eScore

dominos.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Domino's exhibits a masterful digital presence, functioning as a technology leader that sells pizza. Its strategy ensures overwhelming dominance for high-intent, transactional search queries like 'pizza delivery,' driven by a massive brand footprint and app-first approach. The company's 'AnyWare' technology and innovations like Pinpoint Delivery demonstrate a sophisticated approach to capturing customers across a multitude of digital platforms, including voice and text, ensuring a consistent multi-channel presence. While its content authority is built on technological innovation rather than traditional content marketing, its domain authority is exceptionally high, solidifying its top search rankings.

Exceptional search intent alignment and dominance for high-value, transactional keywords, seamlessly converting user intent into orders through a highly optimized digital ecosystem.

Proactively create and optimize content around its technological innovations (e.g., 'pizza delivery to a park,' 'AI food ordering') to capture emerging search queries and further solidify its brand identity as a tech leader.

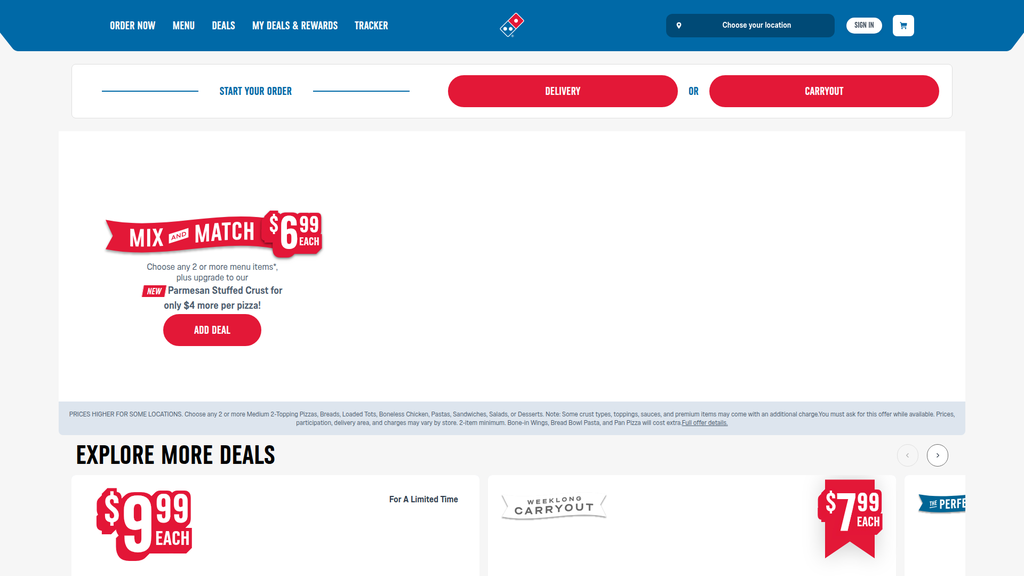

The brand's communication is a masterclass in transactional efficiency, relentlessly focused on value and calls to action that drive immediate orders. Messaging around promotions like the 'Mix & Match' deal is exceptionally clear and effectively targets value-conscious families and students. However, this strength comes with a significant weakness: a near-total failure to communicate its most powerful differentiator—its technological superiority—on its primary consumer-facing platforms. This creates a purely transactional relationship, missing the opportunity to build brand equity around innovation.

An incredibly clear and consistent messaging hierarchy that prioritizes value and direct calls-to-action, minimizing friction and expertly guiding users toward conversion.

Integrate messaging about technology leadership (e.g., Pizza Tracker, Pinpoint Delivery) into the main user journey to differentiate the brand beyond price and build long-term brand equity.

Domino's website and app are ruthlessly optimized for conversion, serving as a benchmark for frictionless e-commerce. The user journey is designed to minimize cognitive load and guide users from landing page to checkout in the fewest possible steps. Due to the landmark *Robles v. Domino's* lawsuit, the company maintains a high level of accessibility compliance, which not only mitigates legal risk but also expands its addressable market. The entire experience is engineered for speed and efficiency across all devices, perfectly aligning with the brand's core promise.

A laser-focused, low-friction conversion funnel that eliminates virtually all barriers to ordering, making the process exceptionally fast and intuitive for new and returning users.

The user interface, while functional, is visually dated. A modernization of the UI with subtle micro-interactions and improved aesthetics could enhance perceived brand quality and user delight without compromising its hallmark efficiency.

Domino's credibility is anchored in its globally recognized brand, which serves as the ultimate trust signal. This is reinforced by a consistent product and a reliable digital experience, including transparent features like the Pizza Tracker. The company offers unique risk mitigation through its 'Delivery Insurance' program and maintains a high degree of transparency in its privacy policies and pricing. While it lacks traditional third-party seals or numerous customer testimonials on its site, its market leadership and sheer scale of successful daily transactions provide overwhelming proof of reliability.

Immense brand recognition and market leadership act as the primary trust signal, assuring customers of a reliable and consistent experience.

Incorporate social proof elements, such as customer ratings or 'fan favorite' tags on menu items, to build deeper trust and help guide user choice.

Domino's competitive advantage is formidable and highly sustainable, rooted in a 'moat' built from technology, operational efficiency, and a massive scale. Its proprietary tech stack, vertically integrated supply chain, and efficient franchise model are incredibly difficult for competitors to replicate. This system allows for continuous innovation in both the digital customer experience and delivery logistics. While competitors can match prices, they struggle to match the seamless integration of Domino's entire value chain.

A deeply integrated ecosystem of proprietary technology, a vast and efficient franchisee network, and a vertically-integrated supply chain that creates a highly sustainable competitive advantage.

Address the brand perception of lower food quality compared to competitors like Papa John's, which position themselves as a premium alternative and represent a key vulnerability.

The business model is exceptionally scalable due to its asset-light, 99% franchised structure, which allows for rapid global expansion with minimal corporate capital expenditure. Strong unit economics and a focus on franchisee profitability fuel continued growth. The centralized supply chain and technology platforms create significant operational leverage. While domestic markets show signs of saturation, a significant runway for international growth remains, particularly in emerging markets like India and China.

An asset-light franchise model that facilitates rapid, capital-efficient global expansion while generating high-margin, predictable revenue from royalties and supply chain sales.

Mitigate the growing operational bottleneck of labor shortages, especially for delivery drivers, which is a primary constraint on meeting demand and ensuring service quality.

Domino's possesses one of the most coherent and effective business models in the QSR industry. There is perfect alignment between its technology-first strategy, its franchisee-focused operational model, and its value/convenience-based customer value proposition. Resources are strategically allocated to technology and franchisee support, which are the primary drivers of growth. This strategic focus has allowed Domino's to perfectly time the market's shift to digital and off-premise dining, creating a self-reinforcing system of success.

Exceptional alignment between the core strategy (tech-driven convenience), the business structure (asset-light franchise model), and revenue streams (royalties, supply chain), creating a powerful, self-reinforcing growth engine.

Reduce the model's heavy dependence on the financial health of its franchisees, who are vulnerable to macroeconomic pressures like rising food and labor costs, posing a systemic risk.

As the world's largest pizza company, Domino's wields significant market power, consistently gaining share and setting industry standards for digital innovation. Its massive scale provides substantial leverage over suppliers and partners. While it engages in promotional pricing, its strong brand loyalty and convenient digital platform give it a degree of pricing power. The primary threat to its power is the rise of third-party delivery aggregators, which can disintermediate the customer relationship and commoditize the market.

Dominant market share and the ability to influence industry trends, particularly in digital ordering and delivery logistics, forcing competitors to constantly react to its innovations.

Counter the strategic threat from third-party delivery aggregators, which erode Domino's direct customer relationship and challenge its core in-house delivery advantage.

Business Overview

Business Classification

Franchise-based Quick Service Restaurant (QSR)

eCommerce & Food Delivery

Foodservice

Sub Verticals

- •

Pizza Delivery

- •

Fast Food

- •

Food Technology

Mature

Maturity Indicators

- •

Extensive global presence with over 20,000 stores in 90+ markets.

- •

High brand recognition and established market leadership.

- •

Consistent dividend payments and share repurchase programs.

- •

Focus on operational efficiency, franchisee profitability, and incremental growth.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Supply Chain Sales to Franchisees

Description:Sale of pizza dough, food ingredients, and equipment to franchisees. This is the largest revenue segment, accounting for approximately 60% of total revenue, but operates on lower margins to ensure franchisee profitability.

Estimated Importance:Primary

Customer Segment:Franchisees

Estimated Margin:Low

- Stream Name:

Franchise Royalties and Fees

Description:Collection of ongoing royalties (typically 5.5% of sales) and one-time franchise fees from store operators. This is a high-margin, stable revenue source.

Estimated Importance:Primary

Customer Segment:Franchisees

Estimated Margin:High

- Stream Name:

Company-Owned Store Sales

Description:Direct sales of pizza and other food items to consumers through a smaller number of corporate-owned stores. This represents a smaller portion of overall revenue compared to the franchise-based streams.

Estimated Importance:Secondary

Customer Segment:General Consumers

Estimated Margin:Medium

- Stream Name:

Technology Fees

Description:Franchisees pay technology-related fees for use of the proprietary point-of-sale system (PULSE), online ordering platforms, and other digital innovations.

Estimated Importance:Tertiary

Customer Segment:Franchisees

Estimated Margin:High

Recurring Revenue Components

- •

Franchise Royalties

- •

Ongoing Supply Chain Purchases by Franchisees

- •

Technology Fees

Pricing Strategy

Value-Based & Promotional Pricing

Mid-range

Transparent

Pricing Psychology

- •

Bundling (e.g., 'Mix & Match' deals)

- •

Charm Pricing (e.g., $6.99)

- •

Promotional Discounts (App-only deals, coupons)

- •

Loyalty Program Incentives

Monetization Assessment

Strengths

- •

Highly diversified and resilient revenue model not solely dependent on food sales.

- •

Franchise model allows for rapid, capital-light expansion.

- •

Vertically integrated supply chain creates a stable, albeit low-margin, revenue stream and ensures product consistency.

- •

High-margin royalties provide predictable cash flow.

Weaknesses

- •

Heavily reliant on the financial health and operational performance of franchisees.

- •

Low margins in the dominant supply chain segment.

- •

Growth is tied to the ability to open new franchise locations, which may be reaching saturation in some domestic markets.

Opportunities

- •

Increasing technology fees as more digital services are rolled out to franchisees.

- •

Strategic price increases within the supply chain, balanced against franchisee profitability.

- •

Monetizing data analytics by providing premium insights to franchisees.

- •

Expanding partnerships with third-party delivery aggregators, projected to be a significant sales driver.

Threats

- •

Rising food and labor costs could squeeze franchisee margins, potentially impacting royalty payments and store growth.

- •

Intense price competition from other major pizza chains and QSRs.

- •

Economic downturns reducing consumer discretionary spending on food delivery.

Market Positioning

Technology-enabled convenience, speed, and value

Market Leader in the U.S. and global pizza delivery segment.

Target Segments

- Segment Name:

Value-Seeking Families

Description:Families with children looking for a convenient, affordable, and crowd-pleasing meal option, particularly for evening and weekend meals.

Demographic Factors

- •

Age 25-50

- •

Middle-income households

- •

Reside in suburban and urban areas.

Psychographic Factors

- •

Value convenience and time-saving solutions

- •

Budget-conscious

- •

Seek reliable and consistent food options

Behavioral Factors

- •

High frequency of ordering for delivery or carryout

- •

Responsive to promotions and bundle deals (e.g., 'Mix & Match')

- •

Often order for shared occasions (e.g., family dinner, parties)

Pain Points

- •

Time-consuming meal preparation

- •

Finding meal options that satisfy everyone in the family

- •

High cost of dining out or ordering from multiple places

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Tech-Savvy Young Adults & Students

Description:Individuals aged 15-30, including high school/college students and young professionals, who prioritize digital convenience and are frequent users of mobile and online ordering.

Demographic Factors

- •

Age 15-30

- •

Lower to middle income

- •

Urban and semi-urban dwellers.

Psychographic Factors

- •

Early adopters of technology

- •

Value speed and efficiency

- •

Spontaneous and occasion-driven (e.g., late-night study, social gatherings).

Behavioral Factors

- •

Primarily use mobile apps for ordering

- •

High engagement with loyalty programs

- •

Likely to order during non-traditional hours

- •

Influenced by digital marketing and social media

Pain Points

- •

Clunky or slow ordering processes

- •

Lack of transparency in delivery time

- •

Limited budget for meals

Fit Assessment:Excellent

Segment Potential:High

Market Differentiation

- Factor:

Technology & Digital Ordering Platform

Strength:Strong

Sustainability:Sustainable

- Factor:

Efficient Delivery & Logistics Network

Strength:Strong

Sustainability:Sustainable

- Factor:

Franchise Model & Scalability

Strength:Strong

Sustainability:Sustainable

- Factor:

Brand Recognition & Marketing

Strength:Strong

Sustainability:Sustainable

Value Proposition

Delivering craveable pizza and more with unparalleled convenience, speed, and value, powered by industry-leading technology.

Excellent

Key Benefits

- Benefit:

Convenience

Importance:Critical

Differentiation:Unique

Proof Elements

- •

AnyWare ordering technology (via app, web, voice, smart devices).

- •

Extensive network of stores for rapid delivery/carryout

- •

Real-time Pizza Tracker

- Benefit:

Speed

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Historical '30 minutes or less' guarantee which built the brand's reputation.

- •

Optimized delivery logistics and store placement

- •

AI-powered tools for order prediction and prep planning.

- Benefit:

Value

Importance:Important

Differentiation:Common

Proof Elements

- •

Mix & Match deal

- •

Domino's Rewards loyalty program

- •

Regular promotional offers and coupons

Unique Selling Points

- Usp:

Technology-First Approach: A food company that operates like a tech company, focusing on a seamless digital customer experience from ordering to tracking.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Fortressing Strategy: High saturation of stores in a given market to reduce delivery times, improve service, and dominate local market share.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

The need for a quick, easy, and reliable meal solution.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Uncertainty and lack of transparency in food delivery times.

Severity:Major

Solution Effectiveness:Complete

- Problem:

The high cost of convenient food options for families and groups.

Severity:Major

Solution Effectiveness:Partial

Value Alignment Assessment

High

The value proposition directly aligns with the growing consumer demand for convenience, speed, and digital integration in the QSR and food delivery market.

High

The focus on digital convenience and value strongly resonates with the core target segments of tech-savvy young adults and budget-conscious families.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Franchisees (over 99% of stores).

- •

Technology Partners (for AI, cloud services, and digital platforms).

- •

Third-Party Delivery Aggregators (e.g., Uber Eats, DoorDash).

- •

Food and Equipment Suppliers.

Key Activities

- •

Franchise management and support

- •

Supply chain and logistics management.

- •

Technology development and innovation (e.g., ordering platforms, AI tools).

- •

Brand marketing and advertising

- •

Menu innovation and product development.

Key Resources

- •

Strong global brand recognition.

- •

Proprietary technology platforms (e.g., PULSE POS, online ordering).

- •

Extensive franchise and store network.

- •

Efficient and vertically integrated supply chain.

Cost Structure

- •

Supply chain costs (food, equipment, distribution)

- •

Marketing and advertising expenses (funded by franchisees and corporate)

- •

Technology infrastructure and R&D

- •

General and administrative expenses for corporate operations

Swot Analysis

Strengths

- •

Asset-light, highly scalable franchise business model.

- •

Industry-leading digital and mobile ordering technology.

- •

Powerful brand recognition and a massive global footprint.

- •

Efficient, vertically integrated supply chain ensuring consistency and cost control.

Weaknesses

- •

Over-reliance on the success and compliance of franchisees.

- •

Menu is less diverse compared to broader QSR competitors.

- •

Perception as a 'value' brand can make it difficult to compete in the premium pizza segment.

- •

Negative publicity from a single franchise can impact the entire brand.

Opportunities

- •

Further international expansion, particularly in emerging markets.

- •

Leveraging AI and data analytics for hyper-personalization and operational efficiency.

- •

Expanding menu offerings to capture new dayparts and customer preferences.

- •

Growing revenue from third-party delivery aggregator partnerships.

Threats

- •

Intense competition from other pizza chains (Pizza Hut, Papa John's) and third-party delivery platforms offering wide restaurant choices.

- •

Rising food, labor, and energy costs impacting franchisee profitability.

- •

Shifting consumer preferences towards healthier eating habits.

- •

Economic volatility impacting discretionary consumer spending.

Recommendations

Priority Improvements

- Area:

Menu Diversification

Recommendation:Strategically expand beyond pizza-centric offerings to include more diverse meal options, such as expanded salads, bowls, or premium sandwiches, to increase order frequency and capture a wider range of meal occasions.

Expected Impact:High

- Area:

Franchisee Profitability Tools

Recommendation:Develop and deploy more advanced AI-driven tools for franchisees that focus on optimizing labor scheduling, inventory management, and local marketing spend to help mitigate the impact of rising operational costs.

Expected Impact:Medium

- Area:

Loyalty Program Enhancement

Recommendation:Evolve the 'Domino's Rewards' program to incorporate tiered loyalty levels and personalized, non-monetary rewards to increase customer engagement and lifetime value beyond simple discounts.

Expected Impact:Medium

Business Model Innovation

- •

Launch a 'Domino's Kitchen' concept in dense urban areas—smaller footprint, carryout/delivery-only locations (ghost kitchens) with a curated menu to lower overhead and accelerate expansion.

- •

Develop a B2B supply chain service, leveraging its logistics network to supply other smaller, non-competing food businesses with ingredients or distribution services.

- •

Explore subscription models, such as a 'Pizza Pass' offering a set number of discounted orders per month to create a more predictable, recurring consumer revenue stream.

Revenue Diversification

- •

Introduce a line of branded, store-sold grocery items like pizza sauces, dough, or spice blends.

- •

Monetize its technology stack by licensing a white-label version of its ordering and delivery management software to independent pizzerias or other QSR chains.

- •

Expand catering services with dedicated packages and ordering platforms for corporate and large-scale events.

Domino's operates a highly mature, resilient, and technologically advanced business model that has positioned it as a global leader in the QSR pizza industry. The company's core strength lies in its asset-light franchise structure, which facilitates rapid, low-cost global expansion while generating high-margin, predictable revenue through royalties and fees. This is brilliantly complemented by a vertically integrated supply chain that, while operating on lower margins, ensures product consistency, creates a symbiotic relationship with franchisees, and represents the largest single source of revenue.

The company's strategic pivot from a traditional food retailer to a 'tech company that sells pizza' has been the primary driver of its competitive advantage. Its industry-leading digital ordering platforms, customer-facing innovations like the Pizza Tracker, and internal AI-driven operational tools create significant defensibility and align perfectly with modern consumer behavior. This technological focus has solidified its value proposition of convenience and speed, allowing it to effectively serve its core target segments of value-seeking families and tech-savvy young adults.

However, the model's maturity presents challenges. Key markets like the U.S. may be approaching store saturation, making incremental growth more difficult. The model is also heavily exposed to external economic pressures, such as rising food and labor costs, which directly impact the profitability of its franchisees—the lifeblood of the system. Intense competition from both direct rivals and third-party delivery aggregators who offer greater choice poses a continuous threat.

Future evolution hinges on strategic innovation. The integration with delivery aggregators is a necessary defensive and offensive move to capture a wider audience. The next phase of growth will require further diversification beyond its core pizza offerings to increase ticket sizes and capture new meal occasions. Furthermore, deepening its technological moat through advanced AI and data analytics will be critical to enhance personalization, optimize logistics, and provide greater value to franchisees, thereby ensuring the long-term sustainability and steady growth trajectory of its powerful business model. The 'Hungry for MORE' strategy, focusing on product, operations, value, and franchisee success, provides a clear roadmap to address these challenges and capitalize on future opportunities.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Brand Recognition & Marketing Spend

Impact:High

- Barrier:

Supply Chain & Logistics Network

Impact:High

- Barrier:

Franchise Network Scale

Impact:High

- Barrier:

Technology & Digital Infrastructure

Impact:Medium

- Barrier:

Capital Investment

Impact:Medium

Industry Trends

- Trend:

Digital Transformation & AI

Impact On Business:Reinforces Domino's core strength but requires continuous investment in mobile ordering, AI-powered personalization, and automation to maintain leadership.

Timeline:Immediate

- Trend:

Value Redefined Beyond Price

Impact On Business:Shifts focus from purely low-cost deals to a balance of price, quality, and convenience. Domino's Mix & Match offer is well-positioned, but perceived quality vs. competitors is a constant battle.

Timeline:Immediate

- Trend:

Rise of Third-Party Delivery Apps

Impact On Business:Creates both a threat by disintermediating the customer relationship and an opportunity if leveraged strategically. Domino's in-house delivery is a key differentiator but faces pressure from the convenience of aggregators.

Timeline:Immediate

- Trend:

Health & Wellness Focus

Impact On Business:Drives demand for 'better-for-you' ingredients, plant-based options, and menu transparency. Requires menu innovation to cater to health-conscious segments without alienating the core customer base.

Timeline:Near-term

- Trend:

Menu Diversification & Flavor Innovation

Impact On Business:Customers, especially younger demographics, seek novel and global flavors. Domino's must innovate beyond pizza with items like Loaded Tots and Oven-Baked Dips to maintain excitement and capture new dayparts.

Timeline:Near-term

Direct Competitors

- →

Pizza Hut

Market Share Estimate:Second largest, approx. 23%-29% of online/chain market share.

Target Audience Overlap:High

Competitive Positioning:Positions as a family-friendly brand with a legacy in dine-in, offering a broad menu beyond pizza (e.g., pasta, wings).

Strengths

- •

Strong global brand recognition and loyalty.

- •

Extensive menu with diverse non-pizza offerings like wings and pasta.

- •

Perceived as a more traditional, dine-in restaurant experience.

- •

Strong backing from parent company Yum! Brands.

Weaknesses

- •

Slower to adapt to the digital-first, delivery-focused model.

- •

Reports of declining customer satisfaction and inconsistent franchisee quality.

- •

Perceived as less of a value player compared to Domino's or Little Caesars.

- •

Brand franchising in remote and rural areas is a weakness, creating market gaps.

Differentiators

- •

Iconic menu items like the 'Stuffed Crust Pizza'.

- •

Focus on the dine-in experience in many locations.

- •

Broader menu variety, positioning as a full casual dining option.

- →

Papa John's

Market Share Estimate:Third largest, approx. 21%-22% of online/chain market share.

Target Audience Overlap:High

Competitive Positioning:Focuses on premium quality with its 'Better Ingredients. Better Pizza.' slogan.

Strengths

- •

Strong brand identity centered on quality ingredients.

- •

High customer satisfaction ratings and brand loyalty.

- •

Successful product innovations like 'Papadias'.

- •

Robust digital sales platform.

Weaknesses

- •

Higher price point compared to competitors, making it vulnerable in a price-sensitive market.

- •

Past brand reputation issues and controversies.

- •

Heavy reliance on promotional activities can erode margins.

- •

Limited menu variety compared to Pizza Hut.

Differentiators

- •

Explicit marketing focus on the quality and freshness of ingredients.

- •

Unique side items like Garlic Knots and signature dipping sauces.

- •

Slightly more premium positioning.

- →

Little Caesars

Market Share Estimate:Fourth largest, approx. 13% of chain market share.

Target Audience Overlap:Medium

Competitive Positioning:Extreme value and convenience, epitomized by its 'Hot-N-Ready' model for immediate carryout.

Strengths

- •

Unbeatable value proposition with very low price points.

- •

'Hot-N-Ready' model provides instant gratification for carryout customers.

- •

Strong brand recognition and simple, effective marketing ('Pizza! Pizza!').

- •

Largest carry-out pizza chain in the world.

Weaknesses

- •

Lower perceived quality compared to the other 'big three'.

- •

Historically weak delivery infrastructure, though this is changing.

- •

Limited menu options and customization.

- •

Inconsistent store management and franchisee issues.

Differentiators

- •

The 'Hot-N-Ready' concept is a unique service model in the pizza industry.

- •

Price leadership, positioning as the most affordable option.

- •

Focus on the carryout segment.

Indirect Competitors

- →

Third-Party Delivery Aggregators (DoorDash, Uber Eats, Grubhub)

Description:These platforms offer consumers a single app to order from a vast array of local restaurants, including local pizzerias, other QSRs, and casual dining chains.

Threat Level:High

Potential For Direct Competition:They are already competing for 'share of stomach' and control of the customer ordering interface. They could launch their own ghost kitchens or private label food brands.

- →

Other Quick Service Restaurants (QSRs) (McDonald's, Taco Bell, Chick-fil-A)

Description:Compete for the same convenient, affordable meal occasions. Their offerings (burgers, tacos, chicken sandwiches) are direct substitutes for a quick pizza dinner.

Threat Level:High

Potential For Direct Competition:Low likelihood of selling pizza, but high likelihood of innovating on delivery and value to capture Domino's customer base.

- →

Fast-Casual Pizza Chains (MOD Pizza, Blaze Pizza)

Description:Offer a more customizable, higher-quality, and 'build-your-own' pizza experience at a slightly higher price point. They appeal to consumers seeking fresher ingredients and personalization.

Threat Level:Medium

Potential For Direct Competition:Their model is fundamentally different (fast-casual vs. delivery), but they are capturing a growing segment of the pizza market and setting new quality expectations.

- →

Grocery & Convenience Stores

Description:Offer a wide variety of frozen, take-and-bake, and pre-made hot pizzas that represent a significant, low-cost alternative for at-home consumption.

Threat Level:Medium

Potential For Direct Competition:Low, but their improvement in quality and variety chips away at the low-end market.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Technology & Digital Ordering Platform

Sustainability Assessment:Highly sustainable. Domino's has a significant first-mover advantage and a culture of innovation (e.g., Domino's Tracker, AnyWare ordering) that is deeply integrated into its operations.

Competitor Replication Difficulty:Hard

- Advantage:

Efficient Delivery & Logistics Network

Sustainability Assessment:Highly sustainable. The vertically integrated supply chain and vast, experienced franchisee/driver network are optimized for speed and cost-efficiency, which is difficult for competitors or third parties to replicate profitably.

Competitor Replication Difficulty:Hard

- Advantage:

Strong Brand Recognition & Market Penetration

Sustainability Assessment:Sustainable. With over 18,800 stores globally and decades of marketing, Domino's has immense brand equity and top-of-mind awareness in the pizza delivery category.

Competitor Replication Difficulty:Hard

- Advantage:

Franchisee Profitability Model

Sustainability Assessment:Sustainable. The business model is designed to create profitable franchisees (over 95% of whom started as employees), ensuring alignment, operational excellence, and continued growth.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'Specific Value Promotions (e.g., Mix & Match $6.99)', 'estimated_duration': '1-2 years'}

{'advantage': 'Novelty Menu Items (e.g., Loaded Tots)', 'estimated_duration': '6-18 months'}

Disadvantages

- Disadvantage:

Perception of Lower Food Quality vs. Premium Competitors

Impact:Major

Addressability:Moderately

- Disadvantage:

Dependence on In-House Delivery in a Market Shifting to Aggregators

Impact:Major

Addressability:Difficult

- Disadvantage:

Limited Menu Customization Compared to Fast-Casual Players

Impact:Minor

Addressability:Easily

Strategic Recommendations

Quick Wins

- Recommendation:

Launch a targeted marketing campaign emphasizing the speed and reliability of in-house delivery versus the potential pitfalls of third-party apps (e.g., cold food, incorrect orders).

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Introduce a 'Gourmet Creations' line of limited-time offer (LTO) pizzas with premium ingredients to test the waters in the higher-margin, premium quality segment.

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Enhance the Domino's Rewards program with more personalized offers and gamification elements to increase order frequency and customer loyalty.

Expected Impact:High

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Expand plant-based and healthier menu options, including alternative crusts (e.g., cauliflower) and more salad/vegetable-forward sides, to attract health-conscious consumers.

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Invest in AI-driven personalization within the app to predict customer orders, suggest relevant add-ons, and tailor promotions, increasing average order value.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Develop a formal catering and bulk-ordering program ('Domino's for Business') with a dedicated ordering portal to capture the B2B and large-events market.

Expected Impact:High

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Continue R&D and pilot programs for autonomous delivery vehicles and drone technology to reduce long-term labor costs and further solidify delivery leadership.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Explore strategic acquisition of a smaller, fast-casual pizza chain to gain a foothold in the premium segment and acquire talent/recipes without diluting the core Domino's brand.

Expected Impact:Medium

Implementation Difficulty:Difficult

- Recommendation:

Redesign store formats to create smaller, more efficient delivery/carryout hubs ('Domino's Go') in dense urban areas, reducing real estate costs and improving delivery times.

Expected Impact:High

Implementation Difficulty:Difficult

Maintain and fortify the position as the unparalleled leader in convenient, technology-driven pizza delivery, while strategically introducing premium options to elevate brand perception and capture higher-margin sales.

Double down on technological superiority and delivery efficiency as the core differentiator. Layer this with menu innovation that creates buzz and selectively targets new customer segments (e.g., health-conscious, flavor-seekers) to broaden appeal beyond the core value proposition.

Whitespace Opportunities

- Opportunity:

Premium/Artisanal Pizza Segment

Competitive Gap:Direct competitors (Pizza Hut, Papa John's) have a slightly more premium perception but have not fully captured the 'gourmet' market. There's a gap between mass-market pizza and expensive local pizzerias.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Comprehensive Catering Services

Competitive Gap:None of the major pizza chains have a robust, user-friendly B2B catering platform. This market is served by local pizzerias and non-pizza caterers.

Feasibility:High

Potential Impact:High

- Opportunity:

Expanded Plant-Based & Allergen-Free Menus

Competitive Gap:While competitors offer some options, no major chain is the 'go-to' for consumers with specific dietary needs (vegan, gluten-free). Owning this niche could build significant loyalty.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Late-Night Delivery Dominance

Competitive Gap:The late-night food delivery market is fragmented and often dominated by third-party apps with high fees. A concerted marketing and operational focus on being the most reliable late-night option could capture significant share.

Feasibility:High

Potential Impact:Medium

The competitive landscape for Domino's is mature and dominated by an oligopoly consisting of itself, Pizza Hut, Papa John's, and Little Caesars. Domino's has successfully positioned itself as the undisputed market leader, not by having the 'best' pizza, but by creating the most efficient, technologically advanced, and convenient ordering and delivery system in the industry. This technological prowess, combined with a massive, efficient franchise and supply chain network, forms its primary sustainable competitive advantage.

Direct competitors present distinct challenges: Pizza Hut leverages its legacy brand recognition and broader menu; Papa John's competes on a platform of higher-quality ingredients at a premium price; and Little Caesars dominates the extreme value, carryout-focused segment. While Domino's leads them all in market share, it remains vulnerable to perceptions of lower food quality compared to Papa John's and the growing fast-casual segment.

The most significant disruptive threat comes from indirect competitors, specifically third-party delivery aggregators like DoorDash and Uber Eats. These platforms are fundamentally changing consumer behavior by offering choice and convenience that challenges Domino's core value proposition. While Domino's has strategically avoided these platforms to maintain control over its customer data and delivery experience, this insular approach risks losing customers who prioritize the convenience of a single aggregator app. Other QSRs also compete intensely for the same meal occasions, leveraging their own value deals and delivery partnerships.

Strategic whitespace for Domino's lies in areas its hyper-efficient model has traditionally overlooked. There is a significant opportunity to capture a share of the premium/gourmet market with a dedicated sub-brand or line of LTOs, elevating brand perception without alienating its core value-conscious customer. Furthermore, a formalized and digitally streamlined catering service for businesses and events is a largely untapped market by the major chains. Expanding into more diverse dietary categories, such as becoming a leader in plant-based or allergen-free options, could also build a loyal new customer base.

To sustain its leadership, Domino's must pursue a dual strategy: first, continue to relentlessly innovate its core technology and delivery operations to widen its efficiency gap with competitors. Second, it must selectively and strategically innovate its menu to address evolving consumer tastes for higher quality, healthier options, and flavor variety. This will allow it to defend its market share from direct competitors while mitigating the long-term threat from market disruptors.

Messaging

Message Architecture

Key Messages

- Message:

Get a great deal on food with the Mix & Match offer for $6.99 each.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Banner (Spanish site)

- Message:

Join Domino's Rewards to earn free rewards in just 2 orders.

Prominence:Primary

Clarity Score:High

Location:Top banner of the homepage (English site)

- Message:

Start your order for Delivery or Carryout.

Prominence:Primary

Clarity Score:High

Location:Main initial prompt on the homepage

- Message:

Explore our wide variety of menu items, including a New Crust!

Prominence:Secondary

Clarity Score:High

Location:Browse Menu section

The messaging hierarchy is exceptionally effective and ruthlessly prioritized for conversion. Value-based offers (Mix & Match) and direct calls to order ('Empieza tu Pedido') are the most prominent elements. Secondary messages are organized around menu exploration, successfully guiding a user from 'What's for dinner?' to placing an order.

Messaging is highly consistent across the observed pages. Whether in English or Spanish, the core focus remains on immediate ordering, value promotions, and the loyalty program. The brand does not deviate into brand storytelling or quality messaging, maintaining a singular transactional focus.

Brand Voice

Voice Attributes

- Attribute:

Promotional

Strength:Strong

Examples

- •

Oferta Mix & Match

- •

$6.99 cada uno

- •

Join now to start earning towardsFreerewards

- Attribute:

Direct & Action-Oriented

Strength:Strong

Examples

- •

Empieza tu Pedido

- •

Pide ya

- •

Build Your Own

- •

Sign In/Join Now

- Attribute:

Functional

Strength:Moderate

Examples

- •

Browse Menu

- •

Entregar o Llevar

- •

We value your privacy.

- Attribute:

Enthusiastic

Strength:Weak

Examples

New Crust!

Tone Analysis

Transactional

Secondary Tones

Promotional

Urgent

Tone Shifts

The tone shifts significantly to a formal, legalistic style in the mandatory 'We value your privacy' section, which is an unavoidable but stark contrast to the promotional main content.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

Domino's provides a wide variety of convenient, craveable food, delivered quickly and at an affordable price.

Value Proposition Components

- Component:

Affordability & Value

Clarity:Clear

Uniqueness:Somewhat Unique

Comment:The '$6.99 each' Mix & Match deal is a highly specific and well-marketed price point that gives Domino's a strong anchor in the value space, even if competitors offer similar deals.

- Component:

Convenience & Speed

Clarity:Clear

Uniqueness:Common

Comment:The focus on 'Delivery or Carryout' is central to the user experience. While fast delivery is a brand hallmark, the homepage messaging doesn't explicitly highlight speed (e.g., the old '30 minutes or it's free' promise), making it a standard industry offering at this stage.

- Component:

Menu Variety & Customization

Clarity:Clear

Uniqueness:Common

Comment:The extensive menu ('Pizzas', 'Breads', 'Loaded Tots', 'Pastas', etc.) is clearly communicated, positioning Domino's as a complete meal provider. However, broad menus are now standard among major competitors.

- Component:

Technology & Innovation

Clarity:Unclear

Uniqueness:Unique

Comment:Despite being known as a 'tech company that sells pizza,' the website's initial messaging completely omits any mention of its key technological differentiators like the Pizza Tracker, AI ordering, or Pinpoint Delivery.

The website messaging differentiates Domino's primarily on aggressive, clear-cut pricing promotions and its rewards program. It successfully carves out a position as the reliable, value-driven choice. However, it fails to capitalize on its significant and unique investments in technology, which could elevate the brand beyond just price.

The messaging positions Domino's as the champion of fast, easy, and affordable meals, directly competing with Pizza Hut and Papa John's on convenience and price. While Papa John's message often leans towards 'better ingredients,' Domino's focuses squarely on the transactional benefits of value and variety. This positioning targets customers who prioritize budget and convenience above all else.

Audience Messaging

Target Personas

- Persona:

Value-Seeking Families & Groups

Tailored Messages

- •

Oferta Mix & Match

- •

$6.99 cada uno

- •

Elige dos o más

Effectiveness:Effective

- Persona:

Convenience-Driven Professionals & Students

Tailored Messages

- •

Empieza tu Pedido

- •

Entregar o Llevar

- •

Pide ya

Effectiveness:Effective

- Persona:

Loyal, Repeat Customers

Tailored Messages

Join now to start earning towardsFreerewards in just 2 orders.

Sign In

Effectiveness:Somewhat

Audience Pain Points Addressed

- •

Feeding multiple people affordably

- •

Needing a quick and easy meal solution without cooking

- •

Decision fatigue (by offering simple, clear deals)

Audience Aspirations Addressed

- •

Feeling like a smart shopper by getting a good deal

- •

Enjoying a satisfying, hassle-free meal

- •

Gaining rewards and recognition for loyalty

Persuasion Elements

Emotional Appeals

- Appeal Type:

Desire for Savings/Value

Effectiveness:High

Examples

$6.99 cada uno

- Appeal Type:

Anticipation of Gratification

Effectiveness:Medium

Examples

- •

Browse Menu

- •

New Crust!

- •

Loaded Tots

- Appeal Type:

Desire for Ease/Simplicity

Effectiveness:High

Examples

Empieza tu Pedido

Pide ya

Social Proof Elements

No itemsTrust Indicators

- •

Strong, established brand recognition

- •

Professional and functional website design

- •

Clear, albeit legally-mandated, privacy policy

Scarcity Urgency Tactics

The primary urgency tactic is implicit in the nature of ordering food for immediate consumption. The messaging 'Pide ya' (Order now) leverages this inherent urgency.

Calls To Action

Primary Ctas

- Text:

Pide ya (Order now)

Location:Mix & Match Offer Banner

Clarity:Clear

- Text:

Join Now

Location:Top Rewards Banner

Clarity:Clear

- Text:

Entregar (Delivery) / Llevar (Carryout)

Location:Initial order prompt

Clarity:Clear

- Text:

Build Your Own

Location:Browse Menu section

Clarity:Clear

The CTAs are extremely effective. They are concise, use strong action verbs, and are placed at logical decision points in the user journey. Their clarity leaves no room for ambiguity, efficiently funneling users directly into the ordering process.

Messaging Gaps Analysis

Critical Gaps

- •

Messaging around technology and innovation (e.g., Pizza Tracker, autonomous delivery efforts) is completely absent, despite being a core part of their business model and a key differentiator.

- •

There is no brand storytelling or messaging related to the company's mission, values, or history. The connection is purely transactional.

- •

Messages highlighting food quality, ingredient sourcing, or freshness are missing. This is a key area where competitors like Papa John's attempt to differentiate.

Contradiction Points

No itemsUnderdeveloped Areas

Emotional Connection: The messaging focuses exclusively on the rational benefits of price and convenience, missing the opportunity to connect with the emotional aspects of sharing a meal.

Social Proof: The website lacks testimonials, user ratings, or indications of popular items ('Fan Favorite'), which are common persuasive elements in e-commerce.

Messaging Quality

Strengths

- •

Exceptional clarity and focus on driving orders.

- •

Powerful communication of value through specific, memorable price points.

- •

A seamless and intuitive messaging hierarchy that guides users to conversion.

- •

High consistency in voice and tone across different language versions of the site.

Weaknesses

- •

Over-reliance on price, which can devalue the brand and create price-sensitive, disloyal customers.

- •

Complete failure to message key technological differentiators, ceding a powerful brand position.

- •

Lack of brand-building content creates a purely transactional relationship with customers.

- •

Absence of social proof or quality indicators that could build deeper trust.

Opportunities

- •

Integrate subtle messaging about the Pizza Tracker or other tech innovations into the ordering flow to reinforce the brand's tech-forward identity without disrupting the user journey.

- •

A/B test value propositions that balance price with quality or convenience, such as 'Hot, fresh, and tracked to your door.'

- •

Use the rewards program to build a sense of community and emotional loyalty, beyond just points accumulation.

- •

Highlight 'Most Popular' or 'Fan Favorite' items within the menu to leverage social proof and simplify choice for new customers.

Optimization Roadmap

Priority Improvements

- Area:

Value Proposition

Recommendation:Incorporate a secondary headline on the homepage that communicates the technology/convenience value proposition. Example: 'The easiest way to get your favorites. Track your order from our store to your door.'

Expected Impact:High

- Area:

Persuasion Elements

Recommendation:Integrate social proof elements directly into the 'Browse Menu' section by adding 'Fan Favorite' or 'Most Ordered' tags to specific items.

Expected Impact:Medium

- Area:

Brand Building

Recommendation:Develop a dedicated 'Our Story' or 'Innovation' section in the footer to house content about the brand's history, tech leadership, and commitment to service for users who want to engage beyond a simple transaction.

Expected Impact:Medium

Quick Wins

- •

Add a small, non-intrusive icon or banner referencing the Pizza Tracker early in the user journey.

- •

Test CTA button copy to include more benefits, e.g., 'Start My $6.99 Deal' vs. 'Order Now'.

- •

Rephrase the rewards message to be more compelling: 'Get free pizza faster. Start earning rewards now.'

Long Term Recommendations

- •

Develop a content marketing strategy that tells stories about the user experience, moving beyond the functional aspects of ordering pizza to the emotional outcomes of sharing a meal.

- •

Invest in personalizing the homepage messaging for returning customers, for example, highlighting their 'usual' order or progress towards their next reward.

- •

Evolve the brand voice to incorporate more personality and fun, reflecting the brand's identity as a casual, enjoyable meal choice, not just a utility.

Domino's website messaging is a masterclass in transactional efficiency. The communication strategy is single-mindedly focused on converting a user's intent to order into a completed sale as quickly and frictionlessly as possible. The message hierarchy is flawless in this regard, prioritizing aggressive value offers (Mix & Match $6.99 deal) and direct, unambiguous calls-to-action ('Order Now,' 'Delivery or Carryout'). The brand voice is direct, promotional, and exceptionally consistent, ensuring the user is never confused about the next step. This laser focus on conversion directly supports business objectives by driving high order volume and catering effectively to its core audience of value- and convenience-seeking customers.

However, this strength is also its primary weakness. The messaging is so transactional that it completely neglects brand building. Domino's has invested heavily in becoming a 'tech company that sells pizza,' yet its most powerful technological differentiator—the Pizza Tracker—and other innovations are absent from the homepage messaging. This is a significant missed opportunity to differentiate on a unique value proposition beyond price, which is a common and easily replicated tactic in the highly competitive fast-food pizza market. The communication builds no emotional connection; it sells a commodity, not an experience. There is no story, no mention of quality, and no social proof to build deeper trust or brand affinity.

In essence, the website's messaging has perfected the science of customer acquisition economics for the short term but invests little in the art of long-term brand equity and differentiation. The immediate business outcome is high sales volume, but the strategic risk is a brand image tied solely to price, making it vulnerable to competitors who can match its deals while also telling a more compelling story about quality or community.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Global market leader in the Quick Service Restaurant (QSR) pizza segment with over 21,000 stores in 90+ markets.

- •

Exceptional brand recognition and consistent same-store sales growth over many consecutive quarters.

- •

High volume of digital sales (over 85% in the U.S.), indicating strong adoption of its technology-forward ordering platforms.

- •

Resilient financial performance and market share gains against key competitors like Pizza Hut and Papa John's.

Improvement Areas

- •

Catering to the growing demand for healthier, 'clean-label', and plant-based menu options.

- •

Developing a more robust 'premium' or 'artisanal' product tier to compete with emerging craft pizzerias.

- •

Further adapting menus to hyper-local tastes in international growth markets.

Market Dynamics

The global QSR market is projected to grow at a CAGR of 4-9% annually.

Mature

Market Trends

- Trend:

Digital and Off-Premises Dominance

Business Impact:Continued investment in digital ordering, delivery technology, and carryout efficiency is critical. Over 85% of Domino's U.S. sales are already digital, providing a strong competitive advantage.

- Trend:

Rise of Third-Party Aggregators

Business Impact:Creates both a competitive threat and a partnership opportunity. Domino's has strategically partnered with Uber Eats to reach new customers while aiming to keep the best value on its own channels.

- Trend:

Demand for Value and Convenience

Business Impact:Value-driven promotions (e.g., Mix & Match) are key for customer acquisition. The 'fortressing' strategy of building more stores in dense areas directly addresses the need for faster, more convenient delivery and carryout.

- Trend:

Flavor Innovation and Customization

Business Impact:Consumers, especially younger demographics, seek bold and novel flavors (e.g., hot honey, global-inspired toppings). Menu innovation is crucial for relevance and attracting new customer segments.

The market is mature but dynamic. The timing is opportune for growth through market share capture, driven by technological superiority and operational efficiency, rather than pure market expansion.

Business Model Scalability

High

Highly scalable due to a 98-99% franchise-based model, which outsources most store-level operational costs and capital expenditure to franchisees.

Significant operational leverage is derived from the centralized supply chain, which sells ingredients to franchisees, and the proprietary technology platform that serves the entire network.

Scalability Constraints

- •

Availability and quality of new franchisees.

- •

Rising labor costs and availability, especially for delivery drivers.

- •

Supply chain vulnerabilities and increasing ingredient costs.

- •

Potential for franchisee friction or cannibalization from the 'fortressing' strategy.

Team Readiness

Proven and experienced leadership team with a track record of successful strategic pivots and digital transformation.

A highly effective decentralized franchise structure supported by a centralized corporate team focused on technology, supply chain, and brand marketing.

Key Capability Gaps

- •

Advanced Data Science & AI for hyper-personalization and predictive delivery logistics.

- •

Talent acquisition and retention at the store and driver level.

- •

International market development teams with deep local expertise in emerging regions.

Growth Engine

Acquisition Channels

- Channel:

Digital (Website/App)

Effectiveness:High

Optimization Potential:High

Recommendation:Leverage AI to implement hyper-personalized offers and recommendations based on individual order history and behavior.

- Channel:

National TV & Brand Marketing

Effectiveness:Medium

Optimization Potential:Medium

Recommendation:Shift budget towards campaigns that highlight technology leadership (e.g., Pinpoint Delivery) and the loyalty program to drive digital sign-ups.

- Channel:

Loyalty Program (Domino's Rewards)

Effectiveness:High

Optimization Potential:High

Recommendation:Introduce tiered rewards to incentivize higher frequency and AOV. The program already has over 35 million members and is a key growth driver.

- Channel:

Third-Party Aggregators (Uber Eats)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Optimize menu pricing and promotions on these platforms to acquire new users, with clear calls-to-action to join the native rewards program for better value.

Customer Journey

Highly optimized for speed and convenience, with features like 'one-click reorder' and Pizza Builder simplifying the process from ~13 steps to just 4.

Friction Points

- •

Initial setup and sign-in process for new users.

- •

Decision fatigue from an extensive menu and customization options.

- •

Uncertainty around delivery times during peak hours, despite the Domino's Tracker.

Journey Enhancement Priorities

- Area:

Onboarding

Recommendation:Implement social sign-on (Google, Apple) to expedite account creation and first-time orders.

- Area:

Ordering

Recommendation:Develop an AI-powered 'Quick Suggest' feature based on past orders, time of day, and trending items.

- Area:

Post-Purchase

Recommendation:Enhance the Domino's Tracker with more interactive elements or gamification to improve the waiting experience.

Retention Mechanisms

- Mechanism:

Domino's Rewards Program

Effectiveness:High

Improvement Opportunity:Implement exclusive, members-only menu items or early access to new products to increase program value and stickiness. The recent program relaunch has already significantly boosted active members.

- Mechanism:

Email & Push Notifications

Effectiveness:Medium

Improvement Opportunity:Move from broadcast promotions to triggered, personalized offers based on customer lifecycle (e.g., 'we miss you' offers for lapsed users, upsell offers for frequent customers).

- Mechanism:

Consistent Product & Service

Effectiveness:High

Improvement Opportunity:Utilize franchisee data to identify and standardize best practices for speed and order accuracy across the entire system.

Revenue Economics

Extremely strong. The franchise model ensures high-margin revenue from royalties and supply chain sales, with low corporate capital expenditure. Franchisee EBITDA is best-in-class.

Likely very high, driven by high repeat purchase frequency, strong retention via the loyalty program, and relatively low marginal cost of digital customer acquisition.

High

Optimization Recommendations

- •

Increase Average Order Value (AOV) through AI-powered suggestive upselling of high-margin sides, drinks, and desserts.

- •

Implement dynamic pricing strategies during off-peak hours to stimulate demand and improve asset utilization.

- •

Promote the carryout option more aggressively, as it has a different, highly incremental customer base and lower variable costs.

Scale Barriers

Technical Limitations

- Limitation:

Franchisee Technology Standardization

Impact:Medium

Solution Approach:Incentivize or mandate adoption of the latest proprietary POS (DOM OS) and operational tech to ensure system-wide data consistency and efficiency.

Operational Bottlenecks

- Bottleneck:

Last-Mile Delivery Driver Shortage

Growth Impact:High. This directly impacts delivery times, customer satisfaction, and ability to meet demand.

Resolution Strategy:Continue the 'fortressing' strategy to shorten delivery times and increase deliveries-per-hour. Experiment with autonomous and e-bike delivery solutions in dense urban markets.

- Bottleneck:

In-Store Labor Availability

Growth Impact:Medium. Can lead to longer prep times and order errors, impacting the entire customer experience.

Resolution Strategy:Invest in in-store automation for tasks like dough preparation and topping distribution. Enhance employee value proposition to improve retention.

Market Penetration Challenges

- Challenge:

Intense Price Competition

Severity:Critical

Mitigation Strategy:Compete on overall value, speed, and digital experience rather than just price. Emphasize the quality and convenience differentiators.

- Challenge:

Competition from Third-Party Aggregators

Severity:Major

Mitigation Strategy:Embrace a dual strategy: partner with aggregators for customer acquisition while ensuring the best value and experience remains on native platforms to drive direct, long-term relationships.

- Challenge:

Market Saturation in North America

Severity:Major

Mitigation Strategy:Focus on incremental growth through the 'fortressing' strategy to boost carryout and delivery efficiency in existing markets, and expand into non-traditional venues (e.g., campuses, airports).

Resource Limitations

Talent Gaps

- •

Delivery Drivers

- •

Data Scientists & AI/ML Engineers

- •

In-store operational staff

Low at the corporate level due to the franchise model. Growth is more constrained by franchisee access to capital for new store development and remodels.

Infrastructure Needs

Enhanced data infrastructure to support real-time personalization at scale.

Expansion of supply chain commissaries to support international growth and domestic 'fortressing'.

Growth Opportunities

Market Expansion

- Expansion Vector:

International Growth in Emerging Markets

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Continue focusing on strategic markets like China and India through master franchisee agreements, adapting the menu and marketing to local preferences.

- Expansion Vector:

Non-Traditional Store Formats

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Develop smaller, carryout-focused store models for high-traffic areas like airports, college campuses, and military bases.

- Expansion Vector:

Hyper-Local Delivery with Pinpoint Tech

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Scale the 'Domino's Pinpoint Delivery' technology that allows delivery to locations without a traditional address, such as parks and beaches, opening up new ordering occasions.

Product Opportunities

- Opportunity:

Expanded Plant-Based & Alternative Protein Menu

Market Demand Evidence:Growing consumer trend towards flexitarian, vegetarian, and vegan diets.

Strategic Fit:High - Aligns with attracting younger, health-conscious demographics.

Development Recommendation:Partner with a leading plant-based meat provider to co-brand new pizza and side item offerings.

- Opportunity:

Gourmet / 'Upmarket' Pizza Line

Market Demand Evidence:Rise of artisanal and craft pizza restaurants indicates a willingness to pay more for premium ingredients.

Strategic Fit:Medium - Must be carefully positioned to avoid brand dilution.

Development Recommendation:Launch a limited-time-offer (LTO) line of 'Domino's Finest' pizzas with premium toppings (e.g., prosciutto, goat cheese, balsamic glaze) to test market reception.

- Opportunity:

Catering and Bulk Ordering for B2B

Market Demand Evidence:Return-to-office trends and corporate events create demand for large, convenient meal solutions.

Strategic Fit:High - Leverages existing operational capacity.

Development Recommendation:Develop a dedicated B2B ordering portal with simplified billing and scheduled delivery options for corporate clients.

Channel Diversification

- Channel:

In-Car Commerce Platforms

Fit Assessment:High

Implementation Strategy:Partner with automotive manufacturers (e.g., Ford, GM) to integrate Domino's ordering into their in-vehicle infotainment systems for 'order-ahead' convenience.

- Channel:

Voice and Conversational AI

Fit Assessment:High

Implementation Strategy:Expand existing 'AnyWare' technology capabilities on platforms like Alexa and Google Assistant to allow for more complex, conversational ordering beyond simple reorders.

Strategic Partnerships

- Partnership Type:

Entertainment & Streaming Bundles

Potential Partners

- •

Netflix

- •

Disney+

- •

Spotify

Expected Benefits:Create co-branded 'Dinner and a Movie' deals to tap into at-home entertainment occasions, driving AOV and creating unique marketing angles.

- Partnership Type:

CPG Product Licensing

Potential Partners

Kraft Heinz

Nestlé

Expected Benefits:License the Domino's brand for frozen pizza or sauce lines in grocery stores to increase brand presence and create a new, high-margin revenue stream.

Growth Strategy

North Star Metric

Weekly Active Customers

This metric combines both new customer acquisition and, crucially for a mature business, the frequency and retention of existing customers. Growth in this metric indicates a healthy, expanding, and loyal customer base.

Increase Weekly Active Customers by 5-7% year-over-year.

Growth Model

Hybrid: Digital Product-Led & Brand Marketing

Key Drivers

- •

Digital user experience (ease of ordering)

- •

Order frequency (driven by loyalty program and personalized marketing)

- •

Operational efficiency (delivery speed and accuracy)

Focus on a virtuous cycle: brand marketing drives traffic to digital platforms; a seamless digital experience converts users; a rewarding loyalty program drives repeat orders; data from orders is used to personalize future marketing.

Prioritized Initiatives

- Initiative:

Hyper-Personalization Engine Rollout

Expected Impact:High

Implementation Effort:Medium

Timeframe:6-9 months

First Steps:Consolidate customer data into a unified CDP. Build and test initial AI/ML models for offer personalization and product recommendations on 10% of app users.

- Initiative:

Carryout Experience Overhaul

Expected Impact:High

Implementation Effort:Medium

Timeframe:9-12 months

First Steps:Pilot in-store digital order status boards, curbside pickup technology, and carryout-specific value offers in select 'fortressed' markets to improve speed and convenience.

- Initiative:

Launch Two New Product Platforms

Expected Impact:Medium

Implementation Effort:High

Timeframe:12 months

First Steps:Begin consumer research and R&D for a dedicated plant-based menu line and a new category of loaded sides (expanding on 'Loaded Tots'). Announce at least two new products in 2025.

Experimentation Plan

High Leverage Tests

- Test:

Dynamic Loyalty Rewards

Hypothesis:Offering variable points (e.g., 1.5x points on Tuesdays) will shift demand and increase order frequency during off-peak times.

- Test:

Subscription Model Pilot

Hypothesis:A monthly subscription ('Domino's Plus') for free delivery and exclusive deals will significantly increase LTV for high-frequency customers.

- Test:

AI-Generated Menu Recommendations

Hypothesis:Using generative AI to create unique pizza combinations based on user preferences will increase engagement and AOV.

Utilize A/B testing methodology, tracking the North Star Metric (Weekly Active Customers), Average Order Value (AOV), and Order Frequency as primary KPIs. Use cohort analysis to measure long-term impact on LTV.

Run a continuous cycle of bi-weekly growth experiments managed by a dedicated growth team.

Growth Team

A centralized Growth Team reporting to the Chief Digital Officer, composed of cross-functional 'squads' aligned to key metrics (e.g., Acquisition, Retention, Monetization).

Key Roles

- •

Head of Growth

- •

Data Scientist (Personalization)

- •

Product Manager (Loyalty & Rewards)

- •

Lifecycle Marketing Manager

- •

UX/UI Designer (Conversion Rate Optimization)

Invest in internal training and external hiring for advanced data analytics, AI/ML engineering, and experimentation best practices.

Domino's Pizza is in an exceptionally strong position for continued growth, built upon a foundation of world-class brand recognition, a highly scalable franchise business model, and a significant, long-standing competitive advantage in digital technology. The company has successfully transformed from a fast-food chain into a technology-driven e-commerce leader that happens to sell pizza.

The primary growth foundation is solid, with demonstrable product-market fit and a business model that generates substantial operational leverage through its franchise and supply chain structure. The key challenge in this mature market is not finding growth, but capturing it from competitors and defending against disruption from third-party delivery aggregators. Domino's proactive 'fortressing' strategy is a shrewd defensive and offensive move, simultaneously improving delivery efficiency and boosting the highly incremental carryout business.

The growth engine is already high-performing, driven by a sophisticated digital ordering ecosystem and a successful loyalty program. The next horizon of growth will come from leveraging its massive repository of customer data to move from broad value offerings to hyper-personalized experiences. By using AI to anticipate customer needs, optimize promotions, and enhance the digital journey, Domino's can increase order frequency and average order value, further strengthening its impressive unit economics.

Key barriers to scale are primarily operational and market-based rather than technical or financial. The ongoing challenge of attracting and retaining delivery and in-store labor is the most significant bottleneck. Market saturation in developed regions and intense price competition necessitate a focus on operational excellence and brand differentiation to win.

Numerous growth opportunities exist. Internationally, there is still significant white space in emerging markets. Domestically, growth will be driven by product innovation (particularly in plant-based and premium categories), channel diversification (in-car commerce), and strategic partnerships that embed Domino's into new consumption occasions (e.g., entertainment bundles). The recommended growth strategy is to double down on technological leadership. The North Star Metric of 'Weekly Active Customers' will focus the organization on the dual priorities of acquisition and retention. Prioritized initiatives should center on deploying an AI-powered personalization engine, overhauling the carryout experience to capitalize on its profitability, and launching new product platforms to expand the addressable market. By executing this strategy, Domino's can solidify its market leadership and continue to deliver sustained, profitable growth.

Legal Compliance

Domino's provides a comprehensive privacy policy that is easily accessible from the website footer and the cookie consent banner. The policy explicitly details the types of information collected (e.g., contact data, transaction information, geolocation data), how it's used (e.g., order fulfillment, marketing, analytics), and with whom it's shared (e.g., franchisees, affiliates, service providers). It includes specific, detailed sections for California residents under the CCPA/CPRA and for data subjects in Europe, indicating a global approach to compliance. The policy clearly explains user rights, such as access and deletion, and provides a dedicated portal for submitting such requests, which requires identity verification for security. The distinction between data controlled by Domino's corporate and its independent franchisees is also clarified, directing users to contact local stores for franchisee-specific data requests. This demonstrates a mature understanding of its franchise-based business model's implications for data privacy.

The Terms of Use are clearly structured and accessible. A key strategic element is the clarification of the legal relationship between the customer, Domino's corporate, and the independent franchisee. The terms state that the legal contract for an order is between the customer and the local franchisee, with Domino's acting as an agent on their behalf. This is a crucial liability-limiting position. The terms also cover standard aspects such as user conduct, intellectual property rights, and limitations of liability. Specific conditions for promotions, like the 'Mix & Match' offer, are detailed with clear disclaimers regarding price variations by location, which helps manage customer expectations and reduce claims of deceptive advertising. The presence of specific terms for features like 'Group Order' and 'Driver Tipping' shows a granular and up-to-date approach to governing their evolving digital services.

Domino's employs a best-in-class cookie consent banner that is immediately visible upon visiting the site. It offers clear choices: 'Allow All', 'Reject All', and a 'Configure' option for granular control. The inclusion of a 'Reject All' button is a strong compliance feature aligned with GDPR and CCPA/CPRA principles. The banner text is commendably transparent, explicitly mentioning the use of cookies for 'sales, shares, and targeted advertising' and notifying users of their ability to opt-out via a recognized preference signal like Global Privacy Control (GPC). This proactive support for GPC places them ahead of many competitors in honoring user-driven privacy signals. The mechanism also correctly distinguishes between browser-level, app-level, and system-level opt-outs, providing different links and instructions for each, which, while complex, is legally precise and comprehensive.

Domino's demonstrates a robust data protection framework. For US consumers, the CCPA/CPRA compliance is evident through the explicit 'Do Not Sell or Share My Personal Information' language, support for GPC, and a dedicated portal for exercising privacy rights. The privacy policy details what constitutes a 'sale' under CCPA's broad definition, including certain advertising technology activities. For European users, the policy references GDPR, the invalidation of the EU-U.S. Privacy Shield, and a commitment to using appropriate safeguards for data transfers. Their UK-specific policies further detail the joint controller relationship between the corporate entity and franchisees under GDPR, a sophisticated and necessary clarification for their business model. The use of reCAPTCHA is noted on the site, and the privacy implications of data sharing with Google are implicitly covered by the general disclosures, but could be more explicit. The company also highlights its cybersecurity operations and use of AI/ML for threat detection as part of its data protection strategy.

Accessibility is a mission-critical and historically significant compliance area for Domino's. Following the landmark case Robles v. Domino's Pizza LLC, which established that the Americans with Disabilities Act (ADA) applies to commercial websites and mobile apps, the company operates under intense legal scrutiny. The court ordered Domino's to bring its website into compliance with the Web Content Accessibility Guidelines (WCAG) 2.0. Evidence of compliance on the current site includes basic features like a 'Skip to main content' link. Given the legal precedent, it is highly probable that Domino's engages in regular accessibility audits and maintains a high level of compliance with WCAG standards to mitigate the significant legal risk. This history turns accessibility from a mere compliance checkbox into a core component of their risk management strategy. Failure to maintain these standards would represent a severe and easily targeted legal vulnerability.