, and peace of mind.

Brand Voice

Voice Attributes

- Attribute:

Caring/Empathetic

Strength:Strong

Examples

- •

We care about Aflac’s policyholders affected by the recent wildfires:

- •

To help provide relief for...

- •

Get help coping with the financial and emotional effects of cancer.

- Attribute:

Direct/Problem-Oriented

Strength:Strong

Examples

Health insurance wasn’t designed to cover everything.

Help keep high deductibles from derailing your life plans.

- Attribute:

Reassuring

Strength:Moderate

Examples

Get added peace of mind...

Help protect the financial future of your loved ones.

- Attribute:

Formal/Corporate

Strength:Moderate

Examples

This grace period also provides an extension of filing deadlines for claims and leniency for any other action required under the policy.

Aflac Incorporated Discloses Cybersecurity Incident

Tone Analysis

Helpful

Secondary Tones

- •

Empathetic

- •

Urgent

- •

Reassuring

Tone Shifts

- •

The tone shifts from highly empathetic and service-oriented in the top notifications to direct and marketing-focused in the hero section.

- •

The tone becomes more formal and legalistic in the footer disclaimers.

- •

The 'Check for Cancer' page adopts an inspirational and community-oriented tone.

Voice Consistency Rating

Good

Consistency Issues

The sheer volume of formal, repetitive notification text at the top of the homepage clashes with the more streamlined and persuasive marketing copy that follows, creating a slightly disjointed feel for new visitors.

Value Proposition Assessment

Aflac provides supplemental insurance that pays cash benefits to cover the out-of-pocket expenses that major medical insurance does not, giving policyholders financial peace of mind during unexpected health events.

Value Proposition Components

- Component:

Financial Gap Coverage

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Peace of Mind

Clarity:Clear

Uniqueness:Common

- Component:

Support During Crises

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Corporate Social Responsibility (Cancer Support)

Clarity:Clear

Uniqueness:Unique

Aflac's core value proposition of supplemental insurance is not unique, as it faces competition from companies like Colonial Life, MetLife, and Allstate. However, its differentiation is exceptionally strong due to its iconic brand mascot (the Aflac Duck), which has achieved over 90% name recognition. The messaging effectively leverages this by clearly stating its purpose to avoid brand confusion—a known challenge Aflac has addressed in past campaigns. The 'Check for Cancer' campaign serves as a powerful differentiator, aligning the brand with a proactive health mission and building an emotional connection that transcends a purely transactional insurance relationship.

Aflac positions itself as the essential, accessible addition to any primary health insurance plan. The messaging is not about replacing other insurance but filling a critical, often overlooked, financial gap. This positioning is reinforced by its strong worksite sales channel, which targets employees who already have primary coverage. By focusing on specific needs like 'Accident', 'Cancer', and 'Critical Illness', Aflac carves out a specialist niche, contrasting with broader insurance providers.

Audience Messaging

Target Personas

- Persona:

Individuals & Families

Tailored Messages

- •

Health insurance wasn’t designed to cover everything.

- •

Get added peace of mind and help paying for emergency treatment.

- •

Help protect the financial future of your loved ones.

Effectiveness:Effective

- Persona:

Business Owners / Employers

Tailored Messages

- •

Additional products available through an employer:

- •

Group products designed for large employers:

- •

Strengthen employee benefits packages and provide essential insurance protection to employees during their time of need.

Effectiveness:Somewhat Effective

- Persona:

Brokers and Potential Agents

Tailored Messages

Offer your clients better benefit options with Aflac supplemental insurance policies.

Effectiveness:Ineffective

Audience Pain Points Addressed

- •

High medical deductibles and out-of-pocket costs

- •

Financial stress from unexpected accidents or illnesses

- •

Worry about family's financial security in case of death or critical illness

- •

Inadequacy of primary health insurance coverage

Audience Aspirations Addressed

- •

Achieving financial peace of mind

- •

Protecting one's family and future

- •

Being prepared for the unexpected

- •

Focusing on recovery without financial worry

Persuasion Elements

Emotional Appeals

- Appeal Type:

Fear/Anxiety Reduction

Effectiveness:High

Examples

Health insurance wasn’t designed to cover everything.

Help keep high deductibles from derailing your life plans.

- Appeal Type:

Empathy/Care

Effectiveness:High

Examples

We care about Aflac’s policyholders affected by the recent weather:

Survivors: Aflac employees who took charge of their health

- Appeal Type:

Hope/Empowerment

Effectiveness:Medium

Examples

Ready to take the next step to protect your future?

Join the movement — it could save your life.

Social Proof Elements

- Proof Type:

Employee Testimonials (Survivor Stories)

Impact:Strong

- Proof Type:

User-Generated Content (#CheckForCancer Social Campaign)

Impact:Moderate

- Proof Type:

Partnership (American Cancer Society)

Impact:Strong

Trust Indicators

- •

Prominent disaster relief and policyholder support notifications

- •

Cybersecurity incident disclosure (transparency)

- •

Partnership with reputable organizations like the American Cancer Society

- •

Clear contact information and privacy policies

- •

Longevity mentioned on campaign page ('more than 70 years of experience')

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

Get a Free Quote

Location:Homepage Hero Section

Clarity:Clear

- Text:

Speak to An Agent

Location:Homepage Hero Section

Clarity:Clear

- Text:

Quote & Apply Online

Location:Homepage Hero Section

Clarity:Clear

- Text:

Myself / My Employees

Location:Homepage Mid-page CTA

Clarity:Clear

Good. The calls-to-action are clear, direct, and provide multiple engagement paths ('Get a Quote', 'Speak to An Agent'). The segmentation between 'Myself' and 'My Employees' is a strong strategic choice that effectively funnels different user types into the correct journey. However, the initial quote form in the hero section, which requires Zip Code, Age, and Coverage type, might be a point of friction for users who are not yet ready to provide personal information.

Messaging Gaps Analysis

Critical Gaps

The homepage is critically lacking customer testimonials or stories that aren't related to the specific cancer campaign. Showing how Aflac helped with a common accident or hospital stay would make the value more tangible for a broader audience.

There is no clear, quantifiable data or proof points on the homepage (e.g., 'X million claims paid', 'Average claim paid in Y days') to quickly build credibility beyond brand recognition.

Contradiction Points

No itemsUnderdeveloped Areas

The messaging for 'Business Owners' is underdeveloped on the homepage. While there is a CTA, the primary messaging is heavily skewed towards the individual's perspective. The benefits to the business itself (e.g., employee retention, low/no cost to the company) could be more prominently featured.

The value proposition of 'cash benefits' could be more vividly explained. The messaging focuses on 'helping with expenses' but could be more powerful by illustrating what that cash is used for (e.g., '...cash to help with groceries, mortgage payments, or travel for treatment').

Messaging Quality

Strengths

- •

The core value proposition is communicated with exceptional clarity: 'Health insurance wasn’t designed to cover everything.'

- •

The brand voice is consistently empathetic and helpful, reinforcing the company's mission to provide support.

- •

The 'Check for Cancer' campaign is a masterclass in purpose-driven marketing, effectively linking the brand to a positive social mission and creating an emotional connection.

- •

Audience segmentation is clear and integrated directly into the user flow with 'Myself' and 'My Employees' CTAs.

Weaknesses

- •

The message hierarchy on the homepage is fundamentally flawed due to the overwhelming presence of policyholder notifications, which obscures the primary acquisition-focused messaging.

- •

Over-reliance on brand recognition rather than providing immediate social proof or data points on the homepage.

- •

The website feels static; the core marketing copy is a list of products rather than a compelling narrative about how Aflac integrates into a person's life.

Opportunities

- •

Redesign the notification system to be less intrusive, such as a single, dismissible banner linking to a dedicated alerts page, thereby reclaiming prime homepage real estate for marketing messages.

- •

Create a dedicated 'Customer Stories' or 'How We Help' section on the homepage featuring short, impactful testimonials across various products (accident, disability, etc.).

- •

Develop more dynamic content that illustrates the 'peace of mind' Aflac provides through interactive tools, short videos, or animated infographics explaining how supplemental insurance works in a real-life scenario.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Message Hierarchy

Recommendation:Consolidate the numerous disaster notifications into a single, dismissible banner that links to a dedicated policyholder alerts page. This will immediately elevate the core value proposition and 'Get a Quote' CTA, improving the experience for prospective customers.

Expected Impact:High

- Area:

Social Proof and Credibility

Recommendation:Introduce a prominent 'Customer Stories' module on the homepage featuring brief, powerful testimonials for different coverage types (e.g., accident, hospital). Include key metrics like 'X million policyholders served' to build trust instantly.

Expected Impact:High

- Area:

Value Proposition Tangibility

Recommendation:Revise copy to be more specific about what 'cash benefits' are used for. Instead of 'help with expenses,' use evocative examples like 'cash for your mortgage,' 'help with childcare,' or 'money for travel to the best doctors.'

Expected Impact:Medium

Quick Wins

- •

A/B test the initial quote form fields to see if reducing the required information increases initial engagement.

- •

Add a sub-headline under the 'My Employees' CTA that quickly lists a key benefit for the business, such as 'At no direct cost to your company.'

- •

Feature the 'Check for Cancer' campaign more prominently on the homepage to leverage its strong emotional and brand-building appeal for all visitors.

Long Term Recommendations

- •

Develop a comprehensive content strategy around financial wellness and preparing for the unexpected, positioning Aflac as a thought leader, not just an insurance provider.

- •

Create interactive 'Benefit Estimator' tools for the homepage that are more engaging than a simple form, allowing users to explore potential scenarios and see the value of coverage without submitting personal info upfront.

- •

Invest in video storytelling that follows real or composite customer journeys, from an unexpected event through receiving their Aflac benefits and the relief it provided.

Aflac's digital messaging strategy presents a tale of two extremes. On one hand, its core value proposition—'Health insurance wasn’t designed to cover everything'—is communicated with masterful clarity and serves as a powerful, problem-oriented hook. This is complemented by a consistently empathetic and caring brand voice, powerfully demonstrated through initiatives like the 'Check for Cancer' campaign and the explicit 'We care' messaging in policyholder alerts. These elements successfully position Aflac as a trustworthy, supportive partner in times of need.

However, the effectiveness of this messaging is critically hampered by a flawed information architecture on the homepage. The page is currently dominated by an exhaustive list of disaster relief notifications. While this action aligns with the brand's caring voice, its execution is detrimental to customer acquisition. For a prospective customer, the first impression is not one of a solution to their potential problems, but of a cluttered service bulletin. The primary marketing messages are pushed so far down the page that their impact is severely diminished, creating a significant barrier in the customer journey.

The 'Check for Cancer' page stands in stark contrast, showcasing Aflac's ability to execute a compelling, emotionally resonant, and action-oriented campaign. It seamlessly blends storytelling, social proof, and clear calls-to-action to create a powerful brand statement. The primary opportunity for Aflac is to infuse the homepage with the narrative energy and clarity of its campaign pages. By redesigning the intrusive notification system and elevating tangible proof points like customer stories, Aflac can better align its homepage experience with its strong brand identity, ensuring the first touchpoint is as persuasive and compelling as the brand's broader marketing efforts.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

High brand recognition in the U.S. and Japan, largely driven by the iconic Aflac Duck mascot and sustained marketing efforts.

- •

Operates as the largest provider of supplemental insurance in the U.S. and the leading provider of medical and cancer insurance in Japan, insuring over 50 million people worldwide.

- •

Broad portfolio of relevant products (accident, cancer, critical illness, life, dental, etc.) that address the clear financial pain point of out-of-pocket expenses not covered by major medical insurance.

- •

Dual-market business model targeting both individuals and employer groups (worksite marketing), demonstrating adaptability to different customer segments.

Improvement Areas

- •

Simplify policy language and enhance transparency to meet modern consumer expectations for clarity.

- •

Improve the digital claims submission and processing experience to match the seamlessness of leading Insurtech competitors.

- •

Develop more personalized and bundled product offerings based on life stage and customer data.

Market Dynamics

5.6% - 6.1% CAGR for the supplemental health insurance market.

Mature

Market Trends

- Trend:

Rising healthcare costs and high-deductible health plans (HDHPs)

Business Impact:Increases consumer awareness and demand for supplemental products to cover financial gaps, acting as a primary growth driver for Aflac's core offerings.

- Trend:

Emergence of Insurtech and digital transformation

Business Impact:Creates pressure to innovate digital channels (DTC sales, mobile claims) and leverage data analytics for personalization and efficiency to compete with nimble startups.

- Trend:

Growing gig economy and non-traditional workforce

Business Impact:Opens a new, growing market segment for direct-to-consumer (DTC) products, as these workers lack traditional employer-sponsored benefits.

- Trend:

Increased focus on financial wellness and holistic benefits

Business Impact:Opportunity to position products not just as insurance, but as essential components of an individual's or employee's overall financial security plan.

Favorable. While the market is mature, current economic and healthcare trends are creating strong, sustained tailwinds for supplemental insurance products.

Business Model Scalability

Medium

The model has significant variable costs tied to agent/broker commissions. While this allows for scalable sales efforts, it limits margin improvement at scale compared to a purely digital model.

Moderate. The core insurance product is highly scalable (underwriting and policy administration can be centralized). However, the heavy reliance on a large, independent agent network for distribution creates operational complexity and limits leverage.

Scalability Constraints

- •

Dependence on recruiting, training, and managing a vast network of independent agents and brokers.

- •

Navigating complex and varied state-level regulations for insurance products, which can slow down national product rollouts.

- •

Potential for legacy IT systems to hinder rapid development and integration of new digital products and channels.

Team Readiness

Experienced leadership team with deep expertise in the insurance industry, capable of managing a large, complex organization. The company has demonstrated a balanced approach to capital deployment, including growth investments, dividends, and share repurchases.

Traditional, siloed structure typical of a large incumbent insurer. This can create challenges for agility and cross-functional collaboration required for rapid growth and digital transformation.

Key Capability Gaps

- •

Digital-native product management and user experience (UX) design to build compelling DTC offerings.

- •

Advanced data science and analytics capabilities to drive hyper-personalization, dynamic underwriting, and marketing optimization.

- •

Agile development and DevOps talent to accelerate the pace of technological innovation and escape the constraints of legacy systems.

Growth Engine

Acquisition Channels

- Channel:

Independent Agents/Brokers (Worksite Marketing)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Equip agents and brokers with better digital tools for lead management, remote enrollment, and analytics to improve their efficiency and reach.

- Channel:

Brand Advertising (e.g., Aflac Duck Campaigns)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Shift a portion of brand spend towards performance-based digital advertising that drives measurable actions, such as online quote requests or content downloads.

- Channel:

Direct-to-Consumer (DTC) Online

Effectiveness:Low

Optimization Potential:High

Recommendation:Invest heavily in optimizing the aflac.com quote and application funnel. Focus on SEO, content marketing, and paid search to capture high-intent traffic for individual products. This channel is noted as a growing area for the company.

Customer Journey

The primary path is agent-led, involving personal consultation and enrollment, often at a worksite. The digital path involves finding the website, requesting a quote, and then often being routed to an agent, which can be a point of friction.

Friction Points

- •

Handoff from online interest to an offline agent conversation.

- •

Complexity and jargon in product descriptions, making self-service difficult.

- •

Lack of a seamless, end-to-end digital purchase and onboarding process for all products.

Journey Enhancement Priorities

{'area': 'Digital Onboarding', 'recommendation': 'Develop a fully digital, mobile-first application and policy issuance process for simpler products to capture the DTC market.'}

{'area': 'Product Education', 'recommendation': 'Create interactive tools, videos, and comparison guides on the website to help prospects self-educate and choose the right coverage.'}

Retention Mechanisms

- Mechanism:

Payroll Deduction

Effectiveness:High

Improvement Opportunity:Integrate with modern HR tech and payroll platforms (e.g., Gusto, Rippling) to make benefits administration seamless for SMBs, increasing stickiness.

- Mechanism:

Brand Trust and Customer Service

Effectiveness:Medium

Improvement Opportunity:Leverage AI-powered chatbots and self-service portals to provide instant answers and process simple claims, freeing up human agents for more complex issues.

- Mechanism:

Multi-policy Ownership

Effectiveness:Medium

Improvement Opportunity:Proactively use data to identify and recommend relevant additional policies to existing customers at key life moments (e.g., birth of a child, new job).

Revenue Economics

Strong. As a mature insurer, profitability depends on effective pricing, underwriting, and managing claims costs, which Aflac has done successfully for decades. The business model relies on income from both premiums and investments.

Undeterminable from public data, but likely healthy given the company's long-term profitability and high retention in the worksite channel.

High in traditional channels, but likely low in emerging digital channels due to nascent investment and optimization.

Optimization Recommendations

- •

Lower Customer Acquisition Cost (CAC) by scaling the more efficient DTC digital channel.

- •

Increase Lifetime Value (LTV) by creating product bundles and loyalty programs that encourage holding multiple policies.

- •

Improve claims processing efficiency through automation to reduce operational overhead.

Scale Barriers

Technical Limitations

- Limitation:

Legacy IT Infrastructure

Impact:High

Solution Approach:Adopt a two-speed IT approach: maintain legacy systems for core policy administration while building a modern, API-first tech stack for new digital products and customer-facing interfaces.

- Limitation:

Siloed Data Systems

Impact:Medium

Solution Approach:Invest in a customer data platform (CDP) to create a unified, 360-degree view of the customer, enabling personalization and improved analytics across all channels.

Operational Bottlenecks

- Bottleneck:

Manual Claims Processing

Growth Impact:Limits ability to scale efficiently and can negatively impact customer satisfaction, a key differentiator.

Resolution Strategy:Implement AI and Robotic Process Automation (RPA) to automate routine claims intake, verification, and payment for eligible claims, similar to the 'One Day Pay' initiative.

- Bottleneck:

Agent Channel Management

Growth Impact:High overhead for training, support, and compliance for a large, distributed sales force.

Resolution Strategy:Develop a best-in-class digital portal for agents that provides training, marketing materials, performance dashboards, and simplified commission tracking.

Market Penetration Challenges

- Challenge:

Competition from Insurtech Startups

Severity:Major

Mitigation Strategy:Accelerate digital transformation, launch digital-first products, and potentially acquire or partner with Insurtechs to gain technology and talent.

- Challenge:

Reaching Younger Demographics (Millennials/Gen Z)

Severity:Major

Mitigation Strategy:Develop simpler, more affordable products sold through a fully digital, mobile-first experience. Engage this audience on social media and through partnerships with brands they trust.

- Challenge:

Channel Conflict

Severity:Minor

Mitigation Strategy:Clearly define the role of the DTC channel versus the agent channel. Implement a lead-sharing or hybrid model where online leads can be nurtured digitally or passed to agents based on complexity and customer preference.

Resource Limitations

Talent Gaps

- •

Data Scientists / AI Specialists

- •

Digital Marketing Experts

- •

Cloud Infrastructure Engineers

- •

UX/UI Designers

Capital is not a primary constraint. The challenge is allocating capital effectively towards technological modernization and growth initiatives versus shareholder returns (dividends/buybacks).

Infrastructure Needs

- •

Modern, cloud-based core insurance platform.

- •

Enterprise-wide Customer Relationship Management (CRM) and Customer Data Platform (CDP).

- •

Advanced analytics and business intelligence tools.

Growth Opportunities

Market Expansion

- Expansion Vector:

Gig Economy & Self-Employed Professionals

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Develop a suite of portable benefits products sold directly online. Partner with platforms like Upwork, DoorDash, or Etsy to offer embedded insurance options to their user base.

- Expansion Vector:

Medicare Supplement Market

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Continue to expand and aggressively market the Aflac Medicare Supplement Insurance to the growing population of retiring Americans, leveraging the brand's high trust factor with this demographic.

- Expansion Vector:

Deeper SMB Penetration

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Create a simplified, self-service benefits platform for small businesses (under 50 employees) that integrates with popular payroll and HR software.

Product Opportunities

- Opportunity:

Integrated Financial Wellness Products

Market Demand Evidence:Growing trend of employers offering holistic financial wellness benefits beyond just traditional insurance.

Strategic Fit:High

Development Recommendation:Bundle existing products with new services like financial counseling, student loan assistance programs, or savings tools through partnerships with fintech companies.

- Opportunity:

Parametric Insurance Products

Market Demand Evidence:Increasing frequency of climate-related events creates a need for faster, trigger-based payouts that don't require lengthy claims adjustments.

Strategic Fit:Medium

Development Recommendation:Launch pilot programs for specific, easily-triggered events (e.g., flight delays, hurricane of a certain category making landfall) to test the model and market demand.

- Opportunity:

Pet Insurance Expansion

Market Demand Evidence:The pet insurance market is experiencing rapid growth as pet ownership and spending on pet healthcare increase.

Strategic Fit:High

Development Recommendation:Deepen the partnership with Trupanion or develop a proprietary offering to more aggressively market this high-growth product through all channels.

Channel Diversification

- Channel:

Embedded Insurance Partnerships

Fit Assessment:High

Implementation Strategy:Develop APIs to allow fintech, e-commerce, and travel platforms to offer Aflac's products (e.g., accident insurance, travel insurance) at the point of sale.

- Channel:

Affinity Partnerships

Fit Assessment:High

Implementation Strategy:Partner with large membership organizations (e.g., AARP, credit unions, alumni associations) to offer discounted group plans to their members.

Strategic Partnerships

- Partnership Type:

HR Tech & Payroll Providers

Potential Partners

- •

Gusto

- •

Rippling

- •

Paychex

- •

ADP

Expected Benefits:Streamline benefits administration for SMBs, making Aflac the default supplemental option and creating a highly sticky distribution channel.

- Partnership Type:

Digital Health & Telemedicine Platforms

Potential Partners

- •

Teladoc

- •

GoodRx

- •

Noom

Expected Benefits:Add value to core insurance products by offering policyholders access to discounted health and wellness services, improving retention and brand perception.

Growth Strategy

North Star Metric

Annualized Premium from Digital & Partnership Channels

This metric focuses the entire organization on the highest-potential new growth vectors, moving beyond optimization of the mature agent-led channel. It directly measures progress in capturing the DTC, SMB tech, and embedded markets.

Increase by 50% year-over-year for the next 3 years.

Growth Model

Hybrid: 'Sales-Led' core with a 'Digital/Partnership-Led' growth layer

Key Drivers

- •

Scaling the DTC acquisition funnel.

- •

Number of active technology and affinity partnerships.

- •

Conversion rate of online quotes to policies.

- •

Maintaining productivity of the agent network.

Maintain and optimize the highly profitable agent channel while building a separate, agile, and well-funded business unit focused exclusively on digital and partnership growth to avoid cultural and technical conflicts.

Prioritized Initiatives

- Initiative:

Launch a fully digital, mobile-first 'Gig Worker' insurance bundle

Expected Impact:High

Implementation Effort:High

Timeframe:9-12 months

First Steps:Conduct market research with gig workers to define the ideal product bundle. Assemble a cross-functional 'squad' with product, engineering, and marketing.

- Initiative:

Develop and launch an API platform for embedded insurance partners

Expected Impact:High

Implementation Effort:High

Timeframe:12 months

First Steps:Identify 2-3 initial target partners and co-develop the API specifications and a pilot product offering.

- Initiative:

Optimize the DTC website conversion funnel for the top 3 individual products

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:3-6 months

First Steps:Implement analytics and user behavior tracking (e.g., heatmaps). Begin A/B testing headlines, calls-to-action, and form field layouts on the quote request pages.

Experimentation Plan

High Leverage Tests

- Test:

Pricing and product bundling variations for the DTC market.

- Test:

Different landing page designs and messaging for paid search campaigns.

- Test:

Automated email nurture sequences for abandoned online applications.

Utilize an A/B testing platform (e.g., Optimizely, Google Optimize) to track conversion rates, cost per acquisition, and estimated LTV for each experiment.

Run at least 2-3 concurrent experiments per month focused on the digital acquisition funnel.

Growth Team

A centralized, cross-functional Growth Team dedicated to the digital and partnership channels, reporting directly to a Chief Growth Officer or the head of the U.S. business unit.

Key Roles

- •

Head of Growth

- •

Growth Product Manager

- •

Performance Marketing Manager (SEO/SEM/Social)

- •

Partnerships Manager

- •

Data Analyst

Acquire talent from outside the traditional insurance industry (e.g., from SaaS, Fintech, E-commerce) to bring in new skills and perspectives. Foster a culture of rapid experimentation and data-driven decision-making.

Aflac possesses a formidable growth foundation built on strong product-market fit, exceptional brand recognition, and a deeply entrenched, profitable distribution network in the worksite marketing channel. The company is well-positioned to capitalize on favorable market trends, particularly the rising out-of-pocket healthcare costs that make its supplemental products increasingly necessary for consumers.

The primary challenge and greatest opportunity for Aflac lies in navigating the digital transformation that is reshaping the insurance industry. While its traditional agent-led model is a durable asset, it also creates operational complexity and is less effective at reaching new, digitally-native customer segments like gig workers and younger demographics. The company's future growth hinges on its ability to build a powerful, parallel growth engine focused on direct-to-consumer (DTC) sales and strategic partnerships.

Key barriers to this transformation are common to large incumbents: potential legacy technology constraints, a culture that may resist change, and the risk of channel conflict. Overcoming these will require significant investment in modern technology infrastructure (cloud, APIs, data platforms) and, crucially, in acquiring talent with digital-native skill sets.

Strategic growth opportunities are abundant. The most promising vectors include:

1. Expanding the DTC Channel: Aggressively pursuing the non-traditional workforce and individuals who prefer self-service.

2. Building a Partnership Ecosystem: Embedding Aflac products into HR tech, fintech, and digital health platforms to acquire customers at scale.

3. Targeting the Senior Market: Leveraging its trusted brand to capture a larger share of the growing Medicare Supplement market.

To unlock this potential, Aflac should adopt a hybrid growth model, protecting its profitable core while investing in a distinct, agile unit to pursue digital and partnership initiatives. The recommended North Star Metric, 'Annualized Premium from Digital & Partnership Channels,' will provide the necessary focus to drive this transformation. Success will be defined by the company's ability to evolve from a product sold through agents to a solution bought by customers through the channel of their choice.

Legal Compliance

Aflac's privacy posture is managed through a comprehensive 'Privacy Center,' which is a strategic strength. The policy is readily accessible from the website footer. It addresses key requirements under the Gramm-Leach-Bliley Act (GLBA) by explaining data collection, sharing practices, and consumer opt-out rights. It also provides mechanisms for exercising rights under state laws like the CCPA/CPRA, such as 'Do Not Sell or Share My Personal Information' and a portal to 'Exercise Your Rights.' Given that Aflac deals with health-related insurance, its handling of Protected Health Information (PHI) is implicitly governed by HIPAA. The policy's description of data use in claims and policy administration aligns with HIPAA's requirements for Treatment, Payment, and Health Care Operations. However, the recent disclosure of a cybersecurity incident raises significant questions about the practical implementation and effectiveness of the stated privacy protections.

The 'Terms of Use' are standard for a large corporation and are accessible via the footer. They cover essential areas such as intellectual property rights, limitations of liability, disclaimers of warranties, and governing law. The language is formal and legalistic, which is typical but may reduce readability for the average consumer. From a strategic perspective, the terms are enforceable and provide a solid legal foundation for the website's operation, but they do not actively contribute to building user trust or simplifying the customer experience.

The website provides a 'Do Not Sell or Share My Personal Information' link, which is a direct requirement of the CCPA/CPRA, suggesting the use of tracking cookies and analytics that could be construed as 'sharing'. This is a positive step. However, the initial scraped data does not show an explicit, interactive cookie consent banner that allows users to opt-in or out of different categories of cookies before they are placed. This lack of a granular, upfront consent mechanism is a compliance gap under evolving US state privacy laws and a standard requirement under GDPR (though Aflac's direct EU market exposure is limited). This approach prioritizes implied consent, which is a higher-risk strategy in the current regulatory environment.