eScore

emerson.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

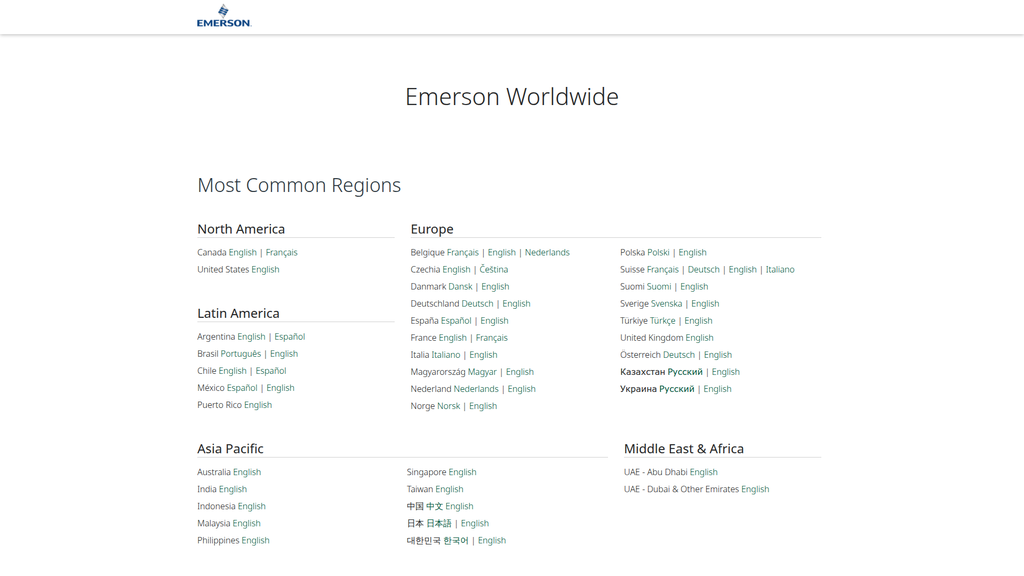

Emerson demonstrates a formidable digital presence, rooted in its strong domain authority and extensive, technically deep content that aligns well with the search intent of engineers and technical buyers. Its global presence is well-supported by localized websites, and its vast portfolio of trusted brands ensures visibility across numerous product-specific queries. However, the presence is less optimized for broader, strategic search terms like 'industrial decarbonization' where competitors are more visible, and there is a noticeable gap in voice search optimization for conversational, problem-based queries.

Exceptional content authority and depth for specific, product-level keywords (e.g., 'pressure regulators', 'ASCO valves'), effectively capturing high-intent technical audiences.

Develop a cohesive content strategy around high-level, solution-oriented topics (e.g., 'The Future of Manufacturing,' 'Industrial Decarbonization') to capture strategic, early-stage search traffic and bridge the gap between their technical content and high-level brand messaging.

Emerson's messaging is highly effective for its core technical audience, communicating precision, reliability, and expertise with authority. However, there is a significant disconnect between the aspirational, high-level corporate messaging ('Go Boldly') and the dense, feature-focused product content. This narrative gap fails to effectively communicate a unified value proposition to executive-level personas and does not clearly differentiate Emerson from competitors who tell similar high-level stories about digital transformation and sustainability.

Messaging to technical audiences (engineers, plant managers) is exceptionally clear, precise, and authoritative, effectively building trust and communicating product value.

Integrate customer success stories and tangible outcome-based proof points directly onto product and category pages to create a narrative bridge, showing *how* specific technologies enable customers to 'Go Boldly' and achieve their strategic goals.

The website's professional design establishes credibility, but it suffers from a passive approach to user guidance that hinders conversion. Critical call-to-action buttons have low color contrast and lack visual prominence, failing to effectively direct users toward key conversion goals like contacting sales. Furthermore, high content density on many pages can create significant cognitive load and decision paralysis for users, while inconsistent interactive cues create usability friction.

The site has a logical information architecture and a comprehensive, well-organized footer that serves as an effective secondary navigation path for determined users.

Revise the site-wide CSS to implement a high-contrast, action-oriented color for all primary CTA buttons and place a persistent 'Request a Quote' or 'Contact Sales' button in the sticky header to reduce friction for high-intent users.

Emerson has established a robust and mature framework for credibility and legal compliance, which is a strategic asset for a global B2B leader. The company demonstrates strong third-party validation through its portfolio of trusted sub-brands, showcases extensive customer success evidence via case studies, and implements best-in-class data privacy and cookie compliance mechanisms. The primary risk factor is a severely outdated Terms of Use document (2016), which creates unnecessary legal ambiguity and undermines an otherwise excellent compliance posture.

Implementation of a granular, user-friendly OneTrust cookie consent banner and a detailed Privacy Notice with dedicated GDPR contacts, showcasing a best-in-class approach to data privacy.

Immediately conduct a comprehensive legal review and update of the Terms of Use to align with the current global regulatory landscape (GDPR, CCPA/CPRA) and to adequately govern its modern software and AI-based service offerings.

Emerson's competitive moat is deep and sustainable, built on a massive global installed base which creates high switching costs and generates recurring aftermarket revenue. This is fortified by a portfolio of highly respected, century-old brands (ASCO, Fisher, Rosemount) and profound domain expertise in complex process industries. The primary weakness is a market perception as a traditional hardware company, which can be a disadvantage when competing for software-centric, digital transformation projects against rivals with a more unified digital narrative.

The combination of a vast installed base and a portfolio of iconic, trusted brands creates powerful, long-lasting barriers to entry and significant pricing power.

Launch a unified marketing and branding initiative for the entire software portfolio (including AspenTech and NI) to counter the fragmented narrative and more effectively compete with integrated platforms like Siemens Xcelerator and Schneider's EcoStruxure.

Emerson is well-positioned for future growth, having decisively pivoted its portfolio towards high-growth, scalable markets like industrial software, sustainability, and life sciences through strategic acquisitions. The business model is actively shifting to increase the mix of high-margin, recurring software revenue, which offers significant operational leverage. However, scalability is constrained by the operational and cultural challenges of integrating large, acquired software companies and the business's continued exposure to cyclical capital spending in its traditional hardware segments.

A clear and decisive corporate strategy, demonstrated by major acquisitions (AspenTech, NI) and divestitures, has repositioned the company to capitalize on the secular growth trends of digitalization and sustainability.

Develop and invest in a dedicated Customer Success function, particularly for the newly acquired software businesses, to ensure rapid customer value realization, drive adoption, and secure long-term recurring revenue.

Emerson has executed a highly coherent and strategically sound transformation into a focused industrial automation leader. The business model is built on the powerful synergy between its foundational 'Intelligent Devices' (hardware) and its high-growth 'Software and Control' segment, creating a defensible value proposition. The strategic focus on leveraging its installed base to cross-sell software is clear and logical, though successful execution depends on overcoming the significant challenge of integrating diverse company cultures and technology stacks.

The synergistic business model that uses the massive installed hardware base as a competitive moat and a fertile ground for upselling high-margin, sticky software solutions is a powerful and coherent strategy.

Accelerate the transition to outcome-based and 'as-a-service' commercial models, where revenue is tied to customer KPIs like uptime or energy efficiency, to fully align Emerson's success with its customers' and create more predictable revenue streams.

As a leader in a mature oligopoly, Emerson wields significant market power, particularly in the process automation sector, affording it strong pricing power and negotiating leverage with partners. Its market share is dominant in many core niches, and its brand is synonymous with reliability. The company faces intense competition from equally powerful global giants like Siemens, ABB, and Rockwell Automation, who are also aggressively competing for leadership in the digital transformation and sustainability narrative.

Dominant market position and brand equity in core process automation segments, built over decades, which provides significant pricing power and customer loyalty.

More aggressively shape the industry narrative around sustainability by packaging products and software into a holistic 'Sustainability-as-a-Service' offering, turning a corporate goal into a quantifiable and dominant market position.

Business Overview

Business Classification

B2B Industrial Manufacturing & Technology Solutions

Industrial Software & Engineering Services

Industrial Automation

Sub Verticals

- •

Process Automation (e.g., Oil & Gas, Chemicals, Power)

- •

Factory Automation (e.g., Automotive, Semiconductor, Life Sciences)

- •

Measurement & Analytical Instrumentation

- •

Control Systems & Software

- •

Sustainability & Decarbonization Technologies

Mature

Maturity Indicators

- •

Founded in 1890, demonstrating long-term market presence.

- •

Global operations in over 150 countries.

- •

Consistent dividend increases for over 65 years, indicating financial stability.

- •

Active portfolio management through strategic acquisitions (e.g., National Instruments, AspenTech) and divestitures (e.g., Climate Technologies, InSinkErator) to focus on core automation markets.

- •

Strong brand recognition and a large, established customer base in critical industries.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Intelligent Devices (Hardware Sales)

Description:Sale of a broad portfolio of physical automation products, including valves, actuators, regulators, sensors, and measurement instruments. This is the historical core of the business and constitutes the largest revenue segment.

Estimated Importance:Primary

Customer Segment:Process, Hybrid, and Discrete Industries

Estimated Margin:Medium

- Stream Name:

Software and Control (Software & Subscriptions)

Description:Licensing of industrial software for control systems, operations management, digital twins, and AI-driven analytics. This includes platforms like DeltaV, Ovation, and solutions from the AspenTech acquisition. A key strategic growth area with a focus on increasing recurring revenue.

Estimated Importance:Primary

Customer Segment:Process, Hybrid, and Discrete Industries

Estimated Margin:High

- Stream Name:

Lifecycle Services & Solutions

Description:Engineering, consulting, project management, maintenance, and support services throughout the lifecycle of a customer's facility. This stream drives customer loyalty and often leads to recurring revenue through long-term service agreements.

Estimated Importance:Secondary

Customer Segment:Process, Hybrid, and Discrete Industries

Estimated Margin:Medium-High

Recurring Revenue Components

- •

Software-as-a-Service (SaaS) subscriptions (e.g., DeltaV SaaS SCADA)

- •

Software maintenance and support contracts

- •

Long-term service agreements (LTSAs)

- •

Aftermarket sales of replacement parts and components

Pricing Strategy

Value-Based & Project-Based

Premium

Opaque

Pricing Psychology

Solution Bundling (Hardware + Software + Services)

Prestige Pricing (Leveraging strong brand reputation for reliability and quality)

Monetization Assessment

Strengths

- •

Diversified revenue across multiple end-markets, reducing cyclical risk.

- •

Strong brand equity allows for premium pricing on hardware and software.

- •

Large installed base creates a captive market for high-margin aftermarket services and upgrades.

- •

Strategic shift to software is increasing higher-margin, recurring revenue streams.

Weaknesses

- •

Historically high dependence on large, cyclical capital projects in industries like oil and gas.

- •

Long and complex sales cycles for major automation projects.

- •

Cultural and operational challenges in transitioning a legacy hardware company to a software-centric model.

Opportunities

- •

Expanding Industrial IoT (IIoT) software and data analytics platforms (e.g., Plantweb).

- •

Capitalizing on the global push for sustainability and decarbonization with specialized solutions (e.g., hydrogen, carbon capture).

- •

Cross-selling software solutions (from AspenTech and NI acquisitions) to the existing hardware customer base.

- •

Developing outcome-as-a-service models tied to customer KPIs like uptime or energy efficiency.

Threats

- •

Intense competition from large industrial conglomerates (e.g., Siemens, ABB, Rockwell Automation) and specialized software firms.

- •

Global economic downturns impacting industrial capital expenditures.

- •

Cybersecurity threats targeting connected industrial control systems.

- •

Supply chain disruptions and rising material costs affecting hardware margins.

Market Positioning

Technology and Application Leadership

Market Leader in many core process automation niches.

Target Segments

- Segment Name:

Process Industries

Description:Large-scale, continuous production facilities in sectors like Oil & Gas, Chemicals, Refining, Power, and Pulp & Paper.

Demographic Factors

Global enterprises with large capital budgets

Operations in highly regulated environments

Psychographic Factors

Highly risk-averse, prioritizing safety, reliability, and uptime

Focused on long-term total cost of ownership over initial price

Behavioral Factors

- •

Long-term procurement cycles

- •

Preference for established vendors with global support networks

- •

Increasingly investing in digital transformation and sustainability.

Pain Points

- •

Ensuring process safety and regulatory compliance

- •

Maximizing asset uptime and operational efficiency

- •

Reducing energy consumption and carbon emissions

- •

Managing aging infrastructure and workforce

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Hybrid & Discrete Manufacturing

Description:Manufacturers in sectors such as Life Sciences, Food & Beverage, Automotive, and Semiconductor manufacturing.

Demographic Factors

Companies ranging from mid-market to large enterprise

Operations requiring both batch processing and high-speed assembly

Psychographic Factors

Focused on product quality, production throughput, and supply chain agility

Increasingly adopting automation and IIoT to gain a competitive edge

Behavioral Factors

Shorter sales cycles than process industries

Adoption of new technologies to meet evolving consumer demands

Pain Points

- •

Improving Overall Equipment Effectiveness (OEE)

- •

Ensuring product consistency and quality control

- •

Need for flexible and scalable automation systems

- •

Integrating operational technology (OT) with IT systems

Fit Assessment:Good

Segment Potential:High

- Segment Name:

Sustainability & New Energy

Description:Companies focused on decarbonization and emerging energy sources, including Hydrogen production, Carbon Capture, Utilization & Storage (CCUS), and renewable power generation.

Demographic Factors

Mix of startups, specialized firms, and divisions of large energy companies

Often supported by government incentives and mandates

Psychographic Factors

Highly innovative and technology-forward

Focused on scaling new processes safely and efficiently

Behavioral Factors

Seeking partners with deep domain expertise to de-risk new projects

Rapidly evolving technology and standards

Pain Points

- •

Lack of established best practices for new processes

- •

Need for precise measurement and control to ensure safety and efficiency

- •

Scaling from pilot projects to full commercial production

- •

Ensuring reliability and bankability of new technologies

Fit Assessment:Good

Segment Potential:High

Market Differentiation

- Factor:

Integrated Portfolio (Hardware, Software, Services)

Strength:Strong

Sustainability:Sustainable

- Factor:

Deep Domain & Application Expertise

Strength:Strong

Sustainability:Sustainable

- Factor:

Global Scale and Support Network

Strength:Strong

Sustainability:Sustainable

- Factor:

Extensive Installed Base

Strength:Strong

Sustainability:Sustainable

- Factor:

Strong Portfolio of Trusted Brands (e.g., Fisher, Rosemount, DeltaV, ASCO)

Strength:Strong

Sustainability:Sustainable

Value Proposition

Emerson is the global technology, software and engineering powerhouse driving innovation that makes the world healthier, safer, smarter and more sustainable.

Good

Key Benefits

- Benefit:

Improved Operational Performance

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Case studies demonstrating increased productivity and efficiency

Portfolio of control and monitoring software (Plantweb, DeltaV)

- Benefit:

Enhanced Safety and Reliability

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Long history of providing reliable hardware for critical applications

Safety-certified instrumentation and systems (SIS)

- Benefit:

Achieving Sustainability Goals

Importance:Important

Differentiation:Unique

Proof Elements

Dedicated solutions for emissions monitoring, hydrogen, and carbon capture

Corporate commitment to Net Zero operations

- Benefit:

Data-Driven Insights and Digital Transformation

Importance:Important

Differentiation:Somewhat unique

Proof Elements

Advanced analytics and AI capabilities from AspenTech acquisition

IIoT platforms and software suites

Unique Selling Points

- Usp:

End-to-end automation portfolio combining leading hardware (Intelligent Devices) with advanced industrial software (Software & Control).

Sustainability:Long-term

Defensibility:Strong

- Usp:

Deep, industry-specific engineering expertise to solve the most complex automation challenges.

Sustainability:Long-term

Defensibility:Strong

- Usp:

The Plantweb™ digital ecosystem, offering a scalable and integrated architecture for industrial IoT.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Unplanned downtime and production losses

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Meeting stringent safety and environmental regulations

Severity:Critical

Solution Effectiveness:Complete

- Problem:

High energy costs and excessive carbon footprint

Severity:Major

Solution Effectiveness:Partial

- Problem:

Lack of visibility into operational performance and asset health

Severity:Major

Solution Effectiveness:Complete

Value Alignment Assessment

High

Emerson's strategic pivot towards software, digital transformation, and sustainability is highly aligned with the key secular growth trends in the industrial sector.

High

The value proposition directly addresses the core pain points of its target segments, focusing on safety, efficiency, reliability, and increasingly, sustainability.

Strategic Assessment

Business Model Canvas

Key Partners

- •

System Integrators

- •

Engineering, Procurement, and Construction (EPC) firms

- •

Technology Partners (e.g., Microsoft, SAP)

- •

Distributors and Sales Representatives

- •

Academic and Research Institutions

Key Activities

- •

Research & Development

- •

Advanced Manufacturing

- •

Software Development

- •

Global Sales & Marketing

- •

Solution Engineering & Project Execution

- •

Lifecycle Support Services

Key Resources

- •

Intellectual Property (Patents, Software Code)

- •

Global Manufacturing and Service Footprint

- •

Skilled Engineering and Technical Workforce

- •

Strong Brand Portfolio and Reputation

- •

Extensive Installed Customer Base

Cost Structure

- •

Cost of Goods Sold (Raw Materials, Manufacturing Labor)

- •

Selling, General & Administrative (SG&A) Expenses

- •

Research & Development (R&D) Investment

- •

Acquisition and Integration Costs

Swot Analysis

Strengths

- •

Dominant market position in core process automation segments.

- •

Highly diversified across geographies and end-markets.

- •

Strong financial position with consistent cash flow generation.

- •

Integrated portfolio of leading hardware and a rapidly growing software business.

Weaknesses

- •

Exposure to cyclical industrial and energy markets can create revenue volatility.

- •

Large organizational structure may slow down agility compared to smaller, software-only competitors.

- •

Integration of large acquisitions like NI and AspenTech presents execution risk.

Opportunities

- •

Accelerating digital transformation (Industry 4.0) in the industrial sector.

- •

Growing global demand for sustainability, decarbonization, and new energy solutions.

- •

Expansion into high-growth hybrid markets like Life Sciences and Semiconductors.

- •

Leveraging AI and machine learning to create autonomous industrial operations.

Threats

- •

Intense competition from established players (Siemens, ABB, Honeywell) and emerging IIoT startups.

- •

Global geopolitical instability and trade tensions impacting supply chains and customer investment.

- •

Increasingly sophisticated cybersecurity threats targeting industrial infrastructure.

- •

Shifts in technology (e.g., open-source platforms) could disrupt proprietary control system models.

Recommendations

Priority Improvements

- Area:

Business Model Transformation

Recommendation:Accelerate the transition to recurring revenue by bundling hardware with mandatory software/service subscriptions ('as-a-service' models) for new product lines.

Expected Impact:High

- Area:

Go-to-Market Strategy

Recommendation:Create a more unified and simplified go-to-market motion for the combined Emerson, NI, and AspenTech software portfolios to streamline the customer experience and boost cross-selling.

Expected Impact:High

- Area:

Value Proposition

Recommendation:More aggressively position cybersecurity as a core, differentiated component of the value proposition, offering it as a managed service to the installed base.

Expected Impact:Medium

Business Model Innovation

- •

Develop outcome-based business models where revenue is tied directly to customer-achieved KPIs, such as percentage uptime, energy saved, or emissions reduced.

- •

Launch a certified partner ecosystem or marketplace for third-party applications that run on the DeltaV and Plantweb platforms, creating a network effect.

- •

Create a dedicated 'Sustainability Transformation' consulting arm to lead strategic engagements, pulling through the entire portfolio of hardware and software.

Revenue Diversification

- •

Expand further into less cyclical, high-tech industries such as battery manufacturing, life sciences, and advanced electronics through targeted R&D and acquisitions.

- •

Build a standalone data analytics business that leverages the vast amounts of process data generated by its installed base, offering industry-wide benchmarks and insights.

- •

Develop and monetize specialized training and certification programs for the next generation of automation engineers, creating a new professional services revenue stream.

Emerson has successfully executed a significant strategic transformation, evolving from a diversified industrial conglomerate into a focused, high-tech industrial automation leader. The divestitures of non-core assets like Climate Technologies and the aggressive acquisitions of software and test-and-measurement leaders like AspenTech and National Instruments signal a clear and decisive pivot towards the higher-growth, higher-margin opportunities of Industry 4.0. The company's core business model strength lies in its massive installed base of 'Intelligent Devices,' which provides a crucial competitive moat and a fertile ground for upselling its expanding 'Software and Control' portfolio. This synergy between hardware and software is Emerson's primary defensible advantage against both legacy competitors and pure-play software challengers. The key challenge ahead is execution: seamlessly integrating its major acquisitions, shifting the corporate culture from hardware-first to solution-centric, and accelerating the transition to recurring revenue models. Future success will be defined by Emerson's ability to leverage its deep domain expertise to solve critical customer challenges in sustainability and digital transformation, thereby solidifying its position not just as a supplier of components, but as an indispensable strategic partner in the future of autonomous and sustainable industry.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

High Capital Investment & R&D Costs

Impact:High

- Barrier:

Established Global Distribution & Service Networks

Impact:High

- Barrier:

Brand Reputation & Customer Trust

Impact:High

- Barrier:

Intellectual Property & Patents

Impact:Medium

- Barrier:

High Customer Switching Costs

Impact:Medium

Industry Trends

- Trend:

Digitalization (IIoT, AI/ML, Digital Twin)

Impact On Business:Shifts focus from hardware to integrated software and services. Creates opportunities for data-driven revenue streams and operational efficiency gains.

Timeline:Immediate

- Trend:

Sustainability & Decarbonization

Impact On Business:Drives demand for energy-efficient products, solutions for renewable energy (like hydrogen), and technologies that help customers meet ESG goals.

Timeline:Immediate

- Trend:

Convergence of IT and OT (Operational Technology)

Impact On Business:Requires new competencies in cybersecurity and data analytics. Fosters partnerships with traditional IT companies and creates demand for integrated, secure solutions.

Timeline:Near-term

- Trend:

Supply Chain Resilience & Regionalization

Impact On Business:Increases demand for automation to enable reshoring and nearshoring of manufacturing. Requires agile and visible supply chain management.

Timeline:Near-term

- Trend:

Shift to Software-Defined Automation

Impact On Business:Challenges the traditional hardware-centric model by decoupling software from specific hardware, potentially reducing vendor lock-in and increasing flexibility for customers.

Timeline:Long-term

Direct Competitors

- →

Siemens

Market Share Estimate:Market Leader in Industrial Automation

Target Audience Overlap:High

Competitive Positioning:Positions itself as a technology powerhouse driving digital transformation in industry and infrastructure, with a strong focus on its 'Totally Integrated Automation' (TIA) and 'Xcelerator' open digital business platform.

Strengths

- •

Comprehensive, integrated portfolio spanning automation, electrification, and digitalization (Digital Industries, Smart Infrastructure).

- •

Strong global brand recognition and market leadership in industrial software and automation.

- •

Heavy investment in R&D and a clear strategy towards IT/OT convergence with its Xcelerator platform.

- •

Deep domain expertise across a wide range of industries.

Weaknesses

- •

Large, complex organizational structure can sometimes slow down decision-making.

- •

Portfolio breadth can create complexity for customers seeking simple, point solutions.

- •

Perceived as having a premium price point for many of its solutions.

Differentiators

- •

End-to-end software and hardware integration (TIA Portal).

- •

Open digital business platform (Siemens Xcelerator) fostering a partner ecosystem.

- •

Strong focus on creating 'digital twins' of products and processes.

- →

ABB

Market Share Estimate:Strong Global Player

Target Audience Overlap:High

Competitive Positioning:Global technology leader in electrification and automation, enabling a more sustainable and resource-efficient future. Strong focus on robotics, e-mobility, and process automation.

Strengths

- •

Global market leader in motion (motors and drives) and a top player in robotics and process automation.

- •

Strong portfolio in electrification, from substation to socket, aligning with sustainability trends.

- •

Extensive global presence and a long-standing reputation for engineering quality.

- •

Emphasis on sustainability as a core part of its value proposition.

Weaknesses

- •

Historically, a more fragmented portfolio with less integration than key competitors like Siemens.

- •

Brand perception in discrete and factory automation is not as strong as in process industries or robotics.

- •

Has undergone significant restructuring, which can create market uncertainty.

Differentiators

- •

Leadership in industrial robotics and machine automation solutions.

- •

Deep expertise in process industries like oil & gas, chemicals, and mining.

- •

Strong offerings in electrification and e-mobility infrastructure.

- →

Rockwell Automation

Market Share Estimate:Leader in North America, Strong Global Player

Target Audience Overlap:High

Competitive Positioning:The largest company purely dedicated to industrial automation and digital transformation. Positions itself around 'The Connected Enterprise' to connect plant-floor operations with the broader business.

Strengths

- •

Dominant market position in the North American discrete automation market, particularly with its Allen-Bradley PLCs.

- •

Strong, loyal customer base and an extensive distributor network.

- •

Clear focus on industrial automation without the diversification of larger conglomerates.

- •

Growing recurring revenue through software and service subscriptions.

Weaknesses

- •

Less diversified geographically and in end-markets compared to Siemens or ABB.

- •

Historically perceived as having a less open architecture, creating high switching costs but also potential resistance from new customers.

- •

Intense competition limits market share growth potential in a mature market.

Differentiators

- •

Pure-play focus on industrial automation and information solutions.

- •

Integrated Architecture platform provides a unified control and information environment.

- •

Strong brand loyalty, especially in the US market.

- →

Schneider Electric

Market Share Estimate:Strong Global Player

Target Audience Overlap:High

Competitive Positioning:Positions as a digital partner for sustainability and efficiency, specializing in energy management and automation.

Strengths

- •

World leader in energy management, with a strong portfolio in electrical distribution and building automation.

- •

Strong push towards software-defined automation with its EcoStruxure platform.

- •

Broad portfolio that addresses needs from residential to industrial applications, enabling cross-selling.

- •

Focus on open, interoperable systems to break down data silos.

Weaknesses

- •

Brand recognition in heavy process automation is not as strong as competitors like Emerson or Honeywell.

- •

Can be perceived as more focused on energy/power management than core industrial process control.

- •

Broad focus can dilute its messaging to specific industrial verticals.

Differentiators

- •

Unique combination of energy management and industrial automation expertise.

- •

EcoStruxure: an open, IoT-enabled architecture and platform.

- •

Strong focus on sustainability and efficiency as key value drivers for customers.

Indirect Competitors

- →

PTC

Description:Provides industrial software, including the ThingWorx IIoT platform, which enables companies to connect, monitor, analyze, and control smart, connected products and operations. Competes for the software and analytics layer of the automation stack.

Threat Level:Medium

Potential For Direct Competition:Low, more likely to be a partner or a competitor in the software space rather than hardware.

- →

Microsoft Azure IoT / AWS IoT

Description:Major cloud providers offering scalable platforms for IoT data ingestion, storage, and analytics. They provide the foundational infrastructure that can compete with Emerson's own cloud and software offerings for plant and enterprise-level data insights.

Threat Level:Medium

Potential For Direct Competition:Low in hardware, but High in the software, data, and analytics space as they build more industry-specific solutions.

- →

Honeywell

Description:A major industrial conglomerate with a strong focus on process solutions (HPS), building technologies, and aerospace. While a direct competitor in many areas, their portfolio is different enough to also be considered an indirect competitor in certain segments.

Threat Level:High

Potential For Direct Competition:Is already a direct competitor in many key areas, particularly process automation.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Broad Portfolio of Trusted Brands

Sustainability Assessment:Emerson's portfolio includes highly respected names like ASCO, AVENTICS, and TESCOM, built over decades. This brand equity creates a significant moat.

Competitor Replication Difficulty:Hard

- Advantage:

Large Installed Base & Global Service Network

Sustainability Assessment:A massive installed base creates high switching costs and generates recurring revenue from services, parts, and upgrades. The global service footprint is difficult to replicate.

Competitor Replication Difficulty:Hard

- Advantage:

Deep Domain Expertise in Process Industries

Sustainability Assessment:Long-standing relationships and deep understanding of complex industries like chemical, oil & gas, and power generation provide a strong competitive advantage.

Competitor Replication Difficulty:Hard

Temporary Advantages

- Advantage:

Specific Product Leadership in Niche Areas

Estimated Duration:1-3 years

Description:Technological leads in specific product categories, such as certain types of valves or regulators, provide a temporary edge until competitors catch up.

- Advantage:

Strategic Acquisitions

Estimated Duration:2-5 years

Description:Acquisitions like the recent purchase of NI (formerly National Instruments) provide a temporary advantage in new markets (test and measurement) while integration is underway and synergies are being realized.

Disadvantages

- Disadvantage:

Fragmented Digital/Software Narrative

Impact:Major

Addressability:Moderately

Description:Compared to Siemens' 'Xcelerator' or Schneider's 'EcoStruxure', Emerson's software and digital transformation story can appear less unified, potentially confusing customers and investors.

- Disadvantage:

Perception as a Traditional Hardware Company

Impact:Major

Addressability:Difficult

Description:Despite significant software assets, the market often perceives Emerson primarily as a hardware/components company, which can be a disadvantage in a market increasingly focused on software-defined solutions.

- Disadvantage:

Portfolio Complexity

Impact:Minor

Addressability:Moderately

Description:The vast number of brands and products can make it difficult for customers to navigate Emerson's offerings and find integrated solutions without significant guidance.

Strategic Recommendations

Quick Wins

- Recommendation:

Launch a unified marketing campaign for Emerson's software portfolio under a single, compelling brand umbrella to clarify its value proposition.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Highlight customer success stories in high-growth areas like hydrogen and life sciences to demonstrate expertise and capture share-of-voice.

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Invest in a unified digital customer experience platform that simplifies product discovery, configuration, and purchasing across all Emerson brands.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Develop a more open and accessible partnership program for software and technology companies to build an ecosystem around Emerson's core platforms.

Expected Impact:High

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Accelerate the transition to recurring revenue models by bundling hardware with software subscriptions (SaaS) and outcome-as-a-service contracts.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Position Emerson as the leader in 'Sustainable Automation,' deeply integrating energy efficiency and emissions reduction capabilities into all core product offerings and marketing.

Expected Impact:High

Implementation Difficulty:Difficult

Emerson should position itself as the pragmatic leader in industrial modernization, combining its unmatched portfolio of reliable hardware and domain expertise with accessible, high-value software to deliver tangible outcomes in productivity and sustainability.

Differentiate through 'Domain-Specific Digitalization.' Instead of competing head-on with pure software platforms, focus on providing integrated, pre-engineered digital solutions for specific, high-stakes applications (e.g., 'Digital Twin for a refinery cracker unit') where Emerson's deep process knowledge is a key advantage.

Whitespace Opportunities

- Opportunity:

Develop 'Automation-as-a-Service' for Small and Medium-Sized Manufacturers

Competitive Gap:Major competitors focus on large enterprises, leaving a gap for scalable, subscription-based solutions that combine hardware, software, and remote support for smaller players who lack in-house expertise.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Create an open marketplace for industrial control applications

Competitive Gap:While competitors have partner ecosystems, a truly open, vendor-agnostic marketplace for control logic, analytics, and HMI applications is still nascent. This could attract a community of developers and system integrators.

Feasibility:Low

Potential Impact:High

- Opportunity:

Integrated Sustainability & Compliance Reporting Solutions

Competitive Gap:There is a need for solutions that not only make operations more sustainable but also automate the data collection and reporting required for ESG compliance. This bridges the gap between OT and corporate governance.

Feasibility:High

Potential Impact:Medium

Emerson operates in a mature, oligopolistic industrial automation and technology market, facing intense competition from diversified global giants like Siemens, ABB, Rockwell Automation, and Schneider Electric. The industry is undergoing a significant transformation driven by digitalization and sustainability. While Emerson holds a formidable position built on a vast portfolio of trusted hardware brands, deep domain expertise, and a large installed base, its primary challenge lies in shifting market perception and its own narrative from a component supplier to an integrated software and solutions provider.

Its direct competitors are aggressively positioning themselves as leaders in digital transformation. Siemens leverages its 'Totally Integrated Automation' and 'Xcelerator' platform, Schneider Electric focuses on 'Sustainability and Efficiency' with its EcoStruxure platform, and Rockwell Automation owns the 'Connected Enterprise' narrative, especially in North America. Emerson's competitive advantage is its unparalleled depth in process control and instrumentation, but this strength can also anchor it to a more traditional, hardware-focused image.

Indirect threats are emerging from IT and software-native companies, such as PTC and cloud hyperscalers like AWS and Microsoft Azure, which are competing for the valuable data and analytics layer of the industrial stack. To remain a leader, Emerson must unify its software messaging, simplify its customer's digital journey across its many brands, and leverage its deep domain expertise to offer tangible, outcome-based digital solutions. The key opportunity lies not in trying to out-software the software companies, but in embedding smart, accessible digital tools into the products and processes it knows better than anyone else, effectively positioning itself as the leader in pragmatic and sustainable industrial modernization.

Messaging

Message Architecture

Key Messages

- Message:

Go Boldly.™

Prominence:Primary

Clarity Score:Medium

Location:Global Footer, Headers

- Message:

Emerson is the global technology, software and engineering powerhouse driving innovation that makes the world healthier, safer, smarter and more sustainable.

Prominence:Primary

Clarity Score:High

Location:Global Footer, Corporate Information

- Message:

Maintain precise control of gases and liquids and ensure safety in your application with reliable Emerson products.

Prominence:Secondary

Clarity Score:High

Location:Product Category Page ('Pressure Regulators & Valves')

- Message:

Emerson engineers are factory automation experts who help our customers solve their toughest challenges and achieve their most ambitious goals by applying comprehensive, innovative floor-to-cloud solutions.

Prominence:Tertiary

Clarity Score:High

Location:Product Category Page (Mid-page section)

The hierarchy is logical but disconnected. The primary, high-level brand messages ('Go Boldly', 'healthier, safer, smarter, more sustainable') are aspirational but feel detached from the very specific, technical, and feature-focused messaging on the product pages. The architecture effectively separates the corporate brand vision from the product-level value propositions, but it lacks a strong narrative thread to connect them.

Messaging is highly consistent within its own level. The corporate message is repeated verbatim in footers. Product category pages are consistently technical and solution-oriented. However, the tone and style are inconsistent between the high-level brand marketing and the dense, expert-level product content, creating a somewhat disjointed user experience.

Brand Voice

Voice Attributes

- Attribute:

Expert

Strength:Strong

Examples

- •

PID -control based solutions that optimize system pressure control.

- •

Highly configurable regulators for maintaining precise downstream backpressure or upstream pressure and flow control.

- •

The ER5000 Series is a microprocessor based PID (Proportional, Integral, Derivative) controller...

- Attribute:

Professional

Strength:Strong

Examples

- •

Consult an Expert

- •

Locate a Sales Office

- •

Emerson is the global technology, software and engineering powerhouse...

- Attribute:

Reliability-Focused

Strength:Strong

Examples

- •

Maintain precise control...

- •

ensure safety in your application...

- •

depend on Emerson for precise, reliable, standard & custom-engineered pressure regulators...

- Attribute:

Aspirational

Strength:Moderate

Examples

- •

Go Boldly.™

- •

...makes the world healthier, safer, smarter and more sustainable.

- •

Together, we can future-proof your operations...

Tone Analysis

Technical and Informative

Secondary Tones

- •

Reassuring

- •

Corporate

- •

Aspirational

Tone Shifts

A notable shift occurs between the aspirational 'Go Boldly' tagline and the deeply technical, jargon-heavy content on product pages. The footer and corporate sections use a broad, world-impact tone, while product sections adopt a narrow, application-specific tone for engineers.

Voice Consistency Rating

Fair

Consistency Issues

The primary inconsistency is the gap between the high-level, benefit-driven corporate voice ('smarter, more sustainable world') and the feature-driven, technical product voice. There is little content that bridges this gap for the user.

Value Proposition Assessment

Emerson provides highly reliable and precise technology, software, and engineering solutions that enable complex industrial operations to be safer, more efficient, and more sustainable.

Value Proposition Components

- Component:

Technical Precision & Reliability

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Comprehensive, End-to-End Solutions ('floor-to-cloud')

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Broad Industry Expertise & Application-Specific Engineering

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Global Support & Scale

Clarity:Somewhat Clear

Uniqueness:Common

- Component:

Driving Innovation for Sustainability

Clarity:Clear

Uniqueness:Common

Emerson's differentiation is based on its reputation for engineering excellence and the sheer breadth of its portfolio, from individual components like valves to complex software systems. However, the messaging does not always crystallize why this breadth leads to a better outcome for the customer compared to competitors like Siemens, ABB, or Rockwell Automation, who make similar claims. The 'Go Boldly' campaign aims to position Emerson as a forward-thinking innovator, but the website content doesn't fully substantiate this claim with compelling stories or evidence beyond product specs. The differentiation is implied through technical authority rather than explicitly stated in benefit-driven terms.

The messaging positions Emerson as a foundational, high-quality engineering partner for critical industries. It competes on reliability, precision, and comprehensive portfolio rather than on price or disruptive technology alone. The recent emphasis on software, sustainability, and 'Go Boldly' is a strategic effort to shift its positioning from a legacy manufacturing stalwart to a modern technology and software leader, directly challenging competitors who are also vying for the 'digital transformation' space.

Audience Messaging

Target Personas

- Persona:

Process/Design Engineer

Tailored Messages

- •

Highly configurable regulators for maintaining precise downstream backpressure...

- •

Regulators for use with specialty, flammable, and industrial gas flows with compact construction and high flow capacity.

- •

Download 3D CAD drawings of your Emerson product.

Effectiveness:Effective

- Persona:

Plant/Operations Manager

Tailored Messages

- •

Ensure safety and service of your instrument installations...

- •

We can move data from our sensors and devices to an on- or off-premise cloud, where it provides valuable insights into machine and process performance...

- •

Together, we can future-proof your operations by solving your toughest automation challenges today.

Effectiveness:Somewhat Effective

- Persona:

Corporate Executive (e.g., CTO, VP of Sustainability)

Tailored Messages

...driving innovation that makes the world healthier, safer, smarter and more sustainable.

Go Boldly.™

Effectiveness:Ineffective

Audience Pain Points Addressed

- •

Need for precise pressure and flow control

- •

Ensuring application safety and reliability

- •

Finding specific components for complex industrial applications (e.g., hydrogen, semiconductor)

- •

System integration and data visibility ('floor-to-cloud')

Audience Aspirations Addressed

- •

Achieving ambitious operational goals

- •

Future-proofing operations

- •

Improving productivity, sustainability, and safety

- •

Contributing to a healthier, safer, smarter, more sustainable world

Persuasion Elements

Emotional Appeals

- Appeal Type:

Safety & Security (Peace of Mind)

Effectiveness:High

Examples

Ensure safety in your application with reliable Emerson products.

Power quality solutions designed to keep production lines moving and protect people, equipment, and information.

- Appeal Type:

Ambition & Achievement

Effectiveness:Medium

Examples

Go Boldly.™

...help our customers solve their toughest challenges and achieve their most ambitious goals...

Social Proof Elements

- Proof Type:

Listing of Sub-Brands

Impact:Strong

- Proof Type:

Case Studies / Proven Results

Impact:Moderate

- Proof Type:

Application Examples

Impact:Strong

Trust Indicators

- •

Vast global presence detailed on the 'Worldwide' page

- •

Showcasing a large portfolio of trusted sub-brands (ASCO, TESCOM, etc.)

- •

Highly detailed technical specifications and product information

- •

Availability of CAD drawings and technical literature

- •

Direct access to 'Consult an Expert'

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

View Products

Location:Product Category Page (Hero and mid-page)

Clarity:Clear

- Text:

Consult an Expert

Location:Product Category Page (Hero)

Clarity:Clear

- Text:

Learn More

Location:Brand showcase sections

Clarity:Clear

- Text:

View Catalog / View Brochure

Location:Product Category Page (Hero)

Clarity:Clear

The CTAs are clear, direct, and well-suited for a B2B technical audience that is either browsing for solutions or seeking specific information. They effectively guide users deeper into the product discovery and sales consideration funnel. However, there is a lack of CTAs that engage users interested in the higher-level 'sustainability' or 'innovation' narratives, such as 'See our innovations in action' or 'Read our sustainability report'.

Messaging Gaps Analysis

Critical Gaps

- •

The 'Go Boldly' tagline feels disconnected from the product-level content. There is a significant narrative gap in explaining how buying a specific TESCOM™ regulator helps a company 'Go Boldly' or make the world more sustainable.

- •

Customer-centric storytelling is largely absent. The focus is on what Emerson's products are, not what customers achieve with them. Case studies are present but not well-integrated into the primary user journey on product pages.

- •

Clear competitive differentiation is missing. The messaging relies on brand authority but doesn't explicitly state why Emerson is a better choice than a key competitor for a given application.

Contradiction Points

No itemsUnderdeveloped Areas

The connection between individual products and the broader 'floor-to-cloud' software and data solutions is mentioned but not fully developed or visualized.

The value proposition for executive-level decision-makers is underdeveloped; the site speaks primarily to engineers and technical managers.

Messaging Quality

Strengths

- •

Messaging to technical audiences is exceptionally clear, precise, and authoritative.

- •

Effectively communicates core values of reliability, safety, and precision.

- •

The brand architecture successfully organizes a vast and complex portfolio of products and sub-brands.

- •

Trust indicators are strong and ever-present, building confidence in the brand's expertise.

Weaknesses

- •

A significant disconnect exists between the high-level, aspirational brand messaging and the dense, technical product messaging.

- •

Over-reliance on technical specifications rather than benefit-driven storytelling.

- •

The messaging does little to differentiate Emerson from its major competitors on a strategic level beyond its established brand name.

Opportunities

- •

Integrate customer success stories and application case studies more prominently on product pages to bridge the gap between features and outcomes.

- •

Develop a middle layer of content that explicitly connects how specific technologies (like pressure regulators) contribute to larger strategic goals (like hydrogen fuel production or semiconductor manufacturing efficiency), thereby linking products to the 'smarter, sustainable' vision.

- •

Create more content tailored to executive personas, focusing on business outcomes like ROI, risk reduction, and achieving sustainability targets.

Optimization Roadmap

Priority Improvements

- Area:

Value Proposition Communication

Recommendation:On key product and industry pages, create a 'Boldly in Action' module that features a mini case study or compelling statistic showing how that specific product line helps a customer achieve a major goal (e.g., 'How our hydrogen regulators helped Company X accelerate their fuel cell development'). This directly links product to promise.

Expected Impact:High

- Area:

Audience-Message Fit

Recommendation:Develop solution-focused content hubs for key personas. For a Plant Manager, this could be a 'Plant Optimization Hub' that pulls together products, software, and services content around themes like safety, efficiency, and predictive maintenance.

Expected Impact:High

- Area:

Narrative & Storytelling

Recommendation:Introduce a clearer narrative that connects the 'why' (sustainability, etc.) with the 'how' (products). Use visual storytelling like infographics or short videos to show a 'floor-to-cloud' data journey, starting with a sensor or valve and ending with a business insight on a dashboard.

Expected Impact:Medium

Quick Wins

- •

Add benefit-oriented sub-headlines to product sections. Instead of just 'Industrial Pressure Regulators', use 'Industrial Pressure Regulators: Unmatched reliability for mission-critical applications'.

- •

On the homepage and key industry pages, feature a prominent link or CTA to a flagship customer success story that embodies the 'Go Boldly' ethos.

- •

Incorporate more direct quotes or testimonials from customers within product pages.

Long Term Recommendations

- •

Restructure parts of the site around customer challenges (e.g., 'Reducing Emissions', 'Optimizing Production') rather than just product categories, guiding users to holistic Emerson solutions.

- •

Invest in a comprehensive content marketing strategy that tells the story of Emerson's role in major industrial trends (Energy Transition, IIoT, etc.), establishing thought leadership beyond product features.

- •

Conduct a formal competitor messaging analysis to identify white space and sharpen differentiation points in all external communications.

Emerson's strategic messaging operates on two distinct and largely disconnected planes. For its core technical audience of engineers and plant managers, the messaging is highly effective, communicating precision, reliability, and expertise with authority. The website functions as an exhaustive, trust-building catalog that empowers technical buyers with the detailed information they need.

However, for higher-level strategic positioning, the messaging struggles. The corporate vision—'Go Boldly' and creating a 'healthier, safer, smarter, and more sustainable' world—is a powerful and necessary evolution of the brand. Yet, this aspirational layer floats above the product content without meaningful connection. A customer journey from the homepage to a specific pressure regulator page involves a jarring tonal shift from a world-changing vision to microprocessor specifications. This narrative gap represents the single largest weakness and opportunity. It fails to arm executive buyers with a clear business case and doesn't fully translate Emerson's impressive engineering prowess into tangible, differentiated strategic value against competitors who are telling similar high-level stories.

To improve effectiveness, Emerson must focus on building a narrative bridge. This means weaving customer success stories, application-specific outcomes, and benefit-driven language throughout the product-level content. The goal is not to dumb down the technical details but to frame them within the context of the larger value they help create. By showing, not just telling, how a specific piece of hardware contributes to a customer's ambitious goals, Emerson can unify its two messaging planes, validate its 'Go Boldly' promise, and create a more compelling and differentiated brand experience.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Long-standing market leadership in core industrial automation and process control sectors, dating back to 1890.

- •

Diversified portfolio serving essential industries like energy, chemicals, power, life sciences, and manufacturing.

- •

High market share in key product categories such as valve manufacturing and industrial control systems.

- •

Strong brand reputation and a vast global footprint, enabling deep customer relationships and service delivery.

- •

Clear strategic pivot to address high-growth areas like sustainability, decarbonization, and digital transformation.

Improvement Areas

- •

Seamlessly integrate the vast portfolio of hardware ('Intelligent Devices') with the rapidly growing software offerings ('Software and Control') to create a unified customer experience.

- •

Accelerate the transition from a hardware-centric to a software-defined, recurring revenue model, particularly following the major acquisitions of AspenTech and National Instruments.

- •

Simplify the customer journey for navigating the complex product and software ecosystem to reduce friction and improve solution discovery.

Market Dynamics

Approx. 6-11% CAGR for the Industrial Automation market through 2035.

Mature

Market Trends

- Trend:

Digital Transformation (Industry 4.0/5.0)

Business Impact:Drives demand for IoT, AI/ML, cloud/edge computing, and digital twin solutions, shifting focus from hardware to integrated, software-driven systems. This is a primary growth vector for Emerson.

- Trend:

Sustainability & Energy Transition

Business Impact:Creates massive opportunities in green hydrogen, LNG, carbon capture, renewables, and energy efficiency, directly aligning with Emerson's strategic focus and mission.

- Trend:

IT/OT Convergence

Business Impact:Increases the need for integrated solutions that bridge the gap between enterprise IT systems and operational technology on the factory floor, demanding new expertise in cybersecurity and data analytics.

- Trend:

Reshoring and Supply Chain Resilience

Business Impact:Drives investment in new and upgraded manufacturing facilities in North America and Europe, creating demand for automation to offset higher labor costs and improve efficiency.

- Trend:

Skilled Labor Shortage

Business Impact:Accelerates adoption of automation, robotics, and remote operation technologies to mitigate the impact of a shrinking industrial workforce.

Excellent. Emerson is strategically repositioning itself during a period of profound technological and economic shifts (digitalization, energy transition). Its recent acquisitions and focus on software-defined automation are well-timed to capture growth from these secular trends.

Business Model Scalability

Medium

High fixed costs associated with R&D, manufacturing facilities, and a global salesforce. The strategic shift towards software and subscription services is aimed at increasing the proportion of highly scalable, recurring revenue.

Moderate. Hardware manufacturing has inherent physical limits. Significant operational leverage can be achieved by scaling the software business, where marginal costs are low, and by integrating AI to optimize internal and customer operations.

Scalability Constraints

- •

Global supply chain complexity and dependencies for physical hardware.

- •

Long, complex B2B sales cycles for large capital projects.

- •

Integration challenges from a frequent M&A strategy, potentially creating siloed technology stacks and business units.

- •

Dependence on cyclical capital spending in key industries like oil and gas.

Team Readiness

Strong and experienced leadership team executing a clear, decisive, and ambitious portfolio transformation towards a higher-growth, software-centric model.

Complex, divisional structure typical of a large multinational. The key challenge is fostering agility and cross-divisional collaboration, particularly between traditional hardware teams and the newly acquired software businesses.

Key Capability Gaps

- •

Deep talent in agile software development, UX/UI design, and modern product management to compete with digital-native firms.

- •

Enterprise sales expertise for complex, recurring-revenue SaaS solutions, which differs from traditional capital equipment sales.

- •

Data science and AI/ML talent to build out the 'Enterprise Operations Platform' and deliver on the promise of predictive and autonomous operations.

Growth Engine

Acquisition Channels

- Channel:

Direct Enterprise Sales Force

Effectiveness:High

Optimization Potential:Medium

Recommendation:Upskill the sales force to shift from product/feature-led selling to consultative, solution-based selling focused on business outcomes (e.g., sustainability goals, operational efficiency). Equip them to sell integrated hardware-software bundles and recurring revenue contracts.

- Channel:

Distribution & Partner Channels

Effectiveness:High

Optimization Potential:High

Recommendation:Develop a partner enablement program specifically for software and digital services. Certify partners to implement and service new digital offerings to scale reach beyond the direct sales force.

- Channel:

Digital Marketing (Content/SEO)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Invest heavily in thought leadership content around sustainability, digital transformation, and key industry challenges. Optimize technical content for search to capture engineers and technical buyers early in their research process. Create interactive digital tools for solution configuration and ROI calculation.

- Channel:

Industry Events & Trade Shows

Effectiveness:High

Optimization Potential:Medium

Recommendation:Shift the focus from showcasing individual products to demonstrating integrated, end-to-end solutions that solve major customer problems, highlighting the 'Boundless Automation' vision.

Customer Journey

The journey is a long-cycle, high-touch B2B process. It starts with awareness (content, events), moves to consideration (technical documentation, consultations), and ends with a complex procurement and implementation phase led by the sales team. The website's primary role is lead generation and technical resource hosting ('Consult an Expert', CAD drawings).

Friction Points

- •

Difficulty navigating the vast and potentially fragmented product portfolio across numerous acquired brands.

- •

Integrating Emerson's new software solutions with customers' existing legacy systems from various vendors.

- •

Transitioning from a familiar perpetual license/hardware purchase model to a new subscription-based software model.

Journey Enhancement Priorities

{'area': 'Digital Experience', 'recommendation': 'Develop a unified digital platform that provides a single pane of glass for customers to discover, configure, purchase (where applicable), and manage their entire Emerson portfolio, from sensors to software.'}

{'area': 'Onboarding & Implementation', 'recommendation': 'Create a dedicated Customer Success function, especially for the AspenTech and NI software businesses, to ensure customers achieve value quickly, driving adoption and long-term retention.'}

Retention Mechanisms

- Mechanism:

High Switching Costs & Installed Base

Effectiveness:High

Improvement Opportunity:Layer high-value, recurring-revenue software and data analytics services on top of the installed hardware base to deepen the moat and increase customer lifetime value.

- Mechanism:

Long-Term Service Agreements (LTSA)

Effectiveness:High

Improvement Opportunity:Evolve traditional maintenance contracts into predictive, data-driven 'Asset Performance Management' subscriptions that offer guaranteed uptime and efficiency improvements, powered by AI/ML.

- Mechanism:

Deep Technical & Engineering Relationships

Effectiveness:High

Improvement Opportunity:Establish a 'Digital Co-Innovation' program with strategic customers to jointly develop solutions for emerging challenges like decarbonization, using Emerson's expanding software and hardware toolkit.

Revenue Economics

Strong. As a mature industrial leader, Emerson has strong gross margins (targeting over 52%) and a clear path to expanding them further by increasing its software revenue mix, which has inherently better unit economics than hardware.

Not Publicly Determinable, but Assumed to be Very High. The combination of mission-critical hardware, long asset lifecycles, and opportunities for service and software expansion revenue leads to extremely high customer lifetime value in their core markets.

Strong. The company has a consistent track record of revenue growth and strong free cash flow generation, demonstrating efficient conversion of resources into revenue.

Optimization Recommendations

- •

Aggressively drive the adoption of subscription models for software to create more predictable, high-margin recurring revenue streams.

- •

Bundle hardware and software into integrated solutions to increase average deal size and create stickier customer relationships.

- •

Utilize data from the installed base to identify and proactively sell expansion opportunities (e.g., upgrades, software add-ons, efficiency services).

Scale Barriers

Technical Limitations

- Limitation:

Portfolio Integration

Impact:High

Solution Approach:Invest heavily in developing the 'Enterprise Operations Platform' as a unified, open architecture to integrate data and control across Emerson's diverse hardware and software portfolio (DeltaV, Ovation, AspenTech, NI) and third-party systems.

- Limitation:

Legacy System Interoperability

Impact:Medium

Solution Approach:Develop robust APIs, connectors, and edge computing solutions that allow new software offerings to easily extract data from and interact with customers' existing, often decades-old, operational technology.

Operational Bottlenecks

- Bottleneck:

Cultural Integration of Acquired Companies

Growth Impact:Can slow down synergy realization and innovation if the agile, software-first culture of companies like AspenTech clashes with Emerson's traditional engineering culture.

Resolution Strategy:Maintain acquired software businesses as distinct units with cultural autonomy (as planned with AspenTech) while creating strong central leadership and shared goals to drive strategic alignment and cross-selling.

- Bottleneck:

Global Supply Chain for Hardware

Growth Impact:Vulnerable to geopolitical disruptions, tariffs, and component shortages, which can impact revenue and margins for the Intelligent Devices segment.

Resolution Strategy:Continue to diversify the supply chain, increase regional manufacturing capabilities, and leverage software for better demand forecasting and inventory management.

Market Penetration Challenges

- Challenge:

Intense Competition from Industrial Giants

Severity:Critical

Mitigation Strategy:Differentiate through a more complete and integrated 'sense, decide, act, optimize' portfolio, from intelligent devices to enterprise optimization software. Compete on providing holistic business solutions (e.g., sustainability) rather than just point products. Key competitors include Siemens, ABB, Honeywell, and Rockwell Automation.

- Challenge:

Disruption from Pure-Play Software/IIoT Vendors

Severity:Major

Mitigation Strategy:Leverage the massive installed base of hardware as a key competitive advantage. Frame software offerings not as standalone products but as the 'brain' that unlocks the full value of Emerson's physical equipment, providing a solution pure-play software vendors cannot match.

Resource Limitations

Talent Gaps

- •

Cloud-native software architects and developers.

- •

AI and Machine Learning engineers with industrial domain expertise.

- •

Cybersecurity specialists for Operational Technology (OT) environments.

Significant capital has already been deployed for major acquisitions (AspenTech, NI). Future capital will be required for R&D to integrate these platforms, as well as potential smaller, bolt-on acquisitions to fill technology gaps.

Infrastructure Needs

- •

A unified cloud infrastructure to host and deliver SaaS offerings across the entire portfolio.

- •

Investment in 'Digital Centers of Excellence' to train employees, partners, and customers on new software-defined solutions.

- •

Upgrades to internal IT systems to support a subscription-based billing and revenue recognition model at scale.

Growth Opportunities

Market Expansion

- Expansion Vector:

High-Growth Sustainability Verticals

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Create dedicated business units and solution bundles for Green Hydrogen, Carbon Capture, and Battery Manufacturing/Electrification. Leverage existing process control expertise and expand the portfolio to meet the unique needs of these emerging industries.

- Expansion Vector:

Deeper Penetration in Life Sciences

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Combine Emerson's process automation technology with NI's test and measurement capabilities and AspenTech's modeling software to offer comprehensive solutions for drug development, personalized medicine, and biomanufacturing.

Product Opportunities

- Opportunity:

Software-as-a-Service (SaaS) for Sustainability Management

Market Demand Evidence:Increasing regulatory pressure (e.g., emissions reporting) and corporate ESG goals are driving massive demand for tools to measure, manage, and optimize environmental footprint.

Strategic Fit:Perfectly aligns with the mission to 'make the world more sustainable' and leverages the full portfolio, from emissions sensors to optimization software from AspenTech.

Development Recommendation:Develop a cloud-native platform that integrates data from Emerson sensors and control systems to provide real-time dashboards for emissions, energy usage, and resource consumption, with AI-driven recommendations for optimization.

- Opportunity:

Digital Twin as a Service

Market Demand Evidence:The industrial sector is rapidly adopting digital twins to optimize design, simulate operations, and predict maintenance needs, reducing costs and accelerating time-to-market.

Strategic Fit:Combines AspenTech's deep process simulation capabilities with Emerson's control systems and asset data to create high-fidelity, real-time virtual models of customer facilities.

Development Recommendation:Launch a tiered subscription service offering everything from component-level digital twins to full-plant simulations, integrated into the Enterprise Operations Platform.

Channel Diversification

- Channel:

Cloud Marketplace Partnerships (AWS, Azure)

Fit Assessment:High

Implementation Strategy:List and integrate key software offerings (especially from AspenTech) on major cloud marketplaces. This simplifies procurement for customers' IT departments and leverages the co-selling power of cloud providers to reach new buyers.

- Channel:

Strategic System Integrators

Fit Assessment:High

Implementation Strategy:Build a robust certification and support program for global and boutique system integrators who specialize in digital transformation projects. They can act as a channel multiplier for implementing complex, multi-product solutions.

Strategic Partnerships

- Partnership Type:

AI & Machine Learning Specialists

Potential Partners

- •

Databricks

- •

Snowflake

- •

NVIDIA

Expected Benefits:Accelerate the development of advanced analytics and autonomous control capabilities within Emerson's software platforms by integrating best-in-class AI infrastructure and tools.

- Partnership Type:

Industrial Cybersecurity Firms

Potential Partners

- •

Dragos

- •

Claroty

- •

Nozomi Networks

Expected Benefits:Embed leading OT cybersecurity technology directly into Emerson's control systems and edge devices, providing customers with 'secure-by-design' solutions and addressing a critical concern in IT/OT convergence.

Growth Strategy

North Star Metric

Annual Recurring Revenue (ARR) from Software and Digital Services

This metric directly tracks the success of Emerson's most critical strategic pivot: the shift from a cyclical, hardware-centric model to a more predictable, high-margin, software-driven model. It aligns the entire organization around the goal of digital growth.

Achieve 15-20% year-over-year growth in ARR for the next 3-5 years, driven by the integration of AspenTech and NI and the development of new SaaS offerings.

Growth Model

Hybrid: Enterprise Sales-Led & Product-Led Growth

Key Drivers

- •

Enterprise Sales Team cross-selling new software into the existing hardware installed base.

- •

Digital Marketing engine generating qualified leads for high-value solutions.

- •

Product-Led motions for specific software tools (e.g., free trials, self-service modules) to drive adoption and create upsell opportunities for the sales team.

Retain the core enterprise sales-led model for complex solutions while building a new 'Digital Growth' muscle. This involves launching modular software products on the website that allow users to sign up and experience value before engaging with sales, feeding a pipeline of highly qualified, product-aware leads to the enterprise team.

Prioritized Initiatives

- Initiative:

Launch Integrated 'Sustainability-as-a-Service' Offering

Expected Impact:High

Implementation Effort:High

Timeframe:12-18 months

First Steps:Form a cross-functional team from the Automation Solutions and AspenTech divisions. Define the initial solution bundle (e.g., emissions monitoring sensors + analytics software). Identify 3-5 strategic customers for a co-development pilot program.

- Initiative:

Unified Digital Customer Portal

Expected Impact:Medium

Implementation Effort:High

Timeframe:18-24 months

First Steps:Conduct a comprehensive audit of all existing customer-facing digital touchpoints. Develop a unified API strategy and identity management system. Start with a pilot portal for a specific product line or customer segment.

- Initiative:

Digital Upskilling Program for Sales & Partners

Expected Impact:High

Implementation Effort:Medium

Timeframe:6-9 months (initial launch)

First Steps:Develop a certification path for selling software subscriptions and integrated solutions. Create a library of on-demand training materials and value-selling playbooks. Launch an incentive program that rewards ARR and bundled sales.

Experimentation Plan

High Leverage Tests

- Test:

Pricing & Packaging Models

Description:Test different pricing tiers for new SaaS offerings (e.g., per-asset vs. per-user vs. consumption-based) with beta customers to identify the model that maximizes adoption and revenue.

- Test:

Product-Led Growth (PLG) Funnel

Description:Offer a free, limited version of a specific analytics tool (e.g., a basic energy consumption calculator) to test its effectiveness at driving sign-ups and conversions to paid tiers or sales consultations.

- Test:

Value Proposition Messaging