eScore

devonenergy.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

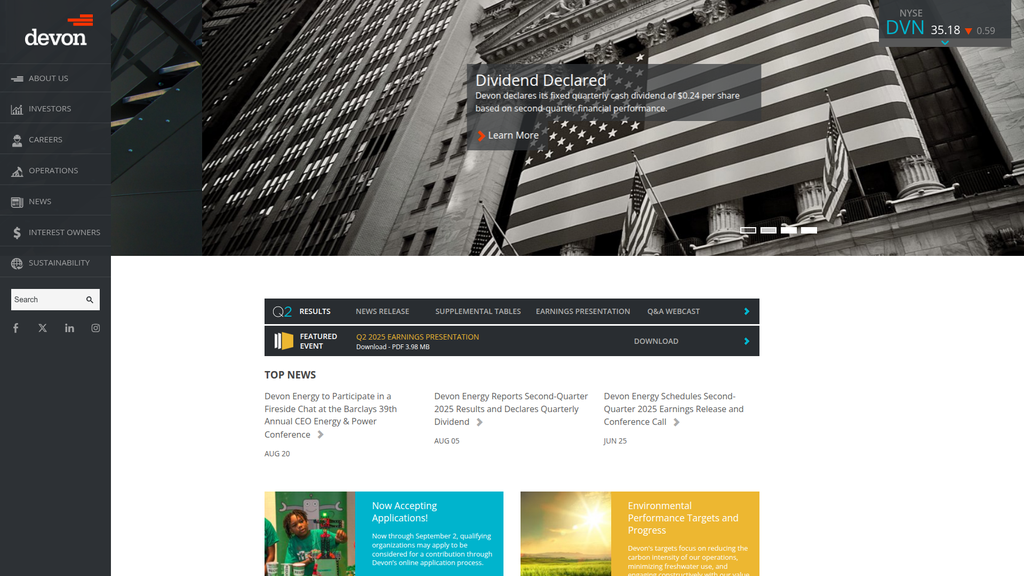

Devon Energy's digital presence is highly authoritative but narrowly focused, primarily serving investor relations and talent acquisition. Content strongly aligns with the search intent of these core audiences, featuring detailed financial reports, operational data, and comprehensive benefits information. However, this focus creates gaps in broader thought leadership topics like AI in energy and advanced sustainability practices, where competitors are more visible. The website lacks voice search optimization and has a limited multi-channel social media presence, concentrating its authority on its corporate domain and financial news outlets.

Deep content authority and search intent alignment for its primary investor audience, evidenced by a data-rich website that ranks well for financial and operational queries.

Develop a thought leadership content hub focused on innovation (e.g., AI, automation) and ESG in practice to attract a wider audience, capture non-branded search traffic, and build authority beyond financial reporting.

The company's messaging is exceptionally effective but siloed, creating two distinct and disconnected narratives for investors and potential employees. Communication to investors is data-driven, transparent, and highly credible, while messaging to recruits is detailed and compelling. However, the lack of a unifying brand story, weak primary calls-to-action on the homepage, and minimal emotional connection prevent the brand from presenting a cohesive public identity. There is little evidence of message testing or a narrative that bridges financial performance with the company's culture and societal impact.

Extreme messaging clarity and detail for its two core audiences (investors and recruits), which builds significant credibility and effectively addresses their specific needs and pain points.

Create a unified brand narrative that connects financial discipline, employee culture, and sustainability efforts into a single, compelling story to bridge the gap between the investor-focused and employer-focused messaging.

The website offers a very low-friction, professional experience with a logical information architecture and excellent mobile responsiveness, minimizing cognitive load for users. However, its conversion effectiveness is hampered by visually weak and ineffective calls-to-action, such as ghost buttons that lack prominence. While the cross-device journey is seamless, the site's micro-interactions are overly subtle, and accessibility considerations appear ad-hoc rather than integrated, limiting the full business impact of its otherwise strong user experience.

An excellent cross-device user journey, with a clear, logical information architecture and seamless mobile responsiveness that ensures a consistent and professional experience on any platform.

Redesign primary call-to-action buttons to make them visually prominent. Use solid, high-contrast colors and more specific, action-oriented language (e.g., 'View Q2 Results' instead of 'Learn More') to guide users more effectively.

Devon excels at building credibility through radical transparency with its key stakeholders, providing detailed financial reports, specific ESG performance data, and comprehensive employee benefit information. The company effectively uses third-party validation by aligning with established reporting frameworks like TCFD and SASB and participating in major financial conferences. While trust signals for investors and recruits are exceptionally strong, the credibility is slightly undermined for the general public by foundational digital compliance gaps, such as the lack of an interactive cookie consent banner and easily accessible Terms of Service.

Unparalleled transparency with its core investor audience through direct access to downloadable financial results, supplemental data, presentations, and SEC filings.

Address the high-severity legal compliance gaps by implementing a cookie consent banner and publishing a comprehensive 'Terms of Use' document to bolster credibility and mitigate legal risk for a general user audience.

Devon's competitive advantage is strong and sustainable, rooted in its high-quality, low-cost acreage in the premier Delaware Basin and its pioneering shareholder return framework. This combination creates a defensible moat, as prime acreage is difficult to replicate and the dividend strategy has built strong investor loyalty. The company is actively investing in technology and AI to maintain its edge in operational efficiency. However, as a commodity producer, it has no pricing power and its advantage does not include network effects or high customer switching costs.

A powerful combination of a world-class, low-cost asset base in the Delaware Basin and an industry-leading fixed-plus-variable dividend framework that attracts and retains significant investor capital.

Accelerate the adoption and development of proprietary AI and digital technologies to create a more durable and hard-to-replicate advantage in operational efficiency and cost leadership against highly competitive peers.

Devon demonstrates high scalability and expansion potential, driven by its strong unit economics, disciplined capital allocation, and a clear strategy for growth through accretive M&A. Recent acquisitions and a focus on operational efficiency underscore its ability to grow profitably. The company is also showing market expansion signals by securing LNG export agreements to access premium international pricing. Scalability is constrained primarily by the capital-intensive nature of the business and the finite inventory of top-tier drilling locations, rather than by operational or market limitations.

Exceptional capital efficiency, consistently reducing capital expenditures while exceeding production guidance, which allows for profitable scaling and robust free cash flow generation.

Establish a dedicated business unit to formally evaluate and pilot investments in low-carbon ventures like geothermal and carbon capture, leveraging existing competencies to build a scalable model for long-term energy transition.

Devon's business model is exceptionally coherent and strategically aligned with current energy market dynamics, which prioritize shareholder returns over growth. There is a clear and consistent focus on maximizing free cash flow from low-cost assets and returning it to shareholders, a strategy evident in every aspect of their operations and communications. Resource allocation is highly efficient and focused on the highest-return projects, demonstrating strong strategic focus. This model shows excellent alignment among investor, employee, and community stakeholders.

An unwavering strategic focus on capital discipline and maximizing free cash flow per share, which aligns the company's operations, financial strategy, and shareholder communications with perfect coherence.

Increase revenue model resilience by systematically securing more long-term, fixed-price or collar-protected sales contracts for natural gas to reduce exposure to volatile domestic spot prices.

As a leading independent producer, Devon holds a significant market position, particularly in the Delaware Basin, and is viewed as a consolidator in the industry. Its market power is demonstrated through its ability to influence industry strategy, having pioneered the variable dividend model that peers have since adopted. However, as a commodity producer, the company has virtually no pricing power and is a 'price taker' subject to global market forces. Its power comes from its operational efficiency and capital discipline, not from control over prices or customers.

Significant influence on industry strategy through its pioneering of the fixed-plus-variable dividend framework, which shifted the sector's focus toward shareholder returns and has been widely emulated.

Mitigate the inherent lack of pricing power by increasing exposure to premium-priced international markets through additional long-term LNG export agreements.

Business Overview

Business Classification

Commodity Producer (Upstream E&P)

Energy Infrastructure Operator

Energy

Sub Verticals

- •

Oil & Gas Exploration and Production (E&P)

- •

Unconventional Shale Resources

- •

Midstream Services

Mature

Maturity Indicators

- •

Long-established company (founded 1971).

- •

Large-cap, publicly traded company (NYSE: DVN) and S&P 500 component.

- •

Operations in well-established, prolific U.S. basins.

- •

Focus on operational efficiency, free cash flow generation, and shareholder returns over high-risk exploration.

- •

Active in strategic M&A to optimize portfolio rather than for initial market entry.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Crude Oil Sales

Description:Sale of crude oil produced from Devon's assets, primarily priced against WTI benchmarks. This is the largest single contributor to revenue.

Estimated Importance:Primary

Customer Segment:Refineries, Commodity Traders, Marketing Firms

Estimated Margin:Medium-High (highly dependent on market price)

- Stream Name:

Natural Gas Liquids (NGLs) Sales

Description:Sale of hydrocarbons like ethane, propane, and butane, which are separated from raw natural gas. Prices are linked to both crude oil and natural gas prices.

Estimated Importance:Secondary

Customer Segment:Petrochemical Companies, Refineries, Propane Distributors

Estimated Margin:Medium (price volatility)

- Stream Name:

Natural Gas Sales

Description:Sale of processed natural gas (methane), primarily priced against Henry Hub and other regional benchmarks.

Estimated Importance:Secondary

Customer Segment:Utility Companies, Industrial Consumers, LNG Exporters, Gas Marketers

Estimated Margin:Medium (price volatility and regional differentials)

- Stream Name:

Marketing and Midstream Activities

Description:Revenue generated from gathering, processing, and transportation services for its own production and potentially third parties, although primarily focused on supporting its upstream operations.

Estimated Importance:Tertiary

Customer Segment:Internal Operations, Other E&P Companies

Estimated Margin:Low-Medium

Recurring Revenue Components

Long-term supply contracts for natural gas and NGLs.

Fee-based revenue from midstream assets (less common as primary focus is on production).

Pricing Strategy

Market-Based / Commodity Pricing

Price Taker (prices are set by global and regional commodity markets like WTI, Brent, and Henry Hub)

Opaque (final realized prices depend on contracts, differentials, and hedging)

Hedging Strategy

Utilizes financial derivatives (swaps, collars, futures) to lock in prices for a portion of future production, reducing downside risk from price volatility.

Aims to protect cash flows required for capital expenditures and dividend commitments.

Monetization Assessment

Strengths

- •

High-quality, low-cost asset base in premier U.S. basins (especially the Delaware Basin) allows for profitability even at lower commodity prices.

- •

Diversified production mix (oil, NGLs, natural gas) provides some cushion against price swings in a single commodity.

- •

Active hedging program mitigates short-term price volatility and protects cash flow.

- •

Strategic focus on capital efficiency and cost reduction enhances margins.

Weaknesses

- •

Fundamentally exposed and highly correlated to volatile, cyclical global commodity prices.

- •

Long-term revenue projections are subject to significant uncertainty from geopolitical events, macroeconomic trends, and the energy transition.

- •

Declining production from existing wells (decline curves) requires continuous capital investment to maintain or grow output.

Opportunities

- •

Increased exposure to international pricing (e.g., LNG-linked contracts) to capture premium pricing over domestic benchmarks.

- •

Further vertical integration into midstream assets to capture more value and control costs.

- •

Leveraging technology (AI, data analytics) to further reduce drilling and completion costs and improve well productivity.

- •

Strategic M&A to acquire high-quality, low-cost assets that are accretive to free cash flow.

Threats

- •

A significant and sustained downturn in global oil and gas prices.

- •

Increasingly stringent environmental regulations (e.g., on methane emissions, flaring) could raise compliance costs.

- •

Accelerated adoption of renewable energy and electric vehicles, leading to long-term demand destruction for hydrocarbons.

- •

Geopolitical instability impacting global supply and demand dynamics.

Market Positioning

A leading, low-cost U.S. onshore producer focused on maximizing free cash flow and shareholder returns from a premier, multi-basin asset portfolio.

Significant Producer (Top-tier independent E&P in the U.S., particularly within the Delaware Basin)

Target Segments

- Segment Name:

Shareholder & Investor Community

Description:Primary audience for the corporate strategy. Includes institutional investors, retail shareholders, and equity analysts seeking returns through dividends and share price appreciation.

Demographic Factors

- •

Global investment funds

- •

Pension funds

- •

Retail investors

Psychographic Factors

- •

Value-oriented

- •

Seeking cash returns (dividends, buybacks)

- •

Risk-averse to speculative exploration

- •

Increasingly ESG-conscious

Behavioral Factors

- •

Analyze free cash flow metrics

- •

Monitor dividend payouts and share repurchase programs

- •

Scrutinize capital discipline and operational efficiency

Pain Points

- •

Commodity price volatility impacting returns

- •

Lack of capital discipline in the E&P sector

- •

Uncertainty around long-term energy transition risks

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Commodity Purchasers (Refineries & Utilities)

Description:Direct buyers of Devon's produced oil, natural gas, and NGLs who require reliable, on-spec supply for their operations.

Demographic Factors

- •

Large integrated oil companies

- •

Independent refiners

- •

Public and private utility companies

- •

Petrochemical manufacturers

Psychographic Factors

- •

Prioritize supply reliability and consistency

- •

Seek favorable contract terms and pricing

- •

Value logistical efficiency

Behavioral Factors

- •

Enter into long-term offtake agreements

- •

Purchase on spot markets

- •

Manage complex supply chain logistics

Pain Points

- •

Supply disruptions

- •

Price volatility impacting input costs

- •

Logistical bottlenecks in takeaway capacity

Fit Assessment:Good

Segment Potential:Medium

Market Differentiation

- Factor:

Fixed-Plus-Variable Dividend Framework

Strength:Strong

Sustainability:Sustainable (contingent on free cash flow)

- Factor:

Premier Delaware Basin Acreage

Strength:Strong

Sustainability:Sustainable (finite resource)

- Factor:

Capital Discipline and Focus on Free Cash Flow

Strength:Moderate

Sustainability:Sustainable (strategic choice)

- Factor:

Operational Efficiency & Cost Leadership

Strength:Moderate

Sustainability:Sustainable (requires continuous innovation)

Value Proposition

For investors: Devon Energy efficiently develops premier U.S. oil and gas assets to generate superior free cash flow, which is responsibly returned to shareholders through a disciplined, industry-leading fixed-plus-variable dividend and share buyback program.

Excellent

Key Benefits

- Benefit:

Significant Cash Returns to Shareholders

Importance:Critical

Differentiation:Unique (pioneered the fixed-plus-variable dividend model)

Proof Elements

- •

Declared fixed-plus-variable dividend history

- •

Active share repurchase programs

- •

Investor presentations highlighting cash return framework

- Benefit:

Exposure to High-Quality, Low Breakeven Oil & Gas Assets

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Acreage maps and production data from the Delaware Basin.

- •

Company guidance on low dividend breakeven prices (e.g., <$45/barrel WTI).

- •

Reports on high capital efficiency and well productivity.

- Benefit:

Commitment to Environmental, Social, and Governance (ESG) Performance

Importance:Important

Differentiation:Common (but strong execution can differentiate)

Proof Elements

- •

Annual Sustainability Reports.

- •

Published targets for reducing GHG emissions and methane intensity.

- •

Participation in initiatives like the Oil & Gas Methane Partnership 2.0.

Unique Selling Points

- Usp:

Industry-first fixed-plus-variable dividend strategy, directly linking shareholder returns to company performance and commodity prices.

Sustainability:Long-term

Defensibility:Moderate (replicable by competitors, but requires financial strength and commitment)

- Usp:

A concentrated, world-class asset position in the Delaware Basin, offering a deep inventory of highly economic drilling locations.

Sustainability:Medium-term (finite resource)

Defensibility:Strong (acreage is difficult and expensive to replicate)

Customer Problems Solved

- Problem:

Investors seek direct, tangible returns from energy investments, not just growth-at-any-cost.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

The E&P sector has a historical reputation for poor capital discipline and destroying shareholder value during downcycles.

Severity:Major

Solution Effectiveness:Complete (via disciplined capital allocation and cash return focus)

- Problem:

Refineries and utilities require a reliable, long-term supply of on-spec crude oil and natural gas.

Severity:Critical

Solution Effectiveness:Partial (as a single supplier in a global market)

Value Alignment Assessment

High

Devon's model is exceptionally well-aligned with the current market sentiment in the energy sector, which prioritizes shareholder returns, capital discipline, and free cash flow generation over production growth.

High

The value proposition directly addresses the primary demands of its key audience (investors) for tangible cash returns and a clear, disciplined corporate strategy.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Midstream companies (for pipeline and processing)

- •

Oilfield service providers (Halliburton, Baker Hughes, etc.).

- •

Joint venture partners in specific asset areas

- •

Technology partners for drilling, extraction, and data analytics

- •

Financial institutions (for credit facilities and hedging)

Key Activities

- •

Geological and geophysical analysis

- •

Drilling and completion of wells

- •

Production operations and facility management

- •

Commodity marketing and hedging

- •

Strategic acquisitions and divestitures (A&D).

- •

ESG reporting and compliance

Key Resources

- •

Proved and unproved oil and gas reserves.

- •

Premier land and acreage positions in key US basins.

- •

Technical expertise in unconventional resource extraction

- •

Physical infrastructure (wells, pads, facilities)

- •

Access to capital markets

Cost Structure

- •

Capital expenditures (drilling and completion)

- •

Lease operating expenses (LOE)

- •

Gathering, processing, and transportation costs

- •

General and administrative expenses

- •

Taxes and royalties

- •

Interest expense on debt

Swot Analysis

Strengths

- •

Strong balance sheet with manageable debt levels.

- •

High-quality, low-cost asset portfolio concentrated in the Delaware Basin.

- •

Leading shareholder return framework (fixed-plus-variable dividend).

- •

Proven track record of operational excellence and improving capital efficiency.

- •

Successful M&A integration capabilities.

Weaknesses

- •

High sensitivity to commodity price fluctuations, impacting revenue and cash flow predictability.

- •

Mature asset base requires continuous investment to offset natural production declines.

- •

Limited geographic diversity, with operations focused solely in the U.S.

- •

Net margins, while solid, can lag industry averages during certain periods, suggesting potential for further cost optimization.

Opportunities

- •

Further consolidation in the U.S. shale industry through accretive M&A.

- •

Adoption of advanced technologies (AI, machine learning) to optimize drilling and reduce operating costs.

- •

Expansion into international markets for LNG offtake agreements to capture higher global gas prices.

- •

Investment in adjacent low-carbon ventures (e.g., carbon capture, utilization, and storage - CCUS) to prepare for the energy transition.

Threats

- •

Sustained low commodity prices due to global oversupply or economic recession.

- •

Increased federal and state environmental regulations targeting the oil and gas industry.

- •

Long-term demand erosion from the global energy transition to renewables and EVs.

- •

Rising operational costs due to inflation or supply chain constraints for oilfield services.

- •

Geopolitical risks impacting global energy markets.

Recommendations

Priority Improvements

- Area:

Operational Efficiency

Recommendation:Accelerate the 'Business Optimization Plan' to realize the targeted $1 billion in annual free cash flow improvements ahead of the 2026 schedule by aggressively deploying advanced analytics and process automation.

Expected Impact:High

- Area:

Portfolio Management

Recommendation:Continuously high-grade the asset portfolio by divesting non-core, higher-cost assets and re-deploying capital into the highest-return areas like the Delaware Basin or through bolt-on acquisitions.

Expected Impact:Medium

- Area:

Marketing & Hedging

Recommendation:Increase exposure to premium international gas pricing by securing additional long-term, LNG-linked supply agreements, reducing reliance on volatile domestic Henry Hub prices.

Expected Impact:Medium

Business Model Innovation

- •

Energy Transition Ventures: Establish a dedicated business unit to evaluate and make pilot investments in CCUS, geothermal, or clean hydrogen projects, leveraging existing geological expertise and land assets. This would serve as a long-term hedge against hydrocarbon demand decline.

- •

Midstream Monetization: Explore strategic options for monetizing a portion of integrated midstream assets (e.g., through a sale or joint venture) to unlock immediate capital that can be returned to shareholders or reinvested in higher-return upstream projects.

- •

Data as a Service: Package and license anonymized operational data and proprietary analytics models related to drilling and completion efficiency to smaller E&P operators or oilfield service companies, creating a new, high-margin revenue stream.

Revenue Diversification

- •

Secure more long-term, fixed-price or collar-protected sales contracts for natural gas to utilities and large industrial customers to create a more stable revenue base.

- •

Expand fee-based revenue by offering water management and midstream services to third-party operators in areas where Devon has existing infrastructure and excess capacity.

- •

Invest in carbon credit generation projects (e.g., reforestation on non-core acreage, methane abatement technologies) to create a new revenue stream and offset the company's own emissions.

Devon Energy has successfully evolved its business model from a traditional growth-oriented E&P company to a mature, value-focused enterprise, exceptionally well-positioned for the current market environment. The core of its strategy—leveraging a premier, low-cost asset base to generate substantial free cash flow and return it to shareholders via its innovative fixed-plus-variable dividend—is a clear market differentiator and a significant competitive advantage.

The company's maturity is evident in its disciplined capital allocation, focus on operational efficiency, and strategic M&A activity aimed at optimizing its portfolio rather than speculative expansion. This model demonstrates high strategic alignment with investor demands for capital returns in a cyclical industry.

However, the model's primary vulnerability remains its direct exposure to volatile commodity prices. While hedging mitigates short-term risk, a prolonged downturn would inevitably pressure the 'variable' component of its dividend and overall profitability. The long-term threat of the energy transition also looms, necessitating proactive strategic evolution.

Strategic Transformation Potential: Devon's path to future-proofing its business model lies in leveraging its core competencies to bridge the gap to a lower-carbon future. The company's significant operational and geological expertise is a key asset that can be redeployed. Strategic evolution opportunities include:

1. Becoming a Low-Carbon Super-Independent: Aggressively pursuing Carbon Capture, Utilization, and Storage (CCUS) projects within its core operating areas. This transforms an ESG liability (CO2 emissions) into a potential service-based revenue stream (sequestering carbon for industrial partners) and extends the life of its core hydrocarbon business.

2. Expanding the Value Chain: Methodically increasing its ownership and control of midstream infrastructure. The recent acquisition of Cotton Draw Midstream is a step in this direction, providing more stable, fee-based cash flows and insulating margins from transportation bottlenecks and costs.

3. Investing in Adjacencies: Allocating a small, disciplined portion of capital to energy transition technologies like geothermal or clean hydrogen production, where its subsurface expertise provides a distinct advantage.

In conclusion, Devon Energy's current business model is a masterclass in value creation within a mature industry. Its future scalability and sustainable advantage will be defined by its ability to incrementally diversify its revenue base and strategically invest in low-carbon adjacencies, transforming from a pure-play E&P into a more resilient and diversified energy producer.

Competitors

Competitive Landscape

Mature

Moderately concentrated

Barriers To Entry

- Barrier:

High Capital Requirements

Impact:High

- Barrier:

Geological and Technical Expertise

Impact:High

- Barrier:

Land and Mineral Rights Acquisition

Impact:High

- Barrier:

Regulatory and Environmental Compliance

Impact:High

- Barrier:

Access to Infrastructure (Pipelines, Processing Facilities)

Impact:Medium

Industry Trends

- Trend:

Increased Focus on Capital Discipline and Shareholder Returns

Impact On Business:Pressure to maintain high dividends and buybacks, influencing capital allocation decisions away from pure production growth.

Timeline:Immediate

- Trend:

Consolidation through Mergers and Acquisitions

Impact On Business:Creates larger, more resilient competitors and puts pressure on smaller players to scale up or be acquired. Devon may be both a consolidator and a potential target.

Timeline:Immediate

- Trend:

Energy Transition and ESG (Environmental, Social, Governance) Scrutiny

Impact On Business:Requires investment in decarbonization technologies (e.g., methane reduction, CCUS) and transparent reporting to attract and retain investors.

Timeline:Immediate

- Trend:

Adoption of AI and Digital Technologies

Impact On Business:Drives operational efficiency in drilling, production, and reservoir management. Companies that fail to invest in these technologies risk falling behind on cost-competitiveness.

Timeline:Near-term

- Trend:

Commodity Price Volatility

Impact On Business:Directly impacts revenues, profitability, and investment decisions, requiring sophisticated hedging strategies and low-cost operations to manage.

Timeline:Immediate

Direct Competitors

- →

EOG Resources, Inc.

Market Share Estimate:Comparable; a leading independent with significant US shale presence.

Target Audience Overlap:High

Competitive Positioning:Positioned as a technology-driven, low-cost operator focused on high-return, organic growth through 'premium' well inventory.

Strengths

- •

Strong focus on operational efficiency and technological innovation in drilling.

- •

Multi-basin portfolio provides diversification and flexibility in capital allocation.

- •

Robust balance sheet with a history of maintaining more cash than debt.

- •

Emphasis on high-return 'premium' drilling locations ensures profitability.

Weaknesses

- •

Revenue is highly susceptible to commodity price fluctuations.

- •

Historically less focused on large-scale M&A compared to peers.

- •

Investor sentiment can be mixed, with stock performance not always correlating strongly with earnings beats.

Differentiators

- •

'Premium' drilling strategy: only developing wells that meet a high-return threshold.

- •

Emphasis on organic growth over large corporate acquisitions.

- •

Strong ESG commitments, including ambitious greenhouse gas reduction targets.

- →

ConocoPhillips

Market Share Estimate:Larger; a major independent with a more global and diversified portfolio.

Target Audience Overlap:High

Competitive Positioning:Positions as a resilient, diversified global E&P company with a focus on a low cost of supply and financial strength.

Strengths

- •

Globally diversified asset portfolio reduces geopolitical and basin-specific risks.

- •

Significant scale and a strong balance sheet provide financial resilience and access to capital.

- •

Low-cost inventory allows for profitability even in low oil price environments.

- •

Strong emphasis on operational excellence and technology adoption to reduce costs.

Weaknesses

- •

Large scale can lead to less agility compared to smaller, more focused players.

- •

Exposure to international political and regulatory risks.

- •

Can face greater scrutiny from global ESG investors due to its larger footprint.

Differentiators

- •

Combination of conventional, unconventional, LNG, and oil sands assets.

- •

Strategic focus on balancing capital discipline with long-term value creation.

- •

Extensive technological expertise and a history of successful large-scale project execution.

- →

Diamondback Energy, Inc.

Market Share Estimate:Comparable; a leading independent primarily focused on the Permian Basin.

Target Audience Overlap:High

Competitive Positioning:A low-cost, pure-play Permian Basin operator known for operational efficiency and an aggressive growth strategy.

Strengths

- •

Dominant, high-quality acreage in the Permian Basin, the most prolific US oil field.

- •

Recognized as a low-cost leader, which provides a significant competitive advantage.

- •

Proven track record of successful, value-accretive M&A activity.

- •

Strong focus on shareholder returns through dividends and buybacks.

Weaknesses

- •

Limited geographic diversification, making it highly dependent on the Permian Basin's performance and regulatory environment.

- •

High capital expenditure associated with its aggressive acquisition strategy.

- •

Financial performance is highly correlated with volatile oil and gas prices.

Differentiators

- •

'Pure-play' Permian strategy provides deep expertise and economies of scale in a single basin.

- •

Agile and aggressive M&A approach to consolidate Permian assets.

- •

Pioneering fracking techniques have given it a historical edge in low-cost production.

- →

Occidental Petroleum Corporation

Market Share Estimate:Larger; diversified international energy company with assets in the US, Middle East, and North Africa.

Target Audience Overlap:High

Competitive Positioning:Positions as a leader in low-carbon initiatives and CO2 management alongside its core E&P business, with a strong domestic asset portfolio.

Strengths

- •

Strong asset base in the Permian Basin and other key US regions.

- •

Leadership in Carbon Capture, Utilization, and Storage (CCUS) and direct air capture (DAC) through its acquisition of Carbon Engineering.

- •

Integrated model with chemical and midstream segments provides some diversification.

- •

History of successful large-scale acquisitions (e.g., Anadarko, CrownRock) to bolster portfolio.

Weaknesses

- •

High debt levels resulting from major acquisitions can strain the balance sheet.

- •

Profitability is highly dependent on volatile commodity prices.

- •

Complex portfolio with international assets introduces geopolitical risk.

Differentiators

- •

Dual-pronged strategy of optimizing traditional E&P while leading in low-carbon ventures.

- •

Extensive experience and infrastructure in CO2-enhanced oil recovery (EOR).

- •

Strategic acquisitions to build scale and lower operational costs in core areas.

Indirect Competitors

- →

ExxonMobil (after acquiring Pioneer Natural Resources)

Description:A global integrated energy and chemical company. Its acquisition of Pioneer Natural Resources makes it the dominant player in the Permian Basin, competing directly with Devon for resources, talent, and infrastructure access.

Threat Level:High

Potential For Direct Competition:Is now a primary direct competitor in Devon's core operating areas.

- →

NextEra Energy

Description:The world's largest producer of wind and solar energy. Competes for investment capital within the broader energy sector and influences public policy and sentiment towards renewables, creating long-term demand risk for fossil fuels.

Threat Level:Medium

Potential For Direct Competition:Low. The competition is for capital, talent, and the long-term energy mix, not for oil and gas assets.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

High-Quality Delaware Basin Acreage

Sustainability Assessment:Highly sustainable. Prime geological assets provide decades of low-cost drilling inventory.

Competitor Replication Difficulty:Hard

- Advantage:

Industry-Leading Shareholder Return Framework (Fixed-Plus-Variable Dividend)

Sustainability Assessment:Moderately sustainable. While the model can be copied, Devon's first-mover advantage and commitment have built strong investor loyalty.

Competitor Replication Difficulty:Medium

- Advantage:

Strong Operational Execution and Cost Management

Sustainability Assessment:Moderately sustainable. Requires continuous innovation to maintain a cost advantage as peers also adopt new technologies.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'Favorable Hedging Positions', 'estimated_duration': '12-24 months, depending on the structure of hedge contracts.'}

Disadvantages

- Disadvantage:

Direct Exposure to Commodity Price Volatility

Impact:Critical

Addressability:Difficult

- Disadvantage:

Negative Public and Political Sentiment Towards Fossil Fuels

Impact:Major

Addressability:Moderately

- Disadvantage:

Increasing Regulatory Burden (e.g., Methane Emissions Rules)

Impact:Major

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Amplify Digital Storytelling on ESG Performance

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Launch a Targeted Investor Relations Campaign Highlighting Capital Efficiency vs. Peers

Expected Impact:Medium

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Pursue Bolt-On Acquisitions of Smaller Operators with Adjacent, High-Quality Acreage

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Invest in Pilot Projects for Emerging Low-Carbon Technologies (e.g., Geothermal, Clean Hydrogen) Leveraging Core Competencies

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Develop and deploy proprietary AI tools for drilling optimization to create a sustainable cost advantage.

Expected Impact:High

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Establish a Formalized Low-Carbon Business Unit to Monetize ESG Initiatives (e.g., selling carbon credits from CCUS)

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Build Strategic Partnerships with Technology Firms and Renewable Energy Companies to Diversify Long-Term Energy Offerings

Expected Impact:High

Implementation Difficulty:Difficult

Solidify positioning as the premier 'shareholder-first' independent E&P, balancing disciplined production with superior, transparent capital returns and top-quartile ESG performance.

Differentiate through an unwavering commitment to the fixed-plus-variable dividend framework, best-in-class operational efficiency in the Delaware Basin, and by becoming the industry benchmark for transparent and verifiable emissions reductions.

Whitespace Opportunities

- Opportunity:

Become the Industry Leader in Digital Methane Emissions Monitoring and Reporting

Competitive Gap:While all competitors report on ESG, none have established a clear leadership position in providing real-time, transparent, and third-party-verified emissions data, which is a growing demand from investors.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Develop a 'Certified Responsibly Sourced Gas' Program for a Portion of Production

Competitive Gap:There is an emerging market for natural gas certified for its low environmental impact (e.g., low methane leakage). This creates a premium product that differentiates from competitors.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Strategic Entry into Geothermal Energy Production

Competitive Gap:Competitors are primarily focused on oil/gas or carbon capture. Geothermal leverages core E&P competencies (drilling, reservoir management) and offers a direct path to low-carbon energy production, a space few peers are exploring.

Feasibility:Low

Potential Impact:High

Devon Energy operates in the mature and highly competitive U.S. oil and gas E&P industry. The landscape is dominated by a handful of large independents, like EOG Resources, ConocoPhillips, Diamondback Energy, and Occidental Petroleum, all vying for capital, talent, and premium acreage. Barriers to entry are exceptionally high due to immense capital costs and the technical expertise required, which insulates established players but also intensifies rivalry among them.

Devon's primary competitive advantage lies in its high-quality asset base, particularly in the Delaware Basin, and its pioneering fixed-plus-variable dividend model, which has been instrumental in attracting and retaining income-focused investors. This shareholder-return focus is a key differentiator in an industry that has shifted from a 'growth-at-all-costs' mentality to one of capital discipline. Direct competitors are pursuing similar strategies of operational efficiency and shareholder returns, but differentiate through their portfolio focus: EOG on organic growth and 'premium' wells , ConocoPhillips on global diversification , and Diamondback on being a low-cost Permian 'pure-play' .

Key industry trends shaping the competitive environment include relentless pressure on ESG performance, industry consolidation, and the adoption of digital technologies to drive down costs. Devon's sustainability will depend on its ability to remain a low-cost operator while demonstrably improving its environmental footprint. The company faces a significant disadvantage shared by all peers: direct exposure to volatile commodity prices and negative public perception.

Strategic whitespace exists for a company to become the undisputed leader in ESG transparency, particularly around methane emissions. By investing in verifiable, real-time monitoring, Devon could turn a regulatory risk into a competitive advantage and attract a premium from ESG-conscious investors. Further opportunities lie in leveraging core E&P skills to explore adjacent low-carbon sectors like geothermal energy, a field not yet crowded by its direct competitors. The primary recommendation is for Devon to double down on its 'shareholder-first' positioning, using its dividend framework and operational excellence as its core identity, while aggressively pursuing technological and ESG leadership to create a durable long-term advantage.

Messaging

Message Architecture

Key Messages

- Message:

Devon Energy is a financially transparent and results-oriented company focused on delivering shareholder value.

Prominence:Primary

Clarity Score:High

Location:Homepage (via 'Results', 'News Release', 'Earnings Presentation' links)

- Message:

Devon offers an exceptionally competitive and comprehensive compensation and benefits package to attract and retain top talent.

Prominence:Primary

Clarity Score:High

Location:Careers / Compensation & Benefits Page

- Message:

Devon is committed to environmental performance, social responsibility, and community engagement.

Prominence:Secondary

Clarity Score:Medium

Location:Homepage (banners for 'Environmental Performance Targets' and 'Applications' for contributions)

- Message:

Devon supports employee well-being through extensive health, wellness, and work-life balance initiatives.

Prominence:Secondary

Clarity Score:High

Location:Careers / Compensation & Benefits Page (sections on Wellness, Work/Life Benefits)

The message hierarchy is extremely clear but siloed. The homepage is unequivocally prioritized for an investor and financial analyst audience. Financial results and corporate news dominate the primary visual real estate. Conversely, the careers page is a deep, singular focus on prospective employees. The hierarchy within each section is effective, but there is a lack of integration between them, creating two separate, parallel narratives rather than one unified brand story.

Messaging is highly consistent within its designated audience channels. The language on the homepage is consistently financial, data-driven, and formal. The language on the careers page is consistently detailed, supportive, and employee-centric. An underlying theme of being a well-resourced, stable, and leading U.S. producer is consistent across both areas.

Brand Voice

Voice Attributes

- Attribute:

Professional & Formal

Strength:Strong

Examples

- •

Devon Energy Reports Second-Quarter 2025 Results and Declares Quarterly Dividend

- •

Devon's targets focus on reducing the carbon intensity of our operations, minimizing freshwater use, and engaging constructively with our value chain.

- •

The information set forth on devonenergy.com is a summary of information regarding benefit plans that Devon currently has in place.

- Attribute:

Data-Driven & Transparent

Strength:Strong

Examples

- •

Annual deductible (medical and prescription drugs) Individual: $2,000 Family: $4,000

- •

Download - PDF 3.98 MB

- •

The company provides a 100 percent match on your contributions up to 6 percent depending on your years of service.

- Attribute:

Supportive & Caring (Employee-Facing)

Strength:Moderate

Examples

- •

Devon places great emphasis on employee wellness.

- •

To encourage work-life balance, Devon has established the Paid Family & Medical Leave (PFML) Policy.

- •

Lyra provides a range of care options for emotional and mental health at no cost.

Tone Analysis

Corporate / Financial

Secondary Tones

- •

Informative

- •

Authoritative

- •

Supportive

Tone Shifts

A significant tone shift occurs when moving from the public-facing homepage (formal, financial) to the internal-facing careers/benefits page (detailed, supportive, personal).

Voice Consistency Rating

Good

Consistency Issues

The brand voice is consistent within its silos but lacks a unifying personality across all audience touchpoints. It adapts so heavily to the audience that it feels like two different brands: 'Devon the Investment' and 'Devon the Employer'.

Value Proposition Assessment

For investors, Devon is a disciplined, leading U.S. oil and gas producer focused on generating free cash flow and returning capital to shareholders. For potential employees, Devon is a stable, top-tier employer offering industry-leading compensation and benefits that support every aspect of their health, wealth, and life.

Value Proposition Components

- Component:

Financial Performance & Shareholder Returns

Clarity:Clear

Uniqueness:Common

- Component:

Comprehensive Employee Benefits & Compensation

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Commitment to Sustainability & ESG

Clarity:Somewhat Clear

Uniqueness:Common

- Component:

Operational Scale and Premier Acreage

Clarity:Somewhat Clear

Uniqueness:Somewhat Unique

Devon's primary messaging differentiator is the extreme transparency and detail provided to its key audiences. For investors, this means direct access to reports, data, and analyst contacts. For employees, the differentiation is the exhaustive, granular detail of the benefits package, which serves as a powerful recruitment tool by substantiating claims of being a supportive employer. The messaging around financial discipline is standard for the industry, but the detail provided gives it more weight.

The messaging positions Devon as a stable, financially prudent, and reliable blue-chip operator in the U.S. energy sector. For talent, it aims to position itself as an employer of choice, competing not just on salary but on a holistic package of best-in-class benefits and work-life balance. It does not message as an aggressive explorer or a disruptive innovator, but as a dependable leader.

Audience Messaging

Target Personas

- Persona:

Investors & Financial Analysts

Tailored Messages

- •

Quarterly results, presentations, and dividend declarations.

- •

News of participation in CEO and energy conferences.

- •

Direct access for qualified analysts via 'Devon Direct'.

Effectiveness:Effective

- Persona:

Prospective Employees

Tailored Messages

- •

Detailed breakdowns of medical, dental, and vision plans.

- •

Specifics on 401(k) matching and company retirement contributions.

- •

Clear policies on Paid Time Off, alternate work schedules, and family leave.

Effectiveness:Effective

- Persona:

Community & ESG Stakeholders

Tailored Messages

Announcements for community contribution applications.

Links to environmental performance targets and progress reports.

Effectiveness:Somewhat

Audience Pain Points Addressed

For Investors: Lack of financial transparency, unpredictable returns, corporate irresponsibility.

For Employees: Inadequate benefits, poor work-life balance, financial insecurity, lack of long-term incentives.

Audience Aspirations Addressed

For Investors: Stable financial returns, disciplined capital allocation, long-term value creation.

For Employees: Career stability, comprehensive health coverage, a secure retirement, and a supportive work environment.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Security / Safety

Effectiveness:High

Examples

The entire benefits page appeals to a potential employee's need for health, financial, and family security.

Messaging around dividends and financial results appeals to an investor's need for financial security.

- Appeal Type:

Trust

Effectiveness:High

Examples

- •

Providing downloadable, data-rich PDFs of financial results.

- •

Explicitly stating deductible amounts, copay percentages, and contribution limits in benefits.

- •

The legal disclaimer, while standard, adds a layer of formal trust.

Social Proof Elements

- Proof Type:

Expert Endorsement (Implicit)

Impact:Moderate

Details:Announcing participation in high-profile financial conferences like Barclays and J.P. Morgan implies endorsement and relevance within the financial community.

Trust Indicators

- •

Detailed financial reports and supplemental tables.

- •

Specific dates on all news releases.

- •

Named plan administrators (BlueCross BlueShield, Delta Dental, VSP).

- •

Explicit contact information for 'Devon Direct' analysts.

- •

A detailed legal disclaimer on the benefits page.

Scarcity Urgency Tactics

Application deadline for community contributions ('Now through September 2'). This is the only instance and is very minor.

Calls To Action

Primary Ctas

- Text:

Download - PDF

Location:Homepage, Featured Event

Clarity:Clear

- Text:

News Release

Location:Homepage, Results section

Clarity:Clear

- Text:

Apply to be considered for a contribution

Location:Homepage banner

Clarity:Clear

- Text:

Find a BlueCross BlueShield provider

Location:Compensation & Benefits Page

Clarity:Clear

The CTAs are highly functional and clear for an audience with pre-existing intent. An investor looking for an earnings presentation will easily find and click 'Download'. However, the CTAs are transactional and do little to persuade or guide a user's journey. They lack persuasive language and fail to invite exploration of the broader Devon brand or mission.

Messaging Gaps Analysis

Critical Gaps

- •

Lack of a unifying brand narrative. There is no clear, overarching story that connects Devon's financial success, its commitment to employees, and its sustainability efforts. The 'Why' behind the company is missing.

- •

No clear messaging for the general public, potential business partners, or policymakers. The website primarily serves investors and recruits.

- •

Absence of human-centric storytelling. There are no employee testimonials, case studies of community impact, or stories of innovation that would bring the brand to life.

Contradiction Points

There are no direct contradictions, but there is a significant 'brand dissonance' between the cold, data-centric homepage and the warm, people-centric careers page. This creates a fractured brand personality.

Underdeveloped Areas

The sustainability message is presented as a 'check-the-box' item via banners and links rather than being integrated into a compelling narrative about responsible energy production.

The 'About Us' or 'Culture' story is not communicated on the homepage or the careers page, representing a missed opportunity to bridge the investor and employer brands.

Messaging Quality

Strengths

- •

Exceptional clarity and transparency for its two primary target audiences.

- •

Credibility is strongly established through detailed data and specific facts.

- •

The careers and benefits messaging is a powerful tool for talent acquisition, clearly communicating immense value.

- •

Professional and authoritative tone aligns with its position as a leading energy producer.

Weaknesses

- •

The messaging is overly siloed, creating a disjointed brand experience.

- •

The homepage functions more like an investor relations portal than a brand showcase.

- •

Lack of emotional connection and persuasive, narrative-driven content.

- •

The overall brand story is undefined, leaving a visitor to connect the dots on their own.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Messaging

Recommendation:Redesign the homepage to serve multiple audiences. Create a compelling headline that communicates the unified brand purpose (e.g., 'Powering Progress, Responsibly.') and create clear visual pathways for 'Investors,' 'Careers,' and 'Sustainability.'

Expected Impact:High

- Area:

Brand Narrative Development

Recommendation:Develop a core 'Our Story' or 'About Devon' section that weaves together the threads of financial discipline, employee culture, innovation, and environmental stewardship into a single, compelling narrative.

Expected Impact:High

- Area:

Content Strategy

Recommendation:Incorporate human-centric stories. Feature employee spotlights, articles on community projects, and content explaining the technology behind their sustainability targets to add depth and relatability to the brand.

Expected Impact:Medium

Quick Wins

- •

Add a prominent 'Careers' link with a value-driven tagline (e.g., 'Join an Industry Leader') to the main navigation of the homepage.

- •

Rewrite functional homepage banners to be more benefit-oriented (e.g., Change 'Environmental Performance Targets and Progress' to 'See Our Commitment to a Sustainable Future').

- •

Add a short, mission-driven tagline below the logo on the homepage.

Long Term Recommendations

- •

Conduct a formal brand voice and messaging architecture project to create a unified framework that can be applied consistently across all communications, bridging the gap between investor relations, HR, and corporate communications.

- •

Invest in video content to showcase company culture and the impact of sustainability initiatives.

- •

Develop a thought leadership content stream around key industry trends like energy transition, digital transformation, and operational efficiency to position Devon as a forward-thinking leader.

Devon Energy's website messaging is a study in bifurcation. It executes with surgical precision in communicating to its two most critical audiences: investors and potential employees. For investors, the homepage is a no-nonsense, data-rich portal that exudes financial transparency and discipline. For recruits, the careers section is an incredibly detailed and persuasive showcase of a top-tier benefits package, effectively communicating the company's commitment to its people.

The primary weakness is that these two powerful narratives run in parallel and never intersect. There is a significant messaging gap where a unified brand story should be. The website fails to answer the fundamental question: 'What is Devon Energy's overarching purpose?' This leaves the brand feeling functional and transactional rather than aspirational and holistic. The messaging lacks emotional resonance and storytelling, which are crucial for building a durable public reputation beyond quarterly earnings. While the trust indicators and data transparency are best-in-class, the opportunity lies in weaving these proof points into a compelling narrative that defines the company's values and vision for the future, thereby uniting its identity as both a sound investment and a great place to work.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Holds a world-class acreage position in the Delaware Basin, one of the most economically attractive and prolific oil and gas plays in the United States.

- •

Consistently demonstrates high capital efficiency, reducing capital spending while meeting or exceeding production guidance.

- •

Maintains a low breakeven cost structure, ensuring profitability even in moderate commodity price environments, with returns possible at sub-$40/bbl WTI.

- •

The business model is focused on generating substantial free cash flow and returning capital to shareholders, which is highly valued in the current market.

Improvement Areas

Continue to high-grade the asset portfolio by divesting non-core, lower-margin assets to concentrate capital in the highest-return areas like the Delaware Basin.

Further leverage technology and data analytics to improve well productivity and Estimated Ultimate Recovery (EUR) from existing acreage.

Market Dynamics

Low to Moderate (U.S. production growth forecast at ~120,000 bpd in 2025)

Mature

Market Trends

- Trend:

Increased Industry Consolidation

Business Impact:Heightened competition for high-quality acreage and M&A targets. Opportunity for Devon to be a consolidator through strategic, bolt-on acquisitions.

- Trend:

Focus on Capital Discipline & Shareholder Returns

Business Impact:Shift from 'growth-at-all-costs' to prioritizing free cash flow, dividends, and share buybacks. Devon's existing cash-return model is well-aligned with this trend.

- Trend:

Heightened ESG Scrutiny & Regulation

Business Impact:Increased pressure to reduce emissions (especially methane) and improve environmental performance. Requires investment in emissions reduction technology and transparent reporting, which Devon is actively pursuing.

- Trend:

Adoption of Digital Technologies (AI/ML)

Business Impact:Opportunity to enhance operational efficiency, optimize drilling, improve safety, and reduce costs through AI-powered analytics.

Favorable. Current market conditions, with a focus on disciplined producers with high-quality assets, align well with Devon's strategy. However, the business is inherently exposed to volatile commodity prices.

Business Model Scalability

Medium

High fixed costs associated with exploration, drilling, and infrastructure, but variable production costs per barrel are managed to be low. Scaling requires significant upfront capital expenditure.

High. Once initial capital costs are covered, profitability increases significantly with higher production volumes and commodity prices.

Scalability Constraints

- •

Finite inventory of high-quality, economic drilling locations ('Tier 1' acreage).

- •

Significant capital required for acquisitions and development programs.

- •

Availability of physical infrastructure, such as pipeline takeaway capacity.

- •

Regulatory approvals and potential for federal leasing restrictions.

Team Readiness

Strong. Experienced leadership team with a clear, disciplined strategy focused on returns, as evidenced by public statements and financial performance.

Well-suited. As a major publicly traded E&P company, the structure is established for managing large-scale, capital-intensive operations.

Key Capability Gaps

Advanced Data Science & AI Implementation: Deepening expertise to fully leverage AI for subsurface modeling, drilling optimization, and predictive maintenance.

Carbon Management & Sequestration: Building technical and commercial expertise in Carbon Capture, Utilization, and Storage (CCUS) as a long-term decarbonization strategy.

Growth Engine

Acquisition Channels

- Channel:

Asset Acquisition (M&A)

Effectiveness:High

Optimization Potential:High

Recommendation:Focus on disciplined, 'bolt-on' acquisitions of adjacent acreage in the Delaware Basin to leverage existing infrastructure, generate synergies, and expand high-quality inventory.

- Channel:

Organic Development (Drilling Program)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Continuously optimize well spacing, completion design, and drilling techniques using real-time data and AI to maximize capital efficiency and recovery.

- Channel:

Acreage Leasing

Effectiveness:Medium

Optimization Potential:Low

Recommendation:Opportunistically acquire strategic leases in core operating areas, though large-scale leasing opportunities are limited compared to M&A.

Retention Mechanisms

- Mechanism:

Reserve Replacement through Drilling

Effectiveness:High

Improvement Opportunity:Improve the capital efficiency of reserve additions by focusing drilling on the most productive zones and continuously improving well performance.

- Mechanism:

Enhanced Oil Recovery (EOR)

Effectiveness:Low (Currently)

Improvement Opportunity:Pilot and test advanced EOR techniques (e.g., gas injection) in mature shale wells to extend the productive life of existing assets.

- Mechanism:

Production Optimization

Effectiveness:High

Improvement Opportunity:Utilize predictive analytics and IoT sensors to optimize artificial lift systems and well interventions, slowing natural production decline curves.

Revenue Economics

Strong. Devon operates in the Delaware Basin, which is recognized for having some of the best well economics globally, characterized by high production rates and low breakeven costs.

Not Applicable. This metric is irrelevant for an E&P company. The equivalent concept is Return on Capital Employed (ROCE) or well-level Internal Rate of Return (IRR), which are strong.

High. The company has a demonstrated track record of improving capital efficiency by lowering spending while increasing production guidance.

Optimization Recommendations

- •

Further reduce Lease Operating Expenses (LOE) per barrel through automation and predictive maintenance.

- •

Secure favorable long-term pricing for a portion of production through hedging or direct marketing agreements to de-risk revenue streams.

- •

Continue to focus on supply chain management to control drilling and completion (D&C) cost inflation.

Scale Barriers

Technical Limitations

- Limitation:

Decline in 'Tier 1' Drilling Inventory

Impact:High

Solution Approach:Acquire additional Tier 1 acreage through M&A and invest in technology to improve the economics of 'Tier 2' locations.

- Limitation:

Parent-Child Well Interference

Impact:Medium

Solution Approach:Utilize advanced reservoir modeling and simulation to optimize well spacing and frac design, minimizing negative interactions between new and existing wells.

Operational Bottlenecks

- Bottleneck:

Midstream Takeaway Capacity

Growth Impact:Can constrain production growth and lead to poor regional price differentials if basin production outpaces pipeline capacity.

Resolution Strategy:Secure firm transportation contracts on existing and new pipelines; consider strategic partnerships or investments in midstream infrastructure.

- Bottleneck:

Supply Chain Inflation & Availability

Growth Impact:Increases in the cost of steel, sand, water, and labor can erode margins and delay development.

Resolution Strategy:Utilize long-term supplier contracts, strategic sourcing, and logistics optimization. Invest in water recycling infrastructure to reduce costs and reliance on freshwater.

Market Penetration Challenges

- Challenge:

Commodity Price Volatility

Severity:Critical

Mitigation Strategy:Maintain a disciplined hedging program to protect cash flows, sustain a low-cost structure to ensure resilience at lower prices, and adhere to a flexible capital program that can be adjusted to market conditions.

- Challenge:

Increasing Regulatory & ESG Pressures

Severity:Major

Mitigation Strategy:Proactively invest in emissions reduction technologies, maintain transparent ESG reporting, and engage constructively with regulatory bodies to shape practical policies. Devon's public targets and progress are positive steps.

- Challenge:

Intense Competition for Premium Assets

Severity:Major

Mitigation Strategy:Maintain a strong balance sheet to be able to act on strategic acquisition opportunities. Focus on operational excellence to be the 'acquirer of choice' and effectively integrate new assets.

Resource Limitations

Talent Gaps

Petrotechnical professionals with deep expertise in data science and machine learning.

Specialists in carbon capture and sequestration (CCUS) technology and project development.

High. Growth is capital-intensive and dependent on generating sufficient operating cash flow and maintaining access to capital markets for development programs and large-scale M&A.

Infrastructure Needs

Continued build-out of water handling and recycling infrastructure in the Delaware Basin.

Access to electrical grid infrastructure to power operations and reduce reliance on fossil fuel-powered equipment.

Growth Opportunities

Market Expansion

- Expansion Vector:

Consolidation within the Delaware Basin

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Pursue a disciplined strategy of acquiring smaller private or public operators with adjacent, high-quality acreage to achieve operational synergies and expand drilling inventory.

Product Opportunities

- Opportunity:

Investment in Geothermal Energy

Market Demand Evidence:Growing demand for 24/7 renewable baseload power. Devon has already invested in geothermal developer Fervo Energy.

Strategic Fit:Leverages core competencies in subsurface characterization and drilling.

Development Recommendation:Continue to support Fervo and explore other strategic partnerships to gain expertise and potentially co-develop projects, treating it as a long-term diversification play.

- Opportunity:

Carbon Capture, Utilization & Storage (CCUS)

Market Demand Evidence:Driven by regulatory incentives (like 45Q tax credits) and corporate decarbonization goals.

Strategic Fit:Leverages expertise in reservoir management and injection wells. Provides a pathway to decarbonize existing operations.

Development Recommendation:Conduct feasibility studies for a pilot CCUS project near core operations. Partner with industrial emitters or technology providers to share cost and risk.

Channel Diversification

- Channel:

LNG Export Agreements

Fit Assessment:High

Implementation Strategy:Secure long-term supply agreements with LNG developers to gain exposure to higher-priced international gas markets, diversifying away from domestic pricing. Devon has already initiated this with a Centrica deal.

Strategic Partnerships

- Partnership Type:

Technology & AI

Potential Partners

- •

Major cloud providers (AWS, Azure, Google Cloud)

- •

Specialized AI/ML software firms (e.g., C3.ai, Palantir)

- •

Drilling technology companies (e.g., SLB, Baker Hughes)

Expected Benefits:Accelerate digital transformation, improve drilling success rates, reduce operational costs, and enhance predictive maintenance capabilities.

- Partnership Type:

Midstream Development

Potential Partners

Major pipeline operators (e.g., Enterprise Products Partners, Plains All American)

Private equity-backed midstream companies

Expected Benefits:Ensure sufficient takeaway capacity for future production growth, improve pricing leverage, and potentially create a new revenue stream through joint-venture ownership.

Growth Strategy

North Star Metric

Free Cash Flow (FCF) per Share

This metric aligns capital-intensive operations with the ultimate goal of shareholder value creation. It forces discipline in capital allocation and prioritizes profitable growth over volume growth, reflecting current investor sentiment in the E&P sector.

Target a 5-7% annual growth in FCF per share through the commodity price cycle, driven by efficiency gains and disciplined capital allocation.

Growth Model

Capital-Disciplined Development & Acquisition Model

Key Drivers

- •

ROCE-driven capital allocation

- •

Operational efficiency (cost per BOE)

- •

Strategic, accretive acquisitions

- •

Systematic shareholder returns (dividend + buybacks)

Prioritize development projects and acquisitions based on their projected return on capital employed. Flex capital spending in response to commodity prices, directing excess cash flow to shareholders.

Prioritized Initiatives

- Initiative:

AI-Driven Drilling Optimization Program

Expected Impact:High

Implementation Effort:Medium

Timeframe:12-18 Months

First Steps:Establish a cross-functional team of reservoir engineers, data scientists, and drilling engineers. Launch a pilot project on a specific multi-well pad to test and validate AI models for optimizing well placement and completion design.

- Initiative:

Execute Delaware Basin Bolt-on Acquisition

Expected Impact:High

Implementation Effort:High

Timeframe:6-12 Months

First Steps:Identify and perform due diligence on 3-5 high-potential private operators with contiguous acreage. Develop a detailed integration plan focusing on rapid synergy capture.

- Initiative:

Formalize Energy Transition Strategy

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:9-12 Months

First Steps:Dedicate a small corporate strategy team to evaluate and rank opportunities in CCUS, geothermal, and other low-carbon ventures. Define clear investment criteria and a multi-year roadmap.

Experimentation Plan

High Leverage Tests

{'experiment': 'Test new Enhanced Oil Recovery (EOR) pilots in mature horizontal wells.', 'hypothesis': 'We can economically increase the recovery factor from existing wells by 3-5% using gas injection techniques.'}

{'experiment': 'Deploy remote operations centers and automation for well monitoring.', 'hypothesis': 'We can reduce Lease Operating Expenses by 10% and improve safety by centralizing the monitoring of 50% of our wells.'}

Measure initiatives based on their impact on key value drivers: Net Asset Value (NAV), Return on Capital Employed (ROCE), FCF per share, and emissions intensity reduction (kgCO2e/boe).

Review pilot project results on a quarterly basis, with a formal 'go/no-go' decision for wider rollout made semi-annually.

Growth Team

This function typically resides within a 'Corporate Strategy & Business Development' group rather than a conventional 'Growth Team'.

Key Roles

- •

VP of Strategy & Corporate Development

- •

M&A and A&D (Acquisitions and Divestitures) Manager

- •

Reservoir Engineer (for asset evaluation)

- •

Energy Transition / Low-Carbon Strategist

- •

Data Scientist

Develop internal capabilities through targeted hiring of talent with data science and renewable energy backgrounds. Utilize strategic consulting engagements for specialized projects and build expertise through pilot projects and partnerships.

Devon Energy possesses a robust foundation for growth, anchored by its premier asset base in the highly economic Delaware Basin. The company's 'product-market fit' is strong, aligning its low-cost production capabilities with a market that currently rewards capital discipline and shareholder returns over production volume growth. The prevailing industry trends of consolidation, digitalization, and ESG focus play to Devon's strategic strengths.

The company's growth engine is not based on traditional customer acquisition but on the efficient development of its reserves and strategic M&A. The primary growth levers are improving capital efficiency—drilling more productive wells for less capital—and executing accretive, 'bolt-on' acquisitions to expand its high-quality drilling inventory. This strategy has proven effective, as demonstrated by their consistent ability to beat production and cost guidance.

However, significant scale barriers exist. Devon's growth is fundamentally tied to the volatile commodity markets and constrained by a finite inventory of top-tier drilling locations, supply chain pressures, and increasing regulatory scrutiny. The most critical challenge is navigating the inherent cyclicality of the oil and gas industry while meeting long-term ESG commitments.

Key growth opportunities lie in both optimizing the core business and strategically diversifying into adjacent, low-carbon verticals. Within oil and gas, consolidating its Delaware Basin position and securing access to international markets via LNG agreements are prime opportunities. For long-term resilience, exploring investments in geothermal and Carbon Capture (CCUS) is a prudent strategy that leverages core competencies in subsurface engineering.

Recommendation: The recommended growth strategy is a 'Capital-Disciplined Development & Acquisition Model' with a North Star Metric of Free Cash Flow (FCF) per Share. This framework ensures that all growth initiatives—whether drilling optimization, M&A, or low-carbon ventures—are judged on their ability to generate sustainable, profitable returns for shareholders. The highest-priority initiatives should be: 1) Deploying AI to maximize the value of the existing asset base, 2) Executing a disciplined acquisition strategy to replenish inventory, and 3) Formalizing an energy transition roadmap to navigate long-term market shifts.

Legal Compliance

Devon Energy maintains a comprehensive Privacy Statement, accessible via a link in the website footer. The policy, effective January 1, 2020, details the types of personal data collected, including identifiers (IP address, cookies), professional information, and contact details. It clearly states the purposes for data collection, such as providing services, website improvement, and fulfilling legal and regulatory requirements (e.g., reporting payments to the IRS). The policy addresses data sharing, noting that data is shared with service providers under strict limitations and may be disclosed for legal reasons or during business transactions. Crucially, it includes a 'California Supplemental Privacy Statement' which details rights under the CCPA/CPRA, demonstrating an awareness of state-specific data privacy laws. The policy lacks a specific section on data retention periods and does not explicitly mention GDPR, which is a minor gap but potentially significant depending on their EU interactions.

A 'Terms and Conditions' or 'Terms of Use' document is not readily accessible from the main corporate website's footer, which is a significant gap. Standard practice for a corporation of this scale is to have a clearly linked document governing website use. A search reveals a 'Terms and conditions of website use' for a 'Devon Energy Partnership Ltd' based in the UK, which appears to be a separate entity and is governed by the laws of England, Northern Ireland, Scotland and Wales, making it irrelevant to the US-based Devon Energy Corp. Without accessible terms, there is ambiguity regarding liability limitations, intellectual property rights, and governing law for the use of the corporate site. This absence creates unnecessary legal risk and fails to set clear expectations for website users and investors accessing the information.

Upon visiting the website, there is no cookie consent banner or pop-up mechanism. The privacy policy mentions the collection of 'Identifiers such as IP address and cookies' and data from 'advertising and social media cookies' used for third-party advertising campaigns. The absence of an upfront consent tool is a major compliance gap, particularly concerning regulations like GDPR and CCPA/CPRA, which require either opt-in consent or a clear opt-out mechanism for non-essential cookies. Users are not given the choice to accept or reject tracking technologies before they are deployed, which is a violation of the principle of user control over personal data.