eScore

eversource.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Eversource's digital presence is highly functional for its core purpose as a utility, effectively capturing high-intent branded search queries for outages and billing. However, its content authority is underdeveloped in strategic, non-branded areas like home electrification and renewable energy, where it competes for mindshare with specialized installers and media outlets. While its multi-state geographic targeting is clear, the overall digital experience lacks the sophistication needed to establish thought leadership, and voice search optimization for complex, advisory-style queries is minimal.

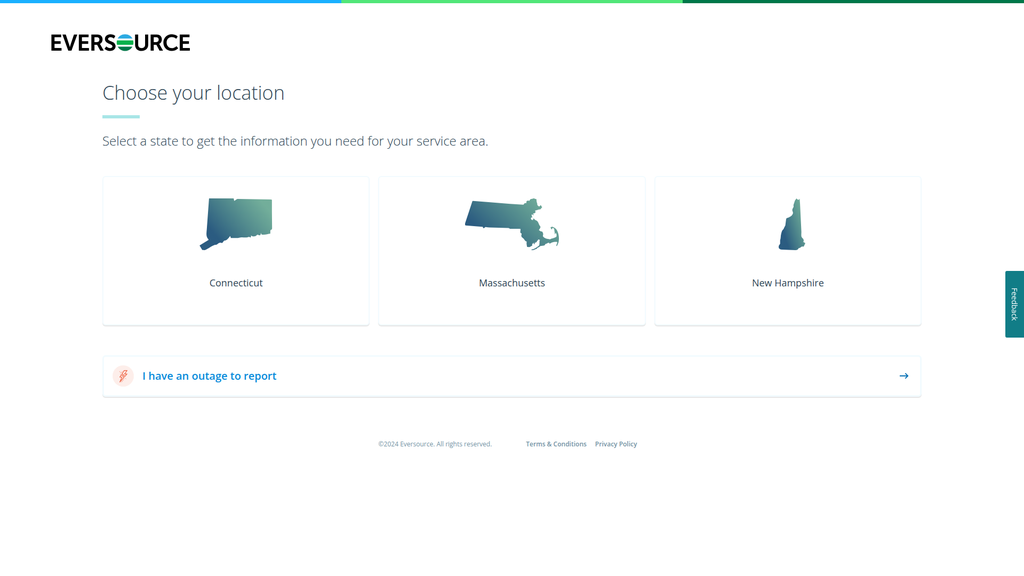

The website excels at search intent alignment for core customer tasks like 'Eversource outage' or 'pay my bill', with a clear, location-based information architecture.

Develop a comprehensive content hub focused on 'The Future of Energy' to build authority and capture organic traffic for non-branded, high-funnel keywords like 'heat pump rebates MA' or 'EV home charger CT'.

The brand messaging effectively addresses core customer pain points like cost and reliability on its main pages, but suffers from a significant disconnect in tone, shifting from helpful to bureaucratic on critical informational pages. While personas like the 'Cost-Conscious Customer' are addressed, the messaging lacks the human-centric storytelling and social proof needed to build a strong emotional connection and fully counter the negative public perception of a faceless utility. The aspirational message of sustainability feels abstract and is not consistently reinforced with tangible proof points across the customer journey.

The homepage messaging hierarchy is logical, immediately addressing primary customer needs (cost, safety, reliability) after presenting a broader vision of sustainability.

Bridge the messaging gap by converting dense, PDF-based regulatory content (like rate summaries) into interactive, user-friendly HTML pages that maintain the supportive brand voice and improve comprehension.

The website serves critical 'conversion' tasks like outage reporting, but the overall experience is hampered by significant friction points, including low-contrast, ineffective calls-to-action and an over-reliance on PDFs which creates a disjointed cross-device journey. While the information architecture is logical, reducing cognitive load on primary tasks, the lack of compelling visual guidance and underdeveloped micro-interactions fails to actively guide users toward adopting value-added services. The identified need to redesign primary CTAs and elevate key tasks highlights a reactive rather than a proactive approach to conversion optimization.

The task-oriented homepage provides a clear entry point for the most urgent user need: reporting a power outage, demonstrating an understanding of critical customer scenarios.

Implement a high-contrast, standardized CTA design system. Primary CTAs (e.g., 'Report Outage,' 'Enroll in Program') should use a solid, brand-aligned color to guide user attention and increase task completion rates.

As a regulated utility, Eversource has inherent credibility, validated by state and federal regulatory bodies. However, this is significantly undermined by a high-risk digital compliance posture, particularly the lack of compliance with the Connecticut Data Privacy Act (CTDPA), which erodes customer trust. While the company provides transparency on rates as required, the complex presentation and lack of customer success stories or testimonials create a trust deficit, which is further compounded by persistently low customer satisfaction scores.

Third-party validation is implicitly strong due to its status as a heavily regulated entity, operating under the oversight of Public Utility Commissions, which provides a baseline of trust and legitimacy.

Immediately remediate the high-severity compliance gaps by updating the privacy policy and deploying a comprehensive cookie consent manager to comply with the CTDPA, thereby mitigating legal risk and demonstrating a commitment to customer data protection.

Eversource's competitive advantage in its core business of energy delivery is exceptionally strong and sustainable, protected by a regulated monopoly on transmission and distribution infrastructure. This creates nearly insurmountable barriers to entry, making its primary 'moat' deep and long-lasting. However, this advantage is eroding at the edges from indirect competitors like rooftop solar installers and competitive energy suppliers. The company's high switching costs are mandated, not earned, and it faces significant disadvantages in customer sentiment when compared to more nimble alternative energy providers.

The regulated monopoly on physical transmission and distribution infrastructure is a highly sustainable advantage that is nearly impossible for competitors to replicate.

Develop a 'Managed DER' service offering to transition from viewing customer-owned generation as a threat to an opportunity, building a new competitive advantage as the central integrator of these resources.

Eversource is positioned for significant capital-driven growth, with a clear strategy to expand its 'rate base' through a massive multi-billion dollar investment in grid modernization and clean energy projects. This regulated investment model provides a clear, predictable path to growth. However, scalability is constrained by regulatory approvals, geographic limitations, and operational bottlenecks like supply chain and workforce shortages, preventing the kind of exponential growth seen in other industries.

The business model is built for steady, predictable growth through large-scale, regulator-approved capital investment in grid modernization and clean energy integration, which directly drives earnings.

Invest in workforce development and strategic sourcing partnerships to mitigate the skilled labor and supply chain bottlenecks that constrain the pace of executing its capital plan.

Eversource's business model is exceptionally coherent and aligned with its market reality as a regulated utility. The revenue model (regulated rate of return) is directly tied to its key activities (capital investment in infrastructure), and its strategic focus on grid modernization aligns perfectly with market trends and public policy goals. The company's recent divestiture of non-core assets shows a strong strategic focus on its core regulated energy delivery business, ensuring high resource allocation efficiency toward its primary growth driver.

There is a very strong and clear alignment between the company's primary activity (investing billions in capital projects) and its revenue model (earning a regulated return on that invested capital).

Proactively develop and propose innovative rate designs, such as performance-based ratemaking, to better align the revenue model with customer-centric outcomes and decarbonization goals, reducing regulatory friction.

Within its designated service territories, Eversource's market power is nearly absolute due to its monopoly status, giving it significant pricing power (as approved by regulators) and leverage over partners and suppliers. The company is a critical piece of infrastructure, allowing it to influence and shape the direction of the regional energy market through its investment plans. However, this power is checked by regulators and challenged by growing customer dissatisfaction and the rise of distributed energy, which reduces dependency on its centralized grid.

Possesses near-total market share and significant pricing power within its service territories, granted and protected by a regulatory framework that creates extreme barriers to entry.

Enhance proactive digital communication and transparency around the drivers of rate increases and infrastructure projects to better manage public perception and maintain its 'social license to operate'.

Business Overview

Business Classification

Public Utility (Regulated)

Energy Infrastructure & Services

Energy & Utilities

Sub Verticals

- •

Electric Transmission

- •

Electric Distribution

- •

Natural Gas Distribution

- •

Water Distribution

Mature

Maturity Indicators

- •

Extensive, established infrastructure and service territories.

- •

Operates within a long-standing, complex regulatory framework.

- •

Stable, predictable revenue streams based on regulated rates of return.

- •

Focus on operational efficiency, reliability, and long-term capital investment plans.

- •

Recent divestiture of non-core assets (offshore wind, water) to focus on core regulated utility operations.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Electric Distribution & Transmission

Description:The core business function involves earning a regulated rate of return on capital invested in the infrastructure used to deliver electricity to end-users. This includes revenue from maintaining and operating the grid, with costs recovered through regulator-approved tariffs.

Estimated Importance:Primary

Customer Segment:Residential, Commercial & Industrial, Municipal

Estimated Margin:Medium

- Stream Name:

Natural Gas Distribution

Description:Revenue is generated from the delivery of natural gas to customers through a network of pipelines. Similar to the electric business, earnings are based on a regulated return on infrastructure investments.

Estimated Importance:Secondary

Customer Segment:Residential, Commercial & Industrial

Estimated Margin:Medium

- Stream Name:

Water Distribution

Description:Through its Aquarion subsidiary, the company earns revenue from distributing water to customers. Note: Eversource has announced the strategic divestiture of this business to focus on core energy delivery.

Estimated Importance:Tertiary

Customer Segment:Residential, Commercial & Industrial

Estimated Margin:Medium

- Stream Name:

Electric Supply (Basic/Standard Service)

Description:For customers who do not choose a competitive third-party supplier, Eversource procures and provides the electricity itself. This is largely a pass-through cost, where the company charges customers the same price it pays for the power on the open market, with minimal to no profit margin.

Estimated Importance:Tertiary

Customer Segment:Residential, Commercial & Industrial

Estimated Margin:Low

Recurring Revenue Components

- •

Monthly customer utility bills (fixed charges)

- •

Volumetric charges based on energy/water consumption

- •

Regulator-approved rate adjustments and riders

Pricing Strategy

Regulated Rate of Return

N/A (Monopoly)

Opaque

Pricing Psychology

Budget Billing / Payment Plans: Offering fixed monthly payments to smooth out seasonal cost variations for customers.

Monetization Assessment

Strengths

- •

Highly predictable and stable revenue due to regulated monopoly status.

- •

Captive customer base of approximately 4 million within service territories.

- •

Guaranteed rate of return on approved capital investments incentivizes infrastructure upgrades.

Weaknesses

- •

Revenue growth is constrained by regulatory approval and economic/population growth in the service area.

- •

Susceptibility to 'regulatory lag' where cost recovery can be delayed.

- •

High capital expenditure requirements for infrastructure maintenance and modernization.

Opportunities

- •

Significant capital investment in grid modernization to support electrification (EVs, heat pumps) and clean energy.

- •

Development and ownership of transmission infrastructure to connect large-scale renewables (e.g., offshore wind) to the grid.

- •

Expansion of EV charging infrastructure programs.

Threats

- •

Increased frequency and severity of storms due to climate change, leading to higher restoration costs.

- •

Growth of distributed generation (e.g., rooftop solar) and energy efficiency measures reducing electricity demand from the central grid.

- •

Unfavorable outcomes in regulatory rate cases impacting profitability.

- •

Cybersecurity threats to critical grid infrastructure.

Market Positioning

Essential Service Provider

Monopoly

Target Segments

- Segment Name:

Residential Customers

Description:Homeowners and renters across Connecticut, Massachusetts, and New Hampshire who rely on Eversource for electricity, gas, and/or water.

Demographic Factors

Varies widely across urban, suburban, and rural areas.

Psychographic Factors

- •

Value reliability and affordability.

- •

Increasing interest in energy efficiency and renewable options.

- •

Concerned about power outages and bill fluctuations.

Behavioral Factors

Consistent, non-discretionary energy consumption.

Increasing adoption of smart home technology and electric vehicles.

Pain Points

- •

High or unpredictable energy bills.

- •

Service disruptions during severe weather.

- •

Complexity in understanding utility rates and bills.

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Commercial & Industrial (C&I) Customers

Description:Businesses ranging from small local shops to large manufacturing facilities and institutions like hospitals and universities.

Demographic Factors

Varies by industry (e.g., healthcare, manufacturing, retail).

Psychographic Factors

- •

Highly sensitive to energy costs as a major operational expense.

- •

Prioritize power quality and reliability to avoid business disruption.

- •

Increasingly focused on meeting corporate sustainability and ESG goals.

Behavioral Factors

- •

High-volume energy consumption.

- •

May participate in demand-response programs.

- •

Often engage with competitive energy suppliers.

Pain Points

- •

Managing energy costs and demand charges.

- •

Ensuring high-quality, uninterrupted power for sensitive equipment.

- •

Meeting decarbonization targets.

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Government & Municipal Agencies

Description:Federal, state, and local government facilities, including military bases, schools, and administrative buildings.

Demographic Factors

Public sector entities with specific procurement processes.

Psychographic Factors

Budget-conscious and mandated to pursue energy efficiency.

Focused on resilience for critical public infrastructure.

Behavioral Factors

Long-term contracts.

Often early adopters of clean energy initiatives and EV fleets.

Pain Points

Securing funding for energy infrastructure upgrades.

Ensuring energy resilience for critical community services (e.g., emergency response).

Fit Assessment:Good

Segment Potential:Medium

Market Differentiation

- Factor:

Exclusive Service Territory Franchise

Strength:Strong

Sustainability:Sustainable

- Factor:

Operational Expertise & Reliability

Strength:Moderate

Sustainability:Sustainable

- Factor:

Scale of Capital Investment

Strength:Strong

Sustainability:Sustainable

Value Proposition

To safely and reliably deliver essential energy and water services to our communities while investing in a cleaner, more resilient energy future.

Good

Key Benefits

- Benefit:

Reliable Energy Delivery

Importance:Critical

Differentiation:Common

Proof Elements

Published power restoration processes.

Ongoing investments in grid hardening and modernization.

- Benefit:

Customer Assistance Programs

Importance:Important

Differentiation:Common

Proof Elements

Website sections dedicated to bill help and energy cost management.

- Benefit:

Enabling the Clean Energy Transition

Importance:Important

Differentiation:Somewhat unique

Proof Elements

Electric Sector Modernization Plan (ESMP) filing in Massachusetts.

Investments in EV charging infrastructure and battery storage projects.

Unique Selling Points

- Usp:

Exclusive, regulator-granted franchise to operate the energy delivery network in its service territory.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Deep, established relationships with state regulators and policymakers.

Sustainability:Long-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Need for consistent and safe access to electricity and natural gas.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Service restoration after weather-related outages.

Severity:Major

Solution Effectiveness:Partial

- Problem:

Difficulty affording energy bills.

Severity:Major

Solution Effectiveness:Partial

- Problem:

Lack of infrastructure to support personal clean energy adoption (e.g., EVs, solar).

Severity:Minor

Solution Effectiveness:Partial

Value Alignment Assessment

High

The core offering of reliable energy delivery is perfectly aligned with the fundamental, non-negotiable needs of the market.

Medium

While aligned on core reliability needs, there is a growing gap with customer expectations around cost, digital experience, and the speed of clean energy integration. The business is actively working to close this gap through modernization plans.

Strategic Assessment

Business Model Canvas

Key Partners

- •

State Public Utility Commissions (PUCs)

- •

Federal Energy Regulatory Commission (FERC)

- •

Competitive Energy Suppliers

- •

Infrastructure & Technology Vendors (e.g., Siemens, GE)

- •

Municipal and State Governments

- •

Contractors and Labor Unions

Key Activities

- •

Operating and maintaining transmission & distribution infrastructure.

- •

Executing large-scale capital investment projects.

- •

Storm and outage restoration.

- •

Regulatory affairs and rate case management.

- •

Customer service, billing, and support.

Key Resources

- •

Physical Infrastructure (poles, wires, substations, pipelines).

- •

Regulated franchise/monopoly rights.

- •

Skilled workforce (lineworkers, engineers, technicians).

- •

Financial capital for investments.

Cost Structure

- •

Capital Expenditures (CapEx) for infrastructure.

- •

Operations & Maintenance (O&M) expenses.

- •

Purchased Power (as a pass-through cost).

- •

Depreciation and Property Taxes.

- •

Interest on Debt.

Swot Analysis

Strengths

- •

Regulated monopoly with a captive customer base ensures stable cash flow.

- •

Extensive existing infrastructure creates immense barriers to entry.

- •

Clear, long-term capital investment plans provide earnings visibility.

- •

Projected 5-7% long-term EPS growth rate provides investor confidence.

Weaknesses

- •

Highly regulated environment can limit operational agility and growth.

- •

Aging infrastructure requires continuous, high-cost capital investment.

- •

Customer satisfaction can be low due to rising rates and outages.

- •

Financial performance is sensitive to regulatory decisions and rate case outcomes.

Opportunities

- •

Lead the energy transition by investing heavily in grid modernization to support electrification.

- •

Expand EV 'make-ready' programs and other charging infrastructure services.

- •

Invest in transmission projects required to connect large-scale renewable energy sources to the grid.

- •

Leverage smart meter (AMI) data to improve grid efficiency and offer new customer programs.

Threats

- •

Increasingly severe weather events driven by climate change straining infrastructure and increasing costs.

- •

Disruptive technologies like microgrids and advanced energy storage could reduce reliance on the central grid.

- •

Public and political pressure to limit rate increases, potentially impacting profitability and investment capacity.

- •

Rising interest rates increasing the cost of capital for major infrastructure projects.

Recommendations

Priority Improvements

- Area:

Customer Experience & Digitalization

Recommendation:Accelerate the rollout of Advanced Metering Infrastructure (AMI) and enhance digital customer tools to provide real-time usage data, personalized energy-saving tips, and proactive outage communications. This improves customer satisfaction and enables demand-side management.

Expected Impact:High

- Area:

Regulatory Strategy

Recommendation:Proactively develop and propose innovative rate designs, such as performance-based ratemaking (PBR), that decouple revenue from energy sales and incentivize efficiency, grid modernization, and customer-benefiting outcomes.

Expected Impact:High

- Area:

Workforce Development

Recommendation:Invest in training and recruitment programs to build the next generation of skilled labor required for modernizing the grid, integrating clean energy technologies, and managing a more complex, digital energy system.

Expected Impact:Medium

Business Model Innovation

- •

Develop an 'Energy as a Service' (EaaS) model for C&I customers, managing their on-site generation, storage, and EV fleets to optimize costs and meet sustainability goals.

- •

Explore creating a platform that facilitates local energy markets, allowing customers with distributed energy resources (like solar and batteries) to provide services back to the grid, with Eversource acting as the platform operator.

- •

Invest in or partner with geothermal network utilities as a new, non-emitting thermal energy delivery business to decarbonize heating in dense service areas.

Revenue Diversification

- •

Expand investment in regulated EV charging infrastructure, potentially owning and operating DC fast charging corridors, which represents a new rate-based asset class.

- •

Pursue regulated investments in large-scale battery energy storage systems to enhance grid reliability and manage renewable energy intermittency.

- •

Evaluate leveraging existing right-of-way infrastructure for fiber optic cable deployment, creating a regulated or non-regulated revenue stream from broadband services where regulations permit.

Eversource Energy operates a quintessential mature, regulated utility business model, characterized by its stability, predictable cash flows, and monopolistic position within its service territories in Connecticut, Massachusetts, and New Hampshire. Its core strength lies in its regulated rate-of-return structure, which guarantees earnings on approved capital investments, providing a clear and steady growth trajectory. However, this same regulatory oversight also constrains agility and subjects the company to political and public pressure regarding rate increases. The paramount strategic imperative for Eversource is navigating the clean energy transition. The company's business model must evolve from a one-way energy delivery system to a dynamic, multi-directional platform that can manage the complexities of distributed generation, widespread electrification of transportation and heating, and the integration of large-scale renewable resources. Eversource's proactive filing of its Electric Sector Modernization Plan (ESMP) demonstrates a clear understanding of this challenge and opportunity. Future success will be contingent on the ability to successfully execute its massive $24.2 billion five-year capital plan, secure favorable regulatory outcomes that support these investments, and manage the significant operational challenges of upgrading an aging grid while maintaining reliability and affordability for its 4 million customers. The evolution from a traditional utility to a modern grid operator and clean energy enabler is the central theme that will define its competitive positioning and financial performance for the next decade.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

High Capital Investment & Infrastructure

Impact:High

- Barrier:

Regulatory Approval and Licensing

Impact:High

- Barrier:

Economies of Scale

Impact:High

- Barrier:

Established Transmission & Distribution Networks

Impact:High

Industry Trends

- Trend:

Decarbonization and Renewable Energy Integration

Impact On Business:Requires significant investment in grid modernization to support intermittent renewables like solar and wind. Creates opportunities for green energy programs but also competition from distributed generation.

Timeline:Immediate

- Trend:

Electrification of Transportation and Heating

Impact On Business:Increases overall electricity demand, creating revenue growth opportunities. Requires substantial upgrades to distribution infrastructure to handle increased load from EV charging and heat pumps.

Timeline:Near-term

- Trend:

Grid Modernization and Digitization (Smart Grids)

Impact On Business:Drives investment in smart meters, sensors, and data analytics to improve reliability, efficiency, and outage response. Also increases cybersecurity risks.

Timeline:Immediate

- Trend:

Distributed Energy Resources (DERs) Proliferation

Impact On Business:Challenges the traditional centralized utility model. Customers generating their own power (e.g., rooftop solar) reduces reliance on the grid, impacting revenue. Creates a need for new business models around DER management.

Timeline:Near-term

Direct Competitors

- →

National Grid

Market Share Estimate:Largest electric utility in Massachusetts and a major competitor in overlapping and adjacent service territories for both electricity and natural gas.

Target Audience Overlap:High

Competitive Positioning:Positions as a large, established energy delivery company focused on a clean energy future and serving millions in the Northeast.

Strengths

- •

Extensive service territory across Massachusetts and New York.

- •

Significant brand recognition in its operating areas.

- •

Large scale of operations provides potential cost efficiencies.

Weaknesses

- •

Faces significant customer complaints regarding billing inaccuracies and service activation delays.

- •

Customer service is frequently cited as a point of frustration, with long wait times and poor communication.

- •

Perceived high costs and complex billing practices can lead to negative customer sentiment.

Differentiators

Strong focus on New York market in addition to New England.

Aggressive investment and branding around clean energy transition.

- →

Avangrid

Market Share Estimate:Major competitor in Connecticut through its subsidiaries United Illuminating (UI), Southern Connecticut Gas (SCG), and Connecticut Natural Gas (CNG).

Target Audience Overlap:High

Competitive Positioning:Positions as a leading sustainable energy company with a focus on innovation, renewable energy, and customer experience.

Strengths

- •

Strong backing from its parent company, Iberdrola Group, a global energy leader.

- •

Reported significant recent improvements in customer satisfaction metrics.

- •

Focus on digital transformation and creating a centralized 'Customer Experience Center of Excellence'.

- •

Heavy investment in renewable energy generation.

Weaknesses

- •

Has faced legal and regulatory challenges, including lawsuits alongside Eversource concerning market practices and disputes with the Connecticut Public Utilities Regulatory Authority (PURA).

- •

Brand recognition of 'Avangrid' itself may be lower than its subsidiary brands like 'United Illuminating'.

- •

Past issues with customer service, although they are actively working to improve this.

Differentiators

Strong international backing and expertise from Iberdrola.

Publicly emphasizes a commitment to ESG (Environmental, Social, and Governance) principles and being a 'sustainable' energy company.

- →

Unitil

Market Share Estimate:Smaller, regional competitor with service territories in Massachusetts and New Hampshire.

Target Audience Overlap:Medium

Competitive Positioning:Positions as a regional energy provider for electricity and natural gas.

Strengths

Focused operational area may allow for more localized customer service.

Serves as both an electric and gas utility, similar to Eversource.

Weaknesses

- •

Significantly smaller scale of operations compared to Eversource and National Grid.

- •

Less brand recognition and marketing power.

- •

Limited geographic footprint.

Differentiators

Operates in specific, smaller communities within the broader New England market.

Indirect Competitors

- →

Rooftop Solar Installers (e.g., Sunrun, Boston Solar, New England Clean Energy)

Description:Companies that install residential and commercial solar panel systems, often paired with battery storage. They offer customers energy independence and potential cost savings by generating their own electricity.

Threat Level:High

Potential For Direct Competition:They directly reduce customer energy purchases from the grid, impacting Eversource's revenue from energy supply and delivery volume.

- →

Competitive Energy Suppliers (e.g., Direct Energy, Constellation)

Description:In deregulated markets like Massachusetts, these companies compete to be the supplier of electricity and natural gas, while Eversource remains the distributor. They compete on price, renewable energy content, and plan structure.

Threat Level:Medium

Potential For Direct Competition:They are already direct competitors for the energy supply portion of the customer's bill, chipping away at Eversource's default 'Basic Service' offering.

- →

Community Choice Aggregation (CCA)

Description:Programs where local governments procure electricity in bulk on behalf of their residents and small businesses, often with a focus on higher renewable energy content and stable pricing, directly competing with Eversource's default supply service.

Threat Level:Medium

Potential For Direct Competition:CCAs replace Eversource as the default electricity supplier for entire municipalities, significantly reducing their supply market share in those areas.

- →

Energy Efficiency & Smart Home Tech (e.g., Nest, HVAC installers)

Description:Technologies and services that help customers reduce their overall energy consumption. This includes smart thermostats, high-efficiency appliances, and home energy audits.

Threat Level:Low

Potential For Direct Competition:Reduces overall demand for energy, which can impact long-term revenue growth. However, utilities like Eversource often run their own energy efficiency programs as part of their mandate.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Regulated Monopoly on Transmission & Distribution

Sustainability Assessment:Highly sustainable due to extreme barriers to entry. It is economically and logistically infeasible for a competitor to build parallel poles, wires, and pipelines in Eversource's service territory.

Competitor Replication Difficulty:Hard

- Advantage:

Established Infrastructure and Physical Assets

Sustainability Assessment:Highly sustainable. The existing network of substations, transmission lines, and distribution infrastructure represents billions of dollars in capital investment built over decades.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'Default Energy Supplier Status', 'estimated_duration': 'This advantage is eroding over the medium term as more customers choose competitive suppliers and more municipalities adopt Community Choice Aggregation programs.'}

{'advantage': 'Brand Recognition and Incumbency', 'estimated_duration': 'While strong, this advantage can be eroded over the long term by persistent negative customer sentiment, poor outage performance, or significant rate hikes.'}

Disadvantages

- Disadvantage:

Negative Customer Sentiment

Impact:Major

Addressability:Moderately

- Disadvantage:

Complex Regulatory Oversight

Impact:Major

Addressability:Difficult

- Disadvantage:

High Operating Costs & Rate Pressure

Impact:Critical

Addressability:Difficult

Strategic Recommendations

Quick Wins

- Recommendation:

Enhance Digital Outage Communication

Expected Impact:High

Implementation Difficulty:Easy

- Recommendation:

Simplify Bill Explanations

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Develop and Market EV Charging Infrastructure Solutions

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Create a 'Managed DER' Service Offering

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Invest Heavily in Proactive Grid Maintenance & Automation

Expected Impact:High

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Transition Business Model from Energy 'Seller' to 'Platform Operator'

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Lead Large-Scale Energy Storage Projects

Expected Impact:High

Implementation Difficulty:Difficult

Shift positioning from a traditional, reactive utility to a proactive, innovative 'Energy Solutions Partner for a Sustainable Future.' Emphasize reliability and safety while aggressively promoting leadership in grid modernization, EV infrastructure, and clean energy integration.

Differentiate through superior operational performance (reliability, outage restoration) and by becoming the easiest and most trusted partner for customers adopting new energy technologies like EVs, solar, and battery storage. Leverage the regulated asset base to enable and integrate these new technologies better than any competitor.

Whitespace Opportunities

- Opportunity:

EV Fleet Electrification Services

Competitive Gap:While many focus on individual residential EV chargers, there is a significant gap in providing comprehensive consulting, infrastructure deployment, and managed charging services for commercial and municipal vehicle fleets.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Grid Services Brokerage for DER Owners

Competitive Gap:No single entity has emerged as the trusted intermediary for homeowners and small businesses to easily sell their excess solar power or battery capacity back to the grid in a managed, profitable way. Utilities are uniquely positioned to fill this role.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Hyper-Localized Community Microgrids

Competitive Gap:While solar installers provide individual resiliency, there's a lack of expertise in developing community-scale microgrids (e.g., for a critical facility, an industrial park, or a new housing development) that can 'island' from the main grid during outages.

Feasibility:Low

Potential Impact:High

Eversource operates in a mature, highly-regulated, and capital-intensive industry. Its primary competitive advantage is its state-sanctioned monopoly on energy transmission and distribution within its service territories in Connecticut, Massachusetts, and New Hampshire. This creates nearly insurmountable barriers to entry for direct competitors seeking to replicate its core delivery business.

The competitive landscape is therefore bifurcated. In the delivery of energy, Eversource's direct competitors are other large regional utilities like National Grid and Avangrid, who operate in adjacent territories. Competition with these peers is not for customers within a specific area, but rather in areas of operational efficiency, regulatory favorability, talent acquisition, and public perception. All major utilities in the region face significant scrutiny over rates and service quality, with customer sentiment often being negative due to high costs and service interruptions. Eversource, National Grid, and Avangrid all score poorly in customer reviews, citing high prices, poor customer service, and billing issues.

The more dynamic and threatening competitive front comes from indirect and disruptive forces. The proliferation of Distributed Energy Resources (DERs), primarily rooftop solar installers, poses a significant threat by reducing customer reliance on the grid. In states with energy deregulation, Competitive Energy Suppliers directly compete with Eversource's default energy supply service, often on price or renewable energy mix. Furthermore, the rise of Community Choice Aggregation (CCA) allows entire municipalities to replace Eversource as the default energy supplier, eroding a key part of their business model.

Key industry trends like decarbonization and electrification present both a challenge and an opportunity. While integrating renewables and supporting the massive load growth from electric vehicles and heat pumps will require immense capital investment in grid modernization, it also solidifies the grid's role as the central platform for the energy transition. This is where Eversource's primary strategic opportunity lies: evolving from a simple energy delivery company to a sophisticated grid operator and energy solutions platform.

Whitespace opportunities exist in value-added services beyond the meter. Providing comprehensive EV fleet management, acting as a broker for customers' DERs to sell services back to the grid, and developing resilient microgrids are areas where competitors are not yet entrenched. To succeed, Eversource must leverage its sustainable advantage—the ownership of the grid—to become the primary enabler of these new energy technologies. The greatest long-term threat is not another utility, but a failure to adapt to a decentralized, decarbonized, and digitized energy future where its role as a simple commodity provider becomes obsolete.

Messaging

Eversource's strategic messaging positions it as a modern, forward-looking utility, moving beyond the traditional role of a commodity provider. The primary challenge for a regulated monopoly like Eversource is not customer acquisition in the competitive sense, but rather securing customer trust, regulatory approval, and public support for its rates and infrastructure investments. The messaging effectively centers on three core pillars: Sustainability ('Building a Sustainable Future'), Affordability/Support ('Help With Your Energy Costs'), and Reliability/Safety ('Power Restoration Process,' 'Safety In Our Community'). This architecture directly addresses the primary concerns and aspirations of residential customers. However, a significant dichotomy exists between the aspirational, community-focused messaging on the homepage and the dense, bureaucratic tone of functional pages like 'Summary of Electric Rates'. While this tone shift is understandable and often necessary for regulatory content, it creates a messaging disconnect that can undermine the people-first brand image. The messaging strategy successfully differentiates Eversource from the stereotype of a faceless utility by emphasizing community partnership and proactive assistance. Yet, it lacks the humanizing element of storytelling and tangible proof points that would make high-level concepts like 'sustainability' feel personal and immediate to the customer. To improve effectiveness, Eversource should focus on bridging this gap, weaving its core brand narratives into every customer touchpoint and translating complex information into benefit-driven, accessible content.

Message Architecture

Key Messages

- Message:

Eversource is a partner in building a sustainable future.

Prominence:Primary

Clarity Score:Medium

Location:Homepage Hero Banner ('Building a Sustainable Future')

- Message:

We provide assistance and tools to help you manage energy costs.

Prominence:Primary

Clarity Score:High

Location:Homepage ('Help With Your Energy Costs and Usage')

- Message:

We are committed to community safety and reliable power restoration.

Prominence:Secondary

Clarity Score:High

Location:Homepage ('Featured Content': Safety, Power Restoration)

- Message:

We offer proactive communication during outages.

Prominence:Secondary

Clarity Score:High

Location:Homepage ('Sign Up For Outage Alerts')

- Message:

Our rates are transparent and approved by regulatory bodies.

Prominence:Tertiary

Clarity Score:Low

Location:Rates & Tariffs Page (Clarity is low due to complexity of content, not the message itself)

The message hierarchy on the residential homepage is logical and effective. It begins with a broad, aspirational vision (sustainability) and immediately pivots to the most pressing customer needs: cost management, safety, and reliability. This structure successfully balances brand-building with practical user concerns.

Messaging is consistent at the brand level but inconsistent in tone and execution. The aspirational, helpful voice of the homepage is lost on the rates page, which is dense, formal, and relies on PDFs. While the information is necessary, its presentation conflicts with the user-friendly brand persona Eversource aims to project.

Brand Voice

Voice Attributes

- Attribute:

Supportive

Strength:Strong

Examples

We offer a variety of programs to connect you with assistance...

Help With Your Energy Costs and Usage

- Attribute:

Community-Oriented

Strength:Moderate

Examples

Safety In Our Community

Helping our friends and neighbors goes beyond the safe delivery of electricity...

- Attribute:

Authoritative/Formal

Strength:Strong

Examples

The following rates are available to our customers and have been approved by the Massachusetts Department of Public Utilities.

In addition to the delivery service charges, to calculate your total bill you will also need to include the supplier services charge...

- Attribute:

Forward-Looking

Strength:Moderate

Examples

Building a Sustainable Future

Tone Analysis

Informative and Service-Oriented

Secondary Tones

Reassuring

Aspirational

Tone Shifts

A significant shift occurs when moving from marketing/brand-level pages (e.g., residential homepage) to administrative/regulatory sections (e.g., 'Summary of Electric Rates'). The tone transitions from warm and supportive to cold, formal, and bureaucratic.

Voice Consistency Rating

Fair

Consistency Issues

The stark contrast in tone between customer-centric landing pages and informational/regulatory pages creates a disjointed brand experience.

Value Proposition Assessment

To be the reliable, safe, and community-focused energy delivery partner that helps customers manage costs while leading the transition to a sustainable future.

Value Proposition Components

- Component:

Reliable Energy Delivery

Clarity:Clear

Uniqueness:Common

- Component:

Cost Management Assistance

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Commitment to Community Safety

Clarity:Clear

Uniqueness:Common

- Component:

Leadership in Sustainability

Clarity:Somewhat Clear

Uniqueness:Somewhat Unique

- Component:

Transparent Restoration Process

Clarity:Clear

Uniqueness:Somewhat Unique

As a regulated utility, differentiation is not about product choice but about service, trust, and forward-thinking leadership. Eversource differentiates by proactively addressing customer pain points (cost, outages) and positioning itself as a leader in sustainability. This shifts the narrative from being a mere utility to being an essential community partner and enabler of a clean energy future. The focus on 'help' is a key differentiator against the perception of indifferent monopolies.

Eversource's messaging positions it against the negative stereotypes of the utility industry (poor communication, lack of support, environmental laggard). Its primary competitive challenge is for public opinion and regulatory favor. By emphasizing community, assistance, and sustainability, it positions itself as a responsible steward and a necessary partner for regional progress, justifying its rates and infrastructure investments.

Audience Messaging

Target Personas

- Persona:

The Cost-Conscious Customer

Tailored Messages

- •

Help With Your Energy Costs and Usage

- •

We offer a variety of programs to connect you with assistance...

- •

Bill help

Effectiveness:Effective

- Persona:

The Safety & Reliability-Focused Customer

Tailored Messages

- •

Safety In Our Community

- •

Power Restoration Process

- •

Sign Up For Outage Alerts

Effectiveness:Effective

- Persona:

The Environmentally-Minded Customer

Tailored Messages

Building a Sustainable Future

Effectiveness:Somewhat

Audience Pain Points Addressed

- •

High energy bills

- •

Uncertainty during power outages

- •

Confusion about rates and billing

- •

Concerns about safety around utility infrastructure

Audience Aspirations Addressed

Contributing to a cleaner environment

Living in a safe and reliable community

Persuasion Elements

Emotional Appeals

- Appeal Type:

Security & Peace of Mind

Effectiveness:High

Examples

Learn about our defined process to get all customers back in service as quickly and safely as possible.

Sign Up For Outage Alerts

- Appeal Type:

Empathy & Care

Effectiveness:Medium

Examples

Help With Your Energy Costs and Usage

Helping our friends and neighbors...

- Appeal Type:

Hope & Optimism

Effectiveness:Low

Examples

Building a Sustainable Future

Social Proof Elements

No itemsTrust Indicators

- •

Explicit mention of approval by the 'Massachusetts Department of Public Utilities'.

- •

Providing a defined 'Power Restoration Process', which implies transparency and accountability.

- •

Dedicated sections for safety information.

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

Bill help

Location:Homepage, under 'Help With Your Energy Costs'

Clarity:Clear

- Text:

Learn more

Location:Homepage, banner for 'Building a Sustainable Future'

Clarity:Somewhat Clear

- Text:

Sign Up For Outage Alerts

Location:Homepage, Featured Content

Clarity:Clear

The CTAs are functional and clear but lack persuasive power. They are instructional rather than benefit-oriented (e.g., 'Get Bill Help' vs. 'Bill help'). For a utility, where the goal is task completion and information dissemination rather than direct sales, this approach is adequate but could be optimized for better user engagement and program adoption.

Messaging Gaps Analysis

Critical Gaps

- •

Lack of human-centric storytelling. The messaging is corporate and institutional; there are no customer testimonials, employee stories, or community project highlights to bring the brand promises to life.

- •

The connection between the high-level 'Sustainability' message and tangible customer benefits or actions is not made clear. It remains an abstract corporate goal.

- •

Absence of social proof. There are no statistics, awards, or testimonials validating their claims of community support, reliability, or leadership.

Contradiction Points

The brand voice of being a helpful, accessible partner is contradicted by the delivery of critical rate information in complex, PDF-only formats.

Underdeveloped Areas

The 'Sustainability' message is a headline without a compelling narrative or supporting content on the main page.

Value of being an Eversource customer beyond the basic provision of energy is not well-articulated. What innovation, technology, or service excellence do they bring that justifies their position and rates?

Messaging Quality

Strengths

- •

Directly addresses key customer pain points like cost and outages on the primary landing page.

- •

Clear, task-oriented navigation for core customer needs (billing, outages).

- •

Establishes a foundational message of being more than just a power company, focusing on community and sustainability.

Weaknesses

- •

Overly formal and bureaucratic tone in detailed sections, which undermines the main brand voice.

- •

Lack of emotional resonance and storytelling makes the brand feel distant.

- •

High-level concepts like 'sustainability' are not translated into tangible, relatable customer benefits.

Opportunities

- •

Create an interactive, simplified 'Understanding Your Bill' section to replace or supplement rate PDFs, reinforcing the 'helpful' brand voice.

- •

Develop a content series showcasing community projects, employee expertise, and customer success stories related to energy efficiency programs.

- •

Quantify the impact of their sustainability efforts in local terms (e.g., 'equivalent to taking X cars off the road in Boston').

Optimization Roadmap

Priority Improvements

- Area:

Content Presentation

Recommendation:Transform the 'Summary of Electric Rates' page from a list of PDFs into an interactive tool. Allow users to see a simplified breakdown of charges with clear explanations, reinforcing the brand's 'helpful' attribute.

Expected Impact:High

- Area:

Narrative Development

Recommendation:Build out the 'Building a Sustainable Future' message with a dedicated content hub. Feature stories, videos, and data visualizations that show tangible progress and community impact.

Expected Impact:High

- Area:

Social Proof Integration

Recommendation:Incorporate customer testimonials (especially for assistance programs) and highlight key performance metrics (e.g., reliability awards, emissions reductions) throughout the site.

Expected Impact:Medium

Quick Wins

- •

Rewrite functional headlines and CTAs to be more benefit-driven (e.g., 'Explore Ways to Save' instead of 'Bill help').

- •

Add a brief, plain-language summary at the top of the rates page explaining what the page is for before linking to dense PDFs.

- •

Incorporate icons and visuals to break up text-heavy sections on the homepage.

Long Term Recommendations

- •

Implement a comprehensive content strategy that consistently bridges the gap between high-level brand promises and the customer's daily reality.

- •

Develop personalized communication paths for different customer segments (e.g., new homeowners, EV owners, customers on assistance programs).

- •

Invest in user experience (UX) copywriting across all sections of the site to ensure the brand voice remains consistent, even in the most technical areas.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Operates as a regulated utility with a captive customer base of approximately 4 million electric, gas, and water customers in Connecticut, Massachusetts, and New Hampshire.

- •

Provides an essential service (energy delivery), ensuring constant demand within its designated service territories.

- •

The business model is built on providing safe, reliable, and affordable electricity, which is the core expectation of the market.

- •

Long history of operations and established infrastructure solidifies its market position.

Improvement Areas

- •

Enhance customer satisfaction beyond basic reliability, focusing on proactive communication, transparent billing, and ease of access to new programs.

- •

Improve public perception and regulatory relationships, which can be strained during rate increase requests or major outage events.

- •

Increase customer adoption of value-added services like energy efficiency, demand response, and EV charging programs to deepen the customer relationship.

Market Dynamics

Projected electricity demand growth of ~1-2% annually, with accelerated demand from data centers, onshoring, and electrification.

Mature

Market Trends

- Trend:

Electrification of Transportation & Heating

Business Impact:Significant increase in electricity demand, requiring substantial grid upgrades and creating new revenue opportunities in EV charging infrastructure and heat pump support.

- Trend:

Grid Modernization & Resilience

Business Impact:Massive capital investment required to upgrade aging infrastructure, integrate renewables, and improve resilience against extreme weather, forming the primary driver of rate base growth.

- Trend:

Decarbonization & Renewable Integration

Business Impact:State-level clean energy mandates and customer demand are pushing for integration of solar, offshore wind, and battery storage, creating investment opportunities in new infrastructure and energy sources.

- Trend:

Rise of Distributed Energy Resources (DERs)

Business Impact:Business model must evolve from a one-way energy delivery system to a two-way 'smart integrator' managing customer-owned solar, batteries, and EVs, creating both operational challenges and new service opportunities.

- Trend:

Increased Data Center Load

Business Impact:Unprecedented growth in power demand from data centers requires utilities to rapidly expand generation and transmission capacity, driving significant new investment.

Excellent. The confluence of decarbonization mandates, aging infrastructure, and surging demand from electrification creates a generational opportunity for capital investment and regulated growth.

Business Model Scalability

Medium

Highly capital-intensive with significant fixed costs (infrastructure). Growth is achieved through large-scale, long-term capital projects that expand the 'rate base', upon which a regulated rate of return is earned.

Low in the short term due to high fixed costs and regulated revenue structures. Long-term leverage comes from efficiently deploying capital into the rate base.

Scalability Constraints

- •

Regulatory Approval: All significant investments and rate changes are subject to approval by state public utility commissions (PUCs), which can be a slow and contentious process.

- •

Capital Intensity: Growth requires massive capital expenditures ($24.2 billion planned for 2025-2029), necessitating constant access to capital markets.

- •

Geographic Limitation: Growth is confined to existing service territories, with major expansion only possible through M&A of other utilities.

- •

Supply Chain & Workforce: Availability of key components (e.g., transformers) and skilled labor can constrain the pace of infrastructure projects.

Team Readiness

Strong in traditional utility operations, engineering, and regulatory affairs. Leadership has demonstrated a strategic pivot towards clean energy and grid modernization.

Traditional, siloed structure typical of large utilities. May need to evolve towards more agile, cross-functional teams to effectively manage new growth areas like DER integration and EV services.

Key Capability Gaps

- •

Data Analytics & AI: Need for advanced capabilities to manage a decentralized grid, forecast demand, and optimize operations in real-time.

- •

Software & Platform Management: As the grid becomes more digitized, expertise in managing complex software platforms for DERs, VPPs, and customer engagement is critical.

- •

Innovative Product/Service Development: Requires a shift in mindset from pure infrastructure management to developing customer-centric energy services and solutions.

- •

Cybersecurity for Distributed Grids: Increased risk surface area with millions of connected DERs requires world-class cybersecurity expertise.

Growth Engine

Acquisition Channels

- Channel:

New Service Connections (Housing/Commercial Development)

Effectiveness:High

Optimization Potential:Low

Recommendation:Streamline the new connection process to improve developer and homeowner satisfaction. This is a captive, not competitive, channel.

- Channel:

EV Program Adoption (Digital Marketing & Rebates)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Utilize targeted digital campaigns and partnerships with auto dealers to increase awareness and sign-ups for EV charging rebates and managed charging programs.

- Channel:

Energy Efficiency Program Enrollment

Effectiveness:Medium

Optimization Potential:Medium

Recommendation:Simplify the application process for energy efficiency rebates and audits. Use data analytics to proactively target customers who would benefit most.

Customer Journey

The 'conversion' path is enrollment in value-added programs (EV charging, efficiency, renewables). The current journey is primarily informational, found within a complex website structure.

Friction Points

- •

Complex website navigation to find information on new programs like geothermal or EV incentives.

- •

Manual or multi-step enrollment processes for rebates and special rates.

- •

Lack of personalized recommendations for customers based on their usage data.

Journey Enhancement Priorities

{'area': 'Digital Program Enrollment', 'recommendation': 'Create a unified, simplified digital portal for customers to explore and enroll in all available clean energy and efficiency programs.'}

{'area': 'Proactive Outage Communications', 'recommendation': 'Enhance outage alert systems with more granular information and more accurate estimated restoration times to improve customer satisfaction during critical events.'}

Retention Mechanisms

- Mechanism:

Service Reliability

Effectiveness:High

Improvement Opportunity:Continued investment in grid hardening and predictive maintenance to minimize outage frequency and duration, especially with increasing storm severity.

- Mechanism:

Customer Support & Assistance Programs

Effectiveness:Medium

Improvement Opportunity:Increase awareness and accessibility of bill assistance programs for vulnerable customers to build goodwill and improve regulatory standing.

- Mechanism:

Community Engagement

Effectiveness:Medium

Improvement Opportunity:Strengthen local partnerships and visibility to build support for necessary infrastructure projects and position Eversource as a key partner in community climate goals.

Revenue Economics

The economic model is based on 'Rate Base Growth'. Revenue is a function of the value of capital assets (the rate base) multiplied by a regulator-approved Rate of Return (RoR). Growth is driven by investing capital in infrastructure and services that regulators deem prudent and beneficial for customers.

Not Applicable

High, within the regulated framework. The company has a consistent track record of getting regulatory approval for capital plans and achieving its earnings targets.

Optimization Recommendations

- •

Focus capital deployment on projects with strong regulatory support, such as grid modernization, clean energy integration, and resilience.

- •

Improve operational efficiency to maximize the allowed rate of return and manage costs within approved rate structures.

- •

Develop performance-based incentive mechanisms with regulators that reward the utility for achieving specific outcomes (e.g., DER integration, emissions reduction).

Scale Barriers

Technical Limitations

- Limitation:

Aging Grid Infrastructure

Impact:High

Solution Approach:Accelerate capital investment in modernization programs, including replacing aging substations, undergrounding cables, and deploying smart grid technologies.

- Limitation:

Interconnection Queues for Renewables

Impact:High

Solution Approach:Invest in grid capacity upgrades and streamline the interconnection study and approval process to enable faster deployment of distributed solar and other renewables.

- Limitation:

Lack of Real-time Grid Visibility

Impact:Medium

Solution Approach:Continue deployment of Advanced Metering Infrastructure (AMI) and other grid sensors to enable better monitoring and control of a more complex, two-way grid.

Operational Bottlenecks

- Bottleneck:

Lengthy Permitting & Siting Processes

Growth Impact:Slows down critical transmission and infrastructure projects needed to meet clean energy goals and demand growth.

Resolution Strategy:Proactive community and stakeholder engagement, enhanced collaboration with state and local agencies, and programmatic permitting approaches.

- Bottleneck:

Supply Chain for Key Electrical Components

Growth Impact:Delays projects and increases costs for essential equipment like transformers and high-voltage cables.

Resolution Strategy:Strategic sourcing, long-term supplier partnerships, and standardization of equipment specifications to improve availability.

- Bottleneck:

Skilled Workforce Shortage

Growth Impact:Lack of qualified lineworkers, engineers, and data scientists can constrain the pace of construction and innovation.

Resolution Strategy:Invest in internal training programs, apprenticeships, and partnerships with technical colleges and universities.

Market Penetration Challenges

- Challenge:

Regulatory Lag and Risk

Severity:Critical

Mitigation Strategy:Maintain constructive relationships with regulators through transparent communication and robust justification for investments. Advocate for forward-looking rate mechanisms like multi-year rate plans.

- Challenge:

Customer Affordability Concerns

Severity:Major

Mitigation Strategy:Balance large-scale investments with cost-control measures. Clearly communicate the long-term benefits of grid modernization (reliability, clean energy) to justify rate impacts. Offer enhanced efficiency and demand management programs.

- Challenge:

Competition from Third-Party DER Providers

Severity:Minor

Mitigation Strategy:Shift the business model to become an enabler and orchestrator of customer-owned resources, offering services for interconnection, management, and grid integration rather than viewing them as a threat.

Resource Limitations

Talent Gaps

- •

Grid orchestration and DER management systems (DERMS) experts

- •

Data scientists and AI/ML engineers for predictive analytics

- •

Customer-centric service and program designers

Extremely high and continuous. Requires consistent, credit-supportive access to debt and equity markets to fund the ~$24B, 5-year capital plan.

Infrastructure Needs

- •

Upgraded transmission lines to support offshore wind and other renewables.

- •

Modernized distribution substations to handle two-way power flows.

- •

A robust, secure fiber optic communications network overlaying the grid for control and data acquisition.

Growth Opportunities

Market Expansion

- Expansion Vector:

Energy-as-a-Service (EaaS) for Commercial & Industrial Customers

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Develop tailored solutions for large customers that combine energy supply, efficiency upgrades, on-site generation (solar/storage), and EV fleet charging, managed by Eversource for a fixed fee.

Product Opportunities

- Opportunity:

Managed EV Charging & Fleet Electrification Services

Market Demand Evidence:Rapidly growing EV adoption in MA, CT, and NH, coupled with state mandates.

Strategic Fit:Core to managing new grid load and provides a new, potentially less-regulated, revenue stream.

Development Recommendation:Expand current rebate programs into a full-service offering for residential (smart charging) and commercial (fleet electrification planning, charger installation, and management) customers.

- Opportunity:

Virtual Power Plant (VPP) Aggregation

Market Demand Evidence:Increasing customer adoption of solar batteries and smart thermostats creates an opportunity to aggregate these resources to provide grid services.

Strategic Fit:Evolves the utility role to a 'smart integrator,' enhancing grid stability without building new power plants.

Development Recommendation:Launch pilot programs with incentives for customers to enroll their devices (batteries, smart thermostats, EV chargers) into a VPP platform managed by Eversource.

- Opportunity:

Offshore Wind Transmission Infrastructure

Market Demand Evidence:Significant offshore wind development planned off the New England coast requires substantial onshore transmission upgrades.

Strategic Fit:Leverages core competency in building and operating large-scale transmission projects.

Development Recommendation:Proactively partner with states and offshore wind developers to plan, permit, and build the necessary transmission infrastructure, such as the Huntsbrook OSW Hub.

- Opportunity:

Networked Geothermal Systems

Market Demand Evidence:Growing demand for non-fossil fuel heating and cooling solutions.

Strategic Fit:Decarbonizes the natural gas business and leverages expertise in managing underground pipe networks.

Development Recommendation:Scale the successful Framingham pilot project to other suitable neighborhoods, seeking a regulatory framework that allows for rate-basing these investments.

Channel Diversification

- Channel:

Mobile App as a Central Customer Hub

Fit Assessment:High

Implementation Strategy:Evolve the mobile app from a simple bill-pay/outage tool to a comprehensive platform for energy management, program enrollment, and personalized insights.

- Channel:

Partnerships with Clean Tech Installers (Solar, HVAC, EV)

Fit Assessment:High

Implementation Strategy:Develop a certified partner network to streamline the customer journey for adopting clean technologies, with Eversource providing financing, rebates, and grid integration services.

Strategic Partnerships

- Partnership Type:

Technology Platform Providers

Potential Partners

- •

DERMS software companies (e.g., Siemens, Schneider Electric)

- •

EV charging network providers (e.g., ChargePoint, EVgo)

- •

Smart home device makers (e.g., Google Nest, Ecobee)

Expected Benefits:Accelerate development of new services, reduce in-house development costs, and leverage best-in-class technology.

- Partnership Type:

Municipalities and State Agencies

Potential Partners

City of Boston, Hartford

State Departments of Energy and Environmental Protection

Expected Benefits:Align on decarbonization goals, streamline permitting for critical infrastructure, and co-develop programs for environmental justice communities.

Growth Strategy

North Star Metric

Annual Capital Deployed into Grid Modernization & Clean Energy Enablement ($B)

Directly measures the primary driver of regulated revenue and earnings growth. It aligns the company's financial success with the public policy goals of decarbonization, resilience, and electrification.

Successfully execute the planned $24.2 billion capital plan over 2025-2029, achieving ~8% rate base growth annually.

Growth Model

Regulated Investment & Service Expansion

Key Drivers

- •

Constructive Regulatory Outcomes

- •

Efficient Capital Project Execution

- •

Customer Adoption of New Energy Services (EVs, Solar, Efficiency)

- •

Systemic Electrification

Focus on a three-pronged approach: 1) Proactively file well-justified rate cases to support capital plans. 2) Achieve operational excellence in project management to deliver projects on time and on budget. 3) Invest in marketing and customer education to drive adoption of new programs that support grid stability and clean energy goals.

Prioritized Initiatives

- Initiative:

Launch 'Electrify Everything' Program Suite

Expected Impact:High

Implementation Effort:High

Timeframe:12-18 months

First Steps:Consolidate existing EV, heat pump, and efficiency programs under a unified marketing umbrella. Develop a digital self-service portal for customers to assess their homes and businesses for electrification potential and seamlessly apply for all relevant rebates.

- Initiative:

Develop a Scalable Virtual Power Plant (VPP) Platform

Expected Impact:High

Implementation Effort:Medium

Timeframe:9-12 months

First Steps:Select a DERMS technology partner and launch an expanded pilot program in a specific service area, offering attractive incentives for customers to enroll their smart thermostats, batteries, and EV chargers.

- Initiative:

Establish a Fleet Electrification Advisory Service

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:6-9 months

First Steps:Create a dedicated team to consult with commercial customers on fleet EV transition planning, TCO analysis, and charging infrastructure deployment, leveraging existing utility incentives.

Experimentation Plan

High Leverage Tests

- Test:

Time-of-Use (TOU) Rate Pilots

Hypothesis:Dynamic TOU rates will shift EV charging and other significant loads to off-peak hours, reducing grid stress and lowering costs.

Success Metric:Percentage of load shifted from peak to off-peak hours.

- Test:

Geothermal Network Pilot Expansion

Hypothesis:Utility-scale geothermal can provide a cost-effective, non-emitting heating/cooling solution that leverages existing operational capabilities.

Success Metric:Customer satisfaction, system reliability, and all-in cost per BTU compared to natural gas or air-source heat pumps.

Utilize AMI data, customer surveys, and engineering analysis to measure the impact of pilots on grid performance, customer behavior, and cost-effectiveness. Present findings in regulatory filings to support broader rollouts.

Launch 1-2 major pilot programs annually, with ongoing A/B testing of marketing and enrollment tactics for existing programs on a quarterly basis.

Growth Team

A centralized 'Grid & Customer Innovation' team that operates as a center of excellence, working with traditional business units (Transmission, Distribution, Customer Service) to develop and scale new initiatives.

Key Roles

- •

Head of Grid Modernization Strategy

- •

Product Manager, Electrification Services

- •

Data Scientist, Grid Analytics

- •

Regulatory Innovation Specialist

Develop capabilities through a combination of hiring external talent with experience in software and clean tech, targeted training for existing high-potential employees, and strategic partnerships with technology companies.

Eversource is well-positioned for a period of sustained, regulator-approved growth, fundamentally driven by the immense capital investment required for the clean energy transition. The company's 'product-market fit' is unassailable as a regulated monopoly providing essential services. The primary growth engine is not traditional customer acquisition but rather the expansion of its rate base through strategic capital deployment. Eversource has correctly identified the key growth vectors: modernizing an aging grid, enabling the integration of offshore wind and distributed solar, and supporting the electrification of transportation and heating. Their planned $24.2 billion capital investment over the next five years is the cornerstone of this strategy.

The most significant opportunities lie in evolving the business model from a simple energy delivery company to a sophisticated 'smart integrator' of a complex, decentralized energy system. This involves creating new revenue streams and value propositions around managed EV charging, virtual power plants (VPPs), and potentially energy-as-a-service offerings for large commercial clients. Success in these areas will require building new organizational capabilities in data analytics, software platform management, and customer-centric service design.

The primary barriers to scaling are not market-based but are institutional and operational. Navigating the complex regulatory environments of three different states to secure timely approval for investments and rate adjustments is the most critical challenge. Furthermore, operational constraints such as supply chain bottlenecks, lengthy permitting processes, and a shortage of skilled labor could impede the pace of execution.

Recommendations are focused on transforming these challenges into competitive advantages. The strategic priority should be to become an indispensable partner to state governments and regulators in achieving their decarbonization goals. This involves proactively proposing innovative solutions like the geothermal pilot and offshore wind transmission hubs , thereby shaping the regulatory framework in their favor. Internally, a shift towards a more agile, product-focused mindset is needed to capitalize on the service-based opportunities presented by electrification and DERs. By successfully executing its massive capital plan while simultaneously innovating its service offerings, Eversource can drive significant long-term growth and solidify its position as a leader in the energy transition.

Legal Compliance

The Eversource website has a dedicated 'Privacy Policy' which is accessible via the site footer. The policy outlines the types of information collected (e.g., personal data for service provision, household income for assistance programs), its usage, and states that data is not sold for monetary consideration. It includes sections on protecting children's privacy (services not directed to persons under 18), a linking policy for third-party sites, and a general disclaimer. However, the policy lacks the specific, granular disclosures and user rights language required by modern data privacy laws in the states where Eversource operates, such as the Connecticut Data Privacy Act (CTDPA). For instance, it does not explicitly detail consumer rights like the right to access, correct, delete, or opt-out of the 'sale' or 'sharing' of data for targeted advertising, which are key components of the CTDPA. It also lacks a 'Do Not Sell or Share My Personal Information' link or a comprehensive privacy choices portal, which is a best practice for compliance.

Eversource provides 'Terms and Conditions' accessible through the website footer. The terms govern the use of their web properties, disclaim warranties regarding the information provided ('as is'), and limit liability. They include clauses on dispute resolution, directing users to contact the company for issues and noting the terms do not alter existing liabilities between the customer and Eversource. The terms also address the cancellation of online access and contain a clear policy regarding links to non-Eversource websites. While the document covers standard provisions, it could be enhanced with clearer language for non-legal audiences to improve readability and user comprehension.

Upon visiting the website, a cookie consent banner appears at the bottom of the page. The banner informs the user that the site uses cookies and provides a link to the Privacy Policy. However, the mechanism is a simple 'accept and close' implementation. It does not offer granular control for users to opt-in or opt-out of different categories of cookies (e.g., functional, advertising, analytics). This approach does not meet the standards of modern privacy laws like the CTDPA, which require the ability to opt-out of processing for targeted advertising. There is no visible cookie settings manager or persistent icon that allows users to change their consent preferences after the initial choice.