eScore

crowdstrike.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

CrowdStrike demonstrates exceptional digital presence through its high-authority domain, driven by industry-leading content like the Global Threat Report and consistent validation from analysts like Gartner and Forrester. Their content strategy masterfully aligns with the search intent of sophisticated cybersecurity professionals, establishing them as a primary thought leader. Their multi-channel presence is strong and consistent, effectively leveraging data-driven storytelling to engage audiences across various platforms. While global reach is extensive, there's an opportunity to create more hyper-localized content for emerging markets to further deepen penetration.

Extraordinary content authority and thought leadership, exemplified by their industry-leading threat reports that attract high-quality backlinks and solidify their position as a definitive source of cybersecurity intelligence.

Enhance voice search optimization by creating more explicit question-and-answer content (e.g., 'What is EDR?') to capture featured snippets and perform better on conversational queries.

The brand's communication is remarkably effective, centered on the clear, powerful, and consistent message: "We stop breaches." They masterfully use an authoritative and urgent tone, reinforced by unique brand assets like the named 'Adversaries,' which make abstract threats tangible. Messaging is well-segmented for different personas, from technical SOC analysts to risk-focused CISOs, and is heavily supported by social proof from top-tier analysts and customers.

Unique and compelling differentiation through the 'Adversary-focused' narrative, which personifies threats and positions CrowdStrike's intelligence capabilities as uniquely sophisticated and actionable.

Develop a more explicit messaging track for non-technical C-suite executives (CEOs, CFOs) that directly translates technical superiority into quantifiable business outcomes like ROI, risk reduction in dollar terms, and cyber insurance benefits.

CrowdStrike provides a clear, logical user journey with prominent calls-to-action ('Free Trial', 'Request a Demo') tailored to different stages of the B2B buying cycle. The cross-device experience is excellent, ensuring a seamless journey from mobile to desktop. However, the analysis provided correctly identifies that deeper technical pages can induce high cognitive load due to content density, and the pricing page's transparency for enterprise tiers could be improved to reduce friction for decision-makers.

A well-structured information architecture and navigation system that effectively guides both technical and business users to relevant content and clear conversion points.

Address the critical compliance gap of the broken 'Accessibility' link in the footer. Immediately implement a comprehensive accessibility statement compliant with WCAG 2.1 AA to mitigate legal risk and align with their premium brand image.

Credibility is CrowdStrike's most dominant asset, built on a foundation of relentless third-party validation. They are consistently named a 'Leader' by top industry analyst firms like Gartner, Forrester, and IDC, which is a critical trust signal for their enterprise target audience. This is further bolstered by perfect scores in technical evaluations, an extensive portfolio of compliance certifications (SOC 2, FedRAMP), and a roster of blue-chip customer logos. The primary risk mitigator for new customers is a frictionless free trial, allowing direct experience with the platform's value.

Unmatched third-party validation from a multitude of industry analyst reports (Gartner, Forrester, IDC) and technical tests, which de-risks the purchasing decision for high-value enterprise clients.

Increase transparency in pricing for enterprise tiers on the website. While bespoke pricing is expected, providing clearer guidance on the factors that influence cost could pre-qualify leads more effectively and reduce initial sales friction.

CrowdStrike's competitive moat is deep and highly sustainable, centered on its pioneering cloud-native architecture and proprietary Threat Graph database. This data network effect is exceptionally difficult for competitors to replicate; more customers generate more data, which in turn makes the AI-driven protection smarter. Their 'land-and-expand' model, with high multi-module adoption, creates significant customer stickiness and high switching costs. Their continuous innovation, particularly with the introduction of their agentic AI analyst 'Charlotte AI', further extends their technological lead.

The proprietary Threat Graph technology, which creates a powerful and defensible network effect, leveraging trillions of data points weekly to deliver superior, AI-driven threat detection that becomes more effective as the customer base grows.

More aggressively counter the 'good enough' security bundles from competitors like Microsoft by creating marketing assets that quantify the Total Cost of Ownership (TCO), including the potential cost of a breach that legacy systems might miss.

The business model is exceptionally scalable, built on a high-margin, recurring-revenue SaaS model. Excellent unit economics are evidenced by a high dollar-based net retention rate (consistently over 115%) and strong free cash flow, indicating a healthy LTV:CAC ratio. The 'land-and-expand' strategy is a proven growth engine, with a significant percentage of customers adopting multiple modules. The platform architecture allows for rapid development and deployment of new modules, enabling efficient expansion into adjacent markets like cloud security, identity, and SIEM.

A proven and highly effective 'land-and-expand' business model, demonstrated by a consistently high net retention rate, which efficiently drives growth by upselling new, high-margin modules to the existing customer base.

Develop a more scalable, low-touch Product-Led Growth (PLG) engine to capture the SMB market more efficiently, as the current enterprise-focused sales model is not cost-effective for that segment.

CrowdStrike's business model is remarkably coherent and strategically focused on becoming the definitive, consolidated security platform. The subscription-based revenue model is highly optimized, comprising over 93% of total revenue and enabling predictable growth. Resource allocation is clearly directed towards platform expansion and innovation, as seen with acquisitions and the development of their Next-Gen SIEM. The company demonstrates excellent market timing by aligning its core messaging and product development with major trends like AI-native security and vendor consolidation.

Exceptional strategic focus on platform consolidation, successfully evolving from a best-of-breed endpoint solution to a comprehensive, unified platform that increases customer value and creates high switching costs.

Diversify go-to-market strategies to better address the mid-market and SMB segments. This includes creating more robust channel enablement and MSP programs to scale beyond the direct enterprise sales force.

CrowdStrike exhibits significant market power as a recognized leader in endpoint security and a growing force in broader cybersecurity categories. Their consistent 'Leader' status in analyst reports gives them considerable influence over market perception and enterprise buying decisions. This brand authority allows them to command premium pricing, even when facing competition from bundled solutions. Their market influence is further demonstrated by their ability to shape industry narratives, such as the shift towards 'AI-native' security operations.

Strong pricing power, enabling them to maintain premium pricing and high margins despite intense competition, which is a direct result of their technological superiority and dominant brand reputation.

Strengthen strategic partnerships with major Cloud Service Providers (CSPs) like AWS and Azure to counter the native security offerings and bundling strategies of competitors.

Business Overview

Business Classification

SaaS

PaaS (Platform-as-a-Service)

Cybersecurity

Sub Verticals

- •

Endpoint Security (EPP/EDR)

- •

Cloud Security (CNAPP)

- •

Identity Security

- •

Threat Intelligence

- •

Security Operations (Next-Gen SIEM)

- •

Managed Detection and Response (MDR)

- •

Exposure Management

- •

XIoT Security

Mature

Maturity Indicators

- •

Established market leader, ranking #1 in Modern Endpoint Security market share.

- •

Publicly traded company (NASDAQ: CRWD) with a significant market capitalization.

- •

Consistently strong revenue growth, reaching $3.06 billion in fiscal 2024.

- •

Global customer base exceeding 21,000 subscription customers.

- •

Comprehensive, multi-product platform (Falcon Platform) addressing numerous risk areas.

- •

Consistently recognized as a leader by industry analysts like Gartner and Forrester.

Enterprise

Rapid

Revenue Model

Primary Revenue Streams

- Stream Name:

Falcon Platform Subscriptions

Description:Recurring subscription fees for access to the cloud-native Falcon platform and its various security modules. This constitutes the vast majority of the company's revenue.

Estimated Importance:Primary

Customer Segment:All Segments (SMB to Large Enterprise)

Estimated Margin:High

- Stream Name:

Professional Services

Description:Fees for services including incident response, proactive security assessments, cybersecurity consulting, and forensic analysis.

Estimated Importance:Secondary

Customer Segment:Primarily Mid-Market and Enterprise

Estimated Margin:Medium

Recurring Revenue Components

- •

Annual or multi-year subscriptions to Falcon platform modules

- •

Managed services retainers (e.g., Falcon Complete)

- •

Threat intelligence data subscriptions

Pricing Strategy

Tiered Subscription

Premium

Semi-transparent

Pricing Psychology

- •

Tiered Bundling (Go, Pro, Enterprise) to create clear value steps

- •

Free Trial offering to lower the barrier to entry and demonstrate value

- •

"Contact Sales" for top-tier managed services (Falcon Complete) to anchor value and facilitate consultative selling

Monetization Assessment

Strengths

- •

High percentage of predictable, recurring subscription revenue (approx. 94-95%).

- •

Proven "land-and-expand" model, where customers adopt more modules over time, increasing customer lifetime value.

- •

Platform model creates high switching costs and customer stickiness.

- •

Premium pricing is justified by market leadership and superior technology.

Weaknesses

Premium pricing can be a barrier for highly price-sensitive segments.

Revenue growth, while strong, is showing signs of deceleration from prior hyper-growth rates.

Opportunities

- •

Further penetration of the existing customer base with newer modules like Identity Security, Next-Gen SIEM, and Data Protection.

- •

Expansion into adjacent markets like IT operations and observability.

- •

Strategic pricing bundles to accelerate adoption of the full platform.

- •

Growing the channel, particularly with MSPs and MSSPs, to reach the down-market segments more effectively.

Threats

- •

Intense price competition from large platform vendors like Microsoft, which can bundle security products at a lower cost.

- •

Macroeconomic pressures leading to constrained IT and security budgets.

- •

Potential platform outages could lead to customer compensation and reputational damage, impacting future revenue.

Market Positioning

AI-Native Cybersecurity Platform Leader

Market Leader

Target Segments

- Segment Name:

Large Enterprise

Description:Fortune 500 companies, large multinational corporations, and major government agencies with complex security needs and dedicated security operations centers (SOCs).

Demographic Factors

- •

5,000+ employees

- •

Global operations

- •

High regulatory compliance requirements

Psychographic Factors

- •

Risk-averse

- •

Value security efficacy and vendor reputation over price

- •

Seeking to consolidate security vendors and reduce tool sprawl

Behavioral Factors

- •

Engage in long sales cycles with proof-of-concept evaluations

- •

Purchase comprehensive platform bundles and professional services

- •

High adoption rate of advanced modules and managed services

Pain Points

- •

Managing a complex ecosystem of siloed security tools

- •

Alert fatigue in the SOC

- •

Inability to detect and respond to sophisticated, nation-state-level attacks

- •

Shortage of skilled cybersecurity talent

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Mid-Market

Description:Medium to large businesses with growing IT environments but smaller, less mature security teams than large enterprises.

Demographic Factors

- •

250 - 5,000 employees

- •

Rapidly growing or digitally transforming

- •

Presence in industries like finance, healthcare, and retail

Psychographic Factors

- •

Seeking efficiency and ease of use

- •

Value solutions that offer both strong protection and operational simplicity

- •

Aware of advanced threats but may lack in-house expertise

Behavioral Factors

- •

Often purchase through channel partners or direct sales

- •

Value transparent pricing and clear ROI

- •

Start with core endpoint protection and expand to other modules over time

Pain Points

- •

Lack of 24/7 threat hunting and response capabilities

- •

Difficulty managing multiple security agents and consoles

- •

Protecting a hybrid workforce and cloud assets with limited resources

- •

Vulnerability to ransomware attacks

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Small Business (SMB)

Description:Small businesses with limited IT and security resources, seeking straightforward, effective protection that is easy to deploy and manage.

Demographic Factors

- •

1 - 250 employees

- •

Often lack a dedicated security professional

- •

High reliance on cloud services

Psychographic Factors

- •

Highly price-sensitive

- •

Desire a "set it and forget it" security solution

- •

Overwhelmed by the complexity of cybersecurity

Behavioral Factors

- •

Purchase online or through Managed Service Providers (MSPs)

- •

Highly influenced by ease of installation and minimal management overhead

- •

Typically purchase entry-level packages like 'Falcon Go'

Pain Points

- •

Lack of budget for enterprise-grade security

- •

Inability to defend against common threats like malware and ransomware

- •

No time or expertise for security management

- •

Belief that they are too small to be a target

Fit Assessment:Good

Segment Potential:Medium

Market Differentiation

- Factor:

AI-Native, Cloud-First Architecture

Strength:Strong

Sustainability:Sustainable

- Factor:

Single Lightweight Agent

Strength:Strong

Sustainability:Sustainable

- Factor:

Proprietary Threat Graph Database

Strength:Strong

Sustainability:Sustainable

- Factor:

Elite Human Expertise (Threat Hunting & Incident Response)

Strength:Strong

Sustainability:Sustainable

- Factor:

Unified Platform Approach

Strength:Moderate

Sustainability:Sustainable

Value Proposition

We stop breaches. CrowdStrike provides a single, AI-native platform to protect all critical areas of enterprise risk—endpoints, cloud, identity, and data—reducing complexity and delivering superior security outcomes.

Excellent

Key Benefits

- Benefit:

Superior Breach Protection

Importance:Critical

Differentiation:Unique

Proof Elements

- •

Leadership in Gartner Magic Quadrant and Forrester Wave reports.

- •

Top rankings in MITRE ATT&CK evaluations.

- •

Customer testimonials and case studies.

- Benefit:

Reduced Complexity and Agent Sprawl

Importance:Critical

Differentiation:Unique

Proof Elements

- •

Single lightweight agent architecture.

- •

Unified management console for all modules.

- •

Customer testimonials on operational efficiency and vendor consolidation.

- Benefit:

Increased SOC Efficiency

Importance:Important

Differentiation:Somewhat unique

Proof Elements

- •

AI-powered detections to reduce alert fatigue.

- •

Automated response capabilities.

- •

Introduction of Next-Gen SIEM to accelerate investigations.

- Benefit:

Real-time Visibility and Threat Hunting

Importance:Critical

Differentiation:Unique

Proof Elements

- •

Continuous endpoint activity monitoring.

- •

Access to elite threat hunting teams (Falcon OverWatch).

- •

Rich data provided by the Threat Graph.

Unique Selling Points

- Usp:

The Threat Graph: A cloud-based graph database that correlates trillions of security events per week in real-time to detect and prevent threats at scale.

Sustainability:Long-term

Defensibility:Strong

- Usp:

AI-Native Platform: Built from the ground up to leverage AI and machine learning for detection and prevention, rather than adding it as a feature.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Single, Cloud-Managed Lightweight Agent: A frictionless agent that deploys rapidly and provides immediate protection and visibility without performance degradation or system reboots.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Inability to stop sophisticated, novel, and fileless attacks that bypass traditional antivirus.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

High operational overhead and performance impact from managing multiple, heavy security agents.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Lack of visibility into endpoint, cloud, and identity-based threats across the enterprise.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Slow detection, investigation, and response times to security incidents.

Severity:Critical

Solution Effectiveness:Partial

Value Alignment Assessment

High

The value proposition directly addresses the market's primary challenges: the increasing sophistication of threats, the complexity of the IT environment (hybrid work, cloud adoption), and the shortage of security talent. The unified platform approach aligns with the strong market trend of vendor consolidation.

High

The messaging and benefits are well-aligned with the pain points of CISOs and security leaders, focusing on tangible outcomes like stopping breaches, reducing complexity, and improving operational efficiency. Tiered offerings effectively tailor this value to different segments, from SMBs to large enterprises.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Cloud Service Providers (AWS, Google Cloud, Azure).

- •

Technology Alliance Partners (e.g., Zscaler, Cloudflare).

- •

Global System Integrators & Consultants (Accenture, Deloitte).

- •

Channel Partners, Resellers, and Managed Security Service Providers (MSSPs).

Key Activities

- •

Research & Development of the Falcon Platform and AI models

- •

Global Threat Intelligence Research and Threat Hunting

- •

Sales, Marketing, and Brand Building

- •

Delivering Professional and Managed Security Services

- •

Managing Cloud Infrastructure at Scale

Key Resources

- •

Proprietary Falcon Platform and Threat Graph technology.

- •

Vast and growing dataset of security telemetry

- •

World-class cybersecurity talent (researchers, engineers, threat hunters, incident responders)

- •

Strong brand recognition and reputation

- •

Extensive partner ecosystem

Cost Structure

- •

Sales and Marketing expenses to drive customer acquisition

- •

Research and Development for continuous innovation

- •

Cost of subscription revenue (cloud hosting, customer support)

- •

General and Administrative expenses

Swot Analysis

Strengths

- •

Market leadership in core endpoint security market.

- •

Technologically superior cloud-native, AI-driven platform.

- •

Strong brand equity and reputation for efficacy.

- •

Highly scalable and profitable subscription-based business model.

- •

Proven "land-and-expand" strategy driving revenue growth from existing customers.

Weaknesses

- •

Premium price point compared to some competitors.

- •

Recent platform outage caused business disruption and financial impact, highlighting operational risk.

- •

Historically enterprise-focused, with a newer, less-established presence in the MSP/SMB channel.

Opportunities

- •

Massive and growing Total Addressable Market (TAM) for cybersecurity.

- •

Lead the emerging market for securing AI and LLMs.

- •

Displace legacy SIEM solutions with Falcon Next-Gen SIEM.

- •

Further expansion into adjacent security domains (Data Protection, IoT/OT Security).

- •

Deeper strategic partnerships to bundle services and reach new customers (e.g., cyber insurance, telcos).

Threats

- •

Intense competition from large, well-funded platform players like Microsoft and Palo Alto Networks.

- •

Rapidly evolving adversary tactics that could challenge existing detection models.

- •

Potential for commoditization in the endpoint security market.

- •

Macroeconomic headwinds impacting corporate IT spending.

- •

Increased regulatory scrutiny of cloud service providers.

Recommendations

Priority Improvements

- Area:

Go-to-Market Strategy for SMBs

Recommendation:Aggressively expand and simplify the Managed Service Provider (MSP) partner program to accelerate down-market penetration. Offer MSP-specific tooling, simplified billing, and more attractive incentives.

Expected Impact:High

- Area:

Product Marketing & Value Communication

Recommendation:Develop and promote clear Total Cost of Ownership (TCO) and Return on Investment (ROI) models that quantify the value of consolidating security tools onto the Falcon platform, directly countering pricing objections from competitors like Microsoft.

Expected Impact:Medium

- Area:

Platform Resilience and Transparency

Recommendation:Proactively communicate platform resilience investments and architecture improvements following the recent outage. Consider establishing a public-facing trust center with detailed uptime metrics and incident post-mortems to rebuild confidence.

Expected Impact:High

Business Model Innovation

- •

Develop a consumption-based pricing model for the Next-Gen SIEM module based on data ingestion and analytics, providing a more flexible and scalable alternative to traditional SIEM licensing.

- •

Launch a dedicated 'CrowdStrike for Startups' program with heavily discounted bundles to build loyalty and grow with high-potential companies from an early stage.

- •

Create an integrated risk quantification service, leveraging Falcon data to help customers model their cyber risk in financial terms, enabling better discussions with insurers and boards.

Revenue Diversification

- •

Expand the 'Falcon for IT' offerings to move beyond security into unified endpoint management, directly competing with IT management platforms and expanding the buyer personas within customer organizations.

- •

Build a dedicated practice around AI Security consulting, helping enterprises secure their own AI models and applications, leveraging CrowdStrike's expertise in this emerging domain.

- •

Partner with cyber insurance carriers to offer 'Falcon-certified' policies, where customers using specific CrowdStrike modules receive preferential terms and lower premiums, creating a powerful new sales channel.

CrowdStrike has successfully executed a strategic evolution from a best-of-breed endpoint detection and response (EDR) vendor to a dominant, unified cybersecurity platform. Its business model is built on a highly scalable, recurring revenue SaaS framework that has proven incredibly effective, evidenced by its market leadership and sustained high-growth trajectory. The company's core strength lies in its cloud-native, AI-driven architecture, embodied by the proprietary Threat Graph and a single lightweight agent, which provides a significant and sustainable competitive advantage over both legacy vendors and newer competitors.

The primary strategic opportunity for CrowdStrike is to leverage its entrenched position in the enterprise to drive further platform consolidation. As CISOs look to reduce complexity and improve security outcomes, CrowdStrike is exceptionally well-positioned to displace point solutions in cloud security (CNAPP), identity protection, and particularly the legacy SIEM market with its Next-Gen SIEM offering. This 'land-and-expand' motion is the central engine of its future growth.

However, the company faces two principal strategic challenges. First, intense competition from Microsoft, which can leverage its enterprise agreements to bundle 'good enough' security at a marginal cost, threatening CrowdStrike's premium positioning. Countering this requires a relentless focus on communicating superior efficacy and a lower total cost of ownership. Second, operational resilience has emerged as a key risk. While its technology is best-in-class, any platform instability can have widespread consequences, creating an urgent need to invest in and communicate the robustness of its infrastructure.

Future business model evolution should focus on three areas: deeper penetration of the mid-market and SMB segments via a more robust channel strategy, innovating on pricing models (e.g., consumption-based options for data-heavy products), and expanding the platform's scope beyond pure security into adjacent IT operations. By successfully navigating the competitive landscape and solidifying its platform's resilience, CrowdStrike is poised to become the definitive, consolidated security platform for the AI era.

Competitors

Competitive Landscape

Growth

Moderately concentrated

Barriers To Entry

- Barrier:

Brand Reputation and Trust

Impact:High

- Barrier:

Threat Intelligence Infrastructure

Impact:High

- Barrier:

AI/ML Development and Data Volume

Impact:High

- Barrier:

Global Sales and Support Channels

Impact:Medium

- Barrier:

High Customer Switching Costs

Impact:Medium

Industry Trends

- Trend:

Platform Consolidation (EPP, EDR, XDR, CNAPP, SIEM)

Impact On Business:Favors CrowdStrike's unified platform approach but increases competition from broad-platform vendors like Microsoft and Palo Alto Networks.

Timeline:Immediate

- Trend:

AI-Driven Security Operations

Impact On Business:Reinforces CrowdStrike's core marketing of an 'AI-native' platform but requires continuous innovation to maintain a lead against competitors also heavily investing in AI.

Timeline:Immediate

- Trend:

Expansion of Attack Surfaces (IoT, OT, Cloud)

Impact On Business:Creates demand for CrowdStrike's XIoT and Cloud Security modules, offering significant growth opportunities.

Timeline:Near-term

- Trend:

Shortage of Skilled Cybersecurity Professionals

Impact On Business:Drives adoption of managed services like Falcon Complete (MDR) and solutions that offer automation and ease of use.

Timeline:Immediate

- Trend:

Zero Trust Architecture Adoption

Impact On Business:Aligns with CrowdStrike's identity security offerings and reinforces the need for robust endpoint and identity verification, playing into their strengths.

Timeline:Near-term

Direct Competitors

- →

SentinelOne

Market Share Estimate:9.5%

Target Audience Overlap:High

Competitive Positioning:Positions as a leader in autonomous, AI-powered security, emphasizing machine-speed response without human intervention.

Strengths

- •

Strong autonomous AI and machine learning capabilities for detection and response.

- •

Automated remediation and rollback features are highly regarded.

- •

Singularity platform offers a unified agent for EPP, EDR, and XDR.

- •

Gaining significant market share, particularly in the mid-market.

Weaknesses

- •

Brand recognition is still catching up to CrowdStrike in the large enterprise segment.

- •

Some users report that the high degree of automation can limit manual control for advanced security teams.

- •

Threat intelligence capabilities are perceived as less extensive than CrowdStrike's.

Differentiators

Emphasis on 'autonomous' response, aiming to resolve threats without human intervention.

Storyline Active Response (STAR) for automated threat hunting and response workflows.

- →

Microsoft

Market Share Estimate:10.6% - 40% (depending on source and included products)

Target Audience Overlap:High

Competitive Positioning:Leverages its massive enterprise footprint to offer a 'good enough' security solution that is deeply integrated into the Windows OS and Microsoft 365 ecosystem.

Strengths

- •

Deep, native integration with Windows and the broader Microsoft 365 Defender suite.

- •

Often bundled with enterprise licensing agreements (E5), making it a cost-effective choice for existing Microsoft customers.

- •

Vast global telemetry from its ecosystem provides significant data for threat detection.

- •

Strong AI capabilities and a comprehensive XDR approach.

Weaknesses

- •

Perceived as less effective for non-Windows environments (macOS, Linux) compared to specialists like CrowdStrike.

- •

Can be complex to manage outside of a pure Microsoft environment.

- •

Historically viewed as a follower in cutting-edge endpoint security, though this perception is changing.

Differentiators

Unparalleled native OS integration on Windows endpoints.

Unified security across endpoint, identity, email, and applications within the Microsoft 365 Defender portal.

- →

Palo Alto Networks

Market Share Estimate:Not specified for EDR, but a major player in overall cybersecurity.

Target Audience Overlap:High

Competitive Positioning:Offers a comprehensive, integrated security platform (network, cloud, endpoint), positioning its endpoint solution (Cortex XDR) as one piece of a broader security fabric.

Strengths

- •

Excels at correlating data from multiple sources (endpoint, network, cloud) for a holistic view of threats.

- •

Strong brand reputation in network security, which they leverage to sell their XDR platform.

- •

Powerful choice for organizations already invested in the Palo Alto Networks ecosystem.

- •

Advanced AI and machine learning capabilities.

Weaknesses

- •

Can be more complex and costly to deploy, especially for organizations not already using their products.

- •

Primarily known for network security, their endpoint solution is a newer, though strong, entrant.

- •

The 'all-in-one' platform approach may not appeal to customers seeking a best-of-breed endpoint solution.

Differentiators

Integration of EDR with Network Detection and Response (NDR) is a core value proposition.

Positions as a true XDR platform, not just an EDR solution.

- →

Trellix

Market Share Estimate:6.6% (Post-merger of McAfee Enterprise and FireEye)

Target Audience Overlap:Medium

Competitive Positioning:Positions as a 'living security' company, emphasizing an adaptable XDR architecture that leverages a large sensor network and threat intelligence from its combined McAfee and FireEye heritage.

Strengths

- •

Extensive threat intelligence from the combined legacy of McAfee and FireEye.

- •

Broad portfolio covering endpoint, network, data, and email security.

- •

Large existing customer base from its legacy companies.

Weaknesses

- •

Post-merger integration challenges and potential for product overlap/confusion.

- •

Often perceived as a more traditional or legacy vendor compared to cloud-native players like CrowdStrike.

- •

Can be less agile and slower to innovate than more focused competitors.

Differentiators

Focus on an open, interoperable XDR platform.

Combined threat intelligence from two historically significant security vendors.

Indirect Competitors

- →

Amazon Web Services (AWS)

Description:Provides a suite of native security tools (e.g., Amazon GuardDuty, AWS Security Hub) that secure the cloud infrastructure itself. While not an EDR, these tools can reduce the need for third-party agents for certain cloud security functions.

Threat Level:Medium

Potential For Direct Competition:Medium. AWS could expand its native agent capabilities to compete more directly in EDR/CWPP, especially for workloads running on AWS.

- →

Cisco

Description:A dominant player in network security (firewalls, switches). Their SecureX platform aims to provide a broad, integrated security architecture. Their competition is more from a network-centric view of security rather than an endpoint-first approach.

Threat Level:Low

Potential For Direct Competition:Medium. Cisco continues to invest in its XDR capabilities and could acquire or build a more competitive endpoint solution to challenge leaders.

- →

Managed Security Service Providers (MSSPs) / Managed Detection and Response (MDR) Providers

Description:Companies like Arctic Wolf or Expel that build services on top of various security technologies. They compete by offering a fully outsourced security operations center (SOC), which can be an alternative for companies that might otherwise buy a platform like CrowdStrike's Falcon Complete.

Threat Level:Medium

Potential For Direct Competition:Low. They are often partners and customers of CrowdStrike, but also compete for the same security budget with their own managed offerings.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Cloud-Native Architecture and Single Lightweight Agent

Sustainability Assessment:Highly sustainable. The architecture provides scalability, ease of deployment, and performance benefits that are difficult for legacy, on-premise solutions to replicate.

Competitor Replication Difficulty:Hard

- Advantage:

Threat Graph Technology

Sustainability Assessment:Highly sustainable. This proprietary database processes trillions of events weekly, creating a powerful network effect; more data leads to smarter AI and better threat detection, which is very difficult to replicate.

Competitor Replication Difficulty:Hard

- Advantage:

Strong Brand Reputation and Market Leadership

Sustainability Assessment:Sustainable. Being recognized as a leader by Gartner and others creates a flywheel effect, attracting top talent and large enterprise customers, reinforcing their market position.

Competitor Replication Difficulty:Medium

- Advantage:

Elite Human Expertise (Falcon OverWatch, Intelligence)

Sustainability Assessment:Sustainable. The combination of AI with world-class human threat hunters and intelligence analysts provides a level of service and insight that is difficult to scale and replicate.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'First-Mover in Cloud-Native EDR', 'estimated_duration': 'Largely eroded. While they pioneered the category, competitors like SentinelOne and Microsoft have developed strong cloud-native offerings, reducing this initial advantage.'}

Disadvantages

- Disadvantage:

Premium Pricing

Impact:Major

Addressability:Moderately

- Disadvantage:

Platform Complexity for SMBs

Impact:Minor

Addressability:Easily

- Disadvantage:

Competition from Bundled 'Good Enough' Solutions

Impact:Major

Addressability:Difficult

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted marketing campaigns highlighting weaknesses in Microsoft Defender for non-Windows environments (macOS/Linux).

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Create simplified solution bundles and pricing models specifically for the mid-market to compete more effectively with SentinelOne.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Promote customer success stories that directly compare the total cost of ownership (TCO) of CrowdStrike vs. managing a 'cheaper' bundled solution.

Expected Impact:Medium

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Deepen technical partnerships and integrations with major cloud providers (AWS, Google Cloud) to become the preferred third-party security solution, countering their native offerings.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Expand the 'Falcon for IT' offerings to further blur the lines between security and IT operations, increasing platform stickiness and competing with IT management tools.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Invest in channel enablement and partner programs for MSSPs to make Falcon the platform of choice for their managed service offerings.

Expected Impact:High

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Lead the market in defining security for emerging technologies, particularly generative AI and quantum computing, to establish the next frontier of competitive advantage.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Explore strategic acquisitions in adjacent areas like Data Loss Prevention (DLP) or API security to fill portfolio gaps and continue the platform consolidation trend.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Build out a more robust compliance and risk management module to move beyond pure security and into the broader GRC (Governance, Risk, and Compliance) space.

Expected Impact:Medium

Implementation Difficulty:Difficult

Solidify positioning as the 'Apple' of cybersecurity: a premium, best-of-breed, AI-native unified platform that 'just works' for stopping breaches, combining elite technology with human expertise. Contrast this with the perceived complexity of platform players like Palo Alto and the 'good enough' bundling of Microsoft.

Double down on the 'Stops Breaches' mission. Use data from the Threat Graph and OverWatch team to publish quantifiable metrics on breach prevention compared to competitors. Focus on business outcomes (risk reduction, insurance premium reduction, SOC efficiency) rather than just technical features.

Whitespace Opportunities

- Opportunity:

Cyber Insurance Readiness and Partnership

Competitive Gap:While many vendors talk about insurability, none have fully productized a solution that streamlines the cyber insurance application and claims process for customers. A dedicated module could assess a customer's environment against major insurers' frameworks and auto-generate reports.

Feasibility:High

Potential Impact:High

- Opportunity:

Managed Threat Hunting for Operational Technology (OT)

Competitive Gap:The convergence of IT and OT is a major trend. While XIoT visibility is offered, a dedicated, managed threat hunting service for industrial control systems (ICS) and OT environments is a niche where deep expertise can create a strong moat.

Feasibility:Medium

Potential Impact:High

- Opportunity:

AI Security Posture Management (AI-SPM)

Competitive Gap:As companies rapidly deploy their own AI models, securing these models from data poisoning, evasion attacks, and data leakage is an emerging and critical need. A dedicated solution to assess and secure customer AI pipelines is a significant blue ocean opportunity.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Simplified, All-in-One Security for the 'S' in SMB

Competitive Gap:Very small businesses (under 50 employees) are often underserved, finding enterprise-grade tools too complex and expensive. A radically simplified, 'set-and-forget' version of the Falcon platform, potentially under a different brand, could capture this long tail of the market.

Feasibility:Medium

Potential Impact:Medium

CrowdStrike operates in the dynamic and growing cybersecurity industry, specifically within the endpoint, cloud, and identity security segments. The market is in a growth phase, characterized by rapid innovation and a trend towards platform consolidation. The market is moderately concentrated, with CrowdStrike holding a leading market share (~20.4%) in endpoint protection, but facing intense competition from other specialized vendors and large, diversified technology companies.

Direct Competition:

CrowdStrike's primary direct competitors are SentinelOne, Microsoft, and Palo Alto Networks.

- SentinelOne competes fiercely on AI-driven automation, positioning itself as the more autonomous, next-generation choice. It represents the most direct threat in terms of technology and go-to-market strategy.

- Microsoft is a formidable competitor due to its market dominance and ability to bundle Microsoft Defender for Endpoint with its widely used enterprise software licenses. This creates a significant pricing and integration advantage, making it the default 'good enough' choice for many organizations heavily invested in the Microsoft ecosystem.

- Palo Alto Networks competes from a broader platform perspective, integrating its Cortex XDR endpoint solution with its market-leading network and cloud security products. Their advantage lies in providing a single, unified security architecture for customers who prioritize vendor consolidation over a best-of-breed endpoint solution.

Competitive Advantages:

CrowdStrike's core sustainable advantages are its pioneering cloud-native architecture, its single lightweight agent, and its proprietary Threat Graph database. The Threat Graph creates a powerful network effect, where the massive volume of data collected continuously improves its AI models and threat intelligence, an advantage that is exceedingly difficult for competitors to replicate. This is further enhanced by their elite human-led services like Falcon OverWatch, which provides a level of expertise that pure technology solutions cannot match.

Market Opportunities & Strategic Imperatives:

The primary strategic challenge for CrowdStrike is to defend its premium, best-of-breed position against the bundling strategies of Microsoft and the expansive platform plays of Palo Alto Networks. The key is to relentlessly focus on the core mission: stopping breaches more effectively than anyone else and proving it with data.

Whitespace opportunities exist in emerging, underserved markets. The rapid corporate adoption of AI creates a critical need for AI Security Posture Management, a field where CrowdStrike's AI-native branding gives it a right to win. Similarly, bridging the gap between cybersecurity posture and cyber insurance underwriting is a tangible business problem that can be solved through their platform. Finally, there is a persistent gap in serving the unique needs of Operational Technology (OT) environments with specialized, managed services. Capitalizing on these opportunities will be crucial for sustaining a high growth trajectory and maintaining market leadership.

Messaging

Message Architecture

Key Messages

- Message:

One Unified Platform. Built to Secure the AI Revolution.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Section

- Message:

We stop breaches.

Prominence:Primary

Clarity Score:High

Location:Implicitly central to the brand mission, underpins all messaging.

- Message:

Leading Cybersecurity into the AI Era.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Section (Rotating)

- Message:

A Leader for the sixth consecutive time - 2025 Gartner® Magic Quadrant™ for Endpoint Protection Platforms.

Prominence:Secondary

Clarity Score:High

Location:Homepage, Why CrowdStrike section

- Message:

Know them. Find them. Stop them.

Prominence:Secondary

Clarity Score:High

Location:Homepage, section driving to Adversary Universe

- Message:

Unified platform. One agent. Complete protection.

Prominence:Tertiary

Clarity Score:High

Location:Homepage, under the platform section

The messaging hierarchy is exceptionally well-structured. The primary message immediately establishes CrowdStrike as a forward-looking leader focused on the most current threat landscape: AI. This is supported by the foundational brand promise ('stop breaches') and validated by secondary messages of market leadership (Gartner reports). The hierarchy logically flows from a high-level strategic imperative (securing AI) down to the practical implementation (one unified platform).

Messaging is highly consistent across the site. The core concepts of a unified 'Falcon' platform, focusing on adversaries, and leveraging AI are woven throughout the homepage, product pages, and even specialized content like the adversary profiles. The confident, authoritative tone is maintained, creating a cohesive and powerful brand narrative.

Brand Voice

Voice Attributes

- Attribute:

Authoritative

Strength:Strong

Examples

- •

A Leader for the sixth consecutive time.

- •

Adversaries weaponize and target AI at scale.

- •

Traditional defenses are obsolete.

- Attribute:

Urgent

Strength:Strong

Examples

- •

AI is the new attack surface.

- •

Experienced a breach?

- •

today’s attacks take only minutes to succeed.

- Attribute:

Forward-Looking

Strength:Strong

Examples

- •

Leading Cybersecurity into the AI Era.

- •

Built to Secure the AI Revolution.

- •

Fal.Con is where the industry meets to shape the future.

- Attribute:

Technical & Precise

Strength:Moderate

Examples

The most complete CNAPP with unified agent and agentless protection, from code to cloud.

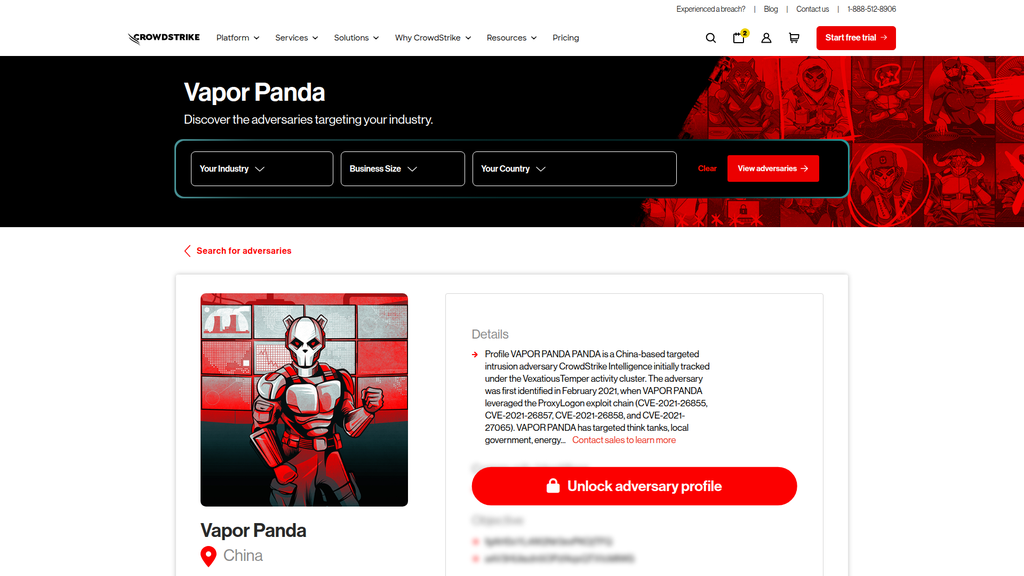

VAPOR PANDA leveraged the ProxyLogon exploit chain (CVE-2021-26855...).

Tone Analysis

Confident and Expert

Secondary Tones

- •

Urgent

- •

Reassuring

- •

Pragmatic

Tone Shifts

The tone shifts from a persuasive, benefit-driven approach on the homepage to a highly factual, technical, and descriptive tone on the adversary profile pages, which is appropriate for the different audiences and purposes of these sections.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

CrowdStrike provides a single, AI-native cybersecurity platform that unifies all necessary security functions to proactively stop breaches in the modern, AI-driven threat landscape, positioning itself as the definitive market leader.

Value Proposition Components

- Component:

AI-Native Platform

Clarity:Clear

Uniqueness:Somewhat Unique

Explanation:Presents their platform not just as using AI, but as being fundamentally built for the AI era. This is a key, modern differentiator.

- Component:

Unified Single-Agent Architecture

Clarity:Clear

Uniqueness:Somewhat Unique

Explanation:Addresses a major customer pain point: complexity and agent fatigue. Communicated as a core benefit of the Falcon platform.

- Component:

Adversary-Focused Intelligence

Clarity:Clear

Uniqueness:Unique

Explanation:The 'Adversary Hub' and naming conventions (e.g., 'Vapor Panda') create a unique and memorable brand asset, framing the conflict as being against intelligent foes, not just inanimate malware.

- Component:

Market Leadership & Validation

Clarity:Clear

Uniqueness:Common

Explanation:While many competitors claim leadership, CrowdStrike's heavy and specific use of Gartner and IDC reports is a powerful and clearly communicated proof point.

CrowdStrike differentiates effectively on two main fronts: 1) Future-focus: They have successfully claimed the narrative around 'securing the AI revolution,' positioning competitors as legacy solutions for a bygone era. 2) Adversary-centricity: Instead of just talking about threats, they personify them. This makes the danger feel more real and their intelligence capabilities seem more sophisticated. This combination moves the conversation from features to a strategic imperative.

The messaging positions CrowdStrike at the apex of the market as the undisputed leader and innovator. By repeatedly citing top-right placement in Gartner Magic Quadrants and leadership in IDC MarketScapes, they create an impression of objective superiority. The tagline 'Leading Cybersecurity into the AI Era' is a direct challenge to competitors, implying others are followers. This assertive positioning aims to make choosing CrowdStrike feel like the safest, most forward-thinking decision for a CISO or IT leader.

Audience Messaging

Target Personas

- Persona:

CISO / Executive Leadership

Tailored Messages

- •

A Leader for the sixth consecutive time.

- •

Lower your risk, enhance your cyber profile, and improve insurance terms.

- •

CrowdStrike vs The Competition

Effectiveness:Effective

- Persona:

Security Operations Center (SOC) Analyst / Threat Hunter

Tailored Messages

- •

Know them. Find them. Stop them.

- •

Accelerate detection and response with autonomous reasoning and action.

- •

Detailed adversary profiles like 'Vapor Panda'.

Effectiveness:Effective

- Persona:

IT Manager / Small & Medium Business Owner

Tailored Messages

- •

Falcon Go: Simplified cybersecurity — install AI-powered antivirus...

- •

Unified platform. One agent. Complete protection.

- •

Unify security and IT with one platform, agent, and console to cut complexity and cost.

Effectiveness:Somewhat Effective

Audience Pain Points Addressed

- •

Fear of sophisticated breaches and ransomware.

- •

Complexity of managing multiple, siloed security tools ('agent fatigue').

- •

Inability to keep up with the speed of modern attacks.

- •

Lack of visibility across the entire IT estate (endpoints, cloud, identity).

- •

The emerging threat of AI-driven attacks.

Audience Aspirations Addressed

- •

Achieving a resilient and mature security posture.

- •

Reducing business risk and ensuring continuity.

- •

Empowering security teams with speed and intelligence.

- •

Simplifying the security stack and reducing total cost of ownership (TCO).

- •

Confidently innovating and adopting new technologies like AI.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Fear, Uncertainty, and Doubt (FUD)

Effectiveness:High

Examples

- •

Adversaries weaponize and target AI at scale.

- •

Traditional defenses are obsolete.

- •

Experienced a breach?

- Appeal Type:

Trust and Authority

Effectiveness:High

Examples

- •

A Leader for the sixth consecutive time.

- •

Customer testimonials from Intel, Target, Salesforce.

- •

CrowdStrike Recognized as a Leader in Exposure Management.

- Appeal Type:

Security and Confidence

Effectiveness:Medium

Examples

Rest easy knowing our team of world-class security experts are protecting your environment day and night, 24/7.

Proven ransomware protection designed to keep adversaries at bay...

Social Proof Elements

- Proof Type:

Industry Analyst Reports (Gartner, IDC)

Impact:Strong

- Proof Type:

Customer Testimonials and Logos (Intel, Salesforce, Target)

Impact:Strong

- Proof Type:

Named Awards and Recognition

Impact:Moderate

Trust Indicators

- •

Prominent display of analyst reports.

- •

High-profile customer logos and video testimonials.

- •

Detailed, transparent technical content in the 'Adversary Hub'.

- •

Clear contact information and 'Experienced a Breach?' emergency lines.

- •

Comprehensive compliance and certification information.

Scarcity Urgency Tactics

The primary urgency tactic is not promotional but environmental. The messaging constantly emphasizes the speed and sophistication of modern threats ('today’s attacks take only minutes to succeed') to compel immediate action.

Calls To Action

Primary Ctas

- Text:

Download report

Location:Homepage Hero, Analyst Report sections

Clarity:Clear

- Text:

Start free trial

Location:Header, Footer, Pricing sections

Clarity:Clear

- Text:

Contact sales

Location:Pricing section for 'Falcon Complete'

Clarity:Clear

- Text:

Explore Agentic AI

Location:Homepage section on AI

Clarity:Clear

- Text:

Register for Fal.Con

Location:Homepage Hero (Rotating)

Clarity:Clear

The CTA strategy is highly effective. It provides a balanced mix of actions catering to every stage of the buyer's journey. For top-of-funnel prospects, 'Download report' offers value with low commitment. For mid-funnel evaluation, 'Start free trial' is a clear next step. For bottom-funnel, purchase-ready leads, 'Contact sales' and 'View pricing' are readily available. The language is direct, and the buttons are visually prominent.

Messaging Gaps Analysis

Critical Gaps

The connection between CrowdStrike's technical capabilities and quantifiable business outcomes (e.g., specific ROI, reduction in incident response costs, dollar value of risk reduction) is not explicitly messaged for a CFO or non-technical CEO persona. It is implied but not directly stated in financial terms.

Contradiction Points

No itemsUnderdeveloped Areas

While the 'single platform' message is strong, the sheer volume of products and modules could still feel overwhelming. A more guided 'solution-finder' or persona-based journey on the homepage could help direct visitors more efficiently.

The 'human element' of CrowdStrike's elite threat hunters and experts is mentioned (e.g., Falcon Complete), but the narrative could be more deeply developed through storytelling to build a stronger emotional connection and further differentiate from purely AI-driven competitors.

Messaging Quality

Strengths

- •

Masterful ownership of the 'AI in cybersecurity' narrative.

- •

Exceptional use of social proof (analyst reports, customer logos) to build credibility and de-risk the buying decision.

- •

A clear, consistent, and memorable brand voice that projects authority and leadership.

- •

Strong message architecture that guides the user from high-level strategy to specific product capabilities.

- •

Unique and compelling differentiation through the adversary-focused intelligence branding.

Weaknesses

The breadth of the platform can lead to message density that may be intimidating for new visitors or smaller businesses.

Over-reliance on technical jargon in some areas can obscure the core business value for non-technical executives.

Opportunities

- •

Create a dedicated C-suite content track that translates technical leadership into the language of business risk, ROI, and shareholder value.

- •

Develop more narrative content around the human experts behind the platform, telling the stories of the 'good guys' to create a more engaging and humanized brand.

- •

Introduce interactive tools to help prospective customers navigate the platform and identify the specific bundle of services that matches their needs, simplifying the customer journey.

Optimization Roadmap

Priority Improvements

- Area:

Executive-Level Messaging

Recommendation:Develop a C-Suite portal or dedicated section featuring case studies and whitepapers that focus exclusively on financial and business metrics (e.g., 'The Total Economic Impact of CrowdStrike,' 'How CrowdStrike Improves Cyber Insurability').

Expected Impact:High

- Area:

Platform Navigation

Recommendation:Simplify the main platform navigation or introduce a persona-based selector ('I am a CISO,' 'I am a SOC Analyst') on the homepage to guide different user types to the most relevant information immediately.

Expected Impact:Medium

Quick Wins

- •

On the pricing page, add a short sentence to each bundle that explicitly states the ideal customer profile (e.g., 'Falcon Go: Best for small businesses under 100 employees').

- •

Elevate a key customer quote to the homepage hero section, rotating it with the current headlines to add a human voice.

- •

Create a 'What is an AI-Native SOC Platform?' explainer video or graphic for the homepage to demystify the core concept for a broader audience.

Long Term Recommendations

Invest in brand storytelling campaigns that feature CrowdStrike's elite threat hunters, moving beyond technical prowess to build an emotional connection with the audience as the ultimate protectors.

Launch a thought leadership series focused not just on threats, but on enabling business innovation, positioning CrowdStrike as a strategic partner for growth, not just a defense mechanism.

CrowdStrike's strategic messaging is world-class, establishing a powerful and dominant market position. The company has masterfully seized the narrative around AI, positioning itself as the essential platform for the current and future threat landscape. Its core value proposition—a unified, AI-native platform that stops breaches—is communicated with exceptional clarity, consistency, and is relentlessly substantiated by a barrage of social proof from top-tier analysts and customers. The brand voice is authoritative and urgent, effectively conveying the high stakes of cybersecurity.

The key differentiator is the adversary-focused intelligence, which transforms abstract threats into tangible enemies that CrowdStrike is uniquely equipped to hunt and defeat. This narrative is compelling and sets them apart from competitors who may focus more on malware or vulnerabilities.

While messaging to technical audiences and security leaders is superb, there is a significant opportunity to develop a more explicit messaging track for non-technical C-suite executives by translating platform capabilities into the language of financial risk, business continuity, and ROI. Further humanizing the brand by telling the stories of their expert teams could also deepen customer connection. Overall, CrowdStrike's messaging is a formidable asset that effectively drives its market leadership and customer acquisition.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Consistent high revenue growth, with annual revenue reaching $3.95B in fiscal 2025, a 29.39% increase year-over-year.

- •

High customer retention rates, with a gross retention rate (GRR) of over 97% and a dollar-based net retention rate (DBNRR) consistently over 115%.

- •

Strong market leadership position in endpoint security, recognized by industry analysts like Gartner and IDC.

- •

High platform adoption, with 71% of customers using four or more modules, indicating deep integration and value realization.

- •

Positive customer testimonials from major enterprises like Intel, Target, and Salesforce on the company website.

Improvement Areas

- •

Simplify the value proposition for the expanding portfolio to avoid customer confusion as more modules are added.

- •

Further streamline the initial onboarding for SMB customers acquired through the 'Falcon Go' free trial to improve trial-to-paid conversion.

- •

Enhance visibility into the ROI of newer, non-endpoint modules (e.g., identity, data protection) to accelerate cross-selling.

Market Dynamics

The global cybersecurity market is projected to grow substantially, with forecasts expecting it to reach between $345 billion and $423 billion by 2026-2030, with a CAGR ranging from 8.7% to 12.45%.

Growing

Market Trends

- Trend:

AI-Native Security Platforms

Business Impact:CrowdStrike's heavy emphasis on its AI-native Falcon platform and 'Agentic AI' positions it perfectly to capitalize on this trend. The AI in Cybersecurity market is expected to grow at a CAGR of over 20%, creating a massive tailwind.

- Trend:

Vendor Consolidation

Business Impact:Customers are looking to consolidate security tools onto a single platform to reduce complexity and cost. CrowdStrike's expanding portfolio of integrated modules (endpoint, cloud, identity, SIEM) directly addresses this need.

- Trend:

Shift to Cloud-Native Security (CNAPP)

Business Impact:The CNAPP market is growing rapidly (20%+ CAGR). CrowdStrike's investment in its Cloud Security module positions it to capture a significant share of this high-growth segment.

- Trend:

Increasing Sophistication of Cyber Threats

Business Impact:The rise of AI-driven attacks and complex threats like ransomware continuously fuels demand for advanced, proactive security solutions like those offered by CrowdStrike.

Excellent. CrowdStrike is a well-established leader in a market experiencing strong, sustainable tailwinds driven by digital transformation, cloud adoption, and a perpetually escalating threat landscape.

Business Model Scalability

High

Primarily subscription-based SaaS model (93% of revenue) with high gross margins (non-GAAP subscription gross margin of 80%) leads to a highly scalable cost structure.

High. As a cloud-native platform, adding new customers or modules has a low marginal cost, creating significant operational leverage as the company scales its customer base and ARR.

Scalability Constraints

Maintaining high levels of customer support and professional services quality as the customer base grows exponentially.

Ensuring the performance and reliability of the cloud-native Threat Graph database as data ingestion grows at a massive scale.

Team Readiness

Proven. The executive team has successfully scaled the company from a startup to a multi-billion dollar public entity and market leader.

Appears well-aligned for growth, with a structure supporting both direct enterprise sales and a channel-led go-to-market strategy.

Key Capability Gaps

Deep expertise in new, highly competitive markets like Next-Gen SIEM and Data Protection to effectively challenge established incumbents.

Specialized sales and marketing talent for targeting and winning the very small business (VSB) segment effectively through a purely PLG motion.

Growth Engine

Acquisition Channels

- Channel:

Direct Sales & Enterprise Marketing

Effectiveness:High

Optimization Potential:Medium

Recommendation:Further specialize the enterprise sales team into industry verticals (e.g., Financial Services, Healthcare) to deepen expertise and improve messaging resonance. Focus account-based marketing (ABM) on displacing legacy AV and competing platform solutions in large enterprises.

- Channel:

Channel Partners (VARs, MSSPs, GSIs)

Effectiveness:High

Optimization Potential:High

Recommendation:Expand and deepen enablement programs for MSSPs to position CrowdStrike as the default platform for their managed security offerings. Launch co-marketing programs with strategic alliance partners like AWS and Google Cloud.

- Channel:

Content Marketing & SEO

Effectiveness:High

Optimization Potential:Medium

Recommendation:Leverage threat intelligence reports (e.g., Global Threat Report, Adversary Hub) to create more targeted, industry-specific content funnels that drive MQLs for the specialized sales teams.

- Channel:

Product-Led Growth (PLG) / Free Trial

Effectiveness:Medium

Optimization Potential:High

Recommendation:Optimize the free trial experience for 'Falcon Go' to be entirely self-service, from sign-up to conversion. Implement automated onboarding sequences and in-product guides to improve user activation and demonstrate value faster for SMBs.

Customer Journey

Hybrid model: A clear 'Start free trial' path for a PLG motion targeting SMB/Mid-Market, and prominent 'Contact Sales'/'Schedule a Demo' paths for a sales-led enterprise motion.

Friction Points

- •

Potential complexity in choosing the right 'Falcon' bundle (Go, Pro, Enterprise) for new users without guidance.

- •

The handoff between the free trial experience and a sales-assisted purchase for larger trial users could be smoother.

- •

Understanding the full scope of the platform's 27+ modules can be overwhelming for prospective customers.

Journey Enhancement Priorities

{'area': 'Pricing & Packaging Clarity', 'recommendation': 'Introduce an interactive pricing calculator or solution finder on the website to guide prospects to the appropriate bundle based on their specific needs (company size, industry, security requirements).'}

{'area': 'Trial to Paid Conversion', 'recommendation': 'Develop product-qualified lead (PQL) scoring based on trial usage (e.g., number of agents deployed, features used) to trigger proactive, targeted outreach from a specialized sales team.'}

Retention Mechanisms

- Mechanism:

Land-and-Expand Model

Effectiveness:High

Improvement Opportunity:Utilize product usage data to proactively identify and recommend relevant additional modules to customers, creating an automated cross-sell engine. A strong DBNRR of 115% indicates this is working well.

- Mechanism:

Platform Stickiness & Integration

Effectiveness:High

Improvement Opportunity:Deepen integrations with third-party tools via the CrowdStrike Marketplace, making the Falcon platform the central hub of a customer's security operations and increasing switching costs.

- Mechanism:

Threat Intelligence & Efficacy

Effectiveness:High

Improvement Opportunity:Continuously publish research and demonstrate the platform's effectiveness against new and emerging threats to reinforce its value and prevent commoditization.

Revenue Economics

Excellent. The combination of a recurring revenue subscription model, high gross margins, strong net retention, and a scalable cloud platform points to highly favorable unit economics.

While precise figures are not public, a high net retention rate (>115%) and strong gross margins (~80%) strongly suggest a very healthy LTV:CAC ratio, likely well above the 3:1 benchmark for successful SaaS companies.

High. Consistent high growth (25-30% YoY) combined with positive and growing free cash flow ($1.07B for FY2025) demonstrates efficient growth.

Optimization Recommendations

Increase focus on the lower-cost PLG channel for SMB acquisition to further improve the blended CAC.

Drive higher adoption of new, high-margin modules like Falcon for IT and Next-Gen SIEM to increase average revenue per customer (ARPC) and LTV.

Scale Barriers

Technical Limitations

- Limitation:

Platform Complexity

Impact:Medium

Solution Approach:Invest in UX/UI unification across all modules to ensure a seamless 'single pane of glass' experience as the platform expands. Simplify policy management and reporting.

- Limitation:

Third-Party Data Integration at Scale

Impact:Medium

Solution Approach:For the Next-Gen SIEM offering, build robust, high-performance data connectors and a scalable ingestion pipeline to handle vast amounts of data from diverse sources without performance degradation.

Operational Bottlenecks

- Bottleneck:

Scaling Professional Services & Support

Growth Impact:Could lead to decreased customer satisfaction and slower enterprise deployments if not managed.

Resolution Strategy:Invest heavily in partner enablement to allow certified partners to handle Tier 1 support and standard professional services engagements. Use AI-powered support bots for common queries.

- Bottleneck:

Sales Team Onboarding & Training

Growth Impact:As the product portfolio expands, ramp time for new sales hires increases, potentially slowing sales velocity.

Resolution Strategy:Develop a modular, continuous training program for the sales team focused on specific solution areas (e.g., Cloud Security, Identity Protection) and industry use cases.

Market Penetration Challenges

- Challenge:

Intense Competition

Severity:Critical

Mitigation Strategy:Compete on platform breadth, AI/ML superiority, and the simplicity of a single agent/console. Key competitors include Palo Alto Networks, SentinelOne, and Microsoft, who can bundle security with other offerings.

- Challenge:

Displacing 'Good Enough' Bundled Security

Severity:Major

Mitigation Strategy:Focus messaging on the gaps and risks of relying on basic, bundled solutions (e.g., from Microsoft). Use threat intelligence and breach case studies to prove the superior efficacy and lower total cost of ownership (TCO) of the Falcon platform.

- Challenge:

Market Saturation in Core Endpoint Market

Severity:Minor

Mitigation Strategy:Drive growth through expansion into adjacent, high-growth markets like CNAPP, SIEM, Identity, and Data Protection. This strategy is already well underway and is a core part of their growth story.

Resource Limitations

Talent Gaps

- •

Elite AI/ML engineers to maintain a competitive edge in threat detection.

- •

Go-to-market specialists for new product categories (e.g., SIEM, Data Protection).

- •

Cybersecurity professionals for the managed 'Falcon Complete' service to maintain high service levels during rapid expansion.

Low. The company is highly profitable and generates significant free cash flow, providing ample capital to fund growth initiatives, R&D, and potential strategic acquisitions.

Infrastructure Needs

Continued global expansion of their cloud data centers to support data sovereignty requirements and reduce latency for international customers.

Investment in scalable R&D infrastructure to accelerate innovation and integration of acquired technologies.

Growth Opportunities

Market Expansion

- Expansion Vector:

Geographic Expansion in APAC & LATAM

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Continue to build out local sales, support, and channel partner networks in these regions. Recent distribution agreements in Latin America are a strong step. Establish local data centers to address data residency regulations.

- Expansion Vector:

Deeper Penetration into the SMB Market

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Create a dedicated growth team focused on a pure PLG motion for the 'Falcon Go' product. Invest in digital acquisition channels (paid search, social) and a fully automated, self-service customer lifecycle to scale efficiently.

- Expansion Vector:

Expansion into Federal Government Sector

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Continue investing in obtaining high-level government certifications (e.g., FedRAMP High). Build a specialized sales and engineering team with experience in public sector procurement cycles.

Product Opportunities

- Opportunity:

Unified AI-Native SOC Platform

Market Demand Evidence:Strong market demand for vendor consolidation and AI-powered automation in the Security Operations Center (SOC).

Strategic Fit:Excellent. This is the core of their current strategy, combining EDR, SIEM, Identity, and Threat Intelligence into a single platform.

Development Recommendation:Accelerate the integration of Humio (Next-Gen SIEM) and other acquisitions into the Falcon platform. Develop AI-driven 'Charlotte AI' capabilities to provide autonomous investigation and response workflows.

- Opportunity:

Data Protection / Data Loss Prevention (DLP)

Market Demand Evidence:Growing regulatory pressure (GDPR, CCPA) and high costs of data breaches are driving demand for unified DLP solutions.

Strategic Fit:Good. It's a natural extension of their single-agent architecture, leveraging endpoint visibility to monitor and control data movement.

Development Recommendation:Integrate the SecureCircle acquisition fully into the Falcon platform. Position it as a simpler, more effective alternative to complex legacy DLP solutions.

- Opportunity:

Securing AI Workloads

Market Demand Evidence:The rapid adoption of enterprise AI and LLMs creates a new, unsecured attack surface that companies need to protect.

Strategic Fit:Excellent. Aligns perfectly with their brand positioning around 'Securing the AI Revolution.'

Development Recommendation:Develop and market specific capabilities for securing AI models, training data, and the infrastructure they run on, as highlighted on their homepage. This is a greenfield opportunity.

Channel Diversification

- Channel:

Cloud Service Provider (CSP) Marketplaces

Fit Assessment:Excellent

Implementation Strategy:Deepen partnerships with AWS, Azure, and Google Cloud. Co-sell with their field sales teams and make the Falcon platform easily purchasable and deployable through their marketplaces, with billing integrated into the customer's cloud spend.

- Channel:

Embedded/OEM Partnerships

Fit Assessment:Good

Implementation Strategy:Partner with hardware or infrastructure providers to embed Falcon protection as a default security layer, creating a new volume-based revenue stream.

Strategic Partnerships

- Partnership Type:

Major Cloud Providers

Potential Partners

- •

Amazon Web Services (AWS)

- •

Microsoft Azure

- •

Google Cloud Platform (GCP)

Expected Benefits:Deeper product integrations (e.g., with native cloud security tools), streamlined procurement via marketplaces, and joint go-to-market initiatives to drive new customer acquisition.

- Partnership Type:

IT Service Management (ITSM)

Potential Partners

ServiceNow

Atlassian

Expected Benefits:Integrate security workflows into IT workflows, allowing for automated incident creation and remediation ticketing, which deepens platform stickiness.

- Partnership Type:

Identity Providers

Potential Partners

Okta

Ping Identity

Expected Benefits:Enhance CrowdStrike's identity protection module by correlating signals from leading identity providers to detect and respond to identity-based attacks more effectively.

Growth Strategy

North Star Metric

Weekly Active Protected Nodes with 2+ Modules

This metric combines customer acquisition (new nodes), retention (active nodes), and expansion (2+ modules). It aligns the entire company around delivering value that encourages deeper platform adoption, which is the core of their 'land-and-expand' model.

Increase the percentage of customers with 4+ and 6+ modules by 15% annually, directly impacting DBNRR and LTV.

Growth Model

Hybrid: Enterprise Sales-Led & Product-Led

Key Drivers

- •

Enterprise Sales Team Effectiveness (New logos & expansion deals)

- •

Channel Partner Sourced Revenue

- •

Free Trial Sign-ups and Trial-to-Paid Conversion Rate

- •

New Module Adoption Rate by existing customers