eScore

ameriprise.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Ameriprise demonstrates strong content authority due to its long-established brand and high domain authority. Its digital presence is expertly optimized for local reach, effectively funneling users to its vast network of financial advisors. However, the website's content strategy is heavily weighted towards bottom-of-the-funnel, decision-stage prospects, missing a significant opportunity to engage users earlier in their journey with educational content, a weakness that tech-forward competitors exploit.

The 'Find an Advisor' tool is a powerful, high-conversion feature that effectively leverages the company's core strength of a nationwide advisor network, dominating local search intent.

Develop a comprehensive top-of-funnel content hub ('Financial Milestones,' 'Market Insights') to capture organic traffic from educational searches, building a pipeline of future clients.

The brand's messaging is exceptionally consistent, effectively communicating trust, stability, and professionalism across all digital assets. It successfully segments its audience, with clear messaging for those seeking a new advisor versus those starting their financial planning journey. The primary weakness is the gap between *claiming* a 'fresh perspective' and *demonstrating* it with tangible thought leadership or unique client success stories, making the key differentiator feel abstract.

Leveraging its 130-year history and third-party awards as social proof creates a powerful and convincing narrative of stability and trustworthiness.

Incorporate client-centric stories or case studies that bring the value proposition to life, shifting the focus from the firm's credentials to tangible client outcomes.

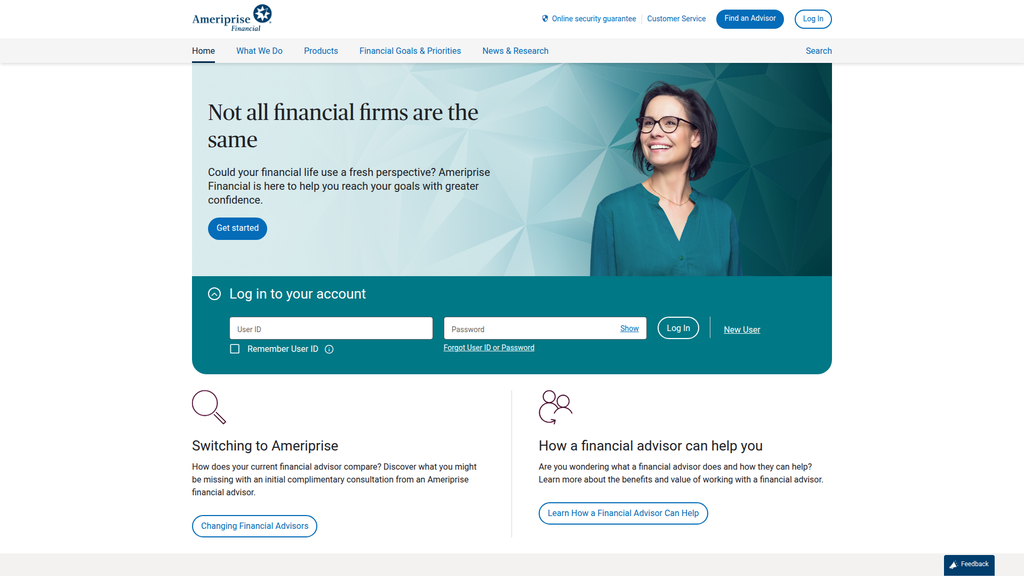

The website provides a solid, responsive cross-device experience, catering to both desktop and mobile users. It clearly prioritizes the journey for existing clients with a prominent login area. However, the conversion path for new prospects suffers from several friction points, including inconsistent call-to-action designs (e.g., low-contrast 'ghost buttons') and high content density on key pages, which increases cognitive load and potentially suppresses lead generation.

The prominent and functional client login portal effectively serves the primary need of the large existing customer base, supporting retention.

Establish a clear visual hierarchy for calls-to-action. Primary CTAs like 'Find an Advisor' should be solid, high-contrast buttons to guide new users and measurably improve conversion rates.

Ameriprise excels in establishing credibility through a robust display of trust signals, including its long history, extensive regulatory disclosures (FINRA, SIPC), and prominent third-party validation from industry awards. Their legal and compliance framework is exceptionally strong, demonstrating meticulous attention to SEC and FINRA rules, which builds significant trust. While customer success is implied through high satisfaction ratings, the site lacks specific case studies or ROI proof points that would further solidify its claims.

Excellent and prominent adherence to FINRA and SEC disclosure requirements, including clear links to FINRA's BrokerCheck, provides best-in-class transparency and builds immense trust.

Develop and feature anonymized client case studies or vignettes that provide concrete evidence of successful outcomes, moving beyond satisfaction scores to demonstrate tangible ROI.

The company's competitive moat is deep and sustainable, built upon two hard-to-replicate pillars: a 130-year-old brand synonymous with trust and a massive distribution network of over 10,000 advisors. These create high switching costs for clients due to strong personal relationships. The primary weakness is a lag in technological innovation compared to digitally native competitors, which could erode its advantage with the next generation of investors.

The vast, nationwide network of financial advisors serves as a powerful and defensible distribution channel that is extremely difficult and expensive for competitors to replicate.

Accelerate the integration of client-facing technology and AI-powered advisor tools to augment the human-led model, framing technology as an enhancement rather than a replacement.

Ameriprise has healthy unit economics, with a high client lifetime value justifying its high-touch acquisition model. The business generates strong free cash flow and has proven its ability to grow assets consistently. However, the core business model, which is fundamentally tied to recruiting and managing human advisors, has inherent scalability constraints compared to technology-driven platforms, limiting the pace of exponential growth.

A highly profitable and predictable recurring revenue model based on assets under management provides exceptional financial stability and funds strategic growth initiatives.

Develop and launch a hybrid, technology-led advisory service to capture the mass-affluent and emerging-affluent segments, creating a more scalable growth engine for future expansion.

Ameriprise operates a highly coherent and resilient business model, with diversified revenue streams across wealth management, asset management, and insurance that reduce volatility. Strategic focus is clear, centered on delivering comprehensive, advisor-led financial planning to affluent retirees. The model is exceptionally well-aligned with its target market's preference for trust and personal relationships, though it is currently adapting to capture the digitally-inclined next generation.

Diversified revenue streams from Advice & Wealth Management, Asset Management, and Retirement & Protection Solutions create a resilient and robust financial model that can withstand market cycles.

Innovate at the edges of the core model by expanding banking services and creating a platform for alternative investments to increase share-of-wallet with existing clients.

As a top wealth manager with over $1.5 trillion in assets, Ameriprise is a major market player with significant influence. Its strong brand and advisor relationships grant it considerable pricing power relative to low-cost alternatives. The firm's key vulnerability is the intense competition for both clients and top advisor talent from tech-forward giants like Schwab and Fidelity and other large incumbents like Morgan Stanley.

The ability to attract and retain high-producing financial advisors, with a track record of successful recruitment from competitors, demonstrates a powerful value proposition within the industry.

Actively build a competitive intelligence function focused on fintech innovation to more rapidly identify and adopt or acquire technologies that can enhance the client and advisor experience.

Business Overview

Business Classification

Diversified Financial Services

Wealth & Asset Management

Financial Services

Sub Verticals

- •

Wealth Management

- •

Asset Management

- •

Retirement & Protection Solutions (Annuities & Insurance)

- •

Consumer Banking

Mature

Maturity Indicators

- •

Founded in 1894, demonstrating over 130 years of operational history.

- •

Over $1.4 trillion in assets under management and administration.

- •

Established network of over 10,000 financial advisors.

- •

Consistent dividend payments and increases for over 20 years.

- •

Strong brand recognition and ranking as a top-tier financial services firm.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Advice & Wealth Management Fees

Description:Represents the largest portion of revenue, generated from fees for financial planning and advisory services. These are primarily asset-based fees, calculated as a percentage of client assets under management (AUM).

Estimated Importance:Primary

Customer Segment:Mass Affluent to High-Net-Worth Individuals

Estimated Margin:High

- Stream Name:

Asset Management Fees

Description:Management fees generated by its subsidiary, Columbia Threadneedle Investments, from managing investment products like mutual funds and ETFs for retail and institutional clients.

Estimated Importance:Primary

Customer Segment:Retail Investors, High-Net-Worth Individuals, Institutional Clients

Estimated Margin:High

- Stream Name:

Retirement & Protection Product Revenue

Description:Revenue earned from selling variable annuities, life insurance, and disability income insurance products through its RiverSource brand. This includes premiums and fees from these products.

Estimated Importance:Secondary

Customer Segment:Individuals seeking retirement income and financial protection

Estimated Margin:Medium

- Stream Name:

Net Investment Income

Description:Income generated from the company's investments, particularly from its insurance reserves and earnings on client cash held in Ameriprise Bank and certificate products.

Estimated Importance:Secondary

Customer Segment:Corporate

Estimated Margin:Medium

Recurring Revenue Components

- •

Asset-based advisory fees (% of AUM)

- •

Asset management fees

- •

Insurance and annuity premiums

- •

Trailing commissions

Pricing Strategy

Asset-Based Fee & Commission-Based

Premium

Opaque

Pricing Psychology

- •

Authority

- •

Social Proof

- •

Value-Based Pricing

Monetization Assessment

Strengths

- •

Diversified revenue streams across wealth management, asset management, and insurance reduce dependency on any single source.

- •

High percentage of recurring, fee-based revenue from AUM provides predictable cash flow.

- •

Strong advisor productivity, with trailing 12-month revenue per advisor exceeding $1 million, indicates an effective monetization model.

Weaknesses

- •

Revenue is highly correlated with financial market performance; downturns directly impact AUM and fee income.

- •

Intense industry-wide fee compression from low-cost competitors like robo-advisors and ETFs could pressure margins.

- •

A high-cost, advisor-centric model may be less scalable than technology-driven competitors.

Opportunities

- •

Expand banking and lending products through Ameriprise Bank to capture a greater share of client wallet.

- •

Develop a hybrid advisory model to serve the emerging affluent with a mix of digital tools and human advice at a lower price point.

- •

Increase penetration of alternative investments, offering new fee-generating products to qualified clients.

Threats

- •

Regulatory changes, such as stricter fiduciary standards, could impact advisor compensation models.

- •

Disruption from FinTech companies offering lower-cost, technology-first investment solutions.

- •

Sustained market volatility could lead to client asset outflows, directly reducing revenue.

Market Positioning

Comprehensive, advice-centric financial planning with a focus on building long-term, personal advisor-client relationships.

Significant Player (Top 10 US wealth manager by assets).

Target Segments

- Segment Name:

Mass Affluent to High-Net-Worth Pre-Retirees

Description:Individuals and households aged 50-65 with investable assets typically between $500k and $5M, actively planning for retirement.

Demographic Factors

- •

Age: 50-65

- •

Income: High-earning professionals or business owners

- •

Assets: $500k - $5M

Psychographic Factors

- •

Values long-term security

- •

Seeks professional guidance and expertise

- •

Prefers a personal relationship with an advisor

Behavioral Factors

- •

Actively saving for retirement

- •

Delegates investment decisions

- •

Concerned with wealth preservation and income generation

Pain Points

- •

Uncertainty about having enough money for retirement

- •

Complexity of managing investments and financial products

- •

Need for tax-efficient withdrawal strategies

- •

Desire for legacy and estate planning

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Established Retirees

Description:Individuals aged 65+ who have already entered retirement and require wealth management for income distribution, capital preservation, and estate planning.

Demographic Factors

- •

Age: 65+

- •

Status: Retired

- •

Assets: Significant accumulated wealth

Psychographic Factors

- •

Risk-averse

- •

Focused on security and legacy

- •

Values trust and long-standing relationships

Behavioral Factors

- •

Drawing down assets for income

- •

Engaged in estate planning

- •

Seeks to protect wealth from market downturns

Pain Points

- •

Fear of outliving savings

- •

Managing required minimum distributions (RMDs)

- •

Planning for healthcare and long-term care costs

- •

Efficiently transferring wealth to heirs

Fit Assessment:Excellent

Segment Potential:Medium

Market Differentiation

- Factor:

Advisor-Centric Model

Strength:Strong

Sustainability:Sustainable

- Factor:

Proprietary 'Confident Retirement®' Approach

Strength:Moderate

Sustainability:Sustainable

- Factor:

Brand Reputation and Longevity (130+ years)

Strength:Strong

Sustainability:Sustainable

- Factor:

Integrated Technology for Advisors

Strength:Moderate

Sustainability:Temporary

Value Proposition

To help clients achieve their financial goals with confidence through a personal, long-term relationship with a dedicated financial advisor, supported by comprehensive planning tools and the resources of a leading, diversified financial services firm.

Good

Key Benefits

- Benefit:

Personalized financial advice from a dedicated advisor

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Network of over 10,000 advisors

- •

Emphasis on one-on-one consultations

- •

High client satisfaction ratings (96%).

- Benefit:

Comprehensive financial planning approach

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Branded 'Confident Retirement®' approach

Integration of investment, insurance, and estate planning

- Benefit:

Access to a wide range of products and expert research

Importance:Important

Differentiation:Common

Proof Elements

- •

Columbia Threadneedle asset management

- •

RiverSource insurance and annuity products

- •

Mention of Ameriprise Investment Research Group

Unique Selling Points

- Usp:

The 'Ultimate Advisor Partnership' model, providing extensive support and technology to attract and retain high-performing advisors, which in turn benefits clients.

Sustainability:Medium-term

Defensibility:Moderate

- Usp:

A 130+ year history of stability and client focus, building a deep well of brand trust that newer competitors cannot replicate.

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Navigating the complexity of financial planning for retirement

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Lack of time and expertise to manage investments effectively

Severity:Major

Solution Effectiveness:Complete

- Problem:

Feeling uncertain and lacking confidence about one's financial future

Severity:Critical

Solution Effectiveness:Partial

Value Alignment Assessment

High

The value proposition is well-aligned with the needs of its target market (affluent pre-retirees and retirees) who prioritize trust, personalization, and comprehensive advice over low cost.

High

The emphasis on a personal advisor relationship and retirement confidence directly addresses the primary pain points of the target audience, who are often overwhelmed by financial complexity and seek a trusted guide.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Financial Product Manufacturers (e.g., BlackRock, Vanguard).

- •

Technology Service Vendors (e.g., Salesforce).

- •

Banks and Credit Unions (Professional Alliance Program).

- •

Clearing Firms

Key Activities

- •

Financial planning and advice delivery

- •

Investment and asset management

- •

Client acquisition and relationship management

- •

Advisor recruitment, training, and support

- •

Product manufacturing (insurance, annuities)

- •

Regulatory compliance and risk management

Key Resources

- •

Network of ~10,000 financial advisors (franchisees and employees).

- •

Strong brand reputation and 130-year history.

- •

$1.4T+ in Assets Under Management & Administration.

- •

Proprietary technology platforms for advisors and clients.

- •

Asset Management subsidiary (Columbia Threadneedle Investments).

- •

Federal Savings Bank Charter (Ameriprise Bank, FSB).

Cost Structure

- •

Advisor compensation (payouts, commissions, bonuses)

- •

Employee salaries and benefits

- •

Marketing and advertising

- •

Technology infrastructure and development

- •

General and administrative expenses

- •

Regulatory and compliance costs

Swot Analysis

Strengths

- •

Powerful, established brand synonymous with trust and financial planning.

- •

Vast distribution network of over 10,000 advisors provides significant market reach.

- •

Diversified and resilient business model spanning wealth, asset management, and insurance.

- •

Strong free cash flow generation and consistent capital returns to shareholders.

- •

High advisor productivity and client retention rates.

Weaknesses

- •

High dependency on the performance of financial advisors and vulnerability to advisor attrition.

- •

Operating model has a higher cost structure compared to FinTech and discount brokerage firms.

- •

Perception as a more traditional firm may hinder attraction of younger, tech-savvy client segments.

- •

Revenue concentration in the U.S. market.

Opportunities

- •

The 'Great Wealth Transfer' from Baby Boomers to their heirs presents a massive opportunity for asset retention and new client acquisition.

- •

Leveraging AI and automation to enhance advisor efficiency and scale personalized advice.

- •

Expanding the Ameriprise Bank offerings (e.g., HELOCs, checking accounts) to deepen client relationships and create new revenue streams.

- •

Strategic acquisition of smaller RIAs to accelerate growth in advisor headcount and AUM.

Threats

- •

Continued fee compression from low-cost passive investments and robo-advisors.

- •

Increasingly stringent regulatory environment (e.g., fiduciary rules) could impact profitability.

- •

Cybersecurity threats and the risk of data breaches are paramount for a firm of this scale.

- •

Competition for top advisor talent from other wirehouses and independent RIAs.

Recommendations

Priority Improvements

- Area:

Digital Client Experience

Recommendation:Invest aggressively in a unified, modern digital portal and mobile app for clients that provides an intuitive, on-demand experience comparable to leading FinTech platforms, focusing on self-service capabilities and data visualization.

Expected Impact:High

- Area:

Advisor Technology & AI Integration

Recommendation:Accelerate the deployment of AI-powered tools within the advisor technology stack to automate administrative tasks, generate proactive client insights, and personalize communication at scale, thereby increasing advisor capacity.

Expected Impact:High

- Area:

Next-Generation Client Acquisition

Recommendation:Develop and market a distinct service model targeting emerging affluent and next-generation clients, potentially a hybrid model combining a lower-cost digital platform with access to human advisors for key planning moments.

Expected Impact:Medium

Business Model Innovation

- •

Launch a 'Family Office as a Service' platform for higher-net-worth clients, integrating tax planning, estate law, and concierge services through strategic partnerships, creating a premium, high-margin offering.

- •

Develop a B2B 'Financial Wellness as a Benefit' program to sell to corporations, leveraging Ameriprise's planning expertise to capture future retail clients earlier in their careers.

- •

Create a proprietary platform for accredited investors to access curated alternative investments (private equity, private credit), leveraging the TIFIN AMP partnership and creating a new, scalable revenue stream.

Revenue Diversification

- •

Expand subscription-based financial planning services, unbundling advice from AUM for clients who need planning but may not meet investment minimums yet.

- •

Grow the securities-based lending and other banking product offerings through Ameriprise Bank to generate more stable, non-market-correlated net interest income.

- •

Build out the insurance and annuities distribution to third-party advisors and channels beyond the Ameriprise network.

Ameriprise Financial operates a mature, robust, and highly successful diversified financial services model. Its core strength lies in its vast network of productive financial advisors who cultivate deep, trust-based relationships with a loyal client base, primarily focused on affluent individuals nearing or in retirement. This advisor-centric approach, combined with a strong brand built over 130 years, creates a significant competitive moat. The business model is resilient due to its diversified revenue streams from wealth management fees, asset management, and protection products, which generate strong, predictable free cash flow.

The primary strategic challenge for Ameriprise is adapting its high-touch, traditional model to an evolving market characterized by demographic shifts (wealth transfer), technological disruption (AI and FinTech), and pressure on fees. While the company is actively investing in technology to empower its advisors, its core business model remains vulnerable to lower-cost, digital-first competitors, especially in attracting the next generation of clients.

Future evolution must focus on a dual strategy: 1) Supercharging the existing advisor-led model with AI and automation to enhance productivity and scale personalization. 2) Innovating on the business model's edges by launching a digitally-native or hybrid offering to capture emerging market segments. Expanding the banking and alternative investment platforms represents a significant opportunity to deepen existing client relationships and diversify revenue away from market-sensitive AUM fees. Successfully navigating this evolution will be critical to sustaining its market leadership and ensuring another century of growth.

Competitors

Competitive Landscape

Mature

Moderately concentrated

Barriers To Entry

- Barrier:

Regulatory Compliance (FINRA, SEC)

Impact:High

- Barrier:

Brand Trust and Reputation

Impact:High

- Barrier:

High Capital Requirements

Impact:High

- Barrier:

Establishing a Large Advisor Network

Impact:High

- Barrier:

Client Acquisition and Asset Growth

Impact:High

Industry Trends

- Trend:

Digital Transformation and AI Integration

Impact On Business:Requires significant investment in technology to meet client expectations for seamless digital experiences and to empower advisors with AI-driven insights for portfolio management and client servicing.

Timeline:Immediate

- Trend:

Holistic Financial Wellness and Personalization

Impact On Business:Clients increasingly expect comprehensive, personalized advice that goes beyond investments to include all aspects of their financial lives, demanding a more sophisticated, client-centric approach.

Timeline:Immediate

- Trend:

Fee Compression

Impact On Business:Pressure from low-cost robo-advisors and discount brokerages is forcing traditional firms to more clearly articulate the value of their higher fees, focusing on comprehensive planning and personalized service.

Timeline:Near-term

- Trend:

Generational Wealth Transfer

Impact On Business:An estimated $53 trillion will be transferred from Baby Boomers to younger generations by 2045, who often prefer digital engagement and have different service expectations, creating both a threat and an opportunity for wealth managers.

Timeline:Near-term

- Trend:

Advisor Migration to RIAs

Impact On Business:The move of financial advisors from large wirehouses to independent Registered Investment Advisor (RIA) models challenges traditional firms to enhance their value proposition to retain top talent.

Timeline:Immediate

Direct Competitors

- →

Morgan Stanley Wealth Management

Market Share Estimate:Top-tier, one of the largest wirehouses.

Target Audience Overlap:High

Competitive Positioning:Positions as a premier global financial services firm for high-net-worth and ultra-high-net-worth individuals, emphasizing its strong brand, comprehensive services, and global presence.

Strengths

- •

Strong global brand and reputation.

- •

Diversified service portfolio (wealth management, investment banking).

- •

Deep expertise serving high-net-worth (HNW) and ultra-high-net-worth (UHNW) clients.

- •

Robust institutional research and insights.

Weaknesses

- •

High investment minimums for premier services, limiting accessibility.

- •

Potential conflicts of interest due to commission-based products.

- •

Heavily reliant on volatile investment banking and trading revenues.

- •

Disciplinary disclosures and legal issues have impacted brand value.

Differentiators

- •

Prestige brand focused on the UHNW segment.

- •

Integration of investment banking capabilities provides access to exclusive opportunities.

- •

Award-winning wealth management services.

- →

Edward Jones

Market Share Estimate:Significant, with a vast network of advisors across North America.

Target Audience Overlap:High

Competitive Positioning:Focuses on building deep, personal, face-to-face relationships with serious, long-term individual investors, particularly in smaller 'Main Street' communities.

Strengths

- •

Vast network of single-advisor offices fosters strong client relationships.

- •

Strong focus on personalized, face-to-face service.

- •

Targets the underserved mass-affluent market with no investment minimums.

- •

Conservative investment philosophy appeals to risk-averse clients.

Weaknesses

- •

Slower to adopt digital tools and online trading compared to competitors.

- •

Less appealing to younger, tech-savvy investors who prefer digital interaction.

- •

Product offerings may be less extensive than larger wirehouses.

- •

Business model may be less scalable than tech-driven competitors.

Differentiators

- •

Hyper-local, single-advisor branch model.

- •

Emphasis on in-person, long-term relationships.

- •

Strong presence in suburban and rural areas.

- →

Charles Schwab

Market Share Estimate:One of the largest players, managing trillions in client assets.

Target Audience Overlap:High

Competitive Positioning:Offers a full spectrum of brokerage, banking, and financial advisory services, positioning itself as a client-centric firm combining the best of people and technology at low costs.

Strengths

- •

Strong brand recognized for low costs and investor advocacy.

- •

Hybrid model effectively serves self-directed investors and those wanting advice.

- •

Industry-leading technology platform and robust digital tools.

- •

High customer satisfaction ratings.

Weaknesses

- •

The model of not charging for a dedicated Financial Consultant (for clients >$500k) may be perceived as less premium than paid models.

- •

Can be perceived as less personal than firms like Edward Jones due to its scale.

- •

Massive scale post-TD Ameritrade acquisition presents integration challenges.

Differentiators

- •

Comprehensive, integrated platform spanning self-directed trading to dedicated wealth management.

- •

Strong reputation for being a champion of the individual investor.

- •

Transparent, often lower-cost fee structure.

- →

Fidelity Investments

Market Share Estimate:A top-tier global asset manager with trillions in assets.

Target Audience Overlap:High

Competitive Positioning:Positions as a diversified financial services leader, leveraging technology and scale to offer a wide range of services including investment management, brokerage, and retirement planning.

Strengths

- •

Strong brand equity and customer loyalty built over decades.

- •

Leader in technology and digital innovation, enhancing user experience.

- •

Economies of scale allow for highly competitive pricing and zero-expense ratio funds.

- •

Deep expertise in retirement planning (e.g., 401k business).

Weaknesses

- •

Can be perceived as more of a product manufacturer (mutual funds) than a pure-play advisory firm.

- •

The sheer breadth of offerings can be overwhelming for some clients.

- •

Faces intense competition on all fronts, from discount brokerages to full-service wealth managers.

Differentiators

- •

Pioneering use of technology for competitive advantage.

- •

Unparalleled scale in asset management and retirement services.

- •

Combination of low-cost products with accessible financial planning.

Indirect Competitors

- →

Betterment

Description:A leading independent robo-advisor that provides automated, algorithm-driven portfolio management and financial planning tools at a low cost.

Threat Level:Medium

Potential For Direct Competition:High. They have already added human CFP professionals to their offerings, creating a hybrid model that directly competes for the mass affluent segment.

- →

Empower Personal Wealth (formerly Personal Capital)

Description:A digital wealth manager that combines a free financial dashboard with personalized advice from human advisors for clients with higher asset levels.

Threat Level:Medium

Potential For Direct Competition:High. Their model is a direct challenge to the traditional advisor, offering sophisticated digital tools combined with human advice, often at a competitive fee.

- →

Vanguard Personal Advisor Services

Description:A hybrid robo-advisor service from a low-cost investment giant, combining automated investment management with access to a team of human financial advisors.

Threat Level:High

Potential For Direct Competition:High. Vanguard's strong brand reputation for low costs and investor trust makes its advisory service a significant threat, particularly for cost-conscious, retirement-focused investors.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Established Brand and 130-Year History

Sustainability Assessment:Highly sustainable. Trust and reputation in wealth management are built over decades and are difficult for new entrants to replicate.

Competitor Replication Difficulty:Hard

- Advantage:

Large Network of 10,000+ Financial Advisors

Sustainability Assessment:Sustainable but requires ongoing investment. The advisor-client relationship creates high switching costs and a powerful distribution channel.

Competitor Replication Difficulty:Hard

- Advantage:

Significant AUM ($1.4 Trillion+)

Sustainability Assessment:Highly sustainable. Massive AUM provides significant economies of scale, operational leverage, and market influence.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': "Industry Awards and 'Top Workplace' Recognition", 'estimated_duration': '1-2 years. These provide valuable marketing material but are frequently updated and can be achieved by competitors in subsequent years.'}

{'advantage': 'Strong Performance of Specific Investment Products', 'estimated_duration': 'Market-dependent. Outperformance in certain funds or strategies is cyclical and not a guaranteed long-term advantage.'}

Disadvantages

- Disadvantage:

Perception as a Traditional, Less Tech-Forward Firm

Impact:Major

Addressability:Moderately

- Disadvantage:

Higher Fee Structure Compared to Robo-Advisors and Discounters

Impact:Major

Addressability:Difficult

- Disadvantage:

Risk of Over-Reliance on an Aging Client Base

Impact:Critical

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted digital marketing campaigns emphasizing the value of human advice during volatile markets, directly contrasting with automated-only platforms.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Enhance the existing client portal with more intuitive data visualization tools and self-service features for common inquiries to improve user experience.

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Develop a tiered, hybrid advisory service to attract and retain next-generation and mass-affluent clients with lower asset levels, combining digital tools with access to human advisors.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Invest heavily in AI and data analytics to create 'Advisor Co-pilot' tools, augmenting advisors' ability to deliver hyper-personalized advice and identify client needs proactively.

Expected Impact:High

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Pursue strategic acquisitions of fintech companies to rapidly integrate cutting-edge technology and talent, particularly in areas like alternative investments platforms or AI-driven financial planning.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Build a comprehensive 'financial wellness' ecosystem that integrates banking, insurance, and investment services on a single platform to increase client stickiness and share-of-wallet.

Expected Impact:High

Implementation Difficulty:Difficult

Double-down on the positioning as the premier provider of comprehensive, relationship-based financial advice. The key is to frame technology not as a replacement for, but as an enhancement to, the trusted human advisor, enabling them to deliver superior, personalized outcomes that algorithms alone cannot.

Differentiate on the depth and quality of the advisor-client relationship and the comprehensiveness of financial planning. Shift the value conversation from 'investment performance' to 'achieving life goals with confidence,' a domain where human advisors excel over purely digital solutions.

Whitespace Opportunities

- Opportunity:

Financial Planning for the 'Great Wealth Transfer'

Competitive Gap:Few firms have a dedicated, multi-generational service model that actively involves both the wealth holders (Boomers) and their heirs (Millennials/Gen Z) in the planning process.

Feasibility:High

Potential Impact:High

- Opportunity:

Democratization of Alternative Investments

Competitive Gap:Access to private market investments (private equity, venture capital, private credit) is still largely limited to UHNW clients. There is a growing demand from affluent investors for access to these asset classes.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Specialized Advisory Services for Niche Professionals

Competitive Gap:Many high-earning professionals (e.g., tech executives with stock options, traveling nurses, entrepreneurs) have unique and complex financial needs that are not adequately addressed by generic financial plans.

Feasibility:Medium

Potential Impact:Medium

Ameriprise Financial operates within the mature and moderately concentrated US wealth management industry. Its primary competitive advantages are its long-standing brand reputation of over 130 years, a vast network of over 10,000 financial advisors, and substantial assets under management, which create high barriers to entry for new competitors. The firm's core strength lies in its traditional, relationship-driven model, which fosters strong client loyalty.

Direct competitors like Morgan Stanley, Edward Jones, Charles Schwab, and Fidelity represent a spectrum of business models. Morgan Stanley competes for high-net-worth clients with a prestige brand, while Edward Jones challenges with a hyper-local, high-touch model for mainstream investors. Charles Schwab and Fidelity are formidable competitors due to their scale, technological prowess, and hybrid models that appeal to a wide range of investors. Ameriprise's positioning is between these models, offering comprehensive advice through a dedicated advisor but facing pressure to innovate digitally.

The most significant threats emerge from industry trends such as digitalization, fee compression, and the rise of indirect competitors like robo-advisors (Betterment) and hybrid digital wealth managers (Empower). These fintech-driven firms are setting new client expectations for seamless digital experiences and lower costs, putting pressure on Ameriprise's traditional, higher-fee structure. Furthermore, the impending 'Great Wealth Transfer' poses a critical challenge: retaining the assets of the next generation, who may not value the traditional advisor model as much as their parents.

According to a J.D. Power study, Ameriprise's customer satisfaction is competitive, ranking just above the industry average but behind leaders like Charles Schwab and Fidelity, indicating room for improvement.

Strategic whitespace exists in serving the next generation through a hybrid digital-plus-human model, democratizing access to alternative investments, and offering specialized planning for niche professional groups. To ensure future growth, Ameriprise must evolve. The firm should strategically invest in technology to empower its advisors and enhance the client experience, without abandoning its core strength of a trusted human relationship. The recommended strategy is to position technology as a tool that augments the advisor, enabling them to deliver the hyper-personalized, holistic advice that justifies their premium value proposition in an increasingly crowded and cost-conscious market.

Messaging

Message Architecture

Key Messages

- Message:

Ameriprise offers a 'fresh perspective' to help you reach your goals with greater confidence.

Prominence:Primary

Clarity Score:Medium

Location:Homepage Hero Section

- Message:

Personalized, one-to-one financial advisor relationships are core to achieving your goals.

Prominence:Secondary

Clarity Score:High

Location:Homepage, throughout site

- Message:

We are an established, award-winning, and trusted leader in the financial industry.

Prominence:Secondary

Clarity Score:High

Location:Homepage ('Top ratings'), Careers Page

- Message:

Discover what's most important to you in retirement.

Prominence:Tertiary

Clarity Score:High

Location:Homepage (Retirement Profiles Quiz)

- Message:

Thrive in a respectful, supportive, and inclusive values-based culture.

Prominence:Primary

Clarity Score:High

Location:Careers Page

The message hierarchy on the homepage effectively prioritizes differentiation ('Not all financial firms are the same') and the core emotional benefit ('greater confidence'). It then logically flows to supporting messages like switching advisors, understanding an advisor's role, and establishing credibility through ratings. The structure successfully guides users from a high-level value proposition to more specific informational needs. The careers page has an equally effective but separate hierarchy focused on the employee value proposition.

Messaging is highly consistent across the analyzed pages. Core themes of trust, longevity ('130 years'), industry leadership ('Top ratings'), and a client-focused approach are reinforced on both the homepage for prospective clients and the careers page for prospective employees. This consistency strengthens the overall brand identity as a stable and reputable institution.

Brand Voice

Voice Attributes

- Attribute:

Reassuring & Confident

Strength:Strong

Examples

- •

Could your financial life use a fresh perspective?

- •

Ameriprise Financial is here to help you reach your goals with greater confidence.

- •

To help people feel more confident about their financial future.

- Attribute:

Professional & Established

Strength:Strong

Examples

- •

Ameriprise Financial is a longstanding leader in financial planning and advice.

- •

For 130 years, we have stayed true to our mission...

- •

Nationally recognized, top-tiered advisors

- Attribute:

Supportive & Encouraging

Strength:Moderate

Examples

- •

Thrive in a respectful, supportive environment

- •

Learn more about the benefits and value of working with a financial advisor.

- •

Hear from our Ameriprise colleagues

Tone Analysis

Professional

Secondary Tones

Reassuring

Formal

Tone Shifts

The tone becomes slightly more aspirational and personal in the 'Retirement Profiles Quiz' section.

The Careers page adopts a more collegial and community-focused tone with phrases like 'Hear from our Ameriprise colleagues' and 'Strengthening our communities'.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

Ameriprise provides a personalized, advisor-led financial planning experience, backed by the stability and resources of an award-winning industry leader, to give clients greater confidence in their financial future.

Value Proposition Components

- Component:

Personalized Advisor Relationship

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Firm Stability and Longevity (130 years)

Clarity:Clear

Uniqueness:Unique

- Component:

Industry Recognition and Awards

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Comprehensive Approach ('Confident Retirement')

Clarity:Somewhat Clear

Uniqueness:Somewhat Unique

Ameriprise attempts to differentiate itself with the opening line, 'Not all financial firms are the same,' immediately positioning against a commoditized market. The core differentiator is the quality of the advisor relationship combined with the firm's history and resources. While many firms claim to put clients first, Ameriprise supports this claim with social proof (awards, ratings) and longevity. The term 'fresh perspective' is a good hook but remains abstract and is not tangibly demonstrated on the homepage. The most unique and defensible differentiator is the 130-year history, which implies stability and trustworthiness through various economic cycles.

The messaging positions Ameriprise as a premium, established, and trustworthy partner, competing directly with other full-service firms like Edward Jones, Morgan Stanley, and Raymond James. It implicitly contrasts its human-centric, personalized model against the lower-touch, technology-driven approaches of robo-advisors or discount brokerages like Charles Schwab and Fidelity. The emphasis on 'confidence' and 'trust' is a direct appeal to clients seeking stability and a long-term relationship over transactional services.

Audience Messaging

Target Personas

- Persona:

The Dissatisfied Delegator: Currently has a financial advisor but is questioning the value they receive and seeking a 'fresh perspective'.

Tailored Messages

- •

Not all financial firms are the same

- •

Switching to Ameriprise

- •

How does your current financial advisor compare?

Effectiveness:Effective

- Persona:

The Pre-Retiree Planner: Affluent individual or couple (ages 50-65) actively planning for retirement and seeking confidence in their strategy.

Tailored Messages

- •

How do you envision your dream retirement?

- •

The Ameriprise ® Retirement Profiles experience...

- •

The Confident Retirement® approach...

Effectiveness:Effective

- Persona:

The Aspiring Advisor: A student or professional considering a career in financial services, looking for a supportive and reputable firm.

Tailored Messages

- •

Thrive in a respectful, supportive environment

- •

The strength of a financial leader

- •

Visit our career areas (Experienced, New, Corporate, Students)

Effectiveness:Effective

Audience Pain Points Addressed

- •

Lack of confidence in financial future

- •

Uncertainty about how to reach financial goals

- •

Feeling that their current financial advisor is not providing sufficient value

- •

Concern about market volatility and investment risk

Audience Aspirations Addressed

- •

Achieving a 'dream retirement'

- •

Feeling confident and in control of one's finances

- •

Building a long-term, trusting relationship with a financial expert

- •

Working for a stable, respected, and values-driven company (for career seekers)

Persuasion Elements

Emotional Appeals

- Appeal Type:

Confidence & Security

Effectiveness:High

Examples

To help people feel more confident about their financial future.

Our financial advisors know that trust is a matter of work, not words.

- Appeal Type:

Aspiration

Effectiveness:Medium

Examples

How do you envision your dream retirement?

Discover the many avenues available for you to take on new challenges and achieve great rewards.

Social Proof Elements

- Proof Type:

Awards and Recognition

Impact:Strong

Examples

- •

Top ratings in the investment industry

- •

Award-winning service with a focus on clients

- •

Recognized as a top workplace

- •

Named one of America's Best Companies in 2025 by Forbes.

- Proof Type:

Scale and Longevity

Impact:Strong

Examples

- •

For 130 years, we have stayed true to our mission...

- •

More than 10,000 advisors

- •

More than $1.4 trillion in assets under management...

- Proof Type:

Testimonials

Impact:Moderate

Examples

Hear from our Ameriprise colleagues

Trust Indicators

- •

Emphasis on 130-year history

- •

Citations for awards and data points (e.g., 'Forbes recognized...')

- •

Links to FINRA's BrokerCheck

- •

Prominent display of financial industry disclaimers

- •

Video explaining the role of the 'Investment Research Group'

Scarcity Urgency Tactics

None observed. The absence of these tactics is appropriate for the brand's positioning, which relies on long-term trust and stability rather than short-term transactional pressure.

Calls To Action

Primary Ctas

- Text:

Get started

Location:Homepage Hero Section

Clarity:Somewhat Clear

- Text:

Find my location

Location:Homepage (Search for a financial advisor)

Clarity:Clear

- Text:

Take our 3-minute quiz

Location:Homepage (Retirement Profiles Quiz)

Clarity:Clear

- Text:

Search and Apply

Location:Careers Page Hero Section

Clarity:Clear

The CTAs are generally effective and well-placed, aligned with specific user intents. For example, the 'Retirement Profiles quiz' CTA is perfectly matched with its aspirational headline. The advisor search is clear and action-oriented. The primary 'Get started' CTA in the hero section is the weakest, as the next step is somewhat ambiguous. It leads to a comparison page, but the text itself could be more specific (e.g., 'Compare Your Advisor' or 'Request a Consultation') to better set user expectations.

Messaging Gaps Analysis

Critical Gaps

- •

Demonstrating the 'Fresh Perspective': The website claims to offer a 'fresh perspective' but fails to provide tangible examples, case studies, or thought leadership content that demonstrates how their advice is different or more insightful than competitors.

- •

Client Storytelling: The site relies heavily on firm-level awards and employee testimonials. There is a significant gap in client-centric stories or case studies that would bring the value proposition to life and create a stronger emotional connection.

- •

Transparency on Approach: The 'Confident Retirement®' approach is mentioned as a branded process, but there is little detail on what it entails, how it works, or what makes it proprietary. This makes it feel like a marketing term rather than a tangible methodology.

Contradiction Points

No itemsUnderdeveloped Areas

Advisor Profiles: While users can search for an advisor, the messaging could do more to humanize them upfront, perhaps by featuring advisor stories or philosophies on the main pages to build trust before the user even searches.

Digital Tool Showcase: The site mentions being invested in the future with 'smart technologies' but doesn't showcase these tools. For a target audience that increasingly expects strong digital experiences, demonstrating this capability could be a powerful persuader.

Messaging Quality

Strengths

- •

Strong Foundation of Trust: The messaging consistently and effectively uses longevity, scale, and third-party awards to build a strong foundation of credibility and trust.

- •

Clear Audience Segmentation: The website and its messaging are clearly structured to address the distinct needs of different audiences (e.g., those new to advice vs. those looking to switch, and different types of job seekers).

- •

Consistent Brand Voice: The professional, reassuring, and established voice is maintained consistently, reinforcing brand identity.

- •

Effective Use of Social Proof: The homepage effectively layers multiple forms of social proof—ratings, awards, and scale—to build a compelling case for the firm's credibility.

Weaknesses

- •

Over-reliance on Claims vs. Demonstration: The central differentiator of a 'fresh perspective' is asserted but not proven, making it less impactful than it could be.

- •

Generic Industry Language: Some phrases like 'help you reach your goals' and 'focus on clients' are common in the financial services industry and do little to differentiate the brand on their own.

- •

Lack of Emotional Storytelling: The messaging is very rational and focuses on the firm's credentials. It misses opportunities to connect on a deeper, more emotional level through client success stories.

Opportunities

- •

Develop Content Hub: Create a blog or insights section that showcases the promised 'fresh perspective' on current financial topics, demonstrating expertise rather than just claiming it.

- •

Introduce Client Success Vignettes: Feature short, anonymized stories or testimonials from clients that illustrate how Ameriprise helped them achieve confidence and their financial goals.

- •

Create Interactive Diagnostic Tools: Beyond the retirement quiz, develop simple tools that help prospects diagnose a financial pain point, providing immediate value and capturing leads.

- •

Enhance 'Why Switch?' Messaging: Bolster the 'Switching to Ameriprise' section with a clear checklist or comparison guide that highlights specific differences in service, process, or advisor support.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Value Proposition

Recommendation:Develop a dedicated section or interactive module that demonstrates the 'fresh perspective' in action. This could include a short case study, a unique planning framework, or a video explaining their advisory philosophy.

Expected Impact:High

- Area:

Social Proof

Recommendation:Integrate compelling, benefit-oriented client testimonials onto the homepage. Shift the balance from being purely about the firm's awards to include the client's voice.

Expected Impact:High

- Area:

Branded Process Explanation

Recommendation:Create a dedicated landing page or an expandable section on the homepage that clearly explains the steps and benefits of the 'Confident Retirement®' approach, turning it from a slogan into a tangible process.

Expected Impact:Medium

Quick Wins

- •

A/B test the primary 'Get started' CTA with more specific language like 'Request a Free Consultation' or 'See the Ameriprise Difference'.

- •

Convert the text-based list of 'Top ratings' into a more visually engaging format using logos of the awarding institutions.

- •

Add a 'Who We Help' section to the homepage that quickly directs key personas (Pre-retirees, Business Owners, etc.) to tailored content.

Long Term Recommendations

- •

Build out a comprehensive thought leadership strategy that provides unique market commentary and financial planning insights, reinforcing the 'fresh perspective' brand promise.

- •

Develop a video series featuring Ameriprise advisors discussing their philosophy and approach to client relationships to humanize the brand and build trust at scale.

- •

Invest in creating more robust client stories and case studies (in video and written formats) to serve as powerful assets across the entire marketing funnel.

Ameriprise Financial's website messaging is expertly crafted to build a foundation of trust and credibility, which is paramount in the financial services industry. The strategy effectively leverages the company's 130-year history, significant assets under management, and numerous industry awards to position itself as a stable, reliable, and leading institution. The brand voice is consistently professional and reassuring, aligning perfectly with its mission to help clients feel more confident about their financial future. The messaging architecture is logical, guiding different audience segments—from those dissatisfied with their current advisor to those just beginning their financial journey—toward a consultation with an Ameriprise advisor.

The primary weakness in the current strategy lies in the gap between claiming differentiation and tangibly demonstrating it. The homepage opens with the powerful premise, 'Not all financial firms are the same,' and promises a 'fresh perspective.' However, the subsequent content pivots primarily to credibility markers (awards, history) rather than illustrating what makes their perspective unique in practice. This is a missed opportunity to create a more compelling and memorable differentiator in a crowded market where many competitors also claim to be client-focused and offer personalized advice.

From a business outcomes perspective, the messaging is well-optimized for lead generation by building the confidence necessary for a prospect to take the next step of speaking with an advisor. However, to improve lead quality and conversion rates, the messaging must evolve to better articulate its unique value. By showcasing its proprietary processes (like the 'Confident Retirement®' approach) more clearly and bringing client success stories to the forefront, Ameriprise can move from being a trustworthy choice to being the only choice for its target audience.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Established market leader with a 130-year history and significant brand trust.

- •

Manages over $1.4 trillion in assets under management and administration, serving over 3.5 million clients.

- •

Consistent growth in client assets, demonstrating strong demand for its advice-based value proposition.

- •

High client satisfaction ratings (4.9 out of 5 stars mentioned in earnings calls), indicating services meet client needs.

Improvement Areas

- •

Enhance digital offerings to meet the expectations of younger, tech-savvy demographics who prefer digital-first engagement.

- •

Develop more flexible service models for emerging affluent clients who may not meet high asset minimums for traditional advisory services.

- •

Increase personalization at scale using technology to deliver bespoke advice beyond traditional models.

Market Dynamics

Approximately 5-8% CAGR for the global financial advisory market.

Mature

Market Trends

- Trend:

Digital Transformation and AI Integration

Business Impact:Clients expect seamless digital experiences and personalized, AI-driven insights. Firms must invest in technology to improve efficiency and enhance the client journey.

- Trend:

Demand for Personalization and Holistic Advice

Business Impact:Shift from product-centric sales to holistic, goals-based financial planning. This requires broader advisor expertise and integrated technology platforms.

- Trend:

Generational Wealth Transfer

Business Impact:Massive transfer of wealth from Baby Boomers to younger generations (Millennials, Gen Z) who have different communication preferences and investment priorities (e.g., ESG).

- Trend:

Competition from Fintech and Robo-Advisors

Business Impact:Increased pressure on fees and the need to demonstrate the value of human advice. Requires developing compelling hybrid (human + digital) service models.

Favorable, but requires urgent adaptation. The core demand for financial advice is strong, especially amidst economic uncertainty. However, the window to capture the next generation of clients through digital transformation is closing as competitors advance.

Business Model Scalability

Medium

The advisor-led model has a significant variable cost component (advisor compensation), which scales with revenue. However, there are substantial fixed costs in technology, compliance, and brand marketing.

Moderate. Technology and centralized platforms (research, marketing) provide leverage, but growth is fundamentally tied to recruiting, training, and supporting a large network of human advisors, which is a linear scaling process.

Scalability Constraints

- •

Dependence on recruiting and retaining a finite pool of qualified financial advisors.

- •

High cost of client acquisition (CAC) inherent in a high-touch, sales-led model.

- •

Regulatory and compliance overhead increases complexity and cost with scale.

Team Readiness

Experienced leadership team with a strong track record of managing a large, complex financial services organization and delivering shareholder returns.

Traditional, with distinct channels (employee, franchise, institutional). While effective for managing the current business, this structure could hinder the agility needed for rapid digital innovation.

Key Capability Gaps

- •

Digital Product Management: Need for experts in creating intuitive, engaging client-facing digital tools and platforms.

- •

Growth Marketing: Talent with expertise in digital lead generation, SEO, and content marketing to attract clients online.

- •

Data Science & AI: Specialists to leverage client data for hyper-personalization, predictive analytics, and advisor efficiency tools.

Growth Engine

Acquisition Channels

- Channel:

Advisor Network (Referrals & Networking)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Equip advisors with better digital tools for prospecting and social selling on platforms like LinkedIn to expand their reach beyond traditional networks.

- Channel:

Brand Marketing & Advertising

Effectiveness:Medium

Optimization Potential:High

Recommendation:Shift budget towards targeted digital advertising campaigns focused on specific client personas (e.g., pre-retirees, tech professionals) with clear calls-to-action that lead to educational content or digital tools.

- Channel:

Website & Content Marketing (SEO)

Effectiveness:Low

Optimization Potential:High

Recommendation:Develop a robust content strategy around key financial planning topics to drive organic traffic. Create high-value content (guides, webinars, tools) that captures leads from users who are not yet ready to speak with an advisor.

Customer Journey

The current online path is heavily geared towards a single conversion point: 'Find an Advisor'. This is a high-friction step for new prospects in the early stages of their research.

Friction Points

- •

Lack of intermediate, low-commitment engagement options online (e.g., webinars, downloadable guides).

- •

Opaque value proposition for digitally-native users before committing to a consultation.

- •

The advisor search is functional but impersonal, lacking content that helps build trust in individual advisors online.

Journey Enhancement Priorities

- Area:

Top-of-Funnel Engagement

Recommendation:Introduce interactive tools and quizzes (similar to the 'Retirement Profiles Quiz' but more extensive) that provide immediate value and capture leads.

- Area:

Lead Nurturing

Recommendation:Implement automated email nurturing campaigns that deliver relevant content to prospects based on their interests, guiding them towards a consultation over time.

- Area:

Digital Onboarding

Recommendation:Develop a streamlined digital onboarding process for new clients to reduce paperwork and improve the initial client experience.

Retention Mechanisms

- Mechanism:

Personal Advisor Relationship

Effectiveness:High

Improvement Opportunity:Augment the human relationship with a superior digital client portal that provides 24/7 access to financial plans, performance tracking, and secure communication, increasing stickiness.

- Mechanism:

The Confident Retirement® Approach

Effectiveness:Medium

Improvement Opportunity:Translate this branded approach into tangible, interactive digital planning tools that allow clients to model scenarios and track progress, making the plan a living, engaging part of their experience.

Revenue Economics

Mature and highly favorable. The business model is built on high Lifetime Value (LTV) from long-term, fee-generating client relationships.

Likely very high, justifying the high-touch, advisor-led acquisition model. Industry standards for established firms are often well above 10:1.

High, as evidenced by consistent profitability and strong operating margins in the wealth management division.

Optimization Recommendations

- •

Lower Customer Acquisition Cost (CAC) by developing more efficient digital acquisition channels to supplement the advisor-led model.

- •

Increase LTV by expanding service offerings to existing clients, such as incorporating more sophisticated tax and estate planning services.

- •

Improve advisor efficiency with AI-powered tools that automate administrative tasks, allowing them to serve more clients effectively.

Scale Barriers

Technical Limitations

- Limitation:

Potential Legacy Technology Stack

Impact:High

Solution Approach:Adopt a bi-modal IT strategy: maintain stable, secure core systems while building new client-facing applications on a modern, agile, cloud-based architecture to accelerate innovation.

- Limitation:

Data Silos Across Business Units

Impact:Medium

Solution Approach:Invest in a centralized data platform to create a 360-degree view of the client, enabling hyper-personalization and identifying cross-selling opportunities.

Operational Bottlenecks

- Bottleneck:

Advisor Recruiting and Onboarding

Growth Impact:Directly constrains the pace of network expansion and market penetration.

Resolution Strategy:Leverage technology to create a more efficient, scalable, and partially virtualized recruiting and training process for new advisors.

- Bottleneck:

Compliance and Regulatory Processes

Growth Impact:Slows down the launch of new digital products and marketing initiatives due to lengthy review cycles.

Resolution Strategy:Integrate compliance workflows into the development lifecycle ('DevSecOps') and use RegTech solutions to automate monitoring and reporting.

Market Penetration Challenges

- Challenge:

Reaching Next-Generation Clients (Millennials/Gen Z)

Severity:Critical

Mitigation Strategy:Launch a distinct sub-brand or a hybrid advice model with lower fees, a digital-first experience, and a focus on values-based investing (ESG) to appeal to this demographic.

- Challenge:

Intense Competition from Tech-Forward Incumbents

Severity:Major

Mitigation Strategy:Focus on a differentiated value proposition that blends superior human advice with a seamless, high-quality digital experience, rather than competing on cost alone. Key competitors include Morgan Stanley, Charles Schwab, and Fidelity.

- Challenge:

Fee Compression

Severity:Major

Mitigation Strategy:Clearly articulate and demonstrate the value of comprehensive financial planning beyond just investment management to justify fees. Shift towards a fee-based model that aligns advisor compensation with client success.

Resource Limitations

Talent Gaps

- •

User Experience (UX) Designers

- •

Data Scientists / AI Engineers

- •

Digital Growth Marketers

- •

Agile Product Managers

Capital is not a primary constraint. The key challenge is allocating sufficient capital towards long-term digital transformation initiatives versus short-term profit optimization.

Infrastructure Needs

- •

Cloud-native application development platform.

- •

Enterprise-wide client data analytics platform.

- •

Modern CRM system to power both advisor-led and digital-first client engagement.

Growth Opportunities

Market Expansion

- Expansion Vector:

Mass Affluent and Emerging Affluent Segments

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Develop a technology-led, hybrid advice model with lower entry barriers (e.g., lower AUM minimums, subscription fees) to capture these clients early in their wealth accumulation journey.

Product Opportunities

- Opportunity:

Hybrid Robo-Advisor Service

Market Demand Evidence:Strong market growth for hybrid models that combine low-cost automated investing with access to human advisors for complex needs.

Strategic Fit:Leverages existing advisor network as a key differentiator against pure robo-advisors.

Development Recommendation:Partner with or acquire a leading B2B robo-advisor platform to accelerate time-to-market, and integrate it deeply with the Ameriprise brand and advisor ecosystem.

- Opportunity:

Personalized ESG & Thematic Portfolios

Market Demand Evidence:Growing investor demand for portfolios that align with personal values and specific market themes.

Strategic Fit:Enhances the value proposition of personalized advice and appeals to younger client segments.

Development Recommendation:Utilize technology to offer customized, rules-based portfolios at scale, allowing for personalization beyond standard model portfolios.

Channel Diversification

- Channel:

Content & Education Platforms (Podcasts, Webinars)

Fit Assessment:High

Implementation Strategy:Create a branded content series featuring Ameriprise advisors discussing key financial topics. Use webinars as a scalable way to engage prospects and generate qualified leads for the advisor network.

Strategic Partnerships

- Partnership Type:

Fintech Integration

Potential Partners

- •

Plaid (for account aggregation)

- •

eMoney Advisor (for advanced financial planning tools)

- •

Betterment for Advisors (for a white-label robo platform)

Expected Benefits:Accelerate digital capabilities, enhance the client portal with best-in-class tools, and improve advisor efficiency without building everything in-house.

- Partnership Type:

Corporate Financial Wellness

Potential Partners

Large corporations

HR technology platforms

Expected Benefits:Create a B2B2C channel to offer financial planning services as an employee benefit, generating a new source of qualified leads.

Growth Strategy

North Star Metric

Net Inflow of Client Assets

This metric captures the two primary growth levers: acquiring new clients and deepening relationships with existing clients (share of wallet). It is a direct leading indicator of future revenue growth.

Achieve a 10-15% year-over-year increase in net inflows by successfully executing on hybrid advice and digital acquisition initiatives.

Growth Model

Hybrid: Advisor-Led & Digital-Enhanced

Key Drivers

- •

Advisor Productivity (Revenue per advisor)

- •

Digital Lead Generation (Marketing Qualified Leads)

- •

Client Digital Adoption Rate

- •

Net Client Asset Flows

A dual approach: 1) Empower the existing advisor network with superior technology to increase their efficiency and effectiveness. 2) Build new, digitally-native funnels to attract and serve emerging client segments, creating a feeder system for the core advisory business.

Prioritized Initiatives

- Initiative:

Launch 'Ameriprise Digital' Hybrid Advice Platform

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 months

First Steps:Commission a build vs. buy vs. partner analysis for the core technology platform. Define the service model, pricing, and target client profile.

- Initiative:

Develop a Targeted Digital Acquisition Funnel for Pre-Retirees (Ages 45-60)

Expected Impact:High

Implementation Effort:Medium

Timeframe:6-9 months

First Steps:Create comprehensive content resources (e.g., a 'Retirement Readiness' guide and webinar series). Launch targeted ad campaigns on platforms like LinkedIn and Facebook driving traffic to these resources.

- Initiative:

Enhance the Advisor Toolkit with AI-Powered Insights

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:12-18 months

First Steps:Pilot an AI tool that analyzes client portfolios and communication to suggest next-best-actions or identify unspoken client needs for a select group of advisors.

Experimentation Plan

High Leverage Tests

{'area': 'Website Conversion', 'test': "A/B test the main call-to-action: 'Find an Advisor' vs. 'Take a Free Financial Assessment' vs. 'Watch Our Retirement Planning Webinar'."}

{'area': 'Lead Generation', 'test': 'Experiment with different content offers (e.g., e-book vs. checklist vs. calculator) to see which generates the highest quality leads.'}

Utilize a framework that tracks key metrics down the funnel: Cost Per Click (CPC) -> Cost Per Lead (CPL) -> Lead-to-Consultation Rate -> Consultation-to-Client Rate -> Average Assets of New Client.

Bi-weekly sprint cycles for website and digital marketing experiments, with quarterly reviews of major strategic tests.

Growth Team

A centralized 'Client Growth & Digital Innovation' team that operates as a center of excellence, working cross-functionally with IT, marketing, and the advisor channels. The team should have its own P&L and be led by a Chief Growth Officer.

Key Roles

- •

Head of Digital Client Acquisition

- •

Product Manager, Client Experience

- •

Data Scientist, Client Insights

- •

Content Strategist

A combination of hiring external digital-native talent and establishing an internal upskilling program to develop digital literacy and a growth mindset across the organization.

Ameriprise Financial possesses a formidable growth foundation built on a century of brand trust, a massive client base, and a highly profitable, advisor-driven business model. Its current product-market fit for its core demographic—affluent individuals seeking traditional, relationship-based financial advice—is exceptionally strong. However, the company is at a critical inflection point where the very model that secured its market leadership is being challenged by profound shifts in market dynamics.

The primary barrier to future growth is not competition on its own terms, but a fundamental change in client expectations driven by digital transformation. The reliance on a physically-scaled advisor network creates operational constraints and market penetration challenges, particularly with younger, digitally-native generations who expect seamless, on-demand, and personalized digital experiences. While the current growth engine is efficient and profitable, its acquisition channels are not optimized for the digital era, creating a strategic vulnerability.

The most significant growth opportunity lies in evolving the business model from being purely 'advisor-led' to 'advisor-led and digitally-enhanced'. This involves creating a compelling hybrid offering that blends the firm's core strength—high-quality human advice—with a superior, technology-driven client experience. This strategy would not only serve to attract the underserved mass-affluent market but also future-proof the business by meeting the expectations of the next generation of high-net-worth clients.

The strategic imperative is to invest decisively in technology, talent, and new service models. This requires prioritizing initiatives like launching a hybrid platform and building a robust digital acquisition engine. The recommended 'North Star Metric' of 'Net Inflow of Client Assets' will effectively align the organization around the dual goals of attracting new clients and assets through these new channels while continuing to deepen relationships within the existing client base. Success will be defined by Ameriprise's ability to innovate at the pace of the market without disrupting the core business that remains its economic engine.

Legal Compliance

Ameriprise maintains a comprehensive and multi-layered approach to privacy, which is a significant strength for a financial institution. Their primary privacy notice is structured to comply with the Gramm-Leach-Bliley Act (GLBA), clearly outlining the types of personal information collected (e.g., Social Security number, income, assets), the reasons for sharing (e.g., for everyday business, marketing, joint marketing), and whether customers can limit this sharing. They provide a distinct addendum for California residents under the CCPA/CPRA, demonstrating an understanding of state-specific requirements. This includes a "Do Not Sell or Share My Personal Information" link in the website footer, which directs users to manage preferences related to cross-contextual behavioral advertising. The policy explicitly states they do not share information with nonaffiliates for marketing purposes but do share with affiliates, for which users can opt-out. The presence of a detailed FAQ document further enhances clarity for consumers. This structure aligns with the GLBA's Financial Privacy Rule, which mandates clear disclosure of information-sharing practices.