eScore

americanexpress.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

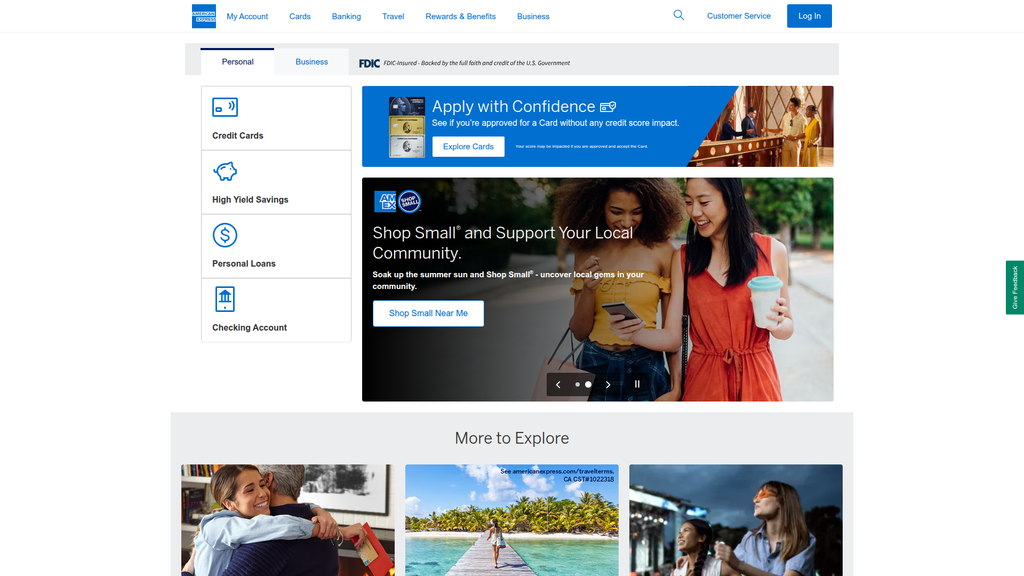

American Express demonstrates a world-class digital presence, commanding dominant authority in high-value search segments like 'best travel credit cards'. Their content strategy is comprehensive, covering the full customer journey from awareness (Open Forum) to conversion. Their multi-channel presence is strong and consistent, leveraging social media and influencer marketing effectively to engage younger demographics.

Exceptional content authority and search intent alignment, particularly for high-value commercial keywords in the premium travel and business segments.

Create more in-house content and interactive tools to simplify and showcase the value of the Membership Rewards program, which is often perceived as more complex than competitors'.

Amex's brand communication is a masterclass in positioning. The messaging perfectly balances aspiration ('Your Dream Vacation Awaits') with reassurance ('Apply with Confidence'), effectively targeting distinct personas like affluent experience seekers and aspiring professionals. The brand voice is impeccably consistent, reinforcing a premium, empowering, and trustworthy identity across all digital touchpoints.

The 'Apply with Confidence' message is a brilliant piece of conversion-focused communication that directly addresses a major customer pain point and removes a key barrier to acquisition.

Incorporate more direct social proof, such as customer testimonials or prominent award logos, on the homepage to bolster third-party validation for new prospects.

The website provides a clean, logical, and trustworthy conversion path, significantly enhanced by the 'Apply with Confidence' feature that reduces user anxiety. The information architecture is clear, and the site demonstrates strong mobile responsiveness. However, inconsistencies in Call-to-Action (CTA) design and the use of a hero carousel, which can hide key offers, present clear opportunities for optimization.

The logical, streamlined application process, which reduces cognitive load and is supported by trust-building elements like clear contact options throughout the journey.

Standardize all primary Call-to-Action buttons to a single, high-contrast design (the solid blue button) to eliminate visual hierarchy confusion and improve click-through rates.

American Express has built its entire brand on a foundation of trust and security, which is reflected in its digital presence. A centralized 'Privacy Center', detailed region-specific compliance notices (GDPR, CCPA), and robust security features establish a world-class credibility framework. The brand name itself is a powerful trust signal, reinforced by transparent features like the pre-approval check without credit score impact.

The sophisticated and user-centric legal and compliance framework, especially the centralized Privacy Center and detailed accessibility statement (WCAG 2.1 AA), which functions as a strategic asset.

Simplify the presentation of the multiple, interlocking privacy statements to reduce potential confusion for users trying to identify the specific policies that apply to them.

Amex's competitive moat is deep and highly sustainable, anchored by its iconic premium brand and proprietary closed-loop network. This network provides unique data advantages that open-loop competitors like Visa and Mastercard cannot replicate, enabling superior analytics and personalization. Significant switching costs are created through the powerful Membership Rewards ecosystem and the 'membership' ethos that fosters deep loyalty.

The closed-loop network is a highly sustainable and hard-to-replicate advantage, providing proprietary data on both cardholder spending and merchant activity.

Address the primary disadvantage of lower merchant acceptance relative to Visa/Mastercard by continuing to expand the network, particularly among small businesses.

The business model is highly scalable, with strong unit economics driven by a high-spending customer base and multiple high-margin revenue streams. Amex is showing strong market expansion signals by successfully acquiring younger demographics (Millennials/Gen Z) and pushing deeper into the global SME market. The acquisition of Kabbage provides a significant platform for creating a scalable, integrated financial suite for businesses.

Excellent unit economics, combining high customer lifetime value from its premium segments with diversified, high-margin revenue streams (fees, interest, merchant discount).

Accelerate the integration of Kabbage to create a unified 'Amex Business Blueprint' digital dashboard, which is critical for fully capitalizing on the SME market expansion opportunity.

American Express's business model is exceptionally coherent, with all components aligned to support its premium positioning. The spend-centric revenue model, which focuses on high-value transactions, directly funds the rich rewards and superior service that attract and retain its target affluent customers. Strategic focus is clear, with targeted initiatives to capture the next generation of premium consumers and expand into the SME market, demonstrating strong stakeholder alignment and market timing.

A powerful, self-reinforcing flywheel where the premium brand attracts high-spending customers, which justifies higher merchant fees, which in turn fund the superior rewards and services that sustain the premium brand.

Build clearer messaging and product bridges between the company's various offerings (cards, banking, loans) to promote ecosystem adoption and increase customer lifetime value.

American Express wields significant market power, particularly in the premium consumer and corporate card segments. This allows for substantial pricing power, reflected in its ability to charge high annual fees and command higher merchant discount rates. The brand's influence shapes market trends towards experiences and lifestyle benefits, and its strong co-brand partnerships with leading travel companies provide significant leverage.

Exceptional pricing power, enabling the company to command premium annual fees and higher merchant discount rates due to its affluent customer base and their high spending levels.

Counter the narrative of having a complex rewards program, as competitors like Chase are often perceived as more straightforward, which can be a deciding factor for some customers.

Business Overview

Business Classification

Integrated Financial Services & Payments Network

Lifestyle & Travel Services Platform

Financial Services

Sub Verticals

- •

Credit & Charge Card Issuing

- •

Payment Processing Network

- •

Consumer & Business Lending

- •

Digital Banking Services

Mature

Maturity Indicators

- •

Established global brand recognition since 1850.

- •

Large, loyal, and high-spending customer base.

- •

Consistent revenue growth and shareholder returns (dividends and buybacks).

- •

Extensive regulatory oversight and established infrastructure.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Discount Revenue (Merchant Fees)

Description:Fees charged to merchants for accepting American Express cards. This is the largest revenue source, driven by a higher average transaction value from its premium cardholder base.

Estimated Importance:Primary

Customer Segment:Merchants

Estimated Margin:High

- Stream Name:

Net Interest Income

Description:Interest earned on outstanding loan and credit card balances that are carried over by card members.

Estimated Importance:Primary

Customer Segment:Card Members (Consumers & Businesses)

Estimated Margin:High

- Stream Name:

Net Card Fees

Description:Annual membership fees for charge and credit card products, which vary by the level of benefits and rewards offered.

Estimated Importance:Primary

Customer Segment:Card Members (Consumers & Businesses)

Estimated Margin:High

- Stream Name:

Other Commissions and Fees

Description:Includes travel commissions, foreign currency conversion fees, delinquency fees, and other service-related charges.

Estimated Importance:Secondary

Customer Segment:Card Members

Estimated Margin:Medium

Recurring Revenue Components

Annual Card Fees

Net Interest Income from revolving balances

Pricing Strategy

Value-Based Tiered Subscription

Premium

Semi-transparent

Pricing Psychology

- •

Prestige Pricing

- •

Tiered Pricing (e.g., Green, Gold, Platinum, Centurion)

- •

Value-Added Benefits (e.g., airport lounge access, concierge services)

Monetization Assessment

Strengths

- •

Diversified revenue from both card members and merchants.

- •

High-margin, recurring fee income provides stable cash flow.

- •

Strong brand equity supports premium pricing for annual fees and higher discount rates.

- •

The 'spend-centric' model focusing on high-spending customers drives significant discount revenue.

Weaknesses

- •

High dependence on consumer and business spending, which is cyclical and vulnerable to economic downturns.

- •

Higher merchant fees can lead to a smaller acceptance network compared to Visa and Mastercard, though this gap is closing.

- •

Revenue is sensitive to interest rate fluctuations.

Opportunities

- •

Expand digital banking services (savings, checking) to deepen customer relationships and create new revenue streams.

- •

Further penetrate the small and medium-sized enterprise (SME) market with tailored expense management and lending solutions.

- •

Leverage rich data from the closed-loop network for personalized offers and potential data monetization.

Threats

- •

Intense competition from fintech companies and other premium card issuers (e.g., Chase Sapphire Reserve).

- •

Potential for increased regulatory scrutiny on interchange fees and other credit card practices.

- •

Shifting consumer preferences towards alternative payment methods like Buy Now, Pay Later (BNPL) or digital wallets.

Market Positioning

Premium Brand & Lifestyle Ecosystem

Leading position in the premium/charge card segment; smaller share of overall transaction volume compared to Visa and Mastercard.

Target Segments

- Segment Name:

Affluent Consumers & High-Net-Worth Individuals

Description:Professionals and individuals with high income and excellent credit who prioritize premium service, travel benefits, and exclusive experiences.

Demographic Factors

- •

High annual income

- •

Excellent credit history

- •

Frequent travelers

Psychographic Factors

- •

Values status, exclusivity, and quality

- •

Seeks convenience and superior customer service

- •

Aspires to a premium lifestyle

Behavioral Factors

- •

High spending volume

- •

Loyalty to brands that provide exceptional value and service

- •

Early adopter of premium products

Pain Points

- •

Lack of personalized financial services

- •

Time-consuming travel planning

- •

Desire for exclusive access and recognition

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Millennials & Gen Z (Mass Affluent)

Description:A rapidly growing cohort of younger, digitally native consumers who value experiences, rewards, and brand authenticity. This group represents over 60% of new account acquisitions.

Demographic Factors

- •

Ages 25-45

- •

Good-to-excellent credit

- •

Increasing income and spending power

Psychographic Factors

- •

Values experiences over material goods

- •

Digitally savvy and expects seamless mobile experiences

- •

Influenced by social trends and brand values

Behavioral Factors

- •

High engagement with loyalty programs

- •

Frequent spending on dining, travel, and entertainment.

- •

Rapid adoption of new digital payment technologies

Pain Points

- •

Seeking to maximize value from spending through rewards

- •

Difficulty accessing premium benefits without a long credit history

- •

Desire for financial tools that fit a flexible, digital lifestyle

Fit Assessment:Good

Segment Potential:High

- Segment Name:

Small and Medium-Sized Enterprises (SMEs)

Description:Businesses requiring sophisticated tools for cash flow management, expense tracking, business travel, and access to working capital.

Demographic Factors

Varying industries and revenue sizes

Psychographic Factors

- •

Focused on operational efficiency and growth

- •

Values control over business finances

- •

Seeks partners that can provide business insights

Behavioral Factors

- •

Need for flexible payment terms

- •

High volume of B2B transactions

- •

Use of corporate cards for travel and expenses

Pain Points

- •

Managing cash flow effectively

- •

Controlling and tracking employee expenses

- •

Access to short-term, flexible funding

- •

Lack of integrated financial management tools

Fit Assessment:Good

Segment Potential:High

Market Differentiation

- Factor:

Closed-Loop Network

Strength:Strong

Sustainability:Sustainable

- Factor:

Premium Brand & Aspirational Marketing

Strength:Strong

Sustainability:Sustainable

- Factor:

Superior Customer Service

Strength:Strong

Sustainability:Sustainable

- Factor:

Membership Rewards Program

Strength:Strong

Sustainability:Sustainable

Value Proposition

Providing discerning individuals and businesses with powerful backing, access to exclusive experiences, and superior service to help them achieve their aspirations.

Excellent

Key Benefits

- Benefit:

Comprehensive Rewards & Benefits

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Membership Rewards program

- •

Co-branded partnerships (e.g., Delta, Hilton)

- •

Travel credits and perks

- Benefit:

Exceptional Global Customer Service

Importance:Critical

Differentiation:Unique

Proof Elements

- •

24/7 customer support

- •

Concierge services

- •

Purchase and fraud protection

- Benefit:

Exclusive Access & Experiences

Importance:Important

Differentiation:Unique

Proof Elements

- •

Global Lounge Collection for travelers

- •

By Invitation Only events

- •

Presale ticket access

- Benefit:

Powerful Financial Tools & Security

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Business Blueprint for SMEs

- •

Advanced fraud detection

- •

Personalized spending insights

Unique Selling Points

- Usp:

The Closed-Loop Network, which provides end-to-end control of the customer experience and unparalleled data insights.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A brand synonymous with prestige, trust, and premium service, built over 170+ years.

Sustainability:Long-term

Defensibility:Strong

- Usp:

The Centurion Card ('Black Card') ecosystem, representing the pinnacle of exclusivity and service.

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Need for a trusted and secure global payment solution.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Desire to be rewarded for spending with valuable and flexible loyalty points.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Complexity of managing business expenses and cash flow for SMEs.

Severity:Major

Solution Effectiveness:Partial

- Problem:

Lack of access to premium travel experiences and personalized service.

Severity:Minor

Solution Effectiveness:Complete

Value Alignment Assessment

High

The value proposition is strongly aligned with the segment of the market that prioritizes service, benefits, and brand prestige over low cost.

High

The focus on premium rewards, travel, and exclusivity directly meets the stated and unstated needs of affluent consumers, aspiring professionals, and business owners.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Co-brand partners (e.g., Delta, Hilton, Marriott)

- •

Premium Merchants

- •

Travel Agencies & Service Providers

- •

Technology Partners (e.g., Apple, Google for digital wallets)

Key Activities

- •

Payment Processing & Network Management

- •

Risk & Credit Management

- •

Brand Marketing & Customer Acquisition

- •

Customer Service & Relationship Management

- •

Product Development & Innovation

Key Resources

- •

Globally Recognized Brand

- •

Proprietary Closed-Loop Payment Network

- •

Rich Customer Spending Data

- •

Capital and Financial Standing

- •

Relationships with high-value customers and partners

Cost Structure

- •

Card Member Rewards & Services

- •

Marketing & Business Development

- •

Salaries & Employee Benefits

- •

Provision for Credit Losses

- •

Technology & Infrastructure

Swot Analysis

Strengths

- •

Iconic global brand synonymous with trust, security, and prestige.

- •

Proprietary closed-loop network provides superior data analytics and control.

- •

Affluent and high-spending card member base leads to lower credit risk and higher revenue per customer.

- •

Diversified revenue streams from consumers (fees, interest) and merchants (discount revenue).

Weaknesses

- •

Higher merchant discount rates can limit acceptance compared to competitors, particularly among smaller businesses.

- •

Business performance is highly correlated with the health of the economy and levels of consumer/business spending.

- •

Perception of being less accessible to non-premium segments, although this is actively being addressed.

Opportunities

- •

Accelerate growth in the SME segment with integrated financial management tools like Business Blueprint.

- •

Deepen engagement with Millennial & Gen Z customers, who are the fastest-growing demographic.

- •

Expand digital banking offerings to capture a larger share of customers' financial lives.

- •

Leverage AI and data analytics for hyper-personalization of offers and services.

Threats

- •

Intensifying competition from agile fintech startups and digital-first financial service providers.

- •

Global economic uncertainty and geopolitical instability impacting travel and cross-border spending.

- •

Potential for increased regulatory oversight on fees, interest rates, and data privacy.

- •

Cybersecurity threats targeting sensitive financial and personal data.

Recommendations

Priority Improvements

- Area:

Digital Ecosystem Integration

Recommendation:Further unify the digital experience across card services, banking, travel, and dining into a single, seamless 'super-app'. This will increase user stickiness and provide a holistic view of the customer's financial life.

Expected Impact:High

- Area:

SME Value Proposition Enhancement

Recommendation:Evolve from a card provider to an essential 'SME Operating System' by integrating more advanced cash flow forecasting, invoicing, and payroll services, potentially through further acquisitions or partnerships.

Expected Impact:High

- Area:

Data-Driven Personalization at Scale

Recommendation:Leverage AI to move beyond targeted offers to predictive, hyper-personalized experiences. Proactively suggest travel itineraries, dining reservations, or business funding opportunities based on real-time spending data and behavioral analytics.

Expected Impact:Medium

Business Model Innovation

- •

Develop a 'Lifestyle-as-a-Service' subscription model, bundling financial products with curated experiences, exclusive content, and premium services for a single, tiered monthly fee.

- •

Launch a data and insights platform for merchant partners, offering anonymized spending trend analysis and consumer behavior reports as a premium service.

- •

Create a venture arm to invest in and partner with emerging fintech and lifestyle tech startups, ensuring Amex stays at the forefront of innovation.

Revenue Diversification

- •

Expand the suite of non-credit financial products, such as wealth management and insurance, tailored to the existing affluent customer base.

- •

Increase focus on fee-based business services for SMEs, such as advanced software solutions for expense management and B2B payments.

- •

Build out a premium digital content platform (e.g., travel guides, business insights) accessible through a subscription for non-card members, creating a new top-of-funnel acquisition channel.

American Express has masterfully evolved from its origins as a travel and charge card company into a globally integrated financial services powerhouse. Its core competitive advantage and strategic nucleus is the proprietary 'closed-loop' network, which differentiates it from the open-loop models of Visa and Mastercard. This structure provides end-to-end control over the payment process, yielding unparalleled data insights, superior risk management, and the ability to cultivate direct, high-value relationships with both card members and merchants. This has enabled the cultivation of a premium brand centered on an aspirational lifestyle, exceptional service, and exclusive access, allowing Amex to command higher fees from both sides of its network.

The business model is robust, with diversified, high-margin revenue streams from merchant discount fees, card membership fees, and net interest income. The strategic focus on a high-spending, affluent customer base has historically provided resilience against economic downturns and lower credit losses. However, the key to its future evolution lies in strategically expanding its aperture. The company is successfully attracting younger, digitally native Millennial and Gen Z customers and aggressively pursuing the lucrative Small and Medium-Sized Enterprise (SME) segment. This pivot is critical for long-term, sustainable growth.

Strategic transformation opportunities are abundant. The evolution from a payment and lending provider to an indispensable financial and lifestyle partner is the primary path forward. This involves deepening the integration of its digital ecosystem—cards, banking, travel, dining, and business services—into a single, cohesive platform. For the consumer segment, this means hyper-personalization at scale, using AI to anticipate needs and deliver value beyond the transaction. For the SME segment, it means becoming an embedded financial operating system. While threats from agile fintech competitors and regulatory pressures are persistent, American Express's powerful brand, loyal customer base, and unique data advantage position it strongly to not only defend its market position but also to redefine the premium financial services landscape for the next generation.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Brand Recognition and Trust

Impact:High

- Barrier:

Regulatory Compliance and Licensing

Impact:High

- Barrier:

High Capital Requirements

Impact:High

- Barrier:

Merchant Acceptance Network

Impact:High

- Barrier:

Economies of Scale

Impact:Medium

Industry Trends

- Trend:

Digital and Mobile Payments

Impact On Business:Requires continuous innovation in digital wallets and contactless payment solutions to maintain relevance.

Timeline:Immediate

- Trend:

Buy Now, Pay Later (BNPL)

Impact On Business:Erodes traditional credit card usage for point-of-sale financing, especially among younger demographics.

Timeline:Immediate

- Trend:

AI and Data Personalization

Impact On Business:Creates an opportunity for Amex to leverage its closed-loop network data for hyper-personalized offers and enhanced fraud detection.

Timeline:Immediate

- Trend:

Embedded Finance

Impact On Business:Threatens the top-of-wallet position of traditional cards as payments become integrated into non-financial platforms.

Timeline:Near-term

- Trend:

Focus on Experiences and Lifestyle

Impact On Business:Aligns perfectly with Amex's brand strategy, creating opportunities to deepen customer loyalty through curated experiences.

Timeline:Near-term

Direct Competitors

- →

JPMorgan Chase & Co.

Market Share Estimate:Largest U.S. issuer by purchase volume (~21%) and outstanding balance (~18%).

Target Audience Overlap:High

Competitive Positioning:Offers a wide range of credit cards, from cashback to premium travel rewards, leveraging its massive retail banking footprint.

Strengths

- •

Largest US credit card issuer by purchase volume.

- •

Strong brand recognition and trust.

- •

Broad portfolio of cards catering to different segments.

- •

Successful loyalty program (Ultimate Rewards).

Weaknesses

- •

Less emphasis on exclusive 'lifestyle' benefits compared to Amex.

- •

Open-loop data provides less insight into merchant-side behavior.

- •

Customer service can be perceived as less premium than Amex.

Differentiators

Massive existing customer base through its retail banking arm.

Popular co-branded cards (e.g., Southwest, United, Marriott).

- →

Visa Inc.

Market Share Estimate:Largest payment network by purchase volume and number of cards in circulation.

Target Audience Overlap:High

Competitive Positioning:Positions itself as the most widely accepted payment network globally, focusing on reliability, security, and innovation.

Strengths

- •

Vast global acceptance network.

- •

Strong brand recognition and trust.

- •

Economies of scale leading to cost advantages.

- •

Extensive partnerships with financial institutions worldwide.

Weaknesses

- •

Open-loop network model provides less direct control over customer experience.

- •

Reliant on issuing banks for card features and marketing.

- •

Does not directly issue cards or manage customer relationships (unlike Amex).

Differentiators

Nearly universal merchant acceptance.

Focus on B2B partnerships with banks and fintechs.

- →

Mastercard Inc.

Market Share Estimate:Second-largest payment network by purchase volume.

Target Audience Overlap:High

Competitive Positioning:Competes with Visa on global acceptance while differentiating through technology, data analytics services, and a focus on new payment flows like B2B.

Strengths

- •

Extensive global acceptance network.

- •

Strong brand recognition.

- •

Innovation in payment technologies (contactless, digital wallets).

- •

Strategic focus on diversifying into B2B payments and data services.

Weaknesses

Slightly smaller network than Visa.

Similar to Visa, operates an open-loop model with less direct customer insight than Amex.

Differentiators

Strong focus on 'Priceless' experiences and sponsorships.

Aggressive investment in new payment technologies and strategic acquisitions.

- →

Capital One Financial Corp.

Market Share Estimate:A top 5 U.S. credit card issuer.

Target Audience Overlap:Medium

Competitive Positioning:Positions itself as a technology company that does banking, leveraging data analytics and a digital-first approach to offer straightforward, high-value products.

Strengths

- •

Strong data analytics and risk management capabilities.

- •

Digital-first banking model with high operational efficiency.

- •

Simple and popular rewards programs (e.g., Venture miles).

- •

Strategic acquisition of Discover will create a new payment network to challenge Visa and Mastercard.

Weaknesses

- •

Brand is not perceived as premium or exclusive as American Express.

- •

Fewer luxury travel perks and benefits.

- •

Historically focused more on mass-market and subprime segments, though moving upmarket.

Differentiators

Technology and data-driven approach to product design and marketing.

Pending acquisition of Discover Financial Services.

- →

Discover Financial Services

Market Share Estimate:Fourth-largest U.S. network by purchase volume, though significantly smaller than the top three.

Target Audience Overlap:Medium

Competitive Positioning:Focuses on cash-back rewards, no annual fees, and strong U.S.-based customer service.

Strengths

- •

Pioneer in cash-back rewards.

- •

High customer satisfaction ratings.

- •

Operates its own payment network (closed-loop model, similar to Amex).

- •

Generally no annual fees on its core products.

Weaknesses

- •

Lower merchant acceptance, particularly outside the U.S.

- •

Significantly smaller market share than Amex, Visa, or Mastercard.

- •

Brand lacks the premium perception of Amex.

Differentiators

Emphasis on customer service and simplicity.

Strong focus on cash-back rewards.

Indirect Competitors

- →

PayPal / Venmo

Description:A leading digital wallet and online payment platform that also offers credit products, P2P payments, and business services.

Threat Level:High

Potential For Direct Competition:High, as it already offers co-branded credit cards and is expanding its financial service offerings.

- →

Affirm / Klarna / Afterpay (Block)

Description:Buy Now, Pay Later (BNPL) providers that offer consumers interest-free, short-term installment loans at the point of sale, both online and in-store.

Threat Level:High

Potential For Direct Competition:Medium, as their model directly challenges the traditional use of credit cards for purchases and is rapidly gaining consumer adoption, especially among younger demographics.

- →

Apple (Apple Card / Apple Pay)

Description:A tech giant offering a seamless digital wallet (Apple Pay) and a co-branded credit card (Apple Card) deeply integrated into its hardware ecosystem.

Threat Level:High

Potential For Direct Competition:High, as it leverages its massive, loyal user base and hardware integration to create a sticky financial ecosystem that bypasses traditional card-swiping.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Premium Brand and Affluent Customer Base

Sustainability Assessment:Highly sustainable, built over decades and associated with status and quality.

Competitor Replication Difficulty:Hard

- Advantage:

Closed-Loop Network Data

Sustainability Assessment:Highly sustainable, as it provides unique, proprietary data on both cardholder spending and merchant activity, enabling superior analytics and targeted offers.

Competitor Replication Difficulty:Hard

- Advantage:

Membership Rewards Ecosystem

Sustainability Assessment:Sustainable, but requires continuous investment to remain competitive against programs like Chase Ultimate Rewards.

Competitor Replication Difficulty:Medium

- Advantage:

Focus on Experiences and Services

Sustainability Assessment:Highly sustainable, as it shifts competition from price (interest rates, fees) to value-added benefits (lounge access, concierge, exclusive events).

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'Exclusive partnerships for specific events or benefits (e.g., music festival access).', 'estimated_duration': '1-3 years, depending on contract terms.'}

{'advantage': 'Highest sign-up bonuses in the market for specific cards.', 'estimated_duration': '3-9 months, as competitors tend to match lucrative offers.'}

Disadvantages

- Disadvantage:

Lower Merchant Acceptance vs. Visa/Mastercard

Impact:Major

Addressability:Difficult

- Disadvantage:

Higher Merchant Discount Rates

Impact:Major

Addressability:Difficult

- Disadvantage:

Perception of High Annual Fees

Impact:Minor

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted digital campaigns showcasing acceptance at everyday merchants (e.g., grocery, online retailers) to combat the 'not accepted everywhere' perception.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Simplify the value proposition of card benefits on the website and app, using personalized data to highlight the most relevant perks for each user.

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Expand 'Plan It' feature (Amex's BNPL equivalent) and integrate it more seamlessly at online checkout with partner merchants to directly compete with Affirm/Klarna.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Deepen partnerships with tech companies (e.g., Uber, Airbnb) to embed Amex benefits and payments, making the card essential to modern digital lifestyles.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Develop more card products targeting the 'mass affluent' and younger professional segments who aspire to a premium lifestyle but may be sensitive to the highest annual fees.

Expected Impact:High

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Leverage closed-loop data to build a B2B data analytics platform for small business customers, providing them insights that Visa/Mastercard issuers cannot.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Invest in or acquire fintechs that specialize in payment infrastructure or cross-border payments to modernize the network and lower transaction costs, enabling more competitive merchant fees.

Expected Impact:High

Implementation Difficulty:Difficult

Solidify the position as the premier 'integrated lifestyle brand' for the modern affluent consumer, moving beyond a 'credit card company' to an essential partner for travel, dining, entertainment, and business.

Double-down on the closed-loop data advantage to offer unparalleled personalization, curated experiences, and value-added services that are impossible for open-loop networks to replicate. The key is to make the annual fee an obvious value by providing services and access that far exceed its cost.

Whitespace Opportunities

- Opportunity:

Hyper-personalized Financial Wellness Tools for the Affluent

Competitive Gap:Competitors offer generic financial planning tools. Amex could use its detailed spending data to offer highly specific, automated insights and advice for its high-spending customer base.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Integrated Business & Personal Card Management Platform

Competitive Gap:Small business owners often struggle to separate and manage personal vs. business expenses. Amex is uniquely positioned with strong offerings in both areas to create a single, seamless digital platform for entrepreneurs.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Subscription-based 'Experience Tiers'

Competitive Gap:Card benefits are currently tied to specific cards. Amex could offer modular, subscription-based access to its ecosystem of perks (lounges, dining credits, concierge) allowing customers to customize their membership level.

Feasibility:Low

Potential Impact:High

- Opportunity:

Expanding into emerging international markets with a growing affluent class.

Competitive Gap:While Visa and Mastercard have broad presence, the premium segment in many developing nations is underserved. Amex's brand prestige is a major advantage here.

Feasibility:Medium

Potential Impact:High

American Express operates within the mature and highly concentrated financial services industry, which functions as an oligopoly dominated by a few key players. Its primary competitive advantage is its unique, closed-loop business model, which integrates both card issuance and network processing. This provides Amex with a wealth of proprietary data on its affluent cardmember base and merchant partners, a significant differentiator from open-loop competitors like Visa and Mastercard who rely on partner banks to issue cards.

Direct competitors like JPMorgan Chase and Capital One are aggressively competing in the premium rewards space, leveraging large existing customer bases and sophisticated data analytics. Meanwhile, network giants Visa and Mastercard command near-universal merchant acceptance, which remains Amex's most significant weakness.

The most potent threats, however, are emerging from indirect, tech-focused competitors. The rise of Buy Now, Pay Later (BNPL) services like Affirm and Klarna directly targets the point-of-sale credit model, particularly with younger consumers who are more debt-averse and digitally native. Similarly, the deep ecosystem integration of Apple Pay and the Apple Card creates a frictionless payment experience that challenges the top-of-wallet position for all physical cards.

Amex's strategic response has been to double down on its premium, lifestyle-focused brand positioning. The company is successfully attracting younger, affluent customers (Millennials and Gen Z) by curating a valuable ecosystem of benefits centered on travel, dining, and exclusive experiences, effectively shifting the value proposition from a payment tool to a 'membership' that provides access and status. This strategy is sustainable as these benefits are difficult and costly for competitors to replicate at the same scale and quality.

Key opportunities for American Express lie in leveraging its unique data advantage more effectively. This includes creating more sophisticated B2B services for its small business clients, offering hyper-personalized financial wellness tools, and better integrating its personal and business product suites. To mitigate the threat from fintechs, Amex must continue to innovate its own digital offerings, such as its 'Plan It' feature, and form strategic partnerships to ensure its services are embedded in the emerging digital ecosystems where its customers spend their time. Addressing the persistent merchant acceptance gap remains a long-term challenge, but focusing on becoming an indispensable lifestyle partner for its target demographic provides a defensible moat against both traditional and emerging competition.

Messaging

Message Architecture

Key Messages

- Message:

Apply with Confidence. See if you’re approved for a Card without any credit score impact.

Prominence:Primary

Clarity Score:High

Location:Homepage, above the fold

- Message:

Your Dream Vacation Awaits. Travel where you want, when you want with an American Express® Personal Loan.

Prominence:Primary

Clarity Score:High

Location:Homepage, Hero Carousel

- Message:

Shop Small® and Support Your Local Community.

Prominence:Primary

Clarity Score:High

Location:Homepage, Hero Carousel

- Message:

Get More When You Get Away.

Prominence:Secondary

Clarity Score:Medium

Location:Homepage, 'More to Explore' section

- Message:

Build Good Credit Habits with American Express® MyCredit Guide.

Prominence:Secondary

Clarity Score:High

Location:Homepage, 'More to Explore' section

The message hierarchy is effective and logically structured. The primary message, 'Apply with Confidence,' directly addresses a major customer pain point (fear of rejection and credit score impact), making it a powerful customer acquisition tool. The rotating hero carousel messages effectively showcase the two core pillars of the Amex value proposition: aspirational lifestyle (travel) and community connection (Shop Small). Secondary messages in 'More to Explore' logically tier down into specific benefits and tools, guiding users to deeper engagement.

Messaging is highly consistent across the homepage. The themes of empowerment ('Apply with Confidence'), aspiration ('Dream Vacation'), and exclusive experiences ('Enjoy more at the events you love') are woven throughout, reinforcing the premium lifestyle brand identity. The clear segmentation between 'Personal' and 'Business' at the very top ensures that subsequent messaging is appropriately framed for the selected audience from the outset.

Brand Voice

Voice Attributes

- Attribute:

Aspirational

Strength:Strong

Examples

- •

Your Dream Vacation Awaits

- •

Get More When You Get Away

- •

Enjoy more at the events you love

- Attribute:

Empowering

Strength:Strong

Examples

- •

Apply with Confidence

- •

Travel where you want, when you want

- •

Build Good Credit Habits

- Attribute:

Community-Oriented

Strength:Moderate

Examples

Shop Small® and Support Your Local Community.

Soak up the summer sun and Shop Small® - uncover local gems in your community.

- Attribute:

Reassuring

Strength:Strong

Examples

See if you’re approved for a Card without any credit score impact.

Customer Service. Browse the Help Center for answers to your most frequently asked questions.

Tone Analysis

Sophisticated & Encouraging

Secondary Tones

Inspirational

Helpful

Tone Shifts

The tone shifts from aspirational ('Dream Vacation') in the hero section to more practical and educational ('FICO® Score and Insights') further down the page, which is an appropriate and effective transition for guiding the user journey.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

American Express provides access to a premium lifestyle of travel, experiences, and community engagement, backed by trust, security, and tools that empower financial confidence.

Value Proposition Components

- Component:

Risk-Free Application

Clarity:Clear

Uniqueness:Somewhat Unique

Details:The 'Apply with Confidence' feature is a significant differentiator that lowers the barrier to entry by removing a key anxiety for potential customers.

- Component:

Lifestyle Enablement (Travel & Experiences)

Clarity:Clear

Uniqueness:Unique

Details:Amex excels at positioning its products not as mere financial tools, but as keys to unlocking exclusive experiences, a core part of its brand equity. Messages like 'Enjoy more at the events you love' reinforce this.

- Component:

Community Support (Shop Small)

Clarity:Clear

Uniqueness:Unique

Details:The 'Shop Small' initiative is a powerful, long-standing brand asset that differentiates Amex by associating it with local community support, adding an emotional and altruistic dimension to the brand.

- Component:

Financial Wellness Tools

Clarity:Clear

Uniqueness:Common

Details:Offering free credit scores and guides is a common feature among financial service providers, but Amex frames it as 'building good habits,' aligning with its empowering voice.

American Express successfully differentiates itself by focusing on the 'why' behind the card, not just the 'what'. While competitors may focus on points and cashback percentages, Amex builds a narrative around experiences, status, and community. The 'Apply with Confidence' feature is a brilliant tactical differentiator in the acquisition funnel, while 'Shop Small' and 'Amex Experiences' are powerful strategic differentiators that build long-term brand affinity and justify the premium positioning.

The messaging positions American Express as a premium lifestyle brand, a tier above competitors like Chase and Capital One who, while also offering premium cards, often lead with more functional benefits. Amex sells an identity and access to a curated world, positioning itself as an essential partner for achieving one's aspirations, which aligns with its stated mission.

Audience Messaging

Target Personas

- Persona:

The Aspiring Professional

Tailored Messages

Apply with Confidence

Build Good Credit Habits with American Express® MyCredit Guide

Effectiveness:Effective

Details:This persona is younger, building their career and credit. The messaging directly addresses their primary concerns: fear of application rejection and the desire for financial stability and upward mobility.

- Persona:

The Affluent Experience Seeker

Tailored Messages

- •

Your Dream Vacation Awaits

- •

Get More When You Get Away

- •

Enjoy more at the events you love

Effectiveness:Effective

Details:This persona values experiences over things and seeks status and exclusivity. The messaging speaks directly to their desires for luxury travel and unique entertainment access, reinforcing the brand's premium value.

- Persona:

The Community-Minded Consumer

Tailored Messages

Shop Small® and Support Your Local Community.

Effectiveness:Somewhat Effective

Details:While the 'Shop Small' message is strong, it could be more deeply integrated across the homepage to more fully capture this persona, who makes purchasing decisions based on brand values.

Audience Pain Points Addressed

- •

Fear of a credit score drop from a card application.

- •

Uncertainty about which financial products are suitable.

- •

The complexity of managing personal finances and credit.

- •

Missing out on unique life experiences due to financial constraints.

Audience Aspirations Addressed

- •

Traveling the world and experiencing new cultures.

- •

Supporting local businesses and feeling connected to the community.

- •

Gaining access to exclusive events and entertainment.

- •

Achieving financial confidence and stability.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Aspiration/Ambition

Effectiveness:High

Examples

Your Dream Vacation Awaits

Get More When You Get Away

- Appeal Type:

Security/Peace of Mind

Effectiveness:High

Examples

Apply with Confidence

See if you’re approved for a Card without any credit score impact.

- Appeal Type:

Belonging/Community

Effectiveness:Medium

Examples

Shop Small® and Support Your Local Community.

Social Proof Elements

- Proof Type:

Brand Authority

Impact:Strong

Details:The American Express brand name itself is a powerful form of social proof, built over decades of marketing and service. The ubiquitous logo and phrases like 'Amex Experiences' leverage this authority.

Trust Indicators

- •

The established and globally recognized American Express brand.

- •

Clear links to Customer Service and FAQs.

- •

Providing educational tools like the 'MyCredit Guide'.

- •

Explicitly stating the (lack of) impact on credit scores for pre-approval.

Scarcity Urgency Tactics

None observed on the homepage. The absence of these tactics is a strategic choice that aligns with the premium, confident, and non-pressuring brand voice.

Calls To Action

Primary Ctas

- Text:

Explore Cards

Location:Homepage, above the fold

Clarity:Clear

- Text:

Explore Loans

Location:Homepage, Hero Carousel

Clarity:Clear

- Text:

Shop Small Near Me

Location:Homepage, Hero Carousel

Clarity:Clear

- Text:

Enroll Now

Location:Homepage, 'More to Explore' section (for MyCredit Guide)

Clarity:Clear

The CTAs are highly effective. They use invitational, low-pressure language like 'Explore' which encourages discovery without demanding commitment. The verbs are clear and action-oriented, leaving no ambiguity about the user's next step. The placement of the primary CTA ('Explore Cards') directly follows the main value proposition ('Apply with Confidence'), creating a seamless and logical user flow towards conversion.

Messaging Gaps Analysis

Critical Gaps

Lack of immediate social proof on the homepage, such as customer testimonials or awards, which could bolster trust for new visitors.

The value proposition for specific card tiers (e.g., Gold, Platinum) is not teased on the homepage, potentially missing an opportunity to direct high-intent users more quickly.

Contradiction Points

There are no significant contradictions in the messaging. The communication is highly aligned and consistent.

Underdeveloped Areas

Storytelling could be more immersive. While the messages provide 'story-starters' ('Your Dream Vacation...'), incorporating brief, powerful narratives of actual member experiences could create a stronger emotional connection.

The connection between different product offerings (e.g., how a Personal Loan can complement a credit card for a large trip) is not explicitly made, representing a missed cross-selling opportunity.

Messaging Quality

Strengths

- •

Exceptional clarity on the primary value proposition of applying without risk.

- •

Strong, consistent brand voice that balances aspiration with reassurance.

- •

Effective segmentation between Personal and Business audiences.

- •

Powerful use of emotional appeals that connect with core human desires for security, status, and community.

- •

Clean, logical message hierarchy that guides users naturally from broad concepts to specific actions.

Weaknesses

- •

Over-reliance on brand authority as the primary trust signal on the homepage.

- •

The rotating hero carousel can dilute the focus, with some users potentially missing key messages.

- •

The benefits of the broader banking ecosystem (Savings, Checking) are presented as a list rather than an integrated financial solution.

Opportunities

- •

Integrate dynamic personalization to surface the most relevant hero message (e.g., travel for a user who has browsed travel sites, Shop Small for a user in a dense urban area).

- •

Feature member stories or user-generated content to add authenticity and powerful social proof.

- •

Create a more cohesive narrative around the full suite of Amex financial products, positioning them as a holistic toolkit for achieving life aspirations.

Optimization Roadmap

Priority Improvements

- Area:

Value Proposition

Recommendation:A/B test a sub-headline under 'Apply with Confidence' that highlights a key card benefit family, such as 'Unlock world-class travel rewards' or 'Experience exclusive entertainment.'

Expected Impact:Medium

Rationale:This could help pre-qualify user intent and direct them more efficiently, potentially increasing conversion rates for specific card products.

- Area:

Social Proof

Recommendation:Incorporate a subtle, well-designed module on the homepage featuring a powerful, one-sentence customer testimonial or a prestigious award logo (e.g., 'J.D. Power #1 in Customer Satisfaction').

Expected Impact:High

Rationale:This would add a layer of third-party validation to the brand's claims, increasing trust and reducing friction for new customers.

- Area:

Audience Messaging

Recommendation:Develop a more prominent narrative around the business offerings on the business version of the homepage, moving beyond a simple product list to tell a story about how Amex helps businesses thrive.

Expected Impact:Medium

Rationale:This will better engage the distinct needs and aspirations of the business segment, improving lead quality and conversion.

Quick Wins

Test different CTA button copy, for example, 'See Your Card Options' instead of 'Explore Cards' to create a more personalized feel.

Add a short, benefit-oriented descriptor under each product in the top navigation menu (e.g., Credit Cards - 'Earn rewards on every purchase').

Long Term Recommendations

- •

Invest in a personalization engine to tailor homepage content based on user data (e.g., browsing history, geolocation, or existing customer status).

- •

Develop a richer content strategy around member stories, creating video and written content that showcases the aspirational lifestyle Amex enables, moving from 'telling' to 'showing'.

- •

Build clearer messaging bridges between Amex's credit card, banking, and loan products to promote ecosystem adoption and increase customer lifetime value.

American Express's website messaging is a masterclass in strategic brand communication. It successfully balances two critical business objectives: reducing friction in the customer acquisition funnel and reinforcing the long-term, premium brand identity. The primary message, 'Apply with Confidence,' is a powerful, data-driven insight translated into clear, reassuring copy that directly addresses a key barrier to conversion and positively impacts customer acquisition economics.

Simultaneously, the messaging architecture reinforces the brand's core differentiators: lifestyle enablement, exclusive experiences, and community focus. Unlike competitors who may compete on fees or reward percentages, Amex competes on identity. The brand voice—aspirational, empowering, and sophisticated—is impeccably consistent and supports its premium market positioning. The strategy is not just to sell a financial product, but to sell entry into a curated lifestyle, thereby justifying its premium price point and fostering deep brand loyalty. While there are opportunities to enhance trust through more explicit social proof and to build a more integrated narrative around its full product suite, the current messaging is highly effective, disciplined, and strategically aligned with its business goals of attracting and retaining high-value customers.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Record annual revenues of $66 billion in 2024, with record net income over $10 billion.

- •

Premium, spend-centric business model with a loyal, high-spending cardmember base.

- •

Strong brand recognition and reputation for premium services, including travel and experiences.

- •

Closed-loop network provides rich data for targeted offerings and risk management.

- •

Millennial and Gen Z consumers were the fastest-growing cohort, accounting for over 60% of new consumer account acquisitions in 2023.

Improvement Areas

- •

Continue expanding merchant acceptance globally to reduce friction for cardmembers, a known historical weakness.

- •

Deepen value propositions for younger, financially savvy demographics who value transparent benefits over brand prestige alone.

- •

Further integrate digital banking services (checking, savings, lending) to create a more comprehensive financial ecosystem for both consumers and SMBs.

Market Dynamics

Projected revenue growth of 8-10% for American Express in 2025. The broader consumer finance industry is growing at 8.4% annually.

Mature

Market Trends

- Trend:

Rise of Digital Wallets and Real-Time Payments

Business Impact:Requires Amex to ensure seamless integration and top-of-wallet status within major digital wallets and payment platforms. Younger consumers are drawn to instant, low-friction payments.

- Trend:

Growth of Buy Now, Pay Later (BNPL)

Business Impact:BNPL is a significant competitor for point-of-sale financing, especially among younger demographics who may be credit-averse. This has prompted Amex to introduce its own installment features like 'Plan It'.

- Trend:

Focus on Younger Demographics (Millennials & Gen Z)

Business Impact:Younger generations are the primary growth driver for new accounts. This necessitates a shift in marketing and product value propositions towards experiences, digital engagement, and transparent value exchange.

- Trend:

Fintech Competition and Innovation

Business Impact:Nimble fintechs are creating intense competition in niche areas like SMB lending, expense management, and digital banking, forcing Amex to accelerate its own digital transformation and acquisition strategy (e.g., Kabbage).

- Trend:

Increased Regulatory Scrutiny

Business Impact:The global financial services industry faces complex and fragmented regulations regarding data privacy, AI, and consumer protection, increasing compliance costs and operational risks.

Favorable. While the core credit card market is mature, the shift to digital payments, the growth in premium travel and experiences, and the demand for integrated SMB financial solutions present significant growth opportunities for a well-positioned incumbent like American Express.

Business Model Scalability

High

The closed-loop network model has high fixed costs (technology, network infrastructure) but highly scalable variable costs, leading to margin expansion as network volume grows.

High. Each incremental dollar of spend on the network generates significant revenue (discount fees, interest income) with relatively low marginal cost.

Scalability Constraints

- •

Navigating complex, country-specific regulatory landscapes for international expansion.

- •

Scaling premium, high-touch customer service to a broader and more diverse customer base.

- •

The need for significant ongoing marketing investment to acquire new customers in a highly competitive market.

Team Readiness

Strong and experienced executive team with a clear long-term growth strategy focused on premium consumers, SMBs, and younger demographics.

A mature, global corporate structure organized by customer segment (Consumer, Commercial) and function (Merchant & Network). The key challenge is fostering agility to compete with smaller fintech rivals.

Key Capability Gaps

- •

Talent for rapid, agile software development and AI/ML product innovation to match the pace of fintech competitors.

- •

Deep expertise in new international markets with unique cultural and regulatory environments.

- •

Specialized product managers for Gen Z-focused financial products that go beyond traditional credit.

Growth Engine

Acquisition Channels

- Channel:

Digital Marketing (SEO, SEM, Affiliates)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Further personalize digital ad targeting using Amex's rich transaction data to improve conversion rates and CAC efficiency for specific card products and demographics.

- Channel:

Strategic Partnerships (e.g., Delta, Hilton)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Expand co-brand partnerships into new lifestyle categories popular with Millennials and Gen Z, such as wellness, gaming, or sustainable brands.

- Channel:

Referral Programs

Effectiveness:High

Optimization Potential:High

Recommendation:Gamify the referral program with tiered rewards and social sharing features to increase viral adoption among digitally-native younger customers.

- Channel:

Corporate & SMB Sales

Effectiveness:High

Optimization Potential:Medium

Recommendation:Bundle Kabbage-powered digital banking and lending solutions with business card offerings to create a more compelling, all-in-one financial toolkit for SMBs.

Customer Journey

The online application process is streamlined, with features like 'Apply with Confidence' reducing friction by providing pre-approval without impacting credit scores.

Friction Points

- •

High annual fees on premium cards can be a barrier for initial adoption, especially for younger customers.

- •

Perception of limited merchant acceptance, although this is actively being addressed and improved.

- •

Complex reward structures and benefit terms can be overwhelming for new customers to fully understand and utilize.

Journey Enhancement Priorities

{'area': 'Onboarding & First 90 Days', 'recommendation': 'Develop a personalized, interactive digital onboarding experience that guides new cardmembers through setting up key benefits and demonstrates the value proposition to drive early engagement.'}

{'area': 'Benefit Utilization', 'recommendation': "Use app push notifications and email triggers to proactively suggest relevant Amex Offers and benefits based on a cardmember's real-time spending patterns and location."}

Retention Mechanisms

- Mechanism:

Membership Rewards Program

Effectiveness:High

Improvement Opportunity:Increase the flexibility of points redemption, potentially by partnering with more fintech platforms or allowing points to be used for a wider range of everyday purchases.

- Mechanism:

Premium Service & Experiences (Lounges, Concierge, Events)

Effectiveness:High

Improvement Opportunity:Curate more exclusive experiences targeted at Millennial/Gen Z interests, such as gaming tournaments, creator events, or sustainable travel adventures.

- Mechanism:

High-Touch Customer Service

Effectiveness:High

Improvement Opportunity:Integrate AI-powered chat and self-service tools more effectively to handle common inquiries, freeing up human agents to focus on high-value, complex customer issues.

- Mechanism:

Ecosystem Lock-in (Multiple Amex Products)

Effectiveness:Medium

Improvement Opportunity:Create stronger incentives and product integrations for customers who hold multiple Amex products (e.g., Card, Savings, Checking), such as preferential rates or bonus rewards.

Revenue Economics

Excellent. The business model combines high-margin revenue streams: discount revenue from merchants, high annual card fees from premium customers, and net interest income from lending.

Assumed to be very high. While exact figures are proprietary, high customer retention, significant annual fees, and high lifetime spending of the target demographic point to a strong ratio.

High. Consistent revenue growth (9% in 2024) and strong net income demonstrate efficient conversion of investment into revenue.

Optimization Recommendations

- •

Drive higher spending per cardmember ('share of wallet') through personalized Amex Offers and integrated payment solutions.

- •

Increase adoption of fee-based premium cards, particularly among the growing Millennial and Gen Z customer base.

- •

Cross-sell new financial products like business checking and personal loans to the existing cardmember base to increase revenue per customer.

Scale Barriers

Technical Limitations

- Limitation:

Legacy Technology Infrastructure

Impact:Medium

Solution Approach:Continue investing in modernizing the tech stack to enable faster product development, API integrations with fintech partners, and more sophisticated use of AI for personalization and risk management.

Operational Bottlenecks

- Bottleneck:

Global Regulatory Compliance

Growth Impact:Creates significant overhead and can slow down the launch of new products and expansion into new markets.

Resolution Strategy:Leverage RegTech (Regulatory Technology) to automate compliance monitoring and reporting. Build strong, localized legal and compliance teams in key growth markets.

Market Penetration Challenges

- Challenge:

Intense Competition for Premium Customers

Severity:Critical

Mitigation Strategy:Double down on differentiated value propositions that competitors cannot easily replicate: exclusive experiences, superior customer service, and a powerful aspirational brand image.

- Challenge:

Merchant Acceptance Gap vs. Visa/Mastercard

Severity:Major

Mitigation Strategy:Continue strategic partnerships with payment processors (e.g., Worldpay, KPay) and direct outreach to expand the merchant network, especially among small businesses and in international markets.

- Challenge:

Attracting Debt-Averse Gen Z

Severity:Major

Mitigation Strategy:Emphasize charge card products (pay-in-full), BNPL features like 'Plan It', and financial wellness tools (MyCredit Guide). Frame products around lifestyle enablement rather than just credit.

Resource Limitations

Talent Gaps

- •

Data Scientists and AI/ML Engineers

- •

User Experience (UX) Designers for Mobile-First Products

- •

Growth Marketers with experience in social commerce and influencer channels

Low. The company is highly profitable and generates strong cash flow, sufficient to fund its growth initiatives and investments.

Infrastructure Needs

Continued investment in cloud computing infrastructure to enhance data processing capabilities and platform scalability.

Expansion of the physical lounge network (e.g., Centurion Lounges) in key international travel hubs to support premium cardmember growth.

Growth Opportunities

Market Expansion

- Expansion Vector:

Deeper Penetration in International Markets

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Focus on key travel corridors and affluent urban centers. Utilize the Global Network Services (GNS) model, partnering with local banks to issue cards and acquire merchants, tailoring value propositions to local preferences.

- Expansion Vector:

Targeting High-Potential Sub-Segments of Gen Z/Millennials

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Develop specific value propositions for sub-segments like digital nomads, creators/influencers, and young entrepreneurs, focusing on benefits that support their specific lifestyles and business needs.

Product Opportunities

- Opportunity:

Integrated SMB Financial Suite

Market Demand Evidence:Strong demand from SMBs for a single platform to manage payments, cash flow, and access to capital.

Strategic Fit:High. Leverages the acquisition of Kabbage and existing strength in the commercial card space.

Development Recommendation:Further integrate Kabbage's lending and checking products into a unified 'Amex Business Blueprint' digital dashboard, providing real-time cash flow insights and seamless access to working capital.

- Opportunity:

Enhanced Digital Banking Services

Market Demand Evidence:Growing consumer preference for digital-first banking and high-yield savings products.

Strategic Fit:High. Complements existing card and loan products, increasing customer stickiness.

Development Recommendation:Expand the features of the Amex Personal Financial Services suite (Savings, Checking) to include budgeting tools, automated savings, and seamless integration with the Membership Rewards ecosystem.

- Opportunity:

BNPL 2.0 / Flexible Payment Features

Market Demand Evidence:Rapid global adoption of BNPL, especially for online retail.

Strategic Fit:Medium. Competes with core lending but is necessary to capture younger consumer behavior.

Development Recommendation:Evolve the 'Plan It' feature into a more proactive, integrated tool that offers installment plans at the point of sale, both online and in-store, potentially through strategic partnerships with e-commerce platforms.

Channel Diversification

- Channel:

Social Commerce & Influencer Marketing

Fit Assessment:High

Implementation Strategy:Partner with travel, food, and lifestyle influencers to showcase Amex experiences and benefits authentically. Develop integrated shopping features within platforms like Instagram and TikTok that allow for seamless Amex checkout.

- Channel:

Embedded Finance

Fit Assessment:High

Implementation Strategy:Develop APIs that allow third-party platforms (e.g., large B2B software, travel booking sites) to embed Amex payment and financing options directly into their user workflows, acquiring customers at their point of need.

Strategic Partnerships

- Partnership Type:

Fintech Integration

Potential Partners

- •

Leading expense management platforms (e.g., Brex, Ramp)

- •

Personal finance management (PFM) apps

- •

B2B payment automation providers

Expected Benefits:Accelerate product innovation, reach new customer segments, and enhance the value proposition of core products.

- Partnership Type:

Lifestyle Brand Collaborations

Potential Partners

- •

High-end wellness brands

- •

Luxury subscription services

- •

Major esports leagues and gaming platforms

Expected Benefits:Increase brand relevance and appeal to younger demographics by aligning with their passions and values.

Growth Strategy

North Star Metric

Billed Business (Total Network Volume)

This metric is the most comprehensive indicator of growth. It reflects the health of the entire ecosystem: the number of active cardmembers, their level of spending, and the breadth of merchant acceptance. It directly drives the two primary revenue streams (discount revenue and interest income).

Sustain 8-10% annual growth, in line with company guidance, with a focus on accelerating international and SMB segment growth.

Growth Model

Hybrid: Brand, Partnership, and Product-Led Growth

Key Drivers

- •

Aspirational Brand Marketing: Creating demand through association with premium lifestyles, travel, and experiences.

- •

High-Value Partnerships: Acquiring customers through co-branded cards (e.g., airlines, hotels) and merchant acceptance networks.

- •

Product-Led Engagement: Using features within the digital experience (Amex Offers, Plan It, Rewards redemption) to drive spending and retention.

Continue to invest heavily in brand marketing while simultaneously deepening digital product capabilities. Empower product teams to drive engagement and monetization loops within the Amex app. Systematically pursue and scale strategic partnerships.

Prioritized Initiatives

- Initiative:

Launch 'Amex for Creators' Product Suite

Expected Impact:High

Implementation Effort:Medium

Timeframe:9-12 months

First Steps:Conduct market research with high-earning creators to identify key financial pain points. Develop a bundled card and cash management offering with custom benefits (e.g., ad spend rewards, faster payouts).

- Initiative:

Fully Integrated 'Business Blueprint' Platform Launch for SMBs

Expected Impact:High

Implementation Effort:High

Timeframe:12-18 months

First Steps:Create a unified technology roadmap for integrating Kabbage services with existing Amex commercial platforms. Launch a beta program with a select group of SMB customers to refine the user experience.

- Initiative:

Global Merchant Acceptance 'Parity' Campaign

Expected Impact:Medium

Implementation Effort:High

Timeframe:Ongoing (24 months for key markets)

First Steps:Identify the top 10 international markets with the largest acceptance gaps. Aggressively pursue partnerships with the top 3 payment acquirers in each of those markets.

Experimentation Plan

High Leverage Tests

- Area:

Acquisition

Experiment:A/B test different welcome bonus structures (e.g., points vs. statement credits vs. experience vouchers) for different demographic segments.

- Area:

Engagement

Experiment:Test the impact of AI-driven, personalized 'Amex Offers' on cardmember spending frequency and 'share of wallet'.

- Area:

Retention

Experiment:Experiment with proactive, targeted retention offers (e.g., bonus points, fee waivers) for cardmembers identified by predictive churn models.

Utilize a centralized data platform to track key metrics for each experiment, including conversion rates, cost per acquisition, customer engagement scores, incremental spend, and retention rates.

Run a continuous cycle of experiments within dedicated growth pods, with a bi-weekly review of results and iteration planning.

Growth Team

A hybrid model: A central growth leadership team that sets strategy and provides resources, with decentralized 'growth pods' embedded within key business units (e.g., Consumer Platinum, SMB Cards, International) to drive execution.

Key Roles

- •

Head of Growth

- •

Product Manager, Growth

- •

Data Scientist / Growth Analyst

- •

Growth Marketing Manager

- •

Software Engineer, Growth

Establish a 'Growth University' internal training program to build experimentation skills across the organization. Actively recruit talent from high-growth tech and fintech companies to inject new perspectives and skills.

American Express exhibits a very strong growth foundation, underpinned by exceptional product-market fit in the premium consumer and SMB segments, a highly scalable closed-loop business model, and a powerful global brand. The company's financial performance is robust, with consistent revenue growth and record profits.

The primary growth engine is firing on multiple cylinders. Amex is successfully acquiring new customers, particularly from the crucial Millennial and Gen Z demographics who are now their fastest-growing cohort. Retention is world-class, driven by the unparalleled Membership Rewards program and a focus on premium experiences. The company is effectively transitioning from being just a credit card provider to a broader financial services partner, especially evident in its strategic push into SMB banking with the Kabbage acquisition.

However, significant scale barriers persist. The competitive landscape is intense, with fintechs innovating rapidly and major banks vying for the same premium customers. The historical challenge of narrower merchant acceptance compared to Visa and Mastercard remains a point of friction, though Amex is making substantial progress in closing this gap. Perhaps the most critical long-term challenge is adapting its premium value proposition to be continuously relevant to younger, financially-savvy, and digitally-native generations who are courted by a myriad of 'free' fintech alternatives and BNPL options.

Numerous high-impact growth opportunities are available. The most promising vectors include:

1. Deepening the SMB Ecosystem: Evolving from a card provider to the primary digital financial hub for SMBs by fully integrating Kabbage's checking and lending capabilities.

2. Winning the Next Generation: Aggressively tailoring products and marketing to the specific lifestyles and financial needs of Gen Z and Millennials, focusing on digital experiences, flexible payments, and aspirational value.

3. International Expansion: Systematically expanding merchant acceptance and card issuance in high-growth international markets.

Recommendation: The recommended growth strategy is to define the North Star Metric as 'Billed Business' and execute through a hybrid growth model. The top strategic priority should be the creation of a fully integrated SMB financial suite, as this leverages a core strength and addresses a massive, underserved market. This should be closely followed by a dedicated initiative to develop and market products specifically for high-potential sub-segments of the Millennial and Gen Z population. By doubling down on these areas, American Express can build upon its formidable foundation to secure another generation of loyal, high-value customers and entrench itself as an indispensable partner for small businesses, ensuring sustainable long-term growth.

Legal Compliance