eScore

amwater.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

American Water's digital presence is highly effective at serving its primary audience of existing customers through a state-segmented model that aligns with their operational structure and local search intent. The company possesses strong content authority due to its market leadership, though its thought leadership could be deeper on emerging topics. The website's architecture, however, creates a functional barrier that is less effective for engaging and aligning with the search intent of potential municipal partners, a key growth audience.

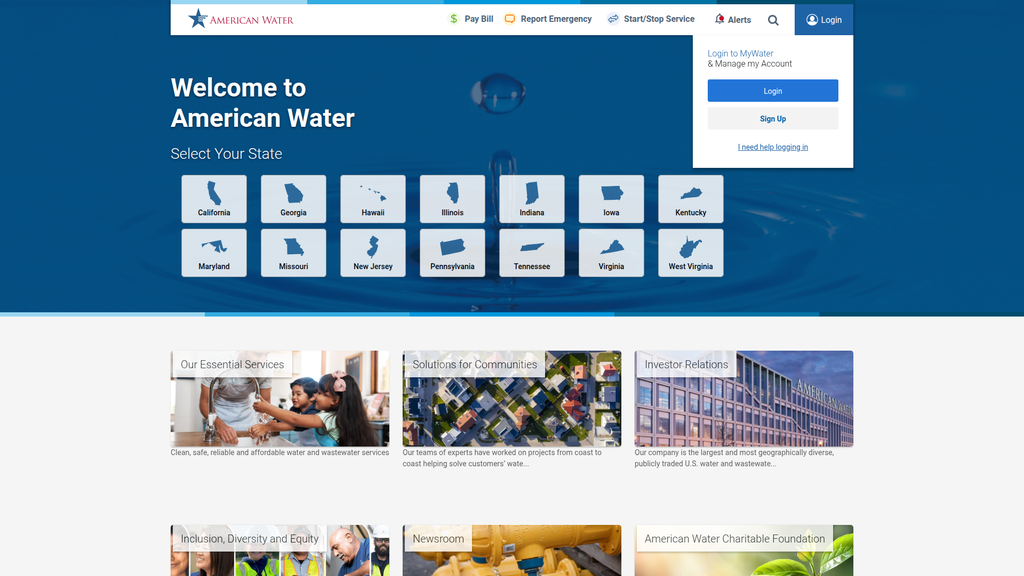

The state-selection gateway on the homepage is a clear and effective mechanism for aligning with the local search intent of the vast majority of users (existing customers).

Develop a dedicated 'Municipal Solutions Hub' with robust content optimized for B2G (Business-to-Government) keywords to better align with the search intent of community leaders researching utility partnerships.

The brand's core message of safety and reliability is consistent and clear, but its effectiveness varies dramatically by audience. Communication is highly effective for investors and regulators, clearly articulating scale and stability. However, the website's structure prevents proactive brand building with residential customers, and the messaging for potential municipal partners is underdeveloped, lacking strong conversion-focused language and dedicated content.

The company effectively differentiates itself by emphasizing its unique scale as the 'largest and most geographically diverse' U.S. water utility, which strongly appeals to investors and regulators.

Redesign the homepage to present a unified brand story *before* the state selector, establishing a 'why' for the brand (community partnership, investment, expertise) to build affinity with all audiences at the first touchpoint.

The conversion experience for existing customers performing self-service tasks is strong, with prominent, task-oriented navigation. However, the overall score is severely hampered by significant friction for other key objectives. The most critical issues are the major accessibility compliance gaps, which pose a legal risk and create barriers for a large user segment, and the underdeveloped journey for potential municipal partners, which lacks clear calls-to-action and a dedicated conversion funnel.

The website provides highly visible, icon-driven links for critical customer tasks like 'Pay Bill' and 'Report Emergency,' effectively reducing friction for the core residential audience.

Immediately conduct a thorough accessibility audit to conform to WCAG 2.1 AA standards and publish a formal Accessibility Statement to mitigate significant legal risk and ensure equal access for all users.

American Water commands immense real-world credibility due to its scale, long history, public status, and critical partnerships with the U.S. military. However, its digital credibility is undermined by significant legal and compliance risks identified in the analysis. The absence of a clear accessibility framework and an outdated privacy policy that fails to meet CCPA/CPRA requirements represent high-severity risks that offset the company's otherwise strong foundation of trust and transparency.

The Military Services Group, with its long-term Department of Defense contracts, serves as an exceptionally strong third-party validation of the company's reliability and operational excellence.

Overhaul the Privacy Policy to achieve full compliance with CCPA/CPRA, including adding detailed consumer rights disclosures and implementing a 'Do Not Sell or Share My Personal Information' mechanism to close a critical compliance gap.

The company's competitive advantage is exceptionally strong and sustainable. Its moat is built on the regulated monopoly model, unparalleled scale and geographic diversity, and superior access to capital markets. These factors create formidable barriers to entry and allow American Water to effectively execute its growth-by-acquisition strategy in a highly fragmented market. Switching costs for its core customers are effectively infinite, solidifying its market position.

The company's scale creates a virtuous cycle or 'flywheel,' where operational efficiencies from acquisitions allow for greater capital investment, which in turn fuels more growth and strengthens its position against smaller competitors.

Establish a public-facing 'Water Innovation Lab' to showcase R&D efforts in PFAS treatment and smart grid technology, translating its operational expertise into a more visible and forward-looking competitive advantage.

The business has a proven, highly scalable growth model centered on the acquisition of smaller utilities and disciplined capital investment. The fragmented nature of the U.S. water market provides a long runway for this expansion. While the business is extremely capital-intensive, its operational model is designed to support this. The primary constraints to scalability are external factors like the pace of regulatory approvals and political sentiment, rather than internal operational limitations.

The company's 'Acquisition & Capital Investment Flywheel' is a highly effective and repeatable model for growth, allowing it to systematically consolidate the fragmented water utility market.

Develop a standardized, technology-enabled playbook for rapidly integrating acquired utilities to accelerate the realization of operational synergies and streamline the expansion process.

American Water's business model is a textbook example of coherence and strategic focus within a mature industry. The revenue model is stable and predictable, resources are strategically allocated to rate base growth, and all activities are aligned with the core strategy of operational excellence, capital investment, and regulatory management. The company is perfectly timed to address the national challenge of aging infrastructure, demonstrating profound alignment between its model and market needs.

The business model perfectly aligns the company's primary growth driver (capital investment in infrastructure) with its revenue mechanism (regulated rate-of-return), creating a clear, sustainable path to long-term value creation.

Accelerate the expansion of market-based businesses, such as homeowner service line protection, to build a higher-margin revenue stream that can balance the capital intensity of the core regulated business.

As the largest publicly traded water utility, American Water wields significant market power. Its market share is actively growing through a successful consolidation strategy. This scale provides substantial leverage with suppliers and influence within the regulatory landscape. While its pricing power is formally constrained by public utility commissions, its ability to successfully file and execute rate cases based on necessary investments is a clear indicator of its strong market position and influence.

The company's status as the leading and most active acquirer in the fragmented water utility market demonstrates a powerful ability to shape the industry and consistently grow its market footprint.

Create a formal data and analytics consulting arm to advise smaller municipalities, leveraging its market intelligence to create a new revenue stream and a pipeline for future acquisitions.

Business Overview

Business Classification

Regulated Utility

Government Contractor

Water & Wastewater Services

Sub Verticals

- •

Municipal Water Distribution

- •

Wastewater Collection & Treatment

- •

Utility Management Services

- •

Military Base Water Services

Mature

Maturity Indicators

- •

Operates as a regulated monopoly in defined service areas.

- •

Growth driven primarily by rate increases and acquisitions of smaller utilities.

- •

Long history of paying dividends to shareholders.

- •

Extensive, capital-intensive infrastructure assets.

- •

Focus on operational efficiency, safety, and regulatory compliance.

- •

Largest publicly traded water and wastewater utility in the U.S.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Regulated Water & Wastewater Services

Description:Sale of water and wastewater services to residential, commercial, industrial, and public authority customers at rates approved by state Public Utility Commissions (PUCs). This constitutes the vast majority of company revenue.

Estimated Importance:Primary

Customer Segment:Residential & Commercial Customers

Estimated Margin:Medium

- Stream Name:

Military Services Group

Description:Long-term (typically 50-year) contracts with the U.S. Department of Defense to own, operate, and maintain water and wastewater systems on military installations.

Estimated Importance:Secondary

Customer Segment:U.S. Government (DoD)

Estimated Margin:Medium

- Stream Name:

Market-Based Businesses

Description:Services offered in competitive markets, such as service line protection programs for homeowners (e.g., Homeowner Services Group).

Estimated Importance:Tertiary

Customer Segment:Residential Customers

Estimated Margin:High

Recurring Revenue Components

Monthly utility bills from regulated customer base

Long-term government contracts

Pricing Strategy

Regulated Rate-of-Return

Regulated Monopoly

Transparent (Publicly Filed Tariffs)

Revenue is determined by a formula allowing the company to recover operating costs and earn an approved rate of return on its capital investments. Pricing changes (rate increases) require formal application and approval from state regulators in a public process known as a 'rate case'.

Monetization Assessment

Strengths

- •

High predictability and stability of revenue due to the essential nature of the service and regulated monopoly status.

- •

Revenue growth is directly linked to necessary capital investment in infrastructure, creating a clear path for expansion.

- •

Geographic diversification across multiple states mitigates risk from any single regulatory environment.

Weaknesses

- •

Revenue growth is constrained by regulatory approval and can involve lengthy and contentious rate case proceedings.

- •

High capital intensity requires significant ongoing investment and access to capital markets, leading to high debt levels.

- •

Limited pricing power; the company cannot independently adjust rates based on market conditions.

Opportunities

- •

Acquisition of smaller, under-invested municipal or private water systems in a highly fragmented market.

- •

Increased federal and state funding for water infrastructure renewal (e.g., lead pipe replacement, PFAS treatment).

- •

Expanding market-based businesses, such as service line protection, to a broader customer base.

- •

Developing advanced water treatment and reuse technologies as a new service line.

Threats

- •

Unfavorable regulatory decisions (rate case denials or reductions) directly impacting profitability.

- •

Increasing stringency of environmental regulations (e.g., for PFAS and other contaminants) requiring substantial, potentially unrecoverable, capital investment.

- •

Public and political opposition to privatization and rate increases, impacting acquisition strategy.

- •

Physical and cybersecurity threats to critical infrastructure.

Market Positioning

Industry Leader & Trusted Community Partner

Largest publicly traded U.S. water and wastewater utility, though overall market share is small due to the highly fragmented nature of the industry (dominated by public municipal ownership).

Target Segments

- Segment Name:

Residential Customers

Description:Households within the company's designated service territories across 14 states.

Demographic Factors

Homeowners and renters

Varied income levels

Psychographic Factors

- •

Expectation of uninterrupted, safe service

- •

Concerned about water quality and safety

- •

Price-sensitive regarding utility bills

Behavioral Factors

- •

Consistent daily water usage

- •

Payment of monthly bills

- •

Limited choice of provider (monopoly)

Pain Points

- •

Service interruptions or boil water advisories

- •

Concerns about contaminants (e.g., lead, PFAS)

- •

Affordability of rate increases

- •

Understanding complex billing

Fit Assessment:Excellent

Segment Potential:Low

- Segment Name:

Municipal & Community Leaders

Description:Elected officials, town managers, and utility directors of small to medium-sized municipalities.

Demographic Factors

Represents communities with aging infrastructure

Often facing budget constraints

Psychographic Factors

- •

Risk-averse regarding public health and safety

- •

Seeking long-term, stable solutions for critical infrastructure

- •

Politically sensitive to resident complaints and rate increases

Behavioral Factors

Evaluating options for privatizing or creating public-private partnerships for their water/wastewater systems.

Seeking operational expertise and access to capital.

Pain Points

- •

Inability to fund necessary capital improvements for aging infrastructure.

- •

Lack of specialized expertise to manage complex utility operations and meet environmental regulations.

- •

Financial burden of utility management on municipal budgets.

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

U.S. Department of Defense (DoD)

Description:Leadership at military installations responsible for base operations and infrastructure.

Demographic Factors

Large, complex facilities with critical operational needs

Psychographic Factors

Prioritizes reliability, security, and long-term operational stability

Focus on mission readiness and resilience

Behavioral Factors

Utilizes the Utilities Privatization (UP) program to partner with private companies.

Enters into long-term (50-year) contracts.

Pain Points

- •

Managing non-core utility functions diverts focus from primary military mission.

- •

Need for capital and expertise to modernize base infrastructure to current standards.

- •

Ensuring water system resilience and security.

Fit Assessment:Excellent

Segment Potential:Medium

Market Differentiation

- Factor:

Scale and Geographic Diversity

Strength:Strong

Sustainability:Sustainable

- Factor:

Operational and Regulatory Expertise

Strength:Strong

Sustainability:Sustainable

- Factor:

Access to Capital Markets

Strength:Strong

Sustainability:Sustainable

Value Proposition

To provide safe, clean, reliable, and affordable water and wastewater services to communities, supported by industry-leading expertise and a commitment to infrastructure investment.

Excellent

Key Benefits

- Benefit:

Reliability of Service

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Track record of operational performance

- •

Ongoing capital investment programs

- •

24/7 customer service and emergency response

- Benefit:

Water Quality and Safety

Importance:Critical

Differentiation:Common

Proof Elements

- •

Compliance with or outperformance of EPA standards

- •

Public water quality reports

- •

Investment in advanced treatment technologies

- Benefit:

Long-Term Infrastructure Stewardship

Importance:Important

Differentiation:Unique

Proof Elements

- •

Large-scale capital expenditure plans

- •

Expertise in acquiring and upgrading aging systems

- •

Status as a preferred partner for municipalities

Unique Selling Points

- Usp:

The scale and financial capacity to acquire and modernize under-invested water systems, solving a major problem for local governments.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Proven expertise in navigating complex state and federal regulatory environments, a key requirement for successful operation.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A dedicated Military Services Group with a strong track record of long-term partnerships with the Department of Defense.

Sustainability:Long-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Lack of access to the capital and expertise needed to maintain and upgrade critical water infrastructure.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

The daily operational burden of providing a highly regulated, essential public service.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Ensuring compliance with ever-evolving and increasingly stringent environmental and safety regulations.

Severity:Critical

Solution Effectiveness:Complete

Value Alignment Assessment

High

The value proposition directly addresses the critical, nationwide issue of aging water infrastructure and the financial and operational challenges faced by municipalities.

High

The proposition is perfectly tailored to the primary growth audiences: municipalities seeking a reliable partner and regulators/investors seeking a stable, well-managed utility.

Strategic Assessment

Business Model Canvas

Key Partners

- •

State Public Utility Commissions (PUCs)

- •

Municipal Governments

- •

U.S. Department of Defense (DoD)

- •

Environmental Protection Agency (EPA) and state environmental bodies

- •

Infrastructure and technology suppliers

- •

Capital Markets (Bondholders and Equity Investors)

Key Activities

- •

Water Treatment & Distribution

- •

Wastewater Collection & Treatment

- •

Infrastructure Maintenance, Repair & Replacement

- •

Capital Program Management

- •

Regulatory Compliance & Rate Case Management

- •

Customer Service & Billing

- •

Mergers & Acquisitions

Key Resources

- •

Vast network of physical assets (pipes, treatment plants, reservoirs)

- •

Water rights and access to water sources

- •

Skilled workforce (engineers, scientists, certified operators)

- •

Financial capital and strong credit rating

- •

Regulatory licenses and permits to operate

Cost Structure

- •

Capital Expenditures (CapEx) for infrastructure projects

- •

Depreciation of assets

- •

Operational Expenditures (OpEx): labor, energy, chemicals, maintenance

- •

Financing costs (interest on debt)

- •

Regulatory and compliance costs

Swot Analysis

Strengths

- •

Defensive business model with inelastic demand for an essential service.

- •

Scale and geographic diversity reduce risk and create efficiencies.

- •

Constructive regulatory relationships in most operating states.

- •

Strong access to capital to fund growth and infrastructure renewal.

Weaknesses

- •

High degree of regulation limits flexibility and growth potential.

- •

Extremely capital-intensive, leading to high levels of debt.

- •

Growth is largely dependent on the slow process of acquisitions and rate cases.

- •

Exposed to public sentiment and political pressure regarding rate increases.

Opportunities

- •

Consolidate the highly fragmented U.S. water utility market through acquisitions.

- •

Address national infrastructure challenges like lead service line replacement and PFAS contamination.

- •

Leverage technology (smart meters, AI, data analytics) to improve operational efficiency and customer service.

- •

Expand non-regulated, market-based services.

Threats

- •

Adverse regulatory outcomes that limit returns on investment.

- •

Rising interest rates increasing the cost of capital for infrastructure projects.

- •

Impacts of climate change, such as drought and extreme weather, on water supply and infrastructure.

- •

Increasingly sophisticated cybersecurity attacks targeting critical infrastructure.

Recommendations

Priority Improvements

- Area:

Operational Efficiency

Recommendation:Accelerate the deployment of smart water meters and advanced leak detection technology across the service territory to reduce non-revenue water, lower operational costs, and provide customers with better data.

Expected Impact:High

- Area:

Customer Experience

Recommendation:Invest in a unified digital platform for customer self-service, including bill payment, outage reporting, and water usage insights, to improve customer satisfaction and reduce call center volume.

Expected Impact:Medium

- Area:

Acquisition Integration

Recommendation:Develop a standardized, technology-enabled playbook for rapidly integrating acquired utilities to accelerate synergy realization and operational improvements.

Expected Impact:High

Business Model Innovation

- •

Develop 'Water-as-a-Service' (WaaS) offerings for large industrial clients, providing comprehensive water management, treatment, and recycling solutions under long-term contracts.

- •

Create a data and analytics consulting arm to advise smaller municipalities on asset management, capital planning, and water loss prevention, creating a new revenue stream and a pipeline for future acquisitions.

- •

Invest in and pilot innovative water supply solutions, such as water recycling/reuse and desalination (where geographically feasible), to position the company as a leader in water sustainability and scarcity solutions.

Revenue Diversification

- •

Aggressively expand the Homeowner Services Group (service line protection) into all existing service territories and explore adjacent home services.

- •

Systematically pursue more contracts with the Department of Defense and other federal government agencies.

- •

Explore opportunities in the unregulated stormwater management market, helping communities address flooding and water quality issues.

American Water's business model is the archetype of a mature, regulated utility. Its foundation is the stable, predictable revenue generated from providing an essential service within a monopolistic framework. The company's strategic position is exceptionally strong due to its unparalleled scale in the fragmented U.S. water market, its operational expertise, and its proven ability to navigate complex regulatory environments. The primary growth lever is not organic market expansion but rather the strategic acquisition of smaller, capital-starved municipal systems, a strategy fueled by its superior access to capital markets.

The key tension in this model is the balance between the immense, ongoing need for capital investment to maintain and upgrade aging infrastructure and the ability to secure timely and adequate rate relief from regulators. Future evolution will depend on the company's ability to execute its acquisition strategy efficiently, integrate new technologies to drive operational improvements and manage costs, and innovate at the margins of its core regulated business. Strategic transformation potential lies in leveraging its core competencies—large-scale infrastructure management and operational expertise—to create new service lines, such as advanced industrial water management or data-driven consulting, thereby mitigating risks associated with sole reliance on regulated returns and positioning itself as a comprehensive water solutions provider for the 21st century.

Competitors

Competitive Landscape

Mature

Highly fragmented

Barriers To Entry

- Barrier:

High Capital Investment

Impact:High

- Barrier:

Regulatory Approvals and Franchises

Impact:High

- Barrier:

Economies of Scale

Impact:High

- Barrier:

Environmental Compliance

Impact:High

Industry Trends

- Trend:

Consolidation of smaller municipal utilities

Impact On Business:Major growth opportunity for American Water, which specializes in acquiring and integrating smaller, under-capitalized systems.

Timeline:Immediate

- Trend:

Aging water infrastructure requiring significant capital investment.

Impact On Business:Creates a need for rate increases to fund upgrades, but also an opportunity to improve efficiency and reliability. American Water's scale is an advantage in securing capital.

Timeline:Immediate

- Trend:

Increasingly stringent regulations (e.g., PFAS contaminants).

Impact On Business:Requires investment in advanced treatment technologies and increases compliance costs, potentially impacting profitability if not approved in rate cases.

Timeline:Near-term

- Trend:

Digital transformation and adoption of smart water technologies (IoT, AI for leak detection).

Impact On Business:Opportunity to improve operational efficiency, enhance customer service, and differentiate from less technologically advanced competitors.

Timeline:Near-term

- Trend:

Growing customer expectations for digital self-service and transparent communication.

Impact On Business:Requires investment in customer-facing technology and proactive communication strategies to maintain satisfaction, especially around rate changes and infrastructure projects.

Timeline:Immediate

Direct Competitors

- →

Essential Utilities (Aqua)

Market Share Estimate:Second largest publicly traded water utility in the U.S.

Target Audience Overlap:High

Competitive Positioning:Positions itself as a multi-utility provider (water and natural gas), focusing on growth through acquisition of municipal water and wastewater systems across 10 states.

Strengths

- •

Strong track record of municipal acquisitions.

- •

Diversified revenue stream with natural gas utility (Peoples brand).

- •

Solid operational efficiency and financial performance.

- •

High return on equity compared to the sector average.

Weaknesses

- •

Smaller scale and less geographic diversity compared to American Water.

- •

Integration challenges of managing two different utility types (water and gas).

- •

Customer satisfaction scores can be low in some regions.

Differentiators

Dual-utility model (water and natural gas).

Strong focus on specific states like Pennsylvania for growth.

- →

California Water Service Group

Market Share Estimate:One of the largest investor-owned water utilities, primarily on the West Coast.

Target Audience Overlap:Medium

Competitive Positioning:Focuses on providing water and wastewater services primarily in California, with operations in Washington, New Mexico, and Hawaii, positioning as a regional expert.

Strengths

- •

Deep expertise in a major, highly regulated market (California).

- •

Strong financial performance and consistent dividend history.

- •

Positive customer satisfaction rankings in its primary service areas.

- •

Favorable analyst ratings suggesting potential upside.

Weaknesses

- •

High geographic concentration in California, making it vulnerable to regional economic, regulatory, and climate-related risks (e.g., droughts, wildfires).

- •

Smaller overall scale compared to American Water.

- •

Debt is not well covered by operating cash flow.

Differentiators

Regional specialization and deep understanding of West Coast water challenges.

Strong local branding and community engagement within its service territories.

- →

American States Water Company

Market Share Estimate:A significant player, particularly in California, and a direct competitor in military base contracts.

Target Audience Overlap:Medium

Competitive Positioning:A diversified utility with regulated water/wastewater services in California and a major contracted services segment (ASUS) that serves military bases nationwide.

Strengths

- •

Longest dividend growth streak of any publicly traded company (Dividend King).

- •

Direct competitor to American Water's Military Services Group.

- •

Favorable regulatory environment in California supports capital investment.

Weaknesses

- •

High revenue concentration in California for its regulated business.

- •

Smaller scale than American Water.

- •

Recent earnings have been impacted by lower construction activity in its contracted services segment.

Differentiators

Strong focus and success in securing long-term military contracts.

Exceptional history of dividend growth, appealing to income-focused investors.

Indirect Competitors

- →

Veolia North America

Description:Provides a wide range of environmental services, including outsourced water and wastewater operations for municipalities and industrial clients. They focus on complex, technology-driven solutions.

Threat Level:Medium

Potential For Direct Competition:They compete for municipal and industrial service contracts, and their focus on digital solutions and 'smart water' technology could disrupt traditional utility models.

- →

Point-of-Use Filtration Companies (e.g., Culligan, Brita, Pur)

Description:These companies offer products that treat water directly at the tap or in the home, addressing customer concerns about tap water quality.

Threat Level:Low

Potential For Direct Competition:They don't compete on infrastructure but on customer trust. A decline in public trust in tap water safety, fueled by concerns like PFAS, increases their market.

- →

Decentralized Water Technology Providers

Description:Companies developing and implementing localized or on-site water treatment and recycling systems for commercial, industrial, or community-scale applications.

Threat Level:Low

Potential For Direct Competition:Currently a niche market, but could grow as a long-term threat by reducing reliance on centralized utility networks, especially in new developments or water-scarce regions.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Scale and Geographic Diversity

Sustainability Assessment:Highly sustainable. As the largest publicly traded U.S. water utility, this provides operational efficiencies, purchasing power, and risk diversification across multiple state regulatory environments.

Competitor Replication Difficulty:Hard

- Advantage:

Expertise in Acquisitions and Integration

Sustainability Assessment:Highly sustainable. The fragmented nature of the U.S. water market provides a continuous pipeline of acquisition opportunities. American Water has a proven model for integrating these smaller, often troubled, systems.

Competitor Replication Difficulty:Medium

- Advantage:

Military Services Group

Sustainability Assessment:Highly sustainable. Holds long-term (50-year) contracts to operate water systems on military bases, a specialized market with high barriers to entry and a stable, non-regulated revenue stream.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'Leadership in Specific Technology Pilots', 'estimated_duration': '1-3 years'}

{'advantage': 'Positive Customer Satisfaction Rankings in Specific Regions', 'estimated_duration': '1-2 years'}

Disadvantages

- Disadvantage:

High Capital Expenditure Needs

Impact:Major

Addressability:Moderately

- Disadvantage:

Regulatory Scrutiny and Rate Case Dependency

Impact:Major

Addressability:Difficult

- Disadvantage:

Cybersecurity Risks

Impact:Critical

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Launch a targeted digital campaign on water quality, specifically addressing PFAS concerns, to build trust and proactively communicate safety efforts.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Enhance the online customer portal with personalized water usage analytics and conservation tips, improving engagement and perceived value.

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Develop a standardized 'digital-in-a-box' toolkit to rapidly upgrade the customer-facing technology of newly acquired small utilities, improving satisfaction and operational efficiency from day one.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Establish a public-facing 'Water Innovation Lab' to showcase R&D in water quality, smart grid technology, and sustainability, positioning the company as an industry thought leader.

Expected Impact:Medium

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Expand the Market-Based Businesses segment to offer 'Water-as-a-Service' (WaaS) contracts to large industrial clients, leveraging expertise in water management beyond the regulated utility model.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Lead the industry in creating a comprehensive 'smart water grid,' using AI and IoT for predictive maintenance, real-time quality monitoring, and dynamic network optimization.

Expected Impact:High

Implementation Difficulty:Difficult

Solidify and promote American Water's position as the most technologically advanced, reliable, and sustainable water utility in the nation. Shift the narrative from a traditional utility to a forward-thinking resource management company.

Differentiate through a superior and proactive digital customer experience, transparent communication on infrastructure investments and water quality, and demonstrable leadership in ESG (Environmental, Social, and Governance) initiatives.

Whitespace Opportunities

- Opportunity:

Advanced Water Data Analytics as a Consumer Service

Competitive Gap:No competitor currently offers a sophisticated, user-friendly platform that provides homeowners with real-time water usage data, leak alerts, and appliance-level consumption insights.

Feasibility:Medium

Potential Impact:High

- Opportunity:

National Water Quality Education Platform

Competitive Gap:There is a lack of a trusted, centralized, consumer-friendly resource for information on local water quality, treatment processes, and emerging contaminants. This would build significant brand trust.

Feasibility:High

Potential Impact:Medium

- Opportunity:

Green Infrastructure & Water Resilience Consulting for Municipalities

Competitive Gap:Leverage American Water's scale and engineering expertise to create a consulting arm that helps non-acquired municipalities plan and finance climate-resilient water infrastructure, creating a new revenue stream.

Feasibility:Medium

Potential Impact:Medium

The competitive landscape for American Water is unique. As a regulated utility, it operates as a monopoly within its established service territories, meaning it does not compete for residential customers day-to-day. Instead, competition is primarily focused on three fronts: 1) the acquisition of smaller, fragmented municipal water systems, where it competes with firms like Essential Utilities; 2) securing large-scale service contracts, particularly for military bases, against rivals like American States Water's ASUS; and 3) competition for capital in the financial markets. The U.S. water utility market is mature and highly fragmented, presenting a significant growth runway through consolidation.

American Water's primary sustainable advantages are its unparalleled scale, geographic diversity, and deep expertise in both acquisitions and specialized military contracts. These are difficult for competitors to replicate. The main threats are not from direct customer churn but from regulatory challenges, public perception regarding rate increases, and the immense capital required to upgrade aging infrastructure. The key battleground is shifting towards digital transformation and customer engagement. While a customer cannot choose a different water pipe, their satisfaction, driven by digital service options and proactive communication, heavily influences regulatory bodies during rate case reviews. Competitors like Veolia are positioning themselves as technology leaders, creating a need for American Water to not just maintain, but accelerate its digital innovation to defend its leadership position. The largest whitespace opportunity lies in leveraging its vast data and expertise to create new services and educational platforms that build unshakable brand trust and position it as the definitive leader in water resource management.

Messaging

Message Architecture

Key Messages

- Message:

We provide clean, safe, reliable, and affordable water and wastewater services.

Prominence:Primary

Clarity Score:High

Location:Homepage, Corporate Page, Mission Statement

- Message:

We are the largest and most geographically diverse publicly traded U.S. water and wastewater utility.

Prominence:Secondary

Clarity Score:High

Location:Homepage (Investor Relations link), Corporate messaging

- Message:

We are a socially and environmentally responsible community partner.

Prominence:Secondary

Clarity Score:Medium

Location:Homepage (links to ID&E, Charitable Foundation), Corporate Page, Social Media

- Message:

We offer solutions for communities and partnerships with the military.

Prominence:Tertiary

Clarity Score:Low

Location:Homepage Links

The message hierarchy is disjointed and audience-dependent. The primary user action on the homepage ('Select Your State') is purely functional and preempts any brand-level messaging for residential customers. This structure prioritizes routing existing customers over communicating the brand's value to a broader audience. Key corporate messages about scale, responsibility, and investment are present but are secondary to this initial navigational task, primarily targeting stakeholders like investors and potential municipal partners who are more likely to explore beyond the state selection.

Core messaging around safety, reliability, and community support is highly consistent across the corporate site, mission statement, and social media channels. The tagline 'We Keep Life Flowing®' serves as an effective and consistent anchor for this messaging. While the tone varies by channel, the underlying strategic messages remain stable and coherent.

Brand Voice

Voice Attributes

- Attribute:

Dependable

Strength:Strong

Examples

Clean, safe, reliable and affordable water and wastewater services

Our Essential Services

- Attribute:

Corporate

Strength:Strong

Examples

Our company is the largest and most geographically diverse, publicly traded U.S. water and wastewater company.

Our sustainability strategy includes environmental leadership; operational excellence...

- Attribute:

Community-Oriented

Strength:Moderate

Examples

- •

Supporting communities served by American Water.

- •

KeepCommunitiesFlowing

- •

Highlighting one of the American Water Charitable Foundation’s 2025 Water & Environment grantees in Illinois.

- Attribute:

Approachable

Strength:Weak

Examples

Wholly Sheets! Tomorrow is #NationalToiletPaperDay!

Have you ever wondered why fire hydrants are flushed regularly?

Tone Analysis

Professional and Authoritative

Secondary Tones

Informative

Community-Focused

Tone Shifts

The tone shifts significantly between the formal, corporate language of the main website sections and the more casual, engaging, and sometimes playful tone used in the social media feed.

Voice Consistency Rating

Good

Consistency Issues

The primary consistency issue is the jarring shift from the highly functional, impersonal homepage to the more detailed corporate and community stories on secondary pages and social media. The brand doesn't have a unified voice at the first point of contact.

Value Proposition Assessment

American Water is the most reliable and responsible provider of essential water and wastewater services, delivering safety, quality, and affordability at a national scale with local presence.

Value Proposition Components

- Component:

Reliability & Safety

Clarity:Clear

Uniqueness:Common

- Component:

Affordability

Clarity:Somewhat Clear

Uniqueness:Common

- Component:

National Scale & Expertise

Clarity:Clear

Uniqueness:Unique

- Component:

Environmental & Social Responsibility

Clarity:Clear

Uniqueness:Somewhat Unique

As a utility, differentiation on the core product (water) is nearly impossible. American Water's messaging effectively differentiates the company itself by emphasizing its unique scale ('largest and most geographically diverse'), expertise, and deep commitment to Environmental, Social, and Governance (ESG) principles. The messaging positions the company not just as a utility, but as a critical infrastructure partner, a responsible corporate citizen, and a sound investment. This is a strategic choice to appeal to investors, regulators, and municipal partners more than to residential customers who often lack a choice of provider.

The messaging positions American Water as the industry leader and the most stable, trustworthy choice in the water utility sector. By highlighting its size, public trading status, and partnerships with the Department of Defense, it projects an image of unmatched stability and capability, implicitly positioning smaller municipal or private competitors as less experienced or resourceful.

Audience Messaging

Target Personas

- Persona:

Residential Customers

Tailored Messages

- •

Select Your State

- •

Clean, safe, reliable and affordable water

- •

Water is usually the most affordable utility, but for those who need assistance, we’re ready to help.

Effectiveness:Ineffective

- Persona:

Investors & Shareholders

Tailored Messages

- •

Our company is the largest and most geographically diverse, publicly traded U.S. water and wastewater...

- •

Investor Relations

- •

Sustainability

Effectiveness:Effective

- Persona:

Municipal & Community Partners

Tailored Messages

- •

Solutions for Communities

- •

Our teams of experts have worked on projects from coast to coast...

- •

Supplier Diversity

Effectiveness:Somewhat Effective

- Persona:

Regulators & Government Agencies

Tailored Messages

- •

Military Services Group

- •

Sustainability

- •

Inclusion, Diversity and Equity

Effectiveness:Effective

Audience Pain Points Addressed

- •

Concerns about water safety and quality

- •

Frustration with service reliability and outages

- •

Worries about the affordability of essential utilities

Audience Aspirations Addressed

- •

Living in a healthy and thriving community

- •

Supporting environmentally sustainable practices

- •

Partnering with an ethical and equitable company

Persuasion Elements

Emotional Appeals

- Appeal Type:

Trust & Security

Effectiveness:High

Examples

- •

We Keep Life Flowing®

- •

Clean, safe, reliable and affordable water

- •

Your trusted source for local water and wastewater news.

- Appeal Type:

Community Pride & Belonging

Effectiveness:Medium

Examples

- •

Supporting communities served by American Water.

- •

The American Water Charitable Foundation’s Keep Communities Flowing grant program...

- •

We are an Inclusive, Diverse & Equitable company.

Social Proof Elements

- Proof Type:

Scale & Leadership

Impact:Strong

Examples

largest and most geographically diverse, publicly traded U.S. water and wastewater company

serving more than 14 million people

- Proof Type:

Institutional Partnership

Impact:Strong

Examples

strong and on-going partnership with the DoD through the UP Program.

Military Services Group

- Proof Type:

Community Investment

Impact:Moderate

Examples

American Water Charitable Foundation

Keep Communities Flowing grant program

Trust Indicators

- •

Prominent 'Investor Relations' section implying transparency

- •

Emphasis on 'Sustainability' and corporate governance

- •

Long corporate history (since 1886, mentioned in deeper content)

- •

Specific data points and facts in social media posts (e.g., toilet paper usage stats)

Calls To Action

Primary Ctas

- Text:

Select Your State

Location:Homepage

Clarity:Clear

- Text:

[Link to corporate sub-sections like 'Our Essential Services']

Location:Homepage

Clarity:Somewhat Clear

- Text:

Read more

Location:Corporate Page (Social Media Feed)

Clarity:Clear

The primary CTA, 'Select Your State,' is functionally effective but strategically poor for brand building. It acts as a barrier, preventing users from engaging with the parent brand's story. Other CTAs are passive and informational (e.g., 'Read more', 'Learn more'), lacking compelling, action-oriented language that would drive deeper engagement or lead generation for potential municipal partners. The site lacks strong CTAs that drive measurable business outcomes beyond routing existing customers.

Messaging Gaps Analysis

Critical Gaps

- •

A unified brand narrative on the homepage. The entry point is a functional directory, not a brand experience.

- •

Customer-centric storytelling. There are no testimonials, case studies, or stories that humanize the service and demonstrate impact from a resident's perspective.

- •

A clear value proposition for residential customers. Since they often have no choice in provider, the messaging fails to build brand affinity or justify the value they receive for their payments.

- •

A dedicated, well-developed portal for potential municipal or community partners that clearly outlines services, benefits, and case studies.

Contradiction Points

The brand voice strives to be community-focused and approachable on social media, but the website's structure and primary interaction (the state selector) is impersonal and siloed.

Underdeveloped Areas

The 'Solutions for Communities' message is a headline without substance. It needs to be built out with specific service offerings, case studies, and clear benefits for potential partners.

The 'Our Solution Offering' section on the corporate page appears to be a content placeholder, representing a missed opportunity to detail their B2B and B2G services.

Messaging Quality

Strengths

- •

Strong, consistent core message of reliability, safety, and quality.

- •

Effective and memorable tagline ('We Keep Life Flowing®').

- •

Clear and robust messaging for investors and regulators around sustainability, governance, and scale.

- •

Good use of social media for daily engagement and community-focused content.

Weaknesses

- •

Fragmented user journey that prevents brand building with residential customers.

- •

Overly corporate, dry tone on primary web pages.

- •

Lack of emotional connection and storytelling for the end-user.

- •

Passive, weak calls-to-action that don't drive strategic objectives.

Opportunities

- •

Redesign the homepage to tell the American Water brand story before asking for a state selection, creating a 'why' before the 'where.'

- •

Develop content that showcases the 'behind-the-scenes' work and expertise of employees to build trust and demonstrate value.

- •

Create a targeted content hub for municipal leaders with case studies, white papers, and clear partnership pathways.

- •

Leverage customer data to provide personalized information and build a stronger, more direct relationship with end-users.

Optimization Roadmap

Priority Improvements

- Area:

Homepage User Experience & Messaging

Recommendation:Redesign the homepage to feature a primary brand message and value proposition (e.g., 'Keeping Life Flowing for 14 million Americans') above the 'Select Your State' functionality. The state selector should be integrated, not the sole focus.

Expected Impact:High

- Area:

B2B / B2G Messaging

Recommendation:Build a dedicated 'Solutions for Communities' section with detailed service offerings, case studies of successful municipal partnerships, and clear calls-to-action for interested officials.

Expected Impact:High

- Area:

Customer-Centric Content

Recommendation:Launch a content initiative focused on storytelling. Feature employee profiles, community impact stories from grant recipients, and 'day-in-the-life' content that humanizes the brand and its services.

Expected Impact:Medium

Quick Wins

- •

Update passive CTA text from 'Learn more' to more engaging, benefit-oriented language like 'See Our Impact' or 'Explore Partnership Solutions'.

- •

Add a concise, 2-3 sentence brand mission statement directly on the homepage before the state selector.

- •

Repurpose positive social media content and community grant stories into a 'Community Spotlight' section on the corporate page.

Long Term Recommendations

- •

Develop a comprehensive content strategy that maps specific messages to each target audience at different stages of their journey.

- •

Invest in a more integrated digital experience where the national brand story and the local state information are more seamlessly connected.

- •

Implement a personalization strategy to provide more relevant content to users based on their location or browsing behavior.

American Water's strategic messaging is bifurcated and highly effective for its investor and regulator audiences but underdeveloped for its residential customers and potential municipal partners. The brand successfully projects an image of stability, scale, and corporate responsibility—key decision drivers for financial stakeholders. The core value proposition of providing 'clean, safe, reliable, and affordable' water is clear and consistent.

However, the website's architecture is the single greatest impediment to its messaging strategy. The homepage acts as a functional off-ramp, immediately directing the majority of users (residential customers) to state-specific microsites without establishing a relationship with the parent brand. This creates a significant messaging gap, failing to build brand equity, trust, or affinity with the end-users who ultimately pay for the service. Consequently, for millions of customers, 'American Water' is likely perceived as just a name on a bill rather than a trusted steward of a vital resource.

The messaging for potential B2B and B2G partners (e.g., 'Solutions for Communities') is present but lacks the depth, proof points, and compelling calls-to-action needed to be a strong business development tool. While the social media content demonstrates a more approachable and community-focused voice, it exists in a silo, disconnected from the formal, impersonal experience of the main website.

To optimize, American Water must unify its digital presence, creating a compelling brand narrative at the national level that engages all audiences before directing them to localized content. The immediate priority should be to redesign the homepage to tell a story, not just provide directions. Subsequently, building out robust content for community partners and weaving customer-centric stories into the corporate narrative will be critical to transforming the brand from a faceless utility into a valued community and national asset.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Serves as an essential life-sustaining service (water/wastewater) to a captive customer base of over 14 million people.

- •

Largest and most geographically diverse publicly traded U.S. water and wastewater utility, indicating significant market trust and regulatory approval.

- •

Long-standing operations since 1886, demonstrating a durable and resilient service model.

- •

Consistent dividend growth and stable financial performance underscore a reliable service that customers and regulators support.

Improvement Areas

- •

Enhancing digital customer service tools for billing, service alerts, and water usage information to meet modern consumer expectations.

- •

Increasing public transparency and education around water quality testing, especially concerning emerging contaminants like PFAS.

- •

Developing more robust customer assistance and affordability programs to mitigate the impact of necessary rate increases.

Market Dynamics

Low but stable (Projected 3.82% CAGR for global water utility services market from 2025-2033). Growth is primarily driven by acquisitions and regulated capital investment.

Mature

Market Trends

- Trend:

Aging Infrastructure Crisis

Business Impact:Creates a massive, non-discretionary need for capital investment in pipe replacement and plant modernization, which forms the basis for regulated rate increases and earnings growth.

- Trend:

Industry Consolidation

Business Impact:Highly fragmented market (84% of water systems are publicly owned) presents a significant opportunity for growth via acquisition of smaller, under-capitalized municipal systems.

- Trend:

Increasingly Strict Environmental Regulations (e.g., PFAS)

Business Impact:Drives need for advanced treatment technologies, increasing capital expenditure requirements and operational complexity, but also creates opportunities to demonstrate expertise and secure rate adjustments for compliance.

- Trend:

Water Scarcity and Climate Change

Business Impact:Increases focus on water efficiency, conservation technologies, and developing resilient infrastructure, creating new investment avenues and demonstrating environmental leadership.

Excellent. The confluence of aging infrastructure, tightening regulations, and financial pressures on municipalities creates a favorable environment for a well-capitalized, expert operator like American Water to accelerate its acquisition-led growth strategy.

Business Model Scalability

Medium

High fixed costs associated with infrastructure (plants, pipes). Scale is achieved by spreading these costs over a larger customer base, primarily through acquisitions. For every $1 of opex saved, AWK can invest up to $8 in its asset base with no change to customer bills.

High. Acquiring adjacent or 'tuck-in' systems allows American Water to leverage existing operational teams, expertise, and purchasing power, creating significant efficiencies.

Scalability Constraints

- •

Regulatory approval process for acquisitions and rate cases can be lengthy and unpredictable.

- •

Requirement for massive, ongoing capital investment to fund both organic infrastructure renewal and acquisitions.

- •

Geographic limitations; growth is focused on expanding within or adjacent to their existing 14-state footprint.

- •

Political and public resistance to the privatization of municipal water systems.

Team Readiness

Strong. The leadership team demonstrates deep expertise in regulated utility operations, capital markets, and M&A, as evidenced by their consistent execution of their growth strategy.

Effective. A decentralized, state-based subsidiary structure allows for focused management of local regulatory relationships, while corporate provides centralized expertise in finance, engineering, and M&A.

Key Capability Gaps

- •

Advanced Data Analytics & AI: Need for deeper skills in leveraging data for predictive maintenance, leak detection, and optimizing capital deployment.

- •

Digital Customer Experience: Potential gap in talent focused on creating seamless, modern digital interactions for customers.

- •

Environmental Scientists/Toxicologists: Increasing need for in-house expertise on emerging contaminants (PFAS) to stay ahead of regulatory curves.

Growth Engine

Acquisition Channels

- Channel:

Strategic M&A of Municipal & Private Systems

Effectiveness:High

Optimization Potential:High

Recommendation:Develop a programmatic M&A strategy that segments potential targets by size and political readiness, creating specialized pursuit teams for large municipal systems versus smaller 'tuck-in' acquisitions.

- Channel:

Government Relations & Regulatory Advocacy

Effectiveness:High

Optimization Potential:Medium

Recommendation:Proactively engage with state legislators to advocate for policies that facilitate fair market value acquisitions and streamlined consolidation of smaller, non-compliant systems.

- Channel:

Military Services Group (DoD Partnerships)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Leverage successful partnerships on military bases as case studies to showcase long-term operational excellence to large municipalities considering public-private partnerships.

Customer Journey

The 'customer' in a growth context is a municipality. The journey involves awareness of infrastructure/financial challenges, consideration of privatization, evaluation of partners, negotiation, regulatory approval, and finally, integration.

Friction Points

- •

Political opposition and concerns over loss of local control.

- •

Disagreements on the valuation of aging municipal assets.

- •

Lengthy and complex state-level regulatory approval processes.

- •

Public sentiment against rate increases post-privatization.

Journey Enhancement Priorities

{'area': 'Early-Stage Education', 'recommendation': "Create a dedicated 'Community Solutions' portal with case studies, financial modeling tools, and regulatory guides for municipal leaders exploring their options."}

{'area': 'Public Engagement', 'recommendation': 'Develop a public advocacy toolkit for target municipalities to clearly communicate the benefits of partnership, such as improved safety, reliability, and long-term rate stability.'}

Retention Mechanisms

- Mechanism:

Regulated Monopoly Status

Effectiveness:High

Improvement Opportunity:Not applicable for retention, but service quality and rate affordability are critical for maintaining regulatory and public support.

- Mechanism:

Reliable Service & Water Quality

Effectiveness:High

Improvement Opportunity:Invest in smart grid technologies (sensors, AI) for proactive leak detection and pressure management to further improve service reliability and reduce water loss.

- Mechanism:

Customer Service & Communication

Effectiveness:Moderate

Improvement Opportunity:Implement a unified, omni-channel customer service platform across all state subsidiaries for a consistent, modern customer experience.

Revenue Economics

Strong. The regulated utility model allows for the recovery of prudent capital investments and operating costs plus an authorized rate of return on equity, creating a predictable and profitable model.

Not Applicable. The relevant metric is 'Regulated Rate Base Growth' driven by capital investment and acquisitions, which directly correlates to earnings growth.

High. American Water demonstrates strong operational efficiency, which allows them to invest more capital for the same impact on customer bills, creating a competitive advantage.

Optimization Recommendations

- •

Continue to leverage scale for procurement savings on chemicals, pipes, and technology.

- •

Standardize best practices for operational efficiency across all state subsidiaries to lower O&M costs.

- •

Aggressively pursue cost recovery through infrastructure surcharges and timely rate case filings to align revenue with capital deployment.

Scale Barriers

Technical Limitations

- Limitation:

Aging Infrastructure

Impact:High

Solution Approach:This is also the primary growth driver. The solution is a disciplined, long-term capital investment plan, funded by retained earnings, debt, and equity, and recovered through regulated rates.

Operational Bottlenecks

- Bottleneck:

Regulatory Lag

Growth Impact:The time between making a capital investment and getting it reflected in rates can impact cash flow and returns.

Resolution Strategy:Utilize legislative and regulatory mechanisms like forward-looking test years and infrastructure surcharges to shorten the recovery cycle.

- Bottleneck:

Skilled Labor Shortages

Growth Impact:A retiring workforce of licensed water/wastewater operators and engineers could constrain operational excellence and project execution.

Resolution Strategy:Invest in robust apprenticeship programs, university partnerships, and technology (automation, remote monitoring) to mitigate the impact of workforce demographic shifts.

- Bottleneck:

Supply Chain for Infrastructure Components

Growth Impact:Global supply chain disruptions can delay capital projects and increase costs for essential materials like pipes, pumps, and valves.

Resolution Strategy:Develop strategic sourcing partnerships with key suppliers and diversify the supplier base to enhance resilience.

Market Penetration Challenges

- Challenge:

Competition from Other Investor-Owned Utilities

Severity:Major

Mitigation Strategy:Leverage superior scale, lower cost of capital, and a proven track record of successful integrations to present a more compelling offer to acquisition targets. Key competitors include Essential Utilities and California Water Service Group.

- Challenge:

Political and Public Opposition to Privatization

Severity:Critical

Mitigation Strategy:Engage in proactive, transparent community outreach. Highlight commitments to employees, local investment, and long-term rate stability. Frame acquisitions as public-private partnerships.

Resource Limitations

Talent Gaps

- •

Data Scientists and AI Specialists

- •

Cybersecurity Experts for SCADA/Operational Technology systems

- •

Regulatory Strategists with expertise in innovative rate design

Extremely high and continuous. Growth is directly tied to the ability to raise billions in capital annually for infrastructure investment and acquisitions. The company has a stated capital plan of $3.3 billion for 2025.

Infrastructure Needs

- •

Modernization of IT and OT (Operational Technology) systems.

- •

Investment in centralized data analytics platforms.

- •

Upgrades to research and development labs for testing new treatment technologies.

Growth Opportunities

Market Expansion

- Expansion Vector:

Acquisition of Small-to-Medium Municipal Systems

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Focus on 'tuck-in' acquisitions within the existing 14-state footprint to maximize operational synergies and regulatory familiarity. Recent acquisitions of Butler Area Sewer Authority and Nexus Water Group are prime examples of this strategy.

- Expansion Vector:

Expansion into New Regulated States

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Consider entry into new states with favorable regulatory environments and fragmented water markets, likely through the acquisition of a smaller, existing investor-owned utility in that state.

Product Opportunities

- Opportunity:

Water Resilience as a Service (WRaaS)

Market Demand Evidence:Increasing frequency of droughts, floods, and other climate-related events are stressing municipal systems.

Strategic Fit:High

Development Recommendation:Develop a consulting and management service line for municipalities and large industrial clients focused on climate resilience planning, water reuse technology, and advanced conservation programs.

- Opportunity:

PFAS Remediation Solutions

Market Demand Evidence:New EPA regulations create a multi-billion dollar compliance need for utilities nationwide.

Strategic Fit:High

Development Recommendation:Position American Water's R&D and engineering teams as industry leaders in cost-effective PFAS treatment. Offer technical assistance and contract operations to smaller utilities struggling with compliance.

- Opportunity:

Smart Water Metering & Analytics Services

Market Demand Evidence:Desire for greater water efficiency and customer empowerment.

Strategic Fit:Medium

Development Recommendation:Expand the B2B offerings of subsidiaries like American Water Resources to provide advanced metering infrastructure (AMI) installation, network management, and data analytics as a service to other utilities.

Channel Diversification

- Channel:

Public-Private Partnership (P3) Concessions

Fit Assessment:High

Implementation Strategy:Develop a dedicated team to pursue long-term concession agreements where American Water manages and invests in a municipal system without taking ownership, offering a politically palatable alternative to outright sale.

Strategic Partnerships

- Partnership Type:

Technology & AI Firms

Potential Partners

- •

Autodesk

- •

Bentley Systems

- •

Palantir

- •

Specialized water tech startups

Expected Benefits:Accelerate digital transformation, leverage AI for predictive analytics on asset failure and water quality, and create 'digital twin' models of the water systems for optimized capital planning.

- Partnership Type:

Infrastructure Investment Funds

Potential Partners

- •

Blackstone Infrastructure Partners

- •

Global Infrastructure Partners

- •

Brookfield Asset Management

Expected Benefits:Co-invest in very large municipal system acquisitions or P3s, reducing the capital burden on American Water's balance sheet and enabling the pursuit of larger growth opportunities.

Growth Strategy

North Star Metric

Annual Regulated Rate Base Growth

This metric is the most direct driver of long-term, sustainable earnings and dividend growth in a regulated utility. It encompasses both organic growth (capital investment) and inorganic growth (acquisitions), aligning the entire organization on value creation.

Maintain a consistent 7-9% annual growth rate, in line with stated long-term targets.

Growth Model

Acquisition & Capital Investment Flywheel

Key Drivers

- •

Scale-driven operational efficiencies.

- •

Disciplined capital investment in infrastructure renewal.

- •

Strategic acquisitions of municipal and private utilities.

- •

Constructive regulatory relationships and timely cost recovery.

As American Water grows through acquisitions, it achieves greater scale. This scale leads to operational efficiencies and a lower cost of capital, which frees up more funds for infrastructure investment. This investment expands the rate base, which, with regulatory approval, generates higher earnings, providing more capital for further acquisitions, thus spinning the flywheel faster.

Prioritized Initiatives

- Initiative:

Launch 'Programmatic Tuck-In Acquisition' Team

Expected Impact:High

Implementation Effort:Medium

Timeframe:6-9 months

First Steps:Create a dedicated team focused on identifying and acquiring systems under 10,000 connections within the existing footprint, using a standardized playbook to accelerate diligence and integration.

- Initiative:

Establish a Digital Transformation & AI Center of Excellence

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:12 months

First Steps:Hire a Chief Digital Officer to lead a centralized team focused on deploying AI for predictive maintenance, optimizing energy usage in treatment plants, and enhancing cybersecurity.

- Initiative:

Develop a 'PFAS Compliance Solutions' Package

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 months

First Steps:Formalize internal expertise into a marketable service offering for other utilities, including consulting on technology selection, engineering design, and contract operations for new treatment facilities.

Experimentation Plan

High Leverage Tests

- Experiment:

Pilot innovative financing structures for acquisitions (e.g., seller financing, earn-outs) with smaller municipalities.

Hypothesis:Flexible financing will make privatization more attractive to capital-constrained towns.

- Experiment:

Test performance-based rate-making mechanisms in a single jurisdiction.

Hypothesis:Aligning revenue directly with key performance indicators (e.g., water loss reduction, customer service) will be viewed favorably by regulators and customers.

- Experiment:

Deploy AI-powered satellite imagery analysis for early leak detection in a pilot service area.

Hypothesis:This technology can significantly reduce non-revenue water and operational costs compared to traditional methods.

For each experiment, define clear KPIs (e.g., deal conversion rate, approved ROE, water loss percentage), establish a baseline, run the experiment for a defined period (6-12 months), and compare results against a control group or historical performance.

Review and approve new pilot projects on a semi-annual basis, with quarterly progress reports to a central growth/innovation steering committee.

Growth Team

A 'Growth Council' comprising the CEO, CFO, COO, and heads of Corporate Development (M&A), Regulatory Affairs, and a new Chief Strategy & Innovation Officer. This council would oversee the prioritized initiatives and pilot programs.

Key Roles

- •

Chief Strategy & Innovation Officer: To explore and develop non-traditional growth vectors like WRaaS and P3s.

- •

Director of M&A Integration: To ensure the successful and efficient integration of acquired utilities, realizing projected synergies.

- •

Head of Government & Public Affairs: To lead the political and community engagement efforts critical for successful acquisitions.

Establish a rotational program for high-potential employees to spend time in Corporate Development, Regulatory Affairs, and Operations to build a pipeline of future leaders with a holistic understanding of the growth model.

American Water is in an exceptionally strong position for sustained, long-term growth. Its foundation is built on the non-discretionary need for water and wastewater services, operating within a mature, regulated market that provides predictable returns. The company's primary growth engine is not traditional customer acquisition, but a sophisticated 'Acquisition & Capital Investment Flywheel'. The massive, nationwide challenge of aging water infrastructure, coupled with tightening environmental regulations (especially concerning PFAS), acts as a powerful tailwind. These challenges overwhelm smaller municipal systems, creating a steady stream of acquisition opportunities for a large, well-capitalized, and expert operator like American Water.

The company's core strategy of acquiring fragmented local utilities and investing heavily in capital upgrades (with a planned $3.3B in 2025) is sound and proven. The scale provides a distinct competitive advantage, allowing for operational efficiencies and a lower cost of capital that smaller rivals cannot match. The main barriers to accelerating this growth are not operational or technical, but regulatory and political. The lengthy approval process for acquisitions and rate cases, along with potential public opposition to privatization, are the primary constraints.

Key growth opportunities lie in optimizing their core acquisition model and expanding into adjacent services. They can accelerate 'tuck-in' acquisitions by creating a programmatic, repeatable process. Furthermore, American Water is uniquely positioned to capitalize on emerging industry needs by offering 'Water Resilience as a Service' or becoming a leading solutions provider for complex challenges like PFAS remediation. These new service lines leverage their core expertise and could create high-margin, less capital-intensive revenue streams.

To execute this, the recommended growth strategy is to double down on the flywheel model while building capabilities for the future. The North Star Metric of 'Annual Regulated Rate Base Growth' will keep the entire organization focused on the primary driver of shareholder value. Prioritized initiatives should focus on streamlining the acquisition process, investing in a digital and AI core to enhance efficiency, and formalizing their expertise to seize new market opportunities. The creation of a dedicated 'Growth Council' and the hiring of a Chief Strategy & Innovation Officer will ensure that the company not only executes on its current model but also actively builds its next engine of growth.

Legal Compliance

American Water maintains several documents that function as privacy policies across its various web properties. The primary policy is titled 'Privacy Policy' and a more detailed 'Customer Privacy Policy' is also available. These policies state that the company collects personally identifiable information (PII) such as name, email, address, and phone number when users register, subscribe, or fill out a form. The stated purpose for data collection includes responding to inquiries, sending information, and securing their services. The company explicitly states it does not sell, trade, or otherwise transfer PII to outside parties, except to trusted third parties who assist in business operations under confidentiality agreements. However, the policy allows for the sharing of non-personally identifiable visitor information for marketing or advertising. For California residents, the company notes compliance with the California Online Privacy Protection Act and states it will not distribute personal information to outside parties without consent. The policy lacks specific details required by the CCPA/CPRA, such as enumerating the specific rights of California consumers (e.g., right to know, delete, correct) and providing a clear 'Do Not Sell or Share My Personal Information' link. The existence of multiple policies (including one for a 'Brand Store' which appears to be managed by a third party) could create confusion for users trying to understand their rights.

American Water provides 'Terms of Use' that govern its website (amwater.com) and related services. The terms are accessible, though not prominently linked from the main landing page. They define the relationship between the company and the user, stating that by accessing the site, the user agrees to be bound by the terms. Key provisions include a disclaimer of warranties, providing the site and its content on an 'AS IS' and 'AS AVAILABLE' basis. It also includes limitations on liability and establishes the jurisdiction for any legal disputes in the State of New Jersey. The document addresses hyperlinks to third-party sites, disclaiming all liability for their content or services. While comprehensive for website usage, these terms do not seem to cover the specifics of the utility-customer service relationship (e.g., service disconnection, billing disputes), which are likely governed by state-level public utility commission regulations and separate customer agreements.