eScore

costargroup.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

CoStar Group demonstrates exceptional digital presence through its 'house of brands' strategy, with dominant players like LoopNet, Apartments.com, and the rapidly growing Homes.com. This multi-channel approach ensures massive visibility across different real estate segments. Content authority is extremely high, rooted in a proprietary data collection process that has become an industry standard, giving them a powerful data moat.

The company operates a portfolio of the most heavily trafficked marketplaces in distinct real estate verticals (CRE, multifamily, residential), ensuring unparalleled reach and market penetration.

The corporate site should create a centralized 'CoStar Group Intelligence' hub to consolidate thought leadership from its subsidiary brands, elevating the parent company from a holding entity to the definitive source for comprehensive real estate intelligence.

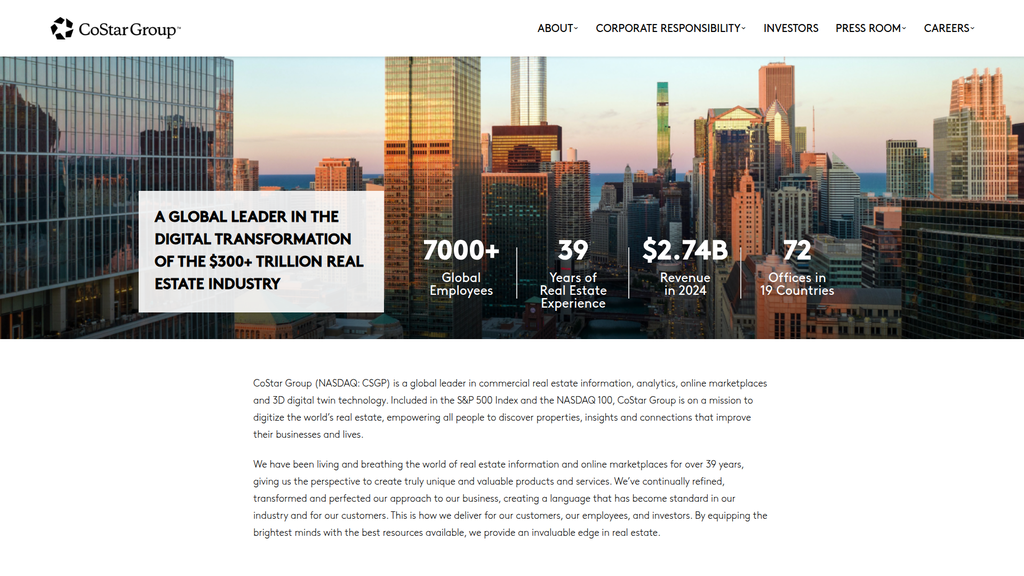

The brand messaging on the corporate site is masterfully tailored to its primary audiences: investors and top-tier talent, effectively communicating market leadership, financial stability, and scale. The messaging architecture is clear, authoritative, and consistent. However, it completely lacks a customer-centric journey, making it difficult for potential business customers to find the right solution within their vast ecosystem.

The value proposition of being the definitive market leader, backed by financial metrics (S&P 500 inclusion) and scale (7000+ employees), is communicated with exceptional clarity and authority.

Incorporate customer voice through testimonials and case studies to substantiate claims of leadership from a user's perspective, moving beyond self-proclaimed authority.

The corporate website's conversion experience is highly optimized for its specific goals: guiding investors, media, and job seekers to relevant information. The information architecture is logical and reduces cognitive load for these target personas. However, the site's CTAs are understated, and it completely fails to convert potential business customers, forcing them to navigate to the appropriate subsidiary brand site on their own.

The information architecture is intuitive for its target corporate audiences, allowing users to self-segment and find financial reports, press releases, or job opportunities with minimal friction.

Add a 'Solutions' or 'For Your Business' section to the main navigation to help potential customers self-segment (e.g., 'Broker,' 'Owner,' 'Lender') and guide them to the relevant brands and services.

CoStar projects immense credibility through its world-class data privacy and security framework, highlighted by a 'Trust Center' and adherence to ISO 27001 and SOC 2 standards. This is counterbalanced by a very high-risk legal posture in antitrust law, with ongoing FTC scrutiny and litigation posing a material threat. While customer success is evident in the performance of its brands, the corporate site lacks direct testimonials or case studies.

Operation of a comprehensive 'Trust Center' that centralizes security, privacy, and compliance documentation, demonstrating transparency and a mature governance framework that builds significant customer trust.

Proactively mitigate the high-severity antitrust risk by conducting an internal review of broker agreements and engaging with regulators to address concerns, which are a major threat to their business model.

CoStar's competitive advantage is exceptionally strong and sustainable, built upon a deep, proprietary data moat that has been developed over decades and is incredibly difficult to replicate. This is fortified by powerful network effects within its marketplaces (LoopNet, Apartments.com) and the financial scale to outspend competitors and make strategic acquisitions like Matterport. High switching costs are evident from customer renewal rates exceeding 90% for core products.

The proprietary database, maintained by over 1,500 researchers, represents a nearly insurmountable data moat that competitors cannot easily or cheaply replicate, making CoStar's information the industry standard.

Fully integrate and weaponize the Matterport acquisition across all marketplace platforms to create a superior, data-rich 3D user experience that would further widen the competitive gap.

The business model is highly scalable, with a primarily fixed-cost structure and high-margin subscription products leading to significant operational leverage. The company has a proven and aggressive M&A strategy for market expansion, recently entering the UK and Australian residential markets. The primary constraint on scalability is the ongoing, capital-intensive 'portal war' with Zillow in the US residential market, which is currently depressing overall profitability.

A highly profitable, recurring subscription-based revenue model in its core commercial business generates substantial free cash flow to fund aggressive expansion into new verticals (residential) and geographies.

Establish a dedicated post-merger integration team and playbook to accelerate synergy realization and technology consolidation from its numerous acquisitions, unlocking value faster.

CoStar's business model is exceptionally coherent, leveraging a profitable core in commercial real estate data to fund strategic expansion into adjacent high-growth markets like residential and 3D visualization. The 'house of brands' strategy allows for focused market penetration, and the entire ecosystem is aligned around the mission of digitizing real estate. The primary strategic challenge is maintaining focus and profitability while waging a costly market share battle in the residential sector.

The model masterfully uses the high-margin, high-retention CoStar Suite as a cash-cow to fund aggressive, strategic entries into new, larger addressable markets, demonstrating excellent resource allocation and strategic focus.

Develop and promote a unified client identity and data API across the portfolio to transition from a 'house of brands' to a truly interconnected ecosystem, which will increase customer stickiness and unlock powerful cross-selling opportunities.

CoStar wields immense market power, holding a dominant, near-monopolistic position in US commercial real estate data, which grants it significant pricing power. It operates the #1 marketplaces in both commercial (LoopNet) and multifamily (Apartments.com) real estate. While it is currently a challenger in the residential space, its aggressive investment has already propelled Homes.com to the #2 position in traffic, demonstrating its ability to influence and shape markets.

Dominant market share in its core commercial data business (estimated over 80%) gives it substantial pricing power and makes its platform indispensable for industry professionals.

Leverage its market power to proactively shape the industry narrative around its legal and competitive battles, framing its value proposition and intellectual property strength more effectively against competitors like Zillow and CREXi.

Business Overview

Business Classification

Information Services & Online Marketplace Platform

Data-as-a-Service (DaaS)

Real Estate Technology (PropTech)

Sub Verticals

- •

Commercial Real Estate Data & Analytics

- •

Online Real Estate Marketplaces (Commercial & Residential)

- •

Hospitality Data & Analytics

- •

Real Estate Portfolio & Lease Management SaaS

Mature

Maturity Indicators

- •

Inclusion in major stock indices (S&P 500, NASDAQ 100).

- •

Over 55 consecutive quarters of double-digit revenue growth.

- •

Established global presence with 72 offices in 19 countries.

- •

Systematic growth-by-acquisition strategy to enter new markets and acquire technology (e.g., Matterport, Domain, Visual Lease).

- •

Significant brand recognition and market leadership in core segments.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

CoStar Suite Subscriptions

Description:Subscription fees from commercial real estate professionals (brokers, owners, lenders, appraisers) for access to a proprietary database of property information, comps, tenant data, and market analytics.

Estimated Importance:Primary

Customer Segment:Commercial Real Estate Professionals

Estimated Margin:High

- Stream Name:

Multifamily Marketplace (Apartments.com)

Description:Advertising and listing fees paid by property managers and owners to market rental properties on the Apartments.com network. This is a significant revenue driver, approaching $1.2 billion annually.

Estimated Importance:Primary

Customer Segment:Multifamily Property Owners & Managers

Estimated Margin:High

- Stream Name:

Commercial Marketplace (LoopNet)

Description:Premium advertising and listing services for brokers and owners to market commercial properties for sale or lease on the leading online marketplace.

Estimated Importance:Secondary

Customer Segment:Commercial Real Estate Professionals

Estimated Margin:High

- Stream Name:

Other Marketplaces & Data Services

Description:Includes revenue from various other brands such as STR (hospitality data), Ten-X (online auction transaction fees), BizBuySell (business-for-sale listings), and Land.com (rural land listings).

Estimated Importance:Secondary

Customer Segment:Varies by brand (Hoteliers, CRE Investors, Business Brokers)

Estimated Margin:Medium-High

- Stream Name:

Residential Marketplace (Homes.com)

Description:Emerging revenue stream based on an agent-friendly advertising model, where agents pay for premium placement and features to connect directly with buyers and sellers. This is a major strategic growth area.

Estimated Importance:Tertiary (Growth)

Customer Segment:Residential Real Estate Agents & Brokers

Estimated Margin:Low (currently in investment phase)

Recurring Revenue Components

- •

Subscription fees for CoStar Suite and other data products

- •

Recurring advertising packages on marketplace platforms (Apartments.com, LoopNet)

- •

SaaS license fees for platforms like CoStar Real Estate Manager

Pricing Strategy

Tiered Subscription & Value-Based Advertising

Premium

Opaque

Pricing Psychology

- •

Value-Based Pricing

- •

Bundling

- •

Exclusive Features

Monetization Assessment

Strengths

- •

Extremely high percentage of recurring subscription revenue (over 95%).

- •

Strong pricing power due to dominant market position in CRE data.

- •

Diversified portfolio of brands catering to different real estate segments.

- •

High customer renewal rates (over 90%) demonstrate product stickiness.

Weaknesses

- •

High price point can be a barrier for smaller, independent real estate professionals.

- •

Heavy investment in the residential sector (Homes.com) is currently compressing overall profit margins.

- •

Complex, multi-brand ecosystem can be difficult for customers to navigate for bundled value.

Opportunities

- •

Successfully monetizing the Homes.com platform with its agent-friendly model to challenge Zillow.

- •

Cross-selling and bundling services across the brand portfolio (e.g., Matterport 3D tours integrated into LoopNet and Homes.com listings).

- •

International expansion through further strategic acquisitions.

- •

Leveraging AI to create premium, predictive analytics subscription tiers.

Threats

- •

Antitrust scrutiny and litigation due to market dominance in the CRE data space.

- •

A significant and prolonged downturn in the commercial or residential real estate markets.

- •

Intense and costly competition from Zillow Group in the residential marketplace.

- •

Disruption from new PropTech startups with lower-cost, niche solutions.

Market Positioning

Market Leader & Industry Standard

Dominant in US Commercial Real Estate Data (estimated over 80%); Challenger in US Residential Marketplaces.

Target Segments

- Segment Name:

Commercial Real Estate Professionals

Description:Brokers, appraisers, lenders, and investors who rely on data for transactions, valuation, and market analysis.

Demographic Factors

Professionals in the CRE industry

Employed by firms of all sizes, from small brokerages to large institutional investors

Psychographic Factors

- •

Data-driven

- •

Risk-averse

- •

Value accuracy and comprehensiveness

- •

Time-sensitive

Behavioral Factors

- •

High daily usage of data platforms

- •

Dependence on platform for workflow

- •

Low price sensitivity for mission-critical data

Pain Points

- •

Inaccurate or outdated property data

- •

Difficulty in finding reliable comparables

- •

Inefficient market research process

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Property Owners & Managers (Multifamily)

Description:Owners and operators of apartment buildings who need to market vacancies and attract qualified tenants.

Demographic Factors

Decision-makers at property management companies

Portfolio managers

Psychographic Factors

- •

Focused on ROI

- •

Concerned with occupancy rates and marketing effectiveness

- •

Value lead generation

Behavioral Factors

Purchase advertising on a recurring basis

Track leasing performance and marketing analytics

Pain Points

- •

High vacancy rates

- •

Inefficient marketing spend

- •

Time-consuming lead management

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Residential Real Estate Agents

Description:A key growth segment being targeted by Homes.com. These are licensed agents who represent buyers and sellers.

Demographic Factors

Licensed real estate professionals

Often work as independent contractors or for brokerages

Psychographic Factors

- •

Entrepreneurial

- •

Relationship-focused

- •

Frustrated with lead-gen models of competitors (e.g., Zillow)

Behavioral Factors

Active on multiple listing services (MLS)

Invest in marketing to build their personal brand

Pain Points

- •

Paying high fees for leads that are shared with other agents

- •

Losing the connection with potential clients on third-party portals

- •

Difficulty differentiating themselves in a crowded market

Fit Assessment:Good (and improving)

Segment Potential:High

Market Differentiation

- Factor:

Proprietary Data & Research Infrastructure

Strength:Strong

Sustainability:Sustainable

- Factor:

Comprehensive Portfolio of Integrated Brands

Strength:Strong

Sustainability:Sustainable

- Factor:

Aggressive and Successful M&A Strategy

Strength:Strong

Sustainability:Sustainable

- Factor:

Financial Strength and Profitability

Strength:Strong

Sustainability:Sustainable

Value Proposition

To digitize the world's real estate, empowering professionals and consumers with comprehensive data, powerful analytics, and efficient online marketplaces to make superior decisions.

Excellent

Key Benefits

- Benefit:

Access to Verified, Comprehensive Data

Importance:Critical

Differentiation:Unique

Proof Elements

- •

Over 1,500 researchers employed to verify data.

- •

Decades of historical data accumulation.

- •

Claims of covering over 6.2 million commercial properties.

- Benefit:

Increased Market Visibility and Lead Generation

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Leadership position of LoopNet and Apartments.com.

- •

Rapid traffic growth on Homes.com.

- •

Claims of over 150 million unique monthly visitors across their network.

- Benefit:

Actionable Analytics and Market Insights

Importance:Important

Differentiation:Somewhat unique

Proof Elements

- •

Suite of analytical tools within CoStar.

- •

Specialized reports from STR for the hospitality sector.

- •

Integration of new technologies like AI and 3D modeling from Matterport.

Unique Selling Points

- Usp:

Unmatched data collection infrastructure combining technology with a large human research team for verification, creating a deep competitive moat.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A 'house of brands' strategy that creates an end-to-end ecosystem covering nearly every asset class and transaction type in real estate.

Sustainability:Long-term

Defensibility:Strong

- Usp:

An 'agent-friendly' value proposition for Homes.com ('Your Listing, Your Lead') that directly counters the primary business model of its main competitor, Zillow.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Uncertainty and risk in high-value real estate transactions due to poor information.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Inefficient marketing of properties for sale, lease, or rent.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Complex lease portfolio management and accounting compliance for corporations.

Severity:Major

Solution Effectiveness:Complete

Value Alignment Assessment

High

The value proposition is exceptionally well-aligned with the needs of the commercial real estate market, where data accuracy and comprehensiveness are paramount. Alignment with the residential market is rapidly increasing through strategic investment and a differentiated model.

High

For its core CRE audience, the alignment is near-perfect. For the emerging residential agent audience, the 'agent-friendly' model is highly aligned with their primary pain points, though brand awareness and adoption are still in a growth phase.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Real estate brokerage firms (e.g., CBRE, JLL)

- •

Multiple Listing Services (MLS)

- •

Property owners and developers

- •

Industry associations

- •

Technology partners

Key Activities

- •

Data Collection, Aggregation, and Verification

- •

Software and Platform Development

- •

Aggressive Sales and Marketing

- •

Strategic Acquisitions and Integration

Key Resources

- •

Proprietary Real Estate Database

- •

Large-scale Human Research Team

- •

Portfolio of High-Equity Brands (CoStar, LoopNet, Apartments.com)

- •

Significant Financial Capital for Investment and M&A

Cost Structure

- •

Salaries and benefits (especially for large research and sales teams)

- •

Sales and Marketing Expenses (significant investment in Homes.com).

- •

Technology Infrastructure and R&D

- •

Acquisition Costs

Swot Analysis

Strengths

- •

Dominant market leader in commercial real estate data with a significant data moat.

- •

Highly profitable, subscription-based recurring revenue model.

- •

Proven ability to acquire and successfully integrate companies.

- •

Strong financial position with substantial cash reserves.

Weaknesses

- •

High dependency on the health of the broader real estate market.

- •

Significant current expenditure on residential marketing is depressing short-term profitability.

- •

Potential for brand dilution or confusion with a large, diverse portfolio of brands.

- •

Relatively low international revenue contribution compared to domestic.

Opportunities

- •

Capture significant market share in the U.S. residential portal market from Zillow.

- •

Further international expansion into untapped or underserved markets.

- •

Leverage recent acquisitions like Matterport to create new, high-margin data products (e.g., digital twins for property management).

- •

Utilize AI and machine learning for more advanced predictive analytics services.

Threats

- •

A protracted and expensive 'portal war' with Zillow could lead to value destruction if unsuccessful.

- •

Increased regulatory and antitrust scrutiny in markets where it holds a dominant position.

- •

Cyclical downturns in real estate affecting transaction volumes and advertising spend.

- •

Emergence of disruptive, low-cost PropTech competitors.

Recommendations

Priority Improvements

- Area:

Cross-Brand Integration & Synergy

Recommendation:Develop a unified client dashboard and data API that allows enterprise customers to seamlessly access analytics and services across CoStar, LoopNet, STR, and Matterport. This will increase stickiness and create powerful network effects.

Expected Impact:High

- Area:

Residential Market Execution

Recommendation:Maintain aggressive marketing for Homes.com to build brand equity, but simultaneously focus on converting traffic into tangible, monetizable value for agents to ensure long-term sustainability against entrenched competitors.

Expected Impact:High

- Area:

International Growth Strategy

Recommendation:Following the acquisition of Domain in Australia, create a repeatable playbook for entering new international markets that combines targeted acquisition with the rollout of core CoStar data and marketplace technologies.

Expected Impact:Medium

Business Model Innovation

- •

Launch a 'CoStar Capital Markets' service that leverages proprietary data to facilitate transactions, potentially taking a small percentage fee, moving beyond pure data/ad sales.

- •

Develop a comprehensive ESG (Environmental, Social, and Governance) data module as a premium subscription, helping investors and corporations assess property portfolios on sustainability metrics.

- •

Utilize the Ten-X auction platform to explore fractional ownership or tokenization of commercial real estate assets, opening up new investment vehicles.

Revenue Diversification

- •

Expand the Matterport SaaS model beyond real estate into adjacent verticals like insurance (claims adjustment), construction (progress monitoring), and retail (store planning).

- •

Create and sell anonymized, aggregated data sets and trend reports to financial institutions, hedge funds, and government entities.

- •

Develop a suite of SaaS-based workflow and CRM tools specifically for residential real estate agents, leveraging the Homes.com brand to drive adoption.

CoStar Group has masterfully executed a strategy of building an impregnable moat in the commercial real estate data sector, which now serves as a highly profitable foundation for aggressive expansion into adjacent markets. Its business model is characterized by high-margin, recurring subscription revenue and a disciplined, yet aggressive, acquisition strategy that systematically consolidates markets and acquires new technologies. The company is at a pivotal strategic inflection point. Its core CRE business is a mature cash cow, while its foray into the residential marketplace with Homes.com represents its most significant growth opportunity and its greatest risk. The 'portal war' against Zillow is a capital-intensive battle for market share that will test CoStar's marketing prowess and ability to execute a differentiated, 'agent-friendly' business model. The success of this evolution from a B2B data powerhouse to a B2C/B2B marketplace giant will define its valuation and growth trajectory for the next decade. The key challenge is to maintain the profitability of its core business while funding this ambitious expansion, all while integrating a growing portfolio of powerful brands into a cohesive and synergistic ecosystem.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Proprietary Data Collection & Aggregation

Impact:High

- Barrier:

Network Effects in Online Marketplaces

Impact:High

- Barrier:

High Capital Requirements for Marketing & R&D

Impact:High

- Barrier:

Brand Recognition and Trust

Impact:Medium

- Barrier:

Technological Infrastructure and Expertise

Impact:Medium

Industry Trends

- Trend:

AI and Predictive Analytics

Impact On Business:Critical for enhancing property valuation, forecasting market trends, and personalizing user experiences. CoStar is actively investing in this area.

Timeline:Immediate

- Trend:

Sustainability and ESG Data Integration

Impact On Business:Growing demand from investors and corporations for ESG metrics on properties creates a new data vertical and a potential revenue stream.

Timeline:Near-term

- Trend:

Immersive 3D/VR Property Tours

Impact On Business:CoStar's acquisition of Matterport positions it as a leader in this trend, which is becoming a standard expectation for property marketing.

Timeline:Immediate

- Trend:

Big Data Consolidation

Impact On Business:The ability to integrate disparate datasets (e.g., property, economic, demographic, climate) provides a more holistic and valuable product, reinforcing CoStar's competitive moat.

Timeline:Near-term

- Trend:

Tokenization and Fractional Ownership

Impact On Business:While still emerging, blockchain-based real estate transactions could disrupt traditional brokerage and data models in the long run.

Timeline:Long-term

Direct Competitors

- →

Moody's Analytics CRE

Market Share Estimate:Significant, but secondary to CoStar in CRE data.

Target Audience Overlap:High

Competitive Positioning:Positions as a risk-management and financial analytics powerhouse, leveraging the Moody's brand for credibility in CRE data.

Strengths

- •

Strong brand reputation in financial analytics and risk assessment.

- •

Acquired and integrated REIS, a long-standing CoStar competitor.

- •

Focus on data partnerships to create a comprehensive data network.

- •

Deep expertise in economic forecasting and credit risk models.

Weaknesses

- •

Less comprehensive property-level data compared to CoStar's extensive field research.

- •

Data is aggregated from partners rather than collected directly, which can impact integration and quality control.

- •

Newer to the integrated CRE platform space, still building market penetration against a deeply entrenched incumbent.

Differentiators

Emphasis on risk analytics and integration with financial modeling tools.

Modular approach allowing users to select applications that fit their workflow.

- →

Zillow Group

Market Share Estimate:Dominant leader in U.S. residential real estate portal traffic.

Target Audience Overlap:High (for Homes.com and Apartments.com)

Competitive Positioning:The premier consumer-facing real estate marketplace, focused on empowering users with data and connecting them to agents.

Strengths

- •

Massive brand recognition and consumer traffic (over 52% traffic share when combined with Trulia).

- •

The 'Zestimate' is a powerful, albeit controversial, user engagement tool.

- •

Long-established network of real estate agents in its Premier Agent program.

- •

Broad portfolio of services including rentals, mortgages, and buying/selling tools.

Weaknesses

- •

Business model relies on selling leads to agents, which CoStar's Homes.com is directly attacking with its 'your-listing, your-lead' model.

- •

Data accuracy can be a concern, particularly with non-MLS listings like FSBOs.

- •

Facing increasing competition and scrutiny over its agent lead generation practices.

Differentiators

- •

Consumer-first brand focus.

- •

Commission-sharing model in certain markets.

- •

Extensive use of user-generated content and reviews.

- →

CREXi

Market Share Estimate:Growing, but significantly smaller than LoopNet.

Target Audience Overlap:High (for LoopNet and Ten-X)

Competitive Positioning:A modern, tech-forward commercial real estate marketplace focused on a superior user experience and transaction management.

Strengths

- •

Praised for its user-friendly interface and modern design.

- •

Offers a suite of transaction management tools directly on the platform.

- •

Strong customer support and more transparent pricing models are often cited.

- •

Growing rapidly and gaining traction with brokers seeking alternatives to CoStar's ecosystem.

Weaknesses

- •

Significantly smaller property inventory and user base compared to LoopNet.

- •

Lacks the deep historical data and analytics of the CoStar platform.

- •

Less brand recognition among established, traditional CRE professionals.

Differentiators

- •

End-to-end transaction management capabilities.

- •

Focus on user experience and technology-driven features.

- •

Different pricing and advertising structure that some users find more favorable.

- →

Yardi Matrix

Market Share Estimate:Strong niche competitor, especially in multifamily.

Target Audience Overlap:Medium

Competitive Positioning:A specialized data provider with deep roots in property management software, offering highly detailed multifamily data.

Strengths

- •

Exceptional depth and accuracy in the multifamily sector, leveraging Yardi's property management software footprint.

- •

Proprietary, objective property rating system (Context®) used by lenders.

- •

Unique data points like tracking all loan types, not just CMBS.

- •

Strong integration with the broader Yardi software ecosystem.

Weaknesses

- •

Less comprehensive coverage across other commercial asset types (office, industrial, retail) compared to CoStar.

- •

User interface is sometimes considered less intuitive than competitors'.

- •

Primarily known as a software company, not a data-first brand like CoStar.

Differentiators

- •

Deep focus on the multifamily asset class.

- •

Direct integration with property management systems, providing unique operational insights.

- •

Patented, standardized property rating system.

Indirect Competitors

- →

Large Brokerage Firms (CBRE, JLL, etc.)

Description:These firms possess vast amounts of proprietary market research and transaction data, which they use for their own brokers and clients. While they are major customers of CoStar, they also compete by providing exclusive in-house analytics.

Threat Level:Medium

Potential For Direct Competition:Low, as productizing their data would conflict with their core brokerage business and put them in direct competition with a key supplier (CoStar).

- →

PropTech Startups

Description:A fragmented but dynamic group of startups focusing on niche data solutions, such as foot traffic analytics, ESG data platforms (e.g., Measurabl), or AI-driven valuation models.

Threat Level:Medium

Potential For Direct Competition:Low individually, but high as a collective force of innovation. CoStar often acquires promising startups to integrate their technology.

- →

Google

Description:Google possesses unparalleled data on location, businesses, and user search intent. An aggressive move into real estate search or analytics could significantly disrupt the market.

Threat Level:Low

Potential For Direct Competition:Medium. Google has the data and resources, but real estate data is complex and requires specialized research, which is outside their current business model.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Proprietary Data Moat

Sustainability Assessment:Highly sustainable. CoStar has invested over $5 billion over 38 years, employing a large research team to build a database that is incredibly difficult and expensive to replicate.

Competitor Replication Difficulty:Hard

- Advantage:

Network Effects

Sustainability Assessment:Highly sustainable. Marketplaces like LoopNet and Apartments.com benefit from a virtuous cycle: more listings attract more searchers, which in turn attracts more listings. This creates a powerful barrier to entry.

Competitor Replication Difficulty:Hard

- Advantage:

Scale and Financial Resources

Sustainability Assessment:Sustainable. As a profitable, publicly-traded company, CoStar has the financial firepower to outspend competitors on marketing (e.g., Homes.com launch), R&D, and strategic acquisitions (e.g., Matterport).

Competitor Replication Difficulty:Hard

- Advantage:

Integrated Brand Portfolio

Sustainability Assessment:Sustainable. Owning leading brands across data (CoStar), marketplaces (LoopNet, Apartments.com), and technology (Matterport) allows for cross-selling and data integration that standalone competitors cannot match.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'First-Mover in New Data Verticals', 'estimated_duration': '2-3 Years. Being the first to market with comprehensive ESG data or other new analytics provides a temporary lead until competitors can catch up or new niche players emerge.'}

Disadvantages

- Disadvantage:

High Product Cost and Rigid Contracts

Impact:Major

Addressability:Moderately. This pricing strategy creates an opening for lower-cost, more flexible competitors like CREXi to gain a foothold with smaller firms and independent brokers.

- Disadvantage:

Antitrust and Regulatory Scrutiny

Impact:Major

Addressability:Difficult. CoStar's dominant market share has led to legal challenges and could constrain future acquisitions of direct competitors.

- Disadvantage:

Customer Sentiment

Impact:Minor

Addressability:Moderately. There is a perception in the industry of CoStar as an aggressive monopolist, which can lead to customer frustration and a willingness to try alternative platforms.

Strategic Recommendations

Quick Wins

- Recommendation:

Launch Targeted Campaigns Highlighting Data Verification

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Prominently Feature Matterport 3D Tours on Homes.com Listings

Expected Impact:High

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Develop a "CoStar Lite" Subscription Tier

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Build out a comprehensive ESG data module for CoStar Suite

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Deepen Integration Between STR (Hospitality) Data and CoStar (CRE) Data

Expected Impact:Medium

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Expand aggressively into international markets through strategic acquisitions of leading local platforms.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Invest in AI to create a predictive analytics engine for residential real estate on Homes.com, providing agents a unique value proposition over Zillow.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Explore providing anonymized data APIs to foster a developer ecosystem, increasing the stickiness of CoStar's data.

Expected Impact:High

Implementation Difficulty:Difficult

Solidify its position as the indispensable, high-fidelity 'Bloomberg of Real Estate,' providing the foundational data, analytics, and marketplaces that power the entire global real estate ecosystem, from institutional capital to individual agents and consumers.

Differentiate on the unparalleled depth, accuracy, and verification of its proprietary data, combined with a seamlessly integrated, end-to-end platform that spans all asset classes and services (analytics, marketplaces, 3D visualization).

Whitespace Opportunities

- Opportunity:

Standardized ESG Data Platform for Commercial Real Estate

Competitive Gap:The market currently lacks a single, trusted source for comprehensive ESG and climate risk data at the property level. This is a natural extension of CoStar's data collection capabilities.

Feasibility:High

Potential Impact:High

- Opportunity:

AI-Powered Predictive Analytics for Residential Agents

Competitive Gap:Zillow and Realtor.com primarily serve leads. Homes.com could offer agents sophisticated, CoStar-powered predictive tools (e.g., neighborhood appreciation forecasts, optimal pricing models) as a key differentiator.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Small-to-Medium Business (SMB) CRE Solutions

Competitive Gap:Many smaller investors and businesses are priced out of CoStar's institutional-grade products. A scaled-down, more affordable offering could capture this underserved market segment currently targeted by CREXi.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Construction & Development Lifecycle Data

Competitive Gap:There is an opportunity to provide deeper data and analytics for the pre-development phase, including land valuation, entitlement tracking, and construction cost data, integrating it with their existing Land.com marketplace.

Feasibility:Medium

Potential Impact:Medium

CoStar Group commands a formidable position in the real estate technology and data industry, anchored by a nearly unassailable competitive moat in the North American commercial real estate (CRE) data sector. This dominance, built over decades of meticulous data collection and strategic acquisitions, generates the substantial cash flow necessary to fund an aggressive expansion strategy into adjacent markets. The competitive landscape must be viewed not as a single battlefield, but as a multi-front war that CoStar is waging from its fortified core.

In its primary CRE data market, CoStar faces credible competition from players like Moody's Analytics, but its proprietary, field-researched dataset provides a significant quality and depth advantage that is difficult for competitors to overcome. In the CRE marketplace segment, LoopNet's incumbency and network effects are challenged by more modern, agile platforms like CREXi, which compete on user experience and pricing. However, CoStar's biggest and most capital-intensive battle is in the U.S. residential portal space. With its brand Homes.com, CoStar is challenging the established oligopoly of Zillow and Realtor.com. Instead of competing on the same business model, CoStar is attempting to disrupt the market with an agent-friendly, 'your-listing, your-lead' proposition, a direct attack on Zillow's primary revenue stream. This is a high-stakes, high-spend endeavor, but one that leverages CoStar's core competency in building valuable information platforms.

CoStar's overarching strategy is one of integration and ecosystem dominance. The acquisition of Matterport for 3D tours, STR for hospitality data, and numerous other platforms is designed to create a comprehensive, interconnected suite of services that is indispensable to real estate professionals across all asset classes. Emerging trends like the demand for ESG data present a natural growth vector that aligns perfectly with their core business. While facing challenges from antitrust scrutiny and customer resentment over pricing, CoStar's fundamental competitive advantages—its proprietary data, network effects, and financial scale—remain robust and sustainable, positioning it to continue shaping the digital transformation of the real estate industry globally.

Messaging

Message Architecture

Key Messages

- Message:

A Global Leader in the Digital Transformation of the $300+ Trillion Real Estate Industry.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Banner

- Message:

We are digitizing the world's real estate, empowering all people to discover properties, insights, and connections that improve their businesses and lives.

Prominence:Secondary

Clarity Score:High

Location:Homepage, About Us Page

- Message:

CoStar Group is a portfolio of leading brands covering all aspects of real estate.

Prominence:Secondary

Clarity Score:High

Location:Homepage 'Our Brands' section

- Message:

CoStar Group is a high-growth, financially sound company included in the S&P 500 and NASDAQ 100.

Prominence:Tertiary

Clarity Score:High

Location:Homepage, Press Releases

The messaging hierarchy is clear and effective. It immediately establishes market dominance and scale ('Global Leader'), followed by a mission-driven purpose ('digitizing the world's real estate'). This is supported by tangible proof points in the form of a diverse and powerful portfolio of market-leading brands. The structure logically serves the primary audiences of investors and potential employees by emphasizing stability, market leadership, and vision.

Messaging is highly consistent across the analyzed pages. The core mission statement is repeated verbatim, and the theme of market leadership, data authority, and comprehensive industry coverage is reinforced through headlines, body copy, and news updates. This creates a unified and credible corporate narrative.

Brand Voice

Voice Attributes

- Attribute:

Authoritative

Strength:Strong

Examples

- •

A Global Leader...

- •

We’ve continually refined, transformed and perfected our approach...

- •

...creating a language that has become standard in our industry...

- Attribute:

Corporate

Strength:Strong

Examples

- •

CoStar Group (NASDAQ: CSGP) is a global leader in commercial real estate information, analytics, online marketplaces...

- •

Included in the S&P 500 Index and the NASDAQ 100...

- •

Board Approves Stock Repurchase Program

- Attribute:

Confident

Strength:Strong

Examples

- •

The most comprehensive platform...

- •

The #1 global commercial real estate marketplace...

- •

The global leader in hospitality data benchmarking

- Attribute:

Data-Driven

Strength:Moderate

Examples

- •

7000 Global Employees

- •

$2.74 Revenue in 2024

- •

72 Offices in 19 Countries

- •

...information, analytics and online marketplaces...

Tone Analysis

Formal & Professional

Secondary Tones

Aspirational

Declarative

Tone Shifts

The tone shifts slightly from corporate/declarative on the homepage to a slightly more narrative and historical tone on the 'About Us' page ('Since 1986, our work has kept the customer at the center...').

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

For investors and talent, CoStar Group is the definitive market leader in real estate digitization, offering unparalleled stability, growth, and industry-wide impact through its comprehensive portfolio of data, analytics, and marketplace brands.

Value Proposition Components

- Component:

Market Dominance

Clarity:Clear

Uniqueness:Unique

Description:Positioning as the '#1', 'largest', or 'leading' platform across multiple real estate sectors.

- Component:

Comprehensive Data & Analytics

Clarity:Clear

Uniqueness:Somewhat Unique

Description:Providing the foundational 'language' and data that the industry trusts.

- Component:

Breadth of Portfolio (House of Brands)

Clarity:Clear

Uniqueness:Unique

Description:Owning top-tier brands across commercial, residential, hospitality, land, and technology sectors.

- Component:

Financial Strength & Stability

Clarity:Clear

Uniqueness:Somewhat Unique

Description:Highlighting revenue, NASDAQ/S&P 500 inclusion, and consistent growth.

CoStar Group effectively differentiates itself through scale and scope. The 'house of brands' strategy is its most powerful differentiator; competitors may challenge one brand (e.g., Zillow vs. Homes.com), but few can match the entire portfolio's reach across all property types. The message that they 'created a language that has become standard' powerfully positions them not just as a participant, but as a foundational pillar of the industry.

The messaging positions CoStar Group as an incumbent institutional powerhouse, the established standard for real estate data and marketplaces. It frames the company as a safe, reliable, and dominant force, appealing to investors and enterprise clients seeking stability and comprehensive solutions.

Audience Messaging

Target Personas

- Persona:

Investors & Financial Analysts

Tailored Messages

- •

Included in the S&P 500 Index and the NASDAQ 100

- •

Revenue in 2024

- •

CoStar Group 2024 Full Year Revenue Increased 11% Year-over-Year

- •

Links to 'Investors' section with stock info, filings, etc.

Effectiveness:Effective

- Persona:

Potential Employees / Talent

Tailored Messages

- •

7000 Global Employees

- •

CoStar Group Named One of America’s Best Large Employers by Forbes

- •

Learn about opportunities at CoStar Group.

- •

VIEW JOBS

- •

Links to Culture, Community, and DEI

Effectiveness:Effective

- Persona:

Corporate Partners & Media

Tailored Messages

- •

Press Room

- •

CoStar Group Acquires Ag-Analytics...

- •

Leadership profiles and corporate responsibility sections.

Effectiveness:Somewhat

Audience Pain Points Addressed

For Investors: Market volatility and investment risk (addressed by highlighting financial stability, growth, and market leadership).

For Talent: Career instability (addressed by showcasing scale, longevity, and 'Best Employer' awards).

Audience Aspirations Addressed

For Investors: Desire for high-growth, market-defining investments.

For Talent: Aspiration to work for a respected industry leader with global opportunities.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Authority/Trust

Effectiveness:High

Examples

- •

Included in the S&P 500 Index and the NASDAQ 100

- •

39 Years of Real Estate Experience

- •

creating a language that has become standard in our industry...

- Appeal Type:

Ambition/Success

Effectiveness:Medium

Examples

empowering all people to discover properties, insights, and connections that improve their businesses and lives

we provide an invaluable edge in real estate

Social Proof Elements

- Proof Type:

Metrics of Scale

Impact:Strong

Description:Displaying large numbers like '7000 Global Employees', '$2.74 Revenue', and '72 Offices' to demonstrate size and stability.

- Proof Type:

Awards & Recognition

Impact:Moderate

Description:Mentioning inclusion in the S&P 500/NASDAQ 100 and being named a 'Best Large Employer by Forbes'.

- Proof Type:

Market Leadership Claims

Impact:Strong

Description:Repeatedly using terms like '#1', 'largest', 'leading', and 'most comprehensive' for its various brands.

Trust Indicators

- •

Longevity ('Since 1986')

- •

Publicly traded status (NASDAQ: CSGP)

- •

Prominent display of financial news and press releases

- •

Physical office locations and HQ details

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

VIEW JOBS

Location:Homepage, mid-section

Clarity:Clear

- Text:

Read more

Location:News and Press Room sections

Clarity:Clear

- Text:

View All

Location:Brands section

Clarity:Clear

The CTAs are clear and functional but are narrowly focused on talent acquisition and information dissemination (news). For the primary audience of investors and potential employees, they are effective. However, the site lacks any significant business development or lead generation CTAs. There is no clear pathway for a potential customer to engage, forcing them to know which specific sub-brand they need and navigate there independently.

Messaging Gaps Analysis

Critical Gaps

Absence of a customer-centric journey. The site excels at telling you who CoStar Group is but fails to guide a potential customer to the right solution within its vast ecosystem. There is no 'Solutions' or 'Products' entry point in the main navigation.

Lack of customer voice. The site uses self-proclaimed titles ('#1', 'leader') but features no customer testimonials, case studies, or success stories to substantiate these claims from a user's perspective.

Contradiction Points

The mission statement 'empowering all people' suggests a broad, almost consumer-level focus, which contrasts with the website's overwhelmingly corporate, investor-focused, and B2B tone and content.

Underdeveloped Areas

Storytelling. The messaging is very declarative and data-focused. There is an opportunity to build a more compelling narrative around how CoStar Group's digitization has transformed businesses or improved lives, moving beyond statistics to stories.

Benefit-oriented language. The messaging is feature-heavy (e.g., 'information, analytics, online marketplaces'). It could be strengthened by translating these features into tangible benefits for different customer segments.

Messaging Quality

Strengths

- •

Excellent at establishing credibility and authority.

- •

Clearly communicates financial strength and market leadership to an investor audience.

- •

Effectively showcases the impressive breadth of its brand portfolio.

Weaknesses

- •

Overly corporate and impersonal tone, lacking emotional connection.

- •

Fails to address the needs or journey of a potential business customer.

- •

Over-reliance on self-proclaimed authority without third-party validation (testimonials, case studies).

Opportunities

- •

Humanize the brand by featuring stories of customer success or employee impact.

- •

Create a 'Solutions Finder' or guided pathway to help potential customers navigate the brand portfolio.

- •

Develop content that explains the synergistic value of the combined portfolio, rather than just listing the brands.

Optimization Roadmap

Priority Improvements

- Area:

User Journey & Navigation

Recommendation:Add a 'Solutions' or 'For Your Business' tab to the main navigation. This section should help users self-segment (e.g., 'I am a Broker', 'I am an Owner', 'I am a Lender') and guide them to the relevant brands and services.

Expected Impact:High

- Area:

Social Proof & Storytelling

Recommendation:Incorporate a 'Customer Stories' or 'Case Studies' section featuring recognizable clients. Showcase tangible results and testimonials to add a layer of human-centered proof to the claims of leadership.

Expected Impact:High

- Area:

Value Proposition Messaging

Recommendation:Translate the core value proposition for a customer audience. Create a messaging block on the homepage that answers 'How CoStar Group helps your business succeed' with benefit-driven language.

Expected Impact:Medium

Quick Wins

- •

Re-label the 'Brands' section in the navigation to 'Our Brands & Solutions' to better signal its purpose to potential customers.

- •

Add logos of key customers (with permission) to the homepage to act as immediate social proof.

- •

Change generic 'Read More' CTAs on key announcements to be more action-oriented, such as 'See the Financials' or 'Explore the Acquisition'.

Long Term Recommendations

- •

Develop an integrated brand narrative that explains how the different brands in the portfolio work together to create a unique, compounding value for customers.

- •

Conduct persona research for key customer segments (beyond investors/employees) to tailor messaging and content specifically to their pain points and aspirations.

- •

Rethink the corporate site's primary goal. While it serves investors and talent well, it has the potential to become a powerful, top-of-funnel business development tool for the entire brand ecosystem.

CoStar Group's corporate website is a masterclass in messaging for an investor and talent acquisition audience. The communication strategy is executed with precision, establishing undeniable authority, financial strength, and market dominance. The message architecture is logical, the brand voice is consistent, and the use of data as social proof is highly effective. The site successfully positions CoStar Group as a blue-chip leader in the real estate technology sector.

However, the strategy reveals a significant gap when viewed through the lens of customer acquisition. The website functions as a corporate holding page, not a business development engine. It speaks about its brands but does not actively sell through them or guide potential customers to them. The messaging is entirely inward-looking, focused on the company's own achievements and statistics, rather than on the customer's problems and potential solutions. There is a stark absence of customer voice, storytelling, or a clear user journey for anyone who might want to procure CoStar Group's services.

While this may be a deliberate strategic choice to keep the corporate site separate from the consumer- and business-facing brands, it represents a missed opportunity. The site could be leveraged to build a more holistic brand narrative, demonstrate the synergistic value of its portfolio, and serve as a powerful entry point that directs high-value enterprise leads to the appropriate solution within its ecosystem. The key strategic shift required is to evolve the messaging from 'Here is who we are' to 'Here is how we help you win.'

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Market leadership across multiple real estate verticals: CoStar (CRE data), LoopNet (#1 CRE marketplace), Apartments.com (#1 multifamily network), and Homes.com (#2 US residential marketplace).

- •

Consistent double-digit revenue growth for 55 consecutive quarters, with $2.74B revenue in 2024.

- •

Inclusion in S&P 500 and NASDAQ 100 indices, signifying market stability and scale.

- •

High subscription renewal rates (over 90%) for core data products, indicating deep integration into customer workflows.

- •

Aggressive and successful M&A strategy (e.g., Matterport, OnTheMarket, Domain) to acquire technology and market share.

Improvement Areas

- •

Develop a more unified user experience and data fabric across the portfolio of acquired brands.

- •

Strengthen the value proposition of Homes.com to effectively compete with Zillow's entrenched network effects.

- •

Enhance integration of Matterport's 3D digital twin technology across all relevant marketplace platforms to create a unified, immersive experience.

Market Dynamics

11-16% CAGR for the global PropTech market.

Growing

Market Trends

- Trend:

AI & Big Data Analytics in Real Estate

Business Impact:Massive opportunity to leverage CoStar's proprietary dataset for predictive analytics, automated valuation models (AVMs), and market forecasting, creating a significant competitive moat.

- Trend:

Digital Twins and Immersive Virtual Tours

Business Impact:The acquisition of Matterport positions CoStar to lead this trend, enhancing user engagement and enabling remote property exploration.

- Trend:

Sustainability and ESG Data

Business Impact:Growing demand for data on building energy efficiency and sustainability presents a new data product opportunity.

- Trend:

Marketplace Consolidation

Business Impact:CoStar is a primary driver of this trend; continued M&A can accelerate market entry and eliminate competition, but also attracts regulatory scrutiny.

Excellent. The real estate industry is accelerating its adoption of technology, moving from intuition-based to data-driven decision-making. CoStar is well-positioned as the established data leader to capitalize on this secular shift.

Business Model Scalability

High

Primarily fixed-cost model based on data and software assets, leading to high gross margins (approx. 80%) and significant operational leverage as subscriber base grows.

High. The marginal cost of adding a new software/data subscriber is low. Revenue growth should outpace expense growth, although this is currently diluted by heavy investment in residential.

Scalability Constraints

- •

Dependence on a large research team (1,500+ researchers) for data collection and verification, which scales linearly with market coverage.

- •

High sales and marketing spend required to enter and compete in new markets, particularly the residential space ($900M+ investment).

- •

Integration complexity and costs associated with a serial acquisition strategy.

Team Readiness

Proven and aggressive leadership with a 39-year track record of growth and successful capital allocation, particularly in M&A.

A 'House of Brands' structure that allows for focused execution in different market segments, but may create silos and hinder cross-platform synergy.

Key Capability Gaps

- •

Cross-brand integration and product management to unify the customer experience across the portfolio.

- •

Deep expertise in consumer-facing product development and marketing to effectively challenge established B2C players like Zillow.

- •

International market development teams to accelerate global expansion beyond acquisitions.

Growth Engine

Acquisition Channels

- Channel:

Enterprise & Field Sales (CoStar, LoopNet)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Develop bundled subscription packages that include services from newly acquired brands (e.g., Matterport scans, STR data) to increase average contract value (ACV).

- Channel:

Brand Marketing & SEO (Apartments.com, Homes.com)

Effectiveness:Medium-High

Optimization Potential:High

Recommendation:Shift Homes.com marketing from pure brand awareness (e.g., Super Bowl ads) to performance marketing focused on organic traffic and user retention to improve ROI, as over 50% of its traffic is from paid search.

- Channel:

Mergers & Acquisitions

Effectiveness:High

Optimization Potential:High

Recommendation:Establish a dedicated post-merger integration team to accelerate synergy realization and technology stack consolidation from acquisitions like Matterport and Domain.

Customer Journey

Varies significantly by brand. B2B (CoStar) is a long, sales-led cycle. B2C (Apartments.com, Homes.com) is a self-service, marketplace-driven path.

Friction Points

- •

Lack of a single sign-on or unified identity across the CoStar brand portfolio, forcing users to manage multiple accounts.

- •

Navigating between different platforms (e.g., from LoopNet for purchase to CoStar for data) can be disjointed.

- •

Onboarding for complex data products can be a barrier for smaller customers.

Journey Enhancement Priorities

{'area': 'Cross-Platform Integration', 'recommendation': "Develop a unified 'CoStar Passport' identity system to enable seamless navigation and data sharing between brands."}

{'area': 'Personalization', 'recommendation': 'Leverage data from one service (e.g., a user searching for multifamily properties on LoopNet) to personalize content and listings on another (e.g., STR data for hospitality trends in that area).'}

Retention Mechanisms

- Mechanism:

High Switching Costs (Data Products)

Effectiveness:High

Improvement Opportunity:Embed CoStar data deeper into customer workflows via APIs and integrations with other essential real estate software (CRM, accounting).

- Mechanism:

Marketplace Network Effects (Listing Sites)

Effectiveness:High

Improvement Opportunity:Supercharge network effects by integrating Matterport's superior virtual tours as a default feature, making listings more valuable and attracting more buyers.

- Mechanism:

Proprietary Data Moat

Effectiveness:High

Improvement Opportunity:Continuously expand the breadth and depth of data collection into new areas like ESG, construction materials, and hyper-local economic indicators to stay ahead of competitors.

Revenue Economics

Strong for mature B2B segments (CoStar, Multifamily) with high margins. Currently weak/negative for the residential segment due to massive investment cycle.

Likely high (>5x) for established B2B subscription products. Substantially lower (<1x currently) for the high-growth, high-spend residential segment.

Good. Demonstrates consistent double-digit growth, but profitability has been impacted by heavy reinvestment, leading to recent net income declines.

Optimization Recommendations

- •

Monetize the Homes.com platform via its agent-friendly 'Your Listing, Your Lead' model to begin generating returns on the significant marketing investment.

- •

Create new, high-margin revenue streams by productizing data analytics and insights derived from the massive spatial data library acquired with Matterport.

- •

Focus on international revenue growth, which grew 53% but still represents a small portion of total revenue, offering significant upside.

Scale Barriers

Technical Limitations

- Limitation:

Disparate Technology Stacks

Impact:High

Solution Approach:Invest in a multi-year platform engineering initiative to create a common data infrastructure and API layer across the portfolio to enable seamless data flow and product integration.

- Limitation:

Scaling AI and Data Processing

Impact:Medium

Solution Approach:Continue investing heavily in cloud infrastructure and MLOps to efficiently process and derive insights from the growing trove of data, especially Matterport's spatial data.

Operational Bottlenecks

- Bottleneck:

Post-Merger Integration

Growth Impact:Slows down synergy realization and can lead to cultural clashes and talent attrition.

Resolution Strategy:Create a standing, senior-level corporate development team focused exclusively on executing a standardized playbook for integrating acquired companies.

- Bottleneck:

Manual Data Verification at Scale

Growth Impact:Limits the speed of international expansion and increases operational costs.

Resolution Strategy:Accelerate investment in AI/ML tools to automate aspects of data ingestion, verification, and anomaly detection, freeing up human researchers for higher-value tasks.

Market Penetration Challenges

- Challenge:

Intense Competition in US Residential

Severity:Critical

Mitigation Strategy:Continue to differentiate Homes.com with its 'agent-friendly' business model and superior user experience powered by Matterport, while executing a multi-year marketing plan to build an organic traffic moat.

- Challenge:

Antitrust and Regulatory Scrutiny

Severity:Major

Mitigation Strategy:Proactively engage with regulators and highlight pro-competitive aspects of acquisitions. Diversify growth strategy to include more organic product development and international expansion alongside M&A.

- Challenge:

Slower Tech Adoption in CRE

Severity:Minor

Mitigation Strategy:Focus on customer education and demonstrate clear ROI through case studies. Develop tiered product offerings to ease smaller, less tech-savvy firms into the ecosystem.

Resource Limitations

Talent Gaps

- •

AI/ML and Computer Vision specialists to exploit the Matterport spatial data library.

- •

Consumer product managers with experience building and scaling B2C marketplaces.

- •

International business development and localization experts.

Low. The company is well-capitalized with a strong balance sheet and free cash flow from mature segments to fund growth initiatives.

Infrastructure Needs

A unified global data center and cloud strategy to support the combined needs of all brands.

Advanced data governance and security infrastructure to manage a growing and highly valuable dataset.

Growth Opportunities

Market Expansion

- Expansion Vector:

International Residential Marketplaces

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Use the recent acquisitions of OnTheMarket (UK) and Domain (Australia) as a playbook for entering other high-value international residential markets through strategic M&A.

- Expansion Vector:

Deeper Penetration in Continental Europe

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Expand beyond existing footholds in Germany (THOMAS DAILY) and France (Bureaux Locaux) through targeted acquisitions and organic sales team growth in key markets like Spain and the Netherlands.

- Expansion Vector:

Adjacent Data Verticals

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Leverage the Land.com and Ag-Analytics acquisitions to expand into agriculture technology data services. Explore expansion into construction and insurance data verticals.

Product Opportunities

- Opportunity:

AI-Powered Property Intelligence Platform

Market Demand Evidence:Surging industry demand for predictive analytics, automated valuation, and risk assessment.

Strategic Fit:Core to the business; leverages CoStar's data moat and Matterport's spatial data.

Development Recommendation:Create a dedicated R&D group to build a generative AI solution that can answer complex queries about properties and markets by synthesizing data from across the entire CoStar ecosystem.

- Opportunity:

Integrated Transaction and Fintech Services

Market Demand Evidence:Competitors like Zillow are moving into mortgage and closing services, indicating market demand for integrated transaction platforms.

Strategic Fit:Logical extension of the marketplace business model, capturing more value from each transaction.

Development Recommendation:Begin by partnering with fintech providers to offer services like mortgage pre-qualification and insurance quotes within marketplace listings, with a long-term view to potentially acquire or build these capabilities.

- Opportunity:

Digital Twin for Property Management

Market Demand Evidence:Growing adoption of smart building technology and demand for operational efficiency.

Strategic Fit:Leverages Matterport's core technology and CoStar's existing relationships with property owners and managers.

Development Recommendation:Develop a subscription service for property managers that uses the Matterport digital twin as a platform for facility management, predictive maintenance, and space planning.

Channel Diversification

- Channel:

Data as a Service (DaaS) API

Fit Assessment:Excellent

Implementation Strategy:Develop and market a robust API that allows enterprise customers (e.g., financial institutions, hedge funds, insurers) to stream CoStar's proprietary data directly into their own models and platforms for a recurring fee.

- Channel:

Government & Urban Planning Sector

Fit Assessment:Good

Implementation Strategy:Create a dedicated public sector sales team to package data and analytics solutions for municipalities, economic development agencies, and transit authorities.

Strategic Partnerships

- Partnership Type:

Smart Building / IoT Platform Integrations

Potential Partners

- •

Johnson Controls

- •

Siemens

- •

Schneider Electric

Expected Benefits:Enrich CoStar's property data with real-time operational data (e.g., energy usage, occupancy), enabling new analytics products for property management and ESG reporting.

- Partnership Type:

Financial Services Data Providers

Potential Partners

- •

Bloomberg

- •

Refinitiv

- •

Moody's Analytics

Expected Benefits:Co-develop analytics products that link commercial real estate performance with broader financial market trends, creating new subscription services for institutional investors.

Growth Strategy

North Star Metric

Weekly Active Cross-Platform Users

This metric shifts focus from siloed brand performance to the overall ecosystem value. It measures user engagement and the success of cross-selling and integration efforts, which is critical for realizing the full potential of the 'House of Brands' strategy.

Increase by 20% annually by creating unified user profiles and promoting cross-brand discovery.

Growth Model

Hybrid: M&A-Led Expansion + Marketplace Network Effects

Key Drivers

- •

Strategic acquisitions to enter new markets and acquire technology.

- •

Aggressive marketing spend to build brand awareness and drive initial traffic to new marketplaces.

- •

Superior product experience (data depth, immersive tours) to convert traffic into engaged users and build network effects.

- •

Enterprise sales force to monetize data and analytics products.

Continue the disciplined M&A strategy to acquire #1 or #2 players in target markets. Follow acquisitions with a heavy, centralized marketing blitz to scale the brand. Simultaneously, leverage the central data/tech platform to enhance the acquired product and integrate it into the CoStar ecosystem.

Prioritized Initiatives

- Initiative:

Full Matterport Technology Integration

Expected Impact:High

Implementation Effort:High

Timeframe:12-24 months

First Steps:Launch a pilot program to make Matterport 3D tours a free, standard feature on a subset of Homes.com and LoopNet premium listings to measure the lift in user engagement and leads.

- Initiative:

Launch Residential Marketplace in the UK

Expected Impact:High

Implementation Effort:Medium

Timeframe:9-18 months

First Steps:Leverage the OnTheMarket acquisition to introduce the Homes.com 'Your Listing, Your Lead' business model as a competitive alternative to existing UK portals. Begin by building the brand with a targeted digital marketing campaign.

- Initiative:

Develop Enterprise DaaS API Offering

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:12 months

First Steps:Identify the top 10 most requested data sets from institutional clients and package them into a beta API product. Offer it to a select group of existing high-value customers to gather feedback and refine the offering.

Experimentation Plan

High Leverage Tests

{'test': 'Bundled Subscription Tiers', 'hypothesis': "Offering a 'CoStar Pro Plus' subscription that bundles CoStar data with STR hospitality reports and a set number of Matterport scans will increase ACV by over 15%."}

{'test': 'Dynamic Pricing for Marketplace Listings', 'hypothesis': 'Using AI to dynamically price premium placements on LoopNet based on real-time supply and demand for certain property types/locations will increase marketplace revenue by 10%.'}

Utilize an A/B testing framework to measure impact on key metrics: Average Revenue Per User (ARPU), lead conversion rates, churn rate, and user engagement.

Run parallel experiment sprints on a monthly basis for each major brand, with a quarterly review by a central growth council to share learnings across the portfolio.

Growth Team

A centralized 'Portfolio Growth' team that functions as an internal consulting group, supporting the individual brand teams. This team would own cross-platform initiatives, M&A integration, and the overall growth experimentation framework.

Key Roles

- •

Head of Portfolio Growth

- •

M&A Integration Manager

- •

Principal Data Scientist (AI/ML)

- •

Director of International Expansion

Acquire talent from leading B2C tech companies to infuse consumer product DNA. Establish a formal rotation program for high-potential employees to work across different brands to foster a holistic understanding of the business.

CoStar Group is in a formidable position for sustained growth, built upon a foundation of a near-impregnable data moat in commercial real estate and a highly scalable, profitable business model. Its long-term strategy of aggressive, disciplined M&A has successfully consolidated the market and acquired key technological capabilities, most notably Matterport's 3D digital twin technology, which represents a massive, untapped opportunity across its entire portfolio.

The primary growth vectors are clear: 1) A full-scale assault on the residential real estate market, leveraging a differentiated, agent-friendly business model and massive marketing investment. 2) Aggressive international expansion, replicating its US success by acquiring leading marketplaces in mature markets like the UK and Australia. 3) Moving up the value chain from data provider to intelligence engine by leveraging AI and the vast spatial data from Matterport to create next-generation analytics and predictive tools.

The most significant barriers are not capital or competition in its core market, but execution risk. The company faces the critical challenge of integrating a diverse portfolio of acquired companies into a cohesive ecosystem rather than a collection of siloed assets. Furthermore, its massive investment in the hyper-competitive residential sector is a high-stakes gamble that is currently suppressing overall profitability and will require flawless execution to overcome entrenched competitors like Zillow. The key to unlocking the next decade of growth lies in successfully weaving its disparate brands and technologies into a unified platform, transitioning from a 'house of brands' to a truly interconnected real estate intelligence ecosystem.

Legal Compliance

CoStar Group maintains a comprehensive 'Global Privacy Notice' that is centrally managed and linked from its corporate and brand websites. The policy is detailed, covering key aspects required by major regulations like GDPR and CCPA/CPRA, such as types of data collected, purposes of processing, data sharing practices with affiliates and vendors, and data retention principles. It explicitly mentions international data transfers to the US, UK, and other countries where they operate, which is critical for a global company. The notice also provides clear mechanisms for users to exercise their privacy rights, including a dedicated 'Exercise your Privacy Rights' link in the footer and a 'Do Not Sell My Personal Information' page for California residents. The company has appointed a Data Protection Officer, demonstrating a commitment to accountability under GDPR. The policy addresses the collection of various data types, including biometric data for authentication, and states that consent will be obtained where required.

The 'Terms of Use' are robust and clearly define the scope of the license granted to users, emphasizing that it is a license, not a sale, and that CoStar retains all intellectual property rights to its data and platforms. The terms incorporate the Privacy Notice by reference and outline prohibited uses, such as data scraping, reverse engineering, and sharing access passcodes. There are specific clauses regarding user responsibility for registration accuracy and payment of license fees for premium products. The terms also grant CoStar the right to terminate or suspend access for violations, providing a strong enforcement mechanism to protect its core data assets. However, the extensive litigation history, particularly around intellectual property and data usage, suggests these terms are frequently and aggressively enforced.