eScore

cencora.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Cencora possesses immense content authority due to its market-leading position as a Fortune 500 company, giving it a strong backlink profile and high domain authority. However, its digital presence is more of a corporate portal than a strategic inbound marketing engine, with significant gaps in content that aligns with new customer search intent. The brand unification is still in progress, with legacy domains and fragmented digital touchpoints diluting the core brand's strength and creating a disjointed multi-channel experience.

High inherent domain authority and brand recognition as a market leader, providing a strong foundation for SEO.

Develop a unified thought leadership hub ('Cencora Insights') to create content that targets mid-funnel keywords, captures new prospect interest, and consolidates brand authority.

The core brand message of being a unified, end-to-end global partner is communicated clearly and professionally on the homepage. However, the messaging is highly abstract and lacks segmentation for its diverse audiences, such as manufacturers versus providers. It also heavily lacks concrete proof points like case studies or testimonials to substantiate its broad claims of being 'unrivaled,' weakening its persuasive power.

A clear, consistent, and professional top-level message that effectively communicates the strategic vision of the unified Cencora brand.

Incorporate a 'Solutions For' section on the homepage to direct key personas to tailored content, and add customer proof points (testimonials, case studies) to substantiate claims.

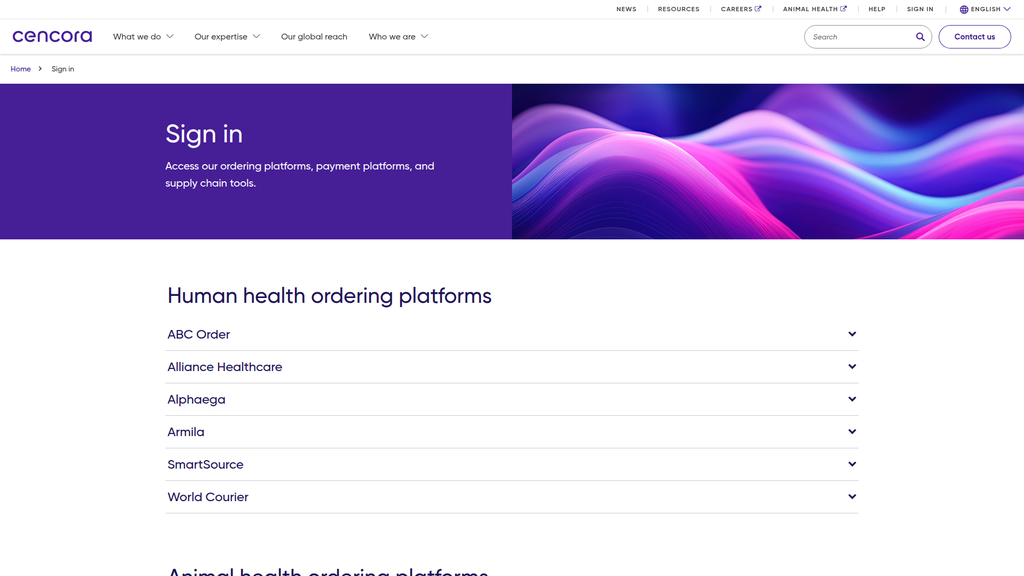

The website provides an excellent, low-friction experience for its primary audience: existing customers who need to access various service portals via the well-organized 'Sign In' page. Conversely, it performs poorly in converting new business leads, as there are no clear, compelling calls-to-action or conversion paths for prospective clients. The company shows a strong commitment to accessibility, which is a key strength, but the overall site is not optimized for new customer acquisition.

A highly effective and user-centric 'Sign In' portal that significantly reduces cognitive load for existing customers navigating a complex suite of tools.

Integrate clear, persona-based conversion pathways on core pages with CTAs like 'Request a Consultation' or 'Download Solution Brief' to capture new business leads.

Cencora's credibility is a paradox; it benefits from the immense trust associated with its market leadership and Fortune #10 status, yet this is severely undermined by the major February 2024 data breach. This incident exposed a critical gap between its stated security policies and operational reality, creating significant regulatory and reputational risk. While its public commitment to accessibility and GDPR-compliant cookie policy are strengths, the data breach represents a fundamental failure in protecting sensitive partner and patient information.

A public and detailed Digital Accessibility Mission Statement committing to WCAG 2.1 AA standards, which mitigates legal risk and promotes inclusivity.

Launch a proactive and transparent 'Trust Shield' initiative, including a third-party security audit and enhanced public communication, to rebuild confidence after the data breach.

Cencora operates within a classic oligopoly, protected by exceptionally high barriers to entry including massive economies of scale, complex regulatory requirements, and deeply embedded customer relationships. This creates a powerful and sustainable competitive moat that is nearly impossible for new entrants to challenge. Switching costs for its major partners are prohibitively high due to deep integration into their procurement and inventory systems.

Massive economies of scale and deeply integrated, long-term contracts with major healthcare providers create extremely high switching costs and a durable competitive moat.

Better articulate the unique value proposition of its integrated end-to-end model (from clinical trials to patient adherence) on its website to differentiate from competitors who are strong in specific niches.

The business model is highly scalable due to immense operational leverage in its core distribution network and a clear strategy to expand into higher-margin, asset-light services like data analytics and consulting. Strong product-market fit in high-growth areas like specialty pharmaceuticals and cell-and-gene therapy logistics provides significant expansion potential. The company's aggressive and successful M&A strategy is a proven lever for entering new markets and service areas.

A proven M&A strategy that allows for rapid expansion into high-growth, high-margin adjacent markets like specialty provider networks and regulatory consulting.

Accelerate the integration of siloed technology stacks from acquisitions to create a unified platform that can scale more efficiently and unlock cross-selling opportunities.

Cencora demonstrates a highly coherent and deliberate business model, strategically using its massive, low-margin distribution business as a foundation to build and scale a diversified portfolio of high-margin services. The rebranding from AmerisourceBergen to Cencora was a pivotal move to align its corporate identity with this unified, end-to-end solutions strategy. This strategic focus is well-aligned with key market trends, such as the growth in specialty pharmaceuticals.

A clear strategic focus on using the scale of its core distribution business to fund and grow a diversified portfolio of higher-margin services, such as specialty commercialization and data analytics.

Develop and commercialize a suite of predictive analytics products to create a new, high-margin revenue stream that fully leverages its unique data assets.

As one of the 'Big Three' distributors controlling over 90% of the U.S. market, Cencora's market power is immense. This oligopolistic position grants it significant leverage with both suppliers (pharmaceutical manufacturers) and customers, influencing industry standards and pricing structures. The company's ability to shape the market is further enhanced by its vertical integration into provider services, solidifying its central role in the healthcare ecosystem.

Dominant market share as part of a 'Big Three' oligopoly, which provides substantial pricing power, supplier leverage, and the ability to influence market direction.

Mitigate customer dependency risk by continuing to diversify revenue streams across a wider range of specialty services and international markets, reducing reliance on a few key accounts.

Business Overview

Business Classification

Pharmaceutical Distribution & Healthcare Solutions

Global Logistics, Manufacturer Services, and Technology Platforms

Healthcare

Sub Verticals

- •

Pharmaceutical Wholesale & Distribution

- •

Specialty Pharmaceuticals

- •

Animal Health

- •

Clinical Trial Logistics

- •

Healthcare Consulting & Data Analytics

Mature

Maturity Indicators

- •

Recent rebranding from a legacy name (AmerisourceBergen) to reflect a unified, global strategy.

- •

Consistent history of large-scale strategic acquisitions to expand service offerings (e.g., Alliance Healthcare, OneOncology, Retina Consultants of America).

- •

Ranked #10 on the Fortune 500, indicating massive scale and market entrenchment.

- •

Extensive and diversified portfolio of services spanning the entire pharmaceutical lifecycle.

- •

Operates as one of the 'Big Three' distributors, forming an oligopoly in the U.S. market.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

U.S. Healthcare Solutions

Description:Core business segment involving the distribution of pharmaceuticals (branded, generic, specialty, and over-the-counter), equipment, and supplies to a wide range of providers including hospitals, health systems, and retail pharmacies across the United States. This segment accounts for the vast majority of company revenue.

Estimated Importance:Primary

Customer Segment:Healthcare Providers (Hospitals, Pharmacies, Clinics)

Estimated Margin:Low

- Stream Name:

International Healthcare Solutions

Description:Encompasses pharmaceutical wholesale, distribution, and a range of specialized services for manufacturers and providers outside the U.S., including global clinical trial logistics (World Courier) and specialty distribution.

Estimated Importance:Secondary

Customer Segment:Pharmaceutical Manufacturers, International Healthcare Providers

Estimated Margin:Medium

- Stream Name:

Manufacturer & Pharma Services

Description:A suite of higher-margin services including commercialization support, market access consulting, data analytics, patient support programs, and regulatory consulting (PharmaLex) for pharmaceutical and biotech companies.

Estimated Importance:Secondary

Customer Segment:Pharmaceutical & Biotech Manufacturers

Estimated Margin:High

- Stream Name:

Animal Health

Description:Distribution of pharmaceuticals, vaccines, and other products to the companion and production animal markets through its MWI Animal Health subsidiary.

Estimated Importance:Tertiary

Customer Segment:Veterinarians and Animal Health Providers

Estimated Margin:Medium

Recurring Revenue Components

- •

Long-term distribution and service contracts

- •

Service Level Agreements (SLAs) with manufacturers and providers

- •

Subscription fees for technology platforms (e.g., inventory management software)

Pricing Strategy

Contractual & Service-Based

Premium

Opaque

Pricing Psychology

Bundling (combining distribution with value-added services)

Value-Based Pricing (for consulting and data analytics services)

Monetization Assessment

Strengths

- •

Massive revenue scale (~$294 billion in FY2024) provides significant market power.

- •

Diversification into higher-margin services (specialty, consulting) balances the low-margin core business.

- •

Deeply integrated into the healthcare ecosystem, creating high switching costs for customers.

Weaknesses

- •

Razor-thin operating margins (around 1.2%) in the core distribution business.

- •

High dependency on a small number of large customers and suppliers.

- •

Revenue is sensitive to drug pricing pressures and regulatory changes.

Opportunities

- •

Expansion in high-growth specialty pharmaceutical and cell/gene therapy logistics.

- •

Leveraging data and analytics to create new, high-margin revenue streams.

- •

Further vertical integration by acquiring or partnering with provider networks and other healthcare entities.

Threats

- •

Increased government regulation on pharmaceutical pricing and distribution.

- •

Potential market disruption from non-traditional players like Amazon.

- •

Consolidation among customers (providers) and manufacturers, increasing their negotiating power.

Market Positioning

Market Leadership through End-to-End Solutions

Leader/Major Player (Part of the 'Big Three' with McKesson and Cardinal Health, controlling over 90% of the U.S. market).

Target Segments

- Segment Name:

Pharmaceutical & Biotech Manufacturers

Description:Global pharmaceutical companies, specialty drug makers, and emerging biotech firms requiring services from clinical trial logistics to full-scale commercialization and market access.

Demographic Factors

Varying sizes from startups to multinational corporations

Psychographic Factors

Focused on speed-to-market and maximizing therapy success

Concerned with regulatory compliance and supply chain integrity

Behavioral Factors

Seeks long-term strategic partnerships

Requires global reach and specialized handling capabilities (e.g., cold chain)

Pain Points

- •

Navigating complex global regulatory landscapes

- •

Ensuring secure and timely delivery of high-value, sensitive products

- •

Gaining market access and demonstrating product value to payers

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Healthcare Providers

Description:Acute care hospitals, health systems, independent and chain retail pharmacies, clinics, and long-term care facilities.

Demographic Factors

Range from large integrated delivery networks (IDNs) to small independent pharmacies

Psychographic Factors

Prioritize patient care and operational efficiency

Value reliability and cost-effectiveness

Behavioral Factors

Relies on just-in-time inventory

Seeks to streamline procurement and manage costs through GPOs or direct contracts

Pain Points

- •

Managing inventory to prevent stockouts or waste

- •

Drug shortages and supply chain disruptions

- •

Controlling pharmaceutical spend and improving profitability

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Specialty Practices

Description:Physician practices in areas like oncology and ophthalmology (retina) that administer complex, high-cost 'buy-and-bill' drugs.

Demographic Factors

Independent practices, physician networks (e.g., OneOncology, Retina Consultants of America)

Psychographic Factors

Focused on providing cutting-edge patient treatments

Highly concerned with reimbursement and practice profitability

Behavioral Factors

Requires specialized logistics and inventory management for sensitive drugs

Benefits from practice management support and data analytics

Pain Points

- •

Financial risks associated with purchasing and billing for expensive specialty drugs

- •

Complex inventory and cold chain management requirements

- •

Need for data insights to optimize clinical and financial performance

Fit Assessment:Excellent

Segment Potential:High

Market Differentiation

- Factor:

Unmatched Scale and Global Reach

Strength:Strong

Sustainability:Sustainable

- Factor:

Integrated End-to-End Service Portfolio

Strength:Strong

Sustainability:Sustainable

- Factor:

Specialized Logistics Capabilities (World Courier)

Strength:Strong

Sustainability:Sustainable

- Factor:

Growing Network of Owned/Affiliated Provider Services (e.g. OneOncology)

Strength:Moderate

Sustainability:Sustainable

Value Proposition

We provide end-to-end support across the entire pharmaceutical spectrum, offering comprehensive solutions for human and animal health — from drug research and commercialization to distribution and patient support, paving a reliable path to patients.

Excellent

Key Benefits

- Benefit:

Supply Chain Security & Reliability

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Massive global distribution infrastructure

- •

Decades of operational experience

- •

Ranked #10 on Fortune 500

- Benefit:

Market Access for New Therapies

Importance:Critical

Differentiation:Unique

Proof Elements

- •

Comprehensive manufacturer services

- •

Global logistics for clinical trials

- •

Consulting on commercialization and reimbursement

- Benefit:

Operational Efficiency for Providers

Importance:Important

Differentiation:Somewhat unique

Proof Elements

- •

Inventory management technology (CubixxMD, Nucleus)

- •

Practice management insights tools

- •

Extensive product catalog and ordering platforms

Unique Selling Points

- Usp:

Unified global brand (Cencora) with a cohesive, integrated service offering across human and animal health.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Deep expertise and leadership in high-growth specialty pharmaceuticals, including oncology and biosimilars.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Strategic vertical integration into provider services, creating a captured customer base and deeper market insights.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Ensuring safe, timely, and compliant delivery of pharmaceuticals from manufacturer to patient.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Managing the complex logistics and market access challenges for specialty and cell/gene therapies.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Optimizing inventory, procurement, and financial performance for healthcare providers and pharmacies.

Severity:Major

Solution Effectiveness:Partial

Value Alignment Assessment

High

The value proposition is exceptionally well-aligned with the market's core needs for reliability, efficiency, and specialized expertise in an increasingly complex pharmaceutical landscape.

High

Cencora provides tailored solutions that directly address the primary pain points of its key segments: market access for manufacturers and operational/supply chain stability for providers.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Pharmaceutical & Biotech Manufacturers

- •

Hospitals, Health Systems, and GPOs

- •

Retail & Specialty Pharmacies

- •

Government Agencies

- •

Logistics & Technology Providers

Key Activities

- •

Pharmaceutical Sourcing & Distribution

- •

Global Logistics & Supply Chain Management

- •

Technology Platform Development & Maintenance

- •

Consulting & Data Analytics Services

- •

Regulatory Compliance Management

Key Resources

- •

Extensive Global Distribution Network (warehouses, transportation fleet)

- •

Proprietary Technology Platforms and Data Analytics Capabilities

- •

Broad Portfolio of Manufacturer and Provider Contracts

- •

Human Capital (logistics experts, consultants, regulatory specialists)

- •

Strong Financial Position and Access to Capital

Cost Structure

- •

Cost of Goods Sold (pharmaceutical products)

- •

Operational Costs (logistics, warehousing, labor)

- •

Selling, General & Administrative (SG&A) Expenses

- •

Investment in Technology and M&A Activity

Swot Analysis

Strengths

- •

Dominant market share and scale create significant barriers to entry.

- •

Diversified business model with growing, high-margin service segments.

- •

Deeply entrenched relationships across the entire healthcare value chain.

- •

Global leader in specialty logistics, a high-growth and complex area.

Weaknesses

- •

Extremely low profit margins on the core distribution business.

- •

High level of debt, often used to finance acquisitions.

- •

Operational complexity of managing numerous legacy brands and platforms under a unified name.

Opportunities

- •

Capitalize on the boom in specialty drugs, biosimilars, and cell/gene therapies.

- •

Expand data monetization and analytics-as-a-service offerings.

- •

Further strategic acquisitions to enter new service areas or geographies.

- •

Leverage AI and automation to drive further operational efficiencies in logistics.

Threats

- •

Intensifying drug pricing pressures from government and payers.

- •

Litigation risks (e.g., related to opioid distribution).

- •

Disintermediation threat from major technology companies or direct-to-provider models.

- •

Global supply chain disruptions and geopolitical instability.

Recommendations

Priority Improvements

- Area:

Technology Platform Integration

Recommendation:Accelerate the integration of disparate ordering and inventory management platforms (e.g., ABC Order, ASD Healthcare, Besse Medical) into a unified, modern user experience to enhance customer stickiness and operational efficiency.

Expected Impact:Medium

- Area:

Data & Analytics Commercialization

Recommendation:Develop and aggressively market a suite of predictive analytics products for manufacturers (e.g., demand forecasting, market access modeling) and providers (e.g., inventory optimization, performance benchmarking) to build a high-margin, scalable revenue stream.

Expected Impact:High

- Area:

Margin Enhancement in Core Business

Recommendation:Deploy AI-driven logistics and warehouse automation to reduce operational costs and incrementally improve the razor-thin margins in the core U.S. distribution segment.

Expected Impact:Medium

Business Model Innovation

- •

Develop a 'Healthcare Logistics as a Service' (HLaaS) platform, offering Cencora's best-in-class logistics and supply chain capabilities to adjacent industries or smaller healthcare players on a subscription or usage basis.

- •

Create a more robust data marketplace, providing anonymized, aggregated insights into pharmaceutical trends and utilization to a wider range of stakeholders, including investors, researchers, and public health organizations.

- •

Expand the vertical integration strategy beyond specialty practices into areas like home infusion services or digital pharmacies to capture more of the value chain.

Revenue Diversification

- •

Aggressively expand services for cell and gene therapies, which require ultra-specialized, high-value logistics and patient support services.

- •

Broaden the animal health segment's offerings to include practice management software and data services for veterinarians, mirroring the successful strategy in human health.

- •

Further build out the global consulting arm (building on PharmaLex acquisition) to compete more directly with established life sciences consulting firms.

Cencora's strategic evolution from AmerisourceBergen marks a deliberate and necessary pivot from a traditional, low-margin pharmaceutical distributor to a fully integrated global healthcare solutions partner. The rebranding unifies a vast portfolio of services under a single, cohesive identity, better reflecting its end-to-end value proposition to the market.

The company's business model is a classic example of leveraging immense scale in a low-margin core business (pharmaceutical distribution) to fund and build a diversified portfolio of higher-margin, value-added services. Its dominant position within the U.S. distribution oligopoly provides a stable, albeit low-profitability, foundation. The key to its future growth and profitability lies in its strategic focus on specialty pharmaceuticals, manufacturer services, and technology. Acquisitions like OneOncology and Retina Consultants of America represent a shrewd vertical integration strategy, securing a loyal customer base for its high-margin specialty products and creating a valuable feedback loop for service development.

The primary challenge for Cencora is navigating the immense pressure on its core business, including regulatory scrutiny on drug pricing and the ever-present threat of market disruption. Its future success is contingent on its ability to accelerate the growth of its service and technology segments, effectively using its unparalleled access to data to create indispensable analytical tools and insights for its partners. The business model's scalability is strong, but its strategic transformation potential hinges on successfully integrating its numerous acquired assets and shifting its customer perception from a logistics provider to an essential strategic partner in healthcare innovation.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Massive Capital Investment

Impact:High

- Barrier:

Stringent Regulatory Compliance (e.g., DSCSA)

Impact:High

- Barrier:

Economies of Scale

Impact:High

- Barrier:

Established Relationships with Manufacturers and Providers

Impact:High

- Barrier:

Complex Logistics and Cold Chain Infrastructure

Impact:High

Industry Trends

- Trend:

Growth in Specialty Pharmaceuticals and Biologics

Impact On Business:Requires investment in specialized handling, cold chain logistics, and high-touch patient support services, creating higher-margin opportunities.

Timeline:Immediate

- Trend:

Increased Focus on Supply Chain Resilience and Digitization

Impact On Business:Drives investment in technology like AI, machine learning, and digital twins for better forecasting, risk management, and operational efficiency.

Timeline:Immediate

- Trend:

Vertical Integration and Direct-to-Patient Models

Impact On Business:Creates both opportunities for new service offerings (patient logistics) and threats from new entrants (e.g., Amazon) who bypass traditional distribution channels.

Timeline:Near-term

- Trend:

Data Analytics as a Value-Added Service

Impact On Business:Shifts competition from pure logistics to providing actionable insights to manufacturers and providers, creating new revenue streams.

Timeline:Near-term

- Trend:

Sustainability and ESG Initiatives

Impact On Business:Increasing pressure to adopt greener logistics, reduce carbon footprint, and ensure ethical sourcing, impacting operational strategies and brand reputation.

Timeline:Long-term

Direct Competitors

- →

McKesson Corporation

Market Share Estimate:Approximately one-third of the U.S. market, similar to Cencora and Cardinal Health.

Target Audience Overlap:High

Competitive Positioning:Positions as a leader in healthcare supply chain management, retail pharmacy solutions, and technology, with a strong focus on oncology and specialty care.

Strengths

- •

Extensive and highly efficient distribution network.

- •

Strong technology offerings (e.g., pharmacy management software).

- •

Deeply embedded in the U.S. oncology ecosystem (The US Oncology Network).

- •

Significant scale and purchasing power.

- •

Strong government partnerships (e.g., COVID-19 vaccine distribution).

Weaknesses

- •

Complex organizational structure can lead to slower decision-making.

- •

Has been divesting from its European businesses, potentially reducing its global footprint compared to Cencora.

- •

Faces similar legal and reputational risks related to pharmaceutical distribution (e.g., opioid litigation).

Differentiators

- •

Market-leading position in oncology and specialty practice solutions.

- •

Integrated technology solutions for pharmacies and health systems.

- •

Strong focus on improving operational efficiency through technology and R&D investment.

- →

Cardinal Health

Market Share Estimate:Approximately one-third of the U.S. market, forming the oligopoly with Cencora and McKesson.

Target Audience Overlap:High

Competitive Positioning:Positions as an integrated healthcare services and products company, emphasizing its role as the 'backbone of the healthcare system'. Differentiates through its medical products segment and a growing focus on specialty solutions.

Strengths

- •

Diversified business model with both pharmaceutical and medical products segments.

- •

Strong presence in hospital supply chains and ambulatory care.

- •

Operates the largest network of radiopharmacies in the U.S.

- •

Investing heavily in specialty care growth and next-generation data platforms.

- •

Strategic sourcing ventures (e.g., Red Oak Sourcing with CVS) provide cost advantages.

Weaknesses

- •

The medical products segment has faced profitability challenges and is undergoing a turnaround.

- •

Perceived as less globally focused than Cencora.

- •

Historically, has been viewed primarily as a logistics supplier, a perception they are actively trying to change.

Differentiators

- •

Significant manufacturing and distribution of medical and surgical products (e.g., gloves, gowns).

- •

Unique leadership position in the radiopharmaceutical market.

- •

Aggressive expansion into specialty physician services management.

Indirect Competitors

- →

Amazon Pharmacy

Description:An online pharmacy and prescription delivery service that leverages Amazon's vast logistics network, Prime membership base, and customer-centric technology to offer price transparency and convenience.

Threat Level:High

Potential For Direct Competition:High, particularly if it expands into B2B distribution or leverages its logistics to bypass traditional wholesalers.

- →

UPS Healthcare

Description:A specialized division of UPS offering end-to-end logistics for pharma, biopharma, medical devices, and labs, with a focus on cold chain, quality assurance, and global reach.

Threat Level:Medium

Potential For Direct Competition:Medium. While primarily a partner, its expanding, integrated healthcare logistics services compete directly with Cencora's World Courier and specialty logistics arms.

- →

CVS Health

Description:A vertically integrated healthcare giant that includes a major retail pharmacy chain, a pharmacy benefit manager (PBM), and an insurance provider (Aetna). It has its own distribution capabilities and strategic sourcing ventures.

Threat Level:Medium

Potential For Direct Competition:Medium, as its vertical integration allows it to control more of the supply chain, potentially reducing reliance on traditional distributors for certain functions.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Massive Economies of Scale

Sustainability Assessment:The sheer scale of Cencora's distribution network creates cost efficiencies that are nearly impossible for new entrants to match.

Competitor Replication Difficulty:Hard

- Advantage:

Embedded Customer Relationships and Long-Term Contracts

Sustainability Assessment:Deeply integrated into the procurement and inventory systems of major pharmacies (e.g., Walgreens Boots Alliance) and health systems, creating high switching costs.

Competitor Replication Difficulty:Hard

- Advantage:

Comprehensive Global Service Portfolio

Sustainability Assessment:The breadth of services, from clinical trial logistics (World Courier) to commercialization and distribution, offers a unique end-to-end value proposition. The Cencora rebrand emphasizes this global, unified approach.

Competitor Replication Difficulty:Medium

- Advantage:

Regulatory Expertise and Infrastructure

Sustainability Assessment:Decades of experience navigating complex global pharmaceutical regulations creates a significant compliance moat.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'Exclusive Distribution Agreements for Specific Drugs', 'estimated_duration': 'Varies by contract (typically 1-5 years)'}

{'advantage': 'First-mover in Niche Logistics Solutions (e.g., Cell & Gene Therapy)', 'estimated_duration': '2-4 years, until competitors build out similar capabilities.'}

Disadvantages

- Disadvantage:

Oligopolistic Scrutiny

Impact:Major

Addressability:Difficult

- Disadvantage:

Dependence on a Few Large Customers

Impact:Major

Addressability:Moderately

- Disadvantage:

Complex and Fragmented Brand Portfolio (Pre-Cencora)

Impact:Minor

Addressability:Easily

Strategic Recommendations

Quick Wins

- Recommendation:

Launch a targeted digital marketing campaign to solidify the unified Cencora brand identity, clearly communicating the integrated value proposition to all customer segments.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Harmonize the user interface across the numerous customer sign-in portals to create a more seamless and less fragmented digital customer experience.

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Double down on investment in high-growth, high-margin specialty areas, particularly logistics and data services for cell and gene therapies.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Develop and commercialize an integrated data analytics platform that provides predictive insights on drug utilization, inventory management, and supply chain risks for providers and manufacturers.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Expand animal health digital platforms to offer more value-added services like practice management software and predictive analytics for veterinary clinics.

Expected Impact:Medium

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Strategically acquire technology startups specializing in AI-driven supply chain optimization, blockchain for traceability, or digital health to preempt disruption from tech giants like Amazon.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Build out a modular, direct-to-patient logistics and support service that can be white-labeled by manufacturers, particularly for specialty drugs and clinical trials.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Continue strategic global expansion, focusing on emerging markets where pharmaceutical infrastructure is less mature and an integrated service model can capture significant market share.

Expected Impact:High

Implementation Difficulty:Difficult

Position Cencora as the central nervous system of the global pharmaceutical ecosystem—an indispensable partner that provides not just distribution, but intelligent, technology-enabled solutions that accelerate patient access to therapies.

Differentiate through superior global reach and a seamlessly integrated suite of services, from clinical trial logistics to patient support programs. Emphasize deep expertise in the most complex and high-growth areas of pharma, such as biologics and cell & gene therapies.

Whitespace Opportunities

- Opportunity:

Develop a 'Supply Chain Control Tower' service for hospital systems.

Competitive Gap:Competitors offer pieces of this, but no single entity provides a fully integrated, predictive analytics platform for managing pharmaceutical and medical supply inventory, forecasting demand, and mitigating shortage risks in real-time.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Create a standardized, global platform for cell and gene therapy (CGT) orchestration.

Competitive Gap:The CGT supply chain is highly fragmented and complex. A single platform that manages the 'chain of identity' and 'chain of custody' from patient cell collection to infusion would be a significant differentiator.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Launch a dedicated ESG-focused logistics service ('Green Pharma Chain').

Competitive Gap:While all competitors are addressing sustainability, none have productized it as a distinct, premium service offering optimized routes, sustainable packaging, and carbon offsetting for environmentally-conscious pharma manufacturers.

Feasibility:High

Potential Impact:Medium

The pharmaceutical distribution industry is a mature, highly concentrated oligopoly dominated by Cencora, McKesson, and Cardinal Health. Together, they control over 90% of the U.S. market, a position protected by formidable barriers to entry including massive capital requirements, regulatory complexity, and entrenched relationships. Competition among this trio is fierce, based on operational efficiency, scale, and an expanding portfolio of value-added services that extend beyond core distribution.

Cencora, following its rebranding from AmerisourceBergen, is strategically positioning itself as a unified, global leader in pharmaceutical access and healthcare solutions. This move aims to leverage its significant global footprint and diverse service offerings—from specialty distribution to clinical trial logistics—as a key differentiator against its more North America-focused rivals. Its core sustainable advantages are its immense scale, deep integration into customer workflows, and a uniquely comprehensive service portfolio.

The primary competitive threats are twofold. First, direct competitors McKesson and Cardinal Health are aggressively investing in their own areas of specialization—McKesson in oncology and technology, and Cardinal in medical products and specialty physician services —to carve out defensible, high-margin niches. Second, and more significantly in the long term, are market disruptors. Amazon Pharmacy represents a substantial threat, leveraging a powerful brand, superior logistics DNA, and a direct-to-consumer model that could eventually disintermediate traditional distributors. Simultaneously, specialized logistics providers like UPS Healthcare are becoming direct competitors in high-value areas such as cold chain and biopharma logistics.

Key industry trends are shaping the competitive landscape. The rapid growth of specialty drugs, biologics, and cell and gene therapies demands more complex, temperature-controlled supply chains and patient support services, shifting the basis of competition towards expertise and technology rather than just volume. Digitization, including the use of AI and predictive analytics, is becoming critical for managing supply chain resilience and providing data-driven insights to partners.

Cencora's strategic imperative is to leverage its unified global brand to deliver a seamlessly integrated customer experience that its competitors cannot easily replicate. Success will depend on its ability to out-innovate in high-growth specialty areas, effectively integrate technology and data analytics into its core offerings, and build a defensible moat against tech-first disruptors. The key opportunities lie in addressing the fragmented and complex needs of emerging therapeutic areas like cell and gene therapy and providing holistic, data-driven supply chain management solutions.

Messaging

Message Architecture

Key Messages

- Message:

Paving a reliable path to patients.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Headline

- Message:

We provide end-to-end support across the entire pharmaceutical spectrum, offering comprehensive solutions for human and animal health — from drug research and commercialization to distribution and patient support.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Sub-headline

- Message:

Cencora’s depth and breadth of world-class human and animal health solutions is unrivaled.

Prominence:Secondary

Clarity Score:Medium

Location:Homepage Mid-page Section

- Message:

Join us in creating healthier futures for all.

Prominence:Secondary

Clarity Score:High

Location:Homepage Careers Section

- Message:

Access our ordering platforms, payment platforms, and supply chain tools.

Prominence:Tertiary

Clarity Score:High

Location:Sign-in Page Headline

The message hierarchy is logical but bifurcated. The homepage effectively prioritizes a high-level, corporate brand message of comprehensive, end-to-end partnership. However, there's a significant disconnect between this strategic message and the highly functional, fragmented messaging on the 'Sign-in' page. The architecture successfully elevates the unified 'Cencora' brand but does not provide clear pathways from the top-level message to the specific solutions that different audiences need.

Messaging is consistent in its professional tone but varies significantly in its level of abstraction. The homepage speaks in broad, strategic terms ('Paving a reliable path,' 'creating healthier futures'), while the sign-in page is purely tactical and operational ('Sign in to Health Systems Ordering,' 'Access oncology medications'). This is appropriate for the function of each page, but the lack of a connecting narrative between the 'why' (homepage) and the 'how' (sign-in page) is a missed opportunity to reinforce the unified brand value proposition across all touchpoints.

Brand Voice

Voice Attributes

- Attribute:

Corporate & Professional

Strength:Strong

Examples

- •

We provide end-to-end support across the entire pharmaceutical spectrum...

- •

Discover our suite of end-to-end capabilities...

- •

Cencora helps bring your aspirations, innovations, and essential services...

- Attribute:

Authoritative & Confident

Strength:Strong

Examples

- •

Our customers and partners... have access to our groundbreaking tools and strategies...

- •

Cencora’s depth and breadth... is unrivaled.

- •

We have industry-leading solutions...

- Attribute:

Purpose-Driven

Strength:Moderate

Examples

- •

Join us in creating healthier futures for all.

- •

Our impact is felt in many ways around the world.

- •

Expanding access to strengthening communities...

- Attribute:

Comprehensive

Strength:Strong

Examples

- •

across the entire pharmaceutical spectrum

- •

end-to-end support

- •

human and animal health

- •

from concept to delivery

Tone Analysis

Formal and declarative

Secondary Tones

- •

Aspirational

- •

Reassuring

- •

Informative

Tone Shifts

Shifts from a broad, aspirational tone on the homepage to a direct, functional tone on the sign-in page, which is appropriate for the context.

The 'Join us' careers section shifts to a more inclusive and purpose-oriented tone.

Voice Consistency Rating

Good

Consistency Issues

The voice is highly consistent at the corporate level. However, the sheer number of sub-brands and platforms listed on the sign-in page (e.g., ASD Healthcare, Besse Medical, CubixxMD, World Courier) highlights a key challenge: the Cencora corporate voice has not yet fully cascaded into a unified identity across these legacy brands, which still carry their own equity and likely their own voice on their respective platforms.

Value Proposition Assessment

Cencora is the indispensable, unified global partner for the entire pharmaceutical ecosystem, providing unrivaled end-to-end solutions that simplify complexity and accelerate positive health outcomes for both humans and animals.

Value Proposition Components

- Component:

Comprehensive Scope

Clarity:Clear

Uniqueness:Unique

Details:Coverage from drug research and commercialization to distribution and patient support. The combination of human and animal health under one umbrella is a key differentiator.

- Component:

Global Scale & Reach

Clarity:Clear

Uniqueness:Somewhat Unique

Details:Messaging emphasizes global reach with local impact, positioning them as a partner for multinational pharmaceutical companies. This is a key competitive arena with players like McKesson and Cardinal Health.

- Component:

Reliability & Partnership

Clarity:Clear

Uniqueness:Common

Details:Phrases like 'Paving a reliable path' and 'Partner with us' frame the relationship as more than transactional, though this is a common claim in the B2B services industry.

- Component:

Innovation & Forward-Focus

Clarity:Somewhat Clear

Uniqueness:Somewhat Unique

Details:Mention of 'groundbreaking tools,' 'next-level capabilities,' and a 'Global Products and Solutions team' signals a focus on innovation, but this is less substantiated with concrete examples on the homepage.

Cencora's primary differentiation stems from its communicated scope and scale. The messaging successfully portrays the company not just as a distributor, but as a comprehensive solutions provider across the entire value chain and for both human and animal health. The use of words like 'unrivaled' and 'entire spectrum' is a direct attempt to claim a superior, all-encompassing position in the market. The unification under the single brand 'Cencora' is a strategic move to make this comprehensive value proposition clearer and more powerful than when it was a collection of businesses under AmerisourceBergen.

The messaging positions Cencora as a strategic partner, aiming to move the conversation beyond the commoditized logistics and distribution services that define the industry. By emphasizing 'solutions,' 'commercialization,' and 'patient support,' they compete not just with other distributors like McKesson and Cardinal Health on efficiency, but also with a wide array of specialized consulting and service firms on strategic value. The recent rebrand is central to this effort, creating a unified front that appears more integrated and comprehensive than a holding company of disparate brands.

Audience Messaging

Target Personas

- Persona:

Pharmaceutical Manufacturer

Tailored Messages

- •

We provide end-to-end support... from drug research and commercialization to distribution...

- •

Reshaping how healthcare is delivered with new products and solutions

- •

Access our ordering platforms... and supply chain tools.

Effectiveness:Somewhat

- Persona:

Healthcare Provider (Hospitals, Health Systems, Specialty Clinics)

Tailored Messages

- •

Health Systems Ordering

- •

Speciality Ordering (ASD Healthcare)

- •

Access oncology medications and resources...

- •

Simplify inventory management with CubixxMD

Effectiveness:Effective

- Persona:

Retail & Community Pharmacy

Tailored Messages

- •

Wholesale Ordering

- •

Seasonal Vaccine Ordering

- •

Good Neighbor Pharmacy

Effectiveness:Effective

- Persona:

Animal Health Professionals (Veterinarians)

Tailored Messages

Manage operations, client experiences, and deliver products and services for top-notch animal pharmaceutical care...

MWI Animal Heath

Effectiveness:Effective

Audience Pain Points Addressed

- •

Supply chain complexity

- •

Inventory management and cost control

- •

Navigating market access and commercialization challenges

- •

Operational efficiency for pharmacies and providers

- •

Need for reliable, timely delivery of medications

Audience Aspirations Addressed

- •

Optimizing business operations

- •

Elevating patient (and animal) care

- •

Successfully bringing innovations to market

- •

Creating healthier futures for communities

Persuasion Elements

Emotional Appeals

- Appeal Type:

Purpose & Impact

Effectiveness:Medium

Examples

- •

Join us in creating healthier futures for all.

- •

Our impact is felt in many ways around the world.

- •

improving the lives of people and animals everywhere.

- Appeal Type:

Trust & Reliability

Effectiveness:High

Examples

- •

Paving a reliable path to patients.

- •

Partner with us to optimize your business...

- •

The sheer scale and professionalism of the website and the exhaustive list of services imply stability and trustworthiness.

Social Proof Elements

- Proof Type:

Implied Market Leadership

Impact:Strong

Details:Claims like 'unrivaled,' 'industry-leading,' and showcasing a massive global scope imply they are a trusted leader that many others rely on.

- Proof Type:

Media Mentions

Impact:Moderate

Details:The 'Newsroom' section with press releases serves as a form of social proof, demonstrating company activity and industry recognition.

Trust Indicators

- •

Professional and modern website design

- •

Clear articulation of their global scale and comprehensive services

- •

The recent, well-publicized rebrand from AmerisourceBergen to Cencora, signaling a forward-looking strategy.

- •

Presence of a detailed 'Sign-in' page listing numerous established, operational platforms.

Scarcity Urgency Tactics

None observed. This is appropriate for Cencora's B2B partnership model, which focuses on long-term, high-consideration relationships rather than impulsive transactions.

Calls To Action

Primary Ctas

- Text:

Explore our capabilities

Location:Homepage Hero Section

Clarity:Clear

- Text:

Contact us

Location:Homepage Footer

Clarity:Clear

- Text:

Sign in to [Platform Name]

Location:Sign-in Page (multiple instances)

Clarity:Clear

- Text:

Learn more about [Topic]

Location:Homepage (multiple instances)

Clarity:Clear

The CTAs are clear and functional but lack persuasive drive. They are primarily navigational ('Explore', 'Learn more'), guiding users to more information rather than prompting a specific conversion action. This is suitable for an informational corporate homepage. The 'Sign-in' page CTAs are highly effective for their purpose: routing existing customers to the correct portal. There is an opportunity to add more persona-based CTAs on the homepage to guide potential new partners more effectively (e.g., 'Solutions for Manufacturers,' 'Support for Providers').

Messaging Gaps Analysis

Critical Gaps

- •

Lack of a clear 'Who We Serve' or 'Solutions For' section on the homepage. The messaging is a monolithic 'we do everything' statement, which forces diverse audiences (a pharma manufacturer vs. a community pharmacy) to work hard to find their place in the narrative.

- •

Absence of customer proof points. There are no testimonials, case studies, or partner logos on the homepage to substantiate claims like 'unrivaled' or 'groundbreaking tools.'

- •

The 'Why Cencora?' is not explicitly answered. The rebrand from AmerisourceBergen was a major strategic move to unify the company; the messaging could do more to explain the tangible benefits of this unification for customers.

Contradiction Points

There are no direct contradictions. However, there's a tension between the message of being a single, unified company ('We are Cencora') and the presentation of a long, fragmented list of separately-branded ordering platforms on the sign-in page. This suggests the brand unification is still a work in progress from a customer experience perspective.

Underdeveloped Areas

Storytelling. The 'Our impact' message is communicated through broad statements ('expanding access,' 'strengthening communities'). This could be far more powerful if told through specific stories of a patient, a pharmacy, or a manufacturer partnership.

Innovation narrative. The site mentions a 'Global Products and Solutions team' and developing new offerings, but provides little detail on what this innovation looks like or what problems it solves for customers.

Messaging Quality

Strengths

- •

Successfully communicates immense scale and comprehensive capabilities.

- •

The core value proposition of being an 'end-to-end' partner is clear and consistent.

- •

The brand voice is professional, confident, and appropriate for a global industry leader.

- •

The homepage effectively establishes the new, unified Cencora brand identity.

Weaknesses

- •

Over-reliance on corporate jargon ('suite of end-to-end capabilities,' 'pharmaceutical spectrum').

- •

Messaging is abstract and lacks concrete, tangible examples or proof points.

- •

Fails to effectively segment and speak directly to its varied core audiences on the homepage.

- •

The connection between the high-level brand promise and the specific product/platform offerings is weak.

Opportunities

- •

Develop persona-based content hubs to create clear pathways for key audiences (manufacturers, providers, pharmacies).

- •

Incorporate case studies and testimonials to transform abstract claims into compelling stories.

- •

Clarify the 'one Cencora' advantage by explaining how the integration of its various services provides unique value that competitors cannot match.

- •

Humanize the brand by featuring the experts behind the solutions and telling the stories of their impact.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Audience Segmentation

Recommendation:Redesign the homepage below the hero section to include a 'Solutions For' module that directs key personas (e.g., 'Pharmaceutical Manufacturers,' 'Health Systems,' 'Pharmacies,' 'Veterinarians') to tailored landing pages. This will bridge the gap between the corporate message and user needs.

Expected Impact:High

- Area:

Value Proposition Substantiation

Recommendation:Create a 'Customer Stories' or 'Case Studies' section featuring recognizable partners. Use metrics and quotes to prove the effectiveness of Cencora's solutions and bring the 'impact' message to life.

Expected Impact:High

- Area:

Simplify Language

Recommendation:Review homepage copy to replace jargon with more direct, benefit-oriented language. For example, instead of 'suite of end-to-end capabilities,' try 'From clinical trials to patient hands, we manage every step to ensure your therapy succeeds.'

Expected Impact:Medium

Quick Wins

- •

Add a sub-navigation menu on the homepage that clearly outlines solutions for different customer types.

- •

Incorporate key statistics on the homepage to quantify Cencora's scale (e.g., 'Delivering X doses daily,' 'Serving X countries').

- •

Feature partner logos in the footer or a dedicated section to act as immediate social proof.

Long Term Recommendations

- •

Develop a comprehensive content marketing strategy that tells the story of Cencora's impact through thought leadership, detailed case studies, and partner spotlights.

- •

Execute a brand integration plan to more seamlessly connect the master Cencora brand with its many sub-brands and platforms, creating a more unified user experience.

- •

Invest in interactive tools or content that help potential partners diagnose their own supply chain or commercialization challenges and see how Cencora's solutions can help.

Cencora's strategic messaging on its website effectively establishes its new, unified brand identity as a global, end-to-end pharmaceutical solutions partner. The core value proposition of unrivaled scope and scale is communicated clearly and confidently, positioning the company as a leader competing with giants like McKesson and Cardinal Health. The voice is professional and authoritative, successfully conveying the gravity and reliability required in the healthcare supply chain. However, the messaging operates at a very high level of abstraction, creating a significant gap between the corporate brand promise and the specific, tangible solutions its diverse customer base requires. The primary weakness is the failure to segment audiences on the homepage, forcing pharmaceutical manufacturers, hospitals, and community pharmacies into the same generic narrative. While the functional sign-in page reveals the depth of their targeted solutions, there is no clear bridge from the homepage's 'why' to the specific 'how' for new prospects. The lack of customer stories, case studies, or tangible proof points makes powerful claims like 'unrivaled' and 'groundbreaking' feel unsubstantiated. To improve business outcomes, Cencora's messaging strategy must evolve to create clearer, persona-based user journeys, substantiate its claims with compelling proof, and translate its abstract corporate vision into concrete value for each of its key market segments.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Cencora (formerly AmerisourceBergen) is one of the 'Big Three' pharmaceutical distributors, forming an oligopoly that controls over 90% of the U.S. drug distribution market.

- •

Reported consolidated revenue of $294 billion in fiscal year 2024, demonstrating massive market acceptance and scale.

- •

The company's website showcases a vast and highly specialized portfolio of solutions for human and animal health, catering to diverse customer segments from large hospital systems to independent pharmacies and biopharma manufacturers.

- •

Long-standing, deeply integrated customer relationships are evident from the numerous specialized ordering, inventory, and data portals (e.g., ABC Order, MWI Animal Health, Nucleus).

- •

Strategic acquisitions of companies like Alliance Healthcare and Retina Consultants of America indicate a successful model of integrating new services to meet evolving market needs.

Improvement Areas

- •

Simplify and unify the customer experience across a complex portfolio of dozens of distinct brands and login portals, which was a stated goal of the Cencora rebranding.

- •

Enhance cross-selling and integration between core distribution services and higher-margin specialty services (e.g., data analytics, commercialization support).

- •

Increase investment in user experience (UX) for digital platforms to create a more seamless and modern interface for healthcare providers.

Market Dynamics

Mid-single-digit growth (around 9.45% CAGR projected for 2024-2028) for the core pharmaceutical wholesale and distribution market, with much higher growth (14.8% CAGR) in the specialty pharmaceuticals segment.

Mature

Market Trends

- Trend:

Growth of Specialty Pharmaceuticals

Business Impact:High-margin growth opportunity. Cencora is strategically focused on expanding its leadership in specialty drugs, which require complex logistics and patient support services.

- Trend:

Increased Regulatory Scrutiny

Business Impact:Operational complexity and compliance costs are increasing, particularly with regulations like the Drug Supply Chain Security Act (DSCSA), requiring significant investment in traceability and security.

- Trend:

Digitalization and Data Analytics

Business Impact:Opportunity to monetize vast datasets on drug utilization and supply chain performance. Demands investment in AI, blockchain, and real-time tracking technologies to enhance efficiency and create new value-added services.

- Trend:

Vertical Integration and M&A

Business Impact:Acquisitions are a key growth driver, allowing Cencora to expand internationally and move into adjacent service areas like provider networks (OneOncology) and regulatory consulting.

- Trend:

Animal Health Market Expansion

Business Impact:The global animal health market is growing steadily (projected CAGR of 6-8%), driven by increased pet ownership and demand for animal protein, presenting a durable, diversified revenue stream.

Excellent. While the core distribution market is mature, Cencora is well-timed to capitalize on high-growth adjacent markets like specialty pharma, cell & gene therapy logistics, and data-driven healthcare solutions.

Business Model Scalability

High

The core distribution business has significant fixed costs (warehouses, logistics networks) but achieves massive economies of scale, leading to scalable variable costs per unit distributed. Higher-margin service businesses are more talent-dependent but highly scalable.

High. Small improvements in efficiency within their vast logistics network or increased adoption of high-margin services can lead to significant increases in operating income.

Scalability Constraints

- •

Integration of a complex web of legacy IT systems from numerous acquisitions.

- •

Navigating disparate and evolving international regulatory frameworks as the company expands globally.

- •

Intense competition within the oligopolistic market structure, limiting pricing power on core distribution services.

Team Readiness

Proven and experienced leadership team with a clear long-term growth strategy focused on specialty pharma and global expansion. The transition from AmerisourceBergen to Cencora signals a forward-looking vision.

Operates through two primary segments: U.S. Healthcare Solutions and International Healthcare Solutions. The key challenge is fostering an 'enterprise-powered mindset' to break down silos and drive synergy across its many acquired brands and business units.

Key Capability Gaps

- •

Agile Product Development: Need for faster development cycles for technology and data products to compete with more nimble tech-focused startups.

- •

Unified Data Science & AI: Requires further centralization and investment to fully leverage data assets across all business segments for predictive analytics and new service offerings.

- •

Global Integration Management: As acquisitions continue, a core competency in rapidly and seamlessly integrating international companies and their platforms is critical.

Growth Engine

Acquisition Channels

- Channel:

Enterprise & Direct Sales

Effectiveness:High

Optimization Potential:Medium

Recommendation:Equip sales teams with tools and incentives to cross-sell the full suite of Cencora's higher-margin services, not just core distribution contracts.

- Channel:

Mergers & Acquisitions (M&A)

Effectiveness:High

Optimization Potential:High

Recommendation:Continue strategic acquisitions in high-growth areas like specialty provider networks, cell & gene therapy logistics, and biopharma commercialization services to expand capabilities and market reach.

- Channel:

Strategic Partnerships

Effectiveness:High

Optimization Potential:High

Recommendation:Deepen partnerships with biopharma innovators early in the clinical trial process to become the embedded commercialization and distribution partner post-approval.

- Channel:

Corporate Website / Inbound

Effectiveness:Low

Optimization Potential:Medium

Recommendation:The website serves primarily as a corporate portal and sign-in hub. Develop targeted content and lead capture for specific high-value service lines to generate inbound interest from biopharma and specialty providers.

Customer Journey

Highly complex and relationship-based, involving long sales cycles, RFPs, and contract negotiations with major health systems, pharmacy chains, and manufacturers.

Friction Points

- •

Fragmented digital experience with numerous separate portals and brand identities for different services, hindering a unified view of the customer relationship.

- •

Potential difficulty for existing customers to discover and adopt new services from other parts of the Cencora portfolio.

- •

Onboarding and integration processes for new services can be complex for large healthcare organizations.

Journey Enhancement Priorities

{'area': 'Customer Onboarding & Cross-Selling', 'recommendation': 'Develop a unified customer portal or single sign-on (SSO) solution that provides a consolidated view of all services a customer uses and proactively recommends relevant additional solutions.'}

{'area': 'Digital Self-Service', 'recommendation': 'Expand self-service capabilities for reporting, analytics, and service management to empower customers and reduce administrative overhead.'}

Retention Mechanisms

- Mechanism:

High Switching Costs

Effectiveness:High

Improvement Opportunity:Deepen integration of Cencora's technology platforms (e.g., inventory management, ordering systems) into the core operational workflows of customers to make switching even more prohibitive.

- Mechanism:

Long-Term Contracts

Effectiveness:High

Improvement Opportunity:Structure contracts to include incentives for adopting a broader range of Cencora's value-added services over the contract term.

- Mechanism:

Integrated Service Offerings

Effectiveness:Medium

Improvement Opportunity:Bundle core distribution with consulting, data analytics, and patient support services to create sticky, high-value solution packages that are difficult for competitors to replicate.

Revenue Economics

Blended model: Core distribution is a high-volume, low-margin business. Growth and profitability are driven by layering high-margin specialty and commercialization services on top of the distribution relationship. Net margins are thin overall (around 0.86%), but the scale is enormous.

Extremely High. Customer relationships with large health systems and manufacturers can last for decades, generating immense lifetime value. Customer acquisition cost is significant but is amortized over a very long and profitable relationship.

High

Optimization Recommendations

- •

Systematically increase the penetration of high-margin services within the existing customer base.

- •

Leverage technology and automation to continue driving down operational costs in the core distribution business.

- •

Develop and scale data-as-a-service (DaaS) products, creating a new, high-margin revenue stream from existing data assets.

Scale Barriers

Technical Limitations

- Limitation:

Siloed Technology Stacks

Impact:High

Solution Approach:A multi-year platform unification strategy. Prioritize creating data warehouses and APIs that can connect disparate systems, even if full consolidation isn't immediately feasible.

- Limitation:

Legacy System Modernization

Impact:Medium

Solution Approach:Adopt a cloud migration strategy, modernizing core logistics and ordering platforms piece-by-piece to improve agility, security, and scalability.

Operational Bottlenecks

- Bottleneck:

Global Supply Chain Complexity

Growth Impact:Constant threat of disruption from geopolitical events, raw material shortages, and logistics failures.

Resolution Strategy:Invest in predictive analytics and control tower visibility tools for real-time risk monitoring. Diversify logistics partners and build redundancy into critical supply routes.

- Bottleneck:

Cold Chain Logistics for Specialty Drugs

Growth Impact:Specialty pharma growth is dependent on flawless temperature-controlled logistics, where failures are extremely costly.

Resolution Strategy:Continue investing in state-of-the-art cold chain technologies (e.g., advanced monitoring, IoT sensors) and expand specialized infrastructure globally.

Market Penetration Challenges

- Challenge:

Oligopolistic Competition

Severity:Critical

Mitigation Strategy:Compete on value-added services rather than price for core distribution. Focus growth on expanding the service portfolio and international markets where competition may be less entrenched.

- Challenge:

Drug Pricing Pressure and Regulatory Risk

Severity:Major

Mitigation Strategy:Diversify revenue streams away from pure distribution margins and into services like consulting and data analytics that are less susceptible to drug pricing regulations. Proactively engage with policymakers.

- Challenge:

Antitrust Scrutiny

Severity:Minor

Mitigation Strategy:Focus M&A strategy on acquiring capabilities in adjacent markets (tech, services) rather than direct competitors to minimize antitrust risk.

Resource Limitations

Talent Gaps

- •

Data Scientists & AI/ML Engineers

- •

Cell & Gene Therapy Logistics Specialists

- •

Global M&A Integration Experts

- •

Digital Product Managers

Significant capital required for ongoing strategic acquisitions, global infrastructure expansion (especially cold chain), and technology modernization.

Infrastructure Needs

- •

Expansion of specialized, temperature-controlled warehousing for biologics and cell therapies.

- •

Investment in a unified, global IT infrastructure and data analytics platform.

- •

Modernization of logistics network with automation and robotics to improve efficiency.

Growth Opportunities

Market Expansion

- Expansion Vector:

Deeper Penetration in Animal Health

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Leverage existing MWI Animal Health infrastructure to expand service offerings beyond distribution, including practice management software, data analytics, and specialty compounding for veterinarians.

- Expansion Vector:

Geographic Expansion in Asia-Pacific

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Pursue strategic acquisitions or partnerships to enter high-growth APAC markets, focusing on countries with rising healthcare expenditures and expanding biopharma sectors.

- Expansion Vector:

Clinical Trial Logistics Services

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Expand the World Courier brand's capabilities to provide end-to-end logistics and patient support for decentralized clinical trials, a rapidly growing market segment.

Product Opportunities

- Opportunity:

Commercial Data & Analytics Platform

Market Demand Evidence:Pharmaceutical manufacturers spend billions on market intelligence. Cencora's transactional data offers unparalleled insight into real-world drug performance and supply chain dynamics.

Strategic Fit:High

Development Recommendation:Develop a subscription-based data-as-a-service (DaaS) platform offering anonymized, aggregated insights on prescribing patterns, inventory levels, and market access for pharma clients.

- Opportunity:

End-to-End Cell & Gene Therapy (CGT) Solutions

Market Demand Evidence:The CGT market is one of the fastest-growing segments in pharma, with unique and highly complex 'vein-to-vein' logistics and patient service requirements.

Strategic Fit:High

Development Recommendation:Integrate logistics (World Courier), patient support (TheraCom), and provider services to create a comprehensive, high-value service package specifically for CGT innovators.

- Opportunity:

Provider Practice Management Solutions

Market Demand Evidence:Independent physician practices (like those in the OneOncology and RCA networks) require sophisticated software for inventory management, revenue cycle, and patient engagement.

Strategic Fit:High

Development Recommendation:Acquire or build a modern, cloud-based practice management software suite and leverage the existing distribution relationship as a powerful sales channel.

Channel Diversification

- Channel:

Direct-to-Biotech Digital Platform

Fit Assessment:Good

Implementation Strategy:Create a digital portal specifically for emerging biotech and pharma companies to access Cencora's pre-commercialization and clinical trial services, simplifying the procurement process for smaller, resource-constrained innovators.

Strategic Partnerships

- Partnership Type:

Technology & AI

Potential Partners

- •

Palantir

- •

Snowflake

- •

Leading AI-powered logistics optimization firms

Expected Benefits:Accelerate development of data analytics platforms, enhance supply chain predictive capabilities, and improve operational efficiency.

- Partnership Type:

Venture Capital & Incubators

Potential Partners

Healthcare-focused VC firms

Biotech incubators

Expected Benefits:Gain early access and build relationships with promising biopharma startups that will become future customers for commercialization and distribution services. Cencora Ventures is a good start to build upon.

Growth Strategy

North Star Metric

Annual Recurring Revenue (ARR) from Services

This metric shifts focus from the low-margin, transactional revenue of core distribution to the high-margin, sticky revenue from software, data, and commercialization services. Growth in this metric directly reflects success in the company's diversification and value-add strategy.

15-20% year-over-year growth in Services ARR.

Growth Model

Platform & Ecosystem Model

Key Drivers

- •

Acquisition of new distribution customers (the platform foundation).

- •

Cross-selling and up-selling of integrated services (software, data, patient support) to the existing customer base.

- •

Strategic M&A to add new high-value capabilities to the platform.

Establish dedicated teams focused on maximizing 'share of wallet' within key enterprise accounts. Incentivize sales and account management to sell integrated solutions rather than standalone products. Market the unified Cencora brand as a single strategic partner for the entire pharmaceutical value chain.

Prioritized Initiatives

- Initiative:

Launch 'Cencora Intelligence Cloud' Data Platform

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 Months

First Steps:Appoint a Head of Data Products. Consolidate data from top 3 business units into a unified data lake. Develop a pilot analytics dashboard for an initial set of pharma partners.

- Initiative:

Unified Customer Portal Project

Expected Impact:Medium

Implementation Effort:High

Timeframe:24-36 Months

First Steps:Conduct a comprehensive audit of all customer-facing portals. Develop a single sign-on (SSO) solution as a first step. Design a unified dashboard UI/UX.

- Initiative:

Expand Cell & Gene Therapy Service Offering

Expected Impact:High

Implementation Effort:Medium

Timeframe:12-18 Months

First Steps:Form a cross-functional CGT business unit. Create bundled service packages and marketing collateral. Target late-stage clinical CGT companies for partnership.

Experimentation Plan

High Leverage Tests

{'test': 'Test different pricing and packaging models for bundled service offerings (e.g., distribution + inventory management + analytics).', 'hypothesis': 'Bundled solutions will increase customer LTV and retention by over 25%.'}

{'test': "Pilot a 'white glove' onboarding program for newly acquired strategic accounts to accelerate adoption of Cencora's service portfolio.", 'hypothesis': 'A dedicated onboarding program will increase service cross-sell rate by 40% in the first year.'}

Utilize cohort analysis to track service adoption, revenue per customer, and retention rates. Implement A/B testing for digital marketing initiatives aimed at new service lines.

Quarterly review of key growth experiments and initiatives by a dedicated growth council.

Growth Team

A centralized Corporate Strategy & Growth team that works horizontally across the U.S. and International business segments. This team should include M&A, Corporate Development, and a new 'Product Innovation' group.

Key Roles

- •

Chief Strategy Officer

- •

VP of Data Products & Monetization

- •

Head of M&A Integration

- •

Director of Global Market Access Solutions

Invest in training for the existing salesforce on solution-selling methodologies. Actively recruit top talent from the technology and biotech sectors to infuse new skills in product management and data science.

Cencora possesses an exceptionally strong foundation for growth, anchored by its dominant position in the mature pharmaceutical distribution market. The 2023 rebranding from AmerisourceBergen was a strategic necessity to unify a sprawling portfolio and signal a clear future direction centered on becoming a global, integrated healthcare solutions partner. The company's product-market fit is undeniable, evidenced by its massive revenue and deep entrenchment in the healthcare ecosystem.

The primary growth vector is not in gaining marginal share in the oligopolistic distribution market, but in shifting its revenue mix towards higher-margin, technology-enabled services. Cencora's most significant untapped asset is the immense amount of transactional data flowing through its network. The highest-priority strategic initiative should be the development and commercialization of a data and analytics platform, transforming a cost center (data infrastructure) into a high-margin recurring revenue stream.

Key scale barriers are internal: the technical and organizational debt from decades of acquisitions. Integrating disparate platforms and fostering a unified corporate culture are critical to unlocking synergistic growth. The company's aggressive M&A strategy must be paired with an equally robust integration capability to realize the full value of its acquisitions.

Future growth will be defined by three key areas: