eScore

coca-colacompany.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

The Coca-Cola Company's corporate website demonstrates exceptional authority and multi-channel consistency, serving as the definitive source for investor and media information. Its SEO strategy effectively captures high-intent corporate search queries, reinforcing its market leadership. While its global reach is unparalleled, the digital presence could evolve from being a corporate broadcaster to an industry thought leader by creating more content on broader market trends like health and wellness.

Exceptional brand authority and domain strength, ensuring top rankings for corporate, financial, and investor-related search terms.

Transition from only reporting company news to creating a dedicated 'Insights' hub that offers thought leadership on global beverage trends, sustainability, and consumer behavior to attract a wider audience and higher-quality backlinks.

The website's messaging masterfully reinforces brand vitality and market leadership, effectively targeting investors, media, and potential talent in segmented sections. It uses powerful social proof like awards and celebrity endorsements to project success. However, there is a significant messaging gap on the homepage regarding sustainability and the company's health/wellness portfolio, which are critical topics for modern stakeholders and are buried in secondary pages or PDFs.

The messaging is highly effective at projecting an image of cultural dominance and financial strength, using brand news and marketing wins to reinforce its position as an industry leader.

Integrate a prominent, dynamically updated ESG and sustainability narrative onto the homepage to proactively address this critical industry issue, rather than relegating it to less visible sections of the site.

The website provides a highly professional and low-friction experience for its target audiences, with clear navigation and a logical information architecture. For its primary purpose—serving information to stakeholders like investors and journalists—the journey is efficient and the cognitive load is light. Minor weaknesses in understated CTAs and potential accessibility contrast issues slightly detract from a perfect score but do not significantly hinder the core user paths.

A clean, intuitive user interface with a clear visual hierarchy that allows key stakeholders (investors, media, job seekers) to find relevant information efficiently and with minimal effort.

Conduct a comprehensive accessibility audit, particularly focusing on text-over-image color contrast to ensure compliance with WCAG 2.1 AA standards, mitigating legal risk and demonstrating a commitment to inclusivity.

The company demonstrates a world-class approach to credibility and risk management, highlighted by a robust and sophisticated legal compliance framework that acts as a strategic asset. Trust signals such as financial transparency, longevity ('135+ years'), and third-party validation are expertly deployed. The public commitment to accessibility and detailed, easily accessible legal policies project an image of transparency and corporate responsibility, effectively mitigating legal and reputational risks.

A comprehensive, mature, and transparent legal posture, particularly in data privacy (GDPR/CCPA) and accessibility, which serves as a competitive advantage by reducing legal risk and building stakeholder trust.

Streamline the user experience for managing data preferences into a single, centralized privacy portal to reduce potential confusion arising from numerous regional and subsidiary policies.

Coca-Cola's competitive advantages, or 'moat,' are exceptionally strong and sustainable. The combination of unparalleled global brand recognition, built over a century, and a deeply entrenched global distribution and bottling network creates nearly insurmountable barriers to entry. These core advantages grant significant pricing power and economies of scale that competitors find incredibly difficult to replicate, ensuring long-term market leadership.

The synergistic power of its universally recognized brand equity and its extensive, franchised global distribution network provides a durable and hard-to-replicate competitive moat.

Accelerate the portfolio diversification to reduce the company's strategic vulnerability and over-reliance on the declining carbonated soft drinks (CSDs) category in mature markets.

The company's business model is exceptionally scalable due to its capital-light franchise structure, which focuses on high-margin concentrate sales while partners handle most capital-intensive bottling and distribution. This model allows for efficient global expansion and high operational leverage. Future growth is strong, centered on penetrating emerging markets and expanding into high-growth adjacencies like coffee and alcoholic ready-to-drink beverages.

The asset-light business model of selling concentrate to a global network of bottlers provides immense operational leverage and makes the business highly scalable with relatively low capital expenditure.

Address the strategic challenge of agility; the vast, decentralized franchise system can be slower to adapt to hyper-local consumer trends compared to smaller, more nimble competitors.

The business model is fundamentally coherent and highly profitable, effectively leveraging its key resources (brands, formulas) through a network of partners (bottlers). However, a strategic tension exists between protecting the legacy CSD business and fully embracing the necessary pivot to a 'total beverage company'. This is reflected in public-facing assets like the website, where the health and wellness narrative is underdeveloped compared to the promotion of core brands.

The core concentrate-and-franchise model is a historically proven, high-margin, and coherent system that aligns brand-building activities with a vast distribution network for immense market penetration.

More aggressively align resource allocation and public messaging with the stated 'total beverage company' strategy, ensuring that investments and brand communications fully reflect the pivot to health, wellness, and sustainability.

As the definitive market leader in the non-alcoholic beverage industry, Coca-Cola wields immense market power. This is demonstrated through its dominant market share in core categories, significant pricing power, and its ability to influence industry trends and set marketing standards. Its powerful relationships with distributors, retailers, and food service partners provide preferential treatment and further solidify its commanding position.

Demonstrated pricing power, allowing the company to increase prices to offset inflation and drive revenue growth even with flat or declining volumes, which is indicative of immense brand loyalty and market control.

Mitigate the long-term risk associated with the secular decline of the CSD market by continuing to build market-leading positions in alternative growth categories to maintain overall market influence.

Business Overview

Business Classification

Consumer Packaged Goods (CPG) - Manufacturer

Franchisor & Brand Licensor

Beverage

Sub Verticals

- •

Carbonated Soft Drinks (CSD)

- •

Juice, Dairy & Plant-Based Beverages

- •

Hydration (Water, Enhanced Water)

- •

Sports Drinks

- •

Tea & Coffee

- •

Energy Drinks

Mature

Maturity Indicators

- •

Dominant global market share in core categories.

- •

Vast, established global distribution and bottling network.

- •

Strong brand equity and recognition built over a century.

- •

Focus on operational efficiency, portfolio optimization, and incremental growth.

- •

Publicly traded company with consistent dividend history.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Sale of Beverage Concentrates and Syrups

Description:The core, high-margin business of manufacturing and selling beverage concentrates and syrups to a global network of independent and company-owned bottling partners. This accounts for the majority of revenue.

Estimated Importance:Primary

Customer Segment:Bottling Partners (Franchisees)

Estimated Margin:High

- Stream Name:

Sale of Finished Products

Description:Revenue from company-owned or controlled bottling, sales, and distribution operations, particularly through the Bottling Investments Group (BIG), which manages struggling franchisees. This is a lower-margin, higher-revenue-per-unit business compared to concentrate sales.

Estimated Importance:Secondary

Customer Segment:Retailers, Wholesalers, Distributors

Estimated Margin:Low

- Stream Name:

Brand Licensing and Royalties

Description:Revenue generated from licensing brands for use on non-beverage merchandise and other strategic partnerships.

Estimated Importance:Tertiary

Customer Segment:Manufacturing & Retail Partners

Estimated Margin:High

Recurring Revenue Components

Ongoing concentrate and syrup sales to bottling partners under long-term agreements.

Long-term contracts with major food service partners (e.g., McDonald's).

Pricing Strategy

B2B2C (Business-to-Business-to-Consumer)

Mid-range

Opaque

Pricing Psychology

- •

Tiered Pricing (e.g., different prices for fountain drinks, cans, bottles)

- •

Bundle Pricing (e.g., in combo meals)

- •

Geographic Pricing (adjusting for local market conditions)

Monetization Assessment

Strengths

- •

Highly scalable and profitable concentrate model allows for rapid global expansion with lower capital expenditure.

- •

Diversified revenue across hundreds of brands and over 200 countries reduces geographic and product-specific risk.

- •

Strong pricing power derived from immense brand loyalty and market leadership.

Weaknesses

Indirect control over final retail pricing and in-store execution due to the bottler model.

Revenue is highly dependent on the operational efficiency and financial health of bottling partners.

Opportunities

- •

Premiumization of existing brands (e.g., smaller pack sizes, premium ingredients) to increase price-per-ounce.

- •

Leverage digital platforms and the Coca-Cola App for direct-to-consumer engagement, data collection, and potential future monetization.

- •

Expand into new beverage categories with higher price points, such as ready-to-drink alcoholic beverages and functional wellness drinks.

Threats

- •

Increased commodity costs (sugar, aluminum) putting pressure on margins for both Coca-Cola and its bottlers.

- •

Government regulations like sugar taxes which can decrease sales volume or force costly reformulation.

- •

Intense price competition from rival PepsiCo and private label brands.

Market Positioning

Global Brand Leadership & Portfolio Diversification

Market Leader (Dominant share in global Carbonated Soft Drinks).

Target Segments

- Segment Name:

The Core Consumer (Broad Market)

Description:A wide demographic of individuals aged 10-40 who seek familiar, refreshing beverages for social occasions, meals, and daily enjoyment. This group values brand trust, consistency, and the emotional connection associated with Coca-Cola.

Demographic Factors

- •

Age: 10-40

- •

Broad income levels (working to upper class)

- •

Global presence across urban, suburban, and rural areas.

Psychographic Factors

Values happiness, togetherness, and tradition.

Lifestyle: Social, active, enjoys celebrations and shared moments.

Behavioral Factors

- •

High brand loyalty.

- •

Regular consumption as part of a lifestyle habit.

- •

Purchases through multiple channels (retail, restaurants, vending).

Pain Points

Desire for a consistent, trusted taste experience.

Need for a simple, readily available refreshment.

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

The Health-Conscious Modernizer

Description:Predominantly Millennials and Gen Z who are increasingly health-aware, seeking low/no-sugar, natural, and functional beverage options. They are less brand loyal and more willing to try new products that align with their wellness goals.

Demographic Factors

- •

Age: 18-40

- •

Typically urban or suburban

- •

Medium to high income

Psychographic Factors

- •

Values health, wellness, and transparency.

- •

Seeks products with functional benefits (e.g., vitamins, probiotics, energy).

- •

Conscious of sugar intake and artificial ingredients.

Behavioral Factors

- •

Reads nutritional labels.

- •

Willing to pay a premium for perceived health benefits.

- •

Influenced by social media and wellness trends.

Pain Points

- •

Difficulty finding flavorful yet healthy beverage options.

- •

Skepticism towards large corporations' health claims.

- •

Lack of variety in the low/no-sugar space.

Fit Assessment:Good

Segment Potential:High

Market Differentiation

- Factor:

Brand Equity & Recognition

Strength:Strong

Sustainability:Sustainable

- Factor:

Global Distribution Network

Strength:Strong

Sustainability:Sustainable

- Factor:

Product Portfolio Breadth

Strength:Strong

Sustainability:Sustainable

- Factor:

Marketing & Advertising Prowess

Strength:Strong

Sustainability:Sustainable

Value Proposition

To refresh the world and make a difference by offering a diverse portfolio of high-quality beverages for every occasion, built on a foundation of trust, happiness, and universal accessibility.

Excellent

Key Benefits

- Benefit:

Consistent & Trusted Taste

Importance:Critical

Differentiation:Unique

Proof Elements

Over 135 years of consistent product quality.

Globally recognized secret formula.

- Benefit:

Universal Availability

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Products available in over 200 countries.

Extensive distribution network reaching remote areas.

- Benefit:

Choice & Variety

Importance:Important

Differentiation:Common

Proof Elements

Large portfolio of brands across multiple beverage categories (water, juice, soda, coffee).

Introduction of new flavors and low/no-sugar options.

Unique Selling Points

- Usp:

The iconic brand experience and emotional connection associated with Coca-Cola, representing happiness, nostalgia, and shared moments.

Sustainability:Long-term

Defensibility:Strong

- Usp:

An unparalleled global bottling and distribution system that ensures products are within 'an arm's reach of desire'.

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Thirst and the need for refreshment.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Lack of beverage options for different tastes, occasions, and dietary needs.

Severity:Major

Solution Effectiveness:Partial

- Problem:

The desire for a small, affordable moment of pleasure or reward.

Severity:Minor

Solution Effectiveness:Complete

Value Alignment Assessment

Medium

While core offerings remain highly popular, the value proposition is under pressure from the significant market shift towards health and wellness. The company is actively adapting but its legacy portfolio creates a perception gap.

High

The value proposition aligns exceptionally well with its core, broad market segment. For the growing health-conscious segment, alignment is improving through portfolio diversification into brands like Smartwater, Vitaminwater, and Coca-Cola Zero Sugar.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Independent Bottling Partners (Franchisees)

- •

Retailers (Supermarkets, Convenience Stores, etc.)

- •

Food Service Partners (e.g., McDonald's, Subway)

- •

Suppliers (Raw materials like sugar, aluminum, PET)

- •

Technology Partners (e.g., Microsoft for AI and cloud services)

- •

Strategic Brand Partners (e.g., Monster Beverage Corp.)

Key Activities

- •

Brand Marketing & Advertising

- •

Product Research & Development (Innovation)

- •

Concentrate Manufacturing

- •

Supply Chain & Franchise Management

- •

Global Distribution & Logistics Coordination

Key Resources

- •

Brand Portfolio & Trademarks (Intellectual Property)

- •

Secret Formulas (Trade Secrets)

- •

Global Distribution Network

- •

Bottling Agreements & Partner Relationships

- •

Financial Capital

Cost Structure

- •

Marketing and Advertising Expenses

- •

Selling, General & Administrative (SG&A) Costs

- •

Cost of Goods Sold (Concentrate Ingredients)

- •

Research & Development

Swot Analysis

Strengths

- •

Unmatched global brand recognition and loyalty.

- •

Extensive and deeply entrenched global distribution and bottling network.

- •

Highly diversified portfolio of billion-dollar brands across multiple categories.

- •

Strong financial performance and ability to invest in marketing and innovation.

Weaknesses

- •

Heavy revenue dependence on carbonated soft drinks, a category facing declining consumption in mature markets.

- •

Negative public perception related to health impacts of sugary drinks.

- •

Complex, decentralized system can lead to slower adaptation compared to more nimble competitors.

- •

Vulnerability to criticism regarding plastic waste and water usage.

Opportunities

- •

Accelerate expansion into high-growth health and wellness categories (e.g., functional beverages, prebiotic sodas, premium hydration).

- •

Growth in emerging markets where CSD consumption is still rising.

- •

Further penetration into the ready-to-drink alcohol market.

- •

Leverage data and digital platforms for personalized marketing and direct consumer relationships.

Threats

- •

Intensifying shift in consumer preferences away from sugary beverages toward healthier alternatives.

- •

Increased government regulation, including sugar taxes and advertising restrictions.

- •

Intense competition from PepsiCo, Keurig Dr Pepper, and a rising number of agile, niche brands.

- •

Negative environmental, social, and governance (ESG) scrutiny regarding plastic packaging and water stewardship.

Recommendations

Priority Improvements

- Area:

Portfolio Transformation

Recommendation:Aggressively reallocate capital and marketing spend from declining core CSDs to accelerate the growth of 'better-for-you' categories. Focus on acquiring and scaling challenger brands in the functional beverage space.

Expected Impact:High

- Area:

Sustainability & Packaging

Recommendation:Lead the industry in developing and scaling sustainable packaging solutions beyond recycled PET (rPET), such as plant-based materials or refillable models, to mitigate significant brand risk.

Expected Impact:Medium

- Area:

Digital Consumer Engagement

Recommendation:Evolve the 'Coca-Cola App' from a simple loyalty program into a comprehensive digital ecosystem that provides personalized experiences, collects valuable first-party data, and explores direct-to-consumer (DTC) opportunities for niche products.

Expected Impact:Medium

Business Model Innovation

- •

Develop a 'Beverage-as-a-Service' model for enterprise clients (offices, gyms) using smart, connected fountain dispensers (like Coca-Cola Freestyle) that offer personalization and subscription-based pricing.

- •

Incubate or acquire a portfolio of hyper-localized craft beverage brands, allowing them to operate independently to maintain authenticity while leveraging Coca-Cola's distribution network.

- •

Launch a DTC subscription service for curated beverage boxes, focusing on new product discovery and premium offerings (e.g., international products, limited editions).

Revenue Diversification

- •

Expand strategic partnerships in the alcoholic beverage space, moving beyond hard seltzers to co-brand spirits or ready-to-drink cocktails.

- •

Further invest in the Costa Coffee platform to build a significant presence in the at-home and retail coffee market, competing more directly with Nestlé and Starbucks.

- •

Explore licensing brand IP for experiential ventures, such as themed cafes or entertainment venues, to create new, high-margin revenue streams.

The Coca-Cola Company exemplifies a mature, enterprise-level CPG firm with a business model that has historically been one of the most successful in the world. Its core strength lies in a symbiotic, capital-light relationship with a global network of bottling partners, allowing it to focus on its most profitable activities: brand building and concentrate manufacturing. This model has created unparalleled brand equity and a distribution network that serves as a formidable competitive moat.

However, the very foundation of this success—its dominance in carbonated soft drinks—is now its primary vulnerability. The global, secular trend towards health and wellness poses an existential threat to its core revenue streams. The company's strategic response, led by CEO James Quincey, is a deliberate pivot from a beverage company to a 'total beverage company,' aggressively diversifying into water, juices, teas, coffees, and functional drinks. This transformation is evident in both product innovation (e.g., Coke Zero Sugar, prebiotic sodas) and strategic acquisitions (e.g., Costa Coffee).

The key challenge for future growth is the pace and effectiveness of this evolution. While the company's financial strength and marketing prowess are significant assets, it faces a cultural and operational challenge in shifting its center of gravity away from the iconic Coca-Cola brand. Furthermore, significant ESG headwinds, particularly concerning plastic waste and water usage, represent a material risk to its brand reputation and could invite further regulation.

For sustained future success, The Coca-Cola Company must evolve its business model beyond simple portfolio expansion. The most significant opportunities lie in leveraging technology to build direct consumer relationships, innovating in sustainable packaging to turn a defensive weakness into a competitive advantage, and exploring new service-based revenue models. The company must prove it can innovate not just its products, but the fundamental way it goes to market, to maintain its leadership position for the next century.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Brand Equity & Loyalty

Impact:High

- Barrier:

Global Distribution & Bottling Network

Impact:High

- Barrier:

Capital Investment for Production & Marketing

Impact:High

- Barrier:

Shelf Space Access in Retail

Impact:Medium

Industry Trends

- Trend:

Health and Wellness Focus

Impact On Business:Shift in consumer preference away from sugary carbonated soft drinks (CSDs) to low/no sugar options, functional beverages, and bottled water. Requires significant portfolio diversification.

Timeline:Immediate

- Trend:

Sustainability and Eco-Friendly Packaging

Impact On Business:Increasing consumer and regulatory pressure to reduce plastic waste, requiring investment in R&D for alternative packaging solutions and improved recycling infrastructure.

Timeline:Immediate

- Trend:

Premiumization and Flavor Innovation

Impact On Business:Opportunity to capture higher margins through premium offerings, unique flavor combinations, and craft-style beverages. Consumers are willing to pay more for perceived higher quality or novel experiences.

Timeline:Near-term

- Trend:

Rise of Functional Beverages

Impact On Business:Growing demand for drinks with added benefits like energy, relaxation, gut health, or cognitive enhancement, creating new market segments and competitive threats.

Timeline:Near-term

- Trend:

Direct-to-Consumer (D2C) & E-commerce

Impact On Business:Shift in purchasing habits requires developing digital sales channels, though the traditional retail/distribution model remains dominant for beverages.

Timeline:Long-term

Direct Competitors

- →

PepsiCo, Inc.

Market Share Estimate:Globally, holds ~19-20% of the carbonated soft drink market, and ~10% of the broader soft drink market.

Target Audience Overlap:High

Competitive Positioning:Diversified food and beverage giant, leveraging synergies between its snack (Frito-Lay) and beverage portfolios to capture a wider range of consumption occasions.

Strengths

- •

Highly diversified portfolio including market-leading snack brands (Lays, Doritos) which provides revenue stability and cross-promotional opportunities.

- •

Strong global distribution network and brand recognition, second only to Coca-Cola.

- •

Agile marketing, often targeting a younger demographic with 'challenger brand' positioning.

- •

Robust presence in the sports drink category with Gatorade.

Weaknesses

- •

Perceived as a follower to Coca-Cola in the core cola segment.

- •

Brand image is also heavily tied to unhealthy sugary beverages and snacks.

- •

Lower market share in key international markets compared to Coca-Cola.

- •

Recent operational issues and declining snack sales have impacted profitability.

Differentiators

- •

Synergistic food and beverage portfolio.

- •

Stronger position in the savory snacks market.

- •

Often more aggressive in pricing and promotional strategies.

- →

Keurig Dr Pepper

Market Share Estimate:Significant #3 player, particularly in the U.S. where Dr Pepper recently surpassed Pepsi as the #2 CSD.

Target Audience Overlap:Medium

Competitive Positioning:A major player in both hot and cold beverages, with a strong portfolio of flavored CSDs and a dominant position in the single-serve coffee market (Keurig).

Strengths

- •

Unique and loyal following for its flagship Dr Pepper brand with its distinctive flavor.

- •

Dominant Keurig single-serve coffee ecosystem creates a recurring revenue model.

- •

Strong distribution network in North America.

- •

Diverse portfolio of owned and licensed brands (e.g., Snapple, Canada Dry, Mott's).

Weaknesses

- •

Significantly smaller international presence compared to Coca-Cola and PepsiCo.

- •

Less diversified outside of the beverage category.

- •

Coffee business faces challenges from category promotions and market volatility.

- •

Heavily reliant on the North American market.

Differentiators

- •

Leadership in the at-home single-serve coffee segment.

- •

Strong portfolio of non-cola carbonated soft drinks.

- •

Strategic focus on acquiring and partnering with emerging beverage brands.

Indirect Competitors

- →

Nestlé S.A.

Description:Global food and beverage company with a massive portfolio in bottled water (e.g., Perrier, S.Pellegrino), ready-to-drink coffee (Nescafé, Nespresso), and health-science products.

Threat Level:High

Potential For Direct Competition:Already competes directly in bottled water, juices, and teas. Could leverage its health-focused R&D to become a stronger player in functional beverages.

- →

Red Bull GmbH & Monster Beverage Corporation

Description:Dominate the high-growth energy drink market, a category where Coca-Cola has a presence but is not the market leader.

Threat Level:High

Potential For Direct Competition:Compete for the same consumer 'share of throat' and disposable income, particularly among younger demographics. Their focus on high-margin, functional products is a direct challenge.

- →

Starbucks Corporation

Description:Leader in the retail coffee space, with a significant and growing presence in ready-to-drink (RTD) beverages sold in retail channels, competing with Coca-Cola's coffee and tea offerings.

Threat Level:Medium

Potential For Direct Competition:Their expertise in coffee and premium branding poses a threat as they expand their RTD portfolio into new categories.

- →

Private Label Brands

Description:Store-brand sodas, waters, and juices offered by major retailers like Walmart (Great Value), Costco (Kirkland Signature), etc.

Threat Level:Medium

Potential For Direct Competition:Compete primarily on price, posing a threat during economic downturns when consumers become more price-sensitive. Quality and variety are continuously improving.

- →

Emerging Health & Functional Beverage Startups

Description:A fragmented but rapidly growing group of companies focused on niches like kombucha, prebiotic sodas (e.g., Olipop, Poppi), adaptogenic drinks, and CBD-infused beverages.

Threat Level:Low (Individually) / High (Collectively)

Potential For Direct Competition:These brands are capturing the attention of health-conscious consumers and driving innovation. They are prime acquisition targets for major players and collectively erode market share from traditional beverages.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Unparalleled Brand Recognition & Equity

Sustainability Assessment:The Coca-Cola brand is one of the most recognized and valuable in the world, built over a century of marketing. This emotional connection is incredibly durable.

Competitor Replication Difficulty:Hard

- Advantage:

Extensive Global Distribution and Bottling Network

Sustainability Assessment:A deeply entrenched, franchised network that provides unmatched scale and reach into nearly every corner of the globe. This physical infrastructure is a massive barrier to entry.

Competitor Replication Difficulty:Hard

- Advantage:

Economies of Scale

Sustainability Assessment:Massive production volumes allow for significant cost advantages in sourcing, manufacturing, and logistics, enabling competitive pricing.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'Exclusive Sponsorships & Marketing Campaigns', 'estimated_duration': 'Event- or campaign-specific (e.g., Olympics, FIFA World Cup). Provides a significant but temporary boost in visibility and association.'}

{'advantage': 'First-Mover in a New Beverage Sub-Category', 'estimated_duration': '1-3 years before competitors launch similar products.'}

Disadvantages

- Disadvantage:

Over-reliance on Carbonated Soft Drinks (CSDs)

Impact:Major

Addressability:Moderately

- Disadvantage:

Negative Public Health Perception

Impact:Major

Addressability:Difficult

- Disadvantage:

Environmental Concerns Regarding Plastic Waste

Impact:Major

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Launch aggressive digital marketing campaigns for existing 'zero sugar' and healthier portfolio brands (e.g., Smartwater, Vitaminwater, Honest Tea) to capitalize on the health and wellness trend.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Introduce limited-time, innovative flavor extensions for core brands (e.g., Coke, Sprite) to drive excitement and trial among younger consumers.

Expected Impact:Low

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Acquire or take a strategic stake in a high-growth functional beverage company, particularly in the gut health or relaxation space, to quickly gain market share and innovation capabilities.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Accelerate R&D and investment in sustainable packaging solutions, such as 100% rPET bottles or plant-based materials, and market these efforts proactively to improve brand perception.

Expected Impact:Medium

Implementation Difficulty:Difficult

- Recommendation:

Expand the portfolio of premium, non-alcoholic adult beverages to cater to the 'sober curious' movement and capture higher-margin occasions.

Expected Impact:Medium

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Fundamentally rebalance the global portfolio to reduce the percentage of revenue from traditional CSDs, focusing on long-term growth in water, sports drinks, coffee, and functional beverages.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Invest in 'beyond the bottle' platforms, such as personalized beverage dispensers (e.g., Coca-Cola Freestyle) or subscription services, to build direct consumer relationships.

Expected Impact:High

Implementation Difficulty:Difficult

Transition from being positioned as a 'soft drink company' to a 'total beverage company,' emphasizing portfolio breadth, health-conscious options, and sustainability leadership to future-proof the business against declining CSD trends.

Differentiate through superior brand storytelling, unmatched global availability, and by leading the industry in sustainable practices. Leverage the core Coca-Cola brand for emotional connection while aggressively innovating in growth categories to meet evolving consumer needs for health, wellness, and functionality.

Whitespace Opportunities

- Opportunity:

Personalized Nutrition Beverages

Competitive Gap:Currently, no major player offers beverages tailored to individual nutritional needs (e.g., based on activity level, dietary goals, or even biometric data). This moves beyond generic 'functional' drinks to hyper-personalized solutions.

Feasibility:Low

Potential Impact:High

- Opportunity:

Premium Non-Alcoholic Social Tonics

Competitive Gap:While the non-alcoholic beer/wine space is growing, there is a gap for sophisticated, complex, ready-to-drink beverages using botanicals and adaptogens designed specifically for adult social occasions, moving beyond simple mocktails.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Beverage-as-a-Service for Businesses

Competitive Gap:Leverage the Freestyle machine technology and distribution network to offer a subscription-based, fully-managed beverage solution for corporate offices, hotels, and other businesses, creating a new B2B revenue stream.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Water Enhancement & Customization Platforms

Competitive Gap:Beyond simple liquid enhancers, develop a platform (e.g., pods, concentrates) for premium filtered water systems that allows consumers to add functional ingredients (electrolytes, vitamins, nootropics) at home, competing with both bottled water and functional drinks.

Feasibility:High

Potential Impact:High

The Coca-Cola Company operates within a mature, oligopolistic non-alcoholic beverage industry, defined by its intense rivalry with PepsiCo and, to a lesser extent, Keurig Dr Pepper. The primary competitive arena is a battle for market share, shelf space, and consumer loyalty. Coca-Cola's core sustainable competitive advantages are its unparalleled global brand equity and its vast, deeply entrenched distribution network, which create formidable barriers to entry.

The most significant threat to Coca-Cola's dominance is not from its direct competitors, but from a profound secular shift in consumer behavior toward health and wellness. This trend is eroding the core carbonated soft drink (CSD) market and fueling the rapid growth of indirect competitors in categories like functional beverages, premium water, and ready-to-drink coffee. Companies that were once niche, such as Red Bull or emerging prebiotic soda brands, now collectively represent a major challenge for consumer 'share of throat.'

PepsiCo's key advantage is its diversification into snacks, which provides a hedge against the decline in CSDs. Keurig Dr Pepper's strength lies in its unique flavor portfolio and its dominance in the at-home coffee pod system. Coca-Cola's strategy has been to evolve into a 'total beverage company' by acquiring and developing brands across the entire beverage spectrum. While this is the correct strategic direction, the company remains heavily reliant on its legacy brands for profitability, creating a strategic tension between protecting its core and investing in future growth.

Key whitespace opportunities exist in areas that merge personalization, health, and premium experiences, such as personalized nutrition, sophisticated adult social beverages, and at-home customization platforms. To maintain its leadership, Coca-Cola must aggressively accelerate its portfolio transformation, lead the industry on sustainability to mitigate brand risk, and leverage its marketing prowess to connect its newer, healthier brands with the next generation of consumers.

Messaging

Message Architecture

Key Messages

- Message:

Brand & Product Innovation: Showcasing new flavors, brand collaborations (Star Wars), and marketing campaigns ('Share a Coke').

Prominence:Primary

Clarity Score:High

Location:Homepage hero carousels and 'The Freshest News' section.

- Message:

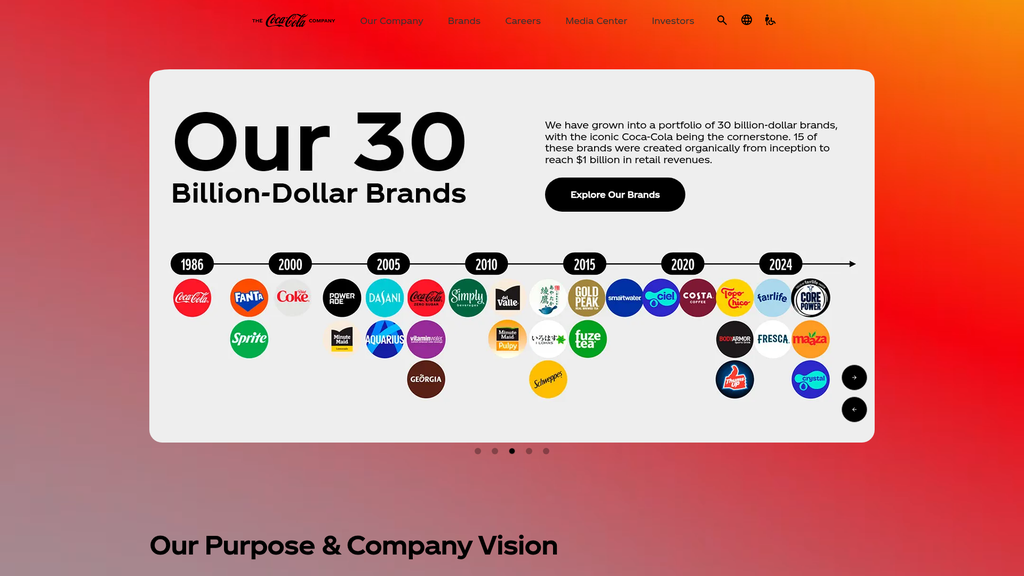

Corporate Strength & Growth: Highlighting a portfolio of '30 billion-dollar brands' and reporting quarterly results.

Prominence:Secondary

Clarity Score:High

Location:Homepage content blocks and 'The Freshest News' section.

- Message:

Corporate Purpose & Vision: Communicating the company's mission to 'Refresh the world. Make a difference.'

Prominence:Secondary

Clarity Score:Medium

Location:Dedicated section on the homepage with links to PDF documents.

- Message:

Local Economic Contribution: Emphasizing the company's local impact through its supply and distribution network ('Refreshingly Local').

Prominence:Tertiary

Clarity Score:Medium

Location:Homepage content blocks, appears multiple times.

- Message:

Career Opportunities: Attracting talent by positioning the company as a place to 'Unleash Your Potential'.

Prominence:Tertiary

Clarity Score:High

Location:Dedicated careers section towards the bottom of the homepage.

The message hierarchy is heavily skewed towards marketing and brand news, effectively functioning as a corporate media center. This is clear and effective for journalists or brand enthusiasts. However, core corporate messages like purpose, vision, and sustainability are less prominent, often linked out to PDFs, which weakens their immediate impact. The primary message is 'we are an innovative and culturally relevant portfolio of brands,' while the corporate identity message is secondary.

Messaging is thematically consistent within its sections (e.g., all news items are upbeat and promotional, career messaging is aspirational). However, there's a lack of a single, unifying narrative thread on the homepage that connects brand excitement with corporate responsibility. The 'Refreshingly Local' message, while positive, feels disconnected from the global, high-profile brand campaigns featured alongside it.

Brand Voice

Voice Attributes

- Attribute:

Celebratory

Strength:Strong

Examples

- •

Collect the Galaxy

- •

A flavor twist you can't resist

- •

The Coca‑Cola Company Delivers Big at Cannes with 13 Wins

- Attribute:

Aspirational

Strength:Moderate

Examples

- •

Unleash Your Potential

- •

Refresh Your Career

- •

Find your place in our story

- Attribute:

Corporate

Strength:Moderate

Examples

- •

Coca‑Cola Reports Second Quarter 2025 Results and Updates Full Year Guidance

- •

We have grown into a portfolio of 30 billion-dollar brands

- •

The Coca‑Cola system contributes to the local economy

- Attribute:

Nostalgic

Strength:Weak

Examples

The beloved Share a Coke campaign is back for a new generation

For more than 135 years, we've been flowing with ideas

Tone Analysis

Promotional & Upbeat

Secondary Tones

Inspirational

Informative (Financial)

Tone Shifts

Shifts from a high-energy, consumer-focused marketing tone in the news section to a more formal, corporate tone when discussing financial results.

Transitions to an inspirational and employee-centric tone in the 'Careers' section.

Voice Consistency Rating

Good

Consistency Issues

The primary challenge is not inconsistency, but rather the clear segmentation of voice for different audiences. The site effectively speaks 'marketer-to-marketer' in the news section and 'recruiter-to-candidate' in the careers section, but lacks a single, overarching 'Coca-Cola Company voice' that binds these different facets together for a generalist visitor.

Value Proposition Assessment

The Coca-Cola Company is a resilient, growing, and culturally dominant 'total beverage company' that drives value through a massive portfolio of iconic, billion-dollar brands.

Value Proposition Components

- Component:

Brand Power & Portfolio Strength

Clarity:Clear

Uniqueness:Unique

Evidence

We have grown into a portfolio of 30 billion-dollar brands

- Component:

Innovation & Cultural Relevance

Clarity:Clear

Uniqueness:Somewhat Unique

Evidence

Coca‑Cola Debuts Limited-Edition Packaging Featuring Star Wars Characters

Coca‑Cola Drops Retro-Inspired Flavor Innovation

- Component:

Financial Performance

Clarity:Clear

Uniqueness:Common

Evidence

Coca‑Cola Reports Second Quarter 2025 Results and Updates Full Year Guidance

- Component:

Talent Destination

Clarity:Clear

Uniqueness:Somewhat Unique

Evidence

Unleash Your Potential

Refresh Your Career

The messaging strongly differentiates the company based on the sheer scale and cultural penetration of its brand portfolio. Unlike competitors who might focus more on product attributes (e.g., health benefits), Coca-Cola's corporate site message is one of market leadership, cultural omnipresence, and financial strength. The emphasis on high-profile marketing wins (Cannes Lions) and partnerships (Star Wars, Jennifer Aniston) reinforces its position as a cultural institution, not just a beverage manufacturer.

The messaging positions The Coca-Cola Company as an enduring, innovative industry leader. Compared to a key competitor like PepsiCo, which often positions itself as a youthful challenger, Coca-Cola's corporate messaging takes on the posture of the established incumbent, focusing on its legacy ('135 years'), scale ('30 billion-dollar brands'), and iconic status. The content is a confident display of market leadership.

Audience Messaging

Target Personas

- Persona:

Investors & Financial Analysts

Tailored Messages

Coca‑Cola Reports Second Quarter 2025 Results and Updates Full Year Guidance

We have grown into a portfolio of 30 billion-dollar brands, with the iconic Coca‑Cola being the cornerstone.

Effectiveness:Effective

- Persona:

Media & Journalists

Tailored Messages

- •

The Freshest News

- •

smartwater® and Jennifer Aniston Reunite for 2025 Campaign

- •

The Coca‑Cola Company Delivers Big at Cannes with 13 Wins

Effectiveness:Effective

- Persona:

Potential Employees / Talent

Tailored Messages

- •

Unleash Your Potential

- •

Refresh Your Career

- •

Start the Next Chapter

Effectiveness:Somewhat Effective

- Persona:

General Public / Brand Enthusiasts

Tailored Messages

Collect the Galaxy: Coca‑Cola Debuts Limited-Edition Packaging

Share a Coke

Effectiveness:Effective

Audience Pain Points Addressed

No itemsAudience Aspirations Addressed

Career Growth: 'Unleash Your Potential', 'Transformative training. Unbottled opportunities.'

Belonging & Connection: 'Share a Coke', messaging around joining the company's 'story'.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Excitement / Novelty

Effectiveness:High

Examples

'A flavor twist you can't resist'

Coca‑Cola Debuts Limited-Edition Packaging Featuring Star Wars Characters

- Appeal Type:

Nostalgia / Belonging

Effectiveness:Medium

Examples

The beloved Share a Coke campaign is back for a new generation

- Appeal Type:

Aspiration / Self-Actualization

Effectiveness:Medium

Examples

Unleash Your Potential

Start the Next Chapter

Social Proof Elements

- Proof Type:

Awards & Recognition

Impact:Strong

Examples

The Coca‑Cola Company Delivers Big at Cannes with 13 Wins Across Global Campaigns

- Proof Type:

Celebrity Endorsement

Impact:Strong

Examples

smartwater® and Jennifer Aniston Reunite for 2025 Campaign

- Proof Type:

Brand Collaboration

Impact:Strong

Examples

Coca‑Cola Debuts Limited-Edition Packaging Featuring Star Wars Characters

Trust Indicators

- •

Longevity: 'For more than 135 years...'

- •

Financial Transparency: Publishing quarterly results.

- •

Scale: 'portfolio of 30 billion-dollar brands'

- •

CEO Communications: 'Letter to Employees from Chairman and CEO James Quincey'

Scarcity Urgency Tactics

Implicit scarcity with 'Limited-Edition Packaging Featuring Star Wars Characters'

Calls To Action

Primary Ctas

- Text:

Explore

Location:Homepage carousels and content blocks

Clarity:Somewhat Clear

- Text:

Explore Our Brands

Location:Homepage brands section

Clarity:Clear

- Text:

See All News

Location:End of news section

Clarity:Clear

- Text:

Explore more / Turn the page

Location:Careers section

Clarity:Clear

The CTAs are generally low-friction and discovery-oriented ('Explore', 'Learn More'). This fits the informational purpose of a corporate site. However, the consistent use of the vague 'Explore' CTA is a missed opportunity for more directive language that could better segment user journeys. For example, 'See our latest campaigns' or 'Read the financial report' would provide more clarity and intent.

Messaging Gaps Analysis

Critical Gaps

- •

Sustainability & ESG (Environmental, Social, and Governance): Despite being a critical topic for CPG companies, there is no prominent messaging on the homepage about sustainability initiatives, recycling, water stewardship, or health and wellness. This is a significant gap given consumer and investor focus on these areas.

- •

Consumer Health & Choice: There's no messaging addressing the shift towards healthier, low/no-sugar beverage options, despite the company's significant investment in this area. The homepage focuses on classic soda and new flavors rather than the broader portfolio.

- •

Direct Investor Portal: While financial news is present, a clear, top-level navigation item or homepage block for 'Investors' is missing, forcing this key audience to find information through news articles or the site footer.

Contradiction Points

No itemsUnderdeveloped Areas

Corporate Purpose Narrative: The 'Purpose & Vision' is presented via links to PDFs rather than being woven into an engaging narrative on the site itself. This diminishes its impact and accessibility.

Local Impact Storytelling: The 'Refreshingly Local' message is stated but not supported with compelling stories, data, or visuals on the homepage, making it feel like a generic corporate platitude.

Messaging Quality

Strengths

- •

Showcasing Brand Vitality: The site excels at communicating that the company's brands are dynamic, culturally relevant, and constantly innovating.

- •

Reinforcing Market Leadership: The messaging consistently projects an image of strength, scale, and success, effectively positioning the company as the definitive industry leader.

- •

Clear Media Hub Functionality: The site is extremely effective as a 'media center' for journalists and those interested in the latest marketing and brand news.

Weaknesses

- •

Over-emphasis on Marketing at the Expense of Corporate Strategy: The homepage reads more like a brand PR site than a holistic corporate website. Key corporate themes like sustainability, long-term vision, and investor relations are buried.

- •

Fragmented Audience Journey: Different audiences (investors, job seekers, ESG analysts) have to hunt for their relevant content rather than being guided by clear messaging pathways from the homepage.

- •

Static and Unengaging 'Purpose' Content: Linking to PDFs for core mission and vision content is an outdated approach that fails to tell a compelling story.

Opportunities

- •

Integrate a dynamic Sustainability/ESG section on the homepage to address a critical industry topic and improve corporate reputation.

- •

Develop a more balanced narrative that connects brand excitement with corporate responsibility and long-term strategy.

- •

Create dedicated, easily accessible portals or messaging hubs for key audiences like 'Investors' and 'Careers' directly from the main navigation or homepage.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Messaging Hierarchy

Recommendation:Restructure the homepage to create a more balanced narrative. Introduce a prominent, visually engaging module dedicated to the company's 'World Without Waste' or other key sustainability/ESG initiatives. This should be positioned with the same prominence as brand news.

Expected Impact:High

- Area:

Audience Segmentation

Recommendation:Revamp the main navigation and homepage to include clear entry points for key audiences: 'Brands & Innovation,' 'Our Impact' (for ESG), 'Investors,' and 'Careers.' This creates clear, targeted user journeys.

Expected Impact:High

- Area:

Purpose & Vision Content

Recommendation:Transform the PDF-linked 'Purpose & Vision' into a rich, interactive webpage featuring video, infographics, and storytelling that brings the mission to life.

Expected Impact:Medium

Quick Wins

- •

Change generic 'Explore' CTAs to be more specific and action-oriented (e.g., 'See Q2 Results', 'Discover the Campaign').

- •

Add a 'Sustainability' or 'Our Impact' link to the primary navigation menu.

- •

Feature a quote or short video from the CEO on the homepage that links to the 'Purpose' section, adding a human element.

Long Term Recommendations

- •

Develop a comprehensive content strategy that consistently balances brand marketing news with stories about innovation in sustainability, local economic impact, and employee success.

- •

Rethink the website's primary objective: Is it a media center, an investor portal, a recruitment tool, or a corporate reputation hub? A strategic refocus will clarify messaging priorities for a full redesign.

- •

Integrate data visualizations to showcase ESG progress, local economic contributions, and portfolio growth, making the corporate value proposition more tangible and compelling.

The Coca-Cola Company's corporate website effectively executes a primary objective: to project an image of a dynamic, culturally dominant, and financially robust leader in the beverage industry. The messaging strategy is laser-focused on showcasing brand vitality through a continuous stream of new products, high-profile collaborations, and marketing awards. This positions the company as an engine of innovation and a cultural tastemaker, which strongly supports brand equity and investor confidence in its market leadership.

However, this focus creates a significant strategic imbalance. The website functions more as a PR and marketing megaphone than a holistic corporate communications platform. Critical messaging pillars for a modern global corporation—particularly sustainability, ESG performance, and consumer health—are conspicuously absent from the primary user experience. In an era where investors, consumers, and talent are increasingly making decisions based on corporate values and impact , burying this content or linking out to static documents is a major vulnerability. This gap could position the company as being less transparent or less focused on these issues than its competitors.

The messaging architecture serves the media and brand enthusiasts well but fails to create clear pathways for other key stakeholders like investors or ESG analysts. The brand voice is consistently celebratory and upbeat but lacks a unifying corporate narrative that connects the excitement of 'Share a Coke' with the responsibilities of being a global industrial giant. To evolve, the messaging strategy must pivot from solely broadcasting marketing success to fostering a multi-faceted dialogue that balances brand power with corporate purpose and accountability.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Global brand recognition and a portfolio of over 30 billion-dollar brands, demonstrating appeal across diverse consumer segments and geographies.

- •

Sustained organic revenue growth (5-6% projected in 2025) despite volume pressures, indicating strong pricing power and brand loyalty.

- •

Gained value share in the total nonalcoholic ready-to-drink (NARTD) beverages market, confirming competitive strength.

- •

Successful portfolio diversification into juices, water, sports drinks, coffee, and teas to meet evolving consumer needs beyond traditional sodas.

- •

High consumer engagement through iconic marketing campaigns like 'Share a Coke' and strategic partnerships (e.g., Star Wars).

Improvement Areas

- •

Accelerate the pivot towards healthier options (low/no sugar, functional beverages) to counter the secular decline in sugary soda consumption.

- •

Enhance product offerings with natural ingredients and clean labels to cater to increasing consumer demand for transparency.

- •

Strengthen the value proposition in emerging markets where consumer preferences may be shifting and saturation is a risk.

Market Dynamics

The global non-alcoholic beverages market is projected to grow at a CAGR of approximately 5-7% between 2025 and 2034.

Mature

Market Trends

- Trend:

Health and Wellness Focus

Business Impact:Sustained shift away from high-sugar beverages towards functional drinks, low/no-sugar alternatives, and natural ingredients. This is a primary driver of innovation and acquisition strategy.

- Trend:

Sustainability and Ethical Consumption

Business Impact:Increasing consumer and regulatory pressure regarding packaging waste (especially plastics), water usage, and carbon footprint, creating significant reputational risk and operational challenges.

- Trend:

Premiumization and Personalization

Business Impact:Consumers are willing to pay more for premium products, unique flavors, and customized beverage experiences, creating opportunities for value-added products and direct-to-consumer engagement.

- Trend:

Digitalization and E-commerce

Business Impact:Growth of online grocery and direct-to-consumer (D2C) channels requires new marketing strategies and supply chain capabilities. Coca-Cola is increasing its digital media spend significantly to adapt.

Optimal for portfolio diversification. The core soda market is mature, but the timing is perfect to aggressively capture growth in adjacent, higher-growth categories like functional beverages, coffee, and premium waters.

Business Model Scalability

High

Asset-light model focused on concentrate manufacturing and brand marketing, with bottling and distribution largely franchised. This creates a highly variable cost structure that scales efficiently with volume.

High operational leverage due to the franchise model. The company benefits from the scale of its global bottling partners without bearing the full capital expenditure of production and distribution infrastructure.

Scalability Constraints

- •

Complexity of managing a vast network of independent bottling partners with varying levels of operational efficiency.

- •

Geopolitical instability and currency fluctuations impacting international operations and revenue reporting.

- •

Global supply chain vulnerabilities for raw materials (sugar, aluminum, etc.) and logistics disruptions.

Team Readiness

Experienced leadership with a proven track record of managing a global enterprise and navigating complex market shifts. Strong focus on revenue growth management (RGM) and disciplined execution.

A globally networked organization that combines the benefits of scale with local market intimacy. The structure supports a 'digital-first' marketing model.

Key Capability Gaps

- •

Agility in responding to hyper-local consumer trends and insurgent brands.

- •

Deep expertise in sustainable materials science to solve packaging challenges.

- •

Advanced data science capabilities for predictive analytics in consumer behavior and supply chain optimization.

Growth Engine

Acquisition Channels

- Channel:

Retail Distribution (Supermarkets, Convenience Stores)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Leverage data analytics to optimize shelf space allocation, ensuring prime placement for high-growth products (e.g., Coke Zero Sugar, functional beverages) alongside core brands.

- Channel:

Food Service & On-Premise (Restaurants, Venues)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Develop exclusive product offerings and tailored marketing programs for key food service partners to drive volume and enhance brand experience.

- Channel:

Digital & E-commerce

Effectiveness:Medium

Optimization Potential:High

Recommendation:Invest heavily in online grocery partnerships, enhance D2C capabilities through the Coca-Cola App, and explore subscription models for products like Costa Coffee.

- Channel:

New Verticals (e.g., Costa Coffee)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Accelerate the global expansion of Costa Coffee retail outlets and ready-to-drink (RTD) products to create a new, significant revenue stream.

Customer Journey

Primarily an offline, impulse-driven journey at the point of sale. The digital journey is focused on brand engagement and loyalty building rather than direct conversion.

Friction Points

- •

Out-of-stock situations in retail channels, leading to lost sales.

- •

Inconsistent brand experience across a fragmented global network of distributors and retailers.

- •

Growing consumer 'choice paralysis' due to an increasingly crowded beverage market.

Journey Enhancement Priorities

{'area': 'Point of Sale Experience', 'recommendation': 'Utilize smart coolers and IoT sensors to monitor stock levels and ensure product availability, while using digital displays for dynamic promotions.'}

{'area': 'Digital Engagement', 'recommendation': 'Transform the Coca-Cola App from a simple promotional tool into a personalized loyalty platform offering exclusive content, rewards, and early access to new products.'}

Retention Mechanisms

- Mechanism:

Brand Equity & Emotional Connection

Effectiveness:High

Improvement Opportunity:Continue investing in global marketing campaigns that build cultural relevance and connect with the next generation of consumers (Gen Z) on platforms like TikTok and through experiential events.

- Mechanism:

Ubiquitous Availability

Effectiveness:High

Improvement Opportunity:Focus on 'smart availability' by using data to predict demand and ensure the right product mix is available in the right channels at the right time.

- Mechanism:

Product Portfolio Variety

Effectiveness:High

Improvement Opportunity:Continuously innovate and acquire brands in trending categories to ensure consumers stay within the Coca-Cola portfolio even as their tastes evolve.

Revenue Economics

Strong. The company has demonstrated robust pricing power, with a 6% increase in price/mix in Q2 2025 helping to drive organic revenue growth despite slight volume declines.

Not Applicable (N/A for CPG/FMCG model). A more relevant metric is Brand Equity ROI, which remains exceptionally high.

High. Strong operating margins (expanded to 34.1% in Q2 2025) and effective cost management highlight an efficient revenue engine.

Optimization Recommendations

- •

Continue to apply sophisticated Revenue Growth Management (RGM) techniques to optimize pricing, pack sizes, and promotional strategies by market.

- •

Increase focus on premium products which carry higher margins and cater to the premiumization trend.

- •

Improve marketing spend efficiency by shifting further towards digital channels with higher measurable ROI.

Scale Barriers

Technical Limitations

- Limitation:

Data Integration & Analytics Infrastructure

Impact:Medium

Solution Approach:Invest in a unified data platform to integrate consumer data, supply chain metrics, and retail performance for real-time decision-making and AI-driven forecasting.

Operational Bottlenecks

- Bottleneck:

Supply Chain Resilience

Growth Impact:High potential for disruption from geopolitical events, climate change affecting agricultural inputs, and volatility in commodity prices (e.g., aluminum).

Resolution Strategy:Diversify sourcing for key raw materials, invest in regionalized supply chains to reduce transport distances, and use advanced analytics for better demand forecasting and inventory management.

- Bottleneck:

Packaging Sustainability

Growth Impact:Critical reputational and regulatory risk. Failure to meet sustainability goals for recycled content and collection could lead to boycotts, taxes, and fines.

Resolution Strategy:Aggressively invest in R&D for alternative materials, expand refillable/reusable packaging systems, and build robust collection and recycling partnerships.

Market Penetration Challenges

- Challenge:

Changing Consumer Health Preferences

Severity:Critical

Mitigation Strategy:Accelerate portfolio transformation towards low/no-sugar and functional beverages through both in-house innovation and strategic acquisitions of health-focused brands.

- Challenge:

Market Saturation in Developed Countries

Severity:Major

Mitigation Strategy:Drive growth through premiumization, occasion-based marketing, and penetrating adjacent categories like alcoholic ready-to-drink (ARTD) beverages.

- Challenge:

Intense Competition

Severity:Major

Mitigation Strategy:Leverage superior marketing, distribution, and brand portfolio to maintain market share. Compete aggressively on innovation, especially in high-growth segments. Key competitors include PepsiCo and Keurig Dr Pepper.

Resource Limitations

Talent Gaps

- •

Sustainability Scientists & Circular Economy Experts

- •

AI/ML Engineers & Data Scientists

- •

D2C E-commerce & Digital Marketing Specialists

Capital is not a primary constraint. The key is disciplined capital allocation towards high-return initiatives, including strategic M&A, technology upgrades, and sustainability investments.

Infrastructure Needs

- •

Upgrades to bottling partners to handle new packaging formats (e.g., paper bottles, lighter glass).

- •

Expansion of chilled and cold-chain distribution for newer product categories.

- •

Investment in advanced recycling infrastructure through partnerships.

Growth Opportunities

Market Expansion

- Expansion Vector:

Deeper Penetration in Emerging Markets

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Expand the portfolio with locally relevant products and affordable pack sizes, while building out cold-chain distribution infrastructure. Focus on high-growth regions like Asia Pacific and Africa.

- Expansion Vector:

Alcoholic Ready-to-Drink (ARTD) Beverages

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Leverage iconic brands (e.g., Jack & Coke, Topo Chico Hard Seltzer) through strategic partnerships with alcohol companies to navigate regulatory complexity and capture share in this fast-growing segment.

Product Opportunities

- Opportunity:

Functional & Wellness Beverages

Market Demand Evidence:The functional beverages segment holds the largest market share and is projected to see strong growth, driven by consumer demand for drinks with benefits like gut health (probiotics), energy, and relaxation (adaptogens).

Strategic Fit:High

Development Recommendation:Expand existing brands (smartwater, Powerade) with functional variants and acquire or develop new brands in high-potential sub-segments like kombucha and functional coffee.

- Opportunity:

Premium Coffee (RTD & At-Home)

Market Demand Evidence:The RTD coffee market is projected to surpass $133 billion by 2027, driven by convenience and premiumization.

Strategic Fit:High

Development Recommendation:Leverage the Costa Coffee acquisition to aggressively expand RTD coffee products globally and innovate in at-home coffee solutions, competing directly with Nestlé and Starbucks.

- Opportunity:

Personalized Beverages

Market Demand Evidence:Consumers show increasing interest in customizable drinks. Trends point towards flavor cartridges and personalized nutrition.

Strategic Fit:Medium

Development Recommendation:Pilot a D2C platform for personalized beverages, potentially leveraging AI to recommend blends based on user preferences and wellness goals. This could be an extension of the Coca-Cola Freestyle platform.

Channel Diversification

- Channel:

Direct-to-Consumer (D2C) Subscriptions

Fit Assessment:Medium

Implementation Strategy:Launch curated subscription boxes for specialty products like international flavors, Costa Coffee, or functional beverage discovery packs to build direct relationships and recurring revenue.

- Channel:

Smart Vending & Automated Retail

Fit Assessment:High

Implementation Strategy:Deploy AI-powered, cashless vending machines in high-traffic areas (offices, transport hubs) that offer a wider range of products and personalized promotions.

Strategic Partnerships

- Partnership Type:

Technology & AI

Potential Partners

- •

Google Cloud

- •

Microsoft Azure

- •

Palantir

Expected Benefits:Enhance supply chain visibility, optimize marketing spend through predictive analytics, and improve demand forecasting accuracy.

- Partnership Type:

Sustainability & Recycling

Potential Partners

- •

TerraCycle

- •

Loop

- •

Leading chemical recycling startups

Expected Benefits:Co-invest in and scale up innovative recycling technologies and reusable packaging platforms to meet ambitious 'World Without Waste' goals and mitigate regulatory risk.

- Partnership Type:

Ingredient Innovation

Potential Partners

- •

Givaudan

- •

Firmenich

- •

Food-tech startups specializing in natural sweeteners

Expected Benefits:Accelerate development of next-generation, natural, zero-calorie sweeteners and novel functional ingredients to lead the industry in healthier product formulations.

Growth Strategy

North Star Metric

Weekly Active Drinkers Across Portfolio

This metric shifts the focus from volume of a single product to the breadth and frequency of consumer engagement with the entire Coca-Cola brand ecosystem. It measures penetration, frequency, and loyalty, encouraging growth through both core products and expansion into new categories.

Increase metric by 5% annually by recruiting new consumers and increasing consumption frequency among existing ones.

Growth Model

Portfolio Expansion & Occasion Penetration Model

Key Drivers

- •

Product Innovation (launching new products in high-growth categories)

- •

Marketing & Brand Building (creating demand for new and existing products)

- •

Distribution Excellence (ensuring availability for every consumption occasion)

- •

Strategic M&A (acquiring high-growth brands to enter new markets/categories)

Adopt a 'category-first' strategy. For each beverage category (e.g., hydration, energy, coffee), define a clear 'win' strategy, allocate resources accordingly, and empower teams to innovate and execute with speed.

Prioritized Initiatives

- Initiative:

Launch a Global 'Hydration 2.0' Platform

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 months

First Steps:Consolidate smartwater, Powerade, Vitaminwater, and Topo Chico brands under a unified functional hydration strategy. Launch new products with added electrolytes, nootropics, and adaptogens.

- Initiative:

Aggressive Expansion of Costa Coffee RTD

Expected Impact:High

Implementation Effort:Medium

Timeframe:12-18 months

First Steps:Secure prime refrigerated shelf space with key global retailers for Costa RTD coffee and launch an integrated marketing campaign targeting at-home and on-the-go coffee drinkers.

- Initiative:

Develop a Scalable Reusable Packaging Model

Expected Impact:Medium (Financial), High (ESG/Risk Mitigation)

Implementation Effort:High

Timeframe:24-36 months

First Steps:Partner with a company like Loop to pilot a 'smart' refillable bottle program in several major European and North American cities, testing consumer adoption and reverse logistics.

Experimentation Plan

High Leverage Tests

- Test Name:

Dynamic Pricing in Smart Vending

Hypothesis:Implementing dynamic pricing based on time of day, weather, and local events will increase total revenue per machine by 15%.

- Test Name:

AI-Generated Ad Creative

Hypothesis:Using generative AI to create hyper-localized digital ad variants will improve click-through rates and reduce cost-per-acquisition by 20%.

- Test Name:

D2C 'Flavor Drop' Model

Hypothesis:Launching limited-edition, online-exclusive flavors will generate significant social media buzz and provide valuable data on emerging flavor trends.

Utilize a combination of A/B testing platforms for digital experiments, retail sales lift analysis for in-store tests, and consumer sentiment tracking through social listening tools.

Maintain a continuous, high-tempo experimentation cycle within the digital marketing team (weekly sprints) and a structured cadence for in-market pilot programs (quarterly reviews).

Growth Team

A hub-and-spoke model. A central 'Growth & Innovation' team sets strategy, identifies major trends, and provides tools/frameworks. 'Spoke' teams embedded within regional business units and key brand teams are empowered to execute experiments and localize initiatives.

Key Roles

- •

Head of Portfolio Growth

- •

Lead Data Scientist (Consumer Insights)

- •

Director of D2C & E-commerce

- •

Circular Economy Program Manager

- •

Venture & Partnerships Lead

Establish an internal 'Growth Academy' to train marketers and commercial leaders on agile methodologies, experimentation design, and data analytics. Actively recruit talent from the tech and digitally-native CPG sectors.

The Coca-Cola Company exhibits a strong growth foundation, built upon unparalleled brand equity, a highly scalable franchise business model, and a proven ability to manage revenue and profitability effectively. Its Q2 2025 results, showing 5% organic revenue growth driven by pricing power despite minor volume declines, underscore its resilience in a challenging macroeconomic environment.

The primary challenge and greatest opportunity for Coca-Cola lie in navigating the profound shift in consumer preferences away from its core sugary carbonated soft drinks and towards healthier, functional, and sustainable options. The company is actively addressing this through a 'total beverage' strategy, diversifying its portfolio via innovation (e.g., Coke Zero Sugar, Simply Prebiotic Soda) and strategic acquisitions (e.g., Costa Coffee, BodyArmor). This portfolio evolution is the central pillar of its future growth.

Key growth vectors are clear: 1) Product Innovation in functional beverages, coffee, and low/no-sugar alternatives to capture 'share of throat' from health-conscious consumers. 2) Market Penetration by expanding this diversified portfolio into emerging markets where disposable incomes are rising. 3) Channel Diversification by strengthening its presence in e-commerce and exploring direct-to-consumer models.

However, significant scale barriers exist. The company faces critical pressure on sustainability, particularly plastic waste, which poses a substantial reputational and regulatory risk. Operational complexity in its vast global supply chain and the constant threat of intense competition from rivals like PepsiCo require continuous investment in efficiency and marketing.

Strategic Recommendation:

Coca-Cola must accelerate its transformation from a beverage manufacturer into a data-driven, consumer-centric platform. The recommended growth strategy is a 'Portfolio Expansion & Occasion Penetration Model'. The North Star Metric should shift from simple volume to 'Weekly Active Drinkers Across the Portfolio' to incentivize capturing every consumer drinking occasion, whether it's a morning coffee, a post-workout sports drink, or an evening mixer.

Priorities should be:

1. Aggressively scale growth brands like Costa Coffee and Powerade with functional innovations.

2. Solve the sustainability challenge by making tangible, scaled investments in reusable packaging and advanced recycling, turning a defensive necessity into a competitive advantage.

3. Build a world-class digital and data infrastructure to create more personalized consumer relationships and a more intelligent, resilient supply chain.

By successfully executing this pivot, The Coca-Cola Company can leverage its immense scale and brand power to not only defend its current market position but also dominate the future of the beverage industry.

Legal Compliance

The Coca-Cola Company maintains a comprehensive and recently updated (June 2024) Consumer Privacy Policy. It is easily accessible through the website's footer. The policy clearly defines personal information, its collection methods (direct and indirect), and its usage for service provision, marketing, and business management. It explicitly mentions combining data from third-party sources. The policy details user rights under various legal frameworks, including GDPR, and provides a contact email ([email protected]) for inquiries. It also addresses international data transfers, stating the use of appropriate safeguards like Standard Contractual Clauses. Specific sections for jurisdictions like California are included, demonstrating a tailored approach to compliance.

The Terms of Service (ToS) are clearly articulated and accessible. They define the agreement between The Coca-Cola Company and users of its services, including the website and apps. The ToS cover key areas such as permitted uses of the services, intellectual property ownership, and user-generated content, where it specifies a broad license granted to the company for any submitted content. Crucially, it includes significant limitations on liability and a mandatory dispute resolution clause, directing potential legal issues into a specific process. The language, while legalistic, is structured with clear headings to improve readability.