eScore

att.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

AT&T demonstrates a dominant digital presence for high-intent, commercial search terms, leveraging its immense brand authority to capture bottom-of-funnel traffic effectively. Its multi-channel presence is consistent, driving users towards transactional outcomes through its website, social media, and extensive retail network. However, the strategy is weak in addressing top-of-funnel, informational search queries, missing opportunities to engage customers early in their journey with educational content and thought leadership.

Exceptional visibility and authority for branded and commercial keywords (e.g., 'iPhone 16 pro', 'AT&T deals'), effectively capturing users ready to make a purchase.

Develop a robust content strategy around user problems and solutions (e.g., 'how to improve home wifi') to capture informational search traffic and build trust before the purchase decision.

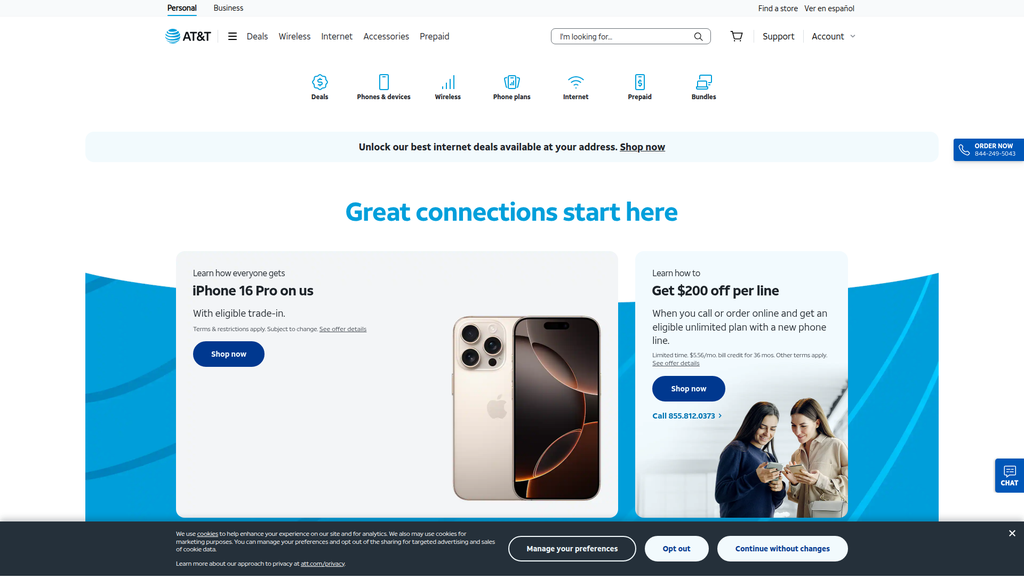

The brand's communication is exceptionally clear and effective at driving customer acquisition through aggressive, device-centric promotions. Messaging is laser-focused on deals like 'iPhone on us', which strongly resonates with deal-driven consumers. This singular focus, however, creates a significant disconnect from the corporate mission of 'simplicity and inspiration' and fails to build a durable brand preference based on network quality or customer experience, making it vulnerable to competitor promotions.

Messaging is highly effective and consistent in communicating high-value, transactional offers for the latest smartphones, directly appealing to in-market, price-sensitive customers.

Integrate network superiority messaging (e.g., 'America's most reliable 5G network') into promotional headlines to connect the tangible device incentive with a core service differentiator.

AT&T's website presents a visually cluttered experience with a high cognitive load, featuring numerous competing offers and calls-to-action that can lead to choice paralysis. While individual conversion elements like offer cards are clear, the overall hierarchy is confusing and lacks a single, guided path for the user. The analysis indicates a need to simplify the hero section and establish a clearer visual hierarchy for CTAs to improve the user journey and reduce friction.

The use of varied and clear CTAs ('Shop now', 'Call', 'Preorder') effectively funnels users with different preferences into the sales process.

Simplify the homepage hero section to focus on a single primary marketing message or offer, reducing the number of competing CTAs to minimize cognitive load and guide users more effectively.

AT&T has a robust and mature legal and compliance framework, including a comprehensive privacy center and a strong commitment to accessibility. However, its credibility is significantly undermined by a history of major data breaches, leading to large settlements and an erosion of consumer trust. The gap between documented security policies and operational execution represents a persistent and high-severity risk to the business and its brand reputation.

A public, well-structured commitment to accessibility (WCAG standards), which reduces legal risk under the ADA and expands market access.

Strengthen third-party vendor security oversight with mandatory, recurring independent audits to prevent further data breaches and rebuild consumer trust.

AT&T's primary competitive advantage is its extensive and difficult-to-replicate network infrastructure, particularly its rapidly expanding fiber network. High switching costs, enforced through 36-month device financing plans, create a significant customer moat. However, the company struggles with a clear brand identity, often caught between Verizon's premium positioning and T-Mobile's value and 5G speed leadership, making its market position less defensible.

Ownership of a vast and growing proprietary fiber optic network, which provides a sustainable technological advantage over cable and fixed wireless competitors in markets served.

Develop and consistently market a clear, unique brand identity focused on 'converged reliability'—the seamless integration of superior fiber and 5G—to differentiate from competitors.

The business model has immense scalability due to high operational leverage on its established network, where each new subscriber adds significant profit. Growth potential is strong, driven by the strategic expansion of its high-margin fiber network and the development of new enterprise revenue streams from 5G, such as private networks and IoT. However, this potential is constrained by the massive, ongoing capital expenditures required for network buildouts and a significant existing debt load.

A clear growth strategy focused on expanding its fiber footprint to 50 million locations and monetizing its 5G network through high-margin enterprise solutions.

Accelerate the decommissioning of legacy copper networks to reduce maintenance costs, thereby freeing up capital and operational resources to focus exclusively on fiber and 5G expansion.

AT&T has demonstrated excellent strategic focus by divesting media assets to concentrate entirely on its core connectivity business. The business model is highly coherent, centered on a 'convergence' strategy of bundling high-speed fiber with 5G wireless to increase customer lifetime value and reduce churn. This clear and focused strategy aligns resource allocation with the most significant growth opportunities in the telecommunications sector.

A clear and disciplined strategic focus on connectivity, leveraging the symbiotic relationship between its fiber and 5G network assets to drive a powerful 'convergence' growth flywheel.

Better align the transactional, deal-focused messaging on the website with the high-level brand strategy of being a premium, reliable connectivity provider.

As one of the three dominant players in the U.S. telecom oligopoly, AT&T wields significant market power, though it currently trails Verizon and T-Mobile in wireless market share. Its pricing power is constrained by intense competition, but its extensive infrastructure provides leverage with suppliers. The company's recent strategic spectrum acquisition is a decisive move to close the 5G performance gap and enhance its competitive position for the future.

Dominant position as one of the top three national carriers, providing significant economies of scale, brand recognition, and negotiating leverage with key partners like device manufacturers.

Continue to aggressively acquire and deploy mid-band spectrum to improve 5G network performance and close the perceived speed and coverage gap with market leader T-Mobile.

Business Overview

Business Classification

Telecommunications Services Provider

Internet Service Provider (ISP)

Telecommunications

Sub Verticals

- •

Wireless Communications

- •

Fiber & Broadband Internet

- •

Business Network Solutions

Mature

Maturity Indicators

- •

Extensive national infrastructure (5G and Fiber)

- •

Large, stable subscriber base

- •

Strong brand recognition and legacy

- •

Focus on customer retention and average revenue per user (ARPU) growth

- •

Strategic shift back to core connectivity business after divesting media assets.

- •

Consistent dividend payments and share repurchase programs.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Mobility Services (Postpaid & Prepaid)

Description:Recurring monthly revenue from consumer and business wireless plans, including data, voice, and text services. This is the largest revenue segment.

Estimated Importance:Primary

Customer Segment:Consumers & Businesses

Estimated Margin:High

- Stream Name:

Consumer Wireline (Fiber & Broadband)

Description:Recurring monthly revenue from high-speed fiber and legacy broadband internet services for consumers. This is a key growth area for the company.

Estimated Importance:Primary

Customer Segment:Consumers

Estimated Margin:High

- Stream Name:

Business Wireline

Description:Connectivity and specialized services for enterprise customers, including networking, voice, and data solutions. This segment faces challenges from declining demand for legacy services.

Estimated Importance:Primary

Customer Segment:Businesses

Estimated Margin:Medium

- Stream Name:

Equipment Sales

Description:Revenue from the sale of smartphones, tablets, and other connected devices, often financed over 36 months. These sales are critical for acquiring and retaining service subscribers.

Estimated Importance:Secondary

Customer Segment:Consumers & Businesses

Estimated Margin:Low

Recurring Revenue Components

- •

Monthly Wireless Plan Subscriptions

- •

Monthly Internet Plan Subscriptions

- •

Device Installment Plans

- •

Business Managed Services Contracts

Pricing Strategy

Subscription (Tiered)

Mid-range to Premium

Semi-transparent

Pricing Psychology

- •

Bundling (discounts for combining wireless and fiber)

- •

Promotional Pricing ('iPhone on us', 'up to $1,000 off')

- •

Trade-in Incentives

- •

Long-term Installment Plans (36 months)

Monetization Assessment

Strengths

- •

Large base of recurring subscription revenue provides stable cash flow.

- •

Growing high-margin fiber subscriber base.

- •

'Convergence' strategy of bundling wireless and fiber increases customer lifetime value and reduces churn.

Weaknesses

- •

Intense price competition in the wireless market limits pricing power.

- •

Declining revenue from legacy Business Wireline services.

- •

Heavy reliance on promotional offers and device subsidies can impact margins.

Opportunities

- •

Aggressively expand the fiber footprint to capture more market share from cable providers.

- •

Monetize 5G through new enterprise use cases like IoT, private networks, and fixed wireless access.

- •

Further penetrate existing wireless customer base with fiber offerings ('flywheel effect').

Threats

- •

Aggressive pricing and network improvements from competitors like T-Mobile and Verizon.

- •

Market saturation in the US wireless industry.

- •

High capital expenditure required for network upgrades could be constrained by high debt levels.

Market Positioning

A premium, reliable connectivity provider with the nation's largest fiber network and a robust 5G infrastructure, leveraging bundling and aggressive promotions to drive a 'converged' customer strategy.

A top-three competitor in the U.S. wireless market, with an estimated 27% market share as of late 2024, trailing T-Mobile (35%) and Verizon (34%).

Target Segments

- Segment Name:

Families & Multi-Line Households

Description:Households seeking multiple wireless lines and home internet, valuing reliability, network coverage, and bundled discounts.

Demographic Factors

- •

Multiple age groups

- •

Suburban/Urban

- •

Middle to high income

Psychographic Factors

- •

Value simplicity and bundled billing

- •

Seek reliable performance for streaming, remote work, and school

- •

Brand conscious

Behavioral Factors

- •

High data usage across multiple devices

- •

Likely to be long-term customers if service is reliable

- •

Responsive to promotional offers on new devices

Pain Points

- •

High cost of multiple lines and devices

- •

Complexity of managing different services

- •

Inconsistent network performance at home

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Small & Medium Businesses (SMBs)

Description:Businesses requiring dependable wireless and internet connectivity, along with solutions like dedicated internet access and security services.

Demographic Factors

Various industries

Geographically diverse

Psychographic Factors

- •

Value reliability and customer support

- •

Cost-conscious but prioritize uptime

- •

Seeking scalable solutions

Behavioral Factors

Often purchase multiple lines and services

Require business-grade features and support

Pain Points

- •

Unreliable connectivity disrupting operations

- •

Lack of dedicated IT support

- •

Cybersecurity threats

Fit Assessment:Good

Segment Potential:Medium

- Segment Name:

Enterprise Clients

Description:Large corporations needing complex, scalable, and secure networking solutions, including global IP networks, cloud connectivity, IoT, and 5G-enabled applications.

Demographic Factors

Fortune 500 companies

Global operations

Psychographic Factors

Prioritize security, scalability, and service level agreements (SLAs)

Focus on digital transformation

Behavioral Factors

- •

Long sales cycles

- •

High-value contracts

- •

Require customized solutions and consulting services.

Pain Points

- •

Managing complex global networks

- •

Ensuring data security across distributed locations

- •

Integrating new technologies like 5G and IoT

Fit Assessment:Good

Segment Potential:High

Market Differentiation

- Factor:

Extensive Fiber Network

Strength:Strong

Sustainability:Sustainable

- Factor:

Converged Offerings (Wireless + Fiber Bundle)

Strength:Strong

Sustainability:Sustainable

- Factor:

Brand Legacy and Trust

Strength:Moderate

Sustainability:Temporary

- Factor:

Promotional Device Offers

Strength:Weak

Sustainability:Temporary

Value Proposition

AT&T delivers America's best connectivity experience by combining the nation's largest fiber network with a reliable 5G wireless network, offering seamless and high-speed connections for consumers and businesses.

Good

Key Benefits

- Benefit:

High-Speed, Reliable Internet Connectivity

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Claims of being the nation's largest fiber network

- •

Aggressive fiber expansion goals to 60 million locations.

- •

Consistent fiber subscriber additions for 21 consecutive quarters.

- Benefit:

Nationwide 5G Wireless Coverage

Importance:Critical

Differentiation:Common

Proof Elements

5G network maps and coverage claims

Ongoing investments in mid-band spectrum to enhance 5G performance.

- Benefit:

Access to Latest Devices with Attractive Deals

Importance:Important

Differentiation:Common

Proof Elements

Homepage promotions for new iPhones, Samsung, and Google Pixel devices

Significant trade-in credits and monthly payment offers

Unique Selling Points

- Usp:

The largest and most rapidly expanding fiber network in the U.S., providing a superior broadband experience.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A powerful 'convergence' strategy that bundles high-value fiber and wireless services, leading to lower churn and higher customer lifetime value.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Need for fast, reliable internet for work, school, and entertainment.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Desire for ubiquitous mobile connectivity on a reliable nationwide network.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

High upfront cost of new smartphones.

Severity:Major

Solution Effectiveness:Partial

Value Alignment Assessment

High

AT&T's strategic focus on the two most critical components of modern connectivity—fiber and 5G—is perfectly aligned with market demand for faster, more reliable data services.

High

The value proposition of bundled, reliable services at a promotional price strongly appeals to families and businesses who are the core target segments.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Device Manufacturers (Apple, Samsung, Google)

- •

Network Equipment Vendors (Ericsson, Nokia)

- •

Retail Partners (e.g., Best Buy, Walmart)

- •

Infrastructure Partners (e.g., Gigapower joint venture)

Key Activities

- •

Network Buildout & Maintenance (5G/Fiber)

- •

Customer Acquisition & Service

- •

Marketing & Sales

- •

Device Procurement & Logistics

- •

Research & Development in Network Technology

Key Resources

- •

Wireless Spectrum Licenses

- •

Extensive Fiber-Optic Network Infrastructure

- •

Strong Brand Reputation

- •

Large Existing Customer Base

- •

Retail Store Footprint

Cost Structure

- •

Capital Expenditures (Network Investment).

- •

Marketing & Sales Costs

- •

Operational Costs (Customer Service, Network Operations)

- •

Device Subsidies and Promotional Costs

- •

Debt Servicing Costs

Swot Analysis

Strengths

- •

Owner of the largest and fastest-growing fiber network in the U.S.

- •

Strong brand recognition and a massive existing customer base.

- •

Successful convergence strategy driving bundled sales and reducing churn.

- •

Solid and stable cash flow from a large recurring revenue base.

Weaknesses

- •

High debt load relative to competitors.

- •

Lagging Verizon and T-Mobile in wireless market share.

- •

Declining revenues in the legacy Business Wireline segment.

- •

Perception of average customer service and complex billing.

Opportunities

- •

Accelerate fiber expansion to take market share from cable and fixed wireless providers.

- •

Develop and monetize new 5G-enabled services for enterprises (e.g., private networks, IoT).

- •

Simplify customer experience and billing to improve brand perception and reduce churn.

- •

Leverage AI to optimize network management and enhance customer service.

Threats

- •

Intense price and network competition from Verizon and T-Mobile.

- •

Market saturation limiting organic growth in the U.S. wireless market.

- •

High interest rates impacting the cost of capital for network expansion.

- •

Potential for disruptive technologies and regulatory changes.

Recommendations

Priority Improvements

- Area:

Business Model Evolution

Recommendation:Accelerate the transition from a pure connectivity provider to a platform enabler by developing B2B2C models. Partner with industries like healthcare, logistics, and manufacturing to build and monetize private 5G networks and edge computing solutions.

Expected Impact:High

- Area:

Customer Experience

Recommendation:Radically simplify the product portfolio, billing structure, and customer service interactions. Invest heavily in digital self-service tools powered by AI to provide transparent and efficient support, reducing operational costs and improving Net Promoter Score (NPS).

Expected Impact:High

- Area:

Operational Efficiency

Recommendation:Aggressively decommission legacy copper networks to reduce maintenance costs and focus capital and operational resources exclusively on the fiber and 5G networks, as planned.

Expected Impact:Medium

Business Model Innovation

- •

Develop tiered 'Network-as-a-Service' (NaaS) offerings for enterprises, providing managed, on-demand connectivity with guaranteed SLAs for specific applications (e.g., low-latency for autonomous systems).

- •

Create strategic partnerships with content and cloud gaming providers to offer premium, low-latency connectivity bundles optimized for their services, creating a new value proposition beyond speed.

- •

Explore open-access models for the fiber network in certain markets, wholesaling capacity to other providers to accelerate ROI on infrastructure investment.

Revenue Diversification

- •

Expand the enterprise IoT solutions portfolio with industry-specific, end-to-end offerings.

- •

Build a managed cybersecurity services practice tailored for SMBs, bundling it with core connectivity products.

- •

Monetize anonymized network data by providing insights-as-a-service to sectors like urban planning, retail, and transportation.

AT&T is a mature telecommunications incumbent executing a sound, albeit challenging, strategic transformation. After divesting its media assets, the company has wisely re-centered its business model on its core competency: providing high-quality connectivity through 5G and fiber networks. This 'back to basics' approach is critical in a saturated, hyper-competitive market. The company's primary competitive advantage and engine for future growth is its aggressive expansion of a superior fiber network, which it effectively leverages in a 'convergence' strategy to bundle with wireless services, increasing customer stickiness and value. However, the business model faces significant headwinds, including a substantial debt load, declining legacy business revenues, and relentless competitive pressure that compresses margins.

Future success and market leadership will not come from simply selling connectivity, but from evolving the business model to monetize the infrastructure in new ways. The most significant opportunity lies in shifting from a commodity provider to a strategic enabler for the enterprise sector. By building scalable, secure, and application-specific solutions on top of its 5G and fiber assets (such as private networks, edge computing, and IoT platforms), AT&T can create new, high-margin revenue streams and embed itself more deeply into the operational fabric of its business customers. The strategic imperative is to execute this pivot while simultaneously simplifying the consumer experience and maintaining fiscal discipline to manage debt and fund the massive capital expenditures required for its network leadership ambitions.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

High Capital Requirements

Impact:High

- Barrier:

Spectrum Licensing

Impact:High

- Barrier:

Regulatory Hurdles

Impact:High

- Barrier:

Economies of Scale

Impact:High

- Barrier:

Established Network Infrastructure

Impact:High

Industry Trends

- Trend:

5G Network Expansion and Monetization

Impact On Business:Critical for offering competitive wireless and Fixed Wireless Access (FWA) internet services. Drives device upgrades and new revenue streams like IoT and edge computing.

Timeline:Immediate

- Trend:

Fiber Optic Network Deployment

Impact On Business:Essential for competing in the high-speed broadband market against cable and other fiber providers. AT&T aims to reach 30 million locations by the end of 2025.

Timeline:Immediate

- Trend:

AI Integration in Customer Service and Network Operations

Impact On Business:Opportunity to improve customer satisfaction and operational efficiency, reducing costs. AI-powered networks can predict disruptions and optimize performance.

Timeline:Near-term

- Trend:

Convergence of Services (Bundling)

Impact On Business:Increased pressure to offer attractive bundles of wireless, internet, and other value-added services to increase customer stickiness and lifetime value.

Timeline:Immediate

- Trend:

Growth of Fixed Wireless Access (FWA)

Impact On Business:Both an opportunity to compete with cable broadband and a threat from competitors like T-Mobile who are aggressively expanding their FWA offerings.

Timeline:Near-term

Direct Competitors

- →

Verizon Communications

Market Share Estimate:~34% (US Wireless, end of 2024).

Target Audience Overlap:High

Competitive Positioning:Positions itself as the premium provider with the most reliable and highest-quality network.

Strengths

- •

Strong brand recognition and reputation for network reliability.

- •

Extensive and robust 4G LTE and growing 5G network infrastructure.

- •

Large, loyal customer base.

- •

Strong financial position allowing for significant capital investment.

Weaknesses

- •

Often perceived as having higher prices than competitors.

- •

Slower 5G download speeds compared to T-Mobile.

- •

Reported consecutive quarters of postpaid phone subscriber losses.

- •

Customer service is often criticized for complexity and wait times.

Differentiators

- •

Focus on network quality and reliability as the primary value proposition.

- •

Strong presence in the business and enterprise segment.

- •

Leverages its Fios fiber network in key markets for bundling opportunities.

- →

T-Mobile US

Market Share Estimate:~35% (US Wireless, end of 2024, leading the market).

Target Audience Overlap:High

Competitive Positioning:The 'Un-carrier' disruptor, focusing on value, customer-friendly policies, and superior 5G network performance.

Strengths

- •

Leading 5G network coverage and speed, particularly in mid-band spectrum.

- •

Successful 'Un-carrier' strategy has built a strong, customer-centric brand identity.

- •

Consistently leads the industry in postpaid phone subscriber growth.

- •

Aggressive pricing and promotional strategies.

Weaknesses

- •

Historical perception of weaker rural network coverage compared to Verizon and AT&T.

- •

Lower customer retention rates for long-term customers compared to Verizon.

- •

Brand may not be perceived as 'premium' as Verizon.

- •

Customer service quality can be inconsistent.

Differentiators

- •

'Un-carrier' moves (e.g., taxes and fees included, no annual contracts).

- •

Leadership in 5G network performance metrics.

- •

Aggressive bundling of perks like 'Netflix on Us'.

Indirect Competitors

- →

Comcast (Xfinity)

Description:A major cable provider offering bundled services including high-speed internet, TV, and Xfinity Mobile, an MVNO that runs on Verizon's network.

Threat Level:High

Potential For Direct Competition:High, by leveraging their massive broadband customer base to bundle mobile services, increasing churn pressure on AT&T.

- →

Charter Communications (Spectrum)

Description:Another leading cable company providing broadband, TV, and a mobile service (Spectrum Mobile) that also utilizes Verizon's network to create compelling bundles for their internet customers.

Threat Level:High

Potential For Direct Competition:High, through aggressive bundling that undercuts standalone wireless and internet pricing from traditional carriers.

- →

Dish Network

Description:Building out its own 5G network, Dish is transitioning from an indirect satellite TV competitor to a fourth direct wireless carrier, though its buildout is still in early stages.

Threat Level:Medium

Potential For Direct Competition:High, once its 5G network is fully deployed and competitive.

- →

MVNOs (e.g., Mint Mobile, Google Fi)

Description:Mobile Virtual Network Operators that don't own their own network but lease capacity from the major carriers. They target price-sensitive customers with flexible, low-cost plans.

Threat Level:Medium

Potential For Direct Competition:Low, as their business model depends on the major carriers.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Extensive Network Infrastructure

Sustainability Assessment:Highly sustainable due to the enormous capital investment and regulatory hurdles required to replicate a nationwide wireless and fiber network.

Competitor Replication Difficulty:Hard

- Advantage:

Strong Brand Recognition

Sustainability Assessment:Sustainable due to a long history and massive marketing spend, fostering customer trust and loyalty.

Competitor Replication Difficulty:Medium

- Advantage:

Large Existing Customer Base

Sustainability Assessment:Moderately sustainable, providing economies of scale and a foundation for upselling and cross-selling, though susceptible to churn from aggressive competitors.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'Exclusive Device Promotions', 'estimated_duration': 'Short-term (3-6 months per device cycle)'}

{'advantage': 'Promotional Pricing on Plans', 'estimated_duration': 'Short-term (until matched by competitors)'}

Disadvantages

- Disadvantage:

Lacks a Clear Identity vs. Competitors

Impact:Major

Addressability:Moderately

- Disadvantage:

Perception of Mediocre Customer Service

Impact:Major

Addressability:Moderately

- Disadvantage:

High Debt Levels

Impact:Major

Addressability:Difficult

- Disadvantage:

Lagging 5G Speeds Compared to T-Mobile

Impact:Major

Addressability:Difficult

Strategic Recommendations

Quick Wins

- Recommendation:

Simplify Website Offer Presentation

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Launch Targeted Social Media Campaigns Highlighting Network Reliability

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Enhance Digital Self-Service Tools

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Aggressively Market Fiber and Wireless Bundles

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Invest in AI-Powered Proactive Customer Support

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Develop Hyper-Personalized Plan Options

Expected Impact:Medium

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Expand Enterprise IoT and Edge Computing Solutions

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Invest in Next-Generation Network Technology (6G)

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Strategic Acquisitions in Adjacent Technology Sectors

Expected Impact:High

Implementation Difficulty:Difficult

Position AT&T as the premier provider of converged connectivity, emphasizing the seamless and reliable integration of its robust 5G wireless and high-speed fiber networks for the modern connected life.

Differentiate based on the quality and reliability of the combined fiber and wireless experience, rather than competing on price (T-Mobile) or solely network reputation (Verizon). Focus on being the 'best of both worlds' provider.

Whitespace Opportunities

- Opportunity:

Managed Whole-Home/Business Connectivity Service

Competitive Gap:Competitors focus on delivering a connection to the building, but not on optimizing the experience within it. There's a gap for a premium, managed service for WiFi, security, and IoT device management.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Targeted Connectivity Solutions for the 'Prosumer' and SMB Market

Competitive Gap:Small businesses and remote power-users are often caught between consumer-grade plans and complex, expensive enterprise solutions. A simplified, high-performance bundle for this segment is a gap.

Feasibility:High

Potential Impact:High

- Opportunity:

Gamified Loyalty Program Integrated Across Services

Competitive Gap:Current loyalty programs are passive. An engaging, gamified program that rewards customers for bundling services, timely payments, and engaging with content could significantly reduce churn.

Feasibility:Medium

Potential Impact:Medium

The U.S. telecommunications landscape is a mature oligopoly, fiercely dominated by AT&T, Verizon, and T-Mobile. AT&T is a formidable player with sustainable advantages in its extensive network infrastructure and strong brand equity. However, it faces intense competitive pressure and a critical strategic challenge: being caught in the middle. Verizon successfully owns the 'premium reliability' position, while T-Mobile has effectively captured the 'disruptive value and 5G speed' narrative. This leaves AT&T without a distinct, winning identity in the minds of many consumers.

AT&T's direct competitors have clear value propositions. Verizon leverages its long-standing reputation for network coverage to command premium pricing. T-Mobile, through its 'Un-carrier' strategy, has reshaped market expectations around customer-friendly policies and has established a clear lead in 5G network speeds. AT&T's own marketing, as seen on its website, focuses heavily on device-centric promotions—a necessary but easily replicated tactic that does little to build a unique long-term brand preference.

The most significant threats are not just direct, but also indirect. Cable companies like Comcast and Charter are aggressively bundling their existing broadband services with mobile plans (as MVNOs), creating sticky ecosystems that are highly attractive to their large customer bases and increasing churn pressure.

Opportunities for AT&T lie in leveraging its unique combination of assets. Its aggressive expansion of a high-quality fiber network is a key differentiator that T-Mobile lacks at scale. The strategic imperative is to pivot from competing on individual products (wireless vs. wireless) to competing on the power of a converged network. AT&T must position itself as the most reliable provider for the total connected experience—seamlessly integrating the best 5G mobile service with superior fiber-optic broadband. This 'converged reliability' narrative could carve out a defensible and premium market position, addressing the current identity crisis and providing a clear answer to the question of why a customer should choose AT&T over its sharply defined competitors.

Messaging

Message Architecture

Key Messages

- Message:

Get the latest flagship smartphones (iPhone, Samsung Galaxy, Google Pixel) for free or at a significant discount.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero and subsequent content blocks

- Message:

These deals are available to 'everyone,' contingent on an eligible trade-in and/or signing up for an eligible plan.

Prominence:Secondary

Clarity Score:Medium

Location:Sub-headings and fine print associated with each device offer

- Message:

Unlock the best internet deals available at your address.

Prominence:Tertiary

Clarity Score:High

Location:Top banner, above the main hero section

The messaging hierarchy is exceptionally clear but one-dimensional. It prioritizes aggressive, high-value customer acquisition offers for mobile devices above all else. The brand's broader value proposition around connectivity and network quality is completely subordinate to the transactional deal. The primary message is 'get a cheap phone,' not 'join a superior network.'

Messaging is highly consistent across the provided homepage content. Every major content block reinforces the central theme of device promotions. The repetitive framing 'Learn how everyone gets...' creates a strong, consistent, though uninspired, promotional rhythm.

Brand Voice

Voice Attributes

- Attribute:

Promotional

Strength:Strong

Examples

- •

iPhone 16 Pro on us

- •

Get $200 off per line

- •

up to $1,000 off

- •

FREE

- Attribute:

Transactional

Strength:Strong

Examples

- •

With eligible trade-in.

- •

Shop now

- •

Preorder

- •

Req’s 0% APR 36-mo. agmt.

- Attribute:

Direct

Strength:Moderate

Examples

- •

Unlock our best internet deals available at your address.

- •

No trade-in required.

- •

Any year. Any condition.

- Attribute:

Inspirational

Strength:Weak

Examples

Great connections start here

Tone Analysis

Urgent and Deal-Oriented

Secondary Tones

Informational

Prescriptive

Tone Shifts

The initial headline 'Great connections start here' attempts a warmer, more relationship-focused tone, but it immediately and abruptly shifts to a hard-sell, promotional tone for the remainder of the page.

Voice Consistency Rating

Fair

Consistency Issues

There is a significant disconnect between the stated corporate mission of 'Connecting people to greater possibility – with expertise, simplicity, and inspiration' and the website's voice, which is almost entirely transactional and promotional. The voice lacks 'inspiration' and the complexity of the required terms contradicts 'simplicity'.

Value Proposition Assessment

Switch to AT&T and we will make it financially easy for you to acquire the latest, most desirable smartphone.

Value Proposition Components

- Component:

Device Affordability

Clarity:Clear

Uniqueness:Common

- Component:

Generous Trade-in Offers

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Switching Incentives (e.g., $200 off)

Clarity:Clear

Uniqueness:Common

- Component:

Network Quality & Reliability

Clarity:Unclear

Uniqueness:Common

Differentiation is weak and appears to be based on the specifics of the current promotion rather than a durable brand attribute. Competitors like Verizon and T-Mobile offer nearly identical device-centric promotions, creating a 'sea of sameness'. The 'Any year. Any condition.' trade-in for the Google Pixel is a rare, specific point of differentiation, but it's a tactic, not a core brand pillar. The primary value communicated is cost savings on hardware, which is a commoditized and easily replicated strategy in the telecom industry.

The messaging positions AT&T as a direct, aggressive competitor on price and promotions, primarily targeting customers who are in-market for a new device. This strategy is typical for a mature market but fails to build a brand preference based on service, quality, or experience. It directly competes with T-Mobile's 'Un-carrier' value positioning and Verizon's premium network narrative by focusing purely on the upfront hardware incentive.

Audience Messaging

Target Personas

- Persona:

The Deal-Driven Switcher

Tailored Messages

- •

iPhone 16 Pro on us

- •

Get $200 off per line

- •

Samsung Galaxy S25 Ultra for up to $1,000 off

Effectiveness:Effective

- Persona:

The Technology Enthusiast

Tailored Messages

The new Google Pixel 10 Pro XL FREE

Preorder

Effectiveness:Effective

- Persona:

The Value-Seeking Family

Tailored Messages

Choose from our most popular plans

iPhone 15 for $7.99/mo.

Effectiveness:Somewhat

Audience Pain Points Addressed

- •

High cost of new smartphones

- •

Feeling stuck with an old or damaged phone (addressed by 'Any year. Any condition.')

- •

Complexity of finding the best deal

Audience Aspirations Addressed

- •

Owning the latest and greatest technology

- •

Feeling like a smart shopper who secured a great deal

- •

Seamlessly upgrading to a new device without a large upfront cost

Persuasion Elements

Emotional Appeals

- Appeal Type:

Desire / Aspiration

Effectiveness:High

Examples

Showcasing the newest, most popular phones like 'iPhone 16 Pro' and 'Samsung Galaxy S25 Ultra' taps into the desire for status and cutting-edge technology.

- Appeal Type:

Financial Gain / Savings

Effectiveness:High

Examples

- •

'on us'

- •

'FREE'

- •

'up to $1,000 off'

- Appeal Type:

Inclusivity / Social Proof (implied)

Effectiveness:Low

Examples

The repeated phrase 'Learn how everyone gets...' attempts to create a sense of a popular, can't-miss opportunity, implying that 'everyone' is taking advantage of these deals.

Social Proof Elements

No itemsTrust Indicators

- •

Established and recognizable AT&T brand logo

- •

Disclosure of terms and restrictions ('Terms & restrictions apply. Subject to change.') builds a baseline of legal transparency, though it can undermine simplicity.

- •

Prominent display of customer service phone numbers

Scarcity Urgency Tactics

Limited time. (Explicitly stated for one offer, implied for others)

Calls To Action

Primary Ctas

- Text:

Shop now

Location:Homepage hero, multiple offer blocks

Clarity:Clear

- Text:

Call 855.812.0373

Location:Offer block for new lines

Clarity:Clear

- Text:

Preorder

Location:Google Pixel offer block

Clarity:Clear

- Text:

ORDER NOW 844-249-5043

Location:Sticky or prominent button

Clarity:Clear

The CTAs are highly effective for driving immediate, transactional behavior. They are clear, concise, and use strong action verbs. The variety of CTAs ('Shop now', 'Call', 'Preorder') effectively channels users with different preferences (online self-service vs. phone support) into the sales funnel. However, their singular focus on sales means there are no CTAs for users in an earlier, consideration phase of their journey (e.g., 'Compare plans', 'Check coverage').

Messaging Gaps Analysis

Critical Gaps

- •

Network Value Proposition: There is a complete absence of messaging related to network quality, speed (5G), coverage, or reliability. Competitors often lead with their network as a key differentiator. Without this, the phone is just a commodity, and the service has no perceived quality advantage.

- •

Brand Story: The messaging fails to connect with the brand's mission of enabling 'greater possibility'. There is no storytelling or emotional connection beyond the transactional high of getting a deal.

- •

Customer Experience: There is no mention of customer service, support, or the benefits of being an AT&T customer long-term (e.g., loyalty programs, customer satisfaction). This weakens the case for customer retention.

Contradiction Points

The brand mission's promise of 'simplicity' is directly contradicted by the reliance on complex offers that require 'eligible trade-in', 'eligible unlimited plan', '36-mo. agmt', and are subject to 'Terms & restrictions'.

Underdeveloped Areas

Bundling Value: While 'Bundles' is in the main navigation, the homepage does not message the value of combining internet and mobile services, a key strategic advantage for integrated carriers.

'Why AT&T?': The page successfully answers 'What deal can I get?' but completely fails to answer 'Why should I choose AT&T over Verizon or T-Mobile for my service?'

Messaging Quality

Strengths

- •

Clarity of Offer: The core promotional offers are easy to understand at a glance.

- •

Strong Acquisition Focus: The entire page is a highly optimized funnel for acquiring new customers or securing upgrades through hardware incentives.

- •

Effective Headlines: Use of words like 'on us' and 'FREE' are powerful attention-grabbers.

Weaknesses

- •

Overly Transactional: The messaging feels like a direct-mail flyer, lacking brand personality and emotional resonance.

- •

Weak Differentiation: The value proposition is easily matched by competitors, leading to a race-to-the-bottom on price rather than building brand equity.

- •

Disconnect from Brand Mission: The inspiring language of the corporate mission is absent from the primary customer touchpoint, creating a brand identity gap.

Opportunities

- •

Integrate network superiority messaging (e.g., speed, reliability) as the reason the latest phones are worth having on AT&T.

- •

Create content that tells stories of 'great connections' enabled by AT&T, bridging the brand promise with the product offering.

- •

Develop clearer, more transparent messaging around deal qualifications to better align with the 'simplicity' mission.

Optimization Roadmap

Priority Improvements

- Area:

Value Proposition

Recommendation:Revise key offer headlines to pair the device deal with a network benefit. For example: 'iPhone 16 Pro on us. Unleashed on America's most reliable 5G network.' This immediately connects the tangible incentive (phone) to a core service differentiator (network).

Expected Impact:High

- Area:

Brand Messaging

Recommendation:Replace the generic 'Great connections start here' headline with a more powerful, benefit-oriented statement that bridges the gap between technology and human connection. Test headlines that speak to what customers can do with the connection.

Expected Impact:Medium

- Area:

Message Hierarchy

Recommendation:Introduce a secondary content block below the initial wave of phone deals that explicitly states 'Why AT&T?' featuring 2-3 key pillars such as Network Reliability, Security Features, or Bundle Savings.

Expected Impact:High

Quick Wins

- •

A/B test CTA button copy to include benefits, e.g., 'Shop iPhones & Get it on us'.

- •

Add a small, visually distinct icon or badge next to offers that highlights a network feature, like '5G Ultra Wideband'.

- •

In the fine print, rephrase 'Terms & restrictions apply' to something more customer-centric like 'See deal details' to soften the transactional tone.

Long Term Recommendations

- •

Develop a comprehensive content strategy that moves beyond promotions to showcase customer stories, technology innovation, and the societal impact of connectivity, thereby giving substance to the 'Connecting people to greater possibility' mission.

- •

Overhaul the messaging architecture to create distinct journeys for different user intents (e.g., 'I want the best deal', 'I want the best network', 'I want to combine my services'), rather than a one-size-fits-all promotional approach.

- •

Invest in brand-level advertising campaigns that focus on emotional storytelling and network superiority, and ensure the website's messaging and design reflect this elevated brand positioning.

The strategic messaging on AT&T's homepage is a masterclass in aggressive, short-term customer acquisition driven by promotional hardware incentives. The message is clear, consistent, and laser-focused on answering one question for the consumer: 'How can I get the newest phone for the lowest possible price?' This approach is highly effective at capturing in-market consumers motivated by deals and is likely successful in driving quarterly sales and subscriber growth metrics.

However, this singular focus creates significant strategic vulnerabilities. The messaging almost completely abandons brand building in favor of transactional selling. There is a profound gap between the company's aspirational mission—to connect people with 'expertise, simplicity, and inspiration'—and the on-the-ground reality of its primary digital storefront, which is a complex, deal-driven marketplace. This dissonance commoditizes the AT&T brand, positioning it as interchangeable with any competitor who can offer a similar deal.

The most critical messaging gap is the failure to communicate any value in the core service itself: the network. By not mentioning network speed, coverage, or reliability, AT&T forfeits a major pillar of differentiation and provides no compelling reason for a customer to stay once their 36-month agreement is up. This purely transactional approach erodes brand loyalty and pricing power, turning customer relationships into a perpetual cycle of promotional churn. To build a more durable market position, AT&T must evolve its messaging to integrate the 'Why AT&T' (network, service, ecosystem) with the 'What you get' (the free phone).

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

AT&T is the third-largest wireless carrier in the U.S., serving 73 million postpaid and 17 million prepaid phone customers.

- •

Massive existing customer base across wireless, fiber, and business solutions, indicating widespread market acceptance of core connectivity products.

- •

Brand recognition as a foundational pillar of U.S. telecommunications infrastructure for over a century.

- •

Continued subscriber growth in key strategic areas, with over 1.7 million postpaid phone subscribers added in 2023 and fiber subscribers growing to 7.7 million.

Improvement Areas

- •

Enhancing customer experience and service quality to reduce churn in a highly competitive market.

- •

Developing a more compelling value proposition for converged bundles (fiber + wireless) to increase customer lifetime value.

- •

Innovating beyond core connectivity to create new revenue streams in areas like IoT and enterprise edge computing.

Market Dynamics

Low single-digits (approx. 3-6% CAGR).

Mature

Market Trends

- Trend:

5G Network Expansion and Monetization

Business Impact:Growth is dependent on expanding 5G coverage and developing new use cases (e.g., Fixed Wireless Access, private networks) that command premium pricing.

- Trend:

Fiber Optic Deployment

Business Impact:Fiber is a key battleground for high-speed broadband, crucial for competing with cable providers and enabling future services.

- Trend:

AI Integration in Operations and Customer Service

Business Impact:AI is essential for network optimization, predictive maintenance, and creating more efficient, personalized customer journeys to reduce operational costs.

- Trend:

Enterprise IoT and Edge Computing

Business Impact:Significant B2B growth opportunity by providing the connectivity and platforms for massive IoT deployments in various industries.

- Trend:

Intense Competition and Market Saturation

Business Impact:High competition from Verizon, T-Mobile, and cable companies (Comcast, Charter) puts pressure on pricing, margins, and customer acquisition costs.

Critical. AT&T is in a capital-intensive race to build out its 5G and fiber networks to secure market leadership for the next decade of connectivity. The window to establish a network quality advantage is now.

Business Model Scalability

Medium

Characterized by extremely high fixed costs (network infrastructure, spectrum licenses) and relatively low variable costs per additional subscriber on an existing network.

High. Once network infrastructure is in place, each additional customer adds significantly to profitability. However, this is constrained by the need for continuous, massive capital investment in network upgrades and expansion.

Scalability Constraints

- •

Massive capital expenditure required for 5G and fiber buildouts (approx. $22 billion annually).

- •

High debt load, which can constrain financial flexibility for strategic investments.

- •

Regulatory hurdles and spectrum acquisition costs.

- •

Physical limitations and logistical complexity of deploying fiber infrastructure nationwide.

Team Readiness

Experienced leadership team adept at managing a large-scale, capital-intensive business and complex financial structuring.

Traditional, complex corporate structure that can be slow to adapt to rapid technological shifts. A strategic refocus on core telecom assets after divesting media properties is a positive step.

Key Capability Gaps

- •

Agile development for new digital services and enterprise solutions.

- •

Data science and AI talent to fully leverage network and customer data for personalization and operational efficiency.

- •

Developing a more innovative, customer-centric culture to compete with more nimble market disruptors like T-Mobile.

Growth Engine

Acquisition Channels

- Channel:

Online (att.com)

Effectiveness:High

Optimization Potential:High

Recommendation:Implement advanced personalization based on user data to surface the most relevant plans and device offers, and simplify the complex checkout and credit check process to reduce cart abandonment.

- Channel:

Retail Stores (Corporate & Authorized)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Transform retail locations from purely transactional points-of-sale to experiential centers focusing on complex sales like small business solutions, connected home, and IoT.

- Channel:

Call Centers (Inbound Sales)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Leverage AI-powered agent assists to provide real-time recommendations for upselling, cross-selling, and bundling, improving both conversion rates and ARPU.

Customer Journey

The current path is heavily deal-driven, focusing on aggressive hardware promotions. While effective for acquisition, it may attract price-sensitive customers with lower loyalty.

Friction Points

- •

Complex plan comparisons with nuanced differences in data caps, throttling, and perks.

- •

Lack of transparency around final monthly costs, including taxes and fees.

- •

Lengthy and often cumbersome credit check and identity verification process for new customers.

Journey Enhancement Priorities

{'area': 'Onboarding', 'recommendation': 'Develop a streamlined, digital-first onboarding process that is transparent about costs and simplifies activation.'}

{'area': 'Plan Selection', 'recommendation': 'Create interactive tools or guided selling flows to help customers easily identify the best plan based on their actual usage needs, not just on the latest device promotion.'}

Retention Mechanisms

- Mechanism:

Device Financing & Contracts

Effectiveness:High

Improvement Opportunity:Shift focus from contractual lock-in to loyalty driven by superior network performance and customer service to reduce post-contract churn.

- Mechanism:

Bundling (Wireless + Fiber)

Effectiveness:Medium

Improvement Opportunity:Increase the value and simplicity of converged bundles. Offer tangible, unique benefits for customers who bring both their mobile and home internet services to AT&T.

- Mechanism:

Loyalty Programs & Perks

Effectiveness:Low

Improvement Opportunity:Revamp loyalty programs to offer personalized rewards and experiences based on customer tenure and value, rather than generic, easily-replicated discounts.

Revenue Economics

The model is based on a high Customer Acquisition Cost (CAC), reported to be one of the highest in any industry (around $315-$694 per subscriber), which must be recouped over a long customer lifetime.

Assumed to be at or slightly above the healthy 3:1 industry benchmark, but under constant pressure from competitive promotions and churn.

Moderate. While generating massive revenue, the high cost of acquisition and intense capital expenditure required for network maintenance and upgrades impact overall efficiency.

Optimization Recommendations

- •

Focus on increasing Average Revenue Per User (ARPU) through upselling to premium 5G plans and cross-selling fiber internet.

- •

Drive multi-line account adoption (family plans) which inherently have lower churn rates.

- •

Improve digital self-service capabilities to lower the ongoing cost-to-serve for each customer.

Scale Barriers

Technical Limitations

- Limitation:

Legacy IT & OSS/BSS Systems

Impact:High

Solution Approach:Continued investment in modernizing back-office systems to enable faster product launches, more flexible billing, and a unified view of the customer across all services.

- Limitation:

Transitioning from Copper to Fiber

Impact:Medium

Solution Approach:Execute the strategic plan to decommission the majority of the legacy copper network by 2029, and manage the customer migration process seamlessly to fiber or fixed wireless alternatives.

Operational Bottlenecks

- Bottleneck:

Customer Service Scalability

Growth Impact:High churn and negative brand perception if service quality doesn't keep pace with subscriber growth.

Resolution Strategy:Invest heavily in AI-powered chatbots for simple queries, and empower human agents with better tools and data for resolving complex issues on the first contact.

- Bottleneck:

Fiber Deployment & Installation

Growth Impact:The physical pace of fiber rollout directly gates the growth of the high-margin consumer broadband business.

Resolution Strategy:Optimize supply chain, permitting processes, and field technician deployment. Explore strategic partnerships with construction and real estate developers to accelerate penetration.

Market Penetration Challenges

- Challenge:

Wireless Market Saturation

Severity:Critical

Mitigation Strategy:Focus growth on winning customers from competitors through network differentiation (5G speed/reliability), expanding into the business/enterprise segment, and growing share in fixed wireless access.

- Challenge:

Intense Competition from Cable in Broadband

Severity:Major

Mitigation Strategy:Accelerate fiber buildout to offer a technologically superior product. Compete aggressively on bundled pricing for customers taking both fiber and wireless services.

Resource Limitations

Talent Gaps

- •

Software and Network Engineers with expertise in AI, cloud-native architecture, and cybersecurity.

- •

Data Scientists capable of building predictive models for churn, network demand, and customer behavior.

- •

Product Managers skilled in developing and launching innovative digital services beyond connectivity.

Extremely high and ongoing. The company's strategy is dependent on executing a ~$22 billion annual capital investment plan while simultaneously managing and reducing its significant debt load.

Infrastructure Needs

- •

Accelerated buildout of mid-band 5G spectrum coverage to compete with T-Mobile.

- •

Rapid expansion of the fiber network to reach the goal of 50 million locations.

- •

Investment in edge computing data centers to support low-latency enterprise applications.

Growth Opportunities

Market Expansion

- Expansion Vector:

Enterprise 5G & Private Networks

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Develop industry-specific solutions for verticals like manufacturing, logistics, and healthcare that leverage private 5G networks for secure, low-latency connectivity.

- Expansion Vector:

Fiber Expansion to New Geographies

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Prioritize fiber buildouts in adjacent territories ('edge-outs') and areas with favorable density and competitive dynamics to maximize ROI on capital deployed.

- Expansion Vector:

Fixed Wireless Access (FWA)

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Use FWA ('AT&T Internet Air') strategically in areas where fiber is not economical, serving as a tool to capture broadband market share from cable and as a bridge for customers awaiting fiber builds.

Product Opportunities

- Opportunity:

Integrated IoT Solutions for SMBs

Market Demand Evidence:Growing demand from small and medium businesses for simple, plug-and-play IoT solutions to improve operational efficiency.

Strategic Fit:High

Development Recommendation:Package existing IoT connectivity with pre-certified hardware and a user-friendly software platform to create turn-key solutions for specific use cases (e.g., asset tracking, temperature monitoring).

- Opportunity:

Cybersecurity as a Service

Market Demand Evidence:Increasing need for robust security solutions for businesses of all sizes, especially with the rise of remote work and IoT.

Strategic Fit:High

Development Recommendation:Bundle managed security services with core connectivity products for business customers, leveraging AT&T's network visibility to provide threat detection and mitigation.

Channel Diversification

- Channel:

Enhanced Digital Self-Service

Fit Assessment:High

Implementation Strategy:Invest in the AT&T app and web portal to handle a wider range of sales, service, and support tasks, deflecting traffic from higher-cost channels and improving customer satisfaction.

- Channel:

Partnerships with Cloud Hyperscalers

Fit Assessment:High

Implementation Strategy:Deepen collaborations with AWS, Microsoft Azure, and Google Cloud to co-develop and co-market edge computing and private 5G solutions for enterprise clients.

Strategic Partnerships

- Partnership Type:

Smart Cities & Municipalities

Potential Partners

- •

City governments

- •

Public utility commissions

- •

Transportation authorities

Expected Benefits:Co-invest in smart infrastructure (e.g., connected streetlights, smart grids) that creates long-term B2B revenue streams and showcases 5G/IoT capabilities.

- Partnership Type:

Real Estate Development

Potential Partners

- •

Large home builders

- •

Commercial real estate developers

- •

REITs

Expected Benefits:Secure agreements to be the exclusive fiber provider for new developments, locking in customers and guaranteeing ROI on network expansion.

Growth Strategy

North Star Metric

Converged Subscribers

This metric measures the number of customers or households that subscribe to both a mobile and a fixed broadband (preferably fiber) service. It directly reflects the success of the core convergence strategy, as these customers have significantly higher lifetime value and lower churn.

Increase the percentage of the postpaid phone base that also has AT&T fiber by 20% over the next 24 months.

Growth Model

Ecosystem & Convergence-Led Growth

Key Drivers

- •

Superior network quality (5G & Fiber) as the foundation.

- •

Aggressive bundling of mobile and fiber services to increase switching costs and LTV.

- •

Expansion into high-margin enterprise solutions (Private 5G, IoT).

- •

Operational efficiency through digitalization and AI to fund growth investments.

Prioritize capital to accelerate fiber buildout. Structure marketing and sales incentives around selling the converged bundle. Build a dedicated enterprise solutions team to pursue B2B opportunities.

Prioritized Initiatives

- Initiative:

Accelerate Fiber Penetration in Existing Footprint

Expected Impact:High

Implementation Effort:High

Timeframe:Ongoing (12-24 months)

First Steps:Launch a hyper-targeted marketing campaign to all wireless-only customers within the current fiber footprint, offering exclusive, compelling bundle discounts.

- Initiative:

Develop Turn-Key Private 5G Solution Packages

Expected Impact:High

Implementation Effort:High

Timeframe:18-36 months

First Steps:Establish a dedicated business unit for enterprise 5G. Identify 2-3 key industry verticals (e.g., manufacturing, logistics) and build pilot programs with strategic enterprise partners.

- Initiative:

Unified Digital Customer Experience

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:12-18 months

First Steps:Create a cross-functional team to map the end-to-end customer journey across wireless and broadband, identifying and eliminating the top 5 friction points in the first 6 months.

Experimentation Plan

High Leverage Tests

- Experiment:

Dynamic Bundle Pricing

Hypothesis:Offering personalized bundle discounts based on a customer's wireless plan and tenure will increase fiber attachment rates.

- Experiment:

Self-Service FWA Onboarding

Hypothesis:A fully digital, self-install process for AT&T Internet Air will reduce acquisition costs and accelerate adoption in targeted markets.

- Experiment:

Value-Added Service Trials

Hypothesis:Offering free trials of premium services (e.g., advanced cybersecurity, cloud storage) to high-ARPU customers will lead to a significant paid adoption rate.

Utilize A/B testing platforms for digital channels. Track initiatives against key metrics: Converged Subscriber growth, ARPU uplift, Churn Rate reduction, and Net Promoter Score (NPS).

Bi-weekly sprints for digital/marketing tests; quarterly reviews for larger strategic initiatives.

Growth Team

A centralized Growth Council with executive sponsorship, comprised of embedded, cross-functional 'squads' focused on key growth objectives (e.g., Fiber Penetration Squad, SMB Acquisition Squad, Customer Lifecycle Squad).

Key Roles

- •

Head of Converged Growth

- •

Director of Enterprise Solutions Marketing

- •

Lead Data Scientist, Customer Analytics

- •

Head of Digital Product & Experience

Invest in continuous training on agile methodologies, data analytics, and customer-centric design. Foster a culture of experimentation where calculated risks are encouraged and learnings are shared across the organization.

AT&T is a mature telecommunications behemoth at a critical inflection point. Having divested its media assets, its growth foundation is now firmly rooted in its core competencies: providing wireless and broadband connectivity. The company's product-market fit for these core services is undeniably strong, evidenced by its massive subscriber base. However, it operates in a mature, low-growth, and intensely competitive market, making growth a capital-intensive battle for market share.

The primary growth engine is currently fueled by aggressive, hardware-centric promotions to acquire customers from competitors like Verizon and T-Mobile. While effective, this strategy carries a high customer acquisition cost and puts pressure on margins. The most significant strategic imperative and largest growth opportunity lies in executing a 'convergence' strategy: rapidly expanding its superior fiber network and bundling it with its 5G wireless service. Customers who adopt both services represent the highest lifetime value and are less likely to churn.

Key barriers to this growth are the immense capital requirements for network buildouts, a high existing debt load, and the operational complexity of deploying fiber at scale. Furthermore, the organization must continue to evolve from a traditional telco into a more agile, digitally-native organization to improve customer experience and fend off nimble competitors.

The recommended growth strategy centers on a new North Star Metric: 'Converged Subscribers'. This focuses the entire organization on the primary value driver. Growth will be achieved not just by acquiring new customers, but by deepening relationships with existing ones. The highest-impact initiatives involve accelerating fiber penetration, developing high-margin enterprise solutions like private 5G networks, and fundamentally simplifying the digital customer journey to reduce friction and improve retention. Success will be determined by AT&T's ability to execute its massive infrastructure investment plan while simultaneously becoming a more customer-centric and operationally efficient company.

Legal Compliance

AT&T maintains a comprehensive and mature privacy program, evidenced by its detailed Privacy Center. The policy is frequently updated to reflect new state privacy laws (e.g., CCPA/CPRA, VCDPA, CPA). It clearly outlines the categories of personal information collected (including web browsing, location, and Customer Proprietary Network Information - CPNI), the purposes for its use (service delivery, marketing, network security), and sharing practices with affiliates and third parties. The policy provides distinct sections for state-specific rights, demonstrating a robust compliance framework. It also addresses specific programs like 'Personalized' and 'Personalized Plus' advertising, explaining the data used and offering opt-out mechanisms. However, the sheer volume and fragmentation of information across the main Privacy Notice, a dedicated GDPR notice, and various control pages can be overwhelming for the average consumer, potentially impacting genuine transparency.

AT&T's Consumer Service Agreement is a detailed legal document that strongly favors the company in dispute resolution. The most prominent feature is a mandatory binding arbitration clause that requires disputes to be handled on an individual basis, explicitly prohibiting class action lawsuits. This strategically limits large-scale legal challenges from consumers. While the company presents the arbitration process as fair and cost-effective, covering costs for non-frivolous claims under $75,000, this structure is a significant deterrent to litigation and a powerful risk management tool for AT&T. The terms are clearly written from a legal standpoint but are dense and lengthy, reducing the likelihood of full consumer comprehension before acceptance.

AT&T's cookie consent mechanism is visible and functional, offering users choices to 'Accept all cookies,' 'Decline optional cookies,' or 'Manage your cookies.' This layered approach is a good practice. The management interface allows users to toggle off 'Marketing purposes' cookies, which addresses the 'Do Not Sell or Share' requirements under laws like CCPA/CPRA for the context of targeted advertising. However, the banner's design and language may subtly encourage acceptance. More importantly, essential cookies for site functionality and analytics cannot be turned off, a standard but important distinction. The mechanism appears more aligned with the opt-out framework of US state laws rather than the strict opt-in consent required by GDPR before any non-essential cookies are placed.

AT&T's data protection posture is robust, aligning with standards like the NIST Cybersecurity Framework and ISO/IEC 27001:2013. Their Privacy Center emphasizes security as a core principle. As a telecommunications carrier, AT&T is subject to stringent FCC rules regarding the protection of Customer Proprietary Network Information (CPNI), which includes call details, duration, and location. Despite these stated protections, the company has a history of significant data breaches and FCC enforcement actions, including a notable $25 million settlement for privacy violations at overseas call centers and consent decrees related to vendor data breaches. This history indicates a gap between documented policy and operational execution, presenting a persistent business risk. The company's policies also detail how they respond to law enforcement requests, requiring a warrant for location data except in exigent circumstances, which is a strong consumer protection stance.

AT&T demonstrates a strong, public commitment to accessibility and Universal Design. They have a dedicated accessibility section on their website and a Corporate Accessibility Technology Office (CATO) led by a Chief Accessibility Officer. Their policy explicitly references and commits to following industry standards like the Web Content Accessibility Guidelines (WCAG) and complying with relevant laws such as the Americans with Disabilities Act (ADA) and Section 508 of the Rehabilitation Act. This public commitment and established internal governance structure are significant strategic assets, reducing the risk of ADA-related lawsuits and expanding market access to customers with disabilities. The website itself appears well-structured, although a full technical audit would be required to verify WCAG conformance.

As a telecommunications carrier, AT&T's primary industry-specific regulations come from the Federal Communications Commission (FCC) and the Federal Trade Commission (FTC). Key FCC rules include the protection of CPNI, Truth-in-Billing, and regulations against 'slamming' (unauthorized carrier changes). The company has faced FCC enforcement actions and fines for CPNI mishandling, highlighting this as a critical and high-risk compliance area. The FTC's 'Truth in Advertising' principles apply to all marketing claims for plans and devices. The prominent use of 'See offer details' links on the homepage is a direct tactic to comply with these disclosure requirements. The regulatory landscape is complex, with both the FCC and FTC having jurisdiction over different aspects of their business, from consumer privacy to marketing practices.

Compliance Gaps

- •

Potential disconnect between documented security policies and historical data breach incidents, indicating operational vulnerabilities.

- •

The complexity and fragmentation of the Privacy Policy and related documents could be challenged as not being easily understandable for the average consumer.

- •

The cookie consent mechanism, while offering choices, may not fully align with the strict opt-in requirements of GDPR for EU visitors before non-essential trackers are loaded.

- •

While disclosures for promotional offers are present ('See offer details'), the clarity and prominence could be a target for FTC scrutiny if key terms are not presented clearly and conspicuously.

Compliance Strengths

- •

A comprehensive and well-resourced Privacy Center that is regularly updated to comply with the evolving patchwork of US state privacy laws.

- •

A clear and explicit public commitment to accessibility, supported by internal governance (CATO) and adherence to WCAG standards.

- •

Robust legal documentation, including a Terms of Service agreement with a strong, mandatory arbitration clause that significantly mitigates the risk of class-action lawsuits.

- •

Detailed and granular controls for consumers to manage their privacy preferences, including choices related to targeted advertising and data sharing under CCPA/CPRA.

- •

Explicit disclosures regarding call recording in customer service chats and clear explanations of sensitive data use like CPNI.

Risk Assessment

- Risk Area:

Data Security & CPNI Protection

Severity:High

Recommendation:Conduct regular, independent third-party audits of data security practices, particularly for third-party vendors, to bridge the gap between policy and implementation. The history of FCC fines makes this a top priority.

- Risk Area:

Regulatory Fines (FTC & FCC)

Severity:High

Recommendation:Proactively review all marketing materials and billing practices against FTC's Truth-in-Advertising and FCC's Truth-in-Billing rules to ensure all material terms (e.g., pricing, contract length, data caps) are exceptionally clear and conspicuous to consumers.

- Risk Area:

GDPR Non-Compliance

Severity:Medium

Recommendation:Implement geo-IP detection to present EU visitors with a GDPR-compliant cookie consent banner that requires explicit, granular opt-in before any non-essential cookies or trackers are deployed.

- Risk Area:

Consumer Trust Erosion

Severity:Medium

Recommendation:Develop a simplified, user-friendly 'privacy dashboard' that summarizes key data practices and provides direct links to controls, supplementing the dense legal policies to improve transparency and build customer trust.

- Risk Area:

Arbitration Clause Enforceability

Severity:Low

Recommendation:Continuously monitor legal and legislative challenges to mandatory arbitration clauses. While currently a strength, the legal landscape could shift, requiring a pivot in dispute resolution strategy.

High Priority Recommendations

- •

Strengthen third-party vendor security oversight with mandatory, recurring audits to prevent data breaches and avoid further multi-million dollar FCC consent decrees.

- •

Commission an independent review of all consumer-facing marketing and promotional materials to ensure they meet the 'clear and conspicuous' disclosure standards required by the FTC.

- •

Enhance the cookie consent experience for international visitors to ensure strict GDPR compliance, thereby mitigating risk of significant fines from EU authorities.

- •

Invest in simplifying privacy communications through visual aids, FAQs, and dashboards to make complex data practices more accessible to the average consumer, reinforcing brand trust.