eScore

dollargeneral.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Dollar General's digital presence is highly effective at serving its core purpose: driving in-store sales through digital coupons and weekly ads for its existing customer base. However, it shows significant weakness in top-of-funnel strategy, with a notable lack of authoritative, solution-oriented content that could attract new audiences through organic search. While its local reach is unparalleled and supports its physical store dominance, its overall content authority is low, and it is not well-optimized for conversational or voice search queries.

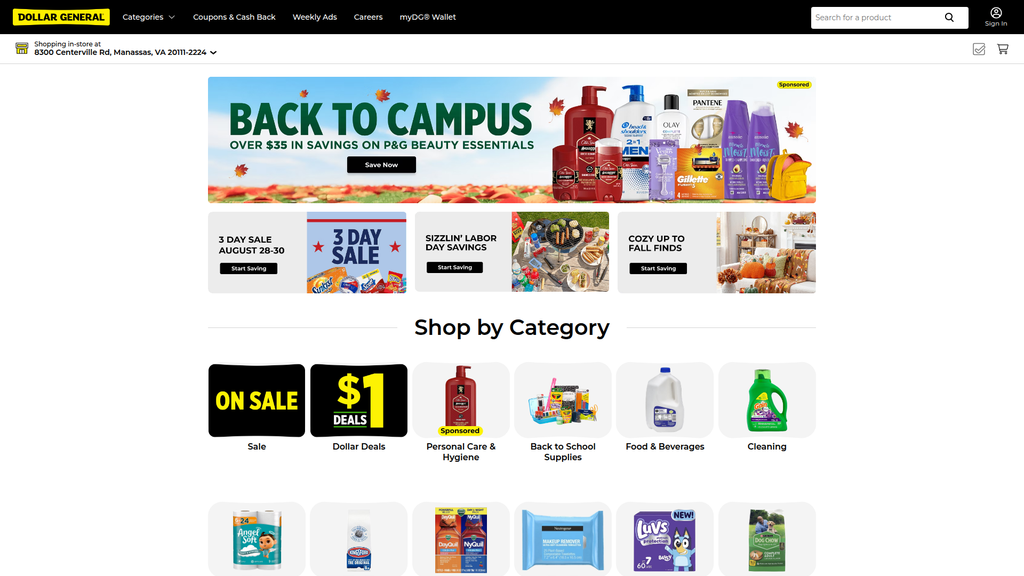

The digital experience is perfectly aligned with the core user's primary search intent: finding deals and coupons for an imminent in-store shopping trip.

Launch a content hub focused on 'value living' (e.g., budget recipes, DIY projects) to build brand authority and capture non-branded, top-of-funnel search traffic.

The brand's communication is exceptionally clear and consistent in its focus on value, deals, and savings, resonating powerfully with its target audience. However, this tactical excellence comes at a strategic cost, as the messaging is one-dimensional and fails to communicate the brand's most powerful differentiator: convenience. There is a complete absence of brand storytelling or emotional connection, making the customer relationship purely transactional and vulnerable to price competition.

The messaging on savings, coupons, and deals is crystal clear, action-oriented, and perfectly tailored to the budget-conscious shopper.

Integrate the 'convenience' value proposition into homepage messaging with a tagline like, 'Your Neighborhood Store for Everyday Savings, Right Around the Corner.'

The website's conversion experience is significantly hampered by high visual clutter, leading to heavy cognitive load and potential decision paralysis for users. Key weaknesses include inconsistent call-to-action designs, poor visual hierarchy in product displays, and friction-adding elements like the lack of a direct 'Add to Cart' function from the homepage. While functional for deal-hunters, the overall user experience is disorganized and not optimized for a smooth, frictionless journey.

The site effectively presents a wide variety of deals and product categories on the homepage, immediately signaling its core value proposition of low prices.

Standardize the call-to-action (CTA) design system to create a clear visual hierarchy for primary, secondary, and tertiary actions, making it easier for users to convert.

Dollar General demonstrates strong credibility through its robust and transparent legal and data privacy framework, particularly for US state-level laws. The company has a comprehensive privacy policy, supports the Global Privacy Control signal, and provides clear opt-out mechanisms, which builds trust with users. While the site design itself is not premium, credibility is established through clear pricing, the presence of trusted national brands, and a formal commitment to accessibility standards.

A comprehensive, multi-state data privacy management framework that is transparent and gives users clear control over their data.

Proactively publish an accessibility conformance report to build trust and mitigate legal risks stemming from the company's history of ADA litigation in its physical stores.

The company's competitive advantage is exceptionally strong and sustainable, rooted in an unmatched physical store density, particularly in rural markets underserved by competitors. This real estate dominance creates a powerful convenience moat that is difficult and costly to replicate. This is further strengthened by a low-cost, efficient operating model and a growing portfolio of higher-margin private-label brands that foster loyalty.

An unparalleled network of over 19,000 stores creates a hyper-convenient physical footprint and a deep, sustainable moat in rural and low-income communities.

Address the disadvantage of a poor in-store experience (clutter, staffing) which erodes the brand loyalty built by convenience and price.

Dollar General has high scalability potential, evidenced by its aggressive and successful new store rollout strategy and expansion into new formats (pOpshelf) and markets (Mexico). Strategic initiatives in healthcare (DG Wellbeing) and fresh food (DG Fresh) provide significant vectors for future growth. However, this potential is currently constrained by major operational bottlenecks, including supply chain inefficiencies and legacy technology systems that must be addressed to enable the next phase of growth.

A proven, repeatable, and cost-effective small-box store model that allows for rapid and disciplined market expansion into underserved areas.

Accelerate investment in modern, AI-driven inventory management systems to resolve supply chain bottlenecks, reduce stockouts, and improve operational leverage.

The business model is exceptionally coherent, with a laser focus on cost leadership and convenience that is perfectly aligned with its target market of budget-conscious households. Strategic growth initiatives like DG Fresh (supply chain), DG Wellbeing (services), and pOpshelf (new demographics) are logical and intelligent extensions that leverage core assets to create new revenue streams. The model is resilient, well-timed for the current economic climate, and shows a clear path for future evolution.

The core value proposition of saving customers time and money is flawlessly executed through a synergistic model of convenient locations, a curated product mix, and a low-cost structure.

Invest in in-store operations and labor to ensure the on-the-ground execution of the business model matches its strategic coherence and doesn't falter due to poor customer experience.

Dollar General wields significant market power, holding a dominant market share in the dollar store segment and demonstrating a growing trajectory. Its immense scale provides substantial leverage over suppliers, which is fundamental to its cost leadership strategy. However, the company has virtually no pricing power, as its brand is built on offering the lowest prices, and it is highly dependent on a specific, financially constrained customer segment.

Dominant market share (~35%) and massive scale give the company significant negotiating power with suppliers, enabling its cost leadership strategy.

Mitigate customer dependency risk by successfully scaling the pOpshelf concept to attract and retain a more affluent, suburban customer demographic.

Business Overview

Business Classification

Retail (Brick-and-Mortar)

eCommerce

Discount Retail

Sub Verticals

- •

Variety Store

- •

Convenience Goods

- •

Discount Grocery

Mature

Maturity Indicators

- •

Extensive national store footprint (>20,000 stores).

- •

Consistent, long-term sales growth and market presence.

- •

Established supply chain and distribution network (DG Fresh).

- •

Well-defined business model focused on cost leadership and convenience.

- •

Active portfolio management, including new store concepts (pOpshelf) and strategic closures.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Sale of Physical Goods (In-Store)

Description:The overwhelming majority of revenue is generated from the in-store sale of merchandise across four main categories: consumables, seasonal, home products, and apparel. Consumables (e.g., food, cleaning supplies, health products) are the largest driver, encouraging frequent customer visits.

Estimated Importance:Primary

Customer Segment:Budget-Conscious Households

Estimated Margin:Low

- Stream Name:

Private Label Product Sales

Description:Sales from an extensive portfolio of private brands such as Clover Valley (food), TrueLiving (household), and DG Home. These products offer higher margins compared to national brands and are a key strategic focus for increasing profitability and customer loyalty.

Estimated Importance:Primary

Customer Segment:Budget-Conscious Households

Estimated Margin:Medium

- Stream Name:

Digital Commerce & Delivery

Description:Revenue from online sales via dollargeneral.com and the DG mobile app, including 'DG Pickup' (Buy Online, Pickup In-Store) services and partnerships with third-party delivery services like DoorDash.

Estimated Importance:Tertiary

Customer Segment:Digitally-Engaged Shoppers

Estimated Margin:Low

- Stream Name:

Retail Media Network (DGMN)

Description:Generates revenue by selling advertising space and data insights to CPG partners, allowing them to target Dollar General's customer base. The DG Media Network grew its volume by over 25% in Q1 2025.

Estimated Importance:Tertiary

Customer Segment:CPG Companies & Advertisers

Estimated Margin:High

Recurring Revenue Components

Frequent, repeat purchases of consumable goods (e.g., groceries, cleaning supplies)

Pricing Strategy

Everyday Low Price (EDLP)

Budget

Transparent

Pricing Psychology

- •

Value-Based Pricing (e.g., 'Dollar Deals')

- •

Bundle Pricing (e.g., '3 FOR $3')

- •

Psychological Pricing (e.g., prices ending in .95)

- •

Promotional Pricing (Digital Coupons, Cash Back)

Monetization Assessment

Strengths

- •

Massive scale and purchasing power allows for cost leadership.

- •

Focus on high-turnover consumables drives consistent foot traffic and revenue.

- •

Growing high-margin private label portfolio enhances profitability.

- •

Loyal customer base dependent on convenience and value.

Weaknesses

- •

Extremely low-margin business model is sensitive to cost fluctuations (labor, freight).

- •

Heavy reliance on a single economic demographic (low-to-middle income).

- •

Physical store footprint constitutes the vast majority of revenue, with digital channels still nascent.

Opportunities

- •

Further expansion of higher-margin private label products.

- •

Growth of the high-margin DG Media Network by leveraging customer data.

- •

Expansion into new services like healthcare (DG Wellbeing) and financial services to increase revenue per store.

- •

Scaling the pOpshelf concept to attract higher-income suburban shoppers.

Threats

- •

Intense price competition from Walmart, Aldi, and Dollar Tree/Family Dollar.

- •

Rising operating costs (wages, rent) could erode thin profit margins.

- •

Economic upturns could lead their core customer to trade up to other retailers.

- •

Negative public perception regarding store conditions and labor practices could impact brand loyalty.

Market Positioning

Cost Leadership & Unmatched Convenience

Leader (Approximately 34.6% of the dollar store market).

Target Segments

- Segment Name:

Rural & Small-Town Households

Description:The core customer base, residing in towns with populations often under 20,000. These consumers have limited retail options and rely on Dollar General for everyday essentials. They are highly budget-conscious and value convenience.

Demographic Factors

- •

Low-to-middle income (often <$40,000 annually).

- •

Geographically located in rural or suburban 'food deserts'.

- •

Predominantly female shoppers, often aged 35+.

Psychographic Factors

- •

Value-driven and price-sensitive.

- •

Prioritizes convenience and efficiency in shopping trips.

- •

Seeks to stretch a limited budget.

- •

Brand loyal to trusted, affordable options.

Behavioral Factors

- •

Frequent shopping trips for necessities.

- •

High consumption of consumable goods.

- •

Responsive to coupons and promotions.

- •

Living 'paycheck to paycheck'.

Pain Points

- •

Lack of access to traditional supermarkets.

- •

Transportation challenges or long travel times for shopping.

- •

Managing a tight household budget.

- •

Needing a one-stop-shop for basic needs.

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Suburban, Higher-Income Shoppers (pOpshelf Target)

Description:A new target segment for the pOpshelf store concept, focused on suburban female shoppers looking for a 'treasure hunt' experience with non-essential items like home decor, party supplies, and beauty products at low price points (<$5).

Demographic Factors

- •

Household income of $50,000 - $125,000.

- •

Primarily female.

- •

Located in suburban communities.

Psychographic Factors

- •

Enjoys discovery and finding deals.

- •

Interested in on-trend, seasonal, and novelty items.

- •

Seeks an enjoyable, stress-free shopping experience.

Behavioral Factors

- •

Discretionary spending on non-consumables.

- •

Impulse purchasing behavior.

- •

Less frequent, more exploratory shopping trips.

Pain Points

- •

Finding affordable, on-trend home and seasonal goods.

- •

Desire for a fun shopping outlet without high prices of specialty stores.

- •

Boredom with traditional discount retail.

Fit Assessment:Good (for pOpshelf concept)

Segment Potential:High

Market Differentiation

- Factor:

Unparalleled Store Density

Strength:Strong

Sustainability:Sustainable

- Factor:

Rural Market Dominance

Strength:Strong

Sustainability:Sustainable

- Factor:

Small-Box Convenience Format

Strength:Strong

Sustainability:Sustainable

- Factor:

Growing Private Label Portfolio

Strength:Moderate

Sustainability:Sustainable

Value Proposition

Dollar General provides everyday essentials and household goods at consistently low prices in convenient, small-box neighborhood stores, saving customers time and money.

Excellent

Key Benefits

- Benefit:

Affordability

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Everyday Low Price (EDLP) model.

- •

"Dollar Deals" section.

- •

Extensive digital coupon program.

- Benefit:

Convenience

Importance:Critical

Differentiation:Unique

Proof Elements

- •

Over 20,000 stores, with ~75% of the US population within 5 miles of a location.

- •

Small store format for quick in-and-out shopping.

- •

Strategic locations in underserved rural areas.

- Benefit:

Accessible Essentials

Importance:Important

Differentiation:Common

Proof Elements

- •

Broad selection of consumables (food, cleaning, health).

- •

Increasing fresh and frozen food options via DG Fresh.

- •

Expansion into healthcare products via DG Wellbeing.

Unique Selling Points

- Usp:

Dominant retail presence in rural America where competitors are scarce.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A highly efficient, low-cost operating model tailored for small-box retail.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A rapidly growing, vertically integrated supply chain for fresh/frozen goods (DG Fresh) that reduces costs and improves product availability.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Limited access to affordable groceries and household staples in rural/low-income areas.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Need to manage a very tight budget for daily necessities.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Lack of time and transportation to travel to large, distant supermarkets.

Severity:Major

Solution Effectiveness:Complete

Value Alignment Assessment

High

The business model is exceptionally aligned with the prevailing economic need for value and convenience, particularly in a landscape where income inequality persists and rural communities remain underserved by large retailers.

High

The value proposition directly addresses the primary pain points of its core low-to-middle income customer base: budget constraints and lack of access to convenient, affordable retail options.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Consumer Packaged Goods (CPG) suppliers (e.g., Procter & Gamble, Coca-Cola)

- •

Private label manufacturers

- •

Real estate developers and landlords

- •

Logistics and transportation providers

- •

Technology partners (e.g., DocGo for healthcare pilots).

Key Activities

- •

Supply Chain Management & Logistics (DG Fresh).

- •

Merchandising and Category Management

- •

Store Operations and Real Estate Management

- •

Private Brand Development & Sourcing.

- •

Digital Marketing and Coupon Distribution

Key Resources

- •

Vast physical store network (>20,000 locations).

- •

Extensive distribution center network.

- •

Strong brand recognition and customer loyalty in its segment.

- •

Private brand portfolio (e.g., Clover Valley).

- •

Customer purchasing data

Cost Structure

- •

Cost of Goods Sold (COGS)

- •

Selling, General & Administrative (SG&A) Expenses (store labor, rent, utilities)

- •

Supply Chain and Logistics Costs

- •

Capital Expenditures for new stores and remodels.

Swot Analysis

Strengths

- •

Dominant market position and unparalleled store footprint, especially in rural areas.

- •

Resilient business model that performs well in various economic conditions.

- •

Efficient, low-cost operating structure.

- •

Strong and growing portfolio of higher-margin private label brands.

Weaknesses

- •

Thin profit margins, making the business vulnerable to cost inflation.

- •

Operational challenges related to store staffing, conditions, and inventory management.

- •

Heavy dependence on a financially constrained consumer segment.

- •

Relatively underdeveloped eCommerce and digital capabilities compared to larger rivals.

Opportunities

- •

Strategic expansion into new services, particularly healthcare (DG Wellbeing) in underserved communities.

- •

Growth of the pOpshelf concept to capture a higher-income, suburban demographic.

- •

Continued expansion of the DG Fresh initiative to improve margins and fresh food availability.

- •

Leveraging customer data to grow the high-margin DG Media Network advertising business.

Threats

- •

Intensifying competition from Walmart, Aldi, and a revitalized Dollar Tree/Family Dollar.

- •

Sustained increases in labor costs and supply chain expenses.

- •

Potential market saturation from aggressive store expansion.

- •

Negative regulatory and public scrutiny over labor practices and store safety.

Recommendations

Priority Improvements

- Area:

In-Store Operations & Customer Experience

Recommendation:Invest in 'Back to Basics' initiatives focusing on store staffing, cleanliness, and in-stock levels to improve customer satisfaction and address negative press. This includes accelerating 'Project Elevate' remodels.

Expected Impact:High

- Area:

Digital Integration

Recommendation:Enhance the DG mobile app by integrating a personalized savings tracker and loyalty program beyond simple digital coupons. Pilot an 'Auto-Ship' subscription service for key consumables to lock in recurring revenue.

Expected Impact:Medium

- Area:

Supply Chain Optimization

Recommendation:Continue the aggressive rollout of the DG Fresh network to cover all stores, focusing on improving margins in the crucial consumables category and enabling a wider assortment of perishable goods.

Expected Impact:High

Business Model Innovation

- •

Scale the DG Wellbeing initiative by creating dedicated health aisles in more stores and expanding the DocGo mobile clinic partnership to become a primary healthcare access point in rural America.

- •

Develop a tiered private label strategy, introducing a 'premium' private brand (e.g., 'Clover Valley Reserve') to improve margins and capture more spending from customers whose financial situations improve.

- •

Accelerate the pOpshelf concept, both as standalone stores and store-in-a-store formats, to create a distinct, higher-margin growth engine that diversifies the core customer base.

Revenue Diversification

- •

Expand in-store financial services beyond basic money transfers, potentially partnering with a FinTech to offer check cashing, bill pay, and reloadable debit cards tailored to the unbanked/underbanked.

- •

Further build out the DG Media Network (DGMN) as a high-margin revenue stream, leveraging transaction data to offer sophisticated advertising solutions to CPG partners.

- •

Pilot a 'DG Business' program offering bulk purchasing options for small businesses (e.g., cleaning companies, local restaurants) in rural areas with limited access to wholesale suppliers.

Dollar General's business model is a masterclass in cost leadership and convenience, built upon an unparalleled physical footprint that dominates rural and small-town America. Its success is rooted in a deep understanding of its core, budget-conscious consumer, for whom Dollar General is not just a store, but an essential lifeline. The model's resilience is proven, demonstrating consistent growth through various economic cycles by focusing on high-turnover, low-cost consumables. The strategic pillars for future evolution are clearly in place and represent a significant transformation from a simple discount retailer to a multi-faceted community hub. The 'DG Fresh' supply chain initiative is the most critical internal evolution, tackling the historical weakness of low margins in grocery by bringing distribution in-house to enhance profitability and product assortment. Externally, the business is evolving through strategic diversification. The 'DG Wellbeing' initiative is a potentially transformative move to monetize its unique rural access by entering the healthcare space, addressing a critical societal need where it has a distinct geographic advantage. Simultaneously, the 'pOpshelf' concept is an intelligent hedge, aiming to capture a higher-income suburban demographic with a completely different, discretionary-focused value proposition, thus diversifying the company's customer base away from its core low-income segment. However, the model faces significant threats from rising operational costs and intense competition. Its core strength—the vast, labor-intensive store network—is also its primary vulnerability. The key to sustainable future growth lies in successfully executing its strategic initiatives: improving operational efficiency in existing stores, scaling the higher-margin pOpshelf and healthcare ventures, and continuing to enhance profitability through the DG Fresh build-out and the expansion of its private label portfolio.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Economies of Scale

Impact:High

- Barrier:

Supply Chain & Logistics Network

Impact:High

- Barrier:

Real Estate Footprint & Site Selection

Impact:High

- Barrier:

Brand Recognition & Customer Loyalty

Impact:Medium

- Barrier:

Supplier Relationships & Sourcing Power

Impact:High

Industry Trends

- Trend:

Inflation and Economic Uncertainty Driving Value-Seeking Behavior

Impact On Business:Positive, as more consumers, including higher-income shoppers, trade down to discount retailers for everyday essentials.

Timeline:Immediate

- Trend:

Growth of Private Label Brands

Impact On Business:Opportunity to increase profit margins and build customer loyalty to proprietary brands like Clover Valley and DG Home.

Timeline:Immediate

- Trend:

Digital Transformation and Omnichannel Integration

Impact On Business:Necessitates investment in e-commerce, mobile apps (especially for digital coupons), and services like DG Pickup to meet evolving customer expectations.

Timeline:Immediate

- Trend:

Expansion of Food & Consumables

Impact On Business:Drives trip frequency and positions Dollar General as a convenient fill-in grocery option, increasing competition with traditional grocers.

Timeline:Near-term

- Trend:

Focus on Health and Wellness Products

Impact On Business:Opportunity to expand into higher-margin categories and serve the needs of its core demographic in underserved areas.

Timeline:Near-term

- Trend:

Increased Scrutiny and Community Backlash

Impact On Business:Potential for regulatory hurdles and negative public perception in some communities, which could slow down store expansion.

Timeline:Long-term

Direct Competitors

- →

Dollar Tree

Market Share Estimate:Significant, but lower than Dollar General. The combined Dollar Tree/Family Dollar entity is a formidable competitor.

Target Audience Overlap:High

Competitive Positioning:Historically known for its single price point ($1.25), now transitioning to a multi-price model ($1.25-$7.00) to offer more variety and attract a broader customer base.

Strengths

- •

Strong brand identity tied to its fixed-price heritage.

- •

Wide product range in categories like party supplies, seasonal decor, and crafts.

- •

Robust distribution network.

- •

Appeals to treasure-hunt shopping behavior.

Weaknesses

- •

Perception of lower product quality compared to other retailers.

- •

Transitioning away from its single-price identity creates customer confusion and operational complexity.

- •

Historically weaker performance from its Family Dollar banner has been a drag on the overall company.

- •

Less developed private label program compared to Dollar General.

Differentiators

Primary focus on discretionary items like party and seasonal goods.

The "thrill of the hunt" shopping experience due to rotating inventory.

- →

Family Dollar (owned by Dollar Tree)

Market Share Estimate:Part of Dollar Tree, Inc.'s overall market share.

Target Audience Overlap:High

Competitive Positioning:A small-format convenience and value retailer focused on serving families in neighborhood locations, with a pricing model similar to Dollar General.

Strengths

- •

Strong presence in urban and suburban neighborhoods.

- •

Offers a mix of consumables and discretionary items.

- •

Leverages Dollar Tree's sourcing and logistics.

- •

Broad customer base of both low and middle-income shoppers.

Weaknesses

- •

Historically has underperformed compared to both Dollar General and Dollar Tree.

- •

Ongoing store closures and rebranding efforts indicate operational challenges.

- •

Inconsistent store experience and product availability.

- •

Faces intense direct competition from Dollar General, which often opens stores nearby.

Differentiators

Focus on being a neighborhood convenience store for family needs.

Offers a mix of private and national brands at discount prices.

- →

Big Lots

Market Share Estimate:Smaller share in the overall discount retail market.

Target Audience Overlap:Medium

Competitive Positioning:A non-traditional, discount retailer specializing in closeouts and offering a wide variety of merchandise, including furniture, home goods, and seasonal items.

Strengths

- •

Strong position in the home goods and furniture categories.

- •

"Treasure hunt" shopping experience with rotating, limited-quantity deals.

- •

Larger store format allows for a broader range of product categories.

- •

Offers financing options for larger purchases.

Weaknesses

- •

Facing significant financial and operational challenges, with declining revenue.

- •

Less emphasis on everyday consumables, leading to lower shopping frequency.

- •

Weaker e-commerce capabilities compared to larger competitors.

- •

Inconsistent inventory due to reliance on closeout deals.

Differentiators

Specializes in discounted furniture, mattresses, and bulky home goods.

Closeout-based inventory model provides unique, non-replicable deals.

Indirect Competitors

- →

Walmart

Description:The world's largest retailer, offering a vast selection of goods, including a full grocery section, at low prices. Competes on being a one-stop shop.

Threat Level:High

Potential For Direct Competition:High, especially as Walmart explores smaller format stores and enhances its online grocery and delivery services, which directly challenge Dollar General's convenience proposition.

- →

Aldi / Lidl

Description:Deep-discount grocery chains with a focus on a limited assortment of high-quality private-label products. They compete intensely on food prices.

Threat Level:Medium

Potential For Direct Competition:Medium. While primarily focused on groceries, their expansion into non-food essentials and their price leadership puts pressure on Dollar General's key consumables category.

- →

Amazon

Description:The dominant e-commerce platform offering a massive selection of products, competitive pricing, and fast delivery, particularly for household staples through programs like Subscribe & Save.

Threat Level:High

Potential For Direct Competition:High. Amazon's convenience and pricing directly challenge Dollar General's value proposition, especially for non-impulse purchases. The threat grows as Amazon improves its last-mile logistics in rural areas.

- →

Target

Description:A mass-market retailer that competes on price but differentiates through a more curated, trend-focused product assortment and a superior shopping experience.

Threat Level:Medium

Potential For Direct Competition:Medium. Target's owned brands and strong digital capabilities appeal to a slightly higher-income demographic, but there is significant overlap in essential product categories.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Unmatched Store Density and Rural Penetration

Sustainability Assessment:Highly sustainable. Dollar General's massive footprint of over 19,000 stores, strategically located in rural and low-income areas often underserved by other retailers, creates a powerful convenience moat.

Competitor Replication Difficulty:Hard

- Advantage:

Cost Leadership through Efficient Supply Chain and Lean Operations

Sustainability Assessment:Sustainable. The business model is built on low operating costs, a simplified supply chain tailored to small-box retail, and a high mix of profitable private-label goods.

Competitor Replication Difficulty:Medium

- Advantage:

Strong Private Label Program

Sustainability Assessment:Sustainable. Brands like Clover Valley and DG Home drive higher margins and create customer loyalty, a difficult advantage for competitors with less scale to replicate.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'Aggressive Digital Couponing', 'estimated_duration': "1-2 years. While currently a strong driver of app engagement and sales , competitors can replicate digital coupon strategies. The advantage lies in the scale of DG's user base."}

{'advantage': "First-Mover in New 'Food Desert' Locations", 'estimated_duration': '2-3 years. The advantage of being the first convenient option in an area diminishes as other dollar stores or small-format grocers eventually follow.'}

Disadvantages

- Disadvantage:

Underdeveloped E-commerce and Digital Experience

Impact:Major

Addressability:Moderately

- Disadvantage:

Negative Brand Perception and In-Store Experience

Impact:Major

Addressability:Difficult

- Disadvantage:

Limited Fresh Food and Grocery Selection

Impact:Major

Addressability:Difficult

Strategic Recommendations

Quick Wins

- Recommendation:

Optimize Website & App for 'Pre-Shopping'

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Launch Targeted Private Label Marketing Campaigns

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Promote DG Pickup Service More Heavily

Expected Impact:High

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Invest in a Formal Loyalty Program Beyond Digital Coupons

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Strategically Expand 'DG Fresh' Supply Chain Initiative

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Enhance In-Store Labor Model and Training

Expected Impact:High

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Develop a Robust Retail Media Network (DGMN)

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Explore Small-Format Urban Store Concepts

Expected Impact:Medium

Implementation Difficulty:Difficult

- Recommendation:

Integrate Basic Financial or Health Services

Expected Impact:High

Implementation Difficulty:Difficult

Solidify its position as America's most convenient and affordable neighborhood general store. Shift brand messaging from just 'low prices' to 'unbeatable value and convenience for your everyday needs, right around the corner.'

Differentiate through hyper-convenience (store density), a curated assortment of trusted national brands and high-quality private labels, and a simple, frictionless digital couponing experience that saves customers both time and money.

Whitespace Opportunities

- Opportunity:

Basic Financial Services Hub

Competitive Gap:Many of DG's core customers in rural areas are unbanked or underbanked. Competitors like Walmart offer some services, but DG's convenience provides an edge.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Expanded Private Label Health & Wellness Offerings

Competitive Gap:While drugstores and supermarkets have extensive health sections, they lack DG's price point and convenience in many rural locations. There is a gap for affordable, accessible private-label healthcare products.

Feasibility:High

Potential Impact:High

- Opportunity:

Hyper-Localized Assortment Using Data Analytics

Competitive Gap:Competitors often use a one-size-fits-all approach. Leveraging sales data to tailor the inventory of individual stores to local community preferences (e.g., more fishing supplies in a lake town) is a significant untapped opportunity.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Last-Mile Delivery Hub for Rural Areas

Competitive Gap:Amazon and other delivery services struggle with the high cost of last-mile delivery in rural areas. DG's vast store network could be leveraged as micro-fulfillment hubs for its own products and potentially for third-party partners.

Feasibility:Low

Potential Impact:High

Dollar General operates in the mature, oligopolistic deep-discount retail industry, where its primary competitive strength is an unparalleled physical footprint. With over 19,000 stores, it has achieved a level of hyper-convenience, particularly in rural and low-income communities, that direct competitors like Dollar Tree and Family Dollar cannot match. This real estate dominance forms a significant barrier to entry and a sustainable competitive advantage.

The company's business model is finely tuned for cost leadership, leveraging an efficient supply chain and a robust private label program (e.g., Clover Valley, DG Home) to maintain healthy margins despite its low-price proposition. In the current economic climate of persistent inflation, Dollar General is well-positioned to attract new, more affluent customers who are 'trading down' to save on everyday essentials, a key industry trend that serves as a tailwind.

Direct competition is fierce, primarily from Dollar Tree, Inc., which operates both the Dollar Tree and Family Dollar banners. Dollar Tree's strategic shift away from a strict $1.25 price point introduces both opportunity and risk; it may attract new customers but could alienate its loyal base and dilute its core value proposition. Family Dollar continues to struggle with operational inconsistencies and store closures, making it a less immediate threat. Big Lots competes in a different niche, focusing more on discretionary home goods and furniture, resulting in less direct overlap on core consumables.

The most significant threats come from indirect competitors. Walmart's sheer scale and one-stop-shop appeal, combined with its advanced omnichannel capabilities, pose a constant threat. Amazon's dominance in e-commerce directly challenges DG's value proposition on non-impulse purchases of household staples. Furthermore, deep-discount grocers like Aldi are intensely competitive on food pricing, a category crucial for driving Dollar General's trip frequency.

Dollar General's primary weaknesses lie in its digital presence and in-store experience. While its website and app are functional, they lag behind the sophisticated, personalized digital ecosystems of competitors like Walmart and Target. The in-store experience is often criticized for being cluttered and understaffed, which can erode brand loyalty. The limited selection of fresh produce and healthier food options is a major competitive gap compared to grocers and mass-market retailers.

Strategic opportunities abound in leveraging its physical store network. Expanding 'DG Fresh' to offer a more compelling food selection, enhancing the DG Pickup service, and growing its nascent Retail Media Network (DGMN) are crucial medium-term strategies. A significant whitespace opportunity exists in offering basic financial or health services to its often-underserved customer base, transforming its stores from simple retail outlets into essential community hubs. To secure its future market leadership, Dollar General must invest in improving its operational execution at the store level and closing the digital experience gap, all while reinforcing its core competitive advantage of being the most convenient and affordable option for everyday needs.

Messaging

Message Architecture

Key Messages

- Message:

Save money on everyday items through digital coupons, cash back, and weekly deals.

Prominence:Primary

Clarity Score:High

Location:Homepage (Featured Coupons, Earn Cash Back, various deal sections)

- Message:

Shop a wide variety of product categories for your household needs.

Prominence:Secondary

Clarity Score:High

Location:Homepage (Shop by Category menu)

- Message:

Get low prices on seasonal items and essentials (e.g., 'Back to School Supplies', 'Fire up the Grill').

Prominence:Secondary

Clarity Score:High

Location:Homepage (themed product carousels)

- Message:

Find value in our private label brands like 'DG Home' and 'Smart & Simple'.

Prominence:Tertiary

Clarity Score:Medium

Location:Implicitly shown within product listings

The message hierarchy is overwhelmingly tactical and transactional. The primary focus is on immediate, price-driven actions like clipping coupons and viewing deals. Strategic brand messaging is virtually nonexistent on the homepage, which prioritizes short-term sales promotions over long-term brand building.

Messaging is exceptionally consistent across all sections of the homepage. Every content block, from 'Featured Coupons' to 'Laundry Essentials', reinforces the core idea of saving money on products. There is no deviation from this price-centric communication.

Brand Voice

Voice Attributes

- Attribute:

Promotional

Strength:Strong

Examples

- •

DIGITAL COUPON

- •

Save $5.00

- •

CASH BACK

- •

Multiple Deals

- Attribute:

Direct

Strength:Strong

Examples

- •

Add coupon

- •

View All

- •

Shop by Category

- •

Fire up the Grill

- Attribute:

Value-Oriented

Strength:Strong

Examples

- •

Dollar Deals

- •

School Stock-Ups Starting at $1

- •

2 FOR $5 SELECT POP TARTS

- Attribute:

Simple

Strength:Moderate

Examples

- •

Tableware for Easy Clean Up

- •

Start the Day with Deals

- •

Laundry Essentials at DG

Tone Analysis

Transactional

Secondary Tones

Urgent

Practical

Tone Shifts

The only noticeable shift is to a formal, legalistic tone in the 'Request to Opt-Out' and privacy policy sections at the footer, which is standard and expected.

Voice Consistency Rating

Excellent

Consistency Issues

The brand voice is exceptionally consistent in its focus on deals and value. While narrow, it is flawlessly executed across the entire user experience on the homepage.

Value Proposition Assessment

Dollar General provides everyday low prices and deals on essential household goods, groceries, and seasonal items.

Value Proposition Components

- Component:

Price Savings

Clarity:Clear

Uniqueness:Common

- Component:

Broad Product Assortment

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Convenience

Clarity:Unclear

Uniqueness:Unique

The website's messaging fails to differentiate Dollar General effectively from competitors like Dollar Tree or discount grocers. The differentiation heavily relies on price, which is a common value proposition in this sector. The company's key differentiator—extreme convenience due to its vast network of stores in rural and underserved areas—is not communicated at all. The messaging positions it as just another place to get deals, not as the most convenient place.

The messaging positions Dollar General as a direct, no-frills destination for budget-conscious shoppers. It competes head-on with discounters like Walmart and other dollar stores purely on the basis of price and promotions. This tactical positioning attracts deal-seekers but does little to build a moat against competitors who can also offer low prices.

Audience Messaging

Target Personas

- Persona:

The Budget-Conscious Household Shopper

Tailored Messages

- •

Save $5.00 on your purchase of $25.00 or more

- •

Earn Cash Back

- •

Dollar Deals

- •

3 FOR $3 SELECT JARRITOS, SENIORAL OR SIDRAL

Effectiveness:Effective

Audience Pain Points Addressed

- •

Stretching a limited household budget.

- •

The high cost of everyday necessities like food and cleaning supplies.

- •

The desire to save money without extensive effort (via digital coupons).

Audience Aspirations Addressed

The messaging does not address audience aspirations beyond the immediate goal of saving money. It is purely functional and does not connect to broader life goals or values.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Relief & Financial Security

Effectiveness:High

Examples

Prominently displayed coupons like 'Save $5.00'.

Sections like 'Earn Cash Back' and 'Dollar Deals' create a feeling of smart, resourceful shopping.

Social Proof Elements

- Proof Type:

Wisdom of the Crowd (Ratings & Reviews)

Impact:Moderate

Examples

Displaying star ratings and review counts on products (e.g., '4.5 (1.5K)' for Tide).

Trust Indicators

- •

Featuring well-known national brands (Coca-Cola, Tide, Kingsford, Crayola).

- •

Clear pricing and deal information.

- •

A functional e-commerce platform with standard privacy controls.

Scarcity Urgency Tactics

Coupon expiration dates (e.g., 'Exp: 08/30/25') create a deadline for action.

Seasonal offers ('BOGO 50% Select Harvest Decor') imply a limited time frame.

Calls To Action

Primary Ctas

- Text:

Add coupon

Location:Coupon and Cash Back sections

Clarity:Clear

- Text:

Add to Wallet

Location:Featured Coupons section

Clarity:Clear

- Text:

View All

Location:Headers of product carousels

Clarity:Clear

The CTAs are highly effective for their intended purpose. They are direct, unambiguous, and use action-oriented language ('Add', 'View'). They successfully guide the user toward immediate, conversion-focused actions like saving a deal or exploring a product category, aligning perfectly with the site's transactional nature.

Messaging Gaps Analysis

Critical Gaps

- •

Brand Mission: The company's official mission of 'Serving Others' is completely absent from the customer-facing website messaging. There is no storytelling about community impact, employee support, or the company's role in its neighborhoods.

- •

Convenience Value Proposition: Dollar General's primary competitive advantage is the convenience of its vast number of neighborhood stores, especially in rural areas. This is a massive messaging gap, as the website focuses exclusively on price, making it indistinguishable from online-only or big-box competitors.

- •

Brand Story: There is no narrative about the company's history, its purpose, or why a customer should feel loyal to the brand beyond the current week's deals.

Contradiction Points

There are no significant messaging contradictions, primarily because the messaging is so narrowly focused on a single theme (price savings).

Underdeveloped Areas

Private Label Value: Messaging for private brands like Clover Valley and DG Home focuses only on price. There's an opportunity to build trust and communicate the quality and value of these brands.

Emotional Connection: The messaging is purely rational and transactional. There is no attempt to build an emotional bond with the customer, which could lead to higher brand loyalty.

Messaging Quality

Strengths

- •

Unbeatable Clarity: The focus on deals, coupons, and low prices is crystal clear and immediately understood by the target audience.

- •

High-Impact for Target Audience: The messaging directly addresses the primary pain point of a budget-conscious consumer, making it highly relevant and effective at driving traffic and sales.

- •

Action-Oriented: The entire homepage is designed to drive immediate action, from clipping coupons to viewing specific deal categories.

Weaknesses

- •

One-Dimensional: The singular focus on price prevents the brand from building equity around other important attributes like convenience, community, and trust.

- •

Lack of Differentiation: Without communicating its convenience advantage, the brand's messaging does not effectively differentiate it from any other discount retailer.

- •

No Brand Loyalty Building: The transactional nature of the messaging encourages deal-hunting rather than brand loyalty. Customers have no reason to stick with DG if a competitor offers a better price.

Optimization Roadmap

Priority Improvements

- Area:

Value Proposition Communication

Recommendation:Integrate the 'Convenience' message into the brand's core value proposition online. Use a persistent headline like 'Your Neighborhood Store for Everyday Savings' or 'Save Time. Save Money. Every Day.' prominently on the homepage.

Expected Impact:High

- Area:

Brand Storytelling

Recommendation:Create a dedicated content section or periodic homepage features that bring the 'Serving Others' mission to life. Showcase community stories, employee spotlights, or literacy foundation work to build an emotional connection.

Expected Impact:Medium

- Area:

Audience Messaging

Recommendation:Develop messaging that subtly addresses the time-saving aspect for busy families or the accessibility for customers in rural areas, broadening the appeal beyond just low prices.

Expected Impact:Medium

Quick Wins

- •

Add a simple, memorable tagline to the website header that communicates both value and convenience (e.g., 'Daily Deals, Right Around the Corner').

- •

Update carousel headlines to reinforce benefits beyond just the product category (e.g., Instead of 'Laundry Essentials,' try 'Save on Laundry Day Essentials').

- •

Incorporate trust-building copy near private label products, such as 'Quality you can trust at prices you'll love.'

Long Term Recommendations

- •

Develop a comprehensive content marketing strategy that tells the brand story and reinforces the 'Serving Others' mission through blog posts, videos, and social media campaigns.

- •

Invest in user experience features that highlight convenience, such as a more prominent store locator or features that emphasize in-and-out shopping.

- •

Conduct A/B testing of brand-level messaging versus purely promotional messaging on the homepage to measure the impact on customer engagement and repeat visits.

Dollar General's website messaging is a masterclass in tactical, high-clarity communication aimed squarely at a budget-conscious consumer. Its primary strength lies in its relentless and unambiguous focus on price, deals, and coupons. For its core audience, this messaging is highly effective, addressing the primary pain point of managing a tight budget and driving immediate, transactional behavior. The message architecture is flat but consistent, with every element reinforcing the core promise of savings.

However, this tactical excellence comes at a significant strategic cost. The messaging is one-dimensional and fails to communicate the brand's most powerful differentiator: convenience. Dollar General's business model is built on being the most accessible option for millions of Americans, particularly in rural and underserved areas, yet this critical component of its value proposition is entirely absent online. This creates a major messaging gap, positioning the brand as just another discount retailer in a crowded market and forcing it to compete solely on price.

Furthermore, the complete absence of the corporate mission of 'Serving Others' means the brand is failing to build any emotional connection or long-term loyalty. The relationship with the customer is purely transactional, leaving the brand vulnerable to any competitor that can offer a slightly better deal. The optimization roadmap should focus on layering the powerful, differentiating message of convenience onto the existing, effective message of value. By bridging the gap between its real-world strategic advantages and its online communication, Dollar General can evolve from being a destination for deals into a trusted, indispensable neighborhood resource, ultimately fostering greater customer loyalty and strengthening its market position.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Consistent same-store sales growth, recently reported at 2.4% for Q1 2025, exceeding expectations.

- •

Successful attraction of a 'trade-down' consumer, including middle- and higher-income shoppers seeking value amidst economic uncertainty.

- •

High visitor loyalty, with 36% of customers shopping three or more times per month, indicating the model meets recurring needs.

- •

Aggressive and continuous store expansion into its target rural and suburban markets, with plans for 575 new stores in the U.S. and expansion into Mexico.

- •

Strong performance of private label brands like Clover Valley, which are found in over half of customer baskets and are undergoing significant expansion.

Improvement Areas

- •

Enhance in-store shopping experience to address criticisms of clutter, understaffing, and safety violations.

- •

Improve consistency and quality of fresh produce and refrigerated goods under the 'DG Fresh' initiative.

- •

Strengthen digital offerings and omnichannel capabilities to compete with online value retailers like Temu and Shein.

Market Dynamics

Moderate (Approx. 3-6% annually)

Mature

Market Trends

- Trend:

Consumer 'Trade-Down' Effect

Business Impact:Increased customer traffic and acquisition from higher-income demographics due to inflation and economic uncertainty, boosting same-store sales.

- Trend:

Demand for Convenience and Accessibility

Business Impact:Dollar General's vast, localized store footprint in underserved rural and suburban areas creates a powerful competitive moat.

- Trend:

Growth of Private Label Brands

Business Impact:Higher margins and increased customer loyalty. DG is capitalizing on this by adding over 1,000 new private label items in 2025.

- Trend:

Expansion into Consumables and Fresh Food

Business Impact:Drives more frequent store visits and increases average basket size. The DG Fresh initiative, now in over 5,000 stores, is a key growth driver.

- Trend:

Retail Healthcare Integration

Business Impact:Creates a new revenue stream and positions DG as a community health destination, especially in rural markets, through its DG Wellbeing initiative.

Favorable. Current economic pressures are driving consumers toward value-oriented retailers, creating a tailwind for Dollar General's core business and strategic initiatives.

Business Model Scalability

High

Highly scalable due to a standardized, small-box store format, low build-out costs, and lean staffing models which keep fixed costs per unit low.

High. Centralized procurement, extensive use of private labels, and an efficient (though recently challenged) supply chain allow for significant margin improvement as sales volume increases.

Scalability Constraints

- •

Supply chain complexity, especially for the DG Fresh initiative, which requires cold-chain logistics and has caused inventory backlogs.

- •

Finding and retaining qualified store-level talent to maintain operational standards across a rapidly expanding network.

- •

Real estate saturation in core markets, necessitating expansion into new formats (pOpshelf) and international markets (Mexico).

Team Readiness

Experienced. The return of CEO Todd Vasos and a focus on a 'Back to Basics' strategy suggests a leadership team capable of addressing recent operational challenges and refocusing on core strengths.

Mature and hierarchical, typical for a large retailer. Well-suited for executing standardized store rollouts but may need more agile, cross-functional teams to drive innovation in digital and healthcare.

Key Capability Gaps

- •

Advanced Data Analytics & AI: Need for deeper capabilities to optimize inventory, personalize promotions, and manage the supply chain, though partnerships with AI firms like Shelf Engine are a positive step.

- •

Digital Customer Experience: E-commerce and mobile app development lag behind larger competitors, representing an untapped growth area.

- •

Healthcare Services Management: Successfully scaling the DG Wellbeing clinic model will require new expertise in healthcare operations, compliance, and patient experience.

Growth Engine

Acquisition Channels

- Channel:

Physical Store Footprint (Real Estate Strategy)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Continue disciplined expansion in underserved rural/suburban areas. Accelerate store remodel programs ('Project Elevate') to improve the in-store experience and drive higher comp sales in mature stores.

- Channel:

Digital Coupons & App

Effectiveness:Medium

Optimization Potential:High

Recommendation:Transition from a retention tool to an acquisition driver by using targeted offers to attract new demographics and leveraging data to personalize the user experience.

- Channel:

Word of Mouth (Value Proposition)

Effectiveness:High

Optimization Potential:Low

Recommendation:Maintain a strong value perception through consistent low prices and expansion of high-value private label products.

Customer Journey

Primarily an in-store, convenience-driven journey focused on a quick trip for essential items. The path is simple: enter, find needed items, and purchase.

Friction Points

- •

Poor in-store experience (clutter, blocked aisles, disorganization).

- •

Inventory stockouts on key items.

- •

Long checkout lines due to minimal staffing.

- •

Limited digital/omnichannel options (e.g., buy-online-pickup-in-store) compared to competitors.

Journey Enhancement Priorities

{'area': 'In-Store Operations', 'recommendation': "Invest heavily in the 'Back to Basics' strategy, focusing on store staffing, cleanliness, and inventory management to reduce friction and improve the core shopping experience. "}

{'area': 'Omnichannel Integration', 'recommendation': "Pilot and scale a robust 'DG GO!' app with integrated shopping lists, mobile checkout, and a streamlined buy-online-pickup-in-store (BOPIS) service."}

Retention Mechanisms

- Mechanism:

Digital Coupon Program

Effectiveness:High

Improvement Opportunity:Increase personalization of offers based on purchase history to drive incremental purchases and category expansion.

- Mechanism:

Geographic Convenience

Effectiveness:High

Improvement Opportunity:Layer on digital convenience, such as partnership with DoorDash for local delivery, to further solidify DG's role as the most accessible option.

- Mechanism:

Expansion of Consumables (DG Fresh)

Effectiveness:Medium

Improvement Opportunity:Improve the quality, variety, and in-stock levels of fresh and refrigerated items to make DG a viable option for a larger portion of the weekly grocery shop.

Revenue Economics

Strong, based on a high-volume, low-margin model. Profitability is driven by immense scale, efficient logistics, high private label penetration, and lean operational costs.

Relatively low, but offset by high customer frequency.

High (over 50% of baskets contain a private label item), which is a key driver of gross margin.

Optimization Recommendations

- •

Continue aggressive expansion of private label products across all categories to further boost gross margins.

- •

Focus on initiatives that increase basket size, such as bundling deals and expanding higher-ticket non-consumable items in appropriate formats (pOpshelf).

- •

Optimize supply chain to reduce transportation and shrink costs, which have recently pressured margins.

Scale Barriers

Technical Limitations

- Limitation:

Legacy Inventory Management Systems

Impact:High

Solution Approach:Accelerate investment in modern, AI-driven inventory and forecasting systems (like the Shelf Engine partnership) across all product categories to reduce stockouts and prevent overstocking.

- Limitation:

Underdeveloped E-commerce Platform

Impact:Medium

Solution Approach:Develop a dedicated roadmap for omnichannel features, starting with a best-in-class BOPIS experience before expanding into more complex ship-from-store capabilities.

Operational Bottlenecks

- Bottleneck:

Supply Chain Inefficiencies & Overstock

Growth Impact:Has led to significant operating losses, inventory shrinkage, and an inability to get the right products to stores, negatively impacting sales and margins.

Resolution Strategy:Continue the supply chain overhaul: rationalize SKUs, close inefficient warehouses, open new modern distribution centers, and improve inventory flow from distribution center to shelf.

- Bottleneck:

In-Store Labor Model

Growth Impact:Lean staffing leads to poor store conditions, increased shrink, and a negative customer experience, which can erode brand loyalty over time.

Resolution Strategy:Reinvest a portion of efficiency gains into store labor hours, focusing on tasks that directly impact customer experience and on-shelf availability.

- Bottleneck:

Shrink and Retail Theft

Growth Impact:Directly erodes profitability and contributes to a perception of unsafe or poorly managed stores.

Resolution Strategy:Implement targeted anti-theft measures, remove high-shrink items, and improve store layouts and staffing to create a more controlled environment.

Market Penetration Challenges

- Challenge:

Intense Competition

Severity:Critical

Mitigation Strategy:Double down on the core value proposition of convenience and price. Differentiate through exclusive private brands and new services like healthcare. Key competitors include Dollar Tree, Family Dollar, Walmart, and ALDI.

- Challenge:

Market Saturation

Severity:Major

Mitigation Strategy:Pursue growth through new formats (pOpshelf), international expansion (Mexico), and deepening penetration in existing markets with new services (DG Wellbeing).

- Challenge:

Negative Public & Community Perception

Severity:Minor

Mitigation Strategy:Engage in proactive community relations, highlight local job creation, and address concerns about store standards and impact on local businesses. Emphasize the role DG plays in combating food deserts.

Resource Limitations

Talent Gaps

- •

Data Scientists and AI/ML Engineers

- •

Digital Product Managers

- •

Healthcare Operations & Compliance Professionals

Significant capital is required for the ongoing store remodel program, new distribution centers, and technology platform upgrades. This appears to be well-managed within existing cash flow and financing capabilities.

Infrastructure Needs

Modernized, cold-chain-capable distribution centers to support DG Fresh expansion.

Upgraded in-store technology (POS systems, handheld devices) to improve efficiency and enable omnichannel services.

Growth Opportunities

Market Expansion

- Expansion Vector:

Demographic Expansion (pOpshelf Concept)

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Despite recent closures, refine and strategically expand the pOpshelf format, which targets higher-income suburban shoppers and boasts higher margins, potentially as a store-within-a-store to leverage existing real estate.

- Expansion Vector:

International Expansion (Mexico)

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Proceed with the initial 10-15 store pilot in Mexico, focusing on adapting the product mix and supply chain to the local market before committing to a large-scale rollout.

Product Opportunities

- Opportunity:

Healthcare Services (DG Wellbeing)

Market Demand Evidence:Significant demand for accessible, affordable healthcare, especially in rural communities where DG has a strong presence.

Strategic Fit:Strong. Leverages existing store footprint and trust within the community to provide essential services and create a new, high-frequency reason to visit.

Development Recommendation:Expand the pilot with DocGo, testing various service levels (e.g., preventative care, urgent care, chronic condition management) to find the most scalable and impactful model.

- Opportunity:

Expanded Fresh Food & Grocery (DG Fresh)

Market Demand Evidence:Consumers are increasingly relying on dollar stores for everyday essentials and grocery top-ups.

Strategic Fit:Core to the business. Drives traffic, increases basket size, and is crucial for serving communities in food deserts.

Development Recommendation:Continue the rollout to more stores while simultaneously investing in supply chain and AI-powered ordering to solve for quality and consistency issues.

- Opportunity:

Enhanced Private Label Offerings

Market Demand Evidence:Private label sales are growing across retail as consumers seek value. Over 50% of DG baskets already include a private brand item.

Strategic Fit:Excellent. Directly supports the value proposition while significantly improving gross margins.

Development Recommendation:Aggressively continue the planned 2025 rollout of new and reformulated private brand products, focusing on quality perception and on-trend categories.

Channel Diversification

- Channel:

Retail Media Network

Fit Assessment:Excellent. DG has a massive, loyal customer base that CPG brands are eager to reach at the point of sale.

Implementation Strategy:Build out a formal retail media network offering sponsored product listings on the DG website/app and in-store digital displays. Leverage purchase data for targeted advertising.

- Channel:

Enhanced Same-Day Delivery

Fit Assessment:Good. Complements the convenience value proposition for customers willing to pay a premium.

Implementation Strategy:Deepen the partnership with DoorDash and explore other last-mile providers to expand coverage and improve service levels and delivery speed.

Strategic Partnerships

- Partnership Type:

Healthcare & Insurance

Potential Partners

- •

DocGo (existing)

- •

Regional Health Systems

- •

Medicare Advantage Plans

Expected Benefits:Expand the range of in-store clinical services, increase patient traffic, and create integrated value propositions for health plan members.

- Partnership Type:

Financial Services

Potential Partners

Fintech companies (e.g., Chime, Green Dot)

Credit Unions

Expected Benefits:Offer basic banking services, check cashing, and credit-building products to underserved customers, creating another reason to visit and increasing customer stickiness.

Growth Strategy

North Star Metric

Average Monthly Spend per Household

This metric combines customer frequency and transaction value, aligning with the strategic goals of driving more frequent trips (via consumables/healthcare) and increasing basket size (via non-consumables/private labels). It shifts focus from just store growth to deepening customer relationships.

Increase by 5-7% annually through successful execution of DG Fresh, private label expansion, and healthcare initiatives.

Growth Model

Convenience & Value Penetration Model

Key Drivers

- •

Store Network Density

- •

Price Leadership & Value Perception

- •

Expansion into Essential Categories (Food & Health)

- •

Private Label Margin Enhancement

Focus on a dual-pronged approach: 1) Disciplined execution of the core retail model ('Back to Basics'). 2) Layering on strategic growth initiatives (DG Fresh, DG Wellbeing, pOpshelf) that leverage the existing store footprint to capture a greater share of wallet.

Prioritized Initiatives

- Initiative:

Accelerate 'Back to Basics' Operational Overhaul

Expected Impact:High

Implementation Effort:High

Timeframe:12-18 Months

First Steps:Allocate dedicated capital and create specialized regional teams focused on improving store standards, staffing levels, and executing the supply chain rationalization plan.

- Initiative:

Scale DG Fresh & Optimize Supply Chain

Expected Impact:High

Implementation Effort:High

Timeframe:24 Months

First Steps:Complete the rollout of AI-powered ordering technology to all fresh-enabled stores. Prioritize construction of new cold-storage distribution centers.

- Initiative:

Expand DG Wellbeing Healthcare Pilot

Expected Impact:Medium (High long-term)

Implementation Effort:Medium

Timeframe:12 Months (Pilot Expansion)

First Steps:Expand the DocGo partnership to 50-100 stores across diverse rural and suburban geographies to validate the economic model and service mix.

- Initiative:

Launch Formal Retail Media Network

Expected Impact:Medium

Implementation Effort:Low

Timeframe:6-9 Months

First Steps:Partner with a technology provider to build the platform. Hire a small, experienced team to manage CPG brand relationships and ad sales.

Experimentation Plan

High Leverage Tests

- Test:

In-Store Layout Variations

Hypothesis:A store layout featuring DG Wellbeing or expanded DG Fresh sections at the front will increase adoption and sales in those categories.

- Test:

pOpshelf 'Store-in-Store' Concept

Hypothesis:Integrating a small pOpshelf section into existing Dollar General stores will capture higher-margin discretionary spending without the cost of a new location.

- Test:

Dynamic Digital Couponing

Hypothesis:Using AI to personalize coupon offers in real-time based on in-app behavior will drive higher redemption rates and larger basket sizes.

Utilize control vs. test store analysis, tracking same-store sales lift, category penetration, average transaction value, and gross margin impact.

Quarterly review of ongoing pilots with a dedicated 'Innovation Council' empowered to scale, modify, or terminate experiments based on results.

Growth Team

A centralized 'Strategic Growth Initiatives' team that acts as an incubator for new concepts, reporting directly to the CEO. This team would oversee the DG Wellbeing, pOpshelf, and International pilots, with dedicated GMs for each.

Key Roles

- •

VP of Strategic Growth

- •

General Manager, Healthcare Services

- •

Director of Format Innovation & Incubation

- •

Lead Customer Data Scientist

Acquire talent from the healthcare, digital-native retail, and data science sectors. Develop internal capabilities through pilot programs and partnerships with specialized technology and service providers.

Dollar General possesses a powerful and resilient business model with a strong product-market fit, particularly in the current economic climate which favors value and convenience. The company's growth foundation is solid, built upon an enormous physical footprint and a deep understanding of its core, budget-conscious consumer. Its primary growth engine is the relentless, data-driven expansion of this physical footprint, augmented by an increasingly important private label program that drives both loyalty and margin.

However, the company is at a critical inflection point. Recent operational stumbles, particularly in supply chain management and in-store execution, have become significant barriers to scale. These issues have led to inventory gluts, increased costs, and a degradation of the customer experience, threatening to erode the company's core strengths. The 'Back to Basics' strategy is a necessary and urgent course correction to stabilize the foundation before building further.

The most significant growth opportunities lie in leveraging the existing store network to move beyond selling just 'things'. The strategic pushes into 'DG Fresh' (food and grocery) and 'DG Wellbeing' (healthcare services) represent transformative vectors that can fundamentally change the business by increasing visit frequency and capturing a much larger share of the essential household budget. The 'DG Wellbeing' initiative, in particular, is a high-potential opportunity to create a durable competitive advantage in underserved rural markets where healthcare access is limited.

To unlock this future growth, the strategic framework must be twofold. First, an unwavering focus on operational excellence is paramount. This means fixing the supply chain, investing in store labor, and creating a clean, consistent, and reliable in-store experience. Second, the company must nurture its key growth initiatives as distinct but integrated business units. Expanding the healthcare pilots, refining the pOpshelf concept, and formalizing a retail media network are the most promising avenues for long-term, high-margin growth. The recommended North Star Metric of 'Average Monthly Spend per Household' will align the entire organization around the dual goals of attracting more customers and, more importantly, deepening the relationship and value extracted from each one.

Legal Compliance

Dollar General's Privacy Policy is comprehensive and clearly outlines the types of personal information collected, how it is used, and with whom it is shared. The policy details data collection from both online and in-store interactions, including purchases, account creation, and promotional sign-ups. It specifies that data is used for purposes like fulfilling orders, personalizing ads through its DG Media Network, and communicating with customers. Information is shared with affiliates, service providers, and product vendors. The policy provides clear instructions for users to manage their preferences regarding emails, text messages, and eReceipts. Crucially, it addresses the requirements of various state privacy laws, including California's CCPA/CPRA, by providing a detailed chart of data categories collected, shared, and sold for targeted advertising. The policy also states that Dollar General does not knowingly collect information from children under 16.

The Terms and Conditions are readily accessible and establish a binding agreement for users of the website and mobile app. A significant feature is a mandatory arbitration clause, requiring disputes to be resolved on an individual basis rather than through jury trials or class actions, which strategically limits legal exposure. The terms define user eligibility, setting the age at 18 or requiring parental supervision for those under 18, and explicitly state they do not knowingly collect data from individuals under 16. The document also incorporates the Privacy Policy by reference and governs specific programs like 'myDG' and 'DG Cash,' clearly stating that DG Cash is not redeemable for cash and has no FDIC insurance.

The website's cookie compliance mechanism is primarily focused on opt-out rights rather than prior opt-in consent. The 'Clarip Do Not Sell Manager' and a 'View / Hide Cookies' option are present, which align with US state privacy laws requiring an opt-out from the 'sale' or 'sharing' of data for targeted advertising. The Privacy Policy also links to an external site ('allaboutcookies.org') for general cookie management and provides a separate link to opt-out of targeting cookies. However, the platform does not appear to use a prominent, upfront cookie consent banner that would be required under stricter regulations like the GDPR. It relies on a more passive approach, where cookies are likely placed upon visiting, and the user must proactively seek out the options to opt out.

Dollar General demonstrates a strong focus on compliance with US state-level data protection laws. The website features a dedicated 'Request to Opt-Out of Sale/Share/Targeted Advertising' form that explicitly lists rights for residents of California, Colorado, Connecticut, and more than ten other states. This shows a proactive and organized approach to managing disparate state regulations. The website's ability to recognize the Global Privacy Control (GPC) signal is a best practice that streamlines the opt-out process for users with GPC-enabled browsers. The Privacy Policy reinforces these rights, detailing how consumers can request to delete, correct, or opt-out of the sale of their personal information. The company states it does not use sensitive personal information beyond specified business purposes and does not knowingly sell or share the data of minors under 16.

Dollar General has a formal Accessibility Statement, indicating a commitment to making its website and apps accessible, specifically targeting WCAG 2.0 Level AA standards. They acknowledge retaining a third-party partner for digital accessibility testing, which is a positive strategic step. The statement provides a customer support phone number for users who experience difficulty, offering a direct channel for assistance. However, the company has a history of ADA-related lawsuits concerning the physical accessibility of its stores, including settlements related to cluttered aisles blocking access for customers with mobility disabilities. While these lawsuits pertain to physical locations, they highlight a corporate-level risk and a history of litigation in the accessibility space, which could attract scrutiny to their digital properties if not maintained diligently.

As a large retailer, Dollar General is subject to numerous industry-specific regulations.