eScore

enphase.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Enphase demonstrates a commanding digital presence with a premium, tech-focused website that aligns well with user intent, from educational top-of-funnel content ('Solar A to Z') to specific product pages. The site architecture clearly segments its diverse audiences (homeowners, installers), enhancing relevance and authority. Their strong SEO performance on core product terms is a direct reflection of their dominant market share and reinforces their content authority.

Excellent audience segmentation on the website, creating tailored and highly relevant user journeys for homeowners, businesses, and installers.

Elevate thought leadership content beyond products to include forward-looking topics like Virtual Power Plants (VPPs) and grid services to capture a new, influential audience.

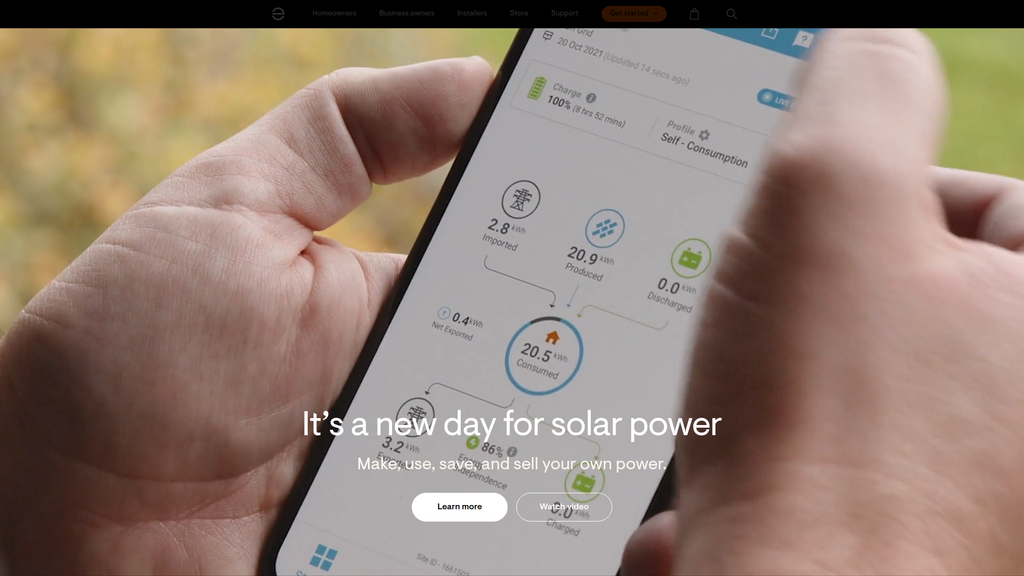

Enphase's messaging is highly effective, centered on the empowering tagline 'Make, use, save, and sell your own power.' The brand voice is consistently innovative and confident, successfully positioning them as a premium technology leader. Messaging is well-tailored for different personas, particularly contrasting the benefit-driven language for homeowners with the technical focus for installers.

A clear, consistent, and confident brand voice that effectively communicates technological superiority and reliability, resonating with both installer and homeowner audiences.

Address the significant messaging gap around cost and financing. The avoidance of financial topics creates a friction point for a market where upfront cost is a primary decision-making factor.

The website provides a clean, intuitive, and low-cognitive-load experience with a logical user flow from learning to finding an installer. The mobile experience is flawlessly executed, ensuring a seamless cross-device journey. However, conversion is slightly hampered by primary CTAs that lack visual prominence and the absence of engaging, interactive tools like a savings calculator to capture leads more effectively.

A clear and logical information architecture with a low cognitive load, making it easy for users to navigate and understand complex product information.

Develop and prominently feature an interactive savings or system ROI calculator on the homepage to provide immediate personalized value and increase high-intent lead capture.

Enphase builds exceptional credibility through a multi-layered approach that includes superior technology, a best-in-class 25-year microinverter warranty, and a vast network of trained, loyal installers. Their proactive compliance with upcoming EU IoT cybersecurity regulations and strategic alignment with the U.S. Inflation Reduction Act demonstrate a mature approach to risk management. This technical and regulatory diligence builds immense trust with both consumers and professional partners.

The 25-year warranty on microinverters serves as a powerful trust signal and risk mitigation tool, tangibly backing up claims of superior reliability and long-term value.

Publish a formal Accessibility Statement outlining their commitment to WCAG standards and providing a clear point of contact to mitigate potential legal risks and improve inclusivity.

Enphase's competitive moat is deep and sustainable, founded on its proprietary microinverter technology which offers inherent reliability and safety advantages over competitors' string inverters. This technological advantage is protected by a strong patent portfolio and reinforced by a fiercely loyal installer network that acts as a powerful sales channel. The integrated product ecosystem (solar, battery, EV charging) creates high switching costs, further solidifying their market leadership.

The foundational microinverter architecture provides a durable technological moat, offering superior reliability (no single point of failure) and safety that is difficult for competitors to replicate.

More aggressively market the unique 'Sunlight Backup' feature of the IQ8 microinverters, which allows for limited power during an outage without a battery, as this is a powerful and temporary technological differentiator.

Enphase is well-positioned for growth, leveraging a capital-light contract manufacturing model and a highly scalable B2B2C sales channel through its installer network. The company shows clear signals of market expansion, particularly in Europe and the nascent commercial sector. The business model's unit economics are strong, with high LTV potential driven by the upselling of ecosystem products like batteries and EV chargers.

A highly scalable and capital-efficient B2B2C business model that leverages a network of third-party installers, allowing for rapid market penetration without a proportional increase in internal sales staff.

Create a dedicated business unit and go-to-market strategy for the small-to-medium commercial (C&I) sector to diversify revenue and reduce heavy reliance on the cyclical residential market.

Enphase's business model is highly coherent, aligning its value proposition of technological superiority with a premium pricing strategy and a B2B2C channel that values reliability. The model has successfully evolved from selling components to providing an integrated home energy ecosystem, increasing customer lifetime value. Strategic acquisitions of software platforms (like Solargraf) show a clear focus on strengthening their core installer-centric strategy.

Excellent alignment between the value proposition (reliability, safety, performance) and the primary sales channel (installers who prioritize minimizing post-installation issues), creating a self-reinforcing ecosystem.

Accelerate the development of a recurring revenue model by monetizing software services (e.g., premium monitoring) and scaling Virtual Power Plant (VPP) programs to reduce reliance on one-time hardware sales.

Enphase holds a dominant position in the U.S. residential inverter market, effectively operating in a duopoly with SolarEdge. This market power grants them significant pricing power, evidenced by high gross margins and a premium product position. The company's ability to influence the market is demonstrated by its technology setting industry standards for safety and reliability, and its loyal installer network provides substantial leverage over its distribution channel.

Dominant market share (~48% in the U.S. residential market) provides significant pricing power and creates a standard that competitors must measure against.

Develop and publish an annual 'State of Home Energy' report using proprietary data from its millions of monitored systems to solidify its role as an industry data leader and shape market narratives.

Business Overview

Business Classification

Integrated Energy Solutions Provider

Hardware + Platform Model

Renewable Energy Technology

Sub Verticals

- •

Solar Energy (MLPE)

- •

Energy Storage Systems

- •

Electric Vehicle (EV) Charging

- •

Energy Management Software

Mature

Maturity Indicators

- •

Publicly traded company (NASDAQ: ENPH) since 2012.

- •

Established global market leader in microinverters, particularly in North America.

- •

Significant revenue and established profitability, although subject to market cyclicality.

- •

Diversified product portfolio beyond core microinverters (batteries, EV chargers, software).

- •

Extensive and loyal global network of certified installers.

- •

Strategic shift towards domestic (U.S.) manufacturing to build supply chain resilience.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Microinverter System Sales

Description:Core revenue from the sale of IQ series microinverters, the IQ Gateway, and related cabling and accessories. Sold primarily through distributors to a network of solar installers.

Estimated Importance:Primary

Customer Segment:Solar Installers & Distributors

Estimated Margin:High

- Stream Name:

IQ Battery System Sales

Description:Sale of modular energy storage systems (IQ Battery 5P, 10C) that integrate with the Enphase solar ecosystem. A key growth driver for the business.

Estimated Importance:Primary

Customer Segment:Solar Installers & Distributors

Estimated Margin:Medium

- Stream Name:

EV Charging Solutions

Description:Sale of IQ EV Chargers for residential and commercial applications, expanding the company's footprint in home electrification.

Estimated Importance:Secondary

Customer Segment:Homeowners, Businesses, Installers

Estimated Margin:Medium

- Stream Name:

Portable Power Solutions

Description:Sale of IQ PowerPack portable power stations and solar panels, targeting a direct-to-consumer market for recreational and backup power needs.

Estimated Importance:Tertiary

Customer Segment:Direct-to-Consumer

Estimated Margin:Medium

Recurring Revenue Components

- •

Software services via the Enlighten monitoring platform (potential for premium tiers).

- •

Extended warranties for products.

- •

Future potential from Virtual Power Plant (VPP) grid service participation fees.

- •

Installer tools and software platforms (e.g., Solargraf) acquired to support the installer network.

Pricing Strategy

Product & System Sales

Premium

Opaque (End-customer pricing is determined by the installer)

Pricing Psychology

- •

System Bundling (encouraging purchase of the full 'Enphase Energy System')

- •

Value-Based Pricing (based on superior technology, reliability, and safety)

- •

Tiered Offerings (multiple microinverter models and battery sizes)

Monetization Assessment

Strengths

- •

Strong brand reputation allows for premium pricing.

- •

Integrated system approach drives higher average revenue per customer.

- •

Loyal installer channel provides a scalable and effective sales force.

- •

High-margin core product (microinverters) drives profitability.

Weaknesses

- •

Heavy reliance on the cyclical residential solar market.

- •

High dependency on the installer channel for sales and customer relationships.

- •

Premium pricing can be a barrier in price-sensitive markets or economic downturns.

- •

Limited direct recurring revenue streams from the existing customer base.

Opportunities

- •

Develop and monetize premium software-as-a-service (SaaS) offerings for energy management and grid services.

- •

Expand Virtual Power Plant (VPP) programs to create a significant recurring revenue stream from aggregated battery capacity.

- •

Aggressively pursue the small commercial market segment.

- •

Increase direct-to-consumer (DTC) sales channels for portable power and EV charging products.

Threats

- •

Intense price competition from string inverter manufacturers like Tesla and low-cost international players.

- •

Changes in government incentives (e.g., net metering) can drastically impact market demand.

- •

Technological advancements from competitors (e.g., SolarEdge, Tesla) could erode differentiation.

- •

Supply chain disruptions and geopolitical risks impacting manufacturing and component costs.

Market Positioning

Technology Leadership & Whole-Home Energy Ecosystem

Market Leader (globally in MLPE, with ~50% share in the U.S. residential inverter market).

Target Segments

- Segment Name:

Solar Installers

Description:The primary B2B2C channel. These are professional installation companies ranging from small local businesses to large national players who value product reliability, ease of installation, safety, and strong manufacturer support.

Demographic Factors

Certified electricians and solar professionals

Psychographic Factors

- •

Risk-averse (prefer reliable products to avoid truck rolls)

- •

Value efficiency and streamlined processes

- •

Seek strong partnerships and training from manufacturers

Behavioral Factors

Brand loyalty based on product performance and support

Purchase through established distribution channels

Pain Points

- •

Costly service calls (truck rolls) for failed equipment

- •

Complex installations with high-voltage DC

- •

Managing multiple vendors for a single project

- •

Need for effective sales and design software

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Residential Homeowners

Description:The end-users of the system. Typically higher-income, tech-savvy individuals interested in energy resilience, cost savings, sustainability, and home improvement.

Demographic Factors

Homeowners (not renters)

Middle-to-high household income

Psychographic Factors

- •

Value energy independence and security (backup power)

- •

Environmentally conscious

- •

Interest in smart home technology

- •

Seek long-term, high-quality investments

Behavioral Factors

- •

Conduct extensive online research before purchasing

- •

Rely on installer recommendations

- •

Desire for user-friendly monitoring apps

Pain Points

- •

High and unpredictable electricity bills

- •

Power outages and grid instability

- •

Complexity of solar technology

- •

High upfront cost of solar and storage systems

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Small Commercial Businesses

Description:Small to medium-sized businesses looking to reduce operating expenses via lower electricity bills and leverage tax incentives for sustainable investments.

Demographic Factors

Business owners with physical locations (roof space)

Psychographic Factors

- •

ROI-focused

- •

Value operational reliability

- •

Desire for positive brand image (sustainability)

Behavioral Factors

Longer sales cycles

Decision-making based on financial modeling

Pain Points

- •

High energy operating costs

- •

Demand charges from utilities

- •

Desire to meet corporate sustainability goals

Fit Assessment:Good

Segment Potential:Medium

Market Differentiation

- Factor:

Microinverter Architecture

Strength:Strong

Sustainability:Sustainable

- Factor:

Grid-Forming IQ8 Technology (Sunlight Backup)

Strength:Strong

Sustainability:Sustainable

- Factor:

Integrated Hardware/Software Ecosystem

Strength:Moderate

Sustainability:Sustainable

- Factor:

Brand Reputation for Quality and Reliability

Strength:Strong

Sustainability:Sustainable

- Factor:

Loyal and Extensive Installer Network

Strength:Strong

Sustainability:Temporary

Operating Model

Key Activities

- •

Semiconductor and Power Electronics R&D

- •

Software Development (Enlighten, Installer Portal)

- •

Installer Network Management and Training

- •

Global Supply Chain and Logistics Management

- •

Brand Marketing and Channel Support

Scalability Analysis

Strengths

- •

Capital-light manufacturing model using contract manufacturers (e.g., Flex) allows for flexible production scaling.

- •

Indirect sales model through installers and distributors is highly scalable without proportional increases in internal sales staff.

- •

Software platforms can be scaled to millions of users with relatively low marginal cost.

- •

Modular product design (batteries, microinverters) allows for flexible system sizing and expansion.

Weaknesses

- •

Reliance on a limited number of contract manufacturers creates concentration risk.

- •

Scaling customer support and installer training to maintain quality can be challenging during rapid growth phases.

- •

Global supply chain is vulnerable to component shortages, tariffs, and geopolitical disruptions.

Operational Efficiency

Metrics

- •

High Gross Margins (often above 40%) indicate efficient production and strong pricing power.

- •

Strategic shift to U.S. manufacturing aims to reduce logistical costs, improve delivery times, and leverage federal incentives (IRA).

- •

Acquisition of software companies (Solargraf, 365 Pronto) is aimed at improving the efficiency of the entire sales-to-installation lifecycle for their partners.

Value Proposition

Enphase provides the most reliable, intelligent, and safe home energy system, empowering homeowners and businesses to make, use, save, and sell their own power through a fully integrated platform of solar, battery, and EV charging solutions.

Excellent

Key Benefits

- Benefit:

Superior Reliability and Safety

Importance:Critical

Differentiation:Unique

Proof Elements

- •

Microinverter architecture eliminates single point of failure.

- •

25-year limited warranty on microinverters.

- •

Low-voltage AC on the roof, eliminating high-voltage DC risks.

- Benefit:

Energy Resilience and Independence

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

IQ Battery provides seamless backup power during outages.

IQ8's 'Sunlight Backup' feature allows for daytime power during an outage even without a battery.

- Benefit:

Maximized Energy Harvest

Importance:Important

Differentiation:Unique

Proof Elements

Module-level power electronics (MLPE) optimize each solar panel independently, mitigating impact from shading or debris.

- Benefit:

Integrated and Simple Monitoring

Importance:Important

Differentiation:Somewhat unique

Proof Elements

The Enphase App (formerly Enlighten) provides a single interface to monitor solar production, energy consumption, battery status, and EV charging.

Unique Selling Points

- Usp:

Pioneering Microinverter Technology

Sustainability:Long-term

Defensibility:Strong

- Usp:

Installer-Centric Business Model

Sustainability:Medium-term

Defensibility:Moderate

- Usp:

Comprehensive 25-Year Microinverter Warranty

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Fear of power outages and grid instability

Severity:Critical

Solution Effectiveness:Complete

- Problem:

High and rising cost of electricity

Severity:Major

Solution Effectiveness:Partial

- Problem:

Safety concerns with high-voltage DC solar systems

Severity:Major

Solution Effectiveness:Complete

- Problem:

Lost energy production due to shading on solar panels

Severity:Minor

Solution Effectiveness:Complete

Value Alignment Assessment

High

The value proposition directly addresses the primary market drivers of energy resilience, cost savings, and sustainability. The shift toward integrated systems aligns with the trend of home electrification.

High

The focus on reliability, safety, and performance strongly resonates with both quality-conscious homeowners and professional installers who prioritize minimizing post-installation issues.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Network of Solar Installers (Enphase Installer Network)

- •

Electronics Distributors (e.g., CED Greentech, BayWa r.e.)

- •

Contract Manufacturers (e.g., Flex, Salcomp)

- •

Utility Companies (for VPP programs)

- •

Solar Panel Manufacturers (for AC Module integration)

- •

Solar Financing Companies

Key Resources

- •

Extensive Patent Portfolio (Intellectual Property)

- •

Strong Brand Reputation and Installer Loyalty

- •

Global Engineering and R&D Talent

- •

Enphase App and Installer Software Platforms

- •

Robust Balance Sheet and Access to Capital

Cost Structure

- •

Cost of Goods Sold (COGS) - Components and contract manufacturing fees

- •

Research & Development (R&D) - Innovation in hardware and software

- •

Sales & Marketing - Channel support, training, and brand building

- •

General & Administrative (G&A)

Swot Analysis

Strengths

- •

Dominant market position and strong brand in the MLPE segment.

- •

Superior and patented microinverter technology.

- •

Deeply entrenched and loyal installer network acting as a competitive moat.

- •

Strong financial health with high gross margins and a solid balance sheet.

- •

Integrated product ecosystem (solar, storage, EV charging) creating high switching costs.

Weaknesses

- •

Premium price point makes it vulnerable to lower-cost competitors.

- •

High revenue concentration in the U.S. residential market.

- •

Business performance is sensitive to changes in solar policy and interest rates.

- •

Complex supply chain reliant on third-party manufacturers.

Opportunities

- •

International expansion, particularly in Europe and Australia where energy prices are high.

- •

Growth of the Virtual Power Plant (VPP) market, creating new service-based revenue.

- •

Expansion into the small and medium commercial solar market.

- •

Leveraging the Inflation Reduction Act (IRA) to enhance competitiveness through U.S. manufacturing.

- •

Further development of direct-to-consumer channels for products like EV chargers and portable power.

Threats

- •

Aggressive competition from SolarEdge and increasingly from Tesla in the inverter and storage space.

- •

Macroeconomic headwinds such as high interest rates dampening consumer demand.

- •

Adverse changes to net metering policies and solar incentives in key markets.

- •

Potential for commoditization of inverter technology over the long term.

- •

Geopolitical risks impacting the global semiconductor supply chain.

Recommendations

Priority Improvements

- Area:

Revenue Model Evolution

Recommendation:Accelerate the development of a recurring revenue model by launching premium software tiers within the Enphase App for advanced analytics, energy trading, and home automation integration. This creates a higher-margin, stable revenue stream independent of hardware sales cycles.

Expected Impact:High

- Area:

Market Diversification

Recommendation:Create a dedicated business unit and product strategy for the small-to-medium commercial (C&I) sector. Adapt the installer network and financing partnerships to better serve the needs of business customers, reducing reliance on the residential market.

Expected Impact:High

- Area:

Installer Ecosystem Deepening

Recommendation:Further integrate financial services and insurance products into the installer platform. By becoming an indispensable operational partner for installers (offering project financing, insurance, lead generation), Enphase can increase loyalty and create an even stronger competitive moat.

Expected Impact:Medium

Business Model Innovation

Transition from a hardware provider to an Energy-as-a-Service (EaaS) platform, aggregating the installed base of batteries into a dominant Virtual Power Plant (VPP) to sell grid services (frequency regulation, capacity) directly to utilities, sharing revenue with homeowners.

Develop a direct financing or leasing model for the complete Enphase Energy System, partnering with financial institutions to lower the upfront cost barrier for homeowners and capture more value across the lifecycle of the system.

Revenue Diversification

- •

Expand the portable power product line to capture the growing recreational and off-grid lifestyle market.

- •

Offer grid services directly to utilities and grid operators through VPP programs, creating a new, high-margin revenue stream.

- •

Build out a paid, premium installer tier within the Enphase Installer Network that provides exclusive leads, advanced software tools, and co-marketing funds.

Enphase Energy has successfully executed a business model centered on technological superiority and a deeply entrenched B2B2C channel strategy. Its foundation is the pioneering microinverter technology, which provides a defensible competitive advantage in reliability, safety, and performance. This technical leadership has cultivated a strong brand and a loyal installer network, which acts as a powerful, scalable sales force and a significant barrier to entry for competitors. The company is at a pivotal stage of its evolution, transitioning from a solar component supplier to an integrated home energy management ecosystem provider. The additions of energy storage and EV charging were logical and necessary extensions that increase the customer's lifetime value and create higher switching costs. The current business model is robust but faces two strategic challenges: a high dependency on the cyclical residential solar market and a revenue model dominated by one-time hardware sales. The primary opportunity for strategic transformation lies in evolving the business model to capture recurring, high-margin service revenue. The most significant potential lies in becoming a dominant distributed energy platform. By leveraging its growing fleet of installed batteries, Enphase can operate large-scale Virtual Power Plants (VPPs), shifting its revenue mix from hardware to grid services. This move would transform the business from being susceptible to construction and interest rate cycles to a more stable, service-oriented model with higher multiples. Recommendations should focus on accelerating this transition by investing heavily in the software and partnerships required to scale VPP operations globally, while simultaneously diversifying into the C&I market to de-risk its reliance on the residential segment. The recent strategic shift to U.S.-based manufacturing is a prudent move to mitigate supply chain risks and capitalize on favorable policy, further strengthening its market position for future growth.

Competitors

Competitive Landscape

Growth

Oligopoly

Barriers To Entry

- Barrier:

High R&D and Technology IP

Impact:High

- Barrier:

Established Installer and Distribution Networks

Impact:High

- Barrier:

Brand Reputation and Reliability Track Record

Impact:High

- Barrier:

Economies of Scale in Manufacturing

Impact:Medium

- Barrier:

Complex Regulatory and Certification Requirements

Impact:Medium

Industry Trends

- Trend:

Electrification of Everything

Impact On Business:Drives demand for integrated home energy solutions (solar, battery, EV charging), expanding Enphase's total addressable market.

Timeline:Immediate

- Trend:

Increasing Grid Instability and Outages

Impact On Business:Boosts consumer demand for energy resilience and backup power, a key value proposition for Enphase's battery storage systems.

Timeline:Immediate

- Trend:

Virtual Power Plants (VPPs) and Grid Services

Impact On Business:Creates new revenue stream opportunities by allowing aggregated Enphase systems to provide services to the grid, enhancing the value proposition for homeowners.

Timeline:Near-term

- Trend:

High Interest Rates and Economic Headwinds

Impact On Business:Temporarily slows residential solar adoption due to higher financing costs, increasing price sensitivity among consumers.

Timeline:Immediate

- Trend:

Domestic Manufacturing Incentives (e.g., IRA)

Impact On Business:Provides a competitive advantage through tax credits and supply chain resilience, aligning with Enphase's strategy of U.S.-based manufacturing.

Timeline:Immediate

Direct Competitors

- →

SolarEdge Technologies

Market Share Estimate:40-45% (US Residential Inverter Market)

Target Audience Overlap:High

Competitive Positioning:Offers DC-optimized string inverters as a cost-effective alternative to microinverters, focusing on maximizing energy yield at the module level.

Strengths

- •

Often lower upfront cost compared to Enphase for certain system sizes.

- •

High system efficiency (rated slightly higher than Enphase in some comparisons).

- •

Strong brand recognition and a large, established installer network.

- •

Mature product ecosystem including batteries, EV chargers, and energy management software.

Weaknesses

- •

Architecture includes a central string inverter, creating a single point of failure that can take the entire system offline.

- •

Warranty is often split: 25 years for optimizers but a shorter 12-year standard warranty on the central inverter (can be extended for a fee).

- •

Less flexible for complex roof layouts or future system expansion compared to microinverters.

- •

Installer feedback and reviews suggest more frequent reliability and customer service issues compared to Enphase.

Differentiators

DC power optimizer technology paired with a central string inverter.

Focus on cost-effectiveness for standard, less complex installations.

- →

Tesla Energy

Market Share Estimate:~15% (predicted 2024 inverter market share); 40-45% (US home battery market).

Target Audience Overlap:High

Competitive Positioning:Leverages its globally recognized brand to offer a vertically integrated, all-in-one ecosystem (solar, Powerwall battery, EV charging) with a focus on sleek design and a simplified customer experience.

Strengths

- •

Exceptional brand recognition and customer loyalty, driving strong demand.

- •

Dominant market leader in the residential battery storage segment with the Powerwall.

- •

Vertically integrated approach provides a seamless, albeit closed, ecosystem.

- •

Often price-competitive, particularly when bundling products.

- •

Strong direct-to-consumer sales channel.

Weaknesses

- •

Closed ecosystem ('walled garden') limits interoperability with third-party components.

- •

Customer service and post-installation support are frequently cited as major pain points.

- •

Less focus on supporting third-party installers, who are a key channel for Enphase and SolarEdge.

- •

Uses string inverter technology, which shares some of the same architectural drawbacks as SolarEdge.

Differentiators

- •

Powerful consumer brand and marketing engine.

- •

Seamless integration between EV charging, solar, and battery storage.

- •

Leadership in battery technology and manufacturing scale.

- →

Generac

Market Share Estimate:Niche but growing, particularly in backup power

Target Audience Overlap:Medium

Competitive Positioning:Positions itself as the leader in whole-home backup power, leveraging its legacy in generators to offer a comprehensive solar + battery + generator solution (PWRcell system).

Strengths

- •

Strong, established brand in home backup power (generators).

- •

Offers unique integration between solar, battery storage, and traditional home standby generators.

- •

Robust power output, often marketed as capable of starting and running large appliances like air conditioners.

- •

Strong distribution network through electrical and HVAC contractors.

Weaknesses

- •

Higher cost on a dollar-per-kWh basis compared to competitors like Tesla and Enphase.

- •

Less brand recognition specifically within the solar industry.

- •

System complexity can be higher than integrated solutions from competitors.

- •

Newer entrant to the solar inverter market compared to Enphase and SolarEdge.

Differentiators

Hybrid approach combining renewable and traditional backup power sources.

Focus on high-power output for whole-home backup scenarios.

Indirect Competitors

- →

Utility Companies

Description:Electric utilities offering green energy plans, demand response programs, or community solar projects that provide customers with some benefits of renewable energy without installing hardware on their homes.

Threat Level:Medium

Potential For Direct Competition:Low

- →

Traditional Generator Manufacturers (e.g., Kohler, Cummins)

Description:Companies specializing in fossil fuel-powered standby generators. They solve the 'backup power' problem but not the 'energy savings' or 'sustainability' problems.

Threat Level:Low

Potential For Direct Competition:Medium (as they may follow Generac's lead into energy storage)

- →

Schneider Electric

Description:A major player in electrical equipment and energy management, offering a wide range of components like inverters, smart panels, and EV chargers, though less focused on a fully integrated residential ecosystem brand.

Threat Level:Medium

Potential For Direct Competition:High

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Superior Microinverter Technology

Sustainability Assessment:The core distributed architecture of microinverters offers inherent benefits in reliability (no single point of failure), safety (all-DC wiring remains on the roof), performance (panel-level optimization), and design flexibility. This is a durable technological advantage.

Competitor Replication Difficulty:Hard

- Advantage:

Strong Installer Loyalty and Channel Partnerships

Sustainability Assessment:Enphase has invested heavily in its network of installers, providing training (Enphase University), support, and a reputation for product reliability. This creates a loyal sales and installation force that is difficult for competitors, especially direct-to-consumer models like Tesla, to replicate.

Competitor Replication Difficulty:Hard

- Advantage:

Proven Product Reliability and Warranty

Sustainability Assessment:Enphase's standard 25-year warranty on microinverters is a key selling point and a testament to their product's low failure rate. This strong track record builds trust and reduces perceived risk for both homeowners and installers.

Competitor Replication Difficulty:Medium

- Advantage:

Integrated and Expanding Product Ecosystem

Sustainability Assessment:The tightly integrated system of IQ Microinverters, IQ Battery, IQ EV Charger, and the Enlighten software platform creates a powerful, unified home energy solution that increases customer lifetime value and creates switching costs.

Competitor Replication Difficulty:Medium

Temporary Advantages

- Advantage:

IQ8's Grid-Forming 'Sunlight Backup' Capability

Estimated Duration:1-3 years

Description:The ability of IQ8 microinverters to form a microgrid and provide limited backup power during an outage without a battery is a unique and compelling technological differentiator. Competitors will likely work to replicate this functionality.

Disadvantages

- Disadvantage:

Premium Price Point

Impact:Major

Addressability:Moderately

Description:Enphase systems typically have a higher upfront cost compared to DC-optimized string inverter systems from SolarEdge or Tesla, which can be a barrier in a price-sensitive market, especially with high interest rates.

- Disadvantage:

Lower Brand Recognition Among End-Consumers (vs. Tesla)

Impact:Major

Addressability:Moderately

Description:While dominant among installers, the Enphase brand does not have the same level of mainstream consumer awareness and pull as Tesla, which can be a disadvantage in direct-to-consumer marketing.

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted marketing campaigns emphasizing the 'No Single Point of Failure' advantage over string inverters.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Promote the superior 25-year standard warranty on microinverters vs. the shorter 12-year warranty on competitors' central inverters.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Create and distribute content for installers that clearly articulates the total cost of ownership (TCO) vs. upfront cost, justifying the premium price.

Expected Impact:High

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Deepen partnerships with homebuilders to make Enphase systems a standard or premium option in new home construction.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Expand software capabilities to include advanced home energy automation and integration with other smart home devices, moving beyond just energy management.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Develop a more streamlined direct-to-consumer financing option to counter the impact of high interest rates and simplify the sales process for installers.

Expected Impact:Medium

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Establish leadership in the Virtual Power Plant (VPP) software and grid services market, turning the distributed network of Enphase systems into a significant revenue-generating asset.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Invest in R&D for next-generation battery chemistries and bi-directional EV charging (V2G/V2H) to stay ahead of the technology curve.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Continue strategic international expansion into high-growth residential solar markets across Europe and Asia-Pacific.

Expected Impact:High

Implementation Difficulty:Moderate

Solidify Enphase's position as the 'premium, reliable, and intelligent' choice for home energy management. Shift the market conversation from upfront cost to long-term value, system resilience, and safety.

Differentiate through superior technology (microinverter architecture, grid-forming capabilities), proven long-term reliability backed by a superior warranty, and the strength of the installer channel relationship.

Whitespace Opportunities

- Opportunity:

Develop tailored solutions for the multi-family and apartment building market, a largely untapped segment for individual energy systems.

Competitive Gap:Most competitors are focused on single-family homes. A scalable solution for multi-tenant dwellings that manages shared solar assets and individual billing is a significant gap.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Create an 'Enphase Certified' marketplace for used or refurbished equipment, promoting a circular economy and providing a lower-cost entry point for some consumers.

Competitive Gap:No major competitor has a formalized program for the secondary market, which could improve sustainability credentials and capture additional market segments.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Enhanced software for commercial-scale systems that simplifies fleet management and financial reporting for businesses with multiple sites.

Competitive Gap:While Enphase has commercial products, its software is still perceived as more residential-focused. A dedicated, powerful commercial management platform could win share in the small-to-medium business segment.

Feasibility:High

Potential Impact:High

- Opportunity:

Strategic partnerships with insurance companies to offer premium discounts for homes with Enphase systems, leveraging their enhanced safety and resilience features.

Competitive Gap:The link between resilient home energy systems and reduced insurance risk (e.g., during outages) is not yet fully commercialized by competitors.

Feasibility:Medium

Potential Impact:Medium

Enphase Energy operates in the rapidly growing but increasingly competitive residential energy technology market. The industry is in a strong growth phase, driven by the global trends of electrification and the rising need for energy resilience. The market for Module Level Power Electronics (MLPE) is a functional oligopoly dominated by Enphase and SolarEdge, who together hold approximately 90% of the U.S. market.

Enphase's primary competitive advantage is its foundational microinverter technology. This distributed architecture provides inherent, sustainable benefits in system reliability, safety, and design flexibility that are difficult for competitors using centralized string inverters (like SolarEdge and Tesla) to fully replicate. This technological superiority is reinforced by a best-in-class 25-year warranty and deep, loyal relationships with the solar installer community, which acts as a powerful, defensible sales channel.

The main direct competitor, SolarEdge, competes primarily on a slightly lower upfront cost but exposes customers to a single point of failure and a less comprehensive standard warranty. Customer and installer feedback suggests higher satisfaction and reliability with Enphase products. The most significant market disruptor is Tesla, which leverages its immense brand power and vertical integration to attract customers to its closed ecosystem. While Tesla dominates the battery market, its inverter technology is not as advanced as Enphase's, and its reliance on a direct sales model and poor reputation for customer service present clear weaknesses.

A key challenge for Enphase is its premium price point in a market facing economic headwinds from high interest rates. The strategic imperative is to shift the customer focus from upfront cost to total cost of ownership, reliability, and peace of mind. The unique 'Sunlight Backup' feature of the IQ8 microinverter is a temporary but powerful differentiator that should be heavily marketed.

Whitespace opportunities exist in underserved markets like multi-family housing and in deepening the software-based value proposition through VPPs and advanced home automation. Long-term success will depend on Enphase's ability to maintain its technological lead, nurture its installer network, and effectively communicate its superior value proposition against lower-cost and high-brand-recognition competitors.

Messaging

Message Architecture

Key Messages

- Message:

Make, use, save, and sell your own power.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Section

- Message:

On or off the grid, our smartest microinverter ever.

Prominence:Secondary

Clarity Score:High

Location:Homepage - IQ8 Series Section

- Message:

The best just got better.

Prominence:Secondary

Clarity Score:Medium

Location:Homepage - IQ Battery 10C Section

- Message:

The ease and reliability of Enphase, at scale.

Prominence:Tertiary

Clarity Score:High

Location:Homepage - IQ8 Commercial Microinverters Section

The message hierarchy is strong and logical. It begins with a broad, empowering vision of energy independence for the homeowner, then flows into specific, technologically advanced products that enable this vision (microinverters, batteries, EV chargers). The structure effectively funnels from 'why' (the vision) to 'how' (the products). Messages for different audiences (homeowners, installers, commercial) are clearly segmented, preventing dilution.

Messaging is highly consistent across the site. The core themes of innovation, reliability, and control are woven throughout product descriptions and audience-specific content. For example, the 'ease and reliability' message for commercial installers echoes the implicit promise of security and performance for homeowners.

Brand Voice

Voice Attributes

- Attribute:

Innovative

Strength:Strong

Examples

- •

The revolutionary IQ8 Series

- •

our smartest microinverter ever

- •

next-generation EV chargers

- Attribute:

Confident

Strength:Strong

Examples

- •

The best just got better.

- •

Unlock California’s NEM 3.0

- •

Your ultimate solar guide.

- Attribute:

Empowering

Strength:Moderate

Examples

Make, use, save, and sell your own power.

Take your power anywhere

- Attribute:

Technical

Strength:Strong

Examples

- •

IQ8 Commercial Microinverters

- •

Expand any existing California NEM system

- •

Finding a system to view site details

Tone Analysis

Aspirational Technology Leader

Secondary Tones

Pragmatic

Reassuring

Tone Shifts

The tone shifts effectively from aspirational and benefit-focused on homeowner pages to highly technical and process-oriented in the 'For Installers' sections.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

Enphase provides a complete, intelligent, and reliable home energy system, centered on superior microinverter technology, that gives you total control over your power—from generation and storage to usage and selling it back to the grid.

Value Proposition Components

- Component:

Technological Superiority (Microinverters)

Clarity:Clear

Uniqueness:Unique

- Component:

System Integration (Solar + Battery + EV)

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Energy Independence & Resilience

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

American Manufacturing

Clarity:Clear

Uniqueness:Somewhat Unique

Enphase’s primary differentiator is its microinverter technology, which contrasts with the centralized string inverters used by major competitors like SolarEdge. This is a powerful technical advantage that translates to key benefits: reliability (no single point of failure), scalability, and panel-level monitoring. The messaging successfully frames this as 'smarter' and more resilient. The emphasis on a fully integrated 'Enphase Energy System' (solar, battery, EV charger, software) further differentiates it from competitors who may only offer parts of the solution.

Enphase positions itself as the premium, technologically advanced choice in the residential and commercial solar market. The messaging is not focused on being the cheapest option, but the most reliable, efficient, and intelligent investment. This positions them effectively against competitors like SolarEdge by focusing on the architectural difference of their technology and against broader energy brands like Tesla by emphasizing their singular focus and expertise in solar energy management systems.

Audience Messaging

Target Personas

- Persona:

Homeowners

Tailored Messages

- •

Make, use, save, and sell your own power.

- •

On or off the grid

- •

Plug in to the power of the sun

- •

Unlock California’s NEM 3.0

Effectiveness:Effective

- Persona:

Installers

Tailored Messages

- •

The ease and reliability of Enphase, at scale.

- •

IQ8 Commercial Microinverters

- •

Finding a system to view site details

Effectiveness:Effective

- Persona:

Business Owners

Tailored Messages

[For business owners] See our next-generation EV chargers.

The ease and reliability of Enphase, at scale.

Effectiveness:Somewhat

Audience Pain Points Addressed

- •

Fear of power outages and grid instability ('On or off the grid')

- •

High and rising electricity bills ('save...your own power')

- •

Complexity of solar technology ('ease and reliability')

- •

Navigating complex regulations like California's NEM 3.0

Audience Aspirations Addressed

- •

Energy independence and self-sufficiency

- •

Contributing to a sustainable future (company mission)

- •

Making a smart, long-term financial investment

- •

Adopting cutting-edge technology ('smartest microinverter ever')

Persuasion Elements

Emotional Appeals

- Appeal Type:

Peace of Mind / Security

Effectiveness:High

Examples

On or off the grid

- Appeal Type:

Empowerment / Control

Effectiveness:High

Examples

Make, use, save, and sell your own power.

Take your power anywhere

- Appeal Type:

Pride in Technology / Being an Early Adopter

Effectiveness:Medium

Examples

The revolutionary IQ8 Series

The best just got better.

Social Proof Elements

- Proof Type:

Customer Stories

Impact:Moderate

Examples

Enphase in the real world Our customers’ stories.

- Proof Type:

Authority/Leadership

Impact:Strong

Examples

Annual Report 2024

Trust Indicators

- •

U.S. manufacturing

- •

Annual Report

- •

Specific, technical product names (IQ8, IQ Battery 10C)

- •

Dedicated portal and training for professional installers

Scarcity Urgency Tactics

Save $350—Limited time offer!

Calls To Action

Primary Ctas

- Text:

Learn more

Location:Multiple product sections on Homepage

Clarity:Clear

- Text:

For homeowners

Location:Product sections (e.g. IQ Battery, EV chargers)

Clarity:Clear

- Text:

For installers

Location:Product sections (e.g. IQ Battery, Expansion)

Clarity:Clear

- Text:

Installation at-home consultation... Add

Location:Service module on multiple pages

Clarity:Clear

The CTAs are clear but could be stronger in driving direct action. The prevalent 'Learn more' is a low-friction, educational CTA, suitable for a high-consideration purchase. However, it misses the opportunity to capture leads from higher-intent visitors. The 'Installation at-home consultation' is an excellent, well-defined CTA for users further down the funnel, but it's presented as a transactional 'add to cart' item which might create friction. Testing more direct, benefit-oriented CTAs like 'Get a Free Quote' or 'Design My System' could improve lead generation.

Messaging Gaps Analysis

Critical Gaps

Cost and Financing: The single biggest barrier for most consumers is the upfront cost. The website messaging almost completely avoids discussion of pricing, financing options, or potential tax credits/incentives until much deeper in the user journey. This is a significant gap.

Quantifiable ROI: While the message implies savings ('save... your own power'), there is a lack of specific, quantified examples or calculators on the homepage to help users understand their potential return on investment. This is a common and effective tool in the solar industry that is missing here.

Contradiction Points

No itemsUnderdeveloped Areas

Selling Power: The promise to 'sell your own power' is a powerful part of the primary headline but is not elaborated on. Explaining how this works (e.g., net metering, VPPs) and its financial benefits could significantly strengthen the value proposition.

Business Owner Persona: The messaging for 'business owners' is much less developed than for homeowners and installers. The content primarily funnels them to EV chargers or commercial installer information, missing an opportunity to address the unique needs of a small or medium-sized business owner for their own facilities.

Messaging Quality

Strengths

- •

Clear articulation of technological differentiation (microinverters).

- •

Excellent segmentation of messaging for core audiences (Homeowner vs. Installer).

- •

Strong, confident brand voice that conveys leadership and innovation.

- •

Effectively addresses timely and regional issues (NEM 3.0, U.S. manufacturing), demonstrating market awareness.

Weaknesses

- •

Avoidance of cost and financing discussions, which are critical to the customer decision process.

- •

Over-reliance on soft, educational CTAs ('Learn more') rather than conversion-focused CTAs.

- •

Lack of quantifiable benefit messaging (e.g., potential savings, ROI calculations).

Opportunities

- •

Develop an interactive savings or system design calculator to engage users and quantify the value proposition.

- •

Create more content and clear pathways for the 'Business Owner' persona.

- •

Build out the 'sell your power' narrative with customer stories and explainers to make this abstract benefit more concrete.

Optimization Roadmap

Priority Improvements

- Area:

Value Proposition

Recommendation:Integrate an interactive ROI/savings calculator on the homepage to immediately quantify the 'save' message and capture user engagement.

Expected Impact:High

- Area:

Calls-to-Action

Recommendation:A/B test primary CTAs from 'Learn more' to more action-oriented language like 'Get a Free Quote,' 'See My Savings,' or 'Design My System' to increase lead capture.

Expected Impact:High

- Area:

Content

Recommendation:Create a dedicated 'Pricing & Financing' page accessible from the main navigation, transparently explaining system costs, federal/state incentives, and financing partnerships.

Expected Impact:High

Quick Wins

- •

Add a small section below the main hero message briefly explaining what 'sell your own power' means in the context of net metering.

- •

Re-label the 'Annual Report 2024' CTA to something more user-benefit-oriented like 'Our Vision for the Future of Energy' to increase clicks.

- •

Add logos of major financing partners (if any) to build trust and address cost concerns passively.

Long Term Recommendations

Develop a robust content hub for business owners, featuring case studies, industry-specific benefits (e.g., for agriculture, retail), and clear financing guidance.

Launch a video series focused on 'Enphase in the real world' that moves beyond static stories to dynamic, narrative-driven testimonials showing the system in action during outages or highlighting low energy bills.

Enphase's strategic messaging is expertly crafted to establish the company as a premium technology leader in the renewable energy space. Its core strength lies in translating a key technical differentiator—microinverters—into clear consumer benefits of reliability, resilience, and intelligence. The message architecture is logical, and the brand voice is consistently confident and innovative. The clear segmentation between homeowner and installer audiences allows the messaging to be highly relevant and effective for each group.

The primary weakness in the strategy is a significant gap in addressing the financial considerations of a high-cost purchase. The near-total absence of pricing, financing, and ROI quantification on primary landing pages creates a major friction point for consumers for whom cost is a primary decision-making factor. While the brand aims to position itself on quality over price, failing to address the financial aspect at all risks alienating a large portion of the potential market early in their journey.

To optimize, Enphase should integrate financial messaging into its current framework, not to compete on price, but to demonstrate value and accessibility. By adding tools like savings calculators and transparently discussing financing options, they can bridge the gap between their premium technology positioning and the practical financial realities of their customers, thereby improving customer acquisition economics and capturing a wider audience without diluting the brand's core message of superior technology.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Market leadership in the microinverter segment of the Module Level Power Electronics (MLPE) market.

- •

Successful expansion into a comprehensive home energy ecosystem, including IQ Battery and EV Chargers, addressing the growing demand for integrated solutions.

- •

High brand recognition and a vast, loyal network of installers globally who are trained and supported by Enphase.

- •

Shipped over 48 million microinverters to 2.5 million systems in over 140 countries, indicating widespread adoption and trust.

- •

Consistent product innovation, such as the new IQ8 series, which can form a microgrid during a power outage without a battery.

Improvement Areas

- •

Further simplify the value proposition for homeowners to accelerate adoption beyond early adopters.

- •

Enhance software offerings to create a more compelling, unified user experience across all energy products (solar, battery, EV charging).

- •

Develop more flexible and accessible financing solutions in-house or through deeper partnerships to address upfront cost barriers.

Market Dynamics

Global residential solar PV market estimated to grow at a CAGR of 7.9% from 2025 to 2034. The Home Energy Management System (HEMS) market is projected to grow even faster, at a CAGR of ~16%.

Growing

Market Trends

- Trend:

Shift to Whole-Home Energy Management

Business Impact:Creates a significant opportunity for Enphase's ecosystem strategy, moving beyond just solar generation to integrated storage, EV charging, and software control. This increases customer lifetime value and creates a competitive moat.

- Trend:

Increasing Adoption of Energy Storage

Business Impact:Directly fuels demand for the IQ Battery. Policy changes like California's NEM 3.0, which reduce compensation for exported solar, make battery storage economically essential for new solar owners.

- Trend:

Electrification of Transportation (EVs)

Business Impact:Drives demand for home EV chargers and creates future opportunities for Vehicle-to-Grid (V2G) technology, where Enphase is well-positioned to play a central role. The V2G market is expected to grow at a CAGR of over 20%.

- Trend:

Regulatory and Policy Volatility

Business Impact:Changes in net metering, tariffs, and tax credits create market uncertainty and can impact demand, as seen with NEM 3.0 in California. This requires agility and a diversified geographical presence to mitigate risks.

Excellent. Enphase is well-positioned at the intersection of several high-growth secular trends: renewable energy adoption, electrification, and smart home technology.

Business Model Scalability

High

Leverages a capital-light model by using contract manufacturers (e.g., Flex, Salcomp), allowing for scalable production without heavy investment in owned factories. This keeps fixed costs lower and makes the cost structure more variable.

High potential for operational leverage through software. Once the Enlighten platform is developed, the marginal cost of adding a new user is low, creating a scalable, high-margin recurring revenue opportunity.

Scalability Constraints

- •

Dependence on a global supply chain for critical components like semiconductors, which is vulnerable to disruptions, shortages, and geopolitical tensions.

- •

Scaling the training, certification, and quality assurance for a growing global network of third-party installers.

- •

Navigating complex and varied regulatory environments in new international markets.

Team Readiness

Strong. The leadership team has successfully navigated the company from a hardware provider to a dominant energy tech platform, demonstrating strategic foresight and execution capability.

Appears well-structured around its core B2B2C model, with clear divisions for homeowners and installers. Recent acquisitions in software and services show a strategic intent to build out capabilities for an integrated energy future.

Key Capability Gaps

- •

Deep expertise in international market entry and localization for dozens of unique regulatory and cultural environments.

- •

Talent in AI/ML to develop next-generation energy management software (e.g., predictive load management, energy trading).

- •

Direct-to-consumer (D2C) marketing and sales capabilities, should they choose to expand channels for simpler products like portable power and EV chargers.

Growth Engine

Acquisition Channels

- Channel:

Installer Network (B2B2C)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Develop an advanced tier/loyalty program for top-performing installers with exclusive benefits, co-op marketing funds, and lead-generation support to deepen the partnership.

- Channel:

Content Marketing & SEO

Effectiveness:Medium

Optimization Potential:High

Recommendation:Expand educational content beyond 'Solar A to Z' to cover the entire home energy ecosystem, including ROI calculators for solar+storage under different utility rates (e.g., NEM 3.0).

- Channel:

Digital Advertising

Effectiveness:Medium

Optimization Potential:High

Recommendation:Implement targeted ad campaigns focused on specific homeowner personas and triggers (e.g., recent EV purchase, high electricity bills, living in outage-prone areas) and direct them to certified local installers.

Customer Journey

The homeowner journey typically involves awareness, research on the Enphase site, and then a handoff to a local installer. The installer journey involves training, certification, and ongoing support through the Enphase Installer App.

Friction Points

- •

The handoff from Enphase-generated interest to a third-party installer can be a point of leakage if not managed smoothly.

- •

Complexity and analysis paralysis for homeowners trying to understand the technology, incentives, and long-term financial benefits.

- •

The complexity of the sales and installation process, which involves multiple parties (sales consultant, site surveyor, installer, utility company).

Journey Enhancement Priorities

{'area': 'Homeowner Onboarding', 'recommendation': "Streamline the initial consultation process by integrating the '$150 At-home Consultation' service more deeply, providing a clear, Enphase-branded pathway from initial interest to a firm quote from a vetted installer."}

{'area': 'Installer Enablement', 'recommendation': 'Enhance the Enphase Installer App with more powerful sales enablement tools, such as an integrated proposal generator that automatically includes the latest Enphase products and local incentives.'}

Retention Mechanisms

- Mechanism:

Ecosystem Lock-in

Effectiveness:High

Improvement Opportunity:Create software-driven 'synergy features' that are only unlocked when multiple Enphase products (e.g., solar + battery + EV charger) are used together, such as intelligent charging of the EV from excess solar.

- Mechanism:

High Switching Costs

Effectiveness:High

Improvement Opportunity:Hardware is inherently sticky. Reinforce this by offering extended warranties or subscription services for proactive monitoring and maintenance, further embedding Enphase in the home's infrastructure.

- Mechanism:

Software Engagement (Enphase App)

Effectiveness:Medium

Improvement Opportunity:Gamify energy savings and production within the app. Introduce community leaderboards and personalized insights to increase daily user engagement and reinforce the value of the system.

Revenue Economics

Strong. While hardware margins face competitive and supply chain pressure, the business model allows for significant expansion revenue per customer by upselling batteries, EV chargers, and future software services, dramatically increasing LTV.

Likely high. CAC is leveraged through the installer network's sales efforts. LTV is high due to the high initial hardware cost and significant cross-sell/upsell potential of the ecosystem.

High. The B2B2C model is capital-efficient for customer acquisition. Focus on increasing the Average Revenue Per User (ARPU) through ecosystem adoption is the key lever for future growth.

Optimization Recommendations

- •

Systematically market and sell the IQ Battery to the existing installed base of over 2.5 million solar-only homes.

- •

Bundle products (e.g., solar + battery) with attractive financing to increase the initial average order value.

- •

Introduce premium software subscription tiers with advanced analytics, energy market participation (VPPs), and V2G capabilities.

Scale Barriers

Technical Limitations

- Limitation:

Supply Chain for Semiconductors and Batteries

Impact:High

Solution Approach:Diversify supplier base geographically to reduce dependence on single regions. Continue investing in U.S. manufacturing, as highlighted on the website, to build resilience and leverage incentives like the IRA.

- Limitation:

Interoperability with Third-Party Devices

Impact:Medium

Solution Approach:Develop a clear API strategy. While a closed ecosystem has benefits, offering certified integrations with popular smart home platforms (e.g., Google Home, Amazon Alexa) and other large electrical loads (e.g., smart heat pumps) could accelerate adoption.

Operational Bottlenecks

- Bottleneck:

Installer Network Management and Quality Control

Growth Impact:A poor installation experience, even by a third party, reflects on the Enphase brand and can slow word-of-mouth growth.

Resolution Strategy:Invest in a tiered certification program with ongoing training and audits. Use homeowner satisfaction scores (NPS) tied to installers to reward top performers and manage out low performers.

- Bottleneck:

Global Logistics and Inventory Management

Growth Impact:Product shortages or delays can cause installers to switch to more readily available competitors like SolarEdge for a given project.

Resolution Strategy:Implement an advanced supply chain planning system with predictive analytics to better forecast demand by region. Establish regional distribution hubs to shorten lead times.

Market Penetration Challenges

- Challenge:

Intense Competition

Severity:Critical

Mitigation Strategy:Compete on system-level benefits (reliability, safety, intelligence) rather than component cost. Emphasize the long-term value and seamless integration of the Enphase ecosystem. Key competitors include SolarEdge, Tesla, and Generac.

- Challenge:

Economic Headwinds and High Interest Rates

Severity:Major

Mitigation Strategy:Solar is a large capital investment, making it sensitive to financing costs. Develop and promote innovative financing partnerships (e.g., leases, PPAs, low-interest loans) to reduce the upfront barrier for homeowners and improve the value proposition.

- Challenge:

Consumer Education and Inertia

Severity:Major

Mitigation Strategy:Invest heavily in simplified, benefit-oriented marketing that focuses on energy independence, savings, and resilience, rather than technical specifications. Utilize customer stories and testimonials to build social proof.

Resource Limitations

Talent Gaps

- •

Firmware and software engineers with expertise in IoT, grid services, and AI/ML.

- •

International business development and regulatory affairs experts for market expansion.

- •

Supply chain and manufacturing operations experts to manage the planned U.S. production ramp-up.

Significant capital required for R&D to maintain technology leadership, strategic acquisitions of software/service companies, and potential capital expenditures for manufacturing joint ventures.

Infrastructure Needs

- •

Expansion of U.S. and European manufacturing and assembly capacity.

- •

Scalable cloud infrastructure to handle data from millions of additional connected energy systems.

- •

Robust cybersecurity infrastructure to protect critical home energy systems from threats.

Growth Opportunities

Market Expansion

- Expansion Vector:

Geographic Expansion in Europe

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Continue the current strategy of launching products in key European markets like Italy, Switzerland, Spain, and Germany. Establish local teams to navigate regulations and build installer networks.

- Expansion Vector:

Commercial & Industrial (C&I) Sector

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Leverage the new 'IQ8 Commercial Microinverters' to target small-to-medium businesses. Develop a dedicated C&I sales channel and partner with commercial solar developers. The C&I market is showing strong growth potential.

- Expansion Vector:

New Home Construction

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Forge strategic partnerships with national and regional home builders to offer the Enphase Energy System as a standard or optional package in new communities, positioning it as a key feature of the modern, electrified home.

Product Opportunities

- Opportunity:

Vehicle-to-Grid (V2G) / Vehicle-to-Home (V2H) Solutions

Market Demand Evidence:The V2G market is projected for explosive growth (CAGRs of 20-38%) as EV adoption rises. EV batteries represent a massive distributed energy resource.

Strategic Fit:Perfect fit. V2G is the natural next step for the Enphase ecosystem, leveraging the IQ System Controller, battery, and EV charger to manage bidirectional energy flow.

Development Recommendation:Aggressively pursue R&D and pilot programs with automotive OEMs and utilities. Develop the software and hardware (bidirectional charger) needed to make V2G a seamless consumer product.

- Opportunity:

Energy-as-a-Service (EaaS) Platform

Market Demand Evidence:Utilities need solutions for grid stability. Homeowners want to maximize the ROI of their assets. Virtual Power Plants (VPPs) are emerging as a key solution.

Strategic Fit:High. Enphase's large, connected fleet of batteries is a prime asset for forming a VPP. This creates a recurring revenue stream from grid services.

Development Recommendation:Expand the internal grid services team and software platform. Actively partner with utilities in key markets to offer Enphase systems as a grid resource, sharing revenue with homeowners.

- Opportunity:

DIY / Portable Power Expansion

Market Demand Evidence:The IQ PowerPack on the website indicates entry into this market. There is growing consumer interest in portable power stations for recreation and emergency backup.

Strategic Fit:Medium. It's a more consumer-direct model than their core business but leverages their battery and power electronics expertise.

Development Recommendation:Explore a broader range of portable products and test D2C sales channels. Position it as an entry point to the Enphase ecosystem.

Channel Diversification

- Channel:

Utility Partnerships

Fit Assessment:High

Implementation Strategy:Develop dedicated teams to propose Enphase's VPP and grid services capabilities as non-wires alternatives for grid upgrades. Offer utility-branded demand response programs to their customers using Enphase hardware.

- Channel:

Automotive OEMs

Fit Assessment:High

Implementation Strategy:Partner with EV manufacturers to bundle the Enphase Home Energy System (including the EV charger) at the point of vehicle sale, offering a complete home charging and energy management solution.

- Channel:

Retail (for select products)

Fit Assessment:Medium

Implementation Strategy:For simpler products like the IQ PowerPack and standalone EV Chargers, explore partnerships with big-box retailers (e.g., Best Buy, Home Depot) or online marketplaces to reach a broader consumer audience.

Strategic Partnerships

- Partnership Type:

Home Automation Platforms

Potential Partners

- •

Google Nest

- •

Amazon Alexa

- •

Apple HomeKit

Expected Benefits:Deeper integration into the smart home ecosystem, allowing for more intelligent energy management based on homeowner routines and preferences (e.g., pre-cooling the house using solar before peak rates).

- Partnership Type:

Financial Institutions

Potential Partners

- •

Mosaic

- •

Sunlight Financial

- •

Major Banks

Expected Benefits:Creation of 'Enphase-certified' loan products with preferential rates or terms, making the entire system more affordable and simplifying the sales process for installers.

Growth Strategy

North Star Metric

Managed Energy Systems with ≥2 Ecosystem Products

This metric moves beyond simple unit sales. It measures the adoption of Enphase's core strategy: the high-LTV, high-retention energy ecosystem (e.g., solar + battery). Growth in this metric proves the platform strategy is working and builds a strong competitive moat.

Increase the percentage of new systems with 2+ products from X% to Y% within 18 months.

Growth Model

Hybrid: B2B2C Sales-Led + Product-Led Ecosystem

Key Drivers

- •

Installer Network Activation & Productivity

- •

Cross-sell/Upsell of Ecosystem Products (Attach Rate)

- •

Homeowner Demand Generation via Content/Marketing

- •

New Market Entry

Double down on installer enablement to make selling the full ecosystem effortless. Simultaneously, run targeted marketing campaigns to homeowners educating them on the benefits of pairing storage and EV charging with solar, creating pull-through demand for installers.

Prioritized Initiatives

- Initiative:

Launch 'Full Ecosystem' Installer Incentive Program

Expected Impact:High

Implementation Effort:Medium

Timeframe:3-6 months

First Steps:Survey top installers to identify key motivators. Design a tiered bonus structure based on the attach rate of batteries and EV chargers to solar installations.

- Initiative:

Develop a V2G Commercialization Roadmap

Expected Impact:High (Long-term)

Implementation Effort:High

Timeframe:18-24 months

First Steps:Establish a dedicated V2G product team. Secure a partnership with one automotive OEM and one utility to launch a pilot program within 12 months.

- Initiative:

Geographic Expansion Playbook

Expected Impact:High

Implementation Effort:High

Timeframe:Ongoing

First Steps:Prioritize the next 3-5 international markets based on solar incentives, electricity costs, and regulatory stability. Hire a country manager for the top priority market.

Experimentation Plan

High Leverage Tests

- Test Name:

Bundled Financing Offers

Hypothesis:Offering a single, low-payment monthly price for a bundled system (solar + battery) will increase the battery attach rate compared to pricing components separately.

- Test Name:

Grid Services Enrollment Bonus

Hypothesis:Offering an upfront cash bonus or discount to homeowners who agree to enroll their battery in a Virtual Power Plant program upon installation will significantly increase VPP participation.

- Test Name:

EV Charger Cross-Sell Campaign

Hypothesis:Marketing a discounted EV charger to existing Enphase solar homeowners via the Enphase App will yield a higher conversion rate than external marketing channels.

Utilize A/B testing methodologies. Key metrics to track include: battery/EV charger attach rate, lead-to-close conversion rate, average order value (AOV), and customer acquisition cost (CAC).

Run and review at least one major growth experiment per quarter, with smaller marketing and messaging tests running on a bi-weekly sprint cadence.

Growth Team

A cross-functional 'pod' structure aligned to key growth vectors. Example pods: 1) Ecosystem Adoption, 2) International Expansion, 3) New Products (V2G/Commercial).

Key Roles

- •

Head of Growth (oversees all pods)

- •

Product Manager, Growth (focused on activation and monetization)

- •

International Expansion Manager

- •

Lifecycle Marketing Manager

- •

Data Scientist

Invest in data analytics infrastructure to better understand the end-to-end customer journey. Foster a culture of rapid experimentation by empowering pods with autonomy and dedicated budgets.

Enphase Energy is in a formidable position for sustained growth, built upon a strong foundation of product-market fit and excellent market timing. The company has successfully transitioned from a component supplier to an integrated home energy systems provider, creating a powerful ecosystem with high switching costs and significant expansion revenue potential. The core growth engine, a highly scalable B2B2C model, is robust and effective.