eScore

copart.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Copart demonstrates a dominant digital presence for high-intent, transactional search queries, leveraging its massive inventory to create a vast long-tail footprint. Its brand authority is high, effectively capturing bottom-of-funnel users who are ready to bid. However, the strategy significantly neglects top-of-funnel educational and informational content, creating a gap in thought leadership and missing the opportunity to engage potential new buyers earlier in their journey.

Exceptional search intent alignment for transactional queries like 'salvage cars for sale', driven by a massive, constantly updated inventory.

Launch a 'Copart Education Hub' to create authoritative content around topics like 'how to buy a salvage car' or 'understanding vehicle titles' to capture top-of-funnel traffic and build trust with new market entrants.

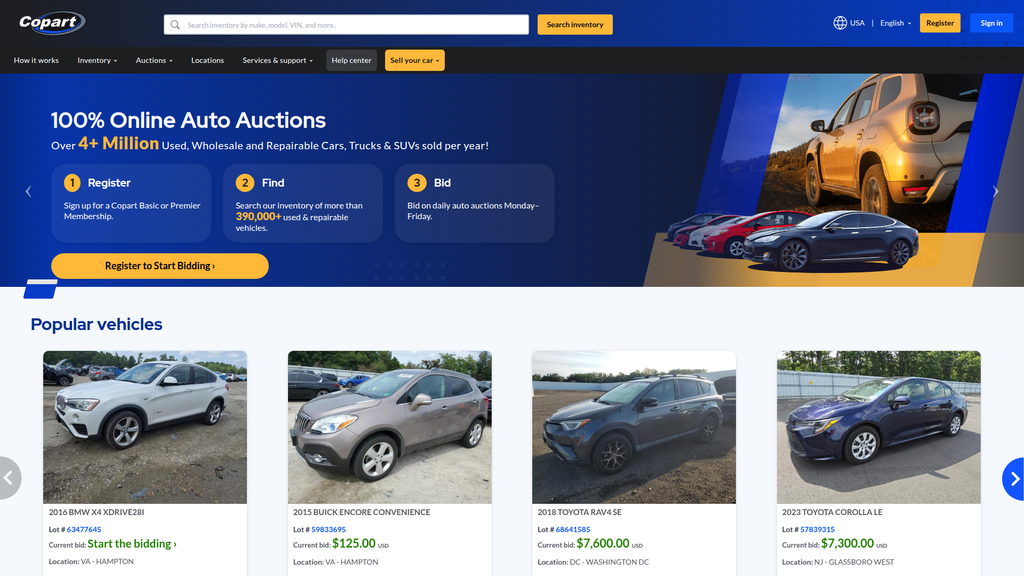

The brand's messaging is exceptionally clear, consistent, and effective at communicating its core value proposition of scale ('4+ Million...sold per year') and simplicity ('Register, Find, Bid'). However, this communication is almost exclusively targeted at buyers, creating a major strategic gap by neglecting the critical seller audience (e.g., insurance companies). The messaging is also highly transactional and lacks the emotional connection or trust-building that testimonials and success stories would provide.

The 'Register, Find, Bid' framework is a simple, powerful, and consistent message that clearly articulates the user journey for buyers.

Create a prominent 'For Sellers' section on the homepage and in marketing communications with a clear value proposition addressing the needs of insurance carriers, fleet operators, and dealerships to balance the messaging architecture.

The conversion path for experienced buyers is direct and functional, with clear calls-to-action for registration and bidding. However, the overall experience is hampered by a lack of prominent trust signals (e.g., testimonials, security badges), which is a significant friction point for high-risk transactions. Furthermore, the analysis points to critical compliance failures, such as non-compliant cookie banners and the absence of a CCPA opt-out link, which introduce both legal risk and user friction.

The visual hierarchy in the hero section is strong, with a prominent primary CTA ('Register to Start Bidding') that effectively guides users to the main conversion goal.

Incorporate a dedicated 'Trust & Credibility' section on the homepage featuring logos of major insurance partners, key business statistics, and customer testimonials to build social proof and reduce user hesitation.

Copart's credibility is built on its market leadership and sheer scale, which provides a level of implicit trust. However, this is significantly undermined by a high-risk legal posture, including aggressive 'AS-IS' disclaimers and major digital compliance gaps with GDPR and CCPA. The website lacks visible third-party validation like media mentions or awards, and transparency is low regarding vehicle condition, placing the full burden of verification on the buyer.

Providing clear, state-by-state guidance on business licensing requirements for purchasing vehicles demonstrates transparency in a complex regulatory area.

Immediately implement a CCPA/CPRA-compliant 'Do Not Sell or Share My Personal Information' link and a GDPR-compliant cookie consent banner to mitigate high-severity legal and reputational risks.

Copart has an exceptionally strong and sustainable competitive moat built on three pillars that are difficult to replicate: a vast network of strategically located and owned physical yards, powerful two-sided network effects, and proprietary auction technology (VB3). This hybrid physical-digital model creates immense barriers to entry. While it operates in a duopoly with IAA, its early move to a 100% online model and its land ownership strategy provide distinct, long-term advantages.

The combination of a massive, owned physical infrastructure with a scalable, proprietary online auction platform (VB3) creates a nearly insurmountable barrier to entry.

Develop and market a specialized service for Electric Vehicles (EVs) and their batteries, establishing a new competitive advantage in the next generation of salvage vehicles before competitors can.

The business model is highly scalable, with strong unit economics and high operational leverage from its online platform. Copart has a proven track record of successful international expansion and is well-positioned to capitalize on industry tailwinds like increasing vehicle complexity. The primary constraint to growth is the capital-intensive and slow process of acquiring and developing new physical land for yards.

The dual-fee model (charging both buyers and sellers) combined with a high-margin, scalable online auction platform creates exceptionally strong and predictable unit economics.

Develop an integrated global logistics and payments platform to simplify cross-border transactions, reducing friction and unlocking further growth from the high-potential international buyer segment.

Copart's two-sided marketplace model is mature, coherent, and highly effective, perfectly aligning its resources with the needs of its core B2B stakeholders. The revenue model is robust, with diversified streams from both buyers and sellers, reducing dependency on one side of the market. The strategic focus on integrating technology with physical assets has been executed with exceptional consistency for decades, solidifying its market leadership.

The hybrid online-physical business model is perfectly aligned, using a vast physical footprint to solve logistics problems and a proprietary tech platform to provide global reach and liquidity.

Productize its vast data assets by launching a 'Copart Intelligence' suite of analytics tools for insurance partners, creating a new, high-margin revenue stream and deepening strategic partnerships.

As one half of a dominant duopoly controlling ~80% of the U.S. salvage market, Copart wields significant market power. This allows for strong pricing power, as evidenced by its high-margin, fee-based revenue model. Its ability to process massive vehicle volumes after catastrophes makes it an indispensable partner for insurance companies, giving it considerable partner leverage and market influence.

Dominant market share in a duopoly provides significant pricing power and the ability to influence industry standards.

Aggressively grow the volume of vehicles sourced from non-insurance segments (dealers, fleets, rentals) to mitigate the customer dependency risk on the insurance industry.

Business Overview

Business Classification

Online Auction Platform

Two-Sided Marketplace

Automotive

Sub Verticals

- •

Vehicle Remarketing

- •

Salvage Auctions

- •

Used Vehicle Sales

- •

Heavy Equipment Auctions

Mature

Maturity Indicators

- •

Established global presence in 11 countries with over 200 physical locations.

- •

Consistent profitability and strong market share in a duopolistic industry.

- •

Long operating history, founded in 1982 and public since 1994.

- •

Well-developed proprietary technology platform (VB3) that has undergone multiple iterations.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Buyer Transaction & Service Fees

Description:Fees charged to vehicle buyers for each transaction, including auction fees, bidding fees, storage, loading, and annual membership/registration fees.

Estimated Importance:Primary

Customer Segment:Vehicle Dismantlers, Rebuilders, Dealers, Exporters, General Public

Estimated Margin:High

- Stream Name:

Seller Service Fees

Description:Fees charged to vehicle sellers (primarily insurance companies) for processing and selling vehicles. This includes consignment fees, often based on a percentage of the final sale price, and fees for title processing.

Estimated Importance:Primary

Customer Segment:Insurance Companies, Fleet Operators, Rental Car Companies, Financial Institutions

Estimated Margin:High

- Stream Name:

Ancillary & Value-Added Service Fees

Description:Revenue from optional services such as vehicle transportation and towing, enhanced vehicle reports, and title services.

Estimated Importance:Secondary

Customer Segment:All Segments

Estimated Margin:Medium

- Stream Name:

Vehicle Sales (Principal)

Description:Revenue generated from the gross sales price of vehicles that Copart purchases outright and resells for its own account, including through its CopartDirect / CashForCars.com brands and in specific international markets like the U.K.

Estimated Importance:Tertiary

Customer Segment:General Public (as seller), All Buyer Segments

Estimated Margin:Low

Recurring Revenue Components

Annual Membership Fees (Basic & Premier)

Recurring vehicle processing contracts with large insurance and fleet companies

Pricing Strategy

Transaction-based & Membership

Mid-range

Semi-transparent

Pricing Psychology

Tiered Pricing (Guest, Basic, Premier memberships with increasing benefits)

Dynamic Pricing (Auction fees often scale with vehicle sale price)

Monetization Assessment

Strengths

- •

Diversified revenue from both buyers and sellers, reducing dependency on one side of the marketplace.

- •

High-margin, fee-based service revenue comprises the majority of income.

- •

Scalable model where revenue grows with transaction volume and vehicle values.

Weaknesses

Revenue is sensitive to fluctuations in used car values and scrap metal prices, which impact auction selling prices.

Dependence on transaction volume, which can be affected by macroeconomic factors like accident rates.

Opportunities

- •

Expand high-margin data-as-a-service (DaaS) offerings to insurance partners.

- •

Introduce financial services (e.g., buyer financing) to generate new revenue streams.

- •

Grow ancillary services, especially in international logistics and vehicle inspections.

Threats

Intense price competition from primary competitor IAA (RB Global) could pressure fee structures.

Regulatory changes in title processing or international trade could increase costs or reduce transaction volumes.

Market Positioning

Market Leadership through Technology and Physical Infrastructure

Market Leader (Controls a significant portion of the ~80% duopoly with IAA in the US salvage market)

Target Segments

- Segment Name:

Insurance Companies

Description:National and regional property and casualty insurers who need to efficiently process and liquidate total-loss, recovered-theft, and other salvage vehicles.

Demographic Factors

Large, enterprise-level corporations

Psychographic Factors

Value efficiency, cost reduction, and maximizing salvage returns.

Risk-averse, seeking reliable and compliant partners.

Behavioral Factors

- •

High-volume, recurring vehicle assignments.

- •

Seek national or regional contracts for consistent service.

- •

Utilize data and reporting to manage performance.

Pain Points

- •

High administrative overhead in managing salvage.

- •

Slow cycle times for vehicle liquidation.

- •

Inconsistent returns on salvaged assets.

- •

Logistical complexity of vehicle pickup and storage.

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Vehicle Dismantlers & Rebuilders

Description:Licensed businesses that purchase damaged vehicles to dismantle for parts or to repair and resell.

Demographic Factors

Small to medium-sized businesses (SMBs)

Often family-owned or independent operators

Psychographic Factors

- •

Value-conscious, seeking profitable inventory.

- •

High expertise in vehicle repair and parts.

- •

Entrepreneurial and resourceful.

Behavioral Factors

- •

Frequent bidders and purchasers.

- •

Purchase a wide variety of makes, models, and damage levels.

- •

Often focus on specific vehicle types or parts.

Pain Points

- •

Sourcing a consistent and diverse supply of salvage vehicles.

- •

Inaccurate vehicle condition reports.

- •

High competition for desirable inventory.

- •

Complexities with title processing and ownership transfer.

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

International Exporters

Description:Buyers located outside of Copart's primary operating countries who purchase vehicles for resale or dismantling in their local markets.

Demographic Factors

Primarily businesses, but can include individuals.

Located in over 190 countries.

Psychographic Factors

Seek arbitrage opportunities based on international vehicle values.

Willing to navigate complex logistics and import regulations.

Behavioral Factors

- •

Purchase in bulk.

- •

Heavily reliant on online vehicle information and photos.

- •

Utilize third-party brokers and shipping services.

Pain Points

- •

High cost and complexity of international shipping and customs.

- •

Inability to physically inspect vehicles before bidding.

- •

Currency exchange rate risk and payment difficulties.

- •

Navigating different countries' vehicle import laws.

Fit Assessment:Good

Segment Potential:High

- Segment Name:

Used Car Dealers & Individuals

Description:Licensed dealers acquiring inventory for retail, and members of the public purchasing clean-title, lightly damaged, or 'No License Required' vehicles.

Demographic Factors

Dealers are SMBs; individuals are varied.

Often located domestically.

Psychographic Factors

Price-sensitive, looking for deals.

DIY-oriented (individuals) or profit-driven (dealers).

Behavioral Factors

- •

Less frequent, smaller volume purchases compared to dismantlers.

- •

Focus on vehicles with minimal damage or clean titles.

- •

More sensitive to ancillary fees (storage, loading).

Pain Points

- •

Competition from professional, high-volume buyers.

- •

Lack of detailed mechanical information.

- •

Navigating complex licensing requirements to bid.

Fit Assessment:Good

Segment Potential:Medium

Market Differentiation

- Factor:

Proprietary VB3 Auction Technology

Strength:Strong

Sustainability:Sustainable

- Factor:

Extensive Global Network of Physical Yards

Strength:Strong

Sustainability:Sustainable

- Factor:

Network Effects (Large, Liquid Marketplace)

Strength:Strong

Sustainability:Sustainable

- Factor:

Deeply Entrenched Relationships with Insurance Companies

Strength:Moderate

Sustainability:Sustainable

Value Proposition

To provide the world's most efficient and liquid online marketplace for buying and selling salvage and used vehicles, maximizing returns for sellers and offering unparalleled inventory for buyers through a combination of advanced technology and a global physical footprint.

Excellent

Key Benefits

- Benefit:

Global Buyer Access

Importance:Critical

Differentiation:Unique

Proof Elements

Buyers in over 190 countries.

Online platform accessible worldwide.

- Benefit:

Massive & Diverse Vehicle Inventory

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Over 390,000+ vehicles listed online.

Sourcing from insurance, fleet, rental, and financial institutions.

- Benefit:

Efficient End-to-End Service

Importance:Important

Differentiation:Somewhat unique

Proof Elements

Services include towing, storage, title processing, and auction.

Integrated online and physical operations.

Unique Selling Points

- Usp:

Hybrid online-physical model combining a vast network of storage yards with a fully digital, patented auction platform (VB3).

Sustainability:Long-term

Defensibility:Strong

- Usp:

Massive scale and network effects create a highly liquid market, leading to competitive pricing and higher sell-through rates.

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Sellers need to liquidate a high volume of salvage vehicles efficiently and for the highest possible return.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Buyers need a consistent, reliable, and diverse source of repairable vehicles and parts.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

The logistical and administrative burden of transporting, storing, and processing titles for salvage vehicles is immense.

Severity:Major

Solution Effectiveness:Partial

Value Alignment Assessment

High

The business model directly addresses the core needs of the salvage auction market: liquidity for sellers and inventory for buyers. The increasing complexity and cost of vehicle repairs drive more cars into the salvage market, a trend Copart is perfectly positioned to capitalize on.

High

Copart's offerings are highly aligned with its primary B2B customer segments (insurers, dismantlers). The tiered membership and 'No License Required' options show a good effort to cater to smaller buyers and individuals as well.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Insurance Companies (e.g., State Farm, Progressive, etc.)

- •

Rental Car Companies (e.g., Hertz, Enterprise)

- •

Fleet Management Companies

- •

Financial Institutions & Banks (for repossessions)

- •

Third-party Logistics & Towing Companies

- •

Automotive Dealers and Dealer Groups

Key Activities

- •

Vehicle Acquisition & Assignment Processing

- •

Vehicle Logistics (Towing & Transportation)

- •

Vehicle Intake, Imaging, and Documentation

- •

Managing Online Auctions via VB3 Platform

- •

Title Processing & Transfer

- •

Customer Service & Member Management

- •

Physical Yard Operations & Management

Key Resources

- •

Proprietary VB3 Online Auction Platform

- •

Global Network of over 200 Physical Storage Yards

- •

Vast, Active Global Buyer Base

- •

Long-term Contracts with Vehicle Sellers

- •

Data Analytics Capabilities

- •

Experienced Operations and Logistics Teams

Cost Structure

- •

Yard Operations (Lease/ownership, labor, equipment, security)

- •

General & Administrative Expenses (Corporate overhead, IT, sales & marketing)

- •

Cost of Vehicle Towing & Transportation

- •

Cost of Vehicle Sales (for principal transactions)

Swot Analysis

Strengths

- •

Dominant market position in a duopoly.

- •

Significant barriers to entry due to high capital requirements for physical yards and proprietary technology.

- •

Strong network effects; more sellers attract more buyers, increasing liquidity and value.

- •

Asset-light agency model for the majority of transactions, minimizing inventory risk.

- •

Global diversification across 11 countries reduces reliance on a single market.

Weaknesses

- •

Revenue is susceptible to cyclicality in the used car and scrap metal markets.

- •

High dependence on the insurance industry as the primary source of vehicle supply.

- •

Operational complexity of managing a large, distributed physical infrastructure.

- •

Potential for negative perception associated with selling 'wrecks' or 'junk'.

Opportunities

- •

Continued international expansion into untapped or underserved markets.

- •

Diversification into adjacent auction categories (e.g., heavy equipment through PurpleWave acquisition, powersports).

- •

Offering more value-added services like buyer financing, enhanced inspections, and data analytics products.

- •

Leveraging data to optimize auction outcomes and provide predictive insights to sellers.

- •

Capitalizing on the growing complexity of vehicles (especially EVs), which increases the likelihood of total-loss declarations.

Threats

- •

Aggressive competition from IAA (now part of RB Global), which has a strong market presence.

- •

Long-term advancements in vehicle safety (ADAS) and autonomous driving could reduce accident frequency.

- •

Changes in government regulations regarding vehicle salvage, emissions, or international trade.

- •

Macroeconomic downturns could reduce new car sales, miles driven, and overall economic activity, impacting vehicle supply.

- •

Disruption from new digital-native competitors, though unlikely given the high barriers to entry.

Recommendations

Priority Improvements

- Area:

International Buyer Experience

Recommendation:Develop an integrated global logistics and payments platform to simplify cross-border transactions, including transparent shipping quotes, customs assistance, and multi-currency payment options.

Expected Impact:High

- Area:

Data & Analytics Services

Recommendation:Productize data offerings for insurance partners, providing advanced analytics on salvage trends, return optimization, and predictive total-loss indicators to deepen partnerships beyond transactions.

Expected Impact:Medium

- Area:

Mobile Platform Enhancement

Recommendation:Invest heavily in a mobile-first strategy, enhancing the mobile app with features like AI-powered damage estimation from photos, personalized inventory alerts, and a more seamless mobile bidding/checkout process.

Expected Impact:Medium

Business Model Innovation

- •

Explore a 'Parts Marketplace' by digitally inventorying high-value components on salvage vehicles before they are auctioned, creating a new revenue stream from individual part sales.

- •

Develop a premium 'Copart Certified' program for low-damage, clean-title vehicles, including detailed mechanical inspections and warranties to attract more retail-focused buyers.

- •

Pilot a 'Copart Go' model in dense urban areas, using smaller, more flexible drop-off and pickup points instead of large yards for certain vehicle types.

Revenue Diversification

- •

Aggressively scale the heavy and industrial equipment auction business (via PurpleWave) to reduce dependency on the automotive salvage cycle.

- •

Expand into the powersports (motorcycles, ATVs) and marine (boats) auction markets, leveraging the existing platform and buyer base.

- •

Launch a B2B service for automotive repair shops, providing them direct access to purchase dismantled parts from Copart's inventory before vehicles are crushed.

Copart's business model is a masterclass in building a defensible, high-margin enterprise by integrating technology with a formidable physical infrastructure. The company operates as a two-sided marketplace that thrives on powerful network effects, creating a virtuous cycle where a vast inventory from sellers attracts a global base of buyers, which in turn ensures high liquidity and optimal returns for sellers. This has solidified its position as a market leader in a duopoly with IAA.

The primary strength lies in its hybrid model. The proprietary VB3 online auction platform provides global reach and scalability, while the extensive network of over 200 physical yards creates immense barriers to entry and solves the critical 'last mile' logistics problem for bulky, immobile assets. This combination is exceptionally difficult and capital-intensive to replicate. Their revenue model is robust, drawing high-margin fees from both sides of the transaction and mitigating inventory risk through a predominantly agency-based approach.

Strategic evolution should focus on moving 'up the value chain.' While the core auction business is mature and highly optimized, significant opportunities exist in layering higher-margin services on top of the transactional foundation. The most promising avenues for strategic transformation are:

1. Global Integration: Evolving from a series of country-specific operations into a truly seamless global marketplace. This involves abstracting away the complexities of cross-border logistics and payments for international buyers, which could unlock significant demand and command premium service fees.

2. Data Monetization: Transitioning the relationship with insurance partners from a transactional service provider to a strategic data partner. By leveraging its vast dataset on vehicle damage and auction outcomes, Copart can offer predictive analytics that help insurers manage risk and optimize total-loss processes, creating deep, strategic entrenchment.

3. Category Diversification: The acquisition of PurpleWave is a strategically sound move to de-risk the business from the automotive cycle. Aggressively expanding into adjacent categories like heavy equipment, powersports, and marine will be crucial for long-term, sustainable growth.

Threats from competition and potential long-term technological shifts (e.g., safer cars) are real but not immediate. Copart's scale, infrastructure, and network effects provide a substantial moat. The key to future success will be leveraging these existing strengths to innovate and expand the business model beyond its current transactional core into a more integrated, data-driven, and diversified global remarketing platform.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Extensive Physical Infrastructure

Impact:High

Description:Operating a network of over 200 large-scale vehicle storage and processing facilities globally requires massive capital investment and zoning approvals, which is difficult for new entrants to replicate.

- Barrier:

Exclusive Supplier Contracts

Impact:High

Description:Long-standing, high-volume contracts with major national and regional insurance companies, which supply the majority of salvage vehicles, are difficult for new players to secure. Copart and IAA control ~80% of this market.

- Barrier:

Proprietary Auction Technology & Network Effects

Impact:High

Description:Copart's patented VB3 online auction platform creates a powerful two-sided network effect; a vast global buyer base attracts more sellers (insurers), and a massive vehicle inventory attracts more buyers, creating a self-reinforcing loop.

- Barrier:

Logistical and Regulatory Expertise

Impact:Medium

Description:Navigating complex vehicle titling laws, transportation logistics, and environmental regulations across numerous jurisdictions requires significant specialized knowledge and established processes.

Industry Trends

- Trend:

Digital Transformation and Data Analytics

Impact On Business:Copart is a digital-first leader, but continued investment in AI for vehicle valuation, damage assessment, and buyer behavior analytics is critical to maintain an edge. Competitors like ACV Auctions are built on modern tech stacks.

Timeline:Immediate

- Trend:

Rise of Electric Vehicles (EVs)

Impact On Business:Presents both an opportunity and a threat. EVs have different damage patterns and high-value components (batteries) that require specialized handling, valuation, and a new buyer ecosystem. This complexity could increase total-loss frequency but also requires new operational capabilities.

Timeline:Near-term

- Trend:

International Market Expansion

Impact On Business:Growth is increasingly coming from outside North America. Copart has been aggressive in global expansion, but this introduces currency risks, regulatory hurdles, and competition with local players.

Timeline:Immediate

- Trend:

Increasing Vehicle Complexity and Repair Costs

Impact On Business:Advanced Driver-Assistance Systems (ADAS), sophisticated sensors, and new materials increase the cost of repairs, leading to a higher likelihood of vehicles being declared 'total loss,' which directly increases the supply of vehicles for Copart's auctions.

Timeline:Near-term

Direct Competitors

- →

IAA, Inc. (now part of RB Global)

Market Share Estimate:30-40% of the U.S. salvage auction market

Target Audience Overlap:High

Competitive Positioning:Positions as a leading global digital marketplace with strong, established relationships with insurance carriers and a focus on leveraging data and technology to serve its clients.

Strengths

- •

Strong, deep-rooted relationships with major insurance companies.

- •

Extensive physical network of over 210 facilities, although many are leased.

- •

Robust digital platform ('AuctionNow') and focus on data analytics to enhance seller returns.

- •

Now part of RB Global (Ritchie Bros.), creating potential synergies in heavy equipment and broader asset disposition.

Weaknesses

- •

Historically slower to adopt a fully online model compared to Copart, who moved to 100% online auctions in 2003.

- •

Higher reliance on leasing physical locations rather than owning, which could be a long-term cost disadvantage.

- •

Potential integration challenges and strategic shifts following the contentious acquisition by Ritchie Bros.

- •

Customer service and title processing can be perceived as more consistent or knowledgeable by some industry professionals.

Differentiators

- •

Focus on 'total loss, damaged, and low-value vehicles' sourced primarily from insurers.

- •

IAA Interact™ merchandising platform provides detailed vehicle information to buyers.

- •

Integration with RB Global's ecosystem may provide access to a different buyer base and financing options.

Indirect Competitors

- →

Manheim (a Cox Automotive company)

Description:The dominant player in the wholesale used-car auction market, serving institutional sellers like automakers, rental fleets, and large dealer groups. Operates both physical and online auctions.

Threat Level:Medium

Potential For Direct Competition:Low in the salvage space, but their dominance in wholesale remarketing and advanced digital capabilities make them a formidable force in the broader auto auction industry.

- →

ACV Auctions

Description:A digital-first, asset-light marketplace for wholesale vehicles, primarily dealer-to-dealer. Differentiates with comprehensive, third-party vehicle condition reports and a modern tech platform.

Threat Level:Medium

Potential For Direct Competition:Could disrupt the non-salvage part of Copart's business (e.g., dealer trade-ins) by offering a more transparent and efficient digital process. Their tech-focused model is a threat to the traditional auction format.

- →

LKQ Corporation

Description:A leading global distributor of alternative and specialty vehicle parts, including recycled parts from salvaged vehicles. LKQ is one of the largest buyers of vehicles from Copart and IAA.

Threat Level:Medium

Potential For Direct Competition:High potential for backward integration. As a massive buyer, LKQ could decide to source vehicles directly from insurance companies, bypassing the auction platforms to control its supply chain. They already have deep relationships with insurers.

- →

AutoBidMaster / RideSafely

Description:These are official brokers or 'market makers' for Copart and IAA auctions, providing access to individuals who do not have the required dealer licenses to bid directly. They essentially act as a retail channel.

Threat Level:Low

Potential For Direct Competition:They are symbiotic partners rather than competitors, expanding the buyer base. However, if Copart decided to create its own in-house public-access program, it could diminish their role.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Unmatched Physical Footprint and Land Ownership

Sustainability Assessment:Copart owns a significant portion of its land, unlike IAA which leases more. This provides a long-term cost advantage and operational stability. This physical network is a massive, capital-intensive moat.

Competitor Replication Difficulty:Hard

- Advantage:

Proprietary Technology and Early Mover Advantage

Sustainability Assessment:Copart's early and decisive shift to a 100% online auction model with its VB3 platform gave it a significant head start in building a global, digital-native buyer base, which is difficult for competitors to erode.

Competitor Replication Difficulty:Medium

- Advantage:

Powerful Two-Sided Network Effect

Sustainability Assessment:With the largest inventory of vehicles from sellers and the largest network of global buyers, Copart creates a flywheel effect that is extremely difficult for smaller players to challenge. More sellers attract more buyers, which in turn attracts more sellers.

Competitor Replication Difficulty:Hard

- Advantage:

Catastrophe Response Capabilities

Sustainability Assessment:Proven ability to rapidly process massive influxes of vehicles after natural disasters (e.g., hurricanes) builds immense goodwill and market share with insurance companies. This logistical prowess is a key service differentiator.

Competitor Replication Difficulty:Hard

Temporary Advantages

No itemsDisadvantages

- Disadvantage:

Negative Customer Sentiment Regarding Fees and Service

Impact:Major

Addressability:Moderately

Description:Online reviews frequently cite high, complex buyer fees and inconsistent customer service at various locations as major pain points, which can damage brand reputation among individual buyers and small businesses.

- Disadvantage:

Asset-Heavy Business Model

Impact:Minor

Addressability:Difficult

Description:While land ownership is a strength, the capital-intensive nature of acquiring and maintaining physical yards can limit flexibility compared to asset-light digital models like ACV Auctions.

- Disadvantage:

Dependence on the Automotive Insurance Industry

Impact:Major

Addressability:Moderately

Description:Approximately 80% of vehicle supply comes from insurance companies. Any major shifts in how insurers handle total-loss claims could significantly impact Copart's core business.

Strategic Recommendations

Quick Wins

- Recommendation:

Simplify and Improve Transparency of Buyer Fee Structure

Expected Impact:Medium

Implementation Difficulty:Moderate

Description:Address a primary source of negative customer sentiment by creating a more straightforward and predictable fee calculator. This can improve trust and retention with smaller, independent buyers.

- Recommendation:

Launch Targeted Marketing Campaigns for Non-Insurance Vehicles

Expected Impact:Medium

Implementation Difficulty:Easy

Description:Increase marketing efforts aimed at dealers, rental companies, and fleet operators to diversify vehicle supply away from heavy reliance on the insurance sector.

Medium Term Strategies

- Recommendation:

Develop a Specialized EV Auction and Processing Service

Expected Impact:High

Implementation Difficulty:Moderate

Description:Invest in training, equipment, and platform features specifically for handling, evaluating, and selling damaged EVs and their high-value battery packs. Establish a marketplace for EV components.

- Recommendation:

Enhance Data-as-a-Service (DaaS) Offerings for Insurers

Expected Impact:Medium

Implementation Difficulty:Moderate

Description:Leverage vast historical auction data to provide more sophisticated predictive analytics on salvage returns, total-loss thresholds, and fraud detection for insurance partners, deepening the relationship beyond just vehicle processing.

- Recommendation:

Expand Integrated Services for International Buyers

Expected Impact:High

Implementation Difficulty:Moderate

Description:Offer bundled services including international shipping, customs brokerage, and financing to make the purchasing process seamless for the crucial and growing international buyer segment.

Long Term Strategies

- Recommendation:

Explore Strategic Partnerships in the EV Battery Second-Life Ecosystem

Expected Impact:High

Implementation Difficulty:Difficult

Description:Forge partnerships with energy storage companies and battery recycling firms to create a new, high-margin revenue stream from end-of-life EV batteries, positioning Copart at the center of the circular economy for EVs.

- Recommendation:

Invest in AI-Powered Vehicle Inspection and Imaging

Expected Impact:High

Implementation Difficulty:Difficult

Description:Develop or acquire technology for automated, AI-driven damage assessment from vehicle photos/scans. This would standardize reporting, increase buyer trust, and create significant operational efficiencies.

Solidify position as the 'Global Technology Leader in Vehicle Remarketing.' Shift messaging from being just an 'auction' to a comprehensive technology and logistics platform that provides superior data insights, global reach, and maximum returns for sellers.

Differentiate on three core pillars: 1) Global Reach (unmatched buyer access), 2) Technological Superiority (the VB3 platform and data analytics), and 3) Operational Excellence (especially in catastrophe response).

Whitespace Opportunities

- Opportunity:

EV Battery Lifecycle Management Marketplace

Competitive Gap:No established, large-scale marketplace exists for second-life or end-of-life EV batteries. Competitors are just beginning to address the EV salvage challenge.

Feasibility:Medium

Potential Impact:High

Description:Create a dedicated auction or exchange platform for salvaged EV batteries, connecting automotive dismantlers with energy storage startups and recycling firms.

- Opportunity:

Enhanced Services for Independent Dealers and Dismantlers

Competitive Gap:The core focus of Copart and IAA is on serving large insurance companies. Smaller buyers and sellers (dealers, repair shops) often feel underserved, facing complex processes and fees.

Feasibility:High

Potential Impact:Medium

Description:Develop a suite of tools and services (e.g., simplified logistics, floor plan financing integrations, parts locator) tailored to the needs of small-to-medium business buyers to increase loyalty and spend.

- Opportunity:

Platform for Public/No-License-Required Vehicle Sales

Competitive Gap:Access to the best salvage inventory is often restricted to licensed dealers. While brokers exist, a trusted, first-party platform could capture a significant retail/hobbyist market.

Feasibility:Medium

Potential Impact:Medium

Description:Expand the 'No License Required' vehicle segment with a more user-friendly interface, transparent pricing, and educational resources to attract and cater to a broader consumer audience.

Comprehensive Competitive Landscape Analysis: Copart, Inc.

Copart operates within the mature and highly concentrated online salvage vehicle auction industry, which functions as a clear oligopoly. Copart and its primary direct competitor, IAA, Inc. (now part of RB Global), collectively control approximately 80% of the U.S. market, creating formidable barriers to entry for new competitors. These barriers are built on three pillars: massive capital investment in a global network of over 200 physical storage yards, deeply entrenched, high-volume contracts with insurance companies, and the powerful network effect of Copart's proprietary VB3 online auction platform.

Direct Competition: A Two-Horse Race

The competitive dynamic is almost entirely defined by the rivalry between Copart and IAA.

- Copart's Strengths: Copart's primary competitive advantages are its early and aggressive adoption of a 100% online model, its strategic decision to own rather than lease most of its real estate, and its superior catastrophe response logistics. This has translated into a larger global buyer base and a reputation for operational stability, which is highly valued by its core insurance clients.

- IAA's Strengths: IAA competes effectively through its own strong insurance company relationships, a focus on data analytics to maximize seller returns, and a potentially more consistent customer service experience in some areas. Its recent acquisition by Ritchie Bros. (RB Global) could introduce synergies by integrating IAA's vehicle marketplace with RBA's heavy equipment and commercial asset platforms, potentially expanding its buyer base and service offerings.

Indirect Competition and Market Disruptors

While the direct competitive threat is contained, indirect pressures are mounting:

- Wholesale Platforms: Digital-first platforms like ACV Auctions threaten the non-salvage segment of Copart's business by offering a more modern, asset-light, and transparent model for dealer-to-dealer transactions.

- Key Suppliers/Buyers: A significant long-term threat is the potential for backward integration by major buyers like LKQ Corporation. As the largest dismantler and parts recycler, LKQ has the scale and industry relationships to potentially source vehicles directly from insurers, disintermediating the auction platforms.

Strategic Opportunities and Emerging Threats

The most significant industry trend is the rise of Electric Vehicles (EVs). This presents a dual-edged sword: the complexity and high cost of EV repairs will likely increase total-loss frequency, boosting vehicle supply. However, it also demands new competencies in battery handling, valuation, and logistics, creating a new competitive battleground.

Strategic whitespace for Copart lies in leveraging its core assets to enter adjacent markets. The most promising opportunity is establishing a marketplace for EV battery lifecycle management, connecting the automotive salvage world with the burgeoning energy storage and recycling sectors. Furthermore, there is a clear opportunity to improve the user experience for smaller, independent buyers by simplifying fee structures and offering integrated services, addressing a key weakness highlighted in customer sentiment analysis.

In conclusion, Copart holds a powerful, defensible market position. Its primary strategic challenge is not fending off new direct competitors, but rather adapting to technological shifts (EVs, AI-driven inspections) and mitigating the risk of disintermediation from powerful players within its own value chain. Continued investment in its technology platform, international expansion, and strategic moves into EV component remarketing will be critical to sustaining its long-term growth and market leadership.

Messaging

Message Architecture

Key Messages

- Message:

100% Online Auto Auctions Over 4+ Million Used, Wholesale and Repairable Cars, Trucks & SUVs sold per year!

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Banner

- Message:

Register, Find, Bid

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Banner

- Message:

Search our inventory of more than 390,000+ used & repairable vehicles.

Prominence:Secondary

Clarity Score:High

Location:Homepage Hero Banner

- Message:

Copart is a global leader in 100% online car auctions featuring used, wholesale and repairable vehicles.

Prominence:Secondary

Clarity Score:High

Location:Homepage 'What is Copart?' Section

- Message:

Copart car auctions have something for everyone — used car buyers, dismantlers, dealers, body shops and individuals.

Prominence:Tertiary

Clarity Score:High

Location:Homepage 'What is Copart?' Section

The message hierarchy is effective and logical. The primary message focuses on the core offering (100% Online Auctions) and the immense scale (4M+ vehicles sold), immediately establishing credibility and value. This is followed by a simple, action-oriented 3-step process ('Register, Find, Bid') that clarifies the user journey. Secondary messages reinforce the value proposition by highlighting inventory size and market leadership. The hierarchy successfully guides the user from understanding the core concept to taking the first step.

Messaging is highly consistent across the homepage. The core ideas of massive inventory, 100% online auctions, and a simple bidding process are repeated in the hero section, the 'What is Copart?' section, and implicitly through the various inventory category links. The language remains focused on scale, variety, and accessibility.

Brand Voice

Voice Attributes

- Attribute:

Transactional

Strength:Strong

Examples

- •

Register to Start Bidding

- •

View details

- •

Current bid: $7,600.00USD

- •

Search Now

- Attribute:

Authoritative

Strength:Strong

Examples

- •

Copart is a global leader

- •

Over 4+ Million... sold per year!

- •

our massive inventory

- Attribute:

Accessible

Strength:Moderate

Examples

- •

Copart car auctions have something for everyone

- •

We make it easy for Members to find, bid on, and win vehicles

- •

No License Required

- Attribute:

Empowering

Strength:Moderate

Examples

Copart puts the power to bid and win into your hands.

Unlock additional features by upgrading

Tone Analysis

Direct and Informational

Secondary Tones

Action-Oriented

Confident

Tone Shifts

No itemsVoice Consistency Rating

Excellent

Consistency Issues

The brand voice is exceptionally consistent across the entire homepage, maintaining a clear, direct, and authoritative tone that supports its market leader positioning.

Value Proposition Assessment

Gain access to the world's largest online inventory of used, wholesale, and repairable vehicles, with the power to find, bid, and win from anywhere.

Value Proposition Components

- Component:

Unmatched Inventory & Variety

Clarity:Clear

Uniqueness:Unique

Evidence

- •

Over 4+ Million... vehicles sold per year!

- •

inventory of more than 390,000+

- •

Extensive category lists (Automobiles, Trucks, Motorcycles, Classics, Exotics, etc.)

- Component:

100% Online Convenience & Accessibility

Clarity:Clear

Uniqueness:Somewhat Unique

Evidence

- •

100% Online Auto Auctions

- •

Bid on daily auto auctions Monday–Friday

- •

global leader in 100% online car auctions

- Component:

Opportunity for All Buyer Types

Clarity:Clear

Uniqueness:Somewhat Unique

Evidence

something for everyone — used car buyers, dismantlers, dealers, body shops and individuals

'No License Required' vehicles available

- Component:

Global Reach

Clarity:Somewhat Clear

Uniqueness:Unique

Evidence

Copart is a global leader

As a global used car auction company

Copart's primary differentiation is its sheer scale. The messaging effectively uses large numbers ('4+ Million', '390,000+') to create a powerful impression of unparalleled inventory that competitors would find hard to match. While other platforms offer online auctions, Copart positions itself as the definitive 'global leader,' implying more choice, more opportunities, and greater liquidity in the market. The explicit inclusion of individuals and 'No License Required' vehicles also broadens its appeal beyond the purely B2B focus of some competitors.

The messaging positions Copart as the dominant market leader, akin to the 'Amazon' or 'eBay' of salvage auto auctions. It competes not on being a niche or specialty platform, but on being the most comprehensive and largest marketplace. This strategy aims to create a network effect where a massive inventory attracts the most buyers, which in turn attracts more sellers (primarily insurance companies). The messaging is less about the technical features of the auction and more about the outcome: access to an unbeatable selection.

Audience Messaging

Target Personas

- Persona:

Professional Buyers (Dealers, Dismantlers, Body Shops, Exporters)

Tailored Messages

- •

Used, Wholesale and Repairable Cars, Trucks & SUVs

- •

WHOLESALE AUCTIONS (Including Bank-Repo Vehicles)

- •

Premier Membership... For those who plan to buy multiple vehicles on a regular basis.

Effectiveness:Effective

- Persona:

Individual Buyers & Hobbyists

Tailored Messages

- •

something for everyone — ... and individuals.

- •

No License Required vehicles available to individuals in public auto auctions

- •

Classic cars, boats, repo cars, ATVs, exotics, motorcycles and more.

Effectiveness:Somewhat Effective

- Persona:

Vehicle Sellers (Insurance Co., Fleets, etc.)

Tailored Messages

Copart is a global leader in 100% online car auctions featuring used, wholesale and repairable vehicles.

Effectiveness:Ineffective

Audience Pain Points Addressed

- •

Difficulty finding specific types of vehicles or parts (addressed by massive inventory).

- •

Geographic limitations in sourcing vehicles (addressed by 100% online, global model).

- •

Time-consuming process of attending physical auctions (addressed by online convenience).

- •

Lack of access to auctions for non-dealers (addressed by 'No License Required' category).

Audience Aspirations Addressed

- •

Finding a hidden gem or a great deal.

- •

Growing a business (dealership, repair shop) with a reliable source of inventory.

- •

Completing a project car or finding a unique recreational vehicle.

- •

The thrill and empowerment of winning an auction.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Opportunity/Gain

Effectiveness:High

Examples

- •

Bid on daily auto auctions

- •

start bidding in our live auctions!

- •

Copart puts the power to bid and win into your hands.

- Appeal Type:

Excitement/Thrill

Effectiveness:Medium

Examples

jump right into the auction

live online auto auctions every weekday

Social Proof Elements

- Proof Type:

Scale & Numbers

Impact:Strong

Examples

Over 4+ Million Used, Wholesale and Repairable Cars, Trucks & SUVs sold per year!

Search our inventory of more than 390,000+ used & repairable vehicles.

- Proof Type:

Market Leadership

Impact:Strong

Examples

Copart is a global leader in 100% online car auctions

Trust Indicators

- •

Clear, tiered membership options ('Guest', 'Basic', 'Premier') with transparent pricing.

- •

Longevity and established brand presence implied by the scale of operations.

- •

Professional website design and functionality.

Scarcity Urgency Tactics

Display of 'Current bid' on vehicle listings creates a sense of ongoing competition.

Daily auctions ('Monday–Friday') imply that inventory is constantly changing and opportunities are time-sensitive.

Calls To Action

Primary Ctas

- Text:

Register to Start Bidding ›

Location:Homepage Hero Banner

Clarity:Clear

- Text:

REGISTER NOW

Location:Membership Options Section

Clarity:Clear

- Text:

View Inventory

Location:Wholesale Auctions Banner

Clarity:Clear

- Text:

Search Now ›

Location:Vehicle Category Sections

Clarity:Clear

The CTAs are clear, direct, and consistently use action-oriented language ('Register', 'View', 'Search'). The primary CTA, 'Register to Start Bidding', is prominently placed and effectively communicates the main conversion goal. The repetition of registration-focused CTAs reinforces the key step in the user journey. The language is functional and effective for a transactional platform.

Messaging Gaps Analysis

Critical Gaps

Lack of Seller-Focused Messaging: The homepage is almost exclusively focused on the buyer's journey ('Register, Find, Bid'). Since insurance companies and other businesses are the primary source of Copart's inventory, there is a significant gap in messaging that speaks directly to their needs (e.g., maximizing salvage returns, efficient vehicle processing, national coverage). A potential B2B seller visiting the site would not immediately see a clear value proposition for them.

Absence of Trust-Building Testimonials: While large numbers provide social proof of scale, the site lacks qualitative social proof like testimonials or case studies from successful buyers (e.g., a dealer who grew their business, a hobbyist who found a rare car). This is a missed opportunity to build emotional connection and trust.

Contradiction Points

No itemsUnderdeveloped Areas

The 'Why Copart?' Narrative: Beyond being the biggest, the messaging could better articulate the 'why'. For example, explaining how their VB3 auction technology creates a more competitive bidding environment that benefits both buyers (fair market price) and sellers (higher returns). The story of their innovation is present in their corporate materials but not effectively translated into marketing messaging on the homepage.

Explanation of Vehicle Conditions: For new or individual users, terms like 'repairable', 'salvage title', and 'clean title' can be confusing. The messaging assumes a high level of industry knowledge and could benefit from more educational content to lower the barrier to entry for novice buyers.

Messaging Quality

Strengths

- •

Clarity of Purpose: The messaging leaves no doubt about what Copart does. It is a 100% online auction for a massive number of vehicles.

- •

Effective Use of Data for Social Proof: The use of large, specific numbers ('4+ Million', '390,000+') is highly effective at establishing credibility and market dominance.

- •

Simple, Actionable User Journey: The 'Register, Find, Bid' framework is a simple and powerful piece of messaging that clarifies the process for new users.

- •

Strong Value Proposition Communication: The core value of unparalleled selection and access is communicated clearly and consistently.

Weaknesses

- •

Overly Buyer-Centric: The messaging neglects the critical seller audience, which is the engine of the business.

- •

Lacks Emotional Resonance: The voice is highly transactional and authoritative, but it misses opportunities to connect with the passion and excitement of car enthusiasts or the business ambitions of professional buyers.

- •

Assumes High User Knowledge: The website uses industry jargon without sufficient explanation, which may intimidate or confuse potential new customer segments.

Opportunities

- •

Develop a dedicated messaging stream and content section for sellers, highlighting benefits like national logistics, high returns, and data reporting.

- •

Incorporate buyer success stories and testimonials to build community and trust.

- •

Create educational content (e.g., videos, guides) explaining vehicle title types and the auction process to attract and convert a broader, less experienced audience.

- •

Highlight the global nature of the marketplace more explicitly to attract international buyers and showcase the breadth of the network to sellers.

Optimization Roadmap

Priority Improvements

- Area:

Audience Messaging

Recommendation:Create a prominent 'For Sellers' section on the homepage with a clear value proposition addressing insurance, fleet, and financial institutions. This should link to a dedicated landing page detailing services, efficiency, and returns.

Expected Impact:High

- Area:

Persuasion Elements

Recommendation:Integrate a 'Success Stories' or 'Testimonials' section featuring short quotes or videos from different buyer personas (dealer, dismantler, individual) to build trust and emotional appeal.

Expected Impact:Medium

- Area:

Value Proposition Communication

Recommendation:Add a small, accessible educational module or tooltips explaining the difference between 'Salvage', 'Repairable', and 'Clean Title' vehicles to demystify the process for new users.

Expected Impact:Medium

Quick Wins

- •

Add a 'For Sellers' link to the main navigation menu.

- •

In the 'What is Copart?' section, add a sentence specifically mentioning key seller benefits, such as: 'For our seller partners, including major insurance companies, we provide a global marketplace to maximize returns on salvage and used vehicles.'

- •

Change 'Become a Member' CTA to 'See Membership Benefits' to provide more information before asking for a commitment.

Long Term Recommendations

- •

Develop a comprehensive content strategy around educational materials (blogs, videos, webinars) to become a trusted resource for the salvage and used car buying community, thereby lowering customer acquisition costs.

- •

Segment the user experience more clearly after the initial landing page, creating distinct pathways and tailored messaging for 'Professional Buyers' and 'Individual Buyers' to improve relevance and conversion.

- •

Invest in brand storytelling that highlights Copart's technology, global impact, and role in the automotive lifecycle, moving the brand beyond a purely transactional perception.

Copart's strategic messaging is a masterclass in establishing market dominance through clarity, scale, and a direct call to action. The homepage effectively communicates its core value proposition—unparalleled access to a massive online inventory of vehicles—to its primary transactional audience: buyers. The brand voice is authoritative and confident, using large numbers as powerful social proof to reinforce its position as the global leader. The message architecture is logical, guiding potential buyers through a simple 'Register, Find, Bid' journey.

However, this singular focus on the buyer creates a significant strategic messaging gap. Copart's business model is a two-sided marketplace that is critically dependent on sourcing vehicles from sellers, primarily insurance companies. The current messaging completely neglects this audience on the homepage, failing to articulate the value Copart provides to them. This could create a vulnerability if competitors develop more effective B2B marketing aimed at vehicle suppliers.

Furthermore, the messaging is highly rational and transactional, missing opportunities for deeper emotional engagement. By not including testimonials or success stories, it fails to build a sense of community or trust beyond the numbers. While highly effective for experienced, professional buyers, this approach may alienate or intimidate novice individuals, a stated target audience.

To optimize, Copart should evolve its messaging to reflect its true nature as a two-sided marketplace. Creating a dedicated and prominent messaging stream for sellers is the highest priority. Layering in more educational content and qualitative social proof would lower the barrier for new buyers and build a more resilient brand, moving perception from a simple transaction platform to an indispensable partner in the automotive ecosystem.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Dominant Market Position: Copart, along with its main competitor IAA, forms a duopoly, controlling approximately 80% of the U.S. salvage auto auction market.

- •

Massive Scale & Network Effects: Sells over 4 million vehicles annually across a global platform, connecting sellers with nearly one million members in over 190 countries. This scale creates a powerful two-sided network effect where a large inventory attracts a global buyer base, which in turn attracts more vehicle sellers.

- •

Embedded with Key Suppliers: Long-standing, deeply integrated relationships with insurance companies, which are the primary source of high-volume, predictable inventory (total-loss vehicles).

- •

Consistent Financial Performance: Demonstrates consistent revenue growth and high-profit margins, indicating strong, sustained demand for its services.

Improvement Areas

- •

Simplify the onboarding and bidding process for individual and non-professional buyers to expand the retail customer base.

- •

Enhance vehicle information and digital inspection tools to increase buyer confidence and reduce reliance on physical previews.

- •

Develop more sophisticated data and analytics dashboards for large-scale sellers (insurers, fleet managers) to provide deeper insights into salvage value optimization.

Market Dynamics

8% to 17% CAGR globally. Different sources project the global online salvage auction market to grow at a CAGR between 8.1% and 17.55% through 2030-2033.

Mature

Market Trends

- Trend:

Increasing Vehicle Complexity & Repair Costs

Business Impact:Higher repair costs for modern vehicles (with ADAS, complex electronics) lead to higher total loss frequency, increasing the supply of vehicles for Copart's auctions.

- Trend:

Electrification (EVs)

Business Impact:The rise of EVs presents both an opportunity and a challenge. EV accidents, especially those involving battery damage, are more likely to be declared total losses. However, handling, dismantling, and recycling EV batteries requires specialized knowledge and infrastructure.

- Trend:

Digitalization and AI

Business Impact:The shift to 100% online auctions is complete, but further growth depends on leveraging AI for vehicle valuation, optimizing logistics, and enhancing the user experience on platforms like VB3.

- Trend:

Sustainability and Circular Economy

Business Impact:Growing emphasis on vehicle recycling and parts reuse strengthens the business model's value proposition. Copart is a key enabler of the circular economy in the automotive sector.

Excellent. As the market leader in a mature but technologically evolving industry, Copart is perfectly timed to consolidate its position, expand internationally, and capitalize on structural tailwinds like increasing vehicle complexity and electrification.

Business Model Scalability

High

The online platform (VB3) has low variable costs per transaction, allowing for high margin scalability. The primary scaling cost is physical real estate (yards), which is a significant fixed/step cost.

High. Once physical capacity is in place, increased vehicle volume flows through the system with high incremental profit margins, driven by the efficiency of the online auction model.

Scalability Constraints

- •

Physical Yard Capacity: Acquiring and receiving zoning approval for large plots of land near urban centers is the single largest constraint to growth.

- •

Logistics & Transportation: Scaling the network of subhaulers and transport services, especially during catastrophic events (e.g., hurricanes) which cause massive inventory surges.

- •

International Regulatory Complexity: Each new country presents unique challenges in vehicle titling, import/export laws, and business regulations.

Team Readiness

Proven. The executive team has a long track record of successful global expansion, strategic acquisitions, and managing a large, complex organization.

Well-suited for scale, with established operations in multiple countries and a clear corporate structure.

Key Capability Gaps

- •

Data Science & AI: Need to build a world-class team to develop predictive analytics for vehicle valuation, optimize logistics, and personalize the buyer experience.

- •

EV Expertise: Developing in-house expertise on EV battery handling, diagnostics, and valuation will be critical for future market leadership.

- •

Retail Digital Marketing: To capture the B2C market, capabilities in content marketing, social media engagement, and simplified e-commerce funnels need to be strengthened.

Growth Engine

Acquisition Channels

- Channel:

Direct Sales (Sellers)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Deepen integration with insurance carriers' claims processing systems to automate vehicle assignment and data transfer, creating higher switching costs.

- Channel:

Organic Search / SEO (Buyers)

Effectiveness:High

Optimization Potential:High

Recommendation:Create targeted content around high-value niches (EVs, classics, specific rebuild projects) and improve localized SEO for yards to attract a wider range of buyers.

- Channel:

Paid Media (Buyers)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Implement sophisticated B2B paid media campaigns targeting specific buyer personas (dismantlers, exporters, dealers) in high-growth international markets.

- Channel:

Brand & Direct Traffic

Effectiveness:High

Optimization Potential:Low

Recommendation:The brand is a primary driver of traffic due to market leadership. Maintain brand health through consistent service delivery and PR.

Customer Journey

The path from discovery to first bid is relatively clear for industry professionals but can be complex for newcomers due to licensing requirements and a complex fee structure.

Friction Points

- •

State-by-state and international licensing requirements for purchasing certain vehicles.

- •

Inability to physically inspect vehicles for many online buyers.

- •

Complexity of auction fees, storage fees, and transportation costs.

- •

The process of arranging international shipping and export documentation.

Journey Enhancement Priorities

- Area:

Onboarding & Licensing

Recommendation:Develop an interactive tool that clearly guides new users through the specific licensing requirements for their location and desired vehicle types.

- Area:

Vehicle Information

Recommendation:Invest in high-resolution 360-degree interior/exterior video tours and AI-powered damage assessment reports for every vehicle to increase bidding confidence.

- Area:

Logistics & Shipping

Recommendation:Integrate a real-time domestic and international shipping calculator directly into the bidding page to provide 'all-in' cost transparency.

Retention Mechanisms

- Mechanism:

Network Effects (Inventory)

Effectiveness:High

Improvement Opportunity:Continue to secure exclusive contracts with large vehicle suppliers to ensure the most comprehensive inventory, making the platform indispensable for buyers.

- Mechanism:

Membership Model

Effectiveness:Medium

Improvement Opportunity:Introduce a tiered 'Pro' membership with value-added services like advanced analytics, priority support, and discounted fees to increase LTV of high-volume buyers.

- Mechanism:

Deep Seller Integration

Effectiveness:High

Improvement Opportunity:Offer sellers API access and data services that become integral to their own operations, creating a high barrier to switching.

Revenue Economics

Very Strong. The dual-fee model (charging both buyers and sellers) on a massive volume of transactions creates highly profitable and predictable unit economics.

Estimated to be very high. CAC for sellers is the cost of a long B2B sales cycle, but the LTV is massive due to multi-year contracts. CAC for buyers is relatively low (often organic), while LTV for professional buyers (dealers, dismantlers) is substantial over many years.

High. The business model is anti-cyclical, as economic downturns may reduce accidents but increase the need for affordable used cars and parts.

Optimization Recommendations

- •

Develop and monetize premium data/analytics services for sellers.

- •

Introduce dynamic pricing for fees based on vehicle demand, location, and buyer history.

- •

Create ancillary revenue streams such as integrated financing, extended warranties on certain vehicle types, and parts location services.

Scale Barriers

Technical Limitations

- Limitation:

Legacy Technology Stack

Impact:Medium

Solution Approach:Continue phased modernization of the tech stack to enable faster feature development, particularly in AI and mobile, without disrupting core auction functionality.

- Limitation:

Data Infrastructure for AI

Impact:High

Solution Approach:Invest heavily in a unified data platform to ingest and process vast amounts of vehicle, sales, and user data, which is foundational for developing proprietary AI valuation and logistics models.

Operational Bottlenecks

- Bottleneck:

Physical Land Acquisition and Development

Growth Impact:This is the primary constraint on physical growth. It's capital-intensive, slow, and subject to significant regulatory hurdles (zoning).

Resolution Strategy:Establish a dedicated real estate team with expertise in industrial zoning and development. Pursue a strategy of owning land as a long-term competitive advantage.

- Bottleneck:

Catastrophe Event (CAT) Response

Growth Impact:Major weather events like hurricanes create a massive, sudden influx of vehicles, stressing logistics, processing capacity, and personnel.

Resolution Strategy:Develop a 'CAT-as-a-Service' playbook with pre-positioned resources, mobile processing units, and agreements with national logistics partners to rapidly scale capacity in affected regions.

Market Penetration Challenges

- Challenge:

Intense Competition in a Duopoly Market

Severity:Critical

Mitigation Strategy:Compete on technological superiority (better auction platform, more data), superior service for sellers, and the strength of network effects rather than price alone. Target non-insurance sellers more aggressively to diversify supply.

- Challenge:

International Market Adaptation

Severity:Major

Mitigation Strategy:Employ a flexible market entry strategy, using acquisitions, greenfield development, or partnerships based on local market structure. Hire local leadership with deep industry relationships.

Resource Limitations

Talent Gaps

- •

AI/ML Engineers and Data Scientists

- •

EV Battery Specialists and Technicians

- •

International Business Development Managers with local market expertise

Significant and ongoing capital required for land acquisition and development of physical yards globally.

Infrastructure Needs

- •

Expansion of physical yard footprint in key domestic and international hubs.

- •

Investment in specialized equipment for handling and storing EV batteries safely.

- •

Upgrading IT infrastructure to support real-time global auctions and massive data processing.

Growth Opportunities

Market Expansion

- Expansion Vector:

Geographic Expansion (Deepening Presence)

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Focus on gaining significant market share in existing high-potential international markets like Germany and Brazil before entering numerous new ones. This could involve acquiring smaller local competitors.

- Expansion Vector:

Non-Insurance Vehicle Supply

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Scale up dedicated sales and marketing efforts for rental agencies, fleet management companies, and dealerships to increase the volume of non-salvage, higher-value vehicles.

Product Opportunities

- Opportunity:

Data-as-a-Service (DaaS)

Market Demand Evidence:Insurance companies and financial institutions require better data to price risk and value assets. Copart's data is unique and extensive.

Strategic Fit:High

Development Recommendation:Package anonymized data on salvage trends, regional parts demand, and total loss valuation into a subscription-based analytics product for insurance carriers.

- Opportunity:

EV Battery Lifecycle Management

Market Demand Evidence:The surge of end-of-life EVs creates a critical need for battery diagnostics, resale, and recycling solutions.

Strategic Fit:High

Development Recommendation:Develop in-house capabilities or partner with specialized firms to offer EV battery grading, remarketing for secondary use (e.g., energy storage), and certified recycling services.

- Opportunity:

Integrated Logistics and Financial Services

Market Demand Evidence:Buyers, especially international ones, face challenges with shipping and financing. A seamless, integrated solution is a major value-add.

Strategic Fit:Medium

Development Recommendation:Create 'Copart Logistics' and 'Copart Capital' arms, offering buyers one-click shipping quotes and pre-approved financing options at the point of sale.

Channel Diversification

- Channel:

Content Marketing & Community Building

Fit Assessment:Good fit for attracting new B2C and prosumer buyers.

Implementation Strategy:Launch YouTube channels and social media content featuring vehicle rebuilds sourced from Copart auctions. Sponsor automotive influencers and build a community forum for rebuilders to share tips and projects.

Strategic Partnerships

- Partnership Type:

OEM & EV Manufacturer Partnerships

Potential Partners

- •

Tesla

- •

Ford

- •

General Motors

- •

Rivian

Expected Benefits:Become the official, certified partner for end-of-life vehicle processing, especially for complex EVs. Gain access to proprietary diagnostic tools and certified repair networks, enhancing the value of salvaged EVs.

- Partnership Type:

Logistics & Shipping Technology

Potential Partners

- •

Flexport

- •

Kuehne + Nagel

- •

Major freight marketplaces

Expected Benefits:Integrate real-time global shipping quotes and tracking into the Copart platform, simplifying the purchasing process for international buyers and creating a new revenue stream.

Growth Strategy

North Star Metric

Global Units Sold

This metric is the ultimate measure of the health and liquidity of the two-sided marketplace. It reflects success in both acquiring vehicle supply from sellers and meeting the demand from a global buyer base, directly driving top-line revenue.

Target 10-12% YoY growth in global units sold, driven by a combination of international expansion and increased volume from non-insurance sellers.

Growth Model

Network Effect & Physical Expansion Flywheel

Key Drivers

- •

Securing exclusive, high-volume seller contracts (especially insurance).

- •

Expanding the global buyer base to increase bidding competition.

- •

Strategically acquiring and developing physical yard space to increase capacity.

- •

Leveraging technology to improve operational efficiency and auction liquidity.

Sequentially invest in each part of the flywheel. Use capital from efficient operations to fund land acquisition. Use increased physical capacity to win larger seller contracts. Market the increased inventory to attract more global buyers, whose bidding activity increases returns for sellers, reinforcing the cycle.

Prioritized Initiatives

- Initiative:

Launch EV Battery Diagnostics & Remarketing Pilot Program

Expected Impact:High

Implementation Effort:High

Timeframe:12-18 months

First Steps:Establish a dedicated EV team. Partner with an EV battery analytics firm to develop a standardized battery health grading system. Launch a pilot program at 3-5 key locations.

- Initiative:

Develop a Premium Analytics Suite for Insurance Sellers

Expected Impact:High

Implementation Effort:Medium

Timeframe:9-12 months

First Steps:Conduct 'voice of the customer' interviews with top 10 insurance partners to identify key data needs. Build a prototype dashboard focusing on real-time salvage value estimation and cycle time optimization.

- Initiative:

Streamline International Buyer Experience

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:6-9 months

First Steps:Integrate a global logistics partner's API to provide instant, guaranteed shipping quotes. Create a dedicated multi-lingual support team for top international markets.

Experimentation Plan

High Leverage Tests