eScore

fedex.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

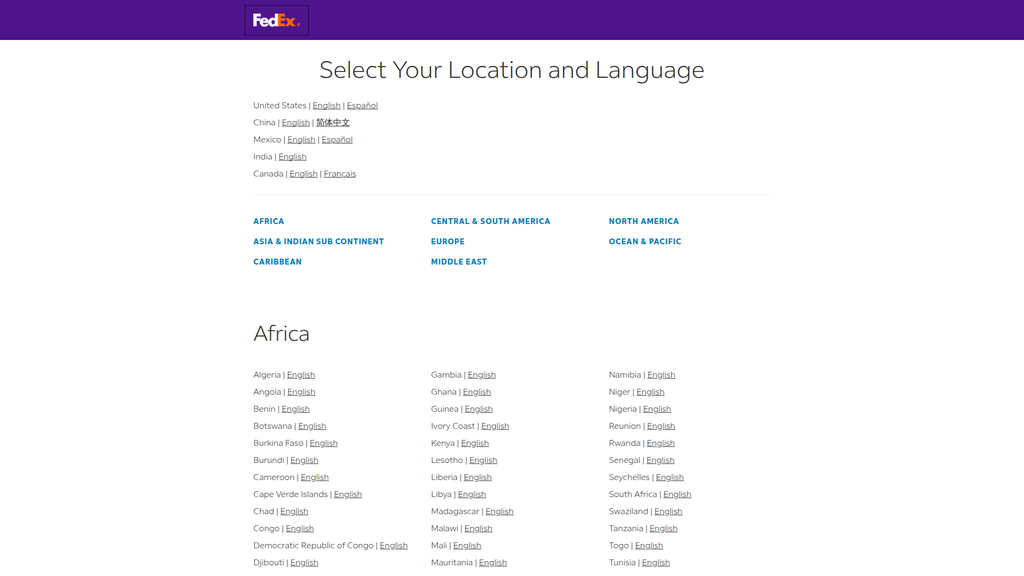

FedEx demonstrates a dominant digital presence with exceptional brand authority and high rankings for transactional, high-intent keywords. Its global-local strategy is evident in its comprehensive website localization, effectively penetrating over 220 countries. However, the digital presence is heavily weighted towards bottom-of-funnel conversion, with a noticeable gap in top-of-funnel thought leadership content that could capture users earlier in their decision-making process.

Immense brand authority and domain strength ensure top rankings for core shipping and tracking-related search queries globally.

Invest in a dedicated thought leadership platform (e.g., 'FedEx Intelligence') using proprietary data to create high-value reports on global trade and logistics, capturing a C-suite audience and high-quality backlinks.

The brand's communication is a masterclass in functional clarity, effectively guiding users through core tasks like shipping and tracking with a professional, direct voice. This utilitarian approach reinforces reliability but creates a significant disconnect from the emotional, reassuring tone of their broader advertising campaigns. The website serves existing customers well but lacks the persuasive, benefit-driven messaging needed to convert new or undecided customers, particularly in the SMB space.

Messaging on core functional tasks is exceptionally clear, simple, and consistent, minimizing friction for users with transactional intent.

Bridge the gap between advertising and web presence by infusing the site with more benefit-oriented headlines and a reassuring tone to build an emotional connection and better articulate the brand's value proposition.

The conversion experience for primary tasks like tracking is clear and prominent, leveraging a strong brand identity to guide users. However, significant friction points detract from the overall experience, including inconsistent CTA design that creates a confusing visual hierarchy and the alarming presence of placeholder text in a key input field. These issues, while fixable, erode the trust and perception of reliability that the FedEx brand is built on, negatively impacting conversion potential for secondary actions.

The primary tracking function on the homepage is highly prominent and logically designed, effectively serving the most common user need.

Implement a rigorous QA process to eliminate all placeholder content and unify all CTA designs within a consistent design system to create a clear, trustworthy path for users to follow.

FedEx's credibility is anchored by its world-renowned brand, decades of reliable service, and a sophisticated, mature legal and data privacy framework that addresses global regulations like GDPR and CCPA. The company provides extensive third-party validation through its sheer scale and market presence. However, recent litigation concerning the accessibility of physical infrastructure and the discovery of unprofessional placeholder text on its website introduce minor but notable risks to its reputation for meticulous execution.

A comprehensive and robust global privacy and data protection framework, including dedicated portals for user rights, builds significant trust in a data-sensitive world.

Enhance customer success evidence by prominently featuring case studies and testimonials, especially for B2B and e-commerce solutions, to move beyond brand trust to proven results.

FedEx's competitive advantage is exceptionally strong and built on a highly defensible moat: its vast, integrated global air and ground network. This physical infrastructure is nearly impossible to replicate due to immense capital and time requirements. This is complemented by one of the world's most recognized brands, synonymous with speed and reliability. While facing intense competition, particularly from UPS and the disruptive force of Amazon Logistics, these core advantages remain sustainable.

The integrated global air express network is a uniquely defensible asset that allows FedEx to command a premium on time-sensitive international shipments.

Accelerate investment in proprietary technology, particularly AI-driven data analytics and supply chain visibility tools, to create a new layer of competitive differentiation beyond physical assets.

FedEx has immense expansion potential, particularly in the high-growth e-commerce and specialized logistics sectors like healthcare. The company's ongoing 'Network 2.0' and 'DRIVE' initiatives are critical and well-timed strategies designed to improve operational efficiency and unit economics, unlocking capital for future growth. However, the business model is inherently asset-heavy, making scaling a capital-intensive process constrained by physical capacity and labor.

The strategic 'Network 2.0' initiative, aimed at consolidating the Express and Ground networks, is set to unlock billions in structural cost savings, fundamentally improving the company's operational leverage and scalability.

Develop more asset-light, high-margin 'Logistics-as-a-Service' (LaaS) digital offerings that leverage the existing network's data and capabilities, allowing for scalable growth without proportionate capital expenditure.

FedEx operates a mature and diversified business model with strong revenue streams across Express, Ground, and Freight services. Historically, the model's coherence was weakened by the operational separation of these units, leading to inefficiencies. The current strategic shift towards 'One FedEx' to create a unified, integrated air-ground network represents a massive and necessary step to improve coherence, reduce costs, and present a single, streamlined face to the customer.

The diversified portfolio of services (Express, Ground, Freight) allows FedEx to serve a wide range of customer needs and weather downturns in any single segment.

Aggressively execute the 'Network 2.0' plan to fully eliminate the structural inefficiencies between the Express and Ground networks, which has been a long-standing competitive disadvantage versus integrated peers like UPS.

As one of the top three global logistics providers, FedEx wields significant market power, enabling it to influence industry standards and maintain premium pricing for its express services. The company's massive scale provides substantial leverage with suppliers and partners. However, its market share is under constant assault from chief rival UPS, international powerhouse DHL, and the increasingly dominant Amazon Logistics, which has capped its pricing power in the B2C e-commerce segment.

FedEx's position as a global oligopoly member, combined with its critical role in global commerce, gives it significant market influence and pricing power, particularly in the B2B and international express sectors.

Counter the threat of Amazon Logistics by becoming the indispensable logistics partner for the rest of the e-commerce market, offering superior technology, reliability, and service integration for SMBs.

Business Overview

Business Classification

Logistics and Transportation Services

E-commerce Solutions Provider

Transportation and Logistics

Sub Verticals

- •

Express Parcel Delivery

- •

Ground Shipping

- •

Less-Than-Truckload (LTL) Freight

- •

Supply Chain Management

- •

Customs Brokerage

Mature

Maturity Indicators

- •

Extensive global network operating in over 220 countries and territories.

- •

Long-standing brand reputation established since 1971.

- •

Significant market share in a highly competitive industry.

- •

Large-scale, complex operations with a substantial asset base (aircraft, vehicles, hubs).

- •

Focus on operational efficiency and cost optimization programs like DRIVE and Network 2.0.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

FedEx Express

Description:Premium, time-definite air and ground delivery services for packages and freight. This is the primary revenue driver, focusing on speed and reliability for urgent shipments.

Estimated Importance:Primary

Customer Segment:B2B (Healthcare, Automotive, High-Tech), B2C (Urgent Shipments)

Estimated Margin:Medium-High

- Stream Name:

FedEx Ground

Description:Cost-effective, day-certain ground package delivery to businesses and residences, primarily in North America. This segment is a major contributor to volume, driven by e-commerce.

Estimated Importance:Primary

Customer Segment:B2B (Retail, E-commerce), B2C (E-commerce Consumers)

Estimated Margin:Medium

- Stream Name:

FedEx Freight

Description:Less-than-truckload (LTL) freight services for larger shipments that do not require a full truck. Serves the B2B market for palletized shipments.

Estimated Importance:Secondary

Customer Segment:B2B (Manufacturing, Retail, Industrial)

Estimated Margin:Low-Medium

- Stream Name:

Value-Added & Logistics Services

Description:Includes a portfolio of services such as customs brokerage, supply chain consulting, fulfillment, and business services offered through FedEx Office.

Estimated Importance:Tertiary

Customer Segment:B2B (Large Enterprises, SMBs)

Estimated Margin:High

Recurring Revenue Components

- •

Contractual agreements with large enterprise clients

- •

Ongoing shipping needs of small and medium-sized businesses (SMBs)

- •

Integrated shipping solutions for high-volume e-commerce platforms

Pricing Strategy

Transactional Pricing

Premium

Semi-transparent

Pricing Psychology

- •

Tiered Pricing (e.g., Priority Overnight, Standard Overnight, 2Day)

- •

Dynamic Surcharges (e.g., fuel, peak season)

- •

Value-Based Pricing (for specialized services like healthcare logistics)

Monetization Assessment

Strengths

- •

Diversified revenue across multiple service lines (Express, Ground, Freight) mitigates risk.

- •

Strong brand allows for premium pricing on time-sensitive services.

- •

Ability to implement dynamic surcharges to respond to market conditions like fuel price volatility.

Weaknesses

- •

High sensitivity to global economic conditions, which impacts shipping volumes.

- •

High fixed operating costs (aircraft, facilities) put pressure on margins.

- •

Complex pricing structure can be opaque for larger clients with negotiated rates.

Opportunities

- •

Continued growth of global e-commerce, driving demand for residential delivery.

- •

Expansion of high-margin logistics and supply chain services.

- •

Leveraging data and analytics to offer smarter, more predictive supply chain solutions.

Threats

- •

Intense competition from UPS, DHL, and increasingly Amazon Logistics.

- •

Volatility in fuel prices directly impacting operating costs.

- •

Potential for economic downturns to reduce overall shipping demand.

Market Positioning

A premium, reliable provider of a comprehensive portfolio of global logistics and transportation services, emphasizing speed, global reach, and technological visibility.

Major player, holding a combined revenue share of over 60% with UPS in the U.S. parcel market. Globally, one of the top three integrated carriers alongside UPS and DHL.

Target Segments

- Segment Name:

Global Enterprise Shippers

Description:Large multinational corporations with complex, high-volume global supply chains.

Demographic Factors

Industries: Healthcare, Aerospace, Automotive, High-Tech, Industrial Manufacturing.

Psychographic Factors

- •

Value reliability, security, and global consistency.

- •

Require sophisticated tracking and supply chain visibility.

- •

Prioritize risk mitigation in their supply chain.

Behavioral Factors

- •

Engage in long-term contracts.

- •

Utilize a wide range of services from express freight to supply chain consulting.

- •

High lifetime value.

Pain Points

- •

Managing customs and cross-border regulatory complexity.

- •

Ensuring integrity of high-value or temperature-sensitive goods.

- •

Lack of end-to-end visibility across their supply chain.

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

E-commerce Businesses (SMB to Enterprise)

Description:Online retailers of all sizes who need reliable and efficient order fulfillment and delivery to end consumers.

Demographic Factors

Varies from small online storefronts to large e-tailers.

Psychographic Factors

- •

Value speed and cost-effectiveness to meet customer expectations.

- •

Seek easy integration of shipping services with their e-commerce platforms.

- •

Concerned with customer satisfaction related to delivery experience.

Behavioral Factors

- •

High volume of B2C shipments.

- •

Need for flexible delivery options (e.g., residential, hold-at-location).

- •

Sensitive to shipping costs as a key component of their COGS.

Pain Points

- •

High last-mile delivery costs.

- •

Managing customer expectations for fast and free shipping.

- •

Handling returns logistics efficiently.

Fit Assessment:Good

Segment Potential:High

- Segment Name:

Individual & Occasional Shippers

Description:Consumers and small business users who ship packages infrequently.

Demographic Factors

General consumers, small office/home office (SOHO) users.

Psychographic Factors

Value convenience and ease-of-use.

Trust in brand name for important shipments.

Behavioral Factors

- •

Transactional relationship.

- •

Utilize retail locations (FedEx Office) or online portals for one-off shipments.

- •

Price-sensitive for non-urgent items.

Pain Points

- •

Complex shipping forms and customs declarations.

- •

Finding convenient drop-off locations.

- •

High cost for single, non-urgent shipments.

Fit Assessment:Good

Segment Potential:Low

Market Differentiation

- Factor:

Extensive Air Express Network

Strength:Strong

Sustainability:Sustainable

- Factor:

Global Brand Recognition & Reputation

Strength:Strong

Sustainability:Sustainable

- Factor:

Integrated Portfolio of Services

Strength:Moderate

Sustainability:Sustainable

- Factor:

Technological Infrastructure (Tracking & Visibility)

Strength:Moderate

Sustainability:Temporary

Value Proposition

FedEx provides a comprehensive suite of reliable, time-definite global transportation and logistics solutions, powered by an integrated digital and physical network to connect people and possibilities around the world.

Excellent

Key Benefits

- Benefit:

Speed and Time-Definite Delivery

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Guaranteed delivery windows for services like FedEx Priority Overnight.

Pioneering history in the overnight delivery market.

- Benefit:

Global Reach and Network

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Service to over 220 countries and territories.

Vast fleet of aircraft and ground vehicles.

- Benefit:

End-to-End Shipment Visibility

Importance:Important

Differentiation:Common

Proof Elements

Real-time package tracking via website and mobile app.

Proactive notifications and proof of delivery.

- Benefit:

Comprehensive Service Portfolio

Importance:Important

Differentiation:Somewhat unique

Proof Elements

Offerings range from express parcels to LTL freight and supply chain solutions.

Ability to serve diverse customer needs under one brand.

Unique Selling Points

- Usp:

Unparalleled Air Express network, enabling rapid global delivery for high-value and time-sensitive shipments.

Sustainability:Long-term

Defensibility:Strong

- Usp:

The strategic initiative to create a unified, fully integrated air-ground network (Network 2.0) to enhance efficiency and service.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Need for urgent, reliable delivery of critical documents and goods.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Complexity of managing a global supply chain and cross-border shipping.

Severity:Major

Solution Effectiveness:Partial

- Problem:

Fulfilling e-commerce customer expectations for fast, trackable shipping.

Severity:Major

Solution Effectiveness:Complete

Value Alignment Assessment

High

FedEx's core offerings of speed, reliability, and global reach are highly aligned with the primary needs of the logistics market, especially in the growing e-commerce and global trade sectors.

High

The tiered service model (Express for urgency, Ground for cost-efficiency) effectively meets the distinct needs of its primary B2B, e-commerce, and B2C segments.

Strategic Assessment

Business Model Canvas

Key Partners

- •

United States Postal Service (USPS) (for last-mile delivery/SmartPost)

- •

Technology providers (e.g., Microsoft for cloud and AI, Nimble for robotics).

- •

Independent contractors (for FedEx Ground delivery).

- •

Customs brokers and international trade organizations.

- •

Large retail partners (e.g., Walgreens, Dollar General for drop-off/pickup points).

Key Activities

- •

Package pickup, sorting, and delivery.

- •

Air and ground transportation network management.

- •

Customs clearance and international trade facilitation.

- •

Technology development (tracking systems, route optimization).

- •

Sales, marketing, and customer service.

Key Resources

- •

Extensive fleet of aircraft and ground vehicles.

- •

Global network of sorting hubs and distribution centers.

- •

Proprietary technology and tracking infrastructure.

- •

Large global workforce of over 500,000 employees.

- •

Strong brand equity and customer relationships.

Cost Structure

- •

Labor (salaries, wages, benefits).

- •

Fuel costs for air and ground fleets.

- •

Maintenance of aircraft, vehicles, and facilities.

- •

Purchased transportation (especially for FedEx Ground).

- •

Technology and infrastructure investment.

Swot Analysis

Strengths

- •

Dominant global brand synonymous with speed and reliability.

- •

Vast, integrated global air and ground network.

- •

Diversified service portfolio catering to multiple market segments.

- •

Strong technological foundation in package tracking and logistics.

Weaknesses

- •

High fixed-cost structure, making it vulnerable to volume fluctuations.

- •

Historically separate operating networks (Express/Ground) leading to inefficiencies.

- •

High dependency on volatile fuel prices.

- •

Dependence on the US market for a majority of its revenue.

Opportunities

- •

Massive growth in global e-commerce shipment volumes.

- •

Significant cost savings and efficiencies from Network 2.0 integration.

- •

Expansion into high-margin, specialized logistics (e.g., healthcare, cold chain).

- •

Leveraging data and AI for predictive logistics and smarter supply chains.

Threats

- •

Intensifying competition from UPS, DHL, and the expanding logistics network of Amazon.

- •

Global economic downturns reducing shipping demand.

- •

Rising labor costs and potential for unionization challenges.

- •

Cybersecurity threats to its vast digital network.

Recommendations

Priority Improvements

- Area:

Operational Efficiency

Recommendation:Accelerate the 'Network 2.0' initiative to fully merge the Express and Ground networks, eliminating redundant routes and facilities to realize targeted cost savings and improve service integration for customers.

Expected Impact:High

- Area:

Digital Customer Experience

Recommendation:Invest in a more seamless digital platform for SMBs, simplifying the entire shipping process from quoting and booking to customs documentation and returns management, thereby lowering the barrier to entry for smaller e-commerce clients.

Expected Impact:Medium

- Area:

Yield Management

Recommendation:Enhance dynamic pricing models using AI to optimize yields, particularly during peak seasons and on high-demand routes, moving beyond broad surcharges to more granular, profitable pricing.

Expected Impact:Medium

Business Model Innovation

- •

Develop a 'Logistics-as-a-Service' (LaaS) platform, allowing businesses to plug into FedEx's network for specific services (e.g., warehousing, last-mile, international customs) on a modular, pay-as-you-go basis.

- •

Create a data monetization arm that provides anonymized, aggregated supply chain insights and predictive analytics as a premium subscription service for large enterprise customers.

- •

Forge deeper alliances with major e-commerce platform providers (e.g., Shopify, BigCommerce) to become the preferred, deeply integrated logistics backbone, offering end-to-end services from fulfillment to final delivery and returns.

Revenue Diversification

- •

Aggressively expand specialized logistics for high-growth, high-margin sectors like healthcare and life sciences, focusing on services like temperature-controlled shipping and clinical trial logistics.

- •

Grow the FedEx Logistics and supply chain consulting arm to capture more of the upstream value chain, moving beyond package delivery to become a strategic partner in supply chain design and management.

- •

Expand sustainable logistics solutions, offering carbon-neutral shipping options and circular economy services (e.g., product take-back and refurbishment logistics) as a premium, value-added service.

FedEx operates a mature, enterprise-scale business model centered on a diversified portfolio of logistics and transportation services. Its primary strength lies in its extensive global air and ground network and a brand synonymous with reliability and speed, allowing it to command a premium in the time-definite delivery market. The company's revenue model is robust, drawing from distinct Express, Ground, and Freight segments, which provides resilience against sector-specific downturns. However, this model is capital-intensive and highly sensitive to macroeconomic trends and fuel price volatility.

The key strategic imperative for FedEx's business model evolution is the successful execution of its 'Network 2.0' and DRIVE initiatives. Historically, the operational separation of its Express and Ground networks has been a significant structural weakness, creating inefficiencies that competitors like UPS (with its integrated network) do not face. The consolidation into a single, unified network is a critical and necessary transformation to lower the cost-to-serve, enhance margins, and present a more streamlined service offering to customers. This transformation is pivotal for competing effectively against both legacy rivals and agile new entrants like Amazon Logistics.

Looking forward, the primary opportunity for strategic transformation lies in evolving from a traditional carrier into a digitally-driven, end-to-end logistics partner. The immense volume of data generated by its network is a vastly underutilized asset. By leveraging AI and predictive analytics, FedEx can transition to offering 'smarter supply chains,' providing customers with proactive insights, optimizing routes dynamically, and managing inventory more effectively. This shift requires moving beyond core transportation to deepen its presence in higher-margin services like supply chain consulting, specialized healthcare logistics, and integrated e-commerce fulfillment solutions. Success will be defined by FedEx's ability to complete its complex network integration while simultaneously innovating its digital offerings to become an indispensable partner in the modern global commerce ecosystem.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Extensive Global Network & Infrastructure

Impact:High

- Barrier:

Massive Capital Investment

Impact:High

- Barrier:

Brand Recognition & Trust

Impact:High

- Barrier:

Regulatory Compliance & Customs Expertise

Impact:High

- Barrier:

Economies of Scale

Impact:Medium

Industry Trends

- Trend:

E-commerce Growth & Direct-to-Consumer Shipping

Impact On Business:Drives significant volume growth, especially in B2C, but increases pressure on last-mile delivery efficiency and cost.

Timeline:Immediate

- Trend:

Sustainability & Green Logistics

Impact On Business:Increasing demand from customers and regulators for eco-friendly operations, requiring investment in electric vehicles, sustainable fuels, and optimized routing.

Timeline:Immediate

- Trend:

Digitalization & Automation

Impact On Business:Requires investment in AI for route optimization, automated sorting hubs, and digital platforms to enhance customer experience and operational efficiency.

Timeline:Near-term

- Trend:

Last-Mile Delivery Innovation

Impact On Business:Competition from new players using gig economy models, autonomous vehicles, and drones necessitates innovation to maintain market share and manage the most expensive part of the delivery process.

Timeline:Near-term

- Trend:

Supply Chain Visibility & Data Analytics

Impact On Business:Customers demand real-time, end-to-end tracking and predictive insights, pushing for more advanced IoT and data analytics capabilities.

Timeline:Immediate

Direct Competitors

- →

UPS (United Parcel Service)

Market Share Estimate:Leads the US market in revenue (~$59.8B), but slightly trails FedEx in overall market share when considering multiple metrics.

Target Audience Overlap:High

Competitive Positioning:Positions itself as a highly reliable, integrated logistics partner with a dominant ground delivery network in the U.S. and a strong B2B focus.

Strengths

- •

Dense and efficient U.S. ground network, leading to cost-effectiveness for domestic shipments.

- •

Strong brand recognition and reputation for reliability.

- •

Extensive integrated supply chain solutions beyond simple parcel delivery.

- •

Leader in brand value within the logistics sector.

Weaknesses

- •

Historically perceived as less flexible and more rigid in its service offerings compared to FedEx.

- •

Less dominant in international express air freight compared to FedEx and DHL.

- •

Can be slower on some international routes.

Differentiators

- •

Focus on operational efficiency and a single, integrated network.

- •

Strong unionized workforce, which can be both a strength (consistency) and weakness (cost, strike risk).

- •

Deeply entrenched in the B2B shipping market.

- →

DHL Express

Market Share Estimate:A dominant player in the international express market, particularly in Europe and Asia, but with a smaller U.S. domestic market share.

Target Audience Overlap:Medium

Competitive Positioning:The premier specialist in international cross-border shipping and logistics, leveraging an unparalleled global network.

Strengths

- •

Unmatched global network and expertise in customs, duties, and international regulations.

- •

Strong market presence and brand recognition in Europe and Asia.

- •

Heavy investment in sustainable logistics and green solutions.

- •

Offers a wide array of logistics and supply chain management services.

Weaknesses

- •

Limited domestic U.S. ground network compared to FedEx and UPS.

- •

Often perceived as a more expensive option for domestic shipping.

- •

Less brand penetration in the American consumer market.

Differentiators

- •

Primary focus on international B2B and e-commerce.

- •

Geocentric operational approach, adapting services to local markets.

- •

Strong emphasis on becoming a leader in green logistics.

- →

United States Postal Service (USPS)

Market Share Estimate:Leads the US market by parcel volume, delivering 7.2 billion packages in 2024, partly due to last-mile deliveries for other carriers.

Target Audience Overlap:Medium

Competitive Positioning:The go-to provider for low-cost, lightweight residential package delivery, leveraging its federally mandated universal service obligation.

Strengths

- •

Unrivaled last-mile delivery network, reaching every address in the U.S.

- •

Often the most cost-effective option for small, lightweight packages.

- •

Federal government backing.

- •

Increasingly a key partner for last-mile delivery for larger players ('postal consolidators').

Weaknesses

- •

Perceived as having less reliable tracking and slower delivery speeds for non-premium services.

- •

Technologically lagging behind private competitors.

- •

Faces financial and operational challenges.

- •

Brand perception is less focused on premium, time-sensitive services.

Differentiators

- •

Universal service obligation to deliver to all U.S. addresses.

- •

Focus on consumer and small business mail and package services.

- •

Hybrid role as both a competitor and a crucial last-mile partner for rivals.

Indirect Competitors

- →

Amazon Logistics (AMZL)

Description:Amazon's internal logistics and shipping arm, which has expanded to become a third-party carrier. It leverages its massive fulfillment network and last-mile delivery infrastructure.

Threat Level:High

Potential For Direct Competition:Amazon Logistics is already a direct competitor in the B2C parcel market, surpassing both FedEx and UPS in U.S. parcel volume.

- →

Digital Freight Forwarders & Brokers

Description:Tech-native platforms that use software to connect shippers with carriers, offering greater transparency, real-time data, and efficiency, primarily in the freight sector.

Threat Level:Medium

Potential For Direct Competition:High, as they disintermediate traditional freight services and could expand further into parcel logistics, eroding FedEx's profitable freight business.

- →

Last-Mile Delivery Startups

Description:Agile, tech-focused companies specializing in the final stage of delivery, often using gig economy drivers and innovative routing software to offer fast, flexible, and hyperlocal delivery options.

Threat Level:Medium

Potential For Direct Competition:These companies are capturing a growing share of the last-mile market, directly competing with FedEx Ground and Express for e-commerce deliveries.

- →

Regional Carriers

Description:Carriers that focus on specific geographic regions, often providing more tailored services and competitive pricing within their service areas.

Threat Level:Low

Potential For Direct Competition:While not a global threat, they erode market share in key regions and can be more agile in meeting local customer needs.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Extensive Integrated Global Air & Ground Network

Sustainability Assessment:Highly sustainable due to the immense capital investment and decades required to replicate.

Competitor Replication Difficulty:Hard

- Advantage:

Strong Brand Recognition & Reputation for Reliability

Sustainability Assessment:Highly sustainable, built over decades of service and marketing, fostering customer trust.

Competitor Replication Difficulty:Hard

- Advantage:

Diverse Portfolio of Services (Express, Ground, Freight)

Sustainability Assessment:Sustainable, as it allows for cross-selling and serving a wide range of customer needs from a single provider.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'Specific Technological Innovations (e.g., advanced tracking features)', 'estimated_duration': '1-3 years'}

{'advantage': 'Strategic Pricing for Key E-commerce Partners', 'estimated_duration': 'Contract-dependent'}

Disadvantages

- Disadvantage:

High Fixed Operating Costs

Impact:Major

Addressability:Difficult

- Disadvantage:

Perceived as a Premium (More Expensive) Service

Impact:Major

Addressability:Moderately

- Disadvantage:

Complex Business Structure (Express, Ground, etc.)

Impact:Minor

Addressability:Moderately

- Disadvantage:

Vulnerability to Fuel Price Volatility

Impact:Major

Addressability:Difficult

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted marketing campaigns for SMBs focused on reliability and global reach to counter lower-cost competitors.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Simplify pricing and enhance the UX for the online shipping portal to reduce friction for casual and small business shippers.

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Expand partnerships with e-commerce platforms to offer integrated, premium shipping solutions directly at checkout.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Accelerate investment in last-mile automation and electric vehicle (EV) fleets to increase efficiency and meet sustainability goals.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Develop a more flexible, on-demand logistics service to compete with agile last-mile startups, possibly leveraging a crowdsourced model in dense urban areas.

Expected Impact:Medium

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Invest in autonomous long-haul and delivery vehicles to fundamentally reduce labor costs and improve network efficiency.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Build out a 'Logistics-as-a-Service' (LaaS) digital platform, allowing businesses to plug into FedEx's network and data analytics for their own supply chain management.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Establish a leadership position in sustainable aviation by investing heavily in sustainable aviation fuels (SAF) and next-generation aircraft.

Expected Impact:Medium

Implementation Difficulty:Difficult

Reinforce FedEx's position as the premium, high-reliability choice for time-sensitive, high-value, and international shipments, while innovating in e-commerce solutions to offer a superior 'value-for-money' proposition, not just the lowest price.

Differentiate on superior technology-driven visibility (e.g., real-time analytics, predictive ETAs), unparalleled international express services, and specialized logistics solutions for high-growth sectors like healthcare and electronics.

Whitespace Opportunities

- Opportunity:

Hyper-Specialized Logistics for High-Value Verticals

Competitive Gap:While competitors offer general services, a dedicated, end-to-end solution for industries like pharmaceuticals, luxury goods, or sensitive electronics with unique handling, security, and compliance requirements is a gap.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Sustainability as a Premium Service

Competitive Gap:Offer businesses a certified carbon-neutral shipping option as a marketable feature they can pass on to their eco-conscious customers. This goes beyond internal sustainability efforts to become a customer-facing product.

Feasibility:High

Potential Impact:Medium

- Opportunity:

Integrated Returns & Reverse Logistics Platform

Competitive Gap:Many e-commerce businesses struggle with the complexity and cost of returns. A seamless, data-driven platform that simplifies this process for SMBs could create significant customer loyalty and a new revenue stream.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Small Business E-commerce Enablement Suite

Competitive Gap:Instead of just offering shipping, provide an all-in-one digital toolkit for small online sellers that integrates inventory management, order fulfillment, and multi-carrier shipping optimization, all powered by FedEx's network.

Feasibility:Medium

Potential Impact:High

FedEx operates within a mature, oligopolistic logistics and transportation industry, where it competes primarily with UPS and DHL on a global scale. The market is characterized by high barriers to entry, including massive capital investment in physical infrastructure and the necessity of brand trust. FedEx's core competitive advantages are its unparalleled global air express network, strong brand reputation for speed and reliability, and a diverse service portfolio catering to everything from overnight envelopes to freight.

The primary competitive dynamic is a battle for efficiency, network optimization, and technological supremacy. While UPS is a formidable domestic competitor with a dense ground network, DHL dominates the international cross-border space, particularly in Europe and Asia. However, the most significant threat is not from these traditional rivals but from indirect and asymmetrical competitors. Amazon Logistics has profoundly disrupted the B2C market by insourcing its own logistics and becoming a carrier itself, fundamentally altering customer expectations around speed and cost. Simultaneously, a wave of tech-first disruptors, from digital freight forwarders like Flexport to last-mile startups, are unbundling the value chain and attacking niche segments with greater agility and data-driven models.

Key industry trends are forcing strategic shifts. The relentless growth of e-commerce is a double-edged sword, providing massive volume while compressing margins and straining last-mile delivery networks. Sustainability is no longer a corporate social responsibility checkbox but a critical competitive differentiator, demanding significant investment in green technologies. FedEx's greatest challenge is to leverage its immense physical assets while becoming as agile and digitally native as its new competitors. Future success will depend on its ability to innovate in last-mile solutions, offer superior data and visibility tools, and successfully position itself as the premium, indispensable partner for complex, high-value global supply chains.

Messaging

Message Architecture

Key Messages

- Message:

Global Reach & Connectivity: FedEx is available in over 220 countries and territories.

Prominence:Primary

Clarity Score:High

Location:Global location selector page, marketing materials.

- Message:

Reliability & Speed: FedEx offers dependable, time-definite delivery services you can trust.

Prominence:Primary

Clarity Score:High

Location:Homepage, service descriptions, and historical slogans like 'When it absolutely, positively has to be there overnight'.

- Message:

Comprehensive Solutions: FedEx provides a wide range of services for individuals, e-commerce, small businesses, and large enterprises.

Prominence:Secondary

Clarity Score:Medium

Location:Service and solutions sections of the website.

- Message:

Tracking & Visibility: Easily track your shipments and get proof of delivery for peace of mind.

Prominence:Secondary

Clarity Score:High

Location:Homepage tracking tool, TopicList page.

The message hierarchy is overwhelmingly functional. The primary focus is on core tasks: selecting a location, tracking a package, or initiating a shipment. Strategic messages about value, reliability, and business solutions are present but secondary to these immediate user actions. This is effective for existing customers but less so for attracting new ones who may be comparing services.

Messaging is highly consistent in its functional and operational focus. The emphasis on global reach, service options, and tracking is uniform across the provided content and general brand perception. There's a consistent projection of a massive, reliable logistics network.

Brand Voice

Voice Attributes

- Attribute:

Professional

Strength:Strong

Examples

- •

Select Your Location and Language

- •

Request Proof of Signature

- •

When your shipment contains hazardous materials, we're here to help.

- Attribute:

Efficient & Direct

Strength:Strong

Examples

Enter up to 30 tracking numbers

track

- Attribute:

Helpful

Strength:Moderate

Examples

we're here to help.

Know your goods arrived at their destination

- Attribute:

Impersonal

Strength:Strong

Examples

The content is almost entirely instructional or navigational, with little to no brand personality or storytelling.

Language is focused on process and features, not user benefits or emotions.

Tone Analysis

Utilitarian

Secondary Tones

Informational

Formal

Tone Shifts

The website content provided is almost exclusively utilitarian. Based on external research, marketing campaigns often shift to a more emotional, reassuring tone ('Relax, it's FedEx') which is absent from the core website experience.

Voice Consistency Rating

Good

Consistency Issues

There is a significant disconnect between the emotional, benefit-driven messaging of their advertising campaigns (e.g., 'What we deliver by delivering') and the purely functional, impersonal voice of the website. The site tells you how to ship, but the ads tell you why it matters. This gap is a missed opportunity to reinforce brand value on their primary digital property.

Value Proposition Assessment

FedEx provides a fast, reliable, and extensive global network for shipping packages and freight, supported by advanced tracking and a comprehensive suite of services for both individuals and businesses.

Value Proposition Components

- Component:

Speed/Express Delivery

Clarity:Clear

Uniqueness:Somewhat Unique

Note:A historical cornerstone of the brand, particularly overnight services. Competitors like DHL and UPS also offer strong express options.

- Component:

Global Network

Clarity:Clear

Uniqueness:Common

Note:Extensive reach to 220+ countries is a key value but is table stakes when competing with DHL and UPS.

- Component:

Reliability & Trust

Clarity:Clear

Uniqueness:Somewhat Unique

Note:This is a core brand attribute built over decades, often communicated through slogans like 'Be absolutely sure'.

- Component:

Business & E-commerce Solutions

Clarity:Somewhat Clear

Uniqueness:Common

Note:Messaging for SMEs, e-commerce, and enterprise is a key focus, offering tailored logistics solutions.

FedEx's primary differentiation in its messaging has historically been its emphasis on speed and absolute reliability, particularly for time-sensitive domestic shipments in the U.S. While competitors have caught up, the brand equity from slogans like 'When it absolutely, positively has to be there overnight' persists. Compared to UPS's strength in ground shipping and DHL's dominance in international logistics, FedEx positions itself as the premium, reliable choice for high-stakes air and express delivery.

The messaging positions FedEx as a premium, highly reliable logistics provider. The brand's heritage is in creating the overnight delivery market, and it leverages this to command trust. The tone is less about being the cheapest option and more about being the most dependable, especially when speed is critical.

Audience Messaging

Target Personas

- Persona:

Enterprise Logistics Manager

Tailored Messages

- •

Comprehensive logistics solutions

- •

Supply chain management

- •

Customs brokerage

Effectiveness:Effective

- Persona:

Small & Medium Business Owner

Tailored Messages

- •

Reliable and affordable shipping options

- •

Inventory management services

- •

Access to a global network to expand customer base

Effectiveness:Somewhat Effective

- Persona:

E-commerce Retailer

Tailored Messages

Fast and reliable delivery services

Inventory management and fulfillment options

Effectiveness:Somewhat Effective

- Persona:

Individual Shipper

Tailored Messages

- •

Easy tracking

- •

Request proof of signature

- •

Guaranteed delivery windows

Effectiveness:Effective

Audience Pain Points Addressed

- •

Uncertainty about package arrival time ('tracking', 'guaranteed delivery')

- •

Need for proof of receipt ('Request Proof of Signature')

- •

Complexity of international shipping and customs

- •

Managing business logistics and supply chains efficiently

Audience Aspirations Addressed

- •

Peace of mind knowing a critical shipment will arrive safely and on time.

- •

Enabling business growth by reaching a global customer base.

- •

Improving operational efficiency and reducing costs for large enterprises.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Peace of Mind / Security

Effectiveness:High

Examples

The entire brand is built on this promise. Past slogans like 'Relax, it's FedEx' directly evoke this emotion.

Features like detailed tracking and signature proof appeal to the need for security and control.

Social Proof Elements

- Proof Type:

Scale and Global Presence

Impact:Strong

Note:The sheer number of countries listed on the location page (220+) serves as powerful social proof of their capability and reach.

Trust Indicators

- •

The globally recognized FedEx brand and logo

- •

Decades of established service and reputation

- •

Professional and secure website design

- •

Prominent package tracking functionality

- •

Explicit mention of handling sensitive items like 'hazardous materials'

Scarcity Urgency Tactics

None observed. The business model is based on on-demand service, so these tactics are not applicable or appropriate.

Calls To Action

Primary Ctas

- Text:

[Country Name] | [Language]

Location:Global Location Selector Page

Clarity:Clear

- Text:

track

Location:Tracking widget (inferred)

Clarity:Clear

The CTAs on the provided pages are extremely clear and task-oriented. On the location page, the goal is to get the user to their regional site, and the CTAs accomplish this perfectly. The tracking CTA is singular and direct. This functional approach ensures users can complete core tasks without confusion, which is a strength for a utility-focused brand like FedEx.

Messaging Gaps Analysis

Critical Gaps

- •

Emotional Connection: The website content is sterile and functional, missing the emotional connection and storytelling seen in their advertising campaigns. It doesn't convey the impact of their deliveries.

- •

Benefit-Oriented Headlines: Headlines are descriptive ('Select Your Location') rather than benefit-driven. There's no aspirational messaging on the provided pages to capture new customers.

- •

Customer Stories/Case Studies: There is no evidence of customer success stories or case studies, which would be a powerful form of social proof, especially for B2B audiences.

Contradiction Points

No direct contradictions were found. The messaging is highly consistent in its functional nature.

Underdeveloped Areas

Value Proposition for SMEs: While FedEx targets SMEs, the messaging could be more developed to address their specific pain points around cost management, growth, and competition.

Sustainability Messaging: While mentioned in corporate strategy documents, visible messaging around sustainability efforts is not prominent on these core functional pages.

Messaging Quality

Strengths

- •

Clarity and Simplicity: The messaging is unambiguous and easy to understand.

- •

Global Authority: The location selector page powerfully and instantly communicates the brand's immense global scale.

- •

Functional Excellence: The website is clearly designed to help users complete core tasks (tracking, shipping) with maximum efficiency.

- •

Brand Recognition: The brand itself carries immense weight, and the site leverages this by not cluttering the experience with unnecessary persuasive copy.

Weaknesses

- •

Overly Utilitarian: The focus on function comes at the expense of brand building and emotional connection.

- •

Lack of Persuasion: The site does little to persuade a potential customer to choose FedEx over a competitor; it assumes the user has already made that choice.

- •

Impersonal Voice: The voice is that of a large, faceless corporation, which can be alienating for small business owners or individual shippers seeking a partner.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Messaging

Recommendation:Integrate primary headlines that blend the core functional need (shipping/tracking) with the emotional benefit (peace of mind, business growth). Shift from a purely functional hub to a more welcoming and benefit-oriented entry point.

Expected Impact:High

- Area:

Audience Segmentation

Recommendation:Create more distinct messaging pathways for key personas (SME, E-commerce, Enterprise) directly from the homepage, with content and case studies tailored to their unique challenges and goals.

Expected Impact:High

- Area:

Brand Voice

Recommendation:Inject more of the reassuring and helpful 'Relax, it's FedEx' tone into the website copy. Use 'you' and 'we' to create a more direct and personal connection with the user, especially in support and service description sections.

Expected Impact:Medium

Quick Wins

Add a benefit-oriented sub-headline on the homepage below the main functional widgets (e.g., 'Connecting your business to a world of possibilities').

Incorporate customer testimonials or logos of well-known business customers on the homepage or in a dedicated section.

Long Term Recommendations

- •

Develop a robust content marketing strategy featuring customer success stories and case studies, showcasing how FedEx helps businesses thrive.

- •

Create an interactive 'solutions finder' tool that guides potential business customers to the right services based on their industry, size, and needs, reinforcing the message of being a strategic partner.

- •

Align the website's brand voice more closely with the emotional storytelling of broadcast advertising campaigns to create a seamless, powerful brand experience across all touchpoints.

The strategic messaging on the FedEx website is a masterclass in functional clarity and conveying global scale. The site is designed as a utility, prioritizing the core tasks of existing customers: tracking packages and selecting a regional portal. This utilitarian approach reinforces brand attributes of efficiency and reliability. The global location page, with its exhaustive list of over 220 countries, is a powerful and immediate visual representation of the company's primary value proposition: its unparalleled network.

However, this focus on function creates a significant messaging gap. The website's voice is impersonal and corporate, standing in stark contrast to the emotional, reassuring, and benefit-driven storytelling found in FedEx's iconic advertising campaigns (e.g., 'Relax, it's FedEx,' 'What we deliver by delivering'). The site effectively serves the converted but does little to persuade the undecided. It answers 'how' but largely ignores 'why.'

For market positioning, this reinforces FedEx as a legacy, blue-chip provider but misses an opportunity to connect with newer, more agile audiences like small business owners and e-commerce entrepreneurs who may be looking for more of a partner than a utility. While competitors like UPS and DHL offer similar services, the battlefield for differentiation is increasingly on customer experience and brand connection. By failing to translate its powerful advertising narrative to its core digital property, FedEx is leaving significant brand equity on the table. The optimization roadmap should focus on bridging this gap by infusing the website with the same emotional intelligence and benefit-oriented language that has made the brand a global powerhouse.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Established global brand synonymous with express delivery.

- •

Comprehensive service portfolio including express, ground, freight, and logistics solutions catering to a wide range of customers from individuals to large enterprises.

- •

Extensive global network reaching over 220 countries and territories, indicating widespread market acceptance and demand.

- •

Consistently high revenue, demonstrating a large and recurring customer base.

Improvement Areas

- •

Enhancing the digital experience and self-service tools for small and medium-sized businesses (SMBs) to compete with digitally native competitors.

- •

Improving the integration and user experience between formerly separate operating companies (Express, Ground) to present a unified service to the customer.

- •

Developing more specialized, high-value services for growing industry verticals like healthcare and high-tech to move beyond commoditized shipping.

Market Dynamics

The global logistics market is projected to grow at a CAGR of 7.2% to 8.7% between 2025 and 2032. The e-commerce logistics sub-market is growing even faster, with a projected CAGR of 18.9%.

Mature

Market Trends

- Trend:

E-commerce Proliferation

Business Impact:Sustained high demand for parcel delivery, especially B2C. Increases pressure on last-mile delivery efficiency and reverse logistics capabilities.

- Trend:

Digitalization and Automation

Business Impact:Requires significant investment in AI, data analytics, and automation to optimize routes, improve warehouse efficiency, and enhance customer visibility.

- Trend:

Sustainability and ESG

Business Impact:Growing customer and regulatory pressure to invest in electric vehicles, sustainable aviation fuels, and optimized networks to reduce carbon footprint.

- Trend:

Supply Chain Resilience

Business Impact:Increased demand for sophisticated logistics services, real-time visibility, and data analytics to help businesses navigate global disruptions.

Crucial. While the market is mature, it is undergoing significant transformation due to technology and e-commerce. FedEx's current strategic shifts (Network 2.0, DRIVE) are well-timed to address these changes, but execution speed is critical to maintain a leadership position against agile competitors.

Business Model Scalability

Medium

High fixed-cost, asset-heavy model (aircraft, hubs, vehicles). Scaling requires massive capital expenditure. The ongoing DRIVE program and Network 2.0 aim to improve the cost structure by reducing redundancies and improving asset utilization.

High. Small changes in volume can have a significant impact on profitability due to the high fixed costs. Network optimization is key to maximizing leverage.

Scalability Constraints

- •

High capital intensity for expanding physical infrastructure (hubs, aircraft).

- •

Dependence on labor availability, particularly for drivers and package handlers, leading to susceptibility to labor shortages and wage pressures.

- •

Physical capacity limits of aircraft and sorting facilities.

- •

Regulatory hurdles in different international markets.

Team Readiness

Experienced leadership team driving a significant and necessary corporate transformation (DRIVE, Network 2.0, One FedEx). This indicates a strong capability to manage large-scale change.

Currently undergoing a major positive overhaul. The move to a unified 'One FedEx' structure, consolidating Express, Ground, and Services, is designed to break down silos, improve efficiency, and create a more agile organization better suited for growth.

Key Capability Gaps

- •

Agile software development and digital product management to accelerate the rollout of customer-facing technology.

- •

Data science and AI talent to fully leverage the vast operational data for predictive analytics and optimization.

- •

Change management expertise at the operational level to ensure smooth execution of the massive Network 2.0 consolidation.

Growth Engine

Acquisition Channels

- Channel:

Direct Enterprise Sales

Effectiveness:High

Optimization Potential:Medium

Recommendation:Equip sales teams with advanced data analytics and supply chain consulting capabilities to sell higher-value, integrated solutions rather than just transportation services.

- Channel:

Digital/Web (SMB & Individual)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Simplify the online onboarding and shipping process. Implement more transparent, dynamic pricing and integrate with major e-commerce platforms (e.g., Shopify, BigCommerce) to capture more of the growing SMB market.

- Channel:

Third-Party Retail Locations (e.g., FedEx Office)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Expand partnerships and services offered at these locations, focusing on convenient returns and drop-offs for e-commerce, making them a key asset in the last-mile network.

Customer Journey

For enterprise customers, the path is a traditional sales-led cycle. For SMB and individual customers, the digital path can be complex, involving navigating different service options (Express vs. Ground), complex rate structures, and customs documentation.

Friction Points

- •

Complexity in choosing the right service and understanding pricing.

- •

Cumbersome process for creating international shipping labels and customs documents for infrequent shippers.

- •

Historically separate tracking and support systems for Express and Ground, which the 'One FedEx' initiative aims to solve.

Journey Enhancement Priorities

{'area': 'Digital Onboarding for SMBs', 'recommendation': 'Create a simplified, guided digital experience for SMBs that recommends the best shipping solutions based on their needs and integrates directly into their sales platforms.'}

{'area': 'Unified Tracking & Support', 'recommendation': 'Accelerate the back-end integration to provide a single, seamless tracking and customer support experience regardless of which internal network a package travels through.'}

Retention Mechanisms

- Mechanism:

Long-term contracts and volume discounts

Effectiveness:High

Improvement Opportunity:Incorporate performance-based incentives and gain-sharing models tied to supply chain efficiency improvements, moving beyond simple volume discounts.

- Mechanism:

Technology Integration (APIs, etc.)

Effectiveness:High

Improvement Opportunity:Develop more user-friendly, low-code/no-code integration tools for SMBs who lack large IT departments, increasing stickiness in this segment.

- Mechanism:

FedEx Rewards Program

Effectiveness:Medium

Improvement Opportunity:Enhance the rewards program to offer more value for high-growth SMBs, including access to premium support, logistics consulting, or preferential pricing.

Revenue Economics

Highly complex and variable, dependent on factors like fuel cost, route density, labor costs, and asset utilization. The core challenge is maximizing the revenue per package while minimizing the cost per stop. The Network 2.0 initiative is specifically designed to improve unit economics by consolidating routes and increasing stop density.

Undeterminable for the entire business, but extremely high for large enterprise accounts with deep integration, and lower for transactional individual customers. The focus should be on increasing LTV in the SMB segment.

Moderate. Significant opportunities for improvement exist, which is the primary driver behind the multi-billion dollar DRIVE and Network 2.0 cost-saving initiatives.

Optimization Recommendations

- •

Aggressively pursue the Network 2.0 consolidation to eliminate redundant routes and improve last-mile density.

- •

Utilize dynamic pricing models, informed by AI, to optimize package profitability based on capacity and demand.

- •

Increase focus on high-margin, value-added services like temperature-controlled healthcare logistics and supply chain consulting.

Scale Barriers

Technical Limitations

- Limitation:

Legacy IT Systems

Impact:Medium

Solution Approach:Continue migrating to a modern, cloud-based, API-first architecture to improve data sharing, enable faster innovation, and provide a unified customer view. The 'One FedEx' strategy is a key enabler here.

- Limitation:

Data Silos

Impact:High

Solution Approach:Create a centralized data platform that integrates data from all operating companies (historical and current) to power network-wide optimization, predictive analytics, and enhanced customer visibility tools.

Operational Bottlenecks

- Bottleneck:

Network Redundancy

Growth Impact:Drives up structural costs and reduces efficiency, limiting profitable growth. This is the single biggest operational barrier.

Resolution Strategy:Full implementation of the 'Network 2.0' plan to consolidate Express and Ground operations into a single, optimized air-ground network.

- Bottleneck:

Last-Mile Delivery Costs

Growth Impact:The most expensive part of the delivery journey, which can erode margins, especially with the growth of B2C e-commerce.

Resolution Strategy:Increase stop density through route consolidation (Network 2.0), invest in route optimization technology, and pilot alternative delivery methods (e.g., EVs, potentially drones in the future).

- Bottleneck:

Labor Shortages & Relations

Growth Impact:Can lead to service disruptions and increased operating costs, impacting reliability and profitability.

Resolution Strategy:Invest in automation in hubs and warehouses, offer competitive wages and benefits, and create clear career paths to attract and retain talent.

Market Penetration Challenges

- Challenge:

Intense Price Competition

Severity:Critical

Mitigation Strategy:Compete on value and reliability rather than price alone. Differentiate through superior technology, delivery speed, and specialized services. The 'DRIVE' program's cost reductions are essential to maintain margin in this environment.

- Challenge:

Rise of Amazon Logistics

Severity:Major

Mitigation Strategy:Position FedEx as the preferred logistics partner for all other e-commerce players, offering a high-quality, reliable alternative. Deepen integrations with e-commerce platforms and provide superior seller tools.

- Challenge:

Global Geopolitical and Economic Volatility

Severity:Major

Mitigation Strategy:Maintain a flexible and intelligent network that can adapt to shifts in global trade flows. Use data analytics to predict and respond to potential disruptions. The potential spin-off of FedEx Freight is one way to increase focus and agility.

Resource Limitations

Talent Gaps

- •

Data Scientists and AI/ML Engineers

- •

Digital Product Managers

- •

Automation and Robotics Engineers

Extremely high. Ongoing need for capital to modernize the air fleet, electrify the vehicle fleet, and invest in hub automation and technology. The current cost-saving programs are designed to free up capital for these investments.

Infrastructure Needs

- •

Continued investment in automated sorting hubs.

- •

Expansion of facilities in high-growth international markets.

- •

Rollout of EV charging infrastructure across the network.

Growth Opportunities

Market Expansion

- Expansion Vector:

Deeper Penetration in E-commerce

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Develop a dedicated suite of services for e-commerce businesses, including seamless platform integration, simplified returns, and flexible delivery options to become the carrier of choice for non-Amazon retail.

- Expansion Vector:

High-Value Verticals (e.g., Healthcare)

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Invest in specialized capabilities like temperature-controlled logistics, secure supply chain solutions, and industry-specific compliance expertise to capture higher-margin business.

- Expansion Vector:

Cross-Border E-commerce

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Simplify international shipping for SMBs with digital tools that automate customs documentation and provide transparent, landed-cost pricing. Focus on high-growth trade lanes.

Product Opportunities

- Opportunity:

Supply Chain as a Service (SCaaS)

Market Demand Evidence:Increasing desire from businesses to outsource complex logistics and gain visibility into their supply chains.

Strategic Fit:Strong. Leverages FedEx's core assets (network, data) to provide higher-margin, recurring revenue services.

Development Recommendation:Package existing capabilities (transportation, warehousing, data analytics, customs brokerage) into an integrated, subscription-based digital platform.

- Opportunity:

Advanced Data & Analytics Products

Market Demand Evidence:Shippers are increasingly looking to 3PLs for data-driven, actionable strategies to optimize their supply chains.

Strategic Fit:Excellent. Monetizes the vast dataset generated by the global network.

Development Recommendation:Develop and sell premium analytics products that provide customers with predictive insights on transit times, carbon emissions tracking, and supply chain risk assessment.

- Opportunity:

Sustainable Shipping Solutions

Market Demand Evidence:Growing consumer and corporate demand for lower-carbon shipping options.

Strategic Fit:Essential for long-term brand reputation and market leadership.

Development Recommendation:Offer customers a portfolio of green shipping options (e.g., Sustainable Aviation Fuel contribution, EV delivery preference) and provide certified carbon footprint reporting.

Channel Diversification

- Channel:

E-commerce Platform Marketplaces

Fit Assessment:Excellent

Implementation Strategy:Develop plug-and-play apps and deeper API integrations for platforms like Shopify, BigCommerce, and WooCommerce to make FedEx the default, easy-to-select shipping option for millions of online merchants.

- Channel:

Logistics-as-a-Service Platforms

Fit Assessment:Good

Implementation Strategy:Partner with and integrate into multi-carrier shipping software platforms that are popular with SMBs, ensuring FedEx services are competitively presented and easy to access.

Strategic Partnerships

- Partnership Type:

Technology (AI/Automation)

Potential Partners

- •

NVIDIA

- •

Palantir

- •

Warehouse robotics firms (e.g., Boston Dynamics)

Expected Benefits:Accelerate the development of network optimization algorithms, predictive maintenance, and warehouse automation to drive efficiency gains.

- Partnership Type:

E-commerce Enablement

Potential Partners

- •

Shopify

- •

Adobe (Magento)

- •

BigCommerce

Expected Benefits:Embed FedEx services deeply into the e-commerce ecosystem, making them the path of least resistance for merchants and capturing significant parcel volume.

Growth Strategy

North Star Metric

Cost Per Shipment

As a mature business in a competitive market, profitable growth hinges on operational efficiency. Reducing the structural cost per shipment is the most critical lever for improving margins and funding future investments. This metric directly tracks the success of the DRIVE and Network 2.0 initiatives.

Achieve the publicly stated goal of over $4 billion in structural cost reductions by FY2025, which directly translates to a lower cost per shipment.

Growth Model

Efficiency and Ecosystem Hybrid Model

Key Drivers

- •

Operational Efficiency Gains (from Network 2.0)

- •

SMB E-commerce Volume Growth (through digital channels and partnerships)

- •

Expansion of High-Margin Enterprise Solutions (e.g., healthcare logistics)

Simultaneously execute a rigorous internal efficiency program (DRIVE) while pursuing external growth through deeper integration into the e-commerce ecosystem and developing value-added services.

Prioritized Initiatives

- Initiative:

Accelerate Network 2.0 Rollout

Expected Impact:High

Implementation Effort:Very High

Timeframe:12-24 months

First Steps:Complete the integration in the initial 50+ locations, codify the playbook, and establish a dedicated team to manage the phased rollout across the rest of the US market.

- Initiative:

Launch 'FedEx E-commerce Suite' for SMBs

Expected Impact:High

Implementation Effort:Medium

Timeframe:6-12 months

First Steps:Bundle existing services (e.g., easy returns, platform integrations, flexible delivery options) into a cohesive digital offering. Launch a targeted digital marketing campaign to acquire new SMB customers.

- Initiative:

Develop & Market Premium Data/Analytics Services

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:9-18 months

First Steps:Pilot a premium visibility and carbon tracking dashboard with a select group of enterprise customers to refine the product and demonstrate value.

Experimentation Plan

High Leverage Tests

{'test': 'Dynamic pricing for SMBs on digital channels based on real-time network capacity.', 'hypothesis': 'We can increase yield and fill empty capacity by offering targeted discounts for flexible-delivery-date shipments.'}

{'test': 'Pilot alternative last-mile vehicles (e.g., e-cargo bikes) in dense urban centers.', 'hypothesis': 'We can lower last-mile delivery costs and improve delivery times in congested areas.'}

Use A/B testing methodologies for digital experiments and pilot programs for operational changes. Key metrics include cost per shipment, on-time delivery percentage, customer satisfaction (NPS), and adoption rate of new features/services.

Quarterly review of major operational pilot programs. Monthly review cycle for digital product and pricing experiments.

Growth Team

A centralized 'Digital Growth and Innovation' team that works cross-functionally with Operations, Sales, IT, and Marketing. This team should be empowered to run experiments and develop new digital products.

Key Roles

- •

Head of Digital Growth (SMB)

- •

Product Manager, E-commerce Solutions

- •

Head of Supply Chain Data Products

- •

Logistics Automation Lead

Acquire talent in data science, AI/ML, and digital product management. Foster an internal culture of experimentation and data-driven decision-making through training and by celebrating both successful and failed experiments as learning opportunities.

FedEx is at a critical juncture, transitioning from a conglomerate of semi-independent operating companies to a single, unified logistics organization. This move is not just an operational shuffle; it is the foundational strategy for future growth. The company's 'Strong' product-market fit is undeniable, built on decades of reliability and a massive global network. However, the market has fundamentally shifted. Growth is no longer about just adding more planes and trucks; it's about network intelligence, digital integration, and efficiency.

The primary growth engine has shifted from pure network expansion to network optimization. The multi-billion dollar 'DRIVE' and 'Network 2.0' initiatives are the correct strategic response to the primary scale barrier: a redundant and high-cost operational structure. Successfully executing this consolidation is the single most important factor for FedEx's near-term growth, as it directly improves the core 'Cost Per Shipment' North Star Metric. This efficiency gain is the fuel for all other growth opportunities.

The most significant growth opportunity lies in capturing a larger, more profitable share of the booming e-commerce market. While Amazon Logistics has become a formidable competitor, it has also created a massive market of independent e-commerce merchants who need a powerful logistics partner. FedEx is uniquely positioned to be that partner. Growth here will be driven not by sales teams, but by product teams building seamless integrations with platforms like Shopify and offering a suite of digital tools that simplify shipping, tracking, and returns for small and medium-sized businesses.

Secondary growth vectors in high-margin verticals like healthcare and the monetization of data through analytics services represent the next horizon. These opportunities shift FedEx from a logistics utility to a strategic supply chain partner. To succeed, FedEx must continue to build new capabilities in data science and agile product development.

In summary, FedEx's growth readiness is moderate but rapidly improving. The strategic framework is sound, but the challenge lies in the speed and precision of execution. The company must successfully navigate a complex internal transformation while simultaneously innovating its customer-facing digital offerings to fend off intense competition. If they can successfully become 'One FedEx' operationally and digitally, they will unlock significant potential for efficient, profitable growth in the new era of logistics.

Legal Compliance

FedEx maintains a comprehensive and globally applicable privacy framework, consisting of a 'Global Privacy Policy' and a more detailed 'Privacy Notice'. The Privacy Notice, last updated in May 2025, clearly articulates the types of Personal Data collected (e.g., name, address, email), the legal bases for processing (performance of an agreement, legal obligations, legitimate interests, and consent), and the purposes for collection, such as service provision and product development. It designates specific data controllers for Europe (FedEx Express International B.V.) and the rest of the world (FedEx Corporation), demonstrating a sophisticated understanding of jurisdictional requirements under GDPR. The policy addresses international data transfers, stating that transfers outside the EEA are governed by appropriate safeguards like model contractual clauses. It also provides clear mechanisms for users to exercise their data rights, with specific portals for California residents and other U.S. residents, as well as a phone number for offline requests. The policy explicitly states that it does not collect sensitive personal information or data from children under 16, providing a contact form for parents if accidental collection occurs.

FedEx's terms and conditions are primarily consolidated within the 'FedEx Service Guide', which constitutes the contract of carriage. The terms explicitly state that they supersede all previous agreements and that FedEx reserves the right to unilaterally modify rates, services, and terms without notice, a common but important clause for users to be aware of. The enforceability is strong, as using the service constitutes agreement. Clarity is achieved by defining key terms like 'transportation charges' and outlining specific billing procedures for 'Bill Sender,' 'Bill Recipient,' and 'Bill Third Party' transactions. The terms also incorporate by reference a number of other critical documents, including the Air Waybill and applicable tariffs, making the full scope of the agreement very extensive. This layered approach is legally robust but can be complex for a casual user to fully comprehend.