eScore

eaton.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

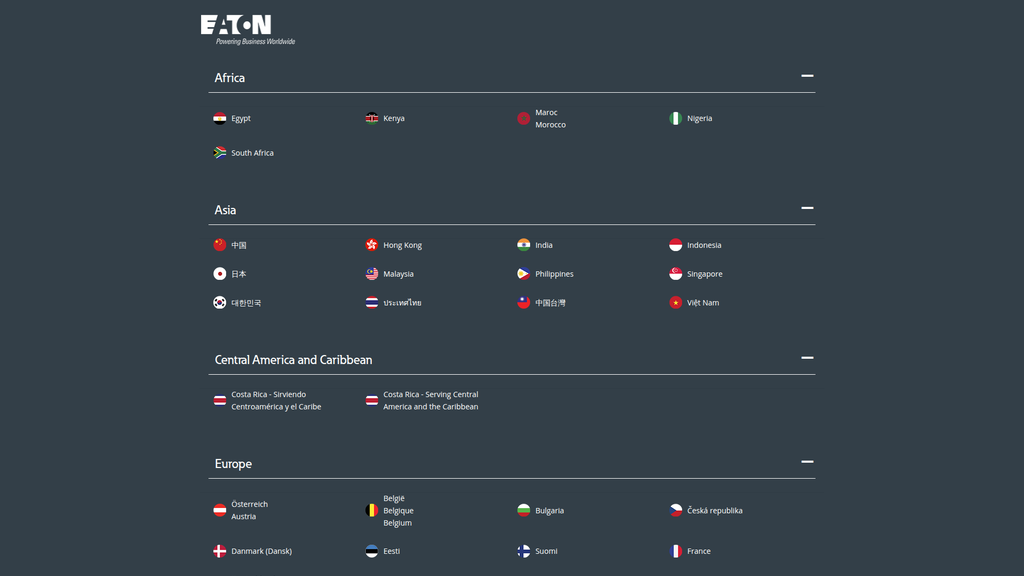

Eaton demonstrates a powerful digital presence, marked by outstanding global reach with extensively localized websites. Its content authority is strong, positioning itself as a thought leader in key industry trends like energy transition and digitalization. However, its search intent alignment could be improved by developing more top-of-funnel content to attract users in the initial 'awareness' stage of their journey, as the current focus is heavily on solution-aware buyers.

Exceptional local vs. global reach with localized website versions for numerous countries and languages, effectively capturing regional search demand.

Expand content strategy to better align with top-of-funnel search intent by creating problem-focused content (guides, articles) that addresses the initial challenges of target personas.

The brand messaging is highly effective at positioning Eaton as an authoritative, stable, and essential B2B leader for high-level audiences like investors and C-suite executives. The messaging is strategically aligned with major global trends and clearly differentiates from competitors by focusing on foundational reliability. The score is held back by weak, passive calls-to-action and overly corporate, abstract language that lacks a human element and compelling customer-centric stories.

Excellent audience segmentation on the homepage, with clear messaging and navigation paths for distinct personas such as investors, job seekers, and prospective customers.

Incorporate customer success stories and testimonials directly into the homepage narrative to substantiate the 'We make what matters work' claim with tangible proof.

The website provides a solid user experience with a clean design, light cognitive load, and good mobile responsiveness. However, the overall conversion experience is significantly hampered by a major compliance gap: the absence of a visible accessibility statement, which poses a legal risk and excludes users with disabilities. Additionally, identified friction points, such as vague calls-to-action and difficulties navigating the vast product portfolio, hinder a seamless user journey.

The website's clean, uncluttered layout and logical information architecture result in a low cognitive load, making it easy for users to process information.

Immediately develop and prominently display a comprehensive Accessibility Statement that outlines commitment to WCAG 2.1 AA standards to mitigate legal risk and improve inclusivity.

Eaton projects immense credibility through powerful trust signals like its NYSE listing, transparent financial reporting, massive global scale ($24.9B in sales, 92k+ employees), and a century-long history. Industry-specific certifications and a focus on cybersecurity further mitigate risk for B2B customers. The primary weakness is a glaring lack of visible customer success evidence on the homepage, failing to translate corporate credibility into relatable, real-world proof for prospective buyers.

Exceptional transparency and financial validation, demonstrated by the prominent display of its NYSE ticker, accessible earnings reports, and clear corporate metrics that establish it as a stable, publicly accountable entity.

Bridge the gap between corporate credibility and customer value by creating a homepage module dedicated to 'Customer Stories' or 'In Action,' showcasing tangible examples of successful outcomes.

Eaton's competitive moat is deep and sustainable, built upon a highly diversified product portfolio, extensive global distribution channels, and a powerful brand reputation for reliability in mission-critical applications. These advantages are extremely difficult for competitors to replicate. While the company is a clear innovator in hardware and systems, its competitive strength is slightly tempered by a market perception that peers like Siemens and Schneider Electric are more advanced in their digital platform strategies.

A large and deeply entrenched installed base of products creates extremely high switching costs for customers, ensuring recurring aftermarket revenue and significant customer lock-in.

Accelerate the marketing and development of the 'Eaton Brightlayer' digital platform to more effectively counter the narratives of Siemens' Xcelerator and Schneider's EcoStruxure, shifting market perception.

The company is exceptionally well-positioned for growth, with its business model perfectly aligned with powerful secular tailwinds like electrification, digitalization, and the energy transition. Its unit economics are strong, and it has a proven track record of expanding into new markets and technologies via strategic acquisitions. While the business is capital-intensive due to its manufacturing nature, it demonstrates high efficiency and robust cash flow, signaling strong potential for continued scalable expansion.

The business model is strategically aligned with durable, high-growth secular trends, particularly the explosive demand for power infrastructure from data centers, grid modernization, and eMobility.

Address operational bottlenecks in the supply chain for key components like transformers and power electronics by continuing to invest in manufacturing capacity expansion in key regions.

Eaton's business model is exceptionally coherent and strategically sound, demonstrating a clear focus on high-growth, high-margin sectors. The company has shown excellent resource allocation by divesting slower-growth legacy businesses to heavily invest in electrification and digitalization. The entire model, from its value proposition of reliability to its revenue streams, is perfectly aligned with the needs of its target markets and the macro trends shaping the future of energy.

Proven ability to execute strategic portfolio management, such as divesting the Hydraulics business to sharpen focus and redeploying capital to acquire companies in high-growth areas like eMobility and digital solutions.

Accelerate the integration of software and recurring services into the core business model by more aggressively bundling high-margin digital offerings (like Brightlayer) at the point of hardware sale.

Eaton wields significant market power as a leader in an oligopolistic industry, enabling premium pricing and strong partner leverage through its vast distribution network. Its highly diversified portfolio across resilient end-markets mitigates customer dependency risk and provides stability. The company actively influences industry direction with its 'Everything as a Grid' vision, solidifying its position as a dominant force, challenged only by a few global peers of similar scale.

A highly diversified business across geographies and end-markets (aerospace, data centers, utilities) provides exceptional resilience against cyclical downturns in any single market.

Launch more targeted marketing campaigns to aggressively build the brand narrative around its digital platform, 'Brightlayer', to directly compete with the strong digital brands of its main rivals.

Business Overview

Business Classification

B2B Manufacturing & Industrial Products

Industrial Services & Solutions

Power Management

Sub Verticals

- •

Electrical (Distribution & Control)

- •

Aerospace

- •

eMobility & Vehicle

- •

Data Centers

- •

Utilities & Grid Solutions

Mature

Maturity Indicators

- •

Founded in 1911, with over a century of operations.

- •

Consistent multi-billion dollar annual revenue ($24.9B in 2024).

- •

Publicly traded on the NYSE (ETN) with a long history.

- •

Large global workforce of over 92,000 employees.

- •

Extensive global presence, selling products in over 175 countries.

- •

History of strategic acquisitions to enter new markets and enhance product portfolios.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Electrical Product Sales

Description:Sale of a wide range of electrical components, systems, and solutions, including circuit breakers, UPS systems, switchgear, power distribution units, and controls. This is the largest contributor to revenue.

Estimated Importance:Primary

Customer Segment:Industrial, Commercial, Data Centers, Utilities, Residential

Estimated Margin:Medium-High

- Stream Name:

Industrial Product Sales (Aerospace & Vehicle)

Description:Sale of highly engineered components for the aerospace and vehicle sectors, including hydraulic, fuel, and motion control systems for aircraft, and drivetrain and powertrain systems for vehicles.

Estimated Importance:Secondary

Customer Segment:Aerospace OEMs, Automotive & Commercial Vehicle OEMs

Estimated Margin:Medium-High

- Stream Name:

Aftermarket Services & Support

Description:Providing maintenance, repair, operational support, and technical services for the extensive installed base of Eaton products globally.

Estimated Importance:Secondary

Customer Segment:All existing industrial and commercial customers

Estimated Margin:High

- Stream Name:

eMobility Solutions

Description:A growing segment focused on electric vehicle technology, including power electronics, EV charging solutions, and power distribution for electric vehicles.

Estimated Importance:Tertiary

Customer Segment:EV OEMs, Charging Infrastructure Providers

Estimated Margin:Medium

Recurring Revenue Components

- •

Long-term service and maintenance contracts

- •

Software licenses and subscriptions for power management software

- •

Consumable components and replacement parts

Pricing Strategy

Value-Based & Project-Based

Premium

Opaque

Pricing Psychology

- •

Total Cost of Ownership (TCO) Focus

- •

Solution Bundling (Hardware, Software & Services)

- •

Reliability & Quality Premium

Monetization Assessment

Strengths

- •

Highly diversified revenue across multiple resilient sectors (e.g., aerospace, utilities).

- •

Large installed base creates a strong, recurring aftermarket and service revenue stream.

- •

Strong brand reputation allows for premium pricing based on quality and reliability.

- •

Strategic portfolio alignment with high-growth secular trends like electrification and digitalization.

Weaknesses

- •

Revenue is susceptible to cyclical downturns in industrial and construction markets.

- •

Dependence on complex global supply chains can lead to margin pressure from volatile raw material costs.

- •

Slower adoption of pure software/SaaS models compared to digital-native competitors.

Opportunities

- •

Expand 'Energy-as-a-Service' (EaaS) models for commercial and industrial clients.

- •

Increase the attachment rate of high-margin software and digital services to core hardware sales.

- •

Capitalize on government infrastructure spending and green energy initiatives globally.

- •

Monetize data from connected devices for predictive analytics and grid optimization services.

Threats

- •

Intense competition from global industrial conglomerates like Siemens, Schneider Electric, and ABB.

- •

Technological disruption from smaller, more agile startups in niche areas like IoT and energy software.

- •

Geopolitical instability impacting global supply chains and international sales.

- •

Cybersecurity threats targeting connected power management products.

Market Positioning

Technology Leadership & Mission-Critical Reliability

Market Leader in multiple product niches.

Target Segments

- Segment Name:

Data Center Operators

Description:Hyperscale, colocation, and enterprise data centers requiring uninterrupted, high-quality power for critical IT infrastructure.

Demographic Factors

- •

Global operations

- •

High energy consumption

- •

Rapid growth and expansion

Psychographic Factors

- •

Extreme risk aversion to downtime

- •

Focus on operational efficiency (PUE)

- •

Increasingly focused on sustainability and carbon footprint

Behavioral Factors

- •

Long-term procurement cycles

- •

Value reliability and scalability over initial cost

- •

Seek integrated solutions (hardware, software, services)

Pain Points

- •

Cost and complexity of managing power at scale

- •

Ensuring 100% uptime and power reliability

- •

Reducing high energy consumption and costs

- •

Managing grid instability and integrating renewables

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Utility & Grid Operators

Description:Public and private utilities responsible for power generation, transmission, and distribution, who are modernizing an aging grid.

Demographic Factors

- •

Regional or national service areas

- •

Heavily regulated industry

- •

Large-scale capital projects

Psychographic Factors

- •

High emphasis on safety and regulatory compliance

- •

Conservative technology adoption

- •

Focus on long-term asset life and grid stability

Behavioral Factors

- •

Long sales and implementation cycles

- •

Preference for established, trusted vendors

- •

Driven by regulatory mandates and grid modernization initiatives

Pain Points

- •

Managing an aging and unreliable infrastructure

- •

Integrating intermittent renewable energy sources

- •

Protecting the grid from physical and cyber threats.

- •

Meeting increasing electricity demand from electrification

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Aerospace & Defense OEMs

Description:Manufacturers of commercial and military aircraft requiring highly reliable, certified, and engineered power, fuel, and motion control systems.

Demographic Factors

- •

Global manufacturing footprint

- •

Consolidated market with few large players

- •

Subject to stringent safety and quality regulations

Psychographic Factors

- •

Safety and reliability are non-negotiable priorities

- •

Value long-term partnerships and engineering collaboration

- •

Focus on weight reduction and fuel efficiency

Behavioral Factors

- •

Deeply integrated into OEM design and production cycles

- •

Long-term contracts and supplier agreements

- •

Significant aftermarket and MRO (Maintenance, Repair, and Overhaul) business

Pain Points

- •

Meeting extreme performance and reliability standards

- •

Managing complex global supply chains

- •

Reducing aircraft weight to improve efficiency

- •

Securing components against counterfeit and cyber threats

Fit Assessment:Good

Segment Potential:Medium

Market Differentiation

- Factor:

Comprehensive & Diversified Portfolio

Strength:Strong

Sustainability:Sustainable

- Factor:

Global Scale & Distribution Network

Strength:Strong

Sustainability:Sustainable

- Factor:

Brand Reputation for Reliability and Quality

Strength:Strong

Sustainability:Sustainable

- Factor:

Strategic Focus on High-Growth Secular Trends

Strength:Moderate

Sustainability:Sustainable

Value Proposition

We are a dedicated global power management company that provides reliable, efficient, safe, and sustainable solutions to help our customers manage electrical, hydraulic, and mechanical power more effectively across critical infrastructure.

Good

Key Benefits

- Benefit:

Enhanced Operational Reliability & Uptime

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Extensive portfolio of UPS and power quality products

- •

Global service and support network

- •

Long history in mission-critical applications like data centers and aerospace

- Benefit:

Improved Energy Efficiency & Sustainability

Importance:Important

Differentiation:Somewhat unique

Proof Elements

- •

Public sustainability goals (e.g., carbon neutrality by 2030).

- •

Products designed for energy efficiency

- •

Solutions enabling renewable energy integration and EV infrastructure.

- Benefit:

Increased Safety & Regulatory Compliance

Importance:Critical

Differentiation:Common

Proof Elements

- •

Products designed to meet or exceed international safety standards (UL, IEC)

- •

Specialized solutions for hazardous environments

- •

Focus on cybersecurity in product design.

Unique Selling Points

- Usp:

The 'Everything as a Grid' Approach

Sustainability:Long-term

Defensibility:Moderate

- Usp:

Deep Domain Expertise Across Both Electrical and Industrial Sectors

Sustainability:Long-term

Defensibility:Strong

- Usp:

Proactive Portfolio Transformation via Strategic M&A

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Unplanned downtime in critical operations due to power issues

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Rising energy costs and pressure to meet sustainability targets

Severity:Major

Solution Effectiveness:Partial

- Problem:

Complexity of modernizing electrical infrastructure for electrification and renewables

Severity:Major

Solution Effectiveness:Complete

Value Alignment Assessment

High

Eaton's value proposition is strongly aligned with the macro trends of electrification, energy transition, and digitalization, which are driving significant market demand.

High

The focus on reliability, efficiency, and safety directly addresses the primary pain points of its core B2B customer segments in critical industries.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Electrical Distributors (e.g., WESCO, Rexel)

- •

IT Resellers and System Integrators (via PowerAdvantage Partner Program).

- •

Original Equipment Manufacturers (OEMs) in automotive, aerospace, and machinery.

- •

Technology Alliance Partners (e.g., VMware, Cisco, Microsoft).

Key Activities

- •

Research & Development in power electronics and materials science.

- •

Advanced, high-precision manufacturing and global supply chain management.

- •

Channel management and partner enablement.

- •

Strategic acquisitions and portfolio management.

Key Resources

- •

Extensive patent portfolio and intellectual property.

- •

Global manufacturing footprint and distribution centers.

- •

Strong brand equity and reputation built over a century.

- •

Experienced engineering and technical sales workforce.

Cost Structure

- •

Cost of goods sold (raw materials like copper, steel; labor)

- •

Selling, General & Administrative (SG&A) expenses

- •

Research & Development (R&D) investments

- •

Costs associated with mergers and acquisitions

Swot Analysis

Strengths

- •

Deeply entrenched position in critical, high-barrier-to-entry markets.

- •

Highly diversified business across geographies and end-markets, providing resilience.

- •

Strong financial performance with a history of profitability and cash flow generation.

- •

Proven ability to execute large, strategic acquisitions like Cooper Industries and Tripp Lite to reshape its portfolio.

Weaknesses

- •

Large, complex organization can lead to slower decision-making compared to smaller rivals.

- •

Significant exposure to cyclical industrial markets can impact short-term performance.

- •

Hardware-centric legacy can slow the transition to recurring software and service revenue models.

Opportunities

- •

Massive global investment in grid modernization and renewable energy infrastructure.

- •

Exponential growth in data centers driven by AI and cloud computing.

- •

Accelerating adoption of electric vehicles creating demand for new infrastructure and components.

- •

Leveraging digitalization and IoT to offer predictive maintenance and energy optimization services.

Threats

- •

Intense competition from well-capitalized global peers like Schneider Electric, Siemens, and ABB.

- •

Disruption from new technologies like solid-state transformers or advanced battery chemistries.

- •

Global trade tensions and supply chain disruptions impacting cost and availability of components.

- •

Increasingly sophisticated cybersecurity threats targeting critical infrastructure.

Recommendations

Priority Improvements

- Area:

Digital Customer Experience

Recommendation:Streamline and unify the digital tools and portals for channel partners and direct customers to simplify doing business, from configuration and quoting to ordering and support.

Expected Impact:Medium

- Area:

Service & Software Integration

Recommendation:Aggressively bundle and incentivize the attachment of service contracts and Brightlayer software subscriptions at the point of hardware sale to accelerate recurring revenue growth.

Expected Impact:High

- Area:

Talent Development

Recommendation:Invest in upskilling the existing workforce and acquiring new talent in software development, data science, and cybersecurity to support the strategic pivot to digital solutions.

Expected Impact:High

Business Model Innovation

- •

Develop and scale 'Energy-as-a-Service' (EaaS) offerings, where Eaton owns and operates on-site energy infrastructure (e.g., microgrids, EV charging) for a predictable, long-term fee, shifting capex to opex for customers.

- •

Launch a dedicated venture capital arm to invest in early-stage startups in adjacent technologies (e.g., battery tech, grid software, hydrogen) to gain early market insights and potential acquisition targets.

- •

Create a data monetization platform that offers anonymized, aggregated insights from its vast installed base of connected devices to help utilities, building managers, and industrial clients benchmark performance and predict failures.

Revenue Diversification

- •

Expand cybersecurity services beyond product-level security to offer network monitoring and threat intelligence for operational technology (OT) environments.

- •

Offer consulting and advisory services focused on energy transition strategy, helping large corporations plan their path to decarbonization and electrification.

- •

Build out a more comprehensive EV charging infrastructure portfolio, including software management platforms and integrated energy storage solutions, to capture more value in the eMobility ecosystem.

Eaton Corporation operates a mature, highly diversified, and robust business model centered on manufacturing and selling mission-critical power management products. Its strategic evolution has been marked by a deliberate and successful pivot away from lower-margin, cyclical industrial businesses (like hydraulics) towards high-growth, technology-driven secular trends in electrification, energy transition, and digitalization. This positions the company exceptionally well for the future, as its core markets—data centers, utilities, and eMobility—are set for sustained, long-term investment. The company's primary strengths lie in its global scale, strong brand reputation for reliability, deep engineering expertise, and entrenched relationships with key channel partners and OEMs. These create significant competitive moats. The primary revenue model, based on selling premium-priced, highly engineered hardware, is profitable but remains vulnerable to economic cycles and supply chain pressures. The most significant opportunity for strategic transformation lies in accelerating the shift from a product-centric model to a solutions-and-service-oriented model. By more tightly integrating its Brightlayer digital platform and expanding recurring revenue from software and services, Eaton can create stickier customer relationships, improve margin stability, and unlock new value streams. Key strategic imperatives should include simplifying the digital customer journey, innovating in 'as-a-service' business models, and continuing to use strategic acquisitions to gain capabilities in software, cybersecurity, and emerging energy technologies. The primary threats are not from operational failure but from intense competition and the pace of technological change. Maintaining its market leadership will require continuous investment in R&D and an organizational culture that embraces the agility needed to compete in a rapidly digitizing industrial landscape.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

High Capital Investment & Manufacturing Complexity

Impact:High

- Barrier:

Extensive Global Supply Chains and Distribution Networks

Impact:High

- Barrier:

Strong Brand Reputation and Customer Loyalty

Impact:High

- Barrier:

Significant R&D and Intellectual Property (Patents)

Impact:High

- Barrier:

Strict Regulatory Standards and Certifications

Impact:Medium

Industry Trends

- Trend:

Energy Transition & Decarbonization

Impact On Business:Drives demand for renewable energy integration, grid modernization, and energy efficiency solutions. Creates massive opportunities for growth.

Timeline:Immediate

- Trend:

Digitalization and IoT (Internet of Things)

Impact On Business:Shifts focus from hardware to software and services. Enables smart grids, predictive maintenance, and digital twin technology, creating new revenue streams.

Timeline:Immediate

- Trend:

Electrification of Everything

Impact On Business:Increased demand for electrical components and systems in transportation (EVs), buildings, and industrial processes. Expands the total addressable market.

Timeline:Near-term

- Trend:

Cybersecurity for Power Systems

Impact On Business:As systems become more connected, the need for robust cybersecurity solutions becomes a critical purchasing criterion and a potential differentiator.

Timeline:Immediate

Direct Competitors

- →

Schneider Electric

Market Share Estimate:Leading competitor with significant market share in energy management and automation.

Target Audience Overlap:High

Competitive Positioning:Global specialist in energy management and automation, with a strong focus on sustainability and digital transformation.

Strengths

- •

Strong brand reputation for quality and reliability.

- •

Extensive global presence and distribution network in over 100 countries.

- •

Heavy investment in R&D, particularly in green technologies and IoT (EcoStruxure platform).

- •

Leader in the electrification and energy management space.

- •

Strong strategic partnerships with tech firms like Microsoft and IBM.

Weaknesses

- •

Perceived as lagging slightly in innovation speed compared to some rivals.

- •

Over-reliance on professional clients, limiting exposure to the consumer market.

- •

Historical challenges with integrating some acquisitions.

- •

Market share in some emerging Asia-Pacific regions is lower than key competitors.

Differentiators

- •

EcoStruxure: an open, interoperable, IoT-enabled system architecture and platform.

- •

Strong push for sustainability as a core business driver.

- •

Comprehensive portfolio for both energy management and industrial automation.

- →

Siemens

Market Share Estimate:A dominant player, particularly strong in industrial automation and smart infrastructure.

Target Audience Overlap:High

Competitive Positioning:A global technology powerhouse focused on industry, infrastructure, transport, and healthcare, with a strong emphasis on digitalization and automation.

Strengths

- •

Best-in-class industrial automation and software portfolio (Digital Industries).

- •

Strong brand recognition and long-standing reputation for engineering excellence.

- •

Aggressive growth strategy in smart infrastructure through acquisitions like Brightly Software.

- •

Deep expertise in complex, large-scale projects (e.g., grid modernization).

- •

Leader in combining the real and digital worlds through its Siemens Xcelerator platform.

Weaknesses

- •

Large, complex organizational structure can sometimes slow decision-making.

- •

Electrification business (Smart Infrastructure) is seen as improving but still catching up to peers in some areas.

- •

Portfolio diversity can sometimes dilute focus compared to more specialized competitors.

Differentiators

- •

Siemens Xcelerator: An open digital business platform to accelerate digital transformation.

- •

Strong integration of hardware with a sophisticated software and digital twin suite.

- •

Deep vertical expertise in key industries like manufacturing, energy, and transportation.

- →

ABB

Market Share Estimate:Major global competitor across electrification, robotics, and automation.

Target Audience Overlap:High

Competitive Positioning:A technology leader in electrification and automation, enabling a more sustainable and resource-efficient future.

Strengths

- •

Market leader in motion (drives and motors) and robotics.

- •

Strong brand equity built on decades of reliable performance.

- •

Expansive global distribution network and a robust supply chain.

- •

Strong focus on innovation and R&D, particularly in sustainable solutions.

- •

ABB Ability™ digital platform leverages IoT and AI for industrial solutions.

Weaknesses

- •

Previously faced challenges with portfolio complexity before strategic reorganization.

- •

Blended automation margins trail behind Siemens due to hardware focus.

- •

Lacks the extensive software focus of Siemens.

Differentiators

- •

Pioneering technology leadership, especially in robotics and electrification.

- •

ABB Ability™ platform for connecting and monitoring devices.

- •

Commitment to sustainability integrated into their core business strategy.

- →

Rockwell Automation

Market Share Estimate:Significant player, particularly in the North American industrial automation market.

Target Audience Overlap:Medium

Competitive Positioning:A global leader in industrial automation and digital transformation, focused on making its customers more productive and the world more sustainable.

Strengths

- •

Strong market position in the industrial automation sector, especially in North America.

- •

Robust portfolio of advanced manufacturing technologies (e.g., ControlLogix).

- •

Extensive ecosystem of partners and system integrators.

- •

Deep expertise in specific industrial applications and strong customer relationships.

Weaknesses

- •

More specialized in automation, lacking the broad electrification portfolio of Eaton, Siemens, or Schneider.

- •

High dependence on manufacturing and industrial capital spending cycles, making it vulnerable to economic downturns.

- •

Smaller global footprint compared to the top three competitors.

Differentiators

- •

The Connected Enterprise®: strategy for converging plant-floor operations with enterprise-level IT.

- •

Focus purely on industrial automation and information.

- •

Studio 5000 integrated development environment.

Indirect Competitors

- →

Honeywell

Description:A diversified technology and manufacturing company with a strong presence in building automation, performance materials, and aerospace. Their building management systems (BMS) and smart building solutions compete with Eaton's offerings in that segment.

Threat Level:Medium

Potential For Direct Competition:Increasingly competing in smart building and energy management solutions.

- →

Emerson Electric

Description:Focuses on automation solutions and commercial & residential solutions. Their process automation and control systems are strong competitors to Eaton's industrial offerings.

Threat Level:Medium

Potential For Direct Competition:High overlap in the industrial automation and control space.

- →

General Electric (GE Vernova)

Description:Post-restructuring, GE Vernova focuses on the energy transition, including power generation, grid solutions, and electrification. Competes with Eaton at the utility scale and in grid infrastructure.

Threat Level:Medium

Potential For Direct Competition:Direct competition in grid-level solutions and power generation components.

- →

Specialized Software & Analytics Companies

Description:Companies focused on AI-powered energy management, predictive analytics for industrial assets, and cybersecurity for operational technology (OT). They offer niche, best-of-breed solutions that can displace the software components of larger integrated providers.

Threat Level:Low

Potential For Direct Competition:Unlikely to compete on hardware, but pose a threat through partnership or by disaggregating the value chain.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Broad & Diversified Product Portfolio

Sustainability Assessment:Eaton's extensive range of products across electrical and industrial sectors allows for cross-selling and integrated solutions that are difficult for more specialized competitors to match.

Competitor Replication Difficulty:Hard

- Advantage:

Established Global Distribution Channels

Sustainability Assessment:Long-standing relationships with distributors and a massive global footprint create a significant barrier to entry and ensure market access.

Competitor Replication Difficulty:Hard

- Advantage:

Strong Brand Reputation for Reliability

Sustainability Assessment:In an industry where reliability and safety are paramount, Eaton's established brand trust is a powerful asset that takes decades to build.

Competitor Replication Difficulty:Hard

- Advantage:

Large Installed Base

Sustainability Assessment:A large installed base creates customer lock-in due to high switching costs and generates a consistent revenue stream from aftermarket services and replacements.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'Leadership in Specific Niche Technologies', 'estimated_duration': '1-3 years'}

Disadvantages

- Disadvantage:

Perception of Being Less Digitally Advanced than Siemens or Schneider

Impact:Major

Addressability:Moderately

- Disadvantage:

Complex Portfolio Management

Impact:Minor

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted digital marketing campaigns highlighting Eaton's role in key trends like 'Energy Transition' and 'Grid Modernization'.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Create bundled solutions for high-growth sectors like data centers and EV charging infrastructure, simplifying the buying process for customers.

Expected Impact:High

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Accelerate the development and marketing of the 'Eaton Brightlayer' digital platform to more effectively compete with Siemens Xcelerator and Schneider's EcoStruxure.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Pursue strategic partnerships with AI and cybersecurity software firms to enhance digital offerings and address emerging customer needs.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Expand service offerings, focusing on predictive maintenance, energy-as-a-service (EaaS), and consulting to build recurring revenue streams.

Expected Impact:Medium

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Invest in next-generation materials and technologies for energy storage and power electronics to secure a leadership position in the future energy landscape.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Consider strategic acquisitions of software or high-growth technology companies to fill portfolio gaps and accelerate digital transformation.

Expected Impact:High

Implementation Difficulty:Difficult

Position Eaton as the pragmatic and reliable partner for the energy transition, combining a century of engineering excellence with intelligent digital solutions. Emphasize the breadth of the portfolio as a key differentiator for customers seeking comprehensive, integrated solutions from a single trusted provider.

Differentiate through 'Intelligent Power Management,' focusing on the seamless integration of hardware and software to deliver tangible outcomes for customers: improved reliability, enhanced safety, greater efficiency, and measurable sustainability.

Whitespace Opportunities

- Opportunity:

Develop comprehensive 'Grid-Edge' solutions for commercial and industrial customers.

Competitive Gap:While all major competitors are active in this space, there is a gap for fully integrated, easy-to-deploy solutions that combine EV charging, energy storage, solar integration, and intelligent load management under a single, unified software platform.

Feasibility:High

Potential Impact:High

- Opportunity:

Offer 'Cybersecure-by-Design' products and services for Operational Technology (OT).

Competitive Gap:Many competitors offer cybersecurity as an add-on or a separate service. There is an opportunity to embed advanced cybersecurity features directly into hardware (e.g., circuit breakers, PLCs) and market this as a core product differentiator, building on the theme of reliability and safety.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Create tailored solutions for the circular economy.

Competitive Gap:There is a nascent but growing demand for equipment lifecycle management, including refurbishment, remanufacturing, and end-of-life recycling services. Establishing a leadership position here would strongly align with sustainability trends and create customer stickiness.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Provide modular and scalable power solutions for emerging industries.

Competitive Gap:Industries like vertical farming, green hydrogen production, and large-scale data centers for AI have unique and rapidly evolving power needs. Developing pre-engineered, modular solutions for these niches could capture significant market share before competitors fully adapt.

Feasibility:High

Potential Impact:High

Eaton Corporation operates in a mature, oligopolistic power management industry, competing against a small number of large, well-resourced global players: primarily Schneider Electric, Siemens, and ABB, with Rockwell Automation being a significant competitor in the industrial automation space. The market is characterized by high barriers to entry, including immense capital requirements, established brands, and extensive global distribution networks, which protects incumbents from new entrants. The entire industry is being reshaped by powerful macro-trends: the global energy transition, pervasive digitalization, and the broad electrification of society. Success is no longer defined just by the quality of hardware, but by the intelligence of the accompanying software and the ability to provide integrated, data-driven solutions. Eaton's primary competitive advantage lies in its incredibly broad portfolio, deep channel relationships, and a sterling reputation for reliability. This positions them as a 'one-stop-shop' for complex projects. However, a key competitive challenge is the market perception that Siemens and Schneider Electric are more advanced in their digital transformation journeys, with their highly marketed IoT platforms (Xcelerator and EcoStruxure, respectively). While Eaton has its Brightlayer digital platform, it lacks the same level of market visibility. Strategic whitespace opportunities exist at the 'grid-edge,' where customers are trying to manage distributed energy resources like solar, storage, and EV charging. There is a clear need for simplified, integrated solutions. Furthermore, embedding cybersecurity directly into operational technology products and developing business models for a circular economy represent significant avenues for differentiation. To win in this evolving landscape, Eaton must leverage its traditional strengths in reliability and portfolio breadth while aggressively accelerating its digital narrative, proving to the market that it is not just a component supplier but a premier provider of intelligent power management solutions for a sustainable future.

Messaging

Message Architecture

Key Messages

- Message:

We make what matters work.

Prominence:Primary

Clarity Score:Medium

Location:Main hero banner

- Message:

Developing more efficient, sustainable power management solutions that meet the ever-changing needs of our world.

Prominence:Secondary

Clarity Score:High

Location:Sub-heading in hero banner

- Message:

We’re solving critical power management challenges with innovative technologies that meet the needs of today and tomorrow.

Prominence:Secondary

Clarity Score:High

Location:Headline for key themes section

- Message:

Focus on Cybersecurity, Electrification, Energy transition, and #WhatMatters.

Prominence:Tertiary

Clarity Score:High

Location:Key themes/pillars section

The message hierarchy is well-defined and logical. The primary tagline, 'We make what matters work,' is the most prominent element, establishing a high-level, aspirational brand promise. This is immediately supported by a clearer, more descriptive secondary message about developing sustainable power management solutions. The page then flows into tangible, strategic pillars (Cybersecurity, Electrification, Energy Transition), effectively breaking down the broad promise into concrete areas of focus.

Messaging on the analyzed page is highly consistent. The core idea of 'making what matters work' is reinforced by the focus on 'critical power management challenges.' The four strategic pillars are presented in a visually repetitive and consistent carousel, ensuring the user understands these are the core focus areas for the company.

Brand Voice

Voice Attributes

- Attribute:

Authoritative & Expert

Strength:Strong

Examples

- •

We’re solving critical power management challenges...

- •

PRODUCT SECURITY HAS NEVER BEEN MORE IMPORTANT

- •

FLEXIBLE ENERGY SYSTEMS

- Attribute:

Corporate & Professional

Strength:Strong

Examples

- •

Eaton announced second quarter 2025 earnings...

- •

The company hosted a conference call...

- •

Access financial presentations and webcasts

- Attribute:

Ambitious & Forward-Looking

Strength:Moderate

Examples

- •

...technologies that meet the needs of today and tomorrow.

- •

Our 2030 strategy

- •

Developing more efficient, sustainable power management solutions...

Tone Analysis

Formal and professional.

Secondary Tones

Confident

Informative

Tone Shifts

The tone shifts from high-level, strategic marketing language in the main sections to a formal, regulated financial tone in the 'earnings' section, which is appropriate for its target audience (investors).

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

Eaton provides innovative, reliable, and sustainable power management solutions to solve the world's most critical energy challenges across essential industries, ensuring that vital systems operate efficiently and safely.

Value Proposition Components

- Component:

Innovation for Future Needs

Clarity:Clear

Uniqueness:Somewhat Unique

Detail:Communicated through themes like 'Electrification' and 'Energy transition,' positioning Eaton as a forward-thinking problem solver.

- Component:

Sustainability & Efficiency

Clarity:Clear

Uniqueness:Common

Detail:A central theme in the mission and homepage messaging ('more efficient, sustainable power management solutions'), which is a common but essential value proposition in the industry.

- Component:

Reliability & Security

Clarity:Clear

Uniqueness:Somewhat Unique

Detail:Emphasized through the focus on 'Cybersecurity' and the mission's mention of 'reliable' and 'safe' technologies, addressing critical operational needs.

- Component:

Corporate Scale & Stability

Clarity:Clear

Uniqueness:Unique

Detail:Implicitly communicated through the display of sales figures ($24.9B), employee count (>92K), and NYSE ticker, signaling a stable, global partner.

Eaton differentiates itself not on a single product feature, but on its comprehensive ability to tackle large-scale, systemic challenges ('critical power management challenges'). While competitors like Siemens and Schneider Electric also focus on sustainability and digitalization, Eaton's tagline 'We make what matters work' frames their role as the essential, reliable force enabling critical infrastructure. This positions them as a foundational partner rather than just a technology provider. The explicit focus on areas like Cybersecurity alongside Electrification provides a tangible differentiator.

The messaging positions Eaton as a global, established industry leader and a peer to other major conglomerates like Siemens, ABB, and Schneider Electric. They are not trying to be a disruptive startup but a stable, innovative, and indispensable partner for major industrial, commercial, and utility customers. The focus on sustainability and energy transition is a key part of their competitive positioning in a market where these are paramount concerns.

Audience Messaging

Target Personas

- Persona:

C-Suite / Business Leader

Tailored Messages

- •

We make what matters work.

- •

Solving critical power management challenges...

- •

Focus on Energy transition, Sustainability, Cybersecurity

Effectiveness:Effective

- Persona:

Investor / Financial Analyst

Tailored Messages

- •

ETN NYSE ticker

- •

24.9B 2024 sales (USD)

- •

Eaton second quarter 2025 earnings

- •

Listen to webcast replay

Effectiveness:Effective

- Persona:

Engineer / Technical Buyer

Tailored Messages

Products Search Eaton products

Effectiveness:Ineffective

Note:The homepage has a clear entry point ('Products') but lacks specific, benefit-driven messaging for this persona. The messaging is almost exclusively high-level and corporate.

- Persona:

Potential Employee

Tailored Messages

Careers at Eaton Search jobs

>92K Employees around the world

Effectiveness:Somewhat Effective

Note:Provides a clear path to careers but lacks compelling messaging about why someone should work at Eaton (e.g., culture, impact).

Audience Pain Points Addressed

- •

Navigating the complexity of the energy transition.

- •

Ensuring cybersecurity for critical infrastructure.

- •

Meeting sustainability and efficiency goals.

- •

Managing the shift to vehicle and industrial electrification.

Audience Aspirations Addressed

- •

Achieving operational reliability and safety.

- •

Future-proofing infrastructure and investments.

- •

Contributing to a more sustainable world.

- •

Partnering with a stable, reputable global leader.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Security & Safety

Effectiveness:High

Examples

The focus on 'Cybersecurity' and the mission statement's emphasis on 'safe' and 'reliable' technologies appeal to the fundamental need for security in critical operations.

- Appeal Type:

Responsibility & Purpose

Effectiveness:Medium

Examples

Messaging around 'Sustainability' and 'improving people’s lives and the environment' appeals to a sense of corporate social responsibility and positive impact.

Social Proof Elements

- Proof Type:

Scale & Market Leadership

Impact:Strong

Detail:Displaying '$24.9B 2024 sales' and '>92K Employees' immediately establishes Eaton as a major, credible player in the global market.

- Proof Type:

Financial Market Validation

Impact:Strong

Detail:The prominent 'ETN NYSE ticker' and detailed investor relations section serve as powerful social proof, indicating a stable, publicly-traded company accountable to the market.

Trust Indicators

- •

Transparency through a dedicated investor relations section with earnings reports and webcasts.

- •

Clear articulation of strategic focus areas (Cybersecurity, Energy Transition), demonstrating expertise.

- •

Global presence shown via the extensive country selector page.

- •

Long-standing corporate identity (founded in 1911).

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

*See how

Location:Hero banner

Clarity:Somewhat Clear

Note:This is an engagement-oriented CTA, but the destination ('what-matters.html') is somewhat vague from the text alone.

- Text:

Search Eaton products

Location:Navigation section below hero

Clarity:Clear

- Text:

Search jobs

Location:Navigation section below hero

Clarity:Clear

- Text:

Our 2030 strategy

Location:Navigation section below hero

Clarity:Clear

- Text:

Listen to webcast replay

Location:Earnings section

Clarity:Clear

The CTAs are clear, functional, and well-organized by audience. They serve primarily as navigational signposts to direct different user types (customer, investor, job seeker) to the right section of the site. However, they are not particularly persuasive or benefit-driven. They lack action-oriented language that would compel a user to click, instead relying on the user's pre-existing intent. For a user who is exploring, the CTAs are passive rather than compelling.

Messaging Gaps Analysis

Critical Gaps

- •

Lack of customer-centric stories. The homepage is entirely about Eaton and what Eaton does. There are no customer testimonials, case studies, or examples of how 'what matters' is actually 'working' for a specific client.

- •

Missing link between problems and products. The site presents high-level challenges (Energy transition) and a generic portal to 'Products' but fails to connect them. A user interested in energy transition is not guided to the specific products or solutions that address that challenge.

- •

Weak human element. The messaging is very corporate and abstract. It lacks stories about the employees, engineers, or leaders who are solving these challenges, making the brand feel impersonal.

Contradiction Points

No itemsUnderdeveloped Areas

Benefit-oriented language. The messaging is feature-oriented (e.g., 'FLEXIBLE ENERGY SYSTEMS') rather than benefit-oriented (e.g., 'Reduce energy costs and improve grid stability').

Industry-specific messaging. The homepage speaks to a generic global audience. There's a missed opportunity to immediately channel visitors by industry (e.g., 'Solutions for Data Centers,' 'Solutions for Utilities') to make the value proposition more tangible.

Messaging Quality

Strengths

- •

Strong, consistent corporate brand identity.

- •

Clear alignment of messaging with major global megatrends (sustainability, electrification, digitalization).

- •

Effective segmentation of messaging for distinct, high-level audiences like investors, customers, and job seekers.

- •

Authoritative voice and tone that builds credibility and trust.

Weaknesses

- •

Overly abstract and corporate; lacks a relatable, human voice.

- •

Weak on customer-centric evidence and social proof (e.g., case studies, testimonials).

- •

Fails to create a clear, compelling narrative connecting high-level challenges to specific Eaton solutions.

- •

Passive, functional CTAs that guide but do not persuade.

Opportunities

- •

Incorporate customer success stories directly on the homepage to substantiate the 'We make what matters work' claim.

- •

Create clear messaging pathways from the strategic challenges (e.g., 'Energy transition') to the relevant product/solution suites.

- •

Humanize the brand by featuring employee or customer spotlights, shifting from a 'what we do' to a 'how we help' narrative.

- •

Develop more persuasive, benefit-led headlines and CTAs.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Narrative

Recommendation:Integrate a 'Customer Stories' or 'In Action' module on the homepage that provides concrete examples of how Eaton's technology solves problems for specific clients. This will bridge the gap between the abstract brand promise and tangible value.

Expected Impact:High

- Area:

Value Proposition

Recommendation:Develop industry-specific landing pages and link to them from the homepage. This will allow visitors from key sectors (data centers, aerospace, utilities) to see a value proposition tailored directly to their pain points.

Expected Impact:High

- Area:

Audience Engagement

Recommendation:Rewrite headlines in the strategic pillars section to be more benefit-focused. For example, change 'Energy transition' to 'Lead the energy transition with flexible, resilient systems.'

Expected Impact:Medium

Quick Wins

Change the primary CTA in the hero from '*See how' to a more descriptive and compelling 'See our impact' or 'Explore our solutions'.

Add a sub-heading to the 'Products' navigation block that says 'Find solutions for your industry,' guiding technical users more effectively.

Long Term Recommendations

- •

Develop a comprehensive content strategy centered around storytelling, focusing on the 'heroes' (engineers, customers) who use Eaton technology to achieve outcomes. This aligns with successful strategies used by competitors like ABB.

- •

Invest in creating more middle-of-funnel content (e.g., white papers, webinars) that directly links the high-level thought leadership topics (like cybersecurity) to specific Eaton methodologies and products, and promote this on the homepage.

- •

Overhaul the product section of the website to be solution-first, allowing users to browse by challenge or industry rather than just by product category.

Eaton's strategic messaging is highly effective at positioning the company as a stable, authoritative, and essential global leader in power management. The message architecture is clear and logical, successfully communicating a high-level corporate vision ('We make what matters work') and breaking it down into relevant, contemporary strategic pillars like Energy Transition and Cybersecurity. The brand voice is exceptionally consistent, projecting professionalism and expertise, which is well-suited for its B2B and investor audiences.

The primary strength of the messaging lies in its appeal to C-suite leaders and the financial community. It speaks the language of global trends, sustainability, and financial stability, building significant brand credibility. However, this strength is also its main weakness. The messaging is almost exclusively corporate-centric, focusing on what Eaton is and does, rather than the specific outcomes it delivers for customers.

There is a critical messaging gap between the grand, abstract challenges and the tangible products. A potential customer arriving on the site is told Eaton solves 'critical power management challenges' but is given no clear narrative path to how a specific Eaton product can solve their specific challenge. The absence of customer stories, case studies, or benefit-driven language makes the brand feel distant and impersonal. While competitors like Siemens and Schneider Electric actively use thought leadership and customer-centric content to engage audiences, Eaton's homepage messaging remains more of a broadcast from the corporation.

To improve effectiveness and drive business outcomes like customer acquisition, the messaging strategy must evolve to be more customer-centric. The immediate priority should be to substantiate the brand's bold claims with concrete proof, showcasing real-world impact through customer stories. By humanizing the brand and creating clear pathways from problems to solutions, Eaton can transform its messaging from a credible corporate statement into a compelling engine for customer engagement and growth.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Established global leader in power management with operations in over 175 countries, indicating deep market penetration and acceptance.

- •

Record 2024 sales of $24.9B and consistent revenue growth demonstrate sustained demand for its products and services across multiple sectors.

- •

Diverse portfolio serving mission-critical industries like data centers, utilities, aerospace, and commercial buildings, which are all experiencing secular growth trends.

- •

Long history of paying dividends (since 1923) reflects stable, profitable operations and a mature business model.

- •

High institutional ownership (over 82%) suggests strong investor confidence in the company's market position and strategy.

Improvement Areas

- •

Achieve consistent profitability in the newer eMobility segment, which currently faces operating losses due to high launch costs for new programs.

- •

Accelerate the transition from being a component/hardware supplier to an integrated 'intelligent power management' solutions provider, combining hardware with software and services.

- •

Strengthen product-market fit for digital offerings and software platforms to compete with more software-native competitors.

Market Dynamics

The global power management system market is projected to grow at a CAGR of 6.8% to 8.7% annually, driven by electrification, grid modernization, and renewable energy integration.

Mature

Market Trends

- Trend:

Energy Transition & Electrification

Business Impact:Massive tailwind for Eaton's entire electrical portfolio, from grid components to EV charging infrastructure and energy storage. The global energy transition market is expected to grow at a CAGR of over 9.5%.

- Trend:

Digitalization and AI Growth

Business Impact:Explosive demand for data centers is a primary growth driver, significantly boosting sales of power distribution, quality, and thermal management solutions.

- Trend:

Grid Modernization & Resilience

Business Impact:Aging infrastructure and the integration of intermittent renewables are driving significant investment in smart grid technologies, voltage regulators, and switchgear, core markets for Eaton.

- Trend:

Re-industrialization and Infrastructure Investment

Business Impact:Government initiatives like the IRA and CHIPS Act in the U.S. are fueling a boom in domestic manufacturing and construction, increasing demand for electrical infrastructure.

Excellent. Eaton is well-positioned at the epicenter of several powerful, long-term secular growth trends, particularly electrification and digitalization.

Business Model Scalability

Medium

High fixed costs associated with manufacturing plants, R&D, and a global supply chain. Scalability is achieved through increasing plant utilization and operational leverage.

Moderate to High. Once fixed costs are covered, increased production volume and strategic pricing have a significant positive impact on operating margins.

Scalability Constraints

- •

Manufacturing capacity for high-demand components like transformers and switchgear.

- •

Supply chain complexity and potential disruptions for raw materials (e.g., copper) and electronic components.

- •

Requirement for significant capital investment to build new facilities and upgrade existing ones.

- •

Availability of skilled labor, particularly for specialized manufacturing and engineering roles.

Team Readiness

Experienced leadership team with a proven track record of managing a large, complex global industrial company and executing strategic shifts (e.g., selling the Hydraulics business to focus on higher-growth electrical and aerospace markets).

A mature, matrixed organization structured by business segment (Electrical, Aerospace, etc.) and geography. This is effective for managing a diverse portfolio but can slow down cross-functional innovation.

Key Capability Gaps

- •

Agile software development and product management talent to accelerate the growth of digital and software-as-a-service (SaaS) offerings.

- •

Digital marketing and e-commerce expertise to create more direct, modern customer engagement channels for specific product lines.

- •

Data science and analytics capabilities to leverage data from connected devices for predictive maintenance and energy optimization services.

Growth Engine

Acquisition Channels

- Channel:

Direct Sales Force & Key Account Management

Effectiveness:High

Optimization Potential:Medium

Recommendation:Equip sales teams with advanced digital tools for solution selling, focusing on total cost of ownership (TCO) and ROI from integrated hardware/software solutions rather than individual product features.

- Channel:

Distributor & Channel Partner Network

Effectiveness:High

Optimization Potential:High

Recommendation:Launch a digital partner portal to streamline ordering, provide co-marketing resources, and offer online training/certification, particularly for newer technologies like EV charging and energy storage.

- Channel:

Digital (SEO, Content Marketing, PPC)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Invest heavily in technical SEO and content marketing (whitepapers, case studies, webinars) targeted at engineers and system architects. Develop persona-based PPC campaigns on platforms like LinkedIn to generate qualified leads for the sales team.

- Channel:

Trade Shows & Industry Events

Effectiveness:Medium

Optimization Potential:Low

Recommendation:Maintain presence at key industry events but shift focus from lead generation to relationship building and demonstrating complex, integrated solutions that are difficult to showcase online.

Customer Journey

Highly complex, multi-stakeholder B2B journey involving awareness, consideration, technical evaluation, specification, procurement, and post-sale support. The path is long, relationship-driven, and primarily offline.

Friction Points

- •

Navigating the vast and complex product portfolio on the website to find the right solution.

- •

Difficulty in comparing solutions and understanding the integration between different hardware and software products.

- •

Long lead times for quotes and technical specifications from sales teams.

- •

Siloed post-sale support experience across different product divisions.

Journey Enhancement Priorities

- Area:

Online Solution Configuration

Recommendation:Develop and promote online configuration tools that allow engineers to build and specify systems, generating a detailed bill of materials and initial quote, thereby shortening the sales cycle.

- Area:

Digital Content Hub

Recommendation:Create a centralized, searchable resource center with technical documentation, application notes, CAD files, and integration guides to support the technical evaluation phase.

- Area:

Unified Customer Portal

Recommendation:Build a single customer portal for order tracking, support tickets, and managing service contracts across all Eaton products they own.

Retention Mechanisms

- Mechanism:

High Switching Costs & Installed Base

Effectiveness:High

Improvement Opportunity:Leverage the large installed base to proactively sell digital services, software upgrades, and predictive maintenance contracts.

- Mechanism:

Long-Term Service Agreements (LTSAs)

Effectiveness:High

Improvement Opportunity:Bundle digital monitoring and energy optimization services into LTSAs to create stickier, higher-margin recurring revenue streams.

- Mechanism:

Deeply Integrated Channel Relationships

Effectiveness:High

Improvement Opportunity:Co-develop solutions with key channel partners to increase their loyalty and create proprietary, bundled offerings.

Revenue Economics

Extremely strong for its core B2B markets. Characterized by high average contract values, long customer lifecycles, and significant after-market service and parts revenue.

Not publicly determinable, but presumed to be very high (likely >10:1) given the nature of industrial B2B sales with long-term, high-value customers.

High. The company demonstrates strong operating margins and consistent free cash flow generation, indicating an efficient revenue engine.

Optimization Recommendations

- •

Increase the mix of recurring revenue from software and services to improve predictability and margins.

- •

Implement value-based pricing strategies for integrated solutions, capturing a portion of the efficiency and cost-saving benefits delivered to the customer.

- •

Utilize digital lead generation to lower the cost of acquisition for smaller, more transactional sales, freeing up the direct sales force for high-value strategic accounts.

Scale Barriers

Technical Limitations

- Limitation:

Hardware-Software Integration

Impact:High

Solution Approach:Adopt a platform-based strategy. Develop a unified software platform (e.g., 'Eaton Brightlayer') that integrates data from across the hardware portfolio, and create open APIs for third-party integration.

- Limitation:

Interoperability of Legacy Systems

Impact:Medium

Solution Approach:Invest in developing gateway devices and software adapters that allow older, installed equipment to connect to modern IoT platforms and software suites.

Operational Bottlenecks

- Bottleneck:

Supply Chain for Power Electronics

Growth Impact:Limits production capacity for high-growth products like EV chargers, energy storage inverters, and variable frequency drives.

Resolution Strategy:Strategic sourcing with multiple qualified suppliers, vertical integration for critical components, and investing in new manufacturing capacity in key regions like North America.

- Bottleneck:

Long Lead Times for Key Components (e.g., Transformers)

Growth Impact:Slows down project execution for large utility and data center customers, potentially leading to lost sales.

Resolution Strategy:Significant capital investment in expanding manufacturing facilities, improving production planning through better demand forecasting, and working with customers on longer-term procurement plans.

Market Penetration Challenges

- Challenge:

Intense Competition from Global Peers

Severity:Critical

Mitigation Strategy:Differentiate through integrated, intelligent solutions rather than individual components. Focus on specific high-growth verticals (e.g., data centers, utilities) where Eaton has a technological or service advantage over competitors like Schneider Electric, ABB, and Siemens.

- Challenge:

Shifting Customer Perception

Severity:Major

Mitigation Strategy:Invest in brand marketing that repositions Eaton from a traditional industrial manufacturer to an 'intelligent power management' technology company. Highlight software capabilities, cybersecurity, and sustainability benefits in all messaging.

Resource Limitations

Talent Gaps

- •

Software Engineers and Architects (Cloud, IoT, Cybersecurity)

- •

Data Scientists and AI/ML Specialists

- •

Digital Product Managers

- •

Power Electronics Engineers

High. Requires continuous, significant capital investment (>$750M recently in North America) for R&D, strategic acquisitions, and manufacturing capacity expansion to meet demand from secular growth trends.

Infrastructure Needs

- •

Upgraded and new manufacturing plants to produce next-generation power electronics.

- •

A robust, scalable cloud infrastructure to support a growing portfolio of digital services and connected devices.

- •

Advanced R&D and testing facilities for high-power applications (e.g., grid-scale storage, EV fast charging).

Growth Opportunities

Market Expansion

- Expansion Vector:

Vertical Market: 'Energy as a Service' (EaaS) for Commercial & Industrial Customers

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Develop financing and operational models to own and operate energy assets (e.g., EV charging, solar+storage) on behalf of customers, selling them power and resilience on a subscription basis. Start with pilot programs for key strategic accounts.

- Expansion Vector:

Geographic Market: Deeper Penetration in APAC's Renewable Energy Sector

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Form strategic partnerships with local developers and EPCs in high-growth markets like India and Southeast Asia. Tailor product offerings to meet local grid codes and standards. Consider strategic acquisitions of regional players.

Product Opportunities

- Opportunity:

Grid Interactive Solutions & Virtual Power Plant (VPP) Software

Market Demand Evidence:Growing need for utilities to manage distributed energy resources (DERs) and maintain grid stability with high renewable penetration.

Strategic Fit:Excellent. Leverages Eaton's strength in switchgear, controls, and energy storage with a high-value software layer.

Development Recommendation:Acquire a specialized DERMS (Distributed Energy Resource Management System) or VPP software provider to accelerate market entry and integrate their technology into Eaton's hardware ecosystem.

- Opportunity:

Solid-State Transformers for DC Power Distribution

Market Demand Evidence:Increasing demand from AI-powered data centers and DC microgrids for more efficient and compact power conversion technology.

Strategic Fit:Excellent. Aligns perfectly with the core power management mission and targets the highest-growth segment of the data center market.

Development Recommendation:Leverage the recent acquisition of Resilient Power Systems to rapidly commercialize and scale production of this next-generation technology.

Channel Diversification

- Channel:

Direct-to-Installer E-commerce Platform

Fit Assessment:Good for specific, standardized product lines like residential EV chargers and circuit breakers.

Implementation Strategy:Launch a dedicated e-commerce portal for certified electrical contractors, offering simplified ordering, bulk pricing, and direct access to technical resources. This bypasses traditional multi-step distribution for smaller, high-volume products.

- Channel:

Consultative Engineering Services

Fit Assessment:Excellent. Moves up the value chain from product supplier to strategic advisor.

Implementation Strategy:Build out a dedicated consulting arm focused on energy transition, grid modernization, and data center power design. This service can specify Eaton solutions while generating high-margin services revenue.

Strategic Partnerships

- Partnership Type:

Technology Ecosystem Partnerships

Potential Partners

- •

NVIDIA, Intel (for data center power co-design)

- •

Microsoft, AWS, Google (for grid-responsive data centers)

- •

Major Automotive OEMs (for V2G technology)

Expected Benefits:Co-develop optimized solutions for next-generation computing and EV infrastructure, ensuring Eaton's technology is embedded as the standard in these ecosystems.

- Partnership Type:

Utility & Energy Provider Alliances

Potential Partners

Major Investor-Owned Utilities (e.g., NextEra, Duke Energy)

Renewable Energy Developers (e.g., Orsted, Invenergy)

Expected Benefits:Become the preferred technology provider for large-scale grid modernization and renewable integration projects, co-developing new grid-interactive technologies.

Growth Strategy

North Star Metric

Revenue from Intelligent Power Solutions

This metric shifts the focus from selling hardware components to selling high-value, integrated systems that include software, services, and connectivity. It directly measures the success of the company's strategic transformation and aligns with higher-margin, recurring revenue streams.

Increase the percentage of total revenue from Intelligent Power Solutions by 15% annually.

Growth Model

Hybrid: Sales-Led & Solution-Led Growth

Key Drivers

- •

Strategic Account Management targeting enterprise customers in key verticals (data centers, utilities).

- •

Solution Engineering teams that design integrated systems tailored to complex customer challenges.

- •

Channel Partner Enablement for scaling the reach of standardized solutions.

Restructure sales incentives to reward the sale of integrated solutions over individual products. Build dedicated cross-functional 'solution pods' (sales, engineering, service) for each key vertical market.

Prioritized Initiatives

- Initiative:

Launch 'Data Center Power-as-a-Service'

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 months

First Steps:Create a dedicated business unit. Secure project financing partners. Develop standardized contracts and operational models. Launch a pilot program with a key hyper-scale data center partner.

- Initiative:

Develop a Unified Digital Platform for Installers & Partners

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:12 months

First Steps:Consolidate existing partner resources onto a single platform. Develop APIs for integration with distributor systems. Launch a beta version with a select group of channel partners for feedback.

- Initiative:

Acquire a Grid Management Software Company

Expected Impact:High

Implementation Effort:Medium

Timeframe:9-12 months

First Steps:Identify and vet potential acquisition targets specializing in DERMS or VPP software. Perform due diligence and negotiate acquisition. Develop a post-merger integration plan focused on technology integration.

Experimentation Plan

High Leverage Tests

- Test:

Value-Based Pricing vs. Cost-Plus Pricing for new software modules.

Hypothesis:Customers will pay a premium for software features that deliver measurable ROI in energy savings or operational uptime.

- Test:

Bundled Hardware + LTSA vs. A La Carte offering for medium-sized commercial customers.

Hypothesis:A bundled, predictable service offering will increase the adoption rate of long-term service agreements.

- Test:

Digital lead generation campaigns for specific product lines (e.g., EV chargers) targeted at new buyer personas (e.g., fleet managers).

Hypothesis:Targeted digital campaigns can generate qualified leads at a lower CAC than traditional sales channels for certain market segments.

Utilize an A/B testing framework for digital initiatives, tracking metrics like Conversion Rate, Cost Per Lead (CPL), and Customer Acquisition Cost (CAC). For larger strategic tests, use pilot programs with control groups to measure impact on revenue, margin, and customer satisfaction.

Monthly review of digital marketing experiments. Quarterly review of strategic pilot programs.

Growth Team