eScore

berkshirehathaway.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

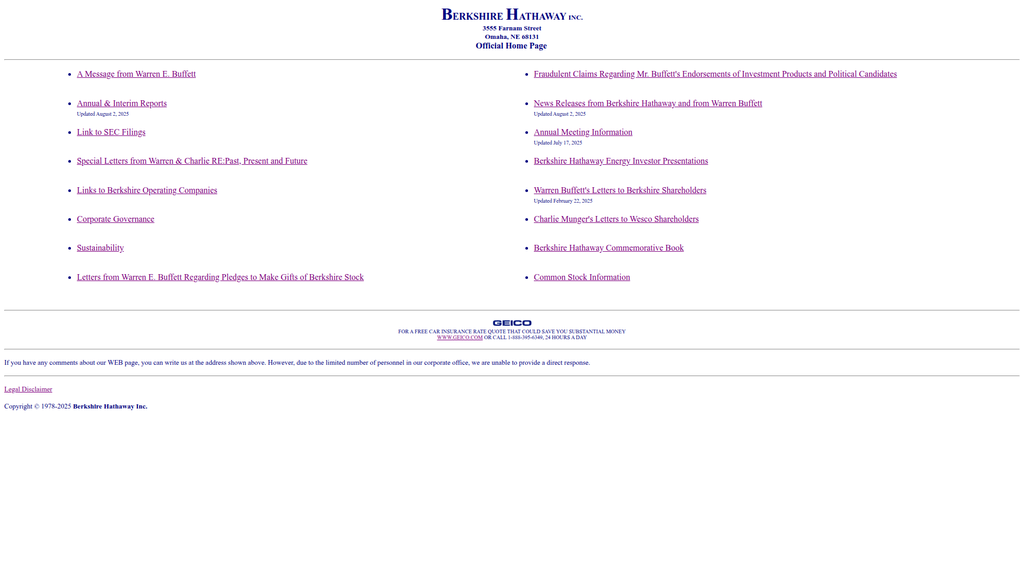

Berkshire Hathaway's digital presence is a strategic paradox; it possesses colossal content authority and aligns perfectly with its core audience's search intent. However, the score is significantly penalized for its deliberate disregard for nearly all modern digital practices. There is no multi-channel presence, zero optimization for voice search, and a complete reliance on its powerful brand to attract visitors, which is a risk.

The website's content, primarily the shareholder letters, represents the pinnacle of authority in its field, making it the undisputed primary source that users actively seek out.

Implement basic technical SEO and schema markup to improve how search engines interpret its authoritative content, and create a searchable, indexed archive of all historical shareholder letters to enhance user utility.

The company's messaging is a masterclass in consistency and differentiation, perfectly reflecting the brand's core values of frugality, substance, and long-term focus. It communicates with unmatched clarity to its primary audience of sophisticated investors. The score is slightly reduced because this hyper-focus makes the messaging completely inaccessible to a broader audience, such as potential next-generation retail investors.

The website's spartan, 'anti-design' is the message, powerfully communicating the brand's ethos of substance over style with world-class authenticity and consistency.

Add a single, unobtrusive 'About Berkshire Hathaway' page that briefly explains the business model and philosophy for new visitors without cluttering the homepage.

While the desktop experience is low-friction for a user with a clear goal, the overall score is extremely low due to critical failures in modern user experience. The analysis confirms the mobile experience is poor, requiring manual zooming and scrolling. Furthermore, a lack of compliance with modern accessibility standards (WCAG) creates a frustrating experience for users with disabilities and exposes the company to legal risk.

For its target shareholder on a desktop computer, the path to critical information like annual reports and investor letters is ruthlessly efficient, with zero distracting elements.

Implement a basic responsive design to ensure the site is legible and navigable on mobile devices, which constitutes a significant and growing portion of all web traffic.

The company's credibility, built on decades of performance and the unparalleled trust in its leadership, is exceptionally high. However, this is significantly undermined by a high-risk digital posture. The complete absence of a Privacy Policy, Terms of Service, and cookie consent mechanism creates major legal and compliance risks under global regulations like GDPR and CCPA.

The Berkshire Hathaway brand name itself, coupled with direct, unadorned access to primary source SEC filings, serves as the ultimate trust signal for its investor audience.

Immediately draft and publish a comprehensive global Privacy Policy and a formal Terms of Service to mitigate legal risk and align with modern corporate governance standards.

The business possesses a set of profound and sustainable competitive advantages that are nearly impossible for competitors to replicate. Its primary moat is the permanent, low-cost capital base from its vast insurance operations, which provides a massive, reliable engine for investments. This is fortified by its unparalleled brand reputation as a 'permanent home' for businesses and a unique decentralized corporate structure.

The structural advantage of using massive, low-cost insurance 'float' to fund investments is a self-reinforcing engine for value creation that competitors cannot match.

Proactively and systematically market the 'permanent home' advantage to source more proprietary acquisition deals outside of competitive auctions, especially in international markets.

The decentralized holding company model is almost infinitely scalable with extremely low corporate overhead, giving it immense potential. The score is constrained because the company's sheer size has become its main impediment to growth. The analysis clearly identifies the difficulty in deploying its massive cash pile into 'elephant-sized' acquisitions at reasonable prices as a significant real-world limit on its expansion potential.

The extremely lean corporate structure and decentralized model allows for massive scale without commensurate increases in overhead, creating exceptional operating leverage and efficiency.

Develop a formal strategy for deploying capital into new, scalable areas beyond traditional acquisitions, such as global infrastructure projects or providing large-scale private credit to other companies.

The business model is a masterclass in strategic alignment, where its diverse revenue streams, unique resources like insurance float, and key activities like capital allocation are perfectly integrated. Every component reinforces the core goal of long-term value creation. The score is slightly tempered by the significant 'key person risk' and the challenges posed by the 'law of large numbers,' which represent potential long-term strains on the otherwise flawless model.

The symbiotic relationship between the insurance operations (which generate low-cost float) and the investment operations (which deploy that float) is the unique and powerful core of the business model.

Continue to elevate the public profile and decision-making authority of designated successors to institutionalize the capital allocation process, ensuring the model's coherence is less dependent on a single individual.

The company wields immense market power, significantly influencing market sentiment and setting industry standards for corporate governance and capital allocation. Many of its subsidiaries are leaders in their respective markets, and its scale provides significant leverage with partners. The score is moderated slightly by the strong competitive performance of low-cost passive index funds, which the analysis notes have at times matched or beaten Berkshire's returns, presenting a challenge for investor capital.

The company's 'fortress' balance sheet and massive cash reserves give it the unique power to act as a stabilizing force during market crises, allowing it to dictate highly favorable investment terms when competitors are constrained.

More clearly articulate the value proposition against its main competitor for capital—S&P 500 index funds—by highlighting the downside protection and value creation from its portfolio of wholly-owned private businesses.

Business Overview

Business Classification

Conglomerate Holding Company

Investment Vehicle & Insurance Operations

Multi-Sector Financials & Industrials

Sub Verticals

- •

Insurance and Reinsurance

- •

Freight Rail Transportation

- •

Utilities and Energy

- •

Manufacturing

- •

Retail and Consumer Products

- •

Financial Products and Services

Mature

Maturity Indicators

- •

Decades of consistent profitability and market leadership.

- •

One of the largest global companies by market capitalization.

- •

Established brand synonymous with stability and value investing.

- •

Highly stable, albeit massive, operational structure with predictable cash flows.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Insurance Premiums & Investment Income

Description:The largest source of revenue and earnings, generated by wholly-owned insurance subsidiaries like GEICO, Berkshire Hathaway Reinsurance Group, and others. This stream includes premiums collected from policyholders and, critically, investment income generated from the 'float' (premiums held before claims are paid).

Estimated Importance:Primary

Customer Segment:Policyholders (Individuals & Businesses) / Investment Markets

Estimated Margin:High (factoring in investment income from float)

- Stream Name:

Manufacturing, Service & Retailing

Description:A diverse collection of revenues from dozens of subsidiaries including industrial manufacturers (Precision Castparts, Lubrizol), consumer products (Duracell, Fruit of the Loom), and retail operations (Nebraska Furniture Mart, See's Candies).

Estimated Importance:Primary

Customer Segment:Varies (B2B, B2C across multiple industries)

Estimated Margin:Medium

- Stream Name:

Freight Rail Transportation

Description:Revenue generated by Burlington Northern Santa Fe (BNSF) Railway, one of the largest freight railroad networks in North America, transporting industrial, consumer, and agricultural products.

Estimated Importance:Secondary

Customer Segment:Industrial & Agricultural Shippers

Estimated Margin:High

- Stream Name:

Utilities & Energy

Description:Revenue from Berkshire Hathaway Energy (BHE), which includes regulated electric and gas utilities, as well as renewable energy projects. This provides stable, predictable earnings.

Estimated Importance:Secondary

Customer Segment:Residential & Commercial Energy Consumers

Estimated Margin:Medium (Regulated)

Recurring Revenue Components

- •

Insurance policy renewals

- •

Regulated utility payments

- •

Long-term freight contracts

Pricing Strategy

Decentralized Subsidiary Pricing

Varies by Subsidiary (e.g., GEICO is value-focused, See's Candies is premium)

Opaque (at the holding company level); varies by subsidiary

Pricing Psychology

Brand Prestige (associated with Berkshire Hathaway)

Value-Based Pricing (common among insurance and B2B subsidiaries)

Monetization Assessment

Strengths

- •

Extreme diversification across non-correlated industries reduces systemic risk.

- •

Use of insurance 'float' provides a massive, low-cost source of permanent capital for investments.

- •

Decentralized structure empowers subsidiary management and reduces corporate overhead.

- •

Strong financial position with massive cash reserves allows for opportunistic acquisitions during market downturns.

Weaknesses

- •

Significant 'key person risk' associated with Warren Buffett's eventual departure.

- •

Law of large numbers: The company's immense size makes it difficult to find acquisitions large enough to meaningfully impact overall growth.

- •

Potential for underperforming or technologically disrupted subsidiaries to lag.

- •

Publicly stated challenges in deploying massive cash reserves into value-accretive investments.

Opportunities

- •

Leverage cash position to acquire distressed assets during economic downturns.

- •

Expand investments in emerging technologies and future-proof sectors.

- •

Further expansion of Berkshire Hathaway Energy's renewable energy portfolio.

- •

Systematic bolt-on acquisitions within existing subsidiaries.

Threats

- •

Uncertainty regarding post-Buffett management performance and capital allocation discipline.

- •

Systemic economic risks that impact the entire portfolio of businesses.

- •

Increased regulatory scrutiny in core sectors like insurance, energy, and rail.

- •

Catastrophic insurance losses, potentially exacerbated by climate change.

Market Positioning

A bastion of long-term value, stability, and ethical management, positioned as a permanent home for great businesses and a reliable vehicle for compound capital growth for shareholders.

Market Leader (As a holding company and investor; many subsidiaries are also market leaders in their respective fields, e.g., GEICO, BNSF).

Target Segments

- Segment Name:

Long-Term Value Investors (Shareholders)

Description:Individuals and institutions seeking stable, long-term capital appreciation over short-term gains. They prioritize trustworthy management, a conservative risk profile, and participation in a diversified portfolio of quality businesses.

Demographic Factors

Typically older, high-net-worth individuals

Institutional investors (pension funds, endowments)

Psychographic Factors

- •

Risk-averse

- •

Value-oriented

- •

Patient

- •

High trust in management and established brands

Behavioral Factors

- •

Buy-and-hold investment strategy

- •

Low trading frequency

- •

Attend annual shareholder meetings

Pain Points

- •

Volatility of the general stock market.

- •

High fees and short-term focus of typical asset managers.

- •

Difficulty in finding trustworthy, long-term stewards of capital.

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Private Business Owners Seeking Permanent Ownership

Description:Founders and families of large, profitable, and durable private companies who are looking to sell their business without it being dismantled, loaded with debt, or resold by private equity.

Demographic Factors

Owners of established, multi-generational family businesses

Founders seeking to secure their company's legacy

Psychographic Factors

- •

Proud of their company's culture and legacy

- •

Averse to the typical private equity model

- •

Value trust and a handshake deal mentality

Behavioral Factors

Seeking a 'soft landing' for their employees and brand

Prioritize the buyer's reputation over the absolute highest bid

Pain Points

- •

Fear of their legacy being destroyed post-acquisition.

- •

Lack of trustworthy buyers who will preserve the company's culture.

- •

Pressure from private equity firms focused on short-term financial engineering.

Fit Assessment:Excellent

Segment Potential:Medium

Market Differentiation

- Factor:

Permanent Capital Base via Insurance Float

Strength:Strong

Sustainability:Sustainable

- Factor:

Brand & Reputation of Warren Buffett

Strength:Strong

Sustainability:Temporary (Dependent on successful succession)

- Factor:

Decentralized, 'Hands-Off' Management Philosophy

Strength:Strong

Sustainability:Sustainable

- Factor:

Long-Term Investment Horizon ('Our favorite holding period is forever')

Strength:Strong

Sustainability:Sustainable

Value Proposition

For shareholders, Berkshire Hathaway offers a uniquely stable and diversified vehicle for long-term capital growth under proven, trustworthy management. For acquired companies, it provides a permanent, decentralized home that preserves their legacy and operational autonomy.

Excellent

Key Benefits

- Benefit:

Compound Capital Growth

Importance:Critical

Differentiation:Unique (in its scale and consistency)

Proof Elements

Decades of market-beating returns.

Annual letters from Warren Buffett detailing performance and philosophy.

- Benefit:

Trustworthy & Ethical Management

Importance:Critical

Differentiation:Unique

Proof Elements

- •

Global reputation of Warren Buffett for integrity.

- •

Minimalist corporate structure with low overhead.

- •

Focus on long-term value over short-term results.

- Benefit:

Operational Autonomy for Subsidiaries

Importance:Critical

Differentiation:Unique (compared to typical acquirers)

Proof Elements

Testimonials from subsidiary CEOs.

Long tenure of subsidiary management post-acquisition.

Unique Selling Points

- Usp:

The 'Berkshire Hathaway' brand itself, synonymous with financial strength and integrity.

Sustainability:Long-term

Defensibility:Strong

- Usp:

The ability to make massive, opportunistic investments with its cash hoard during market panics.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A corporate culture that prioritizes long-term intrinsic value, attracting a like-minded shareholder base.

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

For investors: Navigating market volatility and finding trustworthy, low-cost investment vehicles.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

For selling business owners: Finding a buyer who will protect their company's legacy and employees.

Severity:Critical

Solution Effectiveness:Complete

Value Alignment Assessment

High

The business model is perfectly aligned with a market segment that prizes stability, long-term growth, and proven management over speculative, high-growth strategies.

High

The company's actions, communications (including the famously spartan website), and philosophy are precisely tailored to its target audience of patient, value-oriented investors and business owners.

Strategic Assessment

Business Model Canvas

Key Partners

CEOs and management teams of wholly-owned subsidiaries

Key Activities

- •

Capital Allocation & Investment Management

- •

Acquisition of businesses

- •

High-level oversight of subsidiary operations

- •

Management of insurance and reinsurance risk

Key Resources

- •

Massive capital base and cash reserves

- •

Insurance float as a low-cost investment vehicle

- •

The Berkshire Hathaway brand and reputation

- •

Warren Buffett's and his successors' investment acumen

Cost Structure

Extremely low corporate overhead

Operational costs within subsidiaries (e.g., insurance claims paid, railroad operating costs, manufacturing costs)

Swot Analysis

Strengths

- •

Unparalleled brand reputation for trust and financial prudence.

- •

Extraordinary diversification across numerous industries.

- •

Immense financial strength and access to low-cost capital via insurance float.

- •

Decentralized operating model fostering accountability and efficiency.

Weaknesses

- •

Significant 'key person risk' and uncertainty related to the post-Buffett era.

- •

Immense size makes meaningful growth through acquisition increasingly difficult.

- •

Portfolio concentration in certain sectors could be a vulnerability.

- •

Slower to adapt to technological disruption compared to more agile companies.

Opportunities

- •

Deploying massive cash reserves for large-scale acquisitions during market downturns.

- •

Increasing investment in technology and renewable energy sectors.

- •

Continued bolt-on acquisitions by subsidiary companies to drive incremental growth.

- •

Leveraging the Berkshire brand to enter new markets or industries.

Threats

- •

A prolonged systemic economic downturn impacting all operating businesses.

- •

Major regulatory changes in key industries (insurance, energy, finance).

- •

Potential for a mega-catastrophe event leading to unprecedented insurance losses.

- •

Erosion of the company's unique culture after the departure of its founding leaders.

Recommendations

Priority Improvements

- Area:

Succession Plan Communication

Recommendation:Continue the gradual and transparent transition of leadership responsibilities to designated successors like Greg Abel and Ajit Jain, increasing their public-facing roles to build investor confidence and mitigate 'key person risk'.

Expected Impact:High

- Area:

Capital Deployment Strategy

Recommendation:Develop and articulate a clear strategy for deploying the growing cash pile, potentially including a framework for share buybacks or even a special dividend if suitable large-scale acquisitions remain elusive, to address concerns about idle capital.

Expected Impact:Medium

- Area:

Digital Investor Relations

Recommendation:Modernize the investor relations section of the website to provide more accessible data and analytics for the next generation of investors, while retaining the overall minimalist brand ethos. The current design, while iconic, is anachronistic from a data accessibility standpoint.

Expected Impact:Low

Business Model Innovation

- •

Establish a dedicated technology acquisition vertical focused on acquiring mature, profitable tech companies with strong economic moats, creating a new pillar of growth for the conglomerate.

- •

Create an internal venture capital or innovation fund that subsidiaries can access to fund technological adoption and disruption-proofing initiatives, managed with Berkshire's long-term value discipline.

- •

Explore new insurance models related to emerging risks like cybersecurity and climate data analytics, leveraging the company's immense capital base to pioneer new markets.

Revenue Diversification

While already highly diversified, strategic focus should be on increasing exposure to sectors with high, non-cyclical growth potential, such as digital infrastructure, healthcare technology, and sustainable resources.

Expand the global footprint of non-insurance businesses, which are currently heavily concentrated in the United States.

Berkshire Hathaway's business model is a masterclass in strategic simplicity and long-term discipline. Its foundation is a unique symbiosis between its insurance operations and its investment activities, where insurance float provides a continuous, low-cost source of capital that fuels acquisitions and portfolio investments. This creates a powerful, self-reinforcing cycle of growth. The corporate strategy, brilliantly reflected in its minimalist website, is to eschew presentation for substance, focusing entirely on the core activities of capital allocation and managing a portfolio of autonomous, high-quality businesses. The key competitive advantages are its permanent capital structure, the unparalleled brand trust built by Warren Buffett, a decentralized operational ethos that attracts and retains top managerial talent, and an unwavering long-term perspective.

However, the model faces significant future challenges, primarily centered on succession and scale. The 'Warren Buffett premium' is real, and the transition to new leadership, however well-planned, introduces uncertainty. Furthermore, the company's sheer size makes it increasingly difficult to find 'elephant-sized' acquisitions capable of driving meaningful per-share growth. Future evolution will not involve a radical transformation but rather a disciplined adaptation. Key opportunities lie in leveraging its immense cash reserves during market dislocations, strategically diversifying into technology and sustainable energy, and ensuring the unique corporate culture of trust and autonomy survives its iconic founders. The primary strategic imperative is to prove that the model's success is attributable to its structure and philosophy, not just the genius of one individual.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Capital Requirements

Impact:High

- Barrier:

Reputation and Trust

Impact:High

- Barrier:

Deal Flow and Network

Impact:High

- Barrier:

Regulatory Complexity

Impact:Medium

Industry Trends

- Trend:

Rise of Private Equity and Perpetual Capital

Impact On Business:Increased competition for large-scale acquisitions. Some PE firms are adopting longer-term 'buy-and-hold' strategies, mimicking Berkshire's model.

Timeline:Immediate

- Trend:

ESG (Environmental, Social, Governance) Scrutiny

Impact On Business:Growing pressure on Berkshire and its subsidiaries (especially in energy and manufacturing) to disclose more and improve ESG metrics, potentially affecting investor sentiment and capital allocation.

Timeline:Immediate

- Trend:

Digital Transformation and AI

Impact On Business:Opportunity to drive efficiencies and value creation across the diverse portfolio of operating companies. Risk of subsidiaries falling behind more technologically adept competitors.

Timeline:Near-term

- Trend:

Market Dominance by Passive Investing

Impact On Business:Low-cost index funds represent a major competitor for investor capital, as they offer broad diversification and market returns with minimal fees, a strategy Buffett himself has often recommended for most people.

Timeline:Immediate

Direct Competitors

- →

Broad-Market Index Funds (e.g., Vanguard S&P 500 ETF)

Market Share Estimate:Massive; represents the default investment for a large portion of the market.

Target Audience Overlap:High

Competitive Positioning:The simplest, lowest-cost way to achieve broad market diversification and returns.

Strengths

- •

Extremely low expense ratios (e.g., 0.03% for VOO).

- •

Instant and complete diversification across the S&P 500.

- •

Requires no active management or decision-making from the investor.

- •

Has periodically outperformed Berkshire Hathaway when including reinvested dividends.

Weaknesses

- •

Guaranteed to never beat the market; returns are the market average, less fees.

- •

No downside protection from a skilled capital allocator during market downturns.

- •

No exposure to private companies or concentrated, high-conviction public stock picks.

Differentiators

- •

Passive vs. Active management.

- •

Market return vs. Potential for outperformance (and underperformance).

- •

No operational alpha from wholly-owned subsidiaries.

- →

Large Private Equity Firms (e.g., Blackstone, KKR)

Market Share Estimate:Significant; collectively manage trillions in AUM.

Target Audience Overlap:Medium

Competitive Positioning:Active, hands-on owners who use financial engineering and operational improvements to generate high returns over a defined period.

Strengths

- •

Deep operational expertise in turning around or improving businesses.

- •

Ability to use leverage to amplify returns.

- •

Structured funds with clear mandates and exit strategies (typically 5-10 years).

- •

Increasingly raising 'perpetual capital' to compete directly on longer-term holds.

Weaknesses

- •

Shorter investment horizon can conflict with the interests of long-term business health.

- •

Reliance on debt can increase risk.

- •

Reputation can be seen as focused on financial extraction rather than being a permanent home for a business.

- •

Complex fee structures (management fees, carried interest).

Differentiators

- •

'Buy to sell' vs. Berkshire's 'buy to keep' philosophy.

- •

Active operational intervention vs. Berkshire's decentralized, hands-off approach.

- •

Leverage-focused returns vs. returns from operational earnings and float investment.

- →

Diversified Industrial Conglomerates (e.g., Danaher)

Market Share Estimate:Varies by sector.

Target Audience Overlap:Low

Competitive Positioning:A highly disciplined, operationally-focused acquirer of companies in science and technology, driven by a systematic management philosophy (the 'Danaher Business System').

Strengths

- •

The Danaher Business System (DBS) is a world-class methodology for continuous improvement that drives significant value in acquired companies.

- •

Deep domain expertise within its chosen sectors (Life Sciences, Diagnostics, etc.).

- •

Proven track record of successful integration and operational excellence.

- •

Strong focus on innovation and R&D within its portfolio.

Weaknesses

- •

More focused portfolio than Berkshire's, leading to less diversification.

- •

Does not possess a massive, low-cost capital base from insurance float.

- •

Systematic approach may be less appealing to founders who desire complete autonomy.

Differentiators

- •

Systematic, integrated operational management (DBS) vs. Berkshire's extreme decentralization.

- •

Focus on specific technology and science verticals vs. Berkshire's industry-agnostic approach.

- •

Growth through operational synergies vs. growth through capital allocation and compounding.

Indirect Competitors

- →

Sovereign Wealth Funds (e.g., GIC, Norges Bank)

Description:Massive, state-owned investment funds that deploy capital across public and private markets, including direct investments in companies and infrastructure.

Threat Level:Medium

Potential For Direct Competition:Increasing, as they have the scale to compete for the same 'elephant-sized' acquisitions Berkshire seeks.

- →

Asset Managers (e.g., BlackRock, State Street)

Description:The world's largest asset managers, primarily competing through ETFs and mutual funds, but also expanding into private markets and alternative investments, competing for capital.

Threat Level:Medium

Potential For Direct Competition:Medium, through their growing private equity and direct lending arms.

- →

Activist Investors (e.g., Pershing Square)

Description:Firms that take significant stakes in public companies to influence management and capital allocation decisions, effectively competing for control over corporate assets.

Threat Level:Low

Potential For Direct Competition:Low, as their model is based on influencing existing public companies, not acquiring them outright.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Permanent Capital from Insurance Float

Sustainability Assessment:The massive, low-cost, long-duration capital generated by Berkshire's insurance operations is a structural advantage that is exceptionally durable and provides a powerful engine for investments.

Competitor Replication Difficulty:Hard

- Advantage:

Brand and Reputation as a 'Permanent Home'

Sustainability Assessment:Decades of cultivating a reputation as a friendly acquirer that allows businesses to operate autonomously makes Berkshire the preferred buyer for many family-owned companies seeking a permanent home, not a financial exit.

Competitor Replication Difficulty:Hard

- Advantage:

Decentralized Operational Structure

Sustainability Assessment:The hands-off management approach attracts and retains high-quality, entrepreneurial managers who value autonomy, a key cultural differentiator from most conglomerates and PE firms.

Competitor Replication Difficulty:Medium

- Advantage:

'Fortress' Balance Sheet and Scale

Sustainability Assessment:Enormous cash reserves and low debt allow Berkshire to make huge investments during market crises when competitors are constrained, often on highly favorable terms.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': "The 'Buffett Premium'", 'estimated_duration': 'The unique reputation, network, and capital allocation genius of Warren Buffett provides a significant, but ultimately finite, advantage. This premium may diminish post-succession. '}

Disadvantages

- Disadvantage:

Size and the Law of Large Numbers

Impact:Major

Addressability:Difficult

- Disadvantage:

Succession Risk and Key-Person Dependency

Impact:Major

Addressability:Moderately

- Disadvantage:

Minimalist Digital Presence and Shareholder Engagement

Impact:Minor

Addressability:Easily

- Disadvantage:

Concentration in Mature Industries

Impact:Major

Addressability:Difficult

Strategic Recommendations

Quick Wins

- Recommendation:

Modernize the corporate website for improved usability and accessibility of investor documents, without altering the core minimalist aesthetic.

Expected Impact:Low

Implementation Difficulty:Easy

- Recommendation:

Publish a consolidated 'Berkshire Principles' document that clearly articulates the company's long-standing ESG philosophy through the lens of long-term value creation.

Expected Impact:Medium

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Continue to elevate the public profile and decision-making authority of designated successors (e.g., Greg Abel, Ajit Jain) to build market confidence and ensure a smooth transition.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Establish a lightweight, optional 'center of excellence' to share best practices on digital transformation and AI across subsidiaries, preserving autonomy while unlocking portfolio-wide value.

Expected Impact:Medium

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Aggressively market Berkshire as the 'anti-private equity' permanent home for great businesses, creating a dedicated team to source these unique, long-term acquisition opportunities.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Explore new, large-scale investment domains suited to Berkshire's scale and long-term horizon, such as global infrastructure, renewable energy projects, or even venture capital-style incubation of new industries.

Expected Impact:High

Implementation Difficulty:Difficult

Solidify and promote the positioning as the world's premier 'Permanent Home' for great businesses, contrasting its long-term, partnership-based model against the short-term, transactional nature of private equity and the impersonal nature of public markets.

Double down on the core differentiators: unparalleled permanent capital from insurance, a culture of extreme decentralization and trust, and the unique ability to act as a stabilizing financial force during market dislocations.

Whitespace Opportunities

- Opportunity:

Become the Premier Capital Provider for 'De-SPAC-ing'

Competitive Gap:Many companies that went public via SPACs are now struggling. Berkshire can offer a path back to private ownership with stable, long-term capital, filling a gap left by PE firms who may be wary of the sector.

Feasibility:High

Potential Impact:Medium

- Opportunity:

Global Infrastructure as an Asset Class

Competitive Gap:Few entities have the capital scale and long-term time horizon required to fund massive global infrastructure projects (ports, grids, transport). This fits Berkshire's model perfectly and competes with a small number of sovereign wealth funds.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Create a 'Berkshire Hathaway University' for Subsidiary Management

Competitive Gap:While decentralization is key, a voluntary leadership and operational excellence program based on Berkshire's timeless principles could codify the culture and create immense value without enforcing a rigid top-down system like the 'Danaher Business System'.

Feasibility:Medium

Potential Impact:Medium

Berkshire Hathaway's competitive landscape is unique; it does not compete for customers at the corporate level but for capital and acquisition targets. Its primary competitors are not other companies in its subsidiaries' industries, but rather alternative destinations for capital: broad-market index funds, large private equity firms, and other conglomerates. The company's digital presence, as evidenced by its minimalist website, is a deliberate strategic choice reflecting its no-nonsense, substance-over-style brand. It is designed exclusively for its owner-partners (shareholders), not for marketing or customer acquisition.

The company's most profound competitive advantages are structural and deeply entrenched. The use of permanent, low-cost capital from its insurance operations provides a massive, sustainable engine for investment that is nearly impossible to replicate. This, combined with its unparalleled reputation as a permanent, friendly home for acquired businesses and a decentralized management philosophy, creates a powerful moat. Berkshire can win deals that private equity cannot because it offers sellers a different, often more attractive, value proposition: continuity and autonomy.

However, the company faces significant challenges. Its immense size makes finding 'elephant-sized' acquisitions that can meaningfully impact earnings increasingly difficult, a problem Warren Buffett himself has acknowledged. The inevitable succession from its iconic leadership presents a major risk, with the market closely watching if the deeply ingrained culture and successful capital allocation strategy can persist. Furthermore, the rise of passive investing presents a formidable competitor, with S&P 500 ETFs often matching or even beating Berkshire's returns in recent years, offering a simpler, cheaper alternative for investors.

Strategic imperatives for Berkshire involve navigating these challenges by leveraging its unique strengths. The company must proactively manage the leadership transition to maintain market confidence. It should double down on its positioning as the 'anti-PE' acquirer and explore new, large-scale investment arenas like global infrastructure that are suited to its unique capital base and long-term outlook. While its digital front door is intentionally sparse, minor modernization to improve investor usability would be a low-cost, high-value improvement. The ultimate challenge is to prove that its collection of businesses and its masterful capital allocation strategy can continue to compound value at a rate superior to the passive market, even in a post-Buffett era.

Messaging

Message Architecture

Key Messages

- Message:

We are a no-frills, substance-over-style holding company focused exclusively on long-term value for our shareholders.

Prominence:Primary

Clarity Score:High

Location:Communicated implicitly through the entire website's minimalist design and structure.

- Message:

This is the official, unadorned source for all critical investor information, such as reports, letters, and news releases.

Prominence:Primary

Clarity Score:High

Location:Homepage links and "Official Home Page" text.

- Message:

We are frugal and operate with minimal corporate overhead.

Prominence:Secondary

Clarity Score:High

Location:Implicitly through the site's spartan design and explicitly in the note: "due to the limited number of personnel in our corporate office, we are unable to provide a direct response."

- Message:

For a free car insurance rate quote that could save you substantial money, go to GEICO.COM.

Prominence:Tertiary

Clarity Score:High

Location:A distinct, separate section on the homepage.

The message hierarchy is exceptionally clear due to its extreme simplicity. Primary messages about corporate identity and official information are embodied by the site's existence and core link structure. The commercial message for GEICO is clearly segregated, preventing any confusion with the parent company's core messaging.

The messaging is perfectly and ruthlessly consistent across all provided content. The minimalist, text-only, direct-to-source approach of the homepage is mirrored on the news release page. This consistency is a powerful strategic asset that reinforces the brand's core values.

Brand Voice

Voice Attributes

- Attribute:

Austere

Strength:Strong

Examples

The complete lack of images, branding (beyond text), or marketing copy.

The use of a basic, default web font and color scheme.

- Attribute:

Authoritative

Strength:Strong

Examples

- •

"BERKSHIRE HATHAWAY INC."

- •

"Official Home Page"

- •

Direct, uninterpreted links to SEC filings and shareholder letters.

- Attribute:

Direct

Strength:Strong

Examples

- •

"A Message from Warren E. Buffett"

- •

"News Releases from Berkshire Hathaway"

- •

The site functions as a list of destinations rather than a narrative experience.

- Attribute:

Frugal

Strength:Strong

Examples

The 1990s-era design implies no money is spent on non-essential web development.

"due to the limited number of personnel...we are unable to provide a direct response."

Tone Analysis

Informational

Secondary Tones

Formal

Impersonal

Tone Shifts

The only tone shift is the abrupt switch to a direct-response advertising voice in the GEICO section, which is intentionally separated from the corporate content.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

For serious, long-term investors: Berkshire Hathaway provides direct, unfiltered, and unadorned access to all necessary corporate information, reflecting a corporate ethos of transparency, frugality, and unwavering focus on intrinsic value.

Value Proposition Components

- Component:

Transparency

Clarity:Clear

Uniqueness:Unique

Comment:Communicated by providing direct links to primary source documents like SEC filings and shareholder letters without marketing spin.

- Component:

Frugality & Efficiency

Clarity:Clear

Uniqueness:Unique

Comment:Demonstrated by the website's extreme simplicity, which implies capital is not wasted on non-essentials.

- Component:

Shareholder-as-Partner Ethos

Clarity:Clear

Uniqueness:Unique

Comment:Reflects Warren Buffett's communication philosophy of treating shareholders as partners by giving them direct information.

The website's messaging is a masterclass in differentiation. By consciously rejecting all modern web design and corporate communication conventions, Berkshire Hathaway powerfully signals that it is unlike any other corporation. This anti-marketing stance is its marketing. It creates a brand that is humble, trustworthy, and completely focused on substance, which is a rare and valuable position.

The messaging positions Berkshire Hathaway as the antithesis of a typical modern corporation. While competitors might have slick, professionally designed websites with extensive brand storytelling, Berkshire Hathaway's site positions the company as being above such superficialities. It competes on the basis of its reputation for integrity and long-term performance, and the website is a physical manifestation of that reputation.

Audience Messaging

Target Personas

- Persona:

The Self-Sufficient Shareholder/Investor

Tailored Messages

- •

Direct links to Annual Reports, SEC Filings, and Shareholder Letters.

- •

Plain-text news releases with factual titles.

- •

Absence of any persuasive marketing copy or guidance.

Effectiveness:Effective

Comment:The website is perfectly designed for an audience that wants raw data to perform its own analysis. It respects their intelligence and autonomy.

- Persona:

Financial Journalist/Researcher

Tailored Messages

Clearly organized archives of news releases by year.

Direct access to letters from Warren Buffett and Charlie Munger.

Effectiveness:Effective

Comment:Provides an efficient, no-nonsense portal to primary source materials for research and reporting.

Audience Pain Points Addressed

The frustration of navigating complex, marketing-heavy corporate websites to find fundamental financial data.

The skepticism towards corporate spin and polished marketing narratives.

Audience Aspirations Addressed

The desire to align with an investment philosophy that prioritizes long-term value, honesty, and common sense.

The aspiration to be a serious, substance-focused investor who is not swayed by market trends or hype.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Ethos (Credibility/Authority)

Effectiveness:High

Examples

The names "Warren E. Buffett" and "Charlie Munger" are prominently featured, leveraging their immense personal credibility.

The label "Official Home Page" asserts its status as the single source of truth.

Social Proof Elements

- Proof Type:

Longevity & Enduring Principles

Impact:Strong

Comment:The copyright notice dating back to 1978 and the archives of letters and news releases demonstrate decades of consistent operation and communication. The site's unchanged design itself is a form of social proof, suggesting that their methods are timeless and effective.

Trust Indicators

- •

Direct, unaltered links to SEC filings.

- •

The personal, candid tone of the linked shareholder letters.

- •

Absence of tracking cookies or analytics, implying a respect for privacy and no ulterior motive.

- •

The explicit warning about fraudulent claims, showing a proactive stance on protecting stakeholders.

Scarcity Urgency Tactics

None. The messaging is the complete opposite of urgency; it is built around a philosophy of patience and long-term thinking.

Calls To Action

Primary Ctas

- Text:

Link titles (e.g., 'Annual & Interim Reports', 'Warren Buffett's Letters to Berkshire Shareholders')

Location:Homepage

Clarity:Clear

Comment:These are informational CTAs, directing users to primary documents.

- Text:

WWW.GEICO.COM

Location:Homepage

Clarity:Clear

Comment:This is the only transactional CTA on the page, clearly directing users to a subsidiary for a commercial purpose.

The CTAs are perfectly effective for their intended purpose. For the target audience of investors, the links act as a simple, functional index to get them to the information they need with zero friction. The GEICO CTA is impossible to miss and clearly states its value proposition.

Messaging Gaps Analysis

Critical Gaps

By conventional standards, the website is almost entirely 'gaps'. There is no explanation of what Berkshire Hathaway does, no overview of its diverse operating companies, no brand story, no career information, and no contact information for inquiries.

No messaging targeted at potential employees, future business acquisition targets, or the general public.

Contradiction Points

There are no contradictions. The site's form and function are in perfect, unwavering alignment with the company's stated philosophy.

Underdeveloped Areas

From a strategic standpoint, these 'gaps' are not underdeveloped; they are intentionally absent. To 'develop' them would be to fundamentally misunderstand and dilute the current messaging strategy. The site is a finished piece of communication, not an incomplete one.

Messaging Quality

Strengths

- •

Unmatched authenticity and brand alignment; the medium is the message.

- •

Perfect audience-message fit for its primary target of serious, long-term shareholders.

- •

Extreme clarity of purpose and powerful differentiation through minimalism.

- •

Effectively filters its audience, attracting those who share its values and repelling those who do not.

Weaknesses

- •

Completely inaccessible and potentially confusing for a general audience or prospective retail investors unfamiliar with the brand ethos.

- •

Fails to communicate the scale, diversity, and impact of its subsidiary businesses (e.g., BNSF, Dairy Queen, Duracell).

- •

Offers no narrative to attract or educate a new generation of investors who may not be familiar with Buffett's philosophy.

Opportunities

The greatest opportunity is to maintain the status quo. The current website is a unique and invaluable strategic asset. Any change risks diluting a message that has been cultivated for decades.

Optimization Roadmap

Priority Improvements

- Area:

No Change Required

Recommendation:Do not 'optimize' or 'modernize' the website's design or messaging. Its current form is its core strength. The messaging is not broken and therefore requires no fixing. Any aesthetic or content additions would detract from the central message of frugality and substance.

Expected Impact:High (by avoiding the negative impact of diluting the brand)

Quick Wins

Periodically validate all links to ensure they are not broken, as the site's entire function relies on them.

Long Term Recommendations

Maintain the website as a living archive and a testament to the company's enduring, long-term philosophy. It should be preserved as a core component of the Berkshire Hathaway brand identity.

The strategic messaging of berkshirehathaway.com is a masterstroke of deliberate minimalism and brand-aligned communication. It is not an outdated or poorly designed website; it is a carefully crafted message that perfectly embodies the corporate ethos of its chairman, Warren Buffett: frugality, transparency, and a focus on substance over form. The site's primary function is to serve as a no-nonsense, friction-free portal for its core audience—serious shareholders and investors—to access primary source financial documents. By eschewing all modern corporate web design conventions, Berkshire Hathaway sends a powerful message that it does not waste shareholder money on non-essential marketing and that it trusts its audience to be intelligent and self-sufficient. This 'anti-marketing' approach is a powerful differentiator that builds immense trust and credibility. While it completely fails to serve a broader audience, this is a strategic choice. The website acts as a filter, attracting investors who are already aligned with its philosophy and making no effort to persuade those who are not. The stark, utilitarian design is the message, and it is communicated with absolute clarity and consistency.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Consistent long-term outperformance against the S&P 500, demonstrating superior value creation for its 'customers' (shareholders).

- •

Extremely high shareholder loyalty and a 'cult-like' following, evidenced by massive attendance at annual meetings.

- •

Reputation as the preferred acquirer for founders and family-owned businesses seeking a permanent, hands-off home for their companies.

- •

Ability to attract capital (retained earnings and insurance float) at a very low cost, indicating market confidence in its allocation skill.

Improvement Areas

Articulating a clear vision for value creation in a post-Buffett era to maintain shareholder confidence.

Adapting the value proposition for acquiring modern, technology-driven companies which may require a different ownership approach.

Market Dynamics

Moderate

Mature

Market Trends

- Trend:

Elevated asset valuations and increased competition from private equity for large acquisitions.

Business Impact:Makes it difficult for Berkshire to find 'elephant-sized' acquisitions at prices that meet its stringent value criteria, leading to a massive cash buildup.

- Trend:

Rising geopolitical uncertainty and potential for increased tariffs and trade barriers.

Business Impact:Creates risks for Berkshire's globally-exposed manufacturing, retail, and transportation businesses, but also potential opportunities for investment during market dislocations.

- Trend:

Shift towards technology and intangible asset-driven companies.

Business Impact:Challenges Berkshire's traditional competency in evaluating industrial, consumer, and financial companies, potentially creating a structural headwind if not adapted.

- Trend:

Anticipated easing of interest rates in 2025 after a period of hikes.

Business Impact:Positively impacts insurance investment income and may reduce borrowing costs for operating companies, but could also further inflate asset prices, exacerbating acquisition challenges.

Challenging but opportunistic. Current high valuations limit large-scale capital deployment, but Berkshire's massive cash reserves position it exceptionally well to capitalize on any market downturns or volatility.

Business Model Scalability

High

Extremely low fixed costs at the corporate level ('delegation just short of abdication') create immense operating leverage.

The decentralized holding company model is infinitely scalable; growth is limited by the availability of suitable acquisitions, not by internal operational capacity.

Scalability Constraints

- •

Scarcity of acquisition targets large enough to meaningfully impact Berkshire's overall earnings and value.

- •

Competition from sovereign wealth funds and large-cap private equity, which may have different return hurdles and valuation methodologies.

- •

Potential for a 'conglomerate discount' where the market values the sum of the parts less than the whole, although this has historically been mitigated by the 'Buffett premium'.

Team Readiness

Strong, with a well-defined and highly regarded succession plan. Greg Abel is the designated CEO successor with deep operational experience.

Highly suitable for growth. The extreme decentralization empowers subsidiary leadership and keeps the corporate headquarters lean and focused on its core competency: capital allocation.

Key Capability Gaps

Demonstrating post-Buffett capital allocation prowess at scale, particularly in deploying the massive cash hoard.

Potentially underdeveloped expertise in sourcing and evaluating high-growth technology sector acquisitions compared to traditional industries.

Growth Engine

Acquisition Channels

- Channel:

Deal Flow Generation (Acquisitions)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Leverage Berkshire's unparalleled reputation as a preferred long-term buyer to proactively source proprietary deals, bypassing competitive auctions. Systematize international deal sourcing, building on the success of Japanese trading company investments.

Customer Journey

The 'customer' is an acquisition target. The path involves direct contact with leadership, a swift and simple negotiation process, and the promise of operational autonomy post-acquisition.

Friction Points

Valuation gaps between Berkshire's disciplined approach and sellers' high expectations in a frothy market.

Inability to offer the complex financial engineering (e.g., high leverage) that private equity buyers use to maximize purchase price.

Journey Enhancement Priorities

{'area': 'Deal Sourcing', 'recommendation': 'Empower Greg Abel and his team to build their own global network of contacts to ensure deal flow continuity post-transition.'}

Retention Mechanisms

- Mechanism:

Shareholder Retention

Effectiveness:High

Improvement Opportunity:Continue transparent, educational communication via annual letters and meetings to transition trust from Warren Buffett personally to the enduring Berkshire culture and system.

- Mechanism:

Subsidiary Retention

Effectiveness:High

Improvement Opportunity:Maintain the hands-off, decentralized management philosophy, which is the core value proposition for acquired companies. Reinforce this commitment under Greg Abel's leadership.

Revenue Economics

Not Applicable. Analysis shifts to 'Investment Portfolio Economics'.

Not Applicable

High. The core model uses low-cost insurance 'float' to fund investments, creating a powerful and efficient capital-compounding machine.

Optimization Recommendations

Develop scalable strategies for deploying the record ~$347B cash pile into assets that can generate returns higher than low-risk equivalents, as the cash currently acts as a drag on performance.

Continue to grow the insurance business to expand the low-cost float available for investment.

Scale Barriers

Technical Limitations

- Limitation:

Reliance on Traditional Investment Analysis

Impact:Medium

Solution Approach:Augment the traditional value investing framework with advanced data analytics and modeling to identify opportunities in more complex, technology-driven sectors.

Operational Bottlenecks

- Bottleneck:

Capital Allocation at Scale

Growth Impact:The inability to find and execute 'elephant-sized' deals at attractive prices is the single largest constraint on Berkshire's growth.

Resolution Strategy:Consider programmatic, large-scale international investments, strategic partnerships for mega-deals, or potentially increasing the pace and scale of share buybacks when valuation is favorable.

Market Penetration Challenges

- Challenge:

Competition in M&A Market

Severity:Critical

Mitigation Strategy:Double down on Berkshire's key differentiator: being a 'better owner' that offers a permanent home and operational freedom, appealing to sellers who prioritize legacy over the absolute highest bid.

- Challenge:

Market Saturation in Core US Markets

Severity:Major

Mitigation Strategy:Systematically increase investment focus on international markets with different economic cycles and valuation landscapes, such as Europe and Asia-Pacific.

Resource Limitations

Talent Gaps

The inevitable loss of Warren Buffett's unique capital allocation genius and market-calming credibility.

Need for proven capital allocators under Greg Abel to demonstrate skill in deploying hundreds of billions of dollars.

No limitation. Berkshire is capital-rich to the point where deploying its cash is the primary challenge.

Infrastructure Needs

Enhancement of global deal-sourcing infrastructure to identify and evaluate a wider range of international opportunities.

Growth Opportunities

Market Expansion

- Expansion Vector:

Increased International Acquisitions

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Build on the model of the Japanese trading house investments by identifying other developed international markets with high-quality, undervalued public companies or private businesses.

Product Opportunities

- Opportunity:

Expansion into New Asset Classes/Sectors

Market Demand Evidence:Continued outperformance of technology and alternative energy sectors in the global economy.

Strategic Fit:Medium. Requires building new competencies but is necessary for long-term relevance and growth.

Development Recommendation:Utilize investment managers Todd Combs and Ted Weschler to make larger, more frequent investments in technology and other growth sectors to build institutional knowledge.

Channel Diversification

- Channel:

Structured Capital & Private Credit

Fit Assessment:High

Implementation Strategy:Leverage the massive cash pile to provide large-scale financing solutions (e.g., preferred equity, structured debt) to high-quality companies, earning attractive, equity-like returns with potentially less valuation sensitivity than outright acquisitions.

Strategic Partnerships

- Partnership Type:

Co-investment with other long-term capital partners

Potential Partners

- •

Sovereign Wealth Funds

- •

Family Offices

- •

Other Conglomerates

Expected Benefits:Enables participation in mega-deals that may be too large or complex for Berkshire to pursue alone, and diversifies risk on very large transactions.

Growth Strategy

North Star Metric

Growth in Per-Share Intrinsic Business Value

This is Berkshire's explicitly stated, long-term goal. It aligns perfectly with the business model of compounding capital for shareholders and avoids the distortions of short-term earnings or market fluctuations.

To outperform the total return of the S&P 500 index over any rolling five-year period.

Growth Model

Decentralized Compounding via Acquisition & Reinvestment

Key Drivers

- •

Operating earnings from wholly-owned subsidiaries.

- •

Investment income from insurance float.

- •

Successful acquisition of new, value-accretive businesses.

- •

Compounding of public equity portfolio.

Continue the existing model, with a renewed focus on solving the cash deployment problem and ensuring a smooth leadership transition.

Prioritized Initiatives

- Initiative:

Develop a Scalable Cash Deployment Strategy

Expected Impact:High

Implementation Effort:High

Timeframe:12-24 months

First Steps:Task the investment team under Greg Abel to formally evaluate and present strategies for deploying $50B+ tranches of capital into new international markets or alternative asset classes.

- Initiative:

Execute a Flawless Leadership Transition

Expected Impact:High

Implementation Effort:Medium

Timeframe:Ongoing through 2026

First Steps:Increase Greg Abel's visibility with shareholders and the investment community. Publicly empower him to lead a significant acquisition to demonstrate his capital allocation capability.

- Initiative:

Systematize International Opportunity Scanning

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:6-12 months

First Steps:Establish small, dedicated teams to research and build relationships in target international markets (e.g., Germany, UK, South Korea) known for strong industrial or family-owned businesses.

Experimentation Plan

High Leverage Tests

{'test_name': 'Pilot a private credit fund or partnership', 'hypothesis': 'Berkshire can achieve superior risk-adjusted returns by deploying capital as a strategic lender to high-quality businesses, bypassing M&A valuation competition.'}

{'test_name': 'Acquire a mid-sized, publicly-traded tech company', 'hypothesis': 'Berkshire can successfully own and support a technology business, building the competency for larger future acquisitions in the sector.'}

Evaluate experiments based on Return on Invested Capital (ROIC) over a 3-5 year period and the qualitative knowledge gained.

One to two major strategic 'experiments' (e.g., a new type of large investment) per year.

Growth Team

Maintain the extremely lean corporate structure. Augment the core capital allocation team (Abel, Jain, Combs, Weschler) with dedicated international research and sourcing analysts.

Key Roles

- •

Head of International Investments

- •

Sector Specialists (Technology, Healthcare)

- •

Structured Finance Expert

Build capabilities through small, strategic acquisitions in new sectors and by empowering Combs and Weschler with larger capital allocations to explore non-traditional Berkshire investments.

Berkshire Hathaway's growth foundation is exceptionally strong, built on an unassailable brand, a highly scalable decentralized business model, and a world-class reputation. Its 'product-market fit' with both long-term shareholders and business owners seeking a permanent home is unmatched. However, the company faces a critical paradox: its success has generated a record cash hoard of over $340 billion, and its sheer size makes finding growth opportunities large enough to be meaningful exceedingly difficult. This 'cash pile problem' is the single greatest barrier to future growth, exacerbated by high market valuations and stiff competition from private equity.

The primary growth engine—acquiring large, high-quality businesses—is sputtering due to a lack of viable targets at reasonable prices. The key strategic challenge is therefore not one of capability but of opportunity. The meticulously planned leadership transition to Greg Abel is a major strength, but his team will inherit the critical task of proving they can deploy capital as effectively as Warren Buffett, a task made harder by the sheer scale of the capital base.

Growth opportunities must come from expanding the definition of a traditional Berkshire investment. The most promising vectors are: 1) A systematic push into international markets to find different valuation landscapes and opportunities. 2) Expanding into new asset classes, such as structured credit and providing large-scale financing, which leverages the company's capital advantage without requiring full acquisitions. 3) Cautiously but deliberately building expertise in the technology sector, where much of global economic growth is concentrated.

The recommended strategy is to evolve from an opportunistic, US-centric model to a more systematic, global multi-asset capital allocation platform. The North Star Metric remains 'Growth in Per-Share Intrinsic Value.' The highest priority initiatives must be the flawless execution of the leadership transition and the immediate development of a scalable strategy to deploy the massive cash reserves productively. Failure to do so will result in a long-term drag on performance and a gradual erosion of the company's legendary compounding ability.

Legal Compliance

Berkshire Hathaway Inc.

https://berkshirehathaway.com

2025-08-27

Publicly Traded Multinational Holding Company

Diversified Investments (Insurance, Finance, Utilities, Manufacturing, Retail)

Omaha, Nebraska, USA

Senior Business Analyst & Legal Compliance Expert

The website completely lacks a Privacy Policy. There is no link to, or mention of, a policy that explains what personal data is collected, how it is used, stored, or shared. For an entity of this scale, this is a severe compliance deficiency. Even for a website that appears to collect minimal data, server logs invariably capture IP addresses, which are considered personal data under GDPR and other modern privacy laws. The absence of a policy creates significant legal risk, undermines transparency, and fails to meet fundamental requirements of nearly all global data protection regulations, including GDPR and CCPA/CPRA.

There are no Terms of Service, Terms of Use, or any similar governing document available on the website. While the site is primarily informational, a Terms of Service document is a best practice for managing legal risk, defining the permissible use of website content (such as copyrighted materials like shareholder letters), and limiting liability. The current approach relies solely on a brief 'Legal Disclaimer', which is insufficient for a modern corporate website.

The website does not display a cookie banner, consent management tool, or a cookie policy. A direct inspection of the site reveals that it sets no cookies, which is highly unusual and a deliberate design choice. While this minimalist approach avoids the immediate need for a complex consent mechanism, it does not absolve the company of the need for transparency. A basic notice explaining that the site does not use tracking cookies could be a trust-building measure. Should any third-party content or future script additions introduce cookies, the site would be in immediate violation of ePrivacy directives and other regulations.

The website's strategy for data protection is one of extreme data minimization by design; it almost entirely avoids collecting personal information. There are no contact forms, email sign-ups, or interactive features. It explicitly discourages electronic communication, stating 'we are unable to provide a direct response' to web comments. While this design drastically reduces the data processing footprint and associated risks, it is not a substitute for legal compliance. The company still processes IP addresses and other server log data. The lack of a stated policy for how this data is handled, for how long it's retained, and the rights of data subjects (e.g., access, deletion) is a significant gap under GDPR and CCPA/CPRA.

The website's minimalist, text-only design from the 1990s makes it incidentally usable for screen readers but fails to meet modern accessibility standards (WCAG 2.1 AA). The code uses HTML tables for layout, which is an outdated and non-compliant practice that can confuse assistive technologies. There are no ARIA (Accessible Rich Internet Applications) attributes to define roles or properties for UI elements. While its simplicity prevents many common accessibility issues like complex menus or dynamic content problems, it does not demonstrate proactive compliance with the Americans with Disabilities Act (ADA) or international accessibility standards. This could expose the company to legal challenges from users with disabilities.

As the corporate homepage for a publicly traded holding company, the website's primary regulatory obligation is to provide timely and accurate information to investors in compliance with SEC regulations. The site excels in this specific area. It provides clear, direct links to Annual & Interim Reports, SEC Filings, news releases, and shareholder letters. This direct, no-frills approach is a strategic strength, ensuring compliance with financial disclosure requirements. However, it completely neglects the digital compliance aspects (privacy, accessibility) that are now standard for corporate entities.

Compliance Gaps

- •

Absence of a Privacy Policy.

- •

Absence of Terms of Service.

- •

Lack of a cookie notice or policy, despite the current 'no-cookie' status.

- •

No information provided for data subjects to exercise their rights under GDPR or CCPA/CPRA.

- •

Failure to meet modern web accessibility standards (WCAG/ADA), including the use of tables for layout.

- •

No designated contact information for privacy-related inquiries (e.g., a Data Protection Officer email).

Compliance Strengths

- •

Extreme data minimization by design, significantly reducing the data breach attack surface.

- •

Clear, simple, and direct access to legally required investor information and SEC filings.

- •

Unambiguous corporate identity and contact information (physical address).

- •

Absence of third-party trackers, advertising pixels, or analytics scripts, which simplifies privacy compliance.

Risk Assessment

- Risk Area:

Data Privacy Regulation

Severity:High

Recommendation:Immediately draft and publish a comprehensive, global Privacy Policy that addresses GDPR, CCPA/CPRA, and other relevant regulations. It should disclose the collection of server log data (IP addresses), the legal basis for processing, data retention periods, and instructions for users to exercise their data rights. Appoint a contact for privacy inquiries.

- Risk Area:

Legal Liability & Governance

Severity:Medium

Recommendation:Implement a formal Terms of Service to govern website use, protect intellectual property (e.g., the extensive archive of letters), and include liability limitation clauses.

- Risk Area:

Accessibility (ADA)

Severity:Medium

Recommendation:Update the website's HTML to remove tables for layout and ensure it meets at least WCAG 2.1 Level AA standards. While the site is simple, formal compliance is necessary to mitigate the risk of ADA-related lawsuits, which are increasingly common.

- Risk Area:

User Trust & Corporate Image

Severity:Low

Recommendation:While the minimalist aesthetic is part of the brand, the lack of standard legal documents can be perceived as outdated or non-transparent. Adding these documents would align the company with modern corporate governance standards without altering the core design.

High Priority Recommendations

- •

Develop and deploy a global Privacy Policy compliant with GDPR and CCPA/CPRA at a minimum.

- •

Provide a clear and accessible method for users to submit data subject requests (e.g., an email address or web form).

- •

Conduct a formal accessibility audit and update the website's code to meet WCAG 2.1 AA standards, starting with removing layout tables.

Berkshire Hathaway's website is a unique case study in corporate legal positioning. It employs a strategy of radical minimalism, which serves as an effective, if unintentional, method of risk reduction by minimizing data collection and technological complexity. This aligns with its brand of straightforward, long-term-focused management. The site excels in its core regulatory function: providing clear, unadorned access to investor information as required by the SEC.

However, this minimalist philosophy, rooted in a pre-digital-regulation era, now creates significant legal liabilities. The complete absence of a Privacy Policy, Terms of Service, and modern accessibility considerations is a stark deviation from global compliance norms. While the company may not be actively targeting consumers in jurisdictions like the EU or California through its corporate site, the global nature of its shareholder base and brand means it is subject to their regulations. The current posture is legally precarious and relies on the low probability of enforcement action, which is a risky strategy for a company of this stature. The website's legal positioning is strong in its specific domain of financial disclosure but dangerously weak and outdated in the critical areas of data protection and digital accessibility. The required changes—adding legal documentation and updating legacy code—can be implemented without compromising the site's iconic, simple design.

Visual

Design System

Utilitarian Minimalist

Excellent

Basic

User Experience

Navigation

Hyperlink List

Intuitive

Fair

Information Architecture

Logical

Clear

Light

Conversion Elements

- Element:

Link to Shareholder Letters

Prominence:High

Effectiveness:Effective

Improvement:No immediate improvement needed for the primary audience. The link is clear and serves its purpose.

- Element:

Link to Annual & Interim Reports

Prominence:High

Effectiveness:Effective

Improvement:No improvement necessary. It directly addresses a primary user need.

- Element:

Link to News Releases

Prominence:High

Effectiveness:Effective

Improvement:This is a key task for users. The current placement and labeling are effective.

Assessment

Strengths

- Aspect:

Audience-Centric Design

Impact:High

Description:The website's design is a masterclass in understanding and serving a very specific target audience: Berkshire Hathaway shareholders. It prioritizes their core needs—accessing reports, letters from Warren Buffett, and official news—above all else, presenting this information without any distraction.

- Aspect:

Brand Reflection

Impact:High

Description:The spartan, no-frills design perfectly mirrors the company's and Warren Buffett's philosophy of frugality, transparency, and long-term value over superficial flash. It communicates trust and stability, which is the core of their brand.

- Aspect:

Exceptional Performance & Accessibility

Impact:Medium

Description:With a minimal page size, the website loads almost instantaneously. Its basic HTML structure makes it highly accessible for screen readers and allows for simple user-controlled zooming on mobile devices, even without a formal responsive design.

Weaknesses

- Aspect:

Lack of Modern Design Conventions

Impact:Low

Description:The site lacks common navigational elements like a persistent navigation bar or a structured footer, and basic branding cues like a favicon. This can be disorienting for a general audience unfamiliar with the site's intentional design philosophy.

- Aspect:

Poor Mobile Experience

Impact:Low

Description:While functional due to its simplicity, the website is not optimized for mobile devices. Text does not reflow, requiring horizontal scrolling, and tap targets are small, which deviates from modern mobile usability standards.

- Aspect:

Limited Information Scent

Impact:Low

Description:There is no descriptive copy to provide context for the links. A new or potential investor might not understand the significance of documents like 'Charlie Munger's Letters to Wesco Shareholders' without prior knowledge.

Priority Recommendations

- Recommendation:

Maintain the Core Design Philosophy

Effort Level:Low

Impact Potential:High

Rationale:Any redesign would likely alienate the primary audience and dilute the powerful brand message the current site conveys. The current 'anti-design' is a strategic choice that works. The primary goal should be preservation.

- Recommendation:

Implement a 'Reader-Friendly' View for Reports

Effort Level:Medium

Impact Potential:Medium

Rationale:While the links to PDFs are direct, offering an HTML or a mobile-optimized version of key documents like the Annual Shareholder letters could significantly improve the reading experience on different devices without altering the homepage's core structure.

- Recommendation:

Add a Minimal, Unobtrusive Footer

Effort Level:Low

Impact Potential:Low

Rationale:A simple footer could provide persistent links to the 'Legal Disclaimer' and 'Home' page, offering a subtle usability improvement without compromising the minimalist aesthetic. This addresses the 'dead-end' issue on some pages.

Mobile Responsiveness

Poor

The site is not responsive. It renders as a scaled-down version of the desktop view, requiring users to pan and zoom manually.

Mobile Specific Issues