eScore

aig.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

AIG demonstrates a very strong digital foundation with high domain authority and excellent organic keyword rankings, indicating powerful content authority. The website effectively serves as a global portal, but its messaging is heavily US-centric, suggesting an opportunity to improve localized content for better international market penetration. While the information architecture is logical for directing different audiences, the content is heavily skewed towards top-of-funnel brand awareness and bottom-of-funnel investor relations, with a significant gap in mid-funnel, problem-solving content for B2B customers.

High content authority and domain strength, reflected in over 77,000 organic keywords, which drives significant organic traffic.

Develop dedicated, localized content hubs for key international markets (e.g., EMEA, APAC) to improve non-US search visibility and better align with regional user intent.

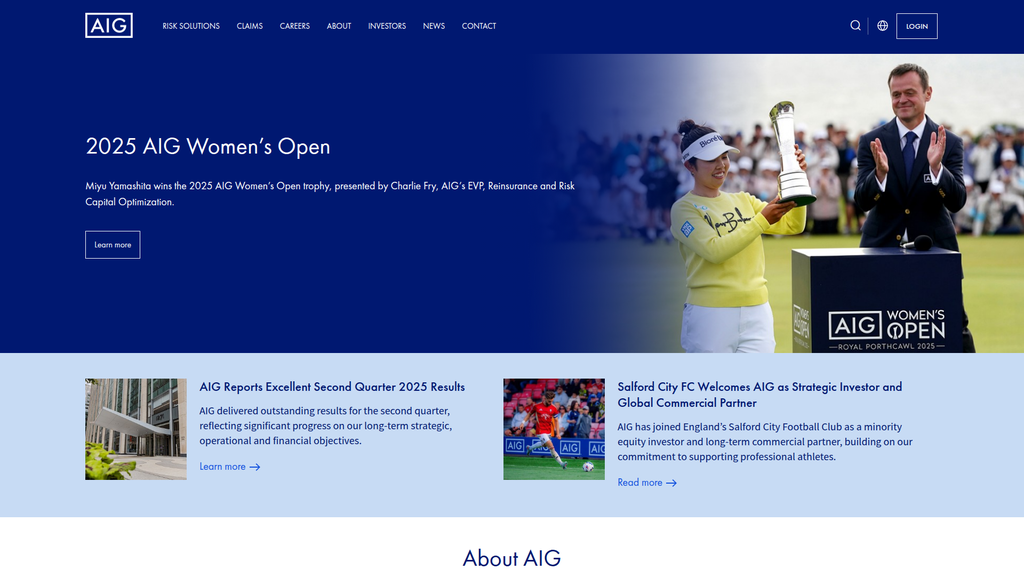

The brand messaging is exceptionally consistent in projecting an image of financial strength and corporate leadership, primarily targeting investors and financial analysts. However, this focus makes the communication ineffective for other key personas like brokers, SMEs, and individual clients, whose needs are not directly addressed on the homepage. The value proposition of being a 'long-term partner' is a strong differentiator but is buried in news articles rather than being a core, upfront message.

The message of financial strength and competent leadership is communicated with extreme clarity and consistency, effectively reassuring investors and large corporate stakeholders.

Restructure the homepage messaging hierarchy to lead with a client-centric value proposition (e.g., 'Navigating a World of Risk, Together') instead of financial results, making the site more welcoming to prospective customers.

The website's primary goal appears to be information dissemination rather than conversion, leading to a suboptimal experience for prospective customers. Calls-to-action are passive and visually understated (e.g., 'Learn more' as text links), failing to guide users toward lead-generating actions. A significant friction point is the poor readability on text-heavy pages due to very wide text containers, which increases cognitive load and likely reduces engagement with key thought leadership content.

The navigation is clear and the information architecture is logical, allowing different audience segments (Individuals, Businesses, Investors) to find their relevant website sections efficiently.

Redesign all primary CTAs to be high-contrast, action-oriented buttons (e.g., 'Explore Our Solutions,' 'Request a Consultation') to create clearer conversion paths and improve lead generation.

AIG excels in establishing credibility through a strong emphasis on its financial performance, leadership authority, and global scale, which are powerful trust signals for its corporate and investor audiences. Third-party validation is evident through high-profile sponsorships and thought leadership events with other major CEOs. The site's legal and compliance sections, particularly regarding industry-specific disclosures and CCPA, are robust, though a gap exists in GDPR cookie compliance.

The prominent display of strong financial results, CEO communications, and the 'unprecedented turnaround' narrative serves as powerful evidence of stability and success, building immense trust.

Implement a geo-targeted, GDPR-compliant cookie consent banner to mitigate legal risk in the significant EMEA market and enhance trust with European users by providing them with expected data privacy controls.

AIG's most sustainable competitive advantages are its immense global footprint across 80+ countries and its deep, specialized underwriting expertise in complex risks, both of which are extremely difficult to replicate. The company is building a new moat through its aggressive and public-facing investment in AI with partners like Palantir and Anthropic, aiming to create a 'high-tech, high-touch' model. While powerful, the brand still carries some reputational legacy from the 2008 financial crisis, and its distribution model is heavily dependent on broker relationships.

The unparalleled global network and licensing to operate in over 80 countries provide a nearly insurmountable moat for servicing large, multinational clients with complex, cross-border needs.

Accelerate the operationalization of AI partnerships to translate the temporary innovation advantage into a durable, systemic improvement in underwriting speed, accuracy, and efficiency across all business lines.

Having completed a major restructuring and the spin-off of its Life & Retirement business, AIG is in a strong position to scale its core P&C operations. The 'AIG Next' initiative has improved operational leverage, and investments in AI are set to further decouple revenue from headcount. However, scalability is constrained by complex global regulations and legacy technology, and expansion potential into the mid-market is underdeveloped, creating a vulnerability to nimble insurtechs.

The strategic focus on AI-powered underwriting and claims processing creates significant operational leverage, allowing for profitable growth in policy volume without a linear increase in operational costs.

Develop a dedicated, digital-first product suite and distribution channel for the underserved SME/mid-market segment to capture a new growth vector and compete with insurtech challengers.

AIG's business model has achieved exceptional coherence following the spin-off of Corebridge Financial, allowing for a laser focus on the global P&C market. There is strong strategic alignment between the company's core resources (global network, underwriting talent) and its value proposition of managing complex risk. The heavy investment in AI directly supports the core activities of underwriting and claims management, demonstrating efficient resource allocation towards future growth drivers.

The strategic decision to divest the Life & Retirement business has created a highly focused and streamlined P&C insurance model, aligning all resources and activities towards a single, coherent mission.

Rebalance stakeholder messaging to better align with customers and brokers. The current model's communication is disproportionately focused on satisfying investor interests, which can alienate the very audiences needed to drive top-line growth.

As one of the largest global P&C insurers, AIG exerts significant market influence, particularly in the commercial and industrial sectors where it is a leading underwriter in the U.S. Its brand, scale, and global network give it considerable leverage with partners and the ability to help shape industry conversations, especially around emerging risks and technology. However, its market share trajectory is relatively stable in a mature market, and it faces intense competition from peers like Chubb and Allianz who are also vying for leadership in the high-end commercial space.

AIG's ability to underwrite the world's most complex and large-scale risks gives it significant pricing power and market influence that smaller competitors cannot match.

Launch a flagship, data-driven annual 'Global Risk Report' using AIG's proprietary claims data to solidify its position as the definitive thought leader and shape market direction on emerging risks.

Business Overview

Business Classification

Insurance Provider

Financial Services & Risk Management

Insurance

Sub Verticals

- •

Property & Casualty (P&C) Insurance

- •

Commercial Lines

- •

Specialty Insurance (e.g., Cyber, D&O, Environmental)

- •

Personal Lines (e.g., Private Client Group, Travel, Personal Accident)

Mature

Maturity Indicators

- •

Over 100 years in operation (founded 1919).

- •

Extensive global presence in over 200 countries and jurisdictions.

- •

Recent major corporate restructuring, including the IPO and deconsolidation of its Life & Retirement business (Corebridge Financial) to focus on P&C insurance.

- •

Strong brand recognition, albeit one that has undergone a significant 'turnaround' narrative post-2008 financial crisis.

- •

Sustained focus on underwriting discipline and improving profitability, with three consecutive years of a sub-92 combined ratio.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Net Premiums Earned

Description:The core revenue source, generated by charging individuals and businesses for insurance policies across various property and casualty lines. This represents the portion of premiums recognized as revenue for the coverage provided during a specific period.

Estimated Importance:Primary

Customer Segment:Commercial, Institutional, and Individual clients

Estimated Margin:Medium

- Stream Name:

Net Investment Income

Description:Income generated from investing the 'float' - premiums collected from policyholders that have not yet been paid out as claims. This capital is invested in a diverse portfolio of assets to generate returns, a critical component of profitability for insurers.

Estimated Importance:Primary

Customer Segment:N/A (Internal capital management)

Estimated Margin:Variable (Dependent on market conditions)

- Stream Name:

Fee-Based Services

Description:Revenue from services such as asset management, advisory services, and other financial services that do not rely on underwriting risk.

Estimated Importance:Tertiary

Customer Segment:Institutional and Commercial clients

Estimated Margin:High

Recurring Revenue Components

Insurance policy renewals

Pricing Strategy

Actuarial-Based Underwriting

Premium

Opaque

Pricing Psychology

- •

Risk Aversion

- •

Authority Branding

- •

Value-Based Pricing

Monetization Assessment

Strengths

- •

Diversified global premium base reduces dependency on any single market.

- •

Significant net investment income from a large asset base provides a substantial secondary revenue stream.

- •

Strong brand and expertise allow for premium pricing on complex commercial and specialty risks.

Weaknesses

- •

Revenue is susceptible to market cyclicality ('hard' vs. 'soft' insurance markets).

- •

Profitability can be significantly impacted by high-severity catastrophic events.

- •

Investment income is exposed to interest rate fluctuations and capital market volatility.

Opportunities

- •

Leverage AI and data analytics to refine underwriting, leading to more accurate pricing and risk selection.

- •

Expand specialty product offerings for emerging risks like cyber threats, climate change, and AI liability.

- •

Grow presence in underserved commercial segments in emerging markets.

Threats

- •

Intense competition from other global P&C insurers like Chubb, Travelers, and Allianz.

- •

Disruption from Insurtech startups leveraging technology for greater efficiency and new distribution models.

- •

Increasing frequency and severity of natural disasters due to climate change, leading to higher claims volatility.

Market Positioning

A leading global partner for complex risk management, leveraging deep underwriting expertise, financial strength, and an extensive worldwide network.

Top-tier Global Player (Among the largest P&C insurers worldwide by premium volume).

Target Segments

- Segment Name:

Multinational Corporations

Description:Large, global enterprises (including 98% of the Fortune 500) requiring complex, coordinated insurance programs across multiple jurisdictions.

Demographic Factors

- •

Global operations

- •

High revenue

- •

Complex supply chains

Psychographic Factors

- •

Value expertise and financial stability

- •

Seek long-term strategic partnerships

- •

Highly risk-averse

Behavioral Factors

- •

Purchase through sophisticated global brokers

- •

Require customized, manuscript policies

- •

Value claims-paying reliability above price

Pain Points

- •

Navigating disparate international regulations

- •

Managing emerging risks (e.g., political risk, cyber warfare)

- •

Ensuring seamless global coverage and claims service

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Commercial (Mid-to-Large Enterprises)

Description:Domestic or regional businesses with significant assets and complex liability exposures, including specialized industries like energy, aviation, and construction.

Demographic Factors

- •

Industry-specific operations (e.g., manufacturing, tech, healthcare)

- •

Significant employee base

- •

Substantial physical and intellectual property assets

Psychographic Factors

Seek industry-specific expertise

Value risk mitigation and loss control services

Behavioral Factors

Work with specialized insurance brokers

Purchase multiple lines of coverage (e.g., property, casualty, financial lines)

Pain Points

- •

Rising cost of liability and property insurance

- •

Protecting against business interruption

- •

Managing workers' compensation and employee safety

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

High-Net-Worth Individuals (Private Client Group)

Description:Wealthy individuals and families requiring bespoke insurance solutions for high-value homes, collections, yachts, and personal liability (umbrella) coverage.

Demographic Factors

High income and net worth

Ownership of multiple properties and valuable assets

Psychographic Factors

Demand high-touch, confidential service

Prioritize asset protection and legacy preservation

Behavioral Factors

Rely on private wealth advisors and specialized brokers

Often require international coverage

Pain Points

- •

Inadequate coverage from standard insurers

- •

Protecting unique and hard-to-value assets

- •

Managing personal liability in a litigious environment

Fit Assessment:Good

Segment Potential:Medium

Market Differentiation

- Factor:

Global Network & Licensing

Strength:Strong

Sustainability:Sustainable

- Factor:

Expertise in Complex & Specialty Risks

Strength:Strong

Sustainability:Sustainable

- Factor:

Financial Strength & Claims-Paying Ability

Strength:Strong

Sustainability:Sustainable

- Factor:

Broker and Agent Distribution Relationships

Strength:Strong

Sustainability:Sustainable

Value Proposition

To provide world-class expertise, financial strength, and risk management solutions that empower businesses and individuals to manage complex risks and achieve their goals with confidence.

Good

Key Benefits

- Benefit:

Comprehensive protection against a wide range of property and casualty risks.

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Extensive portfolio of commercial and personal insurance products.

Decades of claims data and experience.

- Benefit:

Seamless management of global insurance programs across 200+ countries.

Importance:Critical

Differentiation:Unique

Proof Elements

Vast network of AIG operations, licenses, and partners.

Specialized multinational client portals like 'myAIG'.

- Benefit:

Access to specialized underwriting expertise for emerging and complex risks.

Importance:Important

Differentiation:Unique

Proof Elements

Market leadership in lines like Directors & Officers (D&O), cyber, and energy.

Thought leadership and risk insights shared with clients.

Unique Selling Points

- Usp:

Unparalleled global network capable of servicing the world's largest multinational corporations with consistent, compliant coverage.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Pioneering use of Generative AI at the core of the underwriting process to enhance speed and risk selection for complex business.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Financial devastation from catastrophic property damage or major liability lawsuits.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Navigating the complexity of insurance regulations and requirements across different countries.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Inability to secure adequate coverage for unique, high-value, or emerging risks from standard insurers.

Severity:Major

Solution Effectiveness:Partial

Value Alignment Assessment

High

AIG's focus on complex commercial and specialty P&C risks is well-aligned with the growing global need for sophisticated risk management solutions.

High

The value proposition of expertise, financial strength, and global reach directly addresses the core pain points of multinational corporations and large enterprises.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Insurance Brokers & Agents (Primary distribution channel)

- •

Reinsurers

- •

Technology Partners (e.g., Palantir, Anthropic, AWS).

- •

Strategic Investors (e.g., Blackstone).

- •

Network Partners in non-licensed jurisdictions

Key Activities

- •

Underwriting & Risk Assessment

- •

Claims Management & Processing

- •

Investment Portfolio Management

- •

Distribution Channel Management

- •

Regulatory Compliance

Key Resources

- •

Financial Capital & Balance Sheet Strength

- •

Global Underwriting Expertise & Talent

- •

Proprietary Actuarial and Claims Data

- •

Brand Reputation & Trust

- •

Global Operating Licenses

Cost Structure

- •

Loss and Loss Adjustment Expenses (Claims Payouts)

- •

Acquisition Costs (Broker/Agent Commissions)

- •

General Operating & Administrative Expenses

- •

Technology & Transformation Investments

- •

Reinsurance Premiums

Swot Analysis

Strengths

- •

Strong, established global brand and extensive worldwide network.

- •

Deep expertise in high-margin commercial and specialty insurance lines.

- •

Strategic focus on technology, particularly AI, to improve core underwriting and operational efficiency.

- •

Improved financial health and underwriting discipline following a major corporate turnaround.

Weaknesses

- •

Legacy operational complexity and potential for bureaucratic inertia common in large, established organizations.

- •

Reputational risk lingering from the 2008 financial crisis, despite significant restructuring.

- •

High dependency on the independent broker channel for distribution.

Opportunities

- •

Become a market leader in AI-driven underwriting, creating a significant competitive advantage in speed and risk selection.

- •

Capitalize on the divestiture of the life & retirement business to streamline operations and focus resources on core P&C growth.

- •

Develop innovative insurance products for emerging risks associated with technology, climate, and geopolitics.

- •

Expand fee-based risk management and consulting services.

Threats

- •

Intensifying competition from established global insurers and nimble Insurtech startups.

- •

Increasing severity and frequency of catastrophic events straining underwriting profitability.

- •

Global macroeconomic instability and interest rate volatility impacting investment returns.

- •

Potential for adverse reserve development from long-tail casualty lines.

Recommendations

Priority Improvements

- Area:

Digital Transformation & AI Integration

Recommendation:Accelerate the rollout of the 'AIG Underwriter Assistance' platform across all financial and specialty lines to embed AI into the core business, aiming to achieve the stated 2x-5x underwriter productivity gain.

Expected Impact:High

- Area:

Brand Repositioning

Recommendation:Shift marketing narrative from 'turnaround story' to 'future-focused innovator.' Heavily promote partnerships with tech leaders like Palantir and Anthropic to solidify AIG's image as a forward-thinking, data-driven insurer.

Expected Impact:Medium

- Area:

Operational Efficiency

Recommendation:Aggressively pursue the operational excellence goals (formerly 'AIG 200') to continue reducing expense ratios, leveraging the simplified corporate structure post-Corebridge separation to remove legacy complexities.

Expected Impact:High

Business Model Innovation

- •

Develop a 'Risk-as-a-Service' (RaaS) platform, offering AIG's proprietary risk analytics and modeling tools to large corporate clients and captives on a subscription basis.

- •

Create parametric insurance products for risks like non-damage business interruption or specific cyber events, using data triggers for instant claim payouts.

- •

Establish a dedicated venture arm to invest in and partner with early-stage Insurtech companies, creating an ecosystem of innovation and gaining early access to disruptive technologies.

Revenue Diversification

- •

Expand AIG's global risk consulting practice into a more prominent, standalone fee-based business, advising clients on risks beyond what is insurable.

- •

Monetize anonymized, aggregated risk data by providing industry-specific benchmarking and trend analysis reports to corporate clients and industry groups.

- •

Offer white-label specialty insurance products and claims handling services to smaller, regional insurers who lack AIG's global reach and expertise.

AIG has undergone a profound strategic transformation, evolving from a sprawling, complex financial conglomerate into a more streamlined and disciplined global Property & Casualty insurer. The successful IPO and deconsolidation of its Corebridge Financial life and retirement business marks the culmination of a multi-year turnaround focused on simplifying the business model, strengthening the balance sheet, and instilling rigorous underwriting discipline. The current business model is now squarely centered on its historical strength: managing complex commercial and specialty risks for a global clientele.

The company's future evolution hinges on its ambitious bet to weaponize Generative AI at the core of its operations. Partnerships with technology leaders like Palantir and Anthropic are not peripheral experiments but a central pillar of the strategy to create a sustainable competitive advantage through superior risk selection, operational efficiency, and speed-to-market. This positions AIG to move beyond the narrative of recovery and toward one of industry leadership and innovation. Key challenges remain, including intense competition, macroeconomic volatility, and the increasing threat of climate-related catastrophes. However, by successfully integrating advanced technology with its deep-seated underwriting expertise and unparalleled global network, AIG's refined business model is well-positioned for a new era of stable, profitable growth and market leadership.

Competitors

Competitive Landscape

Mature

Moderately concentrated

Barriers To Entry

- Barrier:

Regulatory Capital & Compliance

Impact:High

- Barrier:

Brand Reputation & Trust

Impact:High

- Barrier:

Distribution Network Access (Brokers/Agents)

Impact:High

- Barrier:

Underwriting Expertise & Historical Data

Impact:Medium

- Barrier:

Technology & Legacy Systems

Impact:Medium

Industry Trends

- Trend:

Digital Transformation & AI Adoption

Impact On Business:AI is being used to enhance underwriting, pricing, claims processing, and fraud detection. AIG's explicit focus on GenAI with partners like Anthropic and Palantir, as highlighted on their website, positions them to leverage this trend for efficiency and risk assessment.

Timeline:Immediate

- Trend:

Increasingly Complex & Systemic Risks

Impact On Business:The rise of cyber threats, climate change-related events, and geopolitical instability creates demand for sophisticated risk management and specialty insurance products, which is AIG's core strength.

Timeline:Immediate

- Trend:

Focus on Data Analytics

Impact On Business:Leveraging vast datasets for more accurate risk modeling and personalized pricing is crucial. This can improve profitability and competitive positioning. AIG's partnerships suggest a strategic move to harness advanced analytics.

Timeline:Immediate

- Trend:

Environmental, Social, and Governance (ESG) Integration

Impact On Business:Stakeholders and clients increasingly demand sustainable and responsible business practices. This affects underwriting criteria, investment strategies, and corporate reputation.

Timeline:Near-term

Direct Competitors

- →

Chubb Limited

Market Share Estimate:Leading global P&C insurer, often cited as a top competitor.

Target Audience Overlap:High

Competitive Positioning:Positions itself as a premium, high-service provider for complex commercial risks and high-net-worth individuals, emphasizing underwriting discipline and superior claims service.

Strengths

- •

Strong brand reputation for quality and expertise.

- •

Global presence in 54 countries with a diversified product portfolio.

- •

Excellent financial performance and robust risk management.

- •

Deep expertise in specialty and high-net-worth insurance segments.

Weaknesses

- •

Can be perceived as having higher premiums than competitors.

- •

Vulnerability to large losses from catastrophic events, though managed by reinsurance.

- •

Potential for slower decision-making processes inherent in a large, disciplined organization.

Differentiators

- •

Focus on superior craftsmanship in underwriting and claims.

- •

Strong positioning in the high-net-worth personal lines market.

- •

Customized insurance solutions and deep industry-specific expertise.

- →

The Travelers Companies, Inc.

Market Share Estimate:One of the largest U.S. commercial property and casualty insurers.

Target Audience Overlap:High

Competitive Positioning:Leverages deep relationships with independent agents and brokers, positioning itself as a reliable and financially stable partner with strong risk management expertise.

Strengths

- •

Leading market position in the U.S., especially in workers' compensation and commercial multi-peril.

- •

Extensive and loyal network of independent agents and brokers.

- •

Strong financial stability and consistent performance.

- •

Recognized for industry-leading claims service and risk control.

Weaknesses

- •

Less brand recognition globally compared to AIG or Chubb.

- •

Revenue is more concentrated in the North American market.

- •

Faces intense competition from a wide range of national and regional insurers in the U.S.

Differentiators

- •

Deeply entrenched distribution network through independent agents.

- •

Focus on risk control services to help clients mitigate losses.

- •

Strong specialization in select commercial and specialty lines in the US.

- →

Allianz SE (specifically Allianz Commercial)

Market Share Estimate:A top-tier global insurer with a massive footprint.

Target Audience Overlap:High

Competitive Positioning:Positions itself as a unified global partner for mid-sized businesses, large corporations, and specialty risks by combining the strengths of Allianz Global Corporate & Specialty (AGCS) and local P&C entities.

Strengths

- •

Immense global scale and financial strength as part of Allianz Group.

- •

Broad product portfolio covering aviation, marine, cyber, and construction.

- •

Strong capabilities in serving multinational clients with complex cross-border needs.

- •

Unified 'Allianz Commercial' branding simplifies go-to-market strategy.

Weaknesses

- •

Large organizational structure could lead to complexity and slower responses.

- •

Potential for channel conflict between global and local business units.

- •

Brand perception can vary significantly by region.

Differentiators

- •

Integrated global model offering a seamless experience for multinational clients.

- •

Strong focus on risk consulting and sustainability services.

- •

Leverages the broader Allianz Group's capabilities, including trade credit insurance via Allianz Trade.

- →

Zurich Insurance Group

Market Share Estimate:Major global insurer with significant commercial P&C operations.

Target Audience Overlap:High

Competitive Positioning:A leading multi-line insurer serving global and local markets, focused on providing comprehensive P&C and life insurance products with an emphasis on risk management and resilience services.

Strengths

- •

Strong global brand and presence in over 210 countries and territories.

- •

Diversified business across P&C and life insurance.

- •

Expertise in handling complex multinational programs and offering risk resilience services.

- •

Well-established relationships with large corporate clients.

Weaknesses

- •

Performance can be subject to volatility in life insurance markets.

- •

Like other legacy carriers, faces challenges with modernizing IT infrastructure.

- •

Profitability has faced pressure in certain markets and lines of business.

Differentiators

- •

Offers a holistic approach to risk management through 'Zurich Resilience Solutions'.

- •

Strong focus on sustainability and its integration into business practices.

- •

Comprehensive suite of digital tools for clients and brokers like 'My Zurich'.

Indirect Competitors

- →

Insurtech MGAs (e.g., Coalition, Next Insurance)

Description:Technology-first companies that specialize in specific niches (like cyber or small business insurance), offering streamlined digital purchasing, underwriting, and claims processes. They often partner with traditional insurers for capacity.

Threat Level:Medium

Potential For Direct Competition:High, as they expand their product offerings and potentially seek their own carrier licenses.

- →

Large Insurance Brokers (e.g., Marsh McLennan, Aon)

Description:While primarily distribution partners, they are increasingly offering their own risk management services, analytics platforms, and captive management solutions, which can compete with an insurer's direct offerings.

Threat Level:Low

Potential For Direct Competition:Low, their business model relies on carrier partnerships, but they compete for the 'risk advisor' role.

- →

Professional Services Firms (e.g., Deloitte, PwC)

Description:Offer risk advisory, cybersecurity, and ESG consulting services that overlap with the risk mitigation services offered by large insurers like AIG.

Threat Level:Low

Potential For Direct Competition:Very Low, but they compete for the client's risk management budget and influence.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Global Footprint and Network

Sustainability Assessment:Highly sustainable due to the immense capital, regulatory approvals, and time required to replicate operations in over 200 countries and jurisdictions.

Competitor Replication Difficulty:Hard

- Advantage:

Expertise in Complex & Specialty Risks

Sustainability Assessment:Sustainable, as it is built on decades of proprietary data, underwriting talent, and claims handling experience in niche areas like D&O, cyber, and energy.

Competitor Replication Difficulty:Medium

- Advantage:

Established Broker and Agent Relationships

Sustainability Assessment:Moderately sustainable. While strong, these relationships require constant maintenance and are under threat from digital distribution models and aggressive competitors.

Competitor Replication Difficulty:Medium

- Advantage:

Strong Brand Recognition

Sustainability Assessment:Moderately sustainable. The brand is globally recognized, but still carries some reputational overhang from the 2008 financial crisis, requiring ongoing investment in brand rehabilitation and positive association (e.g., sponsorships).

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'CEO-led Turnaround Momentum', 'estimated_duration': "1-3 years. The narrative of an 'unprecedented turnaround' led by CEO Peter Zaffino, highlighted on the website, creates positive investor and market sentiment but relies on continued exceptional performance."}

{'advantage': 'First-Mover AI Partnerships', 'estimated_duration': '1-2 years. The highlighted partnerships with Palantir and Anthropic provide a near-term innovation edge, but competitors are also investing heavily in AI and can form similar alliances. '}

Disadvantages

- Disadvantage:

Legacy Technology Infrastructure

Impact:Major

Addressability:Difficult

- Disadvantage:

Organizational Complexity

Impact:Major

Addressability:Moderately

- Disadvantage:

Reputational Legacy

Impact:Minor

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Launch a targeted digital campaign highlighting AI-driven risk insights for brokers and risk managers, leveraging the Anthropic/Palantir partnerships.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Create and promote thought leadership content around emerging risks (e.g., GenAI liability, climate transition risks) to reinforce expertise.

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Simplify and digitize the onboarding process for new small-to-mid-sized commercial clients within key broker portals.

Expected Impact:High

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Expand digital-first product offerings for the mid-market segment to counter the threat from insurtechs.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Develop and launch specific ESG-focused insurance products, such as coverage for renewable energy projects or policies with ESG-linked pricing.

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Further streamline the organizational structure ('AIG Next' initiative) to reduce operational friction and improve agility.

Expected Impact:High

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Build a proprietary, unified data platform that integrates underwriting, claims, and risk data across all business lines to create a durable AI advantage.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Explore embedded insurance partnerships with large B2B technology platforms to open new, efficient distribution channels.

Expected Impact:Medium

Implementation Difficulty:Difficult

- Recommendation:

Invest in parametric insurance solutions for climate and catastrophe risks to offer faster, more transparent claims payouts.

Expected Impact:Medium

Implementation Difficulty:Moderate

Solidify AIG's position as the premier global insurer for complex and emerging risks, differentiated by the synthesis of deep human expertise and cutting-edge AI-driven insights.

Focus on a 'High-Tech, High-Touch' model. Use AI and data analytics to empower, not replace, expert underwriters and claims professionals. Market this unique synergy to brokers and large clients who value both technological efficiency and expert partnership in navigating complex risks.

Whitespace Opportunities

- Opportunity:

Integrated Cyber Risk Management Platform

Competitive Gap:While many insurers offer cyber insurance, few provide a fully integrated platform that combines insurance with proactive threat monitoring, incident response services, and post-breach analysis in a seamless digital experience.

Feasibility:Medium

Potential Impact:High

- Opportunity:

ESG Advisory & Insurance Solutions

Competitive Gap:There is a growing need from large corporations for integrated solutions that help them manage ESG-related risks (e.g., climate liability, D&O exposure from ESG disclosures) and provide insurance capacity for their transition to more sustainable operations. This goes beyond simple underwriting and into a partnership role.

Feasibility:High

Potential Impact:Medium

- Opportunity:

Digital-First Mid-Market Commercial Programs

Competitive Gap:Large global insurers often focus on either large, complex accounts or, to a lesser extent, small business. The mid-market segment is often underserved by a truly seamless, digitally-enabled service model from a top-tier carrier.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Parametric Insurance for Supply Chain Disruption

Competitive Gap:Traditional business interruption insurance can have a complex and lengthy claims process. A parametric product that pays out automatically based on predefined triggers (e.g., a port closure for 'x' days, a key supplier's factory in a specific disaster zone) would offer speed and certainty that competitors are not widely offering.

Feasibility:Medium

Potential Impact:Medium

AIG operates in the mature and moderately concentrated global Property & Casualty insurance market. The landscape is dominated by a handful of large, well-capitalized players like Chubb, Travelers, Allianz, and Zurich, making brand, scale, and distribution key competitive moats. Based on its website and strategic communications, AIG is actively crafting a narrative of a successful, tech-forward turnaround under CEO Peter Zaffino. The company's core competitive advantage lies in its vast global network and its long-standing expertise in underwriting complex, specialty commercial risks—a difficult combination for new entrants to replicate.

Direct competitors like Chubb compete fiercely on service quality and underwriting precision, often targeting the same lucrative high-end commercial and private client segments. Travelers holds a dominant position in the U.S. through its powerful independent agent network, while Allianz and Zurich leverage their massive scale and European roots to service multinational clients effectively. The primary competitive axis is shifting from pure financial strength and product breadth to include technological prowess and data analytics. AIG's highly publicized partnerships with Palantir and Anthropic are a clear strategic move to establish a leadership position in this area, directly addressing the industry-wide trend of AI adoption for improved underwriting and operational efficiency.

The main threats to AIG are twofold. First, the risk of inertia from its own scale and legacy systems could cede ground to more agile competitors. Second, the rise of well-funded insurtechs and digital-first Managing General Agents (MGAs) poses a medium-term threat, particularly in less complex commercial segments where they can offer superior digital user experiences.

Strategic opportunities, or 'whitespace', exist in areas where AIG's core strengths can intersect with market gaps. These include developing integrated risk management platforms (particularly for cyber and ESG risks), better serving the mid-market with digital solutions, and innovating on product structure with offerings like parametric insurance for supply chain risks. AIG's success will depend on its ability to execute its 'AIG Next' operational transformation, successfully leverage its AI partnerships to create tangible underwriting advantages, and effectively communicate its revitalized value proposition to its critical broker distribution partners.

Messaging

Message Architecture

Key Messages

- Message:

AIG is a financially strong, operationally excellent, and strategically forward-thinking global leader.

Prominence:Primary

Clarity Score:High

Location:Homepage - Hero section ('AIG Reports Excellent Second Quarter 2025 Results'), 'AIG Performance & Initiatives' section ('Forward We Go', 'AIG’s Unprecedented Turnaround').

- Message:

We provide world-class, industry-leading risk solutions and expertise for businesses and individuals globally.

Prominence:Secondary

Clarity Score:Medium

Location:Homepage - 'About AIG' and 'Risk Solutions' sections.

- Message:

AIG is a committed long-term partner, helping clients manage complex and emerging risks.

Prominence:Secondary

Clarity Score:High

Location:Newsroom - 'What it takes to be a long-term insurance partner'.

- Message:

AIG supports and elevates communities and professional sports through high-profile partnerships.

Prominence:Tertiary

Clarity Score:High

Location:Homepage - 'AIG Women’s Open', 'Salford City FC'.

The message hierarchy is heavily skewed towards investors and corporate stakeholders. Financial performance and strategic leadership messages (e.g., 'Excellent Second Quarter...Results,' 'Unprecedented Turnaround') dominate the homepage. Client-facing messages about solving insurance needs are present but secondary, requiring users to click through to 'Risk Solutions' to find substantive information. This positions the website more as a corporate communications portal than a client acquisition tool.

Messaging is highly consistent in its corporate, authoritative tone. The emphasis on financial strength, leadership, and global expertise is echoed from the homepage headlines to the detailed newsroom articles. This creates a strong, unified brand image, but the consistency also means the client-centric voice remains muted across all analyzed sections.

Brand Voice

Voice Attributes

- Attribute:

Authoritative

Strength:Strong

Examples

- •

AIG delivered outstanding results...

- •

We are... a leading global insurance organization...

- •

Explore our industry-leading solutions...

- Attribute:

Corporate

Strength:Strong

Examples

- •

Chairman & CEO Peter Zaffino reflects on AIG’s turnaround...

- •

AIG Reports Excellent Second Quarter 2025 Results

- •

AIG has joined England’s Salford City Football Club as a minority equity investor...

- Attribute:

Expert-driven

Strength:Moderate

Examples

- •

AIG’s risk experts worked with the firm...

- •

Our local expertise and decades of experience allow us to negotiate and settle claims...

- •

Dominik Bark... shares how AIG helps clients position their organizations for long-term growth...

- Attribute:

Client-centric

Strength:Weak

Examples

We help our clients and partners protect what matters most...

Nurturing long-term relationships allows us to closely follow the development of our clients’ businesses...

Tone Analysis

Formal & Financial

Secondary Tones

Confident

Professional

Tone Shifts

The tone shifts slightly in the newsroom article to be more narrative and explanatory, using a specific employee's experience to illustrate partnership. However, it remains highly professional and formal.

Voice Consistency Rating

Excellent

Consistency Issues

While highly consistent, the voice lacks adaptability. The tone for a potential individual client is the same as for an institutional investor, which can feel impersonal and inaccessible to the former.

Value Proposition Assessment

AIG is a financially stable, global insurance leader with the expertise and resources to manage the most complex risks for businesses and individuals, ensuring their long-term growth and security.

Value Proposition Components

- Component:

Global Reach & Local Expertise

Clarity:Clear

Uniqueness:Somewhat Unique

Examples

...in more than 200 countries and jurisdictions...

'Having teams in place across jurisdictions versed in the local regulatory and legal requirements really makes a difference...'

- Component:

Financial Strength & Stability

Clarity:Clear

Uniqueness:Common

Examples

AIG Reports Excellent Second Quarter 2025 Results

AIG’s Unprecedented Turnaround

- Component:

Tailored, Long-Term Partnership

Clarity:Somewhat Clear

Uniqueness:Somewhat Unique

Examples

'Nurturing long-term relationships allows us to closely follow the development of our clients’ businesses...'

'...developed an insurance solution tailored to the needs of the firm...'

- Component:

Industry-Leading Products & Thought Leadership

Clarity:Somewhat Clear

Uniqueness:Common

Examples

Explore our industry-leading solutions...

Peter Zaffino discusses AI with Alex Karp and Dario Amodei

AIG differentiates primarily through its emphasis on CEO-led strategic vision (e.g., turnaround, AI discussions) and its sheer scale. The concept of 'long-term partnership' is a strong differentiator but is buried in a newsroom article rather than being a prominent homepage message. Competitors like Chubb and Travelers also claim expertise and global reach, so AIG's opportunity is to more vividly demonstrate how its partnership and foresight deliver superior outcomes, moving beyond assertions of being a 'leading' organization.

The messaging positions AIG as a top-tier, institutional-grade insurer focused on financial markets and large, complex corporate risks. It competes on stability, scale, and leadership rather than on product features, customer service accessibility, or price. This positioning is strong for investors and large corporate clients but weak for SMEs and individuals who may not see their needs reflected in the high-level corporate messaging.

Audience Messaging

Target Personas

- Persona:

Institutional Investors & Financial Analysts

Tailored Messages

- •

AIG Reports Excellent Second Quarter 2025 Results

- •

In his annual letter to shareholders, Chairman & CEO Peter Zaffino reflects on AIG’s turnaround...

- •

AIG Investor Day 2025

Effectiveness:Effective

- Persona:

Corporate Risk Managers & CFOs

Tailored Messages

- •

Discover how we’re helping businesses identify emerging challenges and reduce risk...

- •

What it takes to be a long-term insurance partner

- •

What brokers need to know about captive solutions

Effectiveness:Somewhat Effective

- Persona:

Brokers & Agents

Tailored Messages

Learn why AIG is the best partner to develop market-leading risk solutions for our clients.

Effectiveness:Ineffective

- Persona:

High-Net-Worth Individuals ('Private Clients')

Tailored Messages

Explore our industry-leading solutions for individuals, from travel and personal accident insurance to coverage for Private Clients.

Effectiveness:Ineffective

Audience Pain Points Addressed

- •

Navigating complex, multi-jurisdictional regulations ('act locally').

- •

Managing emerging risks like cyber liability.

- •

Finding sufficient insurance capacity in challenging markets ('alternative solutions' like captives).

- •

Ensuring consistency and reliability in an insurance program.

Audience Aspirations Addressed

- •

Achieving long-term, secure business growth ('reach their full potential').

- •

Expanding business globally through mergers or acquisitions.

- •

Realizing personal and business goals with the confidence that risks are managed.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Security & Confidence

Effectiveness:Medium

Examples

We help our clients and partners protect what matters most...

...so they can withstand setbacks and realize their goals.

- Appeal Type:

Prestige & Leadership

Effectiveness:High

Examples

- •

AIG Women’s Open Wins LPGA Gold Drive Award...

- •

AIG’s Unprecedented Turnaround

- •

Peter Zaffino discusses AI with Alex Karp and Dario Amodei

Social Proof Elements

- Proof Type:

Expert Endorsement / Thought Leadership

Impact:Strong

Examples

Featuring CEOs of Palantir and Anthropic discussing AI strategy with AIG's CEO.

- Proof Type:

High-Profile Sponsorships

Impact:Moderate

Examples

AIG Women’s Open

Salford City FC

- Proof Type:

Leadership Authority

Impact:Strong

Examples

Heavy reliance on quotes and letters from the Chairman & CEO, Peter Zaffino.

Trust Indicators

- •

Explicitly stating 'AIG, a leading global insurance organization'.

- •

Highlighting financial reports and investor day events.

- •

Longevity and global presence (founded 1919, in 200+ countries).

- •

Showcasing expertise through employee stories and thought leadership content.

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

Learn more

Location:Homepage - Hero sections for Financial Results and AIG Women's Open.

Clarity:Clear

- Text:

Discover product & services

Location:Homepage - 'Risk Solutions' section for Individuals and Businesses.

Clarity:Clear

- Text:

Read the 2024 Annual Report

Location:Homepage - 'AIG Performance & Initiatives' section.

Clarity:Clear

- Text:

View Careers

Location:Homepage - Careers section.

Clarity:Clear

The CTAs are clear but passive. They primarily encourage further information consumption ('Learn more', 'Read more', 'Watch the video') rather than driving direct business inquiries ('Get a quote', 'Contact a specialist', 'Assess your risk'). This aligns with the site's corporate communication focus but represents a missed opportunity for lead generation, especially for the business and individual client segments.

Messaging Gaps Analysis

Critical Gaps

- •

Lack of client-centric problem/solution framing on the homepage. The messaging is about AIG's successes, not about the visitor's challenges.

- •

Absence of tangible proof points like case studies or client testimonials that demonstrate the value of partnership.

- •

A clear, compelling message for the 'Individuals' segment is missing. It's treated as a generic category without specific value propositions.

- •

The broker and agent value proposition is underdeveloped, summarized in a single, generic sentence.

Contradiction Points

There's a subtle tension between the stated value of being a 'long-term partner' and the impersonal, top-down, corporate-broadcast style of the main website.

The mission to 'help our clients and partners protect what matters most' is not the primary story the website tells; the primary story is about AIG's financial and strategic performance.

Underdeveloped Areas

- •

Persona-based content funnels. A risk manager should have a clear journey that is different from a high-net-worth individual.

- •

Storytelling that features clients as the heroes, with AIG as the expert guide. The current stories feature AIG leaders and employees as the heroes.

- •

Messaging around innovation and technology (like AI) is framed as a corporate strategy, not as a direct client benefit (e.g., 'How our AI strategy leads to faster claims processing for you').

Messaging Quality

Strengths

- •

Effectively projects an image of financial strength, stability, and competent leadership.

- •

Maintains a highly consistent and professional brand voice across all content.

- •

Successfully positions AIG as a major player on the global stage, involved in significant economic and technological conversations.

- •

Leverages high-profile sponsorships and partnerships to build brand prestige.

Weaknesses

- •

Overly focused on an investor audience, alienating prospective clients and partners.

- •

Lacks emotional resonance and human-centric storytelling.

- •

Value proposition is often asserted ('leading solutions') rather than demonstrated.

- •

Passive calls-to-action that fail to capture business leads effectively.

Opportunities

- •

Elevate the 'long-term partnership' theme from a news story to a core brand pillar on the homepage.

- •

Create dedicated content hubs for key personas (Risk Manager, Broker, Private Client) that address their specific pain points.

- •

Translate corporate initiatives (like AI adoption) into tangible client benefits and feature them prominently.

- •

Incorporate client success stories or anonymized case studies to provide concrete proof of value.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Messaging Hierarchy

Recommendation:Restructure the homepage to lead with a client-centric value proposition. Replace or supplement the 'Excellent Second Quarter Results' headline with a message that addresses a core client need, such as 'Navigating a World of Risk, Together.' Move the financial performance section further down the page.

Expected Impact:High

- Area:

Value Proposition Communication

Recommendation:Develop a dedicated 'Why AIG?' section that moves beyond assertions. Use short, powerful case studies or data points to prove claims like 'tailored solutions' and 'local expertise.' For example: 'Solved a multi-jurisdictional compliance challenge for a Fortune 500 company expanding into EMEA.'

Expected Impact:High

- Area:

Audience Segmentation

Recommendation:Enhance the 'Risk Solutions' section. Instead of just two generic buttons, create visually distinct pathways for key segments (e.g., 'For Multinationals', 'For Mid-Sized Business', 'For Private Clients', 'For Brokers') with tailored headline messaging for each.

Expected Impact:Medium

Quick Wins

- •

Rewrite the 'Risk Solutions' headlines to be benefit-oriented. Instead of 'Businesses,' try 'Helping Your Business Thrive by Managing Tomorrow's Risks.'

- •

Change passive 'Learn More' CTAs to more active language like 'Explore Our Solutions' or 'See How We Partner.'

- •

Feature the 'What it takes to be a long-term insurance partner' story more prominently on the homepage to showcase the client-centric side of the brand.

Long Term Recommendations

- •

Invest in a content strategy that builds out persona-based resource centers with thought leadership, case studies, and tools relevant to each key audience.

- •

Develop a more approachable, slightly less formal tone of voice for content aimed at individuals and small businesses to improve resonance and accessibility.

- •

Rethink the website's primary objective. If client acquisition is a key goal, the user experience and messaging architecture must be fundamentally reoriented around the customer journey, not just corporate announcements.

AIG's strategic messaging on its website is executed with precision and consistency, successfully positioning the company as a financially robust, authoritative, and stable global insurance leader. The primary audience for this messaging is unequivocally the investor community, financial press, and major corporate stakeholders. The site functions as an effective vehicle for corporate communications, highlighting strong financial performance, CEO-led strategic initiatives like the 'unprecedented turnaround,' and thought leadership in areas such as AI. However, this investor-first focus creates significant messaging gaps and weaknesses from a market-facing and client-acquisition perspective. The value proposition for key customer segments—particularly businesses, brokers, and individuals—is secondary and underdeveloped. Messaging is AIG-centric ('Our performance,' 'Our initiatives') rather than client-centric ('Your challenges,' 'Our solutions'). The brand voice, while consistently professional, lacks the warmth and directness needed to connect with a broader audience. Consequently, the website misses a critical opportunity to translate its impressive corporate stature into tangible, compelling reasons for prospective clients to engage. To drive better business outcomes, the messaging strategy must pivot to achieve a better balance, elevating the client partnership story from the newsroom to the homepage and clearly articulating how AIG's strength and expertise directly benefit the clients it aims to serve.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

AIG is a leading global insurance organization with a long-standing history and operations in over 200 countries and jurisdictions.

- •

The company serves a diverse client base, from large corporations to individuals, offering a wide range of property casualty insurance and other financial services.

- •

Reported outstanding Q2 2025 financial results, with a 56% year-over-year increase in adjusted after-tax income per diluted share, indicating strong market demand and operational execution.

- •

The 'unprecedented turnaround' highlighted by Chairman & CEO Peter Zaffino suggests a successful realignment of products and services with market needs.

Improvement Areas

- •

Accelerate the development of products for emerging risks like advanced cyber threats, climate change impacts, and risks associated with AI.

- •

Enhance digital product offerings and self-service capabilities to better serve digitally native individual consumers and small-to-medium enterprises (SMEs).

- •

Improve product personalization by leveraging data analytics and AI to move beyond traditional risk pooling.

Market Dynamics

Moderate, with a forecasted CAGR of 4.3% for the global insurance market between 2024 and 2029. P&C growth was ~7.7% in 2024.

Mature

Market Trends

- Trend:

Generative AI and Digital Transformation

Business Impact:AI is reshaping underwriting, claims processing, and customer service, creating opportunities for significant efficiency gains and new product development. AIG is actively pursuing this through partnerships with Anthropic and Palantir.

- Trend:

Rising Importance of ESG and Climate Risk

Business Impact:Increasing frequency of natural catastrophes and growing stakeholder pressure require more sophisticated climate risk modeling and sustainable underwriting practices.

- Trend:

Embedded and On-Demand Insurance

Business Impact:Shift in customer expectation towards integrated, contextual insurance products offered through non-insurance channels, requiring new partnership and technology strategies.

- Trend:

Increased Competition from Insurtechs

Business Impact:Agile, tech-focused startups are challenging incumbents with innovative products and superior customer experiences, particularly in niche markets.

Excellent. Having completed a major turnaround, AIG is in a strong financial position to invest in technology and capture growth from key market trends like AI integration and the expanding risk landscape.

Business Model Scalability

Medium

High fixed costs associated with global infrastructure, technology, and personnel, combined with high variable costs from claims. The 'AIG Next' initiative has successfully reduced general operating expenses.

Moderate. Operational leverage is being actively increased through the adoption of AI in core processes like underwriting, which can accelerate the process by 2x-5x, and claims, thereby decoupling revenue growth from headcount.

Scalability Constraints

- •

Complex and varied regulatory requirements across hundreds of jurisdictions.

- •

Legacy IT infrastructure can slow down the launch of new digital products and integrations.

- •

Capital adequacy requirements (solvency) that constrain the volume of premiums that can be underwritten.

Team Readiness

Strong. The current leadership, led by Peter Zaffino, is widely credited with AIG's successful turnaround and has articulated a clear, forward-looking strategy focused on underwriting profitability and technology adoption.

Complex global matrix structure. While necessary for its scale, it can create silos and slow down decision-making. The focus on AI and digital transformation will require more agile, cross-functional teams.

Key Capability Gaps

- •

Digital Product Management: Expertise in developing and managing end-to-end digital customer journeys.

- •

Data Science & AI Engineering: Advanced talent to fully leverage partnerships with tech firms like Anthropic and build proprietary models.

- •

Insurtech Partnership Management: Specialized skills to identify, negotiate, and integrate with a growing ecosystem of technology partners.

Growth Engine

Acquisition Channels

- Channel:

Brokers & Agents

Effectiveness:High

Optimization Potential:Medium

Recommendation:Equip broker partners with better technology tools for faster quoting, real-time policy information, and data-driven insights to enhance their advisory role.

- Channel:

Direct-to-Consumer (D2C) - Digital

Effectiveness:Low

Optimization Potential:High

Recommendation:Invest significantly in a D2C platform for simpler personal and SME products, focusing on a seamless user experience from quote to claim.

- Channel:

Strategic Partnerships (e.g., brand sponsorships)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Transition brand-building partnerships (like Salford City FC) into active lead generation channels through targeted offers to the partner's ecosystem.

Customer Journey

Predominantly broker-led and relationship-driven for commercial lines, which is thorough but can be slow. The digital path for individuals is not a primary focus on the website.

Friction Points

- •

Lengthy and manual data submission for commercial underwriting.

- •

Lack of transparency and real-time status updates during the claims process.

- •

Complex policy language and documentation for non-expert buyers.

Journey Enhancement Priorities

{'area': 'Commercial Underwriting Submission', 'recommendation': 'Expand the use of AI-powered document ingestion (as piloted with Palantir/Anthropic) to all commercial lines to dramatically reduce submission review time. '}

{'area': 'Digital Claims Portal', 'recommendation': 'Develop a best-in-class, mobile-first claims portal that offers self-service filing, document upload, and real-time status tracking for both individuals and business clients.'}

Retention Mechanisms

- Mechanism:

Long-Term Client & Broker Relationships

Effectiveness:High

Improvement Opportunity:Augment relationships with proactive, data-driven risk management services and insights, solidifying AIG's role as a strategic risk partner, not just a capacity provider.

- Mechanism:

Multi-Policy Programs

Effectiveness:Medium

Improvement Opportunity:Develop a more integrated data platform to identify cross-sell opportunities proactively and offer bundled solutions with simplified administration and pricing benefits.

Revenue Economics

Improving. The turnaround has focused on underwriting discipline, leading to a 46% increase in General Insurance underwriting income in Q2 2025. The focus is on profitable growth, not just premium volume.

High for commercial lines due to high retention and large premiums, but CAC through traditional broker channels is also substantial. The ratio is likely lower and less favorable in personal lines.

Strong and improving, as evidenced by expense reduction from the 'AIG Next' initiative and strong growth in net investment income.

Optimization Recommendations

- •

Utilize AI to refine risk selection and pricing accuracy, improving the loss ratio.

- •

Lower Customer Acquisition Cost (CAC) by investing in lower-cost digital and embedded channels.

- •

Increase customer lifetime value (LTV) by offering value-added risk mitigation services powered by data and analytics.

Scale Barriers

Technical Limitations

- Limitation:

Legacy Core Insurance Systems

Impact:High

Solution Approach:Adopt a two-speed IT architecture: maintain stable legacy systems for core records while building an agile, API-first layer on top for new digital products and partner integrations.

Operational Bottlenecks

- Bottleneck:

Manual Claims Processing & Adjudication

Growth Impact:Hinders ability to scale efficiently and negatively impacts customer satisfaction.

Resolution Strategy:Deploy AI for claims triage, fraud detection, and automated adjudication of simple, high-volume claims, freeing up human adjusters for complex cases.

- Bottleneck:

Regulatory Compliance Across 200+ Jurisdictions

Growth Impact:Slows down product launches and adds significant operational overhead.

Resolution Strategy:Invest in RegTech (Regulatory Technology) solutions to automate compliance monitoring, reporting, and management across different legal frameworks.

Market Penetration Challenges

- Challenge:

Intense Competition

Severity:Critical

Mitigation Strategy:Differentiate through superior risk expertise in complex and emerging areas (e.g., cyber, climate) and by leveraging AI for superior underwriting and claims service. Key competitors include Allianz, AXA, Chubb, and Berkshire Hathaway.

- Challenge:

Market Saturation in Developed Economies

Severity:Major

Mitigation Strategy:Focus on product innovation to capture a larger share of wallet from existing clients and expand into high-growth emerging markets in Asia and Latin America.

Resource Limitations

Talent Gaps

- •

AI/ML Engineers

- •

Digital User Experience (UX) Designers

- •

Cybersecurity Risk Underwriters

Significant, but well-managed. As a large insurer, growth is tied to the capital base. The strong financial performance and capital return program indicate a healthy capital position.

Infrastructure Needs

Modern, cloud-native data analytics platform.

API gateway for secure and scalable partner integrations.

Growth Opportunities

Market Expansion

- Expansion Vector:

Emerging Markets (e.g., Southeast Asia, Latin America)

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Pursue a strategy of targeted acquisitions of local insurers or establish strategic partnerships to navigate complex regulatory environments and leverage local market knowledge.

- Expansion Vector:

Small and Medium-sized Enterprises (SMEs) via Digital Channels

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Develop a suite of standardized, digitally-delivered business insurance products (e.g., cyber, professional liability) with a self-service quote-and-bind process.

Product Opportunities

- Opportunity:

AI-Driven Parametric Insurance Products

Market Demand Evidence:Growing demand for faster, transparent claims payouts for risks like natural catastrophes and supply chain disruptions.

Strategic Fit:High. Leverages AIG's risk expertise and investment in AI.

Development Recommendation:Launch a pilot program with a corporate partner in a specific vertical (e.g., agriculture, shipping) to validate the model before a broader rollout.

- Opportunity:

Advanced Cyber Risk Solutions

Market Demand Evidence:Exponential growth in cyber threats and the complexity of managing cyber risk for businesses of all sizes.

Strategic Fit:High. Aligns with AIG's focus on complex commercial lines.

Development Recommendation:Bundle insurance coverage with proactive cybersecurity services (e.g., threat monitoring, incident response planning) offered through partnerships with leading cybersecurity firms.

Channel Diversification

- Channel:

Embedded Insurance via API Partnerships

Fit Assessment:Excellent. Taps into new customer pools at the point of need.

Implementation Strategy:Create a dedicated 'AIG for Developers' portal with robust APIs and partner with leading platforms in e-commerce, logistics, and SaaS to embed AIG products into their offerings.

Strategic Partnerships

- Partnership Type:

Deep Technology Integration

Potential Partners

- •

Anthropic

- •

Palantir

- •

Major Cloud Providers (AWS, Google Cloud)

Expected Benefits:Move beyond using partner tech to co-developing next-generation insurance solutions, creating a sustainable competitive advantage in underwriting and claims.

- Partnership Type:

Data & Distribution Ecosystems

Potential Partners

- •

Large automotive OEMs

- •

Global logistics companies

- •

Industrial IoT platform providers

Expected Benefits:Gain access to new, real-time data streams for more accurate underwriting (usage-based insurance) and open up new, efficient distribution channels.

Growth Strategy

North Star Metric

Annualized Underwriting Profit from New Risk Products & Digitally-Enabled Channels

This metric aligns growth with profitability, innovation (new risks like cyber/climate), and efficiency (digital channels). It steers the company away from simply chasing premium volume in commoditized lines.

25% year-over-year growth for the next 3 years.

Growth Model

Hybrid: 'Expertise-Led' & 'Platform-Led'

Key Drivers

- •

Deepening specialization in complex commercial risks (Expertise-Led).

- •

Building an ecosystem of API-driven partnerships for embedded insurance (Platform-Led).

- •

Leveraging AI to create superior underwriting and claims experiences (Enabler for both).

Maintain and enhance the broker-centric model for high-touch commercial lines while building a separate, agile business unit to pursue the platform and digital D2C opportunities.

Prioritized Initiatives

- Initiative:

Launch 'AIG-IQ': An AI-Powered Underwriting Workbench

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 months

First Steps:Fully scale the learnings from the current Anthropic/Palantir financial lines pilot to the broader global commercial portfolio.

- Initiative:

Develop an Embedded Insurance API Platform for Logistics Partners

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:9-12 months

First Steps:Identify 3-5 major logistics software platforms and co-develop a pilot for an embedded cargo insurance product.

- Initiative:

Create a Digital Self-Service Portal for SME Clients

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:12 months

First Steps:Conduct UX research with SME clients and brokers to identify the most critical features for a minimum viable product (MVP), such as certificate of insurance generation and basic claim filing.

Experimentation Plan

High Leverage Tests

{'test_name': 'Dynamic Pricing for SME Cyber Insurance', 'hypothesis': "Offering dynamic pricing based on a real-time scan of a company's external cybersecurity posture will increase conversion rates and improve risk selection."}

{'test_name': 'Proactive Parametric Payouts', 'hypothesis': 'Proactively triggering a small, partial parametric payout for a weather event based on public data (before a claim is filed) will significantly increase customer satisfaction and loyalty.'}

Use A/B testing frameworks to measure impact on key metrics: quote-to-bind ratio, loss ratio, customer net promoter score (NPS), and claims processing time.

Quarterly review of a portfolio of growth experiments, managed by a dedicated growth team, with a 'fail fast' and scale-what-works mentality.

Growth Team

A centralized 'Growth & Innovation Office' that reports to the CEO, with embedded 'growth pods' within key business units (e.g., Commercial Lines, Personal Lines) to drive execution.

Key Roles

- •

Head of Insurtech Partnerships

- •

Principal Data Scientist (Generative AI)

- •

Digital Channel Product Manager

- •

Head of Customer Experience (CX)

A combination of strategic hiring from the tech industry, acquisitions of small insurtech teams (acqui-hires), and a robust internal upskilling program focused on data literacy and agile methodologies.

AIG has executed an impressive turnaround, establishing a strong foundation of financial health and underwriting discipline. The company is now at a pivotal inflection point, with the potential to transition from recovery to market-leading growth. Its core strength lies in its global scale, deep expertise in complex commercial risk, and strong broker relationships. The leadership's public commitment to leveraging Generative AI through high-profile partnerships with Anthropic and Palantir is a significant strategic advantage, positioning AIG at the forefront of technological adoption among incumbent insurers.

The primary growth vector is to build upon this AI foundation, transforming core processes from being human-led and technology-assisted to AI-led and human-supervised. This will unlock massive efficiency gains in underwriting and claims, which can be reinvested into growth. The largest untapped opportunities lie in channel diversification—specifically, building robust digital D2C and embedded insurance capabilities. The current business model is highly dependent on traditional broker channels, which, while effective, are high-cost and limit access to the growing SME and digitally native consumer markets.

Key barriers are primarily internal: the inertia of legacy systems and the organizational complexity inherent in a global giant. Overcoming these requires a dedicated, top-down strategic push. The recommended growth strategy is a hybrid model: double down on the 'Expertise-Led' approach for complex risks where AIG's human talent is a key differentiator, while simultaneously building a 'Platform-Led' engine to capture new markets through digital channels and partnerships. Prioritizing initiatives like the AI Underwriting Workbench and an Embedded Insurance API will create a sustainable competitive advantage that is difficult for both traditional competitors and smaller insurtechs to replicate.

Legal Compliance

The website demonstrates a strong foundation in privacy disclosure, with clearly accessible links to a Privacy Policy and a globalprivacy page. This is crucial for a multinational corporation like AIG, operating in over 200 countries and jurisdictions. The presence of a specific privacy notice linked within the CCPA opt-out mechanism (https://www.aig.com/privacy-policy) and another for email sign-ups (https://www.aig.com/globalprivacy) indicates a tiered and context-specific approach. The consent language for the email sign-up explicitly states the purpose of data collection (sending Newsroom updates) and links to the broader policy, which aligns with principles of transparency under GDPR. However, the consent mechanism itself—a single checkbox—lacks the granularity recommended under GDPR for different processing activities.

Based on the provided website content, there is no visible, easily accessible link to a general 'Terms of Service' or 'Terms of Use' document in the main navigational or footer areas. While specific client portals ('Multinational Log In', 'Log In now') likely have terms presented upon login, the absence of a general site-wide agreement is a strategic legal gap. A Terms of Service document is a critical business asset for managing legal risk, defining intellectual property rights, outlining acceptable use of digital properties, and establishing a legal venue for disputes. For a company of AIG's scale, this absence represents a missed opportunity to establish a clear legal framework for all website users.