eScore

cboe.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Cboe demonstrates exceptional digital authority, primarily anchored by its world-renowned VIX® Index, which functions as a powerful thought leadership engine and organic traffic driver. Its content is highly aligned with the search intent of its core institutional audience, providing deep, technical data and product specifications. The company shows strong global reach with dedicated website sections for North America, Europe, and Asia-Pacific, supporting localized visibility. However, its voice search and conversational query performance are likely underdeveloped, and its dominance is concentrated in derivatives, with less visibility in the hyper-competitive equities listing space compared to rivals.

Unparalleled content authority and search intent alignment driven by the globally recognized VIX® Index franchise, making Cboe the definitive online resource for market volatility.

Develop a specific strategy for voice search and conversational AI, focusing on answering key questions about market volatility, VIX futures, and options trading to capture emerging search patterns.

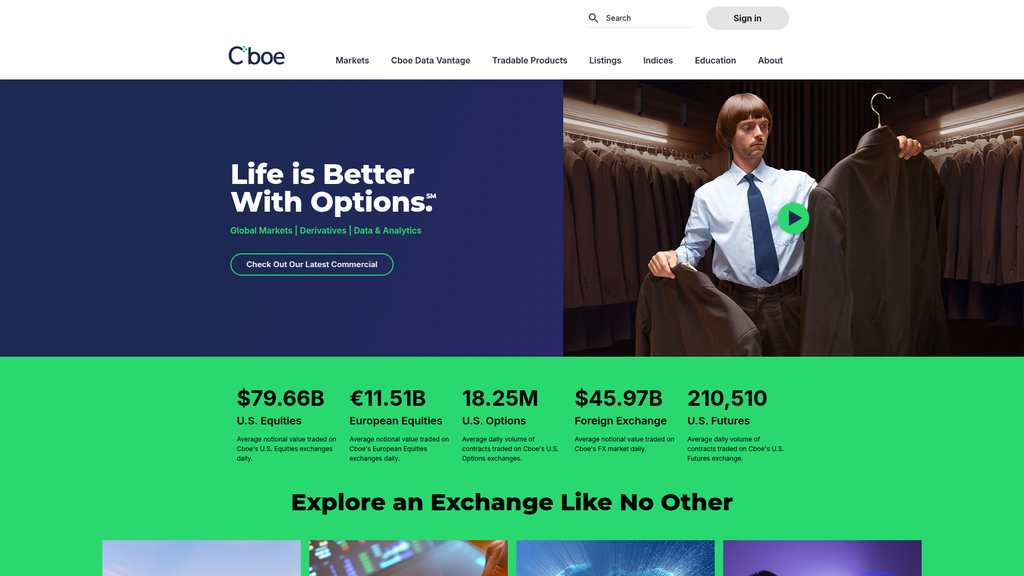

Cboe's messaging is highly effective and authoritative within its core derivatives niche, clearly communicating the value of its proprietary products like the VIX and SPX to institutional traders. The use of large-scale trading data serves as powerful social proof of its market leadership. However, the overall brand narrative is fragmented, with a disconnect between the high-level, consumer-oriented slogan ('Life is Better With Options.SM') and the deeply technical content. Messaging for newer business lines, like ETP listings, is less differentiated and lacks the compelling, benefit-driven language seen in its core offerings.

Crystal-clear messaging and authority around its core VIX® and SPX products, effectively positioning Cboe as the indispensable hub for volatility and derivatives trading.

Create a unified master brand narrative that positions Cboe as the essential partner for navigating modern market complexity, using the VIX franchise as the prime example of this expertise to elevate the entire brand.

The website provides a clear, logically structured experience for its sophisticated user base, with well-defined navigation to complex product and data sections. However, the homepage suffers from high cognitive load, presenting a vast amount of information simultaneously which can obscure key user journeys. The primary call-to-action is weak ('Watch a commercial'), representing a missed opportunity to guide users toward core offerings. While functional, the user experience lacks the polished micro-interactions and seamless design consistency seen on more modern platforms, particularly on text-heavy internal pages.

A logical and clear top-level information architecture that effectively segments Cboe's complex offerings into understandable categories, allowing sophisticated users to quickly find relevant entry points.

Redesign the homepage hero section to feature two primary, action-oriented CTAs aligned with key user goals, such as 'Access Market Data' and 'Explore Trading Products', to immediately direct traffic to core offerings.

As a major global exchange operator, Cboe's credibility is exceptionally high, built on a foundation of stringent regulatory compliance and market transparency. The website serves as a primary tool for this, offering extensive, easily accessible regulatory documents, rulebooks, and circulars. Trust is further reinforced by the global recognition of its proprietary products (VIX), extensive media mentions, and quantifiable proof of its market scale through real-time data. The detailed privacy policy and terms of service are robust, reflecting the company's mature legal posture.

Extensive and well-organized repository of regulatory documents, rulebooks, and circulars, demonstrating an unparalleled commitment to transparency and compliance with global exchange regulations.

Proactively commission a third-party accessibility audit against WCAG 2.1 AA standards and publish the results to mitigate legal risk and reinforce its mission of building an 'inclusive global marketplace'.

Cboe's competitive moat is deep and highly sustainable, primarily due to its exclusive ownership of the VIX® and SPX® index options franchises. These proprietary products have immense brand recognition, deep liquidity, and powerful network effects that are extremely difficult for competitors to replicate. The company also demonstrates strong innovation, evidenced by the continuous development of new products. While formidable, its advantage is less pronounced in the global equities listing space, where it faces larger, more established incumbents like Nasdaq and NYSE.

The proprietary VIX® and SPX® index derivatives franchise provides a highly sustainable competitive moat due to exclusive licensing, global brand recognition, and deep, self-reinforcing liquidity.

Develop a 'VIX for X' product suite, applying the globally recognized VIX methodology to other asset classes like cryptocurrencies or major commodities to leverage and expand the core brand strength.

Cboe's business model is highly scalable, characterized by high operational leverage where increased trading volumes and data subscriptions lead to disproportionately higher profit margins. The strategic focus on growing the recurring revenue from the Cboe Data Vantage business enhances stability and future growth potential. The company has a proven track record of successful M&A for geographic expansion into Europe and Asia-Pacific, demonstrating strong market expansion capabilities. The primary constraint on scalability is navigating the complex and fragmented global regulatory environment, which can slow new product launches.

A high-leverage business model where the fixed costs of technology and infrastructure support massive transaction volumes, allowing for significant margin expansion as the business grows.

Accelerate the distribution of Cboe Data Vantage products through major cloud marketplaces (like AWS, Google Cloud) to create a new, highly scalable, self-service acquisition channel for a global audience.

Cboe exhibits a highly coherent and robust business model, centered on a virtuous cycle: proprietary derivatives products create a defensible moat, drive high-margin transaction revenue, and generate unique data. This data then fuels the high-growth, recurring revenue Data Vantage business, reducing cyclicality. The company demonstrates strong strategic focus by divesting from non-core areas (like the Japanese equities business) to reallocate resources to high-growth opportunities like derivatives and data. This alignment between its revenue model, resource allocation, and strategic focus is a core strength.

A virtuous cycle where exclusive, high-margin derivatives products generate unique data that feeds a growing, high-margin recurring revenue data business, creating a powerful and synergistic model.

Develop a 'Market-Infrastructure-as-a-Service' (MIaaS) offering, white-labeling the Cboe Ti technology platform for niche asset classes to create a new, capital-efficient revenue stream that leverages existing key resources.

Cboe wields significant market power, primarily through its ability to set industry standards and influence global market direction with the VIX® Index. This gives it substantial pricing power for its proprietary data and derivative products. Its market share in U.S. options is dominant, and its trajectory shows consistent growth in revenue and trading volumes, indicating a strengthening position. The company's influence is further amplified by its global network of exchanges, giving it significant leverage with partners and a commanding voice in discussions on market structure and regulation.

Unmatched market influence stemming from the creation and ownership of the VIX® Index, the globally recognized standard for market volatility, which cements Cboe's role as a market leader.

Systematically leverage its unique market data to publish more frequent, high-impact public research on market structure and trading trends, further solidifying its brand as the authoritative voice on market dynamics.

Business Overview

Business Classification

Market Infrastructure Provider

Data & Analytics Services

Financial Services

Sub Verticals

- •

Securities and Derivatives Exchanges

- •

Market Data Providers

- •

Financial Technology (FinTech)

Mature

Maturity Indicators

- •

Established global brand with a long history (founded in 1973).

- •

Consistent revenue growth and profitability.

- •

Operates as a publicly traded company (NASDAQ: CBOE).

- •

Global footprint with exchanges in North America, Europe, and Asia Pacific.

- •

Active in mergers and acquisitions to expand product lines and geographic reach.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Derivatives Markets (Options & Futures)

Description:Transaction and clearing fees from trading of proprietary index options and futures (e.g., SPX and VIX products) and multi-listed equity options. This is Cboe's largest and highest-margin business segment.

Estimated Importance:Primary

Customer Segment:Institutional Investors, Proprietary Trading Firms, Retail Brokers

Estimated Margin:High

- Stream Name:

Data Vantage (Data, Analytics & Access)

Description:Sale of proprietary market data, analytics, and indices. Also includes access and capacity fees for co-location services and connectivity to Cboe's trading platforms. This is a significant source of recurring revenue.

Estimated Importance:Secondary

Customer Segment:Hedge Funds, Asset Managers, Data Vendors, Retail Traders, Academic Institutions

Estimated Margin:High

- Stream Name:

Cash and Spot Markets (Equities & FX)

Description:Transaction fees from equities trading on its four U.S. exchanges, Cboe Australia, Cboe Japan, and European venues. Also includes revenue from its institutional FX trading platform.

Estimated Importance:Secondary

Customer Segment:Broker-Dealers, Institutional Investors, Market Makers

Estimated Margin:Medium

- Stream Name:

Listings

Description:Fees from corporations and Exchange-Traded Product (ETP) issuers for listing their securities on Cboe's global exchanges.

Estimated Importance:Tertiary

Customer Segment:ETP Issuers, Corporations

Estimated Margin:Medium

Recurring Revenue Components

- •

Market data subscriptions (Cboe Data Vantage)

- •

Access and capacity fees

- •

ETP and corporate listing maintenance fees

- •

Licensing of proprietary indices (e.g., VIX)

Pricing Strategy

Transaction-based & Subscription

Premium/Mid-range

Semi-transparent

Pricing Psychology

Tiered Pricing (based on volume)

Service Bundling (e.g., data, access, and execution)

Monetization Assessment

Strengths

- •

Highly diversified revenue across asset classes (options, futures, equities, FX) and geographies.

- •

Strong contribution from high-margin, recurring data and access revenue.

- •

Proprietary products like VIX and SPX options command premium pricing and create a strong moat.

Weaknesses

- •

Transaction-based revenues are cyclical and highly dependent on market volatility and trading volumes.

- •

Complex fee structures can be a barrier for smaller participants.

- •

Intense fee pressure from competitors in cash equities trading.

Opportunities

- •

Aggressively expand the Data Vantage suite with higher-value analytics and AI-driven insights.

- •

Grow the global listings business, particularly for ETPs.

- •

Expand derivatives product suite to new asset classes and geographies, such as Asia Pacific.

Threats

- •

Regulatory changes impacting market structure or fee models.

- •

Increased competition from other major exchange groups (ICE, Nasdaq, CME Group).

- •

Emergence of decentralized finance (DeFi) platforms as long-term alternatives.

Market Positioning

Innovation and Product Leadership

Market Leader in U.S. Options; Significant Player in U.S. and European Equities.

Target Segments

- Segment Name:

Institutional Investors & Asset Managers

Description:Large-scale financial institutions including pension funds, mutual funds, and insurance companies that require deep liquidity and sophisticated risk management tools.

Demographic Factors

Global presence

High assets under management (AUM)

Psychographic Factors

- •

Risk-averse

- •

Focus on long-term performance and fiduciary duty

- •

Value reliability, transparency, and regulatory compliance

Behavioral Factors

- •

Execute large block trades

- •

Utilize complex derivatives for hedging

- •

Subscribe to premium market data and analytics

Pain Points

- •

Managing portfolio volatility

- •

Finding sufficient liquidity for large orders

- •

Accessing global markets efficiently

- •

Compliance with complex regulations

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Proprietary Trading Firms & Hedge Funds

Description:Firms that trade with their own capital, often using high-frequency, algorithmic, and quantitative strategies. They are highly sensitive to latency and transaction costs.

Demographic Factors

Often located in major financial hubs

Technology-centric organizations

Psychographic Factors

- •

Profit-driven

- •

High-risk tolerance

- •

Early adopters of new trading technologies and products

Behavioral Factors

- •

High-volume, low-latency trading

- •

Heavy users of co-location and direct market access

- •

Demand for granular, tick-level historical data

Pain Points

- •

Latency and network performance

- •

High transaction costs (fees and slippage)

- •

Accessing diverse sources of liquidity

- •

Developing and backtesting complex trading algorithms

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Retail & Wholesale Brokers

Description:Brokerage firms that provide market access to individual (retail) investors. They need reliable execution, cost-effective market data, and educational resources for their clients.

Demographic Factors

Serve a large base of individual investors

Range from large online brokers to smaller firms

Psychographic Factors

Focused on customer acquisition and retention

Value platform stability and brand reputation

Behavioral Factors

- •

Route large volumes of aggregated retail order flow

- •

Consume market data feeds for their platforms

- •

Utilize educational content for their clients

Pain Points

- •

Ensuring best execution for clients

- •

Managing rising market data costs

- •

Educating clients on complex products like options

- •

Competing with zero-commission models

Fit Assessment:Good

Segment Potential:High

Market Differentiation

- Factor:

Proprietary & Exclusive Products

Strength:Strong

Sustainability:Sustainable

- Factor:

Global Multi-Asset Class Network

Strength:Strong

Sustainability:Sustainable

- Factor:

Unified, High-Performance Technology Platform (Cboe Ti)

Strength:Moderate

Sustainability:Sustainable

- Factor:

Data & Analytics Ecosystem (Cboe Data Vantage)

Strength:Moderate

Sustainability:Sustainable

Value Proposition

To provide a trusted, inclusive global marketplace with cutting-edge technology, exclusive products, and actionable data, enabling all market participants to manage risk and pursue financial opportunities with confidence.

Good

Key Benefits

- Benefit:

Unique Risk Management Tools

Importance:Critical

Differentiation:Unique

Proof Elements

Exclusive home of the VIX® Index and its ecosystem of options and futures.

Broad suite of S&P 500 (SPX) index options.

- Benefit:

Global Market Access

Importance:Important

Differentiation:Somewhat unique

Proof Elements

Operates 27 exchanges and markets across North America, Europe, and Asia Pacific.

Offers trading in equities, derivatives, FX, and digital assets.

- Benefit:

Comprehensive Data & Analytics

Importance:Important

Differentiation:Somewhat unique

Proof Elements

Cboe Data Vantage suite offers real-time data, historical data, analytics, and indices.

Tools for pre-trade analytics, execution, and post-trade risk management.

- Benefit:

Reliable, Low-Latency Technology

Importance:Critical

Differentiation:Common

Proof Elements

- •

Unified 'Cboe Ti' technology platform across global markets.

- •

Services like 'Dedicated Cores' to reduce latency for customers.

- •

High uptime statistics (99.9%+ across all platforms).

Unique Selling Points

- Usp:

The VIX® Index Ecosystem: As the creator and exclusive marketplace for the world's premier gauge of equity market volatility, Cboe offers an unparalleled and globally recognized tool for risk management.

Sustainability:Long-term

Defensibility:Strong

- Usp:

SPX Options Leadership: Cboe operates the most liquid index options market in the world, providing deep and reliable liquidity for S&P 500 exposure.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Integrated Global Network: Offers a seamless experience across multiple asset classes and geographies on a unified technology backbone, simplifying access for global participants.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Hedging against market uncertainty and portfolio risk.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Accessing deep, reliable liquidity across global markets and asset classes.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Sourcing high-quality, actionable market data and analytics for strategy development.

Severity:Major

Solution Effectiveness:Partial

- Problem:

Efficiently executing trades with minimal latency and market impact.

Severity:Major

Solution Effectiveness:Complete

Value Alignment Assessment

High

Cboe's focus on derivatives, risk management, and data aligns perfectly with the increasing complexity and globalization of financial markets. The growing adoption of options by both institutional and retail investors further solidifies this alignment.

High

The product suite is exceptionally well-aligned with the needs of sophisticated institutional clients. There is a growing opportunity to better align data and educational tools with the rapidly expanding sophisticated retail trader segment.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Index Providers (S&P Dow Jones Indices, MSCI, FTSE Russell)

- •

Broker-Dealers and Futures Commission Merchants (FCMs)

- •

Market Data Vendors and Technology Providers (e.g., Snowflake, AWS)

- •

Regulators (e.g., SEC, CFTC)

- •

Liquidity Providers and Market Makers

- •

Clearing Houses (e.g., Options Clearing Corporation)

Key Activities

- •

Operating and maintaining securities and derivatives exchanges.

- •

Product innovation and development (e.g., new indices and derivatives).

- •

Technology platform management and upgrades (Cboe Ti).

- •

Market data collection, processing, and distribution.

- •

Regulatory compliance and market surveillance.

- •

Sales, marketing, and client education (The Options Institute).

Key Resources

- •

Proprietary intellectual property (VIX®, SPX options).

- •

Global technology infrastructure and data centers.

- •

Regulatory licenses to operate exchanges and clearing houses.

- •

Strong brand recognition and reputation.

- •

Global network of clients and liquidity.

Cost Structure

- •

Compensation and benefits.

- •

Technology and infrastructure support.

- •

Depreciation and amortization of acquired assets.

- •

Professional fees and outside services.

- •

Marketing and communication expenses.

Swot Analysis

Strengths

- •

Dominant market position in U.S. options and volatility trading.

- •

Strong brand equity and a portfolio of exclusive, high-margin products (VIX, SPX).

- •

Diversified business model across asset classes, geographies, and revenue types (transactions vs. recurring data).

- •

Scalable, unified global technology platform enhances efficiency and innovation speed.

Weaknesses

- •

Revenue is sensitive to market trading volumes, which can be cyclical.

- •

Highly complex and heavily regulated operating environment can slow down new initiatives.

- •

Intense competition in lower-margin segments like cash equities puts pressure on fees.

Opportunities

- •

Further expansion of the Data Vantage business into predictive analytics and ESG data solutions.

- •

Growth in international markets, particularly attracting Asia Pacific investors to U.S. derivatives.

- •

Capitalizing on the growth of sophisticated retail options trading through tailored products and education.

- •

Strategic, focused acquisitions to enter new markets or acquire new technologies.

Threats

- •

Adverse regulatory changes impacting market structure, data fees, or product approvals.

- •

Intensifying competition from major global exchanges like ICE, Nasdaq, and CME Group.

- •

Cybersecurity threats targeting critical market infrastructure.

- •

Prolonged economic downturn leading to reduced trading activity and volatility.

Recommendations

Priority Improvements

- Area:

Retail Trader Engagement

Recommendation:Develop a simplified, API-first data product tier under Data Vantage specifically for the 'pro-tail' (professional retail) segment. Enhance educational content through 'The Options Institute' with more interactive tools and multilingual support.

Expected Impact:High

- Area:

Data & Analytics Platform

Recommendation:Transition Cboe Data Vantage from a data provider to a full-fledged analytics platform by integrating AI-powered insights, predictive modeling tools, and more intuitive visualization dashboards to increase subscription value.

Expected Impact:High

- Area:

Geographic Expansion

Recommendation:Deepen the strategic focus on the Asia Pacific region by establishing more local partnerships and developing derivative products specifically tailored to the risk management needs and time zones of Asian institutional investors.

Expected Impact:Medium

Business Model Innovation

- •

Develop a 'Market-Infrastructure-as-a-Service' (MIaaS) offering, white-labeling the Cboe Ti technology platform for niche or emerging asset classes (e.g., ESG assets, digital securities) that require a regulated, high-performance trading venue.

- •

Create a 'Volatility-as-a-Service' API, allowing FinTechs and neobrokers to embed VIX-related analytics and risk indicators directly into their platforms, creating a new licensing revenue stream.

- •

Launch a corporate venture capital (CVC) arm to make strategic investments in early-stage FinTech companies focused on derivatives, data analytics, and trading technology, providing a pipeline for future innovation and acquisitions.

Revenue Diversification

- •

Expand the Global Indices business to create and license a wider range of proprietary benchmarks, particularly focusing on high-growth themes like ESG, digital assets, and thematic investing.

- •

Build out a comprehensive ESG data and analytics offering, leveraging Cboe's market data expertise to provide trusted ESG scores, indices, and related derivatives.

- •

Further develop the Cboe Digital offering by focusing on regulated derivatives for digital assets, moving beyond spot trading to better leverage core competencies in futures and options product creation and clearing.

Cboe Global Markets exhibits a robust and mature business model, strategically positioned as a leader in derivatives and market innovation. Its core strength lies in a virtuous cycle: proprietary products like VIX and SPX options create a deep, defensible moat, driving high-margin transaction revenue and generating unique data. This data, in turn, fuels the high-growth, recurring revenue of the Cboe Data Vantage business. The company's global, multi-asset class network, unified on the Cboe Ti technology platform, provides significant operational leverage and scalability. Future evolution depends on three key pillars: 1) expanding the Data Vantage ecosystem from a raw data provider to a sophisticated, predictive analytics service to reduce reliance on cyclical transaction volumes; 2) capitalizing on the structural growth of derivatives among sophisticated retail and international investors, particularly in Asia Pacific; and 3) strategically innovating in adjacent areas like ESG and digital asset derivatives where its core competencies in product creation, regulation, and market infrastructure can be leveraged for new growth. While facing intense competition and regulatory scrutiny, Cboe's unique intellectual property and global infrastructure provide a sustainable competitive advantage, positioning it for steady, long-term value creation.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Regulatory Capital & Compliance

Impact:High

- Barrier:

Technology Infrastructure & Development Costs

Impact:High

- Barrier:

Network Effects & Liquidity

Impact:High

- Barrier:

Brand Recognition & Trust

Impact:High

- Barrier:

Patents and Proprietary Products (e.g., VIX)

Impact:Medium

Industry Trends

- Trend:

Growth of Data & Analytics as a Service

Impact On Business:Cboe is capitalizing on this by expanding its Data Vantage offerings, creating a significant recurring revenue stream.

Timeline:Immediate

- Trend:

Rise of Retail Options & Derivatives Trading

Impact On Business:Drives higher transaction volumes in Cboe's core, high-margin products like SPX and VIX options. Increases the need for educational resources.

Timeline:Immediate

- Trend:

Globalization of Market Access

Impact On Business:Cboe's strategy of global expansion (Europe, Asia-Pacific) and offering 24/5 trading for certain products directly addresses this demand.

Timeline:Immediate

- Trend:

Technological Arms Race (AI, Cloud, Low Latency)

Impact On Business:Requires continuous, significant capital expenditure to remain competitive on execution speed, reliability, and offering advanced analytics.

Timeline:Near-term

- Trend:

Increased Regulatory Scrutiny

Impact On Business:Heightens compliance costs and can introduce restrictions on market structure or specific product types, potentially impacting profitability.

Timeline:Near-term

Direct Competitors

- →

Nasdaq, Inc.

Market Share Estimate:Major competitor in U.S. equities and options. Cboe and Nasdaq together capture a significant majority of the options market.

Target Audience Overlap:High

Competitive Positioning:Technology-centric global marketplace, strong in tech/growth company listings and market data services.

Strengths

- •

Iconic brand for technology and growth stock listings.

- •

Diversified revenue from market technology, data, and index licensing.

- •

Strong global presence and brand recognition.

- •

Advanced electronic trading platforms and focus on innovation.

Weaknesses

- •

Higher volatility and sector concentration in tech can be a risk.

- •

Dependence on market conditions and trading volumes for revenue.

- •

Less dominant in proprietary index derivatives compared to Cboe's VIX.

Differentiators

- •

Premier destination for technology IPOs.

- •

Extensive market technology solutions sold to other exchanges and financial institutions.

- •

Strong focus on ESG (Environmental, Social, and Governance) solutions and data.

- →

Intercontinental Exchange, Inc. (ICE)

Market Share Estimate:Dominant in U.S. equities through NYSE, major competitor in derivatives and fixed income.

Target Audience Overlap:High

Competitive Positioning:Global leader in exchanges, clearing, and data services across a broad range of asset classes, including energy and mortgages.

Strengths

- •

Owner of the New York Stock Exchange (NYSE), the world's leading venue for large-cap listings.

- •

Highly diversified business model across exchanges, fixed income, data, and mortgage technology.

- •

Strong position in energy and commodity futures.

- •

Robust and recurring revenue from data services.

Weaknesses

- •

Exposure to cyclical trading volumes and interest rate fluctuations.

- •

Operational challenges in integrating large acquisitions like their mortgage technology segment.

- •

Complex regulatory environment across its diverse global operations.

Differentiators

- •

Ownership of the iconic NYSE brand.

- •

End-to-end mortgage technology ecosystem.

- •

Leading global player in energy futures and clearing.

- →

CME Group Inc.

Market Share Estimate:World's leading derivatives marketplace, especially in futures.

Target Audience Overlap:High

Competitive Positioning:The global leader in derivatives, specializing in interest rate, equity index, FX, energy, and commodity futures and options.

Strengths

- •

Dominant market position in a wide array of benchmark futures products (e.g., Eurodollar, Treasury futures).

- •

Deep liquidity and strong network effects in its core markets.

- •

Extremely high profit margins and strong cash flow.

- •

Strong brand reputation for risk management tools.

Weaknesses

- •

Less diversified in cash equities and ETF listings compared to Cboe, Nasdaq, and ICE.

- •

Revenue is highly sensitive to market volatility and interest rate changes.

- •

Faces tough year-over-year comparisons due to periods of exceptionally high volatility.

Differentiators

- •

Unparalleled product breadth in futures and options on futures.

- •

Globally recognized benchmark products across all major asset classes.

- •

Clearing house services (CME Clearing) are a core strength and differentiator.

Indirect Competitors

- →

Alternative Trading Systems (ATS) & Dark Pools

Description:Private trading venues that allow institutional investors to execute large block trades anonymously, without impacting the public market price until after execution. They fragment market liquidity away from public exchanges.

Threat Level:Medium

Potential For Direct Competition:Low (They are a structural feature of the market, not entities that would become exchanges themselves, but they directly compete for order flow).

- →

Large Financial Data & Analytics Providers (e.g., Bloomberg, Refinitiv LSEG)

Description:Provide the data, analytics, and execution tools that are a core part of the value proposition for exchanges. They compete directly with Cboe's Data Vantage segment.

Threat Level:High

Potential For Direct Competition:Medium (LSEG is already a direct competitor through its exchange ownership. Bloomberg could enter the exchange space).

- →

Decentralized Finance (DeFi) Platforms

Description:Emerging blockchain-based platforms that enable peer-to-peer trading of digital assets without a central intermediary. They represent a long-term architectural threat to the traditional exchange model.

Threat Level:Low

Potential For Direct Competition:Low (Currently focused on crypto assets and facing significant regulatory hurdles, but the underlying technology is disruptive).

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Proprietary Index Derivatives Franchise (VIX, SPX)

Sustainability Assessment:Highly sustainable due to strong brand recognition, deep liquidity, and exclusive licensing rights. The VIX is globally synonymous with market volatility.

Competitor Replication Difficulty:Hard

- Advantage:

Integrated Global Multi-Asset Platform

Sustainability Assessment:Sustainable as Cboe continues to integrate its technology and operations across North America, Europe, and Asia-Pacific, offering clients a seamless global experience.

Competitor Replication Difficulty:Medium

- Advantage:

Growing Data and Access Solutions Business

Sustainability Assessment:Highly sustainable, providing high-margin, recurring revenue that is less dependent on transactional volatility. Cboe projects strong growth for this segment.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'First-mover on specific innovative products (e.g., 0DTE options)', 'estimated_duration': '1-2 years, as competitors can replicate successful product structures if they gain traction.'}

{'advantage': 'Favorable fee structures or technology enhancements', 'estimated_duration': 'Less than 1 year, as pricing and technology are key competitive battlegrounds and are matched quickly.'}

Disadvantages

- Disadvantage:

Smaller Scale in Global Equities Listings

Impact:Major

Addressability:Difficult

- Disadvantage:

Less Brand Recognition in Futures vs. CME Group

Impact:Major

Addressability:Difficult

- Disadvantage:

Rising Operating Expenses

Impact:Minor

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted digital marketing campaigns for VIX and SPX products aimed at the sophisticated retail trader segment.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Enhance The Options Institute's online presence with more interactive tools and webinars to capture and educate the growing retail investor base.

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Bundle Cboe Data Vantage analytics with execution services to create a cost-effective, all-in-one solution for small-to-mid-sized institutional clients.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Expand the suite of derivatives based on ESG and climate-focused indices to capture growing investor demand in sustainable finance.

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Continue strategic acquisitions of technology firms or smaller exchanges in key growth regions (e.g., Asia-Pacific) to accelerate global expansion.

Expected Impact:High

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Invest heavily in AI and machine learning to develop next-generation market surveillance tools and predictive analytics for clients.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Build out a comprehensive, regulated digital asset marketplace for institutional-grade trading and clearing of tokenized securities and crypto derivatives.

Expected Impact:High

Implementation Difficulty:Difficult

Solidify Cboe's position as the 'Global Leader in Derivatives, Data, and Market Innovation', emphasizing the interconnectedness of its global exchanges and the unique risk management tools it offers.

Differentiate through superior product innovation in the derivatives space, a more globally integrated and technologically unified platform, and by providing more actionable, data-driven insights to a wider range of market participants.

Whitespace Opportunities

- Opportunity:

Develop a 'VIX for X' product suite, applying the VIX methodology to other asset classes like specific commodities, individual large-cap stocks, or cryptocurrency.

Competitive Gap:Competitors lack a comparable, globally recognized volatility index franchise. This leverages Cboe's core brand strength into new areas.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Create an educational and trading platform tailored specifically to Registered Investment Advisors (RIAs) and wealth managers, helping them use options for portfolio hedging.

Competitive Gap:Most exchanges focus on institutional or active retail traders. The wealth management channel is underserved with institutional-grade tools and education for derivatives.

Feasibility:High

Potential Impact:Medium

- Opportunity:

Launch a suite of data products focused on analyzing retail trading flows in the options market, a valuable dataset for institutional clients.

Competitive Gap:While retail flow is significant, consolidated, high-quality data and analytics on its behavior are scarce. Cboe is uniquely positioned to capture and package this data.

Feasibility:Medium

Potential Impact:High

Cboe Global Markets operates within a mature, oligopolistic financial exchange industry characterized by extremely high barriers to entry. The market is dominated by a few large, well-capitalized players: Cboe, Nasdaq, ICE (owner of NYSE), and CME Group. Competition is fierce, focusing on technology, liquidity, product innovation, and data services.

Cboe's primary competitive advantage is its unparalleled franchise in proprietary index derivatives, most notably the VIX and SPX product suites. This provides a deep, sustainable moat that is difficult for competitors to replicate. The company has successfully leveraged this strength to build a global, multi-asset class operation, with a rapidly growing and high-margin data and analytics business (Cboe Data Vantage) that provides a valuable source of recurring revenue.

Direct competitors like Nasdaq and ICE/NYSE are stronger in the high-profile equities and ETF listings business, while CME Group is the undisputed leader in the broader futures market. Cboe's key challenge is to defend its dominance in options while strategically growing its presence in other areas without overextending resources. The company's recent strategic review and focus on organic growth initiatives reflect an awareness of this challenge.

Indirect threats are significant, with dark pools competing for order flow and large data providers like LSEG competing directly with Cboe's data ambitions. Long-term, disruptive technologies like DeFi pose a potential, though distant, architectural threat.

The most significant opportunities for Cboe lie in leveraging its core strengths. This includes expanding its suite of unique derivatives, creating more sophisticated data products for institutional and retail clients, and enhancing its educational offerings to capture the growing global wave of retail options traders. By positioning itself as the premier global hub for risk management and market insights, Cboe can continue to thrive in this intensely competitive landscape.

Messaging

Message Architecture

Key Messages

- Message:

Life is Better With Options.SM

Prominence:Primary

Clarity Score:Medium

Location:Homepage Hero Banner

- Message:

Explore an Exchange Like No Other

Prominence:Primary

Clarity Score:Low

Location:Homepage Headline

- Message:

The Home of The VIX® Index & SPX

Prominence:Primary

Clarity Score:High

Location:Homepage Sub-section

- Message:

Access some of the largest, most relied upon markets in the world.

Prominence:Secondary

Clarity Score:High

Location:Homepage 'Markets' Section

- Message:

Cboe Data Vantage: Data. Analytics. Execution. Indices. Comprehensive solutions to optimize your workflow.

Prominence:Secondary

Clarity Score:High

Location:Homepage 'Cboe Data Vantage' Section

The messaging hierarchy is somewhat fragmented. A consumer-oriented, high-level slogan, 'Life is Better With Options.SM', sits awkwardly atop a website filled with deeply technical, institutional-grade content. The most powerful and clear message, 'The Home of The VIX® Index & SPX', is correctly given prominence but could be better integrated into an overarching 'Why Cboe' narrative rather than being presented as a standalone feature. The hierarchy serves more as a portal to different business lines than a cohesive brand story.

Messaging is highly consistent within specific product silos. For example, the language around VIX and its associated futures and options is clear, authoritative, and consistent. However, this level of clarity does not extend to the parent brand. The brand-level messaging feels disconnected from the product-level messaging, leading to an inconsistent experience between the aspirational slogans and the functional, data-heavy content.

Brand Voice

Voice Attributes

- Attribute:

Authoritative & Expert

Strength:Strong

Examples

- •

The Home of The VIX® Index & SPX

- •

Access some of the largest, most relied upon markets in the world.

- •

Our insights become innovations that affect the financial world every minute, every day.

- Attribute:

Data-Driven & Quantitative

Strength:Strong

Examples

- •

$79.66B U.S. Equities Average notional value traded...

- •

18.25M U.S. Options Average daily volume of contracts...

- •

The extensive data tables under 'Cboe's Most Active Products'.

- Attribute:

Technical & Complex

Strength:Moderate

Examples

- •

VIX options enable market participants to hedge portfolio volatility risk...

- •

Mini VIX futures provide... greater precision for smaller managed accounts.

- •

The entirety of the 'European Equities Market Volume Summary User Guide' page.

Tone Analysis

Informational

Secondary Tones

- •

Professional

- •

Technical

- •

Formal

Tone Shifts

A notable shift occurs with the headline 'Life is Better With Options.SM' and the mention of a 'Latest Commercial', which adopts a much broader, almost retail-focused tone that is inconsistent with the rest of the site's institutional voice.

Voice Consistency Rating

Good

Consistency Issues

The primary inconsistency is the clash between the top-level, consumer-facing brand slogan and the professional, data-intensive voice used throughout the remainder of the site.

Value Proposition Assessment

Cboe is the world's leading derivatives and exchange network, providing sophisticated market participants with exclusive access to premier volatility products (VIX®), deep global liquidity, and comprehensive data solutions to manage risk and optimize trading strategies.

Value Proposition Components

- Component:

Proprietary Volatility Products (VIX Suite)

Clarity:Clear

Uniqueness:Unique

- Component:

Global Multi-Asset Market Access

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Integrated Data and Analytics (Data Vantage)

Clarity:Somewhat Clear

Uniqueness:Somewhat Unique

- Component:

Global Listing Services

Clarity:Unclear

Uniqueness:Common

Cboe's messaging demonstrates strong differentiation centered on its proprietary products, particularly the VIX® Index and SPX options. This is its undeniable competitive moat. The headline 'The Home of The VIX® Index & SPX' is the most effective differentiator on the site. Differentiation is weaker in equities trading and listings, where the messaging is more generic and competes with established players like NYSE and Nasdaq. The 'exchange like no other' claim is unsubstantiated by immediate, clear messaging on the homepage.

The messaging positions Cboe as an indispensable hub for derivatives and volatility trading, targeting sophisticated users who need to manage complex risks. Against competitors like CME Group, Nasdaq, and NYSE, Cboe's unique strength lies in its volatility franchise. Its positioning in general equities and ETF listings is that of a capable, global alternative but without the same clear message of market leadership.

Audience Messaging

Target Personas

- Persona:

Institutional Traders & Portfolio Managers

Tailored Messages

- •

Manage today's market risks with our proprietary index options and futures.

- •

VIX options enable market participants to hedge portfolio volatility risk...

- •

The real-time data feeds of most active products.

Effectiveness:Effective

- Persona:

Quantitative Analysts & Data Consumers

Tailored Messages

- •

Cboe Data Vantage: Data. Analytics. Execution. Indices.

- •

Comprehensive solutions to optimize your workflow.

- •

The detailed 'User Guide' for market volume summaries.

Effectiveness:Effective

- Persona:

Corporate Issuers (for Listings)

Tailored Messages

We're building the first-ever global listing experience for corporates and ETFs.

List with Cboe for unrivalled support at every step.

Effectiveness:Somewhat

Audience Pain Points Addressed

- •

Managing and hedging portfolio volatility.

- •

Accessing liquid, reliable global markets.

- •

Needing comprehensive, actionable market data.

- •

Optimizing complex trading workflows.

Audience Aspirations Addressed

- •

Gaining a trading edge through unique products.

- •

Achieving a 'sustainable financial future' (from company mission).

- •

Navigating any market environment effectively.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Security & Control

Effectiveness:High

Examples

Manage today's market risks...

...hedge portfolio volatility risk...

- Appeal Type:

Authority & Prestige

Effectiveness:Medium

Examples

- •

Explore an Exchange Like No Other

- •

The Home of The VIX® Index & SPX

- •

Our insights become innovations...

Social Proof Elements

- Proof Type:

Scale & Volume Data

Impact:Strong

Examples

The prominent display of massive daily trading volumes and notional values (e.g., '$79.66B', '18.25M' contracts) serves as powerful proof of market leadership and liquidity.

Trust Indicators

- •

Real-time market data tickers.

- •

Prominent use of registered trademarks (VIX®, Cboe®).

- •

Detailed, technical user guides and methodology explanations.

- •

A professional, data-centric design aesthetic.

Scarcity Urgency Tactics

None observed. This is appropriate for the industry, as urgency is dictated by market conditions, not marketing tactics.

Calls To Action

Primary Ctas

- Text:

Explore Global Markets

Location:Homepage

Clarity:Clear

- Text:

Discover Our Tradable Products

Location:Homepage

Clarity:Clear

- Text:

Get Started

Location:Homepage (Listings Section)

Clarity:Somewhat Clear

- Text:

Learn more about VIX Options

Location:Homepage

Clarity:Clear

The CTAs are clear but passive. They use low-intent words like 'Explore,' 'Discover,' and 'Learn more.' This is suitable for an informational journey but lacks the persuasive punch to drive decisive action. The 'Get Started' CTA for listings is particularly vague and could be improved with more specific, benefit-oriented language.

Messaging Gaps Analysis

Critical Gaps

- •

A Unified 'Why Cboe?' Narrative: The website effectively explains 'What is Cboe?' (a collection of markets and products) but fails to articulate a cohesive 'Why Cboe?' that ties all its offerings together into a single, compelling value proposition.

- •

Lack of Human Element & Case Studies: The site is data-rich but story-poor. There are no testimonials, case studies, or success stories from listed companies or institutional clients to illustrate the real-world impact and benefits of the Cboe ecosystem.

- •

Benefit-Oriented Language for Data & Listings: The messaging for Cboe Data Vantage and Listings is feature-based ('Data. Analytics. Execution.') rather than benefit-based ('Make smarter decisions,' 'Access global capital seamlessly').

Contradiction Points

The primary contradiction is the broad, consumer-style brand campaign slogan ('Life is Better With Options.SM') on a website that is overwhelmingly built for and speaks to a highly sophisticated, institutional audience.

Underdeveloped Areas

Listings Value Proposition: The messaging for corporate and ETF listings is generic and lacks the specificity and authority seen in the derivatives messaging. It doesn't effectively answer 'Why should I list on Cboe instead of Nasdaq or NYSE?'.

Connecting 'Innovation' to User Benefits: The site claims innovation but doesn't consistently connect that innovation back to tangible benefits for its specific audience segments.

Messaging Quality

Strengths

- •

Crystal-clear messaging and authority around its core proprietary products (VIX®).

- •

Effective use of large-scale data points as immediate social proof of market leadership.

- •

A highly consistent, professional, and data-driven voice that resonates with its core institutional audience.

- •

Clean information architecture that allows users to navigate to specific product and data sections easily.

Weaknesses

- •

A fragmented brand narrative with a disconnect between the top-level slogan and the site's actual content.

- •

An over-reliance on technical features rather than user benefits, especially for data and listing services.

- •

Passive and uninspiring calls-to-action that guide rather than persuade.

- •

A vague and unsubstantiated claim to be an 'Exchange Like No Other' on the homepage.

Opportunities

- •

Develop a master brand narrative that positions Cboe as the essential partner for navigating modern market complexity, with the VIX® franchise as the prime example of this expertise.

- •

Create persona-specific content tracks (e.g., for corporates, quants, portfolio managers) that highlight the most relevant benefits and solutions for each.

- •

Incorporate storytelling through case studies and client testimonials to add a layer of qualitative proof to the existing quantitative data.

- •

Translate the 'Life is Better With Options' concept into more sophisticated, benefit-driven messaging for the institutional audience (e.g., 'Better Outcomes Through Optionality').

Optimization Roadmap

Priority Improvements

- Area:

Homepage Messaging Hierarchy

Recommendation:Replace 'Explore an Exchange Like No Other' with a clear, benefit-driven headline that encapsulates the core value proposition. For example: 'Define Your Edge in a Complex World with Cboe’s Unrivalled Markets and Volatility Tools.'

Expected Impact:High

- Area:

Value Proposition Clarity

Recommendation:Create a dedicated 'Why Cboe?' section that clearly articulates the integrated benefits of its ecosystem (markets, products, data, technology) and solidifies its brand promise beyond just individual offerings.

Expected Impact:High

- Area:

Listings Service Messaging

Recommendation:Revamp the listings section messaging to be highly specific, highlighting concrete differentiators vs. competitors (e.g., 'Global cross-listing benefits,' 'Superior market maker support,' 'Access to a unique derivatives ecosystem'). Back claims with data and testimonials.

Expected Impact:Medium

Quick Wins

- •

Change the generic 'Get Started' CTA for listings to a more compelling 'Explore Listing Advantages' or 'Speak with a Listings Expert.'

- •

Add a sub-heading to the 'Life is Better...' banner that contextualizes it for the target audience, such as 'Empowering investors with greater choice and control.'

- •

Rephrase the 'Cboe Data Vantage' heading to be benefit-oriented, such as 'Optimize Your Workflow with Cboe Data Vantage.'

Long Term Recommendations

- •

Invest in developing a content marketing engine that produces case studies, white papers, and thought leadership demonstrating how Cboe's solutions help clients solve critical challenges (e.g., managing volatility, accessing global liquidity).

- •

Conduct messaging research with key client segments to refine the overarching brand narrative and ensure it resonates.

- •

Build out dynamic content personalization on the website, so a visitor identified as a corporate issuer sees listings information more prominently than a derivatives trader.

Cboe's strategic messaging is a tale of two parts: exceptional product-level clarity and fragmented brand-level identity. The company masterfully communicates its authority and unique value in the derivatives space, anchored by the globally recognized VIX® Index. The messaging here is confident, data-driven, and perfectly aligned with its core audience of sophisticated financial professionals. The use of real-time trading volumes as social proof is powerful and immediately establishes credibility and scale.

However, the overall brand narrative that should unify its diverse offerings—from U.S. equities to global listings and data analytics—is underdeveloped. The homepage functions more like a high-quality portal to different business units than a cohesive brand statement. Slogans like 'Explore an Exchange Like No Other' are left unsubstantiated, while the consumer-esque 'Life is Better With Options.SM' campaign feels tonally misaligned with the institutional nature of the site. This creates a messaging gap where the strength of the parts does not fully aggregate to the strength of the whole.

The most significant opportunity for Cboe lies in crafting and elevating a unified master narrative. This story should leverage its undeniable expertise in volatility and risk management as a proof point for a broader promise: that Cboe provides the essential tools, access, and insights needed to navigate and succeed in the complexity of modern global markets. By translating its product-level authority into a cohesive brand-level value proposition, Cboe can more effectively differentiate its less-unique offerings (like listings) and solidify its position not just as a collection of leading exchanges, but as an indispensable strategic partner in global finance.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Established as a leading global market operator with significant daily trading volumes across multiple asset classes (e.g., $79.66B in U.S. Equities, 18.25M U.S. Options contracts daily).

- •

Owner of proprietary, industry-standard products like the VIX® Index and SPX® options, which create a strong competitive moat and consistent demand.

- •

Record net revenues reported in Q2 2025 ($587.3M, +14% YoY), indicating robust and growing demand for its services across derivatives, cash markets, and data solutions.

- •

Continuous volume growth in core products, with SPX options volumes rising 21% year-over-year in Q2 2025.

Improvement Areas

- •

Diversify proprietary product suite beyond the VIX/SPX complex to create new, indispensable benchmarks in emerging asset classes.

- •

Enhance the user experience and integration of the 'Cboe Data Vantage' platform to make complex data more accessible to a wider range of institutional and sophisticated retail clients.

- •

Expand listings services to better attract high-growth technology and international companies, competing more aggressively with Nasdaq and NYSE.

Market Dynamics

High Single-Digit Growth for Exchanges; 10-11% CAGR for Financial Analytics Market.

Mature

Market Trends

- Trend:

Increased demand for data and analytics.

Business Impact:Significant growth opportunity for the 'Cboe Data Vantage' division. The financial data market is a multi-billion dollar industry with strong growth tailwinds.

- Trend:

Surging interest in derivatives and options for risk management.

Business Impact:Directly benefits Cboe's core strength in options and futures. Market volatility and macroeconomic uncertainty drive record trading volumes.

- Trend:

Digitization of assets and emergence of crypto derivatives.

Business Impact:Opportunity to become a leading regulated venue for digital asset derivatives, although recent strategic shifts to integrate this into existing business lines and wind down the spot market indicate a refined, more focused approach.

- Trend:

Globalization and demand for multi-asset class access.

Business Impact:Validates Cboe's strategy of international expansion through acquisitions in Canada, Europe, and Asia-Pacific.

- Trend:

Focus on ESG (Environmental, Social, Governance).

Business Impact:Growing demand for ESG-related data, indices, and tradable products presents a new product development frontier.

Excellent. Cboe is well-positioned to capitalize on key market trends, particularly in data analytics and derivatives. Their strategic focus aligns with the primary growth drivers in the financial markets industry.

Business Model Scalability

High

High fixed-cost base (technology infrastructure, regulatory compliance) with low variable costs per transaction, leading to significant operating leverage as volumes increase.

High. Increased trading volumes and data subscriptions lead to disproportionately higher profit margins once fixed costs are covered.

Scalability Constraints

- •

Navigating complex and fragmented global regulatory environments for new product launches and market entry.

- •

Maintaining technological superiority in a low-latency, high-frequency trading world requires continuous, significant capital investment.

- •

Cybersecurity threats requiring constant vigilance and investment to protect market integrity.

Team Readiness

Strong. The leadership team has a proven track record of strategic acquisitions (BIDS Trading, NEO, Chi-X) and aligning the company's strategy with market trends, such as refocusing its digital asset business.

Well-structured. The creation of a dedicated 'Data and Access Solutions' division and the integration of digital assets into core business lines demonstrate an ability to organize around growth opportunities.

Key Capability Gaps

- •

Deep expertise in emerging data science fields like AI/ML for predictive analytics to enhance the 'Data Vantage' offering.

- •

Talent for developing and marketing products for the rapidly growing sophisticated retail trader segment.

- •

Specialized teams for navigating market entry and regulatory nuances in high-growth regions like Southeast Asia and the Middle East.

Growth Engine

Acquisition Channels

- Channel:

Institutional Sales & Relationship Management

Effectiveness:High

Optimization Potential:Medium

Recommendation:Develop specialized sales teams focused on cross-selling data and analytics solutions to existing trading clients and vice-versa. Focus on acquiring new buy-side clients.

- Channel:

Issuer Services (Listings)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Create a more compelling value proposition for companies to list on Cboe, focusing on data-driven investor relations tools, global visibility through its network, and a streamlined listing process, particularly for innovative sectors.

- Channel:

Strategic M&A and Partnerships

Effectiveness:High

Optimization Potential:High

Recommendation:Continue to pursue targeted acquisitions that provide entry into new geographic markets (like Chi-X) or asset classes (like ErisX), and form partnerships to distribute data and access new customer segments.

- Channel:

Product-Led Growth (for Data & Analytics)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Implement a product-led growth model for 'Cboe Data Vantage' with self-service trials, API-first access, and tiered subscription models to attract a wider user base beyond large institutions.

Customer Journey

The 'customer' journey is segment-dependent: for traders, it's about low-latency connectivity and liquidity; for issuers, it's a high-touch sales and onboarding process; for data consumers, it's about discovering and integrating relevant data feeds.

Friction Points

- •

Complexity in navigating and subscribing to the vast array of data products available through 'Data Vantage'.

- •

Potentially lengthy onboarding processes for new institutional trading members or clearing firms.

- •

Fragmented user experience across different platforms acquired over time (e.g., U.S. vs. European platforms).

Journey Enhancement Priorities

{'area': 'Data Vantage Platform', 'recommendation': 'Develop a unified, intuitive web portal for discovering, testing, and subscribing to all Cboe data products, featuring clear use cases and API documentation.'}

{'area': 'Global Listings Onboarding', 'recommendation': "Create a dedicated 'concierge' service for prospective issuers to guide them seamlessly through the global listing process across Cboe's various exchanges."}

Retention Mechanisms

- Mechanism:

Network Effects & Liquidity

Effectiveness:High

Improvement Opportunity:Continue to enhance market maker programs and incentive structures to deepen liquidity in core and emerging products, creating a virtuous cycle that attracts more participants.

- Mechanism:

Proprietary Products & Indices

Effectiveness:High

Improvement Opportunity:Increase the ecosystem around core products like VIX/SPX by launching complementary products (e.g., micro-contracts, options on related indices) to increase user stickiness.

- Mechanism:

Data & Technology Integration

Effectiveness:Medium

Improvement Opportunity:Promote deeper integration of Cboe's data and execution services into clients' workflows via robust APIs and partnerships with leading FinTech platforms, increasing switching costs.

Revenue Economics

Highly favorable due to the business model's operational leverage. The primary revenue drivers are transaction fees (sensitive to market volatility) and data/access fees (more stable and recurring).

Cboe is strategically growing its recurring non-transactional revenues (Data and Access Solutions) to reduce earnings volatility from trading volumes. This segment saw 11% growth in Q2 2025.

High, evidenced by strong and expanding adjusted operating EBITDA margins (65.8% in Q2 2025).

Optimization Recommendations

- •

Aggressively bundle data subscriptions with transaction services to increase the lifetime value of trading clients.

- •

Introduce tiered pricing for data and access solutions to capture value from different customer segments, from startups to large enterprises.

- •

Expand clearing services to a wider range of products, capturing an additional, stable revenue stream.

Scale Barriers

Technical Limitations

- Limitation:

Technology Debt & Platform Integration

Impact:Medium

Solution Approach:Continue investing in a unified global technology platform to harmonize operations across acquired exchanges, reducing complexity and improving efficiency.

- Limitation:

Cybersecurity Threats

Impact:High

Solution Approach:Maintain and enhance a robust cybersecurity program with ongoing investment in threat detection, prevention, and operational resilience to protect critical market infrastructure.

Operational Bottlenecks

- Bottleneck:

Global Regulatory Compliance

Growth Impact:Acts as a constant brake on the speed of new product launches and geographic expansion, requiring significant legal and operational resources.

Resolution Strategy:Maintain a proactive, deeply-resourced global regulatory affairs team to anticipate changes and build strong relationships with regulators in key markets.

- Bottleneck:

Post-Merger Integration

Growth Impact:Integrating acquired companies' technology, culture, and operations can be slow and divert resources from organic growth initiatives.

Resolution Strategy:Develop a standardized M&A integration playbook that prioritizes key synergies and establishes clear timelines and governance from day one.

Market Penetration Challenges

- Challenge:

Intense Competition from Incumbents

Severity:Critical

Mitigation Strategy:Differentiate through product innovation (unique derivatives), superior technology (lower latency), and by creating integrated, multi-asset class solutions that competitors cannot easily replicate. Key competitors include ICE, CME Group, and Nasdaq.

- Challenge:

Gaining Listings Market Share

Severity:Major

Mitigation Strategy:Target specific high-growth niches (e.g., ETFs, SPACs, bio-tech) and build a reputation for best-in-class service and post-listing support, leveraging the global network as a key differentiator.

- Challenge:

Disruption from Private Markets

Severity:Minor

Mitigation Strategy:Explore opportunities to participate in the private markets ecosystem, potentially by partnering with or acquiring platforms that provide secondary liquidity for private shares, bridging the gap to public listings.

Resource Limitations

Talent Gaps

- •

AI/ML and Data Science specialists to build next-generation analytics products.

- •

Blockchain/DLT experts for the long-term evolution of digital asset infrastructure.

- •

Product marketing professionals with experience in SaaS and data platform GTM strategies.

Growth will be capital-intensive, requiring sustained funding for technology upgrades, global expansion, and strategic M&A. Cboe's strong balance sheet ($1.256B in cash and equivalents as of June 2025) provides ample flexibility.

Infrastructure Needs

Continued investment in global data centers and cloud infrastructure to ensure low-latency access for all market participants.

Development of a unified global technology stack to streamline operations and accelerate product development.

Growth Opportunities

Market Expansion

- Expansion Vector:

Geographic Expansion in Asia-Pacific

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Build upon the Chi-X acquisition to establish a major hub in the region. Pursue further acquisitions or strategic partnerships to gain entry into key markets like Singapore and Hong Kong, and expand data sales efforts.

- Expansion Vector:

Deeper Penetration of European Derivatives Market

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Leverage the new European derivatives marketplace to launch products tailored to European market participants, competing directly with established regional players like Eurex.

- Expansion Vector:

Targeted Retail Investor Products

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Develop simplified versions of complex institutional products (e.g., micro or mini contracts) and partner with retail-focused brokers (like Robinhood, an investor in Cboe Digital) to distribute them.

Product Opportunities

- Opportunity:

AI-Powered Predictive Analytics

Market Demand Evidence:Financial institutions are increasingly leveraging AI for data-driven decision making, creating a large market for advanced analytical tools.

Strategic Fit:Natural extension of the 'Cboe Data Vantage' platform, moving from providing raw data to delivering actionable insights.

Development Recommendation:Acquire a specialized FinTech AI firm or build an in-house data science team to develop predictive models based on Cboe's proprietary data.

- Opportunity:

ESG and Climate-Related Derivatives & Data

Market Demand Evidence:Growing regulatory requirements and investor demand for ESG integration are creating a need for new risk management tools and standardized data.

Strategic Fit:Aligns with the mission of providing tools for a 'sustainable financial future' and leverages core competencies in index creation and derivatives.

Development Recommendation:Partner with a leading ESG rating agency to co-develop benchmark indices and launch futures/options contracts based on them.

- Opportunity:

Expansion of Digital Asset Derivatives

Market Demand Evidence:Despite market volatility, institutional demand for regulated crypto derivatives for hedging and speculation remains strong.

Strategic Fit:Leverages Cboe's regulatory expertise and derivatives leadership. The recent integration of Cboe Digital into the core business strengthens this focus.

Development Recommendation:Focus on launching cash-settled futures on CFE for additional digital assets beyond BTC and ETH and creating related data products, subject to regulatory approval.

Channel Diversification

- Channel:

Cloud Marketplace Distribution (AWS, Google Cloud, Azure)

Fit Assessment:High

Implementation Strategy:Package 'Cboe Data Vantage' datasets and analytics services for easy subscription through major cloud provider marketplaces, reaching a vast new audience of developers and quantitative analysts.

- Channel:

Embedded Finance / API-as-a-Product

Fit Assessment:High

Implementation Strategy:Create a suite of APIs that allow FinTechs and neobrokers to embed Cboe's market data, and potentially trading capabilities, directly into their applications on a usage-based pricing model.

Strategic Partnerships

- Partnership Type:

Data & Analytics Technology

Potential Partners

- •

Snowflake

- •

Databricks

- •

Palantir

Expected Benefits:Enhance the 'Cboe Data Vantage' platform by integrating advanced data warehousing and AI capabilities, accelerating the development of new analytics products.

- Partnership Type:

Global Index Providers

Potential Partners

MSCI

FTSE Russell

Expected Benefits:Co-develop and gain exclusive rights to list derivatives on new, in-demand indices, particularly in thematic and ESG categories, expanding the proprietary product portfolio.

- Partnership Type:

Retail Brokerage Platforms

Potential Partners

- •

Robinhood

- •

Interactive Brokers

- •

Webull

Expected Benefits:Drive adoption of new retail-focused products and increase data distribution. Cboe has already laid the groundwork by bringing many of these firms on as partners for its digital asset business.

Growth Strategy

North Star Metric

Annual Recurring Revenue (ARR) from Data & Access Solutions

This metric aligns the company with the strategic priority of building a more stable, high-growth revenue stream that is less dependent on cyclical trading volumes. It reflects the deep integration of Cboe into customer workflows and has a strong correlation with long-term enterprise value.

Achieve and sustain 10-15% annual growth in this metric, outpacing the growth of transaction-based revenue.

Growth Model

Hybrid: 'Ecosystem Expansion' Model

Key Drivers

- •

New Proprietary Product Launches (creates lock-in)

- •

Strategic M&A (enters new markets/assets)

- •

Growth of recurring data revenue (stabilizes income)

- •

Deepening liquidity (reinforces network effect)

A dual approach: A product-led strategy for scaling the 'Data Vantage' platform globally, combined with a corporate development-led strategy for geographic and asset class expansion through M&A and strategic partnerships.

Prioritized Initiatives

- Initiative:

Scale 'Cboe Data Vantage' Globally

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 months

First Steps:Appoint dedicated regional heads for data sales in APAC and EMEA. Launch a marketing campaign targeting quantitative hedge funds and asset managers. Onboard the first set of data products onto a major cloud marketplace.

- Initiative:

Launch a Suite of ESG/Climate Derivatives

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:12-18 months

First Steps:Finalize a partnership with a leading ESG index provider. Begin the regulatory filing process for the first futures contract. Engage with market makers to ensure liquidity at launch.

- Initiative:

Execute a Strategic Acquisition in APAC Equities or Derivatives

Expected Impact:High

Implementation Effort:High

Timeframe:24+ months

First Steps:Task the corporate development team with identifying and evaluating potential acquisition targets in key markets like Singapore, South Korea, or India. Secure necessary financing lines.

Experimentation Plan

High Leverage Tests

{'area': 'Data Vantage Pricing', 'experiment': 'Test a usage-based pricing model vs. flat-rate subscriptions for a new API-delivered dataset to see which drives higher adoption and revenue.'}

{'area': 'New Product Adoption', 'experiment': 'Run a pilot program for a new derivatives contract with a limited set of trading firms, offering fee incentives in exchange for liquidity commitments and feedback before a full-scale launch.'}

Utilize an OKR (Objectives and Key Results) framework. For each experiment, define success metrics upfront (e.g., adoption rate, revenue per user, trading volume) and use statistical analysis to determine outcomes.

Quarterly review of a prioritized roadmap of growth experiments, with a dedicated cross-functional team empowered to run tests and iterate quickly.

Growth Team

A centralized 'Strategic Growth' office that works across business units. It should consist of three core pods: 1) Product Innovation & GTM, 2) Market & Corporate Development (M&A, Partnerships), and 3) Data & Analytics Monetization.

Key Roles

- •

Head of Strategic Growth

- •

Director of Data Product Monetization

- •

Corporate Development Lead (APAC)

- •

Head of Digital Asset Strategy

Invest in training for product managers on data analytics and SaaS growth models. Hire externally for specialized skills in M&A integration and AI/ML. Foster a culture of experimentation and data-driven decision-making.

Cboe Global Markets is in a strong position for sustained growth, built upon a solid foundation of market leadership in derivatives and a highly scalable business model. The company has demonstrated a clear strategic vision by actively expanding its global footprint and diversifying its revenue streams towards the high-growth, high-margin data and analytics sector. The success of its proprietary products like VIX and SPX provides a powerful competitive moat and a strong platform from which to innovate.

The primary growth engine will be a two-pronged approach: 1) The aggressive expansion of the 'Cboe Data Vantage' platform, evolving it from a data provider into an indispensable analytics engine for global finance. 2) Continued strategic M&A to enter new geographic markets, particularly in the Asia-Pacific region, and to acquire new asset class capabilities. The recent realignment of the digital assets business to focus on derivatives and clearing within the core infrastructure is a prudent move that plays to Cboe's strengths and mitigates risk.

The most significant barriers are the intense competition from other major exchange groups and the complex, ever-present challenge of navigating global financial regulations. Overcoming these will require relentless product innovation and a proactive regulatory strategy.