eScore

extraspace.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Extra Space Storage demonstrates a masterful command of its digital presence, particularly in local search where it dominates high-intent queries essential for customer acquisition. Its content authority is firmly established by its market leadership position, although its thought leadership could be elevated beyond functional guides to industry-wide data reporting. The website's architecture is expertly optimized for its vast geographic reach, with a hyper-local focus that effectively penetrates 98 of the 100 largest US metro markets. Their strong performance on conversational, location-based queries indicates a solid foundation for voice search.

Exceptional search intent alignment and hyper-local SEO strategy that directly converts geographically-targeted searches into online rentals.

Transition from functional content (e.g., sizing guides) to true thought leadership by launching a data-driven annual industry report, leveraging proprietary data to become the market's primary information source.

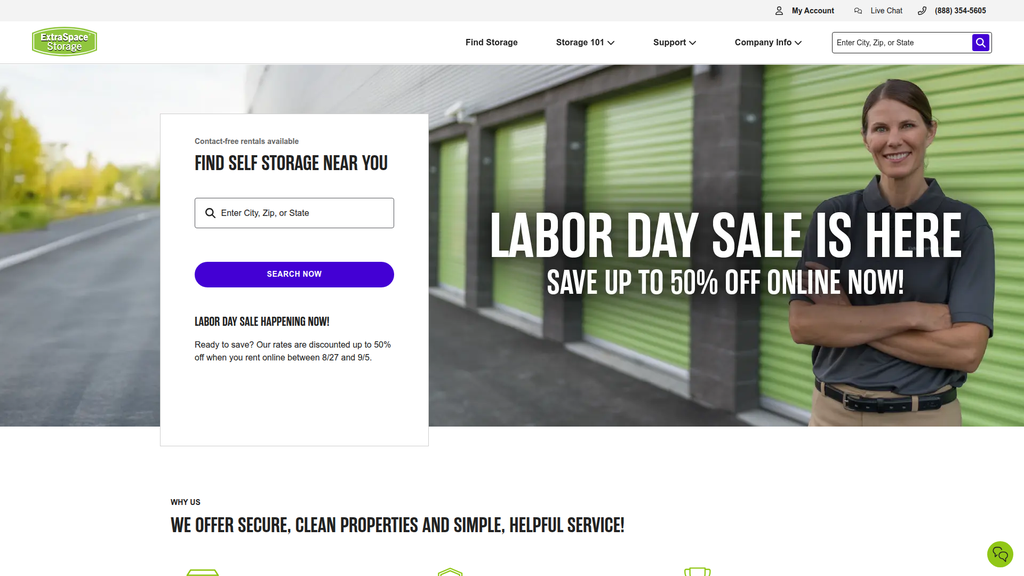

The company's messaging is a case study in clarity, effectively communicating its core value proposition of convenience, security, and cleanliness to its primary audience of personal movers. Conversion messaging is direct and powerful, guiding users seamlessly toward the primary call-to-action. While highly differentiated from smaller competitors, the homepage messaging for the lucrative small business segment is underdeveloped. The emotional journey is well-mapped, appealing to the need for peace of mind during stressful life transitions.

The messaging hierarchy is exceptionally clear, with a primary focus on the user's core intent ('Find self storage near you') and secondary messages that strongly reinforce the value proposition.

Develop a dedicated messaging module and content stream on the homepage specifically for business customers, addressing their unique pain points around inventory management, logistics, and flexible space.

The primary conversion path for renting a unit is highly streamlined and praised for its low cognitive load and effective 'contact-free' process. The mobile experience is strong, contributing significantly to conversions. However, the overall score is significantly penalized by a critical accessibility gap; the lack of a formal Accessibility Statement exposes the business to high legal risk under the ADA and creates a major barrier for users with disabilities. This oversight negatively impacts their potential market reach and is a substantial friction point.

A streamlined, low-friction online rental process that effectively reduces cognitive load and guides users from search to reservation in minutes.

Immediately develop and publish a formal Accessibility Statement committing to WCAG 2.1 standards and conduct a full accessibility audit to mitigate significant legal risk and improve the experience for all users.

Credibility is expertly established through a strong hierarchy of trust signals, most notably the prominent use of authentic customer reviews and Google ratings as powerful social proof. The company's comprehensive privacy policy and granular cookie consent manager demonstrate a mature approach to data protection, a key risk mitigation factor. Third-party validation is evident through their S&P 500 status and market leadership. However, transparency is weakened by the lack of proactive communication around rent increases for existing tenants, a known industry pain point.

Powerful and highly effective use of customer reviews and testimonials directly on the homepage, which serves as authentic, third-party validation that builds significant trust early in the user journey.

Increase pricing transparency by adding messaging that explains their rate policy for existing tenants, proactively addressing a major source of customer dissatisfaction and building long-term trust.

Extra Space possesses a formidable and sustainable competitive moat built on its unmatched scale as the nation's largest self-storage operator by facility count following the Life Storage acquisition. This scale creates significant operational efficiencies and data advantages. A key differentiator is its sophisticated 'ManagementPlus' third-party management platform, which facilitates capital-light growth and creates a pipeline for future acquisitions. While an adopter of technology, a stronger push towards innovation in areas like AI-powered logistics could further widen its lead.

Unmatched operational scale combined with a sophisticated third-party management platform creates a dual advantage that is incredibly difficult for competitors to replicate.

More aggressively market technology as a core differentiator, moving from being a tech adopter to a visible tech leader by highlighting features like app-based access and AI-driven services.

The business model is exceptionally scalable, proven by their successful track record of large-scale M&A, including the massive Life Storage integration. High fixed costs and low variable costs create significant operating leverage, making each new customer highly profitable. The 'ManagementPlus' platform represents a mature, capital-efficient expansion strategy, allowing them to grow their footprint and fee income with minimal capital outlay. The company's status as a large, publicly-traded REIT ensures robust access to capital for continued expansion.

The dual-engine growth model of strategic, large-scale acquisitions combined with the capital-light expansion of its third-party management platform provides unparalleled scalability.

Develop a formal international expansion strategy, likely beginning with a joint venture or acquisition in a stable market like Europe or Australia to replicate their domestic success.

The business model is a textbook example of a mature, coherent, and highly optimized REIT. Revenue streams are expertly diversified beyond core rentals to include high-margin, recurring income from tenant insurance and management fees. Resource allocation is strategically focused on M&A and technology to drive growth and efficiency. The model demonstrates excellent market timing, capitalizing on a consolidating industry, and shows strong alignment between the interests of customers, partners, and shareholders.

A highly diversified and optimized revenue model with multiple recurring, high-margin streams (rentals, management fees, insurance) that create predictable cash flow and exceptional profitability.

Innovate the business model by piloting 'storage-as-a-service' offerings for business customers, such as integrated inventory management or last-mile logistics partnerships, to create new, high-value revenue streams.

As the largest self-storage operator in the U.S. by facility count, Extra Space wields immense market power. Their aggressive acquisition strategy demonstrates a clear trajectory of increasing market share and consolidating the industry. This scale provides significant pricing power, supplier leverage, and the ability to invest in technology and marketing at a level smaller competitors cannot match. Their vast data set from over 4,000 locations gives them an unparalleled intelligence advantage for revenue management and strategic planning.

Dominant market share and scale following the Life Storage merger, which grants significant pricing power, operational leverage, and the ability to influence industry standards.

Leverage their market-leading position to formally influence the industry by publishing data-driven reports on economic and moving trends, solidifying their status as the definitive market authority.

Business Overview

Business Classification

Real Estate Investment Trust (REIT)

Third-Party Property Management

Real Estate

Sub Verticals

Self-Storage

Property Technology (PropTech)

Mature

Maturity Indicators

- •

Publicly traded on NYSE (S&P 500 component).

- •

Largest self-storage operator in the U.S. by store count.

- •

Growth primarily driven by strategic acquisitions, like the merger with Life Storage.

- •

Significant focus on operational efficiency and data analytics to optimize revenue.

- •

Established brand with a nationwide footprint across 43 states.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Storage Unit Rentals

Description:Core revenue from monthly rental of self-storage units to individuals and businesses. This includes various unit sizes and types like climate-controlled, drive-up access, and specialized vehicle storage.

Estimated Importance:Primary

Customer Segment:Residential & Business Customers

Estimated Margin:High

- Stream Name:

Third-Party Management Fees (ManagementPlus)

Description:Fee-based income from managing self-storage facilities for other owners under their 'ManagementPlus' platform. This is a capital-light growth driver.

Estimated Importance:Secondary

Customer Segment:Self-Storage Property Owners

Estimated Margin:High

- Stream Name:

Tenant Insurance

Description:Offering and reinsuring insurance policies for tenants to cover the value of their stored goods, representing a significant high-margin ancillary revenue stream.

Estimated Importance:Secondary

Customer Segment:Residential & Business Customers

Estimated Margin:High

- Stream Name:

Bridge Loans & Financial Services

Description:Origination of mortgage and mezzanine bridge loans for existing and potential third-party management partners, creating another income source and strengthening partner relationships.

Estimated Importance:Tertiary

Customer Segment:Self-Storage Property Owners & Developers

Estimated Margin:Medium

- Stream Name:

Ancillary Retail Sales & Fees

Description:Sales of moving and packing supplies (boxes, locks, tape) at physical locations, as well as administrative and late fees.

Estimated Importance:Tertiary

Customer Segment:Residential & Business Customers

Estimated Margin:Medium

Recurring Revenue Components

- •

Monthly Storage Unit Rentals

- •

Tenant Insurance Premiums

- •

Third-Party Management Fees

Pricing Strategy

Dynamic & Promotional Pricing

Mid-range to Premium

Semi-transparent

Pricing Psychology

- •

Promotional discounts for new customers (e.g., '50% off')

- •

Urgency tactics ('LABOR DAY SALE HAPPENING NOW')

- •

Value-based pricing emphasizing security and cleanliness

Monetization Assessment

Strengths

- •

Highly diversified revenue streams beyond core rentals.

- •

Strong recurring revenue model provides predictable cash flow.

- •

High-margin ancillary services like tenant insurance and management fees boost profitability.

- •

Sophisticated, data-driven revenue management systems to optimize pricing and occupancy.

Weaknesses

- •

Rental revenue is sensitive to economic downturns and fluctuations in housing market activity.

- •

Potential for negative customer perception due to aggressive rent increases for existing tenants.

- •

Occupancy rates and pricing power can be impacted by local oversupply of storage units.

Opportunities

- •

Expand the 'ManagementPlus' platform to capture more of the fragmented market of independent owners.

- •

Leverage vast data sets with AI for more precise, predictive pricing models.

- •

Bundle services with partners (e.g., moving companies, logistics providers) for new revenue channels.

- •

Further develop financial products for storage facility owners and developers.

Threats

- •

Intensifying competition from other large REITs like Public Storage and CubeSmart.

- •

Rising property taxes and operating costs could compress margins.

- •

A slowdown in population mobility or home sales could reduce new customer demand.

Market Positioning

Market Leader through Scale, Quality, and Technology

Largest operator in the U.S. by number of facilities.

Target Segments

- Segment Name:

Residential Movers & Life Transitions

Description:Individuals and families undergoing life events such as moving, downsizing, renovating, or combining households who require temporary storage.

Demographic Factors

Renters and homeowners aged 25-55

Geographically mobile individuals

Psychographic Factors

Seeking convenience and ease during a stressful time

Value security and peace of mind for their belongings

Behavioral Factors

Conduct online searches for 'storage near me'

Highly influenced by location, price, and positive reviews

Pain Points

- •

Stress of moving

- •

Lack of space in new/current home

- •

Need for a secure, temporary location for possessions

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Small to Medium-Sized Businesses (SMBs)

Description:Businesses needing cost-effective space for inventory, equipment, archives, or company vehicles.

Demographic Factors

Contractors, e-commerce retailers, pharmaceutical reps, local service providers

Psychographic Factors

- •

Cost-conscious

- •

Value flexibility over long-term commercial leases

- •

Need for secure and accessible off-site storage

Behavioral Factors

Seeking flexible month-to-month terms

Require features like drive-up access or package delivery services

Pain Points

- •

High cost of commercial warehouse space

- •

Fluctuating inventory levels requiring scalable storage

- •

Need for secure document or equipment storage

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Specialty Storage Users

Description:Individuals requiring specialized storage for high-value items like RVs, boats, classic cars, or wine collections.

Demographic Factors

Higher-income individuals

Hobbyists and collectors

Psychographic Factors

Protective of valuable assets

Willing to pay a premium for specific features (e.g., climate control, enhanced security)

Behavioral Factors

Search for specific keywords like 'RV storage' or 'boat storage'

Value amenities like wide driveways and electrical hookups

Pain Points

- •

Lack of space at home for large vehicles

- •

HOA restrictions

- •

Need for a secure environment to protect valuable assets

Fit Assessment:Good

Segment Potential:Medium

Market Differentiation

- Factor:

Unmatched Scale & National Footprint

Strength:Strong

Sustainability:Sustainable

- Factor:

Technology & Digital Customer Experience

Strength:Strong

Sustainability:Sustainable

- Factor:

Third-Party Management Platform (ManagementPlus)

Strength:Strong

Sustainability:Sustainable

- Factor:

Brand Recognition & Trust

Strength:Moderate

Sustainability:Sustainable

Value Proposition

To provide the most convenient, secure, and professional self-storage solutions, powered by industry-leading technology and a vast national network.

Excellent

Key Benefits

- Benefit:

Convenience

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Contact-free online rentals

- •

Bluetooth gate access via app

- •

Over 4,000 locations nationwide

- Benefit:

Security & Peace of Mind

Importance:Critical

Differentiation:Common

Proof Elements

- •

Well-lit, clean facilities

- •

Gated access

- •

On-site management

- •

Emphasized messaging: 'SAFE & SECURE'

- Benefit:

Flexibility & Variety

Importance:Important

Differentiation:Common

Proof Elements

- •

Wide range of unit sizes

- •

Specialty storage options (climate control, vehicle storage)

- •

Month-to-month leases

Unique Selling Points

- Usp:

Largest Self-Storage Network in the U.S.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Industry-Leading Third-Party Management Platform

Sustainability:Long-term

Defensibility:Strong

- Usp:

Sophisticated Data Analytics for Revenue Management

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Lack of space due to life transitions, clutter, or business needs.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Need for a secure location to store valuable personal or business assets.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Desire for a flexible, cost-effective alternative to long-term commercial real estate leases for businesses.

Severity:Major

Solution Effectiveness:Complete

Value Alignment Assessment

High

The value proposition directly addresses the core market needs for space, security, and convenience, which are persistent drivers of demand in the self-storage industry.

High

The emphasis on a seamless digital experience, security, and a professional image aligns perfectly with the expectations of both modern residential consumers and SMBs.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Third-party property owners (via ManagementPlus)

- •

Real estate developers

- •

Joint venture capital partners

- •

Moving and logistics companies

Key Activities

- •

Property acquisition, development, and management

- •

Digital marketing and customer acquisition

- •

Technology development (online platform, app, revenue management systems)

- •

Capital allocation and financial management

Key Resources

- •

Extensive portfolio of owned and managed real estate assets

- •

Strong brand reputation and market presence

- •

Proprietary technology and data analytics platforms

- •

Access to capital markets as a large REIT

Cost Structure

- •

Property acquisition and development costs

- •

Facility operating expenses (utilities, maintenance, security)

- •

Property taxes

- •

Employee salaries and benefits

- •

Marketing and advertising expenditures

- •

Technology infrastructure and development

Swot Analysis

Strengths

- •

Market leadership and unparalleled scale post-Life Storage merger.

- •

Diversified and high-margin revenue streams (rentals, management, insurance).

- •

Advanced technological infrastructure and data-driven operational model.

- •

Strong balance sheet and proven ability to integrate large acquisitions.

Weaknesses

- •

Capital-intensive business model requires continuous investment.

- •

Performance is susceptible to macroeconomic trends, interest rates, and housing market volatility.

- •

Potential for brand dilution and operational inconsistency across a vast network of facilities.

- •

High property tax expenses in key markets can pressure NOI.

Opportunities

- •

Further consolidate the fragmented self-storage market through targeted acquisitions.

- •

Expand the capital-light 'ManagementPlus' platform both domestically and potentially internationally.

- •

Leverage technology to introduce new services (e.g., 'valet storage,' last-mile logistics hubs).

- •

Increase adoption of sustainable practices like solar power to reduce operating costs and appeal to ESG investors.

Threats

- •

Aggressive competition from other major REITs (e.g., Public Storage, CubeSmart) and private equity.

- •

An economic recession could lead to lower occupancy and increased customer delinquency.

- •

Regulatory changes, including zoning laws and property tax increases.

- •

Disruptive technologies or new business models in the storage and logistics space.

Recommendations

Priority Improvements

- Area:

Customer Lifecycle Management

Recommendation:Develop and implement a more sophisticated pricing strategy for existing tenants to balance revenue optimization with customer retention, potentially offering loyalty-based incentives or longer-term fixed-rate options.

Expected Impact:Medium

- Area:

Operational Integration

Recommendation:Accelerate the full integration of Life Storage's systems and operations to realize cost synergies and standardize the high-quality customer experience promised by the Extra Space brand across all properties.

Expected Impact:High

- Area:

Data Analytics

Recommendation:Invest further in AI and machine learning to move from dynamic to predictive pricing, forecasting demand at a hyper-local level to proactively adjust rates and promotions for maximum yield.

Expected Impact:High

Business Model Innovation

- •

Evolve into a broader 'Personal Logistics' provider by integrating valet storage services (pickup and delivery of items), which leverages the existing facility network while adding a high-margin service layer.

- •

Develop 'Hybrid Storage' facilities that combine self-storage with flexible, small-scale office or co-working spaces to cater to the growing gig economy and remote workforce.

- •

Utilize facilities in dense urban areas as micro-fulfillment or last-mile delivery hubs for e-commerce partners, creating a B2B revenue stream from existing assets.

Revenue Diversification

- •

Formalize and expand partnerships with national moving companies, real estate agencies, and home services providers to create a referral ecosystem and offer bundled service packages.

- •

Enhance the retail component by offering a wider range of high-margin moving and organization products, both in-store and online.

- •

Explore offering specialized business services like secure shredding, package acceptance, and short-term office rentals within facilities.

Extra Space Storage has successfully executed a strategy of aggressive growth through acquisition, culminating in its position as the largest self-storage operator in the United States following the pivotal Life Storage merger. The company's business model is a mature, robust, and highly effective combination of a traditional REIT structure with a sophisticated, technology-driven property management operation. Its primary strengths lie in its immense scale, which provides significant operational and marketing efficiencies, and its diversified, high-margin revenue streams. The 'ManagementPlus' third-party management platform is a key strategic asset, enabling capital-light expansion and creating a valuable pipeline for future acquisitions. The company's value proposition of convenience, security, and professionalism is clearly articulated and well-aligned with market demands.

However, the company faces threats inherent to the real estate sector, including sensitivity to economic cycles, rising operating costs, and intense competition. Future success will depend on its ability to seamlessly integrate its vast portfolio, maintain service quality at scale, and continue innovating. The most significant strategic opportunities lie in leveraging its data and technology leadership to pioneer new services beyond traditional storage. By evolving towards a more integrated logistics and space-as-a-service model—offering solutions like valet storage, micro-fulfillment hubs, and hybrid work/storage spaces—Extra Space can build a deeper competitive moat, create new revenue streams, and solidify its market leadership for the long term.

Competitors

Competitive Landscape

Mature

Moderately concentrated

Barriers To Entry

- Barrier:

High Capital Investment for Real Estate

Impact:High

- Barrier:

Local Zoning and Land Use Regulations

Impact:High

- Barrier:

Achieving Economies of Scale

Impact:Medium

- Barrier:

Brand Recognition and Marketing Spend

Impact:Medium

Industry Trends

- Trend:

Increased Technology Adoption

Impact On Business:Requires investment in smart units, online rental platforms, and automation to meet customer expectations for convenience and security.

Timeline:Immediate

- Trend:

Market Consolidation

Impact On Business:The acquisition of Life Storage by Extra Space Storage exemplifies this trend, creating larger players with greater scale and pricing power.

Timeline:Immediate

- Trend:

Demand for Climate-Controlled Units

Impact On Business:Growing customer preference for climate-controlled storage necessitates facility upgrades and offers a premium pricing opportunity.

Timeline:Near-term

- Trend:

Sustainability and Eco-Friendly Practices

Impact On Business:Adopting green designs with solar power and energy-efficient lighting is becoming a brand differentiator.

Timeline:Long-term

Direct Competitors

- →

Public Storage

Market Share Estimate:Largest owner with ~11.4% of market share.

Target Audience Overlap:High

Competitive Positioning:Positions itself as the most established and recognizable brand with a vast network of facilities in prime, supply-restricted markets.

Strengths

- •

Unmatched brand recognition and trust.

- •

Extensive portfolio of properties in high-barrier-to-entry urban markets.

- •

Significant economies of scale in operations and marketing.

- •

Strong financial position and balance sheet for acquisitions.

Weaknesses

- •

Customer service complaints have been noted.

- •

Potentially slower to adopt newest technologies compared to more nimble competitors.

- •

Can be perceived as having higher prices due to brand leadership.

Differentiators

- •

First-mover advantage in acquiring prime real estate decades ago.

- •

Scale of operations is larger than the next three competitors combined.

- •

Strong focus on a lucrative ancillary insurance business.

- →

CubeSmart

Market Share Estimate:~2.6% of the market.

Target Audience Overlap:High

Competitive Positioning:Focuses on superior customer service and a modern, tech-forward user experience, often in high-income metropolitan areas.

Strengths

- •

Strong emphasis on customer service as a key differentiator.

- •

Advanced technology platform, including a robust mobile app and AI-powered customer management.

- •

Sophisticated data analytics and revenue management systems to optimize pricing.

- •

Growing third-party management platform provides a capital-light expansion model.

Weaknesses

- •

Smaller scale and market share compared to Public Storage and Extra Space.

- •

Portfolio is more concentrated in specific metropolitan areas, leading to regional economic vulnerability.

- •

Intense competition from both large REITs and local operators.

Differentiators

- •

Emphasis on a high-touch, customer-centric service model.

- •

Use of a sophisticated, data-driven platform for pricing and promotion decisions.

- •

Focus on high-quality assets in densely populated urban markets.

- →

U-Haul

Market Share Estimate:~4.7% of the market.

Target Audience Overlap:High

Competitive Positioning:An integrated, one-stop-shop for DIY moving and storage, leveraging its vast network of truck rental locations.

Strengths

- •

Synergistic business model combining truck/trailer rentals with self-storage.

- •

Massive physical presence with over 22,000 locations, many through a dealer network.

- •

High brand recognition in the moving industry, creating a built-in customer funnel for storage.

- •

Often a leader in new construction and development.

Weaknesses

- •

Customer service can be inconsistent, particularly at franchised dealer locations.

- •

Self-storage can be seen as a secondary business to truck rentals, potentially impacting facility quality.

- •

The dealer model can lead to a less standardized customer experience.

Differentiators

- •

Offers a complete ecosystem for moving, including rentals, supplies, and storage.

- •

Unique dealer network model allows for rapid and widespread market penetration.

- •

Provides specialized business services like package acceptance and warehouse options.

Indirect Competitors

- →

Neighbor.com

Description:A peer-to-peer (P2P) marketplace that connects individuals with unused space (garages, basements, driveways) to those needing storage. Often marketed as the "Airbnb of storage".

Threat Level:Medium

Potential For Direct Competition:Low, as their asset-light model is fundamentally different from owning and operating facilities. However, they compete directly for customers.

- →

Clutter / MakeSpace

Description:On-demand or "valet" storage services that provide pick-up, storage, and delivery of customers' belongings, often with a digital inventory.

Threat Level:Medium

Potential For Direct Competition:Medium. These companies could be acquisition targets for large REITs looking to enter the full-service vertical.

- →

PODS

Description:Provides portable storage containers that are delivered to a customer's location, which can be stored on-site or at a secure PODS facility.

Threat Level:Low

Potential For Direct Competition:Low. Their business is centered on logistics and portable units, not fixed real estate assets.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Unmatched Scale and Market Density

Sustainability Assessment:Following the Life Storage acquisition, Extra Space is the largest operator by store count, creating significant operational efficiencies, data advantages, and purchasing power.

Competitor Replication Difficulty:Hard

- Advantage:

Sophisticated Third-Party Management Platform

Sustainability Assessment:The 'Management Plus' platform allows for capital-light expansion, generates fee income, and creates a pipeline for future acquisitions, a strategy that is difficult to replicate at scale.

Competitor Replication Difficulty:Hard

- Advantage:

Advanced Data Analytics for Revenue Management

Sustainability Assessment:The vast amount of data from over 4,000 locations and millions of customers provides a deep moat for optimizing pricing, promotions, and operational strategies.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': "Promotional Pricing (e.g., 'Labor Day Sale')", 'estimated_duration': 'Short-term (seasonal)'}

{'advantage': 'Integration Synergy from Life Storage Acquisition', 'estimated_duration': '1-3 years, as cost savings and operational efficiencies are realized. '}

Disadvantages

- Disadvantage:

Integration Complexity

Impact:Major

Addressability:Moderately

- Disadvantage:

Brand Dilution Risk

Impact:Minor

Addressability:Easily

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted digital marketing campaigns highlighting tech advantages like the app-based gate access mentioned in customer reviews.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Prominently feature 'contact-free rentals' on all local search landing pages to capture convenience-focused customers.

Expected Impact:Medium

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Develop and market specialized storage solutions for niche segments like e-commerce inventory, pharmaceutical reps, or wine collectors.

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Standardize and upgrade technology across the newly acquired Life Storage portfolio to include smart locks, enhanced security, and seamless online management.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Establish formal partnership programs with apartment complexes, moving companies, and real estate agents to create a referral ecosystem.

Expected Impact:High

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Invest in or acquire a technology company in the P2P or valet storage space to hedge against market disruption and capture new customer segments.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Expand the third-party management platform aggressively to consolidate the fragmented market of independent operators under the Extra Space operational umbrella.

Expected Impact:High

Implementation Difficulty:Moderate

Solidify the position as the technologically superior, most convenient, and professionally managed premium storage provider, justifying its scale and price point.

Differentiate through a seamless, technology-driven customer journey—from online rental to app-based access and automated payments—combined with the assurance of security and professionalism that comes with the largest operator in the nation.

Whitespace Opportunities

- Opportunity:

Full-Service Business Logistics

Competitive Gap:Traditional self-storage offers space, but not services. Competitors like U-Haul offer package acceptance, but a more comprehensive solution for small businesses (inventory management, shipping/receiving) is a gap.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Hyper-Localized, On-Demand Micro-Storage

Competitive Gap:Valet storage is city-wide. There is a gap for ultra-convenient, neighborhood-level storage lockers (similar to Amazon Lockers) for short-term needs, accessible 24/7 via an app.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Managed P2P Storage Platform

Competitive Gap:Companies like Neighbor.com are pure marketplaces. Extra Space could leverage its brand trust to create a 'managed' P2P platform, where it vets, insures, and manages the process for hosts and renters, taking a larger commission.

Feasibility:Low

Potential Impact:High

The U.S. self-storage industry is a mature and resilient market, characterized by steady demand driven by life events and economic shifts. The competitive landscape, while historically fragmented, is undergoing significant consolidation, with large Real Estate Investment Trusts (REITs) at the top. Extra Space Storage has aggressively cemented its leadership position through its transformative acquisition of Life Storage, making it the largest operator by store count in the nation.

Direct Competition: The primary competitive threats are from other national REITs, mainly Public Storage and CubeSmart. Public Storage competes on its unparalleled brand recognition and vast portfolio of prime real estate. CubeSmart differentiates through a focus on superior customer service and technological prowess. U-Haul represents a unique competitor with its integrated moving and storage model, creating a powerful customer acquisition funnel. Extra Space Storage's key competitive advantages are its now-unmatched scale, sophisticated data analytics for revenue management, and a robust third-party management platform that facilitates capital-light growth.

Indirect and Emerging Threats: The industry faces disruption from asset-light models. Peer-to-peer marketplaces like Neighbor.com offer a lower-cost, hyper-local alternative, while valet storage companies like Clutter provide a high-convenience service model. While currently posing a medium threat, these models cater to evolving consumer expectations for on-demand, digitally-native services.

Strategic Position and Opportunities: Extra Space is exceptionally well-positioned due to its scale. The primary challenge and opportunity lie in successfully integrating the Life Storage portfolio, standardizing operations, and leveraging the combined data to create an even more powerful predictive pricing and management engine. Significant whitespace exists in offering more value-added services, particularly for small business customers who require more than just space. Opportunities to innovate around logistics, on-demand micro-storage, or even entering the P2P space via a managed platform could provide future growth vectors and defend against disruption.

Messaging

Message Architecture

Key Messages

- Message:

Find self storage near you

Prominence:Primary

Clarity Score:High

Location:Hero section, above the fold

- Message:

We offer secure, clean properties and simple, helpful service!

Prominence:Secondary

Clarity Score:High

Location:Sub-heading below the hero section

- Message:

LABOR DAY SALE HAPPENING NOW! Our rates are discounted up to 50% off when you rent online...

Prominence:Secondary

Clarity Score:High

Location:Promotional banner below hero search

- Message:

We'll take great care of your stuff!

Prominence:Tertiary

Clarity Score:High

Location:Heading for the Customer Reviews section

- Message:

HOW BIG OF A STORAGE UNIT DO I NEED?

Prominence:Tertiary

Clarity Score:High

Location:Heading for the 'Storage 101' section

The messaging hierarchy is exceptionally clear and effective. The primary message, 'Find self storage near you,' is a direct call to action that addresses the user's core intent immediately. Secondary messages reinforce the value proposition (secure, clean, simple) and create urgency (Labor Day Sale). Tertiary messages support the customer journey by building trust and resolving common questions.

Messaging is highly consistent. The core themes of convenience ('Find... near you', 'Do it all online'), security ('SAFE & SECURE'), and quality ('CLEAN & BRIGHT') are woven throughout the hero section, value proposition icons, and customer reviews, creating a cohesive and reinforcing narrative.

Brand Voice

Voice Attributes

- Attribute:

Helpful / Service-Oriented

Strength:Strong

Examples

- •

We’ll take care of your stuff as if it were our own.

- •

have on-site staff help you out.

- •

Use our custom tools to find the best unit size for you.

- Attribute:

Simple / Direct

Strength:Strong

Examples

- •

Find self storage near you

- •

Reserve and check out in minutes, flat.

- •

Do it all online, easily...

- Attribute:

Reassuring / Trustworthy

Strength:Strong

Examples

- •

Enjoy peace of mind while storing what’s precious.

- •

Our storage facilities are always tidy and well-maintained.

- •

SAFE & SECURE

- Attribute:

Friendly / Approachable

Strength:Moderate

Examples

Dust bunnies can’t hide under these bright lights.

Extra Space is like an extension of your own home.

Tone Analysis

Functional and reassuring

Secondary Tones

Promotional

Customer-centric

Tone Shifts

Shifts from a direct, action-oriented tone in the hero section ('Find... search now') to a more benefit-driven and reassuring tone in the 'Why us' section ('Enjoy peace of mind').

Adopts a promotional tone for the sales banner, creating urgency.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

Extra Space Storage provides the most convenient, secure, and clean self-storage solutions, making the rental process simple and giving you peace of mind.

Value Proposition Components

- Component:

Convenience & Simplicity

Clarity:Clear

Uniqueness:Somewhat Unique

Details:Emphasized through 'Contact-free rentals', 'Do it all online, easily', and the prominent location search bar. The streamlined digital experience is a key differentiator in a traditionally physical industry.

- Component:

Security & Safety

Clarity:Clear

Uniqueness:Common

Details:A table-stakes requirement in the self-storage industry, communicated through phrases like 'SAFE & SECURE' and 'gated in a nice community'. While not unique, it's communicated effectively to address a primary customer concern.

- Component:

Cleanliness & Quality

Clarity:Clear

Uniqueness:Somewhat Unique

Details:Positioned as a key differentiator with 'CLEAN & BRIGHT' and 'well-maintained'. This addresses a common pain point of storage facilities being perceived as dirty or neglected, elevating the brand above low-cost competitors.

- Component:

Helpful Service

Clarity:Clear

Uniqueness:Common

Details:Communicated through mentions of 'on-site staff' and positive customer reviews about service. This hybrid of digital convenience and human support is a strong value proposition.

Extra Space differentiates itself not by offering a single unique feature, but by effectively bundling and communicating the core tenets of convenience, security, and cleanliness. The primary differentiation strategy is operational excellence, messaged as a simple, tech-enabled customer experience ('Reserve and check out in minutes, flat', 'app that is used to open the gate'). This positions them as a modern, reliable, and premium choice in a crowded market.

The messaging positions Extra Space Storage as a market leader that leverages scale and technology to provide a superior and frictionless customer experience compared to smaller, local operators. Against major competitors like Public Storage, the emphasis on 'clean' and 'secure' properties appears to be a subtle competitive jab at a perceived weakness of rivals. The strategy focuses on value and quality over being the cheapest option.

Audience Messaging

Target Personas

- Persona:

The Mover / Life Transitioner (e.g., downsizing, moving cities)

Tailored Messages

- •

Find self storage near you

- •

Reserve and check out in minutes, flat.

- •

safe, climate-controlled space in which to store our belongings!

Effectiveness:Effective

- Persona:

The Home Declutterer / Organizer

Tailored Messages

- •

Extra Space is like an extension of your own home.

- •

HOW BIG OF A STORAGE UNIT DO I NEED?

- •

CLEAN & BRIGHT

Effectiveness:Effective

- Persona:

The Small Business Owner

Tailored Messages

- •

Business Self Storage

- •

choice of outside or climate-controlled storage

- •

they even store boats and RVs

Effectiveness:Somewhat

Notes:While 'Business Self Storage' is listed in the footer, the homepage messaging is overwhelmingly geared towards personal storage needs. This represents a potential area for more targeted messaging.

Audience Pain Points Addressed

- •

The process of finding and renting storage is difficult and time-consuming. ('Reserve and check out in minutes, flat.')

- •

Storage facilities are unsafe or dirty. ('CLEAN & BRIGHT', 'SAFE & SECURE')

- •

Worrying about the safety of my belongings. ('We’ll take care of your stuff as if it were our own.')

- •

Uncertainty about what size unit is needed. ('HOW BIG OF A STORAGE UNIT DO I NEED?')

Audience Aspirations Addressed

- •

A stress-free and smooth moving or life transition.

- •

Peace of mind knowing valuables are protected.

- •

A more organized and less cluttered home or business.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Peace of Mind / Security

Effectiveness:High

Examples

- •

Enjoy peace of mind while storing what’s precious.

- •

We’ll take care of your stuff as if it were our own.

- •

safe, climate-controlled space

- Appeal Type:

Relief / Simplicity

Effectiveness:High

Examples

- •

Reserve and check out in minutes, flat.

- •

Easy online booking!

- •

quick and painless

Social Proof Elements

- Proof Type:

Customer Reviews & Testimonials

Impact:Strong

Details:A dedicated section with multiple, specific quotes from named customers with locations and 5-star ratings from Google. This is a powerful and well-executed form of social proof.

- Proof Type:

Scale & Authority

Impact:Moderate

Details:The footer mentions operating 'over 4,000 self storage properties in 43 states' and being the 'largest storage units operator in the U.S.'. This establishes credibility and market leadership.

Trust Indicators

- •

Clean & Bright Facilities

- •

Safe & Secure Properties

- •

On-site Staff Availability

- •

Authentic Customer Reviews

- •

Clear Privacy Policy links

Scarcity Urgency Tactics

Limited-time Offer: 'LABOR DAY SALE HAPPENING NOW! ...rent online between 8/27 and 9/5.'

Calls To Action

Primary Ctas

- Text:

search now

Location:Hero section

Clarity:Clear

- Text:

OPEN SIZE GUIDE

Location:Storage 101 section

Clarity:Clear

The primary CTA ('search now') is highly effective. It is action-oriented, uses a clear verb, and is placed prominently above the fold, aligning perfectly with the user's primary goal. The secondary CTA ('OPEN SIZE GUIDE') is also effective as it addresses a key customer question and moves them further down the consideration funnel. The overall CTA strategy is focused and drives users toward the core conversion action.

Messaging Gaps Analysis

Critical Gaps

Lack of detailed security feature specifics on the homepage (e.g., 24/7 video surveillance, electronic gate access, on-site managers). While 'SAFE & SECURE' is mentioned, substantiating this claim with specifics would be more powerful.

No direct messaging addressing the common customer pain point of unexpected rent increases after promotional periods. This is a known issue in the industry and a source of negative reviews.

Contradiction Points

No itemsUnderdeveloped Areas

Business Storage Messaging: The homepage lacks compelling messaging for business customers, despite it being a listed service. Tailoring a small section to this valuable audience could improve lead generation.

Technology as a Benefit: The site mentions an app for gate access in a customer review but doesn't feature this as a key benefit in its own messaging. Highlighting tech-forward features like this could strengthen their 'convenience' value proposition.

Messaging Quality

Strengths

- •

Exceptional Clarity: The core value proposition and call to action are immediately understandable.

- •

Strong Problem/Solution Framing: The messaging directly addresses key customer pain points like security, cleanliness, and complexity.

- •

Powerful Use of Social Proof: The customer review section is robust and builds significant trust.

- •

Effective Hierarchy: Messages are prioritized logically to guide the user from discovery to action.

Weaknesses

Over-reliance on Generic Terms: Phrases like 'SAFE & SECURE' are industry-standard and could be strengthened with more specific proof points.

Under-leveraging Technology in Messaging: The company has technological advantages (like the app) that are not prominently featured in the primary marketing copy.

Opportunities

- •

Create dedicated content/messaging streams for key segments like business users, students, or military personnel.

- •

Proactively address the issue of pricing transparency to build long-term trust and differentiate from competitors.

- •

Develop a narrative around being 'an extension of your home,' humanizing the storage experience and appealing to the emotional needs of declutterers.

Optimization Roadmap

Priority Improvements

- Area:

Value Proposition Substantiation

Recommendation:Beneath the 'SAFE & SECURE' icon, add a short bulleted list of specific features (e.g., '24/7 Video Monitoring,' 'Electronic Gate Access,' 'Well-Lit Premises'). A/B test this against the current version to measure impact on conversion.

Expected Impact:High

- Area:

Audience Segmentation

Recommendation:Add a small module on the homepage for 'Business Storage' with a targeted message like 'Your business's extra stockroom' and a direct CTA to a dedicated landing page.

Expected Impact:Medium

- Area:

Pricing Transparency

Recommendation:Add a small, reassuring message near the promotional offer, such as 'We offer transparent pricing. Ask about our rate policies.' This can build trust and pre-emptively address a major customer concern.

Expected Impact:Medium

Quick Wins

Incorporate the 'Bluetooth gate access app' benefit from the customer review into the 'ALWAYS CONVENIENT' section.

Change the 'search now' button text to 'Find My Storage' to create a greater sense of personalization.

Long Term Recommendations

Develop a comprehensive content strategy around 'life transitions,' providing helpful resources (moving checklists, organization tips) that position Extra Space as a helpful partner, not just a commodity service.

Invest in video testimonials to bring the positive customer experiences to life and enhance emotional connection.

Extra Space Storage's website messaging is a masterclass in clarity, focus, and efficiency, directly supporting its business objective of customer acquisition in a competitive market. The messaging architecture is strategically designed to reduce friction and guide the user to the primary conversion action—finding a nearby unit. It successfully positions the brand as a premium, reliable, and modern option by focusing on three core value pillars: convenience, security, and cleanliness. This narrative directly counters the common negative stereotypes of the self-storage industry (dirty, unsafe, complicated) and justifies a potential price premium over lower-tier competitors.

The brand voice is consistent, employing a helpful and reassuring tone that builds trust, a critical factor when customers are entrusting personal belongings. The heavy and effective use of social proof through detailed customer reviews further solidifies this trust and validates the brand's claims.

However, there are clear opportunities for optimization. The messaging, while effective for its primary audience (personal movers), is underdeveloped for the lucrative business segment. Furthermore, by not prominently highlighting its technological differentiators (like the mobile app) and specific security features, Extra Space is missing an opportunity to more strongly substantiate its premium positioning. The most significant strategic risk is the messaging gap around pricing and rate increases, a known industry-wide pain point. Proactively addressing this could be a powerful differentiator and foster greater long-term brand loyalty. Overall, the current strategy is highly effective at driving top-of-funnel conversions, but could be enhanced to capture additional market segments and build deeper, more transparent customer relationships.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Positioned as the largest self-storage operator in the U.S. with over 4,000 properties, indicating massive market acceptance and scale.

- •

Diversified service offerings catering to personal, business, boat, and RV storage needs, addressing multiple customer segments.

- •

Positive customer reviews on the website consistently praise core value propositions: cleanliness, security, convenience, and helpful staff.

- •

High national occupancy rates (reported at 93.4% in Q1 2025) demonstrate sustained demand for their product.

- •

Successful M&A strategy, including the major acquisition of Life Storage, proves the value of their platform and operational model in the industry.

Improvement Areas

- •

Enhance the mobile app experience beyond gate access to include features like digital inventory tracking and seamless unit management.

- •

Further develop the 'storage-as-a-service' model for business customers, moving beyond space rental to include logistics and operational support.

- •

Standardize technology and service levels across all properties, especially newly acquired ones, to ensure a consistent brand experience.

Market Dynamics

Moderate, with a projected CAGR of approximately 3.6% to 4.5% for the global market through 2030-2033.

Mature

Market Trends

- Trend:

Technological Integration & Automation

Business Impact:Demand for smart storage solutions, including AI-powered security, contactless online rentals, and mobile app integration, is becoming a key differentiator.

- Trend:

Industry Consolidation

Business Impact:Large REITs like Extra Space are acquiring smaller operators, leading to increased market share but also intense competition among the top players.

- Trend:

Growing Demand from Business & E-commerce

Business Impact:The rise of e-commerce and small businesses creates a significant growth opportunity for commercial storage, including inventory management and micro-fulfillment services.

- Trend:

Focus on Sustainability

Business Impact:Eco-friendly practices like solar panels and energy-efficient lighting are becoming a consumer preference and can lead to operational cost savings.

Excellent for strategic consolidation and service expansion. While the rapid growth phase of the industry has stabilized, Extra Space's market leadership positions it perfectly to capitalize on consolidation, technology adoption, and the growing demand for specialized business storage solutions.

Business Model Scalability

High

High fixed-cost model (property ownership/leases) with low variable costs per new customer, creating significant operating leverage as occupancy increases.

High. Once a facility is operational, the incremental cost of adding a customer is minimal, making occupancy rate a key driver of profitability.

Scalability Constraints

- •

Capital required for property acquisitions and development.

- •

Availability of suitable acquisition targets in high-growth markets.

- •

Maintaining operational consistency and quality control across a rapidly expanding portfolio of thousands of locations.

Team Readiness

Proven. The executive team has a strong track record of successful M&A integration, capital management, and strategic growth, as evidenced by their market leadership.

Well-established for its core business of property management and acquisitions. Appears to have a robust corporate structure supporting a vast network of physical locations.

Key Capability Gaps

- •

Deep expertise in digital product management to develop and scale tech-enabled services beyond storage rental.

- •

Specialized B2B sales and logistics talent to fully capture the e-commerce and commercial storage opportunity.

- •

Data science and AI talent to optimize dynamic pricing, predict customer churn, and enhance marketing effectiveness.

Growth Engine

Acquisition Channels

- Channel:

Local SEO / Google My Business

Effectiveness:High

Optimization Potential:Medium

Recommendation:Invest in hyper-local content and advanced schema markup to dominate 'near me' searches. Actively manage and solicit customer reviews for all locations to boost local rankings and social proof.

- Channel:

Paid Search (PPC)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Utilize AI-driven bidding strategies to optimize for cost-per-acquisition based on unit size, location, and customer lifetime value. Continuously A/B test ad copy and landing pages with dynamic promotional offers.

- Channel:

Property Acquisitions (M&A)

Effectiveness:High

Optimization Potential:High

Recommendation:Develop a standardized playbook for rapid technological and operational integration of acquired properties to accelerate time-to-profitability and ensure brand consistency.

- Channel:

Third-Party Management ('Management Plus')

Effectiveness:High

Optimization Potential:High

Recommendation:Market the Management Plus platform as a feeder system for future acquisitions, offering a seamless path from management contract to buyout for property owners.

Customer Journey

Streamlined for online rentals. The website emphasizes a simple, 'contact-free' process from search to reservation, which is a significant strength.

Friction Points

- •

Analysis paralysis for customers choosing a unit size, despite the availability of a size guide.

- •

Lack of transparency around potential rent increases after the initial promotional period.

- •

Navigating the insurance requirement during the checkout process could be a point of confusion or drop-off.

Journey Enhancement Priorities

- Area:

Unit Selection

Recommendation:Implement an AI-powered tool where users can upload a photo or list items to get an instant size recommendation, as envisioned by industry experts.

- Area:

Mobile Experience

Recommendation:Enhance the mobile app to be the central hub for the customer lifecycle: from initial rental to payments, gate access, and adding ancillary services.

- Area:

Post-Rental Onboarding

Recommendation:Develop a digital onboarding sequence (email, SMS, app notifications) that welcomes new tenants, explains facility features, and reinforces the value of their choice.

Retention Mechanisms

- Mechanism:

High Switching Costs

Effectiveness:High

Improvement Opportunity:While inherently sticky, this can be strengthened by offering integrated services (e.g., inventory management) that become deeply embedded in a business customer's workflow, making it even harder to leave.

- Mechanism:

Customer Service & Facility Quality

Effectiveness:Medium

Improvement Opportunity:Leverage technology like remote monitoring and automated maintenance alerts to ensure consistent cleanliness and security standards across all 4,000+ locations, preventing service gaps that could trigger churn.

- Mechanism:

Promotional Pricing

Effectiveness:High (for acquisition)

Improvement Opportunity:Develop a structured, transparent pricing model for existing tenants to manage rate increases and reduce 'sticker shock' churn. Test loyalty programs for long-term customers.

Revenue Economics

Strong. The business model is characterized by high, recurring revenue per occupied unit against relatively low, fixed operational costs, leading to high-margin profitability at scale.

Assumed Healthy. As a market leader with significant brand recognition and scale, CAC is likely optimized. LTV is driven by the length of stay, which in self-storage can be substantial.

High

Optimization Recommendations

- •

Systematically expand ancillary revenue streams, such as tenant insurance, retail sales of moving supplies, and truck rentals at more locations.

- •

Develop and price premium services for business customers, such as package acceptance, inventory management, and use of flex office space.

- •

Implement a sophisticated dynamic pricing engine that adjusts rates in real-time based on local occupancy, competitor pricing, demand signals, and seasonality.

Scale Barriers

Technical Limitations

- Limitation:

Legacy Systems Integration

Impact:Medium

Solution Approach:Prioritize the development of a unified property management and customer relationship platform. Create a clear technology migration path for all acquired facilities to ensure consistent data and operations.

- Limitation:

Data Silos

Impact:Medium

Solution Approach:Invest in a centralized data warehouse to consolidate data from operations, marketing, and finance. This will enable advanced analytics for pricing, customer behavior, and predictive maintenance.

Operational Bottlenecks

- Bottleneck:

Maintaining Brand Standards Across a Franchised/Managed Network

Growth Impact:Inconsistent customer experiences can dilute brand equity and increase churn.

Resolution Strategy:Implement a robust quality assurance program with regular audits, performance scorecards for managers, and technology for remote monitoring of facilities.

- Bottleneck:

On-site Staffing and Training

Growth Impact:Difficulty in hiring and training qualified managers for thousands of locations can impact sales and customer service.

Resolution Strategy:Develop a scalable, centralized training platform (e-learning). Explore a 'hub-and-spoke' staffing model where experienced managers oversee multiple locations, potentially enabling more unmanned or automated sites.

Market Penetration Challenges

- Challenge:

Market Saturation and Intense Competition

Severity:Critical

Mitigation Strategy:Focus on differentiation through superior technology (smart units, better app), specialized business services, and exceptional customer service. Continue strategic acquisitions to gain market share in competitive MSAs.

- Challenge:

Rising Property Taxes and Operating Costs

Severity:Major

Mitigation Strategy:Aggressively pursue operational efficiencies through technology and automation (e.g., energy-efficient lighting, remote monitoring). Leverage scale to negotiate national vendor contracts and appeal property tax assessments.

Resource Limitations

Talent Gaps

- •

Data Scientists / AI Specialists

- •

Digital Product Managers

- •

B2B Logistics and Supply Chain Experts

Significant and ongoing capital is required for acquisitions. As a publicly-traded REIT, they have strong access to capital markets, but this is dependent on market conditions and investor confidence.

Infrastructure Needs

Upgrading older facilities with modern technology (smart locks, enhanced security, solar panels).

Building out a robust, scalable cloud infrastructure to support a unified technology platform.

Growth Opportunities

Market Expansion

- Expansion Vector:

Secondary & Tertiary US Markets

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Utilize data analytics to identify underserved markets with strong population and small business growth. Pursue acquisitions of smaller, local operators in these regions.

- Expansion Vector:

International Expansion (e.g., Europe, Australia)

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Begin with a strategic joint venture or acquisition of an established operator in a target country to gain local market knowledge and operational expertise.

Product Opportunities

- Opportunity:

Business Logistics & Micro-Fulfillment Hubs

Market Demand Evidence:The rapid growth of e-commerce creates a need for local inventory storage and fulfillment services for small to medium-sized businesses.

Strategic Fit:High

Development Recommendation:Pilot a 'Business Storage+' service at select urban locations, offering package acceptance, inventory placement, and partnerships with last-mile delivery services.

- Opportunity:

Valet Storage Service

Market Demand Evidence:Competitors like Closetbox and LoveSpace exist, indicating a market for convenient, full-service storage solutions.

Strategic Fit:Medium

Development Recommendation:Launch a pilot program in a dense, high-income urban market. Partner with a local moving/logistics company to handle the pickup and delivery aspects initially to minimize capital investment.

- Opportunity:

Flex Office/Warehouse Space

Market Demand Evidence:The website already mentions offering office space. The trend of hybrid work and entrepreneurship increases demand for flexible, low-cost workspaces combined with storage.

Strategic Fit:High

Development Recommendation:Formalize and expand this offering. Retrofit underutilized space at existing facilities to create dedicated, rentable small office or workshop areas with integrated storage access.

Channel Diversification

- Channel:

Real Estate & Mover Partnerships

Fit Assessment:High

Implementation Strategy:Develop a formal partnership program with national moving companies, real estate brokerages, and property management firms. Offer referral fees or preferred rates for their clients.

- Channel:

Direct B2B Sales Team

Fit Assessment:High

Implementation Strategy:Build a small, targeted B2B sales team focused on acquiring multi-unit accounts from specific industries (e.g., pharmaceutical sales, construction, e-commerce) that have known storage needs.

Strategic Partnerships

- Partnership Type:

Last-Mile Logistics Providers

Potential Partners

- •

FedEx

- •

UPS

- •

DoorDash

- •

Instacart

Expected Benefits:Transform storage facilities into micro-fulfillment hubs, creating a new, high-margin revenue stream from business customers and increasing the stickiness of the service.

- Partnership Type:

E-commerce Platforms

Potential Partners

- •

Shopify

- •

Etsy

- •

eBay

Expected Benefits:Offer integrated inventory storage solutions directly to sellers on these platforms, creating a scalable customer acquisition channel for the business storage segment.

Growth Strategy

North Star Metric

Total Occupied Square Footage

This metric combines the two primary growth levers: acquiring new properties (increasing total available footage) and filling them with paying customers (increasing occupancy). It directly correlates with top-line revenue and market share.

Achieve a 5-7% year-over-year increase through a combination of acquisitions and same-store occupancy gains.

Growth Model

Acquisition & Optimization Hybrid

Key Drivers

- •

Strategic M&A of independent operators and regional chains.

- •

Third-party management platform growth as a pipeline for acquisitions.

- •

Performance marketing excellence to drive high occupancy rates.

- •

Ancillary revenue growth from existing customers (insurance, services).

Continue to leverage the REIT structure for large-scale acquisitions while simultaneously investing in a dedicated 'Growth & Innovation' team to optimize digital marketing, develop new tech-enabled services, and improve operational efficiency across the portfolio.

Prioritized Initiatives

- Initiative:

Launch 'Business Logistics Services' Pilot Program

Expected Impact:High

Implementation Effort:Medium

Timeframe:6-9 months

First Steps:Select 10-15 urban facilities. Hire a B2B Product Manager. Develop service packages and pricing. Forge a partnership with a local last-mile delivery service.

- Initiative:

Develop a Unified Technology & Integration Playbook

Expected Impact:High

Implementation Effort:High

Timeframe:12-18 months

First Steps:Form a cross-functional team of IT, Operations, and M&A. Define the standard tech stack (access control, PMS, CRM). Document the 90-day integration process for newly acquired facilities.

- Initiative:

Optimize Ancillary Revenue Streams

Expected Impact:Medium

Implementation Effort:Low

Timeframe:3-6 months

First Steps:A/B test the placement and pricing of tenant insurance and retail merchandise during the online checkout process. Introduce bundled offerings (e.g., 'Mover's Package' with unit, boxes, and insurance).

Experimentation Plan

High Leverage Tests

- Area:

Pricing

Experiment:Test dynamic pricing algorithms versus fixed-rate promotions in matched-pair markets.

- Area:

Conversion

Experiment:A/B test an interactive AI-powered size calculator against the current static size guide.

- Area:

Retention

Experiment:Pilot a loyalty program offering a small discount or amenity for customers who stay beyond 12 months.

Utilize a combination of A/B testing software (e.g., Optimizely), web analytics (Google Analytics), and backend transactional data. Key metrics: Conversion Rate, Average Rental Value, Customer Churn Rate, Ancillary Revenue per Customer.

Run continuous, overlapping experiments on the website. Aim for at least one major operational or pricing experiment per quarter.

Growth Team

Centralized 'Growth & Innovation' team that works cross-functionally with M&A, Operations, Marketing, and IT. This team would own the digital customer experience and the development of new services.

Key Roles

- •

Head of Digital Product

- •

Senior Data Scientist (Pricing & Analytics)

- •

B2B Partnerships Manager

- •

Customer Lifecycle Marketing Manager

Acquire talent from technology and logistics sectors to bring in fresh perspectives. Establish a formal experimentation process and culture, empowering teams to test and learn quickly.

Extra Space Storage exhibits a robust growth foundation, characterized by strong product-market fit, a highly scalable business model, and a dominant position in a mature, consolidating industry. As the largest US operator, its primary growth lever has successfully been M&A, a strategy that should continue to be a core competency. The company's digital presence and online rental process are significant strengths, forming an effective customer acquisition engine.

The most significant growth opportunities now lie beyond simple expansion and require an evolution of the business model. The key is to leverage their vast physical footprint to offer higher-margin, tech-enabled services. The burgeoning need for localized logistics and fulfillment for e-commerce businesses represents a transformative opportunity. By repositioning select facilities as 'Business Logistics Hubs'—offering package acceptance, inventory management, and flex office space—Extra Space can create a powerful competitive moat and a new, scalable revenue stream that competitors cannot easily replicate.

Key barriers to this evolution include overcoming the operational complexity of managing a distributed service network and acquiring the necessary talent in digital product management and logistics. Prioritized initiatives should therefore focus on a dual-track strategy: 1) continue to execute the highly successful acquisition and integration playbook, and 2) pilot and scale new business-focused, ancillary services. By establishing a dedicated Growth and Innovation team, Extra Space can systematically experiment with and launch these new offerings, securing its market leadership and creating a new vector for sustained, profitable growth into the next decade.

Legal Compliance

The Privacy Policy is comprehensive, easily accessible via the website footer, and appears to be regularly updated (last noted update: January 2024). It effectively outlines the types of personal information collected (e.g., contact details, payment information, usage data), the purposes for collection, and the categories of third parties with whom data is shared. A key strength is the inclusion of specific sections detailing rights for residents of California, Colorado, Connecticut, Utah, and Virginia, demonstrating a proactive approach to the patchwork of US state privacy laws. The policy also acknowledges data subjects from the EEA/UK, providing relevant information, although it clarifies that services are primarily directed at a U.S. audience. The provision of a consolidated 'Your Privacy Choices' portal is a user-friendly and best-practice implementation for managing privacy rights.

A general 'Terms of Use' or 'Terms of Service' document governing the use of the website itself is not readily accessible from the main navigation or footer. While the legally binding terms and conditions are correctly presented within the specific rental agreement during the checkout process, the absence of a general site usage agreement is a minor gap. This document would typically govern aspects like intellectual property rights for website content, permissible uses of the site, and limitations of liability for information provided. The rental agreement itself, presented during a transaction, is the core legal document and appears to be location-specific, which is critical for compliance with state-level self-storage laws.

The website demonstrates strong cookie compliance. Upon a user's first visit, a clear and conspicuous cookie banner appears. It provides users with multiple options, including 'Accept' and 'Cookie Settings'. The 'Cookie Settings' link leads to a granular consent manager, allowing users to opt-in or out of different categories of non-essential cookies (e.g., Performance, Functional, Targeting). This implementation aligns with the requirements of major privacy regulations like GDPR and CCPA/CPRA, which require informed, specific consent for tracking technologies. The mechanism is a significant strength in their compliance posture.

Extra Space Storage has implemented robust data protection measures from a digital perspective. The detailed privacy policy, granular cookie consent manager, and dedicated 'Your Privacy Choices' portal indicate a mature approach to data privacy management. They clearly articulate user rights under various state laws, which is crucial for a company operating across 43 states. The use of a third-party platform ('RequestEasy') for handling privacy requests suggests a systematic process for managing data subject access requests (DSARs), which is a key operational requirement for compliance. While the digital side is strong, the analysis is limited to the website; overall data protection would also need to cover the physical security of paper records and data security at individual storage facilities.

The website appears to have a baseline level of accessibility; for instance, keyboard navigation follows a logical sequence. However, there is a significant compliance gap due to the absence of a visible Accessibility Statement. This statement is crucial for affirming the company's commitment to accessibility, detailing the standards it follows (e.g., Web Content Accessibility Guidelines - WCAG 2.1), and providing a channel for users with disabilities to report issues. Without this, the company is exposed to a higher risk of legal complaints and demand letters under the Americans with Disabilities Act (ADA), which has been consistently interpreted by U.S. courts to apply to commercial websites.

As a self-storage operator in 43 states, the primary industry-specific challenge is complying with a wide array of state laws governing rental agreements, lien procedures, and customer notifications. The website's strategy of presenting a location-specific rental agreement during the online rental process is the correct approach. This ensures that the terms a customer agrees to in Texas are compliant with Texas law, while a customer in California is bound by California-compliant terms. This demonstrates a sophisticated legal and operational capability to manage regulatory complexity, which is a significant competitive advantage and a mitigator of state-level legal risk. The terms of these agreements must meticulously cover state requirements regarding late fees, auction processes for delinquent accounts, and required disclosures.

Compliance Gaps

- •

Absence of a public-facing Accessibility Statement detailing commitment to standards like WCAG.

- •

No readily available general 'Terms of Use' for governing the use of the website itself, separate from the rental agreement.

- •

Potential for inconsistent application of physical data security measures across a large network of facilities, which is not addressed in website documentation.

Compliance Strengths

- •

Excellent implementation of a granular cookie consent mechanism.

- •

Comprehensive and up-to-date Privacy Policy with specific sections for multiple U.S. state privacy laws.

- •

User-friendly 'Your Privacy Choices' portal that centralizes data rights requests.

- •

Effective management of state-by-state legal variations through location-specific rental agreements presented during the online rental process.

- •

Clear footer links to key legal and privacy documents, enhancing transparency.

Risk Assessment

- Risk Area:

Website Accessibility (ADA)

Severity:High

Recommendation:Immediately develop and publish an Accessibility Statement committing to WCAG 2.1 AA standards. Conduct a formal accessibility audit and create a remediation plan to address any identified issues. Provide a clear feedback mechanism for users with disabilities.

- Risk Area: