eScore

gehealthcare.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

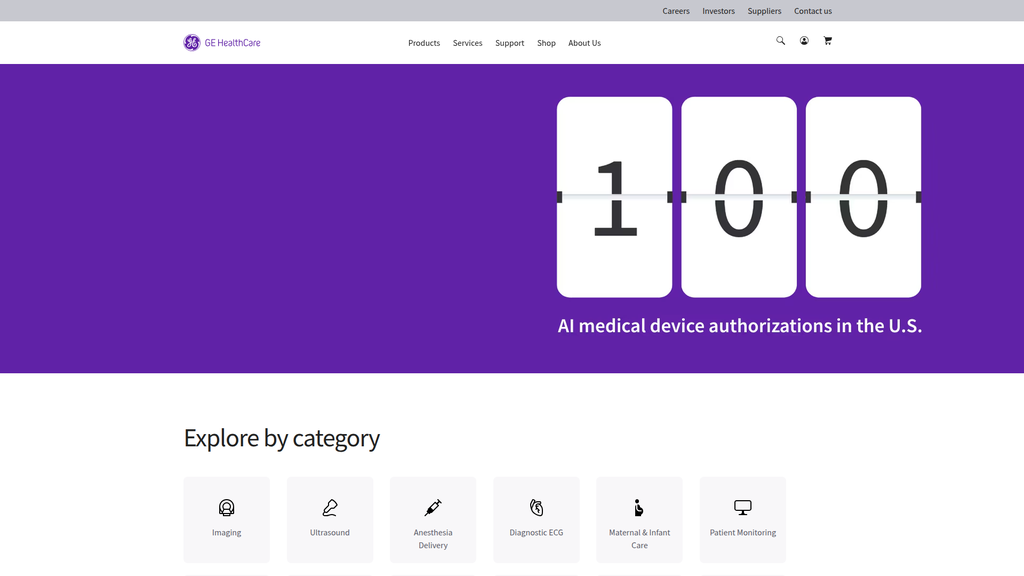

GE HealthCare has a formidable digital presence, characterized by high content authority and strong brand recognition which translates to excellent performance in branded search. The website's content effectively positions them as a thought leader, particularly in AI-enabled devices and digital health solutions, aligning well with the research-intensive search intent of their B2B audience. While their global digital footprint is extensive, there is an opportunity to enhance local market penetration with more region-specific content. Voice search optimization is likely strong for informational queries due to their authoritative content, though not explicitly optimized.

Exceptional content authority and brand reputation that strongly aligns with the complex, solution-oriented search intent of healthcare decision-makers.

Develop and deploy more localized thought leadership content for high-growth geographic markets (e.g., Asia-Pacific) to address specific regional challenges and improve non-branded search visibility.

The brand's messaging is highly consistent and effectively tailored to different B2B personas, including hospital administrators, clinicians, and IT managers. The core value proposition of 'precision care' driven by AI and digital efficiency is clear and well-differentiated from competitors. However, the communication lacks a strong emotional connection, with an over-reliance on technical specifications and a notable absence of customer testimonials or patient impact stories. The website's calls-to-action are functional but passive, representing a missed opportunity for more persuasive conversion messaging.

Crystal-clear messaging hierarchy that effectively communicates a complex value proposition, tailored to distinct B2B personas by focusing on efficiency, outcomes, and technical robustness.

Incorporate customer-centric storytelling by launching a 'Customer Spotlight' program with video testimonials and case studies to add social proof and create a stronger emotional connection with the audience.

The website provides an excellent cross-device experience with a clean layout and intuitive navigation, reducing user friction from a technical standpoint. Accessibility standards are clearly a priority, broadening market reach and ensuring compliance. However, deeper content pages suffer from high cognitive load due to dense, text-heavy layouts, and key calls-to-action are visually passive ('ghost buttons' or text links), which likely hinders lead generation. The primary friction points are not on the website itself, but in the long, complex B2B procurement cycles inherent to the industry.

Excellent mobile responsiveness and a clean, uncluttered layout provide a seamless and professional user experience across all devices.

Systematically elevate all key calls-to-action (CTAs) to be high-contrast, visually prominent buttons to increase click-through rates and more effectively guide users toward conversion pathways.

Credibility is exceptionally high, built on the 125-year GE legacy, extensive third-party validation through numerous FDA authorizations, and a wealth of trust signals like quantifiable R&D investment and patient impact data. The company demonstrates robust risk mitigation through comprehensive legal policies, strong security commitments for its digital products, and proactive regulatory engagement. The primary weakness is a lack of transparency in specific areas like pricing and a critical gap in customer success evidence, with no visible case studies or testimonials on the main site.

World-class third-party validation, particularly its leadership in FDA-authorized AI-enabled devices, which serves as a powerful and defensible proof point of innovation and credibility.

Increase customer success evidence by prominently featuring in-depth case studies and ROI models on product and solution pages to substantiate value claims and support B2B buyer decision-making.

GE HealthCare possesses multiple sustainable competitive advantages, forming a deep and defensible moat. Its massive global installed base of over 5 million devices creates significant customer stickiness and a recurring revenue stream from services. This is compounded by a powerful brand reputation, a comprehensive and integrated product portfolio, and substantial investment in innovation, particularly in AI. While competitors are strong, the difficulty in replicating GE HealthCare's scale, service network, and regulatory expertise makes its position very secure.

The massive global installed base of equipment, which creates formidable switching costs and provides a captive market for high-margin, recurring revenue from services, consumables, and digital upgrades.

Develop a vendor-neutral AI integration platform (an 'app store' model) to leverage the installed base, neutralize threats from niche AI startups, and own the operational ecosystem, further increasing switching costs.

The business model is highly scalable, leveraging a global sales and service network to efficiently introduce new solutions. The strategic shift towards high-margin, recurring revenue from SaaS, services, and consumables demonstrates strong unit economics health. Clear market expansion signals exist with strategies for emerging markets and new healthcare segments, though this is tempered by the complexities of global regulatory approvals and intense competition. The growth model is not viral but is built on a robust enterprise sales engine and strategic partnerships.

A powerful hybrid business model that combines high-value capital equipment sales with highly scalable, high-margin recurring revenue from services, consumables, and a rapidly growing portfolio of SaaS solutions.

Pilot and scale 'Equipment-as-a-Service' (EaaS) models to lower the upfront capital barrier for customers, accelerating adoption of new technology and converting more of the business to a recurring revenue model.

The business model demonstrates exceptional coherence, particularly following the spin-off which sharpened its strategic focus on 'Precision Care'. There is clear alignment between its value proposition (improving efficiency and outcomes), its key activities (R&D in AI and digital), and its revenue model (shifting to SaaS and recurring revenue). Market timing for this digital pivot is excellent, aligning with major industry trends toward data-driven healthcare. Resource allocation is clearly directed at strategic growth areas, indicating strong execution of its core strategy.

An exceptionally clear and focused strategy centered on 'Precision Care', which aligns all aspects of the business—from R&D investment in AI to the revenue model's shift to digital—towards a single, coherent goal.

Further integrate the sustainability message ('Healthier planet, healthier people') into the core value proposition to better align with the ESG (Environmental, Social, and Governance) goals of large hospital systems.

GE HealthCare is a dominant player in a med-tech oligopoly, consistently ranking as a top-three leader with stable market share. The company exhibits significant pricing power due to its premium brand positioning and technological innovation. Its market influence is substantial, demonstrated by its ability to shape industry trends with its leadership in AI. While competition is intense from peers like Siemens Healthineers and Philips, GE HealthCare's scale, vast installed base, and comprehensive portfolio grant it considerable leverage with partners and customers.

Substantial market power derived from its position within a stable oligopoly, a massive installed base, and a comprehensive portfolio that allows it to act as a strategic, single-source partner for large health systems.

Expand 'in-country, for-country' product development in key emerging markets like China and India to more effectively compete with regional players on both price and feature relevance.

Business Overview

Business Classification

B2B Medical Technology & Equipment Manufacturing

B2B Digital Health & SaaS Provider

Healthcare Technology (MedTech)

Sub Verticals

- •

Medical Imaging

- •

Ultrasound

- •

Patient Care Solutions

- •

Pharmaceutical Diagnostics

- •

Healthcare IT & Cloud Solutions

Mature

Maturity Indicators

- •

Recent spin-off from General Electric (January 2023) to create a more focused, agile organization.

- •

Vast global installed base of over 4 million equipment units serving 1 billion+ patients annually.

- •

Significant annual R&D investment (~$1B) fueling continuous innovation, especially in AI.

- •

Long-standing brand reputation and history of over 125 years in the healthcare industry.

- •

Established global presence and distribution network in over 100 countries.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Imaging Equipment Sales

Description:Sale of high-value capital equipment such as MRI, CT, X-ray, and molecular imaging systems to hospitals and diagnostic centers. This is a primary, traditional revenue source.

Estimated Importance:Primary

Customer Segment:Large Hospital Systems, Specialty Clinics

Estimated Margin:Medium

- Stream Name:

Ultrasound Equipment Sales

Description:Sale of a wide range of ultrasound systems, from high-end console units to portable and handheld devices, for various clinical applications.

Estimated Importance:Primary

Customer Segment:Hospitals, Private Clinics, Outpatient Centers

Estimated Margin:Medium-High

- Stream Name:

Patient Care Solutions

Description:Sales of patient monitoring systems, anesthesia delivery, diagnostic cardiology (ECG), and maternal/infant care equipment.

Estimated Importance:Secondary

Customer Segment:Hospitals, Acute Care Facilities

Estimated Margin:Medium

- Stream Name:

Pharmaceutical Diagnostics (PDx)

Description:Sale of contrast media and radiopharmaceuticals used to enhance the visibility of tissues and organs during imaging procedures. This is a significant source of recurring, high-margin revenue.

Estimated Importance:Secondary

Customer Segment:Hospitals, Imaging Centers

Estimated Margin:High

- Stream Name:

Services & Maintenance Contracts

Description:Long-term service agreements for the maintenance, repair, and support of the large installed base of equipment, providing a stable, recurring revenue stream.

Estimated Importance:Primary

Customer Segment:All Equipment Owners

Estimated Margin:High

- Stream Name:

Digital Solutions & SaaS

Description:Subscription-based revenue from digital offerings, including cloud-based enterprise imaging solutions (Genesis portfolio), AI-powered analytics, and workflow management software. This is a key strategic growth area.

Estimated Importance:Tertiary

Customer Segment:Large Hospital Systems, Integrated Delivery Networks

Estimated Margin:High

Recurring Revenue Components

- •

Long-term service and maintenance contracts

- •

Software-as-a-Service (SaaS) subscriptions for digital platforms

- •

Sales of consumable pharmaceutical diagnostic agents

Pricing Strategy

Value-Based & Capital Equipment Sales; evolving to include Subscription (SaaS)

Premium

Opaque

Pricing Psychology

- •

Bundling (equipment with service and software)

- •

Enterprise Agreements (long-term, multi-product partnerships)

- •

Prestige Pricing (leveraging brand and technology leadership)

Monetization Assessment

Strengths

- •

Diversified revenue across equipment, services, consumables, and software.

- •

Large installed base creates a significant, high-margin recurring revenue stream from service contracts.

- •

High-margin Pharmaceutical Diagnostics (PDx) segment provides a strong, recurring consumables business.

- •

Strategic shift to SaaS models creates a scalable, high-growth, and predictable revenue future.

Weaknesses

Heavy reliance on large, cyclical capital expenditures from healthcare providers, which can be affected by economic downturns.

Long sales cycles for major equipment purchases can lead to lumpy revenue recognition.

Opportunities

- •

Expand 'as-a-service' models for equipment to lower upfront capital barriers for customers.

- •

Monetize aggregated, anonymized data through analytics platforms to provide population health insights.

- •

Increase penetration of AI-powered software upgrades to the existing installed base.

Threats

- •

Increased price pressure from competitors and budget-constrained healthcare systems.

- •

Shift towards value-based care may lead to new purchasing models that challenge traditional capital equipment sales.

- •

Geopolitical risks and tariffs impacting supply chains and profitability.

Market Positioning

Technology and Innovation Leader in Precision Health

Market Leader (Top 3)

Target Segments

- Segment Name:

Large Hospital Systems & Integrated Delivery Networks (IDNs)

Description:Large, multi-site healthcare organizations requiring enterprise-wide, integrated solutions for imaging, patient monitoring, and data management.

Demographic Factors

- •

High patient volume

- •

Multiple locations/departments

- •

Significant IT infrastructure

Psychographic Factors

- •

Focus on operational efficiency and cost reduction

- •

Value interoperability and data integration

- •

Seeking long-term strategic partners

Behavioral Factors

- •

Engage in long-term enterprise agreements

- •

Centralized purchasing decisions

- •

High adoption rate for new technology

Pain Points

- •

Data silos between departments and systems

- •

Clinician burnout and workforce shortages.

- •

Managing large and growing volumes of medical data.

- •

Pressure to reduce operational costs

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Specialty Clinics & Outpatient Imaging Centers

Description:Private or specialized medical facilities (e.g., radiology, cardiology, women's health clinics) that require specific, high-performance diagnostic equipment.

Demographic Factors

Focused on specific care pathways (e.g., oncology, cardiology)

Smaller scale than large hospitals

Psychographic Factors

Prioritize clinical efficacy and diagnostic accuracy

Brand reputation and reliability are key decision factors

Behavioral Factors

Purchase decisions often made by physician-owners

Value total cost of ownership over the equipment's lifecycle

Pain Points

- •

Budget constraints for high-end capital equipment

- •

Need for high patient throughput

- •

Keeping up with the latest diagnostic technology

Fit Assessment:Good

Segment Potential:Medium

- Segment Name:

Academic & Research Institutions

Description:University hospitals and medical research centers that require cutting-edge technology for clinical research, trials, and advancing medical science.

Demographic Factors

Affiliated with universities

Receive research grants and funding

Psychographic Factors

Driven by innovation and discovery

Value research collaboration with industry partners

Behavioral Factors

Early adopters of novel technologies

Purchase decisions influenced by research needs and grant specifications

Pain Points

- •

Access to the most advanced, pre-commercial technology

- •

Managing complex research data sets

- •

Translating research into clinical practice

Fit Assessment:Excellent

Segment Potential:Medium

Market Differentiation

- Factor:

Integrated Hardware, Software, and Consumables Portfolio

Strength:Strong

Sustainability:Sustainable

- Factor:

Leadership in AI-enabled Medical Devices (FDA Authorizations)

Strength:Strong

Sustainability:Sustainable

- Factor:

Vast Global Installed Base and Service Network

Strength:Strong

Sustainability:Sustainable

- Factor:

Strong Brand Legacy and Trust

Strength:Strong

Sustainability:Sustainable

Value Proposition

To create a world where healthcare has no limits by providing integrated solutions, services, and data analytics that enable precision care, making hospitals more efficient, clinicians more effective, and patients healthier.

Excellent

Key Benefits

- Benefit:

Improved Operational Efficiency

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

AI-powered workflow solutions (e.g., AIR Recon DL for faster MRI scans).

- •

Cloud-based platforms (Genesis) to reduce IT overhead.

- •

Enterprise partnerships to optimize technology and service delivery.

- Benefit:

Enhanced Diagnostic Confidence

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Advanced imaging technology with high-fidelity detail.

- •

AI algorithms to aid in detection and characterization.

- •

High-margin pharmaceutical diagnostics for clearer scans.

- Benefit:

Integrated Patient View

Importance:Important

Differentiation:Unique

Proof Elements

- •

Vendor Neutral Archive (VNA) solutions to unify patient data.

- •

Digital ecosystem (Edison Platform) integrating data from multiple sources.

- •

Strategic partnerships with health systems like Sutter Health and UCSF.

Unique Selling Points

- Usp:

Pioneering use of AI and deep learning embedded directly into imaging devices to improve speed and quality.

Sustainability:Long-term

Defensibility:Strong

- Usp:

The only major imaging vendor with an in-house pharmaceutical diagnostics business, creating a synergistic advantage.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Comprehensive 'Precision Care' strategy, connecting smart devices, digital solutions, and targeted therapies.

Sustainability:Long-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Managing overwhelming volumes of unstructured healthcare data.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Workforce shortages and clinician burnout.

Severity:Critical

Solution Effectiveness:Partial

- Problem:

Fragmented data across disparate IT systems.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Pressure on healthcare providers to reduce costs while improving outcomes.

Severity:Major

Solution Effectiveness:Partial

Value Alignment Assessment

High

GE HealthCare's focus on AI, digital transformation, and efficiency directly addresses the most pressing trends and challenges in the global healthcare market, such as workforce shortages and data overload.

High

The value proposition of integrated, efficient, and intelligent solutions is perfectly aligned with the needs of their primary target segment: large, complex hospital systems striving for better integration and operational excellence.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Cloud Providers (e.g., Amazon Web Services).

- •

Major Health Systems (e.g., Sutter Health, UCSF, Ascension).

- •

Technology Companies (e.g., Enlitic for AI data migration).

- •

Academic & Research Institutions (e.g., UW–Madison).

- •

Pharmaceutical Companies (for developing diagnostic agents).

Key Activities

- •

Research & Development (especially in AI and digital health).

- •

Manufacturing of complex medical devices.

- •

Global sales and marketing.

- •

Providing installation, maintenance, and support services.

- •

Developing and deploying cloud-based software solutions.

Key Resources

- •

Extensive patent portfolio and intellectual property in AI and imaging.

- •

Global service and support infrastructure.

- •

Large, loyal customer base and installed equipment base.

- •

High-value brand reputation and legacy.

- •

Skilled workforce of engineers, data scientists, and clinical specialists.

Cost Structure

- •

Research & Development expenses.

- •

Cost of Goods Sold (COGS) for manufacturing.

- •

Sales, General & Administrative (SG&A) expenses.

- •

Costs associated with maintaining a global service network.

Swot Analysis

Strengths

- •

Dominant market position in key segments like Ultrasound and Imaging.

- •

Comprehensive, integrated portfolio spanning hardware, software, and consumables.

- •

Strong brand equity and long-standing customer relationships.

- •

Leadership in AI with a high number of FDA-cleared AI-enabled devices.

- •

Large installed base provides a stable, high-margin service revenue stream.

Weaknesses

- •

Legacy hardware business model can have long, cyclical sales cycles.

- •

Mature end markets may limit organic growth opportunities.

- •

Higher exposure to supply chain disruptions compared to some peers.

Opportunities

- •

Accelerate the shift to recurring revenue through SaaS and cloud solutions (e.g., Genesis Portfolio).

- •

Leverage the vast installed base to upsell AI and digital workflow solutions.

- •

Expand strategic enterprise partnerships with large health systems.

- •

Growth in emerging markets and demand for precision medicine.

Threats

- •

Intense competition from established players (Siemens Healthineers, Philips) and nimble new entrants.

- •

Stringent and evolving global regulatory landscapes (e.g., FDA).

- •

Cybersecurity risks associated with connected medical devices and cloud data.

- •

Economic pressures on healthcare provider budgets and global tariff uncertainties.

Recommendations

Priority Improvements

- Area:

Digital Solution Adoption

Recommendation:Develop streamlined onboarding processes and flexible pricing tiers for the Genesis portfolio to accelerate adoption among small and mid-sized hospitals, not just large enterprises.

Expected Impact:High

- Area:

Service Model Innovation

Recommendation:Pilot and scale 'Equipment-as-a-Service' (EaaS) or pay-per-scan models for key imaging modalities to convert large capital expenditures into predictable operating expenses for customers.

Expected Impact:High

- Area:

Portfolio Integration

Recommendation:Further invest in the Edison platform to ensure seamless data flow and a unified user experience across all product categories, from imaging devices to patient monitors, to fully deliver on the 'integrated solutions' promise.

Expected Impact:Medium

Business Model Innovation

- •

Develop a data monetization strategy that offers anonymized, aggregated insights from its vast network of devices to pharmaceutical companies, researchers, and public health organizations.

- •

Launch a certified third-party developer marketplace on the Edison platform, allowing other health-tech innovators to build and sell applications, creating a powerful ecosystem effect.

- •

Create a dedicated consulting and workflow optimization arm that leverages its deep expertise to redesign clinical pathways for hospital clients, moving beyond technology provision to holistic operational improvement.

Revenue Diversification

- •

Expand the direct-to-clinician channel with portable, AI-enabled devices (like handheld ultrasound) sold through a more direct, e-commerce-like model.

- •

Build out remote patient monitoring solutions as a service, leveraging patient care solutions expertise to tap into the growing home healthcare market.

- •

Increase investment and focus on the radiopharmaceutical pipeline, moving beyond diagnostics to therapeutic agents (theranostics).

GE HealthCare stands as a mature, formidable leader in the medical technology industry, currently navigating a pivotal strategic evolution. The recent spin-off from its parent, General Electric, has instilled a renewed focus, allowing the company to aggressively pursue a future centered on 'Precision Care.' Its traditional business model, anchored by the sale and service of high-value imaging and patient care equipment, remains a robust foundation, providing significant market share and a large, loyal customer base. However, the true catalyst for future growth and competitive differentiation lies in its strategic pivot towards becoming an integrated digital health and SaaS provider.

The launch of the Genesis cloud portfolio and the consistent rollout of AI-enabled devices are not merely product extensions; they represent a fundamental transformation of the business model. This evolution aims to shift the revenue mix towards more predictable, high-margin, recurring streams from software and consumables (Pharmaceutical Diagnostics). This strategy directly addresses the core pain points of its primary customers—large hospital systems—who are grappling with data overload, operational inefficiencies, and clinician burnout. By positioning itself as a strategic partner that integrates smart devices with intelligent software, GE HealthCare is moving up the value chain from an equipment vendor to a holistic solutions provider.

The primary challenges will be managing the cultural and operational shift from a hardware-centric to a software-first mindset, accelerating the adoption of its new digital platforms, and fending off intense competition from both legacy giants like Siemens Healthineers and Philips, and a new wave of agile health-tech startups. The company's success will be defined by its ability to leverage its immense scale and installed base as a launchpad for its digital ecosystem, effectively converting its hardware customers into long-term software subscribers and creating a more scalable, defensible, and profitable business model for the next decade.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

High R&D and Capital Investment

Impact:High

- Barrier:

Stringent Regulatory Approvals (e.g., FDA, EMA)

Impact:High

- Barrier:

Established Sales Channels & Service Networks

Impact:High

- Barrier:

Intellectual Property & Patents

Impact:High

- Barrier:

Brand Reputation and Customer Trust

Impact:Medium

- Barrier:

High Customer Switching Costs (Training, Integration)

Impact:Medium

Industry Trends

- Trend:

Integration of Artificial Intelligence (AI) and Machine Learning

Impact On Business:Critical for improving diagnostic accuracy, workflow efficiency, and creating new service lines. GE HealthCare's leadership in FDA AI authorizations is a key advantage.

Timeline:Immediate

- Trend:

Shift to Cloud-Based and SaaS Models

Impact On Business:Moves revenue from one-time capital sales to recurring models. Increases need for robust, secure, and interoperable digital platforms like GE's new Genesis portfolio.

Timeline:Immediate

- Trend:

Focus on Enterprise-Wide, Integrated Solutions

Impact On Business:Healthcare providers are seeking to consolidate vendors. This favors large players like GE that can offer a broad, integrated portfolio over niche, best-of-breed solutions.

Timeline:Near-term

- Trend:

Personalized and Precision Medicine

Impact On Business:Drives demand for advanced imaging and diagnostic tools that can inform tailored treatment paths. GE's Pharmaceutical Diagnostics and molecular imaging agents are well-positioned.

Timeline:Near-term

- Trend:

Growth of Telehealth and Remote Patient Monitoring

Impact On Business:Creates opportunities for portable and connected devices, and the software platforms to manage them. Philips has been particularly strong in this area.

Timeline:Near-term

- Trend:

Increased Competition from Localized Manufacturing in Emerging Markets

Impact On Business:Policies in countries like China and India favor domestic manufacturers, increasing competition and pricing pressure for international vendors like GE.

Timeline:Long-term

Direct Competitors

- →

Siemens Healthineers

Market Share Estimate:Leading or close second in many imaging segments; reported €21.7 billion revenue in 2023.

Target Audience Overlap:High

Competitive Positioning:A technology leader with a strong, comprehensive portfolio across imaging, laboratory diagnostics, and advanced therapies.

Strengths

- •

Dominant market share in key imaging modalities like CT and MRI.

- •

Strong portfolio in laboratory diagnostics, an area where GE is less focused.

- •

Aggressive R&D and innovation, such as their photon-counting CT platform.

- •

Broad portfolio makes them an attractive partner for large health networks looking to consolidate vendors.

- •

Acquisition of Varian solidified their leadership in radiation oncology.

Weaknesses

Historically has had a multiplatform setup in diagnostics that they are now working to streamline.

Like other large players, can be outmaneuvered by more agile, niche competitors in specific sub-segments.

Differentiators

- •

Deep integration of diagnostics and imaging.

- •

Strong focus on digital health and enterprise services.

- •

Leadership position in advanced therapies and radiation oncology via Varian.

- →

Philips Healthcare (Koninklijke Philips N.V.)

Market Share Estimate:A major player, with a strong focus on connected care and personal health alongside diagnostics.

Target Audience Overlap:High

Competitive Positioning:Focuses on integrated solutions across the health continuum, from healthy living to diagnosis, treatment, and home care.

Strengths

- •

Leader in image-guided therapy, patient monitoring, and health informatics.

- •

Strong brand in consumer health, which can be leveraged in the home care and remote monitoring markets.

- •

Clear strategic focus on connected care and digital health platforms (e.g., HealthSuite).

- •

Strong position in the mHealth and telehealth solutions market.

Weaknesses

- •

Recent product recalls have impacted brand reputation and financials.

- •

Some customers have expressed frustration during the transition to new platforms like their Vue PACS.

- •

Divested its anesthesia business, a segment where GE is still active.

Differentiators

- •

'Health continuum' strategy that connects consumer and professional healthcare.

- •

Leadership in specific areas like cardiac ultrasound and remote patient monitoring.

- •

Strong platform-based approach to data integration with HealthSuite.

- →

Canon Medical Systems

Market Share Estimate:A significant player, but smaller than the top three.

Target Audience Overlap:Medium

Competitive Positioning:An innovation-focused provider of high-end diagnostic imaging systems.

Strengths

- •

Strong legacy of innovation from its Toshiba Medical Systems heritage.

- •

Reputation for high-quality CT, MRI, and ultrasound systems.

- •

Focus on AI-powered automation platforms to improve workflow.

- •

Backed by the global technology and R&D prowess of Canon Inc.

Weaknesses

- •

Less comprehensive portfolio compared to the 'big three' (GE, Siemens, Philips).

- •

Smaller global sales and service footprint.

- •

Less emphasis on enterprise-wide software solutions and services.

Differentiators

Deep focus purely on diagnostic imaging excellence.

Collaborative development approach with medical and research institutions.

Indirect Competitors

- →

Healthcare AI Startups (e.g., Qure.ai, Rad AI, Aidoc)

Description:Agile companies developing best-in-class AI algorithms for specific diagnostic tasks (e.g., stroke detection, nodule identification). They often integrate with existing PACS systems.

Threat Level:Medium

Potential For Direct Competition:Low (more likely to be partners or acquisition targets, but they challenge the value proposition of incumbent AI offerings).

- →

Enterprise IT & Cloud Providers (e.g., Oracle Health, Microsoft Azure, AWS)

Description:Provide the underlying cloud infrastructure (like AWS for GE's Genesis) but also offer their own healthcare data platforms, potentially competing at the data management and analytics layer.

Threat Level:Medium

Potential For Direct Competition:Medium (They are unlikely to build scanners, but can compete fiercely in the high-margin healthcare data, VNA, and AI platform space).

- →

Regional Competitors in Emerging Markets (e.g., Shenzhen Mindray, Shanghai United Imaging)

Description:Companies in markets like China that benefit from local manufacturing policies and can offer competitive products at a lower price point, challenging GE's market share in those key growth regions.

Threat Level:Medium

Potential For Direct Competition:Medium (Initially regional, but with potential for global expansion).

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Massive Global Installed Base

Sustainability Assessment:The 5M+ installed equipment base creates significant customer stickiness, high switching costs, and a consistent, high-margin revenue stream from service and consumables.

Competitor Replication Difficulty:Hard

- Advantage:

Brand Reputation and Longevity

Sustainability Assessment:Over 125 years in the industry creates a deep well of trust with healthcare providers, which is crucial for high-stakes medical purchasing decisions.

Competitor Replication Difficulty:Hard

- Advantage:

Comprehensive and Integrated Product Portfolio

Sustainability Assessment:Ability to be a single-source vendor for imaging, patient monitoring, and digital solutions is a powerful advantage as health systems look to consolidate partners.

Competitor Replication Difficulty:Hard

- Advantage:

Global Sales and Service Network

Sustainability Assessment:A vast, experienced network for sales, installation, and maintenance is a major operational moat that new entrants cannot easily replicate.

Competitor Replication Difficulty:Hard

- Advantage:

Regulatory Expertise

Sustainability Assessment:Deep experience navigating complex global regulatory frameworks (FDA, EMA, etc.) allows for more efficient product approvals and market access.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'Leadership in FDA-Authorized AI Algorithms', 'estimated_duration': '1-3 years. Competitors are investing heavily in AI and will likely close the gap in the number of authorizations.'}

{'advantage': 'First-Mover Advantage with New Technologies (e.g., specific imaging techniques)', 'estimated_duration': '2-4 years. Competitors are fast followers and will develop comparable technologies.'}

Disadvantages

- Disadvantage:

Customer Sentiment on Certain IT Products

Impact:Major

Addressability:Moderately

- Disadvantage:

Incumbent Size and Complexity

Impact:Minor

Addressability:Difficult

- Disadvantage:

High Price Point vs. Regional Competitors

Impact:Major

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Launch an aggressive marketing campaign for the Genesis cloud portfolio targeting the existing installed base.

Expected Impact:High

Implementation Difficulty:Easy

- Recommendation:

Prominently feature 'Leader in FDA AI Authorizations' in all digital marketing and sales collateral to reinforce innovation leadership.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Create bundled offerings of hardware, software (Genesis), and AI solutions to increase switching costs.

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Develop a formal partnership/integration program for third-party AI startups to run on GE's digital platforms, creating an 'app store' ecosystem.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Invest in improving customer experience and support for digital solutions to address negative sentiment found in KLAS reports.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Expand 'in-country, for-country' product development in key emerging markets to compete with local players.

Expected Impact:High

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Transition the business model further towards recurring revenue by prioritizing SaaS, service contracts, and consumable sales over one-time equipment sales.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Invest in R&D for predictive analytics and operational efficiency tools that move beyond diagnostics to help hospitals manage workflows and reduce costs.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Explore strategic acquisitions of innovative AI or digital health companies to acquire new capabilities and talent, as done with Caption Health.

Expected Impact:High

Implementation Difficulty:Moderate

Solidify GE HealthCare's position as the premier 'Precision Care' partner by deeply integrating hardware, software, and AI. The messaging should focus on being the most reliable, innovative, and comprehensive solutions provider that helps health systems improve both clinical outcomes and operational efficiency.

Differentiate through the seamless integration of a vast portfolio. While competitors may excel in individual niches, GE's strength lies in providing an end-to-end, AI-enabled ecosystem from the scanner to the cloud, simplifying procurement, training, and data management for complex health systems.

Whitespace Opportunities

- Opportunity:

AI-Powered Hospital Operations Management

Competitive Gap:Most competitors focus their AI on clinical diagnostics. There is a significant gap in providing a platform that uses AI to optimize patient scheduling, equipment utilization, staffing, and supply chain management.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Vendor-Neutral AI Integration Platform

Competitive Gap:Hospitals use equipment from multiple vendors. A truly vendor-neutral software platform that can ingest data from any source and run a marketplace of AI algorithms (both GE's and third-party) would be a powerful, sticky solution.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Sustainable/Green Medical Equipment Solutions

Competitive Gap:As hospitals become more environmentally conscious, there is a growing demand for medical equipment with lower energy consumption, refurbished options, and sustainable lifecycle management. This is currently an underserved market dimension.

Feasibility:High

Potential Impact:Medium

- Opportunity:

Turnkey Diagnostic Solutions for Underserved/Rural Markets

Competitive Gap:The major players focus on high-end systems for large hospitals. There is an opportunity to create bundled, lower-cost, and easier-to-operate 'clinic-in-a-box' imaging solutions for rural and developing markets.

Feasibility:Medium

Potential Impact:High

GE HealthCare operates in the mature and highly concentrated medical technology industry, which functions as an oligopoly dominated by itself, Siemens Healthineers, and Philips Healthcare. The barriers to entry are exceptionally high due to immense capital requirements for R&D, stringent global regulations, and the necessity of a vast sales and service network. The company's recent spin-off from General Electric and its strong emphasis on becoming a more focused, agile healthcare leader is a timely strategic move. The key competitive battleground is shifting rapidly from hardware specifications to the integration of software, AI, and cloud services. GE HealthCare's stated leadership in FDA-authorized AI algorithms and the launch of its Genesis cloud portfolio are critical assets in this fight.

Its primary competitors, Siemens and Philips, pose a formidable threat. Siemens Healthineers is a powerhouse in core imaging and has a significant advantage with its strong laboratory diagnostics division, allowing for a more comprehensive diagnostic offering. Philips differentiates itself with a 'health continuum' strategy, effectively linking clinical solutions with a strong consumer and home healthcare presence. Both competitors are investing heavily in their own digital ecosystems. GE's core sustainable advantage is its massive installed base, which provides a captive audience for high-margin services, consumables, and software upgrades. This, combined with its comprehensive product portfolio and trusted brand, creates a powerful defensive moat.

However, the company faces challenges. Customer sentiment data, particularly from KLAS Research, indicates weaknesses in its IT and software offerings, with some users citing poor value and relationships. This is a critical vulnerability as the company pivots to a more software-centric model. Furthermore, GE faces 'competition from all angles', including agile AI startups that can innovate faster in niche areas and increasingly capable regional competitors in key growth markets like China who compete aggressively on price.

Strategic whitespace exists in moving beyond clinical diagnostics into AI-driven operational intelligence for hospitals—optimizing workflows, patient flow, and asset management. Developing a truly open, vendor-neutral platform for AI integration could also be a game-changing move, shifting the competitive dynamic from selling individual products to owning the ecosystem. To win, GE HealthCare must leverage its installed base to drive adoption of its new digital platforms, address customer service gaps in its software divisions, and continue to innovate at the intersection of hardware and intelligent software, proving it can be the single, integrated 'Precision Care' partner for the modern, data-driven health system.

Messaging

Message Architecture

Key Messages

- Message:

Leading healthcare AI innovation.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Banner

- Message:

We are driven by our purpose to create a world where healthcare has no limits.

Prominence:Primary

Clarity Score:Medium

Location:Homepage 'About Us' section, Company Mission

- Message:

As a stand-alone company, GE HealthCare is a leader in precision care, infusing innovation with patient-focused technologies to enable better care.

Prominence:Secondary

Clarity Score:High

Location:Homepage 'Introducing our new era' section

- Message:

Digitizing healthcare, driving productivity to improve the lives of patients, and creating meaningful efficiencies for providers.

Prominence:Secondary

Clarity Score:High

Location:Company Mission, reflected in Press Release content

- Message:

GE HealthCare advances its cloud strategy by unveiling the Genesis portfolio to improve speed of digital innovation adoption.

Prominence:Tertiary

Clarity Score:High

Location:Press Release Headline

The message hierarchy is logical and well-structured. The primary message on the homepage immediately establishes 'AI innovation' as the core focus, which aligns with current industry trends and is a strong differentiator. Secondary messages effectively support this by explaining the 'how' (precision care, digitization) and the 'why' (a world without limits, better patient care). The transition from the high-level brand promise on the homepage to specific product innovations in the press release is clear and effective.

Messaging is highly consistent across the homepage and the press release. The theme of leveraging technology (AI, Cloud) to drive efficiency and improve patient care is central to both. The press release on the 'Genesis portfolio' serves as a concrete proof point for the broader claims of 'leading AI innovation' and 'digitizing healthcare' made on the homepage. This creates a cohesive and believable narrative.

Brand Voice

Voice Attributes

- Attribute:

Authoritative & Confident

Strength:Strong

Examples

- •

Leading healthcare AI innovation

- •

As a stand-alone company, GE HealthCare is a leader in precision care

- •

tops FDA's list of AI authorizations

- Attribute:

Innovative & Forward-Looking

Strength:Strong

Examples

- •

Building a healthier future we can thrive in

- •

Introducing our new era

- •

advances its cloud strategy

- Attribute:

Professional & Corporate

Strength:Strong

Examples

- •

Stay up to date on GE HealthCare’s plans for growth as a standalone company.

- •

a portfolio of cloud enterprise imaging software-as-a-service (SaaS) solutions

- •

facilitate interoperability through centralized patient data storage

- Attribute:

Aspirational & Purpose-Driven

Strength:Moderate

Examples

create a world where healthcare has no limits

Healthier planet, healthier people

Tone Analysis

Professional

Secondary Tones

- •

Innovative

- •

Confident

- •

Aspirational

Tone Shifts

The tone shifts from broadly aspirational and strategic on the homepage to more technical and benefit-oriented in the press release, which is appropriate for the respective audiences.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

GE HealthCare provides integrated, AI-powered digital solutions and medical technologies that enable healthcare providers to improve operational efficiency, deliver more precise and personalized care, and improve patient outcomes.

Value Proposition Components

- Component:

AI Leadership & Innovation

Clarity:Clear

Uniqueness:Unique

Details:Backed by the claim of topping the FDA's list of AI authorizations for 4 years, this is a clear and defensible differentiator.

- Component:

Improved Efficiency & Productivity

Clarity:Clear

Uniqueness:Somewhat Unique

Details:Messaging consistently highlights making hospitals more efficient and clinicians more effective, addressing key customer pain points like budget constraints and staff shortages.

- Component:

Precision & Personalized Care

Clarity:Clear

Uniqueness:Somewhat Unique

Details:The concept of 'precision care' is a central theme, linking technology innovation directly to better, more individualized patient therapies and diagnostics.

- Component:

Cloud-Enabled Scalability & Access

Clarity:Clear

Uniqueness:Common

Details:The 'Genesis portfolio' press release clearly outlines the value of cloud solutions (reduced costs, easier access), a common but necessary offering in the digital health space.

GE HealthCare differentiates itself effectively through its asserted leadership in AI, backed by specific proof points (FDA authorizations). While competitors like Siemens Healthineers and Philips also focus on innovation and digital health, GE's messaging is heavily and successfully weighted towards AI leadership. The legacy of the GE brand, combined with the narrative of a newly agile, standalone company, creates a unique positioning of established credibility and forward-thinking focus.

The messaging positions GE HealthCare as a legacy leader aggressively pivoting to the future of digital health. It is not positioned as a disruptive startup, but as an established partner for digital transformation. This directly competes with Siemens Healthineers' 'pioneering breakthroughs' and Philips' 'innovation and you' narratives, but with a more explicit emphasis on AI and data analytics at the enterprise level.

Audience Messaging

Target Personas

- Persona:

Hospital Administrators & C-Suite

Tailored Messages

- •

creating meaningful efficiencies for providers, health systems, and researchers

- •

make hospitals more efficient

- •

reduce operational costs, and maintain robust security standards

Effectiveness:Effective

- Persona:

Clinicians (e.g., Radiologists)

Tailored Messages

- •

clinicians more effective, therapies more precise

- •

Allows healthcare providers to more easily store, access, and manage large volumes of medical images

- •

streamline workflows, and support radiologists and caregivers

Effectiveness:Effective

- Persona:

Healthcare IT Managers

Tailored Messages

- •

GE HealthCare advances its cloud strategy

- •

reduce infrastructure investments and operational costs

- •

deployed on the Amazon Web Services (AWS), architected to be the most secure cloud computing environment

Effectiveness:Effective

Audience Pain Points Addressed

- •

Budget constraints and the need to reduce operational/IT costs

- •

Staffing shortages and clinician burnout

- •

Increasing volume and complexity of patient data

- •

Difficulty in managing and accessing large volumes of medical images

- •

High cost and complexity of on-premises IT infrastructure

Audience Aspirations Addressed

- •

Accelerating digital transformation efforts

- •

Improving patient care coordination and outcomes

- •

Delivering precise and timely patient care

- •

Creating a more resilient and sustainable healthcare system

Persuasion Elements

Emotional Appeals

- Appeal Type:

Aspiration & Hope

Effectiveness:Medium

Examples

Building a healthier future we can thrive in

create a world where healthcare has no limits

- Appeal Type:

Trust & Security

Effectiveness:High

Examples

- •

Serving patients and providers for more than 125 years

- •

provide high levels of security for sensitive healthcare data

- •

collaboration with Enlitic

- •

deployed on the Amazon Web Services (AWS)

Social Proof Elements

- Proof Type:

Quantifiable Achievements

Impact:Strong

Examples

- •

~$1B Annual R&D & product investment spend in 2021

- •

5M+ Installed base equipment

- •

1B+ Patients served annually

- •

tops FDA's list of AI authorizations for 4th year

- Proof Type:

Industry Events

Impact:Moderate

Examples

The Genesis portfolio will be showcased at the Healthcare Information and Management Systems Society (HIMSS) 2025 conference

Trust Indicators

- •

Legacy GE brand name (used under license)

- •

Explicit mention of 'robust security standards'

- •

Partnership with AWS, a trusted cloud provider

- •

Prominent links to Compliance, Privacy Policy, and Security

- •

Large, quantifiable data points on R&D investment, installed base, and patients served

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

Learn more

Location:Homepage Hero Banner, Career opportunities section

Clarity:Clear

- Text:

About us

Location:Homepage 'Building a healthier future' section

Clarity:Clear

- Text:

Read more

Location:Homepage 'Investors' section

Clarity:Clear

- Text:

Sign up for updates

Location:Homepage 'Get in touch' section

Clarity:Clear

The CTAs are clear, well-placed, and appropriate for a B2B audience focused on information gathering. They effectively guide users deeper into the site based on their interests (e.g., general info, investor relations, careers). However, they are passive and lack strong, benefit-oriented verbs. There's an opportunity to test more action-oriented CTAs like 'Explore our AI solutions' or 'See how we improve efficiency' to increase engagement.

Messaging Gaps Analysis

Critical Gaps

- •

Lack of direct customer voice: There are no testimonials, case studies, or quotes from hospital administrators or clinicians, which would significantly strengthen social proof.

- •

Vague patient impact stories: While the ultimate goal is to help patients, the messaging lacks specific, tangible stories of how these technologies improve a patient's journey or outcome. Competitors sometimes use more emotive storytelling to connect with audiences on a human level.

- •

Minimal segmentation for different provider sizes: The messaging seems geared towards large hospitals and health systems. There is little content that speaks directly to the needs and challenges of smaller clinics or specialized practices.

Contradiction Points

No itemsUnderdeveloped Areas

The 'New Era' narrative: The website states GE HealthCare is a 'stand-alone company' but doesn't fully articulate what this new independence and focus means for its customers. This could be a powerful story about increased agility, customer focus, and innovation speed.

Sustainability message: 'Healthier planet, healthier people' is mentioned as a 'What's new' item but isn't integrated into the core value proposition. Competitors like Philips are making sustainability a central part of their brand message.

Messaging Quality

Strengths

- •

Strong, clear positioning as a leader in healthcare AI.

- •

Excellent consistency in messaging across different website sections.

- •

Effective use of large-scale data points and statistics to build credibility and authority.

- •

Clear articulation of benefits (efficiency, precision) that address key B2B customer pain points.

Weaknesses

- •

Over-reliance on corporate and technical jargon can make the content feel impersonal.

- •

Lack of human-centric storytelling (patient or clinician stories) to create an emotional connection.

- •

Calls-to-action are functional but passive and could be more persuasive.

- •

The visual presentation of key messages is text-heavy; more infographics or dynamic content could improve engagement.

Opportunities

- •

Develop a robust case study program featuring diverse healthcare providers to add authenticity and social proof.

- •

Create persona-based content hubs that address the specific challenges and goals of hospital leaders, clinicians, and IT managers.

- •

Build out the 'standalone company' narrative to emphasize benefits like agility and customer-centric innovation.

- •

Integrate the sustainability message more deeply into the brand narrative to appeal to ESG-focused stakeholders.

Optimization Roadmap

Priority Improvements

- Area:

Social Proof & Storytelling

Recommendation:Launch a 'Customer Spotlight' section featuring video testimonials and in-depth case studies from key personas (e.g., hospital CEOs, heads of radiology). Showcase measurable outcomes like reduced costs, improved workflow times, or diagnostic accuracy.

Expected Impact:High

- Area:

Value Proposition Narrative

Recommendation:Create a dedicated landing page or video explaining the 'New Era' as a standalone company. Clearly articulate the top 3 benefits this brings to customers (e.g., 'More Focused Innovation', 'Faster Decision Making', 'Deeper Partnerships').

Expected Impact:High

- Area:

Audience Segmentation

Recommendation:Develop dedicated messaging tracks and solution pages for different segments, such as large integrated health networks vs. outpatient imaging centers, highlighting the most relevant products and benefits for each.

Expected Impact:Medium

Quick Wins

- •

Revise key CTAs to be more benefit-driven. For example, change 'Learn More' under the AI banner to 'Explore Our AI Innovations'.

- •

Incorporate customer quotes directly onto the homepage and key product pages.

- •

Create a simple infographic visualizing the key data points (~$1B R&D, 5M+ equipment, 1B+ patients) to make them more digestible.

Long Term Recommendations

- •

Develop a comprehensive thought leadership platform with content (articles, webinars, reports) that addresses future healthcare challenges, solidifying the brand's position as a forward-thinking partner, not just a vendor.

- •

Build an interactive solution finder tool that guides different user personas to the most relevant products and content based on their specific needs and challenges.

- •

Invest in creating more emotive brand storytelling content that connects the high-tech solutions to their ultimate human impact, showcasing patient and clinician journeys.

GE HealthCare's strategic messaging is highly effective at positioning the company as an authoritative and innovative leader in the medical technology space, with a specific and defensible stronghold in AI. The message architecture is clear and consistent, successfully translating a high-level corporate vision of 'a world where healthcare has no limits' into tangible value propositions like improved efficiency and precision care for its B2B audience. The brand voice is confident and professional, leveraging the credibility of the GE legacy while signaling a new era of focus as a standalone entity.

The primary strength lies in the clarity of its value proposition for hospital administrators and IT departments, directly addressing critical pain points such as budget constraints, data management complexity, and the need for digital transformation. The use of large, impressive data points (~$1B in R&D, 1B+ patients served) serves as powerful social proof, building a strong foundation of trust and scale.

However, the messaging exhibits significant gaps in emotional resonance and human-centric storytelling. It communicates effectively from a business-to-business perspective but lacks the voice of the customer—the clinicians and, by extension, the patients who benefit from the technology. Competitors like Siemens Healthineers have demonstrated the power of emotive campaigns (e.g., turning MRI noises into children's stories), an area where GE HealthCare's messaging is underdeveloped. The calls-to-action, while clear, are passive and information-based, representing a missed opportunity to drive deeper, more action-oriented engagement.

The key strategic opportunity is to enrich the current logical, data-driven messaging with authentic human stories. By showcasing real-world case studies, clinician testimonials, and patient impact narratives, GE HealthCare can bridge the gap between its impressive technology and its ultimate purpose. Furthermore, fleshing out the 'standalone company' narrative with specific customer benefits would sharpen its competitive edge, transforming a corporate restructuring event into a compelling reason for customers to partner with them for the future of healthcare.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Established global leader in medical technology with a massive installed base of over 5 million pieces of equipment.

- •

Serves over 1 billion patients annually, indicating widespread market adoption and trust.

- •

Broad and diversified product portfolio across key healthcare segments including Imaging, Ultrasound, Patient Care Solutions, and Pharmaceutical Diagnostics.

- •

Consistent annual revenue of approximately $19.7 billion, demonstrating sustained market demand.

- •

Strong focus on innovation, evidenced by ~$1B annual R&D investment and leadership in AI-enabled medical devices with a high number of FDA authorizations.

Improvement Areas

- •

Accelerate the integration of digital and AI solutions across the entire product portfolio to meet the growing demand for data-driven healthcare.

- •

Enhance interoperability of devices and software with existing hospital IT systems and Electronic Health Records (EHRs).

- •

Strengthen value propositions to align with the shift towards value-based care, focusing on how GE HealthCare's solutions improve patient outcomes and reduce overall healthcare costs.

Market Dynamics

Medical Devices Market projected to grow at a CAGR of ~7%; AI in Medical Imaging at ~34-36%; Healthcare Cloud Computing at ~16-17%.

Mature

Market Trends

- Trend:

Increased adoption of AI and Machine Learning for diagnostics and workflow automation.

Business Impact:Creates significant opportunities for GE HealthCare's AI-focused digital solutions to gain market share, improve diagnostic accuracy, and enhance operational efficiency for clients.

- Trend:

Shift to value-based care models.

Business Impact:Requires a shift from selling standalone products to providing integrated solutions that demonstrate clear clinical and economic outcomes. This pressures pricing but creates opportunities for partnership-based models.

- Trend:

Rapid adoption of cloud computing and SaaS models in healthcare.

Business Impact:Supports GE HealthCare's strategic pivot towards recurring revenue models through offerings like the Genesis cloud portfolio, reducing upfront capital expenditure for customers.

- Trend:

Growing importance of cybersecurity in connected medical devices.

Business Impact:Increases development complexity and regulatory scrutiny, but also offers a competitive advantage for companies that can ensure robust data security.

Excellent. The market is at an inflection point where digital transformation, AI, and data analytics are becoming critical. GE HealthCare's recent spin-off and strategic focus on these areas position it well to capture growth.

Business Model Scalability

High

Moderately high fixed costs related to R&D and manufacturing, but a growing software and services component introduces highly scalable, high-margin revenue streams.

High. As a market leader with a global footprint, GE HealthCare can leverage its existing sales, service, and distribution networks to introduce new products and digital solutions efficiently.

Scalability Constraints

- •

Complex and country-specific regulatory approval processes can slow down the rollout of new products and software.

- •

Supply chain disruptions for specialized components can impact hardware production.

- •

Integration complexity with diverse and often legacy hospital IT infrastructure.

Team Readiness

Strong. The leadership team, led by CEO Peter Arduini, has articulated a clear strategy focused on precision care, innovation, and financial discipline since the spin-off.

Well-suited. Operating as a standalone, healthcare-focused company allows for greater agility and a more targeted allocation of resources compared to its prior structure within the broader GE conglomerate.

Key Capability Gaps

- •

Need for deeper expertise in cloud-native software development, data science, and AI/ML talent to accelerate the digital transformation.

- •

Expansion of commercial teams skilled in selling complex, subscription-based enterprise software solutions (SaaS) rather than just capital equipment.

- •

Specialized talent in navigating value-based care contracting and partnership models with large health systems.

Growth Engine

Acquisition Channels

- Channel:

Direct Enterprise Sales Force

Effectiveness:High

Optimization Potential:Medium

Recommendation:Equip the sales force with skills to sell integrated, outcome-based solutions and long-term strategic partnerships rather than transactional equipment sales. Focus on C-suite engagement.

- Channel:

Strategic Partnerships (e.g., with health systems like Ascension)

Effectiveness:High

Optimization Potential:High

Recommendation:Expand strategic partnerships with large health systems globally, co-developing solutions that address their specific operational and clinical challenges. This creates a moat and ensures long-term revenue.

- Channel:

Digital Marketing & Content (Insights Articles, Whitepapers)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Develop targeted, persona-based content marketing campaigns for hospital administrators, IT leaders, and clinical department heads. Use analytics to track engagement and generate qualified leads for the sales team.

- Channel:

Channel Partners & Distributors

Effectiveness:Medium

Optimization Potential:Medium

Recommendation:Enhance training and incentive programs for distributors to effectively sell and support new digital and AI-powered solutions, particularly in emerging markets.

Customer Journey

Primarily a long, complex B2B sales cycle involving multiple stakeholders (clinicians, IT, procurement, C-suite). The journey starts with awareness created by brand reputation, events, and content, leading to engagement with the direct sales team.

Friction Points

- •

Lengthy and complex procurement and contracting processes within hospitals.

- •

Difficulty in demonstrating clear ROI for new technologies amidst tight hospital budgets.

- •

Integration challenges with existing multi-vendor environments and legacy IT systems.

- •

Navigating internal hospital politics and getting buy-in from all relevant departments.

Journey Enhancement Priorities

{'area': 'ROI & Value Proposition', 'recommendation': "Develop interactive ROI calculators and detailed case studies that clearly articulate the financial and clinical benefits of GE HealthCare's solutions, tailored to specific hospital needs."}

{'area': 'Implementation & Integration', 'recommendation': "Create a dedicated 'Integration Services' team to streamline the deployment of digital solutions, offering clear roadmaps and support to de-risk the purchasing decision for hospital IT departments."}

Retention Mechanisms

- Mechanism:

Long-Term Service & Maintenance Contracts

Effectiveness:High

Improvement Opportunity:Bundle proactive, AI-driven predictive maintenance services with equipment contracts to increase value and reduce unplanned downtime, further embedding GE HealthCare into hospital operations.

- Mechanism:

Software Subscriptions (SaaS)

Effectiveness:Medium

Improvement Opportunity:Drive adoption of cloud-based SaaS solutions like the Genesis portfolio to shift customers from one-time capital purchases to recurring revenue relationships, increasing customer lifetime value.

- Mechanism:

Consumables & Pharmaceutical Diagnostics

Effectiveness:High

Improvement Opportunity:Leverage the installed base of imaging equipment to drive recurring sales of proprietary contrast media and molecular imaging agents.

- Mechanism:

Customer Training & Education

Effectiveness:Medium

Improvement Opportunity:Offer advanced clinical and technical training programs to ensure customers are maximizing the value of their equipment, which can lead to higher satisfaction, loyalty, and future upgrades.

Revenue Economics

Strong. The business model combines high-value initial equipment sales with long-term, high-margin recurring revenue from service, consumables, and increasingly, software subscriptions.

High (Undeterminable from public data, but implied by long customer relationships, high switching costs, and significant recurring revenue streams).

High. The company demonstrates consistent revenue generation and profitability, with recent net income margin improvements.

Optimization Recommendations

- •

Aggressively scale the SaaS and cloud-based offerings to increase the proportion of high-margin, recurring revenue.

- •

Develop enterprise-wide platform solutions that lock in health systems and create up-sell and cross-sell opportunities across departments.

- •

Implement value-based pricing models where feasible, tying contract value to the achievement of specific, measurable patient and operational outcomes.

Scale Barriers

Technical Limitations

- Limitation:

Data Interoperability

Impact:High

Solution Approach:Champion and heavily invest in open standards and APIs. Actively partner with EHR vendors and other medical device manufacturers to create seamless data exchange ecosystems. Position the Genesis VNA as a central hub for enterprise imaging data.

- Limitation:

Legacy Product Architecture

Impact:Medium

Solution Approach:Continue the strategic shift towards cloud-native applications. For existing hardware, develop 'edge' solutions (like in the Genesis portfolio) that enable connectivity and data flow to the cloud, bridging the gap between legacy systems and modern architecture.

Operational Bottlenecks

- Bottleneck:

Global Supply Chain Complexity

Growth Impact:Can delay equipment delivery and increase costs, impacting revenue and margins.

Resolution Strategy:Further diversify the supplier base, increase regionalization of manufacturing where possible, and use advanced analytics for better demand forecasting and inventory management.

- Bottleneck:

Long Sales and Implementation Cycles

Growth Impact:Slows revenue recognition and increases the cost of customer acquisition.

Resolution Strategy:Standardize and streamline implementation processes for digital solutions. Develop modular offerings that allow for faster 'land and expand' sales motions.

Market Penetration Challenges

- Challenge:

Intense Competition from Siemens Healthineers, Philips, and others.

Severity:Critical

Mitigation Strategy:Differentiate through a superior, integrated ecosystem of hardware, software, and AI. Focus on strategic partnerships with major health systems to create deep, defensible relationships. Compete on total value and outcomes, not just on product features.

- Challenge:

Capital Budget Constraints in Hospitals

Severity:Major

Mitigation Strategy:Aggressively promote SaaS and other subscription-based models that shift customer spend from CapEx to OpEx, lowering the initial barrier to adoption for new technology.

- Challenge:

Navigating Diverse Global Regulatory Landscapes

Severity:Major

Mitigation Strategy:Maintain a world-class regulatory affairs team and design products with a 'global-first' mindset, incorporating flexibility to meet varying international standards from the outset.

Resource Limitations

Talent Gaps

- •

Senior Cloud Architects and Engineers

- •

AI/Machine Learning Research Scientists with healthcare domain expertise

- •

Enterprise SaaS Sales Executives

- •

Cybersecurity specialists for connected medical devices

Sustained high investment in R&D (~$1B+ annually) is critical to maintain technology leadership. Additional capital may be required for strategic acquisitions of innovative AI/software startups.

Infrastructure Needs

Expansion of global cloud infrastructure (in partnership with providers like AWS) to support the growth of SaaS offerings.

Investment in advanced cybersecurity operations centers to monitor and protect the vast network of connected devices.

Growth Opportunities

Market Expansion

- Expansion Vector:

Geographic Expansion in Emerging Markets (Asia-Pacific)

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Develop market-specific products that are more affordable and tailored to local needs. Establish local partnerships for distribution, service, and manufacturing to navigate regulatory hurdles and build trust.

- Expansion Vector:

Expansion into Ambulatory Surgical Centers and Outpatient Clinics

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Develop and market more compact, cost-effective imaging and monitoring solutions specifically designed for the needs and budgets of non-hospital settings, which is a high-growth end-user segment.

Product Opportunities

- Opportunity:

AI-Powered Clinical Decision Support Tools

Market Demand Evidence:The AI in Medical Imaging market is growing at over 30% CAGR, driven by the need to improve diagnostic accuracy and reduce radiologist workload.

Strategic Fit:Perfectly aligns with the 'precision care' strategy and leverages existing leadership in medical imaging.

Development Recommendation:Accelerate development of AI algorithms for disease detection, quantification, and prediction. Integrate these tools seamlessly into existing imaging workflows and digital platforms. Pursue both in-house development and strategic acquisitions of AI startups.

- Opportunity:

Remote Patient Monitoring and Virtual Care Platforms

Market Demand Evidence:The shift to care outside the hospital is a major trend, accelerated by the pandemic and the need for cost-effective management of chronic diseases.

Strategic Fit:Expands the Patient Care Solutions business beyond the hospital walls and creates new recurring revenue streams.

Development Recommendation:Develop a comprehensive, secure, and user-friendly platform that integrates wearable sensors and home-based monitoring devices with GE HealthCare's hospital-based systems, providing a continuous patient view.

Channel Diversification

- Channel:

Direct-to-Consumer (for specific products)

Fit Assessment:Low to Medium. Only applicable for a small subset of products like certain handheld ultrasound devices (e.g., Vscan Air for specific professional segments).

Implementation Strategy:Explore targeted e-commerce strategies for specific, lower-cost professional devices, bypassing traditional institutional sales channels where appropriate.

- Channel:

Partnerships with Technology Companies (e.g., Big Tech)

Fit Assessment:High

Implementation Strategy:Collaborate with major cloud providers (extending AWS partnership) and enterprise software companies (e.g., Salesforce, Microsoft) to co-market and integrate solutions, leveraging their reach into the healthcare IT space.

Strategic Partnerships

- Partnership Type:

AI & Data Analytics Startups

Potential Partners

Innovative startups specializing in radiological AI, genomic data analysis, or predictive analytics.

Expected Benefits:Acquire cutting-edge technology and talent, accelerate R&D cycles, and quickly fill portfolio gaps.

- Partnership Type:

Pharmaceutical & Life Sciences Companies

Potential Partners

Major pharma companies developing targeted therapies.

Expected Benefits:Co-develop companion diagnostics and imaging biomarkers to support new drug development and personalized medicine, creating a powerful, combined value proposition.

- Partnership Type:

Academic Medical Centers

Potential Partners

Leading research hospitals and universities globally.

Expected Benefits:Collaborate on research and validation of new technologies and AI algorithms, ensuring clinical relevance and generating evidence to support market adoption.

Growth Strategy

North Star Metric

Number of Enterprise Customers on a Recurring Revenue Platform

This metric shifts the focus from transactional hardware sales to building long-term, sticky relationships. It directly measures the success of the strategic pivot to digital and SaaS, which is crucial for sustainable, high-margin growth. It captures customer commitment, platform adoption, and future revenue potential.

Increase by 25% annually over the next 3 years.

Growth Model

Hybrid: Enterprise Sales-Led & Product-Led Growth

Key Drivers

- •

Deep, C-level relationships built by the enterprise sales team.

- •

Demonstrable clinical and economic outcomes from integrated solutions.

- •

Adoption of digital platforms and SaaS solutions that create network effects within a hospital system.

- •

A 'land and expand' strategy where an initial product sale leads to broader platform adoption.