eScore

ford.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Ford.com demonstrates a sophisticated digital presence, effectively aligning its vast product portfolio with user search intent, from broad category searches ('electric SUV') to specific model queries ('Ford Mustang'). The site's deep integration with a national dealer network provides excellent local and global reach, seamlessly connecting online research to offline sales. Its content authority is exceptionally high, built on decades of brand recognition for iconic models like the F-150 and Mustang, which naturally attracts high-quality backlinks and dominates branded search.

The seamless integration of a strong national brand presence with localized dealer inventory and offers is a key competitive advantage, effectively bridging the online-to-offline customer journey.

Develop a dedicated thought leadership content hub around 'The Future of Mobility' to capture broader, top-of-funnel search intent and solidify its position as an innovator beyond just manufacturing vehicles.

Ford's messaging is highly effective at a product level, masterfully tailoring its voice to distinct audience segments—'Built Ford Tough' for truck buyers and 'unlimited thrills' for Mustang enthusiasts. The brand uses powerful social proof, like J.D. Power awards, to drive its quality message and clearly communicates its value proposition around ownership convenience with services like mobile repair. However, it lacks a single, powerful, overarching brand narrative that cohesively links its rugged heritage with its innovative, electric future.

Product-level messaging is powerful and evocative, with a clear and distinct voice for each key product line (e.g., F-150, Mustang, Bronco) that resonates strongly with its target audience.

Craft a unifying brand theme for the homepage that synthesizes Ford's core value proposition, connecting the themes of toughness, freedom, and innovation under a single, memorable brand story.

The website provides a clear and logical conversion funnel for high-intent users, with prominent 'Build & Price' and 'Search Inventory' CTAs. The user journey is well-structured to guide different personas (truck vs. SUV buyers) to relevant sections, reducing cognitive load. However, the analysis identifies significant friction in the handoff between the online experience and the physical dealership, and long, scrolling product pages can create fatigue without sticky navigation elements.

The primary conversion funnel ('Build & Price' -> 'Search Inventory' -> 'Find a Dealer') is clear, prominent, and logically structured to capture leads effectively.

Implement a sticky sub-navigation on long-scroll product detail pages to improve usability, reduce scroll fatigue, and allow users to quickly find specific information, enhancing engagement and conversion.

Ford demonstrates a mature and sophisticated approach to credibility and risk management. The website prominently features third-party validation from J.D. Power, employs a robust legal and privacy framework with granular cookie consent, and is highly transparent about accessibility standards. Its detailed disclaimers for financing offers and advanced driver-assistance systems (ADAS) show a clear effort to mitigate regulatory risk in a highly scrutinized industry.

The comprehensive, multi-layered privacy policy, particularly for connected vehicles, and the use of a leading consent management platform (OneTrust) provide exceptional transparency and build significant user trust.

Proactively strengthen the disclaimers and educational content around 'hands-free' driving technology like BlueCruise to mitigate the risk of consumer overestimation of the system's capabilities.

Ford's competitive advantage is anchored by incredibly strong, sustainable moats, including the brand equity of the F-Series truck line, which has dominated sales for decades, and a massive physical dealer and service network. The creation of Ford Pro, an integrated ecosystem for commercial customers, represents a new and powerful moat. However, the company is perceived as lagging behind tech-native competitors like Tesla in software and is struggling with the high costs of its legacy infrastructure.

The brand equity of the F-Series, America's best-selling truck for decades, provides immense pricing power and a loyal customer base that is exceptionally difficult for competitors to replicate.

Invest in improving the user interface (UI) and responsiveness of the in-car SYNC infotainment system to better compete with the seamless software experience offered by tech-first competitors.

Ford's scalability is a tale of two businesses: the highly profitable and efficient Ford Pro and Ford Blue divisions are funding the currently unprofitable Model e division. The business model is extremely capital-intensive, with high fixed costs that limit agility and rapid scaling. While the Ford Pro ecosystem shows immense potential for high-margin, scalable software revenue, the overall business is constrained by the financial drag of the EV transition and long product development cycles.

The Ford Pro commercial division is a highly scalable and profitable growth engine, bundling vehicles with high-margin, recurring-revenue software and services that create a sticky customer ecosystem.

Aggressively pursue cost reductions in second-generation EV platforms and battery manufacturing to achieve per-unit profitability in the Model e division, which is the single largest barrier to overall scalable growth.

Ford's strategic decision to split the company into three distinct units (Ford Blue, Model e, Ford Pro) demonstrates a coherent and focused approach to navigating the automotive industry's massive transformation. This structure allows for clear resource allocation, with the profitable ICE and commercial businesses funding the EV transition. The Ford Pro business, in particular, represents a highly coherent and synergistic model, bundling hardware, software, and financing into a single customer solution.

The creation of Ford Pro as an integrated, end-to-end solution for commercial customers is a strategic masterstroke, creating a highly coherent and profitable business unit with multiple, reinforcing revenue streams.

Address the strategic tension between the dealer network's traditional sales model and the consumer expectation of a more direct, seamless online purchasing experience, as seen with EV competitors.

Ford maintains significant market power, holding a top-three market share position in the U.S. and demonstrating pricing power with its iconic, high-demand models like the F-150 and Bronco. The Ford Pro division gives it immense leverage with commercial fleet customers, a segment where it is a clear leader. While facing intense competition and margin pressure in the EV space, its overall influence, manufacturing scale, and established supply chain give it a formidable position in the market.

Ford's decades-long dominance in the highly profitable U.S. full-size truck and commercial van markets gives it substantial pricing power and a resilient market position.

Diversify its profitability base to reduce over-reliance on the North American truck and SUV market, particularly by developing more affordable and profitable EV platforms for global markets.

Business Overview

Business Classification

Automotive Manufacturer & Mobility Provider

Technology & Software Services

Automotive

Sub Verticals

- •

Internal Combustion Engine (ICE) Vehicles

- •

Electric Vehicles (EV)

- •

Commercial Vehicles & Fleet Management

- •

Automotive Financing

- •

Connected Vehicle Services

Mature

Maturity Indicators

- •

Over 100-year operating history.

- •

Established global brand recognition and market presence.

- •

Extensive manufacturing footprint and dealership network.

- •

Actively undergoing a strategic transformation (Ford+) to adapt to industry shifts like electrification and connectivity.

- •

Significant legacy costs (pensions, ICE infrastructure) alongside heavy investment in future technologies.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Vehicle Sales (Ford Blue & Ford Model e)

Description:Direct sales of internal combustion engine (ICE), hybrid, and all-electric (EV) vehicles to consumers and fleet customers through a global dealership network. This remains the core revenue generator, encompassing iconic nameplates like the F-Series, Mustang, Explorer, and the growing EV lineup like the Mustang Mach-E and F-150 Lightning.

Estimated Importance:Primary

Customer Segment:Individual Consumers & Commercial Fleets

Estimated Margin:Low-to-Medium

- Stream Name:

Commercial Solutions (Ford Pro)

Description:An integrated business unit offering commercial vehicles, software, charging solutions, financing, and services as a comprehensive package for business and government customers. This is a high-growth, high-margin area for the company, aiming to increase uptime and reduce total cost of ownership for fleets. It is expected to generate $45 billion in revenue by 2025.

Estimated Importance:Primary

Customer Segment:Commercial & Government Fleets

Estimated Margin:High

- Stream Name:

Automotive Financing (Ford Motor Credit)

Description:Provides financing and leasing options for both consumers and dealerships, generating interest income and supporting vehicle sales. It also offers commercial financing for vehicles and charging infrastructure through Ford Pro FinSimple.

Estimated Importance:Secondary

Customer Segment:Individual Consumers & Dealerships

Estimated Margin:Medium

- Stream Name:

Parts, Service & Accessories

Description:Sales of original equipment (OE) parts, maintenance/repair services through dealerships, and vehicle accessories. This provides a consistent, high-margin revenue stream throughout the vehicle lifecycle.

Estimated Importance:Secondary

Customer Segment:Existing Vehicle Owners

Estimated Margin:High

- Stream Name:

Software & Connected Services Subscriptions

Description:Recurring revenue from subscriptions to services like the BlueCruise hands-free driving system, telematics for fleet management, and other in-vehicle connectivity features. This is a key emerging stream central to the Ford+ transformation strategy.

Estimated Importance:Tertiary

Customer Segment:Individual Consumers & Commercial Fleets

Estimated Margin:High

Recurring Revenue Components

- •

Ford Pro software subscriptions (e.g., Telematics)

- •

BlueCruise hands-free driving subscriptions

- •

FordPass connectivity plans

- •

Vehicle financing and leasing interest payments

Pricing Strategy

Tiered & Optional Feature Pricing

Mid-range

Semi-transparent

Pricing Psychology

- •

Tiered pricing with clear feature differentiation between trims (e.g., Mustang EcoBoost vs. GT vs. Dark Horse)

- •

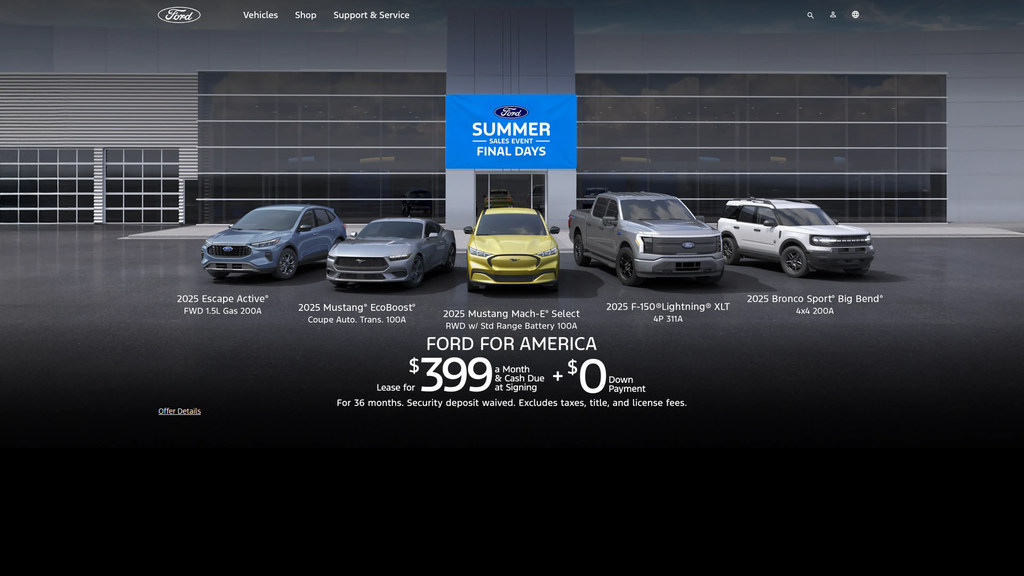

Financing and lease offers to reduce perceived upfront cost (e.g., '$399/mo lease')

- •

Time-limited offers and incentives to create urgency ('Ending Soon')

- •

Bundling of features into packages (e.g., Performance Package, Nite Pony Package)

Monetization Assessment

Strengths

- •

Highly profitable commercial division (Ford Pro) with integrated services providing a competitive moat.

- •

Strong financing arm (Ford Credit) that supports and stabilizes vehicle sales.

- •

Diversified portfolio across trucks, SUVs, and performance cars catering to various price points.

- •

Emerging high-margin, recurring revenue from software subscriptions like BlueCruise.

Weaknesses

- •

EV division (Model e) is currently unprofitable, facing significant losses due to high investment and price competition.

- •

Heavy reliance on the highly profitable but mature North American truck market.

- •

Legacy cost structure from ICE operations can pressure overall margins.

Opportunities

- •

Scale the Ford Pro model globally to capture more of the commercial market.

- •

Grow the subscriber base for high-margin services like BlueCruise and commercial telematics.

- •

Develop more affordable EV platforms to drive mass-market adoption and achieve profitability in the Model e division.

- •

Leverage data from connected vehicles for new services and efficiency improvements.

Threats

- •

Intense price competition in the EV market, particularly from Tesla and Chinese automakers, compressing margins.

- •

Slower-than-expected consumer adoption of EVs could delay return on investment.

- •

Potential changes in government regulations and EV tax credits.

- •

Rising raw material costs impacting manufacturing profitability.

Market Positioning

Broad Market Differentiator

Major Player

Target Segments

- Segment Name:

The Traditionalist / Brand Loyalist

Description:Values American heritage, durability, and proven performance. Often a repeat buyer, particularly for trucks like the F-150 or iconic cars like the Mustang. They see their vehicle as a tool for work or a symbol of freedom and are loyal to the 'Built Ford Tough' ethos.

Demographic Factors

- •

Male, 35-65+

- •

Middle-to-upper-middle income

- •

Often located in suburban or rural areas.

Psychographic Factors

- •

Values tradition and reliability

- •

Brand-loyal

- •

Practical and pragmatic

- •

Seeks powerful and capable vehicles.

Behavioral Factors

- •

High repeat purchase rate

- •

Less price-sensitive for trusted models

- •

Values dealership relationships for service.

Pain Points

- •

Concerns about the reliability of new, unproven technology

- •

Fear of losing the power and capability of ICE vehicles

- •

High maintenance and fuel costs

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

The Modern Family

Description:Seeks safe, spacious, and versatile vehicles for daily commuting, family activities, and road trips. They prioritize comfort, technology, and value for money. SUVs like the Explorer and Expedition are central to this segment.

Demographic Factors

- •

Adults aged 30-55

- •

Households with children

- •

Middle-income

- •

Suburban dwellers.

Psychographic Factors

- •

Safety-conscious

- •

Values practicality and convenience

- •

Seeks comfort and in-car entertainment/connectivity features.

Behavioral Factors

- •

Researches safety ratings and reviews

- •

Influenced by family needs and lifestyle

- •

Considers total cost of ownership.

Pain Points

- •

Needing a vehicle that can adapt to various needs (commuting, hauling kids, cargo)

- •

Balancing budget with the desire for modern safety and tech features

- •

Vehicle reliability and longevity are critical.

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

The Commercial Workhorse

Description:Comprises small businesses, large fleet operators, and government agencies that rely on vehicles for their operations. They prioritize uptime, total cost of ownership, durability, and efficiency. This is the core target for the Ford Pro business unit.

Demographic Factors

- •

Business owners

- •

Fleet managers

- •

Tradespeople (plumbers, electricians, contractors)

Psychographic Factors

- •

Highly pragmatic and ROI-focused

- •

Values efficiency and productivity

- •

Risk-averse regarding vehicle downtime.

Behavioral Factors

- •

Bulk purchasing

- •

Focus on long-term service and support

- •

Increasingly considers telematics and fleet management software.

Pain Points

- •

Vehicle downtime leading to lost revenue

- •

Managing fuel, maintenance, and repair costs across a fleet

- •

Complexity of transitioning to electric vehicles (charging, routing)

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

The Tech-Forward EV Adopter

Description:Early adopters and mainstream buyers interested in electric vehicles for their technology, performance, and environmental benefits. They are attracted to models like the Mustang Mach-E and F-150 Lightning and value features like over-the-air updates and advanced driver-assistance systems.

Demographic Factors

- •

Aged 25-50

- •

Higher-than-average income

- •

Often live in urban or suburban areas with charging access.

Psychographic Factors

- •

Environmentally conscious

- •

Values innovation and cutting-edge technology

- •

Open to new brands and experiences.

Behavioral Factors

- •

Conducts extensive online research

- •

Influenced by tech reviews and charging infrastructure availability

- •

Values a seamless digital experience (in-car and app).

Pain Points

- •

Range anxiety

- •

Public charging reliability and availability

- •

Higher upfront cost of EVs compared to ICE counterparts.

Fit Assessment:Good

Segment Potential:High

Market Differentiation

- Factor:

Dominance in Key Segments (Trucks & Commercial)

Strength:Strong

Sustainability:Sustainable

- Factor:

Brand Heritage and Iconic Nameplates (Mustang, F-150, Bronco)

Strength:Strong

Sustainability:Sustainable

- Factor:

Integrated Commercial Ecosystem (Ford Pro)

Strength:Strong

Sustainability:Sustainable

- Factor:

Extensive Dealer and Service Network

Strength:Moderate

Sustainability:Sustainable

- Factor:

Electric Vehicle Portfolio

Strength:Moderate

Sustainability:Temporary

Value Proposition

Ford provides a diverse range of tough, capable, and innovative vehicles, from iconic trucks and performance cars to family-friendly SUVs and a growing lineup of electric vehicles, all supported by a comprehensive ecosystem of services designed to empower freedom and productivity for both individuals and businesses.

Good

Key Benefits

- Benefit:

Capability and Durability ('Built Ford Tough')

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

F-Series' decades-long status as America's best-selling truck

- •

Extensive durability testing and engineering claims

- •

Strong brand reputation in the commercial vehicle space

- Benefit:

Choice of Powertrains (ICE, Hybrid, EV)

Importance:Important

Differentiation:Common

Proof Elements

Availability of gas, hybrid, and electric versions of key models like the F-150

Broad product lineup covering all three powertrain types

- Benefit:

Advanced Technology and Connectivity

Importance:Important

Differentiation:Somewhat unique

Proof Elements

- •

BlueCruise hands-free driving technology

- •

SYNC infotainment system with large touchscreens

- •

FordPass app for remote vehicle control and owner services

- Benefit:

Comprehensive Owner and Business Support

Importance:Important

Differentiation:Unique

Proof Elements

- •

Ford Pro's integrated suite of vehicles, software, and services

- •

Ford Mobile Service and Pickup & Delivery options

- •

Extensive dealership network for sales and service

Unique Selling Points

- Usp:

Ford Pro: A one-stop shop for commercial customers, integrating vehicles, software, charging, and financing to maximize fleet productivity.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Iconic, segment-defining products like the F-150 and Mustang that command immense brand loyalty and cultural significance.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Leadership in the commercial vehicle market, providing deep customer understanding and a scaled advantage.

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Need for a reliable, powerful, and versatile vehicle for work and daily life.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Complexity and high total cost of managing a commercial fleet of vehicles.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Desire to transition to electric vehicles without sacrificing capability or access to a reliable service network.

Severity:Major

Solution Effectiveness:Partial

- Problem:

Reducing the stress and fatigue of highway driving.

Severity:Major

Solution Effectiveness:Partial

Value Alignment Assessment

High

Ford's product portfolio, especially its dominance in the highly profitable truck and SUV segments, is well-aligned with current North American market demand. The strategic push into commercial services with Ford Pro directly addresses a critical and underserved market need.

High

The company effectively serves its core audiences of truck loyalists, families, and commercial operators. Its brand messaging of toughness, freedom, and heritage resonates strongly. The expansion into EVs and technology is beginning to attract new, more tech-focused demographics, though alignment with this group is still developing.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Global Dealership Network

- •

Automotive Parts Suppliers (e.g., Bosch, Magna)

- •

Battery Suppliers (e.g., SK On, LG Energy Solution)

- •

Technology Partners (e.g., Google for in-car infotainment, Stripe for payments).

- •

Manufacturing & Sustainability Partners (e.g., Manufacture 2030).

Key Activities

- •

Research & Development (Vehicle design, EV platforms, autonomous tech)

- •

Manufacturing & Assembly

- •

Supply Chain Management

- •

Marketing & Sales

- •

Financial Services (Ford Credit)

- •

Software Development (Ford Pro, BlueCruise)

Key Resources

- •

Global Manufacturing Plants & Infrastructure

- •

Strong Brand Equity & Iconic Nameplates

- •

Intellectual Property (Patents, Engineering expertise)

- •

Extensive Dealer & Service Network

- •

Access to Capital & Financing (Ford Credit)

Cost Structure

- •

Raw Materials & Parts Procurement

- •

Manufacturing & Labor Costs

- •

Research & Development Expenses (especially for EVs and software)

- •

Marketing & Advertising

- •

Warranty & Recall Costs

- •

Legacy Pension & Healthcare Obligations

Swot Analysis

Strengths

- •

Dominant market position and brand loyalty in highly profitable truck and commercial vehicle segments.

- •

Strong and extensive global dealership and service network.

- •

Highly profitable and integrated Ford Pro business unit offers a significant competitive advantage.

- •

Iconic brands (F-150, Mustang, Bronco) with deep cultural resonance and pricing power.

Weaknesses

- •

Significant financial losses in the EV (Model e) division, pressuring overall profitability.

- •

Over-reliance on the North American market, particularly for trucks and SUVs.

- •

Vulnerability to product recalls and quality control issues, which can damage reputation and incur high costs.

- •

Higher legacy costs compared to EV-native competitors.

Opportunities

- •

Growth in the global EV market and development of more affordable electric vehicle platforms.

- •

Expansion of high-margin, recurring revenue from software and connected services (e.g., BlueCruise, Ford Pro Intelligence).

- •

Leveraging the Ford Pro model to capture a larger share of the global commercial market, including EV charging and fleet management.

- •

Strategic partnerships in technology and battery manufacturing to accelerate innovation and reduce costs.

Threats

- •

Intense competition from both legacy automakers and EV-focused companies like Tesla and new Chinese entrants.

- •

Global supply chain disruptions and volatility in raw material prices.

- •

Potential shifts in government policy regarding emissions standards and EV incentives.

- •

Changing consumer preferences and a potential slowdown in demand for large, less fuel-efficient vehicles.

Recommendations

Priority Improvements

- Area:

EV Profitability (Model e)

Recommendation:Aggressively pursue cost reductions in battery sourcing and manufacturing for the second generation of EVs. Focus the product roadmap on high-volume, profitable segments and consider strategic partnerships to share development costs.

Expected Impact:High

- Area:

Software & User Experience

Recommendation:Continue to invest in the seamless integration of software across the vehicle, the FordPass app, and services like BlueCruise. Focus on reliability and user-centric design to compete with tech-first rivals and justify subscription fees.

Expected Impact:High

- Area:

Product Quality & Reliability

Recommendation:Implement more rigorous quality control measures throughout the supply chain and manufacturing process to reduce recalls, lower warranty costs, and rebuild consumer trust, which has been a persistent weakness.

Expected Impact:Medium

Business Model Innovation

- •

Expand 'vehicle-as-a-service' offerings, potentially bundling insurance, maintenance, charging, and software subscriptions into a single monthly payment for retail customers, mirroring the Ford Pro model.

- •

Develop a platform strategy for EV components, potentially selling battery packs or 'skateboard' platforms to other, smaller-volume manufacturers to generate new revenue and achieve greater economies of scale.

- •

Leverage the dealership network as multi-purpose mobility hubs, offering EV charging, mobile service dispatch, and short-term rentals or vehicle subscription services.

Revenue Diversification

- •

Accelerate the rollout of new paid, over-the-air software updates and features, creating an ongoing revenue stream post-vehicle sale.

- •

Expand Ford Pro's software and telematics services to be compatible with non-Ford vehicles, positioning it as a comprehensive fleet management solution for mixed fleets.

- •

Explore energy services by leveraging connected EVs and bidirectional charging capabilities, enabling customers to participate in vehicle-to-grid (V2G) programs and creating a new service revenue opportunity.

Ford Motor Company is a mature automotive giant at a pivotal moment of strategic transformation. Its current business model is a hybrid, balancing the immense profitability of its legacy internal combustion engine (ICE) business, particularly trucks and commercial vehicles ('Ford Blue' and 'Ford Pro'), against the significant, yet currently unprofitable, investments in its electric vehicle future ('Ford Model e').

The company's core strength and primary profit engine is its undisputed dominance in the North American truck and commercial vehicle markets. The creation of Ford Pro as a distinct, integrated business unit is a strategic masterstroke, creating a defensible moat by bundling vehicles with high-margin software, charging, and services. This provides a stable, growing revenue base that can fund the costly transition to electrification.

However, the primary strategic challenge lies in navigating the EV transition profitably. The Model e division faces intense price competition, high battery costs, and slower-than-anticipated mainstream adoption, resulting in substantial financial losses. The business model evolution must focus on developing next-generation, lower-cost EV platforms to make this segment financially viable. The future scalability and competitive advantage of Ford will be determined not just by selling electric cars, but by building a profitable ecosystem around them.

The website effectively communicates this dual strategy. It showcases the legendary ICE products like the Mustang and F-150 while prominently featuring the growing EV lineup and advanced technologies like BlueCruise. The emphasis on owner benefits and services like mobile repair and the FordPass app signals a clear shift from a transactional manufacturing model to a relationship-based service model.

To succeed, Ford must leverage its legacy strengths—brand loyalty, manufacturing scale, and its dealer network—while accelerating its transformation into a more agile technology and software company. The key to future revenue optimization and sustainable advantage lies in successfully scaling the Ford Pro model, achieving profitability in the Model e division, and growing the base of high-margin, recurring software subscriptions across its entire customer base.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

High Capital Investment

Impact:High

- Barrier:

Manufacturing & Supply Chain Complexity

Impact:High

- Barrier:

Brand Loyalty & Reputation

Impact:High

- Barrier:

Regulatory & Safety Compliance

Impact:High

- Barrier:

Established Dealership & Service Networks

Impact:Medium

Industry Trends

- Trend:

Vehicle Electrification (EVs)

Impact On Business:Fundamental shift in powertrain technology, requiring massive R&D and manufacturing retooling. Puts Ford in direct competition with EV-native companies.

Timeline:Immediate

- Trend:

Advanced Driver-Assistance Systems (ADAS) & Autonomous Driving

Impact On Business:Creates a new axis of competition based on software and technology (e.g., BlueCruise). Requires significant investment in AI and sensor technology.

Timeline:Immediate

- Trend:

Vehicle Connectivity & Software-Defined Vehicles

Impact On Business:Vehicles are becoming connected platforms, creating opportunities for subscription services, over-the-air (OTA) updates, and data monetization. Increases the importance of the in-car user experience.

Timeline:Immediate

- Trend:

Shift in Ownership Models (Subscriptions, Mobility-as-a-Service)

Impact On Business:Potential long-term threat to the traditional individual ownership model, particularly in urban areas. Requires exploring new business models beyond manufacturing and sales.

Timeline:Near-term

Direct Competitors

- →

General Motors (Chevrolet & GMC)

Market Share Estimate:17% (Leading US Market Share)

Target Audience Overlap:High

Competitive Positioning:A diverse portfolio of brands targeting a wide range of consumers, with significant strength in trucks (Silverado, Sierra) and a growing EV lineup (Ultium platform).

Strengths

- •

Dominant market share in the US.

- •

Strong brand portfolio with distinct identities (Chevrolet for mainstream, GMC for premium trucks/SUVs).

- •

Robust and profitable truck and SUV franchises.

- •

Well-regarded ADAS technology in Super Cruise.

- •

Extensive dealership and service network.

Weaknesses

- •

Slower to the EV market than some competitors, leading to a game of catch-up.

- •

High cost structure and legacy pension liabilities.

- •

Brand image has been impacted by past recalls and quality issues.

- •

Over-dependence on the North American market for profitability.

Differentiators

- •

GMC brand offers a 'premium mainstream' alternative to Ford's core offerings.

- •

Aggressive investment in the Ultium battery platform as a foundation for a wide range of future EVs.

- •

Super Cruise is often seen as a strong competitor to BlueCruise and Autopilot.

- →

Toyota Motor Corporation

Market Share Estimate:15% (Second in US Market Share)

Target Audience Overlap:High

Competitive Positioning:Leader in reliability, quality, and manufacturing efficiency, with a dominant position in the hybrid vehicle market.

Strengths

- •

World-class brand reputation for quality, durability, and reliability.

- •

Mastery of lean manufacturing (Toyota Production System) leading to high efficiency and profitability.

- •

Dominant leadership in hybrid vehicle technology (e.g., Prius, RAV4 Hybrid).

- •

Strong global presence and a resilient supply chain.

- •

High customer satisfaction and loyalty.

Weaknesses

- •

Slower to commit to fully battery-electric vehicles (BEVs) compared to competitors, potentially ceding ground in the fastest-growing segment.

- •

Seen as lagging in in-car technology and infotainment user experience.

- •

Struggles to compete in the full-size truck segment against Ford and GM.

- •

Autonomous driving technology development is perceived to be behind US rivals.

Differentiators

- •

Unmatched leadership and consumer trust in hybrid powertrains.

- •

Focus on long-term value and low cost of ownership as a core marketing message.

- •

A more conservative, deliberate approach to new technology adoption.

- →

Stellantis (Ram & Jeep)

Market Share Estimate:8%

Target Audience Overlap:High

Competitive Positioning:A house of powerful, distinct brands with leadership in highly profitable niches like off-road SUVs (Jeep) and full-size trucks (Ram).

Strengths

- •

Extremely strong and iconic brands in Jeep and Ram with dedicated, loyal customer bases.

- •

Highly profitable product mix focused on SUVs and trucks.

- •

Jeep is a globally recognized leader in the off-road and adventure lifestyle segment.

- •

Ram trucks are consistently praised for interior quality, comfort, and ride, creating a key differentiator.

- •

Strong market presence in North America and Europe.

Weaknesses

- •

Trailing behind competitors in electrification and advanced technology development.

- •

Struggling with declining sales and market share.

- •

Customer satisfaction scores are among the lowest in the industry, particularly for Ram and Chrysler.

- •

Portfolio is less diversified, with notable weaknesses in sedans and a delayed entry into the mainstream EV market.

Differentiators

- •

Unparalleled brand equity of Jeep in the off-road space.

- •

Ram's focus on a 'luxury truck' experience with premium interiors.

- •

A multi-brand strategy that allows for highly targeted product development and marketing.

Indirect Competitors

- →

Tesla

Description:An EV-native manufacturer that has disrupted the automotive industry with its direct-to-consumer sales model, advanced technology, and strong brand.

Threat Level:High

Potential For Direct Competition:Is already a direct competitor in the EV space and is increasingly competing for traditional luxury and performance buyers.

- →

Rivian

Description:An EV startup focused on the premium adventure vehicle segment with its electric pickup truck (R1T) and SUV (R1S).

Threat Level:Medium

Potential For Direct Competition:Directly competes with the F-150 Lightning and Bronco. Threat level is medium due to lower production volume but high in terms of brand perception in the lucrative 'adventure' segment.

- →

Uber/Lyft

Description:Ride-sharing services that offer an alternative to personal car ownership, particularly for urban and younger demographics.

Threat Level:Low

Potential For Direct Competition:Unlikely to become a direct competitor but represents a long-term systemic threat to the volume of personal vehicle sales by promoting mobility-as-a-service.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Brand Equity in Core Segments (F-Series, Mustang, Bronco)

Sustainability Assessment:The F-Series has been the best-selling truck for decades, and Mustang is an iconic brand. This deep-rooted loyalty is difficult for competitors to erode.

Competitor Replication Difficulty:Hard

- Advantage:

Massive Dealer and Service Network

Sustainability Assessment:Provides a physical presence for sales, test drives, and service that EV-native, direct-to-consumer brands cannot easily match, which is a key advantage for many mainstream buyers.

Competitor Replication Difficulty:Hard

- Advantage:

Manufacturing Scale and Expertise

Sustainability Assessment:Decades of experience in mass-producing complex vehicles provides significant efficiencies and supply chain advantages over newer entrants.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'Current J.D. Power Quality Awards', 'estimated_duration': '1-2 years. These awards are annual and can be a powerful marketing tool, but competitor models may win in subsequent years.'}

{'advantage': 'Specific Financing Offers and Incentives', 'estimated_duration': '1-3 months. These are short-term tactical promotions that are easily matched by competitors.'}

Disadvantages

- Disadvantage:

Lagging Customer Satisfaction

Impact:Major

Addressability:Difficult

- Disadvantage:

Legacy Infrastructure Costs

Impact:Major

Addressability:Difficult

- Disadvantage:

Perception of Technological Lag vs. Tesla

Impact:Major

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Prominently feature Ford's extensive service network and options like Mobile Service on EV product pages to counter 'range anxiety' with 'service accessibility'.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Launch targeted digital campaigns directly comparing BlueCruise's safety and reliability ratings against Tesla's Autopilot, leveraging favorable third-party reviews.

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Streamline the digital sales funnel by creating a more seamless integration between the online 'Build & Price' tool and real-time dealer inventory to reduce customer friction.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Invest in improving the user interface (UI) and responsiveness of the SYNC infotainment system to better compete with the in-car tech experience of competitors like Tesla and Hyundai/Kia.

Expected Impact:High

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Develop a comprehensive strategy for the entire vehicle lifecycle, including certified pre-owned (CPO) programs for EVs and battery recycling/second-life initiatives to build a sustainable ecosystem.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Expand the portfolio of affordable, smaller EVs and Hybrids to capture market share from competitors like Toyota and Hyundai and to hedge against over-reliance on large trucks and SUVs.

Expected Impact:High

Implementation Difficulty:Difficult

Position Ford as the pragmatic and trustworthy choice for the electric transition, blending innovation with a century of manufacturing excellence. Emphasize the tangible benefits of the established dealer network, proven reliability in core segments (trucks), and a more hands-on, safety-focused approach to autonomous technology.

Differentiate by electrifying iconic, trusted nameplates (F-150, Mustang, Bronco) to appeal to the mainstream market, rather than creating new, unfamiliar EV sub-brands. Focus on creating a complete ownership ecosystem (FordPass, service, charging network partnerships) that simplifies the transition to EV for traditional buyers.

Whitespace Opportunities

- Opportunity:

Develop a 'Ford Adventure' subscription service bundling access to off-road capable vehicles (Bronco, Ranger) with curated outdoor experiences and partnerships.

Competitive Gap:While some luxury brands offer subscriptions, no mass-market automaker has capitalized on the lucrative 'adventure lifestyle' trend with a comprehensive vehicle and experience package, directly challenging Jeep's brand dominance.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Create a transparent, simplified online tool for battery health and replacement costs for used Ford EVs.

Competitive Gap:A major concern for used EV buyers is battery degradation and replacement cost. Providing a clear, trustworthy platform would build confidence in Ford's EV residual values, a weakness for many competitors.

Feasibility:High

Potential Impact:Medium

- Opportunity:

Launch a dedicated 'Ford Pro' digital ecosystem for small-to-medium business owners, integrating vehicle telematics, service scheduling, and financing tools specifically for commercial vehicles.

Competitive Gap:Competitors often lump commercial sales with retail. A dedicated, software-first platform for business owners would solidify Ford's existing dominance in the commercial vehicle market and create a sticky ecosystem.

Feasibility:High

Potential Impact:High

The competitive landscape for Ford Motor Company is in a state of profound transformation. The automotive industry, traditionally a mature oligopoly, is being reshaped by the seismic shifts towards electrification and software-defined vehicles. This places Ford in a complex position, fighting a war on two fronts.

On one front, Ford continues to battle its legacy rivals—General Motors, Toyota, and Stellantis—for dominance in the highly profitable truck and SUV segments. Ford's strength here is undeniable, with the F-Series and Mustang representing iconic brands with deep customer loyalty. However, this traditional battlefield is no longer the sole determinant of success. Competitors like Toyota leverage a stellar reputation for reliability, while GM pushes its broad portfolio and advanced ADAS with Super Cruise. Stellantis, despite lagging in technology and overall customer satisfaction, possesses formidable brand power in Jeep and Ram that commands specific, profitable market niches.

On the second front, Ford faces a new breed of competitor, headlined by Tesla. This battle is not just about product, but about business models, technology perception, and brand image. Tesla's direct-to-consumer model and leadership in EV technology have fundamentally altered consumer expectations. Ford's challenge is to pivot its massive industrial and dealership infrastructure—a traditional strength—to compete with the agility and tech-first narrative of these new entrants. Ford's strategy of electrifying its icons (F-150 Lightning, Mustang Mach-E) is a savvy move to bridge this gap, leveraging existing brand equity to ease mainstream consumers into the EV transition.

Key industry trends such as connectivity and autonomous driving are now critical competitive differentiators. Ford's BlueCruise is a credible contender but must fight for mindshare against the more established names of Tesla's Autopilot and GM's Super Cruise. The digital experience, from the in-car infotainment system (SYNC) to the online buying journey on ford.com, is now as important as horsepower and torque. The website analysis shows a strong focus on driving customers through the traditional sales funnel—Build & Price, Find a Dealer, Pre-Qualify—which serves its current model well but also highlights the gap compared to the seamless, dealer-less transaction offered by disruptors.

Ford's sustainable advantages are its powerful brands in core segments and its vast physical dealer network. However, its disadvantages, including lower customer satisfaction scores compared to top rivals and the perception of being a step behind pure-play EV companies in technology, are significant hurdles.

Opportunities for Ford lie in leveraging its strengths to demystify and de-risk the transition to EVs for the average American consumer. By creating a seamless ecosystem that combines online tools with the tangible support of its dealer network and focusing on its commercial vehicle dominance, Ford can carve out a unique and defensible position. The primary threat is not just losing market share to any single competitor, but failing to adapt quickly enough to a future where the car is a connected software platform, and the brand experience is defined as much by its digital interface as its driving dynamics.

Messaging

Message Architecture

Key Messages

- Message:

America's Most Awarded Brand for New Vehicle Quality - J.D. Power, 2025

Prominence:Primary

Clarity Score:High

Location:Homepage Banner

- Message:

Find Your Ford (by vehicle category: Trucks & Vans, Electric & Hybrid, SUVs & Cars)

Prominence:Primary

Clarity Score:High

Location:Homepage - Main Content Section

- Message:

Technology: Create Your Perfect Drive (BlueCruise™, WI-FI®, Co-Pilot360®)

Prominence:Secondary

Clarity Score:Medium

Location:Homepage - Mid-page Content Block

- Message:

The Ford Owner Experience (Mobile Service, Pickup & Delivery, FordPass® Rewards)

Prominence:Secondary

Clarity Score:High

Location:Homepage - Lower Content Block

- Message:

Specific vehicle taglines (e.g., F-150 Lobo: 'Swaggers Hard. Hustles Harder.'; Expedition: 'All New, For All New Memories')

Prominence:Tertiary

Clarity Score:High

Location:Homepage - Vehicle Spotlight Sections

- Message:

Unmatched New Vehicle Quality (Mustang page)

Prominence:Secondary

Clarity Score:High

Location:Vehicle Detail Page (Mustang)

- Message:

Don't Miss up to $7,500 Federal Tax Credit

Prominence:Secondary

Clarity Score:High

Location:Homepage - F-150 Lightning Section

The message hierarchy is product-centric and logical, guiding users immediately toward vehicle categories. The primary message leverages a strong, third-party validation (J.D. Power), immediately establishing credibility. Secondary messages effectively bucket key consideration factors like Technology and Ownership. However, a unifying brand-level message that ties all these products together is less prominent, making the homepage feel more like a digital showroom than a cohesive brand statement.

Messaging is highly consistent within product verticals. The language used for trucks consistently emphasizes toughness and capability, while the Mustang page is all about performance, heritage, and thrills. The 'Technology' and 'Owner Experience' messages are consistently framed as benefits across the site. There is no notable contradiction in messaging across the provided content.

Brand Voice

Voice Attributes

- Attribute:

Confident & Assertive

Strength:Strong

Examples

- •

Swaggers Hard. Hustles Harder.

- •

Owns the streets, with no apologies.

- •

Mustang® Is America’s Best-Selling Sports Car*

- •

All ranked #1 among their segments

- Attribute:

Aspirational & Evocative

Strength:Strong

Examples

- •

Picture Yourself in One

- •

All New, For All New Memories

- •

Chasing the Checkered Flag

- •

Ignite Your Senses and Stir Your Soul

- Attribute:

Pragmatic & Informative

Strength:Moderate

Examples

- •

Get a Quote. Get Keys. Get Going.

- •

Know your budget. Zero credit impact.

- •

Our technicians can perform a lot of the same services remotely that we do in the dealership.

- •

Detailed specifications lists on the Mustang page.

- Attribute:

Rooted in American Heritage

Strength:Strong

Examples

- •

A true American icon celebrates 61 years in style

- •

America's Most Awarded Brand for New Vehicle Quality

- •

This American muscle car is still going strong

Tone Analysis

Aspirational Confidence

Secondary Tones

- •

Inspirational

- •

Authoritative

- •

Action-Oriented

Tone Shifts

The tone shifts from broadly aspirational on the homepage to highly technical and feature-focused on the vehicle specs pages (e.g., Mustang specs).

The 'Buying a Ford' section adopts a very direct, transactional tone compared to the more evocative, lifestyle-oriented messaging in vehicle spotlights.

Voice Consistency Rating

Good

Consistency Issues

While generally consistent, the primary voice is so product-dominant that a singular, overarching Ford brand voice gets slightly diluted. The voice of 'F-150' or 'Mustang' is clearer than the voice of 'Ford' as a whole.

Value Proposition Assessment

Ford offers a diverse range of award-winning, American-made vehicles that combine proven toughness and performance heritage with modern technology and convenience, empowering every individual's freedom to move and pursue their dreams.

Value Proposition Components

- Component:

Quality & Reliability

Clarity:Clear

Uniqueness:Somewhat Unique

Evidence:Heavy promotion of J.D. Power awards as the top message on the homepage.

- Component:

Broad Choice & Versatility

Clarity:Clear

Uniqueness:Common

Evidence:Clear segmentation into Trucks, SUVs, and Electric/Hybrid vehicles catering to different needs.

- Component:

Performance & Capability

Clarity:Clear

Uniqueness:Unique

Evidence:Iconic models like F-150 ('Hustles Harder') and Mustang ('Made to thrill') are positioned as leaders in their respective performance categories.

- Component:

Technological Innovation

Clarity:Somewhat Clear

Uniqueness:Somewhat Unique

Evidence:Dedicated 'Technology' section highlighting BlueCruise™, Ford Co-Pilot360®, but the messaging is feature-based rather than benefit-led.

- Component:

Owner Convenience

Clarity:Clear

Uniqueness:Unique

Evidence:Prominent 'Ford Owner Experience' section detailing Mobile Service and Pickup & Delivery, a strong post-purchase value proposition.

Ford differentiates itself by skillfully blending its heritage of toughness and American identity with a forward-looking portfolio that includes EVs and advanced technology. While competitors also offer trucks or EVs, Ford's key differentiator is the credibility of its iconic nameplates (F-150, Mustang) now being electrified. The emphasis on the 'Ford Owner Experience' with services like mobile repair and vehicle pickup is a significant and tangible differentiator against competitors who focus more on the point-of-sale.

The messaging positions Ford as an established, reliable, and quintessentially American leader that is actively innovating. It implicitly contrasts this with legacy competitors by highlighting quality awards and with newer EV-only players (like Tesla) by showcasing its manufacturing scale, service network, and a broader range of vehicle types. The 'Built Ford Tough' ethos is a long-standing competitive moat for its truck segment.

Audience Messaging

Target Personas

- Persona:

The 'Doer' (Truck/Van Buyer)

Tailored Messages

- •

Swaggers Hard. Hustles Harder.

- •

Ford F-150® for Full Size Trucks... ranked #1... for New-Vehicle Quality

- •

Super Duty® for Heavy Duty Trucks

Effectiveness:Effective

- Persona:

The Modern Family (SUV Buyer)

Tailored Messages

- •

All New, For All New Memories

- •

The 2025 Expedition is ready for your next family adventure

- •

Escape® for Small SUVs... ranked #1

Effectiveness:Effective

- Persona:

The Enthusiast (Performance/Mustang Buyer)

Tailored Messages

- •

Made to thrill. Priced to sell.

- •

Mustang® Is America’s Best-Selling Sports Car

- •

Grin-Generating V8 Engines

- •

Unbelievable Power, Unlimited Thrills

Effectiveness:Highly Effective

- Persona:

The Tech-Forward/EV Adopter

Tailored Messages

- •

Don't Miss up to $7,500 Federal Tax Credit

- •

Explore F-150 Lightning®

- •

The spirit of Mustang® — electrified.

- •

Experience the magic of hands-free highway driving on 97% of controlled access highways

Effectiveness:Somewhat Effective

Audience Pain Points Addressed

- •

Vehicle Quality Concerns: Addressed by prominently featuring J.D. Power awards.

- •

Financial Uncertainty: Addressed by 'Pre-Qualify' CTA with 'Zero credit impact' and clear lease/finance offers.

- •

Vehicle Maintenance Hassles: Addressed directly by 'Ford Mobile Service' and 'Ford Pickup & Delivery'.

- •

Technology Complexity: Addressed by segmenting technology into understandable categories like 'WI-FI®, Apps, and Maps' and 'Ford Co-Pilot360® Technology'.

Audience Aspirations Addressed

- •

Freedom and Adventure: 'Home is wherever you roam' (Ranger), 'Run with the Herd' (Mustang Community).

- •

Status and Confidence: 'Owns the streets, with no apologies' (F-150 Lobo), 'A true American icon'.

- •

Family Connection: 'All New, For All New Memories' (Expedition).

- •

Exhilaration and Thrill-Seeking: 'Chasing the Checkered Flag', 'Adrenaline-Boosting Drift Brake' (Mustang).

Persuasion Elements

Emotional Appeals

- Appeal Type:

Pride & Patriotism

Effectiveness:High

Examples

- •

America's Most Awarded Brand

- •

A true American icon

- •

Mustang® Is America’s Best-Selling Sports Car

- Appeal Type:

Freedom & Adventure

Effectiveness:High

Examples

- •

Let your Mustang Mach-E® SUV run free

- •

The Ford Ranger® truck is ready for adventure

- •

Turn every drive into a truly freeing, open-air experience.

- Appeal Type:

Power & Dominance

Effectiveness:High

Examples

- •

Swaggers Hard. Hustles Harder.

- •

Hear the roar of the powerful 5.0L Ti-VCT V8 engine.

- •

Unbelievable Power, Unlimited Thrills

- Appeal Type:

Nostalgia & Heritage

Effectiveness:Medium

Examples

A Mustang 60 Years in the Making

A true American icon celebrates 61 years in style

Social Proof Elements

- Proof Type:

Expert Validation (Awards)

Impact:Strong

Evidence:Heavy and repeated emphasis on J.D. Power awards, positioned at the top of the homepage and on relevant product pages.

- Proof Type:

Popularity (Best-Seller Claims)

Impact:Strong

Evidence:Stating 'Mustang® Is America’s Best-Selling Sports Car' leverages the wisdom of the crowds to build confidence.

Trust Indicators

- •

J.D. Power awards for quality

- •

Mention of specific safety technologies like 'Ford Co-Pilot360®' and 'Pre-Collision Assist with Automatic Emergency Braking'

- •

Complimentary 2-Year Maintenance Plan

- •

Clear offer details and disclaimers

Scarcity Urgency Tactics

- •

Limited-time offers: 'ends 9/30/2025' for the F-150 Lightning tax credit.

- •

Urgency language: 'Ending Soon' tag on Mustang lease offers.

- •

Exclusivity: 'limited-edition Mustang 60th Anniversary Package'

Calls To Action

Primary Ctas

- Text:

Build & Price

Location:Buying A Ford section, Vehicle Detail pages

Clarity:Clear

- Text:

Search Inventory

Location:Buying A Ford section, Vehicle Detail pages

Clarity:Clear

- Text:

View Offers

Location:Homepage Banner

Clarity:Clear

- Text:

Learn More

Location:Homepage - Vehicle Category sections

Clarity:Somewhat Clear

- Text:

Find a Dealer

Location:Buying A Ford section

Clarity:Clear

The calls-to-action are generally effective, direct, and well-placed. The 'Buying A Ford' section provides a clear, logical funnel for users ready to take the next step: customize ('Build & Price'), find ('Search Inventory'), or visit ('Find a Dealer'). Lower-funnel CTAs are very strong. Mid-funnel CTAs like 'Learn More' could be more specific and benefit-oriented (e.g., 'Explore Truck Models', 'Discover EV Benefits') to better set user expectations.

Messaging Gaps Analysis

Critical Gaps

A unifying brand narrative is missing. The site effectively sells individual products but lacks a strong, cohesive story about what Ford stands for as a whole in 2025, beyond its mission statement. How do trucks, EVs, and muscle cars all connect to one central Ford idea?

The sustainability message, a key corporate objective, is not prominently featured on the homepage. While 'Electric & Hybrid' is a category, the 'why' behind this shift (environmental responsibility, future-proofing) is not communicated.

Contradiction Points

There are no direct contradictions, but there is a tonal tension between the rugged, traditional, V8-powered 'American muscle' messaging and the clean, quiet, tech-focused future of electric vehicles. The messaging doesn't yet bridge this gap to tell a single story of 'Ford's future power'.

Underdeveloped Areas

Technology as a core benefit. The 'Technology' section lists features (BlueCruise™, Co-Pilot360®) but could be developed to tell a more compelling story about how this tech makes life easier, safer, or more enjoyable, connecting back to the brand promise of freedom.

Community and lifestyle. While the Mustang page hints at community ('Find Your Mustang® Family'), this powerful brand asset could be more broadly integrated to showcase the lifestyle and community that comes with being a Ford owner, beyond just the vehicle itself.

Messaging Quality

Strengths

- •

Product-level messaging is powerful, evocative, and tailored to specific personas (e.g., the language for F-150 vs. Mustang is distinct and effective).

- •

Excellent use of social proof (J.D. Power awards) to build immediate credibility and trust.

- •

The value proposition for post-purchase ownership (Mobile Service, Pickup & Delivery) is clearly and compellingly communicated.

- •

Conversion-focused design with clear, action-oriented CTAs for users further down the purchase funnel.

Weaknesses

- •

Over-reliance on product silos dilutes the overall brand message. The homepage feels more like a catalogue of separate brands than a unified Ford experience.

- •

The messaging struggles to connect Ford's rich heritage with its electric future, creating a slight disconnect between its past identity and future direction.

- •

The communication of advanced technology is feature-heavy and could be more focused on human-centric benefits.

Opportunities

- •

Craft a unifying brand theme for the homepage that encapsulates Ford's unique position: bridging legendary strength with smart, electric innovation.

- •

Elevate the 'Owner Experience' messaging, positioning it as a primary reason to choose Ford, not just a post-purchase benefit.

- •

Develop narrative content that showcases real customer stories, linking the use of Ford vehicles back to the company's mission of enabling people to 'pursue their dreams'.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Message Hierarchy

Recommendation:Introduce a new primary brand messaging block below the main banner that synthesizes Ford's core value proposition, connecting the themes of toughness, freedom, and innovation under a single, memorable tagline.

Expected Impact:High

- Area:

Technology Messaging

Recommendation:Reframe the 'Technology' section around core customer benefits. For example, instead of 'BlueCruise™', lead with 'Arrive More Relaxed: Your Hands-Free Highway Co-pilot.' Focus on the outcome, not just the feature.

Expected Impact:Medium

- Area:

EV Value Proposition

Recommendation:Create a dedicated messaging block that clearly articulates the 'Why' behind Ford's EV push, linking it to sustainability, lower ownership costs, and superior performance. Address common pain points like charging anxiety directly.

Expected Impact:High

Quick Wins

- •

Update generic 'Learn More' CTAs to be more specific (e.g., 'Explore All SUVs', 'Compare Trucks').

- •

Incorporate the 'Owner Experience' benefits (e.g., 'Service That Comes to You') as a small, trust-building icon or sub-point near the primary 'Buying a Ford' CTAs.

- •

Add a 'Best-Selling' or 'Award-Winning' badge directly onto the vehicle category images on the homepage to reinforce social proof.

Long Term Recommendations

- •

Develop a comprehensive content strategy centered around customer storytelling, creating videos and articles that show how Ford vehicles are integral to people's lives and adventures, reinforcing the brand mission.

- •

Integrate the 'Community' aspect more deeply across the site, moving beyond just a link on the Mustang page to showcase owner groups and events as a key part of the Ford value proposition.

- •

Create a more seamless narrative bridge between ICE and EV products, focusing on shared brand DNA like performance, capability, and innovation, rather than treating them as entirely separate categories.

Ford's strategic messaging is highly effective at the product level, leveraging the immense brand equity of names like F-150 and Mustang to communicate targeted value propositions with confidence and clarity. The brand masterfully uses social proof, such as J.D. Power awards, to establish a foundation of quality and trust. Its communication of the 'Ford Owner Experience' is a key differentiator, addressing post-purchase pain points head-on. However, the overall architecture is a collection of strong product messages rather than a single, unified brand narrative. The homepage functions as a digital forecourt, expertly directing traffic to different vehicle categories but missing a critical opportunity to tell a cohesive story about what Ford, as a master brand, represents in the modern automotive landscape. The messaging has not yet fully reconciled the brand's rugged, powerful heritage with its clean, technological future, creating a gap where a powerful, unifying story could exist. The primary strategic opportunity is to elevate the brand-level narrative, creating a messaging framework that demonstrates how Ford's legacy of toughness and freedom is the very foundation for its innovation in electrification and technology, thus positioning the company not as one transitioning between two worlds, but as one defining the future of American mobility.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

The Ford F-Series has been the best-selling truck in the U.S. for over 40 consecutive years, indicating deeply entrenched market leadership in a highly profitable segment.

- •

Iconic brands like Mustang and Bronco possess strong brand equity and appeal to specific, loyal customer demographics.

- •

Early leadership in the electric truck (F-150 Lightning) and commercial van (E-Transit) segments has established Ford as a credible EV manufacturer beyond just sedans.

- •

Strong growth in both EV and hybrid sales demonstrates an ability to meet shifting consumer demand for electrified options.

Improvement Areas

- •

Expand the portfolio of affordable EVs to compete with an influx of lower-cost models, particularly from Chinese manufacturers.

- •

Enhance the software and connected vehicle experience (infotainment, over-the-air updates, app integration) to match and exceed standards set by tech-first competitors like Tesla.

- •

Address the significant financial losses in the EV division to ensure long-term, profitable product-market fit for electric models.

Market Dynamics

Low single digits (approx. 3-4% globally), with high double-digit growth in the EV sub-segment.

Mature

Market Trends

- Trend:

Electrification Shift

Business Impact:Massive capital investment required for R&D and factory retooling. Creates opportunities for new revenue streams (charging, battery services) but also intense margin pressure and competition.

- Trend:

Software-Defined Vehicles (SDVs)

Business Impact:Shifts the basis of competition from hardware to software, enabling recurring revenue through subscriptions (e.g., BlueCruise). Requires a fundamental transformation in talent and R&D focus from mechanical to software engineering.

- Trend:

Connected Services & Data Monetization

Business Impact:Creates new, high-margin revenue opportunities, particularly in the commercial 'Ford Pro' segment, by offering telematics, fleet management, and uptime optimization services.

- Trend:

Autonomous Driving Technology

Business Impact:Requires significant, long-term R&D investment with an uncertain timeline for mass-market profitability. Level 2+ features are becoming mainstream and are a key competitive differentiator.

- Trend:

Supply Chain Volatility

Business Impact:Ongoing risk of disruption (e.g., chips, battery materials) necessitates more resilient and localized supply chain strategies, impacting cost structures and production capacity.

Critical. The automotive industry is at an inflection point. Companies that fail to effectively navigate the transition to EVs and software-defined vehicles in the next 3-5 years risk significant market share loss and long-term irrelevance.

Business Model Scalability

Low

Extremely high fixed costs associated with manufacturing plants, R&D facilities, and global supply chain infrastructure. This creates significant operating leverage but makes the business model capital-intensive and slow to scale or pivot.

High. Small changes in production volume can have a large impact on profitability due to the high fixed cost base. However, this also means downturns can quickly lead to large losses.

Scalability Constraints

- •

Massive capital expenditure required to build or retool factories for new models, especially EVs.

- •

Complex, global supply chains are vulnerable to bottlenecks and geopolitical risks.

- •

Long product development cycles (typically 3-5 years) hinder rapid adaptation to market shifts.

- •

Dependence on a physical dealership network for sales and service adds complexity compared to a direct-to-consumer model.

Team Readiness

Experienced leadership team navigating a massive corporate transformation. The creation of distinct business units (Ford Blue for ICE, Ford Model e for EV, Ford Pro for Commercial) shows a strategic approach to managing the transition.

The strategic split into Ford Blue, Model e, and Pro is a bold and necessary move to allow each unit to focus on its unique challenges and opportunities. However, ensuring seamless collaboration and avoiding internal silos is a critical ongoing challenge.

Key Capability Gaps

- •

Software Engineering & AI/ML Talent: Competing with tech giants for top-tier software talent is a major hurdle for a traditional manufacturer.

- •

Battery Chemistry and Engineering: Deep in-house expertise is critical for cost reduction and performance improvement in EVs.

- •

Direct-to-Consumer (DTC) Experience Management: Building capabilities in e-commerce, digital customer service, and managing a hybrid sales model with dealers.

Growth Engine

Acquisition Channels

- Channel:

Dealer Network

Effectiveness:High

Optimization Potential:Medium

Recommendation:Transform dealers from simple points of sale to experience centers, focusing on test drives, service, and managing the complexities of EV ownership (charging, incentives). Integrate digital and physical retail for a seamless customer journey.

- Channel:

Digital Marketing (Ford.com)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Enhance the 'Build & Price' and inventory search tools to provide a fully transactable online experience. Use data analytics to personalize offers and content, driving higher quality leads to dealers or online checkout.

- Channel:

Brand & Content Marketing

Effectiveness:High

Optimization Potential:Medium

Recommendation:Leverage iconic brands (Mustang, Bronco, F-150) to create compelling content that builds community and drives desire, especially for new EV variants. Emphasize Ford Performance and racing heritage to build credibility for performance EVs.

- Channel:

Ford Pro (B2B Sales)

Effectiveness:High

Optimization Potential:High

Recommendation:Double down on the integrated, one-stop-shop approach for commercial customers, bundling vehicles with high-margin software, financing, charging, and service solutions. This is a key growth and profitability engine.

Customer Journey

The primary online path is Awareness (viewing models) -> Consideration (Build & Price, compare specs) -> Intent (Search Inventory, Get a Quote) -> Handoff to a physical dealer for test drive and purchase.

Friction Points

- •

The handoff between the online experience and the physical dealership can be disjointed, leading to inconsistent pricing and customer service.

- •

Complex financing and lease offers presented on the site can be confusing for customers to evaluate without dealer assistance.

- •

Availability and accuracy of real-time dealer inventory on the website can be a point of frustration.

Journey Enhancement Priorities

{'area': 'Online-to-Offline Integration', 'recommendation': "Implement a system where a customer's online configuration and pre-qualification data are seamlessly transferred to the dealership, creating a single, unified customer profile."}

{'area': 'EV Education', 'recommendation': 'Develop more robust educational tools on the website to simplify concepts like range, charging times, battery degradation, and total cost of ownership for first-time EV buyers.'}

Retention Mechanisms

- Mechanism:

FordPass App & Rewards

Effectiveness:Medium

Improvement Opportunity:Integrate more high-value services into the app, such as proactive maintenance alerts, charging station payment, and subscription feature management, to increase daily active usage and brand loyalty.

- Mechanism:

Ford Mobile Service / Pickup & Delivery

Effectiveness:Medium

Improvement Opportunity:Expand the availability and scope of these convenience-focused services, as they are a strong differentiator and can significantly improve the ownership experience, justifying a potential price premium.

- Mechanism:

Ford Pro Service & Software Subscriptions

Effectiveness:High

Improvement Opportunity:Continue to expand the suite of software services for commercial fleets, as this creates a sticky, high-margin, recurring revenue stream that locks in customers for future vehicle purchases.

Revenue Economics

Challenged. While the traditional ICE business (Ford Blue) and Commercial (Ford Pro) are profitable, the EV division (Model e) is experiencing significant per-unit losses. Overall profitability hinges on the high margins from trucks and SUVs.

Unclear from public data, but a key strategic goal. LTV in automotive is driven by repeat purchases (brand loyalty), financing, and high-margin post-sale service and parts. High CAC is a given due to massive marketing spends and dealer margins.

Medium. Record revenues have been posted, but margins are under pressure due to the costly EV transition and competitive landscape. The Ford Pro segment, with its high-margin software and services, is a standout for efficiency.

Optimization Recommendations

- •

Aggressively pursue cost reductions in EV battery and manufacturing processes to achieve per-unit profitability.

- •

Scale the Ford Pro software and services business, as it represents the highest-margin and most efficient revenue stream.

- •

Increase the penetration rate of Ford Credit financing and extended service plans at the point of sale to capture more of the customer's total lifetime value.

Scale Barriers

Technical Limitations

- Limitation:

EV Battery Production & Cost

Impact:High

Solution Approach:Continue investing in battery R&D (e.g., LFP batteries) and joint ventures for battery manufacturing (e.g., BlueOval SK) to secure supply and drive down costs. Develop a new, more affordable EV platform.

- Limitation:

Software Development & Integration

Impact:High

Solution Approach:Overhaul the in-house software development capabilities to create a unified, competitive OS for vehicles. Pursue strategic partnerships with tech companies for non-core software components while retaining control over the critical vehicle OS and user experience.

Operational Bottlenecks

- Bottleneck:

Legacy Manufacturing Transformation

Growth Impact:Slows down the rollout of new EV models and introduces significant execution risk and cost in retooling massive, complex factories.

Resolution Strategy:Adopt more flexible manufacturing platforms that can accommodate both ICE and EV variants initially, while building new, dedicated EV-only plants for next-generation vehicles to maximize efficiency.

- Bottleneck:

Dealer Network EV Readiness

Growth Impact:Inconsistent sales and service experience for EV customers can damage the brand and slow adoption. Dealers may require significant investment in charging infrastructure and technician training.

Resolution Strategy:Implement a tiered certification program for dealers with significant co-investment and support for training and infrastructure. Align dealer incentives with EV sales and customer satisfaction metrics.

Market Penetration Challenges

- Challenge:

Intense EV Competition

Severity:Critical

Mitigation Strategy:Differentiate by focusing on segments where Ford has a dominant brand and product advantage (trucks, vans, performance vehicles). Leverage the established dealer and service network as a key advantage over newer, service-constrained competitors like Tesla.

- Challenge:

Consumer EV Hesitancy (Range Anxiety, Charging, Cost)

Severity:Major

Mitigation Strategy:Invest in consumer education on total cost of ownership. Partner aggressively to expand access to reliable public charging networks. Offer a portfolio of solutions, including hybrids and PHEVs, as a bridge for consumers not yet ready for full BEVs.

- Challenge:

Brand Perception Shift

Severity:Minor

Mitigation Strategy:Continue to market EV products under strong, established sub-brands (Mustang, F-150) to transfer brand equity. Heavily promote technology like BlueCruise to position Ford as an innovator.

Resource Limitations

Talent Gaps

- •

Senior Software Architects and Developers

- •

Battery Engineers and Chemists

- •

Data Scientists specializing in telematics and user behavior

Extremely high. The announced investment of over $50 billion through 2026 for electrification highlights the massive capital needed for R&D, new factories, and battery production.

Infrastructure Needs

- •

Scaling up EV charging infrastructure at dealerships and partner locations.

- •

Building out a robust cloud infrastructure to support millions of connected vehicles.

- •

Establishing a resilient battery supply chain, including raw material sourcing and recycling facilities.

Growth Opportunities

Market Expansion

- Expansion Vector:

Ford Pro Commercial Services in Europe

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Leverage Ford's existing strong market share in European commercial vans to aggressively roll out the full suite of Ford Pro software, charging, and service solutions, creating a new high-margin revenue stream.

- Expansion Vector:

Entry-Level EV and Hybrid Segments

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Develop and launch a new, dedicated small EV platform to offer more affordable electric options, particularly in Europe and Asia, to capture first-time EV buyers and compete with lower-cost brands.

Product Opportunities

- Opportunity:

Expansion of Software-as-a-Service (SaaS) Offerings