eScore

ea.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

EA.com demonstrates exceptional Digital Presence Intelligence through its dominant brand authority and high-volume traffic for its core franchises. The site masterfully aligns with high-intent search queries for its blockbuster titles, effectively serving as the primary conversion hub. Its global reach is strong, with localized sites for key markets, and the multi-channel presence is robust, leveraging massive social media followings and video platforms to drive engagement and traffic.

EA possesses near-total dominance for branded search terms related to its key franchises (e.g., 'EA SPORTS FC', 'Madden'), making it the authoritative source and primary destination for its massive player base.

Develop content hubs around broader, non-branded topics (e.g., 'sports gaming culture,' 'competitive shooter strategies') to capture top-of-funnel audience segments and reduce reliance on established brand recognition.

The website's brand communication is highly effective at driving conversions for specific products, using an energetic, action-oriented voice for its games and a clear value proposition for its EA Play subscription. However, the overall brand narrative is fragmented, creating a disconnect between the product-focused messaging and the corporate mission of 'inspiring the world to play'. While messaging is well-tailored for existing franchise loyalists, it lacks a unifying story to build a stronger emotional connection with the parent EA brand.

Messaging for primary calls-to-action ('Pre-Order Now', 'Join Now') is exceptionally clear, direct, and effective at funneling users towards key revenue-generating actions.

Create a unifying homepage narrative that bridges the gap between the corporate mission and product marketing, framing its blockbuster games as the tangible proof of its commitment to 'inspire the world to play'.

EA.com provides a highly optimized conversion experience with a visually immersive design, intuitive navigation through its mega menu, and a low cognitive load for users. The site excels with a seamless cross-device journey, adapting perfectly to mobile. Key conversion elements for new game releases are prominent and effective, though there is a slight weakness in communicating the value proposition for the EA Play subscription with the same level of impact.

The website's use of a clear information hierarchy and intuitive navigation, especially the desktop mega menu, allows users to find key products and information efficiently, minimizing friction in the conversion path.

Enhance the 'EA Play' subscription section with more dynamic content, such as member testimonials or a rotating carousel of included hit games, to more forcefully communicate its value and increase subscription conversion rates.

EA demonstrates strong credibility through its public commitment to accessibility and comprehensive privacy portals, which serve as powerful trust signals. However, its overall risk profile is significantly elevated by two key issues: a non-compliant cookie consent banner that poses a high GDPR risk, and the business's heavy reliance on 'loot box' mechanics, which face intense, ongoing regulatory scrutiny worldwide. While the company adheres to industry standards like age ratings, the regulatory uncertainty around its core monetization strategy presents a substantial, persistent risk.

A strong, public, and well-resourced commitment to accessibility (ea.com/able), including published patents and partnerships, which enhances brand reputation and mitigates legal risk.

Immediately overhaul the cookie consent banner for GDPR compliance by implementing a clear, equally prominent 'Accept' and 'Reject' button and ceasing the use of implied consent models.

EA's competitive advantage is exceptionally strong and sustainable, forming a deep moat around its business. This is built on two primary pillars: a portfolio of world-renowned, owned IP like Apex Legends and The Sims, and exclusive, long-term licensing agreements for major sports leagues (NFL, Premier League), which create a near-monopoly in the sports simulation genre. These advantages are further solidified by massive network effects within its online communities and significant economies of scale in global marketing and distribution.

Exclusive sports licenses (e.g., NFL, global soccer leagues) create a highly durable and difficult-to-replicate competitive moat, locking in a massive, loyal player base with annual purchase habits.

Address franchise fatigue and the perception of iterative innovation by dedicating significant investment to the creation of new, blockbuster-scale owned IP to reduce long-term reliance on existing franchises.

EA is exceptionally well-positioned for scalability and expansion, underpinned by a high-margin digital business model with low variable costs. The company's live services are designed for massive scale, and its clear strategic focus on expanding into mobile and emerging markets demonstrates a strong readiness for growth. While the company is highly profitable and capital-efficient, a key constraint is the challenge of scaling creative talent to develop new IP at a pace that matches market opportunities.

The live services model, which accounts for the majority of revenue, provides extremely strong and scalable unit economics, where the lifetime value of an engaged player vastly exceeds the acquisition cost.

Accelerate mobile-first expansion in high-growth markets like Asia and LATAM by developing native mobile versions of core IP or acquiring successful regional studios to capture the next wave of gamers.

EA's business model is highly coherent and has successfully transitioned to a predictable, recurring revenue model dominated by high-margin live services and subscriptions. This strategic focus aligns perfectly with current market trends and has delivered strong financial results. However, the model's heavy reliance on a few key franchises for the bulk of its revenue creates a concentration risk and a strategic vulnerability should one of these tentpole titles falter.

The successful pivot to a 'Live Services' model, which now accounts for over 70% of revenue, provides a highly profitable, recurring, and predictable financial structure.

Proactively innovate and diversify monetization strategies to be less reliant on controversial 'loot box' mechanics, thereby mitigating regulatory risk and improving long-term brand sentiment.

As a key player in a market oligopoly, EA wields significant market power, particularly in the sports simulation genre where its exclusive licenses grant it substantial pricing power and influence. The company's ability to command premium prices for its AAA titles and sustain highly profitable in-game economies demonstrates its dominant position. This power is reinforced by its massive global marketing infrastructure and the strong network effects of its online games, which create high switching costs for players invested in its ecosystems.

EA's exclusive licenses and portfolio of blockbuster IP grant it significant pricing power, allowing it to set premium prices and implement lucrative monetization strategies without substantial loss of market share.

Address the negative player sentiment and brand perception that persists around its business practices, as this is a key disadvantage that competitors can exploit to erode its market influence over time.

Business Overview

Business Classification

Digital Content Publisher & Live Service Provider

Subscription Platform Operator (EA Play)

Interactive Entertainment

Sub Verticals

- •

Video Game Development & Publishing

- •

Esports

- •

Mobile Gaming

- •

Games as a Service (GaaS)

Mature

Maturity Indicators

- •

Established global brand recognition and market leadership.

- •

Consistent revenue generation, with FY24 revenue at $7.56 billion.

- •

Diversified portfolio of long-standing, successful intellectual properties (IPs).

- •

Significant transition from a product-based (physical sales) to a service-based (digital live services) model.

- •

Active in mergers and acquisitions to acquire talent and IP (e.g., Codemasters, Respawn).

- •

Regular payment of dividends and implementation of large-scale stock repurchase programs.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Live Services & Other

Description:This is the dominant revenue stream, encompassing microtransactions, in-game purchases (e.g., Ultimate Team packs in EA SPORTS FC), downloadable content (DLC), and revenue from free-to-play titles like Apex Legends. This segment represents the core of EA's Games as a Service (GaaS) strategy, focusing on long-term player engagement and monetization beyond the initial game sale. It accounted for approximately 73-74% of total revenue in recent fiscal years.

Estimated Importance:Primary

Customer Segment:Engaged Players of Core Franchises

Estimated Margin:High

- Stream Name:

Full Game Downloads (Digital Sales)

Description:Revenue from the digital sale of full games through platforms like PlayStation Store, Xbox Games Store, Steam, and EA's own PC platform. This has largely replaced physical sales as the primary method of game distribution, representing around 18-20% of revenue.

Estimated Importance:Secondary

Customer Segment:All Gamers

Estimated Margin:Medium-High

- Stream Name:

Subscriptions (EA Play)

Description:Recurring revenue from the EA Play subscription service, which offers access to a library of EA titles, early trials of new games, and discounts on digital purchases. Available on PlayStation, Xbox, and PC, with a standard and a 'Pro' tier on PC offering immediate access to new releases.

Estimated Importance:Tertiary

Customer Segment:Value-Conscious & Broad-Interest Gamers

Estimated Margin:Medium

- Stream Name:

Packaged Goods & Other (Physical Sales)

Description:Revenue from the sale of physical copies of games through retail partners. This stream is in a long-term decline as the industry shifts to digital distribution, now representing less than 10% of total revenue.

Estimated Importance:Tertiary

Customer Segment:Traditional Retail Shoppers & Collectors

Estimated Margin:Low

Recurring Revenue Components

- •

EA Play Subscriptions

- •

Live Service content (e.g., seasonal battle passes in Apex Legends)

- •

Recurring in-game purchases (e.g., Ultimate Team packs)

Pricing Strategy

Hybrid Monetization

Premium

Semi-transparent

Pricing Psychology

- •

Tiered Offerings (Standard vs. Deluxe/Ultimate game editions)

- •

Subscription Tiers (EA Play vs. EA Play Pro)

- •

Time-Limited Offers and Sales

- •

In-Game Currency Abstraction (e.g., FIFA Points, Apex Coins)

Monetization Assessment

Strengths

- •

Highly successful transition to a high-margin, recurring revenue 'Live Services' model.

- •

Dominant monetization engines in key franchises (e.g., Ultimate Team).

- •

Diversified streams across premium sales, free-to-play, and subscriptions.

- •

EA Play subscription creates ecosystem lock-in and a predictable revenue base.

Weaknesses

- •

Reputational risk and regulatory scrutiny associated with loot box/microtransaction mechanics.

- •

Heavy reliance on a few key franchises (EA SPORTS, Apex Legends) for live service revenue.

- •

Potential for player fatigue or backlash against aggressive monetization.

- •

Declining, low-margin physical goods segment.

Opportunities

- •

Expansion of the EA Play subscription service to include more third-party content or cloud gaming features.

- •

Development of new free-to-play titles to capture new audiences and monetization opportunities, such as the upcoming 'Skate.'.

- •

Leveraging AI to create more personalized in-game offers and dynamic content.

- •

Growth in emerging markets, particularly in mobile gaming.

Threats

- •

Increased government regulation on in-game purchases and loot boxes.

- •

Intense competition from other publishers with strong live service games (e.g., Activision Blizzard, Take-Two).

- •

Shifts in consumer spending habits away from discretionary entertainment during economic downturns.

- •

Competitors' subscription services (e.g., Xbox Game Pass) offering a more compelling value proposition.

Market Positioning

Market Leader in Sports Simulation & Publisher of Diversified Blockbuster IP

Top-tier global publisher, though specific market share varies by genre. It is a major competitor to platform holders like Microsoft and Sony and other large publishers like Take-Two Interactive and Tencent.

Target Segments

- Segment Name:

The Sports Fanatic

Description:Core audience for the EA SPORTS portfolio (EA SPORTS FC, Madden NFL). Highly engaged, often makes annual purchases of new titles and is the primary driver of 'Ultimate Team' live service revenue.

Demographic Factors

Primarily male, aged 13-35.

Global audience with strong concentrations in Europe and North/South America for football, and North America for American football.

Psychographic Factors

- •

Passionate about sports and competition.

- •

Values authenticity and realism in sports simulation.

- •

Enjoys community and competitive online play.

Behavioral Factors

- •

High repeat purchase rate for annual franchises.

- •

High engagement with in-game monetization (Ultimate Team).

- •

Follows esports and related content creators.

Pain Points

- •

Perceived lack of significant innovation in annual releases.

- •

Frustration with monetization mechanics.

- •

Desire for more stable and balanced online gameplay.

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

The Competitive Action Gamer

Description:Players of fast-paced, competitive multiplayer games like Apex Legends and Battlefield. This segment values skill-based gameplay, regular content updates, and a thriving online community.

Demographic Factors

Typically aged 16-30.

Global audience, skewing male but with a growing female player base.

Psychographic Factors

- •

Competitive, seeks mastery of game mechanics.

- •

Values social interaction and team-based play.

- •

Driven by progression systems and cosmetic customization.

Behavioral Factors

- •

High time investment in a single game.

- •

Engages with battle passes and cosmetic microtransactions.

- •

Active on platforms like Twitch and Discord.

Pain Points

- •

Server instability and cheating issues in online games.

- •

Content droughts between major updates.

- •

Balancing issues with weapons, characters, or game mechanics.

Fit Assessment:Good

Segment Potential:High

- Segment Name:

The Life Simulator & Creative Player

Description:The dedicated audience for The Sims franchise. This segment is motivated by creativity, storytelling, and self-expression. They have a long history with the franchise and engage heavily with expansion packs and custom content.

Demographic Factors

Skews heavily female, broad age range (teens to adults).

Global and diverse player base.

Psychographic Factors

- •

Creative, enjoys building and designing.

- •

Interested in storytelling and character creation.

- •

Values open-ended, sandbox-style gameplay.

Behavioral Factors

- •

High purchase rate of DLC (expansion, game, and stuff packs).

- •

Long-term engagement with a single title.

- •

Active in online communities, sharing creations and stories.

Pain Points

- •

High cost of entry for the complete collection of DLC.

- •

Desire for more depth in core gameplay mechanics.

- •

Technical bugs and performance issues, especially with multiple expansions installed.

Fit Assessment:Excellent

Segment Potential:Medium

Market Differentiation

- Factor:

Exclusive Sports Licenses

Strength:Strong

Sustainability:Sustainable

- Factor:

Owned Blockbuster IP Portfolio

Strength:Strong

Sustainability:Sustainable

- Factor:

Live Service Expertise and Infrastructure

Strength:Strong

Sustainability:Sustainable

- Factor:

Global Publishing and Marketing Scale

Strength:Strong

Sustainability:Sustainable

- Factor:

Proprietary Game Engines (e.g., Frostbite)

Strength:Moderate

Sustainability:Sustainable

Value Proposition

To provide high-quality, immersive, and connected interactive entertainment experiences through blockbuster franchises and market-leading live services.

Good

Key Benefits

- Benefit:

Authentic Sports Simulation

Importance:Critical

Differentiation:Unique

Proof Elements

Official licenses with major sports leagues (e.g., Premier League, NFL).

Realistic player likenesses, stadiums, and presentation.

- Benefit:

High-Fidelity, Large-Scale Gaming

Importance:Important

Differentiation:Somewhat unique

Proof Elements

Graphically advanced games like the Battlefield series.

Massive online communities and player counts.

- Benefit:

Continuously Evolving Gameplay (Live Services)

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Regular content updates, seasons, and events in games like Apex Legends.

Dynamic content in Ultimate Team modes reflecting real-world sports.

- Benefit:

Access to a Broad Library of Games (EA Play)

Importance:Important

Differentiation:Somewhat unique

Proof Elements

The Play List of titles available through the subscription.

Early access trials for upcoming releases.

Unique Selling Points

- Usp:

The definitive, officially licensed interactive football experience with EA SPORTS FC.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A portfolio of some of the world's most recognized gaming franchises across multiple genres (Madden, The Sims, Battlefield, Apex Legends).

Sustainability:Long-term

Defensibility:Strong

- Usp:

Deeply integrated and highly profitable live service ecosystems, particularly 'Ultimate Team'.

Sustainability:Long-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Desire for authentic and engaging ways to interact with favorite sports.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Need for high-quality, large-scale competitive multiplayer entertainment.

Severity:Major

Solution Effectiveness:Partial

- Problem:

Lack of creative outlets for storytelling and life simulation.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Wanting access to a variety of games without high individual purchase costs.

Severity:Minor

Solution Effectiveness:Partial

Value Alignment Assessment

High

EA's strategic shift to live services, massive online communities, and open-world games aligns directly with dominant player behavior and market trends.

High

The company effectively serves its core segments with genre-defining titles, although monetization strategies sometimes create friction with the player base.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Platform Holders (Sony PlayStation, Microsoft Xbox, Nintendo)

- •

Digital Storefronts (Steam, Epic Games Store)

- •

Sports Leagues & Associations (e.g., Premier League, NFL, NFLPA)

- •

Independent Development Studios (via EA Partners program)

- •

Cloud Service Providers (e.g., AWS, Azure)

- •

Hardware & Peripheral Manufacturers

Key Activities

- •

Game Development & Production (AAA titles)

- •

Publishing, Marketing & Distribution

- •

Live Service Operations & Content Creation

- •

Intellectual Property Management & Licensing

- •

Platform Management (EA Play, EA app)

- •

Esports League Operation

Key Resources

- •

Owned Intellectual Property (EA SPORTS FC, Madden, Battlefield, Apex Legends, The Sims, etc.)

- •

World-class Development Studios (DICE, Respawn, BioWare, Maxis, etc.)

- •

Exclusive Licensing Agreements

- •

Proprietary Technology (e.g., Frostbite Engine)

- •

Global Marketing & Distribution Network

- •

Vast Player Data & Analytics Capabilities

Cost Structure

- •

Research & Development (Game development is the largest cost)

- •

Marketing & Sales

- •

Licensing Fees & Royalties

- •

General & Administrative Expenses

- •

Infrastructure Costs (Servers, Live Service Operations)

Swot Analysis

Strengths

- •

Dominant portfolio of high-value, owned IP and exclusive sports licenses.

- •

Highly profitable and mature Games as a Service (GaaS) model driving recurring revenue.

- •

Strong financial position with significant cash flow and global market reach.

- •

Extensive network of talented in-house development studios.

Weaknesses

- •

Over-reliance on a small number of key franchises for the majority of revenue.

- •

History of negative public perception regarding monetization practices and game launches.

- •

Vulnerability to franchise fatigue if innovation stagnates in annualized titles.

- •

High cost and long development cycles for AAA games.

Opportunities

- •

Expansion into high-growth markets like mobile and cloud gaming.

- •

Leveraging AI to improve development efficiency and create new player experiences.

- •

Growing the EA Play subscription base and increasing its value proposition.

- •

Capitalizing on the growth of esports to further monetize key franchises.

- •

Developing new, successful IP to diversify the portfolio.

Threats

- •

Intense competition from major publishers and platform holders (e.g., Microsoft/Activision, Sony, Take-Two, Tencent).

- •

Potential for increased government regulation on loot boxes and in-game monetization.

- •

Rapidly changing consumer preferences and the rise of new entertainment platforms.

- •

Risk of losing key licenses or talent to competitors.

- •

Industry consolidation creating more powerful competitors.

Recommendations

Priority Improvements

- Area:

Monetization Strategy

Recommendation:Innovate on monetization models to be less reliant on controversial loot box mechanics. Focus on value-driven cosmetics, battle passes, and content that are perceived as fairer by the community to mitigate regulatory risk and improve brand sentiment.

Expected Impact:Medium

- Area:

IP Portfolio Diversification

Recommendation:Accelerate investment in developing and launching new, successful IP outside of the core sports and shooter genres. This reduces reliance on annualized franchises and opens new revenue streams.

Expected Impact:High

- Area:

Subscription Service Enhancement

Recommendation:Evolve EA Play by integrating cloud gaming capabilities and potentially bundling third-party games to create a more competitive offering against services like Xbox Game Pass.

Expected Impact:Medium

Business Model Innovation

- •

Develop a transmedia strategy around key IP (e.g., The Sims movie partnership with Amazon MGM Studios) to create new revenue streams and deepen brand engagement.

- •

Explore Web3/blockchain technologies for unique in-game assets or player-driven economies, but with extreme caution due to market volatility and player sentiment.

- •

Launch a dedicated EA SPORTS app to create a social and interactive hub beyond the games themselves, integrating live sports data and content to drive daily engagement.

Revenue Diversification

- •

Expand the EA Originals program to publish more innovative indie titles, taking a publisher fee and potentially identifying breakout hits for acquisition.

- •

Invest further in the mobile gaming market, focusing on creating free-to-play versions of core IP that are built natively for the platform.

- •

Monetize proprietary technology by licensing game engines or development tools to third-party developers.

Electronic Arts has successfully executed a strategic transformation from a traditional, product-centric video game publisher to a dominant digital entertainment and live services provider. The core of its current business model revolves around the Games as a Service (GaaS) concept, which has shifted its revenue focus from one-time premium game sales to a more predictable, high-margin stream of recurring income from in-game purchases, content updates, and subscriptions. This is evidenced by the fact that 'Live Services' consistently contribute over 70% of the company's net bookings. The company's key strengths—a powerful portfolio of owned IP like Battlefield and The Sims, and near-monopolistic licensed sports franchises like EA SPORTS FC and Madden NFL—provide a robust foundation for this model. These established brands command massive, loyal communities that are receptive to long-term monetization. The EA Play subscription service further strengthens this ecosystem by increasing player retention and creating a direct-to-consumer relationship.

However, this model is not without significant challenges and risks. EA's heavy reliance on a few key franchises creates a concentration risk, where the underperformance of a single major title could disproportionately impact financials. Furthermore, the company's monetization methods, particularly the 'Ultimate Team' loot box mechanic, face persistent negative player sentiment and the looming threat of stricter government regulation globally, which could fundamentally disrupt its most profitable revenue stream. Competition is also intensifying, not just from other publishers, but from the platform holders themselves (e.g., Microsoft's acquisition of Activision Blizzard and the growth of Xbox Game Pass), which threatens to commoditize content and squeeze publisher margins.

For future evolution, EA's strategy must focus on three core pillars: diversification, innovation, and reputation management. Diversification involves aggressively pursuing new, successful IP to lessen the dependency on annualized sequels and expanding its footprint in high-growth areas like mobile and cloud gaming. Innovation requires leveraging new technologies like AI to streamline development and deliver more personalized player experiences, while also evolving the EA Play value proposition to remain competitive. Finally, proactive reputation management is critical; EA must innovate its monetization strategies to be more player-friendly and value-oriented to rebuild community trust and preempt regulatory action. The company's long-term sustainable advantage will depend on its ability to balance its highly effective but controversial monetization engine with a renewed focus on delivering diverse, innovative, and respected gaming experiences.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

High Development & Marketing Costs for AAA Titles

Impact:High

- Barrier:

Intellectual Property (IP) & Franchise Ownership

Impact:High

- Barrier:

Exclusive Licensing Agreements (e.g., Sports Leagues)

Impact:High

- Barrier:

Distribution Channels & Platform Holder Relationships (Sony, Microsoft, Nintendo)

Impact:Medium

- Barrier:

Brand Recognition & Established Player Communities

Impact:Medium

Industry Trends

- Trend:

Live Services & Games-as-a-Service (GaaS)

Impact On Business:Central to EA's revenue model (e.g., Ultimate Team, Apex Legends), requiring continuous content development and community management to maintain player engagement and recurring revenue.

Timeline:Immediate

- Trend:

Cloud Gaming & Subscription Services (e.g., Xbox Game Pass)

Impact On Business:Both an opportunity (EA Play integration) and a threat (devaluation of individual game purchases). Shifts power to platform holders.

Timeline:Immediate

- Trend:

AI in Game Development & Operations

Impact On Business:Opportunity to streamline development, create more dynamic gameplay, and personalize player experiences. Competitors are also investing heavily, making it a crucial area for R&D.

Timeline:Near-term

- Trend:

Cross-Platform Play

Impact On Business:Becoming a player expectation. Increases the potential player base for multiplayer games but adds technical complexity and cost.

Timeline:Immediate

- Trend:

Expansion into Emerging Markets (LATAM, Southeast Asia)

Impact On Business:Significant growth opportunity, particularly for mobile titles, requiring localization and new payment models.

Timeline:Near-term

Direct Competitors

- →

Activision Blizzard (a Microsoft subsidiary)

Market Share Estimate:High

Target Audience Overlap:High

Competitive Positioning:Publisher of some of the world's largest blockbuster franchises with a strong focus on multiplayer, live-service, and mobile gaming.

Strengths

- •

Massively powerful IPs (Call of Duty, World of Warcraft, Diablo, Candy Crush).

- •

Extensive experience and success in the live services model.

- •

Strong foothold in the lucrative mobile gaming market via King.

- •

Backed by Microsoft's financial and technological resources, including integration with Xbox Game Pass.

Weaknesses

- •

Heavy reliance on a few key franchises, particularly Call of Duty.

- •

Past reputational damage from workplace culture issues.

- •

Integration with Microsoft may stifle some creative autonomy or lead to strategic shifts focused on the Xbox ecosystem.

Differentiators

- •

Ownership of the top-selling annual first-person shooter franchise.

- •

Dominance in the MMORPG genre with World of Warcraft.

- •

Unmatched reach in casual mobile gaming through King.

- →

Take-Two Interactive

Market Share Estimate:Medium-High

Target Audience Overlap:Medium

Competitive Positioning:A publisher focused on creating the highest-quality, critically acclaimed, and commercially successful AAA titles.

Strengths

- •

Owner of globally recognized, high-quality IPs like Grand Theft Auto and Red Dead Redemption.

- •

Reputation for quality-over-quantity, leading to massive launch sales and longevity.

- •

Strong recurring revenue from GTA Online and NBA 2K.

- •

Expanded mobile presence through the acquisition of Zynga.

Weaknesses

- •

Extreme dependence on a small number of key franchises, creating long gaps between major releases.

- •

Vulnerable to delays in major game releases, significantly impacting financial projections.

- •

Slower-than-expected performance in the mobile segment post-Zynga acquisition.

Differentiators

- •

Industry-leading expertise in creating massive, detailed open-world games.

- •

Unparalleled cultural impact and brand strength of the Grand Theft Auto series.

- •

Dominance in the basketball simulation market with NBA 2K.

- →

Nintendo

Market Share Estimate:High

Target Audience Overlap:Low-Medium

Competitive Positioning:An integrated hardware and software company focused on creating unique, family-friendly, and innovative gaming experiences.

Strengths

- •

Extremely strong portfolio of iconic, exclusive, and beloved IPs (Mario, Zelda, Pokémon).

- •

Vertically integrated business model, controlling both hardware and software to create a unique ecosystem.

- •

Broad demographic appeal, attracting families, children, and casual gamers.

- •

Consistently strong financial performance and brand loyalty.

Weaknesses

- •

Hardware is typically less powerful than competitors, limiting third-party AAA game support.

- •

Online services and infrastructure lag behind Sony and Microsoft.

- •

Hesitancy to fully embrace new business models like subscription services for new titles.

- •

Often poor relationships with third-party developers.

Differentiators

- •

Focus on gameplay innovation over graphical fidelity.

- •

Complete control of its hardware platform (e.g., Nintendo Switch).

- •

Unmatched brand safety and family-friendly reputation.

- →

Ubisoft

Market Share Estimate:Medium

Target Audience Overlap:High

Competitive Positioning:A global publisher with a diverse portfolio of established franchises, specializing in open-world and live-service games.

Strengths

- •

Large and diverse portfolio of well-known IPs (Assassin's Creed, Far Cry, Rainbow Six).

- •

Global network of development studios enabling large-scale game production.

- •

Strong expertise in creating large, engaging open-world environments.

- •

Successful transition of key franchises to live-service models.

Weaknesses

- •

Perceived homogenization in game design ('Ubisoft formula') leading to franchise fatigue.

- •

Struggles with consistent innovation and has faced recent financial pressures.

- •

High production costs in a crowded AAA market.

Differentiators

- •

Leader in the tactical shooter sub-genre with Rainbow Six Siege.

- •

Historical and culturally rich settings for its major franchises.

- •

Broad portfolio across multiple genres.

Indirect Competitors

- →

Netflix / Disney+ / Streaming Services

Description:Compete for the same user leisure time and entertainment budget by offering vast libraries of on-demand video content.

Threat Level:Medium

Potential For Direct Competition:Low (Though they are increasingly investing in mobile and casual games).

- →

YouTube / Twitch

Description:Video platforms that capture audience attention both through game streaming (a complement) and other forms of entertainment (a competitor for time).

Threat Level:Low

Potential For Direct Competition:Low (More of a symbiotic relationship, but competes for active engagement time).

- →

Roblox / Epic Games (Fortnite)

Description:User-generated content platforms and metaverses that function as social hubs, competing for the engagement time of younger demographics beyond just playing a single game.

Threat Level:High

Potential For Direct Competition:High (They are self-contained ecosystems that directly compete with EA's live service titles for players and revenue).

- →

TikTok / Instagram

Description:Social media platforms that compete for attention and screen time, particularly among younger audiences, with short-form video content.

Threat Level:Medium

Potential For Direct Competition:Very Low

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Exclusive Sports Licenses

Sustainability Assessment:Highly sustainable as long as licenses are renewed. These multi-year deals create a powerful moat in the sports simulation genre (e.g., NFL, Premier League).

Competitor Replication Difficulty:Hard

- Advantage:

Owned, Evergreen IP Portfolio

Sustainability Assessment:Highly sustainable. Franchises like The Sims, Battlefield, and Apex Legends have dedicated fan bases and can be monetized for years.

Competitor Replication Difficulty:Hard

- Advantage:

Live Services Expertise & Data Analytics

Sustainability Assessment:Sustainable. Deep experience in running live services like Ultimate Team provides vast amounts of player data, enabling effective monetization and retention strategies.

Competitor Replication Difficulty:Medium

- Advantage:

Global Publishing & Marketing Infrastructure

Sustainability Assessment:Sustainable due to scale. A large, established global network provides significant economies of scale in marketing and distribution.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'First-mover advantage on new platforms/technologies', 'estimated_duration': '12-24 months'}

{'advantage': 'Timed exclusive content or marketing deals with platform holders', 'estimated_duration': '6-18 months'}

Disadvantages

- Disadvantage:

Negative Player Sentiment & Brand Perception

Impact:Major

Addressability:Difficult

- Disadvantage:

Franchise Fatigue & Innovation Risk

Impact:Major

Addressability:Moderately

- Disadvantage:

Dependence on a Few Key Revenue Drivers

Impact:Critical

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Increase Transparency in Monetization

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Launch Community-Focused Marketing Campaigns

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Invest in New, Owned IP

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Expand the 'EA Originals' Program

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Develop a Coherent Transmedia Strategy

Expected Impact:Medium

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Build a Creator-Centric UGC Platform

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Innovate Beyond Established Genres

Expected Impact:High

Implementation Difficulty:Difficult

Shift positioning from a 'Publisher of Blockbuster Hits' to a 'Creator of Enduring Entertainment Ecosystems'. This involves emphasizing the community, longevity, and player-centric value of its live-service games, rather than focusing solely on annual releases.

Differentiate through 'Premium Live Services.' While competitors also have live services, EA can focus on delivering a higher quality, more polished, and better-supported experience, leveraging its AAA development capabilities and valuable licenses. This means fewer bugs, more robust content roadmaps, and community management that feels premium and responsive.

Whitespace Opportunities

- Opportunity:

Mid-Budget 'AA' Creative Titles

Competitive Gap:The market is dominated by massive AAA blockbusters and small indie games. There is a significant gap for high-quality, polished games with a focused scope, which the EA Originals program has touched upon but not fully scaled.

Feasibility:High

Potential Impact:Medium

- Opportunity:

Cooperative (Co-op) Focused Games

Competitive Gap:While many games have co-op modes, few are built from the ground up for a cooperative experience outside of the indie space. EA has IPs (e.g., in the fantasy or sci-fi space) that could be leveraged for this market.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Interactive Storytelling Leveraging AI

Competitive Gap:Generative AI can create truly dynamic narratives that respond to player choice in ways current scripted games cannot. No major publisher has successfully launched a flagship title based on this technology.

Feasibility:Low

Potential Impact:High

- Opportunity:

Gaming for Untapped Demographics

Competitive Gap:Many large publishers focus on the 18-35 male demographic. There are large, underserved markets, such as older adults or female-centric genres outside of mobile puzzles, that could be targeted with dedicated PC/console titles.

Feasibility:Medium

Potential Impact:Medium

Electronic Arts operates as a key player within a mature, oligopolistic interactive entertainment industry. The market is characterized by high barriers to entry, primarily driven by soaring AAA development costs and the immense value of established intellectual property. EA's primary competitive advantages are its exclusive, high-value sports licenses (Madden, EA Sports FC) and its portfolio of evergreen, owned IP (Apex Legends, The Sims, Battlefield), which form the backbone of a lucrative live services model. This model, while highly profitable, also exposes EA to disadvantages, including negative player sentiment regarding monetization and franchise fatigue from annualized releases.

Direct competition is fierce and concentrated among a few major players. Activision Blizzard, now backed by Microsoft, presents a formidable threat with its dominant franchises and deep integration into the Xbox ecosystem. Take-Two Interactive competes on the basis of unparalleled quality with its tentpole releases, while Nintendo operates in a distinct, highly defensible niche with its integrated hardware-software model and family-friendly appeal. Ubisoft competes directly with a similar portfolio of open-world and live-service games but has struggled with product differentiation.

Indirect competition is increasingly significant, not for direct product substitution, but for audience 'share of time'. Platforms like Roblox, Fortnite, Netflix, and TikTok compete for the same leisure hours and disposable income. Key industry trends shaping the landscape include the shift to subscription services like Game Pass, the rise of AI in development, and the player expectation for cross-platform functionality.

Strategic opportunities for EA lie in diversifying its portfolio beyond its core franchises. Expanding the 'EA Originals' program could improve brand image and cultivate new IP. There is also a significant whitespace opportunity in developing high-quality, non-predatory games for underserved demographics and in pioneering new genres, such as dedicated co-op experiences or AI-driven narratives. To sustain its market leadership, EA must address its negative brand perception, balance monetization with player value, and strategically invest in innovation to avoid creative stagnation.

Messaging

Message Architecture

Key Messages

- Message:

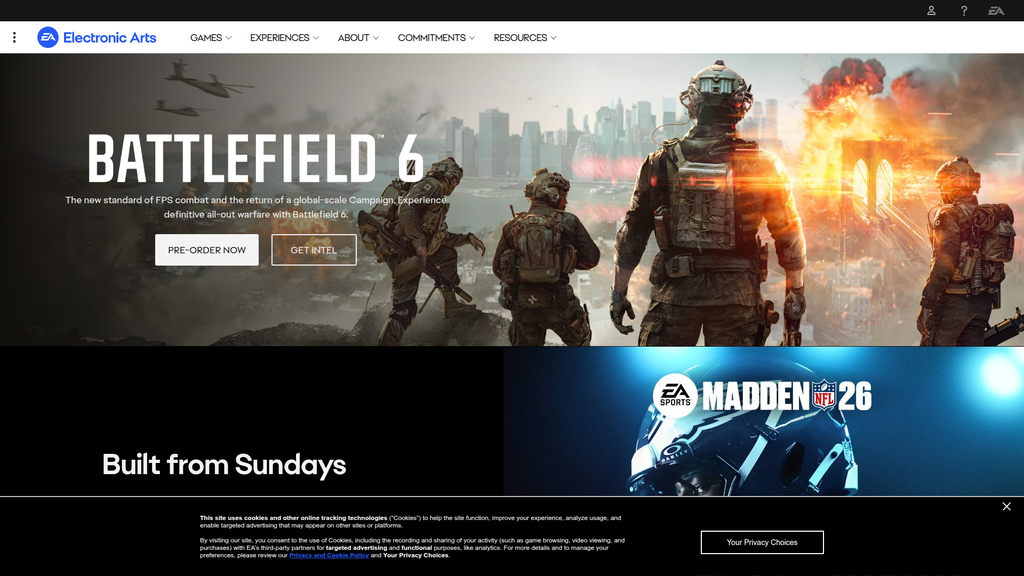

Experience definitive all-out warfare with Battlefield 6.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Banner

- Message:

Unlock a world of thrill. Experience unlimited access to a collection of top EA titles, trials of select new games and more.

Prominence:Secondary

Clarity Score:High

Location:Homepage Mid-section (EA Play)

- Message:

How our incredibly talented, values-driven teams are continuously working to help foster lasting impact to lead the future of entertainment.

Prominence:Tertiary

Clarity Score:Medium

Location:Homepage Lower-section (Corporate Commitments)

The messaging hierarchy is unequivocally product-first, prioritizing immediate, high-impact revenue drivers like pre-orders for blockbuster titles (Battlefield, Madden). The secondary focus is on the recurring revenue stream of the EA Play subscription service. The overarching corporate brand message is tertiary, positioned as supporting content rather than a primary driver. This hierarchy is effective for driving short-term sales but weakens the overall corporate brand narrative.

Messaging is consistent within its silos. The tone and language for game promotions are high-energy and action-oriented. The EA Play messaging is value-focused. The corporate messaging is formal and values-driven. However, there is a distinct lack of a connecting narrative thread between these silos, making the transition between them feel abrupt and creating a fragmented brand experience on a single page.

Brand Voice

Voice Attributes

- Attribute:

Energetic & Action-Oriented

Strength:Strong

Examples

- •

Experience definitive all-out warfare

- •

The new standard of FPS combat

- •

Unlock a world of thrill

- Attribute:

Promotional & Direct

Strength:Strong

Examples

- •

PRE-ORDER NOW

- •

PLAY NOW

- •

Join Now

- •

EA app Deals

- Attribute:

Corporate & Formal

Strength:Moderate

Examples

- •

How our incredibly talented, values-driven teams are continuously working...

- •

Positive Play

- •

People & Inclusive Culture

- •

Our Commitments

Tone Analysis

Promotional

Secondary Tones

- •

Exciting

- •

Urgent

- •

Aspirational

Tone Shifts

A significant shift occurs from the game-centric, high-excitement tone to a formal, socially conscious tone in the 'Our Commitments' section.

Voice Consistency Rating

Fair

Consistency Issues

The brand voice feels bifurcated between the 'product voice' (EA Games) and the 'corporate voice' (Electronic Arts, Inc.).

The corporate mission 'To inspire the world to play' is not actively reflected in the primary, product-focused messaging, which is more about combat and winning.

Value Proposition Assessment

EA provides access to the world's most popular and immersive interactive entertainment franchises.

Value Proposition Components

- Component:

Portfolio of Blockbuster Titles

Clarity:Clear

Uniqueness:Unique

Comment:EA's key differentiator is its ownership of globally recognized IP like FIFA (now EA Sports FC), Madden NFL, Battlefield, and The Sims. This is communicated implicitly by showcasing these games.

- Component:

Subscription-Based Access (EA Play)

Clarity:Clear

Uniqueness:Somewhat Unique

Comment:Communicated as 'Unlock a world of thrill', this offers a value proposition of variety and affordability, similar to competitors' services like Xbox Game Pass.

- Component:

Cutting-Edge Gaming Experiences

Clarity:Somewhat Clear

Uniqueness:Common

Comment:Phrases like 'The new standard of FPS combat' imply technological leadership, but this is a common claim in the AAA gaming space.

EA's differentiation is almost entirely dependent on the strength of its exclusive intellectual property. The messaging doesn't build a separate, compelling case for 'Why EA?' beyond 'We have the games you already want.' This makes the brand reliant on continued franchise success and vulnerable if a key title falters.

The messaging positions EA as a publisher of premium, high-budget, must-have titles. It competes on the scale and popularity of its franchises against competitors like Activision Blizzard and Take-Two Interactive. The focus is on mainstream, blockbuster entertainment rather than niche or indie innovation (despite the 'EA Originals' program existing).

Audience Messaging

Target Personas

- Persona:

The Franchise Loyalist

Tailored Messages

Built from Sundays (Madden)

Experience definitive all-out warfare with Battlefield 6

Effectiveness:Effective

Comment:Messaging speaks directly to fans of established series, using insider language and focusing on the next iteration of their favorite game.

- Persona:

The Value-Seeking Gamer

Tailored Messages

Unlock a world of thrill

Experience unlimited access to a collection of top EA titles

Effectiveness:Effective

Comment:The EA Play messaging clearly targets gamers who want access to a large library of games for a single, recurring price.

- Persona:

The Corporate Stakeholder (Investor/Employee)

Tailored Messages

- •

How our incredibly talented, values-driven teams are... foster[ing] lasting impact

- •

Read The Report

- •

Positive Play

- •

Social Impact

Effectiveness:Somewhat Effective

Comment:The messaging exists and uses appropriate language, but its placement and generic nature limit its impact. It feels more like a necessary disclosure than a compelling narrative.

Audience Pain Points Addressed

- •

Boredom / Lack of Excitement ('Unlock a world of thrill')

- •

Cost of buying multiple full-priced games (Addressed by EA Play subscription)

- •

Fear of Missing Out (FOMO) ('PRE-ORDER NOW', 'Latest Games')

Audience Aspirations Addressed

- •

Mastery and Competition ('The new standard of FPS combat')

- •

Being part of a global community (Implicit in massive franchises like Battlefield)

- •

Experiencing the latest in entertainment technology

Persuasion Elements

Emotional Appeals

- Appeal Type:

Excitement & Adrenaline

Effectiveness:High

Examples

definitive all-out warfare

world of thrill

- Appeal Type:

Belonging & Identity

Effectiveness:Medium

Examples

Built from Sundays

EA SPORTS

Comment:This relies on the audience's pre-existing identity as a fan of a particular sport or franchise.

Social Proof Elements

- Proof Type:

Brand Recognition

Impact:Strong

Comment:The most powerful social proof is the use of globally recognized game titles like FIFA, Madden, and Battlefield. Their established popularity serves as an implicit endorsement.

Trust Indicators

- •

Professional website design and UX

- •

Prominent links to Help, Community Forums, and Legal policies

- •

Detailed sections on Corporate Responsibility and Positive Play

Scarcity Urgency Tactics

Pre-order CTAs ('PRE-ORDER NOW')

Sections for 'Coming Soon' and 'Latest Updates' to create anticipation and timeliness.

Calls To Action

Primary Ctas

- Text:

PRE-ORDER NOW

Location:Homepage Hero Banner

Clarity:Clear

- Text:

PLAY NOW

Location:Homepage 'Madden NFL' section

Clarity:Clear

- Text:

Join Now

Location:Homepage 'EA Play' section

Clarity:Clear

The primary CTAs are highly effective. They are direct, use strong action verbs, and are placed in contextually relevant sections. The desired action for the user is unambiguous, effectively funneling traffic towards key conversion points like sales and subscriptions.

Messaging Gaps Analysis

Critical Gaps

- •

Lack of a unifying brand story. The corporate mission 'To inspire the world to play' is absent from the homepage's primary messaging, which is dominated by transactional and product-specific calls to action.

- •

Absence of community messaging. Modern gaming is highly social. There is no messaging that highlights or celebrates the massive player communities that form around EA's games.

- •

The 'Why'. The messaging is excellent at communicating 'What' (new games, a subscription) and 'How' (Pre-order, Join), but fails to build an emotional connection to 'Why' players should choose the EA ecosystem over others beyond its IP.

Contradiction Points

The aggressive, combat-focused language ('all-out warfare') can clash with the corporate messaging around 'Positive Play' without a narrative bridge to connect the fantasy of play with the reality of community safety.

Underdeveloped Areas

EA Originals. This initiative, which supports indie developers, is a powerful potential brand builder that could counter negative public perception. However, it is relegated to a simple navigation link with no featured story or messaging on the homepage.

The 'Player'. The messaging focuses heavily on the product (the game) but rarely on the hero (the player). Telling stories about players' experiences could significantly increase emotional engagement.

Messaging Quality

Strengths

- •

Clarity and directness in product promotion.

- •

Strong, unambiguous calls-to-action that drive conversions.

- •

Effective showcasing of the breadth and power of its game portfolio.

- •

Clear value proposition for its EA Play subscription service.

Weaknesses

- •

Overly transactional focus erodes brand building.

- •

Fragmented messaging architecture with poor narrative flow between product, service, and corporate.

- •

Fails to leverage community, a key asset in the gaming industry.

- •

The corporate brand feels disconnected from the product brands.

Opportunities

- •

Create a homepage narrative that weaves together the core brand mission with its products, telling a story of 'how' EA inspires the world to play through games like Battlefield and Madden.

- •

Feature player community stories and content to build social proof and emotional connection.

- •

Elevate the 'EA Originals' program to showcase EA's role in fostering creativity and innovation, thereby improving brand perception.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Narrative

Recommendation:Develop a new primary headline and introductory block for the homepage that encapsulates the 'Inspire the world to play' mission, framing the individual games below as proof points of that mission.

Expected Impact:High

- Area:

Community Messaging

Recommendation:Introduce a dynamic content block on the homepage that features user-generated content, player spotlights, or community event highlights.

Expected Impact:High

- Area:

Brand Voice Unification

Recommendation:Revise copy to bridge the gap between product and corporate messaging. For example, connect the excitement of gaming to the commitment to 'Positive Play' by framing it as 'Creating thrilling worlds where everyone can play safely.'

Expected Impact:Medium

Quick Wins

Feature an 'EA Originals' game prominently on the homepage with a headline about fostering developer creativity.

Add player-centric subheadings, such as 'Join a Global Battlefield Community of Millions' to the existing game promotion blocks.

Long Term Recommendations

Invest in a content marketing strategy focused on telling stories from within the EA ecosystem: developer diaries, player case studies, and the impact of social initiatives.

Rethink the information architecture to create a more integrated journey between the corporate brand story and the product offerings, rather than treating them as separate destinations.

Electronic Arts' website messaging is a highly optimized, yet fragmented, conversion engine. Its primary strength lies in its direct, clear, and action-oriented communication for its blockbuster game franchises and the EA Play subscription service. The messaging architecture is ruthlessly efficient at driving pre-orders and subscriptions by leveraging the immense power of its globally recognized IP. The calls-to-action are best-in-class in their clarity and transactional effectiveness.

However, this singular focus on product conversion comes at a significant cost to brand building. The website presents a bifurcated identity: the high-energy, adrenaline-fueled 'EA Games' versus the formal, detached 'Electronic Arts Inc.'. There is a critical messaging gap where a unified brand narrative should be. The corporate mission, 'To inspire the world to play,' is not used as a central theme to connect its diverse portfolio. As a result, the brand feels like a holding company for popular products rather than a cohesive entertainment leader with a clear purpose.

The most significant missed opportunity is the near-total absence of community-centric messaging. In an industry defined by social interaction and passionate fanbases, the website speaks at players about products, but rarely with or about them and their experiences. This transactional approach fails to build the emotional equity needed to weather industry shifts or franchise fatigue. To evolve, EA's messaging strategy must shift from purely showcasing its products to telling the story of the world it creates for its players, bridging the gap between its powerful games and a purpose-driven corporate identity.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Dominant, recurring revenue from major franchises like EA SPORTS FC (formerly FIFA) and Madden NFL, indicating a massive, loyal customer base.

- •

Apex Legends stands as one of the most successful battle royale games, with revenue exceeding $1.6 billion since its launch, showcasing strong fit in the free-to-play shooter market.

- •

The Sims franchise maintains a dedicated and active community with significant user-generated content, demonstrating deep product engagement.

- •

Net bookings driven significantly by live services (73% of total), which rely on sustained player engagement and recurring spending within established games.

Improvement Areas

- •

Reducing reliance on annualized sports titles by developing new, successful intellectual properties (IPs).

- •

Addressing 'franchise fatigue' in long-running series by introducing more significant innovation year-over-year.

- •

Improving community sentiment, which can be volatile due to monetization strategies and perceived lack of innovation in certain titles.

Market Dynamics

10.15% to 10.37% CAGR forecasted through 2030-2034.

Mature

Market Trends

- Trend:

Dominance of Live Services and Recurring Revenue Models

Business Impact:EA is well-positioned, as live services are the foundation of its business, accounting for ~74% of revenue. This model provides predictable, long-term revenue streams.

- Trend:

Growth in Mobile and Cross-Platform Gaming

Business Impact:Represents a major growth vector. Success requires adapting AAA franchises to mobile and ensuring seamless cross-progression, an area of strategic focus for EA.

- Trend:

Expansion of Cloud Gaming

Business Impact:Lowers the barrier to entry for AAA games, potentially expanding EA's addressable market to players without high-end consoles or PCs. Partnerships like the one with Xbox Game Pass are crucial.

- Trend:

AI in Game Development and Personalization

Business Impact:EA is actively leveraging AI to drive efficiency in development, expand game experiences (e.g., UGC), and personalize player engagement.

- Trend:

Increased Competition and Market Consolidation

Business Impact:Major competitors like Microsoft (with Activision Blizzard) and Take-Two Interactive create intense pressure, requiring EA to innovate and secure key licenses to maintain market share.

Excellent. EA's strategic pivot to live services, subscription models, and community-driven platforms aligns perfectly with current dominant market trends, positioning it well for continued growth.

Business Model Scalability

High

High fixed costs in game development (R&D, talent) but extremely low variable costs for digital distribution. Live services add ongoing, but scalable, operational costs.

High. Once a digital game or service is developed, each additional user adds significant revenue with minimal incremental cost, leading to high-margin growth.

Scalability Constraints

- •

Scaling creative and technical talent is a primary bottleneck in a highly competitive industry.

- •

Maintaining quality control and innovation across an expanding portfolio of complex live service games.

- •

Server infrastructure and cybersecurity must scale to support massive, concurrent online communities, especially during new game launches.

Team Readiness

Experienced leadership team with a clear, articulated long-term growth strategy focused on community, live services, and AI.

A large, distributed studio model (BioWare, DICE, Respawn, etc.) allows for specialization but can create challenges in ensuring consistent quality and strategic alignment.

Key Capability Gaps

- •

Agility in new IP development; the organization is structured to iterate on existing franchises rather than creating new blockbuster hits from scratch.

- •

Deeper expertise in mobile-first game design and monetization for emerging markets.

- •

Talent in emerging fields like generative AI for game content and leveraging user-generated content platforms at scale.

Growth Engine

Acquisition Channels

- Channel:

Major Franchise Launches (e.g., EA SPORTS FC, Madden)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Leverage launch momentum to more effectively cross-promote and onboard players into the broader EA Play ecosystem and other live service games.

- Channel:

Digital Storefronts (PlayStation Store, Xbox, Steam, EA App)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Optimize store pages with A/B testing of creative assets and pricing strategies. Increase focus on driving traffic to the first-party EA app to improve margins.

- Channel:

Free-to-Play (F2P) Games (e.g., Apex Legends)

Effectiveness:High

Optimization Potential:High

Recommendation:Expand the F2P portfolio into new genres (e.g., strategy, RPG) on PC and mobile to act as a top-of-funnel for the entire EA network.

- Channel:

Subscription Bundles (EA Play with Xbox Game Pass)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Explore deeper integrations and partnerships with other platform holders (e.g., Sony, Nintendo) or non-gaming subscription services to expand reach.

Customer Journey

The journey is bifurcated: 1) High-intent purchase of a premium AAA title. 2) Low-friction entry via a free-to-play game. Both paths are increasingly designed to funnel users into long-term, monetized live service ecosystems or the EA Play subscription.

Friction Points

- •

Mandatory use of the EA app on PC can be a point of friction for users accustomed to other launchers like Steam.

- •

Complex onboarding for new players in deeply established live service games like Ultimate Team can be intimidating.

- •

Negative sentiment around certain monetization practices (e.g., 'loot boxes') can deter potential new players.

Journey Enhancement Priorities

{'area': 'Onboarding to Live Services', 'recommendation': "Develop more robust First-Time User Experience (FTUE) tutorials and 'starter packs' within complex live service games to reduce the learning curve and improve early retention."}

{'area': 'Cross-Game Ecosystem', 'recommendation': 'Create a unified player identity/rewards program across the EA portfolio to incentivize players to try new games and deepen their engagement with the overall ecosystem.'}

Retention Mechanisms

- Mechanism:

Live Service Content Updates (e.g., new seasons, events, players)

Effectiveness:High

Improvement Opportunity:Utilize AI and player data to personalize content drops and event schedules to match player segments' preferences, increasing relevance and engagement.

- Mechanism:

EA Play Subscription Service

Effectiveness:High

Improvement Opportunity:Increase the value proposition by adding more early access trials for blockbuster titles and potentially including cloud gaming access as a core feature of the Pro tier.

- Mechanism:

Community & Social Platforms (Ultimate Team, Online Modes)

Effectiveness:High

Improvement Opportunity:Invest in building out-of-game community hubs and social platforms, like the planned EA SPORTS App, to keep players engaged with the franchise even when they are not actively playing.

Revenue Economics

Extremely Strong. The business model's shift to digital and live services means the Lifetime Value (LTV) of an engaged player, particularly in franchises like EA SPORTS FC Ultimate Team or Apex Legends, is exceptionally high relative to the initial acquisition cost.

High (Not publicly disclosed, but implied by high profitability and focus on live services). F2P titles and established franchises likely have a very efficient CAC, while the LTV of engaged users can span multiple years and thousands of dollars.

High

Optimization Recommendations

- •

Further diversify revenue by expanding into new mobile genres and markets to capture a wider range of spending habits.

- •

Develop more non-monetized engagement loops (e.g., user-generated content tools, social hubs) to increase stickiness, which is a precursor to long-term spending.

- •

Experiment with hybrid monetization models in new titles, combining cosmetic sales with battle passes and potential subscription tie-ins to maximize LTV.

Scale Barriers

Technical Limitations

- Limitation:

New IP Engine & Tooling

Impact:High

Solution Approach:Internal R&D on next-generation game engines optimized for emerging trends like AI-driven content and massive-scale UGC. Potentially acquire smaller, innovative studios with unique tech stacks.

- Limitation:

Cross-Platform Development Complexity

Impact:Medium

Solution Approach:Invest in a unified development framework and platform that streamlines deploying and updating games across PC, console, and mobile, ensuring feature parity and cross-progression.

Operational Bottlenecks

- Bottleneck:

Coordinating a Global Network of Studios

Growth Impact:Can lead to inconsistent quality, release delays, and a lack of cohesive strategy.

Resolution Strategy:Implement a centralized strategic framework while allowing for creative autonomy. Strengthen 'Centers of Excellence' for key disciplines (e.g., live ops, AI, data analytics) that support all studios.

- Bottleneck:

Managing Live Service Cadence

Growth Impact:Failure to deliver a consistent stream of high-quality content can lead to player churn in revenue-critical live service games.

Resolution Strategy:Expand live ops teams and invest heavily in predictive analytics to anticipate player needs and plan content roadmaps 12-18 months in advance.

Market Penetration Challenges

- Challenge:

Franchise Fatigue and Over-reliance on Sequels

Severity:Critical

Mitigation Strategy:Establish a dedicated internal incubator or fund a separate publishing label (similar to EA Originals but for larger projects) focused exclusively on developing new, blockbuster IP.

- Challenge:

Intense Competition from Tech Giants and Established Publishers

Severity:Major

Mitigation Strategy:Focus on building defensible 'community platforms' rather than just games. Leverage exclusive licenses (sports leagues) and unique IP to create ecosystems competitors cannot easily replicate.

- Challenge:

Regulatory Scrutiny (e.g., loot boxes, monetization)

Severity:Major

Mitigation Strategy:Proactively shift monetization models towards battle passes, cosmetic items, and subscriptions. Increase transparency with players about in-game economies and odds.

Resource Limitations

Talent Gaps

- •

World-class creative directors with experience launching new AAA IP.

- •

Mobile game designers and product managers, especially with experience in Asian markets.

- •

AI/ML engineers specialized in generative content and player behavior modeling.

Low. EA is highly profitable with substantial cash reserves, capable of funding major development projects and strategic acquisitions internally.

Infrastructure Needs

Expansion of global server capacity to support growth in cloud gaming and emerging markets.

Development of a unified, cross-platform player data and analytics infrastructure to provide a 360-degree view of the customer.

Growth Opportunities

Market Expansion

- Expansion Vector:

Mobile Gaming in Emerging Markets (Asia, LATAM)

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Develop mobile-first versions of major IPs or acquire successful mobile studios in target regions to leverage local market expertise.

- Expansion Vector:

Cloud Gaming Platforms

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Deepen partnerships with services like Xbox Cloud Gaming and explore launching a standalone EA cloud offering for the EA Play Pro subscription tier.

Product Opportunities

- Opportunity:

Development of New, Non-Licensed IP

Market Demand Evidence:Market success of original IPs like Elden Ring and Baldur's Gate 3 demonstrates strong appetite for high-quality new franchises.

Strategic Fit:Critical for long-term growth and reducing dependency on annualized sports titles and licensed properties.

Development Recommendation:Greenlight multiple high-risk, high-reward projects under independent studio leadership, shielding them from the financial pressures of the core franchises.

- Opportunity:

AI-Powered User-Generated Content (UGC) Platforms

Market Demand Evidence:Success of platforms like Roblox and Minecraft showcases massive demand for player-driven creation. 50% of EA's audience already engages with UGC.

Strategic Fit:Aligns with EA's strategy to build massive online communities. The Sims is a natural starting point for a more advanced UGC platform.

Development Recommendation:Build 'Project Rene' (The Sims) as an open, extensible platform with AI-assisted creation tools that can serve as a blueprint for other franchises.

- Opportunity:

Transmedia Expansion (Film & TV)

Market Demand Evidence:Success of video game adaptations like 'The Last of Us' (HBO) and 'Arcane' (Netflix).

Strategic Fit:Strengthens brand awareness and creates new revenue streams. EA has already announced a movie based on The Sims.

Development Recommendation:Establish an internal division to manage IP licensing for film/TV, ensuring creative alignment and quality control to protect the core brand.

Channel Diversification

- Channel:

Direct-to-Consumer Web Shops for In-Game Content

Fit Assessment:High

Implementation Strategy:Create web-based stores for microtransactions (e.g., FC Points, Apex Coins) to bypass the 30% platform fees on mobile and PC, increasing margins.

- Channel:

Expanding Beyond Gaming with Social Apps

Fit Assessment:Medium

Implementation Strategy:Launch the EA SPORTS App as a pilot to create a social ecosystem around sports content, integrating game data and live sports. If successful, replicate this model for other genres.

Strategic Partnerships

- Partnership Type:

AI & Technology

Potential Partners

- •

NVIDIA

- •

Google

- •

Microsoft Azure

Expected Benefits:Accelerate the integration of generative AI in development pipelines, enhance cloud gaming infrastructure, and co-develop tools for personalized player experiences.

- Partnership Type:

Entertainment & Media

Potential Partners

- •

Amazon MGM Studios

- •

Netflix

- •

Disney

Expected Benefits:Co-develop and distribute film and television projects based on EA's rich portfolio of IP, driving brand growth and creating new licensing revenue.

Growth Strategy

North Star Metric

Network Engagement Score

As EA's business model shifts from discrete product sales to a networked community, a simple metric like revenue or MAU is insufficient. A Network Engagement Score (a composite of metrics like Monthly Active Users, hours played, subscription attachment rate, and cross-game activity) better reflects the health and growth of the entire ecosystem.

Increase the score by 15% year-over-year by focusing on cross-franchise engagement and retention.

Growth Model

Hybrid: Community & Platform-Led Growth

Key Drivers

- •

Breadth and depth of IP portfolio.

- •

Scale of interconnected online communities.

- •

Value proposition of the EA Play subscription.

- •

Network effects within multiplayer and social games.

Focus strategic initiatives on increasing the connections between games. Treat the entire portfolio as a single, interconnected network where engagement in one area (e.g., playing Apex Legends) creates opportunities to engage in another (e.g., subscribing to EA Play).

Prioritized Initiatives

- Initiative:

Launch a Mobile-First 'EA SPORTS FC' Experience for Emerging Markets

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 months

First Steps:Establish a dedicated mobile development studio in Southeast Asia or LATAM. Begin prototyping core gameplay loops optimized for mobile.

- Initiative:

Develop a Centralized, Cross-Game Player Identity and Loyalty Program

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:12 months

First Steps:Form a cross-functional team to define the architecture for a unified EA Account. A/B test simple rewards for players who own multiple EA titles.

- Initiative:

Greenlight Two New, Non-Sports AAA IPs

Expected Impact:High (long-term)

Implementation Effort:Very High

Timeframe:3-5 years

First Steps:Allocate a protected, multi-year budget for a new IP incubator. Empower a veteran creative director to build a new team outside of existing franchise structures.

Experimentation Plan

High Leverage Tests

- Test:

Test bundling cloud gaming access with the EA Play Pro subscription.

Hypothesis:Adding cloud gaming will significantly increase subscriber acquisition and retention for the highest subscription tier.

- Test:

Experiment with AI-generated, personalized in-game challenges and rewards in a live service title.

Hypothesis:Personalized content will lead to higher daily engagement and session length compared to static, universal challenges.

- Test:

Offer a small discount on microtransactions purchased through a direct-to-consumer web store vs. in-game.

Hypothesis:A small financial incentive is sufficient to shift a meaningful percentage of transaction volume to a higher-margin channel.

Use an A/B testing framework to measure key metrics like conversion rate, average revenue per user (ARPU), 30-day retention, and channel attribution. Analyze results by player cohort.

Run marketing and monetization experiments on a bi-weekly sprint cycle. Larger in-game feature experiments should align with major seasonal content updates.

Growth Team

A centralized 'Growth Strategy' team that reports to the C-suite, combined with embedded 'Growth Pods' within major franchise teams (e.g., EA SPORTS, Apex Legends, The Sims). The central team focuses on network-level opportunities (e.g., subscriptions, new platforms), while pods focus on optimizing their specific product.

Key Roles

- •

Head of Growth Strategy

- •

Director of New Platforms (Mobile, Cloud)

- •

Principal Data Scientist (Player Behavior Modeling)

- •

Product Manager, Player Network & Loyalty

Establish an internal 'Growth Academy' to train product managers and marketers on data analysis, experimentation, and live service management. Actively recruit talent from mobile gaming and consumer tech companies to bring in new perspectives.

Electronic Arts is in a position of formidable strength, having successfully transitioned its business model to a highly profitable, scalable, and predictable live services and subscription foundation. Its core franchises (EA SPORTS, Apex Legends, The Sims) demonstrate exceptional product-market fit and serve as powerful engines for revenue and engagement. The company's strategic alignment with dominant market trends—such as recurring revenue, community-driven platforms, and the application of AI—positions it well for sustained growth.

However, this strength is concentrated in a handful of aging, albeit powerful, franchises. The most significant barrier to long-term, exponential growth is a demonstrated weakness in developing new, owned intellectual property. Franchise fatigue is a critical risk, and the intense market competition from consolidated giants like Microsoft/Activision and innovators like Tencent means that standing still is not an option. Future success is contingent on EA's ability to balance the optimization of its current cash cows with genuine, risk-taking investment in the creation of the next generation of blockbuster hits.