eScore

bunge.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Bunge's digital presence is sharply bifurcated; it excels in serving an investor and corporate audience with high-authority financial data and press releases, but severely underperforms in aligning with B2B customer search intent. The website lacks a robust content ecosystem around its solutions, ceding thought leadership and commercial query visibility to competitors. While its global reach is physically immense, this is not reflected in a localized or customer-centric digital strategy, and optimization for modern search behaviors like voice is not evident.

High content authority and domain strength for corporate and financial search queries, establishing credibility with investors and media.

Develop a comprehensive, customer-centric content strategy with dedicated 'Solutions' and 'Insights' hubs to capture commercial search intent and establish thought leadership in key B2B segments.

Brand communication is clear, consistent, and highly effective for its primary target audience: investors, particularly the post-merger message of enhanced scale. However, it fails to tailor messaging for commercial customers, lacking a narrative around solving their specific problems. The communication is overly rational, missing emotional connection, and does not substantiate its claim of being a 'solutions company' with tangible proof points or differentiated competitive messaging beyond scale.

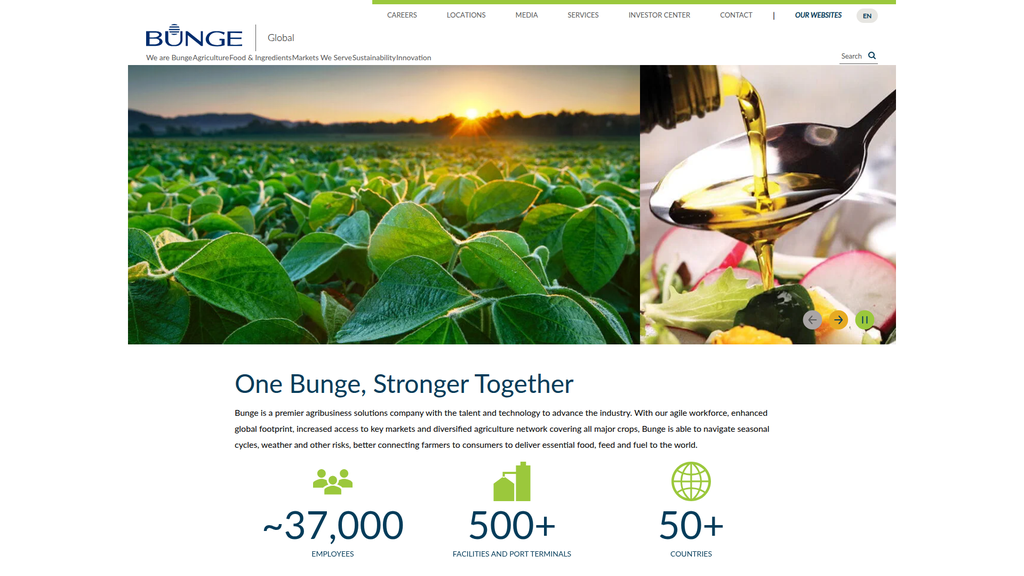

The core message of increased scale and strength post-Viterra merger ('One Bunge, Stronger Together') is communicated with exceptional clarity and consistency to the financial community.

Create customer-centric messaging frameworks for key industry segments (Food, Feed, Fuel) that translate the company's scale into specific, tangible benefits like supply chain resilience, risk mitigation, and sustainable sourcing.

The website is designed for information dissemination, not lead generation or conversion, which inherently lowers this score. The analysis reveals understated and inconsistent calls-to-action, creating friction for users who wish to delve deeper into specific content. While the site benefits from a low cognitive load and good mobile responsiveness, the lack of a formal web accessibility statement presents a significant business and compliance risk.

The clean, uncluttered user interface and logical information architecture provide a low cognitive load, allowing users to easily browse and find corporate information.

Conduct a full WCAG 2.1 AA accessibility audit and publish an accessibility statement to mitigate legal risk. Simultaneously, redesign key CTAs to use a visually prominent, solid-fill style to guide users more effectively to strategic content.

As a major publicly-traded company, Bunge's credibility is exceptionally high. The website reinforces this through a professional design, a dedicated investor center with transparent SEC filings, and comprehensive legal and compliance documentation. The company proactively reports on sustainability and supply chain transparency, which mitigates reputational risk. The primary weakness is a lack of customer-facing success evidence, such as case studies or testimonials.

Extensive third-party validation through its status as a major NYSE-listed company, coupled with a high degree of transparency for investors via its comprehensive 'Investor Center'.

Develop and prominently feature customer success stories or case studies that provide tangible proof of how Bunge's solutions create value, bridging the gap between corporate credibility and commercial proof.

Bunge's competitive advantage is immense and highly defensible, primarily due to the transformative merger with Viterra. This creates a nearly insurmountable moat based on economies of scale and a global, complementary physical asset network. This enhanced footprint provides unmatched origination capabilities and logistical efficiency. While the company's digital innovation narrative is weak, its operational scale and integrated supply chain create extremely high switching costs for customers.

The enhanced global asset network post-Viterra merger provides a highly sustainable competitive advantage through unmatched scale, geographic diversification, and control over the supply chain.

Develop and communicate a clear innovation story, showcasing investments in R&D, agri-tech partnerships, and digital tools to shift perception from a legacy commodity trader to a forward-thinking technology leader.

The company's scalability is inherent to its business model, where increased volume drives profitability across a high-fixed-cost asset base. Expansion potential is extremely high, driven by the Viterra merger which unlocks greater market access and the strategic pivot to serve the booming renewable fuels market. Analyst reports reflect confidence in this strategy, suggesting strong potential for future growth. The primary near-term constraint is the complexity of executing the massive integration.

Strong market expansion signals, evidenced by the Viterra merger and a clear strategic focus on capitalizing on the high-growth renewable fuels market.

Aggressively execute the post-merger integration plan to unlock projected synergies quickly, and develop a clear deleveraging strategy to ensure financial flexibility for future growth investments.

Bunge's vertically integrated business model is powerful and coherent, connecting origination directly to processing and distribution. The strategic decision to merge with Viterra demonstrates excellent market timing and a clear focus on strengthening its core competitive advantage of scale. While the revenue model is susceptible to commodity volatility, the company is actively optimizing its portfolio by divesting non-core assets and investing in higher-margin, high-growth areas like renewable fuels and specialty ingredients, showing strong strategic alignment.

Excellent market timing and strategic focus, demonstrated by the transformative Viterra merger, which directly addresses the industry trend of consolidation and enhances the core business model.

Accelerate the diversification into value-added revenue streams, such as specialty ingredients and sustainability-as-a-service offerings, to reduce earnings volatility and capture higher margins.

Following the merger, Bunge is an undisputed global market leader with immense market power. Its market share trajectory has been transformational, placing it on par with its largest competitors. This scale grants significant leverage with suppliers and a high degree of pricing power, moderated only by the global nature of commodity markets. The company's ability to shape market direction, influence logistics, and manage global trade flows solidifies its position as a dominant force in the agribusiness sector.

A rapidly growing market share trajectory due to the Viterra merger, solidifying its position within the global agribusiness oligopoly and granting immense supplier and partner leverage.

Leverage its enhanced market intelligence capabilities to become the definitive source for data-driven insights on global commodity markets, further solidifying its influence and thought leadership position.

Business Overview

Business Classification

B2B Agribusiness Solutions

Food & Ingredient Manufacturing

Agribusiness

Sub Verticals

- •

Grain & Oilseed Sourcing and Trading

- •

Food & Ingredient Processing

- •

Animal Feed Solutions

- •

Biofuels & Renewable Feedstocks

- •

Global Logistics & Supply Chain Management

Mature

Maturity Indicators

- •

Publicly traded company (NYSE: BG) with a long history since 1818.

- •

Extensive global footprint with over 500 facilities in more than 50 countries.

- •

Large-scale enterprise with approximately 37,000 employees.

- •

Recently completed a transformative, multi-billion dollar merger with Viterra, a major industry player.

- •

Consistent dividend payments for over two decades.

Enterprise

Steady with potential for acceleration post-merger

Revenue Model

Primary Revenue Streams

- Stream Name:

Agribusiness

Description:Core business segment involving the purchase, storage, transport, processing, and sale of agricultural commodities, primarily oilseeds (soybeans, rapeseed) and grains (wheat, corn). This includes processing oilseeds into vegetable oils and protein meals. This is the largest segment, representing approximately 72-73% of total revenue.

Estimated Importance:Primary

Customer Segment:Food Manufacturers, Animal Feed Producers, Biofuel Industry

Estimated Margin:Low to Medium

- Stream Name:

Refined and Specialty Oils

Description:Production and sale of packaged and bulk edible oil products, including oils, shortenings, margarines, and specialty fats derived from vegetable oil refining. This segment accounts for about 20-25% of revenue.

Estimated Importance:Secondary

Customer Segment:Food Processors, Food Service Companies, Retailers

Estimated Margin:Medium

- Stream Name:

Milling

Description:Production and sale of wheat flours, bakery mixes, and milled corn and rice products. Although Bunge has divested some corn milling assets, this remains a key global segment, contributing around 3-6% of revenue.

Estimated Importance:Tertiary

Customer Segment:Food Processing (Cereal, Snack, Bakery, Brewing), Food Service

Estimated Margin:Medium

Recurring Revenue Components

Long-term supply agreements with major food and feed manufacturers

Continuous global demand cycle for essential food, feed, and fuel

Pricing Strategy

Market-Based Pricing

Market Leader

Opaque to public, transparent via contracts

Monetization Assessment

Strengths

- •

Diversified revenue across multiple segments and geographies, reducing dependency on any single market.

- •

Vertically integrated model allows for capturing value across the entire supply chain.

- •

Scale and market leadership provide significant pricing power and operational efficiencies.

Weaknesses

- •

High exposure to volatile commodity prices, which can significantly impact revenue and margins.

- •

Susceptibility to geopolitical risks, trade policies, and climate-related disruptions to supply.

- •

Relatively low gross profit margins, particularly in the core Agribusiness segment.

Opportunities

- •

Realize significant cost synergies and enhanced market access from the Viterra merger.

- •

Capitalize on growing demand for renewable diesel feedstocks and plant-based proteins.

- •

Expand offerings in high-margin specialty ingredients and value-added sustainable solutions.

Threats

- •

Intense competition from other global agribusiness giants like ADM, Cargill, and Louis Dreyfus.

- •

Increased regulatory scrutiny regarding market concentration following the Viterra merger.

- •

Growing pressure from consumers and investors regarding ESG factors, particularly deforestation and climate impact.

Market Positioning

Global, Vertically Integrated Agribusiness Solutions Leader

Market Leader (Top Tier)

Target Segments

- Segment Name:

Global Food & Beverage Manufacturers

Description:Large multinational CPG companies, national food processors, and bakeries requiring a reliable, large-scale supply of processed ingredients like oils, fats, grains, and flours.

Demographic Factors

Enterprise-scale operations

Global or significant regional presence

Psychographic Factors

- •

Value supply chain reliability and consistency

- •

Increasingly focused on sustainability and traceability

- •

Risk-averse regarding supply disruptions

Behavioral Factors

- •

Engage in long-term supply contracts

- •

Require sophisticated risk management and hedging services

- •

Collaborate on new product development.

Pain Points

- •

Securing consistent quality and quantity of raw materials

- •

Managing commodity price volatility

- •

Meeting consumer demand for sustainable and traceable ingredients

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Animal Feed Producers

Description:Livestock and aquaculture industries requiring protein meals (e.g., soybean meal) as a primary component of animal feed.

Demographic Factors

Range from large integrated producers to regional feed mills

Psychographic Factors

Highly price-sensitive

Focused on nutritional content and feed conversion efficiency

Behavioral Factors

Bulk purchasing based on commodity market prices

Pain Points

Managing input cost volatility

Sourcing consistent protein content

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Biofuel & Renewable Energy Producers

Description:Companies producing renewable diesel and other biofuels that require agricultural feedstocks like vegetable oils and grains.

Demographic Factors

Energy sector companies, both established and new entrants

Psychographic Factors

Driven by government mandates and carbon reduction goals

Focus on feedstock efficiency and low carbon intensity

Behavioral Factors

Forming strategic partnerships and joint ventures for feedstock supply.

Pain Points

Securing a large, reliable supply of low-carbon feedstocks

Navigating complex regulatory environments

Fit Assessment:Good

Segment Potential:High

Market Differentiation

- Factor:

Unmatched Global Network & Scale

Strength:Strong

Sustainability:Sustainable

- Factor:

Vertically Integrated Supply Chain

Strength:Strong

Sustainability:Sustainable

- Factor:

Risk Management & Logistics Expertise

Strength:Strong

Sustainability:Sustainable

Value Proposition

Connecting farmers to consumers by leveraging a premier, integrated global network to deliver essential and sustainable food, feed, and fuel solutions.

Excellent

Key Benefits

- Benefit:

Supply Chain Reliability & Security

Importance:Critical

Differentiation:Unique

Proof Elements

Global network of 500+ facilities

Vertically integrated operations from farm to factory

- Benefit:

Global Market Access & Origination

Importance:Critical

Differentiation:Unique

Proof Elements

Post-Viterra merger, enhanced presence in key export regions like North America and Australia.

- Benefit:

Sustainable & Traceable Sourcing

Importance:Important

Differentiation:Somewhat unique

Proof Elements

Commitment to deforestation-free supply chains by 2025.

Public sustainability reports and partnerships.

Unique Selling Points

- Usp:

The combined scale and complementary geographic footprint of Bunge and Viterra, creating an unparalleled global agribusiness solutions platform.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Ability to provide end-to-end solutions, from origination and risk management to specialized processing and final delivery.

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Sourcing massive quantities of agricultural commodities with consistent quality.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Managing exposure to extreme price volatility in commodity markets.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Meeting increasing consumer and regulatory demands for sustainable and traceable products.

Severity:Major

Solution Effectiveness:Partial

Value Alignment Assessment

High

The business model is directly aligned with the fundamental global needs for food, animal feed, and renewable fuels. The focus on sustainability and efficiency addresses key market trends.

High

Bunge provides the scale, reliability, risk management, and increasingly, the sustainability assurances that its large B2B customers critically require.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Farmers and agricultural cooperatives

- •

Grain elevators and aggregators

- •

Logistics and shipping companies

- •

Technology partners (for traceability and efficiency)

- •

Financial institutions and commodity brokers

- •

Joint venture partners (e.g., in biofuels)

Key Activities

- •

Commodity Sourcing & Origination

- •

Processing & Refining (Oilseeds, Grains)

- •

Global Trading & Merchandising

- •

Supply Chain & Logistics Management

- •

Risk Management & Hedging

- •

Research & Development in food ingredients and sustainable practices.

Key Resources

- •

Global network of physical assets (processing plants, port terminals, silos).

- •

Extensive logistics and transportation infrastructure.

- •

Human capital: expert traders, agronomists, and supply chain managers.

- •

Significant financial capital and access to credit markets.

- •

Proprietary market intelligence and data analytics.

Cost Structure

- •

Cost of goods sold (primarily raw agricultural commodities)

- •

Logistics and freight costs

- •

Manufacturing and processing plant operating expenses

- •

Selling, General & Administrative (SG&A) expenses

- •

Interest expense on significant debt.

Swot Analysis

Strengths

- •

Enhanced global scale and diversified footprint following the Viterra merger.

- •

Vertically integrated business model provides control over the value chain.

- •

Deep expertise in risk management, crucial for navigating volatile commodity markets.

- •

Strong, long-standing relationships with both farmers and major global customers.

Weaknesses

- •

Significant debt load, increased by merger financing and recent bond offerings.

- •

Operational complexity of integrating Viterra's assets and corporate culture.

- •

Profitability is highly sensitive to commodity price cycles and processing margins.

- •

Exposure to currency fluctuations due to global operations.

Opportunities

- •

Drive significant growth through expanded capabilities in high-demand renewable fuel feedstocks.

- •

Leverage combined network to become the leader in providing certified sustainable and deforestation-free supply chains.

- •

Expand further into higher-margin, value-added specialty plant proteins and ingredients.

- •

Utilize digital technologies like blockchain for enhanced supply chain traceability and efficiency.

Threats

- •

Potential for anti-trust and regulatory challenges in key markets due to increased concentration.

- •

Climate change impacts on agricultural yields and supply chain disruptions.

- •

Global trade disputes and protectionist policies impacting commodity flows.

- •

Intense competition from well-capitalized peers (ADM, Cargill, Louis Dreyfus).

Recommendations

Priority Improvements

- Area:

Post-Merger Integration

Recommendation:Aggressively execute on the Viterra integration plan to swiftly realize projected cost synergies and operational efficiencies, focusing on cultural alignment and network optimization.

Expected Impact:High

- Area:

Capital Structure Management

Recommendation:Develop a clear deleveraging strategy to manage the increased debt load post-merger, ensuring financial flexibility while continuing to invest in strategic growth areas.

Expected Impact:High

- Area:

Digital Supply Chain

Recommendation:Accelerate investment in digital platforms for end-to-end supply chain visibility, leveraging data analytics and AI to improve forecasting, optimize logistics, and enhance traceability.

Expected Impact:Medium

Business Model Innovation

- •

Develop a premium 'Sustainability-as-a-Service' model, offering customers fully traceable, certified low-carbon or deforestation-free products, supported by verifiable data.

- •

Create a dedicated venture arm to invest in ag-tech and food-tech startups that can be integrated into the core business, particularly in areas of alternative proteins and regenerative agriculture.

- •

Platformize market intelligence and risk management services, offering them as a standalone digital product to smaller players in the food and agriculture ecosystem.

Revenue Diversification

- •

Expand the portfolio of high-margin specialty ingredients, moving further downstream from bulk commodities to custom-formulated solutions for food manufacturers.

- •

Build out services related to regenerative agriculture, offering agronomic support and market access for farmers, potentially monetizing the associated carbon credits.

- •

Further invest in joint ventures and partnerships in the renewable energy sector to secure long-term offtake agreements for low-carbon feedstocks.

Bunge's business model has undergone a strategic and transformational evolution with the successful merger of Viterra. This move solidifies its position as a top-tier global agribusiness titan, shifting its classification from a traditional commodity trader to a comprehensive 'Agribusiness Solutions Company.' The core model remains anchored in leveraging an immense, vertically integrated global network to source, process, and distribute essential agricultural commodities. Its primary strengths—unmatched scale, a diversified geographic and product footprint, and sophisticated risk management—are substantially amplified by the merger.

The primary strategic challenge lies in the execution of this massive integration. The company must navigate significant operational complexities and manage an increased debt load while simultaneously fending off intense competition and navigating volatile markets. However, the opportunities are compelling. Bunge is now uniquely positioned to capitalize on powerful secular trends, including the rapidly growing demand for renewable fuel feedstocks and the increasing market requirement for sustainable, traceable, and deforestation-free supply chains. Future success will be defined by its ability to not only realize merger synergies but also to innovate its business model—moving further into higher-margin, value-added ingredients and monetizing its sustainability credentials to create a durable competitive advantage in the 21st-century food system.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

High Capital Intensity

Impact:High

- Barrier:

Global Logistics and Supply Chain Networks

Impact:High

- Barrier:

Economies of Scale

Impact:High

- Barrier:

Regulatory Hurdles and Compliance

Impact:Medium

- Barrier:

Established Farmer and Customer Relationships

Impact:Medium

Industry Trends

- Trend:

Sustainability and Traceability

Impact On Business:Increasing demand for responsibly sourced products requires investment in transparent supply chains and sustainable practices to meet customer and regulatory expectations.

Timeline:Immediate

- Trend:

Digitalization and Agri-Tech Adoption

Impact On Business:Leveraging AI, IoT, and data analytics is crucial for optimizing supply chains, improving precision agriculture, and enhancing risk management.

Timeline:Immediate

- Trend:

Growth in Renewable Fuels and Bioenergy

Impact On Business:Creates significant opportunities for Bunge's oilseed processing segment, particularly in supplying feedstocks for renewable diesel and sustainable aviation fuel.

Timeline:Near-term

- Trend:

Market Consolidation

Impact On Business:As evidenced by the Bunge-Viterra merger, consolidation is key to achieving greater scale, efficiency, and geographic diversification to compete effectively.

Timeline:Immediate

- Trend:

Geopolitical Volatility and Food Security

Impact On Business:Heightens risks in global trade flows but also increases the value of diversified, resilient supply chains that can navigate disruptions and ensure food security.

Timeline:Immediate

Direct Competitors

- →

Cargill, Inc.

Market Share Estimate:Largest (by revenue, as a private company)

Target Audience Overlap:High

Competitive Positioning:The largest, most diversified global player with a massive private footprint across agriculture, food, financial, and industrial sectors.

Strengths

- •

Unmatched scale and global reach across 70 countries.

- •

Highly diversified business portfolio mitigates risk from any single segment.

- •

Private ownership allows for long-term strategic investments without public shareholder pressure.

- •

Strong capabilities in value-added ingredients and animal nutrition.

Weaknesses

- •

Massive size can lead to slower decision-making and less agility compared to more focused competitors.

- •

Private status means less transparency and public scrutiny, which can be a reputational risk.

- •

Has faced criticism regarding sustainability and environmental impact in its supply chains.

Differentiators

- •

Extreme diversification beyond pure agribusiness into financial services and industrial products.

- •

Deep expertise in risk management services offered to customers.

- •

Significant investment in R&D for higher-margin, value-added products.

- →

Archer Daniels Midland (ADM)

Market Share Estimate:Major Competitor

Target Audience Overlap:High

Competitive Positioning:A global leader with a strong focus on processing and value-added nutrition, positioning itself as a key ingredient and solutions provider.

Strengths

- •

Strong vertical integration from origination to processing and distribution.

- •

Leader in nutrition, including human and animal health, plant-based proteins, and flavorings.

- •

Extensive global network of processing plants and transportation assets.

- •

Strong focus on sustainability and biofuels.

Weaknesses

- •

Less geographically diversified in origination compared to the newly merged Bunge-Viterra.

- •

Recent accounting issues and internal investigations have created financial and reputational headwinds.

- •

Susceptible to commodity price volatility despite its processing focus.

Differentiators

- •

Deep focus on creating value-added products from agricultural commodities.

- •

Strong brand and innovation pipeline in the high-growth nutrition sector.

- •

Leader in corn processing for sweeteners and ethanol.

- →

Louis Dreyfus Company (LDC)

Market Share Estimate:Significant Competitor

Target Audience Overlap:High

Competitive Positioning:A global merchant with a strong heritage in commodity trading and merchandising, focusing on an efficient, integrated value chain.

Strengths

- •

Expertise in commodity trading and risk management.

- •

Comprehensive control over its agricultural value chain from farm to consumer.

- •

Strong presence in key commodities like cotton, coffee, sugar, and grains.

- •

Increasing investment in downstream processing and value-added solutions.

Weaknesses

- •

Smaller in scale and revenue compared to the other 'ABCD' giants, especially the merged Bunge.

- •

Less diversified into non-agricultural sectors than Cargill.

- •

As a privately held company, it has more limited access to public capital markets for large-scale investments.

Differentiators

- •

Strong focus on a farmer-centric and customer-centric approach to its value chain.

- •

Agile and entrepreneurial culture stemming from its long history as a family-controlled merchant.

- •

Strategic focus on digitalizing its supply chains to enhance efficiency and value.

Indirect Competitors

- →

COFCO International

Description:China's largest food and agriculture company. As a state-owned enterprise, it has significant strategic backing and is a major buyer and trader, integrating its operations globally to serve the Chinese market.

Threat Level:High

Potential For Direct Competition:Already a direct competitor in many areas, its influence is growing rapidly with strong state support.

- →

Agri-tech Startups (e.g., Pivot Bio, Indigo Agriculture)

Description:Technology-focused companies creating disruptive solutions in areas like microbial fertilizers, carbon markets, and supply chain transparency, potentially altering traditional relationships between farmers and agribusiness giants.

Threat Level:Medium

Potential For Direct Competition:Low, but they are disruptors that could shift value pools and change how Bunge interacts with its farmer suppliers.

- →

Large Food & CPG Companies (e.g., Nestlé, Danone)

Description:Major food manufacturers who are increasingly engaging in backward integration, establishing direct sourcing programs and investing in sustainable supply chains to secure raw materials and meet consumer demands for transparency.

Threat Level:Low

Potential For Direct Competition:Low, they are primarily customers, but their direct sourcing initiatives could bypass traditional intermediaries for certain commodities.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Enhanced Global Asset Network (Post-Viterra Merger)

Sustainability Assessment:Highly sustainable. The combined physical network of ports, processing plants, and grain elevators is a formidable, capital-intensive advantage.

Competitor Replication Difficulty:Hard

- Advantage:

Increased Origination Footprint

Sustainability Assessment:Highly sustainable. The merger provides a more balanced geographic footprint, particularly strengthening Bunge's access to North American and Australian origination, reducing dependency on South America.

Competitor Replication Difficulty:Hard

- Advantage:

Economies of Scale

Sustainability Assessment:Highly sustainable. The increased scale post-merger enhances purchasing power, lowers per-unit logistics costs, and improves operational efficiency.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'Post-Merger Integration Synergies', 'estimated_duration': "2-3 Years. The ability to realize cost savings and operational efficiencies provides a temporary financial advantage until fully priced into the market and potentially matched by competitors' own efficiency drives."}

Disadvantages

- Disadvantage:

Merger Integration Complexity

Impact:Major

Addressability:Moderately

- Disadvantage:

Dependence on Volatile Commodity Markets

Impact:Major

Addressability:Difficult

- Disadvantage:

Lower Profile in High-Margin Nutrition Segments

Impact:Minor

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Launch a unified branding and communications campaign highlighting the enhanced global network and farmer/customer benefits of the Bunge-Viterra merger.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Harmonize key digital systems for farmer-facing portals and customer order management to create a seamless initial experience.

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Invest heavily in supply chain digitalization to create end-to-end traceability solutions, offering premium 'sustainable and verified' products to CPG customers.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Expand capabilities in renewable fuel feedstocks by optimizing the combined oilseed crushing assets to serve the growing renewable diesel market.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Develop and scale a regenerative agriculture program that provides financial and agronomic incentives for farmers, creating a defensible source of low-carbon grain and oilseeds.

Expected Impact:High

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Diversify into adjacent value-added ingredient markets, such as plant proteins or specialty fats and oils, through targeted M&A or strategic partnerships.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Position Bunge as a leader in agricultural carbon markets, leveraging its direct relationships with millions of farmers to facilitate carbon sequestration and generate new revenue streams.

Expected Impact:Medium

Implementation Difficulty:Difficult

Position the new Bunge as the premier global agribusiness solutions company, emphasizing its unmatched, diversified origination network and its role as the most efficient and reliable partner for connecting farmers to global markets for food, feed, and fuel.

Differentiate through superior operational excellence and supply chain efficiency, leveraging the combined asset base. Further differentiate by offering customers unparalleled transparency and traceability in sustainable sourcing at a global scale.

Whitespace Opportunities

- Opportunity:

Develop a 'Sustainable Ag Solutions' platform for corporate clients.

Competitive Gap:While competitors offer sustainable products, a holistic platform providing traceable commodities, carbon insetting/offsetting services, and regenerative agriculture program management at scale is a gap.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Expansion into Biostimulants and Biological Inputs.

Competitive Gap:Major grain traders have not significantly entered the biologicals market, which is a fast-growing segment focused on sustainable yield improvement. This could be a new, high-margin revenue stream and strengthen farmer relationships.

Feasibility:Low

Potential Impact:High

- Opportunity:

Agri-Fintech Services for Farmer Network.

Competitive Gap:Competitors offer risk management products, but a dedicated fintech platform providing loans, insurance, and direct payment solutions integrated with grain purchasing could create a sticky ecosystem for farmer suppliers.

Feasibility:Medium

Potential Impact:Medium

The global agribusiness industry is a mature, oligopolistic market dominated by the 'ABCD' companies: ADM, Bunge, Cargill, and Louis Dreyfus. The recent merger of Bunge and Viterra is a seismic event, significantly increasing market concentration and catapulting the new Bunge into a stronger competitive position, particularly against the larger and more diversified Cargill.

The primary competitive battleground is shifting. While scale and efficiency remain paramount, key differentiators are now emerging in sustainability, supply chain traceability, and the creation of value-added products from raw commodities. Companies are increasingly competing on their ability to provide customers with sustainably sourced, low-carbon ingredients and to help them meet their ESG goals.

Bunge's merger with Viterra is a direct strategic response to this landscape. It dramatically enhances Bunge’s primary competitive advantage: its global asset network. By integrating Viterra's formidable grain origination strength in North America and Australia, Bunge has created a more geographically balanced and resilient supply chain, better equipped to serve global customers and compete head-to-head with Cargill's scale.

Key competitive dynamics are as follows:

- ADM competes by moving up the value chain, focusing heavily on processing and high-margin nutrition ingredients. Its strategy is less about pure origination scale and more about transforming commodities into specialized products.

- Cargill competes with its unparalleled diversification and private status, allowing it to weather market volatility and make long-term investments across a broad portfolio, from food and feed to financial and industrial products.

- LDC remains a formidable trading-focused merchant, leveraging its agility and deep market expertise to optimize its integrated value chain.

For Bunge, the immediate challenge and opportunity lie in successfully integrating Viterra to unlock projected synergies. Beyond integration, strategic imperatives include leveraging its enhanced network to lead in sustainable and traceable supply chains, expanding its role in the booming renewable fuels market, and exploring adjacent value-added markets to capture higher margins. The company's key disadvantage remains its relative under-exposure to the high-growth nutrition and ingredients sector compared to ADM. Addressing this, while solidifying its position as the world's premier origination and processing powerhouse, will define its long-term success.

Messaging

Message Architecture

Key Messages

- Message:

One Bunge, Stronger Together

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Banner

- Message:

Connecting farmers to consumers to deliver essential food, feed and fuel to the world.

Prominence:Secondary

Clarity Score:High

Location:Homepage Body, Footer

- Message:

A premier agribusiness solutions company.

Prominence:Tertiary

Clarity Score:Medium

Location:Homepage Body

The messaging hierarchy is dominated by the recent Viterra merger, encapsulated in 'One Bunge, Stronger Together'. This is a timely and critical message for investors and partners, establishing the company's new, enhanced scale. However, it overshadows the core mission ('Connecting farmers to consumers...'), which communicates broader, more enduring value. The term 'solutions company' is tertiary and lacks specific substantiation on the homepage, making it corporate jargon without clear customer benefit.

Messaging is highly consistent across the provided content. The tone is uniformly corporate and professional. The focus remains on scale, global reach, and financial performance, which aligns with the primary audience of investors and large-scale business partners.

Brand Voice

Voice Attributes

- Attribute:

Corporate & Professional

Strength:Strong

Examples

Bunge is a premier agribusiness solutions company...

We are reimagining the industry’s ability to sustainably deliver value for all stakeholders.

- Attribute:

Confident & Authoritative

Strength:Strong

Examples

We are stronger together. We are Bunge.

We have and unmatched global oilseeds footprint.

- Attribute:

Global

Strength:Strong

Examples

enhanced global footprint, increased access to key markets and diversified agriculture network...

500+ Facilities and Port Terminals in 50+ Countries

Tone Analysis

Formal

Secondary Tones

Informational

Financial

Tone Shifts

The tone shifts slightly to be more aspirational and employee-focused in the 'Culture & Values' and 'Careers' sections with phrases like 'Live the Possibilities at Bunge!' and 'We are passionate, bold and driven.'

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

As a newly expanded global powerhouse, Bunge offers unmatched scale, a diversified and integrated supply chain, and an enhanced global footprint to reliably and efficiently connect farmers to consumers with essential food, feed, and fuel.

Value Proposition Components

- Component:

Unmatched Global Scale

Clarity:Clear

Uniqueness:Unique

Notes:The merger with Viterra makes their scale a primary and unique differentiator against many competitors. This is communicated effectively with stats (500+ facilities, 50+ countries).

- Component:

Integrated Supply Chain

Clarity:Clear

Uniqueness:Somewhat Unique

Notes:The concept of connecting farmers to consumers is a common value proposition for major agribusiness firms like ADM and Cargill. Bunge's differentiation lies in the specific assets and reach of its newly combined network.

- Component:

Risk Mitigation through Diversification

Clarity:Somewhat Clear

Uniqueness:Somewhat Unique

Notes:This is implied through phrases like 'diversified agriculture network covering all major crops' and ability to 'navigate seasonal cycles, weather and other risks', but it is not explicitly stated as a core benefit for customers or partners.

- Component:

Stakeholder Value Creation

Clarity:Clear

Uniqueness:Common

Notes:Phrases like 'deliver greater value to all stakeholders' are standard corporate messaging, particularly for an investor audience.

Bunge's primary differentiation strategy, as communicated on the website, is its massive and newly enhanced scale following the Viterra merger. The messaging frames Bunge as a leading, if not the leading, global player. It's a 'bigger is better' argument, implying greater stability, reach, and efficiency. Differentiation on other vectors like innovation, sustainability, or customer partnership is underdeveloped in the homepage content.

The messaging squarely positions Bunge as a top-tier global agribusiness titan, on par with or exceeding historical competitors like ADM and Cargill. The Viterra merger is the central proof point for this claim, aimed at reshaping market perception of the company's competitive standing.

Audience Messaging

Target Personas

- Persona:

Investors & Financial Analysts

Tailored Messages

- •

One Bunge, Stronger Together

- •

Bunge Reports Second Quarter 2025 Results

- •

Bunge and Viterra Complete Merger to Create Premier Global Agribusiness Solutions Company

- •

We are now better positioned to deliver greater value to all stakeholders.

Effectiveness:Effective

- Persona:

Large Commercial Customers (Food, Feed, Fuel Producers)

Tailored Messages

enhanced global footprint, increased access to key markets and diversified agriculture network

better connecting farmers to consumers to deliver essential food, feed and fuel to the world.

Effectiveness:Somewhat Effective

- Persona:

Potential Employees (Corporate)

Tailored Messages

- •

Live the Possibilities at Bunge!

- •

We are passionate, bold and driven.

- •

Learn more about how you can grow your career at Bunge

Effectiveness:Effective

- Persona:

Farmers / Agricultural Producers

Tailored Messages

No itemsEffectiveness:Ineffective

Notes:The corporate site's messaging is not directed to farmers; it speaks about them in the context of the value chain. Direct engagement likely happens on regional or specialized B2B portals.

Audience Pain Points Addressed

Supply Chain Instability & Risk (Implicitly addressed by scale and diversification)

Market Access (Implicitly addressed by 'enhanced global footprint')

Audience Aspirations Addressed

Shareholder Value & Growth (For investors)

Career Advancement at a Global Leader (For potential employees)

Persuasion Elements

Emotional Appeals

- Appeal Type:

Appeal to Ambition/Pride

Effectiveness:Medium

Examples

We are stronger together. We are Bunge.

Live the Possibilities at Bunge!

Social Proof Elements

- Proof Type:

Scale & Authority

Impact:Strong

Notes:Demonstrated through large numbers: ~37,000 Employees, 500+ Facilities, 50+ Countries. This is the primary form of proof used.

- Proof Type:

Expertise (CEO Message)

Impact:Moderate

Notes:The message from the CEO acts as an authoritative statement on the company's direction and strength.

Trust Indicators

- •

NYSE: BG stock ticker

- •

Prominent display of financial press releases

- •

Detailed contact information for Investor and Media Relations

- •

Professional and modern website design

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

Read article

Location:Press Release sections

Clarity:Clear

- Text:

Find Jobs

Location:Careers section

Clarity:Clear

- Text:

Watch Now

Location:CEO Message section

Clarity:Clear

The CTAs are clear and functional for the website's primary purpose as a corporate information hub. They effectively guide specific audiences (investors, media, job seekers) to relevant content. There are no CTAs aimed at lead generation or direct sales, which is appropriate for this type of B2B corporate site.

Messaging Gaps Analysis

Critical Gaps

- •

Customer-Centric Messaging: The website fails to articulate the 'solutions' in its 'agribusiness solutions' positioning. There are no case studies, customer testimonials, or detailed descriptions of how Bunge helps its commercial customers solve problems or innovate.

- •

Sustainability Narrative: While sustainability is a critical theme in agribusiness, it is underdeveloped on the homepage. The message 'sustainably deliver value' is present but lacks the prominence and proof points (e.g., specific goals, progress reports) needed to be a compelling part of the core value proposition.

- •

Innovation & Technology: The role of technology and innovation in Bunge's operations—a key trend in the industry—is not a significant part of the core messaging.

Contradiction Points

No itemsUnderdeveloped Areas

The 'Why' Beyond Scale: The messaging effectively communicates the 'what' (a bigger, more integrated company) but is less effective at communicating the 'so what' for customers and society. Why does this increased scale matter beyond shareholder value?

Human Element: The narrative is very corporate. There is an opportunity to tell the human stories behind the supply chain—from the farmer to the end consumer—to build a stronger brand connection.

Messaging Quality

Strengths

- •

Clarity for Investors: The messaging is exceptionally clear and tailored to the financial community, effectively communicating the strategic rationale and impact of the Viterra merger.

- •

Consistency: The professional, authoritative voice is maintained consistently across the site, building a strong corporate brand identity.

- •

Communicates Scale: The website excels at conveying the immense scale and global reach of the new combined entity.

Weaknesses

- •

Overly Rational: The messaging relies almost exclusively on rational appeals (logos) of scale and financial performance, lacking emotional connection (pathos).

- •

Audience Imbalance: The heavy focus on investor messaging potentially alienates or fails to engage other important audiences, such as commercial customers or prospective partners.

- •

Lacks Tangible 'Solutions': The promise of being a 'solutions company' is not substantiated with concrete examples or evidence.

Opportunities

- •

Elevate Sustainability: Make sustainability a primary messaging pillar, not a tertiary one. Showcase specific initiatives, targets, and impacts to differentiate from competitors and appeal to ESG-conscious partners and investors.

- •

Develop Customer-Focused Content: Create a dedicated section for 'Solutions' or 'Industries' that details how Bunge's scale and expertise translate into tangible benefits for different customer segments.

- •

Humanize the Brand Narrative: Launch a content series that tells the story of the value chain, featuring farmers, employees, and communities to build a more relatable and trusted brand.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Value Proposition

Recommendation:Refine the hero section message to immediately translate the 'Stronger Together' concept into a customer benefit. For example: 'One Bunge, Stronger Together. Delivering unparalleled reliability and reach for the world's food, feed, and fuel supply chains.'

Expected Impact:High

- Area:

Customer-Centric Content

Recommendation:Develop a 'Markets We Serve' or 'Solutions' section with specific pages for Food, Feed, and Fuel customers. Detail the challenges faced by these industries and showcase how Bunge's integrated value chain provides solutions, using case studies or examples.

Expected Impact:High

- Area:

Sustainability Messaging

Recommendation:Create a prominent 'Sustainability' section in the main navigation. Use this section to feature a dynamic dashboard of progress against goals (e.g., deforestation-free supply chains), impact stories, and detailed reports. This would transform sustainability from a background statement to a core brand pillar.

Expected Impact:High

Quick Wins

- •

Add a 'Learn More About Our Sustainable Sourcing' CTA on the homepage.

- •

Incorporate key benefits for customers (e.g., 'Enhanced reliability', 'Greater market access') into the body text describing the Viterra merger.

- •

Add a sub-section under 'Learn more about Bunge' titled 'Our Solutions' that links to a new, dedicated page.

Long Term Recommendations

- •

Develop a comprehensive content strategy that balances the four key audiences: Investors, Customers, Employees, and Producers/Partners.

- •

Invest in brand storytelling that humanizes the global supply chain, showcasing the people and communities Bunge impacts.

- •

Integrate messaging about technology and innovation more deeply into the core narrative, positioning Bunge not just as a large company, but as a smart and forward-looking one.

Bunge's strategic messaging is currently in a post-merger consolidation phase, sharply focused on communicating strength, scale, and enhanced value to the investment community. The website effectively functions as a corporate headquarters portal, prioritizing financial news, corporate structure, and recruitment. The dominant message—'One Bunge, Stronger Together'—is a powerful and necessary declaration of its new market position after the landmark Viterra merger, aimed at reassuring stakeholders and recalibrating its competitive standing against rivals like ADM and Cargill.

The brand voice is consistently professional, authoritative, and global, which successfully builds a perception of a stable, powerful industry leader. However, this focus creates significant messaging gaps. The communication is heavily weighted toward a single stakeholder group (investors) at the expense of others, particularly commercial customers. The website clearly states what Bunge is—a massive, integrated agribusiness—but does a poor job of explaining how it delivers superior value and why that matters to its customers. The term 'solutions' is asserted but not demonstrated, representing a major missed opportunity to translate scale into tangible customer benefits.

Furthermore, critical industry themes like sustainability and technology innovation are underdeveloped. While mentioned, they are not woven into the core value proposition. In an era where ESG performance and tech-driven efficiency are paramount, this relegates Bunge to a more traditional, commodity-based positioning. To evolve, the messaging strategy must transition from being primarily a post-merger announcement to a multi-faceted narrative that engages all key audiences. This requires building out content that showcases customer solutions, elevates the sustainability story from a footnote to a headline, and humanizes the brand beyond corporate metrics. By doing so, Bunge can transform its messaging from simply declaring its new scale to proving its superior value in the marketplace.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Bunge is a long-established global leader in agribusiness, forming part of the 'ABCD' group of dominant global commodity traders (along with ADM, Cargill, Louis Dreyfus).

- •

The recent merger with Viterra creates a global titan, enhancing its scale and reach to be on par with its largest competitors.

- •

The company's purpose—'connecting farmers to consumers to deliver essential food, feed and fuel'—addresses fundamental, non-discretionary global needs.

- •

They operate a highly integrated, end-to-end value chain across more than 50 countries with over 500 facilities.

- •

Despite recent market volatility and lower earnings compared to record highs, the company maintains a solid strategic position and analyst confidence.

Improvement Areas

- •

Deepen integration with Viterra's grain origination network to create a more resilient and diversified supply chain, especially in North America and Australia where Viterra is strong.

- •

Accelerate expansion into higher-margin, value-added products (e.g., specialty oils, plant proteins) to reduce exposure to commodity price volatility.

- •

Leverage combined company data to enhance risk management, trading intelligence, and supply chain optimization.

Market Dynamics

Moderate, with a CAGR of approximately 4.6% for the broader agribusiness market. High-growth sub-segments like sustainable fuels and agricultural biologicals are growing much faster.

Mature

Market Trends

- Trend:

Increased demand for sustainable and traceable supply chains.

Business Impact:Creates opportunities for premium pricing and stronger partnerships with CPG companies, but requires significant investment in technology and compliance.

- Trend:

Rapid growth in renewable fuels (Renewable Diesel, Sustainable Aviation Fuel - SAF) driven by decarbonization mandates.

Business Impact:Significant growth vector for Bunge's oilseed processing segment, creating a large, non-food demand source for its products.

- Trend:

Adoption of AgTech, AI, and Precision Agriculture to boost yields and efficiency.

Business Impact:Opportunity to partner with or invest in AgTech to offer value-added services to farmers and improve own supply chain efficiency.

- Trend:

Geopolitical instability and climate change creating supply chain volatility and risk.

Business Impact:Favors large, globally diversified players like the newly merged Bunge-Viterra who can manage risk and re-route supply chains effectively.

- Trend:

Growing consumer demand for plant-based proteins and healthier, value-added ingredients.

Business Impact:Strategic imperative to shift product mix towards higher-margin specialty ingredients and away from pure commodity trading.

Excellent. The Viterra merger has created a more resilient and scaled platform at a time when global supply chain stability, food security, and sustainable fuel production are paramount.

Business Model Scalability

High

High fixed costs associated with physical assets (processing plants, port terminals, elevators), but highly scalable through volume increases and trading activities. The merger with Viterra enhances network density and asset utilization, improving scalability.

High. Small changes in processing margins or trading volumes can have a significant impact on profitability due to the large scale of operations.

Scalability Constraints

- •

Successful and timely integration of Viterra's operations and systems.

- •

Logistics infrastructure limitations (port capacity, rail, shipping).

- •

Navigating complex and varied international regulatory environments.

- •

Exposure to commodity price volatility and macroeconomic cycles.

Team Readiness

Strong. Experienced leadership team that has successfully navigated portfolio restructuring and is now leading one of the largest M&A integrations in the industry's history.

Evolving. The immediate challenge is the successful integration of two massive global organizations. A key priority will be to create a unified 'One Bunge' culture while retaining key regional and functional expertise from Viterra.

Key Capability Gaps

- •

Deep expertise in high-growth downstream markets like Sustainable Aviation Fuel (SAF) and advanced plant-based ingredients.

- •

Advanced data science and AI capabilities for predictive analytics in trading and supply chain management.

- •

Change management and large-scale systems integration expertise to ensure a smooth Bunge-Viterra merger.

Growth Engine

Acquisition Channels

- Channel:

Farmer Origination & Supply Chain Control

Effectiveness:High

Optimization Potential:High

Recommendation:Fully integrate Viterra's world-class grain gathering network, particularly in North America and Australia, to enhance direct sourcing capabilities and reduce reliance on third-party aggregators.

- Channel:

Strategic Account Management (Large CPG & Food Service)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Develop a unified, value-added solutions approach for key global accounts, co-creating products that meet sustainability and clean-label trends, moving beyond transactional commodity sales.

- Channel:

Mergers & Acquisitions

Effectiveness:High

Optimization Potential:Medium

Recommendation:Focus on disciplined 'bolt-on' acquisitions in high-growth areas (e.g., specialty ingredients, biofuels tech) post-Viterra integration to fill capability gaps.

Customer Journey

For a B2B giant, this is a long, complex sales and relationship management cycle involving RFPs, long-term contracts, and integrated logistics. The Viterra merger significantly strengthens the initial 'origination' part of this journey.

Friction Points

- •

Potential disruption and uncertainty for customers and suppliers during the post-merger integration phase.

- •

Fragmented communication and systems between the legacy Bunge and Viterra organizations.

- •

Complexity in navigating global trade compliance and regulations, which can delay shipments.

Journey Enhancement Priorities

{'area': 'Post-Merger Customer & Supplier Integration', 'recommendation': "Establish joint integration teams to create a seamless 'single point of contact' experience for all stakeholders, proactively communicating changes and ensuring business continuity."}

{'area': 'Digital Client Portal', 'recommendation': 'Invest in a unified digital platform for key accounts to manage contracts, track shipments, access traceability data, and manage risk, enhancing transparency and stickiness.'}

Retention Mechanisms

- Mechanism:

Long-Term Supply Agreements

Effectiveness:High

Improvement Opportunity:Embed value-added services like risk management, sustainability reporting, and joint product development into agreements to increase switching costs.

- Mechanism:

Integrated Physical Asset Network

Effectiveness:High

Improvement Opportunity:Optimize the combined Bunge-Viterra network to offer unparalleled logistical efficiency and reliability, creating a significant competitive moat.

- Mechanism:

Risk Management & Hedging Products

Effectiveness:Medium

Improvement Opportunity:Expand the suite of tailored financial and risk management products offered to both farmers (suppliers) and end-customers, creating deeper financial integration.

Revenue Economics

Dominated by processing margins (e.g., 'crush spread' for soybeans) and trading profits. Margins are typically thin on raw commodities but higher on value-added products. The key is massive volume and efficient asset utilization.

Not Applicable. This is a B2B enterprise model focused on long-term, high-volume contracts, not individual customer acquisition.

Moderate. Highly susceptible to commodity cycles and market volatility, as seen in recent earnings reports showing declines from peak years. The strategic imperative is to build more stable, higher-margin revenue streams.

Optimization Recommendations

- •

Drive for the ~$250 million in projected annual synergies from the Viterra merger to improve the cost base.

- •

Aggressively scale the production and sale of specialty oils, fats, and plant proteins which command higher and more stable margins.

- •

Secure long-term offtake agreements in the renewable fuels sector to lock in demand and de-risk investments.

Scale Barriers

Technical Limitations

- Limitation:

Integration of disparate IT, ERP, and Trading Systems

Impact:High

Solution Approach:Develop a phased but aggressive IT integration roadmap. Prioritize systems essential for trading, risk management, and supply chain visibility. Avoid a 'best of both' approach that creates complexity; choose a single platform and migrate.

Operational Bottlenecks

- Bottleneck:

Post-Merger Integration & Cultural Clash

Growth Impact:This is the single largest near-term barrier. A poorly managed integration could erase projected synergies and disrupt operations for years.

Resolution Strategy:Establish a dedicated Integration Management Office (IMO) with executive authority. Over-communicate the strategic vision and define a new, unified corporate culture early.

- Bottleneck:

Regulatory Scrutiny & Divestitures

Growth Impact:Regulatory bodies in key markets like Canada have raised competition concerns, potentially forcing asset sales that could compromise the merger's strategic rationale.

Resolution Strategy:Proactively engage with regulators to address concerns and strategically identify non-core assets for divestiture that satisfy regulators without harming the core network.

Market Penetration Challenges

- Challenge:

Intense Competition from ADM & Cargill

Severity:Critical

Mitigation Strategy:Leverage the new, larger scale to compete more effectively on price and logistical efficiency. Differentiate through superior execution of sustainability and traceability initiatives, which are increasingly important to large CPG customers.

- Challenge:

Commodity Price Volatility and Geopolitical Risk

Severity:Major

Mitigation Strategy:Utilize the combined entity's enhanced global footprint to create a more balanced and adaptable portfolio, reducing dependence on any single geography or crop. Enhance sophisticated trading and risk management capabilities.

Resource Limitations

Talent Gaps

- •

Commercial leaders with experience in high-growth, value-added ingredient markets.

- •

Technical experts in biofuel technology and plant-based protein formulation.

- •

Data scientists and quantitative analysts for advanced trading models.

Significant capital will be required for post-merger integration, upgrading facilities, and investing in new growth areas like biofuel and specialty protein plants.

Infrastructure Needs

Investment in digital infrastructure to unify platforms and enable advanced analytics.

Upgrades to port terminals and logistics to handle increased volumes and improve efficiency.

Growth Opportunities

Market Expansion

- Expansion Vector:

Deeper Penetration in North America & Australia

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Leverage Viterra's strong origination and domestic network in these regions, where Bunge was traditionally less dominant, to offer a more competitive end-to-end solution.

Product Opportunities

- Opportunity:

Become a key supplier to the Sustainable Aviation Fuel (SAF) and Renewable Diesel markets.

Market Demand Evidence:The SAF market is projected to grow exponentially, with some forecasts showing a CAGR of over 40-60%. Environmental regulations and airline commitments are driving massive demand.

Strategic Fit:Perfect. Directly leverages Bunge's core competency in oilseed processing, providing a high-growth demand stream for vegetable oils.

Development Recommendation:Form strategic partnerships with renewable fuel technology companies and secure long-term offtake agreements with airlines and energy majors to underwrite new investments.

- Opportunity:

Expand portfolio of value-added plant-based ingredients (proteins, specialty fats).

Market Demand Evidence:Sustained consumer trends toward healthier, sustainable, and plant-based foods are driving robust growth in the value-added ingredients market.

Strategic Fit:Strong. Moves Bunge up the value chain, capturing more margin and building stickier customer relationships.

Development Recommendation:Acquire smaller, innovative ingredient companies (like the CJ Selecta deal ) and invest in R&D and application labs to co-develop solutions with CPG customers.

- Opportunity:

Develop Carbon Farming & Regenerative Agriculture Services

Market Demand Evidence:Growing interest in agricultural carbon credits and corporate demand for verifiably sustainable supply chains.

Strategic Fit:Excellent. Leverages direct relationship with millions of farmers to offer services that help them sequester carbon and adopt sustainable practices, creating a new, asset-light revenue stream.

Development Recommendation:Pilot programs in key geographies (e.g., Brazil, US) in partnership with AgTech firms specializing in soil carbon measurement, reporting, and verification (MRV).

Channel Diversification

- Channel:

Digital Agribusiness Marketplace

Fit Assessment:Medium. This is a long-term, disruptive opportunity.

Implementation Strategy:Invest in or partner with emerging digital platforms that connect farmers directly to buyers, offering pricing transparency, logistics, and financing. This could disrupt traditional models but also offers a way to secure origination and build loyalty.

Strategic Partnerships

- Partnership Type:

Renewable Fuel Technology & Production

Potential Partners

- •

Neste

- •

TotalEnergies

- •

Gevo

- •

Emerging SAF/RD technology providers

Expected Benefits:Gain access to leading production technology, secure offtake for processed oils, and jointly develop integrated supply chains from farm to fuel.

- Partnership Type:

AgTech & Data Analytics

Potential Partners

- •

John Deere

- •

Trimble

- •

Farmers Business Network (FBN)

- •

AI-driven satellite imagery and analytics firms

Expected Benefits:Enhance supply chain visibility, improve yield forecasting, and provide data-driven insights as a value-added service to farmer suppliers.

Growth Strategy

North Star Metric

Adjusted Return on Invested Capital (ROIC)

For a capital-intensive business like Bunge, growth must be profitable and efficient. ROIC measures how effectively the company is using its massive asset base (both legacy and newly acquired) to generate earnings, aligning strategy with long-term shareholder value.

Increase ROIC by 200 basis points over the next 3 years through successful synergy capture and investment in higher-margin businesses.

Growth Model

Scale, Synergy & Value-Chain Extension

Key Drivers

- •

Successful Viterra integration and synergy realization.

- •

Increased asset utilization and logistical efficiency from the combined network.

- •

Shifting the product portfolio mix towards value-added ingredients and biofuels.

- •

Leveraging global scale to manage risk and capture arbitrage opportunities.

A centrally-led strategy focused on three core pillars: 1) Integration Excellence, 2) Value-Added Innovation, and 3) Sustainable Solutions.

Prioritized Initiatives

- Initiative:

Flawless Execution of Viterra Integration

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 months

First Steps:Finalize the structure and staffing of the Integration Management Office (IMO). Launch Day 1 readiness plans and establish clear communication channels for all stakeholders.

- Initiative:

Launch 'Bunge Sustainable Fuels' Business Unit

Expected Impact:High

Implementation Effort:Medium

Timeframe:6-9 months

First Steps:Appoint a dedicated leadership team. Announce a significant, long-term strategic partnership with a major airline or energy company to anchor the business.

- Initiative:

Expand Specialty Ingredients Portfolio via Bolt-on Acquisition

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:12-18 months

First Steps:Task the corporate strategy team to identify and vet potential acquisition targets in the plant-protein or specialty fats space with annual revenues of $100M-$500M.

Experimentation Plan

High Leverage Tests

- Test Name:

Carbon Farming Services Pilot

Hypothesis:We can create a new, profitable service line by offering farmers agronomic support, carbon MRV tools, and a pathway to sell carbon credits.

Key Metric:Farmer adoption rate; Revenue per acre.

- Test Name:

Dynamic Pricing for Traceable Commodities

Hypothesis:We can command a premium for fully traceable, sustainably-certified commodities by offering dynamic pricing through a digital portal to CPG customers.

Key Metric:Price premium achieved vs. benchmark; Customer adoption of the digital portal.

Utilize a stage-gate process. Pilot initiatives in a single geography, measure against pre-defined KPIs, and only scale up programs that demonstrate a clear path to positive ROIC.

Review pilot program results on a quarterly basis, with major 'go/no-go' decisions on scaling made annually.

Growth Team

A centralized 'Office of Strategy & Growth' reporting to the CEO, with three sub-teams: 1) M&A and Partnerships, 2) New Ventures (focused on incubating opportunities like sustainable fuels and carbon), and 3) Market Intelligence & Analytics.

Key Roles

- •

Chief Strategy Officer

- •

Head of New Ventures

- •

Director of Sustainable Fuels

- •

Head of M&A Integration

Actively recruit talent from outside the traditional agribusiness sector, specifically from renewable energy, specialty chemicals, and technology industries to bring in new perspectives and skills.

Bunge is at a transformational inflection point. The successful closure of the Viterra merger creates a global agribusiness powerhouse with the scale to compete head-to-head with industry leaders ADM and Cargill. The immediate and most critical priority is the flawless execution of this massive integration. Capturing the projected $250 million in synergies is paramount to justifying the deal and strengthening the company's financial foundation.

Beyond integration, Bunge's primary growth vectors lie in moving 'up the value chain.' The company is well-positioned to capitalize on two secular megatrends: the energy transition and the evolution of food consumption. The burgeoning demand for Renewable Diesel and Sustainable Aviation Fuel (SAF) provides a massive, high-growth outlet for Bunge's core oilseed processing output. Strategically pivoting to become a key enabler of the sustainable fuels industry is the single largest growth opportunity and should be pursued aggressively through partnerships and investment. Concurrently, continued expansion into higher-margin, value-added food ingredients like plant-based proteins and specialty fats will provide more stable, less cyclical revenue streams and insulate the business from pure commodity volatility.

The primary barriers to this growth trajectory are internal execution risk associated with the merger and external market volatility. The company must navigate significant operational and cultural integration challenges while contending with geopolitical risks, climate impacts on supply, and intense competition.

Recommendations are centered on a three-pronged strategy: Integrate, Innovate, and Extend. First, Integrate the Viterra assets with speed and precision to build a unified, efficient operational backbone. Second, Innovate by creating dedicated business units and forging partnerships in high-growth adjacencies like sustainable fuels and carbon markets. Third, Extend the value proposition to customers and suppliers by embedding technology, data, and sustainability services into core offerings. By successfully executing on this strategy, Bunge can transition from a traditional commodity trader into a premier, diversified solutions provider for essential food, feed, and fuel, unlocking significant long-term value.

Legal Compliance

Bunge provides a comprehensive 'Online Data Protection and Privacy Policy' accessible via the footer of its website. The policy details the types of personal data collected, the purposes for collection (e.g., fulfilling requests, compliance with legal obligations), and how it's shared with subsidiaries, affiliates, and service providers. It explicitly states it is not intended for children under 16. For EU residents, it references GDPR and outlines data subject rights such as access, rectification, and erasure, providing an email contact ([email protected]) for requests. A separate 'Privacy Notice for California Residents' is available, which addresses CCPA/CPRA requirements, including categories of personal information collected, consumer rights, and a toll-free number for requests, demonstrating a geographically-aware compliance strategy. However, the main policy could be more user-friendly; it's a dense legal document that may be challenging for the average user to navigate. The link in the footer is simply 'Privacy,' which is standard but could be more prominent.

Bunge's 'Terms and Conditions of Websites Use' (also labeled as 'Terms' in the footer) are accessible and detailed. The terms, last updated in May 2024, govern the general use of the website and establish a legal agreement with users. Key clauses include limitations of liability, disclaimers of warranties, use restrictions on website content, and an indemnification clause protecting Bunge from third-party claims arising from a user's breach. The terms specify that users must be at least 18 years of age. They also reserve the right to modify the terms at any time. The language is standard for a large corporation, clearly aimed at protecting the company from legal risk associated with the website's use. Specific business transactions, such as for commodities, are governed by separate, more detailed terms and conditions.

Upon visiting bunge.com, a prominent cookie consent banner appears. It provides 'Accept All Cookies' and 'Cookie Settings' options, which is a strong practice aligned with GDPR's requirement for granular consent. The 'Cookie Settings' allows users to toggle different categories of cookies (e.g., Performance, Targeting). The policy clearly explains what cookies are and lists the types used on the site. It correctly notes that non-essential cookies require user consent before being placed. However, the initial banner design subtly encourages clicking 'Accept All,' which is a common but legally scrutinized practice. The system appears to block non-essential cookies before consent is given, which is a key compliance strength. The overall mechanism demonstrates a solid understanding of modern cookie consent requirements under laws like GDPR.

Bunge demonstrates a mature approach to data protection, reflective of its global operations. The company has a dedicated 'Bunge Europe Business Partner Data Protection Notice' which explicitly mentions compliance with GDPR and outlines procedures for international data transfers, stating it uses appropriate safeguards. Security measures mentioned in the privacy policy include encryption of data in transit, identity and access management, and threat management. The availability of separate policies for different jurisdictions (like California) and business contexts (like for European partners) shows a sophisticated, risk-based approach rather than a one-size-fits-all policy. The company also provides a 'Compliance Helpline' for reporting violations of data protection, among other issues, which strengthens its internal governance framework.