eScore

ameren.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

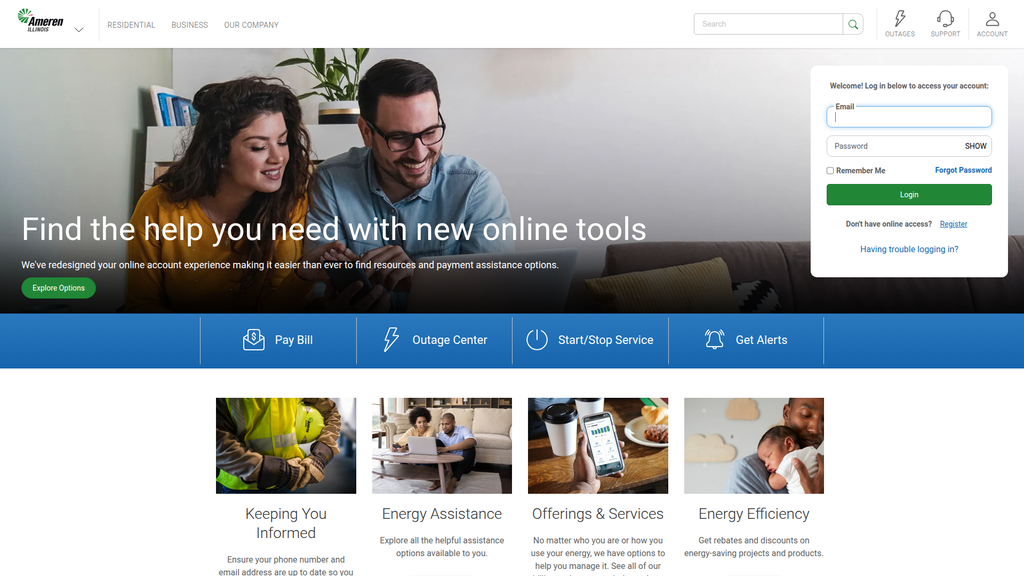

Ameren's digital presence is highly functional and task-oriented, effectively serving its primary audience of existing customers. The website is well-optimized for its geographic service areas in Missouri and Illinois, demonstrating strong local reach. However, its content authority is strong for core utility topics but weaker in competitive, future-focused areas like home solar or EV adoption, where third parties often dominate search results. Voice search optimization appears foundational but not advanced, with a clear opportunity to build out conversational query capabilities.

Excellent geographic segmentation and content targeting for its distinct Illinois and Missouri customer bases.

Develop comprehensive, advisory-style content hubs for competitive topics like 'home solar options' and 'EV charging solutions' to capture user intent earlier and establish greater thought leadership against third-party providers.

Brand communication is exceptionally clear and effective for its primary purpose: helping existing customers manage accounts and get assistance. The messaging is highly tailored to the immediate needs of residential customers, with a consistent, supportive brand voice. The major weakness is a failure to connect this functional messaging to the broader, more resonant corporate mission of 'To power the quality of life,' making the overall communication feel transactional rather than relational. Messaging for future-focused topics like EVs and renewables is present but underdeveloped.

Excellent clarity and audience-message fit for core customer tasks, particularly for customers needing to manage accounts or find payment assistance.

Integrate the aspirational brand mission ('Powering the Quality of Life') into website copy to build a stronger emotional connection and elevate the brand beyond a purely functional utility provider.

The website is highly optimized for its primary 'conversion' tasks: enabling customers to log in, pay a bill, and report an outage with minimal friction. The design is clean, the cognitive load is low for these core functions, and the mobile experience is excellent. However, the conversion path for enrolling in value-added programs (like special rates or rebates) has identified friction points and could be streamlined. While functional, the site lacks engaging micro-interactions that would create a more modern and delightful user experience.

A highly effective, task-oriented homepage design that prioritizes and simplifies the most critical user journeys, such as paying a bill or accessing the outage center.

Create a unified, frictionless digital enrollment portal for all value-added programs (e.g., EV rates, energy efficiency rebates) to increase adoption and reduce customer friction.

As a regulated critical infrastructure provider, Ameren's credibility is inherently high, reinforced by mandatory compliance with stringent standards like NERC CIP for cybersecurity. The website features a sophisticated cookie consent tool and clear terms of service. However, the provided analysis identifies a high-severity risk due to the Privacy Policy's failure to explicitly address consumer rights under state-specific laws like CCPA, which is a significant compliance gap for a company of its scale. The absence of a formal accessibility statement also creates unnecessary legal risk.

Implicitly high data security and credibility driven by the stringent regulatory environment and mandatory compliance with NERC CIP standards for critical infrastructure.

Immediately update the Privacy Policy to include specific language and mechanisms for consumers to exercise rights granted under state privacy laws like CCPA/CPRA to mitigate significant legal and regulatory risk.

Ameren's competitive advantage is exceptionally strong and sustainable, rooted in its status as a regulated monopoly for electricity and gas transmission and distribution within its service territories. This creates nearly insurmountable barriers to entry and makes switching costs for its core service effectively infinite for customers. The primary competitive threats are indirect, coming from disruptive technologies like rooftop solar, which challenge the traditional business model rather than competing directly on infrastructure. Their extensive, owned infrastructure is a durable and hard-to-replicate moat.

A regulated monopoly on essential transmission and distribution infrastructure creates an extremely durable competitive moat with high barriers to entry.

Develop and market 'grid services' for owners of distributed energy resources (DERs), transforming a competitive threat into a new value stream and reinforcing Ameren's central role as the grid operator.

The company is exceptionally well-positioned for a period of sustained growth driven by the secular trends of electrification and a massive increase in demand from data centers. The business model is highly scalable, as growth is achieved by deploying capital into its regulated rate base, which is projected to grow at a high single-digit compound annual rate. The primary constraints are not related to the business model itself but are external factors like regulatory approvals, supply chain logistics, and the ability to attract a skilled workforce for large-scale projects.

The business model is perfectly aligned with a multi-decade supercycle of required investment in grid modernization, renewable energy, and new generation to meet surging demand from data centers and electrification.

Create a dedicated 'Data Center Fast-Track' program to streamline infrastructure planning, site readiness, and rate design to aggressively capture the massive load growth opportunity from the AI and data center boom.

Ameren operates a classic and highly coherent regulated utility business model, which ensures stable, predictable revenues and a guaranteed customer base. The strategic focus on investing heavily in grid modernization and clean energy aligns perfectly with market trends, regulatory mandates, and a massive wave of new demand. The entire model, from key resources (physical infrastructure) to revenue streams (regulated rate of return), is internally consistent and well-aligned with its external environment.

Excellent strategic alignment between the regulated rate-of-return revenue model and the immense market opportunity to deploy billions in capital for grid modernization and clean energy transition, driving predictable earnings growth.

Explore launching a non-regulated business arm focused on 'Electrification-as-a-Service' for commercial fleets to create a new, high-margin revenue stream that diversifies the business model beyond purely regulated returns.

Within its designated service territories, Ameren holds a 100% market share for energy distribution, giving it immense market power. While its pricing power is controlled by regulators, its ability to plan and execute multi-billion dollar infrastructure investments gives it significant influence over the region's economic development and energy future. The company is actively shaping its market by working to attract large-load customers like data centers, demonstrating a proactive exercise of its market power.

Effectively a 100% market share position within its regulated service territories gives it ultimate pricing power (subject to regulatory approval) and significant leverage with partners, suppliers, and regional economic planners.

Proactively use its market position to establish itself as the central platform operator for distributed energy resources, defining the standards and protocols for how smaller players connect to and interact with the grid.

Business Overview

Business Classification

Regulated Utility

Energy Services

Energy & Utilities

Sub Verticals

- •

Electric Power Generation

- •

Electric Transmission & Distribution

- •

Natural Gas Distribution

Mature

Maturity Indicators

- •

Operates as a holding company (Ameren Corporation) formed by a merger in 1997 of long-established utilities.

- •

Serves a large, stable customer base of 2.5 million electric and 900,000 gas customers.

- •

Manages extensive, capital-intensive infrastructure.

- •

Subject to comprehensive state and federal regulations (e.g., ICC, MoPSC, FERC).

- •

Focus on long-term infrastructure modernization and incremental, regulated growth.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Ameren Missouri - Regulated Electric & Gas Service

Description:Generation, transmission, and distribution of electricity and distribution of natural gas to residential, commercial, and industrial customers in Missouri under rates set by the Missouri Public Service Commission (MoPSC).

Estimated Importance:Primary

Customer Segment:Residential, Commercial, Industrial (Missouri)

Estimated Margin:Medium

- Stream Name:

Ameren Illinois - Regulated Electric & Gas Distribution

Description:Delivery of electricity and natural gas to customers in central and southern Illinois under rates set by the Illinois Commerce Commission (ICC). In Illinois, Ameren is a delivery-only company; supply costs are passed through.

Estimated Importance:Primary

Customer Segment:Residential, Commercial, Industrial (Illinois)

Estimated Margin:Medium

- Stream Name:

Ameren Transmission

Description:Development, ownership, and operation of rate-regulated regional electric transmission projects, primarily under the Midcontinent Independent System Operator (MISO).

Estimated Importance:Secondary

Customer Segment:Regional Grid Operators (MISO)

Estimated Margin:Medium

Recurring Revenue Components

- •

Metered sale of electricity

- •

Metered sale of natural gas

- •

Fixed monthly customer charges

- •

Transmission service charges

Pricing Strategy

Regulated Rate of Return

Regulated (Mid-range)

Semi-transparent

Pricing Psychology

- •

Time-of-Use Rates (e.g., ChargeSmart program for EVs to encourage off-peak usage).

- •

Tiered Pricing (based on consumption levels)

- •

Budget Billing (level payment plans)

Monetization Assessment

Strengths

- •

Predictable revenue streams due to regulated monopoly status.

- •

Guaranteed customer base within a defined 64,000-square-mile service territory.

- •

Ability to recover capital investments in infrastructure through rate cases.

Weaknesses

- •

Revenue growth is constrained by regulatory approvals and economic conditions in the service area.

- •

Regulatory lag can delay the recovery of costs.

- •

Limited pricing flexibility to respond to market dynamics.

Opportunities

- •

Develop new revenue streams from non-regulated energy services (e.g., EV charger installation, energy management consulting).

- •

Rate-base growth through significant capital investment in grid modernization and clean energy transition.

- •

Offer new products and services related to Distributed Energy Resources (DERs) like solar and battery storage.

Threats

- •

Adverse regulatory decisions on rate cases or allowed return on equity (ROE).

- •

Increased adoption of customer-owned generation (e.g., rooftop solar), leading to 'grid defection' and reduced energy sales.

- •

Energy efficiency mandates that reduce overall energy consumption.

Market Positioning

Regulated Monopoly & Essential Service Provider

100% within its designated service territories in Missouri and Illinois.

Target Segments

- Segment Name:

Residential Customers

Description:Households across a wide range of income levels and housing types (single-family, multi-family) in Missouri and Illinois.

Demographic Factors

- •

Urban, suburban, and rural residents

- •

Varying income levels, including low-income households requiring assistance.

- •

Homeowners and renters

Psychographic Factors

- •

Seek reliability and affordability.

- •

Growing interest in sustainability and clean energy options.

- •

Desire for digital tools to manage energy usage and costs.

Behavioral Factors

- •

Essential daily energy consumption.

- •

Increasing adoption of smart home devices and electric vehicles.

- •

Seasonal usage peaks (summer for AC, winter for heating).

Pain Points

- •

High energy bills.

- •

Power outages, especially during severe weather.

- •

Complexity in understanding energy rates and assistance programs.

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Commercial & Industrial (C&I) Customers

Description:Businesses ranging from small local shops to large manufacturing facilities and data centers requiring reliable and high-capacity energy for operations.

Demographic Factors

Varying industries: manufacturing, healthcare, retail, education, data centers.

Small, medium, and large enterprises.

Psychographic Factors

- •

Prioritize power reliability and quality as critical to operations.

- •

Focus on cost control and operational efficiency.

- •

Increasing pressure to meet corporate sustainability goals (ESG).

Behavioral Factors

- •

High and consistent energy consumption.

- •

Participation in economic development and energy efficiency programs.

- •

Potential for on-site generation or complex energy management needs.

Pain Points

- •

Operational disruptions and financial losses from power outages.

- •

Volatile energy costs impacting bottom line.

- •

Navigating complex regulations and incentives for energy projects.

Fit Assessment:Excellent

Segment Potential:High

Market Differentiation

- Factor:

Exclusive Service Territory

Strength:Strong

Sustainability:Sustainable

- Factor:

Extensive Physical Infrastructure

Strength:Strong

Sustainability:Sustainable

- Factor:

Operational Expertise & Reliability

Strength:Moderate

Sustainability:Sustainable

- Factor:

Role in Regional Economic Development

Strength:Moderate

Sustainability:Sustainable

Value Proposition

To power the quality of life with safe, reliable, and affordable energy, while transitioning to a cleaner, more sustainable future.

Good

Key Benefits

- Benefit:

Reliable Energy Supply

Importance:Critical

Differentiation:Common

Proof Elements

Grid modernization investments leading to fewer and shorter outages.

Diverse generation portfolio.

- Benefit:

Customer Support & Assistance

Importance:Important

Differentiation:Somewhat unique

Proof Elements

Multiple energy assistance programs for income-qualified customers.

Online tools for account management and payment options.

- Benefit:

Enabling the Clean Energy Transition

Importance:Important

Differentiation:Somewhat unique

Proof Elements

- •

Clear goals for net-zero carbon emissions by 2045.

- •

Significant planned investments in wind, solar, and battery storage.

- •

Programs and rebates to support customer adoption of EVs and renewables.

Unique Selling Points

- Usp:

Sole-provider status within a vast, established service area across two states.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Vertically integrated operations in Missouri (generation, transmission, distribution) provide greater control over the energy value chain.

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Need for a constant, dependable source of electricity and natural gas for daily life and business operations.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Financial difficulty in affording essential energy services.

Severity:Major

Solution Effectiveness:Partial

- Problem:

Desire to adopt cleaner energy technologies (EVs, solar) but facing complexity and high upfront costs.

Severity:Minor

Solution Effectiveness:Partial

Value Alignment Assessment

High

The core proposition of providing reliable and affordable energy is perfectly aligned with the fundamental needs of the market. The increasing emphasis on sustainability aligns with evolving societal and regulatory expectations.

High

Ameren effectively addresses the primary needs of both residential and C&I customers for reliability and affordability, while introducing programs that cater to emerging needs around sustainability and cost management.

Strategic Assessment

Business Model Canvas

Key Partners

- •

State and Federal Regulators (ICC, MoPSC, FERC).

- •

Regional Transmission Organizations (MISO).

- •

Fuel and Power Suppliers

- •

Community Action Agencies and Social Service Organizations.

- •

Equipment Manufacturers & Technology Vendors

- •

Large Industrial Customers & Economic Development Agencies.

Key Activities

- •

Power Generation & Procurement

- •

Transmission & Distribution Grid Maintenance and Modernization.

- •

Customer Service, Billing & Support

- •

Regulatory Compliance & Rate Case Management.

- •

Capital Project Planning & Execution

- •

Executing Clean Energy Transition Strategy.

Key Resources

- •

Physical Infrastructure (Power plants, transmission lines, distribution networks, gas pipelines).

- •

Regulatory Licenses & Service Territory Rights

- •

Skilled Workforce (Engineers, lineworkers, technicians).

- •

Financial Capital for large-scale investments

- •

Customer Relationships & Data

Cost Structure

- •

Capital Expenditures (Grid infrastructure, power plants).

- •

Fuel and Purchased Power Costs

- •

Operations & Maintenance Expenses

- •

Depreciation & Amortization

- •

Interest Expense on Debt

- •

Labor and Employee Benefits

Swot Analysis

Strengths

- •

Regulated monopoly with a stable, predictable revenue base and guaranteed customer demand.

- •

Extensive, established, and difficult-to-replicate infrastructure assets.

- •

Strong track record of operational reliability and expertise in managing complex energy systems.

- •

Defined strategy and capital allocation plan for grid modernization and clean energy transition.

Weaknesses

- •

High capital intensity and significant debt required for infrastructure investments.

- •

Operations and strategy are heavily constrained by regulatory oversight, limiting agility.

- •

Dependence on aging fossil-fuel generation assets that require eventual retirement and replacement.

- •

Geographic concentration makes the business vulnerable to regional economic downturns and severe weather events.

Opportunities

- •

Lead the electrification of transportation by building out robust EV charging infrastructure and offering supportive rate programs.

- •

Modernize the grid to create a 'platform' for new services, integrating distributed energy resources (DERs) and improving efficiency.

- •

Develop non-regulated, value-added services (Energy-as-a-Service, consulting) for C&I customers.

- •

Leverage federal and state incentives for clean energy and infrastructure investments.

Threats

- •

Unfavorable regulatory outcomes that limit rate increases or disallow cost recovery.

- •

Increasingly severe weather events driven by climate change that can damage infrastructure and disrupt service.

- •

Cybersecurity attacks targeting critical grid infrastructure.

- •

Technological disruption from advancements in energy storage and distributed generation, potentially eroding the traditional centralized utility model.

Recommendations

Priority Improvements

- Area:

Customer Experience Digitalization

Recommendation:Evolve the digital customer portal from a simple billing tool into a proactive energy management platform. Provide personalized energy usage insights, predictive high-bill alerts, and seamless enrollment in efficiency and EV programs.

Expected Impact:Medium

- Area:

Grid Modernization & Automation

Recommendation:Accelerate the deployment of smart grid technologies, including advanced sensors, automation, and data analytics. This will enhance reliability, optimize asset management, and create the foundational platform for a DER-integrated grid.

Expected Impact:High

- Area:

Strategic Workforce Planning

Recommendation:Develop a comprehensive plan to attract, train, and retain the next generation of utility workers with skills in data science, cybersecurity, and renewable energy technologies to manage the grid of the future.

Expected Impact:Medium

Business Model Innovation

- •

Launch an 'Energy-as-a-Service' (EaaS) offering for large C&I customers, bundling energy supply, on-site generation (solar/storage), EV fleet charging, and efficiency services into a single, long-term contract.

- •

Develop a marketplace for Distributed Energy Resources (DERs), allowing the company to aggregate and dispatch customer-sited assets (like batteries and smart thermostats) to provide grid services, creating a new revenue stream.

- •

Explore partnerships with telecommunication companies to leverage utility pole and right-of-way assets for the deployment of 5G infrastructure.

Revenue Diversification

- •

Establish a non-regulated subsidiary focused on providing EV charging infrastructure installation and management services for businesses and municipalities.

- •

Offer subscription-based home energy management services, including smart thermostat optimization, appliance monitoring, and energy efficiency audits.

- •

Develop and sell anonymized energy data analytics and forecasting services to third parties such as city planners, real estate developers, and market researchers.

Ameren operates a classic, mature regulated utility business model, which provides significant stability, a guaranteed customer base, and predictable, albeit constrained, growth. Its core business is fundamentally sound due to the essential nature of its service and the high barriers to entry created by its extensive physical infrastructure and exclusive service territory rights. The company's strategic future, however, is not defined by maintaining the status quo but by its ability to navigate the profound transition reshaping the energy industry.

The primary strategic imperative for Ameren is to evolve from a traditional provider of kilowatt-hours and therms into a sophisticated energy infrastructure and services platform. This evolution is driven by three major forces: decarbonization, decentralization, and digitalization. Ameren's strategic plans, particularly its net-zero emissions goal and significant investments in renewables and grid modernization, demonstrate a clear understanding of this shift. The company's business model must transform to embrace these changes as opportunities for rate-based growth and new service offerings.

Key opportunities for strategic evolution lie in the electrification of transportation and the integration of distributed energy resources (DERs). By proactively developing EV charging programs and modernizing the grid to support two-way power flows, Ameren can position itself as a central enabler of the clean energy transition, driving significant capital investment that can be added to its rate base. However, this path is not without threats. The rise of customer-owned generation and storage could erode sales and challenge the centralized utility model. Furthermore, the entire business is underpinned by a constructive regulatory environment; any adverse shifts in state or federal policy could significantly impact financial performance and strategic flexibility.

To secure a sustainable competitive advantage, Ameren must excel in two areas: operational excellence in its core regulated business and strategic innovation in adjacent, potentially non-regulated areas. This involves not only investing in steel and wires but also in data analytics, digital customer engagement, and new service development. The ultimate challenge will be to manage this transformation within the constraints of the regulated utility framework, balancing the need for massive capital investment with customer affordability and delivering consistent returns to shareholders.

Competitors

Competitive Landscape

Mature

Monopolistic

Barriers To Entry

- Barrier:

High Capital Investment

Impact:High

- Barrier:

Regulatory Approvals and Franchises

Impact:High

- Barrier:

Existing Transmission & Distribution Infrastructure

Impact:High

- Barrier:

Economies of Scale

Impact:High

Industry Trends

- Trend:

Decarbonization and Renewable Integration

Impact On Business:Requires significant investment in solar, wind, and grid modernization to meet clean energy goals and integrate distributed energy resources (DERs).

Timeline:Immediate

- Trend:

Electrification and Demand Growth

Impact On Business:Growing demand from data centers, manufacturing, and electric vehicles requires substantial grid expansion and generation capacity additions.

Timeline:Immediate

- Trend:

Grid Modernization and Resiliency

Impact On Business:Investment in smart grids, automation, and hardened infrastructure is crucial to improve reliability, manage two-way power flows, and mitigate climate-related risks.

Timeline:Near-term

- Trend:

Customer Empowerment and Digitalization

Impact On Business:Customers expect personalized digital experiences, real-time data, and more control over their energy usage, driving the need for better online tools and communication.

Timeline:Near-term

- Trend:

Distributed Energy Resources (DERs)

Impact On Business:The rise of rooftop solar, battery storage, and microgrids challenges the traditional centralized utility model, creating both a threat to energy sales and an opportunity for grid service management.

Timeline:Long-term

Direct Competitors

- →

Commonwealth Edison (ComEd)

Market Share Estimate:Largest electric utility in Illinois, serving the northern part of the state.

Target Audience Overlap:High

Competitive Positioning:Positions itself as a leader in grid reliability and a key driver of economic growth in Northern Illinois, emphasizing its smart grid investments and clean energy access.

Strengths

- •

Strong focus on grid reliability and smart grid technology.

- •

Significant experience with a large, dense urban service area (Chicago).

- •

Part of Exelon, a large utility holding company, providing access to extensive resources and expertise.

- •

Aggressive pursuit of economic development projects.

Weaknesses

- •

Faces challenges with customer costs related to alternative retail electric suppliers in its territory.

- •

Historical regulatory and political hurdles in cost recovery.

- •

Operates in a state with a deregulated supply market, creating a complex operating environment.

Differentiators

Emphasis on being a key partner for large-scale economic development, particularly for data centers.

Extensive smart meter deployment and related customer programs like peak time savings.

- →

Duke Energy

Market Share Estimate:One of the largest electric power holding companies in the U.S., operating in six states.

Target Audience Overlap:Medium

Competitive Positioning:Positions as a large, diversified energy holding company with significant investments in grid modernization and an expanding renewable energy portfolio.

Strengths

- •

Large scale and geographic diversity.

- •

Strong investments in renewable energy and infrastructure modernization.

- •

Well-established brand with a significant customer base.

Weaknesses

- •

Faces regulatory scrutiny across multiple states.

- •

Limited geographic expansion opportunities in existing territories.

- •

High operational costs associated with a diverse and aging infrastructure.

Differentiators

Operates a diverse mix of generation including coal, natural gas, nuclear, and renewables.

Dual utility service, providing both electricity and natural gas in many areas.

- →

Evergy

Market Share Estimate:Serves customers in Kansas and Missouri.

Target Audience Overlap:Medium

Competitive Positioning:Positions itself as a major supplier of wind energy and a key player in the Midwest energy landscape, focused on infrastructure investment.

Strengths

- •

Significant investment and capacity in wind energy.

- •

Strong focus on infrastructure upgrades and capital expenditure programs.

- •

Favorable media sentiment scores compared to some peers.

Weaknesses

- •

Faces challenges with rising operating expenses.

- •

Operates in a highly competitive and dynamic market.

- •

Recent declines in net income have been noted.

Differentiators

One of the largest wind energy suppliers in the United States.

Headquartered in Kansas City, giving it a strong regional identity in its core market.

Indirect Competitors

- →

Rooftop Solar and Storage Installers (e.g., Sunrun, Tesla Energy, SunPower)

Description:Provide homeowners and businesses with the ability to generate and store their own electricity, reducing their reliance on utility-provided power.

Threat Level:High

Potential For Direct Competition:They directly reduce Ameren's energy sales (kWh) and challenge its traditional business model by creating 'prosumers'.

- →

Community Solar Providers

Description:Develop and manage local solar facilities that multiple customers can subscribe to, receiving credits on their utility bills and an alternative to utility-supplied energy.

Threat Level:Medium

Potential For Direct Competition:Offers a direct alternative for renewable energy supply, particularly for customers who cannot install rooftop solar.

- →

Alternative Retail Electric Suppliers (ARES)

Description:In deregulated markets like Illinois, ARES compete to sell electricity supply to customers, using the incumbent utility's (Ameren's) infrastructure for delivery.

Threat Level:Medium

Potential For Direct Competition:They directly compete for the energy supply portion of the customer's bill, although their value proposition has been questioned.

- →

Energy Efficiency and Smart Home Tech (e.g., Google Nest, Ecobee)

Description:Offer products and services that help consumers reduce overall energy consumption, thereby lowering their electricity bills and reducing demand on Ameren's system.

Threat Level:Low

Potential For Direct Competition:Reduces overall energy sales volume, impacting revenue. Utilities often partner with these companies for efficiency programs.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Regulated Monopoly on Transmission & Distribution

Sustainability Assessment:The core business of electricity delivery is a natural monopoly with high regulatory barriers, making this a very durable advantage.

Competitor Replication Difficulty:Hard

- Advantage:

Extensive, Owned Infrastructure

Sustainability Assessment:Owning thousands of miles of transmission and distribution lines creates an insurmountable barrier for new entrants in the delivery business.

Competitor Replication Difficulty:Hard

- Advantage:

Established Brand and Community Presence

Sustainability Assessment:Over 100 years of operation creates deep brand recognition and established relationships with customers, regulators, and communities.

Competitor Replication Difficulty:Hard

Temporary Advantages

- Advantage:

Approved Rate Cases and Investment Plans

Estimated Duration:3-5 Years

Description:Specific, regulator-approved plans like the 'Smart Energy Plan' allow for guaranteed returns on large capital investments in grid modernization.

- Advantage:

Positive Customer Satisfaction Rankings

Estimated Duration:1-2 Years

Description:Achieving top rankings in J.D. Power studies for customer satisfaction provides a positive brand halo and marketing advantage.

Disadvantages

- Disadvantage:

Slower Pace of Innovation

Impact:Major

Addressability:Moderately

Description:As a regulated utility, innovation cycles can be slower compared to agile tech companies in the energy space (e.g., solar, storage, software).

- Disadvantage:

Vulnerability to Climate and Weather Events

Impact:Critical

Addressability:Difficult

Description:Extreme weather events pose a significant physical and financial risk to infrastructure, potentially causing widespread outages and costly repairs.

- Disadvantage:

Negative Public Perception of Rate Increases

Impact:Major

Addressability:Moderately

Description:As an essential service provider, any necessary rate increases to fund infrastructure investment are often met with public and political resistance.

Strategic Recommendations

Quick Wins

- Recommendation:

Launch Targeted Digital Campaigns for EV and Renewable Programs

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Simplify and Promote Online Self-Service Tools for Energy Assistance

Expected Impact:Medium

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Develop and Market 'Grid Services' for DER Owners

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Partner with Municipalities on Community Resilience Microgrid Projects

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Invest in Utility-Scale Battery Storage

Expected Impact:High

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Transition Business Model to a Distribution System Operator (DSO)

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Explore Non-Regulated Business Lines in EV Charging Infrastructure or Energy-as-a-Service

Expected Impact:High

Implementation Difficulty:Difficult

Shift positioning from a traditional 'power company' to a 'technology-enabled energy platform' that facilitates a reliable, clean, and resilient energy future for all customers.

Differentiate through superior grid reliability and by becoming the easiest and most trusted partner for customers looking to adopt new energy technologies like solar, batteries, and EVs.

Whitespace Opportunities

- Opportunity:

Energy-as-a-Service (EaaS) for Commercial & Industrial Customers

Competitive Gap:Few competitors can offer a fully integrated solution combining reliable grid delivery with on-site generation, storage, and efficiency management.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Develop a Marketplace for DERs and Grid Services

Competitive Gap:Create a platform where customers with solar, batteries, or smart appliances can be compensated for providing services that support grid stability, a role smaller tech companies cannot fill.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Fleet Electrification Advisory Services

Competitive Gap:Leverage deep knowledge of the grid to provide comprehensive consulting and infrastructure services for businesses transitioning their vehicle fleets to electric.

Feasibility:High

Potential Impact:Medium

Ameren operates within a mature, monopolistic industry defined by high barriers to entry. Its primary competitive advantage is its status as a rate-regulated utility, granting it an exclusive franchise to transmit and distribute electricity and natural gas in its service territories across Illinois and Missouri. Direct competition in this core business is non-existent. Instead, competition manifests through comparisons with peer utilities like ComEd, Duke Energy, and Evergy on metrics such as operational efficiency, reliability, customer satisfaction, and attractiveness for investor capital.

The most significant competitive threat to Ameren is not from other utilities, but from the systemic disruption of the traditional energy value chain. The rise of Distributed Energy Resources (DERs), particularly rooftop solar and battery storage, empowers customers to become energy producers, directly reducing their reliance on Ameren's energy sales. This trend represents an existential threat to the traditional utility business model, which is based on volumetric sales of electricity. Indirect competitors like solar installers, community energy providers, and even energy efficiency technology companies are collectively eroding the utility's incumbent position.

Key industry trends are forcing a strategic pivot. The push for decarbonization, coupled with a surge in electricity demand from electrification (EVs, data centers), necessitates massive investment in both renewable generation and grid modernization. Ameren's future success will depend on its ability to transition from a simple commodity provider to a sophisticated grid operator and energy service platform. This involves not only making the grid stronger and cleaner but also creating new value streams by managing the two-way flow of energy and data from DERs.

Strategic whitespace opportunities lie in leveraging its unique position as the grid owner. By developing services for commercial fleet electrification, creating platforms for customers to participate in grid services, and offering integrated Energy-as-a-Service solutions, Ameren can move beyond its regulated revenue model and capture value from the ongoing energy transition. The core strategic challenge is to embrace these disruptive forces as opportunities for growth rather than viewing them solely as threats to the legacy business.

Messaging

Message Architecture

Key Messages

- Message:

We've redesigned your online account experience making it easier than ever to find resources and payment assistance options.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Banner

- Message:

We offer help and energy assistance options.

Prominence:Secondary

Clarity Score:High

Location:Homepage Content Modules ('Energy Assistance')

- Message:

We provide programs and services to help you manage your energy.

Prominence:Secondary

Clarity Score:High

Location:Homepage Content Modules ('Offerings & Services', 'Energy Efficiency', 'Electric Vehicles', 'Renewables')

- Message:

We support business growth and economic development.

Prominence:Tertiary

Clarity Score:Medium

Location:Homepage Content Module ('Economic Development')

The message hierarchy is clear and logical for the primary audience of existing residential customers. The most prominent message addresses the immediate user experience of managing an account and finding help. Secondary messages logically group various customer programs. Business-focused messaging is correctly de-prioritized on this general landing page.

Messaging is highly consistent across the provided content. Each section reinforces the core themes of customer support, online account management, and providing optional programs. The language and calls-to-action are uniform, creating a cohesive, if purely functional, user experience.

Brand Voice

Voice Attributes

- Attribute:

Supportive

Strength:Strong

Examples

Find the help you need with new online tools

Explore all the helpful assistance options available to you.

- Attribute:

Direct

Strength:Strong

Examples

Welcome! Log in below to access your account:

Ensure your phone number and email address are up to date

- Attribute:

Informational

Strength:Moderate

Examples

No matter who you are or how you use your energy, we have options to help you manage it.

Ameren Illinois wants to help you understand the options available to you...

Tone Analysis

Helpful

Secondary Tones

Functional

Authoritative

Tone Shifts

The shift from customer-centric 'help' language to business-centric 'growth' language in the 'Economic Development' section is a necessary but noticeable change in tone.

Voice Consistency Rating

Excellent

Consistency Issues

No significant consistency issues were identified in the provided content. The voice is uniformly functional and supportive.

Value Proposition Assessment

Ameren provides reliable energy and makes it easier for you to manage your account, control costs, and get help when you need it.

Value Proposition Components

- Component:

Simplified Online Account Management

Clarity:Clear

Uniqueness:Common

- Component:

Accessible Payment & Energy Assistance

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Programs for Energy Efficiency & Renewables

Clarity:Clear

Uniqueness:Common

- Component:

Partner in Economic Development

Clarity:Somewhat Clear

Uniqueness:Somewhat Unique

As a regulated utility, Ameren's core product (energy delivery) is not differentiated. The messaging attempts to differentiate on the customer experience layer: ease of use, support, and access to modern energy solutions (EVs, renewables). While this is a common strategy in the utility sector, the prominent focus on 'help' and 'assistance' provides a modest point of differentiation by leading with empathy.

The messaging positions Ameren not as a choice against direct competitors (which are few for residential customers), but as a necessary service provider that is striving to be a better, more helpful partner to its customers. The emphasis is on improving the customer relationship rather than winning market share.

Audience Messaging

Target Personas

- Persona:

Cost-Conscious/Struggling Residential Customer

Tailored Messages

- •

Find the help you need with new online tools

- •

Explore all the helpful assistance options available to you.

- •

Get Help Today

Effectiveness:Effective

- Persona:

Digitally-Savvy Residential Customer

Tailored Messages

- •

We've redesigned your online account experience

- •

Log in below to access your account

- •

Ensure your phone number and email address are up to date

Effectiveness:Effective

- Persona:

Environmentally-Conscious/Tech-Forward Customer

Tailored Messages

- •

Electric Vehicles

- •

Renewables

- •

Energy Efficiency

Effectiveness:Somewhat

- Persona:

Business/Community Leader

Tailored Messages

Economic Development

It takes power to grow a business and that power comes from trusted partnerships.

Effectiveness:Ineffective

Audience Pain Points Addressed

- •

Difficulty paying energy bills

- •

Confusion navigating an old website/account portal

- •

Concern about unexpected outages or billing issues

- •

Desire to save money on energy costs

Audience Aspirations Addressed

- •

Adopting new technology like Electric Vehicles

- •

Using renewable energy sources

- •

Growing a business within the community

Persuasion Elements

Emotional Appeals

- Appeal Type:

Security/Peace of Mind

Effectiveness:Medium

Examples

Keeping You Informed

Ensure your phone number and email address are up to date so you can receive important information about your account...

- Appeal Type:

Empowerment/Control

Effectiveness:Medium

Examples

we have options to help you manage it

...choose what works best for you.

Social Proof Elements

No itemsTrust Indicators

- •

Official, professional branding and design

- •

Direct, clear, and transparent language about account management and assistance

- •

Availability of specific programs like EV support and Renewables, indicating a forward-looking and stable organization

Scarcity Urgency Tactics

None observed, which is appropriate for the industry and brand voice.

Calls To Action

Primary Ctas

- Text:

Explore Options

Location:Homepage Hero Banner

Clarity:Clear

- Text:

Login

Location:Login Module

Clarity:Clear

- Text:

Get Help Today

Location:Energy Assistance Module

Clarity:Clear

- Text:

Learn More

Location:Multiple Program Modules

Clarity:Somewhat Clear

The CTAs are generally effective and clear. The primary CTA, 'Explore Options,' directly follows the headline about finding help and new tools, creating a strong connection. The repeated use of 'Learn More' is functional but generic; it could be improved with more descriptive, action-oriented language (e.g., 'Find Rebates,' 'Explore EV Chargers,' 'See Renewable Options').

Messaging Gaps Analysis

Critical Gaps

The corporate mission 'To power the quality of life' is completely absent. The messaging is highly transactional and functional, failing to connect its services to this larger, more resonant human benefit.

There is no narrative or storytelling about the company's role in the community, its history, or its vision for a sustainable energy future, which is a missed opportunity to build brand affinity.

Contradiction Points

No direct contradictions were found. The messaging is consistently functional.

Underdeveloped Areas

The messaging for 'Renewables' and 'Electric Vehicles' is underdeveloped. It simply states the topics exist but fails to communicate the benefits, Ameren's commitment, or why a customer should be interested.

The 'Economic Development' message is too generic. It lacks specific proof points, testimonials, or data that would be persuasive to a business audience looking to expand or relocate.

Messaging Quality

Strengths

- •

Exceptional clarity for core customer tasks: logging in, finding help, and understanding available programs.

- •

Strong audience-message fit for customers concerned with account management and payment assistance.

- •

A consistent, helpful, and supportive brand voice that builds trust for a utility provider.

Weaknesses

- •

Overly functional and transactional tone that lacks emotional connection and brand personality.

- •

Absence of a compelling brand narrative that connects services to the company's mission.

- •

Generic 'Learn More' CTAs reduce engagement for forward-looking topics like EVs and renewables.

Opportunities

- •

Integrate the 'Powering the Quality of Life' mission into the homepage copy to elevate the brand beyond a transactional service provider.

- •

Develop customer success stories or case studies for energy efficiency, EV adoption, or business development to serve as powerful social proof.

- •

Create more benefit-oriented messaging for future-focused programs (EVs, Renewables) to drive adoption and position Ameren as an innovative leader.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Hero Messaging

Recommendation:Revise the hero copy to connect the new online tools to the broader brand mission. For example: 'Powering your quality of life starts with making it easy to manage your energy. Explore our new tools and assistance options designed for you.'

Expected Impact:High

- Area:

Program Messaging (EVs, Renewables)

Recommendation:Expand the brief descriptions with benefit-oriented language. Instead of just 'Renewables,' try 'Power your home with clean energy. Learn about our renewable options and how you can participate.'

Expected Impact:Medium

- Area:

Calls-to-Action

Recommendation:Replace generic 'Learn More' CTAs with more specific, value-driven text like 'Find Rebates & Discounts,' 'See EV Charging Rates,' or 'Explore Renewable Plans.'

Expected Impact:Medium

Quick Wins

A/B test different CTA button copy to improve click-through rates on program pages.

Add a short, mission-oriented tagline to the header or footer of the website.

Long Term Recommendations

- •

Develop a content strategy around storytelling, featuring testimonials from residential customers who have benefited from assistance programs and business partners who have grown with Ameren's support.

- •

Build out dedicated landing pages for each key program (EVs, Renewables, etc.) that articulate a clear value proposition, address customer questions, and provide a compelling narrative, rather than just linking to a sub-page.

- •

Conduct audience research to further segment customers (e.g., by their interest in sustainability vs. cost-savings) and tailor messaging on the site accordingly.

Ameren's website messaging is highly effective at its primary, functional purpose: serving existing customers who need to manage their accounts and find assistance. The message architecture is logical, the brand voice is consistently helpful and direct, and the clarity for core tasks is excellent. This builds trust and reduces friction for the majority of users visiting the site.

The significant strategic gap, however, is the complete disconnect between this functional messaging and the company's aspirational mission, 'To power the quality of life.' The communication is purely transactional ('here's how to pay your bill') rather than relational ('here's how we're improving your community'). This positions Ameren as a fungible utility rather than an essential community partner and leader in the sustainable energy future. While messaging around future-focused topics like EVs and renewables exists, it is underdeveloped and lacks persuasive power. By failing to weave its mission into the narrative, Ameren misses a crucial opportunity to build brand equity, foster deeper customer loyalty, and differentiate itself in a market where customers increasingly expect corporations to have a positive societal impact.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Operates as a regulated utility, holding a natural monopoly in its service territories in Illinois and Missouri, ensuring a captive customer base.

- •

Provides an essential service (electricity and natural gas) with inelastic demand, serving 2.4 million electric and over 900,000 natural gas customers.

- •

Website content indicates a focus on core customer needs: account management, energy assistance, and information on new energy programs like EVs and renewables.

- •

Consistently invests in infrastructure to meet customer demand and regulatory reliability standards, which is the primary driver of earnings growth.

Improvement Areas

- •

Enhance customer engagement and education around new offerings like time-of-use rates and demand response programs to increase adoption.

- •

Improve digital self-service tools to meet rising customer expectations for transparency and control over their energy usage.

- •

Increase communication about infrastructure investments and the value they provide to justify rate increases and improve customer satisfaction.

Market Dynamics

1-2% annually in electricity demand, with significant regional acceleration.

Mature

Market Trends

- Trend:

Electrification of Everything

Business Impact:Significant long-term growth driver. Proliferation of electric vehicles (EVs), heat pumps, and industrial process electrification creates sustained growth in electricity demand within a fixed service territory.

- Trend:

Data Center and AI Boom

Business Impact:Massive, concentrated load growth. Ameren expects a 5.5% compound annual sales growth from 2025-2029, primarily driven by data centers, a significant upward revision from near-flat forecasts.

- Trend:

Decarbonization and the Clean Energy Transition

Business Impact:Requires massive capital investment in renewable generation (wind, solar), energy storage, and grid modernization, which drives rate base growth. Ameren plans a $9.5 billion investment for 4,700 MW of renewables by 2036.

- Trend:

Grid Modernization and Resilience

Business Impact:Aging infrastructure and threats from extreme weather necessitate large-scale investment in grid hardening, smart grids, and automation, which forms a core part of Ameren's capital investment strategy.

Excellent. Ameren is positioned at the beginning of a multi-decade supercycle of investment driven by resurgent demand growth and the energy transition.

Business Model Scalability

High

High fixed-cost model. Growth is achieved by deploying capital into long-term regulated assets (rate base). The model's scalability is directly tied to the ability to invest capital and receive regulatory approval for cost recovery and a return on investment.

High. Once infrastructure is in place, the cost of serving an additional kWh to an existing customer is low. Growth is driven by increasing the size of the regulated asset base, which is expected to grow at a ~9.2% compound annual rate from 2024-2029.

Scalability Constraints

- •

Regulatory approval process for new investments and rate adjustments can create time lags and uncertainty.

- •

Supply chain constraints for key equipment like transformers, solar panels, and batteries.

- •

Access to a skilled workforce for large-scale construction, engineering, and new technology deployment.

- •

Physical constraints and public opposition (NIMBYism) to siting new transmission lines and generation facilities.

Team Readiness

Strong. The leadership team demonstrates a clear strategy focused on capital investment in regulated operations, disciplined cost management, and navigating the regulatory environment to achieve stated earnings growth targets of 6-8%.

Traditional, functional structure typical of a large utility. Well-suited for managing large, complex infrastructure projects and regulatory affairs. May need to enhance agility in customer-facing product and service innovation.

Key Capability Gaps

- •

Data analytics and AI for grid optimization, predictive maintenance, and customer segmentation.

- •

Digital product management for developing user-friendly customer programs and experiences.

- •

Partnership and ecosystem management, especially with technology providers, EV companies, and large industrial customers like data centers.

Growth Engine

Acquisition Channels

- Channel:

Economic Development Programs

Effectiveness:High

Optimization Potential:High

Recommendation:Aggressively market to and partner with data center developers and large industrial clients seeking to onshore manufacturing, leveraging attractive rates and site-readiness programs to secure significant load growth.

- Channel:

EV Charger Incentive Programs

Effectiveness:Medium

Optimization Potential:High

Recommendation:Simplify the application process for residential and business EV charger rebates. Partner directly with auto dealerships and electricians to promote programs at the point of sale.

- Channel:

Energy Efficiency & Renewable Program Marketing

Effectiveness:Medium

Optimization Potential:Medium

Recommendation:Use customer data to create targeted campaigns for energy efficiency upgrades and community solar subscriptions, highlighting bill savings and environmental benefits. Proactive communication is key to satisfaction.

Customer Journey

The 'conversion path' for a utility is the adoption of value-added programs. The website shows clear paths for customers to learn about EVs, renewables, and energy efficiency, but the journey from awareness to enrollment could be streamlined.

Friction Points

- •

Complex enrollment processes for special rates or rebate programs.

- •

Lack of personalized recommendations for customers based on their specific energy usage patterns.

- •

Difficulty understanding the financial benefit (ROI) of adopting new technologies like heat pumps or solar panels.

Journey Enhancement Priorities

{'area': 'Digital Enrollment', 'recommendation': 'Create a unified digital portal for customers to easily explore, model savings, and enroll in all available programs (EV rates, efficiency rebates, renewables) with minimal paperwork.'}

{'area': 'Proactive Customer Education', 'recommendation': 'Develop an automated communication flow that educates new homeowners or EV owners about relevant programs and rate plans, guiding them to the most cost-effective options.'}

Retention Mechanisms

- Mechanism:

Natural Monopoly

Effectiveness:High

Improvement Opportunity:While customers are captive, satisfaction is critical for regulatory success. Focus on improving reliability and price stability to maintain public and regulatory support for growth investments.

- Mechanism:

Customer Satisfaction & Reliability

Effectiveness:Moderate

Improvement Opportunity:While Ameren Illinois has ranked highly in J.D. Power studies in the past, overall industry satisfaction is declining due to rising bills. Proactively communicate about grid investments, storm restoration efforts, and cost-saving programs to build trust.

Revenue Economics

Excellent. The business model is based on earning a regulated rate of return on invested capital (the rate base). Growth is directly tied to making prudent, regulator-approved investments in infrastructure.

Not Applicable. Traditional CAC/LTV models do not apply to a regulated monopoly. The key metric is the return on invested capital (ROIC) compared to the allowed rate of return.

High. As a regulated utility, revenue is highly predictable and directly linked to capital deployment and approved rates. Strong financial performance and consistent earnings guidance reflect high efficiency.

Optimization Recommendations

- •

Focus capital on projects with strong regulatory support and clear benefits, such as grid modernization for data centers and renewable integration.

- •

Utilize disciplined cost management to offset inflationary pressures and maximize the capital available for rate base growth.

- •

Seek performance-based ratemaking mechanisms where possible to earn incentives for exceeding reliability or clean energy targets.

Scale Barriers

Technical Limitations

- Limitation:

Aging Grid Infrastructure

Impact:High

Solution Approach:Systematically execute the multi-billion dollar grid modernization and hardening programs already planned. Use predictive analytics to prioritize investments in the most vulnerable areas.

- Limitation:

Interconnection Queues for Renewables

Impact:Medium

Solution Approach:Streamline the study and approval process for new renewable energy projects connecting to the grid. Invest in transmission capacity to unlock access to resource-rich areas.

Operational Bottlenecks

- Bottleneck:

Regulatory Approval Cycles

Growth Impact:Can delay capital deployment and revenue growth.

Resolution Strategy:Maintain transparent and constructive relationships with regulators. Proactively file comprehensive, data-driven rate cases and long-range investment plans (IRPs) to justify expenditures.

- Bottleneck:

Supply Chain for Critical Components

Growth Impact:Can delay project timelines and increase costs for transformers, switchgear, and renewable components.

Resolution Strategy:Develop strategic partnerships with multiple suppliers, pre-order critical long-lead-time equipment, and explore opportunities for domestic sourcing.

- Bottleneck:

Permitting and Siting for New Infrastructure

Growth Impact:Can significantly delay or block essential transmission and generation projects.

Resolution Strategy:Engage in early and continuous community outreach. Highlight the economic and reliability benefits of projects to build local support.

Market Penetration Challenges

- Challenge:

Customer Affordability and Rate Increase Fatigue

Severity:Critical

Mitigation Strategy:Combine rate increase requests with robust energy efficiency programs and assistance for low-income customers. Clearly communicate the value and necessity of investments for long-term reliability and clean energy goals.

- Challenge:

Competition from Distributed Energy Resources (DERs)

Severity:Minor

Mitigation Strategy:Develop utility-owned community solar programs. Create rate structures that fairly value DERs while ensuring all customers contribute to grid maintenance. Position the utility as the orchestrator of a complex, distributed grid.

Resource Limitations

Talent Gaps

- •

Lineworkers and skilled trade professionals for construction.

- •

Data scientists and grid analysts for grid modernization efforts.

- •

Cybersecurity experts to protect critical infrastructure.

Significant and ongoing. Ameren has a planned investment pipeline of over $55 billion for the next decade, which will require continuous access to capital markets.

Infrastructure Needs

- •

Upgraded transmission infrastructure to support renewables and data center load.

- •

Advanced Distribution Management Systems (ADMS) for a smarter, more resilient grid.

- •

Large-scale energy storage solutions to balance intermittent renewables.

Growth Opportunities

Market Expansion

- Expansion Vector:

Beneficial Electrification (Transportation & Buildings)

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Launch aggressive marketing and incentive programs for EVs and electric heat pumps. Partner with automakers, dealers, and HVAC installers to streamline the customer transition and capture new electrical load.

- Expansion Vector:

Data Center Attraction

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Create a dedicated economic development team focused on the data center sector. Pre-qualify industrial sites with robust power and fiber access. Work with regulators to develop specialized rate structures for these large, high-load-factor customers.

Product Opportunities

- Opportunity:

Grid Services & Demand Response Programs

Market Demand Evidence:Increasing need for grid flexibility to manage renewable intermittency and peak loads from EV charging.

Strategic Fit:High. Leverages smart meter infrastructure and positions Ameren as a grid operator rather than just a commodity provider.

Development Recommendation:Pilot and scale programs that offer customers incentives for reducing energy use during peak times, using smart thermostats, or allowing managed EV charging.

- Opportunity:

Utility-Scale Energy Storage

Market Demand Evidence:Ameren's own resource plans call for 800 MW of battery storage to support its renewable energy goals.

Strategic Fit:High. Essential for ensuring reliability in a renewables-heavy portfolio and a key area for rate base growth.

Development Recommendation:Begin with pilot projects to gain operational experience, then scale investments as costs decline and regulatory frameworks mature. Co-locate storage with large solar facilities.

- Opportunity:

Resilience as a Service

Market Demand Evidence:Growing demand from critical facilities (hospitals, data centers) and commercial customers for enhanced power reliability.

Strategic Fit:Medium

Development Recommendation:Explore offering tariff-based microgrid solutions or enhanced reliability services for a premium, allowing customers to fund specific infrastructure upgrades that benefit them directly.

Channel Diversification

- Channel:

Digital Self-Service Portal/App

Fit Assessment:Excellent

Implementation Strategy:Invest in a best-in-class mobile app that provides real-time usage data, personalized savings tips, outage updates, and seamless enrollment in all company programs. This can improve satisfaction and lower service costs.

- Channel:

Contractor & Installer Networks

Fit Assessment:Excellent

Implementation Strategy:Build on the 'EV Partner Network' model for other technologies like heat pumps and solar. Provide training and co-marketing to trusted local contractors, making them a direct sales channel for electrification and efficiency programs.

Strategic Partnerships

- Partnership Type:

Technology & Software Providers

Potential Partners

- •

Google (Grid Modernization, AI)

- •

Siemens (Grid Control Systems)

- •

Oracle (Customer Information Systems)

Expected Benefits:Access to cutting-edge technology for grid management, predictive analytics, and enhanced customer experience.

- Partnership Type:

Large Industrial & Data Center Customers

Potential Partners

Major cloud providers (AWS, Microsoft, Google)

Large manufacturing companies

Expected Benefits:Co-develop infrastructure plans to support their growth, secure long-term revenue streams, and potentially partner on renewable energy procurement.

- Partnership Type:

Automotive OEMs & EV Charging Networks

Potential Partners

Ford, GM, Tesla

Electrify America, EVgo

Expected Benefits:Collaborate on 'smart charging' programs to manage grid impact, streamline home charger installations, and plan for public fast-charging infrastructure along major corridors.

Growth Strategy

North Star Metric

Annual Regulated Rate Base Growth

This metric directly correlates with Ameren's core earnings growth driver. It encapsulates the successful execution of the entire growth strategy: investing in infrastructure to serve new load, enable the clean energy transition, and improve reliability, all while securing regulatory approval.

Maintain a compound annual growth rate (CAGR) of 8-9% in the rate base over the next 5 years, consistent with investor guidance.

Growth Model

Capital-Intensive, Regulatory-Driven Growth

Key Drivers

- •

Disciplined capital investment in regulator-approved projects.

- •

Growth in electricity demand from electrification and economic development.

- •

Constructive regulatory outcomes that allow for timely cost recovery and a fair return.

- •

Operational efficiency and disciplined cost management.

Execute the long-term, multi-billion dollar capital investment plan while actively engaging with regulators, policymakers, and customers to maintain support for the necessary investments in the energy system.

Prioritized Initiatives

- Initiative:

Launch a 'Data Center Fast-Track' Program

Expected Impact:High

Implementation Effort:High

Timeframe:12-18 Months

First Steps:Assemble a cross-functional team (Economic Development, Engineering, Regulatory) to develop a standardized offering for data center clients, including site evaluation, infrastructure planning, and rate design.

- Initiative:

Develop an 'Electrify Everything' Customer Platform

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:9-12 Months

First Steps:Design a unified digital portal where customers can calculate the savings from switching to EVs and heat pumps, find certified local installers, and apply for all available rebates in one place.

- Initiative:

Grid Modernization for Renewable Integration

Expected Impact:High

Implementation Effort:High

Timeframe:Ongoing (Multi-Year)

First Steps:Finalize and file the next phase of the grid modernization plan with regulators, focusing on investments that directly enable the connection of planned solar, wind, and battery storage projects.

Experimentation Plan

High Leverage Tests

- Test Name:

Time-of-Use (TOU) Rate Adoption Pilot

Hypothesis:A targeted educational campaign and simplified opt-in process for TOU rates for new EV owners will increase adoption by 25% and shift 15% of charging load to off-peak hours.

Metrics:TOU enrollment rate, percentage of EV charging occurring off-peak, customer satisfaction score.

- Test Name:

Proactive Outage Communication Experiment

Hypothesis:Sending proactive messages with details on grid hardening work in a neighborhood prior to a storm will increase customer satisfaction scores related to reliability by 5 points, even if an outage occurs.

Metrics:J.D. Power survey scores on 'Communications' and 'Reliability', call center volume during outages.

Utilize A/B testing for digital communications. Track program adoption rates, load profile data from smart meters, and customer satisfaction scores via targeted surveys and J.D. Power results.

Quarterly review of ongoing pilots and identification of new experiments tied to strategic priorities.

Growth Team

A dedicated 'Growth & Electrification' team that sits between traditional utility functions (Engineering, Rates, Customer Service). This team would be responsible for program development, partnership management, and customer adoption.

Key Roles

- •

Head of Electrification & Grid Services

- •

Economic Development Manager (Data Center & Industrial Focus)

- •

Digital Customer Experience Lead

- •

Strategic Partnership Manager (Auto & Tech)

Invest in training for data analytics, digital marketing, and agile project management. Hire talent from outside the utility industry in areas like software product management and business development to bring in new perspectives.

Ameren is exceptionally well-positioned for a period of sustained, long-term growth, a significant shift for a mature utility. The company's growth is not predicated on traditional customer acquisition but on capitalizing on two massive, secular trends: the resurgence of electricity demand driven by data centers and electrification, and the multi-decade transition to a decarbonized energy system. The core growth engine is a straightforward, powerful loop: invest billions in regulator-approved infrastructure projects (grid modernization, renewable generation, transmission), add these investments to the regulated rate base, and earn a stable return. Ameren's clear strategic plan, targeting 6-8% annual earnings growth driven by a 9.2% rate base CAGR, demonstrates a strong foundation. The primary opportunities lie in aggressively pursuing and enabling large-scale load growth from data centers and systematically encouraging the electrification of transport and heating within their captive service territory. The website's focus on EV programs and renewables indicates strategic alignment, but the execution can be accelerated by streamlining customer adoption journeys and forming deeper partnerships. The most significant barriers are not competitive but regulatory and executional. Success hinges on the ability to manage massive, complex infrastructure projects on time and on budget, navigate the regulatory process to achieve constructive outcomes, and maintain customer affordability to secure public support for necessary rate increases. The recommended strategy is to sharpen the focus on being the primary enabler of the region's energy transition and economic growth. This involves creating a dedicated 'Growth & Electrification' function to attract large customers like data centers and to make it seamless for residential and commercial customers to adopt electric technologies. The North Star Metric of 'Annual Regulated Rate Base Growth' will align the entire organization on the central driver of shareholder and stakeholder value for the foreseeable future.

Legal Compliance

Ameren maintains a comprehensive and easily accessible Privacy Policy, linked from the website footer. The policy clearly outlines the types of information collected, including Personal Information (name, address, email) and Anonymous Information. It details how this data is used for customer support, communication, and service provision. The policy also explains the creation and use of aggregated, non-identifiable data for analytics. Crucially, it addresses data sharing with third parties, noting that user information may be governed by the third party's policy once shared, and discloses the use of a third-party provider for its chat function, retaining those conversations. However, the policy lacks specific sections detailing user rights under state-specific laws like the California Consumer Privacy Act (CCPA) or Virginia's VCDPA, which is a significant gap for a company of its scale. While it commits to protecting privacy, it doesn't provide explicit instructions for users in those states to exercise their statutory rights (e.g., right to access, delete, or opt-out of sale/sharing).

The 'Terms and Conditions' are present and linked in the site footer. The document is reasonably clear and covers standard provisions such as ownership of materials, acceptable use of the website, and prohibitions against unlawful or damaging activities. It explicitly forbids reproducing or redistributing site materials for commercial purposes. The terms include important disclaimers of liability and reference the Privacy Policy, incorporating it by reference. They also address user-submitted content, granting Ameren a broad, royalty-free license to use any submissions. A notable strength is the clarity on liability regarding unauthorized account access. The terms are robust for protecting Ameren's intellectual property and limiting liability related to website use.

Upon visiting the website, a cookie consent banner appears at the bottom of the page. It provides three clear options: 'Accept All Cookies', 'Reject All', and 'Cookie Settings'. This mechanism is a strong point, as it allows for user choice beyond simple acceptance. Clicking 'Cookie Settings' reveals a granular control panel where users can toggle consent for different categories of cookies (e.g., Functional, Performance, Targeting). This demonstrates a sophisticated approach to consent that aligns with modern privacy standards. The mechanism appears to block non-essential cookies prior to user interaction, which is a key requirement for compliance with laws like GDPR. The only minor weakness is that once a choice is made, the tool to manage these settings later is not immediately obvious on the main interface, typically requiring a user to find a link in the privacy policy or footer.

As a critical infrastructure entity, Ameren's data protection measures are governed by stringent industry standards. The Privacy Policy mentions a strong commitment to protecting user data. While the public-facing policy doesn't detail specific technical safeguards (as is common for security reasons), the company's regulatory environment necessitates robust security. Ameren is subject to the North American Electric Reliability Corporation's Critical Infrastructure Protection (NERC CIP) standards. These mandatory standards require rigorous cybersecurity measures to protect Bulk Electric System (BES) assets from threats, including controls for system security, incident reporting, and recovery planning. These obligations extend to protecting customer data systems that could be vectors for attacks on critical infrastructure. The policy's disclosure about third-party data sharing for 'essential business functions' without explicit consent is standard for utilities but requires strong contractual protections with vendors to ensure data security downstream.