eScore

chubb.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Chubb demonstrates high content authority and a strong global reach, with a digital presence localized for numerous markets. Its content effectively aligns with the search intent of brand-aware, decision-stage customers. However, it struggles to capture non-branded, top-of-funnel search traffic, and there is no significant evidence of optimization for voice search queries.

High brand and content authority, supported by a global footprint with localized websites for different regions (e.g., /us-en/).

Develop comprehensive, industry-specific content hubs (e.g., 'Risk Intelligence Centers') to capture high-value, non-branded search queries from commercial clients in the awareness and consideration stages.

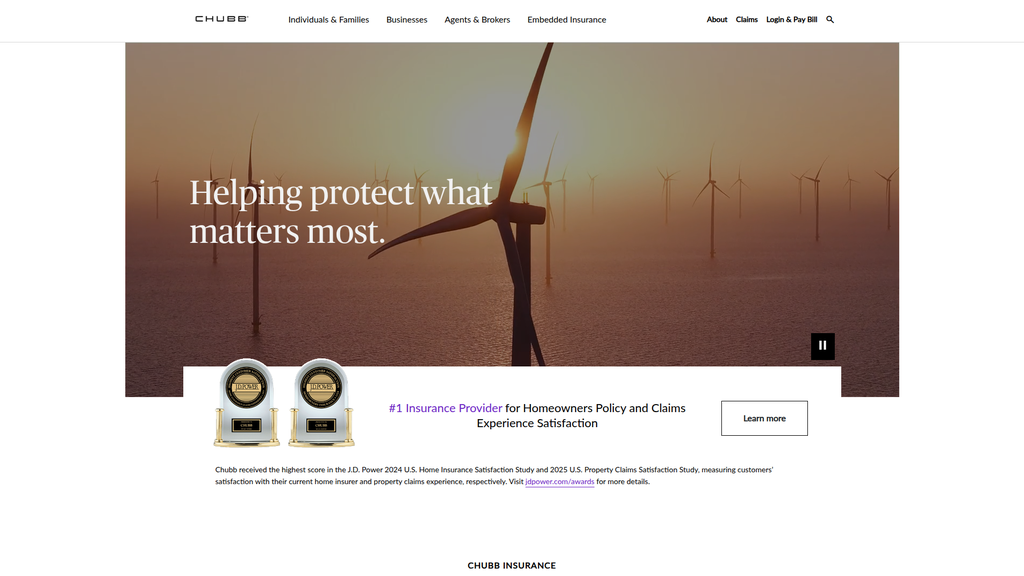

The brand's messaging is exceptionally consistent, authoritative, and well-segmented for its diverse audiences, from individuals to multinational corporations. It masterfully uses social proof like J.D. Power awards to build credibility. The primary weakness is an over-reliance on stating value propositions rather than demonstrating them through human-centric stories on the main homepage.

Flawless audience segmentation messaging that immediately funnels distinct user groups (individuals, businesses, brokers) into relevant and tailored communication journeys.

Integrate a customer testimonial or case study module onto the homepage to vividly demonstrate the 'Claims Difference' in action, shifting from telling to showing.

The website excels in information architecture and provides a seamless cross-device experience, which reduces cognitive load for users. However, its approach to conversion is overly passive, with weak, low-prominence primary calls-to-action in key areas like the hero section. While its accessibility commitment is a strength, the core conversion paths have significant friction points due to this passivity.

Excellent information architecture with clear audience segmentation that simplifies complex user journeys from the first interaction.

Redesign the primary hero section CTA from a low-visibility 'ghost button' to a solid, high-contrast primary button with more action-oriented copy to guide users effectively.

Credibility is a core pillar of Chubb's business, demonstrated through powerful trust signals like prominent financial strength ratings ($200B+ in assets) and third-party awards. The company maintains a sophisticated and robust legal compliance framework, including a proactive stance on web accessibility. The main area for improvement is in consumer-facing transparency, specifically by creating a centralized, easily accessible page for state-by-state licensing information.

Strategic and prominent use of third-party validation, such as the #1 J.D. Power awards, to provide immediate and highly persuasive social proof.

Create a centralized 'Legal & Licensing Information' page, accessible from the website footer, to clearly and transparently provide state-specific licensing details.

Chubb possesses several powerful and sustainable competitive advantages, including its premier brand reputation, deep underwriting expertise in complex risks, and an extensive global distribution network. These moats are difficult for competitors to replicate. While the company is a mature leader, it shows innovation through its 'Chubb Studio' platform, though its agility is a weakness compared to smaller insurtechs.

A deep and defensible moat built on specialized underwriting expertise for complex global risks, a domain where most competitors cannot effectively operate.

Accelerate investment in digital-first service models for less complex products to neutralize the threat from more agile insurtechs attacking the lower end of the market.

The business model is exceptionally scalable, supported by strong unit economics and a global infrastructure across 54 countries. Expansion potential is actively being realized through strategic M&A and the highly scalable 'Chubb Studio' API platform for embedded insurance. The primary constraints to even faster growth are navigating complex global regulations and overcoming the inertia of legacy IT systems.

The 'Chubb Studio' API platform, which creates a highly scalable, tech-driven channel for market expansion via embedded insurance partnerships.

Invest in a unified data platform to break down internal data silos, enabling a 360-degree customer view and more sophisticated AI-driven underwriting at scale.

Chubb's business model is a masterclass in coherence, with a clear strategic focus on quality, service, and underwriting discipline. Its premium value proposition is perfectly aligned with the needs of its target markets (large corporations, high-net-worth individuals), and its revenue streams from underwriting and investments are robust and well-managed. The company avoids feature creep and executes its core strategy with exceptional discipline.

Exceptional alignment between its premium value proposition, target customer segments, and disciplined, risk-based pricing strategy, creating a highly profitable and defensible market position.

Innovate on the delivery model for the SMB segment by creating a more streamlined, digitally-enabled offering to capture this market without diluting the core brand.

As one of the world's largest publicly traded P&C insurers, Chubb wields significant market power, evidenced by its stable market share and ability to command premium prices. Its extensive, long-standing relationships with agents and brokers provide powerful leverage within its most critical distribution channel. The company actively influences the industry, particularly in the complex commercial and financial lines where it is a global leader.

Significant pricing power derived from its strong brand, financial stability, and reputation for superior claims handling, allowing it to compete on value rather than cost.

Systematically leverage proprietary claims and risk data to publish authoritative industry reports, further solidifying its ability to set industry standards and influence market trends.

Business Overview

Business Classification

Insurance Underwriter and Provider

Risk Management and Financial Services

Insurance

Sub Verticals

- •

Property & Casualty (P&C) Insurance

- •

Accident & Health Insurance

- •

Life Insurance

- •

Reinsurance

Mature

Maturity Indicators

- •

Global operations in 54+ countries and territories.

- •

Massive asset base (over $200B).

- •

Recognized as the world's largest publicly traded P&C insurer.

- •

Strong financial strength ratings (AA from S&P, A++ from A.M. Best).

- •

Long-standing brand reputation for quality and claims service.

- •

Diversified and comprehensive product portfolio.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Insurance Premiums

Description:Revenue generated from policyholders in exchange for insurance coverage across various lines, including commercial P&C, personal lines, life, and A&H insurance. This is the company's core revenue source.

Estimated Importance:Primary

Customer Segment:All Segments

Estimated Margin:Medium

- Stream Name:

Investment Income

Description:Income earned from investing the 'float' - premiums collected that have not yet been paid out as claims. Chubb maintains a large, diversified investment portfolio of bonds, equities, and other instruments.

Estimated Importance:Secondary

Customer Segment:N/A (Internal Operation)

Estimated Margin:High

- Stream Name:

Fee-Based Services

Description:Revenue from services such as risk management consulting, claims administration, and other insurance-related services that may be unbundled from traditional policies.

Estimated Importance:Tertiary

Customer Segment:Businesses (Large & Multinational)

Estimated Margin:High

Recurring Revenue Components

Policy Renewals

Multi-year Policy Premiums

Pricing Strategy

Risk-Based / Actuarial Pricing

Premium

Opaque

Pricing Psychology

- •

Prestige Pricing - Positioning as a high-quality, premium service provider.

- •

Authority - Leveraging strong financial ratings and industry awards (e.g., J.D. Power) to justify price.

- •

Peace of Mind - Selling security and reliability, not just a commodity product.

Monetization Assessment

Strengths

- •

Diversified revenue across multiple geographies and product lines mitigates risk.

- •

Strong brand reputation allows for premium pricing and customer loyalty.

- •

Disciplined underwriting culture maintains profitability.

- •

Significant investment income provides a stable, secondary revenue source.

Weaknesses

- •

Premium pricing may be uncompetitive for price-sensitive market segments.

- •

Revenue is susceptible to macroeconomic factors like interest rate fluctuations, which impact investment income.

- •

High dependence on traditional broker distribution channels could be a vulnerability as direct-to-consumer models grow.

Opportunities

- •

Expansion of embedded insurance partnerships to create new, scalable revenue channels.

- •

Growth in high-demand areas like cyber insurance and climate-related risk coverage.

- •

Leveraging AI and data analytics to refine underwriting, improve pricing accuracy, and increase efficiency.

Threats

- •

Increasing frequency and severity of catastrophic events due to climate change, leading to higher claim volumes.

- •

Competition from agile, tech-first 'Insurtech' startups.

- •

Evolving regulatory landscapes in 50+ operating countries.

- •

Prolonged low-interest-rate environments could suppress investment income growth.

Market Positioning

Quality and Service Leadership

Market Leader

Target Segments

- Segment Name:

High-Net-Worth Individuals & Families

Description:Affluent clients seeking comprehensive protection for valuable personal assets such as primary and secondary homes, luxury vehicles, fine art, and jewelry, along with substantial personal liability coverage.

Demographic Factors

High income

Significant personal assets

Psychographic Factors

- •

Value service and expertise over price

- •

Risk-averse

- •

Seek peace of mind and hassle-free experiences

Behavioral Factors

- •

Often work through personal financial advisors or specialized insurance brokers.

- •

High loyalty to trusted brands

- •

Expect premium claims service

Pain Points

- •

Standard insurance policies offer inadequate coverage limits.

- •

Difficulty insuring unique or high-value items.

- •

Concern over liability exposure.

- •

Poor claims experience with mass-market insurers.

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Large & Multinational Corporations

Description:Large domestic and multinational companies requiring complex, tailored insurance programs for a wide range of risks including property, casualty, professional liability, and specialty lines across multiple jurisdictions.

Demographic Factors

- •

Enterprise-level revenue

- •

Global operations

- •

Complex organizational structure

Psychographic Factors

- •

Focused on risk management and business continuity

- •

Value financial stability of their insurer

- •

Seek long-term strategic partnerships

Behavioral Factors

- •

Utilize sophisticated risk managers and global brokerage firms.

- •

Purchase a wide array of complex insurance products.

- •

Require global service capabilities.

Pain Points

- •

Managing disparate insurance policies across different countries.

- •

Navigating complex international regulations.

- •

Finding coverage for emerging risks like cyber threats and climate change.

- •

Ensuring their insurer has the financial capacity to pay massive claims.

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Small & Medium-Sized Businesses (SMBs)

Description:Businesses requiring standard and specialized commercial insurance, from business owner policies to workers' compensation and industry-specific coverage. The website has a dedicated 'Small Business Client Center'.

Demographic Factors

Varies by industry

Fewer than 500 employees

Psychographic Factors

- •

Time-constrained

- •

Often seek value and simplicity

- •

Desire a trusted advisor

Behavioral Factors

- •

Purchase through local agents or brokers.

- •

Increasingly comfortable with digital purchasing channels.

- •

Need responsive service for claims and policy questions.

Pain Points

- •

Complexity of choosing the right insurance coverage.

- •

Lack of in-house risk management expertise.

- •

Balancing cost with adequate protection.

Fit Assessment:Good

Segment Potential:High

- Segment Name:

Digital Ecosystem Partners

Description:Digital-native companies (e.g., fintech, e-commerce, mobility) that partner with Chubb to offer embedded insurance products directly to their customers within their own platforms and apps.

Demographic Factors

Technology-focused businesses

Large customer bases

Psychographic Factors

Prioritize customer experience and seamless integration

Seek to create new revenue streams and increase customer loyalty.

Behavioral Factors

- •

Require robust API integrations (e.g., Chubb Studio platform).

- •

Move at a fast pace

- •

Focus on data-driven decision making

Pain Points

- •

Lack of insurance expertise and licensing.

- •

Technical challenges of integrating insurance offerings.

- •

Desire to enhance their core product without building an insurance company from scratch.

Fit Assessment:Excellent

Segment Potential:High

Market Differentiation

- Factor:

Superior Claims Service

Strength:Strong

Sustainability:Sustainable

- Factor:

Underwriting Expertise and Discipline

Strength:Strong

Sustainability:Sustainable

- Factor:

Financial Strength and Stability

Strength:Strong

Sustainability:Sustainable

- Factor:

Global Reach and Network

Strength:Strong

Sustainability:Sustainable

- Factor:

Brand Reputation and Prestige

Strength:Strong

Sustainability:Sustainable

Value Proposition

Chubb provides unparalleled peace of mind to discerning individuals and businesses by combining deep underwriting expertise, superior claims service, and exceptional financial strength to protect what matters most.

Excellent

Key Benefits

- Benefit:

Fair and Prompt Claims Payment

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

J.D. Power awards for Home Insurance and Property Claims Satisfaction.

$21B in claims paid globally in 2023.

- Benefit:

Financial Security and Stability

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Over $200B in global assets.

High financial strength ratings (AA from S&P, A++ from A.M. Best).

- Benefit:

Tailored and Comprehensive Coverage

Importance:Important

Differentiation:Somewhat unique

Proof Elements

Offers over 200 insurance products and services.

Specific offerings for High-Net-Worth individuals and complex business needs.

- Benefit:

Global Service Capabilities

Importance:Important

Differentiation:Unique

Proof Elements

Claims teams operating in 54 countries.

Unique Selling Points

- Usp:

The 'Chubb Claims Difference' - a commitment to a higher standard of service, empathy, and expertise in handling claims.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Specialized expertise in underwriting complex and specialty risks for which many competitors lack the data or appetite.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Deeply entrenched relationships with the world's top agents and brokers, creating a powerful and loyal distribution network.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Risk of significant financial loss from unexpected events.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Inadequate coverage from one-size-fits-all insurance policies.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Difficulty managing complex insurance needs across multiple geographies.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Poor, slow, or unfair service when filing a claim.

Severity:Critical

Solution Effectiveness:Complete

Value Alignment Assessment

High

Chubb's value proposition of premium quality, expertise, and service is well-aligned with the needs of the complex commercial and high-net-worth personal lines markets, which prioritize comprehensive protection and service over low cost.

High

The value proposition resonates strongly with sophisticated buyers (risk managers, high-net-worth individuals) who understand the nuances of risk and are willing to pay a premium for superior coverage, financial stability, and claims handling.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Independent Insurance Agents & Brokers

- •

Reinsurance Companies.

- •

Digital Ecosystem Partners (e.g., Banks, Fintechs, E-commerce platforms).

- •

Financial Advisors

Key Activities

- •

Risk Assessment & Underwriting.

- •

Claims Management & Processing.

- •

Investment Portfolio Management.

- •

Distribution Channel Management

- •

Product Development & Innovation

Key Resources

- •

Financial Capital & Balance Sheet Strength.

- •

Brand Reputation & Trust

- •

Global Operational Infrastructure

- •

Proprietary Underwriting Data & Actuarial Expertise

- •

Skilled Workforce (Underwriters, Claims Adjusters, Risk Engineers)

Cost Structure

- •

Payment of Claims (Loss & Loss Adjustment Expenses)

- •

Broker and Agent Commissions

- •

Employee Salaries and Benefits

- •

Technology and IT Infrastructure

- •

Marketing and Advertising

Swot Analysis

Strengths

- •

Dominant market position and strong brand recognition.

- •

Exceptional financial strength and stability.

- •

Diversified portfolio across products and geographies.

- •

Deep expertise in underwriting and claims handling.

- •

Extensive and loyal distribution network of agents and brokers.

Weaknesses

- •

Higher cost structure relative to leaner, direct-to-consumer competitors.

- •

Potential for organizational inertia and slower adoption of new technologies due to size.

- •

Premium pricing limits appeal to the broader, more price-sensitive mass market.

Opportunities

- •

Capitalize on the rapid growth of the embedded insurance market through strategic partnerships.

- •

Leverage AI/ML for more sophisticated risk modeling, dynamic pricing, and claims automation.

- •

Expand offerings in high-growth specialty lines like cyber, climate/ESG, and renewable energy risk.

- •

Further digitalize agent/broker tools to improve efficiency and strengthen channel partnerships.

Threats

- •

Systemic risk from global events (pandemics, financial crises, widespread cyber-attacks).

- •

Increased claims volatility from climate change and natural catastrophes.

- •

Disruption from Insurtech companies with innovative, lower-cost business models.

- •

Complex and evolving global regulatory environment.

Recommendations

Priority Improvements

- Area:

Digital Transformation & Channel Enablement

Recommendation:Accelerate investment in the 'Chubb Studio' platform to further streamline API integration for embedded insurance partners and develop a best-in-class digital portal for brokers to quote, bind, and service policies more efficiently.

Expected Impact:High

- Area:

Operational Efficiency

Recommendation:Deploy AI and machine learning across the value chain, focusing on automating routine claims processing and augmenting underwriting decisions with advanced data analytics to improve speed and accuracy.

Expected Impact:High

- Area:

SMB Market Penetration

Recommendation:Develop a streamlined, digitally-enabled product suite for the SMB segment that simplifies the buying process while still reflecting Chubb's quality, potentially through a direct-to-SME channel or a simplified broker interface.

Expected Impact:Medium

Business Model Innovation

- •

Develop 'Risk-as-a-Service' offerings, providing large corporate clients with access to proprietary risk modeling tools, data, and consulting on a subscription basis.

- •

Pioneer parametric insurance products for business interruption and weather-related risks, using verifiable data triggers (e.g., wind speed, rainfall level) for instant, automated claim payouts.

- •

Create a venture arm to strategically invest in and partner with early-stage Insurtech companies to gain access to new technologies and business models.

Revenue Diversification

- •

Expand the new Global Climate Business Unit to become a market leader in insurance and risk management services for the green energy transition.

- •

Aggressively pursue B2B2C partnerships outside of traditional finance, targeting sectors like travel, luxury retail, and the gig economy for embedded insurance opportunities.

- •

Build out a dedicated cyber risk consulting practice to provide fee-based services beyond insurance, including incident response planning and vulnerability assessments.

Chubb operates a classic, highly refined, and successful insurance business model built upon the pillars of underwriting discipline, financial strength, and superior service. Its strategic focus on complex commercial risks and high-net-worth individuals allows it to command premium pricing and fosters deep, defensible relationships through the broker channel. This model has proven exceptionally resilient and profitable, establishing Chubb as a global market leader.

The primary strategic evolution for Chubb is not a radical reinvention of its core, but rather a digital transformation layered on top of its existing strengths. The company's proactive move into embedded insurance via its 'Chubb Studio' platform is a critical and forward-thinking initiative. This transforms Chubb from solely a risk carrier into a B2B2C 'Insurance-as-a-Service' provider, enabling it to tap into new, highly scalable revenue streams by integrating its products into the digital ecosystems of its partners. This is the most significant opportunity for business model evolution, allowing Chubb to reach new customer segments efficiently and defend against digital-native disruptors.

Future success will be determined by Chubb's ability to balance its traditional, relationship-driven broker model with these new digital, partnership-based channels. The key challenge is to infuse technological agility and data-centric decision-making into its mature, global operations without diluting the brand's premium positioning and service-oriented culture. Strategic imperatives should focus on leveraging technology to enhance, not replace, its core competencies: using AI to augment underwriting expertise, digital tools to empower brokers, and new data sources to create innovative products for emerging risks like climate change and cyber threats. By successfully navigating this digital evolution, Chubb is well-positioned to fortify its competitive advantages and continue its trajectory of steady, profitable growth.

Competitors

Competitive Landscape

Mature

Moderately concentrated

Barriers To Entry

- Barrier:

Capital and Solvency Requirements

Impact:High

- Barrier:

Regulatory Compliance and Licensing

Impact:High

- Barrier:

Brand Reputation and Trust

Impact:High

- Barrier:

Distribution Channels (Broker & Agent Networks)

Impact:High

- Barrier:

Underwriting Expertise and Historical Data

Impact:Medium

Industry Trends

- Trend:

Digital Transformation and AI Adoption

Impact On Business:Legacy systems can hinder agility. Investment in AI for underwriting, claims, and customer service is crucial for efficiency and personalization.

Timeline:Immediate

- Trend:

Embedded Insurance

Impact On Business:Chubb is already participating in this B2B2C model, but competition for strategic partnerships with non-insurance brands is intensifying.

Timeline:Immediate

- Trend:

Increasing Climate and Catastrophe Risk

Impact On Business:Drives demand for sophisticated P&C products but also increases claims volatility and underwriting complexity, requiring advanced risk modeling.

Timeline:Immediate

- Trend:

Cyber Risk Escalation

Impact On Business:Creates a significant growth opportunity for specialized cyber insurance products but also poses a substantial underwriting challenge due to evolving threats.

Timeline:Near-term

- Trend:

Hyper-Personalization of Products

Impact On Business:Leveraging data analytics to offer tailored coverage is becoming a key differentiator, moving away from one-size-fits-all policies.

Timeline:Near-term

Direct Competitors

- →

Travelers Companies, Inc.

Market Share Estimate:Approx. 4.0% of U.S. P&C market.

Target Audience Overlap:High

Competitive Positioning:A leading provider of commercial and personal P&C insurance with a strong brand and diversified product portfolio.

Strengths

- •

Strong brand recognition and long-standing history.

- •

Diversified portfolio across business, personal, and specialty lines.

- •

Robust financial performance and underwriting discipline.

- •

Loyal customer base due to good claims management.

Weaknesses

- •

High dependence on the U.S. market, creating geographic risk.

- •

Exposure to significant catastrophe losses.

- •

Faces intense competition and pricing pressures.

- •

Deceleration in business insurance renewal rates noted as a potential challenge.

Differentiators

Deep expertise in specific commercial niches (e.g., construction).

Strong agent and broker relationships built over decades.

- →

American International Group (AIG)

Market Share Estimate:Approx. 1.5% of U.S. P&C market.

Target Audience Overlap:High

Competitive Positioning:A multinational finance and insurance corporation with operations in over 80 countries, offering a vast range of P&C, life, and retirement solutions.

Strengths

- •

Extensive global presence and network.

- •

Highly diversified product portfolio across commercial and personal lines.

- •

Strong brand recognition and reputation.

- •

Significant investment in technology and digital transformation.

Weaknesses

- •

Complex organizational structure can impact operational efficiency.

- •

Past financial instability has had a lingering impact on brand perception.

- •

Faces significant regulatory pressures and compliance challenges.

- •

Vulnerable to economic downturns and market volatility.

Differentiators

Leader in high-stakes, complex risk management for multinational corporations.

Significant offerings in life and retirement products, providing cross-selling opportunities.

- →

The Hartford

Market Share Estimate:Approx. 1.7% of U.S. P&C market.

Target Audience Overlap:High

Competitive Positioning:A leader in P&C insurance, group benefits, and mutual funds, with a strong focus on small business insurance.

Strengths

- •

Market leader in small business insurance.

- •

Strong brand recognition, particularly in the U.S.

- •

Well-established relationships with agents and brokers.

- •

Diversified offerings including group benefits, which provides a competitive advantage.

Weaknesses

- •

Primarily focused on the U.S. market, limiting international growth.

- •

Faces intense competition in the highly contested small business segment.

- •

Like other incumbents, may be slower to adapt to digital trends than insurtechs.

- •

Exposed to economic cycles that impact small business health.

Differentiators

Deep specialization and tailored products for the small business segment.

Integrated offerings of both P&C insurance and employee benefits.

- →

Allianz SE

Market Share Estimate:A top 10 global P&C insurer.

Target Audience Overlap:Medium

Competitive Positioning:A global financial services giant with a core business in insurance and asset management, headquartered in Europe.

Strengths

- •

Massive global footprint and one of the world's largest financial services companies.

- •

Highly diversified across insurance lines (P&C, Life/Health) and asset management.

- •

Strong financial stability and brand reputation worldwide.

- •

Significant investment in innovation and digital platforms.

Weaknesses

- •

Less brand dominance in the U.S. personal lines market compared to North American-native competitors.

- •

Large, complex organization can lead to slower decision-making.

- •

Exposed to diverse and complex global regulatory environments.

Differentiators

Integrated financial services model including a world-leading asset management arm (PIMCO, Allianz Global Investors).

Deep European market penetration.

Indirect Competitors

- →

Lemonade

Description:An insurtech company that uses AI and chatbots to offer renters, homeowners, car, pet, and life insurance. Known for its fast claims processing and social impact model.

Threat Level:Medium

Potential For Direct Competition:Currently focused on personal lines and simpler risks, but could expand into small commercial lines, directly competing with Chubb's small business offerings.

- →

Next Insurance

Description:A digital-first insurance carrier focused on providing customized, affordable coverage for small businesses and self-employed individuals.

Threat Level:Medium

Potential For Direct Competition:Directly targets Chubb's small business segment with a more agile, digital-native platform. While they lack Chubb's breadth, they are a significant threat for simpler small business accounts.

- →

Managing General Agents (MGAs)

Description:Specialized insurance agents/brokers that have underwriting authority from an insurer. They are increasingly used by carriers to access niche markets and specialized underwriting expertise.

Threat Level:Low

Potential For Direct Competition:MGAs are more often partners than competitors, but a rise in highly specialized, tech-enabled MGAs could capture niche profitable markets before large carriers like Chubb can adapt their offerings.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Brand Reputation and Financial Strength

Sustainability Assessment:Chubb's brand is synonymous with premium quality, financial stability ($200B+ assets), and superior claims service, which is critical for large commercial clients and high-net-worth individuals.

Competitor Replication Difficulty:Hard

- Advantage:

Global Underwriting Expertise and Diversified Portfolio

Sustainability Assessment:Deep, specialized underwriting knowledge across 200+ products and 54 countries allows Chubb to price complex risks that smaller or less experienced competitors cannot.

Competitor Replication Difficulty:Hard

- Advantage:

Extensive Broker and Agent Distribution Network

Sustainability Assessment:Long-standing relationships with thousands of independent agents and brokers create a powerful and loyal distribution channel that is difficult for new entrants to build.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'J.D. Power Awards for Home & Claims Satisfaction', 'estimated_duration': '1-2 Years'}

Disadvantages

- Disadvantage:

Agility and Speed of Innovation

Impact:Major

Addressability:Moderately

- Disadvantage:

Digital Customer Experience for Simpler Products

Impact:Minor

Addressability:Easily

Strategic Recommendations

Quick Wins

- Recommendation:

Launch a targeted digital marketing campaign highlighting J.D. Power awards to capture high-net-worth personal lines leads.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Optimize the online quote process for small business insurance to reduce friction and compete more effectively with insurtechs.

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Develop a 'digital-first, human-supported' service model for affluent personal lines clients, combining a seamless app experience with dedicated concierge-level support.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Expand embedded insurance partnerships in high-growth sectors like e-commerce, SaaS, and the sharing economy.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Leverage AI and advanced analytics to create predictive models for emerging risks (e.g., climate, supply chain) to enhance underwriting and offer new advisory services.

Expected Impact:High

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Invest in or acquire a leading insurtech to integrate a more agile technology stack and innovation culture into the core business.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Position Chubb as the premier global partner for managing risks associated with the transition to a net-zero economy, building on existing climate expertise.

Expected Impact:High

Implementation Difficulty:Difficult

Reinforce Chubb's position as the 'gold standard' for complex risk management and superior service, while selectively investing in digital capabilities to defend its market share in less complex segments against digital-native competitors.

Focus on 'Craftsmanship in Risk': Differentiate through unparalleled underwriting expertise, bespoke coverage solutions, and a claims process that is positioned as a concierge-level restoration service, not just a transaction.

Whitespace Opportunities

- Opportunity:

Develop a 'Family Office' Insurance & Risk Management Suite

Competitive Gap:Competitors offer high-net-worth products, but few offer a truly integrated risk management service that covers personal assets, business interests, cyber security, and philanthropic activities under one advisory umbrella.

Feasibility:High

Potential Impact:High

- Opportunity:

Launch Proactive IoT-Based Loss Prevention Services for Commercial Clients

Competitive Gap:While some competitors offer IoT for personal home safety, there is a gap in providing a comprehensive, subscription-based service for businesses (e.g., water leak detection for real estate, temperature monitoring for supply chains) backed by insurance discounts.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Create a Specialized Insurance Division for the Creator Economy

Competitive Gap:Small business insurers are not adequately addressing the unique risks of high-growth digital entrepreneurs, influencers, and freelancers (e.g., intellectual property, demonetization risk, professional liability).

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Offer 'ESG-as-a-Service' for Mid-Market Companies

Competitive Gap:Mid-market companies struggle with ESG (Environmental, Social, and Governance) compliance and risk management. Chubb can bundle D&O insurance with advisory services and risk modeling tools to help them navigate this landscape.

Feasibility:Medium

Potential Impact:High

Chubb operates in the mature and moderately concentrated Property & Casualty (P&C) insurance industry. The market is characterized by high barriers to entry, including immense capital requirements, stringent regulatory licensing, and the necessity of extensive distribution networks, which protects established players like Chubb from new, large-scale competition. Chubb has successfully positioned itself as a premium, global insurer defined by underwriting excellence, financial strength, and superior claims service. This strategy resonates strongly with its core target markets: large multinational corporations, mid-sized businesses, and high-net-worth individuals.

Chubb's primary direct competitors are other large, diversified insurance carriers such as Travelers, AIG, and The Hartford. These companies compete on brand, financial ratings, product breadth, and broker relationships. Chubb's competitive advantages are its deep underwriting expertise in complex and specialty risks, its truly global footprint, and a brand reputation that commands premium pricing. Competitors like Travelers are strong domestically but have less international reach, while AIG boasts a similar global scale but has faced historical brand challenges.

The most significant threat comes not from direct peers but from indirect, digitally-native competitors. Insurtechs like Lemonade and Next Insurance are disrupting the personal and small commercial lines segments, respectively. They attack the market with superior digital customer experiences, faster quoting and claims processes, and aggressive pricing on simpler risks. While they currently lack the capital, brand trust, and underwriting expertise to challenge Chubb in its core complex markets, they are rapidly capturing market share at the lower end and setting new customer expectations for digital service.

Strategic whitespace for Chubb exists at the intersection of its core strengths and emerging market needs. Opportunities include creating holistic risk management solutions for family offices, developing proactive IoT-based loss prevention services, and establishing itself as the leading insurer for ESG and climate transition risks. To succeed, Chubb must pursue a dual strategy: reinforce its premium, high-touch positioning for complex risks while simultaneously investing in targeted digital capabilities to provide a modern, efficient experience for less complex products. This will allow Chubb to protect its core business while neutralizing the threat from more agile, tech-focused disruptors.

Messaging

Message Architecture

Key Messages

- Message:

Helping protect what matters most.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Section

- Message:

Customized insurance for Individuals & Families and Businesses of all sizes.

Prominence:Primary

Clarity Score:High

Location:Homepage, below hero

- Message:

We don’t just process claims. We make things right.

Prominence:Secondary

Clarity Score:High

Location:Homepage, 'The Claims Difference' Section

- Message:

Insurance excellence is our starting point, backed by significant financial strength ($200B+ assets).

Prominence:Secondary

Clarity Score:Medium

Location:Homepage, 'Why Chubb' Section

- Message:

1 Insurance Provider for Homeowners Policy and Claims Experience Satisfaction (J.D. Power).

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Section

The message hierarchy is logical and effective. The primary message, 'Helping protect what matters most,' establishes an immediate emotional connection. This is immediately supported by a powerful social proof point (the J.D. Power award) and clear audience segmentation ('Individuals & Families,' 'Businesses'). Supporting messages about financial strength and claims philosophy are placed further down the page, correctly assuming a user will seek this information after their initial interest is captured.

Messaging is highly consistent. The core themes of protection, customization, and superior claims service are present across the prospect-focused homepage and implied on the customer-focused login page, which provides direct access to claims and service resources. The brand's promise of capability is fulfilled by the functional, resource-rich nature of the logged-in experience.

Brand Voice

Voice Attributes

- Attribute:

Authoritative

Strength:Strong

Examples

- •

Insurance excellence is our starting point.

- •

$200B+ Global assets backing our financial strength

- •

We combine the precision of craftsmanship with decades of experience...

- Attribute:

Reassuring

Strength:Strong

Examples

- •

Helping protect what matters most.

- •

We don’t just process claims. We make things right.

- •

We service and pay our claims fairly and promptly.

- Attribute:

Professional

Strength:Strong

Examples

- •

At Chubb, we assess, assume and manage risk with insight and discipline.

- •

Chubb provides proactive risk management guidance...

- •

Protection for your business, for your employees and your reputation...

- Attribute:

Capable

Strength:Moderate

Examples

54 Countries where claims teams operate

Over 200 Insurance products and client services

Tone Analysis

Professional and Confident

Secondary Tones

Empathetic

Secure

Tone Shifts

The tone shifts from broadly reassuring on the main homepage to more functional and direct on the 'Businesses Log-In' page, which is appropriate for the differing audience intent (prospecting vs. servicing).

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

For discerning individuals, families, and businesses who require more than standard insurance, Chubb provides superior, customized coverage and an exceptional claims experience, delivered with craftsmanship and backed by world-class financial strength.

Value Proposition Components

- Component:

Exceptional Claims Service

Clarity:Clear

Uniqueness:Unique

Detail:Communicated via the J.D. Power award and the promise 'We make things right,' positioning claims not as a transaction, but as a resolution.

- Component:

Financial Strength & Stability

Clarity:Clear

Uniqueness:Somewhat Unique

Detail:Quantified with large, specific numbers ($200B+ assets, $21B claims paid), which builds trust and a sense of security. While other major insurers are also stable, Chubb makes it a prominent part of their messaging.

- Component:

Customized & Comprehensive Coverage

Clarity:Clear

Uniqueness:Somewhat Unique

Detail:Emphasized through clear audience segmentation and phrases like 'coverage tailored to your needs' and 'customized to the unique needs of your industry.'

- Component:

Expertise & Craftsmanship

Clarity:Somewhat Clear

Uniqueness:Unique

Detail:Mentioned in the mission ('precision of craftsmanship') but less developed on the homepage itself. It's a unique angle that could be further amplified.

Chubb differentiates itself effectively from mass-market insurers by focusing on quality, service, and expertise rather than price. The #1 J.D. Power ranking is their most powerful differentiator and is used prominently and effectively. The concept of 'craftsmanship' is a unique and compelling idea in an industry often seen as a commodity. Their messaging consistently reinforces a premium, high-touch brand identity.

The messaging positions Chubb at the premium end of the market, competing with other high-net-worth and large commercial carriers like AIG and Zurich. The strategy is not to compete on cost but on value, targeting customers who are willing to pay for superior protection and peace of mind. This positioning is clear, consistent, and well-supported by the evidence provided on the site.

Audience Messaging

Target Personas

- Persona:

High-Net-Worth Individuals & Families

Tailored Messages

- •

Helping protect what matters most to you.

- •

1 Insurance Provider for Homeowners Policy and Claims Experience Satisfaction.

- •

Customized personal insurance...

Effectiveness:Effective

- Persona:

Business Owners & Executives (Small to Large)

Tailored Messages

- •

Protection for your business, for your employees and your reputation.

- •

customized to the unique needs of your industry - for businesses of all sizes.

- •

Chubb's embedded insurance solutions...

Effectiveness:Effective

- Persona:

Insurance Agents & Brokers

Tailored Messages

Chubb gives you all you need to offer clients a world-class experience...

...tools and resources to support your sales and business growth.

Effectiveness:Effective

Audience Pain Points Addressed

- •

Fear of inadequate coverage after a loss.

- •

The stress and hassle of a difficult claims process.

- •

Concern about an insurer's financial ability to pay large claims.

- •

Finding insurance that understands unique or complex risks (for businesses and HNW individuals).

Audience Aspirations Addressed

- •

Achieving peace of mind about financial security.

- •

Protecting a carefully built lifestyle or business legacy.

- •

Desire for high-quality, responsive service that respects their time and investment.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Security & Peace of Mind

Effectiveness:High

Examples

Helping protect what matters most.

We don’t just process claims. We make things right.

- Appeal Type:

Trust & Reliability

Effectiveness:High

Examples

$200B+ Global assets backing our financial strength

We service and pay our claims fairly and promptly.

Social Proof Elements

- Proof Type:

Third-Party Awards

Impact:Strong

Detail:The prominent display of the J.D. Power #1 ranking is a highly credible and persuasive element.

- Proof Type:

Authority/Scale Figures

Impact:Strong

Detail:Using large numbers like '$200B+ Global assets' and '$21B Claims paid out' establishes credibility and scale.

Trust Indicators

- •

Prominent display of third-party awards (J.D. Power).

- •

Transparent financial strength metrics.

- •

Professional, confident, and consistent brand voice.

- •

Clear, easy-to-navigate website structure.

- •

Explicit statements about their claims philosophy.

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

Get a quote

Location:Bottom of homepage, segmented for Individuals & Businesses

Clarity:Clear

- Text:

Learn more

Location:Multiple sections (e.g., under J.D. Power award, 'The Claims Difference')

Clarity:Clear

- Text:

Explore Careers

Location:Homepage 'Careers' section

Clarity:Clear

The calls-to-action are clear, well-placed, and logically follow the messaging in their respective sections. The segmentation of the 'Get a quote' CTA for individuals and businesses is a smart user experience choice. While effective, the language is standard ('Learn More', 'Get a Quote'). There is an opportunity to test more benefit-oriented CTA language (e.g., 'Protect Your Business', 'Secure Your Home').

Messaging Gaps Analysis

Critical Gaps

Lack of human-centric storytelling on the homepage. While the 'Stories' section exists, it's not on the main landing page. Featuring a compelling customer claim story could powerfully demonstrate the 'We make things right' promise.

The 'craftsmanship' angle is a unique brand concept but is not fully explained or visualized on the homepage. It remains more of a corporate statement than a tangible benefit.

Contradiction Points

No itemsUnderdeveloped Areas

Proactive Risk Management: The homepage mentions providing 'proactive risk management guidance,' but doesn't offer examples or explain what this entails, which is a significant value-add for their target audience.

Embedded Insurance: This is a sophisticated offering mentioned on the homepage but could benefit from a clearer, more concise explanation of its value proposition for potential partners.

Messaging Quality

Strengths

- •

Exceptional clarity in audience segmentation.

- •

Powerful and prominent use of social proof (J.D. Power award).

- •

Consistent and authoritative brand voice that builds trust.

- •

Strong linkage between the brand promise ('protect what matters') and tangible proof points (financial strength, claims service).

Weaknesses

- •

Over-reliance on stating value rather than demonstrating it through case studies or testimonials on the homepage.

- •

The language can feel slightly impersonal and corporate, missing opportunities for more emotive storytelling.

- •

Key differentiators like 'craftsmanship' and 'risk management' are mentioned but not fully developed.

Opportunities

- •

Create a dedicated homepage module for a customer success story or testimonial video to bring the 'Claims Difference' to life.

- •

Develop interactive content or a short explainer to unpack the concept of 'insurance craftsmanship'.

- •

Elevate the 'risk management' benefit by providing a downloadable guide or a short article preview on the homepage, showcasing their expertise.

Optimization Roadmap

Priority Improvements

- Area:

Value Proposition Communication

Recommendation:Integrate a customer story/testimonial module onto the homepage to vividly demonstrate the 'Claims Difference' in action. Shift from telling to showing.

Expected Impact:High

- Area:

Brand Differentiation

Recommendation:Create a dedicated section or interactive element on the homepage that explains 'The Craft of Insurance,' detailing what goes into their underwriting and service to justify the premium positioning.

Expected Impact:Medium

- Area:

Lead Generation

Recommendation:Test more compelling, benefit-driven CTA copy. For example, change 'Get a Quote' to 'Secure Your Quote' or 'Protect My Business'.

Expected Impact:Medium

Quick Wins

Add the official J.D. Power '#1' logo next to the award text for immediate visual recognition and credibility.

Expand the 'Why Chubb' section with a single, powerful sentence under each statistic to explain its benefit to the customer (e.g., under '$200B+ Global assets', add 'The strength to be there for you, no matter what.').

Long Term Recommendations

Develop a more robust content strategy around the key personas, showcasing expertise in the specific risks faced by HNW individuals and various business industries.

Invest in video content that features Chubb's own claims specialists and risk engineers, turning abstract expertise into relatable human stories.

Chubb's website messaging is a masterclass in positioning a premium brand in a competitive market. The strategy is built on a foundation of trust, authority, and proven excellence. Its core strength lies in the clear, logical hierarchy of messages, starting with an emotional connection ('protect what matters most'), immediately backing it up with powerful social proof (the J.D. Power #1 ranking), and then providing rational support (financial strength, claims philosophy).

The brand voice is exceptionally consistent—professional, confident, and reassuring—perfectly aligning with its target audience of high-net-worth individuals and businesses who prioritize quality and reliability over cost. Audience segmentation is executed flawlessly, with clear pathways for individuals, businesses, and brokers, ensuring a relevant user journey from the first click.

The primary weakness is a slight over-reliance on assertion over demonstration. The brand tells us it provides a superior claims experience and that its approach is one of 'craftsmanship,' but it misses the opportunity to show this through compelling, human-centric stories on its most valuable digital real estate—the homepage. While the core messaging is strong and effective, integrating narrative elements would elevate it from merely credible to truly compelling, deepening the emotional connection and making the value proposition even more tangible. The optimization roadmap should focus on bringing these powerful, differentiating concepts to life.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Established as one of the world's largest publicly traded Property & Casualty (P&C) insurers with operations in 54 countries.

- •

Consistently strong financial performance, including a reported 12.1% annual revenue growth in 2024 and a 5-year revenue CAGR of 10.54%.

- •

Recognized for superior service and claims experience, evidenced by J.D. Power awards for Homeowners Policy and Claims Satisfaction.

- •

Broad and diverse product portfolio (over 200 products) serving individuals, small businesses, and large multinational corporations.

- •

Strong underwriting discipline, demonstrated by a healthy combined ratio (e.g., 85.6% in Q2 2025), indicating profitability.

Improvement Areas

- •

Enhancing the digital-first experience for younger, digitally-native customer segments (Millennials, Gen Z) who prefer on-demand and embedded services.

- •

Simplifying the online quoting and binding process for less complex personal and small business lines to compete with insurtech challengers.

- •

Increasing product personalization at scale using AI and advanced data analytics to meet evolving customer expectations.

Market Dynamics

Global insurance premiums estimated to grow by 3.3% in 2024, with P&C personal lines growing around 9.5% in 2022-23.

Mature

Market Trends

- Trend:

Digital Transformation and AI Integration

Business Impact:Insurers are heavily investing in AI and automation to improve underwriting, claims processing, and customer experience, making it a competitive necessity.

- Trend:

Embedded Insurance Growth

Business Impact:The embedded insurance market is projected to grow exponentially (reaching ~$700 billion by 2030), shifting distribution away from traditional channels and toward point-of-sale integrations.

- Trend:

Heightened Climate and Cyber Risk

Business Impact:Increasing frequency and severity of natural disasters and cyber threats are creating demand for new products but also driving underwriting losses and premium hikes.

- Trend:

Evolving Customer Expectations

Business Impact:Customers demand seamless, personalized, and digital-first interactions, pushing carriers to innovate beyond traditional agent-led models.

Optimal. While the market is mature, the current wave of technological disruption (AI, APIs) and the rise of new risk categories create significant opportunities for an established, financially strong player like Chubb to innovate and capture market share.

Business Model Scalability

High

The model is scalable due to the pooling of risk. A significant portion of costs are variable (commissions, claims). Investments in technology represent a growing fixed cost but create efficiencies at scale.

High. Once technology platforms and distribution networks are established, each additional policy written adds significant marginal profit, provided underwriting discipline is maintained.

Scalability Constraints

- •

Regulatory capital requirements across 54 different countries.

- •

Complexity of integrating legacy IT systems with modern, agile platforms.

- •

Talent acquisition in high-demand areas like data science, AI/ML, and cybersecurity.

- •

Maintaining brand consistency and service quality across a global, federated operational structure.

Team Readiness

Strong. Experienced leadership with a clear strategic vision focused on underwriting discipline, global expansion, and technology investment.

Traditional and complex, which can slow down agile decision-making. However, recent leadership changes suggest a move towards strengthening regional strategies and operational frameworks.

Key Capability Gaps

- •

Digital Product Management: Need for talent to design and manage seamless, end-to-end digital customer journeys.

- •

Developer Relations & API Integration Support: To scale the 'Chubb Studio' and embedded insurance partnerships, a strong team is needed to support partner developers.

- •

AI/ML Engineering: Deep technical talent required to move from data analytics to predictive AI models in underwriting and claims.

Growth Engine

Acquisition Channels

- Channel:

Agents & Brokers

Effectiveness:High

Optimization Potential:Medium

Recommendation:Empower agents and brokers with superior digital tools, real-time data analytics, and a streamlined submission process to improve efficiency and make Chubb the preferred carrier to work with.

- Channel:

Embedded Insurance (Partnerships)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Aggressively scale the 'Chubb Studio' platform by targeting partners in high-growth ecosystems (e.g., fintech, e-commerce, mobility). Develop a dedicated team to streamline partner onboarding and integration.

- Channel:

Direct-to-Consumer (DTC) Digital

Effectiveness:Low

Optimization Potential:High

Recommendation:Invest in a user-friendly website and targeted online advertising to capture digitally-native customers for simpler personal and small business lines.

- Channel:

Direct Sales Force (Large Commercial)

Effectiveness:High

Optimization Potential:Low

Recommendation:Maintain and support this high-touch channel for complex, large-scale commercial accounts.

Customer Journey

Predominantly agent-led and relationship-based. The digital path is emerging but likely has multiple steps and potential hand-offs, creating friction.

Friction Points

- •

Manual data entry and documentation for policy applications through traditional channels.

- •

Lack of price transparency and complex jargon in policy documents.

- •

Potentially slow and opaque online quote generation process compared to insurtech competitors.

Journey Enhancement Priorities

{'area': 'Online Quote & Bind', 'recommendation': 'Implement a fully digital, mobile-friendly quote-to-bind process for select products, using pre-filled forms and data enrichment to minimize user effort. '}

{'area': 'Onboarding', 'recommendation': 'Develop a digital welcome and onboarding experience for new policyholders, providing easy access to policy documents, contact information, and self-service options.'}

Retention Mechanisms

- Mechanism:

Superior Claims Service

Effectiveness:High

Improvement Opportunity:Further digitize the claims process (e.g., photo-based estimates, AI-driven assessment, instant payouts for simple claims) to increase speed and transparency.

- Mechanism:

Multi-Policy Bundling & Discounts

Effectiveness:Medium

Improvement Opportunity:Use data analytics to proactively recommend relevant cross-sell and bundle opportunities to clients through their preferred channel (agent or digital).

- Mechanism:

Proactive Risk Management Services

Effectiveness:Medium

Improvement Opportunity:Leverage IoT and data from clients to provide personalized risk mitigation advice and services, creating a continuous value proposition beyond the policy itself.

Revenue Economics

Strong. As a market leader, Chubb benefits from economies of scale and underwriting expertise, leading to a profitable combined ratio and healthy returns on equity.

High (Estimated). High retention rates in insurance, particularly for commercial and high-net-worth clients, lead to a very high Lifetime Value (LTV). While Customer Acquisition Costs (CAC) via agents are significant, the LTV justifies the investment.

High. Chubb has one of the lowest expense ratios in the P&C sector, driven by technology investments and operational discipline.

Optimization Recommendations

- •

Lower CAC for simpler products by shifting acquisition to lower-cost digital and embedded channels.

- •

Increase LTV through data-driven cross-selling and upselling of new products like cyber and climate risk insurance.

- •

Further improve the combined ratio by using AI for more precise underwriting and fraud detection.

Scale Barriers

Technical Limitations

- Limitation:

Legacy Core Systems

Impact:High

Solution Approach:Adopt a two-speed IT architecture. Maintain stable legacy systems for core policy administration while building agile, API-driven platforms (like Chubb Studio) for new digital initiatives and partner integrations.

- Limitation:

Data Silos

Impact:Medium

Solution Approach:Invest in a unified data platform to consolidate customer and risk data from across business units, enabling a 360-degree customer view and more sophisticated analytics.

Operational Bottlenecks

- Bottleneck:

Manual Underwriting & Claims Processing

Growth Impact:Limits speed and scalability, increases operational costs.

Resolution Strategy:Implement intelligent process automation (IPA) and AI/ML models to automate routine underwriting and claims tasks, freeing up human experts for complex cases.

- Bottleneck:

Managing Global Regulatory Compliance

Growth Impact:Slows down new product launches and market entry.

Resolution Strategy:Invest in RegTech solutions to automate compliance monitoring and reporting, and maintain strong, centralized governance over regional operations.

Market Penetration Challenges

- Challenge:

Intense Competition

Severity:Major

Mitigation Strategy:Differentiate on superior service, claims handling, and financial strength. Compete in high-growth niches (cyber, specialty lines) and innovative channels (embedded) where nimbler competitors may lack scale.

- Challenge:

Market Saturation in Developed Economies

Severity:Major

Mitigation Strategy:Focus on strategic acquisitions and expansion in high-growth emerging markets in Asia and Latin America. Target underserved customer segments in mature markets with tailored digital offerings.

- Challenge:

Disintermediation by Insurtechs and Big Tech

Severity:Critical

Mitigation Strategy:Embrace a partnership model. Leverage platforms like Chubb Studio to enable, rather than compete with, new digital ecosystems, turning potential disruptors into distribution partners.

Resource Limitations

Talent Gaps

- •

Data Scientists and AI/ML Engineers

- •

Digital User Experience (UX) Designers

- •

Cybersecurity Risk Specialists

- •

API and Platform Product Managers

Low. As a financially strong company, capital is not a primary constraint. The challenge is allocating capital effectively towards high-ROI digital transformation and growth initiatives.

Infrastructure Needs

- •

Cloud-native, scalable platforms to support digital and embedded insurance initiatives.

- •

Modern data infrastructure capable of handling real-time data ingestion and advanced analytics.

- •

Enhanced cybersecurity infrastructure to protect against increasing threats.

Growth Opportunities

Market Expansion

- Expansion Vector:

Geographic Expansion in Emerging Markets

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Continue pursuing strategic M&A of local/regional players in Asia and Latin America to acquire market access, licenses, and local expertise, as seen with the Liberty Mutual acquisition.

- Expansion Vector:

Demographic Expansion to Younger Segments

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Develop simplified, digitally-delivered products and leverage embedded channels (e.g., via fintech apps, e-commerce) that are popular with this demographic.

Product Opportunities

- Opportunity:

Cyber Insurance for SMEs

Market Demand Evidence:Cyber threats are a rapidly growing risk for small and medium-sized enterprises, which are often underserved by complex corporate cyber policies.

Strategic Fit:High. Leverages Chubb's commercial underwriting expertise and can be distributed digitally at scale.

Development Recommendation:Develop a turnkey, easy-to-understand cyber insurance product for SMEs, potentially bundled with proactive security tools through a partnership.

- Opportunity:

Parametric Insurance for Climate Events

Market Demand Evidence:Increasing volatility from climate change creates demand for faster, more transparent claim payouts based on predefined event triggers (e.g., hurricane wind speed).

Strategic Fit:High. Aligns with Chubb's expertise in catastrophe modeling and risk management.

Development Recommendation:Launch pilot programs for specific perils (e.g., drought for agriculture, hurricanes for coastal properties) in partnership with climate data providers.

Channel Diversification

- Channel:

Embedded Insurance API Platform ('Chubb Studio')

Fit Assessment:Excellent. This is a core growth strategy already in motion.

Implementation Strategy:Double down on investment in Chubb Studio. Build a world-class developer portal, create pre-packaged integration solutions for key verticals (e.g., travel, retail), and actively market it as a B2B solution.

- Channel:

Digital Ecosystems/Marketplaces

Fit Assessment:Good.

Implementation Strategy:Partner with digital platforms that serve homeowners (e.g., real estate platforms) or business owners (e.g., accounting software) to offer integrated insurance solutions.

Strategic Partnerships

- Partnership Type:

Technology & Data Providers

Potential Partners

- •

Cloud Providers (AWS, Azure, GCP)

- •

AI/ML Platform Companies (e.g., Databricks)

- •

Geospatial/Climate Data Providers

Expected Benefits:Enhance underwriting precision, automate processes, and develop next-generation risk models.

- Partnership Type:

Digital Distribution Platforms

Potential Partners

- •

Large Banks and Neobanks

- •

Leading E-commerce and Travel Marketplaces

- •

Automotive OEMs

Expected Benefits:Access to large customer bases for embedded insurance offerings, opening up massive new revenue streams.

Growth Strategy

North Star Metric

Growth in Gross Premiums Written from Digital & Embedded Channels

This metric focuses the organization on the most significant future growth opportunity. It balances top-line growth with the strategic imperative to shift toward more scalable, efficient, and modern distribution channels.

Achieve 25% of new policy growth from these channels within 3-5 years.

Growth Model

Hybrid: Partnership-Led and Sales-Led

Key Drivers

- •

Scaling the number of active partners on the Chubb Studio platform.

- •

Increasing the policy conversion rate within partner ecosystems.

- •

Maintaining the productivity and effectiveness of the existing agent/broker network.

- •

Cross-selling new, innovative products (e.g., cyber) into the existing customer base.

Establish a dedicated Growth/Innovation team to drive the partnership-led model, while continuing to invest in digital tools and support for the sales-led (agent) model.

Prioritized Initiatives

- Initiative:

Scale the Embedded Insurance (Chubb Studio) Go-to-Market Team

Expected Impact:High

Implementation Effort:Medium

Timeframe:6-12 Months

First Steps:Hire dedicated partnership managers for key verticals (fintech, auto, travel). Develop standardized integration playbooks for faster partner onboarding.

- Initiative:

Launch a Digital-First SME Cyber Insurance Product

Expected Impact:High

Implementation Effort:Medium

Timeframe:12-18 Months

First Steps:Assemble a cross-functional team (underwriting, product, tech). Conduct market research with SMEs to define product features. Develop a prototype for the online quote-and-bind journey.

- Initiative:

Digitize the Agent/Broker Submission & Quoting Platform

Expected Impact:Medium

Implementation Effort:High

Timeframe:18-24 Months

First Steps:Conduct in-depth interviews and workshops with top-tier brokers to identify key pain points. Map the existing process and identify key areas for automation and simplification.

Experimentation Plan

High Leverage Tests

{'test': "A/B test different value propositions and pricing models for embedded insurance on a partner's platform.", 'hypothesis': "A 'try-before-you-buy' or tiered pricing model will increase attach rates for embedded insurance."}

{'test': 'Pilot a fully automated claims process for a simple product line (e.g., travel insurance delay).', 'hypothesis': 'Automating simple claims will significantly improve customer satisfaction (NPS) and reduce operational costs.'}

Use a standard framework (e.g., A/B testing statistics, cohort analysis) to measure impact on key metrics like conversion rate, attach rate, NPS, and cycle time.

Run monthly growth experiments within the digital product teams and quarterly strategic pilots for larger initiatives.

Growth Team

A centralized 'Digital Growth & Innovation' hub that works in a matrix structure with regional P&L owners and functional leaders (IT, Underwriting). This hub would own the embedded platform and DTC initiatives.

Key Roles

- •

Head of Digital Growth

- •

Head of Strategic Partnerships (Embedded)

- •

Lead Data Scientist (Growth Analytics)

- •

Digital Product Manager (Customer Experience)

Invest in internal upskilling programs on digital technologies and agile methodologies. Actively recruit experienced talent from the tech and insurtech sectors to inject new skills and perspectives.

Chubb possesses a formidable growth foundation built on a strong brand, global scale, financial strength, and underwriting discipline. Its product-market fit is unquestionable in the traditional insurance landscape. The company's primary growth challenge and opportunity is not about finding a scalable model, but about successfully navigating a fundamental market shift from an agent-centric, analog world to a multi-channel, digital-first future.

The most significant growth vector is Embedded Insurance. Chubb's strategic investment in 'Chubb Studio' is a clear and correct identification of this trend. This initiative has the potential to transform Chubb from a traditional insurer into an 'Insurance-as-a-Service' provider, opening up vast new distribution channels through digital ecosystem partners. Success here will be the single most important driver of long-term, sustainable growth.

However, this transformation is threatened by significant internal and external barriers. Internally, legacy technology and the inertia of a large, successful organization can stifle the agility required to compete. Externally, intense competition from both legacy giants and nimble insurtechs means that speed-to-market and a superior digital experience are critical.

Recommendations are prioritized around doubling down on this core strategic direction. The immediate focus should be on building the commercial and technical capabilities to scale the embedded insurance channel aggressively. This involves treating 'Chubb Studio' as a core product and building a go-to-market engine around it. Simultaneously, Chubb must selectively digitize its existing business, focusing on high-impact areas like the agent/broker digital interface and creating new, digitally-native products like SME Cyber insurance to capture emerging risk pools. By leveraging its core strengths in underwriting and claims while aggressively building new digital distribution capabilities, Chubb can not only defend its market leadership but define the future of the insurance industry.

Legal Compliance

Chubb maintains a comprehensive and multi-layered privacy policy framework, accessible via the website footer. They provide a 'Master Privacy Policy' that explicitly references compliance with major regulations like GDPR. It details the types of personal data collected, the purposes for collection (including analytics and marketing), data sharing practices within the Chubb group of companies, and international data transfer protocols. Crucially, it outlines user rights such as rectification and erasure, directly aligning with GDPR requirements. Additionally, there is a specific 'Online Privacy Policy' for the US market and a dedicated 'California Privacy Notice' to address CCPA/CPRA, demonstrating a geographically targeted compliance strategy. The policy is reasonably accessible and written to be user-friendly, although its complexity reflects the nature of a global financial services entity.

The 'Terms of Use' are readily available and clearly state they govern the use of the website. They identify the website owner as Chubb Group Holdings Inc. and/or its affiliates. The terms include critical disclaimers for a regulated entity, such as clarifying that website content is not an offer to sell insurance and that products/services may not be available in all jurisdictions. Standard clauses covering intellectual property, limitations of liability, and modifications of content are present. The document explicitly links to the Privacy Policy, creating an integrated legal framework for users. The language is formal and legally robust, which is appropriate for a company of Chubb's scale and industry.

Chubb's website implements a cookie consent banner upon initial visit. Their Cookie Policy, often found within the broader privacy documentation, details the use of necessary, analytics, and advertising cookies. It explains that cookies are used to tailor the website experience and for analytics to improve their services. The policy mentions the use of third-party cookies for advertising and analytics, such as Google Analytics, and notes that these are governed by third-party privacy policies. While a consent mechanism is present, the stringency of its 'pre-consent blocking' of non-essential cookies requires technical validation to ensure full compliance with GDPR's strict opt-in requirements.

Chubb's data protection posture appears mature and aligned with global standards. The 'Master Privacy Policy' is explicitly framed around GDPR, detailing the legal basis for data processing and a comprehensive list of data subject rights (access, rectification, erasure, objection). For US consumers, and specifically California residents, Chubb provides a separate notice detailing rights under the CCPA/CPRA, including how to exercise them. This demonstrates a strong understanding of jurisdictional nuances in data protection law. The policies also address the security of sensitive data, such as Social Security Numbers, outlining measures to limit access and prevent misuse, which is critical in the insurance industry and aligns with regulations like the Gramm-Leach-Bliley Act (GLBA).