eScore

dteenergy.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

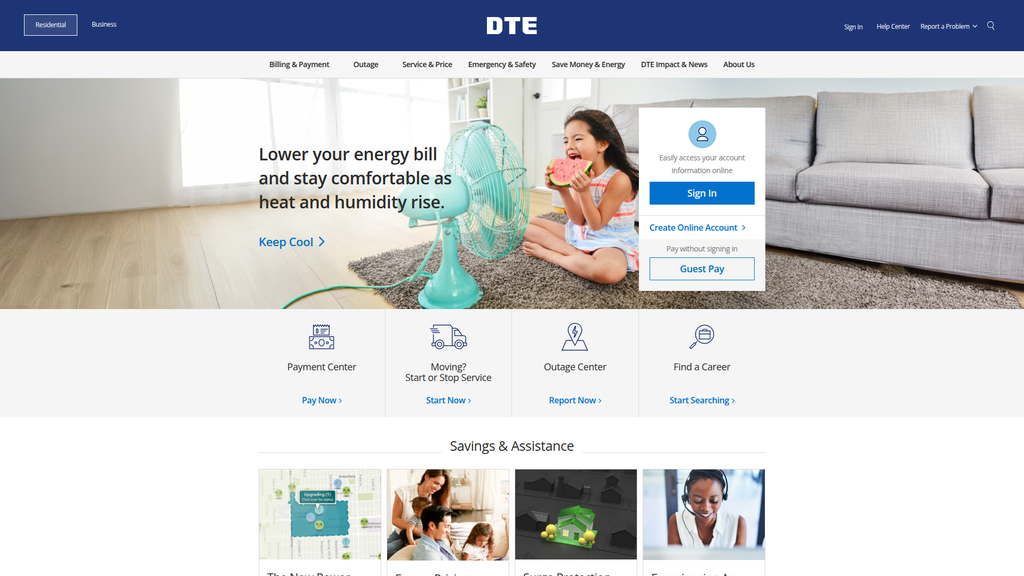

DTE Energy's digital presence is highly authoritative and functional for its core purpose as a utility, excelling at serving existing customers with transactional needs like payments and outage reporting. The website has strong domain authority due to its monopoly status and clearly aligns with high-intent search queries for customer service. However, it underperforms in broader thought leadership content around the energy transition, EV adoption, and sustainability, ceding influence to other sources and failing to capture users earlier in their informational journey.

Excellent search intent alignment for core customer service tasks, making it easy for existing customers to complete primary objectives.

Develop a dedicated thought leadership content hub ('Michigan's Energy Future') with in-depth articles, data, and expert analysis on grid modernization, renewables, and EV integration to capture non-branded search traffic and establish authority.

The brand's communication is exceptionally clear and direct but is overwhelmingly transactional and lacks an emotional connection. The messaging architecture is highly effective for guiding users through tasks but fails to convey the company's broader strategic vision, such as its massive investment in clean energy (CleanVision) and grid modernization. As the provided analysis notes, there is a significant disconnect between DTE's ambitious corporate mission and the purely utilitarian experience presented on the website.

Messaging is simple, direct, and highly effective for a diverse customer base needing to complete essential tasks like paying a bill or reporting an outage.

Integrate the 'CleanVision' and grid modernization narrative into the homepage, reframing it from a simple utility portal to a platform that showcases investment in Michigan's reliable and sustainable energy future.

The website is expertly optimized for its primary "conversions," which are task completions rather than sales. The user experience is built around a clear information architecture, logical navigation, and prominent calls-to-action for the most common user needs (Sign In, Guest Pay, Report Outage). The cognitive load is light, ensuring a low-friction journey for critical customer interactions, which is a significant strength for a public utility.

The task-oriented homepage design is highly effective, immediately presenting users with solutions to their most pressing needs and minimizing friction for core journeys.

A/B test the visual prominence of secondary, yet critical, CTAs like 'Guest Pay' and 'Create Online Account' to ensure they are not visually subordinate to the primary 'Sign In' module, potentially increasing successful one-time payments.

DTE's credibility is inherently high as an established, regulated utility and a major corporate citizen in Michigan. However, this is significantly undermined by major digital compliance gaps, particularly the outdated cookie consent model and the lack of specific CCPA/CPRA disclosures identified in the analysis. Furthermore, the absence of a formal web accessibility statement poses a legal and reputational risk for a provider of essential services, detracting from an otherwise strong foundation of trust.

Maintains separate and detailed privacy policies for online activities versus regulated customer data, demonstrating a sophisticated understanding of data governance and compliance with its primary regulator, the MPSC.

Immediately implement a compliant cookie consent management platform and update the privacy policy to include all CCPA/CPRA-mandated disclosures and a 'Do Not Sell or Share My Personal Information' link to mitigate high-severity legal risks.

DTE's competitive advantage is exceptionally strong and sustainable, rooted in its regulated monopoly status and sole ownership of the transmission and distribution infrastructure in its vast service territory. These factors create nearly insurmountable barriers to entry for direct competitors. While facing pressure from indirect competitors like solar installers, its fundamental moat is deep and protected by a complex regulatory framework, making its core business highly defensible.

The regulated monopoly status and ownership of the physical grid infrastructure provide a highly sustainable, defensible competitive advantage that is nearly impossible for competitors to replicate.

Address the critical disadvantage of poor grid reliability by effectively communicating the multi-billion dollar grid modernization plan to customers, turning a key weakness into a tangible demonstration of investment and improvement.

While the core utility business has low operational leverage due to its capital-intensive nature, DTE's growth potential is significant and driven by its massive, regulated capital investment plan ($30B+ by 2029). This rate base growth is the primary engine of scalability. Further potential exists in expanding non-regulated businesses like DTE Vantage and capturing new, high-growth revenue streams from the electrification of transportation and data center energy demand.

Ability to deploy billions in regulated capital investments for grid modernization and clean energy, which directly expands the rate base—the fundamental driver of earnings growth for a utility.

Establish a dedicated 'Energy Services' business unit to more aggressively pursue non-regulated growth opportunities in EV fleet management and Energy-as-a-Service (EaaS), creating a faster-growing, higher-margin revenue stream.

DTE's business model is highly coherent, leveraging a stable, regulated utility core to fund a massive, strategic transition to clean energy (CleanVision) and modernize its grid. This strategy directly aligns with major market trends (decarbonization, electrification) and a supportive regulatory environment that allows for cost recovery on prudent investments. The model effectively balances the predictable cash flows of the core business with strategic investments in future growth areas.

Strong alignment between the core regulated business model, the long-term strategic focus on clean energy investment, and the supportive regulatory framework that enables capital recovery.

Improve resource allocation transparency to regulators and the public, as recent rate cases have faced challenges arguing that capital expenditures are not sufficiently focused on cost-effective reliability improvements like vegetation management.

DTE wields immense market power as a regional monopoly, giving it a captive customer base of over 2.3 million electric and 1.3 million gas customers. Its pricing power is substantial, exercised through rate cases with the Michigan Public Service Commission. The company's deep integration into the state's economy and its role as a critical infrastructure operator give it significant influence over market direction, industry standards, and energy policy in Michigan.

As the regulated monopoly for electricity and gas distribution in Southeast Michigan, DTE has dominant market share and significant pricing power, subject to regulatory approval.

Leverage market power more effectively to lead the EV transition by creating strategic partnerships with automotive dealerships to offer point-of-sale enrollment in EV rate plans and home charging solutions, solidifying its central role in the future of mobility.

Business Overview

Business Classification

Regulated Utility

Diversified Energy Services

Utilities

Sub Verticals

- •

Electric Power Generation, Transmission & Distribution

- •

Natural Gas Distribution, Storage & Transportation

- •

Non-Utility Energy Services (e.g., Industrial Projects, Renewable Energy Development)

Mature

Maturity Indicators

- •

Extensive and established infrastructure (power plants, transmission lines, pipelines).

- •

Large, stable, and captive customer base (2.3M electric, 1.3M gas).

- •

Operations are heavily governed by state and federal regulators (e.g., Michigan Public Service Commission).

- •

Focus on operational efficiency, infrastructure modernization, and long-term capital investment cycles.

- •

Stable, predictable, and regulated revenue streams.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Regulated Electric Sales

Description:Generation, transmission, and distribution of electricity to 2.3 million residential, commercial, and industrial customers in Southeast Michigan, with rates set by the Michigan Public Service Commission (MPSC). This accounts for the majority of company revenue.

Estimated Importance:Primary

Customer Segment:Residential, Commercial, Industrial

Estimated Margin:Medium

- Stream Name:

Regulated Natural Gas Sales

Description:Distribution, transportation, and sale of natural gas to 1.3 million customers across Michigan. Rates and return on investment are regulated by the MPSC.

Estimated Importance:Primary

Customer Segment:Residential, Commercial, Industrial

Estimated Margin:Medium

- Stream Name:

Non-Utility Operations (DTE Vantage)

Description:Includes services like renewable energy projects, industrial energy solutions, and environmental controls for a nationwide customer base. This provides a source of unregulated, diversified income.

Estimated Importance:Secondary

Customer Segment:Industrial, Commercial

Estimated Margin:High

- Stream Name:

Energy Trading

Description:Physical and financial marketing and trading of gas and power.

Estimated Importance:Tertiary

Customer Segment:Wholesale Energy Market Participants

Estimated Margin:Variable

Recurring Revenue Components

- •

Monthly utility bills from residential, commercial, and industrial customers

- •

Service fees and approved surcharges

- •

Long-term contracts from non-utility industrial projects

Pricing Strategy

Regulated Rate of Return (Tariff-Based)

Regulated Monopoly

Semi-Transparent

Pricing Psychology

- •

Time-of-Use Rates (encouraging off-peak consumption)

- •

Tiered Pricing (cost per unit increases with usage)

- •

Budget Billing (levelized monthly payments)

Monetization Assessment

Strengths

- •

High predictability and stability of cash flows from regulated utility operations.

- •

Guaranteed customer base within a defined service territory provides a strong revenue floor.

- •

Ability to recover major capital investments through the rate base, approved by regulators.

Weaknesses

- •

Revenue growth is constrained by regulatory approval processes and economic conditions in the service area.

- •

Significant public and regulatory scrutiny on rate increase requests.

- •

Profitability is capped by the allowed Return on Equity (ROE) set by the MPSC.

Opportunities

- •

Develop and scale new revenue streams from non-regulated businesses, such as EV charging infrastructure, home energy management services, and expanded renewable projects.

- •

Obtain favorable rate case outcomes for large-scale grid modernization and clean energy investments.

- •

Offer new tiered services or products, such as the 'Surge Protection Plus' or 'Natural Gas Balance' programs seen on the website.

Threats

- •

Unfavorable regulatory decisions that deny or reduce requested rate increases.

- •

Increased adoption of distributed energy resources (e.g., rooftop solar) by customers, leading to load defection and reduced energy sales.

- •

Political and public pressure to limit rate increases, especially for vulnerable customers, could impact revenue.

Market Positioning

Regulated Regional Monopoly & Essential Service Provider

Dominant (Monopoly within service territory)

Target Segments

- Segment Name:

Residential Customers

Description:2.3 million electric and 1.3 million natural gas customers in Michigan, ranging from single-family homes to multi-unit dwellings.

Demographic Factors

Varying income levels

Urban, suburban, and rural locations within Southeast Michigan

Psychographic Factors

- •

Desire for reliable and uninterrupted service

- •

Increasing price sensitivity to utility bills

- •

Growing interest in energy efficiency and environmental impact

Behavioral Factors

Interacts with DTE primarily for billing, service start/stop, and outage reporting

Adoption of smart home technology (thermostats, appliances)

Pain Points

- •

Power outages, particularly during severe weather.

- •

Rising energy costs and bill affordability.

- •

Complexity in understanding rate structures and energy usage.

Fit Assessment:Excellent

Segment Potential:Low

- Segment Name:

Commercial & Industrial (C&I) Customers

Description:Businesses ranging from small retail shops to large-scale manufacturing facilities requiring significant, reliable energy.

Demographic Factors

Diverse industries (automotive, manufacturing, healthcare, technology)

Varying sizes from SMB to large enterprise

Psychographic Factors

- •

Prioritize power quality and reliability to avoid operational disruptions

- •

Focus on managing energy as a significant operational cost

- •

Increasing pressure to meet corporate sustainability and ESG goals

Behavioral Factors

Often have dedicated energy managers

Engage in more complex rate negotiations and energy management programs

Pain Points

- •

Production losses and costs due to power interruptions or poor power quality.

- •

Navigating complex energy regulations and sustainability reporting.

- •

High energy demand charges impacting profitability.

Fit Assessment:Excellent

Segment Potential:Medium

Market Differentiation

- Factor:

Service Reliability & Grid Modernization

Strength:Moderate

Sustainability:Sustainable

- Factor:

Transition to Clean Energy

Strength:Strong

Sustainability:Sustainable

- Factor:

Community Engagement & Local Investment

Strength:Strong

Sustainability:Sustainable

Value Proposition

To provide safe, reliable, and affordable electricity and natural gas to our Michigan communities, while leading the transition to a cleaner energy future through significant investments in grid modernization and renewable generation.

Good

Key Benefits

- Benefit:

Reliable Energy Supply

Importance:Critical

Differentiation:Common

Proof Elements

- •

Public commitment to reduce outages by 30% and cut outage duration in half by 2029.

- •

Multi-billion dollar investment plan for grid modernization.

- •

Website features like the 'Power Improvements Map'.

- Benefit:

Affordable Energy Rates

Importance:Critical

Differentiation:Common

Proof Elements

Statements on website about keeping bills low.

Offering various pricing options and assistance programs.

- Benefit:

Commitment to Sustainability

Importance:Important

Differentiation:Somewhat unique

Proof Elements

- •

Net zero carbon emissions goal by 2050.

- •

Significant investments in wind and solar parks.

- •

Voluntary programs like 'Natural Gas Balance' for customers.

Unique Selling Points

- Usp:

Comprehensive Grid Modernization Plan

Sustainability:Long-term

Defensibility:Strong

- Usp:

Aggressive and Legislatively Aligned Clean Energy Transition Goals

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Need for consistent, uninterrupted power for daily life and business operations.

Severity:Critical

Solution Effectiveness:Partial

- Problem:

Managing household and business energy expenses.

Severity:Major

Solution Effectiveness:Partial

- Problem:

Desire to reduce personal or corporate carbon footprint.

Severity:Minor

Solution Effectiveness:Partial

Value Alignment Assessment

High

The value proposition strongly aligns with the macro trends of decarbonization and electrification, as well as the fundamental market need for reliable power. The focus on grid modernization addresses a key vulnerability.

Medium

While aligned on the need for reliability and sustainability, there is a tension with the target audience's desire for affordability. Large capital investments in grid modernization and clean energy translate into rate increase requests, which can conflict with customer expectations for low bills.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Michigan Public Service Commission (MPSC) and other regulatory bodies.

- •

Industrial equipment and technology suppliers (e.g., for turbines, smart grid tech).

- •

Local and state government agencies.

- •

Environmental organizations (e.g., The Nature Conservancy).

- •

Infrastructure and construction contractors.

- •

Diverse and local Michigan-based suppliers.

Key Activities

- •

Electricity generation from a diverse portfolio (natural gas, nuclear, renewables, coal).

- •

Transmission and distribution grid maintenance, operation, and modernization.

- •

Natural gas purchasing, storage, and distribution.

- •

Customer service, billing, and outage response.

- •

Regulatory compliance and filing rate cases.

- •

Capital-intensive infrastructure projects.

Key Resources

- •

Vast physical infrastructure: power plants, 9,278 miles of transmission lines, 47,525 miles of distribution lines, 1,352 miles of gas pipelines.

- •

Skilled workforce of ~9,500 employees.

- •

State-granted utility franchise for service territories.

- •

Access to capital markets for significant debt and equity financing.

- •

Diverse energy generation portfolio, including the Fermi 2 nuclear plant.

Cost Structure

- •

Capital expenditures for infrastructure modernization and new generation (projected $9B+ over 5 years).

- •

Fuel and purchased power costs.

- •

Operational and maintenance (O&M) expenses for the grid and power plants.

- •

Employee wages and benefits.

- •

Debt servicing costs.

- •

Compliance, environmental, and regulatory costs.

Swot Analysis

Strengths

- •

Regulated monopoly status provides a captive customer base and predictable cash flows.

- •

Diversified asset portfolio across electric, gas, and non-utility segments.

- •

Significant capital investment capacity for large-scale modernization and clean energy projects.

- •

Established infrastructure and deep operational expertise in the region.

Weaknesses

- •

Aging infrastructure contributes to reliability issues and public criticism.

- •

High capital intensity and reliance on debt financing.

- •

Business model is slow to adapt due to regulatory oversight and processes.

- •

Negative public perception regarding outages and rate increases.

Opportunities

- •

Leading the clean energy transition in Michigan to meet state mandates.

- •

Expanding non-regulated services in high-growth areas like EV infrastructure, energy storage, and renewable natural gas.

- •

Leveraging smart grid investments to improve efficiency and offer new data-driven services to customers.

- •

Increased electricity demand from data centers and economy-wide electrification.

Threats

- •

Adverse regulatory outcomes, including lower-than-requested rate increases or penalties.

- •

Increasing severity and frequency of weather events stressing the grid.

- •

Cybersecurity threats to critical infrastructure.

- •

Rising interest rates increasing the cost of capital for infrastructure projects.

- •

Competition from distributed generation (e.g., rooftop solar) and third-party energy service providers.

Recommendations

Priority Improvements

- Area:

Grid Reliability and Resilience

Recommendation:Accelerate the deployment of smart grid technologies, particularly automated reclosers and fault isolation systems, to reduce the scope and duration of outages. Focus investments on the worst-performing circuits first, as identified by MPSC audits.

Expected Impact:High

- Area:

Customer Experience & Communication

Recommendation:Invest in proactive and transparent communication systems for outages, providing real-time, granular updates to affected customers. Simplify the digital experience for billing and service requests to reduce friction.

Expected Impact:Medium

- Area:

Capital Efficiency

Recommendation:Develop a more robust analytics capability to justify grid hardening investments to regulators, clearly linking specific capital projects to quantifiable improvements in reliability metrics to strengthen rate cases.

Expected Impact:High

Business Model Innovation

- •

Transition from a commodity provider to an 'Energy-as-a-Service' (EaaS) platform by offering bundled services for managing home/business energy usage, EV charging, and on-site generation/storage for a recurring fee.

- •

Establish a dedicated, unregulated business unit focused on commercial and residential EV charging solutions, from installation to network management and billing.

- •

Develop a 'grid services' marketplace where customers with distributed energy resources (like batteries or smart thermostats) can be compensated for providing ancillary services to help balance the grid.

Revenue Diversification

- •

Expand the portfolio of non-regulated DTE Vantage projects, particularly in renewable natural gas and industrial energy efficiency solutions across a wider geographic footprint.

- •

Create a home energy services division offering energy audits, HVAC maintenance, and smart home device installation and management on a subscription basis.

- •

Partner with developers and municipalities to build and operate community solar and battery storage projects, offering subscriptions to residential customers who cannot install their own panels.

DTE Energy operates a classic mature, regulated utility business model, which provides a stable and predictable financial foundation but faces significant existential pressures from decarbonization, decentralization, and digitalization. The company's core strategy correctly identifies the primary challenge and opportunity: a massive, multi-decade capital investment cycle to modernize an aging grid and transition its generation portfolio to clean energy sources.

The success of this strategy hinges on navigating the 'utility trilemma': maintaining reliability, ensuring affordability, and achieving sustainability. Currently, DTE faces public and regulatory pressure on both reliability and affordability, with audits highlighting below-average performance in outage restoration. The company's financial health is inextricably linked to the outcomes of MPSC rate cases, making regulatory strategy a critical business function.

Strategic evolution is paramount for long-term growth. The current business model is a cash-flow engine to fund the transition, but the future model must evolve beyond simply selling kilowatt-hours and therms. The greatest opportunity lies in leveraging its direct customer relationships and trusted position to build a platform for energy services. This involves expanding its non-utility businesses and creating new, potentially unregulated, revenue streams in areas like electric vehicle infrastructure, home energy management, and large-scale renewable development. This strategic pivot would transform DTE from a passive infrastructure operator into an active manager of a complex, two-way energy system, unlocking new value pools while simultaneously building the cleaner, more resilient grid the future requires.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

High Capital Investment

Impact:High

- Barrier:

Regulatory Approvals and Franchises

Impact:High

- Barrier:

Economies of Scale

Impact:High

- Barrier:

Control of Transmission & Distribution Infrastructure

Impact:High

Industry Trends

- Trend:

Decarbonization and Clean Energy Transition

Impact On Business:Requires massive investment in renewables (solar, wind) and energy storage, and the retirement of fossil fuel plants (coal). DTE is investing $30 billion from 2025-2029, focusing on clean energy.

Timeline:Immediate

- Trend:

Grid Modernization and Resilience

Impact On Business:Pressure to upgrade aging infrastructure to reduce outages and improve reliability, incorporating smart grid technology. DTE aims to reduce outages by 30% and duration by 50% by 2029.

Timeline:Immediate

- Trend:

Electrification and Demand Growth

Impact On Business:Increased electricity demand from data centers, EVs, and building electrification requires significant new generation and T&D capacity.

Timeline:Near-term

- Trend:

Distributed Energy Resources (DERs)

Impact On Business:Growth of rooftop solar, community solar, and battery storage challenges the traditional centralized utility model, requiring new business models for integration and management.

Timeline:Near-term

- Trend:

Enhanced Customer Digital Experience

Impact On Business:Customers expect seamless digital tools for account management, outage reporting, and energy usage insights, similar to other service industries.

Timeline:Immediate

Direct Competitors

- →

Consumers Energy

Market Share Estimate:DTE Energy serves 2.3 million electric and 1.3 million gas customers, while Consumers Energy serves 1.8 million electric and a portion of 6.8 million total customers across Michigan. They are the two dominant players.

Target Audience Overlap:High

Competitive Positioning:Positions itself as a partner in Michigan's progress, emphasizing a commitment to clean energy transformation ('world class performance delivering hometown service') and grid modernization.

Strengths

- •

Strong focus on a clean energy plan, aiming for net-zero carbon emissions by 2040.

- •

Significant investments in grid modernization to improve reliability.

- •

Established brand and long history in western and northern Michigan.

- •

Proactive communication about summer readiness and grid improvements.

Weaknesses

- •

Also faces significant criticism and regulatory scrutiny for poor reliability and long outage durations, similar to DTE.

- •

Operates a complex system with an 'unusually high' number of different low-distribution voltages due to historical mergers, complicating maintenance.

- •

Faces challenges with long vegetation management cycles, a key cause of outages.

Differentiators

- •

Primary service territory covers different, though sometimes adjacent, parts of Michigan's Lower Peninsula.

- •

Articulates a 'Clean Energy Plan' as a core part of its public identity.

- •

Has a specific goal to be 'zero-coal' and achieve net-zero carbon emissions by 2040.

Indirect Competitors

- →

Rooftop Solar Installers

Description:Provide homeowners and businesses with the ability to generate their own electricity, reducing their reliance on and payments to DTE. Michigan has a growing, though still modest, residential solar market.

Threat Level:Medium

Potential For Direct Competition:They do not sell grid power, but directly reduce DTE's sales volume and challenge its traditional business model.

- →

Community Solar Programs

Description:Allow multiple customers to share the benefits of a single, local solar array, providing access to solar for those who cannot install rooftop panels. Michigan's programs are developing, supported by state and federal initiatives like 'MI Solar for All'.

Threat Level:Low

Potential For Direct Competition:Could become a significant alternative for energy supply if enabling legislation expands and programs scale up.

- →

Energy Efficiency & Smart Home Technology

Description:Offer products and services (smart thermostats, energy-efficient appliances, insulation) that reduce overall energy consumption, thereby lowering customer bills and DTE's revenue.

Threat Level:Medium

Potential For Direct Competition:Indirectly competes by reducing the total addressable market for energy sales.

- →

Alternative Electric Suppliers (AES)

Description:In Michigan's limited 'Electric Choice' program, AESs can supply electricity to a capped number of commercial and industrial customers. This program is limited to 10% of a utility's load and is fully subscribed, with a long waiting list.

Threat Level:Low

Potential For Direct Competition:Directly compete for large customers, but expansion is capped by state law. Threat would become high if the market were fully deregulated.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Regulated Monopoly Status

Sustainability Assessment:Highly sustainable in the short-to-medium term, protected by state regulation and franchise agreements for its service territory.

Competitor Replication Difficulty:Hard

- Advantage:

Ownership of Transmission & Distribution Infrastructure

Sustainability Assessment:Highly sustainable due to the prohibitive cost and regulatory difficulty of duplicating the grid.

Competitor Replication Difficulty:Hard

- Advantage:

Brand Recognition and Incumbency

Sustainability Assessment:Sustainable due to its long-standing presence as the sole energy provider for millions of customers in Southeast Michigan.

Competitor Replication Difficulty:Hard

Temporary Advantages

No itemsDisadvantages

- Disadvantage:

Poor Grid Reliability and Power Outage Performance

Impact:Critical

Addressability:Difficult

- Disadvantage:

Aging Infrastructure

Impact:Critical

Addressability:Difficult

- Disadvantage:

Negative Public and Regulatory Perception

Impact:Major

Addressability:Moderately

- Disadvantage:

Slow Pace of Innovation vs. Tech-Driven Disruptors

Impact:Major

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Enhance Proactive Outage Communication

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Launch a targeted digital campaign promoting existing energy efficiency programs and rebates.

Expected Impact:Low

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Develop and market innovative EV charging solutions and rate plans for residential and commercial customers.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Create a streamlined, user-friendly digital platform for customers interested in interconnecting rooftop solar or other DERs.

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Invest heavily in and publicly demonstrate progress on accelerated vegetation management to directly address a primary cause of outages.

Expected Impact:High

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Transition business model to become a Distributed System Operator (DSO), managing a two-way grid and earning revenue from services that integrate and optimize DERs.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Aggressively invest in large-scale energy storage projects to complement renewable generation and improve grid stability.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Lead the development of community solar programs within its service territory to offer a utility-branded alternative to rooftop solar.

Expected Impact:Medium

Implementation Difficulty:Difficult

Shift positioning from a traditional, reactive utility to a proactive, tech-forward 'Energy Partner' focused on reliability, clean energy, and enabling customer choice through new products and services (e.g., EV charging, DER integration).

Differentiate from Consumers Energy by demonstrating superior, tangible improvements in reliability and outage restoration times. Differentiate from indirect competitors by offering seamless, integrated energy solutions (grid power, EV charging, DER management) that standalone providers cannot match.

Whitespace Opportunities

- Opportunity:

Energy-as-a-Service (EaaS) for Large Customers

Competitive Gap:Neither DTE nor Consumers Energy has a dominant EaaS offering. Indirect competitors (solar developers) offer piecemeal solutions, but not an integrated package.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Advanced EV Fleet Management Services

Competitive Gap:The market for managing the charging logistics and energy costs of commercial EV fleets is emerging. Utilities are uniquely positioned to provide grid-aware charging solutions.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Utility-Led Community Solar Subscriptions

Competitive Gap:While state programs are emerging, there is no large-scale, easy-to-access community solar program in DTE's territory. This allows DTE to embrace solar on its own terms, catering to customers who can't install rooftop panels.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Grid Resilience Services

Competitive Gap:Businesses and communities are increasingly concerned about power disruptions. Offering tailored solutions like microgrids or battery backup systems addresses a key customer pain point that competitors are not solving at scale.

Feasibility:Low

Potential Impact:High

DTE Energy operates in a mature, highly regulated utility industry, which functions as a regional oligopoly alongside its primary direct competitor, Consumers Energy. The most significant competitive pressures are not from territorial encroachment but from public perception, regulatory favor, and performance on key metrics like reliability and rates.

Direct competition with Consumers Energy is a battle of inches, focused on which utility is perceived as a better steward of Michigan's energy future and who can make more credible promises on reliability improvements and clean energy integration. Both utilities suffer from severe, publicly documented weaknesses in grid reliability and outage duration, stemming from aging infrastructure. A recent state-sponsored audit found both to be 'worse than average,' creating a significant reputational and operational disadvantage for both.

The more profound competitive threat comes from indirect and disruptive forces. The rise of Distributed Energy Resources (DERs), particularly rooftop and community solar, challenges the centralized utility model by reducing energy sales. While Michigan's solar penetration is still relatively low, its growth trajectory represents a slow but steady erosion of DTE's core revenue base. Similarly, energy efficiency technologies reduce overall demand. DTE's primary sustainable advantages are its physical infrastructure and its regulated monopoly status, which create nearly insurmountable barriers to entry for new utility players.

Strategic whitespace exists in moving beyond the role of a simple commodity provider. Opportunities in Energy-as-a-Service, advanced EV charging infrastructure and management, and utility-led renewable programs (like community solar) allow DTE to leverage its incumbent position to offer integrated solutions that smaller, indirect competitors cannot. The ultimate strategic imperative is to address its core disadvantage: grid reliability. Tangible, measurable improvements in reducing outage frequency and duration would be the single most powerful differentiator against both its direct and indirect competitors, rebuilding customer trust and regulatory confidence.

Messaging

Message Architecture

Key Messages

- Message:

Manage your account, service, and payments with ease.

Prominence:Primary

Clarity Score:High

Location:Homepage - Main content area

- Message:

Lower your energy bill and stay comfortable.

Prominence:Primary

Clarity Score:High

Location:Homepage - Headline banner

- Message:

Balance your carbon footprint easily and affordably with Natural Gas Balance.

Prominence:Secondary

Clarity Score:High

Location:Homepage - Headline banner

- Message:

We are improving reliability in your area.

Prominence:Secondary

Clarity Score:Medium

Location:Homepage - Savings & Assistance section (via 'Power Improvements Map')

- Message:

Handle immediate service needs like outages and moving.

Prominence:Primary

Clarity Score:High

Location:Homepage - Icon-based navigation (Payment, Moving, Outage)

The messaging hierarchy is exceptionally clear but overwhelmingly transactional. It prioritizes the immediate, functional needs of existing customers (account access, payments, outages) above all else. Strategic messages about value, reliability, and sustainability are present but hold a secondary or tertiary position, requiring users to read further or click through to understand their depth. This supports operational efficiency but weakens brand-building and differentiation efforts.

Messaging is highly consistent across the provided content. The same headlines and functional blocks are repeated, indicating a unified, template-driven approach. While this ensures consistency, it also leads to a sterile and impersonal feel, lacking narrative variation or targeted messaging for different audience mindsets.

Brand Voice

Voice Attributes

- Attribute:

Direct & Functional

Strength:Strong

Examples

- •

Pay without signing in

- •

Guest Pay

- •

Start or Stop Service

- •

Report Now

- Attribute:

Helpful & Service-Oriented

Strength:Moderate

Examples

- •

Lower your energy bill and stay comfortable...

- •

Find out what's right for you, based on your budget, lifestyle and energy needs.

- •

Experiencing An Issue. Try these options for a solution.

- Attribute:

Corporate & Formal

Strength:Strong

Examples

We will be conducting system maintenance...

We apologize for the inconvenience.

- Attribute:

Community-Oriented

Strength:Weak

Examples

Join your neighbors in the program

Tone Analysis

Transactional

Secondary Tones

Informational

Problem-Solving

Tone Shifts

The tone shifts slightly from purely transactional (Pay Now) to benefit-oriented (Lower your energy bill) in the headline banners.

A subtle shift to community-focused language appears with Join your neighbors..., which stands out from the otherwise individual-focused transactional language.

Voice Consistency Rating

Excellent

Consistency Issues

The voice is exceptionally consistent, but to a fault. Its uniformity prevents it from adapting to different messaging goals, such as building emotional connection or inspiring action on clean energy, which are key strategic initiatives for the company.

Value Proposition Assessment

DTE provides reliable and convenient energy services with options to help you save money, manage your usage, and support sustainability.

Value Proposition Components

- Component:

Convenience & Account Management

Clarity:Clear

Uniqueness:Common

- Component:

Cost Savings & Energy Efficiency

Clarity:Clear

Uniqueness:Common

- Component:

Reliability & System Improvement

Clarity:Somewhat Clear

Uniqueness:Common

- Component:

Sustainability & Carbon Reduction

Clarity:Somewhat Clear

Uniqueness:Somewhat Unique

Based on the website content, differentiation is weak. The value proposition is standard for a large utility. Competitors like Consumers Energy also focus on reliability and clean energy. The message 'Balance your carbon footprint' and the 'Power Improvements Map' are modest differentiators, suggesting transparency and a commitment to sustainability, but they are not framed within a compelling, unique brand story that sets DTE apart from other major energy providers.

The messaging positions DTE as a standard, incumbent utility provider focused on core service delivery. It communicates competence and operational focus but lacks the aspirational or innovative messaging needed to position itself as a leader in the clean energy transition, despite this being a stated corporate goal. The website functions as a customer service portal rather than a strategic positioning tool.

Audience Messaging

Target Personas

- Persona:

The Existing Residential Customer (Task-Oriented)

Tailored Messages

- •

Easily access your account information online

- •

Pay Now

- •

Report Now

Effectiveness:Effective

- Persona:

The Cost-Conscious Customer

Tailored Messages

Lower your energy bill...

Energy Pricing Options

Effectiveness:Somewhat Effective

- Persona:

The Eco-Conscious Customer

Tailored Messages

Balance your carbon footprint easily and affordably with Natural Gas Balance.

Effectiveness:Ineffective

Audience Pain Points Addressed

- •

High energy bills during peak seasons

- •

Inconvenience of paying bills or managing service

- •

Frustration from power outages

- •

Uncertainty about service reliability

Audience Aspirations Addressed

- •

Desire to save money

- •

Desire for comfort at home

- •

Interest in reducing personal environmental impact (addressed superficially)

Persuasion Elements

Emotional Appeals

- Appeal Type:

Peace of Mind / Comfort

Effectiveness:Medium

Examples

...stay comfortable as heat and humidity rise.

- Appeal Type:

Financial Security / Savings

Effectiveness:Medium

Examples

Lower your energy bill...

- Appeal Type:

Social Belonging

Effectiveness:Low

Examples

Join your neighbors in the program

Social Proof Elements

- Proof Type:

Bandwagon Effect

Impact:Weak

Examples

The phrase 'Join your neighbors' is a soft attempt at social proof, implying that others are already participating in the Natural Gas Balance program.

Trust Indicators

- •

Direct, upfront communication about service maintenance.

- •

Provision of tools for transparency, like the 'Power Improvements Map'.

- •

Established brand presence as a major utility provider.

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

Sign In

Location:Homepage

Clarity:Clear

- Text:

Pay Now

Location:Homepage - Payment Center

Clarity:Clear

- Text:

Report Now

Location:Homepage - Outage Center

Clarity:Clear

- Text:

Keep Cool

Location:Homepage - Banner

Clarity:Clear

- Text:

Explore the map

Location:Homepage - Savings & Assistance

Clarity:Clear

The CTAs are highly effective for their intended purpose. They use clear, action-oriented language (e.g., 'Pay', 'Report', 'Start') that leaves no ambiguity for the user. They are well-placed to guide existing customers to complete their primary tasks efficiently. However, they are almost exclusively functional and lack CTAs that invite deeper brand engagement or exploration of DTE's broader mission.

Messaging Gaps Analysis

Critical Gaps

- •

Lack of Brand Narrative: The messaging fails to tell a story. DTE's stated mission to be a 'force for growth and prosperity' and 'improve lives with our energy' is entirely absent. The homepage does not connect its services to a higher purpose or community benefit.

- •

Future Vision: There is no forward-looking messaging. While DTE has a net-zero 2050 goal and significant clean energy plans (CleanVision), this strategic narrative is missing from the primary customer touchpoint. This is a major missed opportunity to shape brand perception.

- •

Emotional Connection: The messaging is sterile and utilitarian. It does not attempt to build an emotional connection with customers or convey empathy, which is a key strategy for modern utilities.

Contradiction Points

The corporate aspiration to be a leader in clean energy and a 'force for growth' is contradicted by a website whose primary message is simply 'pay your bill here'.

Underdeveloped Areas

Sustainability Messaging: The 'Natural Gas Balance' program is mentioned but lacks context, impact, or a compelling story. DTE's broader renewable energy efforts are not showcased.

Reliability Story: The 'Power Improvements Map' is a good feature, but the message could be elevated from a simple tool to a larger narrative about building a modern, resilient grid for the future.

Messaging Quality

Strengths

- •

Clarity and Simplicity: The messaging is exceptionally easy to understand, making it effective for a broad, diverse customer base performing essential tasks.

- •

Task-Oriented Efficiency: The site's messaging architecture is highly effective at funneling existing customers toward completing key actions like payments and outage reporting.

- •

Directness: There is no jargon or confusing corporate speak. The language is direct and functional.

Weaknesses

- •

Overly Transactional: The focus on functional tasks eclipses any attempt at brand building, differentiation, or customer relationship development.

- •

Lack of Personality: The brand voice is generic and lacks any distinct character, making the brand forgettable.

- •

Poor Differentiation: The messaging does not effectively differentiate DTE from its main competitors, positioning it as a generic utility rather than a forward-thinking energy leader.

Opportunities

- •

Show, Don't Just Tell: Transform the 'Power Improvements Map' into a compelling story about grid modernization and future reliability.

- •

Humanize the Brand: Feature stories of employees or community partners to bring the 'force for growth and prosperity' mission to life.

- •

Elevate the Sustainability Narrative: Create a prominent, engaging section that visualizes the impact of the CleanVision plan and makes customers feel like part of the clean energy transition.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Narrative

Recommendation:Introduce a new homepage module above 'Savings & Assistance' titled 'Building Michigan's Clean Energy Future.' This section should use strong visuals and concise messaging to connect the CleanVision plan to tangible customer benefits like reliability and a healthier environment.

Expected Impact:High

- Area:

Value Proposition Messaging

Recommendation:Reframe headlines to be more aspirational and benefit-driven. For example, instead of just presenting a map, use a headline like 'Investing in Your Community's Future: See the Grid of Tomorrow, Today.'

Expected Impact:Medium

- Area:

Brand Voice

Recommendation:Systematically inject more empathetic and community-focused language across the site. For instance, in the outage center, add a message like 'We know losing power is disruptive, and our crews are working hard to get your life back to normal.'

Expected Impact:High

Quick Wins

- •

Rewrite the 'Natural Gas Balance' headline to focus on the collective impact: 'Join Thousands of Your Neighbors in Creating a Cleaner Michigan.'

- •

Add a sub-headline under 'Power Improvements Map' that states the core benefit: 'Building a stronger, more reliable grid to power your life.'

- •

Incorporate key phrases from the company's mission, such as 'improving lives with our energy,' into relevant sections.

Long Term Recommendations

Develop a comprehensive content strategy focused on storytelling that showcases DTE's community impact, employee dedication, and progress toward clean energy goals. This content should be integrated throughout the site, not just siloed in an 'About Us' section.

Conduct audience segmentation research to develop tailored messaging for different customer profiles (e.g., EV owners, business owners, customers interested in solar) beyond the current one-size-fits-all approach.

DTE Energy's website messaging is a masterclass in functional, transactional communication. It excels at its primary role as a digital customer service center, guiding existing users to manage their accounts and resolve immediate issues with high clarity and efficiency. However, this singular focus comes at a significant strategic cost.

The messaging completely fails to support the company's broader business objectives of market leadership, brand differentiation, and stakeholder engagement around its clean energy transition. The brand voice is impersonal and institutional, lacking the warmth, empathy, and forward-looking vision necessary to build brand equity in a modern utility landscape where customers increasingly expect their energy provider to be a responsible community partner.

There is a profound disconnect between DTE's ambitious corporate mission—to be a 'force for growth and prosperity' and lead in clean energy —and the purely utilitarian experience presented to customers. Critical messages about massive investments in grid modernization and the CleanVision net-zero plan are either absent or buried, representing a massive missed opportunity to shape public perception, build trust, and create a narrative that justifies rate structures and future investments.

In essence, the website's messaging strategy is optimized for managing an existing, captive customer base, but it does little to build a resilient brand, inspire customer loyalty, or differentiate DTE from competitors in an era of increasing energy choices and public scrutiny. The immediate roadmap should focus on bridging the gap between its functional execution and its strategic narrative, transforming the website from a simple payment portal into a powerful platform for brand storytelling and stakeholder engagement.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Operates as a regulated monopoly for electricity and natural gas distribution in a large, established service area in Michigan, ensuring a captive customer base.

- •

Core services (electricity, natural gas) are essential utilities with inelastic demand.

- •

Offers value-added programs like MIGreenPower and Natural Gas Balance, indicating an effort to meet evolving customer demands for sustainability.

- •

Ranked #1 in Customer Satisfaction with Business Natural Gas Service in the Midwest by J.D. Power in 2024, suggesting strong fit with commercial customers.

Improvement Areas

- •

Address residential customer satisfaction, which appears mixed with a high number of detractors and complaints related to outages and service reliability.

- •

Improve communication and transparency around grid modernization efforts and the justification for rate increases to build customer trust.

- •

Enhance the user experience and adoption rate of digital self-service tools and energy management platforms.

Market Dynamics

Moderate - Electricity demand is projected to grow for the first time in decades, driven by data centers, onshoring of manufacturing, and electrification.

Mature

Market Trends

- Trend:

Energy Transition & Decarbonization

Business Impact:Massive capital investment required to shift from coal to renewables (solar, wind) and natural gas, creating significant rate base growth opportunities. DTE's CleanVision plan targets net-zero by 2050.

- Trend:

Electrification of Everything

Business Impact:Significant growth in electricity demand from Electric Vehicles (EVs), heat pumps, and industrial processes creates a major long-term growth driver. DTE anticipates supporting up to 326,000 EVs by 2028 in its territory.

- Trend:

Grid Modernization & Resilience

Business Impact:Urgent need to invest in a smarter, more resilient grid to handle renewable intermittency, EV charging loads, and extreme weather. DTE is planning a multi-billion dollar investment to automate the grid and reduce outages.

- Trend:

Rising Customer Expectations & Digitalization

Business Impact:Customers demand greater reliability, digital engagement, and personalized service. Failure to meet these expectations can lead to negative regulatory outcomes and public pressure.

- Trend:

Supportive Regulatory Environment

Business Impact:The Michigan Public Service Commission (MPSC) allows for cost recovery mechanisms (like the IRM) and rate increases to fund approved capital projects, providing a stable financial foundation for growth investments.

Excellent. The confluence of decarbonization mandates, federal incentives (like the IRA), and surging demand from electrification creates a generational opportunity for capital deployment and growth.

Business Model Scalability

Medium

Extremely high fixed costs associated with generation, transmission, and distribution infrastructure. Growth is capital-intensive and scales with rate base investment, not customer acquisition.

Low in the core business due to high capital requirements. Higher potential leverage exists in non-regulated businesses (DTE Vantage) and new digital service offerings.

Scalability Constraints

- •

Regulatory approval process for capital projects and rate increases.

- •

Massive capital requirements for grid modernization and renewable energy build-out ($30B+ five-year plan).

- •

Long lead times for planning, permitting, and constructing major energy infrastructure.

- •

Supply chain constraints for key components like transformers and switchgear.

Team Readiness

Strong. Leadership demonstrates a clear, long-term strategic vision (CleanVision plan) and is adept at navigating the complex regulatory and financial landscape of the utility industry.

Traditional, siloed structure typical of a mature utility. Needs to foster more agile, cross-functional teams to accelerate the development and deployment of new customer-centric products and services.

Key Capability Gaps

- •

Digital Product Management: To develop and scale new energy services (e.g., home energy management, EV charging solutions).

- •

Data Science & Analytics: To optimize grid operations, predict failures, and personalize customer offerings.

- •

Customer Experience (CX) Design: To improve digital self-service channels and address negative satisfaction trends.

- •

Partnership & Ecosystem Development: To collaborate with technology companies, EV automakers, and smart home device manufacturers.

Growth Engine

Acquisition Channels

- Channel:

New Program Adoption (Existing Customers)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Develop targeted, multi-channel marketing campaigns to increase enrollment in high-margin, value-added services like MIGreenPower, Surge Protection, and EV charging programs.

- Channel:

New Service Connections (New Construction)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Deepen partnerships with residential and commercial developers to streamline the connection process and promote the adoption of energy-efficient technologies and EV-ready infrastructure from the start.

- Channel:

Non-Regulated Business Development (DTE Vantage)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Aggressively pursue opportunities in renewable natural gas, industrial on-site energy solutions, and customized energy projects, leveraging the parent company's balance sheet and expertise.

Customer Journey

The primary 'conversion' for a utility is the adoption of new programs or services. The website presents these options, but the journey from awareness to enrollment could be streamlined.

Friction Points

- •

Complex rate plans and program terms can be difficult for customers to understand and compare.

- •

Perceived high cost or unclear ROI for voluntary programs like carbon offsets or premium services.

- •

Negative customer service experiences reported in public forums can create distrust and reduce willingness to engage with new offerings.

Journey Enhancement Priorities

{'area': 'Digital Enrollment Process', 'recommendation': "Implement a simplified, 'one-click' style enrollment for new programs within the customer's authenticated online portal, pre-populating information and showing personalized cost/benefit analysis."}

{'area': 'Program Education', 'recommendation': 'Create interactive tools, videos, and personalized energy reports that clearly demonstrate the value proposition of EV rate plans, energy efficiency upgrades, and renewable energy programs.'}

Retention Mechanisms

- Mechanism:

Regulated Monopoly

Effectiveness:High

Improvement Opportunity:While customers cannot easily switch providers for distribution, DTE can improve 'retention of trust' by demonstrably improving grid reliability and customer service, thereby reducing regulatory and political risk.

- Mechanism:

Voluntary Green Energy Programs (MIGreenPower)

Effectiveness:Medium

Improvement Opportunity:Increase program visibility and showcase the direct local impact of customer participation (e.g., 'your subscription helped build this solar farm in your county') to deepen emotional connection and loyalty.

- Mechanism:

Specialized Rate Plans (e.g., Time-of-Use, EV rates)

Effectiveness:Medium

Improvement Opportunity:Proactively identify and migrate eligible customers to optimal rate plans using smart meter data analysis, positioning DTE as a trusted advisor helping them save money.

Revenue Economics

The core business model is based on earning a regulated rate of return on invested capital (rate base). Growth is directly tied to the ability to deploy capital on approved projects like grid upgrades and new generation.

Not Applicable in the traditional sense. 'CAC' is negligible for the core utility service due to the monopoly. The focus is on increasing Customer Lifetime Value (LTV) through the adoption of new services.

High (for core business). The regulated model provides a predictable revenue stream based on approved rates and capital investments.

Optimization Recommendations

- •

Maximize rate base growth by efficiently executing the $30B+ capital investment plan for grid modernization and clean energy.

- •

Increase revenue from non-regulated businesses (DTE Vantage) which offer higher margins and are not subject to rate caps.

- •

Drive adoption of fee-based value-added services (e.g., appliance repair, surge protection) to the existing customer base.

Scale Barriers

Technical Limitations

- Limitation:

Aging Grid Infrastructure

Impact:High

Solution Approach:Systematic, multi-billion dollar grid modernization program to replace legacy equipment, automate circuits with smart devices, and increase capacity.

- Limitation:

Renewable Energy Intermittency

Impact:Medium

Solution Approach:Invest heavily in energy storage solutions (targeting 2,900 MW by 2042) and build flexible natural gas generation to balance the grid when solar/wind are unavailable.

Operational Bottlenecks

- Bottleneck:

Storm Restoration & Outage Management

Growth Impact:Hinders customer satisfaction and can lead to regulatory penalties. This is a major public pain point.

Resolution Strategy:Continue investment in grid hardening (tree trimming, stronger poles) and smart grid technology to isolate faults and speed up restoration.

- Bottleneck:

Interconnection Queues for Distributed Energy

Growth Impact:Slows the deployment of customer-sited solar and other distributed resources, potentially creating customer frustration.

Resolution Strategy:Streamline and digitize the interconnection application and approval process, providing greater transparency to applicants.

Market Penetration Challenges

- Challenge:

Regulatory Lag and Rate Case Scrutiny

Severity:Critical

Mitigation Strategy:Maintain a constructive relationship with the MPSC, justify investments with robust data on reliability and customer benefits, and proactively engage with stakeholder groups.

- Challenge:

Public Opposition to Large Infrastructure Projects

Severity:Major

Mitigation Strategy:Implement comprehensive community engagement strategies, highlight local economic benefits (jobs, tax base), and offer community benefit agreements for host communities of new wind/solar farms.

- Challenge:

Customer Affordability Concerns

Severity:Major

Mitigation Strategy:Balance rate increases with aggressive cost management, leverage federal incentives (IRA) to reduce project costs, and expand energy assistance programs for low-income customers.

Resource Limitations

Talent Gaps

- •

Substation Technicians and Lineworkers (industry-wide shortage).

- •

Data Scientists and Grid Modeling Experts.

- •

Software Engineers for developing new digital customer platforms.

Extremely high. Requires consistent access to capital markets to fund the multi-billion dollar annual investment plan. DTE's strategy relies on a stable investment-grade credit rating.

Infrastructure Needs

- •

Expansion of the high-voltage transmission system to connect new renewable generation zones.

- •

Deployment of a robust fiber communications network to support smart grid devices.

- •

Build-out of a comprehensive public EV fast-charging network.

Growth Opportunities

Market Expansion

- Expansion Vector:

Non-Regulated Energy Services

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Expand DTE Vantage's portfolio in high-growth areas like Renewable Natural Gas (RNG) and on-site energy solutions for large industrial customers nationwide.

- Expansion Vector:

Data Center Energy Supply

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Proactively partner with hyperscale data center developers to attract them to Michigan, offering reliable, renewable power and building new infrastructure to meet their massive energy demand.

Product Opportunities

- Opportunity:

EV Charging-as-a-Service

Market Demand Evidence:Forecasts show EV adoption in Southeast Michigan requiring hundreds of thousands of new chargers by 2028.

Strategic Fit:Directly increases electricity sales (load growth) and leverages utility expertise in managing electrical infrastructure.

Development Recommendation:Develop turnkey charging solutions for businesses (fleet and workplace) and multi-family dwellings, bundling hardware, software, installation, and maintenance into a monthly service fee.

- Opportunity:

Home Energy Management Solutions

Market Demand Evidence:Growing consumer interest in smart homes, energy efficiency, and cost control.

Strategic Fit:Positions DTE as a trusted energy advisor, enhances customer engagement, and creates opportunities to manage residential load.

Development Recommendation:Partner with smart thermostat and home automation companies to offer a DTE-branded energy management platform that helps customers optimize their usage, participate in demand response programs, and manage EV charging.

- Opportunity:

Utility-Scale Battery Storage Projects

Market Demand Evidence:Essential for grid stability with high renewable penetration; Michigan has a statewide energy storage target.

Strategic Fit:A capital-intensive asset that can be added to the rate base, improving reliability and enabling more renewable energy.

Development Recommendation:Aggressively pursue development of large-scale battery storage facilities, leveraging federal incentives from the Inflation Reduction Act to improve project economics.

Channel Diversification

- Channel:

Automotive Dealership Partnerships

Fit Assessment:Excellent

Implementation Strategy:Create a program where EV buyers are offered a DTE home charger rebate and enrollment in a favorable EV electricity rate at the point of sale, facilitated by the car dealer.

- Channel:

Big-Box Retail (Home Improvement)

Fit Assessment:Good

Implementation Strategy:Establish in-store kiosks or partnerships with retailers like Home Depot or Lowe's to promote energy efficiency products, smart thermostats, and home EV chargers, offering instant rebates.

Strategic Partnerships

- Partnership Type:

Technology & Software

Potential Partners

- •

Google Nest

- •

Amazon Alexa

- •

Bidgely

- •

Oracle Utilities

Expected Benefits:Accelerate development of digital customer engagement platforms and demand response programs without building all technology in-house.

- Partnership Type:

EV Infrastructure & Manufacturing

Potential Partners

- •

Ford

- •

General Motors

- •

ChargePoint

- •

Tritium

Expected Benefits:Co-develop and deploy charging infrastructure, align on technology standards, and promote EV adoption through joint marketing and incentive programs.

Growth Strategy

North Star Metric

Regulated Capital Deployed Annually

For a regulated utility, earnings growth is fundamentally driven by the expansion of the rate base. This metric directly tracks the primary engine of financial growth and aligns with the core strategy of modernizing the grid and transitioning to clean energy.

Successfully execute the planned $30 billion in capital investments over the next five years, averaging $6B per year.

Growth Model

Capital-Intensive Platform Growth

Key Drivers

- •

Successful execution of the CleanVision generation transition plan.

- •

Efficient deployment of the grid modernization and reliability program.

- •

Regulatory approval of capital plans and cost recovery.

- •

Growth in electricity demand from electrification (EVs, data centers).

A disciplined, long-term approach focused on project management excellence, stakeholder engagement, and constructive regulatory relationships to ensure consistent capital deployment and recovery.

Prioritized Initiatives

- Initiative:

Accelerate Grid Automation 'Smart Grid' Deployment

Expected Impact:High

Implementation Effort:High

Timeframe:3-5 Years

First Steps:Prioritize circuits with the worst reliability performance for immediate deployment of reclosers and sensors. Launch a public dashboard showing reliability improvements in upgraded areas.

- Initiative:

Launch a 'Business EV Fleet Advisory' Service

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:6-12 Months

First Steps:Create a dedicated team to consult with commercial customers on fleet electrification, providing TCO analysis, charging infrastructure planning, and rebate assistance to accelerate adoption.

- Initiative:

Develop Utility-Owned Community Solar Programs

Expected Impact:Medium

Implementation Effort:High

Timeframe:18-24 Months

First Steps:File a proposal with the MPSC for a community solar program targeted at customers who cannot install rooftop solar (renters, apartment dwellers), adding new renewable assets to the rate base.

Experimentation Plan

High Leverage Tests

- Test:

Dynamic & Gamified Demand Response

Hypothesis:Offering real-time, variable incentives through a mobile app can achieve higher peak load reduction than traditional flat-rate programs.

- Test:

Subscription-Based Home Energy Services Bundle

Hypothesis:Customers will pay a monthly fee for a bundle including surge protection, an energy management app, and proactive HVAC monitoring.

- Test:

Time-of-Day Pricing for Public EV Fast Charging

Hypothesis:Implementing variable pricing at utility-owned fast chargers can shift charging sessions to off-peak hours, reducing grid strain.

A/B testing methodology focused on adoption rates, customer satisfaction (NPS), load-shifting (in MWh), and incremental revenue per user.

Quarterly cycle of designing, launching, and analyzing new product and pricing experiments with small customer cohorts before broader rollout.

Growth Team

A dedicated 'New Energy Services' group, operating with more autonomy than the core utility business. This team should be a cross-functional unit combining product management, marketing, engineering, and regulatory specialists.

Key Roles

- •

Head of Product (Energy Services)

- •

EV Program Manager

- •

Digital Customer Experience Lead

- •

Data Scientist

Actively recruit talent from outside the traditional utility sector (e.g., from tech, software, and automotive industries) to inject new skills in product development and customer-centric design. Utilize strategic partnerships to co-develop new offerings.

DTE Energy is not a traditional growth company but a mature, regulated utility at the epicenter of a once-in-a-generation energy transition. Its growth potential is immense but is defined differently: not by rapid customer acquisition, but by the scale and efficiency of its capital deployment into clean energy and grid modernization. The company has a strong foundation with a captive market, a clear long-term strategic plan in its 'CleanVision' initiative, and a generally supportive regulatory environment in Michigan that allows for the recovery of prudent investments.

The primary growth engine is the multi-billion dollar, multi-year capital investment program to decarbonize its generation fleet and build a resilient, automated 'grid of the future.' This will drive significant expansion of the company's rate base, the fundamental driver of earnings for a regulated utility. Secondary growth vectors are emerging from the electrification of transportation and buildings, and new opportunities in non-regulated businesses via its DTE Vantage subsidiary.

However, significant barriers exist. The company must execute massive, complex infrastructure projects on time and on budget while navigating intense regulatory scrutiny and public concerns about affordability. A key challenge is managing customer satisfaction, which shows signs of weakness, particularly around reliability and outages. Failure to improve service can jeopardize the public and regulatory support needed to approve the very investments that drive growth.

Key Strategic Recommendations:

1. Execute Flawlessly on the Core Capital Plan: The highest priority is the disciplined deployment of capital for grid modernization and renewable generation. This is the primary driver of financial growth and must be managed with excellence.

2. Shift from Utility to 'Energy Advisor': Actively invest in digital tools, customer analytics, and new product teams to move beyond being a commodity provider. Growth opportunities in EV charging, home energy management, and demand response require a customer-centric, product-focused mindset.

3. Champion the EV Transition: Seize the leadership role in building out Michigan's EV charging infrastructure. This represents the most significant organic load growth opportunity in decades. Proactive investment and partnership will secure DTE's central role in the future of mobility.

In conclusion, DTE Energy is well-positioned for a period of sustained, capital-intensive growth. Success will depend on its ability to balance massive infrastructure investment with operational excellence, regulatory acumen, and a genuine transformation in how it engages and serves its customers.

Legal Compliance

DTE Energy maintains two distinct privacy policies: an 'Online Privacy Policy' and a 'Customer Data Privacy Policy'. The Online Policy addresses data collected via the website (like IP addresses and cookies) and Personally Identifiable Information (PII) for online services. The Customer Data Privacy Policy, initiated at the request of the Michigan Public Service Commission (MPSC), governs customer usage data and PII collected through utility services. This dual-policy approach correctly separates web-user data from regulated utility customer data. The policies state that PII will not be knowingly shared for commercial purposes and that DTE will not sell customer information, except for aged receivables to collection firms. Both policies are accessible via the website's footer. However, the language regarding data sharing with 'agents and contractors' could be more specific to enhance transparency. The policies lack specific disclosures required by newer privacy laws like CCPA/CPRA, such as detailing consumer rights to know, correct, and delete data, or a 'Do Not Sell/Share My Info' link.

The website provides 'Terms & Conditions' which are clearly written and accessible. They effectively disclaim liability for damages arising from the use of the website and third-party services linked from it, which is a standard and strong practice for risk management. Specific terms for online payments are also included, outlining user responsibility for sufficient funds and potential fees, which adds a necessary layer of clarity for transactional services. However, the terms are broad and could be improved by creating more specific 'Terms of Use' for distinct services like the online account portal versus general website browsing to ensure enforceability and clarity for different user interactions.

Upon visiting the website, a persistent cookie banner is displayed at the bottom of the page, stating 'By continuing to browse or by clicking "Accept," you agree to our site's privacy policy.' This implies a 'browse-wrap' or implied consent model, which is no longer considered sufficient under modern data privacy laws like GDPR and CCPA/CPRA. There is no visible mechanism for users to manage cookie preferences or reject non-essential cookies, a significant compliance gap. The privacy policy mentions the use of cookies for automated services and internal review but lacks the detailed disclosure of cookie types (e.g., functional, advertising), their purpose, and duration that is now standard practice.

DTE Energy's primary operations in Michigan place it outside the direct jurisdiction of GDPR. However, its size and customer base make compliance with state-level privacy laws, particularly the California Consumer Privacy Act (CCPA) as amended by the CPRA, a key consideration. The current privacy policies do not address specific CCPA/CPRA rights, such as the right to know what specific pieces of information are collected, the right to delete personal information, the right to correct inaccurate information, or the right to opt-out of the sale or sharing of personal information for cross-context behavioral advertising. The website does not feature a 'Do Not Sell or Share My Personal Information' link, which is a mandatory requirement under CPRA. Furthermore, the site does not appear to honor Global Privacy Control (GPC) signals, an automated browser setting that legally-binding opt-out request under CCPA/CPRA.

As a public utility, DTE Energy's website is considered a place of public accommodation and is subject to the Americans with Disabilities Act (ADA). The website should conform to the Web Content Accessibility Guidelines (WCAG) 2.1 AA standard to ensure it is accessible to people with disabilities. The company shows a commitment to accessibility through its 'Abilities in Motion' employee resource group and a general statement on providing reasonable accommodation. However, the website lacks a formal, easily accessible 'Accessibility Statement' that details its commitment to WCAG standards, features available to users with disabilities, and a contact method for reporting accessibility issues. This is a significant omission for a public-facing essential service provider. A full technical audit would be required to assess WCAG conformance, but the absence of a clear policy statement is a strategic and legal risk.