eScore

amazon.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Amazon's digital presence is unparalleled, functioning almost as a product-based search engine in its own right. It demonstrates near-perfect search intent alignment for commercial queries, dominant authority with a massive and high-quality backlink profile, and extensive global reach through localized domains. The platform's immense direct traffic and exhaustive topic coverage underscore its digital supremacy, although its on-site content is less focused on top-of-funnel informational queries.

The brand possesses such dominant authority and user habituation that many consumers bypass traditional search engines and begin their product discovery directly on Amazon.com.

Incorporate more top-of-funnel, informational, and inspirational content directly on the retail platform to capture users earlier in the customer journey, preventing competitors and social platforms from owning the 'discovery' phase.

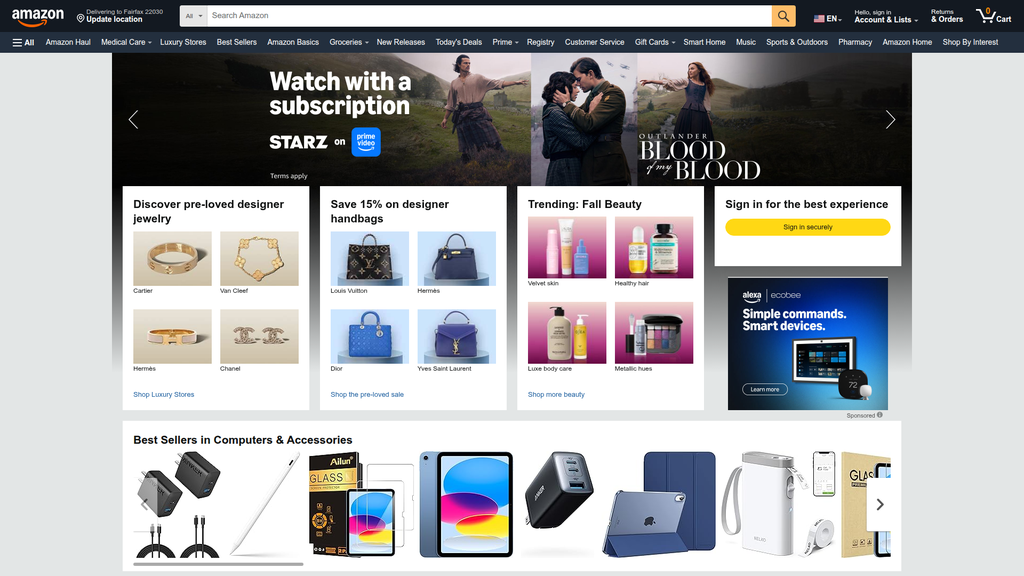

Amazon's messaging is a masterclass in transactional efficiency, effectively segmenting audiences and using clear, action-oriented language to drive conversions. The communication hierarchy relentlessly prioritizes deals and timely needs, which is highly effective for its business model. However, it largely fails to communicate a broader brand narrative or create a strong emotional connection, positioning itself as a utility rather than a beloved brand.

The messaging architecture is hyper-effective at audience segmentation, with content blocks clearly tailored to different user needs (e.g., 'Bargain Hunter', 'Seasonal Shopper') and pain points.

Integrate brand-level storytelling that communicates the company's mission of customer-centricity. The current messaging is almost entirely tactical and misses the opportunity to build a deeper, more resilient brand connection beyond price and convenience.

Amazon has set the global standard for frictionless conversion, pioneering features like 1-Click ordering and a ruthlessly optimized checkout process. Its mobile experience is excellent and the cross-device journey is seamless for logged-in users. The primary drawback is the high cognitive load and visual clutter on key pages, which can overwhelm users and lead to choice paralysis, slightly hampering the experience despite its high effectiveness.

A relentlessly A/B-tested, low-friction checkout process that is the gold standard in e-commerce, minimizing abandoned carts and maximizing sales.

Systematically declutter the homepage and key category pages to reduce cognitive load. A/B test a more focused, personalized hero section instead of a rapidly rotating carousel to improve engagement and reduce 'banner blindness'.

Amazon's credibility with its customer base is exceptionally high, built on years of reliable service, a trusted brand name, and robust trust signals like customer reviews. However, the company faces severe, high-impact risks from a legal and regulatory standpoint. The presence of major antitrust lawsuits, record-breaking GDPR fines in the EU, and increasing liability for third-party products creates a significant disconnect between consumer trust and enterprise-level risk.

The Amazon brand itself is a primary trust signal, reinforced by a massive volume of customer reviews and a familiar, reliable purchasing process that gives consumers confidence.

Proactively restructure marketplace operations to mitigate the core allegations in the FTC and EU antitrust lawsuits. These legal challenges represent an existential threat and require fundamental business practice changes, not just legal defense.

Amazon's competitive advantages are deeply entrenched and exceptionally sustainable, forming a powerful 'moat' around the business. The synergistic 'flywheel' of the Prime ecosystem, the unparalleled logistics and fulfillment network (FBA), and the highly profitable AWS division create immense barriers to entry. These advantages are nearly impossible for competitors to replicate at scale, giving Amazon a durable and commanding market position.

The symbiotic relationship between its three core pillars: the Prime ecosystem for customer lock-in, the FBA logistics network for delivery supremacy, and the AWS cloud business which profitably funds innovation and subsidizes low retail margins.

Address the rising threat of social commerce by integrating more engaging, discovery-based, and creator-led content to prevent platforms like TikTok from owning the top of the sales funnel.

The business model is proven to be highly scalable, evidenced by its global expansion and entry into diverse industries like cloud computing and advertising. Profitability from high-margin segments like AWS and advertising provides massive capital for reinvestment into new growth areas. Significant expansion potential remains in B2B commerce, healthcare, and further international market penetration, though this is constrained by increasing regulatory scrutiny.

The highly profitable and scalable AWS segment acts as a strategic cash cow, funding aggressive, long-term investments in new, high-growth verticals like AI, logistics, and healthcare without depending on retail margins.

Develop and implement a more sophisticated localization strategy for emerging markets, moving beyond a one-size-fits-all approach to better compete with entrenched local players in regions like Southeast Asia and Latin America.

Amazon's business model is the gold standard of a coherent, self-reinforcing ecosystem, famously known as the 'flywheel.' Lower prices and vast selection attract customers, which attracts third-party sellers, which expands selection and competition, improving the customer experience; this entire system is underpinned by the Prime ecosystem and FBA logistics. The addition of high-margin, synergistic revenue streams like AWS and Advertising further strengthens this virtuous cycle.

The 'flywheel' effect, where each component of the business (Marketplace, Prime, AWS, Advertising) synergistically reinforces the others, creating a powerful, self-perpetuating growth engine.

Improve the strategic alignment between the mass-market, low-price perception of the core brand and its newer, high-end luxury and aspirational product categories to create a more consistent brand identity.

With a dominant U.S. e-commerce market share projected to exceed 40%, Amazon exerts immense market power. Its ability to influence consumer behavior, set standards in logistics, and shape the digital advertising landscape is unparalleled. This market power, demonstrated by its dynamic pricing capabilities and leverage over third-party sellers, is both a core asset and the primary source of the significant regulatory challenges it faces globally.

Dominant market share in both e-commerce and cloud computing, which allows it to set industry standards, influence pricing, and create a gravitational pull for both customers and sellers that is difficult for competitors to overcome.

Develop a proactive regulatory strategy that goes beyond legal defense to demonstrate fair practices, thereby mitigating the risk that its market power will be curtailed by government intervention.

Business Overview

Business Classification

Hybrid Ecosystem Platform

eCommerce Marketplace & Cloud Computing Provider

Technology

Sub Verticals

- •

Online Retail

- •

Cloud Infrastructure (IaaS, PaaS)

- •

Digital Advertising

- •

Consumer Electronics

- •

Streaming & Digital Content

- •

Logistics & Fulfillment

- •

Grocery (Physical & Online)

Mature

Maturity Indicators

- •

Sustained global market leadership in core segments (eCommerce, Cloud).

- •

Consistent profitability and massive operating cash flow.

- •

High brand recognition and over 250 million Prime members worldwide.

- •

Active expansion into new, high-growth verticals (e.g., AI, healthcare).

- •

Significant focus on operational efficiency and cost optimization.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Online Stores

Description:Direct first-party sales of a vast range of products where Amazon acts as the seller. This is the foundational revenue stream and the largest by gross revenue.

Estimated Importance:Primary

Customer Segment:Mass-market Consumers

Estimated Margin:Low

- Stream Name:

Third-Party (3P) Seller Services

Description:Commissions, fulfillment (Fulfillment by Amazon - FBA), shipping fees, and other services provided to millions of independent sellers on the Amazon marketplace.

Estimated Importance:Primary

Customer Segment:Small & Medium Businesses, Enterprise Brands

Estimated Margin:Medium

- Stream Name:

Amazon Web Services (AWS)

Description:On-demand cloud computing platforms and APIs for individuals, companies, and governments. Includes IaaS, PaaS, and SaaS offerings. While third in revenue, it is the primary driver of operating income and profitability.

Estimated Importance:Primary

Customer Segment:Developers, Startups, SMBs, Enterprises, Government Agencies

Estimated Margin:High

- Stream Name:

Advertising Services

Description:Sale of advertising services to sellers, vendors, publishers, and others through programs like sponsored products, display, and video advertising. This is one of the fastest-growing and highest-margin segments.

Estimated Importance:Secondary

Customer Segment:Sellers, Brands, Agencies

Estimated Margin:High

- Stream Name:

Subscription Services

Description:Fees associated with Amazon Prime memberships and other subscriptions like Audible, Kindle Unlimited, and Amazon Music. Provides a stable, recurring revenue base.

Estimated Importance:Secondary

Customer Segment:Mass-market Consumers

Estimated Margin:Medium

- Stream Name:

Physical Stores

Description:Revenue generated from physical retail locations, primarily Whole Foods Market and Amazon Go stores.

Estimated Importance:Tertiary

Customer Segment:Grocery Shoppers, Convenience-focused Consumers

Estimated Margin:Low

Recurring Revenue Components

- •

Amazon Prime Membership Fees

- •

AWS Consumption-Based Billing (quasi-recurring)

- •

Audible & other content subscriptions

- •

Third-Party Seller Monthly Subscription Fees

Pricing Strategy

Hybrid (Value-Based, Competitive, Dynamic, Subscription, Pay-as-you-go)

Mid-range to Budget

Transparent

Pricing Psychology

- •

Dynamic Pricing (adjusts based on demand, competition, and user data)

- •

Subscription Model (locks in customers and encourages higher spend)

- •

Loss Leader Pricing (on certain products to attract customers)

- •

Price Anchoring (via 'List Price' strikeouts)

Monetization Assessment

Strengths

- •

Highly diversified revenue streams mitigate risk.

- •

High-margin businesses (AWS, Advertising) fund low-margin retail growth.

- •

Prime subscription model creates a powerful loyalty loop and predictable revenue.

- •

The 'flywheel effect' where each business segment reinforces the others.

Weaknesses

- •

Core online retail business operates on very thin margins.

- •

Heavy reliance on the profitability of AWS to support overall company performance.

- •

Increasing costs for fulfillment and shipping put pressure on retail profitability.

Opportunities

- •

Continued growth of the high-margin advertising business, especially in CTV.

- •

Expansion of AWS into new areas like Generative AI and industry-specific solutions.

- •

Further monetization of the Prime ecosystem through new exclusive services.

- •

Expansion into new verticals such as healthcare (Amazon Pharmacy) and global logistics services.

Threats

- •

Intense competition in cloud computing from Microsoft Azure and Google Cloud could pressure AWS margins.

- •

Global regulatory scrutiny and antitrust investigations targeting the marketplace and advertising businesses.

- •

Economic downturns impacting consumer discretionary spending and enterprise cloud budgets.

Market Positioning

Customer-centric 'Everything Store' providing unparalleled convenience, selection, and value, underpinned by a dominant technology infrastructure.

Dominant leader in US eCommerce (approx. 37-40%) and global Cloud Infrastructure (approx. 30-31%).

Target Segments

- Segment Name:

The Prime Consumer

Description:Loyal, high-frequency shoppers who prioritize convenience, speed, and value. They are deeply integrated into the Amazon ecosystem, using multiple services like Prime Video, Music, and fast shipping.

Demographic Factors

- •

Ages 25-55

- •

Middle to high household income

- •

Urban and suburban dwellers

Psychographic Factors

- •

Values convenience and time-saving

- •

Tech-savvy and comfortable with online services

- •

Brand loyal

Behavioral Factors

- •

High purchase frequency (weekly/monthly).

- •

High annual spend (avg. $1400+).

- •

Utilizes multiple Amazon services beyond retail.

Pain Points

- •

Time-consuming shopping trips

- •

High shipping costs from other retailers

- •

Fragmented digital services (video, music, etc.)

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

The Third-Party Seller (SMB)

Description:Small to medium-sized businesses and entrepreneurs who use Amazon's marketplace to reach a massive customer base and leverage its world-class logistics (FBA).

Demographic Factors

Entrepreneurs

Small business owners

Psychographic Factors

- •

Growth-oriented

- •

Seeking efficiency and scale

- •

Willing to trade margin for volume

Behavioral Factors

- •

Utilizes FBA for logistics

- •

Invests in Amazon Advertising to drive sales

- •

Manages inventory and pricing dynamically

Pain Points

- •

Lack of access to a large customer base

- •

Complexities of logistics and shipping

- •

High costs of building and marketing an independent eCommerce site

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

The Enterprise Developer (AWS Client)

Description:Businesses of all sizes, from startups to global corporations, that use AWS for scalable, reliable, and cost-effective cloud infrastructure, platform services, and emerging tech like AI/ML.

Demographic Factors

Startups, SMBs, Large Enterprises, Government agencies.

Psychographic Factors

- •

Innovation-focused

- •

Cost-conscious (OpEx vs. CapEx)

- •

Values scalability and reliability

Behavioral Factors

- •

Utilizes a pay-as-you-go model

- •

Builds applications and services on the AWS platform

- •

Integrates multiple AWS services

Pain Points

- •

High capital expenditure for on-premise data centers

- •

Inability to scale infrastructure quickly

- •

Need for access to advanced computing technologies without massive upfront investment

Fit Assessment:Excellent

Segment Potential:High

Market Differentiation

- Factor:

The Amazon Flywheel/Ecosystem

Strength:Strong

Sustainability:Sustainable

- Factor:

Logistics and Fulfillment Network

Strength:Strong

Sustainability:Sustainable

- Factor:

AWS Cloud Infrastructure Dominance

Strength:Strong

Sustainability:Sustainable

- Factor:

Brand Recognition and Trust

Strength:Strong

Sustainability:Sustainable

- Factor:

Vast Customer and Purchase Data

Strength:Strong

Sustainability:Sustainable

Value Proposition

To be Earth's most customer-centric company, offering the largest selection of goods with maximum convenience, lowest possible prices, and fastest delivery, all powered by a world-class technology backbone.

Excellent

Key Benefits

- Benefit:

Unmatched Selection

Importance:Critical

Differentiation:Unique

Proof Elements

Millions of products from 1P and 3P sellers

Multiple business lines (groceries, electronics, fashion, etc.)

- Benefit:

Extreme Convenience

Importance:Critical

Differentiation:Unique

Proof Elements

- •

One-click ordering

- •

Fast, free shipping with Prime

- •

Easy returns

- •

Personalized recommendations

- Benefit:

Competitive Pricing

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Regular deals and sales events (e.g., Prime Day)

- •

Dynamic pricing algorithm

- •

Subscribe & Save discounts

- Benefit:

Scalable Technology Infrastructure (for AWS)

Importance:Critical

Differentiation:Unique

Proof Elements

- •

Market leadership in cloud services

- •

Pay-as-you-go pricing

- •

Broadest and deepest set of cloud capabilities

Unique Selling Points

- Usp:

The Prime Membership Bundle (Free Shipping, Video, Music, etc.) creates a highly sticky ecosystem that competitors cannot easily replicate.

Sustainability:Long-term

Defensibility:Strong

- Usp:

AWS provides the foundational infrastructure for a significant portion of the internet, creating a deep technological moat and a highly profitable business that fuels other ventures.

Sustainability:Long-term

Defensibility:Strong

- Usp:

The symbiotic relationship between the marketplace and third-party sellers, powered by FBA, creates a self-reinforcing loop of more selection, better value, and faster delivery.

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Lack of a single, trusted online store with a comprehensive product selection.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

High cost and slow speed of shipping for online orders.

Severity:Major

Solution Effectiveness:Complete (for Prime members)

- Problem:

High upfront cost and complexity of building and maintaining IT infrastructure for businesses.

Severity:Critical

Solution Effectiveness:Complete

Value Alignment Assessment

High

Amazon's model is exceptionally aligned with market demands for convenience, speed, and digital transformation. Its retail arm meets the needs of modern consumers, while AWS powers the digital economy itself.

High

The value proposition is precisely tailored to its key segments: Prime members get unparalleled convenience, sellers get unmatched reach, and AWS customers get scalable, on-demand infrastructure.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Third-Party Sellers & Brands

- •

Logistics & Delivery Partners (incl. Flex drivers)

- •

Content Creators & Studios (Prime Video, Music)

- •

AWS Partner Network (Consultants, Integrators)

- •

Device Manufacturers (Fire TV, Alexa)

- •

Affiliate Marketers & Influencers

Key Activities

- •

Platform Development & Maintenance (Retail & AWS)

- •

Logistics, Warehousing & Supply Chain Management

- •

Data Analytics & Personalization

- •

Research & Development (AI, Robotics, Consumer Tech)

- •

Marketing & Customer Acquisition

- •

Seller & Developer Support

Key Resources

- •

Global Fulfillment & Data Center Infrastructure

- •

Proprietary Technology & Software Platforms

- •

Massive Customer & Seller Data

- •

The 'Amazon' Brand & Reputation

- •

Vast Product & Service Catalog

- •

Human Capital (Engineers, Data Scientists, Operations)

Cost Structure

- •

Cost of Sales (Inventory, fulfillment, shipping)

- •

Technology & Content (R&D, infrastructure, headcount)

- •

Marketing & Sales

- •

General & Administrative

- •

Capital Expenditures (fulfillment centers, data centers)

Swot Analysis

Strengths

- •

Dominant market leadership in core eCommerce and Cloud sectors.

- •

Highly diversified and synergistic revenue streams.

- •

Superior logistics, fulfillment, and supply chain capabilities.

- •

Powerful brand recognition and customer loyalty, anchored by Prime.

- •

Massive data assets that drive personalization and business intelligence.

Weaknesses

- •

Low operating margins in the core retail business.

- •

Negative public perception related to labor practices, environmental impact, and market power.

- •

Imitability of its business model by well-capitalized competitors (e.g., Walmart, Microsoft).

- •

Increasing complexity of managing a vast and diverse global operation.

Opportunities

- •

Further expansion into high-growth international markets.

- •

Growth in untapped, high-margin sectors like healthcare and B2B supplies.

- •

Leveraging AI to enhance personalization, advertising effectiveness, and operational efficiency.

- •

Expanding the advertising business into off-platform and CTV spaces.

- •

Offering 'Logistics as a Service' to third parties, competing with traditional carriers.

Threats

- •

Intensifying global regulatory pressure and antitrust scrutiny.

- •

Fierce competition in every major segment (Walmart in Retail; Microsoft/Google in Cloud; Meta/Google in Ads).

- •

Geopolitical instability and global supply chain disruptions.

- •

Cybersecurity threats and data privacy concerns.

- •

Shifts in consumer behavior post-pandemic and due to economic uncertainty.

Recommendations

Priority Improvements

- Area:

Regulatory Risk Mitigation

Recommendation:Proactively engage with regulators to address antitrust concerns, potentially by offering greater transparency into marketplace algorithms and advertising practices to preempt harsher remedies.

Expected Impact:High

- Area:

Operational Efficiency in Retail

Recommendation:Double down on investments in robotics, AI, and regionalization of fulfillment networks to improve the historically low margins of the core eCommerce business.

Expected Impact:Medium

- Area:

Brand and ESG Perception

Recommendation:Launch more visible and impactful initiatives around sustainability and employee welfare to counter negative public narratives and improve corporate reputation, which is a long-term strategic asset.

Expected Impact:Medium

Business Model Innovation

- •

Develop 'Logistics-as-a-Service' into a fourth major pillar of the business, leveraging existing infrastructure to compete directly with FedEx and UPS for non-Amazon parcels.

- •

Expand the physical retail footprint beyond grocery with technology-first, experiential stores for high-consideration categories like consumer electronics and home goods.

- •

Create a more robust B2B ecosystem by integrating Amazon Business with AWS services, offering a complete suite of products and cloud solutions for enterprise clients.

Revenue Diversification

- •

Accelerate the push into the digital healthcare sector by integrating Amazon Pharmacy more deeply with telehealth services and leveraging AI for diagnostics and patient management.

- •

Expand financial services offerings beyond co-branded credit cards, potentially exploring 'Buy Now, Pay Later' (BNPL) solutions or small business lending integrated with the seller ecosystem.

- •

Build out a comprehensive subscription model for enterprise services, bundling AWS credits, Amazon Business premium features, and dedicated logistics support for a recurring fee.

Amazon's business model is a masterclass in strategic evolution, diversification, and the creation of a self-reinforcing ecosystem, often referred to as the 'flywheel.' Originating as an online retailer, it has strategically expanded into the highly profitable domains of cloud computing (AWS) and digital advertising, which now generate the majority of its operating income, effectively subsidizing the growth and price competitiveness of its lower-margin retail arm. This diversification provides immense resilience and a formidable competitive moat. The Amazon Prime subscription is the glue that binds the consumer-facing ecosystem, creating a loyal, high-spending customer base locked in by a compelling bundle of convenience and content.

The company's key strategic advantage lies in its operational and technological supremacy. Its global logistics network is a tangible asset that is nearly impossible for competitors to replicate at scale, while AWS provides the digital backbone for a significant portion of the modern internet, including many of its direct competitors. This duality of physical and digital dominance is unique.

Looking forward, the primary challenge is not competition in a single vertical, but the management of its own success. Intensifying regulatory scrutiny across the globe poses the most significant threat to its current structure and practices. Future business model evolution must therefore focus on three key areas: 1) navigating this complex regulatory landscape to avoid forced break-ups or crippling fines, 2) continuing to innovate in high-margin growth areas like Generative AI, healthcare, and logistics as a service, and 3) improving the fundamental profitability of its core retail business through automation and efficiency gains. The scalability of its model is proven, but its sustainability will depend on its ability to innovate responsibly while managing immense external pressure.

Competitors

Amazon operates as the undisputed titan in the mature, oligopolistic e-commerce industry, but its dominance is being challenged on multiple fronts. While its core value proposition of vast selection, competitive pricing, and unparalleled convenience remains potent, the competitive landscape is fragmenting. Direct competitors like Walmart are successfully leveraging their massive physical footprint to create a compelling omnichannel alternative, chipping away at Amazon's market share, particularly in groceries and everyday essentials. Simultaneously, a new wave of disruptive players, notably Shein and Temu, are aggressively targeting the price-sensitive consumer segment with an ultra-low-cost model, creating significant pressure on Amazon's low-margin categories. Indirectly, the battle for consumer attention and spending is intensifying, with social commerce platforms turning into direct sales channels and specialized D2C brands offering curated experiences that Amazon's 'everything store' model struggles to replicate. Amazon's most profound and sustainable advantages—its unparalleled logistics network (FBA), the powerful lock-in effect of the Prime ecosystem, and the immense profitability of AWS that fuels its retail experiments—create formidable barriers to entry. However, weaknesses such as an increasingly cluttered and sometimes untrustworthy marketplace, persistent negative sentiment around labor practices, and significant antitrust scrutiny represent critical vulnerabilities. The key strategic imperative for Amazon is to move beyond just being a utility. It must leverage its vast data and AI capabilities to introduce deep personalization and curation, transforming the overwhelming selection into a tailored discovery experience. Addressing the quality and authenticity issues within its third-party marketplace is crucial for maintaining long-term customer trust. Future growth will depend on successfully navigating regulatory pressures, expanding into new verticals like healthcare and services, and innovating in logistics and sustainability to fend off both traditional and emerging disruptors.

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Logistics and Fulfillment Infrastructure

Impact:High

- Barrier:

Brand Recognition and Customer Trust

Impact:High

- Barrier:

Marketplace Network Effects (Sellers & Buyers)

Impact:High

- Barrier:

Technology and Data Infrastructure (including AWS)

Impact:High

- Barrier:

Capital Requirements

Impact:High

Industry Trends

- Trend:

AI-Driven Personalization and Conversational Commerce

Impact On Business:Opportunity to leverage vast customer data for hyper-personalized shopping experiences, but also a threat if competitors create more intuitive conversational interfaces.

Timeline:Immediate

- Trend:

Social Commerce and Livestream Shopping

Impact On Business:Threatens Amazon's position as the primary starting point for product discovery, as platforms like TikTok and Instagram become direct sales channels.

Timeline:Immediate

- Trend:

Sustainability and Circular Economy

Impact On Business:Growing consumer demand for sustainable products and practices presents an opportunity to build trust, but also exposes Amazon to criticism regarding its environmental footprint.

Timeline:Near-term

- Trend:

Ultra-Fast Delivery and Omnichannel Fulfillment

Impact On Business:Reinforces Amazon's strength in logistics but faces increased competition from rivals like Walmart using physical stores for rapid local fulfillment.

Timeline:Immediate

- Trend:

Subscription Economy Growth

Impact On Business:Validates the Prime model but increases competition for subscription dollars from services like Walmart+ and niche subscription boxes.

Timeline:Near-term

Direct Competitors

- →

Walmart

Market Share Estimate:6.4% of US e-commerce market.

Target Audience Overlap:High

Competitive Positioning:Omnichannel leader leveraging its vast physical store network for convenience (in-store pickup, returns) and grocery dominance, competing on price for everyday essentials.

Strengths

- •

Massive brick-and-mortar footprint for fulfillment and returns.

- •

Strong brand recognition and trust in the grocery and essentials categories.

- •

Competitive pricing, particularly on groceries.

- •

Growing third-party marketplace and fulfillment service (WFS).

- •

Walmart+ subscription service offers a compelling, lower-priced alternative to Prime, focusing on groceries and fuel.

Weaknesses

- •

Less extensive product selection compared to Amazon.

- •

Weaker digital entertainment bundle in its subscription service.

- •

Brand perception is less associated with premium or specialty goods.

- •

Technology and web services (AWS equivalent) are not a core competency.

Differentiators

- •

Seamless integration of online and physical retail (omnichannel).

- •

Focus on grocery delivery and in-store pickup.

- •

Fuel discounts as a key pillar of its Walmart+ membership.

- →

Alibaba Group (AliExpress, Tmall, Taobao)

Market Share Estimate:Globally larger than Amazon by GMV (23% vs 12%), but smaller in the US.

Target Audience Overlap:Medium

Competitive Positioning:The dominant force in the Chinese and broader Asian e-commerce market, acting as a gateway for global sourcing and offering extremely competitive pricing on a vast array of goods.

Strengths

- •

Dominant position in the massive Chinese market.

- •

Extensive network of manufacturers and suppliers, enabling low prices.

- •

Strong B2B and C2C platforms in addition to B2C.

- •

Advanced digital payment ecosystem (Alipay).

- •

Significant cloud computing competitor (Alibaba Cloud).

Weaknesses

- •

Weaker brand recognition and trust among Western consumers compared to Amazon.

- •

Longer shipping times to North America and Europe.

- •

Perception of lower product quality and counterfeit issues.

- •

Complex geopolitical environment.

Differentiators

- •

Focus on connecting businesses directly with manufacturers (B2B).

- •

Different marketplace models (Tmall for brands, Taobao for C2C).

- •

Deep integration with social and cultural aspects of the Chinese market.

- →

eBay

Market Share Estimate:3.0% of US e-commerce market.

Target Audience Overlap:Medium

Competitive Positioning:A global marketplace specializing in used, collectible, and unique items, with a strong C2C component and auction-style listings.

Strengths

- •

Dominant market for second-hand and collectible goods.

- •

Auction-style format provides a unique value proposition.

- •

Strong global presence with millions of active buyers.

- •

Lower barrier to entry for individual sellers.

Weaknesses

- •

Less focus on fast, standardized shipping (seller-dependent).

- •

Brand perception is often associated with used goods rather than new products.

- •

Competition from specialized resale apps (e.g., Poshmark, StockX).

- •

Declining revenue in recent years.

Differentiators

- •

Auction and 'Best Offer' pricing models.

- •

Focus on C2C (consumer-to-consumer) sales.

- •

Niche strength in collectibles, vintage items, and auto parts.

- →

Temu / Shein

Market Share Estimate:Rapidly growing; Temu reached a 17% market share in the US discount store category in 2023.

Target Audience Overlap:Medium

Competitive Positioning:Ultra-low-price disruptors with a direct-from-factory model, focused on impulse buys in categories like fashion, home goods, and accessories, driven by aggressive social media marketing.

Strengths

- •

Extremely aggressive pricing that undercuts most competitors.

- •

Highly effective and viral social media marketing strategies.

- •

Gamified shopping experience that encourages frequent engagement.

- •

Direct access to a flexible, on-demand manufacturing supply chain in China.

Weaknesses

- •

Longer shipping times compared to Amazon.

- •

Concerns over product quality, durability, and safety.

- •

Scrutiny over labor practices and sustainability.

- •

Vulnerable to tariffs and changes in international trade policy.

Differentiators

- •

Price as the absolute primary driver.

- •

Focus on trendy, fast-moving, and often unbranded items.

- •

'Discovery' based shopping model driven by algorithm rather than search.

- →

Target

Market Share Estimate:1.9% of US e-commerce market.

Target Audience Overlap:High

Competitive Positioning:An omnichannel retailer focused on a curated selection of affordable-chic products, appealing to families and style-conscious consumers, with strong private-label brands.

Strengths

- •

Strong, well-loved private label brands (e.g., Good & Gather, Cat & Jack).

- •

Curated product assortment that feels less overwhelming than Amazon.

- •

Excellent omnichannel services like Drive Up (curbside pickup) and Shipt (same-day delivery).

- •

Strong brand loyalty and a pleasant in-store shopping experience that translates online.

Weaknesses

- •

Significantly smaller product catalog than Amazon.

- •

Marketplace (Target Plus) is invite-only and much smaller.

- •

Not as price-competitive on a broad range of commodity items.

- •

Less developed media and technology ecosystem.

Differentiators

- •

Focus on curation and design-forward products.

- •

Exclusive partnerships with designers and brands.

- •

Superior private-label brand portfolio.

Indirect Competitors

- →

Specialty Retailers (e.g., Best Buy, Chewy, The Home Depot)

Description:Retailers that focus on a specific category, offering deep expertise, curated selection, and specialized customer service that Amazon's broad approach cannot match.

Threat Level:Medium

Potential For Direct Competition:Low

- →

Social Commerce Platforms (TikTok, Instagram, Pinterest)

Description:These platforms are integrating shopping features directly into their apps, turning product discovery and influencer marketing into immediate purchase opportunities, bypassing the need to visit Amazon.

Threat Level:High

Potential For Direct Competition:Medium

- →

Direct-to-Consumer (D2C) Brands

Description:Brands that sell directly to their customers, controlling the entire user experience, brand narrative, and customer data, thereby building a direct relationship that Amazon's marketplace model disintermediates.

Threat Level:Medium

Potential For Direct Competition:Low

- →

Cloud & Tech Giants (Microsoft Azure, Google Cloud)

Description:Direct and fierce competitors to Amazon Web Services (AWS), Amazon's most profitable division. Their competition in the cloud space impacts the resources Amazon can invest in its retail operations.

Threat Level:High

Potential For Direct Competition:High (in Cloud Services)

- →

Streaming Services (Netflix, Disney+, Spotify)

Description:Compete with Amazon Prime Video and Music for subscriber attention and entertainment budgets, potentially weakening the value proposition of the Prime bundle.

Threat Level:Medium

Potential For Direct Competition:High (in Media)

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Logistics and Fulfillment Network (FBA)

Sustainability Assessment:Highly sustainable due to massive capital investment in physical warehouses, robotics, and transportation, creating immense economies of scale.

Competitor Replication Difficulty:Hard

- Advantage:

Prime Ecosystem

Sustainability Assessment:Highly sustainable; the bundle of shipping, video, music, and other perks creates a powerful customer lock-in effect and high switching costs.

Competitor Replication Difficulty:Hard

- Advantage:

Vast Customer and Marketplace Data

Sustainability Assessment:Highly sustainable; years of purchase data fuel personalization, advertising, and product development, creating a virtuous cycle that is difficult to replicate.

Competitor Replication Difficulty:Hard

- Advantage:

Brand Recognition and Trust

Sustainability Assessment:Sustainable but requires constant maintenance. While the brand is synonymous with online shopping, this is vulnerable to erosion from negative press or poor marketplace experiences.

Competitor Replication Difficulty:Medium

- Advantage:

Amazon Web Services (AWS) Profitability

Sustainability Assessment:Highly sustainable; the massive profits from AWS subsidize low-margin retail operations, fund innovation, and allow for aggressive price competition.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'Exclusive product launches or content', 'estimated_duration': 'Short-term (months)'}

{'advantage': 'Specific promotional events (e.g., Prime Day deals)', 'estimated_duration': 'Short-term (days to weeks)'}

Disadvantages

- Disadvantage:

Regulatory and Antitrust Scrutiny

Impact:Critical

Addressability:Difficult

- Disadvantage:

Dependence on Third-Party Sellers

Impact:Major

Addressability:Moderately

- Disadvantage:

Negative Perception of Labor Practices

Impact:Major

Addressability:Difficult

- Disadvantage:

Imitable Business Model

Impact:Major

Addressability:Difficult

Strategic Recommendations

Quick Wins

- Recommendation:

Improve marketplace search and filtering to prioritize reputable sellers and reduce counterfeit/low-quality results.

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Launch more visible and targeted marketing campaigns highlighting the full value of the Prime bundle beyond just free shipping.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Enhance homepage curation to feature more personalized and discovery-based modules, reducing the feeling of a cluttered, overwhelming catalog.

Expected Impact:Low

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Invest heavily in AI-powered conversational commerce to create a more intuitive and personalized shopping assistant, staying ahead of this emerging trend.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Develop a 'Sustainable Marketplace' vertical with rigorous vetting and clear labeling to capture the growing eco-conscious consumer segment.

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Expand the physical retail footprint beyond groceries (Whole Foods) and convenience (Go) into categories like apparel and electronics for returns and showrooming.

Expected Impact:High

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Proactively address antitrust concerns by structurally separating or creating more transparency between its retail and third-party marketplace operations.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Build out a robust services marketplace (e.g., home services, professional services) to diversify revenue beyond products and AWS.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Lead the industry in supply chain and delivery decarbonization, turning a current point of criticism into a sustainable competitive advantage.

Expected Impact:Medium

Implementation Difficulty:Difficult

Transition from being the 'Everything Store' to the 'Everything, Personalized for You Store'. Maintain the vast selection but pivot messaging and user experience toward curation, discovery, and trust to counter both niche specialists and low-cost marketplaces.

Double down on the Prime ecosystem as the ultimate convenience and entertainment utility, while aggressively using AI to solve the paradox of choice, making the vast marketplace feel like a personal boutique. Differentiate not just on what is sold, but how it's found, delivered, and integrated into the customer's life.

Whitespace Opportunities

- Opportunity:

Hyper-Curation and Personalization as a Service

Competitive Gap:Competitors are either vast and impersonal (Amazon's current state, AliExpress) or curated but small (D2C brands). There's a gap for a service that curates Amazon's vast catalog for individual tastes.

Feasibility:High

Potential Impact:High

- Opportunity:

Integrated Services Marketplace

Competitive Gap:The market for trusted local and professional services is fragmented. Amazon could leverage its brand trust and customer base to become the go-to platform for finding vetted service providers.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Advanced B2B E-commerce Platform

Competitive Gap:While Amazon Business exists, the B2B e-commerce experience still lags B2C. A platform with sophisticated procurement tools, subscription models for supplies, and deep industry-specific catalogs could dominate this space.

Feasibility:Medium

Potential Impact:High

- Opportunity:

First-Party Certified Resale and Refurbishment Program

Competitive Gap:While 'Amazon Renewed' exists, it's not as prominent or trusted as dedicated platforms. A more robust, Amazon-certified program for trade-ins and high-quality used goods could challenge eBay and the circular economy market.

Feasibility:Medium

Potential Impact:Medium

Messaging

Message Architecture

Key Messages

- Message:

Save money with significant discounts and deals.

Prominence:Primary

Clarity Score:High

Location:Hero banner and multiple headline sections ('Up to 50% off', 'Deals up to 40% off')

- Message:

Find items for specific, timely events and needs (seasonal, life events).

Prominence:Primary

Clarity Score:High

Location:Dedicated content blocks ('Costumes for the family', 'Decorations for your dorm', 'Shop Back to School')

- Message:

Discover a vast and varied selection of products across all categories.

Prominence:Secondary

Clarity Score:High

Location:Implicitly communicated through the sheer variety of showcased categories (luxury jewelry, beauty, home, electronics, etc.)

- Message:

Shop trending and desirable items.

Prominence:Secondary

Clarity Score:Medium

Location:Content blocks like 'Trending: Fall Beauty' and 'Our current obsessions'

- Message:

Personalization improves your shopping experience.

Prominence:Tertiary

Clarity Score:High

Location:Dedicated sign-in prompts ('Sign in for the best experience', 'See personalized recommendations')

The message hierarchy is exceptionally effective for its business goal: driving immediate transactions. Price-based messages ('Deals') are most prominent, followed by need-based seasonal/event messaging ('Back to School'). This tactical hierarchy prioritizes conversion over brand storytelling, which is a deliberate and successful choice for Amazon's high-traffic homepage.

Messaging is highly consistent in its transactional nature. Every module, regardless of the product category, is framed around the act of shopping—'Shop now', 'Save 15%', 'Shop by grade'. While the product categories are diverse, the underlying message of 'buy this now' is uniform and relentlessly repeated.

Brand Voice

Voice Attributes

- Attribute:

Transactional

Strength:Strong

Examples

- •

Deals up to 40% off

- •

Shop now

- •

Sign in securely

- Attribute:

Helpful / Guiding

Strength:Moderate

Examples

- •

Shop by grade

- •

Decorations for your dorm

- •

Smart organization for college

- Attribute:

Aspirational

Strength:Weak

Examples

- •

Discover pre-loved designer jewelry

- •

Our current obsessions

- •

Luxe body care

- Attribute:

Matter-of-fact

Strength:Strong

Examples

- •

Best Sellers in Computers & Accessories

- •

Your recently viewed items and featured recommendations

- •

© 1996-2025, Amazon.com, Inc. or its affiliates

Tone Analysis

Promotional

Secondary Tones

- •

Urgent

- •

Inspirational

- •

Solution-oriented

Tone Shifts

Shifts from a value-driven, promotional tone in 'Amazon Outlet' sections to a more aspirational, curated tone in 'Discover pre-loved designer jewelry' and 'The vacation shop'.

Voice Consistency Rating

Good

Consistency Issues

The primary inconsistency lies in the deliberate shift between 'mass-market value' and 'accessible luxury'. While intentional, this can create a slightly disjointed brand character, positioning Amazon as a functional utility rather than a cohesive brand with a singular personality.

Value Proposition Assessment

Amazon is the single, convenient online destination where you can find and buy anything you want, often at the lowest price, for any occasion.

Value Proposition Components

- Component:

Comprehensive Selection

Clarity:Clear

Uniqueness:Unique

Comment:Communicated implicitly by the vast array of categories on one page—from luxury goods to dorm essentials.

- Component:

Competitive Pricing & Deals

Clarity:Clear

Uniqueness:Somewhat Unique

Comment:Explicitly and repeatedly stated in headlines. While many retailers offer deals, Amazon's perceived scale of discounts is a differentiator.

- Component:

Convenience (One-Stop Shop)

Clarity:Clear

Uniqueness:Unique

Comment:The ability to shop for Halloween costumes, college supplies, and designer handbags in the same visit is a core, clearly communicated value.

- Component:

Timely & Relevant Curation

Clarity:Clear

Uniqueness:Somewhat Unique

Comment:Demonstrated through seasonal and event-driven modules ('Back to School', 'Fall Beauty'), positioning Amazon as a go-to for current needs.

Amazon's messaging differentiates it not on any single axis (like price or quality) but on the combination of all axes. It is the 'everything store'. While competitors like Walmart compete on price and specialty retailers compete on curation, Amazon's homepage messaging asserts that it does both, and for every conceivable need. The introduction of 'pre-loved designer jewelry' next to 'Amazon Outlet' is a direct message about its unparalleled breadth.

The messaging positions Amazon as the default starting point for online commerce. It aims to be the top-of-mind destination for any purchasing need, from the mundane to the luxurious. The constant stream of deals and event-based shopping modules creates a sense of continuous activity, encouraging frequent return visits so as not to miss out, thereby capturing a larger share of the customer's wallet against competitors like Walmart, Target, and eBay.

Audience Messaging

Target Personas

- Persona:

The Bargain Hunter

Tailored Messages

- •

Up to 50% off Amazon Outlet

- •

Deals up to 40% off

- •

Save 15% on designer handbags

Effectiveness:Effective

- Persona:

The Student / Parent of Student

Tailored Messages

- •

Decorations for your dorm

- •

Shop Off to College

- •

Smart organization for college

- •

Shop by grade

Effectiveness:Effective

- Persona:

The Fashion/Beauty Enthusiast

Tailored Messages

- •

Trending: Fall Beauty

- •

The vacation shop

- •

Discover pre-loved designer jewelry

Effectiveness:Somewhat Effective

- Persona:

The Seasonal Shopper

Tailored Messages

- •

Costumes for the family

- •

Shop more Halloween

- •

Shop Labor Day Sale

Effectiveness:Effective

Audience Pain Points Addressed

- •

Finding the best price ('Deals up to 40% off')

- •

The inconvenience of shopping at multiple stores ('Shop for the family', 'One-stop shop for college')

- •

Forgetting or not knowing what to buy for a specific event ('College must-haves', 'Costumes for the family')

- •

Budget constraints ('College must-haves under $25')

Audience Aspirations Addressed

- •

Staying on-trend ('Trending: Fall Beauty', 'Our current obsessions')

- •

Achieving a sense of luxury and style ('Discover pre-loved designer jewelry', 'Luxe body care')

- •

Being prepared and organized for life events ('Smart organization for college')

Persuasion Elements

Emotional Appeals

- Appeal Type:

Savings & Financial Security

Effectiveness:High

Examples

Up to 50% off Amazon Outlet

Save 15% on designer handbags

- Appeal Type:

Discovery & Novelty

Effectiveness:Medium

Examples

Discover pre-loved designer jewelry

Our current obsessions

- Appeal Type:

Belonging & Social Norms

Effectiveness:Medium

Examples

Best Sellers in Computers & Accessories

Trending: Fall Beauty

Social Proof Elements

- Proof Type:

Wisdom of the Crowd

Impact:Strong

Examples

Best Sellers in Computers & Accessories

Best Sellers in Home & Kitchen

- Proof Type:

User Ratings

Impact:Moderate

Examples

Shop 4+ star finds for college

Trust Indicators

- •

The Amazon brand itself

- •

Clear 'Sign in securely' prompt

- •

Professional and consistent layout and design

Scarcity Urgency Tactics

Event-based sales with implied deadlines ('Shop Labor Day Sale')

Calls To Action

Primary Ctas

- Text:

Shop now

Location:Multiple product category blocks

Clarity:Clear

- Text:

Shop Labor Day Sale

Location:Promotional deal blocks

Clarity:Clear

- Text:

Sign in securely

Location:Personalization prompt

Clarity:Clear

- Text:

Shop more [Category]

Location:At the end of category-specific blocks

Clarity:Clear

Amazon's CTAs are a masterclass in clarity and transactional efficiency. They are direct, benefit-oriented (by being placed under an appealing category), and leave no ambiguity for the user. The repeated use of 'Shop' reinforces the primary goal of the site. The language is simple, direct, and action-oriented, perfectly aligning with a user's intent to browse and purchase.

Messaging Gaps Analysis

Critical Gaps

There is a near-total absence of brand-level messaging. The company mission of being 'Earth's most customer-centric company' is not communicated at all. The homepage experience is purely a storefront, not a brand destination.

The value proposition of Amazon Prime, a key business driver for loyalty, is not explicitly messaged on the logged-out homepage, aside from its mention in the footer.

Contradiction Points

The positioning of high-end luxury goods ('Cartier', 'Hermès') directly alongside deep discount outlets ('Amazon Outlet') can dilute the brand equity of the luxury items and create a confusing value perception for the overall Amazon brand. It serves the 'everything store' model but at the cost of brand coherence.

Underdeveloped Areas

Storytelling is non-existent. There are no narratives about the products, the sellers, or the customers. It's a grid of items for sale, which is efficient but lacks emotional connection.

Messaging around Amazon's other ecosystem benefits (e.g., Prime Video, AWS, Devices) is relegated to the footer, missing an opportunity to reinforce the holistic value of the Amazon ecosystem.

Messaging Quality

Strengths

- •

Hyper-effective at driving conversions through clear, transactional language.

- •

Excellent segmentation and targeting, with messaging blocks clearly tailored to different user needs and seasonal moments.

- •

Powerful use of social proof ('Best Sellers', '4+ stars') to guide user choice and build confidence.

- •

The message hierarchy is relentlessly focused on the primary business objective of generating sales.

Weaknesses

- •

The messaging lacks personality and emotional resonance, positioning Amazon as a utility rather than a beloved brand.

- •

Over-reliance on price and deals can devalue the brand and train customers to wait for promotions.

- •

The user experience can feel cluttered and overwhelming due to the sheer volume of competing messages on a single page.

Opportunities

- •

Integrate subtle brand storytelling elements within shopping modules to build a stronger emotional connection.

- •

More prominently feature the benefits of the Amazon Prime ecosystem to drive membership sign-ups from new visitors.

- •

Develop curated content hubs that go beyond just product listings, such as style guides or project ideas, to add value and move from a transactional to an inspirational voice.

Optimization Roadmap

Priority Improvements

- Area:

Brand Narrative Integration

Recommendation:Develop a homepage module that subtly communicates the 'customer-centric' mission. This could be through featuring a customer story, highlighting a unique seller, or explaining a customer-service innovation. This would start to build brand equity beyond just price and selection.

Expected Impact:Medium

- Area:

Value Proposition Hierarchy

Recommendation:A/B test replacing one of the secondary deal-focused modules with a module dedicated to the holistic benefits of Amazon Prime (e.g., 'Free delivery, award-winning shows, and more').

Expected Impact:High

- Area:

Audience Engagement

Recommendation:For aspirational categories like 'Luxury Stores' or 'Trending Beauty', experiment with more editorial, magazine-style headlines and copy instead of the standard 'Shop now' approach to better align the tone with the product.

Expected Impact:Medium

Quick Wins

Refine headlines for 'Best Sellers' to create more intrigue, e.g., 'See What Everyone's Buying This Week' instead of just the category title.

Add a sub-heading to the 'Sign in for the best experience' module that hints at a specific benefit, like '...for faster checkout and deals picked for you.'

Long Term Recommendations

Develop a more sophisticated content strategy that balances transactional modules with inspirational or educational content hubs, creating reasons to visit Amazon beyond an immediate purchase intent.

Invest in creating a clearer brand voice that can be consistently applied, even with slight tonal shifts, across all categories to build a more cohesive and less utilitarian brand identity.

Amazon's strategic messaging on its homepage is a masterclass in transactional efficiency and audience segmentation. The message architecture is ruthlessly optimized for a single objective: to convert a visitor's immediate need or impulse into a sale. It achieves this by prioritizing messages of value (deals, discounts) and timeliness (seasonal events, holidays), effectively addressing a vast range of customer personas and their pain points on a single screen. Persuasion techniques like social proof ('Best Sellers') and urgency ('Labor Day Sale') are expertly woven into the user journey to reduce friction and encourage clicks.

The core value proposition—unparalleled selection at competitive prices with ultimate convenience—is not stated but demonstrated through the page's very structure. However, this relentless focus on tactical conversion comes at a strategic cost. The brand voice is functional and matter-of-fact but lacks a distinct, ownable personality. The messaging is almost entirely devoid of brand-level narrative; the 'why' behind Amazon is absent. This creates a perception of Amazon as a vast, efficient utility—a digital vending machine—rather than a brand with a soul. While this has been phenomenally successful, it presents a long-term vulnerability. The lack of emotional connection or brand story means customer loyalty is primarily built on the functional benefits of price and convenience, which can be challenged by competitors. The key strategic opportunity is to begin layering brand-building narrative and emotional resonance into the existing high-performance transactional framework, transforming the world's most efficient store into a more compelling brand destination.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Global brand recognition as the leading e-commerce platform.

- •

Over 260 million Prime members globally as of 2025, demonstrating a powerful value proposition and sticky ecosystem.

- •

Dominant market share in e-commerce in multiple developed countries, particularly the US.

- •

AWS is the leader in cloud infrastructure services with ~30% market share, indicating deep integration into the digital economy.

- •

Consistently high revenue growth, with Q2 2025 revenue hitting $167.7 billion, a 13.3% year-over-year increase.

Improvement Areas

- •

Countering the narrative of being just a 'utility' by enhancing discovery and user experience to compete with more curated or specialized e-tailers.

- •

Improving the quality and reliability of third-party seller products to combat counterfeit issues and build trust in non-Amazon-fulfilled items.

- •

Strengthening the value proposition in international markets where local competitors have a stronger foothold.

Market Dynamics

Global e-commerce market expected to reach ~$7.4 trillion in 2025, with a CAGR of ~8-10%.

Mature

Market Trends

- Trend:

Rise of AI and Generative AI in Commerce

Business Impact:High. Amazon is investing over $100 billion in AI to enhance logistics, customer service (via a revamped Alexa), and power AWS services, creating a significant competitive advantage.

- Trend:

Growth of Retail Media Networks

Business Impact:High. Amazon's advertising business is a major growth engine, projected to exceed $60 billion in 2025, growing faster than its core retail sales and contributing significantly to profitability.

- Trend:

B2B E-commerce Acceleration

Business Impact:High. Amazon Business is a fast-growing segment with over 8 million business customers and annualized sales exceeding $35 billion, targeting a massive global procurement market.

- Trend:

Increased Regulatory and Antitrust Scrutiny

Business Impact:High. Facing investigations in the US, EU, and other regions regarding market dominance, which could lead to significant fines and forced changes to its business model.

Excellent. While the core e-commerce market is mature, Amazon is perfectly timed to capitalize on the generational shifts toward AI-driven cloud services, digital advertising, and B2B online procurement.

Business Model Scalability

High

Highly scalable due to the third-party marketplace model (low marginal cost per new seller/product) and the digital nature of AWS and advertising services. High fixed costs are in logistics infrastructure, which provides a competitive moat.

High. The 'flywheel' effect where marketplace growth drives Prime adoption, which in turn fuels advertising revenue and logistics density, creates powerful operational leverage. High-margin AWS and advertising profits can subsidize retail growth.

Scalability Constraints

- •

Logistical complexity and cost of last-mile delivery, especially in less dense or emerging markets.

- •

Labor relations and the need to manage a workforce of over 1.5 million people.

- •

Navigating complex and divergent international regulations and tax laws.

Team Readiness

Exceptional. Proven leadership with a long-term vision and a track record of entering and dominating new industries (e.g., cloud computing, advertising).

Decentralized structure with clear ownership ('two-pizza teams,' single-threaded leaders) allows for innovation at scale, but can also lead to internal competition and complexity.

Key Capability Gaps

- •

Navigating complex global antitrust and regulatory environments requires a deeper bench of legal and public policy experts.

- •

Competition for top-tier AI and machine learning talent is fierce, requiring continuous investment in recruitment and retention.

- •

Developing expertise in new, highly regulated verticals like healthcare and pharmaceuticals.

Growth Engine

Acquisition Channels

- Channel:

Brand Recognition & Direct Traffic

Effectiveness:High

Optimization Potential:Low

Recommendation:Maintain brand trust and top-of-mind awareness through consistent customer experience and PR. Continue to be the default starting point for online shopping.

- Channel:

SEO

Effectiveness:High

Optimization Potential:Medium

Recommendation:Defend dominant SERP positions for product searches. Optimize for emerging search modalities like voice (via Alexa) and visual search to preempt competitors.

- Channel:

Amazon Advertising (Internal)

Effectiveness:High

Optimization Potential:High

Recommendation:Further integrate machine learning to improve ad relevancy and performance for sellers, which increases ad spend and improves the customer experience. Expand ad placements on Prime Video and Twitch to capture upper-funnel brand budgets.

- Channel:

Affiliate Marketing (Amazon Associates)

Effectiveness:Medium

Optimization Potential:Medium

Recommendation:Revitalize the Associates program with better tools and commission structures to compete with creator-focused platforms like Shopify Collabs and TikTok Shop.

Customer Journey

Highly optimized for low-friction purchasing. Features like 1-Click ordering, personalized recommendations, and 'Buy Now' have set the industry standard for conversion.

Friction Points

- •

Search result clutter due to the proliferation of sponsored products, making organic discovery difficult.

- •

Analysis paralysis from an overwhelming number of choices and similar-looking third-party products.

- •

Inconsistent product detail page quality across the vast third-party marketplace.

Journey Enhancement Priorities

{'area': 'Product Discovery', 'recommendation': 'Leverage generative AI to move beyond keyword search towards a conversational, needs-based discovery engine that guides users to the right product.'}

{'area': 'Mobile & Social Commerce', 'recommendation': "Deepen integration with social platforms for seamless 'shop-in-app' experiences, and enhance the mobile app with more engaging, video-first content."}

Retention Mechanisms

- Mechanism:

Amazon Prime Subscription

Effectiveness:High

Improvement Opportunity:Continuously add value to the Prime bundle (e.g., exclusive content, healthcare perks, unique deals) to justify price increases and defend against subscription fatigue. With over 260M members, this is the core retention driver.

- Mechanism:

Personalization Engine

Effectiveness:High

Improvement Opportunity:Use AI to enhance predictive recommendations ('things you might need before you know you need them') and personalize the entire user interface, not just product carousels.

- Mechanism:

Subscribe & Save

Effectiveness:High

Improvement Opportunity:Expand the program to more categories and offer more flexible delivery cadences. Integrate with smart home devices (e.g., Alexa) for automatic reordering.

- Mechanism:

Ecosystem Lock-in

Effectiveness:High

Improvement Opportunity:Create more seamless integrations between services (e.g., buy a product, get a related Kindle book discount; watch a show on Prime Video, easily buy merchandise) to increase the switching cost for customers.

Revenue Economics

Extremely strong and complex. Low-margin retail business is subsidized by high-margin AWS (39.5% operating margin in Q1 2025) and Advertising segments. This allows for aggressive pricing and investment in growth.

Extremely High (Not publicly calculated, but industry-leading). Prime members have a very high LTV due to increased purchase frequency and spend, coupled with subscription revenue. CAC is relatively low due to immense brand gravity.

High. The ability to cross-sell multiple high-margin services (cloud, ads, subscriptions) to both consumers and businesses on a single platform is unparalleled.

Optimization Recommendations

- •

Continue scaling the advertising business, as it provides a high-margin revenue stream directly layered on top of the core retail operation.

- •

Drive adoption of Amazon Business and its Business Prime subscription to capture a larger share of the high-volume B2B market.

- •

Optimize logistics and fulfillment costs through AI and robotics to improve the margins of the core e-commerce business.

Scale Barriers

Technical Limitations

- Limitation:

Complexity of a Massive, Aging Tech Stack

Impact:Medium

Solution Approach:Continuous refactoring of services into microservices (a process Amazon pioneered). Aggressively adopt serverless and managed services from AWS internally to reduce operational overhead.

Operational Bottlenecks

- Bottleneck:

Last-Mile Delivery Costs and Complexity

Growth Impact:Limits profitability in e-commerce and makes expansion into less dense regions challenging.

Resolution Strategy:Continued investment in its own logistics network (Amazon Logistics), delivery drones (Prime Air), and autonomous delivery vehicles to reduce reliance on third-party carriers and lower costs.

- Bottleneck:

Labor Management and Unionization

Growth Impact:Potential for operational disruptions, increased labor costs, and negative PR.

Resolution Strategy:Invest heavily in warehouse automation and robotics to reduce dependency on manual labor, alongside proactive improvements in wages and working conditions to mitigate unionization drivers.

Market Penetration Challenges

- Challenge:

Intensifying Global Regulatory Scrutiny

Severity:Critical

Mitigation Strategy:Proactively engage with regulators, demonstrate commitment to fair competition on the marketplace, and potentially separate certain business units to preempt forced breakups. Increase lobbying and public policy efforts.

- Challenge:

Competition from Niche and Specialized Players

Severity:Major

Mitigation Strategy:Leverage data advantages to offer superior personalization and convenience that niche players cannot match. Acquire promising competitors in strategic verticals. Compete on speed and reliability of delivery.

- Challenge:

Cultural and Logistical Hurdles in Emerging Markets

Severity:Major

Mitigation Strategy:Adopt a highly localized approach: tailor product selection, payment methods (e.g., cash-on-delivery), and marketing to local customs. Build local logistics infrastructure or partner with established local players.

Resource Limitations

Talent Gaps

- •

Elite AI/ML research scientists, especially in generative AI.

- •

Experts in highly regulated industries (e.g., healthcare compliance, pharmacy).

- •

International market expansion leaders with deep local expertise.

Extremely high, but self-funded. Amazon plans to spend over $100 billion in 2025, mainly on AWS and AI infrastructure, funded by its massive operating cash flow.

Infrastructure Needs

Continued global expansion of AWS data centers to support AI growth and maintain low latency.

Expansion of fulfillment and sortation centers, especially in emerging international markets.

Growth Opportunities

Market Expansion

- Expansion Vector:

B2B (Amazon Business)

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Aggressively scale Amazon Business globally. Enhance features for large enterprise procurement (e.g., advanced analytics, budget controls, invoicing) and deepen integration with business software. Target specific verticals like healthcare and education.

- Expansion Vector:

Emerging Markets (Southeast Asia, Latin America, Africa)

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Pursue a long-term strategy of building localized infrastructure, adapting the Prime value proposition with locally relevant content and benefits, and using a flexible pricing model.

- Expansion Vector:

Physical Retail

Potential Impact:Medium

Implementation Complexity:High

Recommended Approach:Move beyond grocery (Whole Foods) and explore other formats. Focus on using physical stores as showrooms, return hubs, and fulfillment points that integrate seamlessly with the online experience, leveraging 'Just Walk Out' technology.

Product Opportunities

- Opportunity:

AI-as-a-Service (on AWS)

Market Demand Evidence:Massive global demand for generative AI and machine learning capabilities. AWS revenue from these services is a key growth driver.

Strategic Fit:Perfect fit. Leverages AWS's infrastructure leadership and allows Amazon to monetize its deep AI expertise.

Development Recommendation:Continue investing in proprietary AI chips (Trainium, Inferentia) and foundational models. Form strategic partnerships with leading AI firms (e.g., Anthropic) to offer a diverse range of models on the Bedrock platform.

- Opportunity:

Healthcare Services

Market Demand Evidence:Growing demand for more convenient and accessible healthcare. Amazon has already launched Amazon Pharmacy and Amazon Clinic.

Strategic Fit:Leverages logistics, customer obsession, and AI capabilities to disrupt a massive industry.

Development Recommendation:Deepen the integration of pharmacy, telehealth (Amazon Clinic), and diagnostics. Explore using AI for medical record summarization (like AWS HealthScribe) and drug discovery.

- Opportunity:

Connected Home/IoT Ecosystem

Market Demand Evidence:Continued growth of the smart home market.

Strategic Fit:Strong. Amazon's Alexa, Ring, and Echo devices provide a central hub in the home.

Development Recommendation:Move beyond device sales to creating a subscription-based 'ambient computing' service. Use AI to enable proactive assistance and seamless integration between devices, services (e.g., grocery reordering), and content.

Channel Diversification

- Channel:

Interactive Streaming Commerce

Fit Assessment:High. Leverages Prime Video and Twitch audiences.

Implementation Strategy:Integrate 'shoppable video' functionality directly into Prime Video series and movies. Expand live shopping events on Twitch, hosted by influencers and brands, with seamless in-stream purchasing.

Strategic Partnerships

- Partnership Type:

AI Model Providers

Potential Partners

- •

Anthropic (existing)

- •

Mistral AI

- •

Cohere

Expected Benefits:Positions AWS Bedrock as the leading neutral platform for enterprise AI development, offering customers the best models for their specific needs and accelerating AWS growth.

- Partnership Type:

Automotive & Mobility

Potential Partners

Major automakers (e.g., Ford, VW, Toyota)

EV charging networks

Expected Benefits:Integrate Alexa and Amazon services deeply into the next generation of vehicles. Leverage the EV transition to offer integrated home charging and payment solutions via Amazon Pay.

Growth Strategy

North Star Metric

Gross Profit per Customer

As a mature business with multiple revenue streams (retail, subscriptions, cloud, ads), focusing on gross profit per customer encourages growth in high-margin areas (AWS, Ads) and optimizes the profitability of the core retail business, reflecting the true health of the entire ecosystem.

10-15% annual growth, driven by increased adoption of high-margin services.

Growth Model

Ecosystem Flywheel Model

Key Drivers

- •

Prime Membership Growth: Increases customer loyalty and spending.

- •

Third-Party Seller Growth: Expands selection, which attracts more customers.

- •

Advertising Revenue Growth: Increases profitability and allows for reinvestment.

- •

AWS Innovation & Adoption: Funds overall company growth and provides a technical backbone.

Focus on initiatives that accelerate the flywheel. For example, using AWS AI to improve the seller experience, which attracts more sellers, which improves selection for Prime members, who are then more engaged targets for advertisers.

Prioritized Initiatives

- Initiative:

Scale Amazon Business to become the dominant global B2B marketplace

Expected Impact:High

Implementation Effort:Medium

Timeframe:2-3 Years

First Steps:Launch a targeted marketing campaign to increase awareness among small and medium businesses. Develop industry-specific solutions for healthcare and manufacturing procurement.

- Initiative:

Launch a 'Generative AI Shopping Assistant'

Expected Impact:High

Implementation Effort:High

Timeframe:1-2 Years

First Steps:Create a dedicated product and engineering team. Start by beta-testing an AI assistant for complex product categories like electronics or home improvement to help users with research and comparison.

- Initiative:

Expand Advertising surfaces into Prime Video

Expected Impact:High

Implementation Effort:Medium

Timeframe:Current - 1 Year

First Steps:Roll out the ad-supported tier globally and build out advanced targeting capabilities based on viewing habits and purchase data to attract premium brand advertisers.

Experimentation Plan

High Leverage Tests

{'test': 'Dynamic Prime Membership Tiers', 'hypothesis': "Offering different tiers of Prime (e.g., a lower-cost 'shipping-only' tier or a premium 'all-inclusive' tier) could increase total subscriber count and revenue."}

{'test': 'AI-Powered Product Page Generation for 3P Sellers', 'hypothesis': 'Providing a generative AI tool for sellers to create high-quality listings will improve conversion rates and increase seller satisfaction.'}