eScore

fisglobal.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

FIS Global demonstrates a strong digital presence with high domain authority and excellent content for bottom-of-funnel, solution-aware clients. The company's global reach is evident, and its content is well-aligned with specific product and service queries. However, it scores lower on capturing top-of-funnel search intent, with a noticeable gap in thought leadership content that addresses broader industry problems, ceding this space to competitors.

High content authority and domain strength, making it highly visible for branded and product-specific search terms.

Invest in creating top-of-funnel, persona-based content hubs (e.g., for CFOs, CIOs) to capture organic traffic earlier in the buyer journey and establish broader thought leadership.

The brand's messaging architecture is exceptionally clear, using the 'Money at Rest, Motion, Work' framework to simplify a complex portfolio. Messaging is highly consistent and effectively tailored to its core B2B personas in banking and finance, projecting authority and stability. The significant weakness is a critical lack of social proof on key pages; the absence of customer logos, testimonials, or quantified case studies undermines the credibility of its claims.

The 'Money at Rest, Motion, Work' framework is a world-class messaging structure that brilliantly simplifies a complex value proposition.

Immediately integrate a 'Trusted By' client logo bar on the homepage and begin featuring customer success stories with quantifiable outcomes to provide crucial social proof.

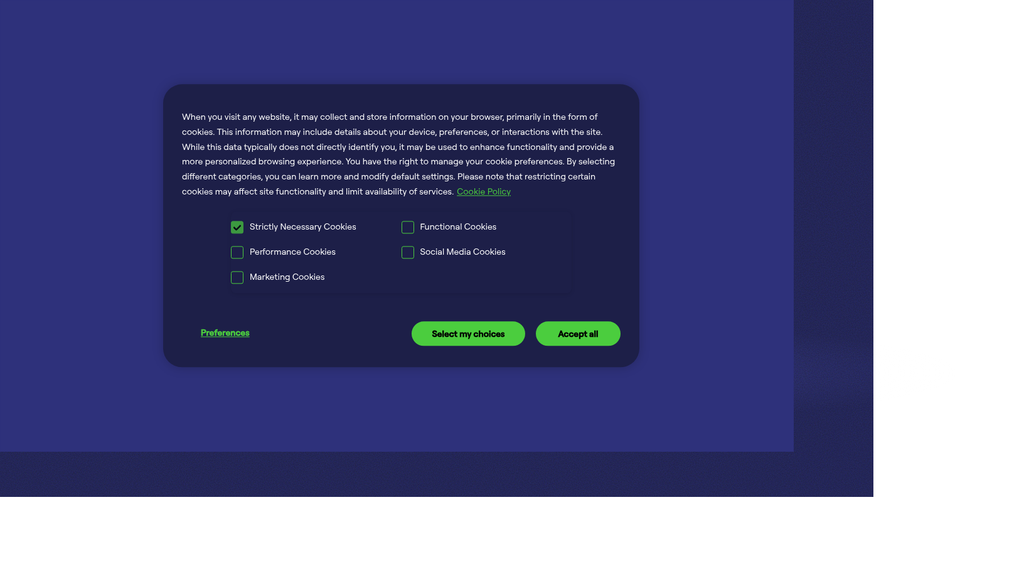

The website's information architecture is logical, but the conversion experience is hampered by significant friction points. The initial full-screen cookie consent modal creates a poor first impression and obstructs the value proposition. Furthermore, primary calls-to-action are often styled as low-prominence 'ghost buttons,' which reduces their effectiveness in guiding high-intent users toward conversion.

The logical content organization and clear information hierarchy allow users who get past initial friction to find relevant information with relative ease.

Replace the intrusive full-screen cookie consent modal with a less obtrusive bottom banner and redesign the primary header CTA to be a solid, high-contrast button to improve visibility and click-through rates.

FIS excels in establishing credibility through its mature and comprehensive legal and compliance framework, which is benchmarked against GDPR. The site effectively showcases third-party validation through industry awards and leadership bios, reinforcing its position as a stable, trustworthy enterprise. The primary detractor is the lack of readily available customer success evidence like case studies and testimonials, which forces users to trust the company's claims without direct client validation.

A sophisticated, global-standard legal and data privacy framework that serves as a core strategic asset and a powerful trust signal for risk-averse clients.

Create a dedicated and prominently featured 'Customer Stories' or 'Case Studies' section on the website to provide tangible proof of customer success and ROI.

FIS's competitive moat is exceptionally strong and sustainable, built on the high switching costs of its deeply embedded core banking and processing systems. Its comprehensive, end-to-end product portfolio and massive global scale create significant barriers to entry that are difficult for competitors to replicate. While the company is perceived as less agile than newer fintechs, its entrenched client relationships provide a powerful, long-term advantage.

Extremely high client switching costs for core financial systems, which ensures industry-leading customer retention and predictable revenue.

Accelerate investment in open API capabilities across the product suite to counter the 'best-of-breed' threat from agile competitors and to turn the integrated platform into a more flexible ecosystem.

The business model is highly scalable, with strong unit economics characterized by high customer lifetime value and significant operational leverage. The strategic divestiture of Worldpay has sharpened focus on high-margin core segments, improving capital efficiency. Expansion potential is high, particularly in penetrating the mid-market and expanding into high-growth areas like BaaS and AI-driven services, though execution will require overcoming the inertia of a large organization.

A business model with a high percentage of recurring revenue from long-term contracts, providing exceptional financial predictability and a stable foundation for growth investments.

Develop a dedicated go-to-market strategy and a modular, 'lite' product offering to more effectively and rapidly capture the underserved mid-market and community bank segment.

FIS exhibits outstanding business model coherence, particularly after the strategic spinoff of its Worldpay merchant business. This move sharpened its focus on its core, high-margin Banking and Capital Markets segments, demonstrating strong strategic clarity and efficient resource allocation. The model is perfectly aligned with the needs of its risk-averse, enterprise target market, prioritizing stability, security, and comprehensive solutions.

The recent strategic divestiture of Worldpay demonstrates a clear, coherent focus on core competencies and high-margin enterprise solutions, optimizing the business model for future growth.

Introduce more flexible, consumption-based pricing models for certain modular services to better compete with cloud-native challengers and appeal to a broader range of emerging fintech clients.

As a top-tier player in an oligopolistic market, FIS wields significant market power, evidenced by its ability to secure long-term contracts with the world's largest banks. Its market share is stable and its pricing power is strong due to the mission-critical nature of its services and the high switching costs involved. The company's deep industry expertise and vast transactional data give it a significant intelligence advantage and the ability to influence industry standards.

Dominant market position serving the majority of the world's top banks, providing immense scale, data intelligence, and influence over the financial technology landscape.

Develop and more aggressively market unique, proprietary insights derived from its vast transactional data to solidify its position as an indispensable thought leader and data authority.

Business Overview

Business Classification

B2B Enterprise Financial Technology & Services

Technology Consulting & Outsourcing

Financial Technology (FinTech)

Sub Verticals

- •

Core Banking Platforms

- •

Digital Banking Solutions

- •

Payments Technology

- •

Capital Markets Technology

- •

Treasury & Risk Management

- •

Wealth & Asset Management Tech

- •

Regulatory & Compliance Tech (RegTech)

Mature

Maturity Indicators

- •

Established Fortune 500 company with a long operational history since 1968.

- •

Large, diversified global client base of over 20,000 institutions in more than 100 countries.

- •

Comprehensive, deeply integrated product suite across banking and capital markets.

- •

Recent strategic divestiture of Worldpay to refocus on core, high-margin business.

- •

Consistent dividend payments and significant share repurchase programs.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Banking Solutions

Description:Provides core processing software, transaction processing, digital banking platforms (Digital One), card issuer services, and risk management solutions to financial institutions of all sizes. Revenue is primarily recurring, derived from long-term contracts, transaction fees, and software maintenance.

Estimated Importance:Primary

Customer Segment:Global, regional, and community banks; credit unions.

Estimated Margin:High

- Stream Name:

Capital Markets Solutions

Description:Offers solutions for securities processing, asset management, trading, treasury, and risk management to financial services firms. This includes platforms like the Private Capital Suite and services for trade execution and compliance.

Estimated Importance:Secondary

Customer Segment:Asset managers, broker-dealers, private equity firms, and corporate treasuries.

Estimated Margin:High

- Stream Name:

Professional & Consulting Services

Description:Provides implementation, customization, integration, and advisory services related to its software platforms. This is a non-recurring revenue stream that is critical for client onboarding and platform modernization projects.

Estimated Importance:Tertiary

Customer Segment:All segments, particularly large enterprises undergoing transformation.

Estimated Margin:Medium

Recurring Revenue Components

- •

Long-term software-as-a-service (SaaS) contracts

- •

Transaction and processing fees

- •

Software licensing and maintenance fees

- •

Managed services and outsourcing agreements

Pricing Strategy

Enterprise Contract-Based & Custom Pricing

Premium

Opaque

Pricing Psychology

- •

Value-Based Selling

- •

Total Cost of Ownership (TCO) Justification

- •

Bundled Solutions Pricing

- •

Long-Term Partnership Discounts

Monetization Assessment

Strengths

- •

High percentage of recurring revenue (approx. 80%) provides financial stability and predictability.

- •

Deeply embedded solutions create high switching costs for clients, ensuring strong customer retention.

- •

Diversified revenue across two major, resilient financial segments (Banking and Capital Markets).

Weaknesses

- •

Long and complex sales cycles for new enterprise clients.

- •

Pricing models may lack the flexibility desired by smaller, more agile fintechs or banks.

- •

Dependence on long-term contracts can slow adaptation to new market pricing trends like consumption-based models.

Opportunities

- •

Cross-selling advanced services like AI-driven analytics and RegTech solutions to the existing client base.

- •

Developing more modular, API-first products to attract emerging digital banks and fintechs.

- •

Expanding 'Banking-as-a-Service' (BaaS) offerings to enable non-financial companies to embed finance.

Threats

- •

Pricing pressure from cloud-native, specialized competitors offering unbundled, pay-as-you-go services.

- •

A shift in the market towards open banking and best-of-breed solutions over monolithic, single-vendor platforms.

- •

Economic downturns could reduce transaction volumes and put pressure on clients' IT budgets.

Market Positioning

Market Leader & Comprehensive Solutions Provider

Top-tier player, often ranked #1 or in the top 3 globally for core banking technology. Competes directly with Fiserv and Jack Henry & Associates.

Target Segments

- Segment Name:

Large Global & Regional Financial Institutions

Description:Tier 1 and Tier 2 banks that require highly scalable, secure, and compliant end-to-end financial technology infrastructure.

Demographic Factors

- •

Assets >$10 billion

- •

Multinational operations

- •

Large, complex IT departments

Psychographic Factors

- •

Highly risk-averse

- •

Prioritize stability, security, and regulatory compliance

- •

Focused on long-term strategic partnerships

Behavioral Factors

- •

Slow technology adoption cycles

- •

Preference for established, reputable vendors

- •

High investment in digital transformation projects

Pain Points

- •

Modernizing legacy core systems without disrupting operations

- •

Managing complex global regulatory requirements

- •

Competing with agile fintech startups and digital-native banks

- •

Integrating disparate technology stacks from previous mergers

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Community Banks & Credit Unions

Description:Smaller institutions needing cost-effective, integrated technology solutions to compete with larger banks and offer modern digital services to their members/customers.

Demographic Factors

- •

Assets <$10 billion

- •

Geographically focused

- •

Limited internal IT resources

Psychographic Factors

- •

Value-conscious

- •

Seek trusted partners for technology outsourcing

- •

Community and relationship-focused

Behavioral Factors

Often rely on a single core provider for most technology needs

Look for pre-integrated digital banking and payment solutions

Pain Points

- •

Lack of scale to develop proprietary technology

- •

Keeping pace with consumer demand for digital banking features

- •

Meeting compliance requirements with limited staff

- •

High cost of core system conversions

Fit Assessment:Good

Segment Potential:Medium

- Segment Name:

Capital Markets Firms

Description:Buy-side and sell-side firms including asset managers, hedge funds, private equity, and broker-dealers requiring specialized platforms for trading, risk, compliance, and asset servicing.

Demographic Factors

Varying sizes from boutique funds to global investment banks

Psychographic Factors

- •

Performance-driven

- •

Highly focused on speed, efficiency, and data accuracy

- •

Need to manage complex financial instruments and regulations

Behavioral Factors

Demand for real-time data and analytics

Need for solutions that can handle high transaction volumes

Pain Points

- •

Operational inefficiencies in post-trade processing

- •

Increasing regulatory reporting burdens (e.g., climate risk)

- •

Need for data-driven investment decision support

- •

Managing liquidity and collateral effectively

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Corporate CFOs & Treasury Departments

Description:Large corporations requiring sophisticated tools for treasury management, payments, and financial risk.

Demographic Factors

Large enterprise companies

Psychographic Factors

Focused on efficiency, control, and cash flow visibility

Behavioral Factors

Seek to automate financial workflows and reduce manual processes

Pain Points

- •

Lack of real-time visibility into global cash positions

- •

Inefficient accounts payable/receivable processes

- •

Managing currency and interest rate risk

Fit Assessment:Good

Segment Potential:High

Market Differentiation

- Factor:

Comprehensive End-to-End Product Portfolio

Strength:Strong

Sustainability:Sustainable

- Factor:

Global Scale and Deep Industry Expertise

Strength:Strong

Sustainability:Sustainable

- Factor:

Embedded Client Relationships and High Switching Costs

Strength:Strong

Sustainability:Sustainable

- Factor:

Robust Regulatory and Compliance Capabilities

Strength:Strong

Sustainability:Sustainable

Value Proposition

FIS provides a comprehensive suite of secure, scalable financial technology solutions that empower banks, capital markets firms, and corporations to efficiently manage the entire money lifecycle—from storing and moving to investing funds—driving modernization, growth, and operational excellence.

Good

Key Benefits

- Benefit:

Operational Stability and Security

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Long history as a trusted provider for top global banks.

- •

Emphasis on compliance and resilience throughout website content.

- •

Manages trillions of dollars in transactions annually.

- Benefit:

Comprehensive, Integrated Solutions

Importance:Important

Differentiation:Unique

Proof Elements

- •

Framing of 'Money at Rest, in Motion, at Work'.

- •

Broad portfolio covering banking, payments, and capital markets.

- •

Ability to serve as a single strategic technology partner.

- Benefit:

Enable Digital Transformation

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Showcasing modern platforms like Digital One and Private Capital Suite.

- •

Publishing insights and articles on IT modernization and innovation.

- •

Industry awards for digital banking platforms.

Unique Selling Points

- Usp:

The ability to provide an integrated technology backbone across the full money lifecycle, reducing vendor complexity for clients.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Unmatched scale and a client base that includes 49 of the top 50 global banks, providing deep data insights and stability.

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Legacy IT infrastructure hindering innovation and efficiency.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Increasingly complex and costly regulatory and compliance burdens.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Pressure to deliver modern, seamless digital experiences to end-customers.

Severity:Major

Solution Effectiveness:Partial

- Problem:

Fragmented vendor relationships leading to integration challenges and higher costs.

Severity:Major

Solution Effectiveness:Complete

Value Alignment Assessment

High

FIS's focus on security, compliance, and scale is perfectly aligned with the primary needs of its core market: established financial institutions. The recent spinoff of Worldpay further sharpens this alignment.

High

The value proposition directly addresses the critical pain points of executives at banks and capital markets firms, such as managing risk, modernizing legacy systems, and navigating complex regulations.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Major cloud providers (e.g., AWS, Azure)

- •

Systems integrators and consulting firms

- •

Fintech startups (via investment and partnership)

- •

Payment networks (Visa, Mastercard)

Key Activities

- •

Research & Development of financial software

- •

Transaction Processing & Data Center Management

- •

Client Implementation & Support

- •

Strategic Mergers, Acquisitions, and Divestitures

- •

Regulatory Compliance Monitoring

Key Resources

- •

Proprietary software platforms and IP

- •

Global, secure data center infrastructure

- •

Vast repository of financial transaction data

- •

Deep bench of financial and technological expertise

- •

Extensive global client relationships

Cost Structure

- •

Personnel costs (R&D, sales, support)

- •

Technology infrastructure and data center operations

- •

Sales and marketing expenses

- •

Costs associated with regulatory compliance

- •

Integration costs from acquisitions

Swot Analysis

Strengths

- •

Dominant market position and brand recognition.

- •

Extremely 'sticky' customer base due to high switching costs of core systems.

- •

Comprehensive and broad product portfolio serving diverse financial sectors.

- •

Strong financial profile with highly recurring revenues and robust cash flow.

Weaknesses

- •

Potential for technological debt in legacy platforms, hindering agility.

- •

Perception as a slower, more traditional provider compared to nimble fintechs.

- •

Complexity of integrating its vast product suite can be a challenge for clients.

- •

Historically, complex organizational structure post-acquisitions (being addressed by Worldpay spinoff).

Opportunities

- •

Accelerating the migration of clients' on-premise solutions to the cloud.

- •

Expanding into high-growth areas like embedded finance and Banking-as-a-Service (BaaS).

- •

Leveraging its vast data assets to offer advanced AI and machine learning-driven insights.

- •

Increased focus on core markets post-Worldpay spinoff allows for more targeted investment and innovation.

Threats

- •

Competition from agile, cloud-native core banking platforms (e.g., Mambu, Thought Machine).

- •

The rise of open banking and API-driven ecosystems may encourage clients to adopt 'best-of-breed' solutions, eroding FIS's all-in-one advantage.

- •

Intensifying cybersecurity threats targeting the financial system.

- •

Disruption from decentralized finance (DeFi) and blockchain technologies in the long term.

Recommendations

Priority Improvements

- Area:

Product Strategy & Technology

Recommendation:Accelerate the transition of legacy platforms to a cloud-native, microservices-based architecture. Prioritize developing a robust, open API layer across all products to facilitate easier integration and support a 'best-of-breed' ecosystem strategy.

Expected Impact:High

- Area:

Go-to-Market & Pricing

Recommendation:Introduce more flexible, modular product offerings and explore consumption-based pricing models. This will lower the barrier to entry for smaller banks and fintechs and better compete with agile challengers.

Expected Impact:Medium

- Area:

Client Experience

Recommendation:Invest in streamlining the client onboarding and implementation process. Simplify the integration experience between different FIS modules to deliver on the promise of a seamless, end-to-end platform.

Expected Impact:Medium

Business Model Innovation

- •

Develop a dedicated Banking-as-a-Service (BaaS) platform that allows fintechs and non-financial corporations to easily embed FIS-powered banking and payment services into their own products.

- •

Create a data monetization business unit that provides anonymized, aggregated transaction insights and market intelligence as a premium service, leveraging its unique position in the financial ecosystem.

- •

Launch a curated fintech marketplace, integrating pre-vetted third-party solutions with FIS core platforms, capturing revenue through partnerships and API access fees.

Revenue Diversification

- •

Expand the suite of RegTech solutions, particularly in high-growth areas like ESG (Environmental, Social, and Governance) and climate risk modeling and reporting for financial institutions.

- •

Invest heavily in AI-powered fraud prevention and cybersecurity services, offered as a standalone or add-on service across all client segments.

- •

Build out a dedicated digital transformation consulting arm to provide strategic advisory services, moving beyond just technology implementation to become a more integral strategic partner.

Fidelity National Information Services (FIS) operates a deeply entrenched and highly defensible business model, positioning itself as the technology backbone of the global financial industry. Its primary strengths lie in its comprehensive product portfolio, immense scale, and the 'stickiness' of its client relationships, which are characterized by high switching costs. The recent strategic decision to spin off the lower-margin Worldpay merchant business is a critical and positive evolution, allowing FIS to sharpen its focus on its core, high-margin Banking and Capital Markets segments. This move enhances strategic clarity and optimizes capital allocation towards innovation in its primary markets.

The current business model, built on long-term contracts and recurring revenue, ensures stability and predictable cash flow. However, the key strategic challenge facing FIS is the pace of technological evolution. The rise of agile, cloud-native competitors and the industry-wide shift towards open, API-driven architectures represent a significant threat to its traditional, all-in-one value proposition. The future success of FIS will be contingent on its ability to transform from a provider of monolithic systems to a more open, modular, and platform-centric technology partner. Accelerating the modernization of its core platforms, embracing an API-first strategy, and innovating its pricing and delivery models are not just opportunities but strategic imperatives for sustained market leadership and long-term growth.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Regulatory Compliance

Impact:High

- Barrier:

High Client Switching Costs

Impact:High

- Barrier:

Significant Capital Investment

Impact:High

- Barrier:

Established Relationships and Trust

Impact:Medium

- Barrier:

Technology and Infrastructure Scale

Impact:Medium

Industry Trends

- Trend:

AI and Machine Learning Integration

Impact On Business:AI/ML is crucial for fraud detection, risk management, and personalizing financial services, creating a new axis of competition.

Timeline:Immediate

- Trend:

Embedded Finance and BaaS (Banking-as-a-Service)

Impact On Business:Creates new revenue streams by enabling non-financial companies to offer financial products, but also enables new competitors to emerge.

Timeline:Immediate

- Trend:

Cloud-Native Platforms

Impact On Business:Legacy providers like FIS are under pressure to modernize their tech stacks to compete with the agility, scalability, and cost-effectiveness of cloud-native fintechs.

Timeline:Near-term

- Trend:

Open Banking and APIs

Impact On Business:Shifts the market towards interconnected ecosystems, requiring FIS to provide robust and developer-friendly APIs to remain central to their clients' operations.

Timeline:Near-term

- Trend:

Increased Focus on Cybersecurity

Impact On Business:As a major infrastructure provider, maintaining state-of-the-art security is a critical brand differentiator and a significant operational cost.

Timeline:Immediate

Direct Competitors

- →

Fiserv

Market Share Estimate:Top 3 Player; often ranked slightly ahead of or behind FIS depending on the specific market segment.

Target Audience Overlap:High

Competitive Positioning:A comprehensive, global provider of financial services technology, with a particularly strong position in merchant acquiring through its Clover and Carat platforms.

Strengths

- •

Dominant position in merchant acquiring and payment processing.

- •

Broad, integrated portfolio of solutions for banks, credit unions, and merchants.

- •

Aggressive expansion into embedded finance.

- •

Strong brand recognition and large, diversified client base.

Weaknesses

- •

Potential integration challenges following the large-scale acquisition of First Data.

- •

Like FIS, faces challenges from legacy technology in its core systems.

- •

Customer support quality can be inconsistent, particularly after major acquisitions.

Differentiators

- •

Clover point-of-sale ecosystem for small and medium-sized businesses.

- •

Finxact cloud-native core banking platform, signaling a push toward modernization.

- •

Carat enterprise-level commerce platform.

- →

Jack Henry & Associates

Market Share Estimate:Third major player in the U.S. core banking market, especially strong in community banks and credit unions.

Target Audience Overlap:Medium

Competitive Positioning:A trusted technology partner for community and regional financial institutions in the U.S., positioning itself on customer service and an open, cloud-native architecture.

Strengths

- •

Strong reputation for customer service and client relationships.

- •

Focused expertise in the U.S. community banking and credit union sector.

- •

Proactive strategy around open APIs and fintech partnerships.

- •

Consistent financial performance and stability.

Weaknesses

- •

Primarily focused on the U.S. market, with limited global reach compared to FIS and Fiserv.

- •

Smaller scale and R&D budget than its larger competitors.

- •

Less presence among the largest, top-tier global banks.

Differentiators

- •

Emphasis on a more open and flexible technology ecosystem.

- •

Strong cultural alignment and focus on the specific needs of smaller financial institutions.

- •

Reputation for being a partner rather than just a vendor.

- →

Broadridge Financial Solutions

Market Share Estimate:Leading provider in specific capital markets and wealth management niches, particularly investor communications.

Target Audience Overlap:Medium

Competitive Positioning:A global fintech leader providing critical infrastructure that powers investing, corporate governance, and communications for banks, broker-dealers, and asset managers.

Strengths

- •

Dominant market position in proxy processing and investor communications.

- •

Deep expertise in capital markets post-trade processing and technology.

- •

Strong, recurring revenue model built on long-term client contracts.

- •

Consistent revenue growth and strong financial performance.

Weaknesses

- •

Narrower focus than FIS's full "money lifecycle" approach.

- •

Less visible brand in retail banking and general payment processing.

- •

Can be perceived as less agile than smaller, specialized capital markets tech firms.

Differentiators

- •

Unique, regulated role in the investor communications ecosystem.

- •

Comprehensive suite of solutions for corporate governance and shareholder engagement.

- •

End-to-end securities processing platforms.

- →

Global Payments

Market Share Estimate:A top-tier player in payment technology and merchant acquiring.

Target Audience Overlap:Medium

Competitive Positioning:A pure-play payment technology company focused on delivering a seamless commerce experience to merchants of all sizes.

Strengths

- •

Strong focus and expertise in merchant solutions and e-commerce.

- •

Extensive global footprint and partnerships.

- •

Recent strategic moves to acquire Worldpay, significantly scaling its merchant services.

- •

Diversified ecosystem of software and payment solutions.

Weaknesses

- •

Divestiture of its issuer solutions business to FIS narrows its scope, reducing its direct competition in core banking.

- •

Faces intense competition from both legacy players and modern fintechs like Stripe and Adyen.

- •

Less diversified across the full financial services spectrum compared to FIS.

Differentiators

- •

Pure-play focus on merchant acquiring and payment technology.

- •

Integrated software and payment solutions for specific industry verticals.

- •

Large-scale transaction processing capabilities.

Indirect Competitors

- →

Stripe

Description:Provides a suite of APIs for online payment processing, financial services, and business operations, increasingly targeting enterprise clients.

Threat Level:High

Potential For Direct Competition:High in the payments and embedded finance space, challenging FIS's "Money in Motion" segment.

- →

Adyen

Description:A global payment company that provides a single, integrated platform for businesses to accept payments anywhere in the world.

Threat Level:Medium

Potential For Direct Competition:High, directly competes with FIS's payment processing and merchant acquiring offerings on a global scale.

- →

Thought Machine

Description:Offers a cloud-native core banking platform, Vault Core, which allows banks to build and launch modern financial products.

Threat Level:Medium

Potential For Direct Competition:High, as it provides a direct, modern alternative to FIS's legacy core banking systems, enabling banks to bypass traditional vendors.

- →

Big Tech (Apple, Google)

Description:Their payment wallets and financial service ecosystems disintermediate traditional payment rails and capture valuable consumer transaction data.

Threat Level:Low

Potential For Direct Competition:Medium, more likely to partner with or pressure incumbent providers than to build full-stack core banking systems.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Entrenched Client Relationships & High Switching Costs

Sustainability Assessment:Core banking and processing systems are deeply integrated into a client's operations, making it incredibly costly and risky to switch providers.

Competitor Replication Difficulty:Hard

- Advantage:

Comprehensive and Integrated Product Portfolio

Sustainability Assessment:The ability to service the entire 'money lifecycle' (banking, payments, capital markets) provides a powerful cross-selling advantage and a single-vendor value proposition.

Competitor Replication Difficulty:Hard

- Advantage:

Global Scale and Distribution

Sustainability Assessment:Extensive global reach allows FIS to serve the largest multinational financial institutions and process massive transaction volumes, creating significant economies of scale.

Competitor Replication Difficulty:Hard

- Advantage:

Regulatory and Compliance Expertise

Sustainability Assessment:Deep institutional knowledge and established processes for navigating complex global financial regulations create a high barrier to entry.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'Recent Strategic Acquisitions', 'estimated_duration': '1-3 Years'}

{'advantage': "Specific 'Best-in-Class' Product Awards", 'estimated_duration': '1 Year'}

Disadvantages

- Disadvantage:

Legacy Technology Stack

Impact:Major

Addressability:Difficult

- Disadvantage:

Perception of Being Less Agile

Impact:Major

Addressability:Moderately

- Disadvantage:

Complex Product Integration

Impact:Minor

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted marketing campaigns highlighting successful client modernization projects on FIS platforms.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Create bundled offerings for regional banks that combine digital banking, payments, and fraud prevention to counter specialized fintechs.

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Accelerate the transition of key legacy platforms to a cloud-native, microservices-based architecture.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Develop a formal developer ecosystem with open APIs, sandboxes, and a marketplace to foster third-party innovation on FIS platforms.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Invest in 'as-a-service' consumption models for core capabilities, allowing clients more flexibility and lower upfront costs.

Expected Impact:Medium

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Pursue strategic acquisitions of innovative, cloud-native fintechs to acquire technology and talent in key growth areas like AI/ML and embedded finance.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Establish a venture arm to invest in early-stage fintechs, gaining insights into emerging technologies and potential future acquisition targets.

Expected Impact:Medium

Implementation Difficulty:Moderate

Position FIS as the indispensable, trusted partner for secure and scalable financial modernization. Emphasize the ability to bridge the gap between legacy stability and fintech innovation, leveraging the full power of the money lifecycle.

Differentiate based on the unparalleled breadth of the integrated portfolio, deep regulatory expertise on a global scale, and the proven ability to handle the most complex, high-volume financial operations for the world's leading institutions.

Whitespace Opportunities

- Opportunity:

Embedded Finance for B2B Vertical SaaS

Competitive Gap:While many focus on B2C embedded finance, there is a large opportunity to provide the backend infrastructure for specialized B2B software platforms (e.g., in construction, logistics, healthcare) to offer payments, lending, and treasury services.

Feasibility:High

Potential Impact:High

- Opportunity:

AI-Powered Compliance and ESG Reporting-as-a-Service

Competitive Gap:Increasingly complex regulations around ESG (Environmental, Social, Governance) and climate risk create a need for sophisticated data aggregation and reporting tools that few competitors offer as a comprehensive service.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Digital Asset and CBDC Infrastructure

Competitive Gap:As central bank digital currencies (CBDCs) and tokenized assets become more prevalent, there is a gap for trusted, institutional-grade infrastructure to manage custody, issuance, and transaction processing.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Modernization-as-a-Service for Mid-Tier Banks

Competitive Gap:Offer a modular, subscription-based service that allows mid-sized banks to progressively modernize their technology stack (e.g., add real-time payments, open banking APIs) without a full 'rip-and-replace' of their core system, competing directly with the value proposition of nimble fintechs.

Feasibility:High

Potential Impact:High

Fidelity National Information Services (FIS) operates as a cornerstone of the global financial technology industry, a mature market characterized by an oligopolistic structure with high barriers to entry. Its primary competitive strength lies in its deeply entrenched position within client operations, creating significant switching costs and long-term, recurring revenue streams. The company's comprehensive product portfolio, which spans the entire 'money lifecycle' from core banking to payments and capital markets, provides a formidable one-stop-shop advantage that is difficult for specialized competitors to replicate.

The competitive landscape is defined by a multi-front challenge. Directly, FIS competes fiercely with Fiserv, another scaled giant with a similar breadth of offerings and a particularly strong foothold in merchant acquiring. Jack Henry & Associates represents a significant threat in the U.S. community banking sector by competing effectively on customer intimacy and a more open technology philosophy. In the capital markets space, Broadridge Financial Solutions is a dominant niche player. Indirectly and perhaps more critically, FIS faces disruption from a new generation of agile, cloud-native fintechs like Stripe and Adyen in payments, and Thought Machine in core banking. These companies are unbundling the traditional financial stack, offering best-in-class, API-first solutions that threaten to erode FIS's market share piece by piece.

The core strategic challenge for FIS is to navigate the innovator's dilemma: leveraging its scale and the stability of its legacy business while aggressively modernizing its technology to compete with the agility of newer entrants. Its future success will be determined by its ability to transition its platforms to the cloud, foster a more open and connected ecosystem, and effectively integrate its vast suite of services to deliver seamless value to clients. The strategic decision to divest from Worldpay and acquire Global Payments' Issuer Solutions business indicates a clear focus on strengthening its core financial institution offerings. To maintain its leadership, FIS must continue to invest in innovation, both organically and through strategic acquisitions, positioning itself not as a legacy provider, but as the essential, secure partner for digital transformation in the global financial system.

Messaging

Message Architecture

Key Messages

- Message:

Unlocking financial technology. Bringing the world's money into harmony.

Prominence:Primary

Clarity Score:Medium

Location:Homepage Hero Section

- Message:

Our technology powers the global economy across the full money lifecycle.

Prominence:Secondary

Clarity Score:High

Location:Homepage, below hero

- Message:

Money at Rest: Securely grow and manage your deposit base.

Prominence:Tertiary

Clarity Score:High

Location:Homepage, first content block

- Message:

Money in Motion: Ensure a seamless flow of funds.

Prominence:Tertiary

Clarity Score:High

Location:Homepage, second content block

- Message:

Money at Work: Expand your strategies and operations.

Prominence:Tertiary

Clarity Score:High

Location:Homepage, third content block

The messaging hierarchy is exceptionally clear and well-structured. It starts with a broad, abstract brand promise ('harmony') and immediately funnels down to a tangible explanation ('powering the global economy'). The 'Money at Rest, in Motion, at Work' framework is a powerful organizing principle that logically segments their vast offerings into understandable categories, effectively guiding the user through their core competencies.

Messaging is highly consistent. The 'money lifecycle' concept introduced in the hero section is systematically explained and reinforced through the three core content blocks. This thematic consistency creates a cohesive and easily digestible narrative for a visitor trying to understand a complex B2B technology portfolio.

Brand Voice

Voice Attributes

- Attribute:

Authoritative

Strength:Strong

Examples

- •

Our technology powers the global economy...

- •

As leaders in core banking systems...

- •

Fintech the world relies on

- Attribute:

Corporate

Strength:Strong

Examples

- •

Synchronize all your transactional activities...

- •

An optimized financial ecosystem that aligns investment approaches...

- •

FIS Reports Strong Second Quarter 2025 Results and Raises Full-Year Outlook

- Attribute:

Technical

Strength:Moderate

Examples

- •

Flexible fund accounting configuration

- •

Modernized interfaces and workflows

- •

Automates reporting and accounting for the private equity industry

- Attribute:

Aspirational

Strength:Weak

Examples

Bringing the world's money into harmony.

Empowering our partners in navigating the money lifecycle

Tone Analysis

Formal and professional

Secondary Tones

Confident

Informative

Tone Shifts

The tone is remarkably consistent. The only slight shift is from the slightly more abstract, marketing-oriented language on the homepage ('harmony', 'unlocking') to the strictly factual, corporate tone in the Media Room and press release titles.

Voice Consistency Rating

Excellent

Consistency Issues

No significant consistency issues were identified. The brand maintains a unified and controlled voice across the analyzed sections, suitable for its target audience of large financial institutions.

Value Proposition Assessment

FIS provides a comprehensive, secure, and resilient technology backbone for the entire financial ecosystem, enabling clients to confidently run, grow, and protect their businesses across the full money lifecycle (banking, payments, and investing).

Value Proposition Components

- Component:

Comprehensive Coverage

Clarity:Clear

Uniqueness:Somewhat Unique

Explanation:The 'Money at Rest, Motion, Work' framework clearly communicates their end-to-end capabilities, a key differentiator against more specialized competitors.

- Component:

Security & Compliance

Clarity:Clear

Uniqueness:Common

Explanation:Phrases like 'compromising the security, compliance, and resilience that FIS is known for' and 'managed security, risk and compliance' are prominent. This is a table-stakes requirement in the industry, but FIS messages it as a core strength.

- Component:

Efficiency & Modernization

Clarity:Clear

Uniqueness:Common

Explanation:Benefits like 'reducing costs and eliminating inefficiencies' and '3 steps to IT modernization in banking' directly address key client pain points related to legacy systems.

- Component:

Scale & Reliability

Clarity:Somewhat Clear

Uniqueness:Somewhat Unique

Explanation:Implicitly communicated through phrases like 'powering the global economy' and 'increasing volumes without sacrificing speed.' However, it could be strengthened with more explicit data points on transaction volumes or uptime.

FIS's primary differentiation stems from the sheer breadth of its offerings, which is effectively communicated through the 'money lifecycle' concept. While competitors may offer best-in-class point solutions, FIS's messaging positions it as the strategic, integrated partner that can manage the entire financial technology stack. The language emphasizes stability and reliability over cutting-edge disruption, which can be a powerful differentiator for risk-averse financial institutions.

The messaging positions FIS as an established, reliable, and comprehensive leader, a safe choice for large-scale financial infrastructure. It competes not by being the most 'innovative' or 'agile' (words more common with smaller fintech startups), but by being the most powerful and complete. This is a classic 'systems integrator' or 'platform' positioning, targeting enterprises that prioritize stability and end-to-end management over niche features.

Audience Messaging

Target Personas

- Persona:

Banking Executives (e.g., CIO, Head of Retail Banking)

Tailored Messages

- •

Securely grow and manage your deposit base

- •

As leaders in core banking systems and digital banking solutions, we help you deliver a seamless experience...

- •

3 steps to IT modernization in banking

Effectiveness:Effective

- Persona:

Corporate Finance Leaders (e.g., CFO, Treasurer)

Tailored Messages

- •

Ensure a seamless flow of funds

- •

Synchronize all your transactional activities, payment, treasury, and financial networks...

- •

Automated Finance: A comprehensive suite of solutions designed to modernize the office of the CFO

Effectiveness:Effective

- Persona:

Investment & Asset Management Leaders

Tailored Messages

- •

Expand your strategies and operations

- •

An optimized financial ecosystem that aligns investment approaches, asset management, and regulatory compliance...

- •

Private Capital Suite: An end-to-end platform that automates reporting and accounting...

Effectiveness:Effective

Audience Pain Points Addressed

- •

Complexity of managing disparate financial systems ('Synchronize all your transactional activities')

- •

Security and compliance risks ('without compromising the security, compliance, and resilience')

- •

Inefficiencies and high costs of legacy systems ('reducing costs and eliminating inefficiencies')

- •

Need for visibility and control over financial operations ('Enhanced visibility and control')

- •

Pressure to modernize and provide better digital experiences ('transform your digital banking experience')

Audience Aspirations Addressed

- •

Achieving seamless customer experiences

- •

Confidently growing the business

- •

Making informed decisions through better data and analytics

- •

Turning bold ambitions into reality

Persuasion Elements

Emotional Appeals

- Appeal Type:

Security & Confidence

Effectiveness:High

Examples

have confidence in increasing volumes without sacrificing speed, accuracy, or security.

confidently run, grow, and protect their businesses.

- Appeal Type:

Clarity & Simplicity (Harmony)

Effectiveness:Medium

Examples

Bringing the world's money into harmony.

Let FIS bring your world into harmony with technology that delivers clarity, speed and scale.

Social Proof Elements

- Proof Type:

Awards & Recognition

Impact:Strong

Explanation:The 'Recognized by the industry' section with a link to 'Our awards' and the specific '2024 PayTech Awards' mention are powerful trust signals for B2B buyers.

- Proof Type:

Expertise & Thought Leadership

Impact:Moderate

Explanation:The 'Insights' and 'Education' sections position FIS as a knowledgeable leader. The promotion of 'The Global Innovation Report' reinforces this.

Trust Indicators

- •

Explicit mention of leadership ('Meet our leaders')

- •

Corporate social responsibility metrics (ESG stats like '35% reduction in energy use')

- •

Longevity and scale implied by 'powering the global economy' and being 'Fintech the world relies on'

- •

Press releases announcing strong financial results

Scarcity Urgency Tactics

None observed. The messaging focuses on long-term partnership and stability, making scarcity tactics inappropriate for the brand and sales cycle.

Calls To Action

Primary Ctas

- Text:

View our Marketplace

Location:Homepage, under each 'Money at...' section

Clarity:Clear

- Text:

Read article

Location:Homepage, linked to specific insights

Clarity:Clear

- Text:

Product details

Location:Homepage, for featured products

Clarity:Clear

- Text:

Contact Us

Location:Media Room footer

Clarity:Clear

The CTAs are clear, logical, and appropriate for an enterprise-level buyer's journey. They prioritize education and exploration ('Read article', 'Product details') over hard sells. The repeated 'View our Marketplace' CTA effectively channels users toward a product discovery environment. However, the homepage lacks a prominent, top-level 'Contact Sales' or 'Request a Demo' CTA, potentially lengthening the sales cycle for visitors with high purchase intent.

Messaging Gaps Analysis

Critical Gaps

- •

Lack of customer evidence: The site is devoid of client logos, case studies, or testimonials on the homepage. This is a significant gap in B2B messaging, where peer validation is crucial.

- •

Human element is missing: The messaging is entirely focused on technology and process. There are no stories about how FIS employees partner with clients or how their technology impacts real people.

- •

Quantifiable outcomes: While the messaging talks about 'efficiency' and 'growth,' it lacks specific, quantifiable proof points or client results (e.g., 'reduced processing costs by X%', 'increased deposit growth by Y%').

Contradiction Points

The tagline 'Unlocking financial technology' and mentions of 'innovation' are slightly at odds with the extremely corporate, stable, and risk-averse tone of the rest of the site. The brand feels more like a 'fortress' than a 'key,' which is not necessarily a bad thing, but there is a slight dissonance.

Underdeveloped Areas

Narrative storytelling: The 'money lifecycle' is a great framework, but it's not a story. Developing a narrative around a client's transformation journey using this framework would be much more compelling.

Developer-focused messaging: While the mission statement mentions helping clients 'run, grow, and protect their businesses', there is little direct messaging for the technical buyers or developers within those businesses who might be evaluating APIs or platform integrations.

Messaging Quality

Strengths

- •

Excellent structural clarity: The 'Money at Rest, Motion, Work' framework is a world-class example of simplifying a complex portfolio.

- •

Strong, consistent corporate voice: The messaging exudes authority, stability, and reliability, which is perfectly aligned with the target audience of large financial institutions.

- •

Effective audience segmentation: The messaging clearly speaks to the distinct needs of banking, corporate finance, and investment management professionals.

- •

Good use of trust indicators like awards and ESG data to build corporate credibility.

Weaknesses

- •

Overly abstract and impersonal: The language is heavy on jargon ('optimized financial ecosystem', 'transactional activities') and lacks human-centric language or emotion.

- •

Absence of social proof: The lack of customer logos or success stories is a major weakness that undermines the claims being made.

- •

Passive CTAs: The CTAs are focused on learning, not acting. High-intent visitors may not have a clear next step to engage with sales.

- •

Potentially undifferentiated from top competitors: Without proof points, the claims of security, efficiency, and scale sound very similar to competitors like Fiserv and Broadridge.

Optimization Roadmap

Priority Improvements

- Area:

Social Proof & Customer Evidence

Recommendation:Integrate a 'Trusted By' logo bar of prominent clients on the homepage. Create a dedicated 'Customer Stories' section and feature 1-2 compelling stories directly on the homepage, linking each to the relevant 'Money at...' category.

Expected Impact:High

- Area:

Call-to-Action Strategy

Recommendation:Add a prominent, secondary CTA in the main navigation and near the top of the homepage such as 'Talk to an Expert' or 'Request a Consultation' to capture high-intent leads.

Expected Impact:High

- Area:

Value Proposition Quantification

Recommendation:Incorporate specific, quantifiable data points into the body copy. For example, instead of just 'reducing costs,' use 'clients have reduced costs by up to 15%'.

Expected Impact:Medium

Quick Wins

- •

Add a client logo strip below the hero section.

- •

Change the primary CTA in the navigation from a generic link to a more action-oriented 'Solutions' or 'Platform' dropdown.

- •

Feature a powerful quote from a client testimonial in each of the 'Money at...' sections.

Long Term Recommendations

- •

Develop a comprehensive content strategy around customer success stories, including video testimonials and in-depth case studies.

- •

Humanize the brand by featuring employee or client-partner stories that illustrate the company's mission in action.

- •

Refine the brand narrative to better connect the concept of 'Harmony' with tangible, emotional business outcomes for their clients, moving beyond just process efficiency.

FIS has developed a masterfully structured and highly disciplined messaging architecture. The 'money lifecycle' framework ('Money at Rest, in Motion, at Work') is a brilliant strategic tool that simplifies a vast and complex product portfolio into a clear, logical narrative. This structure effectively segments their offerings for their core target audiences in banking, corporate finance, and capital markets. The brand voice is authoritative, corporate, and consistent, projecting an image of stability and reliability that resonates with their risk-averse enterprise client base. The value proposition of being a comprehensive, secure, end-to-end technology partner is clearly, if abstractly, communicated.

However, the messaging's greatest strength—its disciplined, corporate focus—is also its primary weakness. The communication is sterile and impersonal, lacking the social proof and emotional connection necessary for maximum persuasion. The complete absence of customer logos, testimonials, or quantifiable success stories on the homepage is a critical gap. In the enterprise B2B space, claims of efficiency, security, and scale are table stakes; without proof, they are just claims. Competitors make similar promises, and FIS misses a key opportunity to substantiate its leadership position.

To elevate its market positioning and improve customer acquisition economics, FIS must pivot from simply stating its value to proving it. By injecting customer evidence, quantifying outcomes, and providing clearer pathways for high-intent prospects to engage sales, FIS can translate its strong architectural messaging into a more powerful and effective business-driving communications strategy. The foundation is rock-solid, but it needs to be brought to life with the voices and successes of its customers.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Established as a leading global provider of technology solutions for merchants, banks, and capital markets firms.

- •

Comprehensive product suite covering the entire money lifecycle ('Money at Rest', 'Money in Motion', 'Money at Work').

- •

Long-standing relationships with a marquee set of clients, including major financial institutions globally.

- •

Consistent industry recognition and awards for its solutions, as highlighted on their website.

- •

Recent financial performance shows solid demand, with the capital markets segment growing 9% and the banking segment 2% in Q1 2025.

Improvement Areas

- •

Enhancing agility to compete with nimble fintech startups that are often faster to market with niche solutions.

- •

Simplifying product messaging and customer journey to help clients navigate the vast and complex portfolio of offerings.

- •

Accelerating the modernization of legacy platforms to improve integration capabilities and reduce tech debt.

Market Dynamics

The global Fintech market is projected to grow at a strong CAGR of approximately 15-16% between 2025 and 2032.

Mature but undergoing rapid transformation

Market Trends

- Trend:

AI and Machine Learning Integration

Business Impact:Massive opportunity to enhance fraud detection, offer predictive analytics, automate compliance (RegTech), and deliver hyper-personalized customer experiences.

- Trend:

Embedded Finance and BaaS (Banking-as-a-Service)

Business Impact:Creates new revenue streams by enabling non-financial companies to offer financial products, expanding FIS's addressable market.

- Trend:

Modernization of Core Banking Systems

Business Impact:High demand for cloud-based, modular, and API-driven core platforms to replace costly and rigid legacy systems, a core FIS strength.

- Trend:

Digital Payments and Real-Time Transactions

Business Impact:Continued growth in digital and mobile payments requires robust, secure, and scalable payment processing infrastructure.

- Trend:

Open Banking and APIs

Business Impact:Drives demand for platforms that can securely manage data sharing and integrate with third-party fintechs, fostering ecosystem growth.

- Trend:

Increased Focus on ESG and Sustainable Finance

Business Impact:Growing demand for technology solutions that help financial institutions with ESG reporting, analytics, and climate risk modeling.

Excellent. The ongoing digital transformation in the financial services industry creates a strong tailwind for FIS's core offerings and new growth areas. Banks are actively seeking to modernize, creating a high-demand environment.

Business Model Scalability

High

Characterized by high fixed costs in R&D, infrastructure, and compliance, but low variable costs for adding new clients to existing software platforms, leading to high gross margins at scale.

High. Once a platform is developed, each additional client adds significantly more to revenue than to costs, creating substantial operating leverage.

Scalability Constraints

- •

Complex and lengthy enterprise sales and client onboarding cycles.

- •

High cost and complexity of integrating with clients' legacy systems.

- •

Navigating diverse and stringent regulatory requirements across different geographic markets.

Team Readiness

Experienced leadership team with deep industry expertise, demonstrated by recent strategic moves like the Worldpay divestiture to refocus the company.

A large, established corporate structure that is effective for managing a global enterprise but may face challenges with agility and rapid innovation compared to smaller competitors.

Key Capability Gaps

- •

Agile, product-led growth teams to rapidly iterate and launch new, more modular solutions.

- •

Specialized talent in emerging technologies like Generative AI, blockchain/DeFi integration, and quantum computing.

- •

Experts in developer relations and ecosystem building to foster a vibrant third-party developer community around FIS platforms.

Growth Engine

Acquisition Channels

- Channel:

Enterprise Direct Sales

Effectiveness:High

Optimization Potential:Medium

Recommendation:Equip the sales team with AI-driven tools for lead scoring and cross-sell/upsell recommendations to increase efficiency and deal size.

- Channel:

Strategic Partnerships (e.g., with consulting firms, cloud providers)

Effectiveness:High

Optimization Potential:High

Recommendation:Formalize and scale the partner program. Develop co-marketing and co-selling initiatives with major cloud providers (AWS, Azure, Google Cloud) and system integrators.

- Channel:

Content Marketing & Thought Leadership (Reports, Webinars)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Double down on creating pillar content around key trends like AI in finance, BaaS, and core modernization to fuel inbound lead generation and establish market leadership.

- Channel:

Mergers & Acquisitions

Effectiveness:High

Optimization Potential:Medium

Recommendation:Continue disciplined, strategic 'tuck-in' acquisitions to acquire new technology and talent, particularly in high-growth areas.

Customer Journey

The enterprise B2B conversion path is long and relationship-driven, involving multiple touchpoints from awareness (reports, events) to consideration (sales demos, solution architects) and decision (contract negotiation).

Friction Points

- •

Navigating the complex product portfolio on the website to find the right solution.

- •

Lengthy and complex procurement and due diligence processes typical for large financial institutions.

- •

Perceived risk and complexity associated with migrating core financial systems.

Journey Enhancement Priorities

{'area': 'Website Experience', 'recommendation': 'Develop interactive solution finders and persona-based journeys on the website to guide potential clients to the most relevant products and content more efficiently.'}

{'area': 'Sales Enablement', 'recommendation': 'Create a robust library of case studies, ROI calculators, and competitive battle cards to help the sales team clearly articulate value and overcome objections.'}

Retention Mechanisms

- Mechanism:

High Switching Costs

Effectiveness:High

Improvement Opportunity:While effective, this can breed complacency. Proactively demonstrate value through regular business reviews and roadmap alignments to move from 'locked-in' to 'loyal'.

- Mechanism:

Deep Product Integration

Effectiveness:High

Improvement Opportunity:Actively identify and promote cross-sell opportunities for clients to further embed FIS solutions across their operations, increasing stickiness.

- Mechanism:

Long-Term Contracts & Support

Effectiveness:High

Improvement Opportunity:Transition from a reactive support model to a proactive customer success model that helps clients achieve their business goals using FIS technology.

Revenue Economics

Highly Favorable. Enterprise-level contracts with recurring revenue streams and long durations result in a high customer lifetime value (LTV).

Not publicly available, but estimated to be very strong (likely >10:1) given the B2B enterprise model with high retention and expansion revenue.

Strong, as evidenced by consistent recurring revenue growth and healthy adjusted EBITDA margins (around 39.8% in Q2 2025).

Optimization Recommendations

- •

Focus on 'Net Revenue Retention' by driving expansion revenue through cross-selling the broad product suite to the existing customer base.

- •

Develop tiered product offerings or 'lite' versions of platforms to capture mid-market or smaller institutional clients more efficiently.

- •

Price new AI-driven features and modules as value-added services to increase the average revenue per account (ARPA).

Scale Barriers

Technical Limitations

- Limitation:

Legacy Technology Debt

Impact:Medium

Solution Approach:Continue to invest in modernizing the tech stack by refactoring monolithic applications into microservices, adopting an API-first architecture, and accelerating cloud migration.

- Limitation:

Inter-product Integration Complexity

Impact:Medium

Solution Approach:Develop a unified data fabric and standardized APIs across the product portfolio to make cross-selling and data sharing more seamless for clients.

Operational Bottlenecks

- Bottleneck:

Complex Client Onboarding and Implementation

Growth Impact:Slows down time-to-revenue and can strain client relationships.

Resolution Strategy:Invest in implementation automation, create standardized onboarding playbooks, and develop a certification program for implementation partners to scale capacity.

- Bottleneck:

Pace of Innovation vs. Startups

Growth Impact:Can be outmaneuvered by smaller, more agile competitors in niche areas.

Resolution Strategy:Establish independent innovation labs or 'internal startups' to accelerate development in high-priority areas like GenAI and DeFi. Foster a culture of experimentation.

Market Penetration Challenges

- Challenge:

Intense Competition

Severity:Critical

Mitigation Strategy:Compete on the breadth and integration of the product suite, which smaller competitors cannot match. Differentiate through trust, security, and deep regulatory expertise. Key competitors include Fiserv, Jack Henry, Equifax, and Global Payments.

- Challenge:

Market Saturation in Developed Markets

Severity:Major

Mitigation Strategy:Focus on geographic expansion in high-growth markets like Asia-Pacific and Latin America. Target underserved segments within developed markets, such as community banks or specialized lenders, with tailored offerings.

- Challenge:

Client Risk Aversion

Severity:Major

Mitigation Strategy:Mitigate perceived risks of core system replacement by offering modular, phased migration paths. Heavily market success stories and case studies to build confidence.

Resource Limitations

Talent Gaps

- •

AI/ML Engineers and Data Scientists with deep financial services domain expertise.

- •

Cloud Architects and DevOps Engineers for accelerating the migration to cloud-native platforms.

- •

Cybersecurity experts specializing in emerging threats to the financial system.

Significant capital required for strategic M&A and sustained R&D investment. The company has a clear capital allocation strategy, including share repurchases and deleveraging after major acquisitions.

Infrastructure Needs

Continued investment in scalable, secure, multi-cloud infrastructure to support BaaS and other cloud-native offerings.

Development of advanced data analytics platforms to harness insights from the vast transactional data FIS processes.

Growth Opportunities

Market Expansion

- Expansion Vector:

Geographic Expansion into APAC

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Pursue a strategy of strategic partnerships with regional banks and acquisitions of local fintech players to navigate regulatory landscapes and establish a market foothold. The APAC region is anticipated to be the fastest-growing fintech market.

- Expansion Vector:

Mid-Market Financial Institutions

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Develop a pre-configured, 'fintech-in-a-box' solution that offers core banking and digital services tailored for community banks and credit unions, leveraging a more scalable, less customized delivery model.

Product Opportunities

- Opportunity:

AI-as-a-Service for Finance

Market Demand Evidence:Financial institutions are actively seeking AI solutions to improve efficiency, manage risk, and personalize services. AI is predicted to generate up to $1 trillion in additional annual value for the banking industry.

Strategic Fit:High

Development Recommendation:Develop and commercialize a suite of AI-powered modules (e.g., fraud detection, credit scoring, compliance monitoring) that can be integrated with existing FIS core platforms or sold as standalone services.

- Opportunity:

Embedded Finance / BaaS Platform

Market Demand Evidence:The embedded finance market is projected to expand at a CAGR of over 23%, enabling non-financial businesses to integrate financial services.

Strategic Fit:High

Development Recommendation:Launch a comprehensive, API-driven BaaS platform that allows third parties (e.g., retailers, tech companies) to leverage FIS's infrastructure to offer services like payments, lending, and accounts.

- Opportunity:

ESG & Climate Risk Analytics Suite

Market Demand Evidence:Increasing regulatory pressure and investor demand for ESG considerations are forcing financial firms to seek robust data and analytics solutions.

Strategic Fit:High

Development Recommendation:Expand the existing capabilities mentioned on the website into a full-fledged suite for ESG data aggregation, regulatory reporting, and climate risk financial modeling for CFOs and investment managers.

Channel Diversification

- Channel:

Self-Service Digital Channel

Fit Assessment:Good for specific, less complex products.

Implementation Strategy:Create a developer portal and a self-service marketplace where clients can discover, trial, and subscribe to specific APIs and product modules with minimal sales intervention.

- Channel:

Consulting & Advisory Services

Fit Assessment:Excellent

Implementation Strategy:Build a dedicated professional services arm that provides strategic advice on digital transformation, leveraging FIS's deep industry expertise. This creates a new revenue stream and drives adoption of FIS technology.

Strategic Partnerships

- Partnership Type:

Fintech Ecosystem Integration

Potential Partners

Innovative startups in RegTech, WealthTech, and InsurTech

Expected Benefits:Enrich the FIS platform with cutting-edge capabilities without needing to build everything in-house. Create a 'one-stop-shop' for financial institutions by curating and integrating best-of-breed fintech solutions.

- Partnership Type:

Big Tech & Cloud Providers

Potential Partners

- •

Google Cloud

- •

Amazon Web Services (AWS)

- •

Microsoft Azure

Expected Benefits:Deepen technical integrations to offer optimized, cloud-native solutions. Co-develop AI/ML solutions leveraging their advanced capabilities. Jointly go to market to reach a broader client base.

Growth Strategy

North Star Metric

Total Services Consumed per Client

This metric shifts the focus from simply acquiring new logos to deepening relationships and increasing the integration of FIS products. It directly measures success in cross-selling and platform adoption, which are key drivers of LTV and retention.

Increase by 15% annually over the next 3 years.

Growth Model

Hybrid: Enterprise Sales-Led + Ecosystem

Key Drivers

- •

Deep, consultative relationships built by the enterprise sales team.

- •

Expansion revenue from cross-selling and up-selling to the existing client base.

- •

A vibrant ecosystem of technology and implementation partners that extend the platform's value.

- •

Strong inbound lead flow generated by authoritative thought leadership content.

Strengthen the core enterprise sales function while simultaneously investing in building a dedicated partner ecosystem team and a world-class content marketing engine.

Prioritized Initiatives

- Initiative:

Launch 'FIS AI Advantage' Suite

Expected Impact:High

Implementation Effort:High

Timeframe:12-18 months

First Steps:Form a dedicated AI product team. Identify 3 pilot clients to co-develop the initial fraud detection and credit risk modules.

- Initiative:

Develop a Scaled Go-to-Market for Mid-Market Banks

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:9-12 months

First Steps:Package a core set of banking and digital solutions into a standardized offering. Build a dedicated inside sales and digital marketing team to target this segment.

- Initiative:

Formalize the FIS Partner Ecosystem Program

Expected Impact:High

Implementation Effort:Medium

Timeframe:6-9 months

First Steps:Hire a Head of Partnerships. Define partnership tiers and benefits. Launch a developer portal with open APIs for key products.

Experimentation Plan

High Leverage Tests

- Experiment:

Value-Based Pricing Models

Hypothesis:Testing pricing models based on client outcomes (e.g., % of fraud reduction) instead of flat fees will increase adoption of new AI products.

- Experiment:

Digital Onboarding Journey

Hypothesis:Creating a limited self-service trial for a specific API product can decrease the sales cycle for developer-led customers.

- Experiment:

Partnership Incentives

Hypothesis:A/B testing different co-selling incentives for consulting partners will identify the most effective model for driving partner-sourced revenue.

Utilize an A/B testing framework for digital experiments. For larger strategic initiatives, use a balanced scorecard measuring leading indicators (e.g., pipeline generated, partner sign-ups) and lagging indicators (e.g., revenue, net retention).

Run monthly sprints for digital/product experiments. Conduct quarterly reviews for larger strategic growth initiatives.

Growth Team

A centralized 'Corporate Strategy & Growth' team that works in a matrixed fashion with the GMs of the major business units (Banking, Capital Markets). This team should be responsible for market analysis, new growth initiatives, and M&A.

Key Roles

- •

VP of Growth Strategy

- •

Director of Strategic Partnerships & Alliances

- •

Product Innovation Manager (focused on emerging tech)

- •

Market Expansion Lead (focused on new geographies/segments)

Build internal capabilities through a combination of hiring external talent with experience in product-led growth and startup environments, and upskilling current employees through dedicated training programs on agile methodologies and emerging financial technologies.

Fidelity National Information Services (FIS) is a deeply entrenched leader in the fintech industry with a strong growth foundation, characterized by robust product-market fit, a scalable business model, and a comprehensive product portfolio. The company is well-positioned to capitalize on powerful market tailwinds, including the universal drive among financial institutions to modernize legacy systems, the integration of AI, and the rise of embedded finance. After strategically divesting a majority stake in its Worldpay merchant business, FIS has sharpened its focus on its core, high-margin Banking and Capital Markets segments, a move poised to unlock significant shareholder value.