eScore

garmin.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Garmin exhibits a world-class digital presence, demonstrating high authority and excellent search intent alignment for its specialized, high-intent customer segments. The website is masterfully structured to channel diverse personas (aviators, mariners, athletes) into relevant product ecosystems, showcasing a sophisticated understanding of its market. Its global reach is evident through localized sites, and its strong brand reputation drives significant organic traffic and high-quality backlinks.

Exceptional market segmentation on Garmin.com, which perfectly aligns with niche, high-intent search queries and guides users to specialized product lines with minimal friction.

Expand top-of-funnel content with more educational guides and data-driven reports (e.g., 'The Global State of Marathon Training') to capture users at the awareness stage and further solidify thought leadership.

Garmin's brand communication is highly effective at a micro-level, with perfectly tailored messaging for its distinct audience segments. The brand voice is authoritative, technical, and aspirational, resonating powerfully with its core base of 'serious users'. However, this strength in vertical messaging creates a horizontal weakness; the website lacks a unifying, top-level brand narrative that clearly articulates the value of the entire Garmin ecosystem.

Masterful audience segmentation messaging, using precise, technical, and aspirational language that speaks directly to the unique pain points and values of each target persona.

Develop and prominently feature a unifying brand message on the homepage that communicates the core promise (e.g., reliability, innovation) connecting its diverse product categories into a single, cohesive ecosystem.

The website provides a technically excellent and low-friction conversion path with a clear information architecture, intuitive navigation, and superb mobile responsiveness. High-impact visuals and prominent 'Add to Cart' CTAs effectively guide users toward purchase. The score is tempered by a significant lack of visible social proof (customer reviews, ratings) on key pages and an overly complex product lineup that can cause choice paralysis for new users.

A clear, logical information architecture and intuitive mega-menu navigation that successfully organizes a vast and diverse product catalog without overwhelming the user.

Implement an interactive 'Product Finder' quiz to simplify the decision-making process for users, reduce choice paralysis, and personalize the product discovery journey.

Garmin has established a sophisticated and robust credibility framework, anchored by its long-standing brand reputation for reliability in mission-critical sectors like aviation and marine. This is supported by a comprehensive legal and data privacy structure, strong third-party validation (e.g., FAA approvals, industry awards), and clear warranty information. The main area for improvement is the lack of prominent customer success evidence, such as testimonials, on product and category pages.

Deep, demonstrated compliance with stringent, industry-specific regulations from bodies like the FAA and FCC, which serves as powerful third-party validation of the products' reliability and quality.

Systematically integrate customer testimonials, user-generated content, and star ratings across product pages to provide direct social proof and build trust with prospective customers.

Garmin's competitive moat is exceptionally strong and sustainable, built on a diversified portfolio that dominates high-margin, high-barrier-to-entry niches like aviation and marine electronics. This diversification provides financial stability that insulates it from the hyper-competitive consumer wearables market. Its advantage is further solidified by a trusted brand reputation, vertical integration, and the growing network effect of the Garmin Connect data ecosystem.

Market leadership in diversified, high-margin niches (Aviation, Marine, Outdoor) provides a stable, profitable foundation that is extremely difficult for consumer-focused competitors like Apple or niche players like Coros to replicate.

More aggressively invest in the Connect IQ app store to incentivize third-party developers, which would deepen the ecosystem's moat and close a key feature gap with competitors like Apple.

The company is exceptionally well-positioned for future growth, evidenced by strong financials, high gross margins (around 58-59%), and efficient vertical integration. Significant expansion potential exists in monetizing its software ecosystem through subscriptions and aggressively scaling its Garmin Health B2B division. While the hardware-centric model has inherent scalability limits compared to pure software, Garmin's operational efficiency and diversification create a robust platform for sustained expansion.

The strategic expansion into the Garmin Health B2B division, which leverages its core technological strengths to enter the lucrative corporate wellness and digital health markets, creating a new, scalable, high-LTV revenue stream.

Accelerate the transition from a hardware-centric to a hybrid revenue model by bundling new premium subscription services (like Connect+) with hardware at the point of sale to increase the attach rate of recurring revenue.

Garmin's business model is a masterclass in strategic diversification, leveraging its core competency in GPS technology across five distinct and highly profitable verticals. This multi-market approach provides exceptional resiliency and is supported by a heavy investment in R&D and vertical integration to maintain product leadership. The model is coherent and proven, with the company now strategically layering high-margin, recurring subscription revenue on top of its strong hardware foundation.

A highly diversified revenue model across five distinct segments (Fitness, Outdoor, Aviation, Marine, Auto), which provides remarkable financial resilience and allows for cross-pollination of R&D.

Refine the rollout and value proposition of new subscription services (e.g., Connect+) to ensure the benefits are clear and compelling, mitigating the risk of alienating a loyal user base accustomed to free software features.

Garmin wields significant market power, stemming from its dominant, standard-setting position in the aviation and marine industries and a strong #2 position in the global smartwatch market. This allows the company to command premium prices, maintain high margins, and invest heavily in innovation, which in turn reinforces its market leadership. Its pricing strategy focuses on adding innovative features to justify higher price points, demonstrating strong pricing power without alienating its customer base.

Exceptional pricing power, demonstrated by its ability to launch new, higher-priced products with innovative features while maintaining demand for older models at lower price points, effectively capturing value across the entire market.

Launch targeted marketing campaigns and create a dedicated competitive comparison hub on the website to more directly address threats from competitors like Apple and Coros by highlighting key differentiators like superior battery life and durability.

Business Overview

Business Classification

Vertically Integrated Hardware Manufacturer

eCommerce & Subscription Services

Consumer Electronics & GPS Technology

Sub Verticals

- •

Wearable Technology

- •

Aviation Avionics

- •

Marine Electronics

- •

Outdoor Recreation Technology

- •

Automotive OEM

Mature

Maturity Indicators

- •

Consistent profitability and revenue growth across diversified segments.

- •

Strong global brand recognition and customer loyalty in core niches.

- •

Extensive and diverse product portfolio serving multiple markets.

- •

Sustained, significant investment in Research & Development.

- •

Established global manufacturing and distribution networks.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Fitness & Outdoor Hardware Sales

Description:Sale of smartwatches, fitness trackers, and handheld GPS devices (e.g., Forerunner, fēnix, inReach). This is consistently Garmin's largest revenue contributor.

Estimated Importance:Primary

Customer Segment:Athletes, Outdoor Enthusiasts, Wellness-Conscious Consumers

Estimated Margin:High

- Stream Name:

Aviation Hardware & Software Sales

Description:Sale of integrated avionics systems, portable GPS navigators, and aviation software/services to OEM and aftermarket customers.

Estimated Importance:Primary

Customer Segment:Aircraft Manufacturers, Pilots (Private & Commercial)

Estimated Margin:Very High

- Stream Name:

Marine Hardware Sales

Description:Sale of chartplotters, sonar modules, radar systems, and trolling motors for recreational and professional boating.

Estimated Importance:Primary

Customer Segment:Boaters, Fishermen

Estimated Margin:High

- Stream Name:

Automotive OEM & Consumer Sales

Description:Sale of embedded navigation systems to auto manufacturers (OEM) and consumer personal navigation devices (PNDs). While consumer PNDs are declining, the OEM segment shows strong growth.

Estimated Importance:Secondary

Customer Segment:Automobile Manufacturers, Consumers

Estimated Margin:Medium

- Stream Name:

Subscription Services

Description:Recurring revenue from services such as inReach satellite communication plans, Navionics chart updates, Garmin Golf memberships, and potentially future premium features in Garmin Connect.

Estimated Importance:Tertiary

Customer Segment:Outdoor Adventurers, Boaters, Golfers

Estimated Margin:High

Recurring Revenue Components

- •

inReach Satellite Communication Plans

- •

Navionics Marine Chart Subscriptions

- •

Garmin Golf App Memberships

- •

FltPlan.com and Garmin Pilot App Services

Pricing Strategy

One-time Purchase & Subscription

Premium

Transparent

Pricing Psychology

- •

Good-Better-Best Tiering (e.g., Venu vs. Forerunner vs. fēnix)

- •

Price Anchoring (Displaying sale prices against original prices)

- •

Financing Options (e.g., Affirm partnerships to reduce upfront cost barrier)

Monetization Assessment

Strengths

- •

High margins on premium hardware products.

- •

Diversified revenue across multiple resilient, high-margin niches.

- •

Strong brand loyalty supports premium pricing.

- •

Growing, albeit small, base of high-margin recurring subscription revenue.

Weaknesses

- •

Heavy dependency on hardware upgrade cycles for revenue growth.

- •

Vulnerability in segments with declining markets (e.g., consumer Auto PNDs).

- •

Limited monetization of the Garmin Connect software platform, which is currently free.

Opportunities

- •

Introduce a premium tier for the Garmin Connect platform with AI-driven coaching and advanced analytics.

- •

Expand B2B subscription services through Garmin Health for corporate wellness and remote patient monitoring.

- •

Bundle hardware with subscription services at the point of sale to increase recurring revenue.

- •

Grow software-based revenue in specialized niches like aviation and marine mapping.

Threats

- •

Intense competition from tech giants like Apple and Samsung in the lucrative wearables market.

- •

Smartphones with 'good enough' GPS and fitness apps eroding the low-end market.

- •

Economic downturns impacting consumer spending on high-end discretionary goods.

- •

Rapid technological changes that could render existing hardware obsolete faster.

Market Positioning

Niche-Focused Product Leadership

Market Leader in specialized GPS segments (Aviation, Marine); Strong Contender (#2 globally) in the broader smartwatch market.

Target Segments

- Segment Name:

The Performance Athlete & Endurance Enthusiast

Description:Dedicated runners, cyclists, triathletes, and swimmers who are data-driven and require advanced performance metrics, long battery life, and durability.

Demographic Factors

Age: 25-55

High disposable income

Psychographic Factors

- •

Performance-oriented

- •

Data-centric

- •

Values reliability over aesthetics

Behavioral Factors

- •

Trains multiple times per week

- •

Participates in competitive events (marathons, triathlons).

- •

Willing to invest in specialized equipment

Pain Points

- •

Inaccurate GPS/Heart Rate data

- •

Short battery life on competing smartwatches

- •

Lack of advanced training and recovery insights

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

The Outdoor Adventurer

Description:Hikers, mountaineers, trail runners, and explorers who operate in remote environments and prioritize safety, off-grid communication, and robust navigation.

Demographic Factors

Age: 30-60

Active, outdoor lifestyle

Psychographic Factors

- •

Prioritizes safety and reliability

- •

Values ruggedness and long-term durability

- •

Self-reliant

Behavioral Factors

Travels to areas with no cellular service

Engages in multi-day expeditions

Pain Points

- •

Fear of getting lost or injured in remote locations

- •

Inability to communicate with emergency services or family

- •

Equipment failure in harsh conditions

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

The Aviation & Marine Professional/Hobbyist

Description:Pilots and boat captains who require certified, highly reliable, and integrated navigation and electronic systems for safety-critical operations.

Demographic Factors

High-income professionals or retirees

Boat or aircraft owners

Psychographic Factors

- •

Extremely safety-conscious

- •

Relies on technology for critical functions

- •

Brand loyal within the industry

Behavioral Factors

Invests heavily in their craft/vessel

Follows strict regulatory and maintenance protocols

Pain Points

- •

Lack of situational awareness

- •

Difficulty integrating disparate electronic systems

- •

Failure of non-certified consumer electronics in critical situations

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

The Health & Wellness Conscious Consumer

Description:Everyday users seeking a stylish smartwatch to track general activity, sleep, stress, and other health metrics, with a balance of features, battery life, and design.

Demographic Factors

Broad age range (25-65)

Slightly female-skewed for specific product lines (e.g., Lily)

Psychographic Factors

- •

Health-conscious

- •

Values convenience and holistic wellness data

- •

Seeks a balance between function and fashion

Behavioral Factors

Monitors daily steps, sleep, and heart rate

Engages in casual fitness activities

Pain Points

- •

Daily charging required for competitor smartwatches

- •

Overly complex or 'sporty' design of high-end models

- •

Desire for a single device to track a wide range of wellness metrics

Fit Assessment:Good

Segment Potential:High

Market Differentiation

- Factor:

Vertical Integration

Strength:Strong

Sustainability:Sustainable

- Factor:

Multi-Market Technology Diversification

Strength:Strong

Sustainability:Sustainable

- Factor:

Superior Battery Life

Strength:Strong

Sustainability:Temporary

- Factor:

Niche Feature Depth

Strength:Strong

Sustainability:Sustainable

Value Proposition

To engineer superior, purpose-built products that are an essential part of our customers' lives, delivering unmatched reliability, features, and value for demanding activities in automotive, aviation, marine, outdoor, and sports.

Good

Key Benefits

- Benefit:

Unmatched Reliability and Durability

Importance:Critical

Differentiation:Unique

Proof Elements

- •

ISO certifications

- •

FAA approvals for aviation equipment

- •

Long-standing brand reputation in harsh environments

- Benefit:

Superior Battery Performance

Importance:Critical

Differentiation:Unique

Proof Elements

- •

Multi-week battery life specs on premium watches (e.g., Enduro)

- •

Solar charging technology (Power Glass™)

- •

Positive reviews comparing battery life to competitors

- Benefit:

Advanced, Purpose-Built Features

Importance:Important

Differentiation:Somewhat unique

Proof Elements

- •

Advanced running dynamics

- •

Dive computer capabilities

- •

Integrated avionics systems

- Benefit:

Comprehensive Health & Activity Tracking Ecosystem

Importance:Important

Differentiation:Common

Proof Elements

- •

Garmin Connect platform features (sleep score, Body Battery™)

- •

Wide range of trackable activities

- •

Integration with third-party apps via Connect IQ™

Unique Selling Points

- Usp:

Vertically integrated model ensuring control over design, manufacturing, and quality from start to finish.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Expertise across five distinct, high-margin technology segments, allowing for cross-pollination of R&D and diversification of revenue.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A singular focus on GPS-centric technology, creating deep institutional knowledge and a robust patent portfolio.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Lack of reliable navigation and communication in remote, off-grid environments.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Need for accurate, actionable performance data to improve in athletic endeavors.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Inadequate battery life of smartwatches for multi-day activities or convenience.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Requirement for certified, integrated, and dependable electronics in aviation and marine applications.

Severity:Critical

Solution Effectiveness:Complete

Value Alignment Assessment

High

Garmin's value proposition is exceptionally well-aligned with the needs of its core, high-value niche markets (Aviation, Marine, Outdoor, Performance Sports) that prioritize reliability, feature depth, and durability over all else.

High

For its primary target segments, the alignment is nearly perfect. For the broader wellness consumer, the alignment is good but faces challenges from competitors who lead with simplicity and ecosystem integration (e.g., Apple).

Strategic Assessment

Business Model Canvas

Key Partners

- •

Retailers & Distributors (e.g., Best Buy, REI, Wellbots).

- •

OEMs (Aircraft manufacturers like Cirrus, Automotive manufacturers).

- •

Technology & Software Partners (e.g., Dexcom, Surfline, Iridium for satellite network).

- •

Event & Influencer Partnerships (e.g., Garmin Marathon Series, sponsored athletes).

Key Activities

- •

Intensive Research & Development.

- •

In-house Manufacturing & Engineering.

- •

Global Marketing & Brand Management.

- •

Software & Ecosystem Development (Garmin Connect, Connect IQ).

- •

Global Logistics & Supply Chain Management

Key Resources

- •

Strong Brand Reputation & Customer Loyalty.

- •

Extensive Patent & Intellectual Property Portfolio.

- •

Vertically Integrated Manufacturing Facilities.

- •

Highly Skilled Engineering Workforce (R&D staff is ~26-29% of employees).

- •

Global Distribution & Retail Network

Cost Structure

- •

Research & Development Expenses (a primary cost driver, consistently over 10% of sales).

- •

Selling, General & Administrative (SG&A) Expenses.

- •

Manufacturing Costs (Cost of Goods Sold)

- •

Marketing & Advertising Expenses.

Swot Analysis

Strengths

- •

Highly diversified business across five distinct and often counter-cyclical segments.

- •

Strong brand equity and market leadership in high-margin niches (aviation, marine).

- •

Vertical integration provides control over quality, cost, and innovation pipeline.

- •

Robust financial health with high gross margins and consistent profitability.

Weaknesses

- •

Over-reliance on the competitive and cyclical hardware market.

- •

User interface and software ecosystem can be perceived as less intuitive than key competitors like Apple.

- •

Slower adoption of subscription-based revenue models compared to the tech industry.

- •

Declining relevance of the legacy consumer automotive segment.

Opportunities

- •

Monetize the Garmin Connect platform through premium subscription tiers.

- •

Expand the Garmin Health B2B division for corporate wellness and digital therapeutics.

- •

Leverage AI and machine learning to provide personalized health and fitness coaching.

- •

Strategic acquisitions of smaller tech firms to enhance capabilities.

Threats

- •

Intensifying competition from tech giants with vast R&D budgets and integrated ecosystems (Apple, Google/Fitbit, Samsung).

- •

The increasing capability of smartphones is making dedicated GPS devices obsolete for casual users.

- •

Potential for supply chain disruptions for key electronic components.

- •

Changes in consumer spending habits on premium electronics during economic downturns.

Recommendations

Priority Improvements

- Area:

Software & Service Monetization

Recommendation:Launch a 'Garmin Connect Pro' subscription tier offering advanced AI-driven coaching, personalized training plans, and deeper wellness analytics. This creates a new recurring revenue stream and increases ecosystem lock-in.

Expected Impact:High

- Area:

User Experience (UX) Simplification

Recommendation:Invest in streamlining the user interface and onboarding process for wellness-focused and entry-level devices to better compete on ease-of-use with mass-market competitors.

Expected Impact:Medium

- Area:

B2B Market Expansion

Recommendation:Aggressively scale the Garmin Health division by creating turnkey solutions for corporate wellness programs, insurance providers, and clinical research, leveraging the platform's robust data capabilities.

Expected Impact:High

Business Model Innovation

- •

Hardware-as-a-Service (HaaS): Pilot a subscription model for high-end professional equipment (e.g., a marine electronics bundle) that includes hardware, premium software/maps, and periodic upgrades for a recurring fee.

- •

Data-as-a-Service (DaaS): Further develop the Garmin Health ecosystem to provide anonymized, aggregated population health data and insights to research institutions, urban planners, and public health organizations as a new B2B revenue stream.

- •

Community & Events Platform: Evolve from sponsoring events to owning and operating them (e.g., Garmin Marathon Series), creating a fully integrated brand experience and a new revenue vertical through registrations, sponsorships, and merchandise.

Revenue Diversification

- •

Expand software-only products, such as advanced standalone navigation and training plan applications for mobile devices.

- •

Create paid API access tiers for third-party developers to build premium applications on the Connect IQ platform.

- •

Develop certified professional training and certification programs for Garmin's aviation and marine equipment.

Garmin's business model is a masterclass in strategic diversification and niche market domination. By leveraging its core competency in GPS technology across five distinct, high-margin verticals (Fitness, Outdoor, Aviation, Marine, and Auto), it has built a resilient and highly profitable enterprise. Its strategy of vertical integration affords significant competitive advantages in quality control, innovation speed, and margin protection. The company's strength lies in serving demanding, 'prosumer' and professional customers who prioritize technical superiority, reliability, and durability—attributes that command premium pricing and foster intense brand loyalty.

The primary business model evolution opportunity lies in transitioning from a purely hardware-centric revenue model to a hybrid model that blends hardware sales with high-margin, recurring software and subscription services. The Garmin Connect platform is a powerful, yet currently under-monetized, asset. Introducing premium subscription tiers could unlock significant new revenue, increase customer lifetime value, and create a stronger competitive moat against rivals like Apple, whose primary advantage is their vast software and services ecosystem.

Furthermore, the strategic expansion of the Garmin Health B2B division represents a significant growth vector, allowing Garmin to leverage its trusted hardware and data analytics capabilities in lucrative markets like corporate wellness, remote patient monitoring, and clinical trials.

Strategically, Garmin must continue its heavy investment in R&D to maintain its product leadership in core segments while simultaneously investing in software UX/UI to broaden its appeal to the mainstream wellness market. The key to future success will be augmenting its world-class hardware with a similarly world-class, and strategically monetized, digital ecosystem.

Competitors

Competitive Landscape

Mature

Moderately concentrated

Barriers To Entry

- Barrier:

Brand Reputation and Loyalty

Impact:High

- Barrier:

R&D and Technological Innovation

Impact:High

- Barrier:

Distribution Channels and Global Supply Chain

Impact:High

- Barrier:

Patents and Intellectual Property

Impact:Medium

- Barrier:

Software and Data Ecosystem (e.g., Garmin Connect)

Impact:Medium

Industry Trends

- Trend:

Integration of AI and Machine Learning for personalized health insights.

Impact On Business:Opportunity to provide more predictive and actionable health data, enhancing user engagement and justifying premium prices.

Timeline:Immediate

- Trend:

Advanced sensor technology for non-invasive monitoring (e.g., blood pressure, glucose).

Impact On Business:A critical area for R&D investment. Falling behind could render current health tracking features obsolete. First-mover advantage would be significant.

Timeline:Near-term

- Trend:

Increased focus on subscription services for advanced features and coaching.

Impact On Business:Opportunity to create new recurring revenue streams beyond hardware sales, but also a risk if competitors offer similar features for free.

Timeline:Near-term

- Trend:

Device agnosticism and interoperability.

Impact On Business:Pressure to ensure Garmin devices and data integrate seamlessly with other platforms (iOS, Android, third-party fitness apps) to avoid being locked out of user ecosystems.

Timeline:Immediate

Direct Competitors

- →

Apple

Market Share Estimate:Leader in the smartwatch segment (approx. 50% in North America in 2024).

Target Audience Overlap:High

Competitive Positioning:Lifestyle and health-focused smartwatch seamlessly integrated into the Apple ecosystem.

Strengths

- •

Unmatched ecosystem integration (iPhone, iCloud, HealthKit).

- •

Superior user interface and app ecosystem.

- •

Strong brand cachet and mainstream appeal.

- •

Advanced health features with medical-grade certifications (e.g., ECG, Fall Detection).

Weaknesses

- •

Significantly shorter battery life compared to Garmin.

- •

Less durable for extreme outdoor activities (though the Ultra model mitigates this).

- •

Limited compatibility (requires an iPhone).

- •

Fewer dedicated, in-depth metrics for niche sports.

- •

Higher reliance on touch screen, which can be difficult during intense activity.

Differentiators

- •

Deep integration with iOS for communication and smart features.

- •

Focus on general wellness and safety features for a broad audience.

- •

Large third-party app store.

- →

Coros

Market Share Estimate:Niche, but rapidly growing among endurance athletes.

Target Audience Overlap:High

Competitive Positioning:The performance-focused, no-frills tool for dedicated athletes, prioritizing battery life and core metrics.

Strengths

- •

Exceptional battery life, often best-in-class.

- •

Competitive pricing, offering premium features at a lower cost.

- •

Lightweight designs.

- •

Simple, athlete-focused user interface without 'lifestyle' clutter.

- •

Strong reputation and adoption among elite runners and mountaineers.

Weaknesses

- •

Fewer smartwatch and lifestyle features (e.g., music storage, contactless payments on some models).

- •

Less vibrant app ecosystem.

- •

Brand recognition is lower than Garmin's outside of the core athlete community.

- •

Some users report less accurate heart rate monitoring compared to Garmin.

Differentiators

- •

Focus purely on athletic performance and data.

- •

Unbeatable battery life as a primary selling point.

- •

Value proposition offering high-end training features at a lower price point.

- →

Suunto

Market Share Estimate:Established player in the outdoor and dive watch market.

Target Audience Overlap:High

Competitive Positioning:Rugged, premium outdoor sports watches with a strong European heritage in navigation and durability.

Strengths

- •

Reputation for exceptional build quality and durability (made in Finland).

- •

Strong legacy and brand trust in mountaineering, diving, and outdoor sports.

- •

Excellent GPS accuracy and navigation features.

- •

Clean, aesthetically pleasing design.

Weaknesses

- •

Historically slower software development and feature rollout compared to Garmin and Coros.

- •

App ecosystem (Suunto App) is less mature than Garmin Connect.

- •

Higher price point for comparable features.

- •

Fewer smartwatch/lifestyle integrations.

Differentiators

- •

Premium, robust hardware and design.

- •

Heritage and specialization in outdoor adventure and diving.

- •

Focus on navigation and environmental data.

- →

Samsung

Market Share Estimate:Major player, second to Apple in the broader smartwatch market.

Target Audience Overlap:Medium

Competitive Positioning:Feature-rich smartwatch for Android users, balancing fitness and lifestyle features.

Strengths

- •

High-quality AMOLED displays.

- •

Strong integration with the Samsung/Android ecosystem.

- •

Offers a wide range of health sensors and smart features.

- •

Competitive pricing and frequent promotions.

Weaknesses

- •

Weaker battery life than Garmin.

- •

Fitness and sports tracking is less specialized and in-depth.

- •

Less-established reputation among serious athletes and adventurers.

- •

Brand is perceived as more general consumer electronics than specialized sports tech.

Differentiators

- •

Deepest integration for Android users.

- •

Often an early adopter of new display and sensor technology.

- •

Balances smartwatch capabilities and fitness tracking for a mainstream audience.

Indirect Competitors

- →

Google (Alphabet Inc.)

Description:Provides Google Maps/Waze for navigation (threatening Garmin's auto segment) and owns Fitbit, which competes in the fitness tracker and entry-level smartwatch space. Android OS is the platform for many competing smartwatches.

Threat Level:High

Potential For Direct Competition:Already a direct competitor through Fitbit and a major indirect competitor through its software and services ecosystem.

- →

Strava

Description:A social fitness network that acts as the central hub for many athletes' data, regardless of the hardware used. It competes with Garmin Connect for user engagement and community.

Threat Level:Medium

Potential For Direct Competition:Low, more likely to remain a key partner/integrator. However, if they were to launch their own hardware, the threat would become critical.

- →

Smartphone OEMs (e.g., Xiaomi, Huawei)

Description:These companies produce low-cost fitness bands and smartwatches that are 'good enough' for casual users, eroding the low-end market. They compete on price and volume.

Threat Level:Medium

Potential For Direct Competition:Already direct competitors in the entry-level segment, putting pressure on Garmin's lower-priced offerings.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Diversified Product Portfolio

Sustainability Assessment:Garmin's leadership in niche, high-margin markets like aviation and marine provides financial stability and a buffer against the hyper-competitive consumer wearables space.

Competitor Replication Difficulty:Hard

- Advantage:

Brand Reputation for Reliability and Accuracy

Sustainability Assessment:Decades of building trust with pilots, mariners, and serious athletes create a powerful brand moat that is difficult for newer entrants to overcome.

Competitor Replication Difficulty:Hard

- Advantage:

Vertical Integration

Sustainability Assessment:In-house design, manufacturing, and marketing allows for greater quality control, faster innovation cycles, and better margin management.

Competitor Replication Difficulty:Medium

- Advantage:

Proprietary Data Ecosystem (Garmin Connect)

Sustainability Assessment:The vast amount of user data and the stickiness of the Garmin Connect platform create high switching costs for deeply embedded users.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'First-to-Market with Niche Features', 'estimated_duration': '6-18 months'}

{'advantage': 'Superior Battery Life on Specific Models', 'estimated_duration': '12-24 months'}

Disadvantages

- Disadvantage:

Premium Price Point

Impact:Major

Addressability:Difficult

- Disadvantage:

Less Developed Third-Party App Ecosystem

Impact:Minor

Addressability:Moderately

- Disadvantage:

UI/UX less intuitive than competitors like Apple

Impact:Minor

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted marketing campaigns highlighting key differentiators (e.g., battery life, durability) against Apple Watch Ultra for specific user personas (e.g., ultra-runners, divers).

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Streamline the Garmin Connect onboarding process to showcase the most powerful features to new users within the first week of use.

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Expand Garmin Pay partnerships to achieve parity with Apple Pay and Google Pay in key markets.

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Invest in the Garmin Connect IQ store to incentivize developers to create high-quality apps, focusing on gaps not filled by Apple or Google.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Introduce a premium subscription tier in Garmin Connect for advanced AI-driven coaching, adaptive training plans, and deeper wellness insights.

Expected Impact:High

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Aggressively pursue R&D in next-generation biometric sensors (e.g., lactate monitoring, hydration levels) to create a new, defensible health data moat.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Leverage Garmin Health to forge deeper partnerships with corporate wellness programs, insurers, and healthcare providers, solidifying B2B revenue streams.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Explore strategic acquisitions of software companies specializing in AI-driven data analysis or community-based fitness platforms.

Expected Impact:Medium

Implementation Difficulty:Difficult

Double down on positioning as the premium, purpose-built tool for serious athletes, adventurers, and professionals. Emphasize reliability, data depth, and superior battery life as non-negotiable features for those whose passions or professions depend on them.

Differentiate through vertical specialization. Instead of competing feature-for-feature with general-purpose smartwatches, focus on creating the absolute best-in-class product for specific verticals (running, cycling, diving, flying, sailing) where compromise is not an option.

Whitespace Opportunities

- Opportunity:

Develop a 'Pro' ecosystem of integrated devices.

Competitive Gap:No competitor offers a seamlessly integrated ecosystem of devices for a specific activity (e.g., a cyclist using a Garmin watch, Edge computer, Varia radar, and Tacx trainer, all working in perfect concert).

Feasibility:High

Potential Impact:High

- Opportunity:

Enhanced community and social features within Garmin Connect.

Competitive Gap:While Strava dominates the social fitness space, its integration is not native. Garmin could build more robust team/club features, challenges, and collaborative route planning directly into its platform to increase user stickiness.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Gamified training and adventure platform.

Competitive Gap:Competitors focus on data and metrics. Garmin could create a platform that uses its mapping and tracking capabilities for gamified experiences, such as virtual scavenger hunts, peak bagging challenges, or community-based exploration goals.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Advanced safety and tracking services for industrial/enterprise use.

Competitive Gap:Leveraging inReach satellite technology for lone worker safety in industries like forestry, energy, and logistics is a B2B application that consumer-focused competitors cannot easily replicate.

Feasibility:High

Potential Impact:Medium

Garmin occupies a powerful and highly defensible position in the technology landscape, built on a foundation of engineering excellence and a diversified portfolio that insulates it from the volatility of any single market. Its primary competitive advantage lies in its vertical dominance; it is not just a wearables company, but a leader in marine, aviation, outdoor, and fitness technology. This diversification provides financial stability and cross-pollination of R&D that consumer-focused competitors like Apple and Samsung cannot match.

In its most visible market—sports and fitness wearables—Garmin faces a two-front war. From the high end, Apple, with its Watch Ultra, is aggressively targeting the adventure and endurance athlete demographic, competing on ecosystem integration and user experience. From the mid and low end, brands like Coros are competing fiercely on price and battery life, appealing to dedicated athletes who prioritize performance metrics over smartwatch features.

Garmin's key strengths are its robust battery life, deep and trusted data metrics, and a reputation for durability that is paramount for its core audience. However, it faces disadvantages in the slickness of its user interface and the breadth of its third-party app support when compared to Apple. The primary strategic challenge for Garmin is to defend its premium position by continuing to innovate in its core areas of GPS accuracy, sensor technology, and battery efficiency, while simultaneously improving the software experience to prevent user churn to more 'user-friendly' ecosystems.

The most significant long-term threat comes from the consolidation of technology by giants like Apple and Google, who can leverage their massive resources to close the feature gap. Garmin's path to sustained growth relies on doubling down on its identity as a specialized toolmaker for people with serious passions. The opportunities lie in deepening the integration between its hardware products, building a more engaging community within its Garmin Connect software ecosystem, and leveraging its unique technologies like inReach for untapped B2B markets.

Messaging

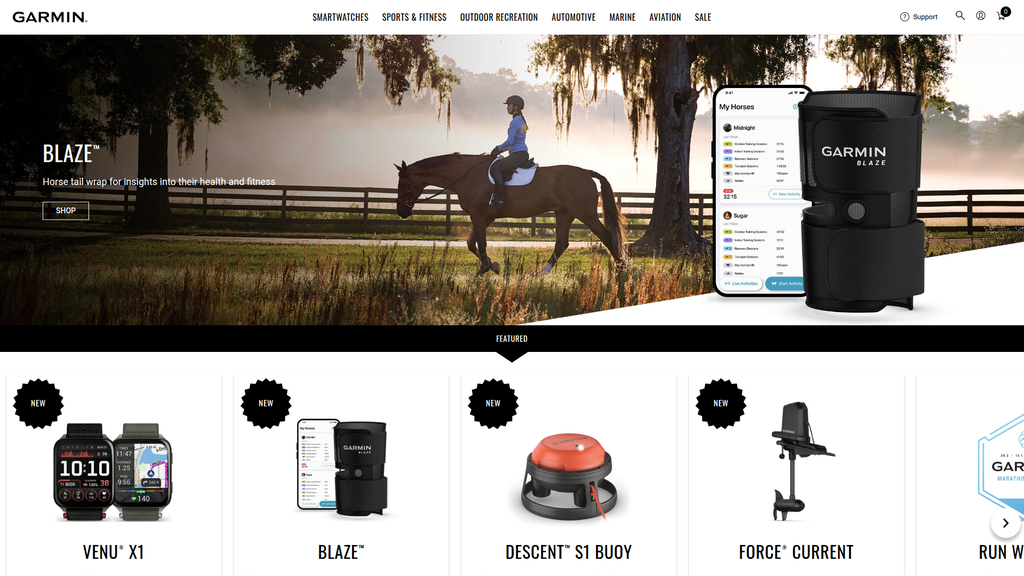

Garmin's strategic messaging is a masterclass in segmented marketing, effectively speaking the language of diverse, high-passion consumer groups. The company excels at positioning its products as superior, purpose-built tools essential for achieving peak performance and safety in specialized activities. This approach is powerfully reflected on its website, where the homepage functions as a portal, directing distinct personas—from ultra-runners and pilots to marine captains and RV drivers—to highly tailored product ecosystems. The brand voice is consistently authoritative, technical, and aspirational, reinforcing its premium, high-performance positioning against more generalized competitors like Apple and Samsung.

However, this strength in vertical segmentation creates a horizontal weakness: a fragmented overall brand narrative. The overarching 'Why Garmin?' story, which unites the brand's core values of reliability, durability, and innovation across all categories, is underdeveloped on the main landing pages. Messaging focuses heavily on what the products do for a specific activity, but less on the unifying ethos of who Garmin is as a brand that underpins all its technology. The result is a brand that feels like a federation of highly successful, specialized sub-brands rather than a singular, powerful entity. This presents a significant opportunity to weave a more cohesive brand story that elevates the entire portfolio and strengthens brand equity beyond individual product lines.

Message Architecture

Key Messages

- Message:

Garmin builds superior, purpose-built products to empower your passions.

Prominence:Primary

Clarity Score:High

Location:Implicitly communicated across the entire homepage through diverse product features (e.g., horse tail wraps, kayak motors, running watches).

- Message:

TRAIN BRILLIANTLY WITH FORERUNNER® – OUR BRIGHTEST RUNNING SMARTWATCHES EVER

Prominence:Secondary

Clarity Score:High

Location:Homepage - Featured Section for Sports & Fitness

- Message:

FĒNIX® 8 — THE ULTIMATE SMARTWATCH...

Prominence:Secondary

Clarity Score:High

Location:Homepage - Featured Section for Outdoor Recreation

- Message:

INREACH® SATELLITE COMMUNICATORS — TWO-WAY MESSAGING FROM THE WILDERNESS

Prominence:Secondary

Clarity Score:High

Location:Homepage - Featured Section for Outdoor Recreation

The message hierarchy is exceptionally well-organized by customer segment. The homepage immediately funnels users into distinct categories like Automotive, Marine, Aviation, and Sports. This is highly effective for a user with a clear intent but makes the overall brand message subordinate to the category-specific messages.

Messaging is highly consistent within each vertical segment. The tone, terminology, and value propositions for 'Marine' are distinct from 'Fitness' but are internally coherent. Across the entire site, the brand maintains a consistent focus on features, performance, and quality, even if the specific application varies dramatically.

Brand Voice

Voice Attributes

- Attribute:

Authoritative & Confident

Strength:Strong

Examples

- •

THE ULTIMATE SMARTWATCH

- •

TRAIN BRILLIANTLY

- •

You’re passionate about fishing, and you want live-scanning sonar...

- Attribute:

Technical & Precise

Strength:Strong

Examples

- •

SubWave™ sonar messaging

- •

Auto-ranging digital bow sight with dual-color LED pins

- •

Compact ballistics chronograph.

- Attribute:

Aspirational

Strength:Moderate

Examples

- •

GOLF DEVICES TO ELEVATE YOUR GAME

- •

See How We Connect People to Their Passions.

- •

RUN WITH US

- Attribute:

Direct & Action-Oriented

Strength:Strong

Examples

- •

SHOP

- •

START

- •

LEARN MORE

Tone Analysis

Informational & Feature-Driven

Secondary Tones

Motivational

Transactional

Tone Shifts

Shifts from aspirational and motivational language in headlines to highly technical and direct language in product descriptions.

The 'Stories' section shifts to a more narrative and emotional tone, contrasting with the product-focused homepage.

Voice Consistency Rating

Good

Consistency Issues

The primary inconsistency is less in the voice itself and more in the lack of a unifying narrative that connects the highly diverse product categories.

Value Proposition Assessment

Garmin delivers purpose-built, technologically superior, and highly reliable devices that enable enthusiasts and professionals to perform better, explore further, and stay safe while pursuing their passions.

Value Proposition Components

- Component:

Specialized Functionality

Clarity:Clear

Uniqueness:Unique

Notes:Clearly communicated through products like diver communication buoys and equine activity trackers, which generalist competitors like Apple do not offer.

- Component:

Durability & Reliability

Clarity:Somewhat Clear

Uniqueness:Somewhat Unique

Notes:Implied through imagery and brand reputation but could be more explicitly stated as a core differentiator against less rugged smartwatches.

- Component:

Long Battery Life

Clarity:Somewhat Clear

Uniqueness:Somewhat Unique

Notes:A major differentiator versus key competitors but often buried in spec sheets rather than used as a primary marketing message on the homepage.

- Component:

Technological Innovation

Clarity:Clear

Uniqueness:Unique

Notes:Showcased with phrases like 'SubWave™ sonar' and 'Laser Locate™', highlighting proprietary technology.

Garmin's messaging strategy effectively differentiates the brand by focusing on its deep expertise in specific, demanding activities. Unlike Apple or Samsung, which position their wearables as lifestyle accessories, Garmin positions its products as essential equipment. The messaging avoids direct comparisons and instead emphasizes unique, advanced features that are non-negotiable for their target users, thereby creating a premium, professional-grade perception.

Garmin positions itself as the premium, high-performance choice for serious athletes, adventurers, and professionals. Its messaging carves out a defensible niche against broader consumer electronics brands by being the undisputed expert in verticals like aviation, marine, and high-endurance sports. It cedes the 'everyday smartwatch' market to compete on performance, reliability, and specialized features where it has a clear advantage.

Audience Messaging

Target Personas

- Persona:

The Dedicated Athlete (Runners, Cyclists, Triathletes)

Tailored Messages

TRAIN BRILLIANTLY WITH FORERUNNER®

Garmin’s very own Boston qualifier is headed to a city near you.

Effectiveness:Effective

- Persona:

The Outdoor Adventurer (Fishers, Divers, Hikers, Hunters)

Tailored Messages

- •

SAVE $400 ON LIVESCOPE™ XR SYSTEM

- •

INREACH® SATELLITE COMMUNICATORS — TWO-WAY MESSAGING FROM THE WILDERNESS

- •

SAVE UP TO $200 ON XERO A1i® BOW SIGHTS

Effectiveness:Effective

- Persona:

The Professional User (Marine, Aviation, Health)

Tailored Messages

SAVE UP TO $100 ON SELECT MARINE CHARTS

MONITOR PATIENTS WITH GARMIN HEALTH

Effectiveness:Effective

- Persona:

The Lifestyle User (General Wellness, Women, Kids)

Tailored Messages

- •

SMARTWATCHES FOR WOMEN

- •

SMARTWATCHES FOR KIDS

- •

SAVE $50 ON VENU® 3

Effectiveness:Somewhat

Audience Pain Points Addressed

- •

Lack of accurate performance data for niche sports

- •

Short battery life on competing devices

- •

Need for communication and SOS capabilities in remote areas without cell service

- •

Requirement for rugged, durable hardware that can withstand harsh environments

Audience Aspirations Addressed

- •

Achieving a new personal best (e.g., qualifying for the Boston Marathon)

- •

Exploring remote wilderness with confidence and safety

- •

Mastering a skill or hobby (e.g., fishing, golfing, diving)

- •

Living a healthier, more active lifestyle

Persuasion Elements

Emotional Appeals

- Appeal Type:

Achievement/Aspiration

Effectiveness:High

Examples

- •

Imagery of athletes performing at their peak.

- •

TRAIN BRILLIANTLY

- •

ELEVATE YOUR GAME

- Appeal Type:

Safety/Security

Effectiveness:High

Examples

INREACH® SATELLITE COMMUNICATORS — TWO-WAY MESSAGING FROM THE WILDERNESS

Keep in touch beyond mobile phone service by exchanging text messages... with this SOS satellite communicator.

- Appeal Type:

Belonging/Community

Effectiveness:Medium

Examples

RUN WITH US

Garmin Marathon Series

Social Proof Elements

- Proof Type:

Brand Authority

Impact:Strong

Notes:Garmin's long-standing reputation as a leader in GPS technology serves as implicit social proof. It is known for quality and reliability.

- Proof Type:

Community Engagement

Impact:Moderate

Notes:The 'Garmin Marathon Series' builds community and demonstrates the brand's commitment to its core running audience.

Trust Indicators

- •

Established brand name with a long history (founded 1989).

- •

Use of specific, technical product details and proprietary technology names (e.g., SubWave™, Laser Locate™).

- •

Clear warranty and shipping information ('Available to ship in 1–3 business days.').

- •

Company mission and values are clearly stated on corporate pages.

Scarcity Urgency Tactics

Explicit 'SALE' tags and price reductions ('SAVE $50', 'SAVE UP TO $200').

Calls To Action

Primary Ctas

- Text:

SHOP

Location:Ubiquitous across product categories and features.

Clarity:Clear

- Text:

LEARN MORE

Location:Used for services and stories (e.g., Garmin Health, Stories section).

Clarity:Clear

- Text:

START

Location:Used for interactive tools like 'FIND YOUR MATCH.'

Clarity:Clear

- Text:

Add To Cart

Location:Primary CTA on product detail pages.

Clarity:Clear

The CTAs are clear, direct, and functionally effective. However, they are largely utilitarian ('SHOP') and miss opportunities to be more persuasive or benefit-oriented (e.g., 'Shop Forerunner Watches' could be 'Find Your Running Partner'). The 'START' CTA for the watch finder quiz is a strong example of an engaging, user-centric call to action.

Messaging Gaps Analysis

Critical Gaps

A unifying brand narrative is absent from the homepage. The message is a collection of category pitches, not a cohesive brand story. The core promise of reliability and quality that connects a fishfinder to a running watch is not articulated.

The value of the Garmin ecosystem (Garmin Connect app, interoperability between devices) is significantly under-communicated on the homepage.

Contradiction Points

There are no direct messaging contradictions, but the extreme diversity of products (e.g., trolling motors next to women's smartwatches) risks brand dilution without a stronger, unifying message.

Underdeveloped Areas

- •

Customer storytelling. While there is a 'Stories' section, integrating user testimonials and stories directly into the product category sections could more powerfully demonstrate the value proposition.

- •

Sustainability and corporate responsibility messaging, which is becoming increasingly important for premium brands.

- •

Explicitly messaging key differentiators like battery life and durability as primary benefits on the homepage, rather than just features on product pages.

Messaging Quality

Strengths

- •

Excellent message-to-audience fit through clear segmentation.

- •

Authoritative and credible brand voice that aligns with its high-performance products.

- •

Clear communication of technical features for expert audiences.

- •

Effective use of aspirational imagery and headlines to capture the spirit of each activity.

Weaknesses

- •

Over-reliance on product-level messaging at the expense of a cohesive, top-level brand story.

- •

Missed opportunities to articulate cross-category brand promises like durability and reliability.

- •

Utilitarian CTAs that could be more persuasive.

- •

The Garmin Connect ecosystem story is a background element rather than a core value proposition.

Opportunities

- •

Develop a unifying brand tagline or statement that encapsulates the entire product portfolio (e.g., 'Engineered for Life's Pursuits').

- •

Create a dedicated homepage section that showcases the power of the Garmin Connect ecosystem.

- •

Elevate customer stories to the forefront to provide social proof and emotional connection across different user groups.

- •

Launch a campaign focused on the brand's core values of reliability and durability, demonstrating how this applies to all its products.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Message Hierarchy

Recommendation:Introduce a primary brand messaging block below the main hero slider that communicates the unifying Garmin promise. This message should focus on the core values of innovation, quality, and reliability that are shared across all product segments.

Expected Impact:High

- Area:

Value Proposition Communication

Recommendation:Explicitly highlight key competitive differentiators like 'Superior Battery Life' and 'Built to Endure' as recurring messaging themes across relevant product categories on the homepage, not just on product detail pages.

Expected Impact:High

- Area:

Ecosystem Marketing

Recommendation:Add a dedicated content block on the homepage explaining the benefits of the Garmin Connect platform, using visuals to show how data from different activities integrates to provide a holistic view of a user's health and performance.

Expected Impact:Medium

Quick Wins

- •

A/B test benefit-oriented CTAs (e.g., 'Find Your Edge' instead of 'Shop' for sports categories).

- •

Add a 'Trusted by Professionals' icon or short testimonial to the Aviation and Marine sections to quickly build credibility.

- •

Incorporate customer photos or short quotes into the relevant category sections on the homepage.

Long Term Recommendations

- •

Develop a major content marketing initiative focused on cross-passion stories, showing how single customers use Garmin products in multiple areas of their lives (e.g., a pilot who is also a marathon runner).

- •

Invest in building out the 'Garmin Marathon Series' and similar community-building events to strengthen emotional connection and brand loyalty beyond product features.

- •

Launch a brand-level advertising campaign that focuses on the trust and reliability of Garmin technology, independent of any single product.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Consistent revenue growth across all five segments (Fitness, Outdoor, Aviation, Marine, Auto OEM), indicating broad market acceptance.

- •

Leadership position in multiple niche markets (Aviation, Marine, Outdoor) and a top-tier competitor in the broader wearables space.

- •

Strong brand recognition and positive customer sentiment for product functionality, features, and durability.

- •

High user engagement within the Garmin Connect ecosystem, which has over 15 million users and fosters a loyal community.

- •

Successfully attracting new customers to the brand, particularly at the premium end of the product range, indicating expanding market appeal.

Improvement Areas

- •

Enhance the software user experience (UX) and integration of the Garmin Connect app to better compete with software-first companies like Apple.

- •

Address consumer concerns about the accuracy of tracking capabilities compared to competitors like Apple and Whoop.

- •

Improve customer support responsiveness and processes, as some users report slow and unhelpful interactions for repairs or replacements.

Market Dynamics

13-16% CAGR for the wearable technology market; ~7% CAGR for the broader navigation market.

Mature

Market Trends

- Trend:

Increasing consumer focus on health and wellness monitoring.

Business Impact:Drives demand for advanced wearables with sophisticated health sensors (e.g., heart rate, SpO2, sleep tracking), creating opportunities for premium products and services.

- Trend:

Shift towards software and subscription-based services for recurring revenue.

Business Impact:Creates an opportunity to monetize the Garmin Connect platform, but risks alienating a user base accustomed to free services. Garmin has recently launched Connect+, a premium subscription.

- Trend:

Integration of AI and machine learning for personalized insights and predictive features.

Business Impact:Necessitates significant R&D investment in software and data science to compete with tech giants. AI is becoming a key differentiator in navigation and wearables.

- Trend:

Intensifying competition from tech giants (Apple, Google/Fitbit, Samsung) in the wearables space.

Business Impact:Puts pressure on market share and margins, requiring continuous innovation and clear product differentiation to maintain a competitive edge.

Favorable. While the market is mature, the growth in health-focused wearables and the nascent opportunity in B2B/Health tech present significant runways for a well-positioned, trusted brand like Garmin.

Business Model Scalability

Medium

Hardware-centric model with significant variable costs tied to manufacturing, components, and supply chain. Vertical integration provides control but also carries high fixed costs for manufacturing facilities.

Moderate. Increased production volume can lower per-unit costs, but the business is not as asset-light as a pure software company. Revenue growth is still fundamentally tied to shipping physical units.

Scalability Constraints

- •

Dependence on physical manufacturing and global supply chains, which are susceptible to disruption.

- •

Hardware-centric revenue model limits the potential for exponential, software-like margin expansion.

- •

Inventory management across a vast and diverse product portfolio presents a significant operational challenge.

Team Readiness

High. The executive team has a proven track record of navigating market shifts (e.g., from automotive GPS to wearables) and delivering consistent financial performance and revenue growth.

Effective for a diversified hardware company. The segmented business structure (Fitness, Outdoor, etc.) allows for focused execution in specialized markets. However, it may create silos that hinder cross-platform software innovation.

Key Capability Gaps

- •

Agile software development and user experience (UX) design to match the polish of software-native competitors.

- •

Data science and AI/ML talent to fully leverage the vast dataset from the Garmin Connect ecosystem for personalized user features and new revenue streams.

- •

Direct-to-consumer (DTC) subscription marketing and management, a newer muscle being developed with the launch of Connect+.

Growth Engine

Acquisition Channels

- Channel:

Retail Partnerships (e.g., Best Buy, specialty sports stores)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Leverage retail presence for in-store experiences and expert recommendations, especially for high-end, specialized products. Implement data-sharing agreements to better understand end-customer profiles.

- Channel:

Direct-to-Consumer (DTC) E-commerce (Garmin.com)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Improve website personalization and implement a more sophisticated CRM strategy to increase direct sales, own the customer relationship, and improve margins.

- Channel:

Brand Marketing & Sponsorships

Effectiveness:High

Optimization Potential:Medium

Recommendation:Continue sponsoring endurance events and athletes to reinforce the brand's authenticity with its core audience. Expand into adjacent wellness and lifestyle influencer marketing to reach new demographics.

- Channel:

Content Marketing (Blogs, 'Stories')

Effectiveness:Medium

Optimization Potential:High

Recommendation:Invest in higher-quality, data-driven content that showcases the value of the Garmin ecosystem, not just individual products. Create content hubs around key activities (running, cycling, diving) to build community and SEO authority.

Customer Journey

The current path is highly product-centric. Users often come with a specific need (e.g., a running watch), navigate through categories, compare features, and purchase. The 'Which Watch?' tool acknowledges the complexity of the product lineup.

Friction Points

- •

Product discovery can be overwhelming due to the sheer number of SKUs with overlapping features.

- •

The value proposition of the Garmin Connect software ecosystem is not always clearly articulated upfront in the hardware purchase journey.

- •

Transition from hardware purchase to active ecosystem user could be smoother with better onboarding.

Journey Enhancement Priorities

{'area': 'Personalized Product Recommendations', 'recommendation': "Implement an interactive quiz or AI-driven tool that goes beyond basic filters to recommend a specific device and highlight relevant ecosystem features based on a user's detailed goals and lifestyle."}

{'area': 'Ecosystem Onboarding', 'recommendation': 'Develop a robust post-purchase email and in-app onboarding sequence that educates new users on the full capabilities of Garmin Connect, encouraging deep engagement from day one.'}

Retention Mechanisms

- Mechanism:

Garmin Connect Ecosystem (Data Lock-in)

Effectiveness:High

Improvement Opportunity:Shift from a passive data repository to a proactive coaching platform. Use AI to provide personalized insights and actionable recommendations, creating a stickier, more valuable user experience.

- Mechanism:

Hardware Upgrade Cycle

Effectiveness:High

Improvement Opportunity:Create a formal trade-in or loyalty program to incentivize existing users to upgrade their devices directly through Garmin, increasing customer lifetime value and brand loyalty.

- Mechanism:

Connect IQ App Store

Effectiveness:Medium

Improvement Opportunity:Better incentivize third-party developers to create high-quality apps and watch faces. A more vibrant app store can significantly enhance device utility and user retention.

- Mechanism:

Subscription Services (inReach, Maps, Connect+)

Effectiveness:Medium

Improvement Opportunity:Bundle services or offer tiered subscriptions that combine hardware and software features. Clearly communicate the value of new premium offerings like Connect+ to avoid alienating loyal customers.

Revenue Economics

Strong. Garmin maintains healthy gross margins (around 58-59%) despite being a hardware company, indicating strong pricing power and efficient manufacturing.

Estimated High. With premium price points, a loyal customer base that often owns multiple devices, and a long upgrade cycle, the lifetime value of a Garmin customer is substantial relative to acquisition costs.

High. The company is highly profitable, with record operating income and strong free cash flow, demonstrating efficient conversion of revenue into profit.

Optimization Recommendations

- •

Increase the attach rate of recurring revenue services (like the new Connect+ subscription) to supplement hardware sales and create more predictable revenue streams.

- •

Expand B2B offerings through Garmin Health for corporate wellness and insurance, creating high-LTV enterprise contracts.

- •

Optimize the product mix to focus on high-margin segments like Outdoor and Aviation, which have gross margins of 67% and 75% respectively.

Scale Barriers

Technical Limitations

- Limitation:

Software & App User Experience (UX)

Impact:High

Solution Approach:Invest heavily in a dedicated UX/UI design team. Adopt a more agile, user-centric software development lifecycle to modernize the Garmin Connect app and compete with the seamless experience of platforms like Apple Health.

- Limitation:

Cross-Platform Integration

Impact:Medium

Solution Approach:Ensure seamless data flow and a consistent user experience across the web platform, mobile apps, and dozens of different hardware devices of varying ages and capabilities.

Operational Bottlenecks

- Bottleneck:

Global Supply Chain Complexity

Growth Impact:Potential for production delays and inventory shortages, especially for new product launches.

Resolution Strategy:Continue leveraging vertical integration for control. Diversify sourcing of key components and enhance supply chain visibility with advanced analytics to anticipate and mitigate disruptions.

- Bottleneck:

Managing a Diverse Product Portfolio

Growth Impact:Increased overhead in R&D, manufacturing, and marketing. Can lead to customer confusion and cannibalization.

Resolution Strategy:Implement a disciplined product lifecycle management process. Periodically rationalize the product lineup to eliminate underperforming SKUs and focus resources on high-growth areas.

Market Penetration Challenges

- Challenge:

Intense Competition from Big Tech

Severity:Critical

Mitigation Strategy:Double down on the core brand promise: building purpose-built, durable devices for serious enthusiasts and professionals. Differentiate on battery life, reliability, and specialized features rather than competing directly on 'smart' features where Apple has an ecosystem advantage.

- Challenge:

Market Saturation in Core Segments

Severity:Major

Mitigation Strategy:Expand into adjacent markets (e.g., corporate wellness, digital health). Attract new demographics by creating more accessible, lifestyle-oriented products without diluting the core brand identity.

- Challenge:

Consumer Price Sensitivity

Severity:Minor

Mitigation Strategy:Maintain a tiered product offering with clear value propositions at each price point. Emphasize total cost of ownership (no mandatory subscription for core features, durability) versus competitors. User reviews sometimes note high prices.

Resource Limitations

Talent Gaps

- •

AI/Machine Learning Specialists

- •

Subscription & Retention Marketing Experts

- •

Cloud Infrastructure Engineers

- •

Mobile UX/UI Designers

Low. The company is financially robust with a strong balance sheet and free cash flow, capable of funding growth initiatives and strategic acquisitions internally.

Infrastructure Needs

Enhanced data analytics and AI infrastructure to process user data and deliver personalized insights at scale.

Upgraded back-end platform to support a growing subscription services business.

Growth Opportunities

Market Expansion

- Expansion Vector:

B2B / Garmin Health

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Build a dedicated enterprise sales force to target corporate wellness programs, insurance companies, and healthcare providers. Develop custom solutions and leverage the API/SDKs for deep integration.

- Expansion Vector:

Geographic Expansion in Asia Pacific

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Establish localized marketing and distribution strategies. Adapt product features and pricing for markets like India and Southeast Asia, which are forecasted to be high-growth regions for wearables.

- Expansion Vector:

Demographic: Mainstream Health-Conscious Consumers

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Develop and market products (like the Venu series) that balance advanced health tracking with lifestyle aesthetics and ease of use to compete more directly with Apple and Fitbit for a less hardcore athletic audience.

Product Opportunities

- Opportunity:

Premium Subscription Tiers (Garmin Connect+)

Market Demand Evidence:Industry trend and competitor success (Whoop, Fitbit Premium). Recent launch of Connect+ validates this direction.

Strategic Fit:High

Development Recommendation:Carefully manage the rollout to avoid alienating existing users. Focus on delivering clear, undeniable value in the premium tier, such as AI-powered coaching, advanced performance analytics, and personalized training plans.

- Opportunity:

Advanced Health Monitoring Devices (e.g., Blood Pressure, CGM integration)

Market Demand Evidence:Growing trend of medical-grade consumer wearables and remote patient monitoring.

Strategic Fit:High

Development Recommendation:Pursue strategic partnerships with medical device companies and navigate the required regulatory approvals (e.g., FDA clearance) to introduce clinically validated health features.

- Opportunity:

Expanding the Auto OEM Business

Market Demand Evidence:This segment is showing very high growth (30%+), driven by shipments of domain controllers to clients like BMW.

Strategic Fit:High

Development Recommendation:Leverage existing relationships and proven technology to secure long-term contracts with other major automotive manufacturers for integrated cockpit and navigation systems.

Channel Diversification

- Channel:

Corporate & Enterprise Sales

Fit Assessment:High

Implementation Strategy:Create a dedicated 'Garmin Health for Business' sales team and support structure. Develop bundled offerings of devices and software platforms for corporate wellness and insurance partners.

- Channel:

Partnerships with Health/Fitness Platforms

Fit Assessment:High

Implementation Strategy:Deepen existing integrations with platforms like Strava and MyFitnessPal. Explore co-marketing or exclusive feature partnerships to drive user acquisition for both platforms.

- Channel:

Insurtech and Digital Health Providers

Fit Assessment:High

Implementation Strategy:Position Garmin as the premier hardware provider for digital health programs that require reliable, high-quality biometric data. Leverage the Garmin Health API and SDKs as a key selling point.

Strategic Partnerships

- Partnership Type:

Health Insurance Providers

Potential Partners

- •

UnitedHealth Group

- •

Aetna

- •

Cigna

Expected Benefits:Integration into wellness programs to incentivize healthy behavior, reduce claims, and create a B2B sales channel for devices.

- Partnership Type:

Automotive Manufacturers

Potential Partners

- •

BMW (existing)

- •

Mercedes-Benz

- •

Ford

Expected Benefits:Secure long-term, high-volume contracts for in-vehicle infotainment and navigation systems, driving growth in the Auto OEM segment.

- Partnership Type:

Medical Technology Companies

Potential Partners

- •

Dexcom

- •

Abbott (Freestyle Libre)

- •

Omron Healthcare

Expected Benefits:Integrate medical-grade sensors and data (e.g., continuous glucose monitoring, blood pressure) into the Garmin ecosystem, enhancing the value proposition for health-focused users.

Growth Strategy

North Star Metric

Weekly Active Engaged Users

This shifts focus from one-time hardware sales to long-term ecosystem value. An 'engaged' user would be defined as someone who actively logs activities, tracks health metrics, or interacts with community features. This metric directly correlates with retention, brand loyalty, and the potential for future recurring revenue.

15% year-over-year growth in Weekly Active Engaged Users.

Growth Model

Ecosystem-Led Growth

Key Drivers

- •

Hardware as an acquisition tool (attracting users into the ecosystem).

- •

Software (Garmin Connect) as the retention engine (creating stickiness and engagement).

- •

Data and insights as the expansion loop (driving upgrades and new service adoption).

Prioritize investment in the Garmin Connect platform to make it an indispensable life-management tool. Market the ecosystem's benefits, not just the device's features. Use data from the ecosystem to inform new hardware and software development.

Prioritized Initiatives

- Initiative:

Accelerate Garmin Health B2B Go-to-Market

Expected Impact:High

Implementation Effort:Medium

Timeframe:12-18 months

First Steps:Hire a seasoned leader for the Garmin Health division and build out a dedicated enterprise sales team. Develop three standardized solution packages for the corporate wellness, insurance, and remote patient monitoring markets.

- Initiative:

Launch 'Garmin Coach AI' within Connect+

Expected Impact:High

Implementation Effort:High

Timeframe:9-12 months

First Steps:Acquire or build a team of data scientists and AI engineers. Develop a roadmap for personalized, AI-driven insights and adaptive training plans to be the flagship feature of the new subscription tier.

- Initiative:

Streamline the Watch Portfolio and Website Journey

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:6-9 months

First Steps:Conduct a full portfolio analysis to identify redundancy. Invest in a truly interactive 'Watch Finder' experience on the website that uses a conversational UI to guide customers to the perfect product.

Experimentation Plan

High Leverage Tests

- Test:

A/B test different pricing and feature tiers for the Garmin Connect+ subscription.

Hypothesis:A lower-priced 'Insights' tier and a higher-priced 'Coaching' tier may increase overall subscriber conversion.

- Test:

Pilot a hardware trade-in program for a specific product line (e.g., Forerunner).

Hypothesis:Offering a credit for old devices will increase upgrade velocity and direct-to-consumer sales.

- Test:

Run targeted marketing campaigns focused on specific competitor weaknesses (e.g., battery life vs. Apple Watch).

Hypothesis:Highlighting key differentiators will improve conversion rates from users considering competitor products.

Utilize an A/B testing platform for web/app experiments. Track key metrics including conversion rate, subscription attach rate, average revenue per user (ARPU), and customer lifetime value (LTV).

Bi-weekly sprint cycle for digital marketing and user journey tests. Monthly review of larger strategic pilots.

Growth Team