eScore

carmax.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

CarMax demonstrates a highly mature digital presence, effectively leveraging its omnichannel strategy to bridge online research with in-store experiences. The company invests significantly in its digital platform, using data science and AI to personalize vehicle recommendations from its vast inventory. Its strong SEO and content strategy captures users across the buying funnel, from early-stage research to high-intent vehicle searches, positioning CarMax as a credible resource. While its overall digital footprint is strong, some competitors are perceived as more digitally native, indicating a small gap in optimizing a fully frictionless online-only transaction path.

Excellent alignment of digital content and tools with the entire customer journey, from awareness and research to consideration and purchase.

Increase investment in hyper-local and persona-based content (e.g., 'best commuter cars for Chicago') to capture more specific, high-intent long-tail search traffic and further dominate regional markets.

CarMax's brand messaging is a masterclass in clarity, consistently centered on trust, transparency, and a hassle-free experience. The 'no-haggle' pricing promise is a cornerstone of its communication, directly addressing a primary consumer pain point and building immediate trust. This core message is effectively supported by proof points like the 'CarMax Certified' quality promise, detailed vehicle history reports, and risk-reversal policies like the 10-day return guarantee. The brand voice is consistently reassuring and customer-centric, though it relies more on rational appeal than deep emotional storytelling.

Exceptional clarity and consistency in communicating a core value proposition of a transparent, trustworthy, and low-stress car buying experience.

Incorporate qualitative customer testimonials and narrative storytelling into homepage messaging to build a stronger emotional connection, complementing the existing, highly effective rational appeals.

CarMax has heavily invested in creating a seamless omnichannel conversion path, allowing customers to fluidly move between online and in-store activities. The website features prominent, clear calls-to-action for financing pre-qualification and vehicle discovery, with a well-organized visual hierarchy that guides users effectively. However, the analysis notes that information-dense vehicle detail pages can create a moderate cognitive load, and the final handoff between a customer's online journey and their in-store experience can have points of friction. The company's focus is on removing this friction to improve conversion.

A mature and flexible omnichannel experience that allows customers to complete as much or as little of the process online as they prefer, catering to a wide range of buying habits.

Reduce cognitive load on vehicle detail pages by introducing more interactive elements, such as tooltips for technical terms or collapsible content sections, to make the vast amount of information more digestible for users.

CarMax has built its entire brand on credibility, effectively mitigating consumer risk at every turn. Its 'no-haggle' pricing, 10-day return policy, and 90-day limited warranty are powerful trust signals that directly address common fears in the used car market. The company's commitment to transparency is further evidenced by providing free AutoCheck history reports and disclosing open safety recalls. This is backed by a mature legal and compliance framework, including a detailed digital accessibility statement, positioning CarMax as a highly reputable and low-risk choice for consumers.

A comprehensive suite of risk-reversal policies (10-day returns, 90-day warranty) that provides customers with significant peace of mind and powerfully differentiates the brand.

Integrate the open safety recall status directly onto the vehicle detail page (e.g., a clear 'Recall Status: Checked/Open') rather than just a link, to exceed compliance requirements and further enhance transparency.

CarMax's primary competitive advantage is its deeply integrated, at-scale omnichannel model, which is a significant and difficult-to-replicate moat. This hybrid 'click-and-mortar' approach, refined over decades, provides a superior experience to both online-only players who lack physical test drives and traditional dealers who lack digital sophistication. This is further strengthened by massive brand trust, proprietary sales data, and an in-house financing arm (CAF) that controls a key part of the value chain. The main disadvantage is a higher overhead cost structure compared to purely digital competitors.

The scaled and integrated omnichannel model, combining the convenience of a robust digital platform with the tangible assurance of a vast physical network for test drives, appraisals, and service.

More aggressively market the omnichannel model as a 'best of both worlds' advantage in campaigns that directly contrast the limitations of online-only retailers and the friction of traditional dealerships.

CarMax is a mature, enterprise-scale business with a steady growth trajectory, but its scalability faces constraints due to its physical footprint. Expansion is capital-intensive, and operational bottlenecks like vehicle reconditioning capacity and logistics can limit the pace of growth. However, the business model has significant potential for expansion into adjacent, high-margin services like comprehensive vehicle maintenance and repair, which could leverage the existing customer base and physical locations. The company has also demonstrated operational leverage by centralizing functions like its financing arm, CarMax Auto Finance.

Strong potential for capital-efficient growth by expanding into adjacent services (e.g., comprehensive vehicle maintenance, insurance) that leverage the existing physical footprint and customer trust.

Develop and pilot smaller-format, lower-cost physical locations for Tier 2 and Tier 3 markets to enable faster, more capital-efficient geographic expansion beyond major metro areas.

CarMax's business model is exceptionally coherent and resilient, built around a core offering of used vehicle sales and supplemented by high-margin, synergistic revenue streams. The integration of retail sales, wholesale auctions for non-retail-ready inventory, in-house financing (CAF), and extended protection plans creates a powerful ecosystem. This diversified model, centered on a clear value proposition of trust and transparency, aligns perfectly with its target audience of hassle-averse buyers. The strategic focus on the omnichannel experience shows a clear, well-executed vision that avoids feature creep and reinforces the core business.

A highly synergistic and diversified revenue model where in-house financing (CAF) and extended warranties directly support and enhance the profitability of the core retail sales operation.

Elevate the 'Sell to CarMax' vehicle acquisition arm to be a co-equal consumer brand, creating dedicated messaging on the homepage to more aggressively fuel its most critical and cost-effective inventory source.

As the largest used-car retailer in the U.S., CarMax holds significant market power and brand recognition. Its no-haggle pricing model is a form of institutionalized pricing power, allowing it to maintain margins without negotiation, though recent results show it is not immune to intense competition on price and eCommerce experience from rivals like Carvana and AutoNation. The company's scale provides considerable leverage with suppliers and enables its nationwide wholesale auction business, influencing a segment of the market directly. CarMax's ability to source a large portion of its inventory directly from consumers further insulates it from auction price volatility and strengthens its market position.

Market leadership and scale, which provide significant advantages in vehicle acquisition, brand recognition, and the ability to operate a proprietary, nationwide wholesale auction network.

Establish a public-facing 'CarMax Data Insights' hub, leveraging proprietary sales and pricing data to become the definitive authority on used car trends, thereby shaping market narratives and boosting brand authority.

Business Overview

Business Classification

Omnichannel Retail

Financial Services

Automotive

Sub Verticals

- •

Used Vehicle Sales

- •

Auto Financing

- •

Wholesale Vehicle Auctions

Mature

Maturity Indicators

- •

Established as the largest used car retailer in the United States.

- •

Extensive national physical footprint with over 240 stores.

- •

Strong brand recognition and reputation for no-haggle pricing.

- •

Facing significant competition from both traditional dealers and newer online-only platforms.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Used Vehicle Retail Sales

Description:Core revenue driver from the sale of used vehicles to consumers at a fixed, no-haggle price. Profit is generated from the spread between the vehicle acquisition cost and the retail selling price.

Estimated Importance:Primary

Customer Segment:All retail customers

Estimated Margin:Low-to-Medium

- Stream Name:

CarMax Auto Finance (CAF)

Description:Significant income generated from originating and servicing auto loans for CarMax customers. Revenue comes from the net interest margin, which is the spread between interest charged to consumers and the company's funding costs.

Estimated Importance:Secondary

Customer Segment:Retail customers requiring financing

Estimated Margin:High

- Stream Name:

Wholesale Vehicle Sales

Description:Revenue from selling vehicles that do not meet CarMax's retail standards to licensed dealers through on-site auctions. This is a crucial channel for inventory management.

Estimated Importance:Secondary

Customer Segment:Licensed auto dealers

Estimated Margin:Low

- Stream Name:

Extended Protection Plans (MaxCare)

Description:Sale of optional extended service plans that cover vehicle repairs beyond the standard 90-day warranty, providing a high-margin, ancillary revenue stream.

Estimated Importance:Tertiary

Customer Segment:Retail customers seeking risk mitigation

Estimated Margin:High

Recurring Revenue Components

Interest income from multi-year auto loans via CarMax Auto Finance.

Pricing Strategy

Fixed Pricing (No-Haggle)

Mid-range

Transparent (on vehicle price), Semi-transparent (on financing and add-ons)

Pricing Psychology

- •

Elimination of negotiation stress to build trust.

- •

Anchoring with estimated monthly payments.

- •

Social proof through customer testimonials.

- •

Risk reduction via included warranties and optional protection plans.

Monetization Assessment

Strengths

- •

Diversified revenue streams beyond just vehicle sales.

- •

High-margin contributions from finance (CAF) and extended warranties (MaxCare).

- •

Integrated model where sales, finance, and service create synergistic revenue opportunities.

- •

The no-haggle price model simplifies transactions and builds trust, potentially increasing conversion.

Weaknesses

- •

Lower gross margins on vehicle sales compared to some traditional dealers who profit from negotiation.

- •

Vulnerability to interest rate fluctuations which can impact CAF profitability and vehicle affordability.

- •

Fixed-price model may deter highly price-sensitive consumers who prefer to negotiate.

Opportunities

- •

Leverage data to offer more personalized financing and insurance products.

- •

Introduce subscription-based models for vehicle usage and maintenance.

- •

Expand post-sale service offerings beyond warranty work.

- •

Further monetize the wholesale channel with additional services for dealers.

Threats

- •

Economic downturns reducing consumer demand for vehicles and increasing loan defaults.

- •

Intense price competition from online-only retailers with lower overhead.

- •

Regulatory changes in auto lending and consumer finance.

Market Positioning

Positioned as the trusted, customer-centric leader in the used car market, offering a transparent, low-pressure, and flexible omnichannel experience.

Largest used vehicle retailer in the U.S., holding approximately 3.7% of the 0-10 year old used vehicle market.

Target Segments

- Segment Name:

The Hassle-Averse Buyer

Description:Consumers who value a simple, transparent, and negotiation-free car buying process. They are willing to pay a fair, fixed price to avoid the stress and uncertainty of traditional dealerships.

Demographic Factors

Broad age range (25-55)

Middle to upper-middle income

Psychographic Factors

- •

Values convenience and time

- •

Risk-averse

- •

Appreciates transparency

- •

Dislikes confrontation and haggling

Behavioral Factors

- •

Conducts extensive online research

- •

Prefers a structured, predictable process

- •

Likely to use in-house financing for simplicity

Pain Points

- •

Stress of price negotiation

- •

Distrust of traditional car salespeople

- •

Fear of hidden fees or unfair deals

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

The Quality-Conscious Shopper

Description:Buyers primarily concerned with the reliability and condition of a used vehicle. They are wary of buying a 'lemon' and seek assurances of quality and post-purchase support.

Demographic Factors

Often families or individuals making a significant long-term purchase

All income levels, but particularly those for whom a car is a critical asset

Psychographic Factors

- •

Prioritizes safety and reliability

- •

Seeks peace of mind

- •

Willing to pay a slight premium for a certified vehicle

Behavioral Factors

- •

Values detailed vehicle history reports

- •

Influenced by warranties and return policies

- •

Reads reviews and seeks third-party validation

Pain Points

- •

Fear of undisclosed vehicle damage or mechanical issues

- •

Worry about expensive, unexpected repairs after purchase

- •

Lack of recourse if the car has problems

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

The Omnichannel Consumer

Description:Modern shoppers who expect a seamless integration between online and physical retail experiences. They want the efficiency of online browsing and paperwork combined with the ability to see and test drive the vehicle in person.

Demographic Factors

Typically younger (20-45)

Digitally native

Psychographic Factors

- •

Values flexibility and control over their buying journey

- •

Expects efficiency and convenience

- •

Comfortable using digital tools for major purchases

Behavioral Factors

- •

Starts the journey online (browsing, financing pre-approval)

- •

May visit a store for a test drive and final purchase

- •

Uses mobile devices heavily throughout the process

Pain Points

- •

Disconnected online and in-store experiences

- •

Having to repeat steps or information at the dealership

- •

Limited online capabilities at traditional dealerships

Fit Assessment:Good

Segment Potential:High

Market Differentiation

- Factor:

Omnichannel Model at Scale

Strength:Strong

Sustainability:Sustainable

- Factor:

No-Haggle Pricing Policy

Strength:Strong

Sustainability:Sustainable

- Factor:

Integrated In-House Financing (CAF)

Strength:Strong

Sustainability:Sustainable

- Factor:

Brand Trust and Reputation

Strength:Strong

Sustainability:Sustainable

- Factor:

CarMax Certified Quality (125-point inspection)

Strength:Moderate

Sustainability:Sustainable

Value Proposition

CarMax provides a trusted, transparent, and stress-free way to buy, sell, and finance used cars through a seamless omnichannel experience, backed by quality guarantees and upfront, no-haggle prices.

Excellent

Key Benefits

- Benefit:

No-Haggle Pricing

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Upfront prices listed on website and in-store

Consistent company messaging for over 30 years

- Benefit:

Large Nationwide Selection

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Extensive online inventory

Ability to ship cars between stores

- Benefit:

10-Day Money-Back Guarantee

Importance:Important

Differentiation:Somewhat unique

Proof Elements

Explicitly stated on website and in marketing materials

- Benefit:

Included 90-Day Limited Warranty

Importance:Important

Differentiation:Somewhat unique

Proof Elements

Details of warranty coverage provided on vehicle pages

- Benefit:

Flexible Omnichannel Experience

Importance:Important

Differentiation:Unique (at their scale)

Proof Elements

Options to buy fully online, in-store, or a hybrid of both

Online financing pre-qualification tools

Unique Selling Points

- Usp:

The combination of a massive physical retail footprint with a fully integrated, mature online sales and financing platform.

Sustainability:Long-term

Defensibility:Strong

- Usp:

In-house financing arm (CAF) provides a strategic advantage in loan approvals and profitability, fully integrated into the sales process.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Decades-long brand reputation built on transparency and trust, which is difficult for newer competitors to replicate quickly.

Sustainability:Long-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

The stress, pressure, and time-consuming nature of haggling at traditional dealerships.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Fear of purchasing a poor-quality used car with hidden mechanical problems.

Severity:Critical

Solution Effectiveness:Partial

- Problem:

Lack of transparency in pricing and the financing process.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Inconvenience of the traditional car buying process, which often requires multiple long visits to a dealership.

Severity:Major

Solution Effectiveness:Partial

Value Alignment Assessment

High

CarMax's value proposition directly addresses the most significant pain points in the traditional used car market, aligning well with a large segment of consumers seeking trust and simplicity.

High

The proposition is exceptionally well-aligned with 'Hassle-Averse' and 'Quality-Conscious' buyers who prioritize a predictable, low-risk experience over achieving the absolute lowest price.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Wholesale auction houses (for vehicle acquisition)

- •

Automotive service and parts suppliers (for reconditioning)

- •

Third-party lenders (to supplement CAF)

- •

Edmunds (for digital content and market intelligence)

- •

Vehicle history report providers (e.g., AutoCheck)

Key Activities

- •

Vehicle Sourcing & Acquisition (from consumers, auctions, dealers)

- •

Vehicle Inspection & Reconditioning

- •

Inventory Management & Pricing

- •

Retail Sales (Online and In-Store)

- •

Auto Loan Origination & Servicing (CAF)

- •

Marketing & Brand Management

Key Resources

- •

National network of physical stores and reconditioning centers

- •

Large, owned vehicle inventory

- •

CarMax Auto Finance (CAF) subsidiary

- •

Proprietary vehicle pricing and sales data

- •

Established brand and customer trust

Cost Structure

- •

Cost of vehicle inventory acquisition

- •

Employee compensation and benefits (Sales, Technicians, Corporate)

- •

Selling, General & Administrative (SG&A) expenses

- •

Real estate and facility operating costs

- •

Marketing and advertising expenditures

- •

Technology and IT infrastructure costs

Swot Analysis

Strengths

- •

Market leader with strong brand recognition and trust.

- •

Proven and scaled omnichannel operating model.

- •

Integrated and profitable in-house financing arm (CAF).

- •

Vast proprietary dataset on vehicle pricing, sales, and credit performance.

- •

Large physical footprint serves as a competitive moat and logistics network.

Weaknesses

- •

Higher overhead cost structure compared to online-only competitors like Carvana.

- •

Slower to innovate and adapt than more agile, digital-native startups.

- •

No-haggle model can result in leaving margin on the table and deterring some customer segments.

- •

High reliance on debt to finance inventory and operations.

Opportunities

- •

Leverage AI and machine learning to optimize inventory, pricing, and loan underwriting.

- •

Expand into adjacent high-margin services like insurance, vehicle servicing, and parts.

- •

Grow market share in the expanding used Electric Vehicle (EV) market.

- •

Enhance the fully-online transaction experience to better compete with digital-native rivals.

- •

Introduce new ownership models, such as certified used-car leasing or subscription services.

Threats

- •

Intense competition from online-only retailers (Carvana, Vroom) and large dealership groups (AutoNation, Lithia).

- •

Macroeconomic factors such as rising interest rates, inflation, and recessions impacting vehicle affordability and loan performance.

- •

Volatility in used car prices affecting acquisition costs and retail margins.

- •

Disruption from new mobility solutions and changing consumer attitudes towards car ownership.

Recommendations

Priority Improvements

- Area:

Digital Customer Experience

Recommendation:Invest in streamlining the end-to-end online purchase process to achieve 'omnicost neutrality' and reduce friction, matching or exceeding the user experience of digital-native competitors.

Expected Impact:High

- Area:

Operational Efficiency

Recommendation:Continue leveraging technology and AI to optimize reconditioning processes, logistics, and inventory management to mitigate the cost disadvantages of a large physical footprint.

Expected Impact:Medium

- Area:

Data Monetization

Recommendation:More aggressively leverage proprietary sales and finance data to create highly personalized customer offers, improve credit risk modeling, and potentially offer data-as-a-service insights.

Expected Impact:Medium

Business Model Innovation

- •

Develop a 'CarMax Certified+' subscription service bundling the vehicle, insurance, maintenance, and warranty into a single monthly payment.

- •

Launch a trusted peer-to-peer marketplace, where CarMax acts as an intermediary, providing inspection, transaction security, and financing services for a fee.

- •

Create a dedicated business unit for fleet management and sales to small and medium-sized businesses.

Revenue Diversification

- •

Expand post-purchase vehicle servicing beyond reconditioning and warranty work, turning service centers into profit centers.

- •

Build out an in-house insurance brokerage to capture additional recurring revenue at the point of sale.

- •

Offer certified used vehicle leasing programs as an alternative to traditional financing, appealing to customers who prefer lower monthly payments.

CarMax has established a formidable position as the leading used vehicle retailer in the U.S. through a mature, omnichannel business model that successfully addresses key customer pain points of trust, transparency, and convenience. The company's core strength lies in its integrated ecosystem, where retail sales, wholesale auctions, and in-house financing (CAF) operate synergistically. This diversification provides resilience and multiple high-margin revenue streams that supplement the relatively low margins of direct vehicle sales. The no-haggle pricing strategy, once revolutionary, remains a cornerstone of its brand identity and continues to attract a large segment of the market that is averse to traditional dealership tactics.

However, CarMax's maturity and scale, while a strength, also present challenges. Its extensive physical footprint results in a higher cost structure compared to leaner, online-only competitors who have challenged CarMax's market share and forced significant investment in digital transformation. The primary strategic imperative for CarMax is to continue evolving its omnichannel experience to be as seamless and efficient as its digital-native rivals, while simultaneously leveraging its physical locations as a key differentiator for test drives, service, and immediate vehicle acquisition.

Future growth will depend on CarMax's ability to innovate beyond its current model. Key opportunities lie in leveraging its vast data assets for greater personalization, expanding into adjacent, high-margin services like comprehensive vehicle maintenance and insurance, and adapting to new market realities such as the growing prevalence of electric vehicles. While facing intense competition and macroeconomic headwinds, CarMax's strong brand, diversified revenue model, and integrated operational scale position it to maintain its leadership, provided it continues to invest in technology and adapt to changing consumer preferences for vehicle ownership and purchasing.

Competitors

Competitive Landscape

Mature

Moderately concentrated

Barriers To Entry

- Barrier:

High capital investment for inventory and physical locations

Impact:High

- Barrier:

Brand reputation and consumer trust

Impact:High

- Barrier:

Complex logistics for vehicle reconditioning, transportation, and storage

Impact:High

- Barrier:

Regulatory and licensing requirements at state and local levels

Impact:Medium

- Barrier:

Economies of scale in procurement, marketing, and operations

Impact:Medium

Industry Trends

- Trend:

Omni-channel retail model blending online and in-person experiences.

Impact On Business:Reinforces CarMax's existing hybrid model but requires continuous investment in digital tools to ensure a seamless customer journey.

Timeline:Immediate

- Trend:

Growth of the Electric Vehicle (EV) secondary market

Impact On Business:Creates new opportunities but also challenges related to battery health diagnostics, reconditioning expertise, and managing residual value uncertainty.

Timeline:Immediate

- Trend:

Data-driven decision making for pricing and inventory management

Impact On Business:Increases pressure to leverage proprietary data effectively to compete on price and vehicle acquisition against digitally native platforms.

Timeline:Immediate

- Trend:

Heightened consumer price sensitivity due to economic factors.

Impact On Business:Puts pressure on no-haggle pricing models and necessitates clear value communication beyond just the sticker price (e.g., quality certification, warranties).

Timeline:Near-term

- Trend:

Supply constraints on late-model used cars.

Impact On Business:Intensifies competition for acquiring high-quality inventory, potentially impacting margins and selection.

Timeline:Near-term

Direct Competitors

- →

AutoNation

Market Share Estimate:Largest or second-largest US auto retailer by revenue, often competing closely with CarMax and Lithia.

Target Audience Overlap:High

Competitive Positioning:Positions as America's largest and most recognized automotive retailer, offering a comprehensive suite of services for both new and used vehicles, including maintenance and parts.

Strengths

- •

Massive network of physical dealerships providing extensive service and repair capabilities.

- •

Diversified revenue streams from new cars, used cars, financing, and parts/service.

- •

Strong brand recognition and established relationships with manufacturers.

- •

Significant scale provides advantages in inventory management and cost efficiencies.

Weaknesses

- •

Less digitally native than online-only competitors.

- •

Traditional dealership model can be perceived as higher pressure by some consumers.

- •

Higher overhead costs associated with a vast physical franchise network.

- •

Brand perception is tied to the traditional dealership experience.

Differentiators

- •

Sells both new and used vehicles.

- •

Extensive after-sales service and parts network.

- •

Franchise dealership model.

- →

Carvana

Market Share Estimate:Significant player in the online-only used car market, though smaller than CarMax overall.

Target Audience Overlap:High

Competitive Positioning:Positions as the convenient, online-only way to buy a used car, with a 7-day money-back guarantee and as-soon-as-next-day vehicle delivery.

Strengths

- •

Strong brand identity built around a purely online, hassle-free experience.

- •

Innovative 'car vending machine' concept for vehicle pickup creates marketing buzz.

- •

Lower overhead costs compared to competitors with large physical retail footprints.

- •

100-day/4,189-mile warranty is slightly longer than CarMax's.

Weaknesses

- •

History of financial instability and significant losses.

- •

Widely reported issues with vehicle registration, titling, and delays.

- •

Inconsistent vehicle quality and inspection standards compared to CarMax.

- •

No physical locations for test drives or in-person customer service.

Differentiators

- •

Online-only sales model.

- •

As-soon-as-next-day home delivery.

- •

Car vending machines.

- →

Penske Automotive Group (CarShop)

Market Share Estimate:A major automotive retailer with a growing presence in the standalone used car market through its CarShop brand.

Target Audience Overlap:Medium

Competitive Positioning:A diversified international transportation services company with a focus on premium brands and a growing, data-driven used vehicle retail segment (CarShop).

Strengths

- •

Strong operational expertise and a disciplined, data-driven approach.

- •

Diversified business including commercial trucks and international operations.

- •

Growing network of used-only CarShop supercenters in the US and UK.

- •

Strong reputation and financial stability.

Weaknesses

- •

CarShop brand has lower name recognition than CarMax or Carvana.

- •

The used-only supercenter model is still smaller in scale compared to CarMax.

- •

Primarily known for its franchised new car dealerships, which can create brand confusion.

- •

Less emphasis on a singular, nationwide e-commerce brand experience.

Differentiators

- •

Focus on both premium/luxury franchise dealerships and standalone used car supercenters.

- •

Significant international presence.

- •

Strong foothold in the commercial truck industry.

- →

Vroom

Market Share Estimate:Minimal; has ceased e-commerce operations.

Target Audience Overlap:Low

Competitive Positioning:Formerly an online used car retailer, Vroom has pivoted away from e-commerce to focus on its automotive finance (UACC) and data analytics (CarStory) businesses after filing for bankruptcy.

Strengths

Owns United Auto Credit Corporation (UACC), providing a base in auto finance.

CarStory asset provides data analytics capabilities.

Weaknesses

- •

Failed business model in direct-to-consumer used car sales.

- •

Severe financial distress and bankruptcy filing.

- •

Negative brand perception due to operational failures and customer service issues.

- •

No longer a direct competitor in vehicle retail sales.

Differentiators

No longer sells cars directly to consumers online.

Indirect Competitors

- →

CarGurus / Autotrader / Cars.com

Description:Online automotive marketplaces and listing aggregators that connect consumers with thousands of new and used car dealers. They do not own the inventory but provide research tools and generate leads for dealers.

Threat Level:Medium

Potential For Direct Competition:Low

- →

Franchised & Independent Dealerships

Description:Traditional brick-and-mortar dealerships that sell new and used vehicles. They are increasingly adopting digital tools to create their own omni-channel experiences.

Threat Level:High

Potential For Direct Competition:High

- →

Peer-to-Peer Marketplaces (Facebook Marketplace, Craigslist)

Description:Online platforms that facilitate private party vehicle sales. These transactions lack the security, financing, warranties, and convenience offered by established retailers.

Threat Level:Medium

Potential For Direct Competition:Low

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Integrated Omni-Channel Model

Sustainability Assessment:CarMax's established network of physical stores for test drives, service, and trade-in appraisals, combined with a robust online platform, is a deeply integrated advantage that online-only players cannot easily replicate.

Competitor Replication Difficulty:Hard

- Advantage:

Brand Trust and Reputation

Sustainability Assessment:Over 30 years of operation has built significant brand equity centered on transparency and a no-haggle experience, which is difficult for newer, less consistent competitors to match.

Competitor Replication Difficulty:Hard

- Advantage:

Proprietary Data and Scale

Sustainability Assessment:As the largest used car retailer, CarMax possesses a massive dataset on vehicle pricing, sales, and reconditioning costs, allowing for sophisticated inventory and pricing strategies that are hard to duplicate.

Competitor Replication Difficulty:Hard

- Advantage:

In-house Financing (CarMax Auto Finance - CAF)

Sustainability Assessment:CAF allows CarMax to capture additional profit margin and control the customer financing experience, creating a seamless process and approving a wide spectrum of buyers.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'Favorable Inventory Mix', 'estimated_duration': 'Short-term (3-6 months)'}

Disadvantages

- Disadvantage:

Higher Overhead Costs

Impact:Major

Addressability:Difficult

Description:Maintaining a large physical retail and reconditioning footprint results in higher operational costs compared to online-only competitors, which can be reflected in vehicle pricing.

- Disadvantage:

No-Haggle Price Perception

Impact:Minor

Addressability:Moderately

Description:While a key differentiator, the no-haggle price can be perceived as higher than negotiable prices at traditional dealerships, potentially deterring price-sensitive shoppers.

- Disadvantage:

Pace of Digital Innovation

Impact:Major

Addressability:Moderately

Description:As a large, established company, CarMax may innovate on purely digital features (e.g., AI-driven personalization, augmented reality) more slowly than smaller, tech-focused startups.

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted marketing campaigns highlighting the "Love Your Car Guarantee" (30-day return policy) to directly counter the shorter return windows of competitors.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Feature customer testimonials that specifically compare CarMax's smooth omni-channel experience to the pain points of online-only or traditional dealer experiences.

Expected Impact:Medium

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Develop and prominently market a specialized EV certification program that includes a comprehensive battery health report and technicians trained in EV maintenance.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Expand MaxCare service plan offerings to be more competitive and cover EV-specific components, positioning it as a key value-add for post-purchase peace of mind.

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Invest in AI-powered personalization on the website and app to provide more tailored vehicle recommendations and financing options based on user behavior.

Expected Impact:High

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Explore strategic partnerships with EV manufacturers for certified pre-owned programs, becoming the trusted off-lease and trade-in partner.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Pilot a flexible vehicle subscription service as an alternative to ownership, leveraging the existing large inventory and service network.

Expected Impact:High

Implementation Difficulty:Difficult

Solidify CarMax's position as the most trusted and reliable omni-channel retailer in the used car market. Shift messaging from just 'no-haggle' to a holistic 'peace of mind' promise, encompassing certified quality, transparent pricing, flexible shopping options (online/in-store), and superior post-purchase support.

Differentiate through trust and quality assurance, especially in the growing used EV market. While competitors focus on pure digital convenience or a traditional dealer model, CarMax's unique advantage lies in its hybrid nature. This should be the cornerstone of its strategy, marketing the ability to 'Click and Mortar'—start online, but have the confidence of a physical location for test drives, inspections, and service.

Whitespace Opportunities

- Opportunity:

EV Battery Health Certification

Competitive Gap:No major used retailer has established a trusted, standardized certification for used EV battery health and remaining lifespan, which is a primary concern for buyers.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Integrated Ownership Experience

Competitive Gap:The market is fragmented for post-purchase services. CarMax could bundle extended warranties (MaxCare), routine maintenance, and potentially insurance into a single, predictable monthly payment at the point of sale.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Hyper-local Inventory Sourcing

Competitive Gap:While national inventory is a strength, there's an opportunity to better leverage data to acquire vehicles specifically in-demand in local markets, reducing transportation costs and meeting regional tastes more effectively than national-first competitors.

Feasibility:High

Potential Impact:Medium

CarMax operates as the established market leader in the mature and moderately concentrated used car retail industry. Its primary competitive advantage is a deeply integrated omni-channel model that competitors find difficult to replicate. This 'click-and-mortar' approach, refined over 30 years, combines the convenience of a robust online shopping experience with the trust and tangible benefits of a vast physical network for test drives, trade-ins, and service. This foundation has built significant brand equity centered on transparency and a low-pressure, no-haggle environment.

The competitive landscape is defined by two primary types of rivals. Direct competitors like AutoNation and Penske leverage large physical dealership networks but are often perceived as more traditional and less digitally native. On the other end, digitally native players like Carvana attempted to disrupt the market with an online-only model but have faced significant operational and financial challenges, reinforcing the value of CarMax's more stable, hybrid approach. The recent failure of Vroom's e-commerce model serves as a cautionary tale about the complexities of logistics and profitability in this sector.

The most significant industry trends are the rise of the omni-channel customer journey and the growing secondary market for electric vehicles. The omni-channel trend validates and reinforces CarMax's core strategy, while the EV market presents a critical whitespace opportunity. Currently, no competitor has established a trusted standard for certifying used EV battery health, a major point of anxiety for consumers. By pioneering a transparent and reliable EV certification process, CarMax can capture a new generation of buyers and solidify its reputation for quality and trust.

However, CarMax faces disadvantages in its high overhead costs compared to online-only players and a perception that its no-haggle prices may not be the absolute lowest available. To sustain its leadership, strategic focus must be on leveraging its core strengths. Recommendations include enhancing its digital personalization capabilities, aggressively marketing its superior return policy and warranty programs, and, most importantly, investing in becoming the definitive trusted source for used EVs. By fortifying its 'peace of mind' value proposition, CarMax can effectively counter both the pure-play online retailers and the traditional dealership networks.

Messaging

Message Architecture

Key Messages

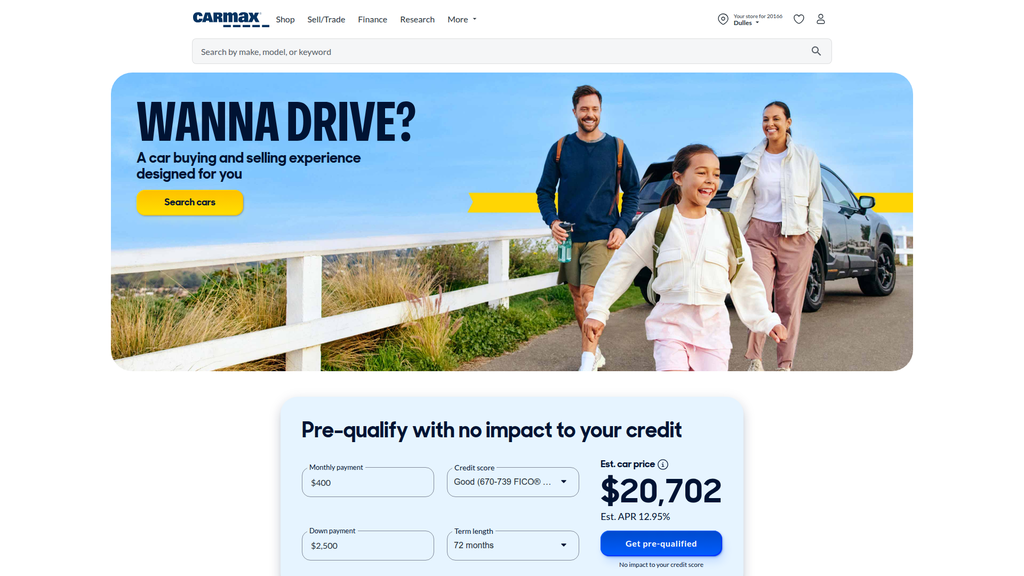

- Message:

A car buying and selling experience designed for you

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Section

- Message:

The CarMax difference

Prominence:Secondary

Clarity Score:High

Location:Homepage Mid-section

- Message:

Upfront prices, CarMax Certified quality, and detailed history reports on every car.

Prominence:Secondary

Clarity Score:High

Location:Under 'The CarMax difference'

- Message:

10-day returns and 90-day or 4,000 mile limited warranty

Prominence:Secondary

Clarity Score:High

Location:Under 'The CarMax difference'

- Message:

Pre-qualify with no impact to your credit

Prominence:Tertiary

Clarity Score:High

Location:Homepage Hero Section (Finance Tool)

The messaging hierarchy is logical and effective. The primary message establishes a customer-centric frame, immediately followed by tangible proof points ('The CarMax difference') that address common customer pain points in the used car market. Financial tools are present but don't overshadow the core value proposition of a better buying experience.

Messaging is highly consistent. The core themes of transparency (upfront pricing, history reports), quality assurance (Certified, 125-point inspection), and customer empowerment (returns, no-pressure help) are reinforced from the homepage to the individual vehicle detail pages, creating a cohesive and trustworthy brand narrative.

Brand Voice

Voice Attributes

- Attribute:

Reassuring

Strength:Strong

Examples

- •

No impact to your credit score

- •

10-day returns

- •

90-day or 4,000 mile limited warranty

- Attribute:

Customer-Centric

Strength:Strong

Examples

- •

A car buying and selling experience designed for you

- •

We provide no-pressure help along the way

- •

See your pre-qualified payments, upfront

- Attribute:

Straightforward

Strength:Strong

Examples

- •

Upfront prices

- •

How Does CarMax Work? Your Questions, Answered

- •

Shop online, in-store, or both.

- Attribute:

Helpful

Strength:Moderate

Examples

- •

Used car research & advice

- •

Finding the Best Commuter Car for You

- •

Explore trim levels and research for the Ford F150 Lightning

Tone Analysis

Trustworthy

Secondary Tones

Empowering

Practical

Tone Shifts

Shifts from a broad, welcoming tone on the homepage ('WANNA DRIVE?') to a more detailed, factual, and practical tone on the vehicle detail pages (listing specs, history, and warranty).

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

CarMax offers a transparent, trustworthy, and flexible way to buy and sell quality used cars, removing the traditional stress and uncertainty of the process through upfront pricing, certified quality, and customer-friendly policies.

Value Proposition Components

- Component:

No-Haggle, Upfront Pricing

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Quality Assurance (CarMax Certified, 125-point inspection)

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Risk Reduction (10-day returns, 90-day warranty)

Clarity:Clear

Uniqueness:Unique

- Component:

Omnichannel Flexibility (Shop online, in-store, or both)

Clarity:Clear

Uniqueness:Unique

- Component:

Transparent Financing

Clarity:Clear

Uniqueness:Somewhat Unique

CarMax effectively differentiates itself by directly addressing the biggest pain points of traditional car buying: opaque pricing, fear of buying a 'lemon', and high-pressure sales tactics. While competitors like Carvana also offer no-haggle pricing and online convenience, CarMax's key differentiator is its established omnichannel model ('Shop online, in-store, or both'). This hybrid approach appeals to a broader customer base, including those who want the ease of online research but still value the ability to see and test drive a car in person. The 10-day return policy is a powerful and unique risk-reversal tool that builds significant customer confidence.

The messaging positions CarMax as the established, reliable, and customer-first leader in the used car market. It frames itself as the antidote to the stressful traditional dealership experience and a more grounded, trustworthy alternative to online-only startups. The emphasis on physical locations and '30 years' of experience subtly positions them as more stable and dependable than newer, more volatile competitors.

Audience Messaging

Target Personas

- Persona:

The Cautious Pragmatist: A buyer who is risk-averse, distrustful of traditional dealerships, and does extensive research. They value security and peace of mind over getting the absolute lowest price.

Tailored Messages

- •

Upfront prices

- •

CarMax Certified quality

- •

125-point inspection

- •

View History Report

- •

10-day returns

Effectiveness:Effective

- Persona:

The Convenience Seeker: A busy individual who values a streamlined, efficient process. They are comfortable with online tools but may still want the option of an in-person experience.

Tailored Messages

- •

A car buying and selling experience designed for you

- •

Shop online, in-store, or both

- •

Get pre-qualified

- •

Test drive first with no obligation, or start buying online

Effectiveness:Effective

Audience Pain Points Addressed

- •

Haggling and price negotiations.

- •

Distrust of dealerships and salespeople.

- •

Fear of buying a vehicle with hidden problems.

- •

Time-consuming and stressful purchasing process.

- •

Opaque and confusing financing.

- •

Buyer's remorse or making the wrong choice.

Audience Aspirations Addressed

- •

Feeling confident and in control of the car buying process.

- •

A simple, hassle-free experience of getting a car.

- •

Owning a reliable vehicle without overpaying or being taken advantage of.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Peace of Mind / Anxiety Reduction

Effectiveness:High

Examples

- •

10-day returns

- •

90-day or 4,000 mile limited warranty

- •

No impact to your credit score

- •

No flood or frame damage

- Appeal Type:

Trust and Credibility

Effectiveness:High

Examples

- •

Driven by happy customers for over 30 years

- •

CarMax Certified quality

- •

AutoCheck® vehicle history report

Social Proof Elements

- Proof Type:

Customer Showcase (User-Generated Content)

Impact:Moderate

Examples

The homepage carousel of Instagram photos from customers with their new cars.

- Proof Type:

Third-Party Validation

Impact:Strong

Examples

Reported by AutoCheck®

Trust Indicators

- •

Explicit warranty details

- •

125-point inspection list

- •

Free vehicle history reports

- •

Upfront pricing and financing information

- •

'Over 30 years' in business

Scarcity Urgency Tactics

None observed. The messaging focuses on a low-pressure environment, and the absence of these tactics reinforces that brand promise.

Calls To Action

Primary Ctas

- Text:

Search cars

Location:Homepage Hero Section

Clarity:Clear

- Text:

Get pre-qualified

Location:Homepage Finance Tool & Vehicle Detail Page

Clarity:Clear

- Text:

Get Started

Location:Vehicle Detail Page (for shipping/pickup)

Clarity:Somewhat Clear

- Text:

View History Report

Location:Vehicle Detail Page

Clarity:Clear

The CTAs are generally clear, well-placed, and logically guide the user through the primary conversion funnels of searching for a car and arranging financing. The language is direct and action-oriented. The CTA 'Get Started' on the vehicle page could be more specific (e.g., 'Reserve for Test Drive' or 'Start Online Purchase') to better set user expectations.

Messaging Gaps Analysis

Critical Gaps

Lack of compelling customer stories or testimonials with text. The Instagram photo wall is a good start, but lacks the narrative depth to build a strong emotional connection.

The value proposition for selling a car to CarMax is not prominently featured on the homepage, despite being a primary navigation item ('Sell/Trade').

Contradiction Points

No itemsUnderdeveloped Areas

Storytelling around the 'Why'. The brand mission of 'driving integrity' is powerful but not explicitly communicated through a brand story on the site. Messaging is very focused on the 'what' and 'how'.

Competitive differentiation is implied rather than stated. There's an opportunity to more directly message why their omnichannel model is superior to online-only or traditional dealer options.

Messaging Quality

Strengths

- •

Exceptional clarity in communicating the core value proposition.

- •

Directly addresses and neutralizes major customer pain points in the used car industry.

- •

Consistent reinforcement of trust, transparency, and quality across all pages.

- •

Brand voice is customer-centric and reassuring, which is perfectly aligned with the business model.

Weaknesses

- •

Messaging is highly functional and rational, with limited emotional storytelling.

- •

Social proof could be strengthened with qualitative testimonials instead of just images.

- •

The 'Sell to us' journey and its value proposition are secondary in the homepage messaging hierarchy.

Opportunities

- •

Develop a content strategy around customer success stories, detailing how the CarMax model solved their problems and alleviated their anxieties.

- •

Create messaging that explicitly highlights the 'best of both worlds' advantage of their omnichannel approach (online convenience + in-person confidence).

- •

Elevate the 'Sell My Car' messaging on the homepage to attract more inventory directly from consumers, a key business objective for used car retailers.

Optimization Roadmap

Priority Improvements

- Area:

Social Proof

Recommendation:Incorporate short, powerful text testimonials alongside the customer photos in the homepage carousel. Focus on quotes that highlight overcoming previous bad experiences or the ease of the process.

Expected Impact:High

- Area:

Value Proposition

Recommendation:A/B test homepage headlines that are more benefit-oriented and emotional. For example, 'The stress-free way to buy your next car' or 'Car buying with confidence. And a 10-day money-back guarantee.'

Expected Impact:Medium

- Area:

Seller Journey

Recommendation:Add a dedicated messaging block on the homepage that clearly communicates the value proposition of selling a car to CarMax (e.g., 'Get a real offer in minutes. Leave with payment today.').

Expected Impact:High

Quick Wins

Change the CTA 'Get Started' on the vehicle detail page to a more descriptive CTA like 'Set up Test Drive / Home Delivery'.

Add the '125-point inspection' and '10-day returns' icons near the primary price on the vehicle detail page to reinforce value at the point of consideration.

Long Term Recommendations

Develop a brand campaign centered on the theme of 'Integrity in Every Interaction,' using video testimonials and narrative content to bring the company mission to life.

Build out the 'Research' section to become a definitive resource for anxious car buyers, creating content that addresses their fears and positions CarMax as the trustworthy guide, thereby improving top-of-funnel customer acquisition.

CarMax's strategic messaging is a masterclass in clarity, consistency, and addressing customer pain points. The entire digital experience is built around a core value proposition of a transparent, trustworthy, and low-stress alternative to traditional car buying. The message architecture is logical, prioritizing a customer-centric promise and immediately supporting it with tangible proof points like 'Upfront prices,' 'CarMax Certified quality,' and a '10-day return' policy. This directly mitigates the primary anxieties—price haggling, vehicle quality, and buyer's remorse—that plague the used car market, thereby lowering the barrier to customer acquisition. The brand voice is consistently reassuring and straightforward, which builds trust and aligns perfectly with its business model.

From a competitive standpoint, the messaging effectively positions CarMax as the reliable incumbent. Its key differentiation lies in its unique omnichannel model ('online, in-store, or both'), which offers a 'best of both worlds' solution that purely online competitors like Carvana cannot match. This is a critical advantage for customers who still value physical interaction and test drives. However, the messaging is heavily rational and functional. A significant opportunity exists to layer in more emotional storytelling. While the 'happy customers' photo carousel provides visual social proof, it lacks the narrative depth of actual testimonials that could forge a stronger connection with prospective buyers. Furthermore, the value proposition for customers looking to sell their cars is underdeveloped in the primary messaging, representing a missed opportunity to more aggressively source consumer inventory. The optimization roadmap should focus on enhancing emotional connection through customer stories and elevating the visibility of the car-selling proposition to drive both sides of its business model.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Established as the largest used car retailer in the United States, indicating significant market acceptance.

- •

Pioneered and maintains a 'no-haggle,' transparent pricing model which directly addresses a major consumer pain point in car buying.

- •

Strong brand reputation built over 30+ years on trust, quality (CarMax Certified), and customer-centric policies like 10-day returns and a 90-day warranty.

- •

Fiscal year 2024 revenues of $27.1 billion and retail used unit sales of over 770,000 demonstrate significant demand and operational scale.

- •

An integrated omnichannel model (online + in-store) caters to modern consumer preferences for both digital convenience and physical vehicle inspection.

Improvement Areas

- •

Enhancing the end-to-end digital purchase experience to better compete with online-only rivals like Carvana.

- •

Expanding post-purchase service offerings to build longer-term customer relationships beyond the initial sale.

- •

Developing specialized value propositions for the growing used Electric Vehicle (EV) market, such as battery health certification.

Market Dynamics

Moderate. The global used car market is expected to grow at a CAGR of 6.0% from 2025 to 2030. The US market specifically is forecasted to see a modest increase of about 1% in used vehicle sales in 2025.

Mature

Market Trends

- Trend:

Omnichannel Experience is King

Business Impact:CarMax's hybrid model is well-positioned, but consumer expectations for a seamless online-to-offline journey are increasing, requiring ongoing investment in technology and process integration.

- Trend:

Growing Used EV Market

Business Impact:Presents a significant growth opportunity but also challenges related to battery health assessment, technician training, and managing residual value uncertainty.

- Trend:

Vehicle Affordability Concerns

Business Impact:High interest rates and inflation pressure consumer demand. CarMax's in-house financing (CAF) and broad inventory at various price points are key assets, but market headwinds can slow growth.

- Trend:

Data & AI in Automotive Retail

Business Impact:Competitors are using AI for inventory management and personalized marketing. CarMax must continue investing in its data analytics capabilities to maintain its pricing and valuation edge.

Favorable, but with urgency. The market is stable but undergoing a fundamental shift towards digitization and electrification. CarMax has the brand and scale to lead this transition, but must innovate at pace with more agile, tech-first competitors.

Business Model Scalability

Medium

High fixed costs associated with physical stores, reconditioning centers, and inventory. This provides a barrier to entry but can hinder rapid, capital-efficient scaling compared to online-only models.

Moderate. Leverage is achieved through centralized functions like CarMax Auto Finance (CAF), national marketing, and large-scale vehicle acquisition. However, each new physical location requires significant capital expenditure and operational ramp-up.

Scalability Constraints

- •

Physical store footprint: Expansion is capital-intensive and time-consuming.

- •

Vehicle reconditioning capacity: The ability to inspect and prepare cars for sale is a physical bottleneck.

- •

Logistics and transportation: Moving a vast inventory of cars between stores and to customers is complex and costly.

- •

Sourcing quality used-car inventory, especially with pandemic-era supply chain disruptions impacting the availability of newer used cars.

Team Readiness

Strong. As a long-standing public company, the leadership team is experienced in managing large-scale retail operations, finance, and logistics.

Mature and functional for a large retailer. However, it may need to evolve to foster greater agility and a tech-centric culture to compete with digital disruptors.

Key Capability Gaps

- •

Software Product Management: Deep expertise in building best-in-class, consumer-facing digital products.

- •

Data Science & AI: Advanced capabilities for personalization, logistics optimization, and dynamic pricing beyond current levels.

- •

EV Technical Expertise: Specialized technicians and appraisers focused on electric vehicle batteries and systems.

Growth Engine

Acquisition Channels

- Channel:

Brand Marketing & Direct Traffic

Effectiveness:High

Optimization Potential:Medium

Recommendation:Leverage strong brand recognition to create more top-of-funnel content around car ownership topics, not just buying/selling, to capture customers earlier in their journey.

- Channel:

SEO/SEM

Effectiveness:High

Optimization Potential:Medium

Recommendation:Optimize for long-tail keywords related to specific used car comparisons, financing questions, and EV ownership to capture high-intent traffic. The 'Research' section of the website is a good foundation for this.

- Channel:

Physical Stores/Walk-ins

Effectiveness:High

Optimization Potential:Low

Recommendation:Continue to optimize the in-store experience as a key differentiator, focusing on the seamless transition from online research to in-person test drives and purchase.

- Channel:

Vehicle Acquisition (Sell to CarMax)

Effectiveness:High

Optimization Potential:Medium

Recommendation:This is a critical, low-cost acquisition channel for both inventory and customers. Streamline the online appraisal and in-person drop-off process to be best-in-class for convenience.

Customer Journey

Well-defined omnichannel path. Customers can seamlessly move from online research and pre-qualification to in-store test drives and purchase. The website clearly presents financing options, vehicle history, and transfer options.

Friction Points

- •

Vehicle transfer fees and logistics can create friction and decision paralysis for customers interested in cars at distant locations.

- •

Handoff between online engagement (chat, pre-qualification) and in-store associates can be disjointed.

- •

The financing application, while streamlined, remains a complex part of the journey with potential for drop-off.

Journey Enhancement Priorities

{'area': 'Online to Offline Handoff', 'recommendation': "Implement a system where in-store associates have full context of a customer's online activity (viewed cars, financing status) to create a more personalized and efficient store visit."}

{'area': 'Test Drive Experience', 'recommendation': "Experiment with 'test drive at home' options in key markets to compete with the convenience offered by online-only players."}

Retention Mechanisms

- Mechanism:

Positive Brand Experience & Repeat Business

Effectiveness:Medium

Improvement Opportunity:Proactively market to past customers when they are likely to be back in the market for a car (e.g., 4-5 years post-purchase) with personalized offers.

- Mechanism:

MaxCare Extended Service Plans (EPP)

Effectiveness:Medium

Improvement Opportunity:Integrate MaxCare more deeply into a broader 'CarMax Ownership' ecosystem, potentially bundling it with other services like maintenance or insurance.

- Mechanism:

CarMax Auto Finance (CAF)

Effectiveness:High

Improvement Opportunity:Offer refinancing options or loyalty rate discounts to repeat customers who finance through CAF, strengthening the financial relationship.

Revenue Economics

Strong and resilient. CarMax maintains healthy gross profit per unit (GPU) in both retail and wholesale channels, demonstrating effective pricing and cost management even in challenging market conditions.

Difficult to calculate precisely for this industry, but likely healthy given the high transaction value. The focus should be on increasing LTV by adding recurring revenue streams post-sale.

High. The business model, with its integrated finance and service plan arms, is highly efficient at maximizing revenue per transaction.

Optimization Recommendations

- •

Develop and scale a post-purchase vehicle service business to create a recurring revenue stream and increase customer lifetime value.

- •

Explore offering branded insurance products at the point of sale, capturing another high-margin ancillary revenue stream.

- •

Optimize vehicle transportation logistics using data analytics to reduce the costs associated with moving inventory nationwide.

Scale Barriers

Technical Limitations

- Limitation:

Legacy Systems Integration

Impact:Medium

Solution Approach:Continue migrating to a modern, API-first architecture to enable faster feature development and seamless integration between online platforms, in-store systems, and logistics.

Operational Bottlenecks

- Bottleneck:

Vehicle Reconditioning Throughput

Growth Impact:Directly limits the number of vehicles that can be made available for sale, capping revenue potential.

Resolution Strategy:Invest in technology and process optimization within reconditioning centers. Explore partnerships with certified third-party repair shops for overflow capacity.

- Bottleneck:

Inventory Sourcing & Acquisition

Growth Impact:Tight supply of desirable late-model used cars can constrain inventory and increase acquisition costs.

Resolution Strategy:Double down on the 'Sell to CarMax' program with enhanced marketing and an even more streamlined customer experience. Build out partnerships with large fleet operators for vehicle acquisition.

- Bottleneck:

National Logistics Network

Growth Impact:The cost and time to ship vehicles across the country can deter customers and compress margins.

Resolution Strategy:Implement a predictive logistics platform to optimize vehicle placement based on regional demand data, minimizing long-haul transfers.

Market Penetration Challenges

- Challenge:

Intense Competition from Digital-First Players

Severity:Critical

Mitigation Strategy:Leverage the omnichannel model as a key differentiator, emphasizing the value of in-person test drives and service. Aggressively invest in the online user experience to achieve parity in digital convenience.

- Challenge:

Market Saturation in Prime Metro Areas

Severity:Major

Mitigation Strategy:Develop smaller-format or service-focused satellite locations in saturated markets. Explore expansion into mid-size markets with less direct competition.

Resource Limitations

Talent Gaps

- •

EV-certified automotive technicians.

- •

Senior software engineers and digital product managers.

- •

Data scientists with experience in logistics and pricing optimization.

Significant and ongoing capital required for inventory acquisition, physical store expansion/remodeling, and technology investment.

Infrastructure Needs

- •

Expansion of reconditioning facilities, potentially with dedicated EV service bays.

- •

Investment in EV charging infrastructure at all retail locations.

- •

Upgrades to core IT systems to support enhanced digital capabilities and data analysis.

Growth Opportunities

Market Expansion

- Expansion Vector:

Expansion into Tier 2 & Tier 3 Cities

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Develop a more flexible, lower-cost store format for smaller markets that can be supported by regional logistics hubs.

Product Opportunities

- Opportunity:

CarMax Vehicle Service Centers

Market Demand Evidence:The average age of vehicles in the US is increasing, driving demand for maintenance and repair services. This provides a natural extension of the customer relationship.

Strategic Fit:High

Development Recommendation:Launch pilot service centers at a selection of existing, high-traffic CarMax locations. Focus initially on servicing vehicles sold under the MaxCare warranty program.

- Opportunity:

Used EV Battery Health Certification

Market Demand Evidence:A primary concern for used EV buyers is battery degradation and longevity. A trusted, standardized certification would be a powerful differentiator.

Strategic Fit:High

Development Recommendation:Partner with a leading battery analytics company to develop a proprietary 'CarMax Certified EV' standard that includes a detailed battery health report.

- Opportunity:

Car-as-a-Service (Subscription Model)

Market Demand Evidence:Younger consumers show increasing interest in flexible mobility solutions over outright ownership.

Strategic Fit:Medium

Development Recommendation:Launch a limited pilot program in a single, dense urban market to test demand, pricing elasticity, and operational complexity for a vehicle subscription service.

Channel Diversification

- Channel:

Enhanced Mobile App Experience

Fit Assessment:High

Implementation Strategy:Develop the mobile app into a primary channel for the entire ownership lifecycle, from shopping and financing to managing service appointments and accessing vehicle history.

Strategic Partnerships

- Partnership Type:

EV Charging Network Providers

Potential Partners

- •

Electrify America

- •

EVgo

- •

ChargePoint

Expected Benefits:Offer exclusive charging discounts or credits to CarMax EV buyers, enhancing the value proposition and easing the transition to electric for customers.

- Partnership Type:

Insurance Companies

Potential Partners

- •

Progressive

- •

GEICO

- •

Allstate

Expected Benefits:Create a seamless, integrated process to get an insurance quote and policy at the time of vehicle purchase, generating a referral revenue stream.

Growth Strategy

North Star Metric

Total Vehicles Transacted (Retail Sales + Wholesale Sales + Vehicles Bought from Consumers)

This metric provides a holistic view of CarMax's role as a market maker in the used car ecosystem. It values not just selling cars, but also the critical function of acquiring them, which fuels the entire business flywheel.

5-7% annual growth, outpacing overall market growth to signify market share gains.

Growth Model

Omnichannel-Led Growth

Key Drivers

- •

Superior customer experience across both digital and physical channels.

- •

Vast, high-quality, and trusted vehicle inventory.

- •

Integrated financial services (CAF) that reduce friction and improve profitability.

- •

Efficient vehicle acquisition engine ('Sell to CarMax').

Focus on creating a 'one-click' style of simplicity for every step of the car buying, selling, and ownership process, whether the click happens online or is facilitated by an in-store associate.

Prioritized Initiatives

- Initiative:

Launch Pilot CarMax Service Centers

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 months for pilot phase

First Steps:Conduct market analysis to select the first 5-10 pilot locations. Develop a service menu focused on common maintenance for 3-10 year old vehicles.

- Initiative:

Develop 'CarMax Certified EV' Program

Expected Impact:High

Implementation Effort:Medium

Timeframe:9-12 months

First Steps:Identify and partner with a battery health analytics firm. Develop training and certification standards for technicians.

- Initiative:

Personalized Digital Customer Journey

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:Ongoing, with first features in 6 months

First Steps:Implement a customer data platform (CDP) to unify user data. Launch initial personalization experiments on the homepage and in vehicle recommendation carousels.

Experimentation Plan

High Leverage Tests

{'test_name': 'Dynamic Vehicle Transfer Fee Testing', 'hypothesis': 'Offering subsidized or free shipping for certain high-demand or high-margin vehicles will increase conversion rates for transferred vehicles.'}

{'test_name': 'Online Test Drive Scheduling', 'hypothesis': 'Allowing customers to fully schedule a test drive online without speaking to an associate will increase the number of completed test drives.'}

Utilize a standard A/B testing framework tracking key metrics like conversion rate, lead submission rate, gross profit per unit, and customer satisfaction (NPS).

A bi-weekly sprint cycle for digital product experiments, with larger operational pilots (like service centers) measured quarterly.

Growth Team

A matrixed growth organization with dedicated 'squads' or 'pods' focused on key stages of the customer journey (e.g., 'Vehicle Discovery & Research', 'Financing & Purchase', 'Ownership & Service').

Key Roles

- •

Head of Growth

- •

Product Manager (Customer Onboarding)

- •

Data Scientist (Logistics & Inventory)

- •

Lead Service Designer

Invest in in-house training on agile methodologies and product management. Actively recruit talent from tech and e-commerce industries to bring in new perspectives.

CarMax possesses a formidable growth foundation built on strong product-market fit and an industry-leading brand. Its established omnichannel model, combining a vast physical footprint with a robust digital presence, remains a significant competitive advantage in a market where consumers value both online convenience and in-person validation.

The primary growth engine is efficient and multi-faceted, leveraging brand strength for customer acquisition and an integrated finance arm (CAF) to optimize revenue per transaction. However, the business model's reliance on physical infrastructure presents scalability challenges and higher fixed costs compared to digital-native competitors like Carvana. Operational bottlenecks in vehicle reconditioning and logistics are the most significant internal barriers to accelerated growth.

The most substantial growth opportunities lie not in simply selling more cars, but in expanding the customer relationship beyond the point of sale. The creation of a post-purchase service and maintenance business ('CarMax Service') represents the single largest vector for creating a recurring, high-margin revenue stream and dramatically increasing customer lifetime value. This move would leverage the existing brand trust and customer base to enter the lucrative auto repair market.

Simultaneously, CarMax is uniquely positioned to become the market leader in the burgeoning used Electric Vehicle (EV) space. By addressing the primary consumer fear—battery health and longevity—through a proprietary certification program, CarMax can build a defensible moat and capture this high-growth segment.

The recommended strategy is to evolve from a transactional retailer into a long-term automotive partner. The North Star Metric should shift towards 'Total Vehicles Transacted' to reflect the company's role as a market hub. Prioritized initiatives must focus on launching pilot service centers and developing a 'Certified EV' program. Success requires continued investment in a seamless digital experience while weaponizing the key differentiator that online-only players cannot match: a trusted, physical presence for service, test drives, and customer support.

Legal Compliance

CarMax maintains a comprehensive and easily accessible 'General Privacy Policy', which appears to be updated regularly (Revised May 9, 2025). The policy is provided in multiple languages, demonstrating a commitment to transparency for a diverse customer base. It clearly outlines the types of personal information collected, both online and in-store, how it is used, and with whom it is shared. It specifically addresses consumer rights under various state laws, including a detailed 'Your Rights' section for California residents, which covers the Right to Know, Correct, and Opt-Out of sale/sharing of personal information. The policy also includes a separate 'Financial Privacy Policy' notice as required by the Gramm-Leach-Bliley Act (GLBA), detailing the handling of sensitive financial data collected during financing applications. The policy discloses that it shares information with third-party vendors and within the CarMax family of companies for business purposes, including digital advertising. This level of detail provides strong legal positioning by meeting the transparency requirements of major US privacy laws.