eScore

bestbuy.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Best Buy demonstrates a commanding digital presence, anchored by extremely high brand authority and market share. Its SEO strategy effectively leverages its physical store network for local search, capturing high-intent 'near me' queries and driving its successful omnichannel model. The content strategy, including buying guides and expanding video content, aligns well with users in the consideration phase, though there is a significant missed opportunity to fully leverage Geek Squad's expertise for top-of-funnel, authority-building content.

The seamless integration of their physical store footprint into their digital strategy provides a powerful advantage in local search and omnichannel fulfillment that online-only competitors cannot replicate.

Systematically amplify Geek Squad's expertise by creating a branded 'Tech Education Hub' with expert-led articles and video tutorials to capture users earlier in their research journey and build a defensible content moat based on trust, not just product listings.

The brand's communication is exceptionally effective but narrowly focused, excelling at creating urgency and driving action for price-motivated shoppers through clear, promotional messaging. However, this creates a major strategic vulnerability by failing to communicate the brand's core differentiators: expert service, in-store advice, and post-purchase support. This positions Best Buy as a generic discounter online, forcing it to compete on price rather than its unique service-based strengths, leaving significant brand equity untapped.

The clarity and urgency of promotional messaging are outstanding, effectively converting deal-focused customer segments with high purchase intent.

Integrate a secondary messaging layer on the homepage and throughout the digital experience that explicitly communicates the value of expert service (e.g., 'Unsure? Chat with an expert now') to capture customers who need guidance and to differentiate from price-only competitors.

The website offers a highly functional and mature conversion experience, characterized by a strong visual hierarchy, multiple navigation paths catering to different user behaviors, and effective promotional elements. While the core path is optimized, the analysis identifies moderate cognitive load on the homepage due to information density and a critical need to streamline the mobile checkout flow. Micro-interactions and the cross-device journey are solid, but personalization is a key area for reducing friction for returning users.

The site's robust information architecture and multi-path navigation system (search, mega-menu, curated deals) effectively cater to diverse user behaviors, from goal-oriented searching to discovery-based browsing.

Implement personalization on the homepage for returning visitors, dynamically reordering modules based on browsing history to reduce information overload and present more relevant products and offers upfront.

Best Buy has a very strong credibility and risk management framework, built on a foundation of high brand trust, a comprehensive and transparent Privacy Hub, and a public commitment to WCAG 2.0 AA accessibility standards. The inclusion of a binding arbitration clause in its terms is a powerful risk mitigation tool. The primary weakness lies in the technical implementation of privacy choices (cookie-based opt-outs) and the ever-present risk of data breaches through third-party vendors, as seen in the past.

The public, explicit commitment to WCAG 2.0 Level AA accessibility standards is a best-in-class practice that builds trust and provides a strong defense against potential ADA-related litigation.

Upgrade the privacy rights management system to honor Global Privacy Control (GPC) signals and shift from a temporary, cookie-based 'Do Not Sell/Share' mechanism to a persistent setting tied to a user's account.

Best Buy's competitive moat is strong and sustainable, rooted in two key advantages that are extremely difficult and expensive for competitors to replicate: its integrated omnichannel presence and the Geek Squad service brand. These assets allow it to offer a level of in-person expertise, hands-on experience, and post-sale support that online giants cannot match. However, the high operating costs of its physical stores and constant price pressure from competitors are significant, persistent disadvantages.

The Geek Squad service brand is a highly sustainable and defensible asset that provides a human-centric, high-margin service layer for support and installation that online-only retailers cannot replicate at scale.

Shift focus from competing on price to monetizing expertise by developing and marketing premium subscription services (e.g., 'Geek Squad Pro' or 'CTO for the Home') that offer unlimited support and proactive device management.

While the core retail business has limited scalability due to high fixed costs, Best Buy's expansion potential is significant and lies in its strategic pivots to high-margin, asset-lighter services. Growth vectors like the Best Buy Ads retail media network, the new third-party marketplace, and especially Best Buy Health are highly scalable and tap into massive new markets. The primary challenge is allocating resources and developing the specialized talent needed to execute these transformative initiatives.

The strategic pivot into the health technology market via Best Buy Health represents the single largest expansion opportunity, leveraging the existing Geek Squad in-home service infrastructure to enter a massive and growing vertical.

Develop a dedicated B2B sales channel and service offering ('Best Buy Business') to systematically target the underserved small-to-medium business market with comprehensive IT procurement, setup, and managed support services.

Best Buy's business model demonstrates a high degree of coherence and a clear strategic focus. The leadership team has correctly identified the existential threat to traditional retail and is executing a logical pivot from a low-margin product sales model to a diversified, high-margin service and solutions model. The investments in Health, Ads, and memberships are all strategically aligned with leveraging the company's core assets (brand trust, physical footprint, Geek Squad) to create more defensible and profitable revenue streams.

The strategic alignment between the company's core challenges (low margins, online competition) and its key initiatives (services, memberships, health tech) is exceptionally strong, indicating a coherent and forward-looking business strategy.

Accelerate the transformation of the in-store experience to better align with the service-led model, focusing store layouts and staff incentives on consultation, solution-selling, and service subscriptions rather than just product sales volume.

Best Buy holds a leading market share in specialty electronics retail, giving it significant influence and strong supplier relationships. However, its market power is constrained. Its pricing power is weak due to the necessity of price-matching online competitors, and its market share is under constant threat from Amazon and mass merchants. The brand's true power lies in its ability to influence the customer experience through its omnichannel and service offerings, setting a standard for in-person tech support that competitors struggle to meet.

Strong partnerships with major brands like Apple and Samsung for 'store-within-a-store' concepts demonstrate significant partner leverage and make Best Buy a critical physical showcase for the industry's most important players.

Systematically leverage first-party customer data and market insights to publish an annual 'Future of Tech' report, establishing thought leadership and influencing market direction beyond just retail transactions.

Business Overview

Business Classification

Omnichannel Retail

Services & Solutions Provider

Consumer Electronics

Sub Verticals

- •

Home Appliances

- •

Computing & Mobile Phones

- •

Home Theater

- •

Health Technology

- •

Entertainment (Gaming, Movies, Music)

Mature

Maturity Indicators

- •

Established brand with high recognition (93% in the U.S.).

- •

Extensive physical store footprint across North America.

- •

Focus on operational efficiency and cost reduction.

- •

Evolving business model from pure retail to services and solutions.

- •

Experiencing revenue declines in recent fiscal years, indicating market saturation and intense competition.

Enterprise

Slow/Declining

Recent fiscal years have shown a decline in annual revenue, facing pressures from online retailers and market saturation. Future growth is contingent on the success of strategic initiatives like Best Buy Health, Best Buy Ads, and the upcoming third-party marketplace, rather than core product sales growth.

Revenue Model

Primary Revenue Streams

- Stream Name:

Product Sales

Description:The core revenue driver, encompassing sales of consumer electronics, computers, mobile phones, appliances, and entertainment products through both physical stores and online channels. This is a traditional retail margin business.

Estimated Importance:Primary

Customer Segment:All Segments

Estimated Margin:Low

- Stream Name:

Services (Geek Squad)

Description:Generates revenue from technical support, installation, repairs, and device protection plans. These services enhance the value of product sales and provide a higher-margin, recurring revenue opportunity.

Estimated Importance:Secondary

Customer Segment:Tech Novices, Families, Small Businesses

Estimated Margin:High

- Stream Name:

Retail Media (Best Buy Ads)

Description:A growing revenue stream from selling advertising placements on BestBuy.com, in the app, and in-store to brand partners who want to reach Best Buy's audience of high-intent tech shoppers.

Estimated Importance:Tertiary

Customer Segment:Brand Partners (e.g., Samsung, Apple, HP)

Estimated Margin:High

- Stream Name:

Health Services (Best Buy Health)

Description:An emerging revenue stream focused on enabling care at home through technology, remote monitoring services, and devices for the aging population. This is a strategic growth area built on acquisitions like Great Call and Current Health.

Estimated Importance:Tertiary

Customer Segment:Aging Population, Caregivers, Healthcare Providers

Estimated Margin:Medium-High

Recurring Revenue Components

- •

My Best Buy Memberships (Paid Tiers)

- •

Geek Squad Protection Plans

- •

Technical Support Subscriptions

- •

Best Buy Health Monitoring Services

Pricing Strategy

Competitive & Promotional Pricing

Mid-range

Transparent

Pricing Psychology

- •

Promotional Pricing (e.g., Labor Day Sale)

- •

Price Matching Guarantee

- •

Bundle Deals

- •

Outlet/Clearance Pricing

Monetization Assessment

Strengths

- •

Diversified revenue streams beyond low-margin product sales.

- •

High-margin Geek Squad services create customer loyalty and recurring revenue.

- •

Rapidly growing, high-margin retail media network (Best Buy Ads) leverages first-party customer data.

- •

Paid membership tiers create a stable, recurring revenue base.

Weaknesses

- •

Over-reliance on the highly competitive and low-margin consumer electronics product sales.

- •

Intense price competition from online giants like Amazon forces price matching, compressing margins.

- •

The success of newer ventures like Best Buy Health is still developing and faces challenges in scaling.

Opportunities

- •

Launch and scale the U.S. third-party marketplace to expand product assortment and create new ad revenue opportunities.

- •

Expand Best Buy Ads by attracting non-endemic advertisers and offering more sophisticated ad products.

- •

Deepen the integration of Best Buy Health with healthcare systems to scale 'hospital-at-home' solutions.

- •

Grow the membership program by adding more exclusive value-added services.

Threats

- •

Aggressive pricing and market share gains by competitors like Amazon, Walmart, and Costco.

- •

Economic downturns reducing consumer discretionary spending on electronics.

- •

Direct-to-consumer (DTC) sales models from major brands (e.g., Apple, Samsung) bypassing retailers.

Market Positioning

Service-Oriented Specialty Retailer

Best Buy positions itself not just as a seller of products, but as a technology partner that provides expert advice, installation, and support, differentiating through its service offerings (Geek Squad) and omnichannel convenience.

Leading specialty retailer, but facing market share erosion in key categories to mass merchants and online retailers.

Target Segments

- Segment Name:

Jill - The Practical Family Shopper

Description:Often a suburban parent who is the primary shopper for the family. May feel intimidated by complex technology and values convenience, practical solutions, and expert, non-technical advice.

Demographic Factors

- •

Ages 30-50

- •

Suburban

- •

Family with children

Psychographic Factors

- •

Value-conscious

- •

Seeks trustworthy advice

- •

Prioritizes family needs

- •

Can be tech-intimidated

Behavioral Factors

- •

Researches purchases but prefers in-store experience

- •

Buys solutions, not just products (e.g., a full home theater setup)

- •

Responsive to service offerings like installation and setup

Pain Points

- •

Feeling overwhelmed by technical jargon and product choices.

- •

Wasting time on products that don't work together.

- •

Difficulty with installation and setup of new technology.

Fit Assessment:Good

Segment Potential:Medium

- Segment Name:

Buzz - The Tech Enthusiast

Description:A young, tech-savvy individual who is an early adopter of new technology. Enjoys exploring the latest gadgets, values having a wide selection, and wants to physically experience products before buying.

Demographic Factors

- •

Ages 18-35

- •

Male-skewed

- •

Urban/Suburban

Psychographic Factors

- •

Early adopter

- •

Loves innovation

- •

Knowledgeable about technology

- •

Values performance and features

Behavioral Factors

- •

Frequent visitor to stores to see new tech

- •

Reads tech reviews and compares specifications

- •

Likely to pre-order new product releases

Pain Points

- •

Inability to test or handle products before purchasing online.

- •

Lack of knowledgeable staff to discuss technical details.

- •

Stockouts of new and popular items.

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Barry - The Affluent Professional

Description:A high-income professional who wants the best technology but lacks the time to research and set it up. Values premium products, turnkey solutions, and high-touch service.

Demographic Factors

- •

Ages 35-60

- •

High household income

- •

Professional/Managerial occupation

Psychographic Factors

- •

Time-poor

- •

Quality-focused

- •

Delegates tasks

- •

Brand conscious

Behavioral Factors

- •

Prefers premium brands (e.g., Magnolia)

- •

Willing to pay for services like in-home consultation, delivery, and installation

- •

Values long-term support and warranties

Pain Points

- •

Lack of time for product research and comparison.

- •

Complexity of integrating new technology into an existing smart home ecosystem.

- •

Desire for a seamless, hassle-free purchase and setup experience.

Fit Assessment:Good

Segment Potential:Medium

Market Differentiation

- Factor:

Omnichannel Presence

Strength:Strong

Sustainability:Sustainable

Description:The seamless integration of a large physical store footprint (where 70% of Americans live within 10 miles of a store) with a robust e-commerce platform allows for services like Buy-Online-Pickup-In-Store (BOPIS), in-store returns, and using stores as fulfillment hubs.

- Factor:

Geek Squad Services

Strength:Strong

Sustainability:Sustainable

Description:A nationally recognized brand for tech support, installation, and repair services that is difficult for online-only competitors to replicate at scale. It provides a crucial value-add beyond the product itself.

- Factor:

Expert Advice & In-Store Experience

Strength:Moderate

Sustainability:Sustainable

Description:Knowledgeable sales associates provide consultation, and in-store 'store-within-a-store' concepts allow customers to experience products hands-on, a key advantage over pure-play e-commerce.

- Factor:

Price Competitiveness

Strength:Weak

Sustainability:Temporary

Description:While Best Buy has a price-matching policy, it cannot sustainably lead on price against leaner operating models like Amazon or Costco. Price is a point of parity, not a differentiator.

Value Proposition

To enrich lives through technology by being a trusted partner, offering expert advice, a curated selection of products, and comprehensive support services for the entire lifecycle of your tech.

Good

Key Benefits

- Benefit:

Expert Consultation and Support

Importance:Critical

Differentiation:Unique

Proof Elements

- •

In-store 'Blue Shirt' sales associates

- •

Geek Squad agents for installation, repair, and support

- •

Free In-Home Advisor program

- Benefit:

Hands-On Product Experience

Importance:Important

Differentiation:Somewhat unique

Proof Elements

- •

Physical retail stores with interactive product displays

- •

Brand experience shops (e.g., Apple, Samsung, Magnolia)

- •

Ability to see, touch, and compare products in person

- Benefit:

Omnichannel Convenience

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Buy Online, Pick Up In Store (BOPIS) options

- •

Ship-from-store capabilities for faster delivery

- •

Easy in-store returns for online purchases

Unique Selling Points

- Usp:

Integrated end-to-end service model combining retail sales with Geek Squad installation, support, and protection plans.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A physical retail footprint that allows customers to experience technology firsthand before buying, a tangible advantage over online-only competitors.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A trusted brand in consumer electronics, built over decades, that provides peace of mind for complex and expensive purchases.

Sustainability:Long-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Technology complexity and choice overload

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Fear of making the wrong high-value purchase without seeing the product

Severity:Major

Solution Effectiveness:Complete

- Problem:

Hassle of setting up, installing, and troubleshooting new devices

Severity:Major

Solution Effectiveness:Complete

Value Alignment Assessment

Medium

The value proposition aligns well with customers who value service and experience, but is less aligned with the large market segment that is purely price-driven. The rise of e-commerce has made the price-sensitive segment larger and more accessible to competitors.

High

For its core target segments (those who are tech-intimidated, time-poor, or enthusiasts wanting hands-on experience), the value proposition is highly aligned with their key pain points and needs.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Consumer Electronics Brands (e.g., Apple, Samsung, Sony, LG, HP)

- •

Appliance Manufacturers (e.g., Whirlpool, GE)

- •

Software and Gaming Companies (e.g., Microsoft, Nintendo)

- •

Telecommunication Carriers (e.g., AT&T, Verizon)

- •

Media & Content Partners (e.g., CNET, Roku).

- •

Healthcare Systems (for Best Buy Health).

Key Activities

- •

Retail Merchandising and Sales (In-store & Online)

- •

Supply Chain and Inventory Management

- •

Technical Support and Installation (Geek Squad)

- •

Marketing and Customer Relationship Management

- •

Developing and Managing Retail Media Network (Best Buy Ads)

- •

Store Operations and Real Estate Management

Key Resources

- •

Physical Store Network

- •

E-commerce Platform and Mobile App

- •

Geek Squad Workforce

- •

Brand Recognition and Customer Trust

- •

Distribution Centers and Logistics Infrastructure

- •

First-Party Customer Data

Cost Structure

- •

Cost of Goods Sold (COGS)

- •

Employee Salaries and Benefits

- •

Store Lease and Operating Expenses

- •

Marketing and Advertising

- •

Technology and Infrastructure Costs

- •

Supply Chain and Logistics

Swot Analysis

Strengths

- •

Strong brand recognition and established market presence.

- •

Effective omnichannel model integrating physical and digital channels.

- •

Unique and defensible service offering with Geek Squad.

- •

Extensive first-party customer data for personalization and advertising.

Weaknesses

- •

High fixed costs associated with a large physical store footprint.

- •

Vulnerability to price-based competition from online retailers.

- •

Declining sales in traditional electronics categories like TVs and laptops.

- •

Dependence on a few major suppliers for a significant portion of merchandise.

Opportunities

- •

Expansion of high-margin revenue streams like Best Buy Ads and membership programs.

- •

Growth in the Health Technology sector through Best Buy Health and care-at-home solutions.

- •

Launching a U.S. third-party marketplace to broaden product assortment and increase ad revenue.

- •

Entering new product and service categories like home automation and smart home consulting.

Threats

- •

Intense competition from e-commerce giants (Amazon), mass merchants (Walmart, Target), and warehouse clubs (Costco).

- •

Economic recessions reducing consumer spending on high-ticket electronics.

- •

Direct-to-consumer sales channels from major tech brands, bypassing retail partners.

- •

Rapid technological obsolescence requiring constant inventory management.

Recommendations

Priority Improvements

- Area:

In-Store Experience Transformation

Recommendation:Accelerate the rollout of smaller, experiential store formats and further tailor store assortments to local market demographics. Focus the in-store experience on consultation, problem-solving, and complex sales that cannot be replicated online.

Expected Impact:High

- Area:

Membership Program Enhancement

Recommendation:Integrate more exclusive, high-value services into the paid My Best Buy membership tiers, such as proactive tech check-ups, exclusive access to Geek Squad, or personalized tech consulting, to increase recurring revenue and customer loyalty.

Expected Impact:High

- Area:

Marketplace Launch and Integration

Recommendation:Ensure a successful launch of the U.S. marketplace by focusing on differentiated categories (e.g., health & wellness, smart home accessories) and seamlessly integrating third-party sellers into the Best Buy Ads ecosystem to rapidly scale advertising revenue.

Expected Impact:High

Business Model Innovation

- •

Evolve Geek Squad from a reactive support service to a proactive 'CTO for the Home' subscription, offering ongoing management of a customer's entire home tech ecosystem.

- •

Develop a B2B 'Best Buy for Business' service that provides small and medium-sized businesses with comprehensive IT procurement, setup, and managed services, leveraging the Geek Squad infrastructure.

- •

Establish Best Buy as a central hub for the connected smart home, offering platform-agnostic consultation and installation services that integrate devices from various manufacturers.

Revenue Diversification

- •

Aggressively scale the Best Buy Ads retail media network by opening it to non-endemic brands that want to reach a tech-savvy audience.

- •

Expand the Best Buy Health division by forging deeper partnerships with hospital systems and insurance providers for 'hospital-at-home' and remote patient monitoring programs.

- •

Introduce a trade-in and certified refurbished marketplace for a wider range of electronics, capitalizing on the circular economy trend and attracting value-conscious consumers.

Best Buy is at a critical juncture in its business model evolution, transitioning from a traditional big-box electronics retailer to a diversified, omnichannel service and solutions provider. Its core business of product sales faces intense margin pressure and declining revenue amidst fierce competition from online giants like Amazon and mass merchants. The company's long-term sustainability hinges not on winning a price war, but on successfully leveraging its unique, defensible assets: its physical store footprint, trusted brand, and the Geek Squad service infrastructure.

The strategic imperatives are clear. First, the company must continue to transform its physical stores from simple transaction points into experience and consultation hubs, justifying their high operating costs by providing value that cannot be digitized. Second, Best Buy must accelerate the growth of its higher-margin, service-oriented revenue streams. Best Buy Ads is a significant opportunity to monetize its valuable first-party customer data, while the My Best Buy membership program is key to building a loyal, recurring revenue base. The most transformative, yet challenging, opportunity lies in Best Buy Health, a strategic pivot that could tap into the massive healthcare market by positioning Best Buy as the technology enabler for at-home care. The upcoming launch of a U.S. marketplace is another crucial step, aimed at expanding assortment without inventory risk and, more importantly, creating a new pipeline of advertisers for its retail media network.

Success requires a fundamental shift in focus from moving boxes to building long-term customer relationships. The future of Best Buy is not as a store, but as an indispensable technology partner for the home, business, and health.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Economies of Scale

Impact:High

- Barrier:

Brand Loyalty & Trust

Impact:High

- Barrier:

Capital Investment (Physical Stores & Logistics)

Impact:High

- Barrier:

Supplier Relationships & Distribution Channels

Impact:High

- Barrier:

Customer Switching Costs (Services, Warranties)

Impact:Medium

Industry Trends

- Trend:

Omnichannel Integration (BOPIS, ROPO)

Impact On Business:Critical for leveraging physical store footprint against online-only competitors. Best Buy is well-positioned here.

Timeline:Immediate

- Trend:

Focus on Services and In-Person Expertise

Impact On Business:A key differentiator against e-commerce giants. Geek Squad is a major asset that needs continuous investment.

Timeline:Immediate

- Trend:

Growth of Refurbished and Second-Hand Market

Impact On Business:Opportunity to capture value-conscious consumers and align with sustainability trends. Best Buy's Outlet is a good start but faces specialized competition.

Timeline:Near-term

- Trend:

Direct-to-Consumer (D2C) Sales by Manufacturers

Impact On Business:Erodes Best Buy's role as the primary intermediary, putting pressure on margins and product exclusivity.

Timeline:Near-term

- Trend:

Personalization and AI in Retail

Impact On Business:Required to enhance customer experience and compete with data-driven recommendations from online players like Amazon.

Timeline:Immediate

- Trend:

Demand for Faster, Cheaper Shipping

Impact On Business:Increases logistical complexity and cost, making it difficult to compete with Amazon Prime's delivery network.

Timeline:Immediate

Direct Competitors

- →

Amazon

Market Share Estimate:Leading online retailer, with a consumer electronics market share rivaling or exceeding Best Buy's.

Target Audience Overlap:High

Competitive Positioning:The 'Everything Store' with unmatched convenience, vast selection, and competitive pricing, powered by a massive logistics network.

Strengths

- •

Unparalleled logistics and delivery speed (Prime).

- •

Vast product selection and third-party marketplace.

- •

Aggressive pricing and low-cost structure.

- •

Strong customer loyalty and massive user base.

- •

Robust recommendation engine and personalized marketing.

Weaknesses

- •

Lack of physical stores for product demos and in-person support.

- •

Challenges with counterfeit products and fake reviews.

- •

Customer service can be impersonal and difficult for complex issues.

- •

Less specialized expertise in complex electronics categories.

Differentiators

- •

Prime membership ecosystem (video, music, shipping).

- •

AWS cloud infrastructure provides massive scale and data capabilities.

- •

Focus on convenience and one-click purchasing.

- →

Walmart

Market Share Estimate:Largest retailer in the world, holds a significant share of the overall retail market, including electronics.

Target Audience Overlap:High

Competitive Positioning:The low-price leader for the mass market, offering a one-stop shop for a wide range of goods, including a substantial electronics department.

Strengths

- •

Massive physical store footprint providing convenience and accessibility.

- •

Strong brand recognition for low prices.

- •

Growing e-commerce and omnichannel capabilities (in-store pickup).

- •

Efficient supply chain and strong supplier leverage.

Weaknesses

- •

Less premium or specialized product selection compared to Best Buy.

- •

In-store staff lacks the specialized technical expertise of Best Buy employees.

- •

Brand perception is focused on value, not technology leadership.

- •

In-store experience is not optimized for electronics browsing.

Differentiators

- •

Everyday Low Prices (EDLP) strategy.

- •

One-stop shopping for groceries, apparel, and electronics.

- •

Extensive reach into rural and suburban markets.

- →

Target

Market Share Estimate:Significant market share in general retail, with a growing electronics segment.

Target Audience Overlap:Medium

Competitive Positioning:A stylish, 'cheap-chic' mass-market retailer offering a curated selection of products, including modern electronics, in an enjoyable shopping environment.

Strengths

- •

Strong brand loyalty and positive in-store experience.

- •

Effective at creating exclusive partnerships and curated assortments.

- •

Robust omnichannel services (Drive Up, Order Pickup).

- •

Strong performance in digital sales growth.

Weaknesses

- •

Product selection is more curated and less comprehensive than Best Buy's.

- •

Limited in-store technical support and expertise.

- •

Not perceived as a primary destination for high-end or specialty electronics.

Differentiators

- •

Focus on design and a pleasant, clean store aesthetic.

- •

Owned brands and exclusive designer collaborations.

- •

Strong appeal to a younger, more design-conscious demographic.

- →

Newegg

Market Share Estimate:Niche leader in the PC components and tech enthusiast space.

Target Audience Overlap:Medium

Competitive Positioning:The premier online destination for PC builders, gamers, and tech enthusiasts, offering a deep selection of components and technical content.

Strengths

- •

Deep, specialized product catalog for PC hardware.

- •

Strong brand reputation and loyal community among tech enthusiasts.

- •

Competitive pricing on components.

- •

Detailed product specifications and user reviews.

Weaknesses

- •

Narrower focus than Best Buy; limited appliance and home theater selection.

- •

No physical retail presence for hands-on experience or immediate support.

- •

Less brand recognition among the general consumer population.

- •

Customer service can be less robust than a brick-and-mortar retailer's.

Differentiators

- •

Focus on the DIY PC builder and gaming community.

- •

Combination of direct sales and a third-party marketplace for specialized tech.

- •

Strong community engagement and content creation.

Indirect Competitors

- →

Apple (Retail & D2C)

Description:Manufacturer of high-end consumer electronics (iPhone, Mac, iPad) selling directly to consumers online and through its own physical retail stores.

Threat Level:High

Potential For Direct Competition:Is already a direct competitor for its own products, setting the standard for premium retail experiences.

- →

Samsung (D2C)

Description:Major electronics manufacturer selling a vast range of products (TVs, smartphones, appliances) directly to consumers online.

Threat Level:Medium

Potential For Direct Competition:Increasingly investing in its D2C channels, which could erode Best Buy's share of Samsung product sales.

- →

Costco

Description:Membership-based warehouse club offering a limited but aggressively priced selection of popular electronics.

Threat Level:Medium

Potential For Direct Competition:Competes on price for high-volume, popular items, but its limited selection and membership model prevent broader direct competition.

- →

The Home Depot / Lowe's

Description:Home improvement retailers that are major players in the large appliance market (refrigerators, washers, dryers).

Threat Level:Medium

Potential For Direct Competition:Direct competitors in the major appliance category, but not in broader consumer electronics.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Omnichannel Presence

Sustainability Assessment:Highly sustainable. The combination of a strong e-commerce platform with a nationwide network of physical stores for pickup, returns, and service is difficult and expensive to replicate.

Competitor Replication Difficulty:Hard

- Advantage:

Geek Squad Service & Expertise

Sustainability Assessment:Highly sustainable. Geek Squad is a recognized brand for tech support, installation, and repair, offering a human touch that online-only retailers cannot match. It drives both revenue and customer loyalty.

Competitor Replication Difficulty:Hard

- Advantage:

Strong Brand Recognition in Electronics

Sustainability Assessment:Sustainable. Best Buy is a top-of-mind destination for consumer electronics, a reputation built over decades.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'Exclusive Product Launches/Deals', 'estimated_duration': 'Short-term (per product cycle)'}

{'advantage': 'Promotional Pricing (e.g., Black Friday)', 'estimated_duration': 'Event-driven, easily matched by competitors'}

Disadvantages

- Disadvantage:

Price Competition from Online Retailers

Impact:Major

Addressability:Moderately

- Disadvantage:

High Operating Costs of Physical Stores

Impact:Major

Addressability:Difficult

- Disadvantage:

Dependence on a Few Key Product Categories (e.g., Computing, Mobile)

Impact:Major

Addressability:Moderately

- Disadvantage:

Perception of Being More Expensive Than Competitors

Impact:Major

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted marketing campaigns promoting Geek Squad's in-home installation for complex smart home setups.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Optimize the in-store pickup process to be faster and more seamless, promoting it as a key advantage over online-only competitors.

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Feature 'Expert Picks' and 'Geek Squad Certified' labels more prominently online to leverage human expertise in the digital space.

Expected Impact:Medium

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Expand the 'Best Buy Outlet' for certified refurbished and open-box products, creating a robust trade-in program to fuel inventory and appeal to sustainable/value shoppers.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Develop a premium 'Geek Squad Pro' subscription service offering unlimited tech support, priority service, and exclusive discounts.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Transform select store sections into interactive 'Experience Zones' for emerging tech like smart homes, VR, and home automation, hosted by expert staff.

Expected Impact:Medium

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Invest in a 'Device-as-a-Service' model, allowing customers to lease the latest technology for a monthly fee with included support and upgrade paths.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Build out a curated third-party marketplace focused on specialty electronics and smart home solutions, leveraging Best Buy's brand trust and logistics.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Expand into adjacent service categories, such as B2B tech support for small businesses or advanced smart home security and automation consulting.

Expected Impact:Medium

Implementation Difficulty:Difficult

Solidify Best Buy's position as the premier 'Technology Solutions Provider' for the mass market. Shift focus from simply selling products to providing end-to-end solutions, from expert advice and product selection to installation, support, and lifecycle management.

Hyper-focus on leveraging the unique synergy between physical stores, knowledgeable employees, and the Geek Squad service brand. Differentiate not on price, but on trust, expertise, and the value of a comprehensive, human-centric service experience that simplifies complex technology for consumers.

Whitespace Opportunities

- Opportunity:

Comprehensive Smart Home Consultation and Installation Service

Competitive Gap:While competitors sell smart home devices, none offer a holistic, brand-agnostic service to design, install, and support a fully integrated smart home ecosystem.

Feasibility:High

Potential Impact:High

- Opportunity:

Tech Subscription Boxes / 'Hardware-as-a-Service'

Competitive Gap:A recurring revenue model for accessing the latest technology (e.g., gaming PCs, camera gear, drones) is underdeveloped in mainstream retail.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Small Business Tech Outfitter and Support

Competitive Gap:Small businesses are often underserved, lacking dedicated IT support. Geek Squad could be positioned as a 'Your Business's IT Department' service.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Center for Sustainable Tech

Competitive Gap:No major retailer has fully claimed the 'sustainability' space for electronics. This includes managing trade-ins, certified repairs, responsible recycling, and selling certified pre-owned products under one trusted brand.

Feasibility:Medium

Potential Impact:Medium

Best Buy operates in a mature and highly competitive consumer electronics retail market, which is best described as an oligopoly dominated by a few major players. Its primary competitive threats come from the e-commerce behemoth Amazon, with its unmatched logistics and pricing, and mass-market giants Walmart and Target, who compete aggressively on price and convenience.

Best Buy's most sustainable competitive advantages are its integrated omnichannel model and its Geek Squad service brand. The ability for customers to research online and then see, touch, and get advice on products in a physical store (ROPO - Research Online, Purchase Offline) remains a powerful differentiator against online-only players. Geek Squad provides a trusted, human-centric service layer for installation, repair, and support that is incredibly difficult for competitors to replicate at scale and is a key driver of customer loyalty.

However, Best Buy faces significant disadvantages, including the high operational costs of its physical retail footprint and the constant price pressure from online competitors who have a lower cost structure. Furthermore, the rise of direct-to-consumer (D2C) sales from major brands like Apple and Samsung threatens to disintermediate Best Buy's role in the value chain.

The strategic imperative for Best Buy is to pivot away from a purely transactional, product-based model and double down on its identity as a solutions provider. The future lies in monetizing its expertise. Opportunities in comprehensive smart home services, 'Device-as-a-Service' subscription models, and expanding Geek Squad's mandate to serve small businesses represent significant growth vectors. By focusing on the entire product lifecycle—from expert advice and sales to installation, support, and responsible end-of-life trade-ins—Best Buy can solidify a defensible and valuable niche that its biggest competitors cannot easily occupy.

Messaging

Message Architecture

Key Messages

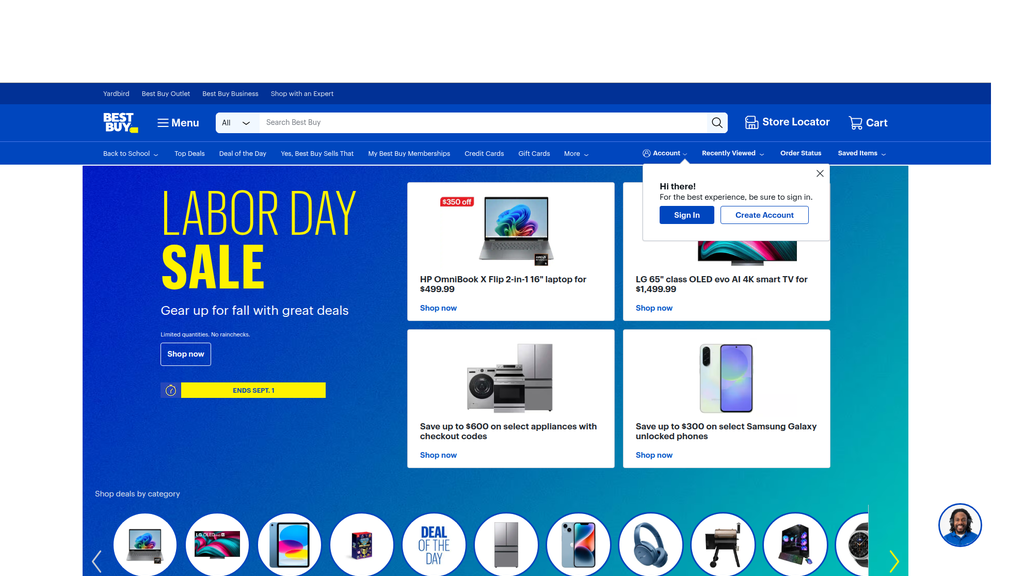

- Message:

Massive, time-sensitive sales and deals on popular electronics.

Prominence:Primary

Clarity Score:High

Location:Homepage hero banner, promotional tiles

- Message:

Specific, deep discounts on high-value products (laptops, TVs, appliances).

Prominence:Secondary

Clarity Score:High

Location:Homepage product-specific promotional sections

- Message:

Savings on open-box, refurbished, and clearance items.

Prominence:Tertiary

Clarity Score:Medium

Location:Best Buy Outlet page title

The messaging hierarchy is exceptionally clear and singularly focused. The top-of-funnel message is overwhelmingly driven by promotional events (e.g., 'LABOR DAY SALE'). This immediately frames the user experience as transactional and positions price savings as the primary reason to engage. Higher-level brand messages about expertise, service, or enriching lives through technology are completely absent from the provided content.

Within the provided content, the promotional messaging is highly consistent. The 'Labor Day Sale' theme is present on both the main homepage and the Outlet page, creating a cohesive, site-wide campaign narrative. The direct, urgent tone is maintained across all deal-related communications.

Brand Voice

Voice Attributes

- Attribute:

Promotional

Strength:Strong

Examples

- •

LABOR DAY SALE

- •

Save up to $600 on select appliances

- •

Save up to $300 on select Samsung Galaxy unlocked phones

- Attribute:

Urgent

Strength:Strong

Examples

ENDS SEPT. 1

Limited quantities. No rainchecks.

- Attribute:

Direct

Strength:Strong

Examples

Shop now

- Attribute:

Expert

Strength:Weak

Examples

None present in the provided content. The voice is purely transactional, lacking any advisory or expert quality.

Tone Analysis

Transactional

Secondary Tones

Urgent

Value-driven

Tone Shifts

There are no discernible tone shifts in the provided content. The voice remains consistently focused on driving immediate sales.

Voice Consistency Rating

Excellent

Consistency Issues

While the transactional voice is consistent, its complete dominance creates a strategic inconsistency with Best Buy's broader brand positioning, which relies heavily on service and expertise (e.g., Geek Squad).

Value Proposition Assessment

Based on the website content, the core value proposition is: 'Best Buy is the destination for significant, time-sensitive discounts on a wide range of brand-name electronics and appliances.'

Value Proposition Components

- Component:

Price Savings & Deals

Clarity:Clear

Uniqueness:Common

- Component:

Broad Product Selection

Clarity:Somewhat Clear

Uniqueness:Common

- Component:

Outlet & Refurbished Value

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Expertise & Service

Clarity:Unclear

Uniqueness:Unique

The messaging fails to communicate Best Buy's key differentiators. Research indicates that Best Buy's competitive advantages are its knowledgeable staff, Geek Squad services, and the ability for customers to experience products in-store. The analyzed content does not mention any of these aspects, reducing Best Buy's messaging to that of a generic online discounter, directly competing with Amazon and Walmart on their strongest turf (price) rather than on its own (service).

The messaging positions Best Buy as a price-focused, mass-market retailer. This head-on competition with online giants and big-box stores on price alone is a strategically vulnerable position. The brand's unique 'omnichannel' and 'service-led' strengths are not being leveraged in its primary digital messaging.

Audience Messaging

Target Personas

- Persona:

The Deal Hunter: A price-sensitive shopper actively looking for sales and major discounts on specific tech items.

Tailored Messages

- •

LABOR DAY SALE

- •

Save up to $600...

- •

Limited quantities. No rainchecks.

Effectiveness:Effective

- Persona:

The Category Upgrader: A consumer who knows they need a new item (e.g., TV, laptop) and is prompted by a sale to make the purchase now.

Tailored Messages

- •

Gear up for fall with great deals

- •

HP OmniBook X Flip 2-in-1 16" laptop for $499.99

- •

LG 65" class OLED evo AI 4K smart TV for $1,499.99

Effectiveness:Effective

- Persona:

The Confused Tech Shopper: A customer who needs guidance and expertise to make a complex purchase decision.

Tailored Messages

No itemsEffectiveness:Ineffective

Audience Pain Points Addressed

The high cost of consumer electronics.

The fear of missing out (FOMO) on a good deal.

Audience Aspirations Addressed

Acquiring new technology and upgrading one's lifestyle affordably.

Feeling smart for securing a great price on a desired item.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Urgency / Fear of Missing Out (FOMO)

Effectiveness:High

Examples

ENDS SEPT. 1Limited quantities. No rainchecks. - Appeal Type:

Desire for Savings / Financial Gain

Effectiveness:High

Examples

Save up to $600for $499.99

Social Proof Elements

{'proof_type': 'None Present', 'impact': 'Weak'}

Trust Indicators

The established 'Best Buy' brand name itself.

Scarcity Urgency Tactics

Time-bound sales (ENDS SEPT. 1)

Quantity limitations (Limited quantities)

Calls To Action

Primary Ctas

- Text:

Shop now

Location:Homepage banners and promotional tiles

Clarity:Clear

The CTAs are clear, direct, and effective for their singular purpose: driving traffic to sales pages. They are highly functional for users with high purchase intent. However, the lack of variation (e.g., 'Learn More', 'Compare Features', 'Talk to an Expert') means they fail to engage users earlier in the customer journey who may need more information before they are ready to 'shop now'.

Messaging Gaps Analysis

Critical Gaps

- •

Service & Expertise Value Proposition: There is a total absence of messaging related to Geek Squad, in-store experts, or post-purchase support, which are Best Buy's primary differentiators against online-only competitors.

- •

Brand Mission: The company mission to 'enrich lives through technology' is not reflected. The messaging is about acquiring things, not about what those things enable people to do.

- •

Social Proof: No customer reviews, ratings, or testimonials are present in the messaging, a standard and critical element for building trust in e-commerce.

- •

Community & Loyalty: No mention of the 'My Best Buy' loyalty program or other community-building initiatives that foster long-term relationships.

Contradiction Points

There is a strategic contradiction between Best Buy's business model, which relies on a service and omnichannel advantage , and its homepage messaging, which positions it as a price-only competitor.

Underdeveloped Areas

Brand Storytelling: The messaging lacks any narrative. It doesn't tell a story about the brand, its employees, or how its products improve customers' lives.

Relationship Building: The communication is purely transactional, with no effort to build a relationship or establish trust beyond the scope of the immediate sale.

Messaging Quality

Strengths

- •

Exceptional Clarity: The promotional messages are unambiguous and easy to understand instantly.

- •

Strong Action Orientation: The user knows exactly what to do ('Shop now') and why they should do it (to get a deal).

- •

Effective Urgency: The use of deadlines and quantity limits is a powerful tactic for accelerating purchase decisions.

Weaknesses

- •

Lack of Differentiation: The messaging could be from any major electronics retailer; it does not communicate what makes Best Buy unique.

- •

Over-reliance on Price: The constant focus on discounts can devalue the brand and attract less loyal, price-driven customers.

- •

No Emotional Connection: The messaging fails to connect with the customer on an emotional level beyond the transient excitement of a sale.

Opportunities

- •

Integrate 'Expertise' messaging into promotional content (e.g., 'Save $300 on the laptop our experts recommend').

- •

Use homepage space to feature stories or content that bring the 'enrich lives through technology' mission to life.

- •

Incorporate social proof like star ratings or 'Customer Favorite' badges directly into deal promotions.

- •

Promote the value of the My Best Buy loyalty program as a way to get even more from deals.

Optimization Roadmap

Priority Improvements

- Area:

Value Proposition Communication

Recommendation:Create a secondary messaging layer on the homepage dedicated to service and expertise. This could be a static banner below the main sale promotion with messaging like: 'Unsure what to buy? Our experts are here to help, in-store and online.'

Expected Impact:High

- Area:

Social Proof Integration

Recommendation:Dynamically pull star ratings and review counts into all promotional product tiles to add immediate credibility and aid in decision-making.

Expected Impact:High

- Area:

Call-to-Action Diversity

Recommendation:Test alternative CTAs on select product categories. For complex items like home theater systems, test 'Build Your System' or 'Get Expert Advice' against 'Shop Now' to capture users earlier in their journey.

Expected Impact:Medium

Quick Wins

- •

Add a small, persistent banner promoting the benefits of the My Best Buy membership program.

- •

Update the 'Gear up for fall' tagline to include a service element, such as 'Gear up for fall with expert-picked deals.'

- •

Incorporate trust signals like 'Price Match Guarantee' messaging directly within the promotional banners.

Long Term Recommendations

- •

Develop a content strategy focused on storytelling that showcases how technology sold at Best Buy enriches the lives of real customers.

- •

Rethink the homepage messaging hierarchy to create a more balanced presentation of Price (deals), Product (new tech), and People (expertise/service).

- •

Invest in personalized messaging that tailors content based on a user's purchase history and browsing behavior, moving beyond generic, site-wide sale announcements.

The strategic messaging on Best Buy's website, as evidenced by the provided content, is a highly optimized, yet narrowly focused, transactional engine. It excels in clarity, urgency, and driving action for price-motivated shoppers. The message architecture is ruthlessly efficient at funneling users toward current sales events, leaving no ambiguity about the primary call to action.

However, this singular focus on promotional messaging creates a significant strategic vulnerability. It fails to communicate the brand's core differentiators: expert service, in-person advice, and post-sale support (Geek Squad). By stripping out these crucial elements of its value proposition, the website positions Best Buy as just another online discounter, forcing it to compete directly with Amazon, Walmart, and other e-commerce giants on price alone—a battle that is difficult to win long-term. This messaging strategy successfully drives short-term sales but does little to build brand equity, foster customer loyalty, or justify why a consumer should choose Best Buy over a competitor for reasons other than a temporary discount. The brand's mission to 'enrich lives through technology' is entirely absent, replaced by a message that implicitly values the transaction over the transformation technology can provide. To improve market positioning and customer lifetime value, Best Buy must evolve its messaging to integrate its unique service and expertise differentiators into the digital customer experience, creating a more balanced and defensible brand narrative.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Brand Recognition & Market Share: Best Buy is a household name in North America for consumer electronics, capturing a significant market share (31% according to one report).

- •

Established Omnichannel Presence: With over 1,000 retail stores complementing a robust online platform (online sales are ~39.5% of domestic revenue), Best Buy meets customers where they are.

- •

Differentiated Service Offerings: The Geek Squad provides a unique, high-margin service that competitors like Amazon and Walmart cannot easily replicate, fostering customer loyalty.

- •

Strong Vendor Relationships: Key partnerships with brands like Apple and Samsung for 'store-within-a-store' concepts and post-purchase services solidify its market position.

Improvement Areas

- •

Value Proposition Beyond Price: Must continuously reinforce its value proposition around expert advice and post-sale support to combat intense price competition from online-only retailers.

- •

Adapting to Younger Demographics: Needs to evolve the in-store and online experience to better attract and retain Gen Z and Millennial customers who may be more inclined towards DTC brands or social commerce.

- •

Modernizing In-Store Experience: Continue refreshing store formats to be more experiential and service-oriented, moving away from a purely transactional model.

Market Dynamics

Low to Moderate (Approx. 2-5% CAGR for North American consumer electronics).

Mature

Market Trends

- Trend:

Omnichannel Integration is Table Stakes

Business Impact:Customers expect a seamless experience between online and physical stores (e.g., BOPIS, real-time inventory checks). Failure to deliver creates significant friction.

- Trend:

Rise of Services and Subscriptions

Business Impact:Shift from one-time product sales to recurring revenue streams via memberships (My Best Buy Total) and tech support services is critical for margin improvement and customer loyalty.

- Trend:

Focus on Sustainability & Circular Economy

Business Impact:Growing consumer interest in refurbished products, trade-in programs, and repairs presents an opportunity for a new revenue stream and enhances brand reputation.

- Trend:

Expansion into Health Technology

Business Impact:The aging population and integration of tech into wellness create a massive new market opportunity, leveraging Geek Squad's in-home service capabilities for a new vertical.

- Trend:

AI-Powered Personalization

Business Impact:Leveraging data and AI to provide personalized recommendations and support is becoming a key differentiator for customer experience.

Challenging but Opportunistic. While the core market is mature and highly competitive, the timing is excellent for strategic pivots into high-growth service areas like health tech and leveraging its physical footprint for superior omnichannel experiences.

Business Model Scalability

Medium

High fixed costs associated with a large physical store footprint (leases, utilities, staffing) limit pure scalability. The online channel has a more scalable, variable cost structure.

Moderate. Best Buy can achieve operational leverage by increasing sales of high-margin services (Geek Squad, memberships) and optimizing its supply chain, which spreads fixed costs over higher revenue.

Scalability Constraints

- •

Physical Store Footprint: The cost and complexity of opening, remodeling, and managing physical locations.

- •

Inventory Management: Capital-intensive and complex to manage inventory across a vast network of stores and distribution centers.

- •

Labor Dependency: Heavily reliant on a large, trained workforce for in-store sales and in-home services.

Team Readiness

Experienced. The leadership team, under CEO Corie Barry, has demonstrated a clear strategic focus on evolving the business model towards services and health, building on the successful 'Renew Blue' turnaround.

Traditional retail hierarchy, which can be slow to adapt. Recent strategies suggest a move towards a more integrated omnichannel structure, but agility remains a challenge.

Key Capability Gaps

- •

Data Science & AI Talent: Deep expertise needed to fully leverage customer data for hyper-personalization and predictive analytics at scale.

- •

Healthcare Vertical Expertise: Requires specialized talent in healthcare logistics, compliance (e.g., HIPAA), and B2B sales to health systems to successfully scale Best Buy Health.

- •

Digital Product Management: Continued need for talent focused on improving the end-to-end digital customer experience, from app usability to checkout flow.

Growth Engine

Acquisition Channels

- Channel:

Physical Stores / Retail Footprint

Effectiveness:High

Optimization Potential:Medium

Recommendation:Transition stores from transactional hubs to experiential and service centers. Focus on interactive product demos, consultation spaces for complex sales (e.g., smart home), and Geek Squad service points.

- Channel:

Online Search (SEO/SEM)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Enhance SEO for service-related keywords ('TV mounting near me', 'computer repair') and create rich content comparing complex products to capture high-intent searchers.

- Channel:

Email Marketing & CRM

Effectiveness:Medium

Optimization Potential:High

Recommendation:Implement more sophisticated personalization and segmentation. Trigger campaigns based on purchase history, browsing behavior, and lifecycle events (e.g., 'Your warranty is expiring').

- Channel:

Retail Media Network (Best Buy Ads)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Expand the retail media network to more non-endemic brands and leverage first-party data to offer highly targeted advertising, creating a significant new revenue stream.

Customer Journey

Omnichannel path is dominant, with many customers researching online before purchasing in-store (ROBO) or buying online for in-store pickup (BOPIS).

Friction Points

- •

Inventory Discrepancies: Inconsistency between online stock information and actual in-store availability.

- •

Transition from Digital to Physical: Lack of continuity when a customer who has researched online enters a store and has to start their journey over with a sales associate.

- •

Post-Purchase Support: Navigating warranty claims, returns, and tech support can be complex if not seamlessly integrated into the customer account.

Journey Enhancement Priorities

{'area': 'Connected Customer Profile', 'recommendation': "Equip store associates with tools (e.g., tablets) to access a customer's online browsing history, wish lists, and past purchases to provide a truly personalized in-store consultation."}

{'area': 'Appointment Scheduling', 'recommendation': "Streamline online booking for in-store consultations (e.g., 'Plan your smart home') and Geek Squad services to bridge the online-offline gap and guarantee expert availability."}

Retention Mechanisms

- Mechanism:

My Best Buy Membership Program

Effectiveness:High

Improvement Opportunity:Further differentiate the paid tiers (

PlusandTotal) with exclusive, high-value perks beyond just free shipping, such as early access to new tech, members-only pricing events, and deeper discounts on Geek Squad services. - Mechanism:

Geek Squad Tech Support & Protection Plans

Effectiveness:High

Improvement Opportunity:Proactively market Geek Squad services as a solution for 'tech anxiety' with new product categories (e.g., smart home, health tech). Integrate support more deeply into the My Best Buy Total membership to make it a core value driver.

- Mechanism:

Trade-In Program

Effectiveness:Medium

Improvement Opportunity:Promote the trade-in program more aggressively as a way to fund new purchases and highlight the sustainability angle. Offer bonus trade-in values for My Best Buy members to drive loyalty.

Revenue Economics

Challenging on pure product sales due to intense price competition, but significantly improved by attaching high-margin services, warranties, and membership fees.

Qualitatively Moderate to High for engaged members. Customers who subscribe to My Best Buy Total and regularly use Geek Squad have a significantly higher LTV, justifying acquisition costs. Transactional, price-sensitive shoppers have a lower LTV.

Medium. High fixed costs from retail operations weigh on overall efficiency, but the push towards higher-margin services is improving the model.

Optimization Recommendations

- •

Increase Service Attachment Rate: Make it a primary KPI for all sales channels to offer and attach a membership, protection plan, or installation service to every eligible product sale.

- •

Optimize Membership Tiers: Continuously analyze the value perception and uptake of the

PlusandTotaltiers to maximize recurring revenue. - •

Expand B2B Offerings: Grow Geek Squad for Business and bulk sales programs, which typically have larger order values and stickier relationships.

Scale Barriers

Technical Limitations

- Limitation:

Legacy Systems Integration

Impact:High

Solution Approach:Continued investment in a unified commerce platform to ensure real-time synchronization of inventory, customer data, and order management across all channels.

- Limitation:

Data Analytics Infrastructure

Impact:Medium

Solution Approach:Invest in a modern data stack (e.g., cloud data warehouse, CDP) to enable advanced personalization, demand forecasting, and customer journey analytics.

Operational Bottlenecks

- Bottleneck:

Last-Mile Delivery & In-Home Service Logistics

Growth Impact:Limits the speed and geographic reach of installations and repairs, which are key growth drivers.

Resolution Strategy:Optimize routing and scheduling software for Geek Squad fleets. Explore partnerships with third-party logistics (3PL) providers for standard delivery to free up specialized technicians for high-value services.

- Bottleneck:

Employee Training and Expertise

Growth Impact:The value proposition of 'expert advice' depends on highly trained staff. Rapid product cycles and expansion into new categories like health tech make this a constant challenge.

Resolution Strategy:Develop a robust, continuous learning platform for associates with modular, just-in-time training on new products and service offerings. Create tiered expert certifications.

Market Penetration Challenges

- Challenge:

Intense Price Competition

Severity:Critical

Mitigation Strategy:Do not compete on price alone. Differentiate aggressively on service, expert advice, and the immediate gratification of in-store pickup. Bundle products with exclusive services or extended warranties.

- Challenge:

Direct-to-Consumer (DTC) Trend

Severity:Major

Mitigation Strategy:Position Best Buy as an essential multi-brand showcase and service partner for the DTC brands. Offer them a physical retail presence and post-sale support they cannot provide themselves.

- Challenge:

Market Saturation in North America

Severity:Major

Mitigation Strategy:Focus on wallet share expansion within the existing customer base through services, rather than purely geographic or new customer growth. The Best Buy Health initiative is a prime example of this strategy.

Resource Limitations

Talent Gaps

- •

Healthcare Professionals: To build credibility and effectively scale Best Buy Health, hiring talent with experience in healthcare systems and technology is crucial.

- •

In-Home Service Technicians: A constant need to recruit, train, and retain a large, skilled Geek Squad workforce to meet service demand.

- •

AI/ML Engineers: Competition for top tech talent to build out personalization and operational efficiency tools is fierce.

Significant ongoing capital is required for store remodels, supply chain automation, and technology platform upgrades.

Infrastructure Needs

Upgraded Store Technology: Modernizing Point-of-Sale systems and equipping associates with mobile tools.

Supply Chain Automation: Investing in automated fulfillment centers to improve speed and efficiency for online orders.

Growth Opportunities

Market Expansion

- Expansion Vector:

Small Business (B2B)

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Create a dedicated 'Best Buy Business' program with tailored pricing, dedicated account managers, and a suite of Geek Squad services for IT support, device management, and office setup.

- Expansion Vector:

Deeper Penetration into the Senior/Aging-in-Place Market

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Fully operationalize the Best Buy Health strategy by integrating Current Health's remote monitoring platform with Geek Squad's in-home installation capabilities. Forge partnerships with health systems and insurance providers.

Product Opportunities

- Opportunity:

Expansion of Smart Home & IoT Services

Market Demand Evidence:Continued growth in the smart home market, but high consumer friction in setup and integration.

Strategic Fit:Perfect fit for Geek Squad's capabilities. Moves from selling devices to selling whole-home solutions.

Development Recommendation:Develop tiered 'Smart Home' packages (e.g., Security, Entertainment, Energy Management) that include hardware, installation, and ongoing support subscriptions.

- Opportunity:

Growth of Outlet/Refurbished Business

Market Demand Evidence:Increasing consumer price sensitivity and interest in sustainability.

Strategic Fit:Leverages trade-in program and reverse logistics capabilities. Provides a lower-priced entry point for new customers.

Development Recommendation:Prominently feature the 'Best Buy Outlet' online and create dedicated outlet sections in-store. Offer Geek Squad certification for refurbished products to build trust.

Channel Diversification

- Channel:

Smaller Format / 'Experience' Stores

Fit Assessment:Excellent

Implementation Strategy:Continue the strategy of closing large-format stores while opening smaller, more strategically located stores focused on consultation, services, and showcasing new technology.

- Channel:

Enhanced B2B Sales Channel

Fit Assessment:Good

Implementation Strategy:Develop a dedicated online portal for business customers, offering volume discounts and specialized product catalogs. Deploy a small, specialized B2B sales force.

Strategic Partnerships

- Partnership Type:

Healthcare & Insurance Providers

Potential Partners

- •

UnitedHealth Group

- •

Aetna (CVS Health)

- •

Major hospital systems

Expected Benefits:Integrate Best Buy Health services into insurance plans and post-discharge care, creating a massive, recurring revenue channel and validating the health offering.

- Partnership Type:

Home Builders & Property Management

Potential Partners

Lennar

Greystar

Expected Benefits:Become the default provider for smart home technology installation and support in new constructions and apartment complexes, capturing customers at the point of move-in.

- Partnership Type:

Direct-to-Consumer (DTC) Brands

Potential Partners

- •

Sonos

- •

Ring

- •

Peloton

Expected Benefits:Serve as the official physical showroom and installation/service partner for top DTC brands, driving store traffic and service revenue.

Growth Strategy

North Star Metric

Customer Lifetime Value (CLV)

This metric shifts focus from short-term, transactional product sales to long-term customer relationships built on services and recurring revenue. It aligns the entire organization around increasing repeat business, service attachment, and membership retention, which are the key drivers of profitable growth.

Increase average 3-year CLV by 15%.

Growth Model

Service-Led Growth

Key Drivers

- •

Membership Penetration Rate: Percentage of active customers enrolled in a paid My Best Buy tier.

- •

Service Attachment Rate: Percentage of hardware sales that include a Geek Squad service, protection plan, or installation.

- •

Cross-Category Purchase Frequency: Number of distinct product/service categories a customer purchases from over a 12-month period (e.g., buys a laptop, then uses Geek Squad, then buys an appliance).

Incentivize sales staff based on service attachment and membership sign-ups, not just sales volume. Heavily market the benefits of the My Best Buy Total plan as the 'easy button' for all technology. Position Geek Squad as the lead offering for new, complex categories like Health and Smart Home.

Prioritized Initiatives

- Initiative:

Scale Best Buy Health B2B Partnerships

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 months

First Steps:Establish a dedicated business development team with healthcare industry experience to build a pipeline of potential health system and insurance partners. Run a pilot program with one major regional health system.

- Initiative:

Launch 'Geek Squad Smart Home' Bundles

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:6-9 months

First Steps:Define 3-4 standardized smart home packages. Develop a streamlined sales and installation process. Create marketing materials that focus on solving customer problems (e.g., 'Peace of Mind Security Package') rather than selling individual products.

- Initiative:

Personalize the Omnichannel Journey

Expected Impact:High

Implementation Effort:Medium

Timeframe:12 months (ongoing)

First Steps:Deploy a Customer Data Platform (CDP) to unify online and offline data. Launch an initial experiment to arm associates in one store district with tablets showing customer wish lists and browsing history.

Experimentation Plan

High Leverage Tests

{'test': 'A/B test different benefit messaging for the My Best Buy Total membership on the website homepage.', 'hypothesis': "Highlighting '24/7 Tech Support' will drive more sign-ups than highlighting 'Free 2-Day Shipping'."}

{'test': "Run a holdout group for proactive outbound calls from Geek Squad offering a 'tech check-up' to recent high-value purchasers.", 'hypothesis': 'Proactive support engagement will increase service revenue and customer satisfaction within the test group.'}

Use a combination of A/B testing platforms for digital experiments and matched-market testing for in-store initiatives. Track North Star Metric (CLV) and driver metrics (attachment rate, conversion rate, membership sign-ups) for all experiments.

A continuous, bi-weekly cycle of launching and analyzing digital tests. Quarterly review of larger, in-store or strategic pilot programs.

Growth Team

A cross-functional 'Growth' team, reporting to a Chief Customer or Chief Growth Officer. The team should be organized into pods focused on key parts of the customer journey (e.g., Acquisition Pod, Membership Pod, Services Pod).

Key Roles

- •

Head of Growth: Overall lead responsible for the North Star Metric.

- •

Data Scientist/Analyst: To analyze experiment results and uncover user behavior insights.

- •

Product Manager, Growth: To own the experimentation backlog and roadmap.

- •

Marketing Channel Experts: Specialists in SEM, CRM, etc., embedded within the team.

- •

Retail Operations Liaison: To ensure seamless execution of in-store experiments.

Establish a company-wide 'Experimentation Center of Excellence' to provide training, tools, and best practices for running valid tests. Foster a culture that rewards learning from both successful and failed experiments.

Best Buy has successfully navigated the existential threat of e-commerce to establish a strong, defensible omnichannel position. Its core growth foundation is solid, anchored by strong brand recognition and the unique competitive moat provided by the Geek Squad. However, the company is at a critical inflection point.

The consumer electronics market is mature and hyper-competitive, with margins on product sales under constant pressure from giants like Amazon and Walmart. Mere survival is not a growth strategy. Best Buy's future growth and market leadership will not come from selling more gadgets, but from embedding itself into the customer's technological life through services and support.

The most significant growth opportunities lie in two key areas:

1. Deepening Service Integration: The evolution of the My Best Buy membership program into a comprehensive service subscription is the central pillar of the growth engine. The strategy must be to transition customers from transactional hardware buyers to long-term service subscribers. Every initiative should be measured against its ability to drive adoption of the My Best Buy Total tier, as this is the primary vehicle for increasing Customer Lifetime Value (CLV).

2. Strategic Expansion into New Verticals: Best Buy Health represents the single largest vector for transformative growth. By leveraging its existing in-home service infrastructure (Geek Squad) to serve the massive and growing aging-in-place market, Best Buy can create a new, high-margin revenue stream that competitors cannot easily replicate. This is a bold but logical adjacency that plays to the company's unique strengths.