eScore

costco.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Costco possesses immense brand authority, translating into massive direct and branded search traffic. Its local SEO is highly effective, with functional pages for each warehouse that capture location-based intent. However, the overall digital presence suffers from a significant lack of informational, top-of-funnel content, ceding ground to competitors who engage customers earlier in their journey. While e-commerce sales are growing, the website's primary function remains transactional for existing members rather than a tool for new customer acquisition.

Dominant brand authority and highly effective local SEO for driving traffic to physical warehouses.

Launch a comprehensive content marketing hub focused on 'value and quality' to capture non-branded, informational search traffic and attract prospective members.

The brand message of 'value and savings' is communicated with relentless consistency and clarity, especially through urgent, promotional language. This resonates perfectly with its existing member base. However, the communication strategy almost entirely neglects new member acquisition, failing to articulate the core value proposition of a membership. Furthermore, it misses the opportunity to tell the story of its key differentiator, the Kirkland Signature brand, and lacks tailored messaging for important segments like small business owners.

Exceptionally clear and consistent messaging around immediate savings and promotional urgency, which effectively drives transactions from existing members.

Develop a dedicated messaging track and prominent homepage section for prospective members that clearly articulates the holistic value of a Costco membership beyond just daily deals.

The website's design is utilitarian, reflecting the brand's no-frills ethos, but this translates into a poor digital experience. Users face a high cognitive load due to visual clutter, a chaotic information architecture, and an overwhelming navigation menu. The provided analysis data highlights an inconsistent design system and weak visual hierarchy, creating significant friction. While the checkout process is functional, the overall journey from discovery to conversion is cumbersome compared to modern e-commerce leaders.

The functional, straightforward design for specific tasks like finding a warehouse or viewing weekly deals aligns with the brand's core identity of efficiency for determined bargain-hunters.

Implement a modern, consistent design system and redesign the homepage to establish a clear visual hierarchy, reducing cognitive load and guiding users more effectively.

Costco has built a fortress of credibility through decades of delivering on its value promise, backed by a famously generous return policy. This is supported by a sophisticated legal and compliance framework, including a best-in-class cookie consent platform and a public commitment to WCAG 2.1 AA accessibility standards. The Kirkland Signature brand itself is a massive trust signal, often perceived as equal or superior to national brands. The primary risk lies not in policy, but in operational execution in highly regulated areas like pharmacy services.

An exceptionally strong foundation of trust built on a simple value promise, a generous return policy, and the high perceived quality of its Kirkland Signature brand.

Incorporate more explicit social proof, such as member testimonials and success stories, on the website to leverage its immensely loyal customer base as a credibility asset.

Costco's competitive moat is one of the deepest in retail, built on a powerful combination of cost leadership, a loyal membership model, and the destination status of its Kirkland Signature brand. These advantages are highly sustainable and create a virtuous cycle: membership fees fund low prices, which drives loyalty and volume, which in turn increases buying power. The model is extremely difficult for competitors to replicate, though a significant disadvantage is the underdeveloped e-commerce experience compared to rivals like Amazon.

The membership model creates a powerful loyalty loop and a stable revenue stream that funds an aggressive cost leadership strategy, forming a highly sustainable competitive moat.

Invest strategically in digital convenience (e.g., personalized offers, seamless click-and-collect) to bridge the omnichannel gap with competitors and defend against Amazon's convenience proposition.

The business model is proven to be highly scalable, evidenced by successful international expansion and consistent growth. Unit economics are exceptional, with a very high LTV-to-CAC ratio due to low advertising spend and high member retention. While the capital-intensive nature of opening new warehouses is a constraint, the operational model is famously lean and efficient. The largest barriers to future scale are domestic market saturation and the need to acquire talent in digital experience and data science to fuel the next phase of growth.

Exceptional unit economics, driven by a low-cost, high-retention membership model that makes expansion into new markets highly profitable and predictable.

Develop a repeatable, systematized blueprint for international market entry to reduce the time and complexity of launching in new countries, accelerating global growth.

Costco's business model is a masterclass in coherence and strategic focus, where every component reinforces the others. Membership fees (~2% of revenue) generate the majority of operating profit, enabling the core activity of selling high-quality goods at near-breakeven prices. This simple, powerful flywheel is executed with extreme discipline, avoiding feature creep and maintaining a ruthless focus on value. The alignment between the cost structure, value proposition, and revenue model is nearly perfect.

The symbiotic relationship between high-margin membership fees and low-margin product sales creates a self-reinforcing flywheel that is the model's core, coherent genius.

Evolve the membership model to include a premium digital tier, offering benefits like free/faster shipping to better align with modern consumer expectations and compete with Amazon Prime.

As the leader in the warehouse club industry, Costco exerts significant market power. Its immense purchasing volume gives it substantial leverage over suppliers, allowing it to dictate terms and ensure quality for its Kirkland brand. This translates to strong pricing power, as the value proposition is so compelling that the company can raise membership fees without significant churn. While it faces intense competition from giants like Amazon and Walmart, its market influence is demonstrated by its ability to shape consumer buying habits around a bulk-purchasing model.

Tremendous supplier leverage due to massive purchasing volume, enabling it to maintain cost leadership and enforce high quality standards for its Kirkland Signature brand.

Establish and scale a formal retail media network to monetize its valuable first-party shopper data, creating a new high-margin revenue stream and further solidifying its power in the retail ecosystem.

Business Overview

Business Classification

Membership Wholesale Retail

eCommerce

Retail

Sub Verticals

- •

Warehouse Clubs

- •

Supermarkets/Hypermarkets

- •

Diversified Consumer Services

Mature

Maturity Indicators

- •

Consistent positive net income and revenue growth.

- •

High brand recognition and immense customer loyalty (90%+ membership renewal rates).

- •

Established global footprint with a steady pace of new warehouse openings.

- •

Dominant market share in the warehouse club segment.

- •

Long-standing, efficient operational model and supply chain.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Product Sales

Description:The primary source of revenue (~98%) generated from selling a wide range of products in bulk, from groceries to electronics. This stream operates on exceptionally low margins, with markups strictly capped at 14-15% to drive volume and reinforce member value.

Estimated Importance:Primary

Customer Segment:All Members (Individuals, Families, Small Businesses)

Estimated Margin:Low

- Stream Name:

Membership Fees

Description:Annual fees paid by customers for the right to shop at Costco warehouses and online. This stream accounts for a small fraction of total revenue (~2%) but constitutes the majority of the company's operating profit (approx. 65-73%), enabling the low-margin product pricing strategy.

Estimated Importance:Primary

Customer Segment:All Members (Individuals, Families, Small Businesses)

Estimated Margin:High

- Stream Name:

Ancillary Services

Description:Revenue from a variety of services offered to members, often in partnership with third parties. This includes gas stations, pharmacies, optical centers, hearing aids, food courts, and Costco Travel. These services enhance the value of the membership and drive traffic to warehouses.

Estimated Importance:Secondary

Customer Segment:All Members

Estimated Margin:Medium

Recurring Revenue Components

Annual Membership Fees (Gold Star, Business, Executive)

Pricing Strategy

Membership & Cost-Plus

Budget

Transparent

Pricing Psychology

- •

Loss Leader Pricing (e.g., $1.50 hot dog, rotisserie chicken)

- •

Odd-Even Pricing (prices ending in .99, .97, etc.)

- •

Bundle Pricing (bulk purchasing)

- •

Exclusivity (Member-only access)

Monetization Assessment

Strengths

- •

Highly stable and predictable revenue from membership fees, which covers most operating costs.

- •

Low product prices drive high sales volume and rapid inventory turnover.

- •

High membership renewal rates (~92.7% in US/Canada) indicate strong customer lock-in and satisfaction.

- •

Ancillary services increase the 'stickiness' of the membership and create additional revenue streams.

Weaknesses

- •

High dependence on the physical warehouse model, with a slower, though accelerating, adoption of e-commerce.

- •

The model's success is tied to high sales volume, making it vulnerable to significant economic downturns affecting consumer spending.

- •

Limited SKU count, while efficient, may not meet the needs of all consumers seeking broader selection.

- •

Over-reliance on North American markets for the majority of revenue.

Opportunities

- •

Tiered membership evolution (e.g., adding more digital-exclusive perks for Executive members).

- •

Expanding the Costco Next program to onboard more high-end brands and create a curated marketplace.

- •

Developing a retail media network to monetize first-party shopper data.

- •

Further international expansion into untapped or underserved markets.

Threats

- •

Intense competition from omnichannel giants like Walmart (Sam's Club) and Amazon, who have more advanced digital capabilities.

- •

Shifting consumer preferences towards online shopping and convenience, which challenges the warehouse-visit model.

- •

Supply chain disruptions and rising labor costs could pressure the low-margin model.

- •

Market saturation in core regions like North America.

Market Positioning

Cost Leadership & Quality Assurance

Leader in the warehouse club segment; a major competitor in the overall grocery and retail market.

Target Segments

- Segment Name:

Suburban Families

Description:Middle to upper-middle-class families living in suburban areas, often with multiple children. They are homeowners who value quality and are motivated by savings on bulk purchases of groceries, household goods, and other family necessities.

Demographic Factors

- •

Age: 35-64

- •

Income: $75,000+

- •

Household Size: 3+

- •

Location: Suburban metropolitan areas

Psychographic Factors

- •

Value-conscious and pragmatic

- •

Brand-aware but open to high-quality private labels

- •

Enjoy the 'treasure hunt' aspect of shopping

- •

Seek convenience and one-stop shopping

Behavioral Factors

- •

Bulk purchasing behavior

- •

High frequency of large shopping trips

- •

High loyalty and membership renewal rate

- •

Utilize ancillary services like gas and pharmacy

Pain Points

- •

High cost of living, especially feeding a family

- •

Time constraints for shopping at multiple stores

- •

Desire for high-quality products without paying premium brand prices

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Small Business Owners

Description:Owners of small businesses (e.g., restaurants, offices, convenience stores) who use Costco as a primary supplier for inventory, office supplies, and operational necessities. They are focused on cost control, efficiency, and reliable access to products.

Demographic Factors

Occupation: Entrepreneur, Small Business Owner

Business Size: Small to Medium

Psychographic Factors

- •

Highly cost-sensitive and profit-driven

- •

Value efficiency and time savings

- •

Seek reliable and consistent product availability

Behavioral Factors

- •

Very high-volume, frequent bulk purchases

- •

Purchase a mix of business and personal goods

- •

Often hold Business or Executive level memberships

Pain Points

- •

Managing procurement costs to maintain profitability

- •

Need for a reliable, one-stop source for diverse supplies

- •

Lack of purchasing power compared to larger corporations

Fit Assessment:Excellent

Segment Potential:High

Market Differentiation

- Factor:

Kirkland Signature Private Label

Strength:Strong

Sustainability:Sustainable

- Factor:

Membership Model & Exclusivity

Strength:Strong

Sustainability:Sustainable

- Factor:

Low-Price Leadership

Strength:Strong

Sustainability:Sustainable

- Factor:

Treasure Hunt Shopping Experience

Strength:Moderate

Sustainability:Sustainable

- Factor:

Employee Satisfaction and Low Turnover

Strength:Moderate

Sustainability:Sustainable

Value Proposition

To continually provide our members with quality goods and services at the lowest possible prices.

Excellent

Key Benefits

- Benefit:

Significant Savings

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Strict markup caps (14-15%)

- •

Bulk product sizing

- •

Low gas prices

- Benefit:

High-Quality Products

Importance:Critical

Differentiation:Unique

Proof Elements

- •

Reputation of Kirkland Signature brand, often co-branded or made by leading manufacturers.

- •

Limited, curated SKU selection focusing on best-in-class items.

- •

Generous return policy signals confidence in product quality.

- Benefit:

One-Stop Shopping Convenience

Importance:Important

Differentiation:Common

Proof Elements

- •

Wide product range from groceries to electronics and furniture.

- •

On-site services like pharmacy, optical, auto, and travel.

- •

Food court and gas station

Unique Selling Points

- Usp:

The Kirkland Signature brand offers premium quality comparable to national brands at a significantly lower price.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A curated 'treasure hunt' experience with a rotating selection of high-value items, creating urgency and shopping excitement.

Sustainability:Long-term

Defensibility:Moderate

- Usp:

A membership model that fosters extreme loyalty and funds low prices, creating a virtuous cycle competitors find hard to replicate.

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Overpaying for groceries, household essentials, and high-ticket items.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Uncertainty about the quality of private-label or discounted products.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Wasting time and effort shopping at multiple stores for different needs.

Severity:Major

Solution Effectiveness:Partial

Value Alignment Assessment

High

The value proposition of low prices on quality goods is highly aligned with market needs, particularly in times of economic uncertainty. The model serves both value-seeking families and cost-conscious small businesses effectively.

High

The model is perfectly aligned with the psychographics of its target audience, who are pragmatic, value-driven, and appreciate quality. The bulk-buying format directly serves the needs of suburban families and small businesses.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Major national brand suppliers (e.g., P&G, Starbucks)

- •

Co-manufacturers for Kirkland Signature products

- •

Logistics and distribution providers

- •

Citi (for co-branded credit card)

- •

Affirm (for Buy Now, Pay Later services)

- •

Service providers (e.g., for auto buying, travel, insurance)

Key Activities

- •

Global procurement and bulk purchasing

- •

Supply chain and logistics management

- •

Warehouse operations

- •

Membership management and marketing

- •

Product curation and quality control

- •

eCommerce platform development

Key Resources

- •

Global network of warehouse locations

- •

Strong brand reputation and member loyalty

- •

Kirkland Signature private label brand

- •

Efficient supply chain and distribution network

- •

Extensive first-party member data

Cost Structure

- •

Merchandise procurement costs

- •

Employee wages and benefits

- •

Warehouse operating costs (real estate, utilities)

- •

Logistics and distribution

- •

Minimal marketing and advertising spend

Swot Analysis

Strengths

- •

Powerful brand loyalty and high membership renewal rates.

- •

Extremely efficient, low-cost operating model.

- •

Kirkland Signature as a high-quality, high-margin, and exclusive brand.

- •

Strong supplier relationships enabling favorable terms.

- •

Consistently profitable due to the membership fee structure.

Weaknesses

- •

Lagging digital/e-commerce experience compared to competitors like Amazon and Walmart.

- •

Limited product selection (SKU count) can be a deterrent for some shoppers.

- •

Heavy reliance on physical store traffic.

- •

Geographic concentration in North America.

- •

Aging customer base, with slower adoption among younger demographics.

Opportunities

- •

Accelerate e-commerce growth, particularly in big & bulky items and grocery delivery.

- •

Enhance personalization using rich member data to improve online experience and drive sales.

- •

Expand international presence in high-growth markets.

- •

Diversify services and partnerships (e.g., healthcare, financial services).

- •

Launch a sophisticated retail media network to create a new high-margin revenue stream.

Threats

- •

Intense and evolving competition from omnichannel retailers and pure-play e-commerce.

- •

Changes in consumer behavior favoring convenience and on-demand delivery over bulk-buying trips.

- •

Potential for economic downturns to impact discretionary spending and membership renewals.

- •

Global supply chain vulnerabilities and inflationary pressures.

- •

Inability to attract and retain younger, digitally-native generations.

Recommendations

Priority Improvements

- Area:

Digital Transformation & eCommerce

Recommendation:Invest heavily in creating a seamless omnichannel experience. This includes a revamped mobile app with in-store navigation, personalized offers based on purchase history, and a 'click-and-collect' service that rivals competitors.

Expected Impact:High

- Area:

Membership Model Evolution

Recommendation:Introduce a 'Costco Prime' or premium tier of Executive Membership that includes benefits like free online shipping, exclusive access to digital content or services, and enhanced personalization to better compete with Amazon Prime.

Expected Impact:High

- Area:

Data Monetization

Recommendation:Build and scale a formal retail media network, allowing brand partners to purchase targeted advertising on Costco.com and in-app, leveraging Costco's valuable first-party data to create a new, high-margin revenue stream.

Expected Impact:Medium

Business Model Innovation

- •

Develop a B2B-specific digital platform with features like recurring orders, specialized product catalogs, and integration with business accounting software to better serve and expand the small business segment.

- •

Expand the 'Costco Next' model into a more integrated, curated marketplace for direct-to-consumer brands that align with Costco's value proposition, taking a percentage of sales.

- •

Pilot smaller, urban-format stores with a curated selection of best-selling items and a focus on grocery and click-and-collect services to penetrate dense city centers.

Revenue Diversification

- •

Formalize and grow the retail media network as a significant new revenue stream.

- •

Expand high-margin service offerings, potentially moving into areas like home maintenance, financial planning, or expanded healthcare services through partnerships.

- •

Create subscription box services for Kirkland Signature products (e.g., coffee, snacks, wine), leveraging the brand's strength to create a new recurring revenue source outside of the primary membership fee.

Costco's business model is a masterclass in operational efficiency and value creation, built upon a symbiotic relationship between two core revenue streams: near-breakeven product sales and high-margin membership fees. This structure creates a powerful competitive moat, funding aggressive pricing that competitors with traditional margin structures cannot sustain. The Kirkland Signature brand is a strategic pillar, transforming the concept of a private label into a trusted, high-quality powerhouse that drives loyalty and profit. The company's strengths—immense customer loyalty, an efficient supply chain, and a strong brand—are deeply entrenched.

However, the model faces a critical inflection point. Its historical reliance on the physical warehouse experience is a significant vulnerability in an increasingly digital-first retail landscape. Competitors like Amazon and Walmart are leveraging their vast e-commerce and logistics infrastructure to offer convenience that directly challenges Costco's core value proposition. While Costco's online sales are growing, its digital user experience lags, and its omnichannel strategy is still in a nascent stage compared to its rivals.

For future growth and sustained market leadership, Costco must undergo a strategic evolution. The primary imperative is to transform its digital presence from a supplementary channel into a fully integrated component of the member experience. This involves not just improving the website and app, but reimagining how digital can enhance the in-warehouse experience, personalize value for members, and create new revenue streams through initiatives like a sophisticated retail media network. The key challenge will be to innovate and embrace digital transformation without diluting the core 'treasure hunt' appeal and operational discipline that have defined its success for decades. Evolving the membership model to offer more digital-centric benefits will be crucial to attracting and retaining the next generation of members and ensuring the long-term resilience of this iconic business.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

High Capital Investment

Impact:High

- Barrier:

Economies of Scale

Impact:High

- Barrier:

Supply Chain & Logistics Network

Impact:High

- Barrier:

Strong Brand Loyalty and Membership Model

Impact:High

- Barrier:

Access to Distribution Channels

Impact:Medium

Industry Trends

- Trend:

Omnichannel Integration

Impact On Business:Requires significant investment in e-commerce, mobile apps, and services like BOPIS (Buy Online, Pickup In-Store) to meet customer expectations.

Timeline:Immediate

- Trend:

Growth of Private Label Brands

Impact On Business:This is a core strength for Costco (Kirkland Signature), but competitors are also investing heavily, increasing competition on quality and price for in-house brands.

Timeline:Immediate

- Trend:

Focus on Sustainability and Ethical Sourcing

Impact On Business:Increasing consumer demand for sustainable products and transparent supply chains puts pressure on sourcing and operations, but also offers a brand-building opportunity.

Timeline:Near-term

- Trend:

Personalization and Data Analytics

Impact On Business:Leveraging member data to offer personalized promotions and product recommendations is a key area for growth, especially online, where competitors like Amazon excel.

Timeline:Near-term

Direct Competitors

- →

Sam's Club (Walmart)

Market Share Estimate:Approx. 36% of U.S. warehouse club market

Target Audience Overlap:High

Competitive Positioning:Positions itself as a value-oriented club for both families and small businesses, leveraging Walmart's vast supply chain and increasingly focusing on digital innovation.

Strengths

- •

Strong digital integration (e.g., Scan & Go technology)

- •

Leverages Walmart's massive supply chain and logistics network

- •

Appeals to cost-conscious shoppers and small businesses.

- •

Often more locations than Costco in certain regions

Weaknesses

- •

Brand perception is often tied to Walmart, which can be a negative for attracting higher-income shoppers

- •

Lower sales per square foot compared to Costco

- •

Perceived lower quality of private label brand (Member's Mark) compared to Kirkland Signature

Differentiators

Advanced in-club technology like Scan & Go

Integration with the broader Walmart+ membership program

- →

BJ's Wholesale Club

Market Share Estimate:Approx. 9-10% of U.S. warehouse club market

Target Audience Overlap:Medium

Competitive Positioning:A regional powerhouse (primarily East Coast U.S.) that competes on convenience by offering a wider product selection, smaller pack sizes, and accepting manufacturer coupons.

Strengths

- •

Accepts manufacturer's coupons, unlike Costco and Sam's Club

- •

Offers a broader SKU count and smaller package sizes, appealing to families.

- •

Stronger digital sales growth rate in recent quarters compared to competitors.

- •

More convenient locations in its core markets.

Weaknesses

- •

Significantly smaller national footprint and market share.

- •

Less brand cachet and perceived quality compared to Costco

- •

Lower sales volume and purchasing power than competitors

Differentiators

- •

Acceptance of coupons

- •

Greater product assortment and smaller pack sizes

- •

Full-service deli offerings.

- →

Amazon

Market Share Estimate:Dominant in e-commerce, but not a direct market share comparison for warehouse clubs.

Target Audience Overlap:High

Competitive Positioning:The ultimate online convenience retailer, offering a vast selection, fast delivery (Prime), and a competing subscription model that bundles media and shopping perks.

Strengths

- •

Unmatched e-commerce platform, user experience, and logistics network.

- •

Massive product selection (millions of SKUs vs. Costco's ~4,000).

- •

Highly effective personalization and recommendation engine

- •

Prime membership offers a compelling value proposition beyond just shopping (video, music, etc.).

Weaknesses

- •

Lacks the in-person 'treasure hunt' experience

- •

Variable product quality from third-party sellers

- •

No equivalent for fresh food/bakery/deli experience at scale

- •

Higher prices for many bulk items compared to warehouse clubs

Differentiators

- •

Speed and convenience of delivery

- •

Breadth of product selection

- •

Integrated digital ecosystem (Prime Video, Music, etc.)

Indirect Competitors

- →

Walmart Supercenters

Description:Global big-box retailer offering a vast range of products at 'Everyday Low Prices' without a membership fee. A direct competitor in many product categories, especially groceries.

Threat Level:High

Potential For Direct Competition:Already a direct competitor in many aspects; the Walmart+ program is a direct challenge to the membership model.

- →

Target

Description:General merchandise retailer focused on a more curated, design-forward product selection. Competes on 'style and quality for less' and has a strong private label portfolio.

Threat Level:Medium

Potential For Direct Competition:Low, as their business model focuses on a different shopping experience (curation over bulk).

- →

The Kroger Co. (and other large grocery chains)

Description:Traditional supermarkets competing on convenience, location, and a wide selection of fresh foods. They offer bulk items but not at the scale or price point of warehouse clubs.

Threat Level:Medium

Potential For Direct Competition:Low. While they compete on groceries, their fundamental business model (high SKU count, convenience focus) is different.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Cost Leadership and Purchasing Power

Sustainability Assessment:Highly sustainable. Achieved through a limited SKU model (~4,000 items), which concentrates buying power, and a commitment to extremely low markups (avg. 11%).

Competitor Replication Difficulty:Hard

- Advantage:

Membership Model and Customer Loyalty

Sustainability Assessment:Highly sustainable. The membership fee creates a powerful loyalty loop and a stable revenue stream, with renewal rates consistently around 90% or higher.

Competitor Replication Difficulty:Hard

- Advantage:

Kirkland Signature Private Label Brand

Sustainability Assessment:Highly sustainable. Kirkland is a destination brand in itself, known for high quality at a low price, driving significant sales and margin.

Competitor Replication Difficulty:Medium

- Advantage:

Employee Satisfaction and Operational Efficiency

Sustainability Assessment:Sustainable. Industry-leading wages and benefits lead to extremely low employee turnover (6% after the first year), resulting in higher productivity and better customer service.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': "Exclusive Product Deals ('Treasure Hunt' Items)", 'estimated_duration': 'Short-term (per product)'}

Disadvantages

- Disadvantage:

Underdeveloped E-commerce Experience

Impact:Major

Addressability:Moderately

- Disadvantage:

Limited Product Selection

Impact:Minor

Addressability:Difficult

- Disadvantage:

Dependence on Physical Stores

Impact:Major

Addressability:Difficult

- Disadvantage:

Bulk Purchase Requirement

Impact:Minor

Addressability:Difficult

Strategic Recommendations

Quick Wins

- Recommendation:

Optimize Website/App Search and Navigation

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Prominently feature 'Click & Collect' (BOPIS) options online.

Expected Impact:Medium

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Implement Personalized Offers and Product Recommendations

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Expand Fulfillment Options

Expected Impact:High

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Explore Smaller, Urban-Format Stores

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Invest in a proprietary logistics network for last-mile delivery of bulky items.

Expected Impact:High

Implementation Difficulty:Difficult

Solidify Costco's position as the undisputed leader in 'high-quality, low-price' bulk retail, while strategically investing in digital convenience to bridge the gap with omnichannel competitors and defend against Amazon.

Double down on the 'treasure hunt' experience in-store and the unparalleled quality of the Kirkland Signature brand. Digitally, differentiate not by trying to out-Amazon Amazon, but by creating a seamless omnichannel experience that makes the Costco membership more valuable (e.g., exclusive online deals, easy re-ordering of in-store purchases, and efficient pickup services).

Whitespace Opportunities

- Opportunity:

Enhanced Digital Services for Business Members

Competitive Gap:Direct competitors offer basic online ordering for businesses, but none provide a sophisticated suite of services like recurring order management, expense tracking, or industry-specific product curation.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Curated Subscription Boxes (e.g., 'Kirkland Favorites')

Competitive Gap:While Amazon has 'Subscribe & Save' on individual items, there is no major player offering a curated, bulk subscription service that leverages the trust and discovery of a brand like Kirkland Signature.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Expansion of High-Value Services

Competitive Gap:Costco already offers services like travel and insurance. There's an opportunity to expand into adjacent high-value areas like home renovation services (beyond current offerings), financial planning, or even renewable energy solutions for homes, leveraging its affluent member base.

Feasibility:Low

Potential Impact:High

Costco operates from a position of immense strength in the mature, oligopolistic warehouse club industry. Its business model, built on the symbiotic relationship between a loyal membership base and a ruthless focus on cost leadership, has created a deep competitive moat that is difficult for direct competitors like Sam's Club and BJ's to breach. The Kirkland Signature brand is a powerhouse differentiator, transforming a private label into a trusted consumer staple that drives both traffic and margin. However, Costco's historical reliance on its physical stores creates a significant vulnerability in an increasingly omnichannel world. Its e-commerce platform and digital user experience lag considerably behind competitors like Amazon and even Sam's Club, which has successfully innovated with features like Scan & Go. This digital gap is the most critical threat to Costco's long-term dominance. While the 'treasure hunt' experience is a key asset, changing consumer preferences demand greater convenience, which Costco is not currently optimized to provide online. Indirect competitors like Walmart and Target also pose a threat by offering convenience and competitive pricing without a membership fee. Strategic imperatives for Costco must center on bridging this digital divide. This does not mean replicating Amazon's endless aisle, but rather creating a seamless digital layer on top of its existing warehouse model. Investments in personalized marketing, robust 'Click and Collect' services, and improved last-mile delivery for online orders are critical. The primary opportunity lies in leveraging its trusted brand and vast member data to make its membership indispensable, whether a customer shops in-store, online, or through a combination of both.

Messaging

Message Architecture

Key Messages

- Message:

Limited-time savings on a wide variety of products.

Prominence:Primary

Clarity Score:High

Location:Homepage (numerous promotional banners)

- Message:

Value is paramount, especially on big-ticket items like appliances.

Prominence:Secondary

Clarity Score:High

Location:Homepage (e.g., 'Why Buy Appliances at Costco?' section)

- Message:

Urgency and scarcity drive purchasing decisions.

Prominence:Secondary

Clarity Score:High

Location:Homepage (repeated use of 'While Supplies Last' and specific sale end dates)

- Message:

Membership provides access to exclusive services and rewards.

Prominence:Tertiary

Clarity Score:Medium

Location:Homepage (Costco Travel, Costco Anywhere Visa Card sections)

The message hierarchy is heavily skewed towards immediate, tactical promotions. The homepage functions like a digital coupon circular, prioritizing 'what's on sale now' above all else. While effective for existing members, this approach buries the strategic, long-term value of a Costco membership, which is the foundational driver of the business model. The core 'why' of Costco is assumed, not articulated.

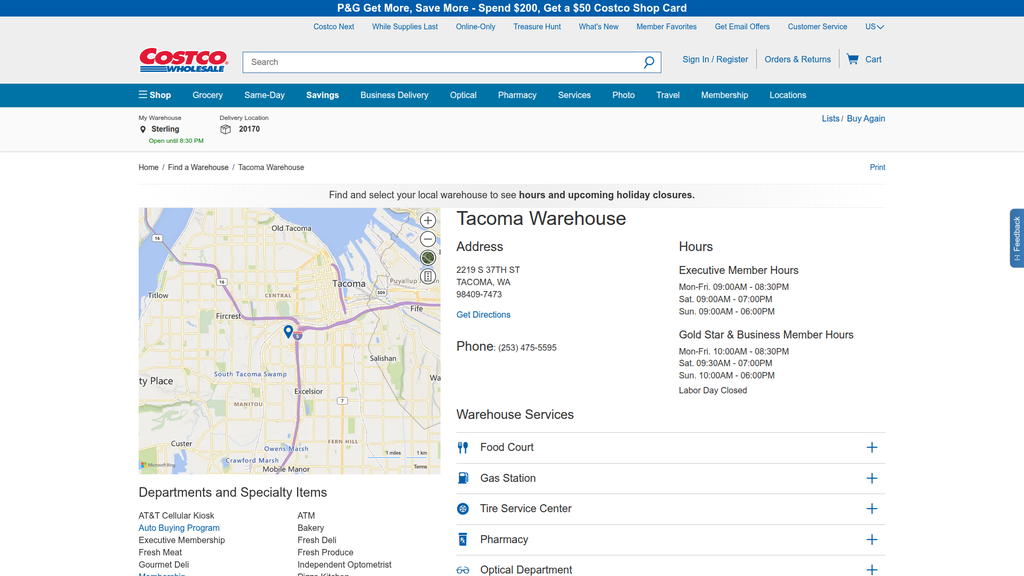

Messaging is highly consistent in its focus on value and savings. From the homepage's deal banners to the warehouse page's gas prices, the theme of getting a good price is constant. However, there's a tonal inconsistency between the high-urgency homepage and the purely functional, informational warehouse pages. The former is a sales tool, the latter a utility, with little brand narrative connecting them.

Brand Voice

Voice Attributes

- Attribute:

Transactional

Strength:Strong

Examples

- •

Additional Savings on Select Appliances

- •

Shop 70+ P&G Products

- •

The price you SEE is the price you PAY!

- Attribute:

Urgent

Strength:Strong

Examples

- •

While Supplies Last

- •

Valid 8/25/25 – 9/21/25

- •

Book by 9/2/25

- Attribute:

Informational

Strength:Moderate

Examples

Find and select your local warehouse to see hours and upcoming holiday closures.

Prices shown here are updated frequently, but may not reflect the price at the pump at the time of purchase.

- Attribute:

Benefit-Oriented

Strength:Weak

Examples

Earn Cash Back Rewards on Every Purchase

Delivery in 3-5 Days in Most Areas

Tone Analysis

Promotional

Secondary Tones

Direct

Factual

Tone Shifts

Shifts from a high-energy, promotional tone on the homepage to a strictly utilitarian and informational tone on the warehouse location pages.

Voice Consistency Rating

Good

Consistency Issues

The voice lacks a strong, unifying personality. It is consistently focused on value but does not build a deeper brand character or narrative. The website communicates deals effectively but doesn't tell the Costco story.

Value Proposition Assessment

To provide members with exclusive access to high-quality, brand-name, and private-label merchandise at the lowest possible prices.

Value Proposition Components

- Component:

Unbeatable Prices / Savings

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

High-Quality, Curated Products (Treasure Hunt)

Clarity:Somewhat Clear

Uniqueness:Unique

- Component:

Member-Exclusive Services (Travel, Auto, etc.)

Clarity:Somewhat Clear

Uniqueness:Unique

- Component:

Bulk Purchasing Convenience

Clarity:Clear

Uniqueness:Common

- Component:

All-Inclusive Pricing (e.g., Appliances)

Clarity:Clear

Uniqueness:Somewhat Unique

Costco's value proposition is well-differentiated in practice but poorly articulated on its website. The site focuses almost exclusively on 'low prices,' which is a point of comparison with competitors like Sam's Club and BJ's. The truly unique elements—the 'treasure hunt' discovery of high-end goods, the exceptional quality of the Kirkland Signature brand, and the sense of smart-shopping pride members feel—are not communicated. The messaging for appliances, which bundles delivery, warranty, and installation into the price, is a rare example of excellent value proposition communication on the site.

The messaging positions Costco as the ultimate destination for deals, primarily for an audience that is already a member. It reinforces the value for existing customers but does little to capture new ones by explaining its unique market position against competitors. Research indicates Costco typically targets a more affluent, quality-conscious shopper compared to Sam's Club's focus on cost-conscious consumers, but this nuance is absent from the website's messaging.

Audience Messaging

Target Personas

- Persona:

Value-Seeking Families (Suburban households)

Tailored Messages

- •

Apparel Buy More and Save

- •

Popular Food Brands Delivered Right to Your Door

- •

Up to 100% Leak-Free Protection (Huggies)

Effectiveness:Effective

- Persona:

Small Business Owners

Tailored Messages

No itemsEffectiveness:Ineffective

- Persona:

Prospective Members (The Unconverted)

Tailored Messages

No itemsEffectiveness:Ineffective

Audience Pain Points Addressed

- •

Overpaying for consumer goods and groceries.

- •

Hidden fees and costs associated with large purchases (e.g., appliance delivery).

- •

Wasting time shopping for everyday essentials.

Audience Aspirations Addressed

- •

Feeling like a smart, savvy shopper who gets the best value.

- •

Accessing premium brands and products at a discount.

- •

Providing high-quality goods for one's family.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Fear of Missing Out (FOMO)

Effectiveness:High

Examples

- •

While Supplies Last

- •

Online-Only

- •

Limit 1 Redemption Per Membership

- Appeal Type:

Anticipation / Discovery (Treasure Hunt)

Effectiveness:Low

Examples

The constant rotation of deals and new items hints at this, but it's an implicit appeal, not an explicitly communicated one.

Social Proof Elements

- Proof Type:

Co-Branding (Authority)

Impact:Strong

Examples

Costco Anywhere Visa® Card by Citi

Featuring brands like P&G, LG, Dyson, Microsoft Surface

Trust Indicators

- •

Well-known, established brand name

- •

Clear, upfront information on warehouse pages (hours, phone numbers, gas prices)

- •

Partnerships with other major brands (Citi, P&G, etc.)

- •

Detailed privacy policy and cookie settings information

Scarcity Urgency Tactics

- •

Time-bound sales with specific start and end dates.

- •

The phrase 'While Supplies Last' is used on nearly every promotional block.

- •

Redemption limits per membership.

Calls To Action

Primary Ctas

- Text:

Shop Now (or specific categories like 'Laundry', 'Refrigerators')

Location:Homepage promotional banners

Clarity:Clear

- Text:

Get Directions

Location:Warehouse Locations page

Clarity:Clear

- Text:

Sign Up

Location:Email subscription form in the footer

Clarity:Clear

The CTAs are clear and direct, effectively guiding users to product pages and promotions. However, the homepage suffers from CTA overload. There is no single, prioritized journey for a user to follow. The most critical CTA for business growth—'Become a Member'—is conspicuously absent from the main messaging flow, requiring a user to actively seek it out.

Messaging Gaps Analysis

Critical Gaps

- •

New Member Acquisition Messaging: The website operates with the assumption that the visitor is already a member. There is no clear, persuasive messaging track that explains the core benefits of membership (e.g., 90%+ renewal rate, average savings, quality guarantee) to a non-member.

- •

The Kirkland Signature Brand Story: Kirkland is a massive revenue driver and a key differentiator known for its quality. There is no content that tells this story, explains the quality standards, or builds the brand equity of this crucial in-house asset.

- •

Community and Social Proof: The immense loyalty of Costco members is one of its greatest assets. The site lacks any form of member testimonials, stories, or community-building content that would leverage this social proof.

- •

Core Company Values: The company's well-known commitment to employee satisfaction and its famous return policy—both powerful trust signals—are not mentioned in the provided content.

Contradiction Points

No itemsUnderdeveloped Areas

Service-Based Value Propositions: While services like Travel and the Auto Program are listed, their unique value propositions are not articulated. It's unclear why a member should use Costco Travel over another service.

Emotional Connection: The messaging is entirely transactional. It misses the opportunity to connect with the emotional drivers of its members: the pride of being a smart shopper, the joy of discovery, and the trust in the brand.

Messaging Quality

Strengths

- •

Effectively creates a sense of urgency and encourages immediate action on deals.

- •

Clearly communicates tactical price savings on individual products and categories.

- •

Provides clear, functional information for existing members seeking warehouse details (hours, services, etc.).

- •

Excels at communicating bundled value in specific, complex categories like major appliances.

Weaknesses

- •

Fails to articulate the core strategic value of membership to non-members.

- •

Overwhelming homepage design that bombards users with deals, lacking a clear hierarchy.

- •

Absence of brand storytelling and emotional connection.

- •

Underutilization of key brand assets like Kirkland Signature and member loyalty.

Opportunities

- •

Develop a dedicated, persuasive onboarding experience for prospective members.

- •

Create content that tells the story of Kirkland Signature's quality and value.

- •

Leverage member testimonials and user-generated content to build social proof.

- •

Clearly articulate the value proposition of Costco Services (Travel, Insurance, etc.) beyond their mere existence.

Optimization Roadmap

Priority Improvements

- Area:

New Member Acquisition

Recommendation:Create a prominent 'The Costco Membership' section on the homepage that clearly articulates the 3-5 key pillars of the value proposition (e.g., Unbeatable Value, The Treasure Hunt, Quality Guarantee, Member Services). This should lead to a dedicated landing page that makes a compelling case for joining.

Expected Impact:High

- Area:

Homepage Messaging Hierarchy

Recommendation:Restructure the homepage to balance tactical deals with strategic value messages. Instead of an endless grid of promotions, feature curated sections that tell a story (e.g., 'The Kirkland Difference,' 'This Month's Most Exciting Finds,' 'See What's Included with Appliance Delivery').

Expected Impact:High

- Area:

Brand Storytelling

Recommendation:Develop a content series or a dedicated 'About' section that tells the story of the Kirkland Signature brand, highlighting its quality control, sourcing, and value. This builds trust and differentiates it from generic store brands.

Expected Impact:Medium

Quick Wins

- •

Add a 'Why Join?' link prominently in the main navigation.

- •

Incorporate member testimonials into the homepage rotation.

- •

For every Kirkland Signature product featured, add a small, consistent badge or tagline that reinforces its quality promise (e.g., 'Kirkland Signature Quality Guaranteed').

Long Term Recommendations

- •

Invest in a content strategy that highlights the 'treasure hunt' aspect, showcasing unique, high-end items as they become available to build excitement and reinforce the discovery value proposition.

- •

Build out robust landing pages for each Costco Service, detailing the specific benefits and value for members compared to outside alternatives.

- •

Integrate messaging about Costco's company culture and satisfaction guarantees to strengthen brand trust and affinity.

Costco's digital messaging strategy is a direct reflection of its in-store experience: a no-frills, value-focused 'warehouse' of deals. The communication is brutally effective at its primary job—alerting existing, high-intent members to current promotions and driving immediate sales through a powerful combination of low prices and urgency. The messaging on the homepage is a high-velocity stream of transactional CTAs, perfectly suited for a member who is already bought into the ecosystem and is visiting with the intent to browse for bargains.

However, this tactical focus creates a significant strategic gap. The website fails to communicate the foundational value proposition of the Costco membership itself, which is the core driver of the company's highly successful business model. For a prospective member, the site offers no compelling narrative for why they should pay an annual fee. Key differentiators like the 'treasure hunt' experience, the superior quality of the Kirkland Signature private label, and the powerful social proof of a 90%+ member renewal rate are left entirely unsaid.

The brand voice is consistent in its transactional nature but lacks personality and emotional depth. It speaks the language of price tags, not the language of the savvy, value-conscious consumer who feels pride in their membership. The messaging architecture is flat and overwhelming, presenting a wall of undifferentiated deals that undermines any attempt at strategic communication.

In essence, costco.com is a highly effective digital circular for the already converted. To support long-term business objectives like new market penetration and attracting the next generation of members, the messaging strategy must evolve. It needs to build a bridge for non-members, articulating the 'why' behind the membership fee with the same clarity and conviction it currently uses to sell a discounted television.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Extremely high membership renewal rates, consistently above 90% globally and even higher in the U.S. and Canada.

- •

Consistent year-over-year revenue and membership growth, with 73.4 million paid household members reported in early 2025.

- •

The Kirkland Signature private label is a massive success, accounting for approximately 28-30% of total revenue and functioning as a powerful customer loyalty driver.

- •

Cult-like customer loyalty and high satisfaction ratings, driven by a strong value proposition of quality goods at low prices.

- •

Successful and rapid membership sign-ups in new international market entries, indicating the business model translates well across cultures.

Improvement Areas

- •

Personalization of the digital and e-commerce experience to match leaders like Amazon.

- •

Catering to younger, digitally-native demographic segments who may prefer more flexible, non-bulk shopping options.

- •

Improving the online user experience to reduce friction in product discovery and checkout.

Market Dynamics

The Warehouse Clubs & Supercenters market in the US is projected to grow at a CAGR of 3.2% through 2025.

Mature

Market Trends

- Trend:

Omnichannel Integration

Business Impact:Increasing pressure to seamlessly blend in-store and online experiences. Costco's e-commerce is growing rapidly (15-19% comparable sales growth) but still represents a small portion of total sales, indicating a significant opportunity.

- Trend:

Value and Private Label Dominance

Business Impact:Economic pressures drive consumers toward value-oriented retailers and private labels. This is a core strength for Costco and its Kirkland Signature brand.

- Trend:

Personalization and Data Analytics

Business Impact:Competitors are leveraging data for personalized marketing. Costco has an opportunity to better utilize its vast membership data to drive targeted promotions and enhance loyalty.

- Trend:

Sustainability and Ethical Sourcing

Business Impact:Growing consumer demand for sustainable products and transparent supply chains presents both a challenge and an opportunity to enhance brand reputation.

Excellent. Costco's value-focused model is highly resilient and performs well during periods of economic uncertainty and inflation, making the current market timing advantageous for growth.

Business Model Scalability

High

High fixed costs associated with large warehouse real estate and initial stocking, but highly scalable variable costs due to immense purchasing power and efficient, low-overhead operations.

High. Once a warehouse reaches its operational break-even point, the high sales volume per location generates strong profits on thin product margins, supplemented by high-margin membership fees.

Scalability Constraints

- •

Acquisition of suitable large-format real estate in dense, high-income areas.

- •

Complexity of global supply chain management and logistics for international expansion.

- •

Maintaining a consistent company culture and high employee satisfaction during rapid expansion.

- •

Capital intensity of building and opening new warehouse locations.

Team Readiness

Strong and stable, with a deep-rooted philosophy focused on member value and employee welfare, which has proven successful for decades.

Highly efficient and famously lean, designed to minimize overhead and pass savings to members. Well-suited for replicating its core warehouse model.

Key Capability Gaps

- •

Agile digital product development and user experience (UX) design talent.

- •

Data science and analytics teams to fully leverage membership data for personalization and business intelligence.

- •

International market entry teams with deep local expertise in complex regulatory and cultural environments like mainland China and Southeast Asia.

Growth Engine

Acquisition Channels

- Channel:

Word-of-Mouth / Brand Reputation

Effectiveness:High

Optimization Potential:Medium

Recommendation:Amplify positive member experiences through user-generated content campaigns and a formal referral program with incentives.

- Channel:

Physical Warehouse Presence

Effectiveness:High

Optimization Potential:High

Recommendation:Use geofencing and location-based mobile notifications to drive traffic for special events or high-value items ('treasure hunt' finds).

- Channel:

Ancillary Services (e.g., Gas Stations)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Bundle gas discounts with in-store purchase thresholds or promote them more heavily in digital channels to acquire new members.

- Channel:

Digital Marketing (Search, Social)

Effectiveness:Low

Optimization Potential:High

Recommendation:Invest in a more sophisticated digital strategy focusing on acquiring younger demographics through channels like TikTok and targeted social ads highlighting unique product finds and value propositions.

Customer Journey

The in-store journey is optimized for 'treasure hunt' style discovery and impulse buys of bulk items. The online journey is more functional and transactional but lacks the experiential element and is less intuitive than competitors.

Friction Points

- •

The e-commerce website and mobile app can be difficult to navigate and search.

- •

Limited online product selection compared to the in-warehouse experience.

- •

Lack of seamless omnichannel features like in-store stock checking from the app or 'buy online, return in store' for all items.

Journey Enhancement Priorities

- Area:

Mobile App Experience

Recommendation:Invest in a best-in-class mobile app with features like in-store navigation, scan-and-go checkout, and personalized shopping lists.

- Area:

E-commerce Search & Discovery

Recommendation:Implement modern search and recommendation algorithms to improve product discovery and personalize the online shopping experience.

- Area:

Omnichannel Integration

Recommendation:Launch a robust 'Buy Online, Pick-up In-Store' (BOPIS) program for a wider range of items to bridge the gap between digital and physical channels.

Retention Mechanisms

- Mechanism:

Annual Membership Fee

Effectiveness:High

Improvement Opportunity:The sunk cost of the fee creates strong retention. The value is reinforced by the Executive Membership's 2% reward, which creates a powerful incentive loop.

- Mechanism:

Kirkland Signature Private Label

Effectiveness:High

Improvement Opportunity:Once customers become loyal to high-quality Kirkland products, they are locked into the Costco ecosystem. Continue expanding the Kirkland line into new, high-demand product categories.

- Mechanism:

Ecosystem of Services

Effectiveness:Medium

Improvement Opportunity:Services like Gas, Tires, Pharmacy, Travel, and the Food Court increase member dependency. Integrate these services more seamlessly into a single digital platform or app.

- Mechanism:

Costco Anywhere Visa Card

Effectiveness:High

Improvement Opportunity:The co-branded credit card provides significant cash-back rewards, especially on gas, creating a strong financial lock-in. Further promote the card's benefits at checkout.

Revenue Economics

Exceptional. The business model is unique: membership fees constitute a significant portion of profit, allowing the company to sell goods at razor-thin margins. This drives a virtuous cycle of value and loyalty.

Extremely High (Estimated). Customer Acquisition Cost (CAC) is very low due to minimal advertising and reliance on word-of-mouth. Lifetime Value (LTV) is exceptionally high due to decades-long memberships and high annual spending.

High. The high sales volume per warehouse and employee, combined with a lean operational model, makes for a highly efficient revenue engine.

Optimization Recommendations

- •

Focus on converting more Gold Star members to the higher-margin, higher-retention Executive tier.

- •

Increase average order value online through better product recommendations and bundling.

- •

Expand high-margin ancillary services like Costco Travel and Business Centers.

Scale Barriers

Technical Limitations

- Limitation:

Outdated E-commerce Platform

Impact:High

Solution Approach:Re-platform or significantly overhaul the existing e-commerce infrastructure to improve UX, personalization, and mobile functionality. This is critical for capturing younger demographics.

- Limitation:

Lack of Advanced Data Analytics Infrastructure

Impact:Medium

Solution Approach:Invest in a modern data stack to unify member data from in-store, online, and service channels to enable true personalization and predictive analytics.

Operational Bottlenecks

- Bottleneck:

Global Supply Chain Complexity

Growth Impact:Disruptions can lead to stockouts and impact the value proposition. Geopolitical tensions and tariffs pose ongoing risks.

Resolution Strategy:Continue diversifying the supplier base, investing in logistics (like Costco Logistics for bulky items), and leveraging the Kirkland brand for vertical integration opportunities.

- Bottleneck:

Physical Store Throughput

Growth Impact:Crowded stores and long checkout lines can degrade the customer experience and limit sales during peak hours.

Resolution Strategy:Pilot and roll out scan-and-go mobile checkout technology. Optimize store layouts for better traffic flow.

Market Penetration Challenges

- Challenge:

Domestic Market Saturation

Severity:Major

Mitigation Strategy:Focus on wallet share expansion through services and e-commerce. Explore smaller, urban-focused store formats and continue methodical international expansion.

- Challenge:

Intense Competition

Severity:Major

Mitigation Strategy:Compete against Walmart/Sam's Club on quality and employee satisfaction, and against Amazon on value and the unique 'treasure hunt' in-store experience. Double down on the Kirkland Signature brand as a key differentiator.

- Challenge:

Adapting to International Markets

Severity:Major

Mitigation Strategy:Carefully research local consumer preferences, regulatory environments, and supply chains before entry. Adapt product mix to local tastes while maintaining the core business model.

Resource Limitations

Talent Gaps

- •

E-commerce and Digital Product Management

- •

Data Science and Machine Learning

- •

International Business Development and Localization

Significant and ongoing capital is required for new warehouse construction, international expansion, and technology infrastructure upgrades.

Infrastructure Needs

- •

Modernization of the e-commerce technology stack.

- •

Expansion of fulfillment centers to support growing online sales, especially for 'Costco Direct' and 2-day delivery.

- •

Investment in data warehousing and analytics platforms.

Growth Opportunities

Market Expansion

- Expansion Vector:

International Expansion (Asia & Europe)

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Continue methodical, data-driven expansion in underpenetrated but high-potential markets like China, while exploring new entry into European countries with a strong appetite for value retail.

- Expansion Vector:

Demographic Expansion (Millennials & Gen Z)

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Launch a targeted digital marketing campaign, enhance the mobile/e-commerce experience, and expand product categories relevant to younger consumers (e.g., sustainable goods, direct-to-consumer brands via Costco Next).

- Expansion Vector:

Costco Business Center Growth

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Accelerate the rollout of Business Centers in metropolitan areas to better serve the needs of small and medium-sized businesses, a high-value customer segment.

Product Opportunities

- Opportunity:

Expansion of Kirkland Signature Brand

Market Demand Evidence:Kirkland accounts for over a quarter of total sales and is a primary driver of store visits and loyalty.

Strategic Fit:Perfectly aligned with the core value proposition.

Development Recommendation:Systematically identify new categories where quality and value are misaligned in the broader market and develop superior Kirkland Signature alternatives (e.g., premium health supplements, plant-based foods, smart home tech).

- Opportunity:

Digital Services Marketplace

Market Demand Evidence:High member trust creates an opportunity to offer curated, high-value digital services.

Strategic Fit:Extends the membership value proposition beyond physical goods.

Development Recommendation:Pilot a marketplace for services like insurance, home security, or financial planning, leveraging partnerships with top-tier providers and offering exclusive member pricing.

- Opportunity:

Costco Next Expansion

Market Demand Evidence:Sales from the Costco Next marketplace are growing rapidly, demonstrating member interest in buying directly from curated brands.

Strategic Fit:Enhances the 'treasure hunt' discovery model in the digital realm.

Development Recommendation:Aggressively expand the portfolio of partner brands on Costco Next, focusing on high-growth, digitally native consumer brands that align with Costco's quality standards.

Channel Diversification

- Channel:

Enhanced Mobile App (Scan & Go)

Fit Assessment:High. Addresses a major in-store pain point (checkout lines) and deepens digital engagement.

Implementation Strategy:Pilot Scan & Go technology in select warehouses, gather user feedback, and plan a phased national rollout.

- Channel:

Retail Media Network

Fit Assessment:High. Leverages first-party member data to create a high-margin revenue stream, similar to Walmart and Amazon.

Implementation Strategy:Build out a sophisticated ad platform allowing suppliers to purchase targeted placements on Costco.com and in email marketing, enhancing supplier relationships and profitability.

Strategic Partnerships

- Partnership Type:

Technology & E-commerce

Potential Partners

Affirm (already launched), Adobe, Salesforce, leading logistics tech providers

Expected Benefits:Accelerate the modernization of the digital customer experience, improve supply chain efficiency, and offer flexible payment options like BNPL to increase conversion on big-ticket items.

- Partnership Type:

Healthcare Services

Potential Partners

Telehealth providers, national lab testing companies, health insurance providers

Expected Benefits:Expand the high-value pharmacy and optical services into a broader health and wellness ecosystem, increasing member dependency and wallet share.

Growth Strategy

North Star Metric

Annual Membership Renewal Rate

This metric is the ultimate indicator of product-market fit and customer loyalty. Since the majority of Costco's profit comes from membership fees, retention is the most critical driver of long-term, sustainable growth and profitability.

Maintain US & Canada renewal rate above 92.5% and increase the global rate from ~90.5% to >91.5%.

Growth Model

Loyalty-Driven Flywheel Model

Key Drivers

- •

Perceived Membership Value (Low Prices + High Quality)

- •

Membership Growth & Renewal

- •

Increased Scale & Buying Power

- •

Lower Cost of Goods

- •

Passing Savings to Members

Continuously reinvest operational efficiencies and scale benefits into lower prices and higher quality products (especially Kirkland Signature), which reinforces the membership value proposition, driving higher renewal rates and attracting new members, thus spinning the flywheel faster.

Prioritized Initiatives

- Initiative:

Digital Experience Transformation

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 Months

First Steps:Appoint a Head of Digital Experience. Begin a comprehensive audit of the current e-commerce platform and mobile app. Develop a roadmap for a new, customer-centric digital ecosystem.

- Initiative:

Targeted International Expansion

Expected Impact:High

Implementation Effort:High

Timeframe:Ongoing (2-3 new countries in 5 years)

First Steps:Conduct deep market analysis for 3-5 target countries. Establish a dedicated market entry team to navigate legal, logistical, and cultural hurdles for the top-ranked country.

- Initiative:

Kirkland Signature Category Dominance

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:12-18 Months

First Steps:Identify 10 new product categories for Kirkland expansion based on market size and margin potential. Begin supplier negotiations and product development for the top three.

Experimentation Plan

High Leverage Tests

- Test:

Personalized homepage and email promotions based on purchase history.

- Test:

Pilot 'Scan & Go' mobile checkout in 5-10 urban warehouses.

- Test:

A/B test different online membership acquisition offers.

Utilize an A/B testing framework measuring impact on conversion rate, average order value, membership sign-ups, and customer satisfaction (NPS).

Run concurrent digital experiments on a bi-weekly sprint schedule. In-store pilots should be run quarterly.

Growth Team

A centralized 'Digital Growth & Membership' team that works cross-functionally with Merchandising, Operations, and Marketing. This team should have dedicated product managers, engineers, and analysts.

Key Roles

- •

VP of Digital Growth

- •

Director of E-commerce Product Management

- •

Head of Member Analytics & Insights

- •

International Expansion Strategist

Acquire top talent from digitally native companies while upskilling internal teams in data analytics, agile development, and digital marketing.

Costco's growth foundation is exceptionally strong, built upon an unshakeable product-market fit, a resilient business model, and unparalleled customer loyalty. The company's core growth engine—a membership-driven flywheel where scale benefits are passed back to the customer—is one of the most powerful and defensible in all of retail. However, this formidable giant faces a critical inflection point. Its primary scale barrier is no longer physical but digital. The company's e-commerce and mobile experiences lag significantly behind competitors, creating a substantial risk of losing the next generation of consumers to more convenient, digitally native options.

The most significant growth opportunities lie in a dual strategy: 1) A radical modernization of its digital channels to transform them from a functional utility into a seamless, personalized, and engaging experience that complements the beloved 'treasure hunt' of its physical stores. 2) Continued, disciplined international expansion into untapped markets where its value proposition is highly likely to resonate. Expanding the high-margin, loyalty-driving Kirkland Signature brand into new categories and further developing ancillary services will also be key drivers of wallet share.

The recommended growth strategy is to protect the core by elevating the North Star Metric of 'Annual Membership Renewal Rate' while aggressively investing in digital transformation. Prioritized initiatives should focus on rebuilding the digital customer experience, methodically entering new international markets, and expanding the Kirkland brand's dominance. Failure to address the digital gap is the single greatest threat to Costco's long-term market leadership. Success in bridging this gap will unlock decades of future growth.

Legal Compliance

Costco maintains a comprehensive and easily accessible Privacy Policy, linked in the website footer, during email sign-ups, and within cookie consent settings. Research indicates the policy is regularly updated and addresses its obligations under various global privacy regimes reflective of its international operations. It details the types of personal information collected (both online and in-store), the purposes for collection, and data sharing practices with service providers and third parties. The policy appears well-structured to build consumer trust by providing clear information on data handling practices across its diverse business segments, including retail, e-commerce, and membership services.

Costco's 'Terms and Conditions of Use' are present and accessible, although not prominently displayed in the footer of every page based on the provided content. Research confirms their existence and comprehensiveness. They cover a wide range of topics including site access, payment terms, intellectual property rights, user-submitted content, and disclaimers of liability. The terms establish a clear legal framework for the use of Costco's digital properties, which is crucial for managing legal risk, protecting intellectual property, and defining the user's obligations. For enhanced legal positioning, ensuring this link is consistently visible in the main site footer across all pages would be a best practice.

Costco has implemented a sophisticated cookie consent management platform powered by OneTrust, a leader in the field. This represents a strong strategic approach to compliance. The system provides granular control, allowing users to opt-in or out of specific categories like 'Personalized Advertising' and 'Performance Cookies', while explaining the function of 'Strictly Necessary Cookies'. This layered approach is aligned with the requirements of GDPR and CCPA/CPRA. The explicit mention of how Safari's browser changes affect cookie persistence demonstrates a high level of diligence. The 'Allow All' and 'Confirm My Choices' buttons provide clear user actions, which is a key component of valid consent.

Costco demonstrates a mature data protection framework aligned with major global regulations. The website prominently features a 'Your Privacy Choices' link, which is the standard mechanism for complying with CCPA/CPRA 'Do Not Sell or Share My Personal Information' requirements. This empowers users, particularly in key markets like California, to control their data. The combination of a detailed privacy policy and a granular cookie consent tool indicates a robust approach to fulfilling GDPR requirements for data subject rights, including consent for non-essential data processing. By having distinct policies and practices for different jurisdictions (e.g., US, Canada, UK), Costco effectively manages its complex international compliance obligations.

Costco has a public and explicit commitment to digital accessibility, stating its adoption of the Web Content Accessibility Guidelines (WCAG) 2.1 Level AA as its standard. This is a critical risk management strategy, as ADA-related website lawsuits are a major source of litigation for retailers. The company provides an Accessibility statement and a dedicated phone number for users with disabilities who need assistance, which is a best practice. While a full technical audit is beyond this analysis, the public commitment and provision of user support channels position Costco strongly in managing legal risks associated with the Americans with Disabilities Act (ADA) and other accessibility mandates.

Costco's legal positioning is complex due to its multi-faceted business model. The website effectively uses disclaimers for promotions, clearly stating validity dates and conditions like 'While Supplies Last,' which aligns with FTC guidelines on truthful advertising. For its financial products, like the 'Costco Anywhere Visa® Card by Citi,' it provides necessary disclosures and links out to the partner institution for detailed terms, which is standard practice. In its pharmacy operations, Costco is subject to the Controlled Substances Act (CSA) and HIPAA. Past settlements with the DEA for lax controls highlight this as a high-risk area requiring continuous and stringent internal compliance monitoring. The sale of specialized items like tires, optical services, and travel packages also carries specific regulatory burdens which appear to be managed through detailed terms on the respective product pages and service portals.

Compliance Gaps

- •

Inconsistent visibility of the main 'Terms and Conditions' link in the primary website footer across all pages.

- •

The inherent complexity of managing numerous third-party vendor relationships (e.g., AT&T, Independent Optometrists, Auto Buying Program) creates a potential risk if data sharing and liability are not meticulously defined and enforced.

- •

While a strong policy exists, the risk of employee error in highly regulated areas like pharmacy services remains a significant compliance challenge, as evidenced by historical enforcement actions.

Compliance Strengths

- •

Implementation of a robust, best-in-class cookie consent management platform (OneTrust).

- •

Clear and accessible mechanisms for users to exercise their data privacy rights under CCPA/CPRA ('Your Privacy Choices').

- •

A public and specific commitment to WCAG 2.1 Level AA accessibility standards, coupled with dedicated user support.

- •

Widespread and consistent use of clear, concise disclaimers for pricing, promotions, and services (e.g., gas prices, appliance delivery).

- •

Strong international presence with localized compliance approaches for different legal jurisdictions.

Risk Assessment

- Risk Area:

Pharmacy & Healthcare Compliance

Severity:High