eScore

chipotle.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Chipotle demonstrates a commanding digital presence, with high brand authority rooted in its 'Food With Integrity' mission and excellent SEO performance for high-intent queries. The website's user experience is highly optimized for its primary goal of driving orders, with a consistent multi-channel presence that engages younger demographics on platforms like TikTok. While its local search optimization is strong for driving foot traffic, it misses a key opportunity by not fully atomizing its deep content, like the sustainability report, into more digestible formats for search and social media, which slightly limits its thought leadership reach.

Exceptional brand authority and search visibility for its core market, effectively translating its real-world brand leadership into a dominant online position.

Atomize the comprehensive Sustainability Report into a dedicated 'Integrity Insights' content hub with blog posts, infographics, and videos to capture a wider range of search queries related to ethical food and sustainable agriculture.

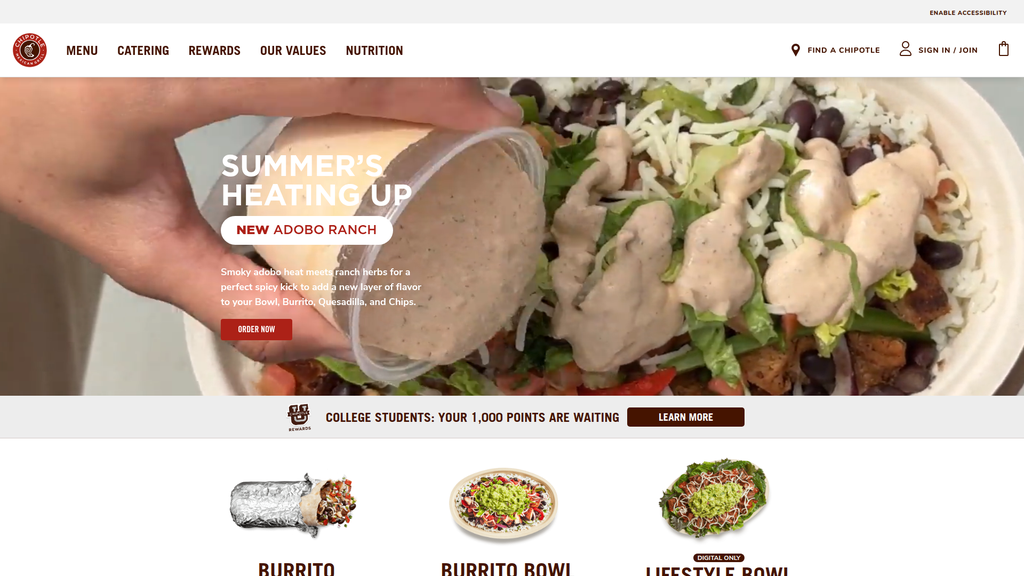

The brand excels at tactical, conversion-focused messaging with crystal-clear calls-to-action and effective segmentation for audiences like students and groups. However, there is a significant and detrimental disconnect between this promotional messaging and the company's core 'Food With Integrity' value proposition, which is nearly invisible on the main homepage. This creates a bifurcated brand narrative, undermining its key differentiator in day-to-day communication and competing on temporary offers rather than its foundational strengths.

Highly effective and clear conversion messaging, with prominent calls-to-action ('ORDER NOW') that expertly guide users toward the primary business goal of placing a digital order.

Integrate the 'Food With Integrity' message directly onto the homepage. This could be a visually engaging module that briefly explains the sourcing philosophy, with a clear link to more detailed content, bridging the gap between brand and transaction.

The conversion experience is best-in-class, characterized by a low cognitive load, a clear visual hierarchy, and an intuitive ordering process that minimizes friction. The mobile experience is seamless, maintaining a strong focus on the primary 'Order Now' CTA across all devices. The main weakness is the website's reliance on a third-party accessibility overlay, which poses a significant legal risk and fails to provide a natively accessible experience for all users, representing a critical flaw in an otherwise stellar conversion funnel.

A laser-focused and frictionless user journey for the primary task of ordering food, supported by prominent CTAs and a clean, product-centric design.

Transition from the third-party accessibility overlay to a native compliance strategy. Conduct a full WCAG 2.1 AA audit and remediate issues directly in the source code to provide a single, universally accessible experience and mitigate legal risk.

Chipotle builds strong credibility through its established brand reputation and radical transparency, exemplified by its detailed annual sustainability report. However, its credibility is persistently shadowed by two major risks: the historical memory of food safety incidents, which creates a lingering vulnerability, and a high-risk approach to digital accessibility (using overlays), which opens the door to significant ADA litigation. While trust signals are high for the majority of customers, these unmitigated risks temper the overall score.

Unmatched transparency in its category through its comprehensive, data-rich Sustainability Report, which serves as a powerful third-party validation and trust signal for conscious consumers.

Proactively address the lingering food safety perception by integrating more visible 'trust signals' into the ordering path, such as icons or short messages highlighting specific safety standards or fresh ingredient handling processes.

Chipotle's competitive moat is deep and sustainable, built on the powerful trifecta of its 'Food With Integrity' brand mission, superior operational efficiency, and a best-in-class digital ecosystem. This combination is extremely difficult for competitors to replicate authentically and at scale, allowing Chipotle to command a premium price. The primary weakness is the inherently low switching cost in the fast-casual industry, making the brand reliant on continuous innovation and execution to prevent customer fatigue.

The synergistic combination of a deeply ingrained, mission-driven brand ('Food With Integrity') with a leading digital platform ('Chipotlanes' and loyalty program), creating a defensible advantage that transcends just the food.

Systematically address the menu fatigue disadvantage by establishing a disciplined calendar of 2-3 high-impact Limited Time Offers (LTOs) per year to create excitement and variety without overly complicating kitchen operations.

The business demonstrates exceptional potential for scalability, underpinned by stellar unit economics, a highly efficient operational model, and a strong balance sheet to self-fund aggressive growth. The 'Chipotlane' format is a transformative catalyst, enabling rapid penetration into suburban markets with higher margins and customer convenience. The primary constraint on this immense potential is the operational challenge of recruiting and retaining a stable, high-quality restaurant workforce to staff this expansion.

The 'Chipotlane' digital order drive-thru is a highly scalable and profitable asset, providing a clear and proven roadmap for future domestic and international unit growth.

Accelerate the testing and rollout of kitchen automation technologies (like the 'Augmented Makeline') to reduce dependency on manual labor, improve service consistency, and de-risk the aggressive expansion plan.

Chipotle's business model is remarkably coherent, with a clear value proposition that aligns perfectly with its revenue streams and key activities. The strategic focus on a simple menu enables operational excellence, while resource allocation is smartly directed towards high-growth drivers like digital innovation (Chipotlanes) and automation. The model is well-timed with market trends toward health, sustainability, and convenience, demonstrating strong alignment between all stakeholders.

An exceptionally strong alignment between the core value proposition of 'Food With Integrity' and the operational model, allowing for consistent, high-quality execution at scale.

Diversify revenue streams by launching a line of Chipotle-branded Consumer Packaged Goods (CPG) for retail, leveraging immense brand equity to capture new revenue outside the restaurant.

Chipotle is the undisputed market leader in the fast-casual Mexican segment, demonstrating significant market power through its ability to set premium prices and influence industry trends towards digital integration and sustainability. Its scale provides considerable leverage with suppliers, reinforcing its 'Food With Integrity' promise. The company maintains a growing market share trajectory and has successfully defended its position against both direct and indirect competitors by focusing on its unique value proposition.

Demonstrated pricing power, with the ability to successfully implement menu price increases to offset inflation without significantly impacting customer traffic, indicating a strong and resilient brand.

Develop and launch targeted marketing campaigns that explicitly justify the premium price point against value-focused competitors (like QDOBA), shifting the narrative from cost to the value of quality, sourcing, and ethical standards.

Business Overview

Business Classification

Fast-Casual Restaurant

Quick-Service Restaurant (QSR)

Food & Beverage Services

Sub Verticals

Mexican Cuisine

Health-Conscious Fast Food

Mature

Maturity Indicators

- •

Extensive physical footprint with over 3,700 locations.

- •

Strong brand recognition and established market leadership.

- •

Focus on operational efficiency, digital optimization, and incremental growth.

- •

Well-defined and resilient supply chain, as detailed in the Sustainability Report.

- •

Long-term growth target of 7,000 restaurants in North America.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

In-Restaurant Sales

Description:Traditional walk-in sales from customers ordering at the counter for dine-in or takeout. This remains a foundational component of the business model.

Estimated Importance:Primary

Customer Segment:All Segments

Estimated Margin:High

- Stream Name:

Digital Sales (Pickup & Delivery)

Description:Orders placed through Chipotle's proprietary website and mobile app for in-store pickup, Chipotlane pickup, or delivery. Represents approximately 35.5% of total food and beverage revenue.

Estimated Importance:Primary

Customer Segment:Health-Conscious Millennials & Gen Z, Busy Professionals

Estimated Margin:Medium-High

- Stream Name:

Catering & Group Orders

Description:Bulk ordering services for groups ranging from 6 to 200 people, including 'Build-Your-Own' options and 'Burritos by the Box', targeting events and corporate lunches.

Estimated Importance:Secondary

Customer Segment:Corporate Clients, Families, Event Planners

Estimated Margin:Medium-High

- Stream Name:

Third-Party Delivery Sales

Description:Revenue generated from orders placed through platforms like DoorDash and Uber Eats. While expanding reach, this channel incurs significant commission fees.

Estimated Importance:Secondary

Customer Segment:Convenience-Focused Consumers

Estimated Margin:Low

Recurring Revenue Components

Chipotle Rewards Program: While not a direct subscription, the loyalty program with over 40 million members creates a powerful recurring revenue engine by driving repeat purchases and increasing customer lifetime value through personalized offers and points-based incentives.

Pricing Strategy

A La Carte / Build-Your-Own

Premium Fast-Casual

Transparent

Pricing Psychology

- •

Tiered Pricing: Differentiated pricing for protein options (e.g., Chicken vs. Steak vs. Guacamole).

- •

Add-on Value Perception: Core items are reasonably priced, with high-margin add-ons like guacamole and queso driving up the average check size.

- •

Value Bundling (Promotional): Occasional promotions like the 'Build-Your-Own Chipotle' for small groups with a discount code ('TRYBYOC').

Monetization Assessment

Strengths

- •

Strong brand equity allows for premium pricing and resilience to price increases.

- •

High-margin add-ons effectively increase average transaction value.

- •

The growing digital channel, especially high-margin pickup and Chipotlane orders, optimizes revenue mix.

Weaknesses

- •

Reliance on third-party delivery services compresses margins on a significant portion of digital sales.

- •

Perceived high cost for certain items (e.g., guacamole) can be a point of friction for budget-conscious consumers.

- •

Recent same-store sales declines indicate sensitivity to macroeconomic pressures and consumer spending shifts.

Opportunities

- •

Leverage loyalty program data for dynamic pricing on digital channels.

- •

Introduce tiered loyalty benefits to encourage higher spending.

- •

Expand catering services to capture a larger share of the corporate market.

Threats

- •

Intense price competition from other QSR and fast-casual brands.

- •

Inflationary pressure on ingredient and labor costs may necessitate further price increases, potentially alienating customers.

- •

Economic downturns leading to decreased consumer discretionary spending.

Market Positioning

Food with Integrity: Differentiating on the basis of fresh, high-quality ingredients, responsible sourcing, and classic culinary techniques, positioning itself as a healthier, more ethical alternative to traditional fast food.

Leader in the fast-casual Mexican segment and a significant player in the broader U.S. fast-casual market with an estimated 7-10% share.

Target Segments

- Segment Name:

Health-Conscious Millennials & Gen Z

Description:Younger, digitally native consumers who prioritize health, wellness, sustainability, and brand transparency. They are active on social media and value customizable food options that align with their lifestyle and dietary preferences.

Demographic Factors

- •

Ages 18-34

- •

Urban and suburban dwellers

- •

Educated (college students and young professionals)

Psychographic Factors

- •

Values sustainability and ethical sourcing

- •

Health-conscious and fitness-oriented

- •

Seeks authentic and transparent brands

Behavioral Factors

- •

High adoption of mobile/online ordering

- •

Frequent diners in the fast-casual category

- •

Influenced by social media and peer recommendations

Pain Points

- •

Difficulty finding quick meal options that are both healthy and customizable.

- •

Lack of transparency from traditional fast-food brands.

- •

Desire for food that fits specific dietary needs (Keto, Paleo, Vegan).

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Busy Professionals & Families

Description:Individuals and households with higher disposable income but limited time. They seek convenient, high-quality meal solutions that can satisfy diverse tastes within a group or family.

Demographic Factors

- •

Ages 25-50

- •

Suburban households

- •

Dual-income families

Psychographic Factors

- •

Values convenience and efficiency

- •

Willing to pay a premium for quality

- •

Seeks reliable and consistent experiences

Behavioral Factors

- •

Utilizes drive-thru (Chipotlane) and group ordering features

- •

Less price-sensitive for quality and convenience

- •

Orders for multiple people at once

Pain Points

- •

Lack of time for meal preparation.

- •

Finding a single restaurant that pleases both adults and children.

- •

Logistical challenges of ordering for a group.

Fit Assessment:Good

Segment Potential:Medium

Market Differentiation

- Factor:

Ingredient Quality & Sourcing (Food with Integrity)

Strength:Strong

Sustainability:Sustainable

- Factor:

Operational Model (Focused Menu & Assembly Line)

Strength:Strong

Sustainability:Sustainable

- Factor:

Digital Ecosystem (Chipotlanes & Loyalty Program)

Strength:Strong

Sustainability:Sustainable

- Factor:

Brand Authenticity & Transparency

Strength:Moderate

Sustainability:Sustainable

Value Proposition

Serving customizable, delicious, and responsibly-sourced food, fast—offering a guilt-free convenience that doesn't compromise on quality or ethics.

Excellent

Key Benefits

- Benefit:

High-Degree of Customization

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Build-your-own model

- •

Lifestyle Bowls (Keto, Paleo, etc.)

- •

Visible assembly line where customers direct their order

- Benefit:

Superior Ingredient Quality and Ethical Standards

Importance:Critical

Differentiation:Unique

Proof Elements

- •

Publicly stated 'Food with Integrity' mission

- •

Detailed annual Sustainability Report

- •

Marketing focused on fresh, non-GMO, and responsibly raised ingredients

- Benefit:

Speed and Convenience via Digital Channels

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Rapidly expanding network of 'Chipotlanes' for digital pickup

- •

User-friendly mobile app with order-ahead functionality

- •

Integrated loyalty program to streamline reordering

Unique Selling Points

- Usp:

The synergistic combination of speed, fresh ingredients, ethical sourcing, and deep customization, which competitors struggle to replicate at scale.

Sustainability:Long-term

Defensibility:Strong

- Usp:

The Chipotlane concept, a high-margin digital-only drive-thru that fundamentally improves asset efficiency and customer convenience.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

The trade-off between speed and food quality/healthiness.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Finding quick, appealing meals for groups with diverse dietary needs and preferences.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Lack of transparency and trust in the sourcing practices of fast-food chains.

Severity:Major

Solution Effectiveness:Partial

Value Alignment Assessment

High

The value proposition is exceptionally well-aligned with prevailing consumer trends toward health, wellness, sustainability, and digital convenience.

High

The focus on quality, customization, and digital access resonates directly with the core demographic of Millennials and Gen Z.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Food Suppliers: A network of farmers and ranchers who adhere to 'Food with Integrity' standards.

- •

Technology Partners: Delivery aggregators (DoorDash, Uber Eats), automation tech companies (Vebu for Autocado, Hyphen for Makeline).

- •

Logistics & Distribution Providers: Ensuring fresh ingredients reach all restaurant locations efficiently.

Key Activities

- •

Supply Chain Management & Ethical Sourcing

- •

In-Restaurant Food Preparation & Service

- •

Digital Platform Development & Management (App, Loyalty, Chipotlanes)

- •

Brand Marketing & Public Relations

- •

Employee Training & Development

Key Resources

- •

Strong Brand Reputation & Customer Loyalty

- •

Extensive Portfolio of Restaurant Locations (especially Chipotlanes)

- •

Proprietary Recipes & Food Preparation Processes

- •

Robust, Vertically-Influenced Supply Chain

- •

Human Capital (trained restaurant crews and corporate staff)

Cost Structure

- •

Food, Beverage, and Packaging Costs: The largest variable expense, sensitive to commodity price fluctuations.

- •

Labor Costs: Significant and rising expense, driving investment in automation.

- •

Restaurant Lease & Operating Expenses: Costs associated with physical locations.

- •

Marketing & Technology Investment

Swot Analysis

Strengths

- •

Dominant brand recognized for quality and integrity.

- •

Highly efficient and scalable 'build-your-own' operational model.

- •

Successful digital transformation, with Chipotlanes providing a key competitive advantage.

- •

Large and engaged loyalty program (40M+ members) providing valuable customer data.

- •

Strong financial performance with consistent revenue growth.

Weaknesses

- •

High sensitivity to food safety issues, with a history of brand-damaging incidents.

- •

Limited menu variety can lead to consumer fatigue.

- •

Rising input costs (food, labor) putting pressure on industry-leading margins.

- •

Operational complexity and high employee turnover at the restaurant level.

Opportunities

- •

International Expansion: Significant untapped potential outside of North America.

- •

Kitchen Automation: Rollout of 'Autocado' and 'Augmented Makeline' to improve speed, consistency, and reduce labor costs.

- •

Menu Innovation: Strategic limited-time offers (LTOs) to drive traffic and excitement without disrupting core operations.

- •

Data Monetization: Deeper use of loyalty data for personalization and demand shaping.

- •

Alternative Formats: Expansion of digital-only kitchens in dense urban markets.

Threats

- •

Intense competition from direct (Qdoba, Moe's) and indirect (Sweetgreen, Panera) fast-casual players.

- •

Macroeconomic pressures (inflation, recession) reducing consumer discretionary spending.

- •

Supply chain vulnerabilities and commodity price volatility.

- •

Evolving consumer preferences and dietary trends.

Recommendations

Priority Improvements

- Area:

Operational Efficiency & Labor Management

Recommendation:Accelerate the pilot and scaled rollout of kitchen automation technologies like 'Autocado' and the 'Augmented Makeline'. Focus deployment in high-wage markets to maximize ROI and mitigate labor cost pressures.

Expected Impact:High

- Area:

Customer Retention & Engagement

Recommendation:Evolve the 'Chipotle Rewards' program by introducing tiered benefits and personalized challenges. Leverage customer data to proactively re-engage at-risk customers with targeted offers.

Expected Impact:High

- Area:

Menu Strategy

Recommendation:Develop a disciplined 12-18 month calendar of Limited-Time Offers (LTOs). Focus on new flavor profiles (like the 'Adobo Ranch') and proteins that utilize existing kitchen equipment to minimize operational disruption.

Expected Impact:Medium

Business Model Innovation

- •

Explore a Subscription Model: Pilot a 'Chipotle Pass' subscription offering benefits like free guacamole/queso, zero delivery fees on direct orders, or exclusive access to new menu items for a monthly fee.

- •

Develop Consumer Packaged Goods (CPG): Launch a line of branded salsas, chips, and salad dressings for retail sale in grocery stores to create a new revenue stream and extend brand presence.

- •

Formalize Corporate Catering Solutions: Create a dedicated B2B sales team to establish ongoing catering contracts with large corporations, moving beyond ad-hoc group orders.

Revenue Diversification

- •

CPG Retail Line: As mentioned above, entering the grocery channel offers significant revenue potential.

- •

International Franchising: While historically company-owned, consider a franchising model for faster, capital-light expansion into new international markets.

- •

Branded Merchandise: Expand the line of branded apparel and goods, leveraging the strong 'Chipotbae' fan culture.

Chipotle Mexican Grill stands as a mature and dominant force in the fast-casual dining sector, built upon a powerful and highly defensible 'Food with Integrity' value proposition. The company's core strength lies in its unique ability to deliver customized, high-quality food at scale and speed, a model that remains difficult for competitors to replicate effectively.

The strategic evolution of Chipotle's business model is most evident in its masterful integration of digital channels. The development and aggressive expansion of the 'Chipotlane' format is a transformative innovation, creating a high-margin, high-convenience channel that directly addresses modern consumer behavior. This digital ecosystem, fortified by a massive and data-rich loyalty program, has become a primary engine for growth, customer retention, and operational efficiency.

However, the company is at a strategic inflection point. Recent slowdowns in same-store sales highlight vulnerability to macroeconomic pressures and intense competition. Future growth is contingent on three key pillars:

1. Operational Excellence through Automation: To combat rising labor and food costs, the successful scaling of kitchen automation is not just an opportunity but a strategic necessity. Technologies like 'Autocado' are crucial for protecting restaurant-level margins and ensuring service consistency.

2. Smarter Growth: While continuing aggressive unit expansion, Chipotle must refine its menu strategy with disciplined innovation (LTOs) to maintain brand relevance without sacrificing its renowned operational simplicity. Furthermore, leveraging its vast customer dataset for deeper personalization can drive frequency and check size.

3. Beyond the Restaurant: Long-term, sustainable growth will require looking beyond the four walls of the restaurant. Strategic initiatives in international expansion, consumer-packaged goods (CPG), and enhanced B2B catering services represent the most promising avenues for significant revenue diversification.

Chipotle's business model is fundamentally sound and well-positioned for the future. Its continued success will depend on its ability to execute flawlessly on these strategic pillars, balancing innovation with the operational discipline that has defined its success to date.

Competitors

Competitive Landscape

Mature

Moderately concentrated

Barriers To Entry

- Barrier:

Brand Recognition & Loyalty

Impact:High

- Barrier:

Supply Chain & Sourcing

Impact:High

- Barrier:

Real Estate & Location Acquisition

Impact:Medium

- Barrier:

Capital Investment

Impact:Medium

- Barrier:

Operational Efficiency at Scale

Impact:High

Industry Trends

- Trend:

Digitalization & Omnichannel Experience

Impact On Business:Chipotle is well-positioned with a strong app, rewards program, and digital-only offerings. Continued investment is crucial to maintain leadership.

Timeline:Immediate

- Trend:

Health & Wellness Focus

Impact On Business:Aligns with Chipotle's core 'Food With Integrity' message. They can further leverage this by highlighting customizable, diet-friendly 'Lifestyle Bowls'.

Timeline:Immediate

- Trend:

Sustainability & Ethical Sourcing Transparency

Impact On Business:This is a core competitive advantage. The detailed sustainability report is a testament to their leadership, appealing to conscious consumers.

Timeline:Immediate

- Trend:

Menu Innovation & Limited-Time Offers (LTOs)

Impact On Business:Chipotle's introduction of items like Adobo Ranch and influencer-led bowls shows adaptation to this trend to drive traffic and create buzz.

Timeline:Near-term

- Trend:

Value Proposition Amidst Inflation

Impact On Business:As a premium-priced fast-casual option, Chipotle must continually justify its cost through quality, speed, and brand experience to avoid losing customers to lower-priced alternatives.

Timeline:Near-term

Direct Competitors

- →

QDOBA Mexican Eats

Market Share Estimate:Second largest in the fast-casual Mexican segment after Chipotle.

Target Audience Overlap:High

Competitive Positioning:Positions itself as the value-oriented choice with a more expansive menu where key add-ons like queso and guacamole are included at no extra cost.

Strengths

- •

All-inclusive pricing (guac and queso included) creates a clear value perception.

- •

Broader menu with more protein options (e.g., brisket) and sauces.

- •

Well-established catering program.

- •

Robust rewards program that is easy to understand.

Weaknesses

- •

Brand perception is often seen as secondary or a 'copy' of Chipotle.

- •

Less emphasis and public documentation on ingredient sourcing and sustainability.

- •

Lower average unit volumes compared to Chipotle.

- •

Digital presence and app functionality are not as mature as Chipotle's.

Differentiators

- •

Signature 3-Cheese Queso.

- •

Pricing model that doesn't 'nickel and dime' customers for popular toppings.

- •

More frequent menu innovations and limited-time offers.

- →

Moe's Southwest Grill

Market Share Estimate:Significant player, particularly strong in the Southeastern U.S.

Target Audience Overlap:Medium

Competitive Positioning:A fun, family-friendly, and slightly irreverent brand focused on a broad appeal with pop-culture-named menu items and a welcoming atmosphere.

Strengths

- •

Strong, memorable brand voice and the iconic 'Welcome to Moe's!' greeting.

- •

Free chips and salsa with every order is a powerful value-add.

- •

More kid-friendly options and atmosphere.

- •

Extensive salsa bar with multiple options.

Weaknesses

- •

Food quality and sourcing are not perceived to be at the same premium level as Chipotle.

- •

Highly franchised model can lead to inconsistency across locations.

- •

Slower to adapt to digital trends compared to Chipotle.

- •

Brand can feel dated to younger, trend-focused demographics.

Differentiators

- •

Free chips and salsa.

- •

Fun, pop-culture-inspired menu names (e.g., 'Homewrecker' burrito).

- •

Extensive salsa bar.

- •

Focus on a casual, less corporate dining experience.

- →

Taco Bell

Market Share Estimate:Market leader in the broader Quick Service Restaurant (QSR) Mexican category, but increasingly competes on digital and convenience fronts.

Target Audience Overlap:Medium

Competitive Positioning:The undisputed leader in value, convenience, and creative, craveable LTOs, targeting a younger demographic with a focus on late-night and snack occasions.

Strengths

- •

Extremely strong value proposition with a low price point.

- •

Highly innovative and buzz-worthy menu LTOs (e.g., Nacho Fries).

- •

Superior convenience with a vast network of drive-thrus.

- •

Masterful digital and social media marketing, creating a cult-like following.

Weaknesses

- •

Perception of lower food quality and less healthy options.

- •

Lacks the 'fresh' and 'ethically sourced' brand pillars of Chipotle.

- •

Does not compete in the premium, health-conscious fast-casual space.

- •

Customization is present but not as central to the experience as Chipotle.

Differentiators

- •

Price and value.

- •

Drive-thru accessibility.

- •

Unique and constantly changing menu items.

- •

Late-night operating hours.

Indirect Competitors

- →

Panera Bread

Description:Fast-casual bakery-cafe offering salads, sandwiches, soups, and bowls. Competes for the same lunch and dinner customer seeking a quick, higher-quality meal than traditional fast food.

Threat Level:High

Potential For Direct Competition:Low, as their core offerings are different, but they compete heavily for the same customer 'share of stomach' and spending on fast-casual dining.

- →

Sweetgreen

Description:A rapidly growing fast-casual chain focused on customizable salads and warm bowls with a strong emphasis on health, technology, and local/seasonal sourcing.

Threat Level:Medium

Potential For Direct Competition:Medium, as they directly appeal to the health-conscious and sustainability-focused consumer that is a core part of Chipotle's base, albeit with a different food type.

- →

Cava

Description:Fast-casual Mediterranean concept with a build-your-own model very similar to Chipotle's. Offers bowls, pitas, and salads.

Threat Level:High

Potential For Direct Competition:High, as it uses the same assembly-line format and appeals to consumers looking for fresh, customizable, and relatively healthy options, representing a direct threat to Chipotle's format dominance.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Brand Equity & 'Food With Integrity' Mission

Sustainability Assessment:The brand is built on a foundation of ethical sourcing and quality ingredients, a message that deeply resonates with modern consumers. The extensive sustainability report solidifies this as an authentic, long-term commitment.

Competitor Replication Difficulty:Hard

- Advantage:

Operational Throughput & Efficiency

Sustainability Assessment:The assembly-line model is highly optimized for speed and customization, allowing Chipotle to serve a high volume of customers quickly, which is difficult to replicate at the same scale and efficiency.

Competitor Replication Difficulty:Medium

- Advantage:

Advanced Digital Ecosystem

Sustainability Assessment:Chipotle's mobile app, rewards program ('Chipotle U' for students), digital-only kitchens, and online ordering system are best-in-class, creating a sticky customer experience and providing valuable data.

Competitor Replication Difficulty:Medium

- Advantage:

Strong Financial Performance & Scale

Sustainability Assessment:Consistently high average unit volumes and profitability provide capital for innovation, marketing, and expansion, creating a virtuous cycle of growth.

Competitor Replication Difficulty:Hard

Temporary Advantages

- Advantage:

Menu LTOs & Influencer Collaborations

Estimated Duration:Short-term (per campaign)

Description:Items like the 'Adobo Ranch' and influencer-named bowls create short-term buzz and drive traffic, but the novelty fades and competitors can quickly launch their own LTOs.

Disadvantages

- Disadvantage:

Premium Price Point & Upcharges

Impact:Major

Addressability:Moderately

Description:The cost of a meal, especially with add-ons like guacamole, can be a significant barrier for price-sensitive customers, making them vulnerable to value-focused competitors like QDOBA.

- Disadvantage:

Historical Food Safety Incidents

Impact:Major

Addressability:Moderately

Description:Despite significant investments in food safety, the brand's reputation remains sensitive to any foodborne illness concerns. This is a persistent vulnerability that competitors can exploit.

- Disadvantage:

Menu Simplicity/Fatigue

Impact:Minor

Addressability:Easily

Description:While the simple menu is a strength for operations, some customers may experience menu fatigue over time compared to competitors with broader or more frequently updated menus.

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted marketing campaigns highlighting the quality and sourcing of ingredients that are 'extra' (e.g., 'The real reason our guac is extra').

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Feature and promote more 'under $10' customizable bowl combinations in digital channels to combat the perception of being overly expensive.

Expected Impact:Medium

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Expand the 'Chipotle U' concept to other key demographics, such as a corporate rewards program with simplified group ordering and tiered benefits for businesses.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Introduce a new protein or a significant plant-based option every 12-18 months to maintain menu excitement without complicating operations.

Expected Impact:Medium

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Leverage the 'Cultivate Next' fund to invest in or acquire technology that enhances supply chain traceability and transparency, further solidifying the 'Food With Integrity' promise.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Pilot and develop new, smaller-footprint restaurant formats ('Chipotlanes' or digital-only kitchens) in international markets to accelerate global expansion.

Expected Impact:High

Implementation Difficulty:Difficult

Maintain and amplify the position as the premium, tech-forward leader in the fast-casual space, unapologetically focusing on quality and ethical standards as the justification for its price point. Shift the value conversation from 'price' to 'what you get for the price.'

Double down on transparency as the ultimate differentiator. Utilize the data from the sustainability report in consumer-facing marketing to create a tangible link between a customer's purchase and its positive impact on people, animals, and the environment. Make sustainability and food quality not just a background promise, but an interactive part of the customer journey.

Whitespace Opportunities

- Opportunity:

Develop a line of Chipotle-branded consumer packaged goods (CPG) like salsas, chips, or bottled marinades for retail.

Competitive Gap:Direct competitors have not established a strong retail presence, creating an opportunity for Chipotle to extend its brand into consumers' homes.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Introduce a dedicated beverage and dessert menu that aligns with the 'Food With Integrity' ethos (e.g., artisanal agua frescas, desserts with clean ingredients).

Competitive Gap:Most direct competitors have standard fountain drinks and limited, uninspired dessert options. This is a gap for increasing ticket size and enhancing the customer experience.

Feasibility:High

Potential Impact:Medium

- Opportunity:

Expand catering options to include more flexible, smaller group packages ('Build-Your-Own Chipotle' is a good start) that are easily orderable through the app for informal social gatherings.

Competitive Gap:While competitors have catering, it's often geared towards large corporate events. There is a gap for tech-enabled, small-scale social catering.

Feasibility:Medium

Potential Impact:Medium

Chipotle operates in the mature and competitive fast-casual restaurant industry. Its primary competitive advantage is a powerful brand built on the 'Food With Integrity' mission, which is substantiated by a sophisticated and transparent supply chain. This, combined with best-in-class operational efficiency and a leading digital ecosystem, allows Chipotle to command a premium price point and maintain high average unit volumes.

Direct competitors like QDOBA and Moe's Southwest Grill primarily compete on price and menu variety. QDOBA's inclusive pricing for popular add-ons is a direct assault on Chipotle's pricing model, while Moe's 'free chips and salsa' and family-friendly branding appeal to a different value-conscious segment. However, neither has successfully replicated Chipotle's premium brand perception or its deep commitment to ethical sourcing.

Indirectly, Chipotle faces significant threats from other fast-casual concepts like Panera and CAVA that vie for the same consumer seeking quick, customizable, and healthier options. The rise of CAVA, which employs a similar service model in the popular Mediterranean category, represents a direct challenge to Chipotle's format leadership.

The company's key vulnerabilities are its premium price point, which can alienate customers during economic downturns, and the lingering brand risk associated with past food safety incidents. The website and sustainability report highlight a clear strategy to mitigate these risks by focusing on transparency, digital innovation, and targeted marketing, such as the 'Chipotle U' program for college students.

Strategic opportunities lie in leveraging its brand strength into adjacent markets like CPG, enhancing the in-store experience with better beverage and dessert options, and expanding its successful digital-first formats ('Chipotlanes') to new domestic and international markets. The ultimate path to sustained leadership involves continuing to use its scale and resources to make its 'Food With Integrity' promise more tangible and accessible to a broader audience, thereby justifying its premium position in a crowded marketplace.

Messaging

Message Architecture

Key Messages

- Message:

NEW ADOBO RANCH: Smoky adobo heat meets ranch herbs for a perfect spicy kick.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Banner

- Message:

ORDER NOW

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Banner, Group Order Section

- Message:

Chipotle U Rewards: College students get 1,000 points instantly and earn points 20% faster.

Prominence:Secondary

Clarity Score:High

Location:Homepage Mid-section

- Message:

Build-Your-Own Chipotle: A new way to serve Real food for 4-6 people.

Prominence:Secondary

Clarity Score:High

Location:Homepage Mid-section

- Message:

Food With Integrity: Sourcing high-quality, responsibly sourced ingredients.

Prominence:Tertiary

Clarity Score:Medium

Location:Sustainability Report, Footer Links (Implicit)

The message hierarchy is overwhelmingly tactical and conversion-focused. Primary messaging is dedicated to new product launches and direct calls-to-action ('ORDER NOW'). Secondary messages target specific, high-value customer segments (students, groups). The foundational brand message of 'Food With Integrity' is almost entirely absent from the main customer conversion path, relegated to corporate sustainability reports, which creates a significant disconnect between brand identity and everyday marketing communication.

There is a stark inconsistency between the transactional, promotional messaging on the homepage and the purpose-driven, corporate messaging in the sustainability report. The homepage is about immediate gratification ('new,' 'spicy kick,' 'order now'), while the corporate documents are about long-term ethical commitments. This creates a bifurcated brand narrative that fails to integrate its core differentiator into its primary sales channel.

Brand Voice

Voice Attributes

- Attribute:

Energetic & Promotional

Strength:Strong

Examples

- •

SUMMER’S HEATING UP

- •

NEW ADOBO RANCH

- •

perfect spicy kick

- Attribute:

Direct & Action-Oriented

Strength:Strong

Examples

- •

ORDER NOW

- •

JOIN NOW

- •

START A GROUP ORDER

- Attribute:

Youthful & Segmented

Strength:Moderate

Examples

- •

COLLEGE STUDENTS: YOUR 1,000 POINTS ARE WAITING

- •

CHIPOTLE U REWARDS

- •

Alex Warren Chipotle Honey Chicken Burrito Bowl

- Attribute:

Corporate & Responsible

Strength:Strong

Examples

- •

Food with Integrity

- •

Stakeholder Engagement

- •

GHG emissions intensity

- •

A CULTURE OF INCLUSIVITY: WHERE EVERYONE BELONGS

Tone Analysis

Promotional and urgent, focused on driving immediate sales.

Secondary Tones

Playful

Informative (for specific programs like Rewards)

Tone Shifts

A dramatic shift occurs between the main website (chipotle.com) and the linked corporate materials like the Sustainability Report. The tone transitions from casual, energetic, and sales-driven to formal, data-heavy, and deeply serious.

Voice Consistency Rating

Poor

Consistency Issues

The primary brand voice on the homepage does not reflect the company's long-standing mission of 'Food with Integrity'.

The voice targeting consumers is entirely different from the voice used in corporate communications, suggesting a lack of a unified brand messaging strategy that spans all touchpoints.

Value Proposition Assessment

Chipotle offers fresh, customizable, and convenient Mexican-inspired fast-casual meals.

Value Proposition Components

- Component:

Fresh, High-Quality Ingredients ('Real Food')

Clarity:Unclear

Uniqueness:Unique

- Component:

Menu Innovation & New Flavors

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Customization & Personalization

Clarity:Clear

Uniqueness:Common

- Component:

Convenience (Digital Ordering & Speed)

Clarity:Clear

Uniqueness:Common

Chipotle's primary differentiator, 'Food with Integrity,' is poorly communicated on its main transactional webpage. The homepage instead competes on temporary product differentiation (e.g., 'NEW ADOBO RANCH'). While this drives short-term interest, it fails to reinforce the foundational brand advantage over competitors like Qdoba or Moe's, who also offer customizable bowls and burritos. The brand's unique value is buried, making it appear more generic in the crowded fast-casual space.

The current homepage messaging positions Chipotle as just another fast-casual chain focused on LTOs (Limited Time Offers) and loyalty programs. This tactical positioning undercuts its premium, ethically-sourced brand identity. It competes on the same level as its rivals in terms of convenience and menu novelty, rather than elevating the conversation to the quality and sourcing of its ingredients, which was its original strategic advantage.

Audience Messaging

Target Personas

- Persona:

The 'Quick & Easy' Lunch/Dinner Customer

Tailored Messages

ORDER NOW

Burrito, Burrito Bowl, Tacos...

Effectiveness:Effective

- Persona:

The College Student / Young Professional

Tailored Messages

- •

COLLEGE STUDENTS: YOUR 1,000 POINTS ARE WAITING

- •

CHIPOTLE U REWARDS

- •

Alex Warren Chipotle Honey Chicken Burrito Bowl

Effectiveness:Effective

- Persona:

The Group/Office Organizer

Tailored Messages

- •

BUILD-YOUR-OWN CHIPOTLE

- •

CATERING

- •

GROUP ORDER

Effectiveness:Effective

- Persona:

The Health & Ethically-Conscious Consumer

Tailored Messages

A whole new way to serve Real food...

Effectiveness:Ineffective

Audience Pain Points Addressed

- •

Need for a fast and convenient meal.

- •

Desire for customizable food options.

- •

Budget constraints for students (addressed by rewards).

Audience Aspirations Addressed

Desire to try new and exciting flavors.

The aspiration to eat ethically and sustainably sourced food is not directly addressed on the main page, creating a major gap.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Appetite & Craving

Effectiveness:High

Examples

- •

Smoky adobo heat meets ranch herbs

- •

perfect spicy kick

- •

Visuals of the food items

- Appeal Type:

Novelty & Excitement

Effectiveness:High

Examples

NEW ADOBO RANCH

SUMMER’S HEATING UP

Social Proof Elements

- Proof Type:

Influencer Endorsement (Implicit)

Impact:Moderate

Examples

- •

Alex Warren Chipotle Honey Chicken Burrito Bowl

- •

The Lola Bowl

- •

Josh’s Chicken Burrito

Trust Indicators

- •

Established brand recognition.

- •

The mention of 'Real food' in the group order section.

- •

Detailed, data-rich Sustainability Report (though not easily accessible).

Scarcity Urgency Tactics

Limited-time offer on the 'Build-Your-Own' option with a promo code: '*Valid 8/26 to 10/21 or 500K redemptions, whichever comes first.'

Calls To Action

Primary Ctas

- Text:

ORDER NOW

Location:Homepage Hero and multiple other sections

Clarity:Clear

- Text:

JOIN NOW

Location:Chipotle U Rewards Section

Clarity:Clear

- Text:

LEARN MORE

Location:Chipotle U Rewards Section

Clarity:Clear

- Text:

ORDER CATERING

Location:Catering Section

Clarity:Clear

The calls-to-action are highly effective in driving a primary business objective: digital orders. They are clear, prominently displayed, and use direct, unambiguous language. The website is architected as a conversion funnel, and the CTAs are the primary mechanism for moving users through it.

Messaging Gaps Analysis

Critical Gaps

The near-total absence of the 'Food With Integrity' mission on the homepage is the single largest messaging gap. This was Chipotle's foundational differentiator and is now a footnote, undermining long-term brand equity for short-term promotional gain.

There is no narrative or storytelling connecting the 'what' (the food) with the 'why' (the sourcing, the ethics, the mission). The story is completely missing from the customer's primary digital experience.

Contradiction Points

The brand claims a mission of 'Food With Integrity' in corporate reports but communicates a message of pure transactionalism and fleeting novelty on its homepage. This creates a strategic contradiction between what the company says it stands for and what it actively promotes to customers.

Underdeveloped Areas

Messaging around ingredient quality and sourcing is severely underdeveloped. A single mention of 'Real food' is insufficient to convey this core value proposition.

Emotional storytelling that could connect customers to the farmers, the sustainable practices, or the positive environmental impact is completely absent.

Messaging Quality

Strengths

- •

Exceptional clarity on tactical promotions and new products.

- •

Highly effective, conversion-oriented CTAs.

- •

Clear and successful messaging for segmented audiences like students and group orders.

Weaknesses

- •

Failure to integrate the core brand differentiator ('Food With Integrity') into primary marketing messages.

- •

A severe disconnect in brand voice and tone between customer-facing marketing and corporate communications.

- •

Over-reliance on short-term promotions at the expense of long-term brand building.

Opportunities

- •

Re-integrate the 'Food With Integrity' narrative into the homepage in a visually compelling, easily digestible format to reinforce brand differentiation.

- •

Develop campaigns that link new menu items back to the core value proposition (e.g., 'Our new Adobo Ranch is made with...').

- •

Use storytelling elements to build a deeper emotional connection with the health and ethically-conscious consumer segment.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Messaging Hierarchy

Recommendation:Introduce a dedicated, visually engaging module on the homepage that tells the 'Food With Integrity' story. Link to a more detailed landing page that explains sourcing and quality, making the brand's core values accessible within one click from the main conversion path.

Expected Impact:High

- Area:

Value Proposition Clarity

Recommendation:Integrate proof points about ingredient quality directly into the product discovery and ordering flow. For example, a small info icon next to 'Chicken' could reveal details about 'Responsibly Raised'.

Expected Impact:High

- Area:

Brand Voice Unification

Recommendation:Develop a unified messaging framework that allows the brand voice to be consistently authentic and purpose-driven across all channels, adapting in tone for different audiences (e.g., promotional vs. corporate) without losing its core character.

Expected Impact:Medium

Quick Wins

Add the phrase 'Made with Real Ingredients' or a similar tagline directly below the main menu item categories on the homepage (Burrito, Burrito Bowl, etc.).

Change the copy for the 'Build-Your-Own' section from 'serve Real food' to 'serve our Real food, made with ingredients you can trust.' to be more direct.

Long Term Recommendations

Launch a major marketing campaign that explicitly reconnects the Chipotle menu items with the 'Food With Integrity' mission, using storytelling about farmers, ingredients, and sustainable practices.

Restructure the website's information architecture to give the 'Our Values' or 'Food With Integrity' section a more prominent place in the main navigation, rather than hiding it in the footer or corporate sections.

Chipotle's website messaging represents a masterclass in tactical, conversion-driven communication at the significant cost of strategic brand differentiation. The user journey is expertly engineered to drive online orders, leveraging clear calls-to-action and targeted promotions for specific segments like students and groups. However, this laser focus on short-term sales has led to the abandonment of its core, foundational brand pillar: 'Food With Integrity.'

This creates a critical strategic vulnerability. While the company's mission and ethical sourcing are detailed extensively in corporate reports, they are virtually invisible to the average customer on the homepage. As a result, Chipotle's messaging positions it as just another player in the crowded fast-casual space, competing on temporary LTOs and loyalty points rather than on the powerful, unique story of quality and responsibility that originally set it apart. The brand voice is schizophrenic—energetic and promotional on the front end, formal and serious on the back end—with no bridge between the two.

To ensure long-term brand health and defend its premium positioning, Chipotle must urgently find a way to reintegrate its 'why' (Food With Integrity) with its 'what' (delicious, customizable food). The current strategy is maximizing immediate revenue but is simultaneously eroding the very brand equity that justifies its market leadership and price point.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Consistent revenue growth, with a 14.6% increase to $11.3 billion for full-year 2024.

- •

Strong brand recognition and customer loyalty, appealing to health-conscious consumers.

- •

Proven pricing power, with the ability to pass on cost increases to consumers.

- •

High average unit volumes (AUVs), demonstrating store-level profitability and demand.

- •

Successful loyalty program with over 27 million members, indicating a highly engaged customer base.

Improvement Areas

- •

Address consumer price sensitivity and value perception amidst rising menu prices.

- •

Continue menu innovation to maintain relevance and attract new demographics beyond core offerings.

- •

Mitigate inconsistencies in portion sizes ('skimpflation') which can erode brand trust.

Market Dynamics

The global fast-casual restaurant market is projected to grow at a CAGR of ~6.6% between 2025 and 2033.

Mature

Market Trends

- Trend:

Digitalization and Convenience

Business Impact:Continued growth in digital sales (35.1% of total revenue in 2024) and the success of Chipotlanes underscore the need for seamless digital experiences and convenient pickup options.

- Trend:

Health and Wellness Focus

Business Impact:Chipotle's 'Food with Integrity' mission aligns perfectly with consumer demand for fresh, high-quality, and responsibly sourced ingredients, creating a key brand differentiator.

- Trend:

Value Consciousness and Inflation

Business Impact:Economic headwinds and inflation are making consumers more price-sensitive, which could impact visit frequency and check size, despite Chipotle's strong brand.

- Trend:

Flavor Innovation and Global Tastes

Business Impact:Younger consumers (Gen Z) are seeking novel flavor combinations ('swicy', 'swalty'), creating opportunities for Limited Time Offers (LTOs) to drive traffic and excitement.

Excellent. As an established leader in a mature but still-growing market, Chipotle is well-positioned to capitalize on key trends like digital ordering and health consciousness that competitors are still trying to master.

Business Model Scalability

High

The model has significant variable costs (food, labor) but benefits from scalable systems for supply chain, marketing, and technology. Strong unit economics allow for self-funded growth.

High. Once a restaurant passes its break-even point, high contribution margins on incremental sales lead to significant profitability, as evidenced by strong restaurant-level margins (26.7% in 2024).

Scalability Constraints

- •

Maintaining the integrity and complexity of the 'Food with Integrity' supply chain at a global scale.

- •

Securing prime real estate for new locations, especially those suitable for Chipotlanes.

- •

Recruiting and retaining high-quality restaurant staff, given high industry turnover.

- •

Ensuring consistent operational execution and food quality across thousands of locations.

Team Readiness

Strong. The executive team has a proven track record of navigating challenges, driving digital transformation, and executing successful growth strategies.

Mature. As a publicly traded company with over 3,700 locations, Chipotle has a sophisticated corporate and regional structure designed for scale.

Key Capability Gaps

International Operations Expertise: While growing, the company is still in the early stages of large-scale international expansion and will need to build deep expertise in diverse markets.

Restaurant-Level Labor Stability: High turnover for hourly crew (reported at 131% in 2024 in the provided documents) poses a significant risk to consistent customer experience and operational efficiency.

Growth Engine

Acquisition Channels

- Channel:

Digital (App & Web)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Leverage customer data from 27M+ loyalty members to create personalized offers and marketing campaigns to increase order frequency and re-engage lapsed users.

- Channel:

In-Store Experience

Effectiveness:High

Optimization Potential:Medium

Recommendation:Focus on improving throughput and order accuracy, especially during peak hours, by optimizing the interplay between in-store and digital order fulfillment.

- Channel:

Social Media & Influencer Marketing

Effectiveness:Medium

Optimization Potential:High

Recommendation:Expand influencer partnerships and user-generated content campaigns that highlight menu hacks, new items, and brand values to attract younger demographics.

Customer Journey

The digital path (app/web -> order -> pickup/delivery) is highly optimized. The in-store path is simple but can be hindered by long queues.

Friction Points

- •

Long lines during peak hours negatively impacting the in-store experience.

- •

Operational bottlenecks where high volumes of digital orders disrupt the flow of the in-person line.

- •

Inconsistent order fulfillment and wait times for digital order pickups.

Journey Enhancement Priorities

{'area': 'Digital Order Pickup', 'recommendation': 'Aggressively expand Chipotlanes, which offer superior convenience, higher sales, and better margins, making them a key strategic priority. '}

{'area': 'In-Restaurant Throughput', 'recommendation': 'Invest in new kitchen technology and layouts, such as the tested automated bowl/salad lines, to handle digital order volume without compromising service for in-store guests. '}

Retention Mechanisms

- Mechanism:

Chipotle Rewards Loyalty Program

Effectiveness:High

Improvement Opportunity:Enhance personalization and gamification. Move beyond a points-for-food model to offer experiential rewards, tiered statuses, and personalized challenges to deepen engagement.

- Mechanism:

Menu Innovation & LTOs

Effectiveness:Medium

Improvement Opportunity:Increase the cadence of compelling Limited Time Offers (LTOs) to create news, drive traffic, and provide variety for loyal customers. This is a proven strategy for competitors.

Revenue Economics

Excellent. Chipotle is known for its best-in-class restaurant-level operating margins (26.7% in 2024) and high Average Unit Volumes (AUVs), which drive strong profitability.

Extremely High (Estimated). High brand awareness and organic demand result in a very low customer acquisition cost (CAC), while strong loyalty and repeat purchases create a high lifetime value (LTV).

High. The company demonstrates strong revenue growth (14.6% in 2024) and comparable sales growth (7.4% in 2024), indicating efficient use of assets and capital to generate sales.

Optimization Recommendations

- •

Focus on increasing transaction frequency from existing loyalty members, which is more cost-effective than acquiring new customers.

- •

Continue disciplined menu price increases where possible, while carefully monitoring consumer value perception to protect transaction volume.

- •

Drive adoption of high-margin add-ons like beverages and queso through targeted in-app promotions.

Scale Barriers

Technical Limitations

- Limitation:

Restaurant Technology Stack Integration

Impact:Medium

Solution Approach:Ensure seamless integration between front-of-house (POS, kiosks), back-of-house (Kitchen Display Systems), and digital platforms (app, web) to optimize order flow and reduce errors.

Operational Bottlenecks

- Bottleneck:

Peak Hour Throughput

Growth Impact:Directly caps the revenue potential of each restaurant and can lead to a poor customer experience (long waits), deterring future visits.

Resolution Strategy:Invest in labor optimization, new kitchen equipment, and consider digital-only kitchens in dense urban areas to offload volume from traditional restaurants.

- Bottleneck:

Labor Recruitment and Retention

Growth Impact:High employee turnover (especially at the crew level) leads to inconsistent execution, slower service, higher training costs, and can constrain the pace of new store openings.

Resolution Strategy:Continue investing in competitive wages, benefits (as detailed in the Sustainability Report), and clear career progression paths from crew to manager to reduce turnover.

Market Penetration Challenges

- Challenge:

Intense Competition

Severity:Major

Mitigation Strategy:Differentiate through the 'Food with Integrity' promise, superior digital experience, and menu innovation. Key competitors include Qdoba, Moe's, and a growing number of fast-casual concepts.

- Challenge:

Market Saturation in Prime US Metro Areas

Severity:Minor

Mitigation Strategy:Focus new unit growth on Chipotlanes in suburban markets and expansion into smaller towns, which are showing strong performance and returns.

- Challenge:

Consumer Price Sensitivity

Severity:Major

Mitigation Strategy:Emphasize the value proposition of large portions and high-quality ingredients relative to competitors. Use the loyalty program for targeted discounts rather than broad price cuts.

Resource Limitations

Talent Gaps

Experienced international operators and supply chain experts.

A stable, well-trained, and motivated restaurant-level workforce.

Low. Chipotle's strong balance sheet and cash flow from operations are sufficient to fund its aggressive expansion plans (315-345 new stores in 2025) without needing significant external capital.

Infrastructure Needs

Expansion of international supply chain and distribution networks.

Continued investment in digital infrastructure to support growing online sales volume and data analytics.

Growth Opportunities

Market Expansion

- Expansion Vector:

International Expansion

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Utilize a combination of company-owned stores in key European markets (UK, France, Germany) and strategic partnerships (like the Alshaya Group agreement for the Middle East) to accelerate entry and leverage local expertise.

- Expansion Vector:

Domestic Small Town / Suburban Growth

Potential Impact:Medium

Implementation Complexity:Low

Recommended Approach:Prioritize opening new restaurants with the Chipotlane format in underserved suburban and small-town markets, where unit economics have proven to be strong.

Product Opportunities

- Opportunity:

Menu Innovation (Proteins & Plant-Based)

Market Demand Evidence:Sustained consumer interest in new and global flavors, as well as growing demand for plant-based options. Successful LTOs like Chicken al Pastor prove the model.

Strategic Fit:High

Development Recommendation:Establish a disciplined LTO pipeline to create regular news and excitement. Continue exploring authentic Mexican-inspired proteins and innovate on plant-based offerings to capture a wider audience.

- Opportunity:

Expanding Dayparts (e.g., Late Night)

Market Demand Evidence:Potential to capture business from younger demographics and in college towns. Requires operational validation.

Strategic Fit:Medium

Development Recommendation:Test extended hours in specific, high-potential markets (e.g., near universities or entertainment districts) to assess operational impact and consumer demand before a wider rollout.

Channel Diversification

- Channel:

Chipotlanes (Digital Order Drive-Thru)

Fit Assessment:Excellent

Implementation Strategy:Make Chipotlanes the default format for new restaurant development, with a target of over 80% of new openings including one.

- Channel:

Catering and Group Orders

Fit Assessment:Good

Implementation Strategy:Simplify the online ordering process for catering and group meals. Actively market these offerings to local businesses and organizations to capture a larger share of B2B sales.

Strategic Partnerships

- Partnership Type:

International Franchise/Development Partners

Potential Partners

Alshaya Group (current)

Expected Benefits:Accelerated, capital-efficient international growth by leveraging partners' real estate, operational, and market expertise.

- Partnership Type:

Consumer Packaged Goods (CPG)

Potential Partners

Kraft Heinz

PepsiCo

Expected Benefits:Extend brand reach into grocery stores with products like salsas, chips, or salad dressings, creating a new, high-margin revenue stream.

Growth Strategy

North Star Metric

Comparable Restaurant Sales Growth

This metric is the primary indicator of the health of the core business, reflecting changes in both customer traffic (transactions) and check size. It is the key driver of profitability and shareholder value for a mature restaurant chain.

Maintain a sustainable 'low to mid-single digit' growth rate annually, as per company guidance for 2025, outperforming the fast-casual industry average.

Growth Model

Hybrid: Channel Expansion & Retention/Loyalty

Key Drivers

- •

New Restaurant Openings (especially Chipotlanes)

- •

Digital Sales Growth

- •

Increased Transaction Frequency from Loyalty Members

- •

Average Check Growth through Pricing and Mix

Focus capital on developing high-return Chipotlane units while simultaneously investing in the digital platform and loyalty program to drive more frequent, higher-margin sales from the existing customer base.

Prioritized Initiatives

- Initiative:

Accelerate Chipotlane Development

Expected Impact:High

Implementation Effort:High

Timeframe:Ongoing (1-3 years)

First Steps:Secure a robust real estate pipeline of suburban, freestanding locations suitable for the Chipotlane format.

- Initiative:

Execute International Expansion Plan

Expected Impact:High

Implementation Effort:High

Timeframe:Ongoing (3-5+ years)

First Steps:Successfully launch initial stores in the Middle East with Alshaya Group to create a playbook for future franchise-led expansion. Continue disciplined company-owned growth in Western Europe.

- Initiative:

Enhance Loyalty Program Personalization

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:12-18 months

First Steps:Invest in data science capabilities to analyze purchasing behavior and deploy targeted, personalized offers and challenges within the Chipotle Rewards app.

- Initiative:

Launch High-Impact Menu LTOs

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:Quarterly

First Steps:Develop a 2026 culinary calendar with 2-3 newsworthy Limited Time Offers that have been operationally tested and align with brand values.

Experimentation Plan

High Leverage Tests

- Test:

New Protein LTOs

Hypothesis:Introducing a new, authentic protein option for a limited time will drive significant incremental traffic from both new and existing customers.

- Test:

Personalized Loyalty Offers

Hypothesis:Sending targeted offers (e.g., 'add queso for 50% off') based on a user's past order history will increase average check size more than a generic offer.

- Test:

Alternative Daypart (Late-Night)

Hypothesis:Extending hours to 2 AM in select college towns on weekends will generate profitable incremental sales that outweigh the additional labor costs.

Utilize A/B testing in control vs. test markets. Key metrics: incremental lift in transactions, comparable sales, average check, new loyalty sign-ups, and restaurant-level margins.

Run at least one major culinary, digital, or operational test per quarter.

Growth Team

A dedicated, cross-functional 'Growth' team that sits at the intersection of Marketing, Digital, Culinary, and Operations, reporting to a Chief Growth or Chief Strategy Officer.

Key Roles

- •

Head of International Development

- •

Director of Loyalty & CRM

- •

Data Scientist / Growth Analyst

- •

Product Manager, Digital Ordering Experience

Invest in advanced data analytics and consumer insights capabilities to better understand customer behavior and personalize the digital experience. Build in-house expertise on international market entry and adaptation.

Chipotle Mexican Grill possesses an exceptionally strong foundation for future growth, anchored by powerful product-market fit, a highly scalable business model, and robust unit economics. The company's 'Food with Integrity' ethos serves as a durable competitive advantage in a market increasingly focused on health and sustainability.

The primary growth engine has successfully transitioned from simple store expansion to a sophisticated, digitally-driven model. The Chipotle Rewards program and the seamless digital ordering experience now account for over a third of sales and provide a powerful platform for driving customer retention and frequency. The 'Chipotlane' format is the company's single most important growth catalyst, offering superior convenience, higher sales, and better margins, effectively future-proofing the brand against shifts in consumer behavior towards convenience.

However, significant scale barriers exist. The primary operational challenge remains managing restaurant throughput, where the surge in digital orders creates bottlenecks for the in-person experience. Furthermore, the persistent challenge of recruiting and retaining restaurant-level talent in a competitive labor market presents a critical risk to consistent execution and the pace of expansion.

Key growth opportunities are clear and actionable. The most significant vector is international expansion, which remains largely untapped. A disciplined strategy combining company-owned stores in core European markets with franchise partnerships in others, like the Middle East, is the optimal approach. Domestically, growth will be driven by penetrating suburban and smaller markets with the highly effective Chipotlane format. Continued menu innovation through impactful LTOs and deeper personalization of the loyalty program will be crucial for maintaining brand relevance and driving same-store sales.

Recommendation: Chipotle's growth strategy should be a dual-pronged approach: 1) Aggressively expand the Chipotlane footprint both domestically and as the primary format for initial international entry, and 2) Deepen digital engagement by evolving the loyalty program from a simple rewards system into a personalized, data-driven relationship engine. Successfully managing these initiatives while relentlessly focusing on operational excellence and solving the throughput/labor challenge will solidify Chipotle's position as a dominant global restaurant brand for the next decade.

Legal Compliance

Chipotle maintains a comprehensive and geographically-segmented privacy policy framework, which is a significant strength. They provide separate policies for the US, Europe (UK/EU), and Canada, demonstrating a clear understanding of jurisdictional nuances. The US policy explicitly references the California Consumer Privacy Act (CCPA) and outlines consumer rights such as access, rectification, and erasure, which aligns with modern privacy standards. It details the types of personal information collected (e.g., for online orders, rewards programs, in-restaurant payments) and the business purposes for collection. The policy also mentions that they do not 'sell or share' personal information in the traditional sense but use it with trusted partners to improve services. The policy includes a 'Notice at Collection' as required by CCPA. A key area for strategic improvement would be to enhance the clarity around data retention periods, moving from general statements like 'as long as is necessary' to more specific criteria where possible.

The website provides clear and accessible Terms of Use. Key strengths include specific terms for the Chipotle Rewards program, which detail eligibility (13+ with parental supervision for ages 13-17), point accrual, and expiration rules (points expire after 180 days of inactivity). The general terms cover account security, user responsibilities, and limitations of liability. The language is standard for a large corporation, including disclaimers of warranties and indemnification clauses. By providing separate, easily digestible terms for specific promotions and programs (like the 'BYOC' offer), Chipotle reduces ambiguity and enhances enforceability. This modular approach to legal terms is a best practice for a consumer-facing brand with multiple engagement channels.

Chipotle's cookie compliance strategy shows awareness of both US (opt-out) and EU (opt-in) models, but implementation could be more robust. They have a detailed cookie policy that categorizes cookies (Essential, Targeting, etc.) and provides a 'Your Privacy Choices' link in the site footer for users to manage preferences. For US visitors, this functions as a CCPA-compliant 'Do Not Sell or Share My Personal Information' link. For EU/UK visitors, a separate policy and likely a different banner mechanism are in place. The primary risk is ensuring that the consent mechanism presented to EU/UK users is strictly opt-in, meaning no non-essential cookies are placed before explicit user consent is granted. The reliance on a footer link rather than a more prominent initial banner for all jurisdictions could be seen as a less transparent approach.

Chipotle's data protection posture is robust, supported by its detailed privacy policies and the governance structures mentioned in its sustainability report. The company collects significant personal data through its online ordering platform, mobile app, and extensive Chipotle Rewards loyalty program, including names, contact information, payment details, and detailed purchase histories. Their privacy policy explicitly acknowledges rights under GDPR and CCPA, indicating a centralized process for handling Data Subject Access Requests (DSARs). Their mention of using CCTV in restaurants for security and analytics requires careful governance to ensure compliance with local laws and transparency with customers. The critical challenge is operationalizing data protection across thousands of physical locations and a massive digital ecosystem, ensuring employee training and secure data handling are consistently maintained.

Chipotle demonstrates a public commitment to accessibility, citing the Americans with Disabilities Act (ADA) and Web Content Accessibility Guidelines (WCAG). However, the primary strategy relies on an 'Enable Accessibility' link which activates a third-party overlay tool provided by UsableNet. While this shows intent, reliance on accessibility overlays is a significant legal risk. Courts have increasingly viewed these tools as insufficient for providing full and equal access compared to building accessibility into the website's source code. This approach can be seen as providing a 'separate but equal' experience, which is contrary to the spirit of the ADA. The company has a history of ADA-related litigation regarding physical store accessibility, making their digital compliance a higher-profile risk area.