eScore

delta.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Delta demonstrates a commanding digital presence with high brand authority and exceptional search visibility for transactional queries. The website and app are highly optimized for direct bookings and loyalty program engagement, serving as a powerful customer acquisition engine. Content is well-aligned with the booking and trip management phases of the customer journey, and the brand maintains a consistent, functional presence across its primary digital channels. The main deficiency lies in a lack of robust content for the 'inspiration' and 'planning' stages, ceding early funnel influence to competitors and OTAs.

Exceptional search intent alignment for high-value, transactional keywords (e.g., flight bookings, trip management), driving a high volume of direct conversions.

Develop a comprehensive 'Delta Destinations' content hub with inspirational guides and travel stories to capture top-of-funnel search traffic and build brand preference earlier in the customer journey.

The website's messaging is a masterclass in functional clarity, excelling at guiding users through transactional tasks like booking flights and managing trips. For logged-in SkyMiles members, the messaging is highly personalized and effectively communicates the value of the loyalty program. However, this ruthless efficiency comes at the cost of brand personality and emotional connection; the site's voice is sterile and fails to convey the premium, service-oriented brand story that Delta tells in other marketing channels.

The messaging hierarchy is exceptionally clear and task-oriented, prioritizing the primary conversion goal (booking a flight) with unambiguous calls-to-action.

Integrate a concise, powerful brand statement (e.g., 'Connecting the world with industry-leading service and reliability.') near the main booking widget to bridge the gap between the functional experience and the premium brand identity.

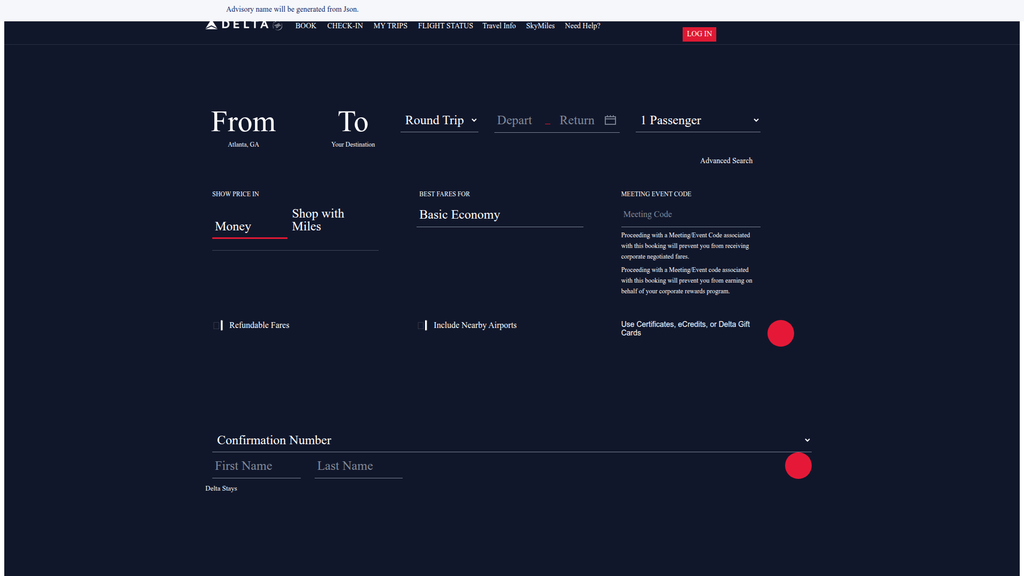

Delta's conversion experience for its primary goal—booking a flight—is highly streamlined and effective, making the process intuitive for most users. The prominence of the booking module and clear primary CTAs facilitate a low-friction path to purchase. However, the experience is weakened by inconsistent CTA design patterns in secondary elements like modals and alerts, which can increase cognitive load and lead to user error. The visual disconnect between the dark-themed hero section and the lighter content modules below also creates a slightly fragmented user journey.

The 'Book a Flight' module is the clear focal point of the homepage, placed above the fold with a logical layout that makes the primary conversion action immediately accessible and easy to initiate.

Standardize all CTA design patterns to create a consistent visual hierarchy. Primary actions should always be the most prominent style (solid red button), while secondary or destructive actions receive lower-emphasis styles (outline button or text link).

Delta has built immense credibility through its consistent, award-winning operational reliability, which serves as a powerful, overarching trust signal. The company demonstrates strong adherence to critical industry regulations like the Air Carrier Access Act (ACAA) and provides transparent, detailed Contracts of Carriage. This is significantly undermined by a high-risk gap in digital compliance, specifically a non-compliant cookie consent mechanism that creates exposure to GDPR fines and erodes trust with privacy-conscious users.

Industry-leading operational performance, consistently ranking as the most on-time U.S. airline, provides powerful, real-world proof of brand promises and builds deep customer trust.

Immediately implement a GDPR-compliant cookie consent management platform that provides clear information and granular, opt-in controls for all non-essential cookies.

Delta's competitive advantages are exceptionally strong and sustainable. The symbiotic, high-margin partnership with American Express for the SkyMiles program creates a powerful loyalty ecosystem and a formidable barrier to entry that is difficult for competitors to replicate. This is compounded by a brand reputation built on superior operational reliability and a dominant hub structure, particularly in Atlanta. These deeply entrenched moats allow Delta to command a premium price and maintain market leadership.

The highly lucrative and deeply integrated SkyMiles co-brand credit card partnership with American Express creates a powerful ecosystem that fosters extreme customer loyalty and high switching costs.

While leading in free Wi-Fi, this is a temporary advantage; competitors are catching up. Delta should focus on the next layer of digital differentiation, such as hyper-personalization of the in-flight experience through its Delta Sync platform.

Delta demonstrates strong expansion potential, underpinned by a proven ability to leverage strategic joint ventures (e.g., LATAM) for capital-efficient international growth. The business model, with its highly profitable loyalty and ancillary revenue streams, shows robust unit economics that support scaling. However, as a legacy carrier in a mature industry, scalability is inherently constrained by high capital intensity, infrastructure limits at key airports, and a high fixed-cost base.

Effective use of international joint ventures and the SkyTeam alliance allows for capital-efficient network expansion, providing global reach without the full financial burden of operating every route directly.

Accelerate the modernization of legacy IT infrastructure to enable greater operational agility and support more sophisticated, AI-driven personalization at scale.

Delta's business model is exceptionally coherent and strategically aligned. The company maintains a clear focus on the premium travel segment, and all key activities—from fleet acquisition to service standards—support this positioning. Revenue streams are diversified and synergistic, with the high-margin loyalty program acting as a stabilizing force that funds investment in the core airline product. This creates a virtuous cycle where a superior product drives loyalty, and loyalty funds further product improvements.

The synergistic relationship between the core airline product and the SkyMiles loyalty program is a masterclass in business model design. The loyalty program is not just an add-on; it's a core profit center that enhances the value and defensibility of the entire enterprise.

Further deepen the integration of ancillary services like Delta Vacations into the core booking path to transform the model from a transportation provider to a comprehensive premium travel platform.

As a market leader in a consolidated industry, Delta wields significant market power. Its ability to command a price premium is evidence of strong pricing power, driven by its reputation for reliability and service. The airline exerts considerable influence through its dominant hub structure and has strong leverage with key partners like American Express and the SkyTeam alliance. This market power allows Delta to shape competitive dynamics and influence industry standards for service and operational excellence.

Demonstrated pricing power, enabling the airline to command a revenue premium over competitors by successfully differentiating on service, reliability, and brand rather than competing solely on price.

Develop a more robust strategy to address the growing influence of low-cost carriers in the domestic market, potentially through more sophisticated segmentation of its 'Basic Economy' product to compete without diluting the main brand.

Business Overview

Business Classification

Passenger & Cargo Air Transportation

Loyalty Program & Travel Services

Aviation

Sub Verticals

- •

Commercial Airlines

- •

Air Cargo Services

- •

Travel & Tourism

Mature

Maturity Indicators

- •

Extensive global brand recognition and long-standing history (founded 1925).

- •

Large, modern fleet of nearly 1,000 aircraft.

- •

Dominant market share in key domestic and international routes.

- •

Highly developed and profitable SkyMiles loyalty program.

- •

Consistent, multi-billion dollar annual revenue streams.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Passenger Revenue

Description:Core revenue from the sale of airline tickets to individuals and corporations, segmented into various fare classes such as Main Cabin, Comfort+, First Class, and Delta One. Premium cabins consistently show higher revenue growth than Main Cabin.

Estimated Importance:Primary

Customer Segment:All Traveler Segments

Estimated Margin:Medium

- Stream Name:

Loyalty Program Revenue (SkyMiles)

Description:High-margin revenue generated from the sale of miles to strategic partners, most notably American Express. This partnership is extremely lucrative, generating nearly $7 billion in remuneration in a recent year.

Estimated Importance:Primary

Customer Segment:Corporate Partners (e.g., American Express)

Estimated Margin:High

- Stream Name:

Cargo Revenue

Description:Revenue from the transportation of freight and mail across its global network.

Estimated Importance:Secondary

Customer Segment:Logistics & Freight Forwarding Companies

Estimated Margin:Low-Medium

- Stream Name:

Ancillary Revenue & Other

Description:Includes revenue from baggage fees, onboard sales, ticket change fees, and commissions from travel packages like Delta Vacations, car rentals, and hotels.

Estimated Importance:Secondary

Customer Segment:All Traveler Segments

Estimated Margin:High

- Stream Name:

Refinery Operations

Description:Revenue from its wholly-owned Monroe Energy oil refinery, which supplies jet fuel for Delta's operations and sells other refined products.

Estimated Importance:Tertiary

Customer Segment:Internal (Fuel Hedging) & External Markets

Estimated Margin:Low

Recurring Revenue Components

- •

Loyalty program mile sales to partners (e.g., American Express)

- •

Corporate travel contracts

- •

Co-branded credit card annual fees and spending

Pricing Strategy

Dynamic Yield Management

Premium

Semi-transparent

Pricing Psychology

- •

Tiered pricing (fare classes)

- •

Unbundling (Basic Economy)

- •

Loyalty rewards (SkyMiles)

- •

Dynamic pricing based on demand, time, and competition

Monetization Assessment

Strengths

- •

Highly diversified revenue streams reduce reliance on ticket sales alone.

- •

Extremely profitable and high-margin loyalty program partnership with American Express acts as a stable, growing revenue source.

- •

Strong focus on the premium travel segment, which yields higher margins.

- •

Robust ancillary revenue generation from a wide array of services.

Weaknesses

- •

High exposure to volatile fuel prices, despite owning a refinery.

- •

Core passenger revenue is susceptible to economic downturns and geopolitical instability.

- •

High fixed operating costs inherent to the airline industry.

Opportunities

- •

Expand the SkyMiles loyalty program into a broader lifestyle and travel ecosystem.

- •

Further integrate ancillary services (hotels, car rentals) into the booking flow to capture more travel wallet share.

- •

Utilize AI and machine learning to further optimize dynamic pricing and ancillary offers.

- •

Develop subscription-based products for frequent business travelers.

Threats

- •

Intense price competition from both legacy and low-cost carriers.

- •

Potential for economic recessions to significantly reduce travel demand, especially in the high-yield corporate segment.

- •

Changes in consumer loyalty and the perceived value of frequent flyer programs.

Market Positioning

Premium Service & Operational Excellence

Leader (Approx. 17.8% of U.S. market).

Target Segments

- Segment Name:

Corporate & High-Value Business Travelers

Description:Professionals traveling for business who prioritize schedule reliability, network reach, convenience, and loyalty rewards. They are less price-sensitive and are the primary market for premium cabin seats.

Demographic Factors

High-income professionals

Frequent flyers

Psychographic Factors

- •

Value time and efficiency

- •

Seek status and recognition

- •

Loyalty program-oriented

Behavioral Factors

- •

Frequent travel

- •

Last-minute bookings

- •

High adoption of loyalty programs and co-branded credit cards

Pain Points

- •

Flight delays and cancellations

- •

Inefficient airport experiences

- •

Lack of productivity while traveling

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Premium Leisure Travelers

Description:Affluent travelers seeking enhanced comfort, service, and experience for personal travel. They are willing to pay for premium economy, business, or first-class products.

Demographic Factors

High household income

Couples, empty-nesters

Psychographic Factors

- •

Value comfort and experience over cost

- •

Brand-conscious

- •

Seek relaxation and luxury

Behavioral Factors

- •

Book travel in advance

- •

Purchase travel packages (e.g., Delta Vacations)

- •

Higher spend on ancillary services

Pain Points

- •

Stressful travel logistics

- •

Crowded cabins

- •

Generic, impersonal service

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Mainstream / Family Travelers

Description:Individuals and families traveling for leisure who balance cost with service quality, safety, and network coverage.

Demographic Factors

Middle to upper-middle income households

Families with children

Psychographic Factors

Value-conscious

Prioritize safety and reliability

Behavioral Factors

- •

Price-sensitive but not exclusively price-driven

- •

Plan travel around holidays and school schedules

- •

Often check baggage

Pain Points

- •

Hidden fees

- •

Uncomfortable seating for long flights

- •

Managing travel with children

Fit Assessment:Good

Segment Potential:Medium

Market Differentiation

- Factor:

Operational Reliability & Excellence

Strength:Strong

Sustainability:Sustainable

- Factor:

SkyMiles Loyalty Program & Amex Partnership

Strength:Strong

Sustainability:Sustainable

- Factor:

Premium Brand Positioning & Service Quality

Strength:Strong

Sustainability:Sustainable

- Factor:

Extensive & Strategically Dominant Hub Network

Strength:Strong

Sustainability:Sustainable

Value Proposition

To be the world's most trusted airline, delivering a superior travel experience through operational excellence, a vast global network, and exceptional customer service.

Excellent

Key Benefits

- Benefit:

Superior Operational Performance

Importance:Critical

Differentiation:Unique

Proof Elements

- •

Consistently ranks #1 in on-time performance among major U.S. carriers.

- •

Recipient of Cirium's Platinum Award for global operational excellence.

- •

High flight completion factor and low rates of mishandled bags.

- Benefit:

Extensive Global Network & Connectivity

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Over 5,400 daily flights to more than 300 destinations.

- •

Founding member of the SkyTeam global alliance.

- •

Strategic joint ventures and equity stakes in key international partners like Air France-KLM, Virgin Atlantic, and LATAM.

- Benefit:

Tiered Product Offering for All Needs

Importance:Important

Differentiation:Common

Proof Elements

- •

Clearly defined fare classes from Basic Economy to Delta One.

- •

Investment in premium cabin experiences and seating.

- •

Website functionality allowing easy comparison of fare benefits.

- Benefit:

Rewarding Customer Loyalty

Importance:Important

Differentiation:Unique

Proof Elements

- •

Robust SkyMiles program with varied redemption options.

- •

Lucrative co-branded credit card portfolio with American Express offering accelerated mileage earning and status qualification.

- •

Tiered Medallion status with clear, valuable benefits (e.g., upgrades, lounge access).

Unique Selling Points

- Usp:

Industry-leading operational reliability, minimizing travel disruptions.

Sustainability:Long-term

Defensibility:Strong

- Usp:

The unparalleled economic power and integration of the SkyMiles-American Express partnership, creating a powerful loyalty ecosystem.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A consistent focus and investment in the premium customer experience, differentiating it from low-cost carriers and many legacy competitors.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Unpredictability and stress of air travel

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Lack of connectivity to desired global destinations

Severity:Major

Solution Effectiveness:Complete

- Problem:

Uncomfortable and impersonal travel experience

Severity:Major

Solution Effectiveness:Partial

- Problem:

Feeling that loyalty is not adequately rewarded

Severity:Major

Solution Effectiveness:Complete

Value Alignment Assessment

High

Delta's focus on reliability and premium service aligns perfectly with the growing demand from high-value corporate and leisure segments who are willing to pay for a better experience.

High

The value proposition is exceptionally well-aligned with business and premium leisure travelers who prioritize reliability, network, and loyalty benefits above pure cost savings.

Strategic Assessment

Business Model Canvas

Key Partners

- •

American Express (Co-branded credit cards & loyalty)

- •

SkyTeam Alliance members (e.g., Air France-KLM, Korean Air).

- •

Joint venture & equity partners (e.g., Virgin Atlantic, LATAM, Aeromexico).

- •

Aircraft manufacturers (Boeing, Airbus).

- •

Corporate clients & travel management companies

- •

Airport authorities

Key Activities

- •

Airline operations (flight scheduling, crew management, ground services)

- •

Fleet management and maintenance (Delta TechOps)

- •

Network and route planning

- •

Marketing, sales, and distribution

- •

Loyalty program management (SkyMiles)

- •

Customer service and experience management

Key Resources

- •

Aircraft fleet

- •

Brand reputation and value

- •

Dominant airport hubs (e.g., Atlanta, Detroit, Minneapolis).

- •

Skilled workforce (pilots, flight attendants, mechanics)

- •

SkyMiles loyalty program member base

- •

Strategic partnership agreements

- •

IT infrastructure and booking platforms

Cost Structure

- •

Labor (salaries, benefits, profit sharing)

- •

Aircraft fuel

- •

Aircraft ownership (depreciation, rent)

- •

Maintenance materials and repairs

- •

Landing fees and airport charges

- •

Sales, advertising, and distribution costs

Swot Analysis

Strengths

- •

Strong brand reputation for operational excellence and customer service.

- •

Dominant market position with a vast, strategic global network.

- •

Highly profitable and deeply integrated loyalty program with American Express.

- •

Diverse revenue streams including premium cabins, cargo, and MRO services.

- •

Large and modernizing aircraft fleet.

Weaknesses

- •

High fixed-cost structure compared to low-cost carriers.

- •

Vulnerability to fuel price volatility and economic cycles.

- •

Dependence on the competitive North American market.

- •

Potential for IT disruptions and vulnerabilities.

Opportunities

- •

Expansion into emerging international markets.

- •

Further leveraging data analytics and AI for personalization and operational efficiency.

- •

Expanding the SkyMiles program into a broader travel and lifestyle platform.

- •

Capitalizing on the growing demand for sustainable aviation and premium travel experiences.

Threats

- •

Intense competition from legacy and low-cost carriers.

- •

Global economic downturns impacting travel demand, particularly corporate travel.

- •

Geopolitical instability, pandemics, and other global crises disrupting travel.

- •

Increasing regulatory pressure related to environmental concerns and consumer rights.

Recommendations

Priority Improvements

- Area:

Digital Customer Experience

Recommendation:Invest heavily in AI-driven personalization within the Delta app and website to create hyper-relevant ancillary offers and seamless travel management, moving from a transactional to a predictive and proactive customer relationship model.

Expected Impact:High

- Area:

Ecosystem Integration

Recommendation:Deepen the integration of Delta Vacations, car rentals, and hotel bookings into the core flight purchasing path. Offer bundled, dynamically priced packages to increase customer lifetime value and capture a larger share of the total travel budget.

Expected Impact:Medium

- Area:

Operational Efficiency

Recommendation:Accelerate the adoption of AI and predictive analytics in maintenance (TechOps), crew scheduling, and fuel management to further reduce costs and enhance the existing operational reliability advantage.

Expected Impact:Medium

Business Model Innovation

- •

Develop a 'Delta Prime' subscription model for high-frequency business travelers, offering benefits like guaranteed overhead bin space, preferred seating, and annual lounge passes for a recurring fee.

- •

Transform SkyMiles from a pure loyalty program into a multi-faceted marketplace, allowing members to use miles for a wider range of lifestyle goods and services, thus increasing the utility and stickiness of the program.

- •

Pioneer a 'Sustainable Aviation' fare class, allowing environmentally conscious corporations and individuals to pay a premium for flights powered by a higher percentage of Sustainable Aviation Fuel (SAF), creating a new, premium revenue stream and brand differentiator.

Revenue Diversification

- •

Aggressively scale the Delta Vacations business to become a more significant contributor to overall revenue, leveraging the airline's brand trust and network.

- •

Expand the Delta TechOps (MRO) services to third-party airlines, capitalizing on its expertise and scale.

- •

Monetize anonymized travel trend data by offering a 'Delta Insights' analytics-as-a-service product to hospitality, tourism, and retail partners.

Delta Air Lines operates a mature, highly refined business model centered on a premium service offering, unparalleled operational reliability, and a deeply entrenched, high-margin loyalty program. Its primary business of passenger transport is effectively supported and differentiated by a strategic focus on high-value corporate and premium leisure travelers, who are less price-sensitive and more responsive to quality and convenience. The company's key strategic asset is the symbiotic relationship between its SkyMiles program and American Express, which generates a stable, high-margin revenue stream that insulates it from some of the volatility inherent in ticket sales. This allows Delta to reinvest in its fleet, customer experience, and airport infrastructure, reinforcing its premium positioning. The core challenge and opportunity for evolution lie in transitioning from a transportation provider to a comprehensive travel platform. While partnerships for hotels and car rentals exist, the integration could be significantly deeper, creating a stickier ecosystem that captures a greater share of the customer's total travel spend. Future growth will be driven by further leveraging its data assets for personalization, expanding the non-flight utility of the SkyMiles program, and capitalizing on the demand for more sustainable travel options. The model is well-positioned for steady growth but must continually innovate its digital experience and ecosystem to fend off intense competition and adapt to evolving traveler expectations.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

High Capital Costs

Impact:High

- Barrier:

Regulatory Hurdles and Safety Standards

Impact:High

- Barrier:

Airport Infrastructure Access (Gates & Slots)

Impact:High

- Barrier:

Brand Loyalty and Frequent Flyer Programs

Impact:Medium

- Barrier:

Economies of Scale

Impact:Medium

Industry Trends

- Trend:

Sustainability and SAF (Sustainable Aviation Fuel)

Impact On Business:Increasing operational costs and regulatory pressure, but also an opportunity for brand differentiation among environmentally conscious consumers.

Timeline:Immediate

- Trend:

AI-Driven Digitalization and Personalization

Impact On Business:Opportunity to enhance customer experience, improve operational efficiency, and increase ancillary revenue. Requires significant technology investment.

Timeline:Immediate

- Trend:

Premium Leisure Travel Growth

Impact On Business:Increased demand for premium economy and business class seats, driving higher yields on leisure routes.

Timeline:Near-term

- Trend:

Economic Uncertainty and Demand Volatility

Impact On Business:Potential for reduced travel demand, especially in corporate and price-sensitive leisure segments, requiring agile capacity management.

Timeline:Near-term

Direct Competitors

- →

American Airlines

Market Share Estimate:17.5%

Target Audience Overlap:High

Competitive Positioning:Positions as the largest airline globally by fleet size with an extensive domestic and international network, leveraging its Oneworld alliance. Focuses on its AAdvantage loyalty program, which is the world's largest.

Strengths

- •

Largest airline by fleet size and extensive global network.

- •

Dominant hubs in key markets like Dallas/Fort Worth (DFW) and Charlotte (CLT).

- •

Strong AAdvantage loyalty program with over 115 million members.

- •

Founding member of the powerful Oneworld alliance, enhancing global reach.

Weaknesses

- •

High operating costs and significant debt load.

- •

Inconsistent customer service reputation.

- •

Vulnerability to intense competition from low-cost carriers on domestic routes.

- •

Complex labor relations can lead to operational challenges.

Differentiators

Scale of its network, particularly its domestic hub structure.

The size and reach of the AAdvantage loyalty program.

- →

United Airlines

Market Share Estimate:16.4%

Target Audience Overlap:High

Competitive Positioning:Positions as a premium global carrier with a strong international network, particularly across the Atlantic and Pacific. Leverages its Star Alliance membership and focuses on corporate travelers and premium cabin experiences.

Strengths

- •

Extensive global route network, a founding member of Star Alliance, the largest airline alliance.

- •

Strong hub presence in major business centers like Chicago, Houston, and Newark.

- •

Significant investments in technology and customer-facing digital tools.

- •

Strong transatlantic and transpacific route network.

Weaknesses

- •

Historically challenged customer service reputation.

- •

High operating costs and sensitivity to fuel price fluctuations.

- •

Significant debt burden from fleet investments and pandemic recovery.

- •

Heavy dependence on the cyclical corporate and international travel markets.

Differentiators

Breadth and depth of its international network, especially through the Star Alliance.

Focus on premium products like its Polaris business class.

- →

Southwest Airlines

Market Share Estimate:17.3%

Target Audience Overlap:Medium

Competitive Positioning:Positions as the leading low-cost carrier in the U.S. with a focus on a simple, customer-friendly model (e.g., 'Transfarency' with no change fees and free checked bags). Primarily serves the domestic point-to-point leisure travel market.

Strengths

- •

Strong cost leadership position due to a highly efficient, single-aircraft-type (Boeing 737) operation.

- •

High brand loyalty and consistently strong customer satisfaction scores, particularly in the economy segment.

- •

Unique corporate culture and motivated, efficient workforce.

- •

Point-to-point network model allows for operational flexibility.

Weaknesses

- •

Limited international network compared to legacy carriers.

- •

No premium cabin offerings, limiting appeal to high-yield corporate travelers.

- •

Vulnerable to operational meltdowns due to its point-to-point system, as seen in past events.

- •

Less sophisticated revenue management and ancillary fee generation compared to legacy peers.

Differentiators

- •

Low-cost, no-frills pricing model with customer-friendly policies like free checked bags.

- •

Point-to-point network structure as opposed to the hub-and-spoke model.

- •

Strong and distinct brand identity centered on friendly service.

Indirect Competitors

- →

Amtrak

Description:The primary passenger rail operator in the United States, offering an alternative mode of transportation, particularly for city pairs in the Northeast Corridor (e.g., Washington D.C. to New York to Boston).

Threat Level:Low

Potential For Direct Competition:Low. Threat is confined to specific, relatively short-distance corridors where train travel time is competitive with air travel (including airport transit and security).

- →

Online Travel Agencies (OTAs)

Description:Digital platforms that aggregate travel options, allowing consumers to compare prices and book flights from various airlines. While they are distribution partners, they also commoditize the flight product.

Threat Level:Medium

Potential For Direct Competition:Low. The threat is not in operating flights but in disintermediating the airline from the customer, weakening brand loyalty and control over the customer relationship.

- →

Video Conferencing Technology

Description:Technology platforms that enable virtual meetings, reducing the need for corporate travel.

Threat Level:Medium

Potential For Direct Competition:None. This technology is a substitute for travel itself, particularly for internal business meetings, posing a long-term threat to the recovery and growth of high-yield corporate travel demand.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Brand Reputation for Operational Reliability and Service

Sustainability Assessment:Delta consistently ranks at or near the top for on-time performance and customer satisfaction, particularly in premium cabins, creating a powerful brand halo.

Competitor Replication Difficulty:Hard

- Advantage:

Dominant and Profitable Hub Structure

Sustainability Assessment:Delta's dominance in key hubs, especially Atlanta (the world's busiest airport), creates significant network effects and pricing power.

Competitor Replication Difficulty:Hard

- Advantage:

SkyMiles Loyalty Program & AmEx Partnership

Sustainability Assessment:The co-brand credit card partnership with American Express is highly lucrative and deeply integrated, creating a strong ecosystem that fosters customer loyalty and high-margin revenue.

Competitor Replication Difficulty:Medium

- Advantage:

Strong Corporate Culture and Employee Relations

Sustainability Assessment:A culture of service and significant profit-sharing programs generally lead to more motivated employees, which translates to a better customer experience.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'Lead in offering free, high-speed inflight Wi-Fi', 'estimated_duration': '1-2 years. Competitors like United and American are actively working to match this offering across their fleets.'}

Disadvantages

- Disadvantage:

Higher Operating Cost Structure vs. LCCs

Impact:Major

Addressability:Difficult

- Disadvantage:

Complexity of a Multi-Fleet Operation

Impact:Minor

Addressability:Moderately

- Disadvantage:

Dependence on High-Yield Corporate and International Travel

Impact:Major

Addressability:Difficult

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted marketing campaigns highlighting superior J.D. Power customer satisfaction scores to attract competitors' disgruntled customers.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Offer limited-time, double-mileage promotions on routes where competitors are showing operational weakness or schedule reductions.

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Continue investment in fleet modernization with next-generation, fuel-efficient aircraft to mitigate fuel cost volatility and support sustainability goals.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Expand the footprint and quality of Delta Sky Clubs to further differentiate the premium ground experience from competitors.

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Leverage AI and machine learning to further personalize the digital experience, from booking to day-of-travel assistance, solidifying the app as a key differentiator.

Expected Impact:High

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Secure a leadership position in Sustainable Aviation Fuel (SAF) offtake agreements and investments to build a long-term cost and brand advantage as the industry decarbonizes.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Explore integrated, 'door-to-door' premium travel services through partnerships with ground transportation and hospitality providers.

Expected Impact:Medium

Implementation Difficulty:Moderate

Solidify and message Delta's position as the undisputed premium, reliable, and customer-centric network carrier in North America. Shift focus from being just an airline to being a premium travel services brand.

Double down on operational excellence and superior, consistent customer service as the core differentiators. Use technology not just for efficiency, but to enable employees to provide an even higher level of service and to create a seamless, personalized digital journey for the customer.

Whitespace Opportunities

- Opportunity:

Develop a 'SkyMiles for Business' platform targeting small and medium-sized enterprises (SMEs) with simplified booking and rewards, a market less catered to by complex corporate contracts.

Competitive Gap:Legacy competitors focus on large corporate contracts, while LCCs lack the network and premium products for many business travelers. This targets the underserved middle.

Feasibility:High

Potential Impact:Medium

- Opportunity:

Create curated, all-inclusive travel packages via Delta Vacations that are heavily integrated with the SkyMiles program, targeting the growing 'premium leisure' segment.

Competitive Gap:Competitors' vacation packages are often less integrated with their loyalty programs. This can create a stickier, higher-margin ecosystem.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Launch branded, premium airport-to-city ground transport services in key hubs like ATL, JFK, and LAX, extending the Delta experience beyond the plane.

Competitive Gap:No US airline currently offers a branded, seamless ground transport solution, representing a break in the premium travel experience.

Feasibility:Medium

Potential Impact:Medium

The U.S. airline industry is a mature, oligopolistic market dominated by three legacy carriers—Delta Air Lines, American Airlines, and United Airlines—and one major low-cost carrier, Southwest Airlines. These 'Big Four' control nearly 70% of the market. Barriers to entry, such as immense capital costs, regulatory requirements, and limited airport access, are exceptionally high, protecting incumbents but fostering intense competition among them.

Delta Air Lines has successfully positioned itself as the premium legacy carrier, differentiating through superior operational reliability and customer service. This is consistently validated by third-party rankings, such as the J.D. Power airline satisfaction studies, where Delta frequently leads in premium cabins. This brand equity is a significant sustainable advantage, allowing Delta to command a revenue premium. Key strengths underpinning this position include dominant hubs like Atlanta, a highly valuable loyalty program and partnership with American Express, and a stable, service-oriented employee culture.

Direct competitors present distinct challenges. American Airlines competes on the sheer scale of its network, while United Airlines boasts a formidable international presence and a strong focus on the corporate market. Both, however, grapple with higher debt loads and less consistent customer service reputations compared to Delta. Southwest Airlines represents a different threat, exerting constant price pressure on domestic routes with its efficient, low-cost model and loyal customer base. This forces Delta to maintain a competitive, albeit higher, price point while justifying the difference through superior service and product offerings.

Indirect competition comes from ground transportation like Amtrak in specific corridors, the commoditizing effect of Online Travel Agencies (OTAs), and the long-term threat of virtual communication technologies reducing business travel. Key industry trends shaping the landscape include the critical push toward sustainability (SAF), the integration of AI and digital tools to personalize the travel journey, and a robust demand for premium leisure travel.

Opportunities for Delta lie in further leveraging its brand strength. This includes deepening its reach into the SME market, creating more tightly integrated premium vacation packages, and extending its brand promise to other parts of the travel journey, such as ground transportation. The primary strategic imperative is to reinforce the value proposition that justifies its price premium over competitors. This involves continued investment in fleet modernization, digital innovation, and, most importantly, the people and processes that deliver its industry-leading service.

Messaging

Message Architecture

Key Messages

- Message:

Book your travel now.

Prominence:Primary

Clarity Score:High

Location:Homepage - Above the fold booking widget

- Message:

Manage your existing trips and check your flight status.

Prominence:Secondary

Clarity Score:High

Location:Homepage - 'Find My Trip' and 'Flight Status' tabs

- Message:

Maximize the value of your SkyMiles membership.

Prominence:Secondary

Clarity Score:High

Location:Homepage - Logged-in user dashboard and SkyMiles navigation tab

- Message:

Delta offers a range of travel experiences and ancillary services.

Prominence:Tertiary

Clarity Score:Medium

Location:Navigation menus (e.g., 'Delta One®', 'Delta Vacations', 'Delta Car Rentals')

The message hierarchy is exceptionally clear and effective for a task-oriented user. The primary goal of the page—to facilitate flight bookings—is given the most prominent real estate and visual weight. Secondary tasks like trip management and loyalty engagement are logically placed and easy to find. The hierarchy strongly favors function over brand storytelling, prioritizing conversion and customer self-service.

Messaging is highly consistent across the homepage. The language is uniformly functional, direct, and transactional. There are no conflicting messages or deviations from the core purpose of serving as a travel booking and management utility.

Brand Voice

Voice Attributes

- Attribute:

Transactional

Strength:Strong

Examples

- •

Submit

- •

Find My Trip

- •

Shop with Miles

- •

Confirmation Number

- Attribute:

Helpful

Strength:Moderate

Examples

- •

Help

- •

Change/Cancel Help

- •

Baggage Help

- •

Help Center

- Attribute:

Personalized

Strength:Moderate

Examples

- •

Good Afternoon

- •

Thank you for being a valued SkyMiles Member

- •

Your MQMs

- Attribute:

Corporate

Strength:Weak

Examples

- •

Negotiated Fares

- •

Accessible Travel Services

- •

Corporate Rewards

Tone Analysis

Functional

Secondary Tones

Efficient

Supportive

Tone Shifts

The tone shifts from impersonal/transactional for a general user to personalized/data-driven for a logged-in SkyMiles member, effectively catering to the user's context.

Voice Consistency Rating

Excellent

Consistency Issues

The voice is remarkably consistent in its functional and transactional nature. However, this consistency comes at the cost of expressing a broader brand personality.

Value Proposition Assessment

The website's implied value proposition is: 'Delta offers the most efficient and comprehensive digital tool to book and manage your travel, with a deeply integrated and rewarding loyalty program.' The broader corporate brand message of being a premium, reliable airline is not explicitly communicated on this transactional page.

Value Proposition Components

- Component:

Extensive Network & Booking

Clarity:Clear

Uniqueness:Common

- Component:

Tiered Premium Products

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Integrated Loyalty Program (SkyMiles)

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Ancillary Travel Services (Hotels, Cars, Vacations)

Clarity:Somewhat Clear

Uniqueness:Common

On the homepage, differentiation from competitors like American and United is weak. The user interface for booking flights is a commoditized experience across the industry. Delta's primary digital differentiator is the depth and clarity of its SkyMiles integration for logged-in members, which is well-executed. The communication of its premium product tiers (e.g., Delta One®) is present but lacks persuasive messaging to convey why they are superior.

The website positions Delta as a large, established, full-service carrier focused on operational efficiency for the end-user. It implicitly targets both leisure and business travelers who value a comprehensive network and are potentially invested in the SkyMiles ecosystem. The messaging does not attempt to compete on price (like Southwest) or on overt luxury (like some international carriers).

Audience Messaging

Target Personas

- Persona:

The Task-Oriented Booker (Business or Leisure)

Tailored Messages

- •

From/To booking widget

- •

Trip Type (Round Trip, One Way)

- •

Find My Trip

Effectiveness:Effective

- Persona:

The Loyal Frequent Flyer

Tailored Messages

- •

SkyMiles® Member dashboard

- •

Miles Available

- •

Start Tracking Towards {{Year}} Medallion Status

Effectiveness:Effective

- Persona:

The Deal-Conscious Traveler

Tailored Messages

- •

Shop with Miles

- •

Flight Deals

- •

SkyMiles Award Deals

Effectiveness:Somewhat

Audience Pain Points Addressed

- •

Difficulty in booking flights

- •

Uncertainty about trip details

- •

Complexity of managing loyalty points and status

Audience Aspirations Addressed

- •

Achieving elite travel status (Medallion Status)

- •

Seamlessly planning a trip

- •

Traveling to desired destinations

Persuasion Elements

Emotional Appeals

- Appeal Type:

Achievement/Status

Effectiveness:Medium

Examples

The Medallion Status tracker visually represents progress, appealing to a user's desire for advancement and recognition.

- Appeal Type:

Efficiency/Ease

Effectiveness:High

Examples

The entire layout is designed to reduce friction and make the user feel competent and in control of their booking process.

Social Proof Elements

No itemsTrust Indicators

- •

Prominent Delta logo and branding

- •

Clear navigation and information architecture

- •

Secure login area for SkyMiles members

- •

Links to 'Help Center' and 'Comment/Complaint'

Scarcity Urgency Tactics

None present in the provided homepage content, though they likely appear later in the booking funnel (e.g., 'Only 3 seats left at this price').

Calls To Action

Primary Ctas

- Text:

Submit (Arrow icon)

Location:Main booking widget

Clarity:Clear

- Text:

Find My Trip

Location:Trip management widget

Clarity:Clear

- Text:

Join SkyMiles

Location:SkyMiles navigation tab

Clarity:Clear

The CTAs are highly effective due to their clarity, simplicity, and prominent placement. The primary CTA to search for flights is the visual focal point of the entire page, leaving no ambiguity for the user. The language is direct and action-oriented.

Messaging Gaps Analysis

Critical Gaps

- •

Brand Narrative: The homepage is devoid of brand storytelling. There is no mention of Delta's mission, its 'Keep Climbing' philosophy, its commitment to service, safety, or reliability.

- •

Emotional Connection: The messaging is entirely functional and fails to evoke the excitement, aspiration, or emotion associated with travel.

- •

Human Element: There is no reference to the 100,000 employees who deliver the Delta experience, a key part of their broader brand communication.

Contradiction Points

There are no direct contradictions due to the sparse, functional nature of the messaging.

Underdeveloped Areas

Value Proposition Communication: Beyond listing cabin classes, there's no persuasive copy explaining the benefits of choosing Delta Premium Select or Delta One®, a missed opportunity to upsell.

Inspirational Content: The page lacks content that inspires travel, such as destination highlights or travel stories, which could engage users not yet ready to book.

Messaging Quality

Strengths

- •

Exceptional Clarity: The page's purpose is immediately understood.

- •

Task-Oriented Efficiency: It excels at helping users complete primary tasks like booking and managing trips.

- •

Effective Personalization: The logged-in experience for SkyMiles members is data-rich and highly relevant, fostering loyalty.

Weaknesses

- •

Lack of Brand Personality: The voice is sterile and lacks the warmth or premium feel often associated with the Delta brand in other marketing channels.

- •

No Emotional Resonance: The messaging fails to connect with the user on an emotional level, making the experience feel generic and utilitarian.

- •

Weak Differentiation: The homepage messaging does little to differentiate Delta from its main competitors, positioning it as a utility rather than a premium brand choice.

Opportunities

- •

Incorporate the 'Keep Climbing' tagline or a similar brand message near the top of the page to frame the experience.

- •

Use the 'FEED' section, which is currently generic, to feature compelling brand stories, destination content, or service highlights.

- •

Add a visually engaging, non-intrusive element that communicates a key brand differentiator, such as on-time performance, customer service awards, or network reach.

Optimization Roadmap

Priority Improvements

- Area:

Brand Messaging

Recommendation:Integrate a concise, powerful brand statement below the main booking widget. For example: 'Connecting the world with industry-leading service and reliability.'

Expected Impact:Medium

- Area:

Value Proposition

Recommendation:Enhance the cabin class links with short, benefit-oriented subtext. For 'Delta One®', add 'Experience the height of luxury and privacy.' This begins the upsell process earlier.

Expected Impact:Medium

- Area:

Emotional Appeal

Recommendation:Test replacing the static background with a high-quality, short video loop showcasing the aspirational aspects of travel (e.g., beautiful destinations, positive human connections) that does not slow down the page.

Expected Impact:High

Quick Wins

- •

Change the primary booking CTA from a generic 'Submit' arrow to more descriptive text like 'Find Flights'.

- •

Utilize the empty space in the 'FEED' section to feature a link to a positive news story or a brand initiative.

- •

Add a trust-building statistic near the footer, such as 'North America's most on-time airline.'

Long Term Recommendations

- •

Develop a content module for the homepage that dynamically surfaces inspirational travel content based on user data (e.g., 'Dreaming of Europe? Explore our deals to Paris').

- •

Create a more robust 'Why Delta' section accessible from the main navigation that clearly articulates brand differentiators around service, network, reliability, and loyalty.

- •

Invest in personalizing the homepage for non-logged-in users based on their browsing history or geolocation to provide more relevant deals and destination suggestions.

The strategic messaging on Delta.com's homepage is a masterclass in functional, task-oriented communication. It is ruthlessly efficient, prioritizing the core business objectives of driving flight bookings and servicing existing customers. The message architecture is crystal clear, with a hierarchy that guides users to action with minimal friction. For logged-in SkyMiles members, the personalized dashboard is a powerful loyalty and retention tool that effectively communicates the value of staying within the Delta ecosystem.

However, this singular focus on utility creates a significant messaging gap: the absence of brand. The website operates as a transactional tool, not as an extension of the premium, reliable, and service-oriented brand that Delta promotes in its broader advertising campaigns like 'Keep Climbing'. The messaging lacks emotional resonance and fails to articulate why a traveler should choose Delta over a competitor beyond route availability or existing loyalty. There is a clear disconnect between the aspirational, human-centric story told in their TV spots and the sterile, functional experience on their primary digital storefront.

The key strategic opportunity is to infuse this highly effective transactional engine with brand narrative without compromising its usability. By subtly integrating messages about service, reliability, and the joy of travel, Delta can bridge the gap between its functional digital experience and its emotional brand identity. This would not only support customer acquisition by providing reasons to choose Delta initially but also reinforce brand preference, creating a more defensible market position against competitors who offer a similarly functional booking experience.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

One of the largest global airlines by market capitalization, operating over 4,000 daily flights to more than 275 destinations.

- •

Consistently strong brand recognition, particularly targeting premium leisure and corporate travelers.

- •

Diverse product offering with multiple cabin classes (Delta One, Premium Select, First Class, etc.) catering to different customer segments.

- •

Robust and highly profitable SkyMiles loyalty program and a multi-billion dollar co-branded credit card partnership with American Express, which drives significant high-margin revenue.

- •

High passenger load factors, often exceeding 88% in peak seasons, indicating strong demand for its services.

Improvement Areas

- •

Enhance the digital booking experience for ancillary services (vacations, hotels, cars) to create a more seamless 'connected trip' and capture more wallet share.

- •

Improve integration and consistency of the customer experience across the SkyTeam Alliance partners.

- •

Continue to invest in the onboard product to fend off aggressive competition from carriers like United who are upgrading their offerings.

Market Dynamics

Global airline passenger traffic is projected to grow by approximately 5.8% to 6.5% in 2025.

Mature

Market Trends

- Trend:

Sustained demand for premium travel

Business Impact:High. This directly supports Delta's strategy of focusing on high-yield premium and corporate customers and investing in premium cabin products.

- Trend:

Increased focus on sustainability (Sustainable Aviation Fuel - SAF)

Business Impact:Medium to High. Growing regulatory pressure (e.g., EU mandates) and consumer sentiment require significant investment in SAF, which currently comes at a high cost premium, impacting profitability.

- Trend:

Hyper-personalization and ancillary revenue growth

Business Impact:High. Opportunity to increase high-margin revenue by using data to offer tailored ancillary products like seat upgrades, lounge access, and travel packages.

- Trend:

Intense competition from both legacy and low-cost carriers (LCCs)

Business Impact:High. Legacy carriers compete on network and service, while LCCs apply downward pressure on fares, particularly in the domestic market.

- Trend:

Aircraft delivery delays and supply chain constraints

Business Impact:Medium. Delays from manufacturers like Boeing and Airbus can constrain capacity growth plans and slow down fleet modernization efforts.

Favorable. The market is in a sustained post-pandemic recovery phase with strong, albeit normalizing, travel demand, particularly in the premium and international sectors where Delta is well-positioned.

Business Model Scalability

Medium

High fixed costs (aircraft, labor, airport facilities) with significant variable costs (fuel, maintenance). Delta has strategically worked to variabilize costs, such as through profit-sharing plans, to gain flexibility.

High. Small changes in revenue (yields, load factor) can have a large impact on profitability due to the high fixed-cost base.

Scalability Constraints

- •

Capital intensity of acquiring new aircraft.

- •

Physical constraints of airport slots and gate capacity.

- •

Availability of skilled labor, particularly pilots and mechanics.

- •

Regulatory hurdles for launching new international routes.

- •

High volatility of fuel prices, a major variable cost.

Team Readiness

Strong. Experienced leadership team with a proven track record of navigating industry volatility, focusing on operational reliability and premium service.

Mature and functional. The structure is well-suited for managing complex global operations but can be prone to the bureaucratic inertia common in legacy carriers.

Key Capability Gaps

- •

Agile digital product development to compete with tech-first travel companies.

- •

Advanced data science and AI talent to fully leverage customer data for hyper-personalization.

- •

Sustainability expertise to navigate the complex transition to SAF and other green technologies.

Growth Engine

Acquisition Channels

- Channel:

Direct (delta.com & Fly Delta App)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Invest in personalization and AI to improve ancillary upsell conversion and create tailored travel packages during the booking flow.

- Channel:

Corporate Travel Programs

Effectiveness:High

Optimization Potential:High

Recommendation:Deepen relationships with corporate clients by providing more sophisticated performance metrics and customized travel solutions.

- Channel:

Online Travel Agencies (OTAs) & Metasearch

Effectiveness:Medium

Optimization Potential:Low

Recommendation:Use primarily for reaching price-sensitive customers in new markets while ensuring the best fares and loyalty benefits remain on direct channels to encourage channel shift.

- Channel:

Co-branded Credit Card Partnerships (AmEx)

Effectiveness:Very High

Optimization Potential:Medium

Recommendation:Develop targeted acquisition campaigns aimed at specific high-spend customer segments and explore tiered card products to capture a wider audience.

Customer Journey

The booking path on delta.com is clear and relatively streamlined for standard flight bookings.

Friction Points

- •

Complexity in understanding the value proposition of different fare classes (e.g., Comfort+ vs. Premium Select).

- •

Potentially disjointed user experience when booking ancillary products like hotels and rental cars, which may redirect to partner sites.

- •

Navigating complex multi-city bookings or award travel redemptions can be cumbersome for less experienced users.

Journey Enhancement Priorities

{'area': 'Ancillary Integration', 'recommendation': "Create a fully integrated 'trip builder' experience where customers can seamlessly add hotels, cars, and activities without leaving the Delta ecosystem."}

{'area': 'Fare Transparency', 'recommendation': 'Use clearer visual comparisons and benefit summaries to help customers easily understand the trade-offs between different fare classes at the point of sale.'}

Retention Mechanisms

- Mechanism:

SkyMiles Loyalty Program

Effectiveness:Very High

Improvement Opportunity:Introduce more non-flight redemption opportunities (e.g., exclusive events, lifestyle products) to increase engagement and cater to members who may fly less frequently.

- Mechanism:

Co-branded American Express Credit Cards

Effectiveness:Very High

Improvement Opportunity:Leverage spending data from AmEx to personalize travel offers and SkyMiles promotions, creating a virtuous cycle of spending and loyalty.

- Mechanism:

Customer Service & Operational Reliability

Effectiveness:High

Improvement Opportunity:Proactively use technology (AI-powered messaging) to manage disruptions, offering automated rebooking and compensation to further solidify brand trust.

- Mechanism:

Delta Sky Club Lounges

Effectiveness:High

Improvement Opportunity:Continue investing in lounge expansion and premium amenities, as this is a key driver of loyalty for high-value Medallion members and premium cabin travelers.

Revenue Economics

Strong but under pressure. Delta typically achieves a higher Passenger Revenue per Available Seat Mile (PRASM) than competitors due to its premium focus, but also has a higher Cost per Available Seat Mile (CASM) due to its service levels and labor structure. The key is maintaining that revenue premium.

Extremely High for loyal customers. The lifetime value of a corporate traveler or a high-tier Medallion member is substantial, driven by repeat high-margin bookings and co-brand credit card revenue. Acquisition cost is amortized over many years.

High. Delta has successfully diversified its revenue streams, with loyalty and ancillary revenue making up a significant and growing portion of profitability, insulating it somewhat from pure ticket price volatility.

Optimization Recommendations

- •

Dynamically price ancillary services based on demand, route, and customer segment.

- •

Optimize fleet deployment to match premium seating capacity with routes that have high premium demand.

- •

Further develop 'Delta Vacations' to capture a larger share of customer travel spend beyond the flight.

Scale Barriers

Technical Limitations

- Limitation:

Legacy IT Infrastructure

Impact:High

Solution Approach:Continue phased modernization of core systems (e.g., passenger service systems, revenue management) to enable more dynamic pricing, personalization, and operational flexibility.

Operational Bottlenecks

- Bottleneck:

Air Traffic Control & Airport Congestion

Growth Impact:Limits the number of flights that can be operated, especially at key hubs, constraining network growth.

Resolution Strategy:Advocate for ATC modernization (NextGen). Optimize schedules for efficiency and utilize larger aircraft to increase passenger flow without adding frequencies.

- Bottleneck:

Aircraft Delivery Delays

Growth Impact:Slows fleet modernization and planned capacity expansion, potentially leading to higher maintenance costs on older planes.

Resolution Strategy:Maintain a flexible fleet strategy, including extending leases on existing aircraft if necessary, and diversify the order book across manufacturers.

- Bottleneck:

Labor Relations and Staffing

Growth Impact:Strikes or protracted contract negotiations can cause significant operational disruptions. Shortages of skilled staff like pilots can constrain growth.

Resolution Strategy:Maintain collaborative labor relations and invest in robust pilot training pipelines and recruitment programs.

Market Penetration Challenges

- Challenge:

Intense Domestic Competition

Severity:Critical

Mitigation Strategy:Focus on differentiation through superior operational reliability, customer service, and a leading loyalty program, rather than competing solely on price against LCCs.

- Challenge:

Complex International Route Expansion

Severity:Major

Mitigation Strategy:Leverage joint ventures (e.g., with LATAM, Air France-KLM) and the SkyTeam alliance to expand global reach with shared risk and capital investment.

- Challenge:

Geopolitical Instability and Economic Volatility

Severity:Major

Mitigation Strategy:Maintain a geographically diversified route network to hedge against downturns or conflicts in any single region. Use dynamic capacity adjustments to shift flying to stronger markets.

Resource Limitations

Talent Gaps

- •

Data Scientists and AI/ML Engineers

- •

Digital Product Managers and UX/UI Designers

- •

Sustainable Aviation Experts

Extremely high. Constant need for capital to fund new, fuel-efficient aircraft, airport infrastructure projects, and technology upgrades.

Infrastructure Needs

- •

Upgraded and expanded terminal facilities at key hubs.

- •

Modernization of IT infrastructure to support data-intensive applications.

- •

Investment in infrastructure for handling and storing Sustainable Aviation Fuel (SAF).

Growth Opportunities

Market Expansion

- Expansion Vector:

Deepen presence in high-growth international regions like Latin America and India.

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Utilize joint ventures and partnerships (like the one with LATAM) to leverage local market knowledge and networks, reducing the risk of direct expansion.

- Expansion Vector:

Target 'Bleisure' (Business + Leisure) travelers

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Create bundled offers through Delta Vacations that allow corporate travelers to easily add leisure components to their trips, promoted through corporate booking channels.

Product Opportunities

- Opportunity:

Subscription-Based Travel Products

Market Demand Evidence:Growing trend in various industries towards subscription models for predictable revenue and customer lock-in.

Strategic Fit:High. Could be positioned as a premium offering for frequent flyers, providing benefits like guaranteed upgrades, lounge access, and preferred pricing.

Development Recommendation:Pilot a regional or segment-specific subscription model (e.g., 'West Coast Shuttle Pass') to test pricing elasticity and demand.

- Opportunity:

Enhanced 'Connected Trip' Platform

Market Demand Evidence:Customers desire a seamless, single-point-of-contact for all travel needs.

Strategic Fit:Very High. Aligns with the goal of owning the entire customer journey and capturing more travel spend.

Development Recommendation:Invest in the technology to deeply integrate partner inventories (hotels, cars, experiences) into the Fly Delta app, offering personalized bundles and itineraries.

- Opportunity:

Corporate Sustainability Solutions

Market Demand Evidence:Corporations are increasingly focused on reducing their carbon footprint from business travel.

Strategic Fit:High

Development Recommendation:Develop a corporate offering that allows companies to purchase SAF credits directly through Delta to offset their travel emissions, providing detailed carbon reporting.

Channel Diversification

- Channel:

Content and Media Platform

Fit Assessment:Medium. Delta has a trusted brand associated with travel and exploration.

Implementation Strategy:Expand Delta's existing content (e.g., in-flight magazine) into a broader digital travel media platform, featuring destination guides and inspirational content that drives direct bookings.

Strategic Partnerships

- Partnership Type:

Lifestyle Brand Collaborations

Potential Partners

- •

Equinox

- •

Starbucks

- •

Leading luxury hotel groups

Expected Benefits:Enhance the premium customer experience, provide unique benefits for SkyMiles members, and create new avenues for earning and redeeming miles, strengthening the loyalty ecosystem.

- Partnership Type:

Technology & Data

Potential Partners

- •

Google

- •

Salesforce

- •

Leading AI startups

Expected Benefits:Accelerate digital transformation, improve personalization capabilities, and leverage advanced analytics to optimize operations and revenue management.

Growth Strategy

North Star Metric

High-Margin Revenue per Customer

This metric shifts focus from simply filling seats to maximizing profitable, loyal relationships. It encompasses high-yield ticket sales, ancillary purchases, and co-brand credit card revenue, aligning with Delta's premium differentiation strategy.

Increase by 10-15% over the next 3 years.

Growth Model

Hybrid: Product-Led & Partnership-Led Growth

Key Drivers

- •

Superiority of the core product (operational reliability, customer service).

- •

Strength of the SkyMiles loyalty program and AmEx partnership as a retention and acquisition engine.

- •

Joint ventures and alliances for efficient global network expansion.

Focus R&D on enhancing the digital and in-flight experience to drive direct bookings and ancillary revenue. Simultaneously, deepen the integration with strategic partners like AmEx and SkyTeam members to create a seamless ecosystem that is difficult for competitors to replicate.

Prioritized Initiatives

- Initiative:

Personalized Ancillary Revenue Engine

Expected Impact:High

Implementation Effort:Medium

Timeframe:12-18 months

First Steps:Develop a pilot project on a specific route to A/B test dynamic pricing and personalized bundling of services like seat upgrades, lounge passes, and Wi-Fi.

- Initiative:

Deepen LATAM Joint Venture Integration

Expected Impact:High

Implementation Effort:High

Timeframe:24 months

First Steps:Align schedules for seamless connectivity, co-locate at key airports, and launch a joint marketing campaign to build awareness of the expanded South American network.

- Initiative:

Launch Corporate SAF Program

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:9-12 months

First Steps:Build a transactional and reporting platform for corporate clients. Secure initial SAF supply agreements to back the program.

Experimentation Plan

High Leverage Tests

- Experiment:

Test different SkyMiles redemption offers for ancillary products to increase mileage 'burn' and drive ancillary revenue.

- Experiment:

A/B test the layout and content of fare selection pages to improve upsell conversion to premium cabins.

- Experiment:

Pilot a 'cancel for any reason' trip protection add-on to measure attach rates and profitability.

Utilize a combination of conversion rates, average revenue per user (ARPU), customer satisfaction (CSAT) scores, and incremental revenue lift for all experiments.

Run at least two significant digital customer experience tests per month, with a quarterly review of results to inform the product roadmap.

Growth Team

A cross-functional 'Growth Tribe' with dedicated squads focused on key objectives (e.g., Ancillary Revenue, Loyalty Engagement, Corporate Travel). The tribe should include members from Digital, Revenue Management, Marketing, Loyalty, and Operations.

Key Roles

- •

Head of Growth

- •

Data Scientist

- •

Product Manager (Ancillary)

- •

Loyalty Marketing Manager

- •

UX Researcher

Establish a formal experimentation process (hypothesis, test, measure, learn). Invest in analytics tools and training to empower teams to make data-driven decisions.

Delta Air Lines possesses a formidable growth foundation built on strong product-market fit, a premium brand position, and a best-in-class loyalty program. The current market dynamics, characterized by a robust demand for premium travel, are highly favorable to Delta's strategic focus. The company's primary growth engine is its ability to attract and retain high-value corporate and leisure travelers who generate superior revenue through premium fares, ancillary services, and co-branded credit card spending. Key growth opportunities lie in deepening this 'premium' moat through enhanced personalization, expanding the 'connected trip' ecosystem to capture more travel wallet share, and leveraging strategic partnerships for efficient international expansion. However, significant scale barriers exist. As a legacy carrier, Delta faces operational complexities, high capital intensity, and intense competition. Growth is constrained by infrastructure limitations, labor dependencies, and the volatile cost of fuel. The primary strategic imperative is not just growth, but profitable and durable growth. The recommended strategy is to adopt a North Star Metric of 'High-Margin Revenue per Customer' and pursue a hybrid growth model that combines product-led initiatives (enhancing the digital and physical customer experience) with partnership-led expansion (deepening alliances and brand collaborations). Prioritized initiatives should focus on developing a personalized ancillary revenue engine, capitalizing on the LATAM joint venture to dominate South American travel, and innovating with new products like corporate sustainability solutions. By focusing on these high-leverage areas, Delta can continue to drive differentiated, high-margin growth that creates lasting competitive advantages in the mature and challenging airline industry.

Legal Compliance

Delta's Privacy Policy is comprehensive and clearly accessible via the website footer. It details the types of personal information collected (e.g., booking information, SkyMiles data, website usage), the purposes for collection (e.g., providing travel services, marketing, legal compliance), and data sharing practices with partners like other airlines and car rental agencies. The policy explicitly mentions rights for residents of specific jurisdictions, acknowledging regulations like GDPR and CCPA, which is a strong strategic move for a global carrier. It also details the role of their Privacy Team and Data Protection Officer, which adds a layer of accountability. However, the policy's language can be dense for the average consumer, and the sheer volume of data collected across various touchpoints (website, app, partners) may not be fully transparent without careful reading, posing a minor risk to customer trust if not managed carefully.

Delta maintains separate, detailed Contracts of Carriage for Domestic and International travel, which is a best practice for clarity and legal precision. These documents are the core of their terms of service and are accessible on the website. They clearly outline Delta's policies on schedules, cancellations, baggage liability, and passenger conduct, incorporating them by reference into the ticket purchase process. The contracts grant Delta significant discretion to alter schedules and substitute carriers, which is standard industry practice but can be a point of contention for passengers. The enforceability is strong, as purchasing a ticket constitutes agreement to these terms. From a strategic perspective, having these detailed and accessible contracts is a critical risk management tool, setting clear expectations and legal boundaries for service delivery.

The cookie consent mechanism observed in the scraped website data is rudimentary and likely non-compliant with GDPR and the ePrivacy Directive. The notice states, 'In order to provide with the best experience possible we might sometimes track information about you... We recommend allowing these functions...' This language implies consent is assumed and does not offer clear, granular options to accept or reject non-essential cookie categories (e.g., advertising, analytics) before they are deployed. A compliant mechanism requires affirmative, opt-in consent. While a formal Cookie Policy exists, the implementation at the user-facing level appears to be a significant gap. This creates a high-risk exposure to fines from EU data protection authorities.

Delta's data protection framework demonstrates a strong awareness of its global obligations, particularly under GDPR for its European operations and CCPA/CPRA for California residents. The Privacy Policy outlines specific rights for data subjects, such as the right to access, delete, or amend personal data, and provides contact information ([email protected]) for exercising these rights. The company's commitment to enterprise-wide training on data security is a notable strength. However, the implementation of a 'Do Not Sell or Share My Personal Information' link, a key requirement under CCPA/CPRA, was not immediately apparent from the provided homepage content. The effectiveness of their data subject access request (DSAR) process is critical; any friction or delay in this process could lead to regulatory scrutiny and erode customer trust.

Delta's website shows a strong commitment to digital accessibility, which is a legal necessity and a competitive advantage in the airline industry. The site is governed by the Air Carrier Access Act (ACAA), which mandates that core functions (like booking, checking in, and checking flight status) conform to WCAG 2.0 Level AA standards. The presence of a prominent 'Skip to main content' link and a dedicated 'Accessible Travel Services' section are excellent indicators of compliance. These features not only mitigate legal risk under the ACAA and ADA but also enhance market access to travelers with disabilities, building significant brand trust and loyalty within this community. Continuous auditing is necessary to ensure all web functions, including third-party integrations, maintain these high standards.