eScore

equifax.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Equifax demonstrates a strong digital presence, effectively bifurcating its content for B2C and B2B audiences, which aligns well with search intent. The company has high domain authority due to its position as a major credit bureau, though this authority is tarnished by reputational issues. While its multi-channel presence is solid in core markets, its global reach relies on separate localized digital properties, and it shows little specific optimization for the growing area of voice search.

Excellent content authority and domain strength, serving as a foundational asset for capturing high-value organic traffic, particularly for B2B financial and verification-related queries.

Develop a dedicated voice search optimization strategy by creating FAQ content and featured snippets that answer common conversational queries about credit, identity theft, and financial wellness.

The brand's messaging is highly effective at segmenting its B2C and B2B audiences, with clear, distinct value propositions for each. However, the communication strategy critically fails to address the 2017 data breach, creating a significant trust deficit that undermines its security-focused messaging. While the messaging uses fear and aspiration to drive conversions, the absence of social proof like testimonials or case studies weakens its overall persuasive power.

Clear and effective message segmentation between 'Personal' (consumer) and 'Business' audiences, ensuring tailored and relevant communication that speaks directly to different user needs and pain points.

Create a prominent 'Trust and Security' messaging pillar on the website that proactively addresses the 2017 breach, details current security investments, and rebuilds credibility through transparency.

The website provides a logically structured, though somewhat dated, user experience with clear navigation for its distinct audiences. For B2C, conversion paths to paid products are prominent, but friction exists due to visual clutter in plan comparisons and inconsistent CTA design. The site demonstrates a commitment to accessibility with a dedicated statement and compliance features, which positively impacts its market reach, but the overall cross-device experience could be smoother, especially on mobile.

Strong accessibility compliance, including a dedicated statement and WCAG 2.0 AA commitment, which expands market reach and mitigates legal risk.

Standardize the Call-to-Action (CTA) design system to create a clear visual hierarchy (e.g., solid for primary actions, outline for secondary), guiding users more effectively and reducing cognitive load.

Equifax's credibility is severely hampered by the legacy of the 2017 data breach, and the website does little to actively rebuild this trust. While it operates under a robust, regulator-supervised security program (a paradoxical strength), it lacks crucial third-party validation like customer testimonials, awards, or recent media mentions. The absence of a proactive trust-building narrative and the de-prioritization of free, mandated services in the site hierarchy create an impression of transactional interest over consumer welfare.

Operating under a court-ordered and regulator-supervised information security program provides a robust, audited framework for data protection, even if it originated from a past failure.

Integrate social proof elements such as customer testimonials (for B2C) and detailed case studies with quantifiable ROI (for B2B) to provide third-party validation of its value and effectiveness.

Equifax possesses a formidable and sustainable competitive advantage anchored by its proprietary data assets, particularly the 'Workforce Solutions' (The Work Number) database, which is nearly impossible to replicate. The company is also deeply embedded in the financial ecosystem, creating high switching costs for its enterprise clients. Its significant investment in a unified cloud platform and AI is a strong indicator of innovation aimed at maintaining its edge in data analytics.

The 'Workforce Solutions' (The Work Number) database is a unique, high-margin asset that provides a powerful and defensible moat against competitors in the verification market.

More aggressively market the 'Equifax Cloud' transformation and its AI capabilities as a key B2B differentiator, shifting the brand perception from a legacy data provider to a modern, agile technology partner.

The business model is highly scalable, characterized by high fixed costs and low marginal costs for its data products, leading to significant operating leverage. The 'Workforce Solutions' segment is a primary growth engine with high margins, and the company generates strong free cash flow to fund expansion. The completed cloud transformation is a major signal of market expansion readiness, designed to accelerate new product development and global deployment.

Excellent unit economics, particularly in the high-margin B2B Workforce Solutions segment, which drives profitability and provides substantial capital for reinvestment in growth and technology.

Develop a product-led growth (PLG) motion with a self-service API platform to capture the underserved SMB and fintech markets, which are currently alienated by long enterprise sales cycles.

Equifax's business model is exceptionally coherent and robust, with highly diversified B2B revenue streams that are deeply integrated into the economic fabric. Its strategic focus is clear, with the 'Workforce Solutions' division identified and capitalized upon as the primary growth and profit engine. The massive $1.5B+ investment in cloud infrastructure demonstrates a strong alignment of resource allocation with the strategic goal of becoming a technology-led data analytics company.

A highly diversified and resilient revenue model, with the Workforce Solutions segment providing strong, counter-cyclical growth that balances the more market-sensitive credit reporting business.

Address the stakeholder misalignment with consumers by improving the user experience and transparency around free, federally mandated credit services to rebuild goodwill and long-term brand equity.

As one of the 'Big Three' credit bureaus, Equifax operates in a stable oligopoly, giving it significant market power and pricing leverage, especially in its B2B segments. The company's unique data assets, particularly 'The Work Number,' provide substantial negotiating power with partners and a distinct advantage over competitors. While its overall market share is stable, its leadership in the high-margin verification space is growing, demonstrating its ability to shape and influence this key market segment.

Dominant position within an oligopolistic market structure, which provides significant pricing power and market stability.

Develop and market innovative B2C product features that free competitors like Credit Karma cannot offer, such as comprehensive family plans or deeper identity theft insurance, to better defend its consumer market share.

Business Overview

Business Classification

Data & Analytics as a Service (DaaS)

Subscription SaaS (for consumer products)

Information Services & Technology

Sub Verticals

- •

Credit Reporting

- •

Risk Management & Analytics

- •

Workforce Solutions (Income/Employment Verification)

- •

Identity & Fraud Prevention

- •

Data-driven Marketing Services

Mature

Maturity Indicators

- •

Founded in 1899, demonstrating extreme longevity.

- •

Operates as one of the 'Big Three' credit bureaus in a stable oligopoly.

- •

Publicly traded (NYSE: EFX) with a multi-billion dollar annual revenue.

- •

Diversified service offerings across numerous B2B verticals and a direct-to-consumer line.

- •

Global operational footprint in North America, Latin America, and Europe.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Workforce Solutions (B2B)

Description:Verification of income and employment data for clients in mortgage, auto lending, government, and pre-employment screening. This is anchored by the proprietary 'The Work Number' database and represents the largest and fastest-growing segment.

Estimated Importance:Primary

Customer Segment:B2B Enterprise (Lenders, Government, Employers)

Estimated Margin:High

- Stream Name:

U.S. Information Solutions (USIS - B2B)

Description:Core B2B services including selling consumer and commercial credit reports, predictive analytics, risk scoring models, and identity & fraud prevention solutions to businesses for decision-making.

Estimated Importance:Primary

Customer Segment:B2B Enterprise (Financial Services, Insurance, Telco)

Estimated Margin:High

- Stream Name:

International (B2B)

Description:Provides credit reporting, risk management, and analytics services to businesses in markets across Latin America, Europe, and the Asia Pacific region.

Estimated Importance:Secondary

Customer Segment:B2B Enterprise (International)

Estimated Margin:Medium

- Stream Name:

Consumer Solutions (B2C)

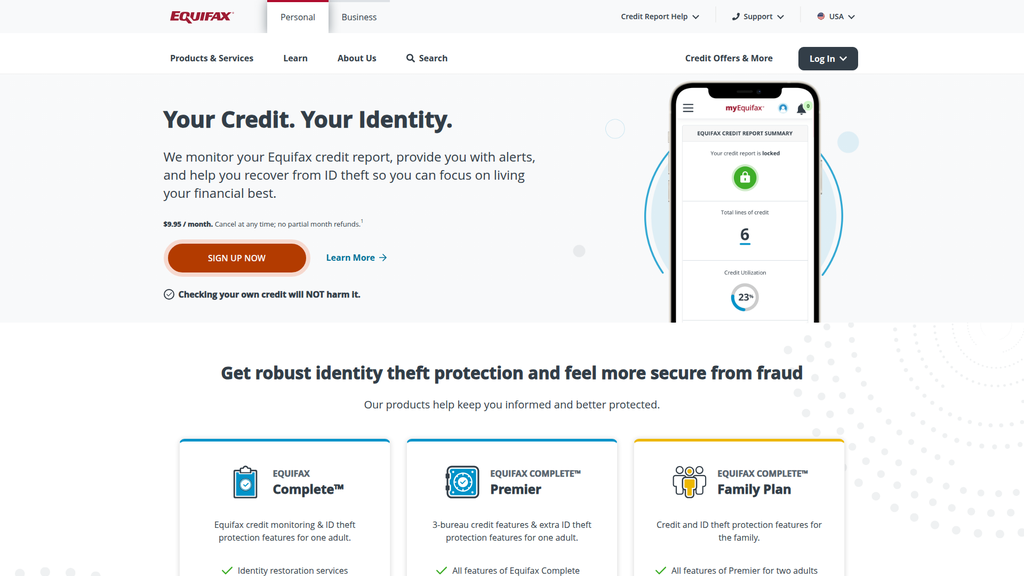

Description:Direct-to-consumer subscription products for credit monitoring, identity theft protection, and credit report access, such as Equifax Complete™, Premier, and Family Plan.

Estimated Importance:Tertiary

Customer Segment:Individual Consumers

Estimated Margin:High

Recurring Revenue Components

- •

B2B subscription fees for ongoing data access and platform usage.

- •

B2C monthly and annual subscriptions for credit monitoring.

- •

Long-term enterprise contracts for verification and risk management services.

Pricing Strategy

Tiered Subscription (B2C) & Custom Enterprise Contracts (B2B)

Mid-range to Premium

Transparent (for B2C), Opaque (for B2B)

Pricing Psychology

- •

Tiered Offerings ('Complete', 'Premier', 'Family')

- •

Annual Discounting (e.g., $99.95/year vs $9.95/month)

- •

Bundling (credit monitoring with ID theft insurance)

Monetization Assessment

Strengths

- •

Highly diversified revenue across multiple B2B segments (Workforce, USIS, International).

- •

Dominant, high-margin position in the income/employment verification market.

- •

Strong recurring revenue base from both B2B contracts and B2C subscriptions.

- •

Entrenched position in the financial ecosystem makes its data indispensable for lenders.

Weaknesses

- •

Consumer-facing revenue is a smaller portion of the business and faces intense competition.

- •

Pricing for B2B services is opaque and complex, potentially creating friction for smaller clients.

- •

Reputational damage from the 2017 data breach may suppress consumer willingness to pay for premium services.

Opportunities

- •

Expand 'The Work Number' into new verticals and geographies.

- •

Leverage AI and ML to create new, premium analytical products from existing data.

- •

Develop more sophisticated solutions for emerging fintech and digital economy clients.

- •

Monetize data through new channels like data marketplaces and partnerships.

Threats

- •

Increased regulatory scrutiny on data monetization and consumer privacy could limit revenue opportunities.

- •

Competition from fintechs using alternative data and new credit scoring models.

- •

Economic downturns that reduce lending and hiring volumes directly impact core revenue streams.

Market Positioning

Indispensable Data & Analytics Partner

Major Player / Oligopoly (One of the 'Big Three' credit bureaus with Experian and TransUnion).

Target Segments

- Segment Name:

B2B - Financial Services & Lenders

Description:Banks, credit unions, mortgage originators, auto lenders, and fintech companies that require data for credit risk assessment, underwriting, and portfolio management.

Demographic Factors

Varying sizes from regional banks to multinational financial institutions.

Psychographic Factors

- •

Risk-averse

- •

Highly regulated

- •

Focused on efficiency and accuracy in decision-making.

Behavioral Factors

- •

High-volume, automated data consumption via APIs.

- •

Requires deep integration into their loan origination systems (LOS).

- •

Long-term contractual relationships.

Pain Points

- •

Minimizing loan defaults.

- •

Preventing application fraud.

- •

Complying with lending regulations (e.g., FCRA).

- •

Quickly and accurately verifying applicant income and employment.

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

B2B - Employers & HR Departments

Description:Large to small enterprises requiring services for pre-employment screening, I-9 management, and unemployment claims.

Demographic Factors

Companies across all industries and sizes.

Psychographic Factors

Focused on compliance and operational efficiency.

Desire to reduce administrative burden on HR teams.

Behavioral Factors

Utilizes platform-based services.

Integrates with existing HRIS and payroll systems.

Pain Points

- •

Time-consuming manual verification processes.

- •

Compliance with employment eligibility regulations.

- •

Managing unemployment claims effectively.

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Individual Consumers

Description:Financially-aware adults seeking to monitor their credit, protect themselves from identity theft, and manage their financial health, especially during major life events like buying a home or car.

Demographic Factors

- •

Adults, typically homeowners or aspiring homeowners.

- •

Higher digital literacy.

- •

Often grouped into individual, couple, or family units.

Psychographic Factors

- •

Value security and peace of mind.

- •

Proactive about financial planning.

- •

Concerned about the risk of identity fraud.

Behavioral Factors

- •

Subscribes to digital services.

- •

Engages with mobile applications.

- •

Responds to alerts and notifications about their financial data.

Pain Points

- •

Fear of identity theft and financial fraud.

- •

Lack of visibility and control over their personal credit data.

- •

Complexity of the credit and lending ecosystem.

Fit Assessment:Good

Segment Potential:Medium

Market Differentiation

- Factor:

Proprietary 'The Work Number' Database

Strength:Strong

Sustainability:Sustainable

- Factor:

Breadth of B2B Service Offerings

Strength:Strong

Sustainability:Sustainable

- Factor:

Direct-to-Consumer Brand Recognition

Strength:Moderate

Sustainability:Sustainable

- Factor:

Global Data Footprint

Strength:Moderate

Sustainability:Sustainable

Value Proposition

For businesses, we provide unique, trusted data and advanced analytics to power critical decisions, mitigate risk, and drive growth. For consumers, we offer the tools and protection to help them manage their financial well-being and live their financial best.

Good

Key Benefits

- Benefit:

Automated Income & Employment Verification

Importance:Critical

Differentiation:Unique

Proof Elements

The Work Number database with data from millions of employers.

- Benefit:

Comprehensive Credit Risk Assessment

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Access to credit data on hundreds of millions of consumers.

- Benefit:

Identity Theft Protection & Monitoring

Importance:Important

Differentiation:Common

Proof Elements

Credit report locking, alerts, and up to $1MM in ID theft insurance.

Unique Selling Points

- Usp:

The Work Number database is the largest commercial repository of payroll information, a nearly impossible-to-replicate asset that creates a significant competitive moat.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Integration of diverse datasets (credit, employment, utility, public records) provides a more holistic view for risk and marketing analytics than competitors who may focus primarily on credit.

Sustainability:Medium-term

Defensibility:Moderate

- Usp:

End-to-end cloud-based platform (Equifax Ignite) that allows enterprise clients to combine Equifax data with their own for faster, AI-driven decision modeling.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Lenders need to quickly and reliably verify a loan applicant's ability to repay.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Businesses need to mitigate the risk of fraud in an increasingly digital environment.

Severity:Critical

Solution Effectiveness:Partial

- Problem:

Consumers are anxious about identity theft and want proactive monitoring and protection.

Severity:Major

Solution Effectiveness:Complete

- Problem:

HR departments spend excessive time manually responding to verification requests.

Severity:Major

Solution Effectiveness:Complete

Value Alignment Assessment

High

Equifax's core services are deeply embedded and essential to the functioning of the credit, lending, and employment markets. Their evolution into a broader data and analytics provider aligns with the market's increasing demand for data-driven decisioning.

High

The value propositions are precisely aligned with the critical pain points of their B2B and B2C target segments, from risk mitigation for banks to peace of mind for consumers.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Data Furnishers (Banks, Lenders, Payroll Processors like ADP, Utilities)

- •

Technology Partners (Cloud providers like Google Cloud, Analytics firms like FICO, Platform integrators like Salesforce).

- •

Resellers and Channel Partners

- •

Government Agencies

Key Activities

- •

Data Acquisition, Aggregation, and Management

- •

Predictive Modeling and Analytics

- •

Platform Development and Maintenance (Equifax Cloud)

- •

Cybersecurity and Compliance Management

- •

Enterprise Sales and B2C Marketing

Key Resources

- •

Proprietary Databases (The Work Number, credit files).

- •

Data Analytics and AI/ML capabilities.

- •

Global Technology Infrastructure (Equifax Cloud)

- •

Regulatory Compliance Expertise

- •

Established Brand and Customer Relationships

Cost Structure

- •

Technology Infrastructure and Cloud Transformation ($1.5B+ investment).

- •

Personnel (Data Scientists, Engineers, Sales)

- •

Cybersecurity and Data Protection

- •

Regulatory, Legal, and Compliance Costs

- •

Marketing and Sales

Swot Analysis

Strengths

- •

Dominant market position in an oligopolistic industry.

- •

Unique and highly defensible proprietary data assets, especially 'The Work Number'.

- •

Diversified B2B revenue streams across multiple industries and geographies.

- •

Deeply integrated into the operational workflows of the financial services industry.

Weaknesses

- •

Significant reputational damage and loss of consumer trust following the 2017 data breach.

- •

High ongoing costs and risks associated with cybersecurity and data privacy compliance.

- •

Potential for data inaccuracies leading to consumer disputes and regulatory action.

Opportunities

- •

Expansion of verification services beyond income/employment to include assets, education, etc.

- •

Leveraging the completed cloud transformation to accelerate new product development using AI/ML.

- •

Strategic acquisitions to enter new data verticals or geographic markets.

- •

Growth in the identity and fraud prevention market as digital transactions increase.

Threats

- •

Increasing competition from fintechs leveraging alternative data and open banking to bypass traditional credit bureaus.

- •

Heightened regulatory oversight and potential for new data privacy laws that restrict data usage.

- •

The constant and evolving threat of major cybersecurity breaches.

- •

Macroeconomic slowdowns that reduce credit and hiring volumes, directly impacting core business.

Recommendations

Priority Improvements

- Area:

Brand Trust & Consumer Experience

Recommendation:Launch a sustained, transparent marketing campaign focused on new security measures and pro-consumer tools. Simplify the consumer dispute process to be best-in-class, turning a historical pain point into a competitive advantage.

Expected Impact:High

- Area:

Data Asset Integration

Recommendation:Accelerate the integration of disparate B2B data assets (credit, commercial, workforce) on the Equifax Cloud to create novel, blended data products that are difficult for competitors to replicate.

Expected Impact:High

- Area:

Fintech and SME Engagement

Recommendation:Develop a streamlined, API-first offering with more transparent pricing to better capture the high-growth fintech and small/medium enterprise (SME) markets, which are currently underserved by complex enterprise contracts.

Expected Impact:Medium

Business Model Innovation

- •

Evolve the B2C model from simple monitoring to a comprehensive 'Personal Data Vault' where consumers can securely manage and grant permissioned access to their verified data (credit, income, identity) for a fee, shifting from a protection model to an empowerment model.

- •

Develop a 'Risk-as-a-Service' consulting arm that leverages proprietary data and analytics expertise to provide strategic advisory services to large enterprises on market entry, portfolio risk, and fraud trends.

- •

Create an 'Alternative Data Incubator' to partner with or acquire startups in emerging data fields (e.g., rental payments, gig economy income, telco data) to stay ahead of market shifts.

Revenue Diversification

- •

Expand further into Workforce Solutions by offering adjacent HR technology services, such as talent analytics, compensation benchmarking, or compliance management tools.

- •

Build out the Data-driven Marketing services by offering more sophisticated audience segmentation and attribution modeling, competing more directly with specialized marketing analytics firms.

- •

Offer data infrastructure and analytics platforms as a white-label service to large international partners in markets where Equifax does not have a direct presence.

Equifax's business model is in a pivotal stage of evolution. While its foundation remains the deeply entrenched and highly profitable B2B data services, the strategic imperative has clearly shifted towards the Workforce Solutions segment, centered on the unparalleled 'The Work Number' asset. This segment is the primary engine for growth and competitive differentiation, insulating Equifax from the increasing commoditization of basic credit data. The massive, multi-year investment in a unified cloud platform is the core enabler for future strategy, designed to accelerate the development of new, AI-driven analytical products and facilitate the integration of its disparate data assets. This technological shift is crucial for defending against nimble fintech competitors who leverage alternative data and more modern tech stacks. The primary challenge is not operational but reputational. The shadow of the 2017 data breach necessitates a dual focus: fortifying cybersecurity to prevent a recurrence and rebuilding trust, particularly in its smaller but still important B2C segment. Future success hinges on three key pillars: 1) Maximizing the moat around Workforce Solutions by expanding its data sources and applications. 2) Leveraging the new cloud infrastructure to innovate faster and create blended data products that competitors cannot match. 3) Successfully navigating the complex landscape of data privacy regulations and cybersecurity threats. The business model is robust and positioned for steady, defensible growth, but its full potential can only be unlocked by transforming from a traditional data repository into a trusted, agile, and indispensable analytics partner for the digital economy.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Vast and Proprietary Datasets

Impact:High

- Barrier:

High Regulatory Compliance Costs (e.g., FCRA)

Impact:High

- Barrier:

Established Relationships with Lenders

Impact:High

- Barrier:

Significant Capital Investment in Technology & Security

Impact:High

- Barrier:

Brand Recognition and Trust

Impact:Medium

Industry Trends

- Trend:

Integration of Alternative Data Sources

Impact On Business:Potential to disrupt traditional credit scoring models; opportunity to serve 'credit invisible' populations.

Timeline:Near-term

- Trend:

Increased Use of AI and Machine Learning

Impact On Business:Enhances predictive power of credit models, improves fraud detection, and enables more personalized B2B and B2C products.

Timeline:Immediate

- Trend:

Growing Consumer Demand for Data Privacy and Control

Impact On Business:Requires significant investment in security and transparency; regulatory pressure is increasing, posing both compliance risks and opportunities to build trust.

Timeline:Immediate

- Trend:

Digital Transformation in Financial Services

Impact On Business:Drives demand for real-time data, verification services, and fraud prevention, benefiting Equifax's B2B segment.

Timeline:Immediate

- Trend:

Rise of 'Freemium' B2C Models

Impact On Business:Commoditizes basic credit score access, forcing a shift in B2C value propositions toward premium monitoring and identity theft protection.

Timeline:Near-term

Direct Competitors

- →

Experian

Market Share Estimate:Leading competitor, often cited as the largest of the 'Big Three' by revenue.

Target Audience Overlap:High

Competitive Positioning:Positions itself as a global leader in data and analytics, with a strong focus on innovation and consumer-facing tools like Experian Boost.

Strengths

- •

Strong global presence and brand recognition.

- •

Innovative consumer-facing products like 'Experian Boost' which incorporates on-time utility payments.

- •

Diversified revenue streams across B2B data, analytics, and B2C services.

- •

Significant investment in data and analytics technology.

Weaknesses

- •

Faces similar reputational risks from data breaches and public scrutiny as other bureaus.

- •

B2C subscription model is challenged by free alternatives.

- •

Complex product offerings can be confusing for consumers.

Differentiators

Experian Boost offers a unique way for consumers to potentially increase their credit scores.

Stronger market position in certain international markets, like Brazil.

- →

TransUnion

Market Share Estimate:The smallest of the 'Big Three' but a formidable competitor with strong growth.

Target Audience Overlap:High

Competitive Positioning:Focuses on providing 'Information for Good,' positioning itself as a consumer-friendly and innovative data provider.

Strengths

- •

Strong focus on consumer-empowerment tools and user-friendly platforms.

- •

Agile and often seen as more innovative in adopting new technologies.

- •

Robust business services, particularly noted for business credit monitoring.

- •

Offers a free identity protection service, TrueIdentity.

Weaknesses

- •

Slightly smaller scale and data breadth compared to Experian and Equifax.

- •

Less international diversification compared to Experian.

- •

Vulnerable to the same market pressures and reputational risks as its peers.

Differentiators

Emphasis on a user-friendly consumer experience and educational resources.

Strong suite of services for businesses, including fraud detection and marketing solutions.

Indirect Competitors

- →

Credit Karma (Intuit)

Description:A fintech company offering free credit scores, reports, and monitoring from TransUnion and Equifax. Monetizes by providing targeted advertising and recommendations for financial products.

Threat Level:High

Potential For Direct Competition:Low, as their business model is symbiotic with the bureaus. However, they have captured a massive user base, disintermediating the bureaus' direct relationship with consumers and commoditizing the core B2C offering (credit scores).

- →

LifeLock (by Norton)

Description:A specialized identity theft protection service offering comprehensive monitoring, alerts, and insurance.

Threat Level:High

Potential For Direct Competition:They are a direct competitor for the identity theft protection component of Equifax's consumer plans. Their brand is singularly focused on security, which can be a powerful advantage.

- →

Aura

Description:A digital security company that bundles identity theft protection, credit monitoring (often 3-bureau), and device security (VPN, antivirus) into a single subscription.

Threat Level:Medium

Potential For Direct Competition:A strong competitor in the consumer protection space, offering a more holistic 'digital safety' value proposition than the credit-focused bureaus.

- →

Dun & Bradstreet

Description:A major player in the B2B data and analytics space, focusing on commercial credit reporting, business information, and sales/marketing solutions.

Threat Level:Medium

Potential For Direct Competition:Directly competes with Equifax's 'Commercial' B2B offerings by providing data and risk assessment tools for businesses evaluating other businesses.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Proprietary Data Assets

Sustainability Assessment:The historical depth and breadth of consumer and commercial credit data are nearly impossible for a new entrant to replicate.

Competitor Replication Difficulty:Hard

- Advantage:

Workforce Solutions (The Work Number)

Sustainability Assessment:This unique and massive database of income and employment data provides a highly differentiated, high-margin service for verification that is a core B2B strength.

Competitor Replication Difficulty:Hard

- Advantage:

Embedded position in the financial ecosystem

Sustainability Assessment:Deeply integrated into the automated decision-making processes of virtually all lenders, creating high switching costs.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'Specific Product Pricing or Bundles', 'estimated_duration': 'Short-term (3-12 months)'}

{'advantage': 'Exclusive Marketing Partnerships', 'estimated_duration': 'Medium-term (1-3 years)'}

Disadvantages

- Disadvantage:

Damaged Brand Trust and Reputation

Impact:Critical

Addressability:Difficult

- Disadvantage:

Perception as a Legacy Player vs. Agile Fintechs

Impact:Major

Addressability:Moderately

- Disadvantage:

Complex B2C Product Tiers and Value Proposition

Impact:Minor

Addressability:Easily

Strategic Recommendations

Quick Wins

- Recommendation:

Simplify B2C product messaging to clearly articulate the value beyond the free credit score, focusing on identity restoration services and 3-bureau monitoring.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Launch a marketing campaign highlighting the unique power and security of the Workforce Solutions (The Work Number) B2B offering to reinforce competitive differentiation.

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Invest heavily in a sustained brand trust campaign focused on security enhancements, transparency, and consumer data control.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Develop a suite of B2B solutions specifically tailored for Small and Medium-sized Businesses (SMBs), offering simplified, scalable risk management tools.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Expand partnerships with fintechs to provide data-as-a-service, embracing their role as an infrastructure player rather than competing for the primary consumer interface.

Expected Impact:Medium

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Acquire or build capabilities in alternative data (e.g., rental payments, utility data) to create next-generation credit scores that promote financial inclusion and defend against disruptors.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Develop a 'personal data vault' product that gives consumers direct control and visibility over their data, potentially monetizing through secure data sharing permissions.

Expected Impact:High

Implementation Difficulty:Difficult

Reposition Equifax as the most trusted and secure steward of financial data. In B2B, be the indispensable data and analytics partner for risk management and growth. In B2C, be the premium, comprehensive solution for identity protection and financial well-being, moving beyond just credit monitoring.

Differentiate primarily through unique, hard-to-replicate data assets like Workforce Solutions. Compete on the depth and sophistication of B2B analytics and fraud prevention, while using a superior, full-service identity restoration guarantee to justify the premium B2C product against free and specialized alternatives.

Whitespace Opportunities

- Opportunity:

Proactive Financial Wellness Tools for Consumers

Competitive Gap:Direct competitors and fintechs are largely reactive (monitoring) or product-focused (loans/cards). A service that uses Equifax's data to provide predictive, personalized financial guidance is a gap.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Simplified Risk Management Platform for SMBs

Competitive Gap:Enterprise-grade B2B tools are too complex and expensive for many small businesses, who are often underserved or rely on basic checks.

Feasibility:High

Potential Impact:High

- Opportunity:

Data Solutions for the 'Credit Invisible'

Competitive Gap:Serving the unbanked or those with thin credit files requires alternative data, which traditional models lack. This addresses a major societal and market need.

Feasibility:Medium

Potential Impact:High

- Opportunity:

API-First 'Identity-as-a-Service' for Businesses

Competitive Gap:While fraud tools exist, a simple, developer-friendly platform that bundles identity verification, authentication, and risk assessment could win share in the tech and e-commerce sectors.

Feasibility:Medium

Potential Impact:Medium

Equifax operates within a mature, oligopolistic market dominated by itself, Experian, and TransUnion. The primary competitive advantages for these incumbents are their vast, proprietary datasets and deep integration into the global financial system, creating formidable barriers to entry.

Equifax's competitive landscape is bifurcated. On the B2B side, it competes directly with Experian and TransUnion, offering sophisticated data, analytics, verification, and fraud prevention services. Here, Equifax's key differentiator is its Workforce Solutions ('The Work Number') database, a unique and powerful asset for income and employment verification. However, it also faces competition from specialized data providers like Dun & Bradstreet in the commercial credit space.

On the B2C side, the landscape is far more fragmented and threatened. While Experian and TransUnion are direct competitors, the larger threat comes from indirect and disruptive forces. Fintech companies like Credit Karma have successfully commoditized basic credit score access, offering it for free and fundamentally eroding the value proposition of paid monitoring services. This forces Equifax to compete on premium features like 3-bureau monitoring and, more importantly, identity theft protection. In this arena, it faces specialized and trusted security brands like LifeLock (Norton) and Aura, which often offer more comprehensive identity monitoring features and higher insurance payouts.

The most significant competitive disadvantage for Equifax is the lingering, severe damage to its brand trust following the 2017 data breach. This makes it particularly challenging to compete in the B2C security space against brands built entirely on trust and protection.

Strategic opportunities lie in leveraging its core data advantages in new ways. There is a significant whitespace for tailored SMB solutions, as enterprise tools are often too complex for this segment. Furthermore, developing capabilities with alternative data sources is crucial for long-term growth and to address the 'credit invisible' population, defending against fintech disruptors who are already moving into this space. The ultimate strategic imperative is to shift the B2C narrative from simple credit monitoring to comprehensive identity and financial protection, while doubling down on the unique data assets that provide a sustainable advantage in the more profitable B2B market.

Messaging

Message Architecture

Key Messages

- Message:

Your Credit. Your Identity.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Section (Consumer)

- Message:

We monitor your Equifax credit report, provide you with alerts, and help you recover from ID theft so you can focus on living your financial best.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Section (Consumer)

- Message:

Delivering a better customer experience and smarter revenue

Prominence:Primary

Clarity Score:Medium

Location:Homepage Hero Section (Business)

- Message:

Driving more informed decisions to deliver exceptional outcomes

Prominence:Secondary

Clarity Score:Medium

Location:Homepage Hero Section (Business)

- Message:

Reach your financial goals

Prominence:Secondary

Clarity Score:High

Location:Homepage Mid-page Section (Consumer)

The messaging hierarchy is clearly and effectively bifurcated between the consumer and business audiences. On the consumer homepage, the primary focus is squarely on selling paid subscription products for credit monitoring and identity theft protection. 'Free' services are deprioritized visually. On the business page, the hierarchy is organized by solution type (Credit Risk, Verification, etc.), which is logical for a business user, but the sheer volume of links under each tab can dilute the primary message.

Messaging is highly consistent within its respective audience tracks (B2C vs. B2B). The consumer side consistently uses language of personal finance, protection, and security. The business side consistently uses language of revenue growth, risk mitigation, and operational efficiency. There is a clear strategic separation that maintains consistency for each target audience.

Brand Voice

Voice Attributes

- Attribute:

Direct

Strength:Strong

Examples

- •

$9.95 / month. Cancel at any time.

- •

Sign Up Now

- •

Get a Free Credit Report

- Attribute:

Authoritative

Strength:Strong

Examples

Driving more informed decisions to deliver exceptional outcomes

Make better credit decisions and expand access to credit with data and analytics only Equifax can deliver.

- Attribute:

Cautionary

Strength:Moderate

Examples

Don't fall prey to identity theft

Find out how identity theft happens, and whether you or your loved ones may be at risk.

- Attribute:

Aspirational

Strength:Moderate

Examples

...so you can focus on living your financial best.

Reach your financial goals

Tone Analysis

Transactional and Informative

Secondary Tones

Fear-mitigating

Goal-oriented

Tone Shifts

The tone shifts significantly between the consumer and business pages, from personal and protective to corporate and results-driven. This is appropriate audience segmentation.

On the consumer page, the tone shifts from product-focused (selling subscriptions) to service-oriented (offering free reports, freezes), which can feel slightly disjointed.

Voice Consistency Rating

Good

Consistency Issues

The highly transactional and direct voice on the consumer page sometimes undercuts the more aspirational and reassuring messages. The focus is heavily on the 'what' (the product) and less on the 'why' (the feeling of security).

Value Proposition Assessment

For consumers: We provide comprehensive monitoring and protection for your credit and identity, giving you peace of mind. For businesses: We provide differentiated data, analytics, and technology to help you make smarter decisions, reduce risk, and drive revenue.

Value Proposition Components

- Component:

Credit & Identity Monitoring (Consumer)

Clarity:Clear

Uniqueness:Common

- Component:

Identity Restoration & Insurance (Consumer)

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Data for Credit Risk Assessment (Business)

Clarity:Clear

Uniqueness:Common

- Component:

Income & Employment Verification (Business)

Clarity:Clear

Uniqueness:Unique

- Component:

Data-driven Marketing Solutions (Business)

Clarity:Clear

Uniqueness:Somewhat Unique

The website messaging does not strongly differentiate Equifax from its primary competitors like Experian and TransUnion, especially on the consumer side where product offerings are very similar. The business side's value proposition is stronger, particularly around its comprehensive data assets for verification and marketing, which are presented as more than just credit data. However, the unique value of 'data and analytics only Equifax can deliver' is asserted but not substantively proven in the homepage messaging.

Equifax positions itself as an essential data and technology partner for both individuals and businesses. For consumers, it's a direct-to-consumer security provider. For businesses, it's a strategic partner for growth and risk management. This dual positioning is standard for the industry. The messaging implicitly positions them as a necessary utility in the modern economy, though it avoids addressing the trust deficit resulting from the 2017 data breach.

Audience Messaging

Target Personas

- Persona:

The Security-Conscious Consumer/Family

Tailored Messages

- •

Get robust identity theft protection and feel more secure from fraud

- •

Don't fall prey to identity theft

- •

EQUIFAX COMPLETE™ Family Plan

Effectiveness:Effective

- Persona:

The Financial Goal-Setter (Consumer)

Tailored Messages

- •

Reach your financial goals

- •

Plan your next big purchase

- •

New Explore Credit Offers

Effectiveness:Somewhat Effective

- Persona:

The Business Risk Manager (Lending, Fraud)

Tailored Messages

- •

Make better credit decisions and expand access to credit

- •

We’ll help you fight fraud at every stage of the customer journey

- •

Uncover Hidden Risks and Opportunities

Effectiveness:Effective

- Persona:

The Corporate Growth Leader (Marketing, HR)

Tailored Messages

Marketing solutions to find and grow relationships with the right customers

Helping HR save time with High-Powered HR Management Services

Effectiveness:Effective

Audience Pain Points Addressed

- •

Fear of identity theft and financial fraud.

- •

Uncertainty about credit health and its impact on major life purchases.

- •

Difficulty for businesses in assessing customer credit risk.

- •

Challenges in verifying income and employment for lending or hiring.

- •

Inefficiency in HR processes and tax form management.

- •

Struggle to target the right marketing audiences with financial capacity.

Audience Aspirations Addressed

- •

Living your financial best.

- •

Achieving major life milestones like buying a home or car.

- •

Driving smarter revenue and achieving exceptional business outcomes.

- •

Delivering a better customer experience.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Fear & Anxiety

Effectiveness:High

Examples

Don't fall prey to identity theft

Get robust identity theft protection and feel more secure from fraud

- Appeal Type:

Security & Peace of Mind

Effectiveness:Medium

Examples

We monitor your Equifax credit report, provide you with alerts, and help you recover from ID theft

Up to $1MM in ID theft insurance

- Appeal Type:

Aspiration & Achievement

Effectiveness:Medium

Examples

Reach your financial goals

Driving more informed decisions to deliver exceptional outcomes

Social Proof Elements

{'proof_type': 'None Present', 'impact': 'Weak'}

Trust Indicators

- •

Brand Recognition: The 'Equifax' name itself is a primary, albeit tarnished, trust indicator.

- •

Specificity: Mentioning '$1MM in ID theft insurance' adds a tangible layer of assurance.

- •

Transparency (Legal): Detailed footnotes and legal disclaimers, while dense, signal a regulated and formal business.

- •

Professional Design: The clean, corporate design of the website conveys professionalism.

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

Sign Up Now

Location:Homepage Hero and Product Sections (Consumer)

Clarity:Clear

- Text:

Learn More

Location:Product Sections (Consumer)

Clarity:Clear

- Text:

View All Credit Risk

Location:Product Tabs (Business)

Clarity:Clear

- Text:

Get a Free Credit Report

Location:Mid-page section (Consumer)

Clarity:Clear

The CTAs are generally clear and direct. For consumers, the persistent 'Sign Up Now' buttons effectively drive users toward the primary conversion goal of paid subscriptions. However, the placement of 'Get a Free Credit Report' is secondary, reflecting a business priority to sell products over providing mandated free services. For business users, the CTAs are specific but the sheer quantity under each tab could lead to choice paralysis.

Messaging Gaps Analysis

Critical Gaps

- •

Trust Rebuilding Narrative: The most significant messaging gap is the complete absence of any language addressing the 2017 data breach. There is no acknowledgment of past failures or a forward-looking message about enhanced security, which is critical for a data security company with a history of a major breach.

- •

Social Proof: There are no customer testimonials, case studies, partner logos, or trust badges. This is a major missed opportunity to build credibility and third-party validation.

- •

Brand-level Differentiation: The messaging fails to articulate a compelling reason to choose Equifax over its direct competitors. The value is communicated at a product-feature level, not a brand-promise level.

Contradiction Points

The core value proposition of protecting customer data is in direct conflict with the public's memory of the massive 2017 data breach. Selling security without acknowledging and addressing this history creates significant cognitive dissonance and undermines trust.

Underdeveloped Areas

Storytelling: The brand does not tell a story. The messaging is functional and transactional. There's no narrative about why they do what they do, their commitment to security, or how they've helped individuals or businesses succeed.

Emotional Connection: Beyond the use of fear, the messaging does little to build a positive emotional connection with the user. The tone is largely corporate and impersonal.

Messaging Quality

Strengths

- •

Clear audience segmentation between consumer and business websites.

- •

Direct and unambiguous calls-to-action.

- •

Logical information architecture on the business page, organized by solution.

- •

Effective use of fear and security motivators to frame the problem for consumers.

Weaknesses

- •

Fails to address the historical data breach, creating a major trust deficit.

- •

Lack of social proof (testimonials, case studies) weakens credibility.

- •

Weak brand differentiation from key competitors like Experian and TransUnion.

- •

Overly transactional tone on the consumer page prioritizes sales over building relationships.

Opportunities

- •

Create a dedicated 'Trust & Security' messaging pillar to proactively address the breach and detail current security investments and practices.

- •

Integrate customer success stories and business case studies to provide tangible proof of value.

- •

Develop a stronger brand narrative focused on empowerment and progress, moving beyond just fear-based messaging.

- •

Humanize the brand voice to build a stronger emotional connection and rapport with consumers.

Optimization Roadmap

Priority Improvements

- Area:

Trust & Transparency

Recommendation:Develop a prominent 'Our Commitment to Security' section or messaging pillar on the website. This should proactively address the past, detail current best-in-class security measures, and outline the company's philosophy on data stewardship.

Expected Impact:High

- Area:

Social Proof Integration

Recommendation:Incorporate consumer testimonials on the consumer page and detailed case studies with quantifiable results (e.g., 'Client X improved fraud detection by 30%') on the business pages.

Expected Impact:High

- Area:

Value Proposition

Recommendation:Sharpen the core value proposition to highlight a unique differentiator. If it's the Workforce Solutions data, make that a more heroic part of the B2B story. For consumers, focus on a unique benefit beyond the standard features.

Expected Impact:Medium

Quick Wins

- •

Add trust badges or security certification logos (e.g., ISO 27001, SOC 2) if applicable.

- •

A/B test aspirational headlines against the current fear-based headlines on the consumer page.

- •

Feature a short, impactful customer quote on the homepage.

Long Term Recommendations

- •

Undertake a brand messaging refresh to build a new narrative centered on being an indispensable and trustworthy partner for financial progress and security.

- •

Invest in content marketing (blogs, whitepapers, webinars) that demonstrates expertise and builds credibility, rather than just selling products.

- •

Rethink the consumer homepage user experience to balance the sale of paid products with the provision of helpful resources and free services to build goodwill.

Equifax's strategic messaging is a study in bifurcation and omission. The company does an effective job of separating its B2C and B2B audiences, tailoring its voice, value propositions, and calls-to-action appropriately for each. The consumer messaging leans heavily on the emotional drivers of fear and the promise of security to sell subscription products, while the business messaging adopts an authoritative, results-oriented tone focused on risk mitigation and revenue generation.

The primary and most critical weakness is the complete failure to address the reputational damage from the 2017 data breach. For a company whose core product is data security and trust, this omission is a significant strategic flaw. It creates a credibility gap that undermines every claim of protection and security. The messaging operates as if the breach never happened, leaving the user's primary unspoken question—'Why should I trust you with my data?'—unanswered. This forces the brand to compete solely on product features, where it shows little differentiation from competitors like Experian and TransUnion.

Furthermore, the strategy is overly reliant on functional, transactional communication and lacks persuasive storytelling and social proof. There are no testimonials or case studies to validate claims, forcing the user to take Equifax at its word—a difficult proposition given its history. While the messaging is clear and the site architecture is logical, it is not compelling. It successfully informs users what Equifax sells, but it fails to build the deep trust necessary to create brand preference and long-term customer loyalty in a highly sensitive industry.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Established as one of the 'Big Three' credit bureaus, a critical component of the financial infrastructure.

- •

Diversified revenue streams across B2B (Workforce Solutions, USIS, International) and B2C (credit monitoring) segments.

- •

The Workforce Solutions segment is a key growth driver, with its unique employment and income data creating a strong competitive moat and showing consistent revenue growth (10% in verification services in Q4 2024).

- •

Continuous demand for credit risk, identity verification, and fraud prevention services from a wide range of industries, as shown on their business solutions portal.

Improvement Areas

- •

Rebuilding and reinforcing consumer trust following the 2017 data breach.

- •

Enhancing the user experience and value proposition of B2C subscription products to compete with 'free' models from fintech challengers.

- •

Improving transparency in data collection and scoring methodologies to address consumer and regulatory concerns.

Market Dynamics

Credit Bureaus Market: ~11.5% CAGR to 2029. Data Analytics Market: ~25.5% CAGR to 2032. Identity Theft Protection Market: ~10-13% CAGR.

Mature

Market Trends

- Trend:

Increased adoption of AI/ML for advanced analytics, predictive scoring, and fraud detection.

Business Impact:Opportunity to develop premium, AI-driven products for B2B clients. Requires significant investment in technology and data science talent to maintain a competitive edge.

- Trend:

Integration of alternative data sources (e.g., rent payments, utility bills) to score thin-file or credit-invisible consumers.

Business Impact:Potential to expand the total addressable market and promote financial inclusion. Creates complexity in data acquisition and modeling.

- Trend:

Stricter data privacy and security regulations (e.g., GDPR, CCPA, FCRA).

Business Impact:Increases compliance costs and operational complexity. However, demonstrating robust compliance can become a competitive advantage and rebuild trust.

- Trend:

Disruption from fintech companies offering new credit products (BNPL), free credit scores, and alternative underwriting models.

Business Impact:Threatens traditional revenue models, especially in the B2C space. Creates opportunities for partnership and data provision to these same fintechs.

Favorable for Growth. While the core market is mature, the demand for sophisticated data, verification services, and digital identity solutions is accelerating, creating significant growth adjacencies.

Business Model Scalability

High

High fixed costs (technology infrastructure, data acquisition, security, compliance) and very low marginal costs for delivering data products, leading to high potential for operating leverage.

High. Once data assets and platforms are established, incremental revenue from selling data access and analytics flows efficiently to the bottom line, particularly in the Workforce Solutions segment.

Scalability Constraints

- •

Massive and continuous investment required in cybersecurity to prevent data breaches.

- •

Complexity and cost of complying with a fragmented landscape of global data privacy regulations.

- •

Technical debt from legacy systems can slow down innovation and integration of acquisitions.

Team Readiness

Experienced leadership team accustomed to operating a large, global, publicly-traded company in a highly regulated industry.

Complex, siloed structure typical of large corporations, which can be a barrier to agile, cross-functional growth initiatives. Strategic shift to cloud-based platforms (EFX Cloud) aims to break down some of these silos.

Key Capability Gaps

- •

Agile, product-led growth (PLG) expertise to develop self-service B2B products.

- •

Top-tier AI and Machine Learning talent to compete with tech-native firms.

- •

Modern B2C digital marketing and user experience (UX) design to enhance the consumer-facing business.

Growth Engine

Acquisition Channels

- Channel:

B2B Direct Sales & Enterprise Partnerships

Effectiveness:High

Optimization Potential:Medium

Recommendation:Equip sales teams with industry-specific, AI-driven insights and solutions. Deepen integrations with key technology platforms (e.g., loan origination systems, HCM platforms).

- Channel:

B2C Digital Marketing (SEO/SEM)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Shift from generic 'credit score' focus to content marketing around financial wellness, identity security, and life milestones. Focus SEO on long-tail keywords related to specific financial goals.

- Channel:

B2B2C & Affiliate Partnerships

Effectiveness:Medium

Optimization Potential:High

Recommendation:Expand partnerships with fintech apps, financial institutions, and employee benefits platforms to offer Equifax products as a value-added service to their customers.

Customer Journey

For B2C, the website presents a clear tiered subscription model. For B2B, the site acts as a lead generation portal directing users to specific industry and solution pages, followed by a sales-led process.

Friction Points

- •

Lingering consumer distrust from the 2017 data breach.

- •

Value proposition ambiguity for paid B2C plans versus free alternatives.

- •

Complex navigation on the B2B side to find the exact data solution needed for a specific problem.

Journey Enhancement Priorities

{'area': 'B2B Self-Service Onboarding', 'recommendation': 'Develop an API-first portal with a developer sandbox to allow smaller businesses and fintechs to experiment with and purchase data services with minimal sales interaction.'}

{'area': 'B2C Trust Building', 'recommendation': 'Prominently feature content, certifications, and testimonials related to security investments and data protection practices throughout the sign-up funnel.'}

Retention Mechanisms

- Mechanism:

Deep B2B System Integration

Effectiveness:High

Improvement Opportunity:Proactively use data analytics to show clients the ROI of Equifax services and identify opportunities for them to leverage additional datasets.

- Mechanism:

Proprietary Data Assets (e.g., The Work Number)

Effectiveness:High

Improvement Opportunity:Continuously expand the breadth and depth of unique datasets to increase customer dependency and create a stronger network effect.

- Mechanism:

B2C Subscription Model

Effectiveness:Medium

Improvement Opportunity:Increase perceived value by adding more personalized insights, financial wellness tools, and proactive alerts that go beyond basic credit monitoring.

Revenue Economics

Strong, particularly for the B2B segments. The high-margin, recurring revenue nature of data and verification services (e.g., Workforce Solutions EBITDA margin >50%) drives profitability.

Undeterminable from public data, but expected to be very high for enterprise B2B clients due to long contract terms and deep integration. Moderate for B2C, requiring careful management of marketing spend.

High. The company is demonstrating consistent revenue growth (7.9% in 2024, projected 4.7%+ in 2025) even in challenging macroeconomic environments like weak mortgage and hiring markets, showcasing the resilience of its business model.

Optimization Recommendations

- •

Focus on cross-selling and up-selling higher-margin analytics and AI-driven solutions to the existing B2B customer base.

- •

Optimize B2C pricing and bundling strategies to increase Annual Recurring Revenue (ARR) per user.

- •

Drive adoption of lower-cost self-service channels for smaller B2B customers.

Scale Barriers

Technical Limitations

- Limitation:

Legacy Technology Stack

Impact:Medium

Solution Approach:Continued migration to the unified 'Equifax Cloud' platform to improve agility, data integration, and innovation speed. The company reports 85% of revenue is now from the EFX Cloud.

- Limitation:

Cybersecurity Threats

Impact:High

Solution Approach:Massive, ongoing investment in a multi-layered security infrastructure, advanced threat detection, and a culture of security. This is a permanent cost of doing business and a potential drag on resources for growth.

Operational Bottlenecks

- Bottleneck:

Navigating Global Regulatory Complexity

Growth Impact:Slows international expansion and product development due to the need for localized legal and compliance review.

Resolution Strategy:Invest in 'RegTech' solutions and build strong in-house legal and compliance teams in key regions. Design products with privacy-by-design principles.

- Bottleneck:

Long Enterprise Sales Cycles

Growth Impact:Can create lumpy revenue and high customer acquisition costs for large B2B deals.

Resolution Strategy:Develop a product-led growth (PLG) motion with self-service APIs to capture the SMB and startup market, shortening the sales cycle for that segment.

Market Penetration Challenges

- Challenge:

Intense Competition

Severity:Critical

Mitigation Strategy:Differentiate through unique, proprietary data assets like Workforce Solutions. Compete on advanced analytics and AI capabilities rather than just raw data. Main competitors include Experian and TransUnion.

- Challenge:

Consumer Trust Deficit

Severity:Major

Mitigation Strategy:Implement a sustained, multi-channel marketing and PR campaign focused on transparency, security enhancements, and consumer empowerment tools. Proactively lead industry discussions on data ethics.

- Challenge:

Fintech Disruption

Severity:Major

Mitigation Strategy:Adopt a dual strategy of competing with and enabling fintechs. Partner with them by providing essential data infrastructure (Data-as-a-Service) while also investing in in-house innovation to match their agility.

Resource Limitations

Talent Gaps

- •

AI/ML Engineers and Data Scientists

- •

Cybersecurity Specialists

- •

Product Managers with API and PLG experience

Low. The business generates strong free cash flow ($813 million in 2024), sufficient to fund organic growth initiatives, strategic bolt-on acquisitions, and return capital to shareholders.

Infrastructure Needs

Completion of the full migration to the EFX Cloud platform to retire legacy systems.

Investment in next-generation AI and machine learning platforms.

Growth Opportunities

Market Expansion

- Expansion Vector:

Geographic Expansion in Emerging Markets

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Pursue strategic acquisitions of local data providers (e.g., Boa Vista in Brazil) and partner with local governments and financial institutions to build credit infrastructure.

- Expansion Vector:

Deeper Penetration in High-Growth Verticals

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Develop tailored solutions for industries like gaming, healthcare (patient identity verification), and government (benefits verification), leveraging core data assets in new contexts.

Product Opportunities

- Opportunity:

Expand Workforce Solutions Beyond Core Verticals

Market Demand Evidence:Strong revenue growth (7% in Q4 2024) despite market headwinds shows robust, diversified demand for income and employment verification.

Strategic Fit:Core strength, leverages unique proprietary data (The Work Number) which has a strong competitive moat.

Development Recommendation:Develop new verification products for tenancy screening, government benefits eligibility, and automated income verification for consumer fintech applications.

- Opportunity:

Develop AI-Powered Predictive Analytics Products

Market Demand Evidence:Financial services firms are heavily investing in AI to automate tasks, improve forecasting, and manage risk in real-time.

Strategic Fit:Logical evolution from providing raw data to delivering higher-value, actionable insights. Aligns with EFX.AI initiatives.

Development Recommendation:Create modular AI solutions that clients can integrate via API, such as predictive fraud models, customer lifetime value scores, and market trend analysis.

- Opportunity:

Financial Inclusion Solutions using Alternative Data

Market Demand Evidence:Regulatory push and market demand to score millions of 'credit invisible' consumers.

Strategic Fit:Aligns with company mission to 'move people forward' and opens a significant new addressable market.

Development Recommendation:Build and validate new scoring models that incorporate trended data, rental history, and utility payments, and partner with fintechs focused on underserved populations.

Channel Diversification

- Channel:

Product-Led Growth (PLG) via Self-Service APIs

Fit Assessment:Excellent fit for B2B data services

Implementation Strategy:Create a dedicated developer portal with public documentation, transparent pricing, and a freemium or trial tier to allow developers at fintechs and SMBs to build applications on Equifax data.

Strategic Partnerships

- Partnership Type:

Data Infrastructure for Fintechs

Potential Partners

- •

Neobanks

- •

Buy Now, Pay Later (BNPL) providers

- •

Personal finance management (PFM) apps

Expected Benefits:Creates a new, high-volume revenue stream by becoming the underlying data provider for the fintech ecosystem, turning potential disruptors into customers.

- Partnership Type:

Cloud and AI Platform Integrations

Potential Partners

- •

Google Cloud

- •

Amazon Web Services (AWS)

- •

Microsoft Azure

- •

Snowflake

Expected Benefits:Make Equifax data products easily accessible through major cloud marketplaces, reducing friction for enterprise clients and leveraging partners' sales channels.

Growth Strategy

North Star Metric

Customer Decisions Powered by Equifax Data

This metric shifts focus from simply selling data to measuring the active usage and integration of Equifax's insights into its customers' core workflows. It aligns B2B and B2C, encourages product depth, and directly reflects the value being delivered.

Increase by 20% year-over-year by driving adoption of API-based services and new analytics products.

Growth Model

Hybrid: Sales-Led + Product-Led Growth (PLG)

Key Drivers

- •

Enterprise Sales Team (for large, complex deals)

- •

Self-Service API Platform (for SMBs and developers)

- •

Strategic Partnerships (for channel expansion)

- •

New Product Innovation (especially in Workforce Solutions and AI)

Maintain the high-touch enterprise sales model while simultaneously building a dedicated PLG team to develop the self-service B2B portal. Align marketing and product to support both motions.

Prioritized Initiatives

- Initiative:

Launch a Self-Service Developer & SMB Portal

Expected Impact:High

Implementation Effort:High

Timeframe:12-18 months

First Steps:Form a cross-functional team (Product, Engineering, Marketing) to define the MVP for an API sandbox and a single flagship data product.

- Initiative:

Expand Workforce Solutions into Tenancy and Gig Economy Verification

Expected Impact:High

Implementation Effort:Medium

Timeframe:9-12 months

First Steps:Conduct market research with property management companies and gig economy platforms to identify key data needs and pilot a new verification product.

- Initiative:

Launch a 'Trust & Transparency' Marketing Campaign

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:6-9 months

First Steps:Create a microsite detailing security investments, data ethics policies, and consumer data rights. Promote this content through PR and digital channels.

Experimentation Plan

High Leverage Tests

{'test_name': 'B2C Subscription Tier Value Proposition', 'hypothesis': "Adding a 'dark web monitoring' feature to the mid-tier plan will increase its conversion rate by 15% compared to the baseline."}

{'test_name': 'B2B API Pricing Model', 'hypothesis': 'A usage-based pricing model for the new API platform will generate a higher LTV than a traditional seat-based license for SMB customers.'}

Utilize an A/B testing platform. Track primary metrics (Conversion Rate, LTV, ARR) and secondary metrics (Engagement, Churn) for each experiment.

Run at least two concurrent experiments on the B2C funnel at all times. For B2B, aim for one major product/pricing experiment per quarter.

Growth Team

Embedded Growth Pods within key business units (e.g., Workforce Solutions, Consumer Services) supported by a central 'Center of Excellence' for tools, data, and experimentation best practices.

Key Roles

- •

Head of Product-Led Growth (B2B)

- •

Data Product Manager

- •

Growth Marketing Analyst

- •

DevRel (Developer Relations) Advocate

Invest in training for existing product and marketing teams on experimentation, data analysis, and PLG principles. Actively recruit talent from tech-native and high-growth SaaS companies.

Equifax possesses a strong growth foundation anchored by its entrenched position in the financial ecosystem and a highly scalable business model. Its most significant asset and primary growth engine is the Workforce Solutions segment, which leverages unique, proprietary data to deliver high-margin verification services, demonstrating resilience even in weak economic cycles. The company's future growth hinges on its ability to evolve from a traditional data repository into an agile, insight-driven technology company.

The primary barriers to accelerated growth are the persistent reputational damage from the 2017 data breach, intense competition from established peers and agile fintech disruptors, and the operational drag of navigating complex global regulations and legacy technology. While the migration to the EFX Cloud is a critical step, the cultural shift to a truly product-led organization remains a key challenge.

The most significant growth opportunities lie in three areas: 1) Doubling down on the Workforce Solutions business by expanding its use cases into new verticals. 2) Embracing a Product-Led Growth (PLG) model for its B2B data services, creating a self-service API platform to capture the underserved SMB and developer market. 3) Leveraging its data and AI capabilities to develop next-generation analytics products and financial inclusion solutions.

To unlock this potential, the recommended strategy is to adopt a hybrid growth model that combines the strength of its existing enterprise sales force with a new, agile PLG motion. The North Star Metric should be 'Customer Decisions Powered by Equifax Data' to focus the entire organization on delivering tangible, integrated value. Prioritized initiatives should focus on building the self-service B2B platform, expanding the application of its core Workforce Solutions data, and launching a sustained campaign to rebuild consumer trust, which is the ultimate currency in their industry.

Legal Compliance

Equifax's privacy posture is central to its legal positioning. The company provides a consolidated U.S. Privacy Statement, which is a positive step towards transparency and simplifies user understanding. It acknowledges its status as a consumer reporting agency under the Fair Credit Reporting Act (FCRA) and carves out FCRA-regulated data from newer privacy laws like the CCPA/CPRA, which is a legally sound distinction. The policy outlines the types of data collected, sources, and usage, which aligns with requirements under GLBA's Financial Privacy Rule. However, given the company's history with the 2017 data breach, the clarity and accessibility of opt-out mechanisms are paramount. The policy describes how to limit affiliate sharing for marketing but could be more prominent to build consumer trust. The adoption of the NIST Privacy Framework as a foundation for privacy controls is a strong strategic move, signaling a commitment to a risk-based and comprehensive approach to data protection.

The provided website content hints at key terms through footnotes and disclaimers for its subscription products like Equifax Complete™. These terms cover payment authorization, recurring billing for monthly and annual plans, and cancellation policies (e.g., 'no partial month refunds'). While these are clear for the specific products advertised, a comprehensive, easily accessible 'Terms of Service' or 'Terms of Use' document governing the entire website is a standard practice that isn't immediately evident from the scraped content. For a company handling such sensitive data and offering complex products, these terms must be robust, clearly defining limitations of liability, dispute resolution mechanisms (likely arbitration), and user responsibilities to be legally enforceable and manage business risk effectively.

The scraped website data does not include information about a cookie consent banner. However, standard practice for a global entity like Equifax, which operates in jurisdictions with explicit consent laws (like the EU/UK under GDPR), necessitates a robust cookie consent mechanism. An effective system would provide granular control over cookie categories (e.g., necessary, analytics, marketing) and log user consent. Without a clear and compliant banner, Equifax risks non-compliance with GDPR and ePrivacy directives, which can result in significant fines. A passive 'by using this site you agree' notice is no longer sufficient in many key markets.

Equifax's data protection strategy is under intense scrutiny due to the 2017 breach. The settlement with the FTC and other bodies mandated the implementation of a comprehensive information security program. This includes annual risk assessments, monitoring, and board-level certification of compliance. The company is also subject to third-party security audits every two years. These externally imposed requirements form the backbone of its current data protection framework. Equifax's public statements emphasize a commitment to data stewardship, security, and responsible use. The company must adhere to the Gramm-Leach-Bliley Act (GLBA) Safeguards Rule, which requires financial institutions to have a written security plan to protect nonpublic personal information (NPI). Compliance is not just a legal obligation but a core business necessity to regain and maintain market trust.

Equifax shows awareness of accessibility requirements. The presence of a 'Skip to main content' link in the scraped HTML is a basic but important feature of WCAG compliance. The company has a multi-year accessibility plan for its Canadian operations, committing to WCAG 2.0 Level AA standards, which indicates a corporate-level accessibility strategy. They also provide an Accessibility Statement with a dedicated customer service number for users with disabilities, which is a best practice. To fully comply with the Americans with Disabilities Act (ADA), which is increasingly interpreted to apply to websites, ongoing audits and adherence to WCAG 2.1 AA across all digital properties is crucial to ensure equal access and mitigate legal risk.