eScore

dominionenergy.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

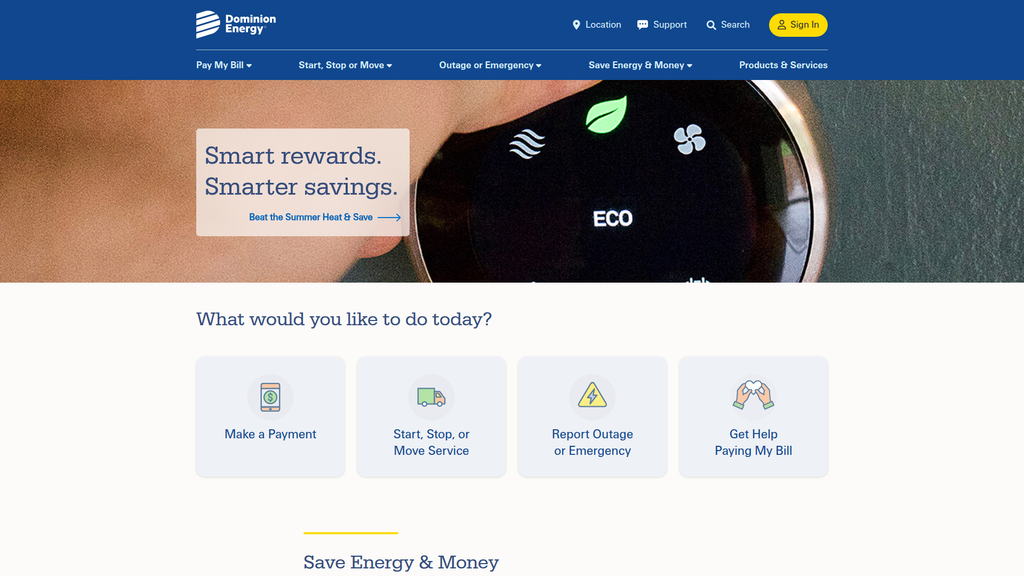

Dominion Energy's digital presence is highly effective and optimized for its primary role as a customer service portal for a captive audience. The website excels at aligning with high-intent user queries like bill payment and outage reporting, demonstrating strong Search Intent Alignment. Its content authority is solid within its operational niche, though it lags in broader energy transition thought leadership. The promotion of a mobile app indicates a good multi-channel strategy, and content is well-segmented for its geographic service areas.

The website's information architecture is expertly designed to service the most common, high-intent queries of its existing customer base, such as 'Make a Payment' or 'Report Outage', making these tasks nearly frictionless.

Develop a dedicated content hub around strategic growth areas like 'the future of energy' or 'powering the data center economy' to build authority and improve organic search rankings for non-branded, forward-looking keywords.

The company's messaging is a masterclass in functional, task-oriented communication, effectively addressing the primary needs of its core customer personas (cost-conscious, busy, safety-minded). However, there is a major, strategic disconnect between the company's multi-billion dollar investments in clean energy and the complete absence of this narrative in its primary customer-facing communications. This omission creates a significant gap between the corporate reality and the brand story, representing a missed opportunity to build deeper customer affinity.

The brand voice is exceptionally clear, direct, and helpful, perfectly aligning with a utility's role in enabling customers to complete essential tasks and find important information quickly.

Integrate the 'increasingly clean energy' value proposition into the primary customer digital experience. Create a homepage section that visually and textually connects everyday energy use to the company's large-scale renewable projects, like the Coastal Virginia Offshore Wind farm.

For a utility, 'conversion' is about successful task completion, and in this, the website excels. The design prioritizes primary user goals, resulting in a low cognitive load and minimal friction for paying bills, reporting outages, or managing service. The cross-device journey is seamless, and the proactive commitment to WCAG 2.1 AA accessibility standards is a best-in-class approach that also expands market reach. While micro-interactions are lacking, the core conversion funnels are highly optimized and effective.

The task-oriented homepage design, featuring large, clear, icon-driven buttons for the most common user tasks, is a prime example of eliminating friction and optimizing for the primary conversion goals of the target audience.

Elevate key secondary CTAs, such as 'Tips & Rebate Programs,' from simple text links to more visually prominent buttons. A/B testing this change could significantly increase engagement with these value-added programs.

Dominion Energy demonstrates a sophisticated and mature approach to credibility and risk mitigation. The website features extensive third-party validation through its detailed regulatory disclosures and a public commitment to WCAG 2.1 AA accessibility standards, which is a significant legal risk mitigator. Transparency is high within its regulated framework, with clear state-specific privacy policies for Virginia and California. While some minor technical compliance gaps exist, the overall trust signal hierarchy and risk posture are exceptionally strong.

The proactive and detailed approach to legal and regulatory compliance, including state-specific privacy policies (VCDPA/CCPA) and a dedicated Accessibility statement, establishes a powerful foundation of trust and significantly mitigates legal risk.

Add a conspicuous 'Do Not Sell or Share My Personal Information' link directly to the website footer to achieve full technical compliance with the California Privacy Rights Act (CPRA) and eliminate a potential minor violation.

Dominion Energy's competitive advantage is immense and durable, anchored by its status as a regulated monopoly in its core service territories—one of the most sustainable business moats possible. Switching costs for transmission and distribution are effectively infinite for customers. The company is actively building new, defensible advantages by developing the largest offshore wind project in the U.S. and becoming the indispensable energy provider for the world's largest data center market.

The regulated monopoly status, which grants an exclusive franchise to provide electricity in defined service areas, creates an extraordinarily durable competitive moat with high barriers to entry and a captive customer base.

Develop and launch a utility-led Virtual Power Plant (VPP) program to co-opt the threat from distributed energy resources (like rooftop solar and batteries), turning a potential competitive threat into a managed grid asset and new service offering.

The company is uniquely positioned for a massive growth phase, driven by the unprecedented surge in electricity demand from the data center market in its Virginia territory. Its detailed $50.1 billion, five-year capital plan demonstrates a clear and aggressive strategy for expansion. However, this scalability is not seamless; it is highly capital-intensive and its pace is gated by regulatory approvals for new projects and rate adjustments, which introduces significant execution risk.

The company's strategic location as the primary energy provider for Virginia's 'Data Center Alley', the world's fastest-growing electricity demand center, provides a clear, undeniable, and massive catalyst for state-sanctioned expansion.

Proactively create collaborative frameworks with regulators to streamline the approval process for the immense infrastructure investments required to serve data center growth, thereby de-risking and accelerating the capital deployment timeline.

Dominion Energy's business model is exceptionally coherent, leveraging a stable, regulated utility framework to execute a massive, capital-intensive pivot to clean energy. The strategy is sharply focused on two core drivers: meeting the hyper-growth demand from data centers and decarbonizing its generation portfolio through rate-based investments in offshore wind, solar, and storage. This approach ensures strong stakeholder alignment, as investments in a cleaner, more reliable grid directly translate to rate base growth for investors and meet the policy goals of regulators.

The business model perfectly aligns the massive market opportunity of data center growth with the strategic imperative of decarbonization, creating a synergistic, regulator-supported justification for the multi-billion dollar capital investments that drive earnings growth.

Innovate on the revenue model by developing an 'Energy-as-a-Service' (EaaS) offering for large data center clients, bundling electricity with services like sustainability reporting, backup generation, and renewable energy credits to create higher-margin, value-added revenue streams.

As a regional monopoly, Dominion Energy wields significant market power. Its market share trajectory is stable and guaranteed within its service areas. The company possesses substantial pricing power, albeit moderated and approved by regulators. Its massive capital plans give it considerable leverage with suppliers and partners. Most importantly, its role in powering the nation's critical data center infrastructure gives it immense influence in setting regional energy policy and shaping the direction of grid development.

The company's position as the primary energy provider to the world's largest data center market gives it outsized market influence, making it a critical partner in regional economic development and a key shaper of state and federal energy policy.

Create a dedicated business development and solutions architecture team focused exclusively on the data center and AI sector to further cement its market power and act as a strategic partner, rather than just a utility provider, to these critical customers.

Business Overview

Business Classification

Regulated Public Utility

Diversified Energy Producer

Energy & Utilities

Sub Verticals

- •

Electric Power Generation

- •

Electric Power Transmission & Distribution

- •

Natural Gas Distribution

- •

Renewable Energy Development

Mature

Maturity Indicators

- •

Extensive, established infrastructure and asset base.

- •

Operates as a regulated monopoly in core service territories, ensuring a stable customer base.

- •

Consistent history of dividend payments and focus on shareholder returns.

- •

Strategic focus has shifted towards modernization, decarbonization, and operational efficiency rather than aggressive market expansion.

- •

Recent divestiture of non-regulated assets to solidify its status as a pure-play, regulated utility.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Regulated Electricity Sales (Dominion Energy Virginia)

Description:Generation, transmission, and distribution of electricity to residential, commercial, and industrial customers in Virginia and North Carolina. Revenue is based on rates approved by state utility commissions. This is the largest revenue segment, accounting for approximately 70% of total revenue.

Estimated Importance:Primary

Customer Segment:Residential, Commercial, Industrial, and Governmental Customers

Estimated Margin:Medium

- Stream Name:

Regulated Electricity & Gas Sales (Dominion Energy South Carolina)

Description:Generation, transmission, and distribution of electricity and distribution of natural gas to customers in South Carolina under a state-regulated framework.

Estimated Importance:Secondary

Customer Segment:Residential, Commercial, and Industrial Customers

Estimated Margin:Medium

- Stream Name:

Contracted Energy

Description:Includes revenue from non-regulated, long-term contracted assets, primarily the Millstone Nuclear Power Station and various solar generation facilities.

Estimated Importance:Tertiary

Customer Segment:Wholesale Energy Purchasers, Other Utilities

Estimated Margin:Medium

Recurring Revenue Components

- •

Monthly utility bills from millions of regulated electricity customers.

- •

Monthly utility bills from regulated natural gas customers.

- •

Long-term power purchase agreements (PPAs) from contracted assets.

Pricing Strategy

Regulated Rate-Based Model

Regulated/Approved

Transparent

Pricing Psychology

Budget Billing: A form of price smoothing that averages energy costs over the year to provide customers with predictable monthly bills.

Rebates & Incentives: Offering financial rewards for adopting energy-efficient appliances and practices, encouraging specific customer behaviors.

Monetization Assessment

Strengths

- •

High predictability and stability of revenue due to the regulated nature of the business.

- •

Guaranteed customer base within service territories, creating a strong economic moat.

- •

Ability to recover capital investments in infrastructure through the rate-making process, funding future growth.

Weaknesses

- •

Lack of pricing flexibility; rates are subject to approval by public utility commissions, which can be a lengthy and contentious process.

- •

Revenue growth is constrained by economic and population growth in service areas and regulatory approvals.

- •

High fixed costs and capital intensity associated with maintaining and upgrading vast infrastructure.

Opportunities

- •

Massive projected growth in electricity demand from data centers in Northern Virginia.

- •

Capitalizing on the clean energy transition by investing heavily in rate-regulated offshore wind, solar, and battery storage projects.

- •

Developing new unregulated or semi-regulated services like EV charging infrastructure and home energy management solutions.

Threats

- •

Adverse regulatory decisions that limit rate increases or disallow recovery of capital expenditures.

- •

Increasing prevalence of distributed energy resources (e.g., rooftop solar) could lead to grid defection and reduced load.

- •

Rising costs of fuel, materials, and capital can compress approved margins.

- •

Political and policy shifts that could impact large-scale projects like the Coastal Virginia Offshore Wind (CVOW).

Market Positioning

Reliable and affordable energy provider transitioning to a clean energy future.

Regulated Monopoly

Target Segments

- Segment Name:

Residential Customers

Description:Individual households and multi-family residences within the service territories of Virginia, North Carolina, and South Carolina.

Demographic Factors

Varying income levels

Homeowners and renters

Psychographic Factors

- •

Seeking reliability and affordability.

- •

Increasingly interested in sustainability and clean energy options.

- •

Value convenience and digital self-service tools (e.g., mobile app).

Behavioral Factors

- •

Consistent, non-discretionary energy consumption.

- •

Responsive to energy-saving tips and rebate programs.

- •

Primary interaction with the company is through billing, payments, and outage reporting.

Pain Points

- •

High or unpredictable energy bills.

- •

Power outages, especially during severe weather.

- •

Lack of control over energy sources and costs.

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Commercial Customers (including Data Centers)

Description:Businesses ranging from small local shops to large corporations and massive data centers, primarily in Northern Virginia.

Demographic Factors

Varying business sizes and industries.

Psychographic Factors

- •

Prioritize power reliability and quality above all else.

- •

Concerned with operational uptime and managing energy as a significant operating expense.

- •

Large corporations may have corporate sustainability mandates.

Behavioral Factors

- •

High and rapidly growing energy consumption, especially for data centers.

- •

Seek customized rate structures and energy solutions.

- •

Require dedicated account management and support.

Pain Points

- •

Any power disruption, which can cause significant financial loss.

- •

Inability to secure sufficient power capacity for expansion plans.

- •

Navigating complex rate structures and regulations.

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Industrial Customers

Description:Large-scale manufacturing and industrial facilities with very high energy consumption.

Demographic Factors

Typically large, established companies in manufacturing, processing, etc.

Psychographic Factors

- •

Absolute priority on power reliability and stability.

- •

Highly sensitive to energy price fluctuations.

- •

Focus on long-term cost management and operational efficiency.

Behavioral Factors

- •

Consume very large, predictable loads of electricity.

- •

Engage in long-term energy contracts and planning.

- •

Often have sophisticated internal energy management teams.

Pain Points

- •

Volatility in energy costs impacting production expenses.

- •

Power quality issues that can damage sensitive equipment.

- •

Grid capacity constraints that limit facility expansion.

Fit Assessment:Excellent

Segment Potential:Low

Market Differentiation

- Factor:

Regulated Monopoly Status

Strength:Strong

Sustainability:Sustainable

- Factor:

Extensive Infrastructure & Asset Base

Strength:Strong

Sustainability:Sustainable

- Factor:

Leadership in Offshore Wind Development

Strength:Moderate

Sustainability:Sustainable

- Factor:

Strategic Location in High-Growth Data Center Market

Strength:Strong

Sustainability:Sustainable

Value Proposition

To provide reliable, affordable, and increasingly clean energy that powers our customers every day.

Excellent

Key Benefits

- Benefit:

Reliable Power Supply

Importance:Critical

Differentiation:Common

Proof Elements

- •

Grid modernization programs (e.g., strategic undergrounding).

- •

Investments in new transmission and substation infrastructure.

- •

Diverse generation portfolio including nuclear, gas, and renewables.

- Benefit:

Affordable and Predictable Energy Costs

Importance:Critical

Differentiation:Common

Proof Elements

- •

Rates kept below national and regional averages.

- •

Budget billing and payment assistance programs.

- •

Energy efficiency tips and rebates offered to customers.

- Benefit:

Transition to Clean Energy

Importance:Important

Differentiation:Somewhat unique

Proof Elements

- •

Commitment to achieve Net Zero emissions by 2050.

- •

Development of the large-scale Coastal Virginia Offshore Wind project.

- •

Significant, ongoing investments in solar and battery storage.

- Benefit:

Customer Self-Service and Convenience

Importance:Nice-to-have

Differentiation:Common

Proof Elements

- •

Comprehensive mobile app for bill pay, outage reporting, and usage monitoring.

- •

Online portal for starting, stopping, or moving service.

- •

Proactive notifications for billing and outages.

Unique Selling Points

- Usp:

Exclusive franchise to provide electricity and/or natural gas in designated service territories.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Owner and developer of the largest offshore wind project in the United States (CVOW).

Sustainability:Long-term

Defensibility:Strong

- Usp:

Primary energy provider to the world's largest and fastest-growing data center market in Northern Virginia.

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

The fundamental need for continuous and reliable electricity and natural gas for homes and businesses.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Unpredictable monthly energy bills causing budget uncertainty.

Severity:Major

Solution Effectiveness:Partial

- Problem:

Inconvenience and lack of information during power outages.

Severity:Major

Solution Effectiveness:Partial

- Problem:

Desire to reduce environmental impact from energy consumption.

Severity:Minor

Solution Effectiveness:Partial

Value Alignment Assessment

High

The value proposition directly addresses the core market needs for reliable and affordable energy. The increasing emphasis on clean energy aligns with broader societal and regulatory trends.

High

The proposition is well-aligned with all key segments: residential customers seek affordability, commercial/industrial customers demand reliability, and all are increasingly influenced by the push for sustainability.

Strategic Assessment

Business Model Canvas

Key Partners

- •

State and Federal Regulators (e.g., Virginia SCC, NCUC, FERC)

- •

Equipment Manufacturers (e.g., Siemens Gamesa, GE)

- •

Fuel Suppliers (Natural Gas, Nuclear)

- •

Infrastructure Investment Firms (e.g., Stonepeak Partners for CVOW)

- •

Regional Transmission Organizations (e.g., PJM Interconnection)

- •

Engineering, Procurement, and Construction (EPC) Contractors

Key Activities

- •

Power Generation from a diverse portfolio (Nuclear, Gas, Solar, Wind, Hydro).

- •

Transmission and Distribution of electricity and gas.

- •

Grid Maintenance, Modernization, and Expansion.

- •

Regulatory Affairs and Compliance.

- •

Customer Service and Billing.

- •

Large-Scale Capital Project Development (e.g., CVOW).

Key Resources

- •

Generation Assets (Power Plants).

- •

Transmission and Distribution Infrastructure (Grid).

- •

Regulatory Licenses and Service Area Franchises.

- •

Skilled Workforce (Engineers, Lineworkers, Technicians).

- •

Significant Capital and Access to Financial Markets.

Cost Structure

- •

Capital Expenditures (Grid upgrades, new generation facilities).

- •

Fuel Costs (Natural gas, uranium).

- •

Operations & Maintenance (O&M) Expenses.

- •

Employee Salaries and Benefits.

- •

Depreciation of Assets.

- •

Interest on Debt.

Swot Analysis

Strengths

- •

Regulated monopoly status provides highly predictable earnings and a captive customer base.

- •

Strategically located to serve the rapidly growing Northern Virginia data center market, a major demand driver.

- •

Diversified generation portfolio, including significant nuclear assets, provides reliable baseload power.

- •

Strong balance sheet and access to capital for large-scale infrastructure projects.

Weaknesses

- •

Heavy reliance on favorable regulatory outcomes for profitability and growth.

- •

High capital intensity requires continuous, large-scale investment to maintain and upgrade aging infrastructure.

- •

Operational complexity of managing a diverse portfolio of generation assets and a vast T&D network.

Opportunities

- •

Lead the U.S. in offshore wind development, creating a new, regulated revenue stream.

- •

Massive investment in grid modernization and expansion to support electrification and renewables.

- •

Develop and offer new energy services and technologies, such as utility-scale battery storage and small modular reactors (SMRs).

- •

Leverage digital tools like the mobile app to enhance customer satisfaction and reduce operational costs.

Threats

- •

Unfavorable regulatory changes, political intervention, or delays in rate case approvals.

- •

Execution risk and potential cost overruns on major projects like the Coastal Virginia Offshore Wind farm.

- •

Increasing frequency and intensity of extreme weather events threatening grid infrastructure.

- •

Rising interest rates increasing the cost of capital for infrastructure investments.

- •

Cybersecurity threats targeting critical grid infrastructure.

Recommendations

Priority Improvements

- Area:

Regulatory Strategy

Recommendation:Proactively engage with regulators to build collaborative frameworks for recovering investments in grid modernization and decarbonization, emphasizing long-term benefits to ratepayers such as reliability and price stability.

Expected Impact:High

- Area:

Capital Project Execution

Recommendation:Implement rigorous project management and risk mitigation strategies for the CVOW project and other large capital investments to control costs and adhere to timelines, thereby minimizing risks of disallowed costs in rate cases.

Expected Impact:High

- Area:

Customer Experience & Digitalization

Recommendation:Expand the functionality of the mobile app and digital platforms to include personalized energy-saving advice, granular usage data, and streamlined enrollment in green power or demand-response programs to increase customer engagement and satisfaction.

Expected Impact:Medium

Business Model Innovation

- •

Develop an 'Energy-as-a-Service' (EaaS) offering for large commercial and industrial customers, particularly data centers, that bundles electricity supply with energy management, backup generation, and sustainability reporting services.

- •

Establish a platform to manage and orchestrate Distributed Energy Resources (DERs), such as customer-owned solar and batteries, creating a virtual power plant that can provide grid services and generate new revenue streams.

- •

Become a key infrastructure provider for transportation electrification by building and operating a network of utility-owned DC fast chargers for electric vehicles, creating a new regulated asset base.

Revenue Diversification

- •

Expand the non-regulated 'Dominion Energy Solutions' arm to offer behind-the-meter solar and battery storage solutions to commercial customers nationwide.

- •

Invest in the development of renewable natural gas (RNG) and green hydrogen production facilities, leveraging existing gas infrastructure and expertise.

- •

Offer consulting services to smaller utilities or large corporations on grid modernization, renewable integration, and navigating the energy transition.

Dominion Energy operates a classic, mature, regulated utility business model, which provides a foundation of stability, predictability, and a strong competitive moat in its core service territories. The company's primary strategic evolution is a massive, capital-intensive pivot towards decarbonization, underscored by its landmark Coastal Virginia Offshore Wind project and significant investments in solar and battery storage. This strategy is not merely an environmental initiative but a core business model evolution designed to replace aging fossil fuel assets with a new generation of regulated, rate-based assets that will drive earnings for decades.

The key opportunity and challenge lie in execution and regulation. The unprecedented electricity demand growth from the Northern Virginia data center market presents a generational opportunity for rate base growth. However, successfully meeting this demand requires flawless execution of complex, multi-billion dollar projects and navigating the regulatory process to ensure timely cost recovery. The company's future success will be defined by its ability to balance three core imperatives: 1) executing its clean energy capital plan on-time and on-budget, 2) securing constructive regulatory outcomes that support these investments while keeping customer rates competitive, and 3) maintaining exceptional operational reliability across its expanding and evolving grid. The current business model is well-positioned for this transition, but its scalability and long-term competitive advantage are entirely dependent on mastering this regulatory and operational balancing act.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

High Capital Intensity & Infrastructure Costs

Impact:High

- Barrier:

Extensive Regulatory & Permitting Hurdles

Impact:High

- Barrier:

Established Service Territories (Regional Monopolies)

Impact:High

- Barrier:

Economies of Scale in Generation & Distribution

Impact:High

Industry Trends

- Trend:

Decarbonization & Clean Energy Transition

Impact On Business:Requires massive capital investment in renewables (offshore wind, solar) and retirement of fossil fuel assets. Creates opportunities for green branding and new revenue streams, but also significant execution risk.

Timeline:Immediate

- Trend:

Grid Modernization & Resilience

Impact On Business:Investment in smart grids, energy storage, and undergrounding lines is necessary to accommodate distributed energy resources (DERs), improve reliability against extreme weather, and enhance operational efficiency.

Timeline:Immediate

- Trend:

Electrification & Load Growth

Impact On Business:Surging demand from data centers (especially in Virginia), EV adoption, and building electrification creates a significant growth opportunity but strains existing generation and transmission infrastructure.

Timeline:Immediate/Near-term

- Trend:

Rise of Distributed Energy Resources (DERs)

Impact On Business:Customer-sited solar, batteries, and smart devices challenge the traditional centralized utility model, potentially reducing load but also creating opportunities for new services like Virtual Power Plants (VPPs).

Timeline:Near-term

Direct Competitors

- →

Duke Energy

Market Share Estimate:Significant overlap in the Carolinas, making it a primary regional competitor.

Target Audience Overlap:High

Competitive Positioning:Positions as a large, reliable energy provider committed to a clean energy transition, similar to Dominion. Emphasizes its large customer base and diverse energy portfolio.

Strengths

- •

Large, diversified generation portfolio including natural gas, nuclear, and a growing renewable base.

- •

Extensive regulated service territory across six states, providing stable revenue.

- •

Significant capital investment plan focused on grid modernization and clean energy.

- •

Strong brand recognition in its service areas.

Weaknesses

- •

Faces public and regulatory scrutiny over environmental issues and rate increases.

- •

Historically has received poor customer satisfaction ratings in some studies.

- •

Execution risk associated with its large-scale capital expenditure projects.

Differentiators

Heavy investment in natural gas infrastructure as a key transition fuel.

Aggressive pursuit of grid improvement and smart meter deployment to enhance efficiency.

- →

NextEra Energy

Market Share Estimate:Competes primarily in the wholesale generation market through NextEra Energy Resources, but not a direct retail competitor in Dominion's territories.

Target Audience Overlap:Low

Competitive Positioning:Positions itself as a leader in clean energy and decarbonization, leveraging its dual-engine model of a stable regulated utility (FPL) and a high-growth renewables development arm.

Strengths

- •

World's largest generator of renewable energy from wind and solar.

- •

Strong financial performance and a reputation for innovation and operational efficiency.

- •

First-mover advantage and scale in battery storage and green hydrogen projects.

- •

Favorable regulatory environment in its primary Florida market.

Weaknesses

- •

Revenue from its unregulated arm (NextEra Energy Resources) can be more volatile than traditional utility earnings.

- •

Faces competition from other developers in the renewables space.

- •

Geographic concentration of its regulated utility in Florida exposes it to regional risks (e.g., hurricanes).

Differentiators

Unmatched scale and expertise in renewable energy development.

A business model that aggressively pursues growth in both regulated and competitive markets simultaneously.

- →

Southern Company

Market Share Estimate:Operates in adjacent southeastern states (Georgia, Alabama, Mississippi), making it a major regional peer and potential competitor in policy and wholesale markets.

Target Audience Overlap:Medium

Competitive Positioning:Positions as a reliable, customer-centric utility with a large, diversified energy portfolio, including a significant commitment to nuclear power.

Strengths

- •

Extensive regulated customer base of ~9 million across the Southeast, ensuring stable revenue.

- •

Significant operator of new nuclear generation in the U.S. (Vogtle units), providing a large source of carbon-free baseload power.

- •

Diversified portfolio across electric and gas utilities.

- •

Strong political and regulatory influence in its core states.

Weaknesses

- •

Experienced significant cost overruns and delays with the Vogtle nuclear project, impacting financials and reputation.

- •

Historically higher reliance on coal compared to some peers, presenting a transition challenge.

- •

Faces competition from other regional utilities and independent power producers.

Differentiators

Leading-edge expertise in modern nuclear power generation.

Strong focus on a regulated business model across its multiple state-level utility brands (e.g., Georgia Power, Alabama Power).

Indirect Competitors

- →

Residential & Commercial Solar Installers (e.g., Sunrun)

Description:Companies that install, and often finance, rooftop solar panels for homes and businesses. They typically use a Power Purchase Agreement (PPA) or lease model with no upfront cost, selling electricity directly to the consumer.

Threat Level:Medium

Potential For Direct Competition:They are already direct competitors for customer energy spend, eroding the utility's traditional sales base. Their threat grows as solar and battery costs decline.

- →

Energy Storage Providers (e.g., Tesla Energy)

Description:Providers of home and grid-scale battery storage solutions, like the Tesla Powerwall. These systems allow customers to store solar energy for use during outages or peak price periods, increasing energy independence.

Threat Level:Medium

Potential For Direct Competition:High. By enabling customers to detach further from the grid, they reduce reliance on the utility for reliability and energy management, turning customers into 'prosumers'.

- Name:

Community Choice Aggregators (CCAs)

Description:Local government entities that procure electricity on behalf of their residents, displacing the utility as the default power supplier. The utility still manages the transmission and distribution grid. CCAs are enabled by state-level legislation.

Threat Level:Low

Potential For Direct Competition:Becomes high if enabling legislation expands more broadly in Dominion's service territories. They directly compete for the generation portion of the customer's bill.

- Name:

Large-Scale Renewable Energy Developers

Description:Independent power producers that develop large wind, solar, and storage projects and sell the power on the wholesale market or through PPAs to corporations and utilities.

Threat Level:High

Potential For Direct Competition:They are direct competitors in the power generation market, competing against Dominion's own generation assets to supply the grid and large customers.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Regulated Monopoly in Service Territories

Sustainability Assessment:Highly sustainable due to immense physical and regulatory barriers to entry for transmission and distribution.

Competitor Replication Difficulty:Hard

- Advantage:

Ownership of Critical Infrastructure

Sustainability Assessment:The existing network of power plants, transmission lines, and distribution networks provides a massive, defensible moat.

Competitor Replication Difficulty:Hard

- Advantage:

Established Regulatory Relationships

Sustainability Assessment:Decades of experience navigating complex state and federal regulatory environments is a significant intangible asset.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'Leadership in Offshore Wind (Coastal Virginia Offshore Wind Project)', 'estimated_duration': '3-5 Years. This provides a first-mover advantage, but other utilities and developers are aggressively pursuing offshore wind projects.'}

Disadvantages

- Disadvantage:

Slower Innovation Cycle

Impact:Major

Addressability:Moderately

Description:As a large, regulated entity, Dominion may be slower to adopt new technologies and business models compared to more agile, tech-focused competitors in the DER space.

- Disadvantage:

Negative Public Perception

Impact:Major

Addressability:Difficult

Description:Utilities often face public criticism regarding rate hikes, service interruptions, and environmental impact, which can affect regulatory outcomes and customer trust. Overall residential customer satisfaction with utilities has been declining.

- Disadvantage:

Aging Grid Infrastructure

Impact:Critical

Addressability:Moderately

Description:Parts of the grid require substantial investment to modernize, improve resilience, and handle the bidirectional energy flows from DERs. This is a capital-intensive, long-term challenge.

Strategic Recommendations

Quick Wins

- Recommendation:

Enhance Digital Customer Engagement

Expected Impact:Medium

Implementation Difficulty:Easy

Description:Based on the website's promotion of its app, continue to add features that provide customers with personalized energy-saving tips, real-time outage updates, and easier billing management to improve customer satisfaction.

- Recommendation:

Launch Targeted Marketing for Energy Efficiency Rebates

Expected Impact:Medium

Implementation Difficulty:Moderate

Description:Proactively communicate and simplify the process for customers to access rebates for smart thermostats, energy-efficient appliances, and home weatherization, reinforcing Dominion's role as an energy-saving partner.

Medium Term Strategies

- Recommendation:

Develop a Utility-Led Virtual Power Plant (VPP) Program

Expected Impact:High

Implementation Difficulty:Difficult

Description:Create programs that incentivize customers with solar, batteries, and smart thermostats to allow Dominion to manage these assets during peak demand, turning a competitive threat into a grid asset.

- Recommendation:

Streamline Interconnection for Customer-Sited Renewables

Expected Impact:Medium

Implementation Difficulty:Difficult

Description:Improve the process and transparency for customers and solar installers to connect DERs to the grid. This can mitigate negative sentiment and position Dominion as an enabler, not an obstacle, to clean energy.

Long Term Strategies

- Recommendation:

Become the Premier Energy Partner for Data Centers

Expected Impact:High

Implementation Difficulty:Difficult

Description:Leverage Virginia's data center boom by developing tailored, high-reliability, 100% renewable energy solutions for large tech customers, creating a premium service offering.

- Recommendation:

Invest in Long-Duration Energy Storage

Expected Impact:High

Implementation Difficulty:Difficult

Description:To complement massive investments in intermittent renewables like solar and offshore wind, pioneer pilot and large-scale projects in technologies like pumped hydro, compressed air, or green hydrogen to ensure 24/7 grid reliability.

Position Dominion Energy as the 'Reliable Clean Energy Leader,' leveraging its legacy of reliability while aggressively demonstrating its commitment to a sustainable, innovative, and customer-centric future.

Differentiate through superior execution on large-scale clean energy projects (like offshore wind) and by creating the most seamless digital customer experience in the utility sector, transforming the traditional utility relationship into a proactive energy partnership.

Whitespace Opportunities

- Opportunity:

Energy-as-a-Service (EaaS) for Commercial & Industrial Customers

Competitive Gap:Direct and indirect competitors are largely focused on selling kilowatt-hours or installing hardware. Few are offering comprehensive, subscription-based energy management solutions that include efficiency, on-site generation, and EV fleet charging.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Grid Services Monetization Platform

Competitive Gap:While DERs are a threat, no competitor has fully cracked the code on seamlessly integrating thousands of residential assets into a cohesive, market-participating VPP. This is a gap between the customer and the wholesale energy market.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Community-Scale Solar and Storage Solutions

Competitive Gap:Rooftop solar serves individual homes, and utility-scale serves the whole grid. There is a gap for developing neighborhood-scale solar and battery projects that provide resilience and cost benefits to specific communities, managed by the utility.

Feasibility:High

Potential Impact:Medium

Dominion Energy operates within a mature, highly regulated, and capital-intensive industry that is currently undergoing a fundamental transformation. Its primary competitive advantages are rooted in its established regional monopoly over transmission and distribution infrastructure and the immense regulatory barriers that protect this core business. Direct competition from peers like Duke Energy and Southern Company is largely geographically defined and centers on operational efficiency, regulatory outcomes, and the pace of decarbonization.

The most significant competitive threat is not from other traditional utilities but from the decentralization of the energy system. Indirect competitors, such as residential solar installers (Sunrun) and energy storage providers (Tesla Energy), are chipping away at the traditional utility model by empowering customers to generate and store their own energy. This trend, coupled with the broader push toward electrification and grid modernization, creates both a critical threat and a substantial opportunity.

Dominion's strategic focus on large-scale renewable projects, particularly the Coastal Virginia Offshore Wind farm, and its public commitment to Net Zero emissions are necessary moves to align with industry trends and policy direction. However, its long-term success will depend on its ability to evolve from a one-way electricity provider into a platform that orchestrates a complex, multi-directional energy grid. The key strategic whitespace lies in bridging the gap between its core regulated business and the emerging world of DERs. By developing services like VPPs and EaaS, Dominion can leverage its scale and grid expertise to co-opt disruptive technologies, turning potential threats into new revenue streams and sources of grid stability.

Ultimately, Dominion Energy must execute a dual strategy: continue to invest in and operate its large-scale infrastructure reliably and affordably, while simultaneously building the digital and customer-centric capabilities to manage a decentralized, decarbonized, and dynamic energy future.

Messaging

Message Architecture

Key Messages

- Message:

Manage your energy costs and save money.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero: 'Smart rewards. Smarter savings.' and 'Save Energy & Money' section.

- Message:

Easily manage your account with our digital tools.

Prominence:Primary

Clarity Score:High

Location:Homepage Quick Links ('Make a Payment', 'Start, Stop, or Move Service') and 'Download the Mobile App!' section.

- Message:

We help you stay safe and prepared for emergencies.

Prominence:Secondary

Clarity Score:High

Location:Homepage: 'Prepare for Hurricane Season' and 'Report Outage or Emergency'.

- Message:

We provide reliable service.

Prominence:Tertiary

Clarity Score:Medium

Location:Implied throughout the site, especially in outage reporting and storm preparedness sections. Not explicitly stated as a primary message.

The messaging hierarchy is highly effective for a utility company. It prioritizes the most common and critical customer tasks (payments, service changes, outages) above all else, which aligns perfectly with the user's primary intent when visiting the site. Secondary messages about savings and safety are also prominent, addressing key customer concerns. Broader brand messaging is appropriately de-prioritized.

Messaging is very consistent across the provided pages. The focus on customer empowerment through cost savings and convenient digital tools is a clear through-line from the homepage to the app-specific page. The tone and core value propositions are seamlessly maintained.

Brand Voice

Voice Attributes

- Attribute:

Helpful

Strength:Strong

Examples

- •

Get tips to help lower your bills.

- •

Explore our resources to start lowering your energy costs today.

- •

Learn ways you can stay prepared for any storm...

- Attribute:

Direct & Efficient

Strength:Strong

Examples

- •

What would you like to do today?

- •

Make a Payment

- •

Report Outage or Emergency

- •

Fast, easy, and secure access to your account whenever, wherever.

- Attribute:

Authoritative & Reliable

Strength:Moderate

Examples

- •

Prepare for Hurricane Season

- •

Downed wires are dangerous and require special attention.

- •

Dominion Energy has your back along the way.

Tone Analysis

Service-Oriented

Secondary Tones

Reassuring

Promotional

Tone Shifts

The tone shifts from highly transactional on the homepage quick links to more promotional and benefit-oriented in the 'Download the Mobile App!' section.

A shift to a more serious, cautionary tone is present in the storm prep messaging and FAQ regarding downed wires.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

Dominion Energy provides reliable and affordable energy that is easy to manage and control through helpful tips and convenient digital tools.

Value Proposition Components

- Component:

Cost Savings & Affordability

Clarity:Clear

Uniqueness:Common

Examples

- •

'Smart rewards. Smarter savings.'

- •

'Get tips to help lower your bills.'

- •

Rebates on energy-efficient appliances.

- Component:

Convenience & Account Management

Clarity:Clear

Uniqueness:Somewhat Unique

Examples

- •

'Download the Mobile App!'

- •

Quick links for payment, service moves, and outage reporting.

- •

Fingerprint or facial recognition login.

- Component:

Safety & Reliability

Clarity:Clear

Uniqueness:Common

Examples

- •

'Prepare for Hurricane Season'

- •

'Report and Monitor Power Outages'

- •

Specific instructions for downed wires.

- Component:

Clean Energy

Clarity:Unclear

Uniqueness:Common

Examples

This is a core part of their stated mission ('increasingly clean energy') but is absent from the provided customer-facing website content.

While reliability and affordability are table stakes in the utility industry, Dominion Energy's messaging attempts to differentiate on the basis of customer empowerment. The heavy emphasis on the mobile app, cost-saving tips, and usage data positions them not just as a provider, but as a partner in managing energy consumption. This focus on digital convenience is a key differentiator against less technologically advanced competitors.

The messaging positions Dominion Energy as a modern, customer-centric utility focused on practical solutions. It moves beyond the traditional, impersonal utility model to one that offers tools and resources for a smarter, more controlled energy experience. This is a strong position in a market where customer service and ease-of-use are often pain points.

Audience Messaging

Target Personas

- Persona:

The Cost-Conscious Homeowner

Tailored Messages

- •

Smart rewards. Smarter savings.

- •

Get tips to help lower your bills.

- •

Check your most recent energy usage and compare to past periods for greater control over your energy bill.

Effectiveness:Effective

- Persona:

The Busy, On-the-Go Customer

Tailored Messages

- •

Download the Mobile App!

- •

Fast, easy, and secure access to your account whenever, wherever.

- •

Sign up for push notifications to receive convenient bill reminders...

Effectiveness:Effective

- Persona:

The Safety-Minded Resident (in a storm-prone area)

Tailored Messages

- •

Prepare for Hurricane Season

- •

Learn ways you can stay prepared for any storm...

- •

If you experience a power outage, reporting and monitoring the status is easier than ever.

Effectiveness:Effective

Audience Pain Points Addressed

- •

High or unpredictable energy bills

- •

Inconvenience of paying bills or managing service

- •

Uncertainty and lack of information during power outages

- •

Forgetting passwords for online accounts

Audience Aspirations Addressed

- •

Gaining control over household expenses

- •

Simplifying life with easy-to-use technology

- •

Ensuring family safety and peace of mind

Persuasion Elements

Emotional Appeals

- Appeal Type:

Peace of Mind / Security

Effectiveness:High

Examples

'Prepare for Hurricane Season'

'Dominion Energy has your back along the way.'

- Appeal Type:

Empowerment / Control

Effectiveness:High

Examples

'Smart rewards. Smarter savings.'

'Check your most recent energy usage... for greater control over your energy bill.'

Social Proof Elements

No itemsTrust Indicators

- •

Clear, professional website design.

- •

Directly addressing safety issues (downed wires).

- •

Providing detailed FAQs to proactively answer customer questions.

- •

Prominent display of service area selection, showing regional relevance.

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

Make a Payment

Location:Homepage

Clarity:Clear

- Text:

Start, Stop, or Move Service

Location:Homepage

Clarity:Clear

- Text:

Report Outage or Emergency

Location:Homepage

Clarity:Clear

- Text:

Play Store (Download the App)

Location:Homepage

Clarity:Clear

- Text:

See Helpful Storm Prep & Safety Reminders

Location:Homepage

Clarity:Clear

The CTAs are exceptionally effective. They are task-oriented, use clear and concise action verbs, and are placed prominently to address the most frequent user needs immediately. This functional, no-nonsense approach is ideal for a utility website where users are often visiting to complete a specific task quickly.

Messaging Gaps Analysis

Critical Gaps

- •

Sustainability & Clean Energy Narrative: The most significant gap is the complete absence of messaging related to the 'increasingly clean energy' component of their corporate mission. Research shows Dominion Energy has significant initiatives in this area, including a Net Zero by 2050 goal, but this is not communicated to the general residential customer on these core pages.

- •

Community Engagement & Corporate Citizenship: There is no messaging about how Dominion Energy supports the communities it serves, which is a missed opportunity to build brand affinity and trust.

- •

Social Proof: The site lacks customer testimonials, case studies, or even statistics (e.g., 'X million customers use our app') that would build credibility and encourage adoption of digital tools.

Contradiction Points

The primary contradiction is one of omission: the stated corporate mission emphasizes a commitment to 'increasingly clean energy,' while the customer-facing messaging is silent on the topic. This creates a disconnect between corporate strategy and brand communication.

Underdeveloped Areas

Brand Storytelling: The messaging is highly functional but lacks a narrative. There is no story about who Dominion Energy is, what it stands for beyond utility provision, or its vision for the future of energy.

Value Beyond the Meter: The focus is entirely on the transactional relationship. There is an opportunity to build a relationship based on shared values, such as environmental stewardship or community support.

Messaging Quality

Strengths

- •

Exceptional Clarity: The messaging is simple, direct, and free of jargon, making it easy for all customers to understand.

- •

Task-Oriented: The website excels at helping users complete their primary tasks (pay bills, report outages) with minimal friction.

- •

Addresses Core Customer Needs: The focus on saving money, convenience, and safety is perfectly aligned with the primary concerns of a utility customer.

Weaknesses

- •

Overly Transactional: The focus on function comes at the expense of brand building. The messaging does little to foster an emotional connection or brand loyalty.

- •

Misses Key Corporate Value Proposition: The failure to communicate the company's significant clean energy initiatives is a major strategic weakness.

- •

Lacks Personality: The voice is helpful but generic. It is a utility, not a distinct brand with a point of view.

Opportunities

- •

Integrate the 'clean energy' story into the customer experience, framing it as a benefit (e.g., 'Power your home with cleaner energy').

- •

Use storytelling to showcase community involvement and employee dedication, humanizing the brand.

- •

Incorporate social proof, such as app ratings or testimonials about savings programs, to increase participation.

Optimization Roadmap

Priority Improvements

- Area:

Value Proposition Communication

Recommendation:Create a new homepage section titled 'Powering a Cleaner Future' that briefly communicates the Net Zero commitment and links to a dedicated sustainability page. This directly addresses the critical messaging gap.

Expected Impact:High

- Area:

Persuasion & Trust

Recommendation:Add customer testimonials or app store ratings to the 'Download the Mobile App' section to provide social proof and encourage downloads.

Expected Impact:Medium

- Area:

Audience Messaging

Recommendation:Develop messaging for an 'Environmentally-Conscious Customer' persona, offering enrollment in green power programs or information on solar initiatives.

Expected Impact:Medium

Quick Wins

- •

Add a sub-headline to the homepage hero that mentions clean energy, e.g., 'Smart rewards. Smarter savings. All from increasingly clean and reliable energy.'

- •

Incorporate a statistic into the app CTA, such as 'Join over 1 million customers managing their account on the go.'

- •

Add a 'Community' or 'Sustainability' link to the main website footer.

Long Term Recommendations

- •

Develop a comprehensive content strategy focused on brand storytelling. Create blog posts, videos, and social media content that highlights clean energy projects (like offshore wind), employee stories, and community partnerships.

- •

Integrate sustainability messaging throughout the customer journey, not just on a separate page. For example, on the bill, show a customer's carbon footprint or the percentage of their energy that comes from renewable sources.

- •

Conduct audience research to understand customer perceptions of sustainability and tailor messaging to resonate with their values and interests.

Dominion Energy's website messaging is a masterclass in functional, task-oriented communication for a utility provider. It demonstrates a deep understanding of its customers' primary needs: paying bills, managing service, reporting outages, and saving money. The message architecture is clear, the brand voice is consistently helpful and direct, and the calls-to-action are highly effective. The strategic focus on digital tools, particularly the mobile app, successfully positions the company as a modern and convenient service provider, which is a key differentiator in a traditionally staid industry.

However, this relentless focus on functionality creates a significant strategic gap. The brand's communication is almost entirely transactional, failing to build a deeper, more resilient relationship with its customers. The most glaring omission is the complete absence of the company's 'increasingly clean energy' mission on its primary customer-facing pages. While Dominion Energy has well-documented, substantial investments and commitments to sustainability and achieving Net Zero emissions by 2050, this core component of its corporate identity and future value proposition is invisible to the average residential customer visiting the site.

This creates a disconnect where the brand perception lags behind the corporate reality. In an era where consumers increasingly prefer brands that align with their values, failing to communicate a commitment to a cleaner energy future is a missed opportunity to build brand equity, foster loyalty, and justify future investments and rate structures. The current messaging effectively serves the customer of today but fails to tell the story of the energy company of tomorrow. The immediate priority should be to strategically weave the sustainability and community narratives into the existing high-functioning digital experience, transforming the brand from a simple utility provider into a forward-looking energy partner.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Operates as a regulated utility in a captive market with over 7 million customers across multiple states.

- •

Core service (reliable and affordable energy) is a fundamental necessity for residential, commercial, and industrial customers.

- •

Meeting unprecedented new demand from the data center sector in Virginia, which now accounts for over 25% of electricity sales in the state.

- •

Actively investing in clean energy generation (offshore wind, solar) in alignment with customer desires and state mandates like the Virginia Clean Economy Act.

Improvement Areas

- •

Enhancing customer experience through digital tools (like the mobile app) to improve satisfaction and perception of value.

- •

Improving communication and justification for rate increases to maintain public and regulatory support, especially as investments grow.

- •

Expanding energy efficiency and demand-response programs to help customers manage costs amid rising demand.

Market Dynamics

Accelerating after two decades of flat demand, now projected at 1-2% annually, with regional demand in Dominion's territory forecasted at 5.5% annually.

Mature but Undergoing Transformation

Market Trends

- Trend:

Explosive Growth in Electricity Demand from Data Centers/AI

Business Impact:Massive, unprecedented growth driver. Dominion is at the epicenter in Virginia, the world's largest data center market, creating a generational capital investment opportunity.

- Trend:

Decarbonization and the Clean Energy Transition

Business Impact:Drives significant capital investment in renewables (offshore wind, solar) and grid modernization, forming the core of the growth strategy and aligning with regulatory mandates.

- Trend:

Grid Modernization and Electrification

Business Impact:Requires substantial investment in smart grid technology, transmission lines, and energy storage to ensure reliability and integrate renewables, creating rate base growth.

- Trend:

Increasing Regulatory and Stakeholder Scrutiny

Business Impact:Heightens the need for robust justification for capital projects and rate increases. Regulatory approvals are a key determinant of growth velocity.

Excellent. Dominion is positioned at the confluence of several powerful, long-term trends (AI-driven demand, energy transition) that necessitate massive capital deployment, which is the primary growth mechanism for a regulated utility.

Business Model Scalability

Medium

Extremely high fixed costs (power plants, transmission lines). Growth is capital-intensive and comes from expanding the 'rate base' (value of assets on which it can earn a regulated return).

High. Once infrastructure is built, the marginal cost of delivering an additional kilowatt-hour is low. The key is deploying capital effectively to meet new, sustained demand.

Scalability Constraints

- •

Regulatory Approval Lag: Growth is gated by state public utility commissions' (PUCs) approval of new projects and the associated cost recovery.

- •

Capital Intensity: Requires enormous capital investment ($50.1 billion planned for 2025-2029) which necessitates access to capital markets.

- •

Construction Timelines & Supply Chains: Large-scale projects like offshore wind farms and transmission lines have multi-year development cycles and are subject to supply chain risks.

- •

Political and Policy Risk: Changes in administration or energy policy can impact major projects and the viability of certain technologies.

Team Readiness

Strong. The leadership team demonstrates a clear strategy focused on the dual opportunities of data center demand and clean energy investment, communicated through their Integrated Resource Plan (IRP).

Traditional, siloed utility structure. May need to evolve to become more agile in developing and integrating new energy services and managing complex, multi-stakeholder projects.

Key Capability Gaps

- •

Agile Project Management for Large-Scale Tech Deployment (e.g., smart grid, DERMS).

- •

Digital Customer Experience & Product Development for new services beyond the meter.

- •

Advanced Data Analytics for grid optimization and load forecasting in a high-DER environment.

Growth Engine

Acquisition Channels

- Channel:

Data Center Business Development

Effectiveness:High

Optimization Potential:High

Recommendation:Develop dedicated teams and streamlined processes for large load interconnection. Propose innovative rate structures and long-term contracts to secure this demand and de-risk associated infrastructure investment.

- Channel:

Regional Economic Development Partnerships

Effectiveness:Medium

Optimization Potential:High

Recommendation:Collaborate with state and local economic development agencies to attract new industrial customers, leveraging the availability of clean and reliable power as a key incentive.

- Channel:

Residential & Commercial Construction

Effectiveness:Medium

Optimization Potential:Medium

Recommendation:Integrate with developers and builders to promote all-electric homes and energy-efficient construction, driving organic load growth.

Customer Journey

The 'customer journey' for a utility is about service initiation, billing, and ongoing engagement. The website and app focus on core tasks: payments, service requests, and outage reporting.

Friction Points

- •

Complexities in understanding rate structures and bill components.

- •

Limited self-service options for complex inquiries or customized energy solutions.

- •

Navigating the process for interconnecting distributed energy resources (like rooftop solar).

Journey Enhancement Priorities

{'area': 'Digital Self-Service (App/Web)', 'recommendation': 'Expand app functionality beyond basic transactions to include personalized energy-saving advice, rate plan comparisons, and proactive outage/service notifications.'}

{'area': 'Large Customer Onboarding', 'recommendation': "Create a 'white glove' onboarding experience for large industrial and data center customers to streamline site selection, infrastructure planning, and interconnection."}

Retention Mechanisms

- Mechanism:

Regulated Monopoly Status

Effectiveness:High

Improvement Opportunity:This is a structural advantage. The focus should shift from 'retention' to 'satisfaction and expansion revenue' to maintain regulatory and public goodwill.

- Mechanism:

Customer Engagement Programs (Energy Efficiency, Rebates)

Effectiveness:Medium

Improvement Opportunity:Increase awareness and simplify enrollment for these programs to drive higher participation, reduce peak load, and enhance customer perception of value.

- Mechanism:

100% Renewable Energy Program

Effectiveness:Low

Improvement Opportunity:Market this voluntary program more effectively to environmentally conscious customers and businesses seeking to meet their own ESG goals.

Revenue Economics

Based on a 'cost-of-service' model. Growth is driven by increasing the regulated rate base through capital expenditures and earning an approved rate of return on that investment from regulators.

Not Applicable. The core metric is Return on Equity (ROE) allowed by regulators on capital investments.

High, within the regulated framework. The model is designed for stable, predictable revenue growth tied directly to investment in the system.

Optimization Recommendations

- •

Focus capital deployment on projects that address the most pressing, regulator-supported needs (reliability for data centers, clean energy mandates) to ensure timely cost recovery.

- •

Optimize operational and maintenance (O&M) expenses to create headroom within rate structures for new capital investments.

- •

Develop non-regulated or performance-based revenue streams from new energy services where possible.

Scale Barriers

Technical Limitations

- Limitation:

Aging Grid Infrastructure

Impact:High

Solution Approach:Accelerate Grid Transformation Plan, including strategic undergrounding of lines, deploying smart meters, and installing automated fault detection and restoration systems.

- Limitation:

Renewable Energy Intermittency

Impact:Medium

Solution Approach:Invest heavily in battery storage (planned 4,500 MW) and maintain flexible natural gas generation to ensure grid stability and reliability as renewable penetration increases.

- Limitation:

Cybersecurity Threats

Impact:High

Solution Approach:Continuous investment in cyber and physical security for both IT and OT systems, as approved by regulators, is critical to protect grid infrastructure.

Operational Bottlenecks

- Bottleneck:

Supply Chain for Key Components

Growth Impact:Can delay major projects (e.g., wind turbines, transformers) and increase costs.

Resolution Strategy:Secure long-term contracts with key suppliers, diversify the supplier base where possible, and support local manufacturing initiatives for critical components.

- Bottleneck:

Skilled Workforce Shortage

Growth Impact:Lack of qualified engineers, linemen, and specialized technicians can constrain the pace of construction and grid modernization.

Resolution Strategy:Invest in partnerships with vocational schools and universities; develop robust internal apprenticeship and training programs to build a talent pipeline.

- Bottleneck:

Permitting and Siting for New Infrastructure

Growth Impact:Lengthy and complex permitting processes can significantly delay transmission lines and generation facilities.

Resolution Strategy:Proactive stakeholder and community engagement; collaborative planning with local, state, and federal agencies to streamline the approval process.

Market Penetration Challenges

- Challenge:

Regulatory Risk and Rate Case Outcomes

Severity:Critical

Mitigation Strategy:Maintain constructive relationships with regulators. Justify investments with clear evidence of customer and economic benefits (reliability, clean energy). Utilize performance-based ratemaking where possible.

- Challenge:

Public Opposition to Rate Increases and Infrastructure

Severity:Major

Mitigation Strategy:Implement comprehensive public relations and education campaigns to explain the necessity of investments for meeting demand and clean energy goals. Highlight economic benefits like job creation.

- Challenge:

Competition from Distributed Energy Resources (DERs)

Severity:Minor

Mitigation Strategy:Embrace DERs by developing platforms to manage and integrate them into the grid (DERMS). Offer services to customers with DERs, turning a potential threat into a grid resource and revenue opportunity.

Resource Limitations

Talent Gaps

- •

Offshore wind project management and operations specialists.

- •

Power systems engineers with expertise in grid modeling for high-DER systems.

- •

Data scientists and software engineers for grid automation and analytics.

Extremely high. The $50.1B five-year capital plan requires consistent and cost-effective access to debt and equity markets. Maintaining a strong credit rating is paramount.

Infrastructure Needs

- •

Major expansion of high-voltage transmission networks to support data centers and connect offshore wind.

- •

Deployment of a universal smart meter network and advanced distribution management system (ADMS).

- •

Development of energy storage facilities at utility scale to support renewable integration.

Growth Opportunities

Market Expansion

- Expansion Vector:

Powering the Data Center Alley

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Execute a dedicated, multi-billion dollar infrastructure investment plan focused on building new transmission lines, substations, and generation to serve the accelerating demand in Northern Virginia.

Product Opportunities

- Opportunity:

Offshore Wind Development (CVOW Project)

Market Demand Evidence:State mandates for clean energy (Virginia Clean Economy Act) and general demand for carbon-free power.

Strategic Fit:Core to the company's decarbonization strategy and a major source of long-term rate base growth.

Development Recommendation:Aggressively manage the on-time, on-budget completion of the $10B+ CVOW project, mitigating supply chain and construction risks to ensure it comes online by the 2026 target.

- Opportunity:

Utility-Scale Solar & Battery Storage

Market Demand Evidence:IRP projects the need for ~12,000 MW of new solar and 4,500 MW of battery storage to meet future demand and renewable targets.

Strategic Fit:Complements offshore wind by providing a diversified renewable portfolio and addresses grid stability challenges.

Development Recommendation:Establish a programmatic approach to site acquisition, permitting, and construction for solar and storage projects to achieve scale and efficiency.

- Opportunity:

Electric Vehicle (EV) Infrastructure Services

Market Demand Evidence:Growing EV adoption requires significant investment in public charging networks and grid upgrades to support at-home charging.

Strategic Fit:Represents a new, regulated or semi-regulated growth area that promotes beneficial electrification.

Development Recommendation:Launch pilot programs for public fast-charging, managed charging (V1G), and fleet electrification to build expertise and justify larger-scale investment.

- Opportunity:

Exploring Small Modular Reactors (SMRs)

Market Demand Evidence:Long-term need for firm, carbon-free baseload power to complement intermittent renewables, especially for data centers.

Strategic Fit:Positions Dominion as a leader in next-generation nuclear technology, providing a long-term growth vector post-2030.

Development Recommendation:Form strategic partnerships (e.g., with Amazon) to explore technology viability, siting, and regulatory pathways for SMR deployment in the mid-2030s.

Channel Diversification

- Channel:

Digital Customer Engagement Platform

Fit Assessment:High

Implementation Strategy:Leverage the new Customer Information Platform and smart meter data to create a digital marketplace for energy-saving products, services, and third-party solutions.

Strategic Partnerships

- Partnership Type:

Hyperscale Data Center Collaboration

Potential Partners

- •

Amazon Web Services

- •

Microsoft Azure

- •

Google Cloud

Expected Benefits:Long-term power purchase agreements (PPAs), joint investment in renewable projects, and collaborative load planning to de-risk infrastructure investments.

- Partnership Type:

Technology & Grid Modernization

Potential Partners

- •

Siemens

- •

GE

- •

Hitachi Energy

Expected Benefits:Access to cutting-edge smart grid technology, co-development of software for grid management (DERMS/ADMS), and improved supply chain security.

- Partnership Type:

Clean Energy Development

Potential Partners

Stonepeak (existing partner for CVOW)

Infrastructure Investment Funds

Expected Benefits:Shared capital investment for large-scale projects, risk mitigation, and access to specialized project finance expertise.

Growth Strategy

North Star Metric

Regulated Rate Base Growth ($ Billions)

This metric directly reflects the core growth driver of a regulated utility: deploying capital into approved infrastructure projects that generate long-term, predictable earnings for shareholders.

Achieve a Compound Annual Growth Rate (CAGR) of 8-10% in the rate base over the next five years, driven by the current capital plan.

Growth Model

Capital-Led Regulated Growth

Key Drivers

- •

Capital Expenditures on New Generation (especially renewables).

- •

Investment in Transmission & Distribution Grid Modernization.

- •

Favorable Regulatory Outcomes (rate case approvals).

- •

Sustained Electricity Demand Growth (led by data centers).

Systematically execute the multi-year, $50B+ capital investment plan outlined in the IRP, focusing on securing regulatory approvals and managing projects to completion on-time and on-budget.

Prioritized Initiatives

- Initiative:

Execute Coastal Virginia Offshore Wind (CVOW) Project

Expected Impact:High

Implementation Effort:Very High

Timeframe:Now - End of 2026

First Steps:Continue rigorous project management of construction milestones, manage supply chain logistics, and maintain constant communication with regulatory bodies and partners.

- Initiative:

Launch 'Data Center Alley' Grid Expansion Program

Expected Impact:High

Implementation Effort:Very High

Timeframe:3-5 Years

First Steps:Secure regulatory approval for the first tranche of transmission and substation projects specifically identified to serve new data center load.

- Initiative:

Accelerate Solar and Storage Deployment

Expected Impact:Medium

Implementation Effort:High

Timeframe:2-4 Years

First Steps:Acquire and permit a portfolio of project sites sufficient to meet the next 3 years of deployment targets outlined in the IRP.

- Initiative:

Full-Scale Smart Meter & Grid Automation Rollout

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:2-3 Years

First Steps:Finalize vendor selection and file for regulatory approval for the remaining service territory, emphasizing operational efficiency and customer benefits.

Experimentation Plan

High Leverage Tests

- Experiment:

Vehicle-to-Grid (V2G) Pilot Program

Hypothesis:Bi-directional EV charging can provide valuable grid stabilization services and create a new revenue stream.

- Experiment:

Green Hydrogen Production Pilot

Hypothesis:Leveraging excess renewable energy to produce green hydrogen can provide long-duration storage and decarbonize other sectors.

- Experiment:

Performance-Based Ratemaking for Energy Efficiency

Hypothesis:A ratemaking mechanism that rewards the utility for achieving specific energy reduction targets will accelerate efficiency program adoption.

For technical pilots: assess technical viability, cost-effectiveness, and grid impact. For regulatory experiments: measure customer adoption, cost-benefit to the system, and alignment with policy goals.

Initiate 1-2 strategic pilot programs annually, with a 24-36 month cycle for testing, data collection, and evaluation for potential scaling.

Growth Team

A centralized 'Strategic Growth & Innovation' group that works cross-functionally with Regulation, Operations, and Finance.

Key Roles

- •

Director of Large Load Interconnection (Data Centers)

- •

Head of New Energy Services (EVs, Hydrogen, Storage)

- •

Manager of Strategic Partnerships

- •

Regulatory Innovation & Strategy Lead

Develop capabilities through a combination of targeted external hiring of individuals with commercial and tech backgrounds, and internal upskilling programs focused on project finance, digital technologies, and stakeholder engagement.