eScore

altria.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Altria.com functions as a highly effective corporate communications and investor relations hub, demonstrating strong authority and search intent alignment for its target audience of investors, media, and regulators. The site's content is deep, albeit narrowly focused on corporate finance, shareholder returns, and its "Moving Beyond Smoking" narrative. However, its multi-channel presence is limited by design to avoid marketing regulations, and it lacks optimization for broader consumer-facing queries like voice search.

Excellent content authority and domain strength, serving as the definitive source for financial reporting and corporate messaging, which aligns perfectly with its investor and media audience.

Develop a dedicated, non-promotional thought leadership hub around U.S. tobacco harm reduction to broaden its influence on policy and public discourse beyond purely financial topics.

The website's messaging is exceptionally disciplined, consistent, and strategically aligned with its primary audience of investors, focusing on financial performance and the 'Moving Beyond Smoking' vision. However, the brand voice is sterile and overly corporate, lacking emotional resonance or human-centric storytelling. There is also an inherent tension between the future-facing vision and the current business reality where combustible products still drive the majority of revenue.

Exceptional message consistency and clarity, with the dual themes of shareholder returns and strategic transformation reinforced across all corporate communications.

Introduce a leadership voice, such as a CEO's letter or video interviews, to humanize the strategic vision and add a layer of authenticity to the corporate messaging.

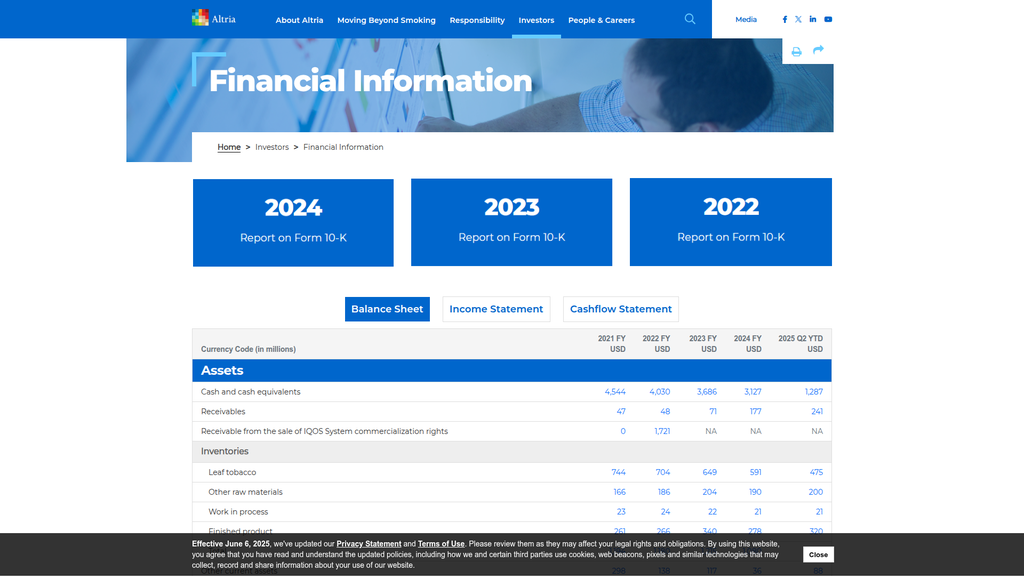

For its primary purpose of informational conversion (e.g., accessing financial reports), the site is logical and effective on desktop. The information architecture is clear, reducing cognitive load for users seeking specific data. However, the analysis identifies significant friction points, most notably the poor mobile user experience for dense data tables and the lack of a formal commitment to web accessibility (WCAG/ADA), which represents a usability and legal risk.

The clear and intuitive navigation and information architecture effectively guide its professional audience to key documents and data with minimal friction on desktop devices.

Implement a mobile-first, responsive solution for all financial data tables, such as converting rows into cards or using sticky columns, to ensure critical information is accessible on all devices.

The website is a masterclass in strategic legal positioning and credibility reinforcement for its investor audience. Trust is built through comprehensive and transparent financial reporting, adherence to SEC regulations, and a clear separation between the corporate site and age-gated brand sites. The primary credibility gap is the use of an outdated 'implied consent' cookie mechanism and the absence of a formal accessibility statement, which are misaligned with modern digital compliance standards.

Meticulous legal positioning, including Terms of Use that explicitly define the site as non-promotional, which is a critical risk mitigation strategy in the highly regulated tobacco industry.

Upgrade the cookie consent mechanism to an explicit 'accept/decline' model and publish a formal Accessibility Statement committing to WCAG 2.1 AA standards to mitigate legal risks.

Altria possesses powerful and sustainable moats in its iconic Marlboro brand equity and its unparalleled U.S. distribution network, which provide immense cash flow. However, these advantages are tied to the declining combustible market. In the growing smoke-free categories, Altria is currently a follower, having acquired NJOY to compete in e-vapor where it lags BAT, and trailing PMI's Zyn in oral nicotine pouches, indicating that its innovation and market creation capabilities are less developed than its operational strengths.

An unmatched U.S. distribution network and sales force, providing a highly defensible and sustainable advantage for scaling any product, including its new smoke-free portfolio, at retail.

Aggressively invest in R&D and consumer insights for the next generation of oral nicotine pouches to leapfrog competitors in product satisfaction and technology, rather than competing on distribution alone.

The business model demonstrates extremely high scalability, rooted in a world-class operational and distribution infrastructure that can launch new products nationally with great efficiency. The company's unit economics are very healthy, with high margins and pricing power in its core business funding the transition. The primary constraint is not operational scalability but market penetration and smoker conversion in the face of intense competition and regulatory hurdles.

High operational leverage from its existing, vast distribution network allows for the efficient and rapid scaling of new products like NJOY into over 100,000 retail stores.

Develop and advocate for a clear, predictable federal regulatory framework that provides a stable off-ramp for combustible smokers to switch to FDA-authorized, less harmful products, thereby de-risking the path to scale.

Altria's business model is highly coherent, with a clear strategy of using the predictable, high cash flows from its declining legacy business to fund its strategic pivot and deliver strong shareholder returns. Resource allocation is focused, as evidenced by the divestiture from Juul and the purposeful acquisition of NJOY with its FDA authorization. However, the model is under stress due to being late to market in key smoke-free trends, creating a challenging transition period.

Excellent capital allocation discipline, balancing significant investments in smoke-free growth (e.g., NJOY acquisition) with consistent, strong shareholder returns through dividends and buybacks.

Urgenly fast-track a strategy to enter the U.S. heated tobacco market to close a critical portfolio gap and ensure it can compete across all major smoke-free categories.

Altria wields immense market power and pricing power in the U.S. combustible cigarette market, where Marlboro remains dominant. However, its power is significantly diminished in the smoke-free categories that represent the future of the market. The company is currently a challenger to BAT's Vuse in e-vapor and PMI's Zyn in oral nicotine pouches, reflecting a declining trajectory in overall market influence as consumer preferences shift.

Sustained pricing power in the premium cigarette segment, which allows the company to manage profitability and fund its strategic transition despite consistent volume declines in its core market.

Articulate a clearer competitive differentiation against PMI's U.S. entry with IQOS and ZYN, focusing on Altria's deep U.S. market expertise and a multi-platform portfolio strategy to regain market influence.

Business Overview

Business Classification

Consumer Packaged Goods (CPG) Holding Company

Regulated Products Manufacturer & Marketer

Tobacco & Nicotine Products

Sub Verticals

- •

Combustible Cigarettes

- •

Oral Tobacco (Moist Smokeless & Nicotine Pouches)

- •

E-Vapor

- •

Heated Tobacco Products

Mature

Maturity Indicators

- •

Dominant market share in a declining core category (cigarettes).

- •

Slightly declining net revenues, offset by price increases.

- •

Strong and consistent cash flow generation and dividend payments.

- •

Strategic pivot and significant investment in adjacent growth categories (smoke-free products).

- •

Significant costs related to litigation, settlements, and excise taxes reflected in financial statements.

Enterprise

Declining (in core) / High Growth (in new ventures)

Revenue Model

Primary Revenue Streams

- Stream Name:

Sale of Smokeable Products

Description:Primarily consists of cigarette sales, dominated by the Marlboro brand, which remains the largest revenue generator. This segment also includes cigars (e.g., Black & Mild).

Estimated Importance:Primary

Customer Segment:Adult Smokers

Estimated Margin:High

- Stream Name:

Sale of Oral Tobacco Products

Description:Includes traditional moist smokeless tobacco (MST) brands like Copenhagen and Skoal, and modern oral nicotine pouches under the

on!brand. The nicotine pouch category is a significant high-growth area.Estimated Importance:Secondary

Customer Segment:Adult Smokeless Tobacco Users & Nicotine Pouch Users

Estimated Margin:High

- Stream Name:

Sale of E-Vapor Products

Description:Revenue generated from the sale of e-vapor devices and pods following the ~$2.75 billion acquisition of NJOY. This stream is central to the 'Moving Beyond Smoking' strategy and targets the vaping segment.

Estimated Importance:Tertiary

Customer Segment:Adult Vapers & Smokers Seeking Alternatives

Estimated Margin:Medium

- Stream Name:

Investment Income & Divestitures

Description:Includes dividends from equity stakes (e.g., Anheuser-Busch InBev) and cash from strategic divestitures, such as the sale of IQOS commercialization rights to Philip Morris International. These activities provide capital for strategic initiatives and shareholder returns.

Estimated Importance:Tertiary

Customer Segment:N/A (Corporate Finance)

Estimated Margin:Variable

Recurring Revenue Components

Repeat purchases of consumable nicotine products driven by consumer habit and brand loyalty.

Pricing Strategy

Value-Based & Tiered Pricing

Premium

Opaque

Pricing Psychology

- •

Brand Prestige (Marlboro)

- •

Price Anchoring (Premium vs. Discount Brands)

- •

Inelastic Demand Pricing

Monetization Assessment

Strengths

- •

Strong pricing power in the premium cigarette segment allows for revenue growth despite volume declines.

- •

Highly predictable cash flows from the core tobacco business fund strategic investments and shareholder returns.

- •

A diversified portfolio across different nicotine categories provides multiple avenues for monetization.

Weaknesses

- •

Heavy reliance on the combustible cigarettes category, which is in secular decline.

- •

Revenue is significantly impacted by federal and state excise taxes, which can be unpredictable.

- •

Monetization of new ventures like NJOY is still in the early stages and requires substantial investment.

Opportunities

- •

Rapidly growing oral nicotine pouch market presents a significant revenue expansion opportunity.

- •

Leveraging its extensive distribution network to accelerate sales of NJOY e-vapor products.

- •

Potential future revenue from heated tobacco products through its joint venture with Japan Tobacco.

Threats

- •

Increased government regulation, including potential flavor bans (menthol) or nicotine level restrictions.

- •

Intensifying competition in the smoke-free space from both established players and agile new entrants.

- •

Shifting public health sentiment and changing consumer preferences away from nicotine altogether.

Market Positioning

A market leader transitioning from a traditional tobacco company to a diversified, smoke-free products enterprise with the stated vision to 'responsibly lead the transition of adult smokers to a smoke-free future'.

Dominant leader in the U.S. cigarette market, with Marlboro alone holding a market share of over 40%.

Target Segments

- Segment Name:

Loyal Adult Smokers

Description:The traditional and largest customer base, primarily comprised of adults 21+ who smoke combustible cigarettes and exhibit strong brand loyalty, particularly to Marlboro.

Demographic Factors

Adults 21+

Cross-section of income levels and geographic locations in the U.S.

Psychographic Factors

- •

Brand loyalists

- •

Value tradition and consistency

- •

Resistant to change or seeking a familiar experience

Behavioral Factors

- •

High frequency of purchase (daily/weekly)

- •

Habit-driven consumption

- •

Less likely to switch to alternative products

Pain Points

- •

Increasing social stigma associated with smoking

- •

Rising costs due to taxes

- •

Health concerns

Fit Assessment:Excellent

Segment Potential:Declining

- Segment Name:

Harm Reduction Seekers

Description:Adult nicotine users (smokers and vapers) actively looking for alternatives they perceive as less harmful or more convenient than traditional cigarettes. This segment is the primary target for Altria's smoke-free portfolio (e-vapor, oral nicotine, heated tobacco).

Demographic Factors

- •

Adults 21+

- •

Often younger than the traditional smoker segment

- •

More urban/suburban

Psychographic Factors

- •

Health-conscious

- •

Open to innovation and new technology

- •

Value convenience and discretion

Behavioral Factors

- •

Willing to experiment with new products

- •

Influenced by product reviews and peer usage

- •

Purchase through diverse channels including online and vape shops.

Pain Points

- •

Uncertainty about the long-term health effects of new products

- •

Dissatisfaction with the performance of early-generation alternatives

- •

Navigating a complex and sometimes confusing product landscape

Fit Assessment:Good

Segment Potential:High

Market Differentiation

- Factor:

Unmatched Brand Equity (Marlboro)

Strength:Strong

Sustainability:Sustainable (within a declining market)

- Factor:

Extensive U.S. Distribution Network

Strength:Strong

Sustainability:Sustainable

- Factor:

Portfolio of FDA-Authorized Smoke-Free Products

Strength:Moderate

Sustainability:Sustainable

- Factor:

Deep Financial Resources and Profitability

Strength:Strong

Sustainability:Sustainable

Value Proposition

For adult tobacco consumers, Altria offers a leading portfolio of satisfying, high-quality nicotine products, from iconic brands like Marlboro to innovative, potentially less harmful smoke-free alternatives, enabling choice for every preference on the journey beyond smoking.

Excellent

Key Benefits

- Benefit:

Brand Trust and Product Consistency

Importance:Critical

Differentiation:Unique

Proof Elements

Decades of market leadership with Marlboro.

Established brands in smokeless tobacco like Copenhagen and Skoal.

- Benefit:

Portfolio of Smoke-Free Alternatives

Importance:Important

Differentiation:Somewhat unique

Proof Elements

- •

Acquisition of NJOY, the only FDA-authorized pod-based e-vapor product.

- •

Ownership of

on!nicotine pouches. - •

Joint venture for Ploom heated tobacco products.

- Benefit:

Wide Retail Availability

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Presence in hundreds of thousands of retail locations.

Decades of experience with tobacco distribution and sales.

Unique Selling Points

- Usp:

The iconic Marlboro brand, representing a powerful symbol of quality and heritage in the tobacco industry.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A strategic and evolving portfolio designed to capture consumers across the full spectrum of nicotine products, from combustibles to smoke-free.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Desire for a consistent, high-quality smoking experience.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Need for satisfying, less harmful alternatives to smoking.

Severity:Major

Solution Effectiveness:Partial

- Problem:

Lack of convenient, discreet nicotine options for use in smoke-free environments.

Severity:Major

Solution Effectiveness:Complete

Value Alignment Assessment

Medium

The value proposition is perfectly aligned with the declining combustible market but is still establishing its alignment with the rapidly growing, highly competitive smoke-free market. Success depends on effectively commercializing their new portfolio.

High

For its core audience of adult smokers, alignment is exceptionally high. For the 'Harm Reduction Seekers,' the alignment is good and improving as Altria builds out its smoke-free offerings like NJOY and on!.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Tobacco Growers & Agricultural Suppliers

- •

Wholesale Distributors & Logistics Providers

- •

Retail Chains (Convenience Stores, Gas Stations, etc.)

- •

JT Group (Heated Tobacco Joint Venture)

- •

Technology & Manufacturing Partners for Smoke-Free Devices

Key Activities

- •

Manufacturing & Supply Chain Management

- •

Brand Marketing & Promotion

- •

Research & Development for Smoke-Free Products

- •

Regulatory Affairs & Government Relations

- •

Distribution & Sales Force Management

Key Resources

- •

Iconic Brands (Marlboro, Copenhagen)

- •

Extensive U.S. Distribution Network

- •

Significant Financial Capital and Cash Flow

- •

Intellectual Property & FDA Marketing Authorizations

- •

Experienced Management & Regulatory Teams

Cost Structure

- •

Excise Taxes on Products

- •

Cost of Sales (Leaf Tobacco & Raw Materials)

- •

Litigation and Settlement Charges

- •

Marketing, Administration and Research Costs

- •

Capital Expenditures for New Product Lines

Swot Analysis

Strengths

- •

Dominant market share and pricing power in the U.S. combustible market.

- •

Exceptional brand equity, particularly with Marlboro.

- •

High profitability and robust cash flow generation to fund dividends and strategic investments.

- •

Vast and established distribution and sales infrastructure.

Weaknesses

- •

Heavy concentration in the declining U.S. cigarette market.

- •

Negative public perception and ESG (Environmental, Social, and Governance) concerns.

- •

Significant legal and regulatory risk exposure, including large settlement costs.

- •

Past strategic failures in diversification (e.g., initial Juul investment).

Opportunities

- •

Capitalize on the high-growth oral nicotine pouch market with the

on!brand. - •

Scale the NJOY e-vapor business to capture share in the vaping market.

- •

Successfully launch heated tobacco products in the U.S. through the Horizon joint venture.

- •

Potential for future growth in adjacent, regulated markets like cannabis, contingent on federal legalization.

Threats

- •

Accelerated decline in cigarette smoking rates.

- •

Adverse regulatory actions, such as a ban on menthol cigarettes or nicotine content reduction.

- •

Intense competition in the smoke-free categories from companies like British American Tobacco (Vuse) and Philip Morris International (Zyn).

- •

Shifts in consumer behavior away from all forms of nicotine.

Recommendations

Priority Improvements

- Area:

Smoke-Free Product Commercialization

Recommendation:Aggressively leverage the existing distribution network and marketing expertise to rapidly scale NJOY's market share and defend

on!'s position against competitors. Focus on converting Altria's existing adult smoker base.Expected Impact:High

- Area:

R&D and Innovation Pipeline

Recommendation:Accelerate the development and regulatory submission for next-generation smoke-free products, such as SWIC, to build a sustainable long-term competitive advantage beyond current offerings.

Expected Impact:High

- Area:

Capital Allocation Discipline

Recommendation:Maintain strict financial discipline, balancing investments in smoke-free growth with continued strong shareholder returns (dividends/buybacks) to maintain investor confidence during the transition.

Expected Impact:Medium

Business Model Innovation

- •

Explore legally-compliant direct-to-consumer (DTC) models for smoke-free products like

on!to build direct customer relationships and gather valuable data. - •

Develop a 'platform' approach, creating an ecosystem of interoperable smoke-free devices and consumables to increase customer lock-in.

- •

Invest in data analytics to better understand the journey of adult smokers transitioning to smoke-free alternatives, enabling more effective marketing and product development.

Revenue Diversification

- •

Continue to build a strategic, non-controlling position in the cannabis sector via investments like Cronos Group, preparing for potential federal legalization.

- •

Evaluate opportunities in adjacent wellness or harm-reduction categories where Altria's expertise in navigating regulated markets could be a key advantage.

- •

Further develop international expansion strategies for its smoke-free portfolio, potentially through new partnerships or acquisitions.

Altria's business model is that of a mature market leader undergoing a critical and necessary strategic transformation. The company's legacy combustible cigarette business, centered around the iconic Marlboro brand, is a highly profitable 'cash cow' that provides the financial firepower for its evolution. However, this core segment is in irreversible secular decline, making the company's 'Moving Beyond Smoking' vision not just a strategic choice, but an existential imperative.

The current business model is a hybrid: one part is focused on maximizing profitability and managing the decline of the smokeable products segment through pricing power and operational efficiency. The other part is a growth-oriented venture capital model, redeploying that cash into acquiring and scaling businesses in the three key smoke-free pillars: e-vapor (NJOY), oral nicotine pouches (on!), and heated tobacco (Horizon JV). The $2.75 billion acquisition of NJOY was a pivotal move, swapping its failed investment in Juul for an asset with the crucial advantage of FDA marketing authorization, thereby de-risking its entry into the e-vapor market.

Scalability for Altria is not about finding a repeatable sales model; it already has one of the most effective in U.S. consumer goods. Instead, scalability is about proving it can successfully graft new, innovative products onto its powerful distribution and marketing platform to win in highly competitive growth markets. The company's future success is entirely dependent on its ability to transition adult smokers from its own high-margin legacy products to its new, potentially lower-margin but growing smoke-free alternatives, all while fending off formidable competition. The financial data clearly illustrates this transition, with massive, stable revenues and cash flows funding new acquisitions (NJOY) and shareholder returns, positioning the company for a future where its primary revenue streams are fundamentally different from today.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Regulatory Hurdles (e.g., FDA Premarket Tobacco Product Applications - PMTA)

Impact:High

- Barrier:

Brand Equity and Loyalty (e.g., Marlboro)

Impact:High

- Barrier:

Extensive Distribution Networks (Retail & Wholesale)

Impact:High

- Barrier:

Capital Intensity and Economies of Scale

Impact:High

- Barrier:

Litigation and Liability Risks

Impact:Medium

Industry Trends

- Trend:

Accelerated decline of combustible cigarette volumes.

Impact On Business:Erodes core revenue and profit source, necessitating a rapid pivot to smoke-free alternatives.

Timeline:Immediate

- Trend:

Rapid growth in smoke-free alternatives (oral nicotine pouches, e-vapor, heated tobacco).

Impact On Business:Creates the primary growth vector for the company, driving the 'Moving Beyond Smoking' strategy and M&A activity (e.g., NJOY acquisition).

Timeline:Immediate

- Trend:

Increased FDA regulation and enforcement on both authorized and illicit products.

Impact On Business:Creates high compliance costs and market uncertainty (e.g., flavor bans) but can also be a competitive advantage for companies with the resources to navigate the PMTA process successfully.

Timeline:Near-term

- Trend:

Shifting consumer preferences toward harm reduction, convenience, and flavor variety.

Impact On Business:Requires significant R&D investment and a multi-category product portfolio to meet diverse consumer demands.

Timeline:Immediate

- Trend:

Heightened focus on ESG (Environmental, Social, and Governance) factors from investors and the public.

Impact On Business:Puts pressure on corporate responsibility, underage use prevention, and sustainability practices, impacting investor relations and public perception.

Timeline:Near-term

Direct Competitors

- →

British American Tobacco (BAT) / R.J. Reynolds

Market Share Estimate:Significant U.S. market share in combustibles (Newport, Camel) and the leading share in e-vapor (Vuse).

Target Audience Overlap:High

Competitive Positioning:A global multi-category leader aggressively transitioning to a smoke-free portfolio with a strong foothold in the e-vapor market.

Strengths

- •

Dominant e-vapor brand (Vuse) with high market share.

- •

Strong portfolio of combustible brands, especially in the menthol category (Newport).

- •

Global scale and extensive R&D capabilities in next-generation products.

- •

Established distribution network comparable to Altria's.

Weaknesses

- •

High dependency on declining combustible cigarette sales.

- •

Significant regulatory risk associated with its menthol brands.

- •

Playing catch-up in the rapidly growing oral nicotine pouch category compared to Swedish Match/PMI.

Differentiators

Early and successful scaling of their Vuse e-vapor platform.

Global brand portfolio (Dunhill, Lucky Strike, etc.) provides broader international insights.

- →

Philip Morris International (PMI)

Market Share Estimate:Currently small but growing, with a stated goal to capture 10% of U.S. tobacco and heated tobacco volume by 2030.

Target Audience Overlap:High

Competitive Positioning:A smoke-free focused competitor re-entering the U.S. market with a premium, FDA-authorized heated tobacco system (IQOS) and the leading oral nicotine pouch brand (Zyn).

Strengths

- •

Owner of Zyn, the dominant brand in the high-growth nicotine pouch category, via its acquisition of Swedish Match.

- •

Global market leader in heated tobacco products with IQOS.

- •

IQOS is the only heated tobacco product with FDA marketing authorization in the U.S.

- •

Strong financial resources to fund aggressive U.S. market entry and expansion.

Weaknesses

- •

Late re-entry into the U.S. market, requiring them to build out distribution and brand awareness for IQOS from a low base.

- •

Initial IQOS launch is limited to specific cities, lacking national scale.

- •

Faces the challenge of educating U.S. consumers on a new category (heated tobacco).

Differentiators

Leadership and first-mover advantage in heated tobacco technology.

Ownership of the hyper-growth Zyn brand, which is defining the oral pouch category.

- →

Swedish Match (Subsidiary of PMI)

Market Share Estimate:Dominant market share (over 70%) in the U.S. oral nicotine pouch category with Zyn.

Target Audience Overlap:Medium

Competitive Positioning:The undisputed leader and category creator for modern oral nicotine pouches in the U.S.

Strengths

- •

Incredible brand loyalty and market share with Zyn.

- •

First-mover advantage created a powerful network effect and brand recognition.

- •

Deep expertise in oral tobacco and smoke-free product development.

Weaknesses

- •

Now fully integrated into PMI, strategy is dictated by the parent company.

- •

Faces intense promotional competition from Altria's on! and BAT's Velo.

- •

Growth is primarily concentrated in a single product category.

Differentiators

Successfully created and defined the modern oral nicotine pouch market in the U.S.

- →

Japan Tobacco International (JTI)

Market Share Estimate:Minor player in the U.S. market compared to Altria and BAT.

Target Audience Overlap:Medium

Competitive Positioning:A global tobacco giant with a limited but strategic presence in the U.S., focusing on partnerships for next-generation products.

Strengths

- •

Significant global scale and brand portfolio outside the U.S.

- •

Partnered with Altria on a joint venture, Horizon Innovations, to market heated tobacco products (Ploom).

- •

Strong R&D capabilities.

Weaknesses

Lacks significant brand recognition and market share in the U.S. combustible market.

Dependent on the success of its joint venture with Altria for U.S. next-generation product growth.

Differentiators

Ploom heated tobacco technology offers a different user experience and design compared to IQOS.

Indirect Competitors

- →

Illicit & Unauthorized Vape/E-Cigarette Brands (e.g., Elf Bar, Geek Bar)

Description:A vast, fragmented market of primarily disposable vaping products, often manufactured overseas and sold without FDA authorization. Geek Bar has emerged as a top-selling brand.

Threat Level:High

Potential For Direct Competition:They are already competing directly for consumer spending, but on an unregulated basis. The illicit market holds a significant share, posing a major challenge to legal, regulated players like Altria's NJOY.

- →

Pharmaceutical Smoking Cessation Products (e.g., Nicorette, Chantix)

Description:Companies like GlaxoSmithKline and Pfizer offer nicotine replacement therapies (NRTs) like gums, patches, and lozenges, or prescription medications designed to help users quit nicotine altogether.

Threat Level:Low

Potential For Direct Competition:Their goal is nicotine cessation, which is fundamentally different from Altria's goal of transitioning users to alternative nicotine products. They compete for the 'desire to quit' moment but not for ongoing nicotine consumption.

- →

Cannabis Companies (e.g., Curaleaf, Trulieve)

Description:Producers and distributors of recreational and medicinal cannabis products, including vapes, edibles, and flower. Altria holds an investment in Cronos Group.

Threat Level:Medium

Potential For Direct Competition:Compete for similar usage occasions (relaxation, mood enhancement) and discretionary spending. The potential for federal legalization and product innovation (e.g., nicotine-cannabis blends) could increase direct competition in the long term.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Unmatched U.S. Distribution Network

Sustainability Assessment:Highly sustainable. The physical infrastructure and long-standing relationships with wholesalers and hundreds of thousands of retailers are incredibly difficult and expensive to replicate.

Competitor Replication Difficulty:Hard

- Advantage:

Iconic Brand Equity in Combustibles (Marlboro)

Sustainability Assessment:Sustainable in the declining combustible category. This brand power provides immense cash flow but is less transferable to new smoke-free categories.

Competitor Replication Difficulty:Hard

- Advantage:

Regulatory and Government Affairs Expertise

Sustainability Assessment:Highly sustainable. Decades of experience navigating complex federal and state regulations is a crucial asset in the heavily scrutinized nicotine industry.

Competitor Replication Difficulty:Hard

- Advantage:

Pricing Power in the Combustible Category

Sustainability Assessment:Moderately sustainable. Ability to raise prices on cigarettes has historically offset volume declines, but this elasticity has limits as volumes continue to fall sharply.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': "NJOY's FDA Authorization for a Pod-Based E-Vapor Device", 'estimated_duration': '1-3 Years. While a significant current advantage over illicit products, competitors like BAT (Vuse) also have authorized products, and others will likely gain authorization over time.'}

Disadvantages

- Disadvantage:

Over-reliance on the Declining Combustible Cigarette Category

Impact:Critical

Addressability:Difficult. The core of Altria's profitability is tied to a shrinking market, making the transition to smoke-free products a 'bet the company' endeavor.

- Disadvantage:

Lagging Market Position in Key Smoke-Free Categories

Impact:Major

Addressability:Moderately. Altria is currently a distant #2 or #3 in e-vapor (behind BAT's Vuse) and oral nicotine pouches (behind PMI's Zyn). The NJOY acquisition is a move to address this, but catching up is a significant challenge.

- Disadvantage:

Negative Public Perception and ESG Headwinds

Impact:Major

Addressability:Difficult. As the parent of Marlboro, Altria faces immense public and investor scrutiny, which can limit strategic options and attract regulatory pressure.

- Disadvantage:

Absence in the U.S. Heated Tobacco Market

Impact:Major

Addressability:Difficult. After selling the IQOS rights back to PMI, Altria is now reliant on its joint venture with JTI for the Ploom device, which is not expected to be on the market for several years, ceding the entire category to PMI in the interim.

Strategic Recommendations

Quick Wins

- Recommendation:

Aggressively leverage Altria's retail distribution network to accelerate the national rollout and secure premium shelf space for NJOY products.

Expected Impact:High

Implementation Difficulty:Easy

- Recommendation:

Launch targeted marketing campaigns for

on!nicotine pouches, focusing on flavor innovation and value propositions to chip away at Zyn's market share.Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Increase public affairs messaging emphasizing the importance of FDA-authorized products to combat the illicit disposable vape market, framing NJOY as a responsible alternative.

Expected Impact:Medium

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Invest heavily in R&D and consumer insights for the next generation of

on!pouches to leapfrog competitors in terms of satisfaction and technology.Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Develop and advocate for a clear, predictable regulatory framework that provides an off-ramp for combustible smokers to FDA-authorized, less harmful products.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Explore strategic partnerships or acquisitions in supply chain or technology to accelerate the timeline and reduce risk for the Ploom heated tobacco launch.

Expected Impact:Medium

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Achieve a majority of revenue from smoke-free products by executing the portfolio strategy to ensure long-term viability beyond combustibles.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Re-evaluate and potentially expand diversification 'beyond nicotine' into adjacent wellness or lifestyle CPG categories, applying lessons learned from past investments.

Expected Impact:Medium

Implementation Difficulty:Difficult

Position Altria as the most responsible and effective U.S. leader in transitioning adult smokers to a diverse portfolio of FDA-authorized smoke-free alternatives, leveraging its American heritage and unmatched retail presence.

Differentiate through operational excellence and distribution superiority. While competitors may lead in specific product categories, Altria can win by ensuring its entire smoke-free portfolio (NJOY, on!, Ploom) is more available, visible, and well-promoted at the point of sale than any competitor.

Whitespace Opportunities

- Opportunity:

Develop a 'Transition Services' Platform for Adult Smokers

Competitive Gap:No competitor exclusively owns the 'switching journey.' This could be a digital platform providing education, support, and product trials to help adult smokers move from cigarettes to Altria's smoke-free portfolio.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Lead in Product Stewardship and Recycling for E-Vapor

Competitive Gap:The e-vapor category, especially disposables, faces significant criticism for its environmental impact. A robust, convenient, and well-marketed recycling program for NJOY pods could be a major differentiator.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Create a Premium, 'Connoisseur-Level' Oral Nicotine Product

Competitive Gap:The current oral pouch market is focused on mainstream flavors and strengths. There is a potential gap for a higher-margin, premium sub-brand with more complex flavors and sophisticated branding.

Feasibility:High

Potential Impact:Medium

Altria Group is at a critical inflection point, navigating the profitable but terminal decline of its core combustible tobacco business. The competitive landscape is no longer a simple duopoly in the U.S. cigarette market; it is a multi-front war across distinct smoke-free categories, each with a different leader. Altria's primary challenge is transforming from a market leader in a declining category to a formidable competitor in high-growth segments where it currently lags.

Its most significant sustainable advantages—brand equity in combustibles (Marlboro), an unparalleled distribution network, and regulatory prowess—are powerful but face the test of translation to new product categories. British American Tobacco (BAT) has leveraged its scale to capture a leading position in the crucial e-vapor market with Vuse, directly challenging Altria's NJOY acquisition. Meanwhile, Philip Morris International's (PMI) re-entry into the U.S. is a paradigm shift; through its acquisition of Swedish Match, PMI now controls Zyn, the dominant brand in the hyper-growth oral nicotine pouch category, and is methodically rolling out its globally-proven IQOS heated tobacco system, a category where Altria is now effectively absent.

The strategic imperative for Altria is clear: its 'Moving Beyond Smoking' vision must be executed with urgency and precision. Success hinges on its ability to leverage its core distribution strength to accelerate NJOY's market share, innovate aggressively with its 'on!' pouch brand to counter Zyn, and successfully bring its Ploom heated tobacco product to market with its JTI joint venture. Failure to rapidly gain significant share in these smoke-free categories will jeopardize its long-term viability, as the immense cash flows from its combustible business cannot defy market trends indefinitely.

Messaging

Message Architecture

Key Messages

- Message:

We are 'Moving Beyond Smoking™' by transitioning adult smokers to a smoke-free future.

Prominence:Primary

Clarity Score:High

Location:Media At-A-Glance (linked under 'Our Vision' and 'Harm Reduction')

- Message:

We deliver strong, consistent financial performance and shareholder returns.

Prominence:Secondary

Clarity Score:High

Location:Media At-A-Glance (Press Release titles like 'Increases Quarterly Dividend' and 'Reports... Results'), Investors section

- Message:

We are a responsible corporate actor committed to harm reduction and preventing underage use.

Prominence:Tertiary

Clarity Score:Medium

Location:Media At-A-Glance (linked under 'Harm Reduction' and 'ESG Reporting & Data')

The messaging hierarchy is strategically sound for its target audiences. The forward-looking vision of 'Moving Beyond Smoking' is the primary strategic narrative. This is underpinned by the secondary message of financial stability, which is the most critical message for the primary audience of investors. The tertiary message of responsibility serves as a crucial defensive and reputational buffer, essential in a highly scrutinized industry.

Messaging is highly consistent across the provided corporate communication channels (Media and Investors). The core themes of strategic evolution ('Moving Beyond Smoking'), financial performance, and corporate responsibility are mutually reinforcing and presented uniformly.

Brand Voice

Voice Attributes

- Attribute:

Corporate

Strength:Strong

Examples

Altria Reports 2025 Second-Quarter and First-Half Results; Narrows 2025 Full-Year Earnings Guidance

Altria to Host Webcast of 2025 Second-Quarter and First-Half Results

- Attribute:

Financial

Strength:Strong

Examples

Altria Increases Quarterly Dividend to $1.06 Per Share

The entire 'Financial Information' page is dedicated to balance sheets, income statements, and cash flow statements.

- Attribute:

Responsible

Strength:Moderate

Examples

- •

Prevent Underage Use

- •

ESG Reporting & Data

- •

Reduce the Harm of Tobacco Products

- Attribute:

Formal

Strength:Strong

Examples

All press release titles and financial statement labels are formal and devoid of casual language.

Tone Analysis

Formal and professional

Secondary Tones

- •

Reassuring (to investors)

- •

Proactive (on harm reduction)

- •

Guarded

Tone Shifts

The tone is consistently formal. There are no significant shifts in the provided content, which is appropriate for a corporate site targeting investors, regulators, and media.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

For investors: Altria provides reliable, high-yield shareholder returns, backed by a resilient core business, while strategically pivoting to lead the future of smoke-free alternatives. For society/regulators: Altria is committed to reducing the harm of tobacco by transitioning adult smokers to a portfolio of scientifically substantiated, less harmful products.

Value Proposition Components

- Component:

Consistent Shareholder Returns (Dividends & Buybacks)

Clarity:Clear

Uniqueness:Somewhat Unique (Hallmark of the company)

- Component:

Strategic Pivot to Harm Reduction / Smoke-Free Products

Clarity:Clear

Uniqueness:Common (Industry-wide trend)

- Component:

Market Leadership in Core Tobacco Business

Clarity:Clear (Implicit)

Uniqueness:Unique (Specific to Marlboro's market share)

- Component:

Commitment to Responsible Practices

Clarity:Somewhat Clear

Uniqueness:Common (A required stance for the industry)

The messaging does not strongly differentiate Altria from its main competitors like Philip Morris International and British American Tobacco, who are all pursuing similar harm-reduction strategies. The differentiation is less in the what (the strategy) and more in the how (specific brands like NJOY, market execution, and financial discipline). The corporate messaging focuses on the high-level strategy rather than competitive product-level advantages, which is appropriate for this audience.

The messaging positions Altria as a stable, responsible incumbent navigating a necessary industry transformation. It leverages its legacy of market leadership and financial strength as the foundation for its pivot to a 'smoke-free future.' It avoids disruptive or aggressive language, instead opting for a message of measured, responsible evolution.

Audience Messaging

Target Personas

- Persona:

Investors & Financial Analysts

Tailored Messages

- •

Altria Increases Quarterly Dividend to $1.06 Per Share

- •

Detailed financial statements (Balance Sheet, Income Statement)

- •

Stock Performance

- •

Annual Reports

Effectiveness:Effective

- Persona:

Media & Journalists

Tailored Messages

- •

Latest Press Releases

- •

Corporate Fact Sheet

- •

Media Contacts

- •

Our Voice & Actions

Effectiveness:Effective

- Persona:

Regulators & Policymakers

Tailored Messages

- •

Moving Beyond Smoking

- •

Reduce the Harm of Tobacco Products

- •

Prevent Underage Use

- •

ESG Reporting & Data

Effectiveness:Somewhat Effective

Audience Pain Points Addressed

- •

For Investors: Concern over declining cigarette volumes is addressed by the 'Moving Beyond Smoking' growth strategy.

- •

For Investors: Fear of litigation and regulatory risk is addressed by messaging around 'Responsibility' and 'Harm Reduction'.

- •

For Society/Regulators: The public health impact of smoking is the core pain point addressed by the entire 'Harm Reduction' narrative.

Audience Aspirations Addressed

For Investors: The desire for stable, high-yield income is directly addressed by announcements of dividend increases and a clear focus on financial strength.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Security/Safety (Logos)

Effectiveness:Medium

Examples

The overwhelming use of financial data and formal announcements is a logical appeal (logos) designed to create a sense of financial security and predictability for investors.

Social Proof Elements

No itemsTrust Indicators

- •

Detailed financial reporting

- •

Links to ESG reports and data

- •

Consistent dividend payment history (implied by press releases)

- •

Formal corporate governance structure (implied by content like 'Proxy Statement')

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

View All Releases

Location:Media At-A-Glance

Clarity:Clear

- Text:

Our Vision

Location:Media At-A-Glance

Clarity:Clear

- Text:

Reduce the Harm of Tobacco Products

Location:Media At-A-Glance

Clarity:Clear

- Text:

Email Alerts

Location:Media At-A-Glance

Clarity:Clear

The CTAs are effective for their intended purpose: guiding a professional audience to specific information silos. They are informational and navigational rather than transactional. They clearly direct users to learn more about the company's vision, financial health, and responsible practices, aligning perfectly with the site's communication objectives for investors and media.

Messaging Gaps Analysis

Critical Gaps

Human-centric Storytelling: The messaging is sterile and lacks a human element. There is no voice from leadership (e.g., a CEO's letter), employees, or stakeholders to make the 'Moving Beyond Smoking' vision more tangible and relatable.

Evidence of Impact: While the 'Harm Reduction' strategy is clearly stated, the messaging lacks compelling data or evidence (within regulatory bounds) to substantiate the real-world impact of this transition.

Contradiction Points

The most significant messaging tension is the unstated contradiction between the 'Moving Beyond Smoking' vision and the business reality that combustible cigarettes remain the primary source of revenue and profit. The corporate messaging focuses exclusively on the future vision, which can be perceived as an evasion of the present business model.

Underdeveloped Areas

The 'Why': The messaging clearly explains what Altria is doing (Moving Beyond Smoking) and how (smoke-free products), but the underlying why behind the transformation could be more powerfully articulated beyond a pure business or responsibility mandate.

Competitive Differentiation: The messaging does not clearly articulate why Altria's approach to the smoke-free future is superior to or different from its competitors' strategies.

Messaging Quality

Strengths

- •

Clarity and Focus: The messaging is exceptionally clear and tightly focused on its key audiences, primarily investors.

- •

Consistency: The brand voice and core messages are highly consistent across all corporate communication sections.

- •

Strategic Alignment: The messaging directly supports the company's core business strategies of delivering shareholder value while navigating a long-term industry transition.

Weaknesses

- •

Lack of Emotional Resonance: The voice is overly corporate and fails to build any emotional connection or deeper brand trust.

- •

Perceived Inauthenticity: The inherent contradiction between the company's vision and its current revenue drivers creates a potential trust gap.

- •

Over-reliance on Jargon: The language is heavy with corporate and financial terminology, making it inaccessible to a broader audience.

Opportunities

- •

Introduce a Leadership Voice: A letter or video from the CEO could add a human face to the strategic vision and make the commitment to change feel more personal and authentic.

- •

Develop Thought Leadership: Create content that positions Altria as a leader in the complex conversation around tobacco harm reduction, corporate responsibility, and managing industry transitions.

- •

Show, Don't Just Tell: Use data visualizations, timelines, and case studies (where appropriate) to bring the 'Moving Beyond Smoking' journey to life and demonstrate tangible progress.

Optimization Roadmap

Priority Improvements

- Area:

Narrative Depth

Recommendation:Create a dedicated 'Our Vision' content hub that goes beyond the current landing page. Feature interviews with R&D leaders, detailed (and legally compliant) explanations of the science behind harm reduction, and a clear roadmap of the company's transition. This will add much-needed substance to the core message.

Expected Impact:High

- Area:

Value Proposition for Investors

Recommendation:Develop a concise 'Investment Thesis' section that explicitly connects the dots between financial strength (dividends, buybacks) and the long-term growth opportunity in smoke-free products. This synthesizes the two main messages into a single, powerful narrative for the primary audience.

Expected Impact:High

Quick Wins

Add a quote or short introductory letter from the CEO to the 'Our Vision' and 'Harm Reduction' pages to immediately inject a human element.

Create a simple infographic on the 'Media At-A-Glance' page that visualizes the 'Moving Beyond Smoking' strategy and key proof points.

Long Term Recommendations

Develop a multi-year content strategy focused on transparently reporting progress against ESG and harm reduction goals, using data to build credibility over time.

Gradually evolve the brand voice to be more direct and transparent in acknowledging the complexities of the industry transition, thereby building long-term trust with stakeholders.

Altria's strategic messaging is a masterclass in disciplined, audience-centric corporate communication. The website functions less as a broad brand-building tool and more as a secure information portal for its most critical stakeholders: investors, media, and regulators. The messaging architecture is clear and effective, prioritizing the forward-looking 'Moving Beyond Smoking' vision while reassuring investors with a constant drumbeat of financial stability and shareholder returns. The brand voice is consistently formal, professional, and guarded—a necessity for a company in a highly regulated and litigious industry.

However, this disciplined approach comes at a cost. The messaging is sterile and lacks any emotional resonance, missing opportunities to build broader trust or humanize its complex corporate transformation. The primary vulnerability is the inherent contradiction between its future-facing vision and its present-day business model, which is heavily reliant on combustible cigarettes. The website's messaging navigates this tension by focusing almost exclusively on the future, a strategy that is effective for its core audience but may appear evasive to a more skeptical observer. The key opportunity for optimization lies not in changing the core messages, but in adding layers of depth, transparency, and humanity to substantiate them, thereby transforming a defensively sound message into a more compelling and credible narrative of corporate evolution.

Growth Readiness

Growth Foundation

Product Market Fit

Moderate

Evidence

- •

Combustible Cigarettes (e.g., Marlboro): Strong, deeply entrenched PMF with a large, loyal adult consumer base, but within a declining market. Financials show significant, stable cash flow from this segment.

- •

Oral Nicotine (

on!): Moderate and growing PMF. Shipment volumes are increasing significantly (up 18% in Q1 2025), and market share in the oral tobacco category is expanding, reaching 8.8%. - •

E-Vapor (NJOY): Moderate but improving PMF post-acquisition. NJOY is the only pod-based e-vapor product with FDA marketing authorization for its ACE device, a significant differentiator. Altria is successfully expanding distribution to over 100,000 stores, addressing previous visibility gaps.

- •

Overall Portfolio: The 'Moving Beyond Smoking' strategy shows a clear understanding of market evolution, but the fit of their new products is still being established against dominant competitors like Zyn (oral) and Vuse (e-vapor).

Improvement Areas

- •

Accelerate innovation in smoke-free products to better match the consumer experience and nicotine satisfaction provided by competitor products.

- •

Enhance brand equity and consumer awareness for

on!and NJOY to more effectively compete with established market leaders. - •

Develop a clearer value proposition for adult smokers to switch, addressing barriers like experience, convenience, and satisfaction.

Market Dynamics

Combustible Cigarettes: Declining (-3% to -5% annually). Smoke-Free Alternatives (E-vapor, Oral Nicotine): Growing (E-vapor CAGR ~8.7%, Smokeless Tobacco CAGR ~3.8-4.6%).

Mature/Declining for combustibles; Growing for smoke-free alternatives.

Market Trends

- Trend:

Shift in Consumer Preference to Smoke-Free Alternatives

Business Impact:This is the primary driver of Altria's strategic pivot. It creates both a massive risk to the core business and the primary growth opportunity for the company.

- Trend:

Intensifying Regulatory Scrutiny (FDA)

Business Impact:Creates significant barriers to market entry and product innovation. However, it can also create a moat for companies like Altria that have the resources to navigate the premarket tobacco product application (PMTA) process.

- Trend:

Flavor Restrictions and Bans

Business Impact:Potential bans on menthol cigarettes and flavored e-vapor products represent a major threat to key revenue streams and harm reduction strategies.

- Trend:

Rise of Illicit Disposable Vapes

Business Impact:Creates unregulated competition that undermines legally marketed, FDA-authorized products like NJOY.

Challenging but Necessary. Altria is late compared to some competitors (e.g., Swedish Match with Zyn) but is now making aggressive moves. The market is clearly shifting, making the timing for a strategic pivot imperative for survival and future growth.

Business Model Scalability

High

High fixed costs associated with manufacturing and distribution are already leveraged across a massive volume of combustible products. This infrastructure can be adapted for new products.

High. Altria possesses a world-class logistics and distribution network with access to hundreds of thousands of retail points of sale, which is a significant competitive advantage for scaling new products like NJOY.

Scalability Constraints

- •

Manufacturing processes for new technologies (e.g., electronics in e-vapor) differ significantly from traditional tobacco processing.

- •

Navigating disparate state-level regulations for new product categories can complicate national rollouts.

- •

Supply chain dependencies for electronic components (e.g., batteries, chips) introduce new risks compared to the agricultural supply chain of tobacco.

Team Readiness

Experienced in managing a mature, highly regulated business and executing large-scale operations and M&A. The key question is their agility and innovative capacity in the faster-moving smoke-free market.

Traditionally structured for a slow-moving consumer staple. They are creating focused teams and subsidiaries (e.g., for NJOY) to better address the new market dynamics, which is a positive step.

Key Capability Gaps

- •

Rapid innovation and product development cycles typical of consumer electronics.

- •

Digital marketing and direct-to-consumer engagement (heavily restricted but important for brand building).

- •

Expertise in navigating the FDA's complex and evolving regulatory framework for new product categories.

Growth Engine

Acquisition Channels

- Channel:

B2B Retail & Wholesale Distribution

Effectiveness:High

Optimization Potential:Medium

Recommendation:Leverage deep relationships with convenience stores and other retailers to secure premium shelf space and point-of-sale visibility for

on!and NJOY, displacing competitors. - Channel:

Point-of-Sale Marketing

Effectiveness:High

Optimization Potential:High

Recommendation:Develop data-driven, targeted in-store promotions and merchandising to encourage adult smokers of Altria's combustible brands to trial smoke-free alternatives.

- Channel:

Age-Gated Digital Properties

Effectiveness:Low

Optimization Potential:High

Recommendation:Invest in building out sophisticated, age-gated digital platforms for direct brand engagement and education with verified adult consumers, where legally permissible.

Customer Journey

The primary growth path is converting existing adult smokers of Altria's own brands (e.g., Marlboro) to their smoke-free portfolio (on!, NJOY). This is a journey of awareness, trial, and complete switching.

Friction Points

- •

Lack of awareness of smoke-free alternatives and their benefits.

- •

Product satisfaction gaps (nicotine delivery, taste, ritual) compared to traditional cigarettes.

- •

Consumer confusion and mistrust regarding the health impacts of new products.

- •

Retail availability and visibility gaps, although this is being actively addressed for NJOY.

Journey Enhancement Priorities

{'area': 'Trial & Onboarding', 'recommendation': 'Develop retailer-based trial programs or starter kits to lower the barrier for adult smokers to try NJOY and on!.'}

{'area': 'Product Education', 'recommendation': 'Create clear, responsible, and compelling messaging (at point-of-sale and on owned digital properties) about the benefits of switching for adult consumers.'}

Retention Mechanisms

- Mechanism:

Brand Loyalty (Core Business)

Effectiveness:High

Improvement Opportunity:Leverage Marlboro brand equity to create a trusted pathway for smokers to switch to Altria's smoke-free products.

- Mechanism:

Product Ecosystem (Growth Business)

Effectiveness:Medium

Improvement Opportunity:Build a portfolio of satisfying smoke-free products that cater to a range of user preferences to retain them within the Altria ecosystem and prevent switching to competitors.

- Mechanism:

Nicotine Satisfaction

Effectiveness:High

Improvement Opportunity:Continue R&D to optimize nicotine delivery in smoke-free products to better replicate the experience of combustible cigarettes, which is a key barrier to switching for many smokers.

Revenue Economics

Very Strong. The core cigarette business is a cash cow with high margins and pricing power. The smoke-free products, particularly consumables like pods and pouches, are designed for high-margin, recurring revenue streams.

Qualitatively High. For the core business, CAC is low and LTV is extremely high due to brand loyalty and the nature of the product. For smoke-free, the strategy is to convert existing high-LTV customers, making the incremental CAC relatively low.

High, but declining due to volume pressures in the core business. The key challenge is replacing highly profitable cigarette revenue with equally or more profitable smoke-free revenue.

Optimization Recommendations

- •

Utilize pricing power on combustible cigarettes to fund investments in the smoke-free portfolio.

- •

Focus on scaling

on!and NJOY to improve margins through economies of scale in manufacturing and marketing. - •

Optimize promotional spending in the oral tobacco segment to improve net revenue per unit, as is already being done successfully with

on!.

Scale Barriers

Technical Limitations

- Limitation:

Heated Tobacco Product Gap

Impact:High

Solution Approach:Altria lost the US rights to commercialize IQOS back to Philip Morris International. They need to accelerate development or acquisition of a competitive heated tobacco product to compete in this emerging category.

- Limitation:

Intellectual Property Disputes

Impact:Medium

Solution Approach:Patent infringement claims from competitors (e.g., Juul) can disrupt product launches and sales. Proactively design around existing patents and build a strong defensive IP portfolio for new products, as they are reportedly doing with a redesigned NJOY ACE.

Operational Bottlenecks

- Bottleneck:

Supply Chain for New Products

Growth Impact:Medium

Resolution Strategy:Strengthen the global supply chain for NJOY to support anticipated volume increases, focusing on sourcing electronic components and ensuring manufacturing quality and capacity.

- Bottleneck:

Organizational Inertia

Growth Impact:High

Resolution Strategy:Continue to foster a more agile, innovative culture within the smoke-free business units, potentially isolating them from the bureaucracy of the larger corporation to speed up decision-making and product development.

Market Penetration Challenges

- Challenge:

Intense Competition

Severity:Critical

Mitigation Strategy:Aggressively leverage superior retail distribution to out-muscle competitors at the point of sale. Compete on product performance and brand trust.

on!is gaining share but Zyn remains dominant; NJOY must compete with Vuse. - Challenge:

Regulatory Uncertainty and Delays

Severity:Critical

Mitigation Strategy:Invest heavily in regulatory affairs and scientific research to build robust PMTAs. Engage proactively with the FDA to advocate for a clear, science-based regulatory framework for harm reduction.

- Challenge:

Public and Consumer Mistrust

Severity:Major

Mitigation Strategy:Execute a long-term strategy of responsible marketing, transparent communication, and a clear commitment to preventing underage use to rebuild credibility as a company genuinely focused on harm reduction.

- Challenge:

Slow Pace of Adult Smoker Conversion

Severity:Major

Mitigation Strategy:Invest in consumer research to deeply understand the barriers to switching and innovate on product features (flavor, nicotine satisfaction, form factor) to create more compelling alternatives.

Resource Limitations

Talent Gaps

- •

Consumer electronics product managers and engineers.

- •

Regulatory scientists with expertise in FDA submissions for novel products.

- •

Brand marketers with experience in building brands in highly restricted, fast-moving categories.

Low. The company generates substantial free cash flow ($8.7B+ annually), sufficient to fund dividends, share buybacks, and strategic investments in growth.

Infrastructure Needs

Expansion of manufacturing facilities for smoke-free products, particularly for NJOY pods and on! pouches.

Investment in R&D labs focused on next-generation product platforms.

Growth Opportunities

Market Expansion

- Expansion Vector:

Convert Existing Adult Smoker Base

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Develop a systematic, data-driven program to market smoke-free alternatives directly to their existing database of ~20-30 million adult smokers, leveraging brand trust and their distribution network.

Product Opportunities

- Opportunity:

Scale NJOY E-Vapor Products

Market Demand Evidence:The e-vapor market is large and growing, though fragmented. NJOY's FDA authorization for ACE provides a key competitive advantage over unauthorized disposable products.

Strategic Fit:Core to the 'Moving Beyond Smoking' vision. Fills a critical gap in their portfolio after the Juul failure.

Development Recommendation:Focus on executing the retail distribution expansion, ensuring product availability and visibility. Invest in marketing to build brand awareness among adult smokers.

- Opportunity:

Grow

on!Oral Nicotine Pouch ShareMarket Demand Evidence:The nicotine pouch category is experiencing explosive growth, and

on!is successfully capturing share, growing faster than the overall segment.Strategic Fit:Perfect fit. A high-margin, scalable, and discrete smoke-free product that is clearly resonating with consumers.

Development Recommendation:Continue to invest in marketing and distribution to challenge Zyn's market leadership. Innovate on flavors and nicotine strengths to capture a wider range of consumer preferences.

- Opportunity:

Develop/Acquire a Heated Tobacco Product

Market Demand Evidence:Heated tobacco is a significant and growing category globally, and a key pillar for competitors like Philip Morris International.

Strategic Fit:Essential third pillar for the smoke-free portfolio. Altria currently has a major gap here.

Development Recommendation:Pursue a multi-pronged approach: accelerate internal R&D, explore partnerships, and actively scan for acquisition targets to re-enter this market as quickly as possible.

- Opportunity:

Long-term Play in Cannabis

Market Demand Evidence:Growing consumer demand and increasing likelihood of federal regulatory changes. Altria has a stake in Cronos Group.

Strategic Fit:Adjacent market that leverages existing expertise in regulated adult-use products and distribution.

Development Recommendation:Maintain the investment in Cronos as a learning opportunity. Develop a clear strategy to quickly scale and leverage their distribution network upon federal legalization.

Channel Diversification

- Channel:

Expanded E-commerce (Age-Gated)

Fit Assessment:Medium

Implementation Strategy:Lobby for clear regulations that would permit responsible, age-verified online sales of smoke-free products. This could be a key channel for consumer education and conversion.

Strategic Partnerships

- Partnership Type:

Technology & Innovation

Potential Partners

- •

Consumer electronics companies

- •

Biotech firms specializing in nicotine delivery

- •

International tobacco companies with advanced smoke-free tech

Expected Benefits:Accelerate R&D for next-generation devices, potentially including heated tobacco and digital health platforms.

Growth Strategy

North Star Metric

Smoke-Free Net Revenue as a Percentage of Total Net Revenue

This metric directly tracks the success of the strategic pivot away from the declining combustible business. It aligns the entire organization around the 'Moving Beyond Smoking' vision and is a clear indicator of long-term sustainable growth.

Increase from ~11% in 2023 to 25% by 2028. Altria's stated goal is to grow smoke-free net revenues to $5 billion by 2028.

Growth Model

Ecosystem Conversion Model

Key Drivers

- •

Conversion rate of existing combustible smokers to Altria's smoke-free products.

- •

Market share growth of

on!and NJOY within their respective categories. - •

Retention of users within Altria's smoke-free product portfolio.

Leverage the cash flow from the combustible business (the 'funding engine') to invest in acquiring and scaling users for the smoke-free portfolio (the 'growth engine'). Use their unmatched retail distribution network as the primary lever for user acquisition and trial.

Prioritized Initiatives

- Initiative:

Aggressive National Rollout and Scaling of NJOY

Expected Impact:High

Implementation Effort:High

Timeframe:12-18 months

First Steps:Secure premium merchandising and shelf space in the top 50 convenience store chains. Launch a national point-of-sale campaign targeting adult smokers.

- Initiative:

Challenge for #1 Market Share in Oral Nicotine with

on!Expected Impact:High

Implementation Effort:Medium

Timeframe:18-24 months

First Steps:Increase marketing investment behind the 'It's On!' campaign. Launch new flavor and strength variations based on consumer data to close gaps with Zyn's portfolio.

- Initiative:

Establish a Viable Heated Tobacco Product Strategy

Expected Impact:High

Implementation Effort:High

Timeframe:24-36 months

First Steps:Form a dedicated corporate development and R&D team to evaluate build vs. buy vs. partner options for entering the U.S. heated tobacco market.

- Initiative:

Advocate for a Pro-Harm-Reduction Regulatory Framework

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:Ongoing

First Steps:Publish scientific evidence supporting the harm reduction potential of the product portfolio. Increase engagement with the FDA and public health officials.

Experimentation Plan

High Leverage Tests

{'test_name': 'Co-Branded Conversion Offers', 'hypothesis': 'Offering exclusive discounts on NJOY or on! starter kits to registered adult Marlboro consumers will significantly increase trial and conversion rates.'}

{'test_name': 'Retail Merchandising Optimization', 'hypothesis': 'Testing different shelf placements and point-of-sale messaging for smoke-free products in controlled store environments will identify the most effective tactics for driving trial.'}

Utilize retail sales data (Nielsen scans), shipment volumes, and market share reports. Track conversion and switching behavior through consumer panels and surveys.

Quarterly review of major initiatives, with monthly sprints for retail-level testing.

Growth Team

A centralized 'Smoke-Free Transition' growth team that sits across the NJOY and on! business units. This team should be led by a Chief Growth Officer and be comprised of experts in product, marketing, data, and regulatory affairs.

Key Roles

- •

Head of Smoker Conversion

- •

Director of Retail Channel Growth

- •

Product Lead, Next-Generation Platforms

- •

Lead, Regulatory & Scientific Affairs

Actively recruit talent from outside the tobacco industry, specifically from CPG, consumer electronics, and regulated healthcare sectors to bring in new skills and perspectives.

Altria Group is a corporate behemoth at a critical inflection point. Its foundation—the highly profitable but steadily declining U.S. combustible cigarette business—provides immense financial strength and an unparalleled distribution network. This forms a powerful, albeit temporary, platform from which to launch its strategic pivot towards a 'smoke-free future'.

Key Strengths for Growth: The company's primary growth assets are its robust cash flow, which funds the transition, and its deep-rooted retail relationships, which provide a significant advantage in scaling new products. The acquisitions of NJOY and on! have provided Altria with viable, FDA-authorized (in NJOY's case) products in the two largest and fastest-growing smoke-free categories: e-vapor and oral nicotine pouches. Early results are promising, with on! consistently gaining market share and the expanded distribution of NJOY starting to show positive results.

Significant Barriers to Scale: Altria's path to growth is fraught with obstacles. The most critical is the immense regulatory uncertainty imposed by the FDA, which can delay product launches, restrict marketing, and create an unpredictable operating environment. Competition is fierce and more nimble; Philip Morris International's Zyn dominates the oral pouch market, and British American Tobacco's Vuse leads in e-vapor. Furthermore, Altria faces a deep-seated public trust deficit and must overcome significant consumer behavior inertia to convert adult smokers. Finally, the company has a glaring portfolio gap in the heated tobacco space after ceding IQOS rights back to PMI.

Strategic Recommendation: Altria's growth strategy must be a tale of two companies: a 'Legacy' business focused on maximizing cash flow from combustibles through pricing power and cost efficiency, and a 'Growth' business ruthlessly focused on winning in smoke-free categories.

The overarching North Star Metric must be Smoke-Free Net Revenue as a Percentage of Total Net Revenue. All strategic initiatives should be aligned with this goal.

Priorities should be:

1. Win in Retail: Aggressively leverage the distribution network to make NJOY and on! the most visible and available products at every point of sale.

2. Accelerate Conversion: Systematically target its massive existing adult smoker base with compelling reasons and products to switch.

3. Close the Portfolio Gap: Urgently develop or acquire a competitive heated tobacco product.

4. Shape the Regulatory Environment: Proactively lead with science and data to advocate for a stable, pro-harm-reduction regulatory framework.

Success is not guaranteed and the transition will take years. However, by leveraging its core financial and operational strengths to aggressively scale its new product portfolio, Altria has a viable, albeit challenging, path to reinvent itself and secure long-term, sustainable growth.

Legal Compliance

Altria's Privacy Statement, accessible via a footer link, is comprehensive and tailored for a corporate communications and investor relations website. It clearly outlines the types of personal information collected (e.g., name, email for 'Contact Us' forms or email alerts) and data gathered automatically via cookies and analytics (e.g., IP address, browsing activity). The policy explicitly states that it does not sell or rent personal information to third parties. It addresses data subject rights, referencing state-specific laws, which indicates an awareness of regulations like the CCPA/CPRA. It details a process for users to access, correct, or delete their data, requiring identity verification for security. The policy also notes that they retain information for a 'reasonably necessary' period, considering statutes of limitation, and use safeguards to protect data, though they correctly disclaim that no method is 100% secure. A key strength is its clarity on what it doesn't collect from passive browsing unless a user voluntarily provides it.

The 'Terms of Use' are prominently available and clearly define the website's purpose as providing general and investor information, explicitly stating it is 'not operated for advertising or marketing purposes.' This is a crucial legal distinction for a tobacco company, as it helps mitigate risks associated with marketing and advertising regulations. The terms include standard disclaimers of liability ('AS IS' and 'AS AVAILABLE' basis), intellectual property clauses protecting their trademarks and logos, and a clause stating that if the website's content is contrary to local laws in a user's jurisdiction, the site is not intended for them. This positions the website as a passive information resource rather than an active commercial platform, which is a sound risk management strategy.