eScore

bankofamerica.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Bank of America commands a dominant digital presence, anchored by immense brand authority and a high-ranking domain. Its content strategy, particularly the 'Better Money Habits' platform, effectively aligns with user search intent for financial education, capturing a wide top-of-funnel audience. The bank's multi-channel presence is robust, with 59 million verified digital users, and its digital-first strategy ensures national reach beyond its physical branches. While its foundational SEO is strong, there is room to enhance optimization for conversational voice search queries to capture emerging user behaviors.

The 'Better Money Habits' financial education platform serves as a powerful top-of-funnel content authority, building trust and capturing organic traffic from users early in their financial journey.

Systematically optimize informational content for voice search by structuring answers to common financial questions in a conversational Q&A format to capture featured snippets and leads from smart speakers.

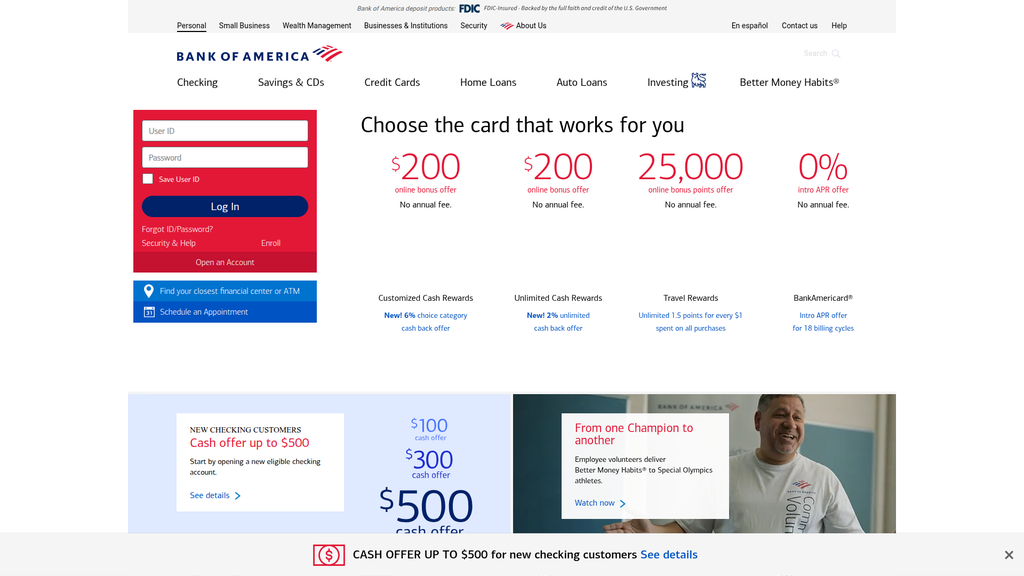

The brand's messaging is exceptionally clear and functional, effectively segmenting audiences and communicating the vast range of its product offerings. However, a significant gap exists between the aspirational brand promise, 'What would you like the power to do?', and the website's highly transactional, product-focused communication. This disconnect prevents the formation of a deeper emotional connection with prospective customers. The bank's most powerful differentiator, the 'Preferred Rewards' program, is often presented as a feature rather than a core strategic message of value.

Messaging clarity is outstanding; the website functions as a highly effective digital storefront where product categories are clearly defined and calls-to-action are direct and unambiguous.

Integrate the aspirational 'power to do' narrative into the homepage and product pages with customer-centric, goal-oriented language (e.g., 'The power to own your home') instead of product-led CTAs ('Explore mortgages').

Bank of America excels in key areas of the user experience, particularly with an excellent mobile responsive design and a laudable, industry-leading commitment to web accessibility. However, the conversion experience for new customers is significantly hampered by high cognitive load on the homepage, where multiple competing offers create choice paralysis. The design of primary CTAs like 'Apply Now' as simple text links lacks the visual prominence of buttons, creating a major friction point that likely suppresses new account acquisition. While the account setup experience scores well once a user is on the path, the initial journey is weak.

An exemplary and proactive commitment to web accessibility (ADA/WCAG guidelines), which not only mitigates legal risk but also expands market reach and reinforces brand inclusivity.

Redesign all primary CTAs ('Apply now', 'Open an account') from text links into high-contrast, solid-fill buttons to increase their visual weight and significantly improve click-through rates for new customer acquisition.

As one of the world's largest financial institutions, credibility is the bedrock of Bank of America's brand, and this is reflected powerfully online. Trust signals such as FDIC membership, a prominent 'Security Center,' and a robust privacy framework aligned with GLBA are expertly deployed. The bank's immense scale, consistent financial performance, and position as a systemically important bank provide unparalleled third-party validation and mitigate perceived risk for consumers and businesses alike.

Deeply embedded regulatory compliance (GLBA, TILA, SEC/FINRA) and a proactive security posture serve as a formidable strategic asset, building foundational customer trust and a high barrier to entry.

Increase transparency by adding a general 'Website Terms of Use' link to the footer to govern non-customer site interaction, closing a minor but noticeable governance gap.

Bank of America's competitive moat is deep and sustainable, built on formidable economies of scale and immense brand trust. Its most defensible advantage is the seamless integration of its comprehensive banking services with Merrill's premier wealth management platform, creating high switching costs for customers. The 'Preferred Rewards' program reinforces this ecosystem by rewarding clients for deepening their relationships, a feature that is difficult for specialized fintech competitors to replicate. While the bank's AI assistant 'Erica' is a leader among peers, the primary weakness is a slower pace of innovation compared to more agile fintech startups.

The integrated BofA-Merrill ecosystem, unified by the 'Preferred Rewards' program, creates a powerful value proposition and high switching costs that competitors cannot easily replicate.

Establish a dedicated corporate venture arm or a more aggressive partnership program to strategically invest in and integrate best-in-class fintech solutions, accelerating innovation without relying solely on in-house development.

The business model is already proven at a massive scale, with a strong foundation for growth demonstrated by 49 million active digital users and a robust digital sales channel. The AI-powered assistant 'Erica' showcases significant automation maturity, handling millions of interactions monthly and reducing operational load. However, scalability is constrained by high fixed costs associated with legacy technology and a vast physical branch network. Expansion potential is focused on deepening wallet share within the existing, saturated US market rather than aggressive geographic expansion.

The highly mature digital banking platform, including the AI assistant 'Erica,' provides a low-variable-cost channel to serve millions of users, driving operational leverage and scalable growth.

Accelerate the modernization of the core banking infrastructure by migrating to a more agile, cloud-native platform to reduce long-term costs and increase the speed of new product development and market expansion.

Bank of America's universal banking model is exceptionally coherent and resilient, with highly diversified revenue streams from consumer banking, wealth management, and global banking. The corporate strategy of 'responsible growth' ensures a strong strategic focus on profitability and risk management, which aligns the interests of customers, employees, and investors. The model effectively leverages its key resources—brand, customer base, and capital—to execute its value proposition of being an indispensable, full-service financial partner. The significant investment in technology and AI is well-aligned with market trends and the strategic goal of organic growth.

A highly diversified revenue model, balancing Net Interest Income with strong fee-based income from wealth management and card services, creates stability and resilience across different economic cycles.

Improve coherence between brand marketing and digital execution by re-architecting the website's information flow to be goal-oriented (e.g., 'Buy a home') rather than strictly product-oriented ('Mortgages').

As the second-largest bank in the US by assets, Bank of America wields immense market power. Its market share trajectory is stable and growing in key areas, evidenced by consecutive quarters of net new checking account growth. This scale gives it significant pricing power, leverage with partners, and the ability to influence industry standards and regulatory discussions. The bank's diversified model across millions of customers minimizes dependency risk, and its massive investments in technology and marketing solidify its dominant position against both traditional and fintech competitors.

Sustained market leadership with a top-two position in US assets and deposits provides enormous scale, influencing pricing, partnerships, and the overall direction of the financial services industry.

Proactively create and dominate niche markets, such as specialized banking for the creator/gig economy, to preempt smaller fintechs from gaining footholds in emerging, high-growth segments.

Business Overview

Business Classification

Universal Bank

Financial Technology (FinTech) Integrator

Financial Services

Sub Verticals

- •

Consumer & Retail Banking

- •

Global Wealth & Investment Management (GWIM)

- •

Global Banking (Commercial & Corporate)

- •

Global Markets (Investment Banking & Trading)

Mature

Maturity Indicators

- •

One of the 'Big Four' US banks, indicating systemic importance.

- •

Vast physical footprint (~3,700 retail centers, ~15,000 ATMs) and massive digital user base (~69 million clients).

- •

Consistent market leadership in key segments like commercial banking and private banking.

- •

Subject to significant global and national regulatory oversight as a systemically important financial institution.

- •

Long history of mergers and acquisitions, including major integrations like NationsBank and Merrill Lynch.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Net Interest Income

Description:The core revenue driver, representing the difference between interest earned on assets (such as loans and securities) and interest paid on liabilities (like deposits). This is highly sensitive to prevailing interest rates.

Estimated Importance:Primary

Customer Segment:All Segments

Estimated Margin:Medium

- Stream Name:

Noninterest Income: Fees and Services

Description:Comprises diverse fee-based income, including card income (interchange fees), service charges on deposit accounts, investment banking and advisory fees, and brokerage commissions.

Estimated Importance:Primary

Customer Segment:All Segments

Estimated Margin:High

- Stream Name:

Wealth Management Fees

Description:Generated by the Global Wealth & Investment Management (GWIM) division, primarily through Merrill and Bank of America Private Bank. Fees are typically based on a percentage of assets under management (AUM).

Estimated Importance:Secondary

Customer Segment:High-Net-Worth Individuals & Institutions

Estimated Margin:High

- Stream Name:

Trading Revenue

Description:Revenue from the Global Markets division's sales and trading activities across fixed-income, credit, currency, commodity, and equity businesses.

Estimated Importance:Secondary

Customer Segment:Institutional Investors & Corporations

Estimated Margin:Variable

Recurring Revenue Components

- •

Interest income from loan portfolios

- •

Account maintenance and service fees

- •

Credit card annual fees and interest

- •

Asset Under Management (AUM) fees from wealth management clients

Pricing Strategy

Tiered & Relationship-Based

Mid-range to Premium

Semi-transparent

Pricing Psychology

- •

Relationship-based rewards (Preferred Rewards program offering fee waivers and discounts based on total assets)

- •

Introductory offers (cash bonuses for new accounts, 0% intro APR on credit cards)

- •

Bundling of services (checking, savings, and investment accounts)

- •

Fee waivers for meeting minimum balance or activity requirements

Monetization Assessment

Strengths

- •

Highly diversified revenue streams across multiple business segments, reducing dependency on any single area.

- •

Significant net interest income driven by a massive deposit base.

- •

Strong noninterest income from a vast credit card portfolio and leading wealth management business.

- •

Cross-selling opportunities across its vast customer base are a key strategic focus.

Weaknesses

- •

Revenue is sensitive to macroeconomic factors, particularly interest rate fluctuations and economic downturns.

- •

High fixed costs associated with maintaining a large physical branch network and complex legacy IT systems.

- •

Intense price competition in commoditized products like mortgages and checking accounts.

Opportunities

- •

Expanding fee-based revenue from digital wealth management solutions (robo-advisors) for the mass-affluent segment.

- •

Leveraging data analytics for more personalized product offerings and dynamic pricing.

- •

Growth in sustainable finance and ESG-related investment banking and asset management fees.

Threats

- •

Margin compression from FinTech competitors offering lower-cost, specialized financial products.

- •

Regulatory changes that could cap fees (e.g., interchange fees, overdraft fees).

- •

Shift in consumer preference away from traditional banking models toward digital-only or decentralized finance (DeFi) alternatives.

Market Positioning

A comprehensive, full-service financial institution positioned as a life-long partner for a broad spectrum of clients, from individuals to global corporations, leveraging a 'high-tech, high-touch' approach.

Top 2 in the U.S. by assets and deposits, competing directly in the 'Big Four' with JPMorgan Chase, Wells Fargo, and Citigroup.

Target Segments

- Segment Name:

Mass Market & Mass Affluent Consumers

Description:Individuals and households requiring core banking services (checking, savings), credit products (cards, auto, mortgage), and accessible investment options.

Demographic Factors

All age groups, with a growing focus on digitally-native Millennials and Gen Z.

Varying income levels.

Psychographic Factors

- •

Seeks convenience and accessibility.

- •

Values security and brand trust.

- •

Increasingly expects seamless digital experiences.

Behavioral Factors

High usage of mobile and online banking for daily transactions.

Responds to loyalty programs and rewards (e.g., cash back, points).

Pain Points

- •

Managing daily finances and budgeting.

- •

Navigating complex financial decisions like home buying or saving for retirement.

- •

High fees for basic banking services.

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

High-Net-Worth (HNW) & Ultra-High-Net-Worth (UHNW) Individuals

Description:Served by Merrill and Bank of America Private Bank, this segment requires sophisticated wealth management, investment strategies, estate planning, and customized credit solutions.

Demographic Factors

High income and significant investable assets.

Psychographic Factors

Values personalized advice and a dedicated relationship with an advisor.

Concerned with wealth preservation, legacy planning, and tax efficiency.

Behavioral Factors

Prefers a 'high-touch' relationship, often involving in-person meetings and a dedicated team.

Increasingly utilizes digital platforms to monitor portfolios and interact with advisors.

Pain Points

- •

Complexity of managing substantial wealth.

- •

Navigating volatile market conditions.

- •

Lack of integrated banking and investment advice.

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Small & Medium-Sized Businesses (SMBs)

Description:Businesses requiring services like business checking, credit lines, merchant services, treasury management, and business loans.

Demographic Factors

Varies by industry, revenue, and number of employees.

Psychographic Factors

Focused on growth, efficiency, and managing cash flow.

Behavioral Factors

Needs a reliable banking partner that understands their business.

Adoption of digital tools for payroll, payments, and cash management.

Pain Points

- •

Access to capital for growth and operations.

- •

Time-consuming financial administration.

- •

Managing day-to-day cash flow effectively.

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Large Corporations & Institutional Investors

Description:Global clients requiring investment banking (M&A advisory, underwriting), capital markets solutions, treasury services, and large-scale financing.

Demographic Factors

Includes Fortune 1000 companies and large institutional funds.

Psychographic Factors

Focused on strategic growth, risk management, and maximizing shareholder value.

Behavioral Factors

Requires specialized expertise and global capabilities.

Engages in complex, high-value transactions.

Pain Points

- •

Raising capital in public or private markets.

- •

Managing global financial operations and currency risk.

- •

Executing large-scale strategic transactions.

Fit Assessment:Excellent

Segment Potential:Medium

Market Differentiation

- Factor:

Integrated Banking & Wealth Management

Strength:Strong

Sustainability:Sustainable

- Factor:

Scale and Brand Recognition

Strength:Strong

Sustainability:Sustainable

- Factor:

Advanced Digital Platform & AI Assistant (Erica)

Strength:Moderate

Sustainability:Temporary

- Factor:

Physical Distribution Network (Branches & ATMs)

Strength:Strong

Sustainability:Sustainable

Value Proposition

To be the indispensable financial partner for every client segment by providing a comprehensive suite of financial solutions, delivered through a seamless integration of industry-leading digital capabilities and an extensive physical network, all underpinned by a commitment to security and responsible growth.

Good

Key Benefits

- Benefit:

Comprehensive Financial Solutions

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Website navigation clearly outlines offerings for Personal, Small Business, Wealth Management, and Institutions.

Broad product range including banking, credit cards, home loans, auto loans, and investing.

- Benefit:

Convenience and Accessibility

Importance:Critical

Differentiation:Common

Proof Elements

- •

Heavy promotion of the highly-rated mobile banking app.

- •

Vast network of financial centers and ATMs.

- •

Ability to schedule appointments online or in person.

- Benefit:

Rewarding Client Relationships

Importance:Important

Differentiation:Unique

Proof Elements

Preferred Rewards program offering tangible benefits like fee waivers and interest rate boosters across banking and investment products.

- Benefit:

Personalized Digital Experience

Importance:Important

Differentiation:Somewhat unique

Proof Elements

Erica, the AI-powered virtual assistant, used by nearly 20 million people for proactive insights and support.

Customizable alerts and digital tools for financial management.

Unique Selling Points

- Usp:

The Preferred Rewards program, which uniquely integrates a client's entire financial relationship (BofA banking and Merrill investing) to deliver tiered benefits, creating high switching costs.

Sustainability:Long-term

Defensibility:Strong

- Usp:

The combined power of Bank of America's banking scale with Merrill's premier wealth management platform, offering a fully integrated service model that few competitors can replicate.

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Fragmentation of financial life across multiple providers.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Difficulty in accessing capital for major life purchases (home, car) or business growth.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Need for convenient, secure, and 24/7 access to banking services.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Lack of sophisticated financial advice and investment management for growing wealth.

Severity:Major

Solution Effectiveness:Complete

Value Alignment Assessment

High

The business model effectively addresses the core financial needs of the broad US market, from basic banking to complex wealth management, aligning well with the current economic structure.

High

Product suites and service delivery models (digital vs. advisor-led) are well-tailored to the distinct needs and preferences of their primary target segments.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Payment Networks (Visa, Mastercard)

- •

Technology Vendors (Cloud providers, Core banking software, AI/ML platforms).

- •

FinTech Companies (e.g., Zelle for P2P payments).

- •

Regulatory Bodies (Federal Reserve, OCC, FDIC, SEC)

- •

Merchants (for co-branded cards and rewards programs)

Key Activities

- •

Retail & Commercial Lending and Deposit Taking

- •

Wealth & Asset Management.

- •

Investment Banking & Capital Markets Services.

- •

Digital Platform Development & Innovation.

- •

Risk Management & Regulatory Compliance

Key Resources

- •

Vast Customer Base and Data

- •

Brand Equity and Trust

- •

Significant Capital and Balance Sheet Strength

- •

Technology Infrastructure (including the Erica AI platform)

- •

Extensive Physical and Digital Distribution Channels.

Cost Structure

- •

Employee Compensation & Benefits

- •

Technology & Infrastructure (including a planned $4B investment in AI and new tech in 2025).

- •

Physical Network Operating Costs (branches, offices)

- •

Provision for Credit Losses

- •

Marketing & Customer Acquisition

- •

Regulatory Compliance and Legal Costs

Swot Analysis

Strengths

- •

Unmatched scale and a highly diversified business model mitigates risk.

- •

Leading market position in nearly all key segments.

- •

Powerful brand recognition and a massive, loyal customer base.

- •

Advanced digital banking platform and significant investment in technology and AI.

- •

Unique integration of banking (BofA) and world-class wealth management (Merrill).

Weaknesses

- •

High operating costs due to legacy systems and extensive physical footprint.

- •

Perceived as less agile than smaller FinTech challengers.

- •

Vulnerability to reputational damage from system outages, security breaches, or regulatory actions.

- •

Complex organizational structure can slow down decision-making and innovation.

Opportunities

- •

Leverage AI and data analytics to create hyper-personalized customer experiences and proactive financial guidance.

- •

Expand digital-first offerings to capture a larger share of the younger demographic.

- •

Growth in sustainable finance, offering ESG-focused loans and investment products.

- •

Further penetrate the small and mid-market business segment with integrated banking and software solutions.

Threats

- •

Intensifying competition from agile FinTechs, neobanks, and large tech companies entering financial services.

- •

Evolving regulatory landscape, potentially leading to increased compliance costs and restrictions on revenue streams.

- •

Persistent cybersecurity threats targeting large financial institutions.

- •

Macroeconomic volatility, including interest rate shifts, inflation, and potential recessions.

- •

Long-term disruption from decentralized finance (DeFi) and blockchain technologies.

Recommendations

Priority Improvements

- Area:

SMB Digital Ecosystem Integration

Recommendation:Evolve beyond traditional business banking by creating an integrated digital platform for SMBs that combines banking, cash flow management, payroll, invoicing, and access to capital in a single interface, potentially through strategic FinTech partnerships or acquisitions.

Expected Impact:High

- Area:

Hyper-Personalization at Scale

Recommendation:Fully operationalize the vast data assets to transition the AI assistant 'Erica' from a reactive tool to a proactive, personalized financial advisor. It should anticipate client needs, offer tailored savings and investment advice, and automatically identify opportunities for financial optimization.

Expected Impact:High

- Area:

Legacy System Modernization

Recommendation:Accelerate the strategic migration from legacy core banking systems to a more agile, cloud-native infrastructure. This would reduce long-term operating costs, increase developmental speed for new products, and enhance resilience.

Expected Impact:Medium

Business Model Innovation

- •

Develop a 'Banking-as-a-Service' (BaaS) offering, allowing non-financial companies to embed BofA's financial products (e.g., loans, accounts) into their own ecosystems, creating a new B2B revenue stream.

- •

Launch a subscription-based premium service tier offering personalized financial planning, dedicated human support, and exclusive investment opportunities for the mass-affluent segment, moving beyond asset-based fees.

- •

Create a data-monetization arm that provides anonymized, aggregated spending and economic trend data as a premium intelligence product for institutional investors and corporate clients.

Revenue Diversification

- •

Expand further into the insurance market, either through partnerships or by developing proprietary insurance products to cross-sell to the existing retail and small business customer base.

- •

Build out a more robust suite of ESG and sustainable finance products, including green bonds, impact investing funds, and carbon credit trading services, to capture growing market demand.

- •

Invest in or partner with companies in adjacent digital ecosystems, such as real estate technology (PropTech) or healthcare payments, to embed financial services at the point of need.

Bank of America's business model is a textbook example of a successful universal bank, characterized by immense scale, diversification, and market leadership. Its primary competitive advantage lies in the seamless integration of its retail and commercial banking operations with the premier wealth management capabilities of Merrill. This creates a powerful, self-reinforcing ecosystem that captures clients across their entire financial lifecycle, fostering loyalty and significant switching costs, most notably through its unique Preferred Rewards program. The company is in a mature stage, with a steady growth trajectory driven by deep market penetration and a focus on 'responsible growth.'

The strategic imperative for Bank of America is to defend its incumbent position against disruption from more agile FinTech competitors. The company is actively addressing this threat through massive investments in digital transformation, particularly in AI with its virtual assistant, Erica. The evolution of its business model hinges on its ability to transition from a 'one-size-fits-all' provider to a 'hyper-personalized' financial partner at scale. Future success will be defined not just by maintaining its physical and brand dominance, but by leveraging its unparalleled data assets to deliver proactive, predictive, and deeply integrated digital experiences that make its comprehensive offerings indispensable to its clients. The primary challenge will be balancing the need for rapid innovation with the operational and regulatory complexities inherent in a systemically important global bank.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Regulatory Compliance and Licensing

Impact:High

- Barrier:

High Capital Requirements

Impact:High

- Barrier:

Brand Recognition and Customer Trust

Impact:High

- Barrier:

Economies of Scale

Impact:High

- Barrier:

Access to Distribution Channels (Branch/ATM Networks)

Impact:Medium

Industry Trends

- Trend:

Hyper-Personalization using AI

Impact On Business:AI-driven analytics are crucial for tailoring product recommendations, offering predictive financial guidance, and enhancing customer engagement to compete with agile fintechs.

Timeline:Immediate

- Trend:

Digital Transformation (Mobile-First)

Impact On Business:The mobile app is becoming the primary customer gateway. A seamless, feature-rich, and intuitive mobile experience is non-negotiable for customer retention and acquisition.

Timeline:Immediate

- Trend:

Embedded Finance and Banking-as-a-Service (BaaS)

Impact On Business:Offers new revenue streams by integrating banking products (like loans or payments) into non-financial platforms, expanding reach beyond traditional channels.

Timeline:Near-term

- Trend:

Open Banking Adoption

Impact On Business:Requires secure data sharing capabilities and fosters an ecosystem of collaboration with fintechs, potentially leading to more innovative customer solutions but also increased competition for specific services.

Timeline:Near-term

- Trend:

Focus on ESG (Environmental, Social, Governance)

Impact On Business:Growing consumer and investor demand for sustainable and socially responsible banking practices is becoming a key brand differentiator and competitive factor.

Timeline:Immediate

Direct Competitors

- →

JPMorgan Chase & Co. (Chase)

Market Share Estimate:Largest US bank by assets, major competitor in all segments.

Target Audience Overlap:High

Competitive Positioning:Positions as a technology-forward, full-service global bank with a vast and loyal customer base.

Strengths

- •

Largest US bank with enormous scale and brand recognition.

- •

Strong investment banking and wealth management divisions.

- •

Considered a leader in digital innovation among the 'Big Four'.

- •

Vast credit card portfolio with popular rewards programs (e.g., Sapphire, Freedom).

Weaknesses

- •

Can be perceived as less customer-centric than smaller competitors.

- •

Legacy systems can slow down certain aspects of innovation.

- •

Size can lead to bureaucratic hurdles and less agility.

Differentiators

- •

Broadest range of services, from basic banking to private wealth.

- •

Strong brand equity and perception of stability.

- •

Leading position in credit card market share and rewards.

- →

Wells Fargo

Market Share Estimate:Top 4 US bank by assets, significant presence in consumer and small business banking.

Target Audience Overlap:High

Competitive Positioning:Focuses on building customer relationships, particularly in community banking and small business lending, while recovering brand trust.

Strengths

- •

Extensive branch network across the United States, particularly strong in the West.

- •

Strong market position in small business and mortgage lending.

- •

Focus on content marketing and audience-centric strategies for specific segments like diverse small businesses.

- •

Comprehensive product suite catering to a wide range of customer needs.

Weaknesses

- •

Significant reputational damage from past scandals (e.g., fake accounts), which erodes trust.

- •

Digital offerings and mobile app functionality have historically lagged behind competitors like Chase and BofA.

- •

Ongoing regulatory scrutiny and asset caps can limit growth.

- •

Perceived as less innovative in the digital space.

Differentiators

Deep roots in community banking and a focus on Main Street businesses.

Emphasis on customer feedback and diversity/inclusion in its marketing and content.

- →

Citigroup (Citibank)

Market Share Estimate:Top 4 US bank by assets, with a significant global footprint.

Target Audience Overlap:High

Competitive Positioning:Positions as a global bank with strong credit card offerings and a large, fee-free ATM network, focusing on major urban centers.

Strengths

- •

Vast global presence, making it a strong choice for international customers.

- •

Highly-rated mobile banking app and strong digital services.

- •

Expansive fee-free ATM network (MoneyPass), larger than other top banks combined.

- •

Strong and diverse portfolio of credit card products.

Weaknesses

- •

Smaller US branch footprint compared to BofA, Chase, and Wells Fargo.

- •

Some of its most competitive savings account rates are not available in all markets.

- •

Monthly fees on accounts unless minimum balance requirements are met.

- •

Historically has had a stronger focus on corporate and investment banking over US retail.

Differentiators

- •

Superior global banking capabilities and international reach.

- •

Extensive ATM network provides significant convenience for cash access.

- •

Focus on urban markets and affluent customers.

Indirect Competitors

- →

Neobanks (Chime, SoFi, Ally Bank)

Description:Digital-only banks offering low/no-fee checking and savings accounts, often with features like early direct deposit and user-friendly mobile apps. They excel at customer acquisition through a simple value proposition.

Threat Level:High

Potential For Direct Competition:High, as they expand their product suites into lending, credit cards, and investments, effectively rebundling the bank.

- →

Fintech Lenders (Rocket Mortgage, SoFi)

Description:Technology-driven platforms that streamline the lending process for mortgages and personal loans, offering faster approvals and a more convenient digital experience than traditional banks.

Threat Level:High

Potential For Direct Competition:Medium, as they are highly specialized but are encroaching on a core, profitable product line for traditional banks.

- →

Online Brokerages & Robo-Advisors (Robinhood, Wealthfront, Charles Schwab)

Description:Offer low-cost, self-directed investing and automated portfolio management, directly competing with Bank of America's Merrill Edge and Merrill Lynch offerings, especially for younger and mass-affluent investors.

Threat Level:High

Potential For Direct Competition:High, as many are adding banking features (cash management accounts, debit cards) to become comprehensive financial platforms.

- →

Payment Platforms & Digital Wallets (PayPal, Apple, Block/Square)

Description:These companies are disintermediating banks in the payments space. They are expanding into other financial services like savings accounts (Apple Savings), peer-to-peer payments, and small business lending, capturing customer data and relationships.

Threat Level:Medium

Potential For Direct Competition:High, as they build out their ecosystems and leverage their massive user bases to offer a suite of financial products.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Integrated Financial Ecosystem

Sustainability Assessment:The combination of consumer/business banking, global wealth management (Merrill), and investment banking provides significant cross-selling opportunities and creates high switching costs for affluent customers.

Competitor Replication Difficulty:Hard

- Advantage:

Economies of Scale and Brand Trust

Sustainability Assessment:As one of the largest US banks, BofA benefits from massive scale, a low cost of capital, and a brand that conveys stability and trust, which is a key consideration for consumers' primary banking relationships.

Competitor Replication Difficulty:Hard

- Advantage:

Vast Physical Footprint

Sustainability Assessment:While digital is key, the extensive network of branches and ATMs remains a significant advantage for brand presence, customer service for complex issues, and serving demographics that prefer in-person banking.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'Specific Promotional Offers (e.g., credit card bonuses)', 'estimated_duration': 'Short-term (3-6 months per campaign)'}

{'advantage': 'Exclusive Partnerships', 'estimated_duration': 'Medium-term (duration of contract)'}

Disadvantages

- Disadvantage:

Innovation Lag vs. Fintechs

Impact:Major

Addressability:Difficult

- Disadvantage:

Perception as a 'Big Bank'

Impact:Major

Addressability:Moderately

- Disadvantage:

Legacy Technology Infrastructure

Impact:Major

Addressability:Difficult

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted marketing campaigns emphasizing the seamless integration of banking and Merrill Edge investing, showcasing it as a superior alternative to juggling separate banking and brokerage apps.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Optimize the mobile app's user onboarding and help sections to reduce friction for new digital users and improve feature discovery.

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Prominently feature 'Better Money Habits' financial literacy content within the app, personalized to user's financial situation, to build trust and engagement.

Expected Impact:Low

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Develop and launch hyper-personalized product offerings and financial advice powered by AI, moving from generic recommendations to predictive insights for individual customers.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Create specialized digital banking solutions for high-growth niche segments, such as gig economy workers or small e-commerce businesses, who are currently underserved by traditional banking products.

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Form strategic partnerships with leading fintech companies to integrate their best-in-class point solutions into the BofA ecosystem, accelerating innovation without building everything in-house.

Expected Impact:High

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Continue modernizing core banking infrastructure by migrating to a more agile, cloud-native platform to increase development speed, reduce operational costs, and enable faster innovation cycles.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Build out a robust Banking-as-a-Service (BaaS) platform, allowing third-party companies to embed BofA's regulated financial products into their own applications, creating a new, scalable revenue stream.

Expected Impact:High

Implementation Difficulty:Difficult

Solidify Bank of America's position as the premier 'integrated financial wellness' platform. Shift messaging from a collection of products (banking, cards, loans, investing) to a unified solution that helps customers manage their entire financial life seamlessly, blending digital convenience with the trust and expert guidance of a major institution.

Differentiate through superior integration. While competitors offer similar products, none have integrated a top-tier banking franchise with a world-class wealth management arm (Merrill) as deeply. This integration should be the core differentiator, enabling holistic financial views, preferential rewards across platforms (Preferred Rewards program), and a customer journey that seamlessly moves from simple banking to complex wealth management.

Whitespace Opportunities

- Opportunity:

Holistic Financial Planning for the Mass Affluent

Competitive Gap:While robo-advisors offer automated investing and banks offer savings products, there's a gap for an integrated digital platform that combines AI-driven financial planning, goal setting, budgeting, banking, and investing in a single, intuitive interface for customers who are wealthy but not yet at the private bank level.

Feasibility:High

Potential Impact:High

- Opportunity:

Banking for the Creator Economy

Competitive Gap:Creators and gig economy workers have irregular income streams and unique business needs (e.g., managing multiple revenue sources, tax planning, short-term cash flow loans) that are poorly served by standard small business banking accounts.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

ESG-Centric Financial Products

Competitive Gap:There is growing demand for financial products that align with customers' values. An opportunity exists to create a suite of products, from checking accounts that fund green loans to managed investment portfolios focused on sustainability, that are transparently and authentically ESG-focused, beyond simple marketing.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Serving Underserved and Multicultural Consumers

Competitive Gap:There are significant opportunities to better serve low- and middle-income Black and Hispanic consumers who are less likely to use traditional financial services. This includes offering more accessible and affordable products, multilingual digital interfaces, and leveraging alternative data for credit assessments.

Feasibility:Medium

Potential Impact:High

Bank of America operates in a mature, oligopolistic financial services industry characterized by high barriers to entry. Its primary competitive set consists of the other 'Big Four' US banks: JPMorgan Chase, Wells Fargo, and Citigroup. These institutions compete across a full spectrum of financial products, with the key battlegrounds being digital customer experience, brand trust, and product integration. Bank of America's core sustainable advantage is its deeply integrated ecosystem, combining its vast consumer and commercial banking operations with the premier wealth management capabilities of Merrill. This allows for significant customer entrenchment and cross-selling opportunities that are difficult for competitors to replicate.

The most significant threat comes not from direct competitors, but from a host of specialized, agile, and digitally native indirect competitors. Neobanks like Chime and SoFi are unbundling the traditional bank by offering superior user experiences in specific verticals like checking and savings. Fintech lenders such as Rocket Mortgage have captured significant market share by streamlining the loan process, while online brokerages like Robinhood are attracting the next generation of investors. These disruptors force Bank of America to accelerate its own digital transformation and innovate continuously to avoid being relegated to a 'dumb utility' in the financial background.

Strategic whitespace exists in serving niche but growing markets like the creator economy and in providing truly holistic, AI-driven financial wellness platforms for the mass affluent. There is also a substantial opportunity in better addressing the needs of underserved communities. Future success will depend on Bank of America's ability to leverage its scale and trust while emulating the agility and customer-centricity of its fintech challengers. The key is to deepen the integration between its banking and investment platforms, positioning itself not just as a place to store money, but as an indispensable partner for achieving financial well-being.

Messaging

Message Architecture

Key Messages

- Message:

Comprehensive Financial Solutions: Banking, Credit Cards, Home Loans & Auto Loans.

Prominence:Primary

Clarity Score:High

Location:Homepage H1 Title

- Message:

Convenient and Secure Digital Banking: 'Do more with the Mobile Banking app.'

Prominence:Primary

Clarity Score:High

Location:Homepage, upper section

- Message:

Rewarding Customer Loyalty: 'Preferred Rewards members can save hundreds in banking fees annually.'

Prominence:Secondary

Clarity Score:Medium

Location:Pop-up menus for Checking, Savings, Loans

- Message:

Financial Empowerment and Education: 'Videos and tips to better manage your financial life' via Better Money Habits®.

Prominence:Secondary

Clarity Score:High

Location:Homepage, mid-section; Main navigation

- Message:

Accessibility and Inclusion: 'Accessible services, tools and technology to support you.'

Prominence:Tertiary

Clarity Score:High

Location:Dedicated 'Accessible Banking' page, linked from footer

The message hierarchy is logical but highly product-centric. The primary message is about the breadth of product offerings (checking, savings, loans, etc.). Digital convenience is a close second. The overarching brand promise, 'What would you like the power to do?', is absent from the homepage and feels disconnected from the transactional focus of the content. Messages around rewards and financial education are present but secondary, requiring user interaction (hovering, scrolling) to discover.

Messaging is highly consistent within product verticals. For example, each major product section (Checking, Savings, Credit Cards) follows a similar template of showcasing options, providing a clear CTA, and highlighting the benefits of the Preferred Rewards program. The 'Better Money Habits' and 'Accessible Banking' sections maintain a consistent, helpful, and supportive tone, though this tone is distinct from the more direct, sales-oriented language of the product sections.

Brand Voice

Voice Attributes

- Attribute:

Comprehensive

Strength:Strong

Examples

Bank of America - Banking, Credit Cards, Home Loans & Auto Loans

Find the perfect credit card from among our most popular options

- Attribute:

Direct

Strength:Strong

Examples

- •

Explore checking solutions

- •

Shop all credit cards

- •

Get started

- •

Apply for an auto loan

- Attribute:

Secure

Strength:Moderate

Examples

Your activities are protected by industry-leading security features

Check your browser address bar to make sure you're on our real website

- Attribute:

Empowering

Strength:Weak

Examples

Reinventing what it means to be a confident investor

Your financial goals matter

Tone Analysis

Transactional

Secondary Tones

- •

Reassuring

- •

Promotional

- •

Educational

Tone Shifts

Shifts from transactional product descriptions ('Explore auto loans') to educational and empowering on the 'Better Money Habits' section ('Your financial goals matter').

Adopts a highly supportive and empathetic tone on the 'Accessible Banking' page ('We're committed to treating all individuals with dignity and respect').

Voice Consistency Rating

Fair

Consistency Issues

The high-level brand mission of empowerment ('What would you like the power to do?') is not reflected in the predominantly transactional and product-focused voice of the homepage.

The voice shifts significantly between sections, feeling like a collection of different business units rather than a single, unified brand voice.

Value Proposition Assessment

Bank of America offers a comprehensive suite of financial products for all life stages, integrated with a rewarding loyalty program and accessible through powerful, secure digital tools.

Value Proposition Components

- Component:

Breadth of Products

Clarity:Clear

Uniqueness:Common

- Component:

Digital Banking Convenience

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Integrated Rewards (Preferred Rewards)

Clarity:Somewhat Clear

Uniqueness:Unique

- Component:

Financial Education (Better Money Habits)

Clarity:Clear

Uniqueness:Somewhat Unique

Bank of America's primary differentiator is not a single product feature, but the integration of its comprehensive offerings through the 'Preferred Rewards' program. This program, which provides tangible benefits for holding multiple products (e.g., deposits and investments), is a strong, albeit subtly communicated, differentiator. While competitors also offer a wide range of products and strong digital platforms, the explicit reward for deepening the customer relationship across categories is BofA's key competitive angle. The 'Better Money Habits' platform also serves as a soft differentiator, positioning the bank as a helpful guide rather than just a product provider.

The messaging positions Bank of America as a reliable, full-service financial behemoth, capable of meeting nearly any consumer or business need. It competes directly with other 'Big Four' banks like JPMorgan Chase and Wells Fargo on the basis of scale and product variety. Its emphasis on a leading mobile app and digital services is a clear attempt to retain and attract younger, digitally-native customers who might otherwise be drawn to fintechs or neobanks. The positioning is one of a safe, stable, and convenient choice for the mainstream consumer.

Audience Messaging

Target Personas

- Persona:

Mainstream Consumer / Family

Tailored Messages

- •

Stay flexible with Bank of America Advantage Banking

- •

Savings made simple and rewarding

- •

Explore home loans

- •

Videos and tips to better manage your financial life

Effectiveness:Effective

- Persona:

Small Business Owner

Tailored Messages

Business Checking: Convenient checking solutions to fit your unique business needs

(Link in main nav) Small Business

Effectiveness:Somewhat

- Persona:

Wealth Management Client

Tailored Messages

- •

Reinventing what it means to be a confident investor

- •

Work with a dedicated advisor

- •

(Link in main nav) Wealth Management

Effectiveness:Somewhat

- Persona:

Students

Tailored Messages

Student Banking: Ready to go wherever you go...

Cards for Students

Effectiveness:Effective

Audience Pain Points Addressed

- •

Complexity of managing finances ('Savings made simple')

- •

Fear of missing out on rewards ('Earn a 25%-75% rewards bonus')

- •

Concern about security ('protected by industry-leading security features')

- •

Inconvenience of traditional banking ('Do more with the Mobile Banking app')

Audience Aspirations Addressed

- •

Achieving financial goals ('Your financial goals matter')

- •

Becoming a confident investor

- •

Owning a home ('Get the right mortgage to finance your new home')

- •

Financial education and know-how ('build your financial know‑how')

Persuasion Elements

Emotional Appeals

- Appeal Type:

Security & Peace of Mind

Effectiveness:High

Examples

- •

Your activities are protected by industry-leading security features

- •

Level up your account security

- •

Protect yourself online: 5 new scams to watch out for now

- Appeal Type:

Financial Gain / Achievement

Effectiveness:High

Examples

- •

Cash offer up to $500 for new checking customers

- •

$200 online bonus offer

- •

Get a 5%-20% savings interest rate booster with Preferred Rewards

- Appeal Type:

Convenience & Simplicity

Effectiveness:Medium

Examples

- •

Do more with the Mobile Banking app

- •

Snap a photo to deposit a check, and get instant confirmation

- •

Savings made simple and rewarding

Social Proof Elements

{'proof_type': 'Brand Scale/Authority', 'impact': 'Strong'}

Trust Indicators

- •

Prominent display of security features and warnings

- •

Links to 'Privacy & Security' in the main navigation

- •

Educational content via 'Better Money Habits' positions them as a knowledgeable authority

- •

Explicit commitment to accessibility and inclusion on dedicated pages

Scarcity Urgency Tactics

Limited-time offers are implied but not heavily emphasized on the homepage (e.g., 'online bonus offer' on credit cards).

Calls To Action

Primary Ctas

- Text:

Log In

Location:Header

Clarity:Clear

- Text:

Explore checking solutions

Location:Checking Account Section

Clarity:Clear

- Text:

Shop all credit cards

Location:Credit Card Section

Clarity:Clear

- Text:

Get the mobile and online banking app

Location:Mobile Banking Section

Clarity:Clear

- Text:

Get started

Location:Investing Section

Clarity:Clear

- Text:

Schedule an appointment

Location:Header and various product sections

Clarity:Clear

The CTAs are extremely effective from a functional standpoint. They are clear, concise, and use action-oriented language ('Explore', 'Shop', 'Get'). Their placement is logical, appearing directly after the relevant product information. However, they are entirely transactional and do little to reinforce the brand's higher-level aspirational message.

Messaging Gaps Analysis

Critical Gaps

The aspirational brand tagline, 'What would you like the power to do?', is completely absent from the homepage and key product pages. This creates a major disconnect between the brand's stated purpose and the user's online experience, which is purely transactional.

There is a lack of human-centric storytelling. The site heavily features products and their attributes but misses the opportunity to showcase how these products empower customers to achieve their goals, which would directly support the brand's mission.

Contradiction Points

The brand positions itself as an 'enabler' for customers' unique goals and aspirations, but the website's structure forces users into predefined product silos ('Checking', 'Savings', 'Loans') rather than guiding them based on their life goals ('Buying a Home', 'Saving for College', 'Starting a Business').

Underdeveloped Areas

The messaging around the 'Preferred Rewards' program is underdeveloped. It's mentioned as a bullet point but isn't explained as the core strategic advantage that it is. A clear, compelling narrative on how consolidating your financial life with BofA creates compounding value is missing.

The connection between the 'Better Money Habits' content and BofA's actual products is weak. The site doesn't effectively guide a user from an educational article (e.g., 'How to choose the right credit card') to a specific BofA card that meets those needs.

Messaging Quality

Strengths

- •

Clarity: The website is exceptionally clear. Users can easily understand the product categories and find what they are looking for.

- •

Comprehensiveness: The messaging effectively communicates the vast range of products and services available.

- •

Action-Oriented: CTAs are direct and leave no ambiguity about the next step.

- •

Segmentation: The top-level navigation clearly segments audiences (Personal, Small Business, Wealth Management), allowing for efficient user journeys.

Weaknesses

- •

Lack of Emotional Connection: The messaging is functional and transactional, failing to build a deeper brand relationship or emotional connection.

- •

Fragmented Narrative: The site feels like a digital catalog of products rather than a cohesive brand experience guided by a central story.

- •

Over-reliance on Features: The messaging often defaults to listing product features instead of translating them into compelling customer benefits and outcomes.

Opportunities

- •

Integrate the 'What would you like the power to do?' narrative throughout the site with customer success stories and goal-oriented navigation.

- •

Elevate the 'Preferred Rewards' program as a central pillar of the value proposition, creating a dedicated messaging stream around its benefits.

- •

Create clearer pathways from 'Better Money Habits' educational content directly to relevant product solutions, demonstrating the bank's role as both educator and solution-provider.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Narrative

Recommendation:Redesign the homepage hero section to lead with the 'What would you like the power to do?' concept. Instead of a grid of products, feature goal-oriented pathways (e.g., 'Powering your first home', 'The power to grow your business', 'Powering your retirement') that then lead to relevant product bundles.

Expected Impact:High

- Area:

Value Proposition Communication

Recommendation:Create a dedicated, interactive module on the homepage that clearly explains the value of the Preferred Rewards program. Use simple visuals to show how adding more relationships (checking, investing, loans) unlocks greater benefits.

Expected Impact:High

- Area:

Content Integration

Recommendation:Embed contextual links and CTAs within 'Better Money Habits' articles that guide readers to relevant Bank of America products. For example, an article on debt management should seamlessly link to information on low-interest credit cards or HELOCs.

Expected Impact:Medium

Quick Wins

- •

Add the brand tagline 'What would you like the power to do?' to the website header.

- •

A/B test benefit-oriented headlines for product sections (e.g., 'Unlock more rewards with every purchase' instead of 'Find the perfect credit card').

- •

Feature a customer testimonial in the hero section that connects a life achievement to using Bank of America's services.

Long Term Recommendations

- •

Develop a comprehensive content strategy that maps customer life goals to BofA's integrated solutions, using storytelling across all digital channels to reinforce the brand's 'enabler' positioning.

- •

Overhaul the website's information architecture to be more goal-oriented rather than product-oriented, improving user experience and cross-sell opportunities.

- •

Invest in hyper-personalization to deliver messaging and product recommendations that align with an individual customer's known financial situation and goals.

Bank of America's website messaging is a masterclass in functional clarity and operational efficiency. It functions as a highly effective digital storefront, clearly segmenting its vast product portfolio and guiding users toward transactional outcomes with unambiguous calls-to-action. The communication of digital convenience via the mobile app and the undercurrent of security are well-executed and address key consumer needs in the modern banking landscape. However, the messaging strategy reveals a significant disconnect between the corporation's aspirational brand mission—'What would you like the power to do?'—and the customer's digital experience. The website communicates what Bank of America sells, but fails to articulate what it stands for. This represents a critical missed opportunity to differentiate in a commoditized market. While competitors also sell mortgages and credit cards, Bank of America's unique value proposition lies in the integrated benefits of its Preferred Rewards program, a powerful loyalty driver that is currently buried as a secondary message. The messaging architecture is product-led, not customer-led. This functional, siloed approach lowers the ceiling on customer lifetime value by inhibiting natural cross-selling and failing to build the emotional resonance that fosters deep brand loyalty. By shifting from a product-catalog model to a goal-driven narrative, and by elevating its key differentiators, Bank of America could transform its website from a simple transaction hub into a powerful engine for brand differentiation and relationship deepening.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

One of the largest banking institutions in the U.S. with a comprehensive suite of services across consumer banking, wealth management, and corporate banking, indicating deep market penetration and acceptance.

- •

Consistently strong revenue and net income growth, with Q1 2025 net income rising 10.5% to $7.4 billion.

- •

Sustained growth in customer accounts, achieving 25 consecutive quarters of net new consumer checking account growth.

- •

High digital engagement, with 49 million active digital users, indicating successful adaptation to modern consumer banking preferences.

Improvement Areas

- •

Enhancing the digital user experience to compete with agile fintech startups, particularly for younger demographics like Gen Z and millennials who are more inclined to use non-traditional banking methods.

- •

Further personalization of product offerings using AI and data analytics to increase customer loyalty and share of wallet.

- •

Streamlining the omnichannel experience to reduce friction when customers switch between digital and physical (branch) interactions.

Market Dynamics

Modest; US bank net interest income projected to increase 5.7% year-on-year in 2025. The overall US economy is expected to grow around 1.5-2%.

Mature

Market Trends

- Trend:

Digital Transformation and Fintech Disruption

Business Impact:Incumbent banks must innovate to compete with customer-centric, tech-savvy fintechs. This drives heavy investment in mobile banking, AI-powered assistants (like BofA's 'Erica'), and data analytics to personalize services and improve efficiency.

- Trend:

Focus on ESG (Environmental, Social, Governance)

Business Impact:Growing investor and consumer demand for sustainable and socially responsible banking products. Bank of America has committed to mobilizing $1.5 trillion in sustainable finance by 2030, creating a significant growth opportunity in green bonds and ESG-focused investments.

- Trend:

Growth in Wealth Management

Business Impact:The wealth management market is projected to grow significantly, driven by an increase in High-Net-Worth Individuals (HNWIs) and demand for digital investment solutions. This is a key growth area for Bank of America's Merrill Lynch division.

- Trend:

Intense Competition and Consolidation

Business Impact:Competition is fierce from other megabanks (JPMorgan Chase, Wells Fargo), regional banks, and non-traditional lenders. The largest banks are expected to continue gaining market share.

Favorable. While the market is mature, the current wave of technological change (AI, digital platforms) and the societal shift towards sustainability create significant opportunities for a well-capitalized incumbent like Bank of America to capture new growth.

Business Model Scalability

Medium

High fixed costs associated with a large physical branch network, regulatory compliance, and legacy IT infrastructure. However, digital channels offer a highly scalable, low-variable-cost model for growth.

Moderate, with high potential for improvement. Investments in technology and automation can significantly improve the efficiency ratio by reducing non-interest expenses relative to revenue growth.

Scalability Constraints

- •

Legacy technology infrastructure can hinder rapid product development and integration.

- •

Significant regulatory and compliance overhead acts as a drag on operational agility.

- •

The high cost of maintaining a vast physical branch network in an increasingly digital world.

- •

Intense competition for specialized tech talent (AI, cybersecurity, data science).

Team Readiness

Strong. The leadership team has demonstrated a clear focus on a 'responsible growth' strategy, successfully navigating economic cycles and prioritizing key initiatives like digital transformation and ESG.

Traditional and hierarchical, which can slow down innovation. The bank is organized into major divisions (Consumer Banking, Global Wealth & Investment Management, etc.), which is efficient for managing a large enterprise but may create silos.

Key Capability Gaps

- •

Agile Product Development: Need to further embed agile methodologies to compete with fintechs' speed-to-market.

- •

Data Science and AI at Scale: While progress has been made with tools like 'Erica', there is a need to deepen the integration of AI for hyper-personalization across all business lines.

- •

Cybersecurity Talent: Perpetual need for top-tier cybersecurity experts to defend against increasingly sophisticated threats.

Growth Engine

Acquisition Channels

- Channel:

Digital Marketing (Paid & Organic Search, Social Media)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Increase focus on content marketing through 'Better Money Habits' to attract younger demographics. Optimize paid campaigns for high-value products like mortgages and wealth management services.

- Channel:

Brand Recognition and Physical Presence (Branches/ATMs)

Effectiveness:High

Optimization Potential:Low

Recommendation:Continue to optimize the branch network, transitioning locations to advisory centers rather than transactional hubs, and ensuring a seamless link to digital platforms.

- Channel:

Referral Programs & Promotions

Effectiveness:Medium

Optimization Potential:High

Recommendation:Implement a more robust, digitally integrated referral program that rewards existing customers for bringing in new, high-quality clients. Use targeted promotions to attract specific customer segments.

- Channel:

Cross-selling to Existing Customers

Effectiveness:High

Optimization Potential:High

Recommendation:Leverage AI and data analytics to proactively identify cross-selling opportunities (e.g., offering a Merrill investment account to a high-balance checking customer) through personalized digital prompts.

Customer Journey

The digital account opening process is a primary conversion path. The website clearly funnels users towards opening accounts, applying for cards, or getting prequalified for loans.

Friction Points

- •

Potential for cumbersome online applications, which can lead to channel switching (abandoning online for a branch visit).

- •

Navigating the broad product suite can be overwhelming for new customers without clear guidance.

- •

Onboarding process post-account opening could be more personalized to drive immediate engagement and product adoption.

Journey Enhancement Priorities

{'area': 'Digital Onboarding', 'recommendation': 'Use A/B testing and user behavior analysis to streamline the application process, minimizing steps and data entry. Leverage tools like real-time user monitoring to identify and fix rage clicks or drop-off points.'}

{'area': 'First 90 Days Engagement', 'recommendation': 'Develop a personalized, automated onboarding journey that introduces new customers to key digital features (like Erica, bill pay, Zelle) and relevant products based on their initial profile.'}

Retention Mechanisms

- Mechanism:

Preferred Rewards Program

Effectiveness:High

Improvement Opportunity:Expand reward tiers and partnerships to offer more value beyond banking fee discounts, potentially including lifestyle or wellness benefits to increase stickiness.

- Mechanism:

Product Bundling & High Switching Costs

Effectiveness:High

Improvement Opportunity:Proactively offer bundled solutions (e.g., checking, credit card, mortgage, and investment account) with preferential rates to deepen relationships and make switching competitors prohibitively complex.

- Mechanism:

Digital Engagement (Mobile App, 'Erica' assistant)

Effectiveness:High

Improvement Opportunity:Evolve 'Erica' from a reactive assistant to a proactive financial wellness coach, offering personalized insights and advice to build a deeper, more valuable relationship.

Revenue Economics

For a universal bank, key metrics are Net Interest Margin (NIM), Efficiency Ratio, and Return on Assets (ROA). Bank of America demonstrates solid profitability with a rising NIM and a focus on improving operational efficiency.

Not directly applicable in the traditional sense. A better metric is 'customer lifetime profitability,' which is strong due to high retention rates and extensive cross-selling opportunities across banking, credit, and investments.

Strong. The bank's focus on 'responsible growth' emphasizes cost discipline and operational excellence. The efficiency ratio is a key metric tracked by management and investors.

Optimization Recommendations

- •

Drive adoption of lower-cost digital channels for routine transactions to improve the overall efficiency ratio.

- •

Increase focus on non-interest income sources like wealth management fees and investment banking to diversify revenue streams.

- •

Utilize data analytics to optimize loan pricing and deposit strategies to maximize Net Interest Margin.

Scale Barriers

Technical Limitations

- Limitation:

Legacy Core Banking Systems

Impact:High

Solution Approach:Adopt a two-speed IT architecture: maintain stable legacy systems for core processing while building a flexible, API-driven layer on top for rapid innovation and fintech partnerships.

- Limitation:

Data Silos Across Business Units

Impact:Medium

Solution Approach:Invest in a unified data platform to create a single view of the customer, enabling hyper-personalization and more effective cross-selling across all divisions (Retail, Wealth, etc.).

Operational Bottlenecks

- Bottleneck:

Regulatory Compliance and Reporting

Growth Impact:Acts as a constant drag on resources and can slow the launch of new products. However, it also serves as a competitive moat against new entrants.

Resolution Strategy:Invest heavily in Regulatory Technology (RegTech) and automation to streamline compliance processes, reduce manual effort, and lower the risk of errors.

- Bottleneck:

Manual Processes in Loan Origination and Underwriting

Growth Impact:Slower loan processing times compared to fintech lenders can lead to lost business.

Resolution Strategy:Implement AI and machine learning models to automate data collection, verification, and initial risk assessment to accelerate underwriting decisions.

Market Penetration Challenges

- Challenge:

Intense Competition from Megabanks and Fintechs

Severity:Critical

Mitigation Strategy:Differentiate on trust, security, and a superior, integrated customer experience that combines digital convenience with human advice. Compete by becoming the primary financial relationship for customers.

- Challenge:

Market Saturation in Core US Consumer Banking

Severity:Major

Mitigation Strategy:Focus on deepening existing customer relationships (increasing share of wallet) and targeting high-growth segments like the mass affluent and specific demographics (e.g., Gen Z) with tailored digital offerings.

Resource Limitations

Talent Gaps

- •

AI/ML Engineers and Data Scientists

- •

Cybersecurity specialists

- •

User Experience (UX) Designers and Digital Product Managers

Capital is not a limitation; as a G-SIB, the bank is exceptionally well-capitalized. The challenge is the efficient allocation of capital towards high-growth technology and digital initiatives versus maintaining legacy systems.

Infrastructure Needs

- •

Modernization of the core technology stack.

- •

Expansion of cloud computing capabilities to enhance scalability and data processing power.

- •

Continuous investment in cybersecurity infrastructure to protect against evolving threats.

Growth Opportunities

Market Expansion

- Expansion Vector:

Deepen Penetration in Wealth Management (Mass Affluent)

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Leverage the existing consumer banking customer base to identify and digitally onboard clients into Merrill Lynch's wealth management platforms, offering hybrid robo-advisor and human-guided investment solutions.

- Expansion Vector:

Targeted Growth in Younger Demographics (Gen Z)

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Develop and market specific products that resonate with Gen Z, such as accounts with no overdraft fees, integrated budgeting and financial literacy tools, and a seamless mobile-first experience.

Product Opportunities

- Opportunity:

Expansion of ESG-focused Investment and Lending Products

Market Demand Evidence:Significant and growing demand from both individual and institutional investors for sustainable finance options.

Strategic Fit:Excellent. Aligns perfectly with the corporate strategy of 'responsible growth' and the $1.5 trillion sustainable finance goal.

Development Recommendation:Create a portfolio of accessible ESG products for retail investors through the Merrill platform and actively market green loans for consumers (EVs, solar panels) and businesses.

- Opportunity:

Embedded Finance / Banking-as-a-Service (BaaS)

Market Demand Evidence:Growing trend of non-financial companies wanting to embed financial products (payments, lending) into their platforms.

Strategic Fit:Strong. Leverages the bank's robust infrastructure and regulatory expertise.

Development Recommendation:Develop a secure, API-based platform to partner with large tech or retail companies, providing the underlying banking infrastructure for their branded financial services.

Channel Diversification

- Channel:

Enhanced AI-Powered Conversational Banking

Fit Assessment:Excellent. This is a natural evolution of the 'Erica' platform.

Implementation Strategy:Invest in advanced natural language processing (NLP) and predictive analytics to transform 'Erica' into a proactive financial advisor that can handle complex queries and offer personalized financial guidance.

- Channel:

Strategic Fintech Partnerships

Fit Assessment:Strong. Allows the bank to offer innovative niche services without building everything in-house.

Implementation Strategy:Establish a dedicated corporate venture arm or partnership program to identify and collaborate with fintech startups in areas like alternative lending, international payments, or specialized financial planning tools.

Strategic Partnerships

- Partnership Type:

Big Tech Collaboration

Potential Partners

- •

Apple

- •

Google

- •

Amazon

Expected Benefits:Access to vast customer ecosystems and user experience expertise. Co-branded products (like the Apple Card with Goldman Sachs) can drive massive customer acquisition.

- Partnership Type:

Vertical SaaS Integration

Potential Partners

Leading Small Business SaaS providers (e.g., in accounting, CRM)

Expected Benefits:Embed Bank of America's business banking and lending products directly into the platforms small businesses use to run their operations, creating a frictionless acquisition channel.

Growth Strategy

North Star Metric

Primary Digital Banking Customers

This metric moves beyond simply counting 'active users' and focuses on customers who consider BofA their main bank (e.g., measured by direct deposit activity and number of products used). Growth in this metric signals deepening relationships, higher retention, and greater lifetime value.

Increase the percentage of digitally active customers identified as 'primary' by 10% over the next 24 months.

Growth Model

Ecosystem Deepening & Expansion

Key Drivers

- •

Cross-selling additional products to existing customers.

- •

Increasing digital engagement and self-service adoption.

- •

Leveraging brand trust to expand into adjacent financial services.

- •

Using data to personalize the customer experience and anticipate needs.

Focus marketing and product development on creating a seamless, integrated experience where banking, borrowing, and investing are managed within a single digital ecosystem. Use the Preferred Rewards program as the central pillar to incentivize deeper engagement.

Prioritized Initiatives

- Initiative:

AI-Powered Personalization Engine

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 months

First Steps:Consolidate customer data onto a unified platform. Develop pilot programs in one product area (e.g., credit cards) to predict customer needs and offer proactive solutions.

- Initiative:

Streamline Digital Mortgage and HELOC Application

Expected Impact:High

Implementation Effort:Medium

Timeframe:12-18 months