eScore

genpt.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

The website demonstrates high intelligence for its core investor audience, aligning perfectly with search intent for financial data and corporate information. However, its overall digital presence is weak, with significant gaps in broader thought leadership content, which harms its authority on industry trends like vehicle electrification. The site lacks modern SEO practices like voice search optimization and its multi-channel strategy is not evident from the corporate site, which acts more as a data repository than a strategic communication platform.

The content is exceptionally well-aligned with the search intent of its primary target audience: investors and financial analysts seeking specific corporate data.

Develop a dedicated 'Industry Insights' hub with content on EVs, supply chain tech, and MRO trends to capture a wider audience and establish authority beyond financial reporting.

Brand communication is highly effective and consistent for its primary investor audience, successfully conveying a message of stability, scale, and reliability rooted in its long history. The messaging is well-segmented for investors and corporate partners, using emotional appeals to security to build trust. The primary weakness is a significant messaging gap regarding innovation and technology, making the brand appear conservative and less appealing to potential tech talent.

The messaging masterfully uses the company's long history (since 1928) and immense scale as powerful, tangible proof points for stability and market leadership.

Create a compelling, forward-looking innovation narrative on the website that showcases strategic investments in technology and the company's vision for the future of distribution.

For its specific purpose—information retrieval by investors—the site has a low cognitive load and clear information architecture. However, the overall user experience is hampered by a dated visual design, poor mobile responsiveness, and a lack of engaging micro-interactions. The most significant issue is the poor accessibility, which poses a medium legal risk and creates a major barrier for a segment of users, negatively impacting the business.

The information architecture is logical and the cognitive load is light, making it easy for the target user to find specific financial reports and corporate data.

Prioritize a full WCAG 2.1 AA accessibility audit and remediation to mitigate legal risk and ensure all users can access critical information.

The company scores exceptionally high in credibility due to its robust transparency, providing easy access to SEC filings, detailed financial reports, and clear corporate governance information. Trust signals are strong, leveraging a nearly 100-year history, the well-known NAPA brand, and its status as a stable dividend-paying S&P 500 company. The primary risk identified is not financial or operational but legal, stemming from the website's lack of accessibility compliance.

Exceptional transparency through detailed, easily accessible financial reporting and governance documents builds a very high level of trust with the investment community.

Publish a formal Accessibility Statement and remediate known issues to close the single most significant legal and reputational risk identified.

The company possesses a powerful and sustainable competitive moat built on its immense physical distribution network, the strong brand equity of NAPA, and its diversified presence across automotive and industrial sectors. These advantages are extremely difficult for competitors to replicate. However, the company's strength is undermined by a lack of visible innovation indicators, which creates a long-term threat as the industry shifts towards EVs and digitalization.

The vast, physical distribution network enables rapid parts availability, a critical factor for professional customers that is a durable and hard-to-replicate competitive advantage.

Invest in and prominently showcase innovation initiatives, particularly around EV parts and services, to prove the moat is adaptable to future market shifts.

The business has strong underlying unit economics and has proven its ability to expand globally through strategic acquisitions. However, its scalability is constrained by a capital-intensive model with high fixed costs tied to its physical footprint. Future growth is also hampered by legacy IT systems and a low level of automation maturity, requiring significant investment to unlock greater operational leverage.

The company has a clear and proven playbook for market expansion via strategic, bolt-on acquisitions in both domestic and international markets.

Modernize the technology stack, particularly by investing in a unified data platform and AI-driven supply chain tools, to improve operational efficiency and enable more agile scaling.

The business model is exceptionally coherent, with two primary revenue streams in counter-cyclical industries providing stability and diversification. The strategy is highly focused, and the value proposition of parts availability and expertise is perfectly aligned with the needs of its core B2B customer base. The model's only significant flaw is its market timing, as it appears to be reactive rather than proactive in addressing major technological shifts like electrification.

The diversification across the automotive aftermarket and industrial MRO sectors creates a resilient, financially stable business model that can weather downturns in any single industry.

Establish a dedicated business unit to accelerate the company's strategy for the EV market to address the critical issue of market timing and future-proof the revenue model.

Genuine Parts Company wields significant market power derived from its massive scale, dominant brand recognition (NAPA), and diversified market presence. This affords the company strong leverage with suppliers, pricing power in its markets, and the ability to influence industry standards through programs like NAPA AutoCare. Its steady market share trajectory and diversified customer base indicate a powerful and stable competitive position.

The combination of the NAPA brand's trust with professionals and the company's immense purchasing scale gives it significant pricing power and negotiating leverage.

Better leverage its market intelligence by publishing proprietary reports and insights, transforming its passive market knowledge into an active tool for market influence and thought leadership.

Business Overview

Business Classification

B2B and B2C Distributor

Franchisor (for NAPA Auto Parts)

Parts Distribution

Sub Verticals

Automotive Aftermarket

Industrial MRO (Maintenance, Repair, and Operations)

Mature

Maturity Indicators

- •

Established in 1928, demonstrating long-term market presence.

- •

Consistent dividend payments since 1948, indicative of financial stability.

- •

Large market capitalization (~$19.4B).

- •

Extensive global footprint with over 10,700 locations in 17 countries.

- •

Operates as a component of the S&P 500 index.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Automotive Parts Group Sales

Description:Sale of automotive replacement parts, accessories, and service items through a global network, primarily under the NAPA brand. This segment serves both commercial (Do-it-for-me/DIFM) and retail (Do-it-yourself/DIY) customers.

Estimated Importance:Primary

Customer Segment:Professional Repair Shops, DIY Consumers, Fleet Operators

Estimated Margin:Medium

- Stream Name:

Industrial Parts Group Sales

Description:Distribution of industrial replacement parts and supplies via its subsidiary, Motion Industries. This segment serves a wide range of MRO and OEM customers in industries like manufacturing, food and beverage, and mining.

Estimated Importance:Primary

Customer Segment:Industrial MRO & OEM Customers

Estimated Margin:Medium-High

Recurring Revenue Components

- •

Consumable parts sales to commercial auto repair shops

- •

MRO contracts with large industrial clients

- •

Franchise fees and royalties from independently-owned NAPA stores

Pricing Strategy

Tiered & Contract Pricing

Mid-range to Premium

Opaque

Pricing Psychology

- •

Volume discounts for commercial clients

- •

Contract-based pricing for large industrial customers

- •

Brand-value pricing (NAPA)

Monetization Assessment

Strengths

- •

Diversified revenue across two major, counter-cyclical segments (Automotive and Industrial).

- •

Strong brand recognition (NAPA) supports premium pricing.

- •

Massive scale and distribution network create purchasing power and logistical efficiencies.

Weaknesses

- •

Susceptibility to economic downturns that affect vehicle miles driven and industrial production.

- •

Complex global supply chain is vulnerable to disruptions.

- •

Margin pressure in the competitive automotive segment.

Opportunities

- •

Expand e-commerce capabilities for B2B clients in both segments.

- •

Increase the portfolio of higher-margin private-label products.

- •

Strategic acquisitions of smaller, regional distributors to consolidate market share.

- •

Develop services and parts offerings for the growing Electric Vehicle (EV) market.

Threats

- •

Intensifying competition from online-native parts retailers like Amazon.

- •

Long-term shift to EVs, which have fewer moving parts and different maintenance needs, potentially reducing demand for traditional replacement parts.

- •

Direct-to-consumer sales models from automotive OEMs.

Market Positioning

Service-oriented distribution leader, focusing on parts availability, speed, and expertise.

Significant player, but operates in a fragmented market. One of the top distributors in both the automotive aftermarket and industrial MRO spaces.

Target Segments

- Segment Name:

Professional Automotive Repair (DIFM)

Description:Independent repair shops, dealerships, and service stations that perform maintenance and repairs for consumers.

Demographic Factors

Small to medium-sized businesses

Psychographic Factors

Value reliability and trust in suppliers

Risk-averse regarding part quality and fitment

Behavioral Factors

- •

Frequent, small-batch orders

- •

Requires rapid, often same-day, delivery

- •

Relies on supplier's cataloging and technical support

Pain Points

- •

Vehicle downtime waiting for parts

- •

Incorrect parts leading to rework

- •

Managing inventory for a wide variety of vehicle models

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Industrial MRO & OEM

Description:Maintenance, repair, and operations departments within manufacturing plants, food processors, and other industrial facilities, as well as original equipment manufacturers (OEMs).

Demographic Factors

Medium to large enterprises across various sectors (manufacturing, energy, etc.).

Psychographic Factors

Focused on operational efficiency and minimizing downtime

Value technical expertise and broad product availability

Behavioral Factors

- •

Planned purchases based on maintenance schedules

- •

Urgent orders for unexpected breakdowns

- •

Often have integrated procurement systems

Pain Points

- •

Unplanned equipment downtime

- •

Sourcing specialized or legacy parts

- •

Managing a complex supply chain for maintenance parts

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Retail Automotive (DIY)

Description:Individual consumers who perform their own vehicle maintenance and repairs.

Demographic Factors

Varies widely, but often skews towards vehicle enthusiasts and budget-conscious owners

Psychographic Factors

- •

Enjoy hands-on work

- •

Seek value and may be price-sensitive

- •

Trust established brands

Behavioral Factors

- •

Infrequent, project-based purchases

- •

Seeks advice and guidance from store staff

- •

Increasingly shops and compares prices online.

Pain Points

- •

Lack of technical knowledge or confidence

- •

Access to specialty tools

- •

Identifying the correct part for their specific vehicle

Fit Assessment:Good

Segment Potential:Medium

Market Differentiation

- Factor:

Unmatched Distribution Network

Strength:Strong

Sustainability:Sustainable

- Factor:

Brand Recognition (NAPA)

Strength:Strong

Sustainability:Sustainable

- Factor:

Dual Market Presence (Auto & Industrial)

Strength:Strong

Sustainability:Sustainable

- Factor:

Breadth of Inventory

Strength:Strong

Sustainability:Temporary

Value Proposition

To be the leading global service provider of automotive and industrial replacement parts, delivering the right part at the right time through an extensive network, deep inventory, and knowledgeable service.

Excellent

Key Benefits

- Benefit:

Rapid Parts Availability

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Vast network of over 10,700 stores and distribution centers.

- Benefit:

Trusted Quality and Expertise

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Long-standing NAPA brand reputation since 1925.

Knowledgeable store and field personnel

- Benefit:

Comprehensive Product Catalog

Importance:Important

Differentiation:Somewhat unique

Proof Elements

Access to over 12 million industrial parts.

Extensive automotive parts catalog.

Unique Selling Points

- Usp:

Integrated Global Network Serving Two Distinct, Massive End Markets (Automotive and Industrial)

Sustainability:Long-term

Defensibility:Strong

- Usp:

Hybrid Model of Company-Owned and Independent Stores (NAPA)

Sustainability:Long-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Minimizing vehicle and equipment downtime for commercial customers.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Sourcing the correct, high-quality part for a specific application.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Managing procurement complexity for MRO supplies.

Severity:Major

Solution Effectiveness:Partial

Value Alignment Assessment

High

The business model is highly aligned with the core needs of both the automotive aftermarket and industrial MRO sectors, which prioritize availability, speed, and reliability.

High

GPC effectively serves its primary B2B customer segments (DIFM and Industrial MRO) by solving their most critical pain point: downtime. Its B2C offering is strong but faces more intense competition on price and convenience.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Automotive & Industrial Parts Manufacturers (e.g., Bosch, Delphi).

- •

Independent NAPA Store Owners.

- •

Logistics and Freight Providers (e.g., UPS, FedEx).

- •

Large Commercial and Fleet Accounts

- •

Technology Partners (e.g., Microsoft Azure, SAP).

Key Activities

- •

Global Supply Chain & Logistics Management

- •

Inventory Management and Procurement

- •

Store and Distribution Center Operations

- •

Sales and Marketing (B2B and B2C)

- •

Mergers & Acquisitions

Key Resources

- •

Global Network of >10,700 Stores & Distribution Centers.

- •

Strong Brand Equity (NAPA, Motion Industries).

- •

Vast Inventory of Parts (~19 million items for Motion).

- •

Experienced Workforce of >60,000 Teammates.

- •

Relationships with thousands of suppliers

Cost Structure

- •

Cost of Goods Sold (Inventory Procurement)

- •

Selling, General & Administrative (SG&A) Expenses (incl. labor, marketing)

- •

Logistics, Warehousing, and Freight Costs

- •

Store Operating and Lease Expenses

- •

Technology and E-commerce Infrastructure Investment

Swot Analysis

Strengths

- •

Dominant and diversified market presence in both automotive and industrial sectors.

- •

World-class distribution and logistics infrastructure providing a significant competitive moat.

- •

Strong brand equity and customer loyalty, especially with NAPA.

- •

Proven ability to grow through strategic acquisitions and integrate them effectively.

Weaknesses

- •

Legacy systems and infrastructure may be less agile than digital-native competitors.

- •

Complex, decentralized franchise model can lead to inconsistent customer experiences.

- •

Historically lower emphasis on e-commerce and digital channels compared to competitors.

- •

Potential for margin compression due to rising operating costs and competitive pressure.

Opportunities

- •

Digitally transform the B2B customer experience with advanced e-commerce, inventory management, and predictive ordering tools.

- •

Expand portfolio of parts and services for Electric Vehicles (EVs) and Advanced Driver-Assistance Systems (ADAS).

- •

Leverage data analytics for supply chain optimization, demand forecasting, and personalized marketing.

- •

Continue international expansion and consolidation in fragmented European and Asia-Pacific markets.

Threats

- •

The long-term shift to EVs threatens a significant portion of the traditional internal combustion engine (ICE) parts market.

- •

Intensifying competition from pure-play e-commerce platforms (e.g., Amazon, RockAuto) and vertically integrated players.

- •

Global supply chain volatility and geopolitical risks.

- •

Right-to-repair legislation could alter the competitive landscape and empower new entrants.

Recommendations

Priority Improvements

- Area:

Digital Transformation (B2B E-commerce)

Recommendation:Invest heavily in a unified, best-in-class B2B e-commerce platform for both NAPA and Motion Industries, featuring real-time inventory visibility, advanced search, and integration with customer procurement systems.

Expected Impact:High

- Area:

EV Strategy Development

Recommendation:Establish a dedicated business unit to develop a comprehensive EV strategy, focusing on sourcing EV-specific parts (batteries, thermal management, etc.), technician training programs, and diagnostic tools for repair shops.

Expected Impact:High

- Area:

Supply Chain Modernization

Recommendation:Implement AI and machine learning for demand forecasting and inventory optimization across the global network to improve efficiency, reduce carrying costs, and mitigate stockout risks.

Expected Impact:Medium

Business Model Innovation

- •

Develop a 'Service-as-a-Subscription' model for large fleets, offering predictive maintenance, guaranteed parts availability, and consolidated billing.

- •

Create a marketplace for hard-to-find or remanufactured parts, leveraging GPC's network to connect niche suppliers with customers.

- •

Vertically integrate into adjacent services by acquiring or partnering with technician training institutes or mobile repair service providers.

Revenue Diversification

- •

Expand service offerings to include diagnostics, software updates, and ADAS calibration services.

- •

Monetize anonymized sales and vehicle repair data by offering market trend insights to suppliers and financial institutions.

- •

Increase penetration of high-margin, private-label brands across all product categories.

Genuine Parts Company (GPC) represents a mature, highly successful, and resilient business model built on the foundational principles of distribution excellence: scale, availability, and service. Its dual-pronged strategy, serving the vast automotive aftermarket and the critical industrial MRO sector, provides significant revenue diversification and a hedge against sector-specific downturns. The company's primary competitive moat is its physical distribution network—an asset that is difficult and costly to replicate. However, this traditional strength faces a paradigm shift. The primary strategic challenge for GPC is not optimizing its current model, but evolving it to thrive in a future defined by two major disruptions: digitalization and vehicle electrification. The rise of e-commerce competitors threatens to erode the competitive advantage of physical proximity, while the transition to EVs will fundamentally alter the composition of parts demand, rendering a substantial portion of its current catalog obsolete over the long term. GPC's future success hinges on its ability to execute a dual transformation: defending its core business through operational excellence while aggressively investing in the digital capabilities and EV-related competencies that will define the next generation of parts distribution. Strategic initiatives focused on e-commerce, data analytics, and building an EV parts and services ecosystem are not just opportunities for growth, but existential imperatives for long-term market leadership.

Competitors

Competitive Landscape

Genuine Parts Company (GPC) operates as a dominant player in the mature and moderately concentrated automotive aftermarket and industrial MRO (Maintenance, Repair, and Operations) distribution industries through its key segments, NAPA Auto Parts and Motion Industries. The competitive landscape is characterized by intense rivalry among a few large, established players with extensive physical footprints, and growing pressure from digital-first entrants. GPC's primary advantage lies in its vast distribution network, strong brand equity (particularly NAPA's trust with professional mechanics), and diversification across two major, albeit cyclical, industries. However, the company faces significant long-term threats from the automotive industry's transition to electric vehicles (EVs), which have fewer replacement parts, and the increasing channel shift to e-commerce, championed by giants like Amazon and specialized online retailers. The key strategic challenge for GPC is to leverage its physical assets for rapid fulfillment while aggressively accelerating its digital transformation and building a strong position in the emerging EV aftermarket.

Mature

Moderately Concentrated

Barriers To Entry

- Barrier:

Extensive Distribution & Logistics Network

Impact:High

- Barrier:

Supplier Relationships & Sourcing Scale

Impact:High

- Barrier:

Brand Recognition & Trust (especially with professionals)

Impact:High

- Barrier:

High Capital Investment for Inventory and Real Estate

Impact:High

- Barrier:

Technical Expertise & Knowledgeable Sales Force

Impact:Medium

Industry Trends

- Trend:

Electrification of Vehicles (EVs)

Impact On Business:Reduces demand for traditional internal combustion engine (ICE) parts (e.g., filters, spark plugs), creating a need to pivot to EV-specific components (batteries, thermal systems, sensors).

Timeline:Long-term

- Trend:

Growth of E-commerce & Digital Channels

Impact On Business:Shifts customer purchasing behavior online, increasing competition from digital-first players and requiring significant investment in B2B/B2C platforms.

Timeline:Immediate

- Trend:

Increasing Vehicle Complexity & ADAS

Impact On Business:Drives demand for higher-margin, technologically advanced parts and requires ongoing investment in technician training and diagnostic tools.

Timeline:Near-term

- Trend:

Supply Chain Digitization & Resilience

Impact On Business:Creates pressure to improve inventory visibility, demand forecasting, and logistics efficiency to compete on availability and speed.

Timeline:Immediate

- Trend:

Market Consolidation

Impact On Business:Both an opportunity for strategic acquisitions and a threat as larger competitors gain scale and efficiency advantages.

Timeline:Near-term

Direct Competitors

- →

AutoZone, Inc.

Market Share Estimate:Leading (in DIY segment)

Target Audience Overlap:High

Competitive Positioning:Dominant retailer for the Do-It-Yourself (DIY) customer with a strong commercial (Do-It-For-Me/DIFM) program.

Strengths

- •

Strong brand recognition and retail presence in prime locations.

- •

Highly effective inventory management and supply chain.

- •

Successful loyalty program (AutoZone Rewards) driving repeat DIY business.

- •

Robust private label program (Duralast) with high margins.

Weaknesses

- •

Historically less focused on the professional/DIFM segment compared to NAPA or O'Reilly.

- •

Store model is heavily reliant on retail foot traffic.

- •

Perceived by some professionals as more DIY-oriented.

Differentiators

Leading brand in the DIY customer segment.

In-store services like free battery testing and loaner tools.

- →

O'Reilly Automotive, Inc.

Market Share Estimate:Leading (overall)

Target Audience Overlap:High

Competitive Positioning:Balanced 'dual-market' strategy effectively serving both DIY and professional customers.

Strengths

- •

Exceptional supply chain and parts availability, often considered best-in-class.

- •

Strong culture of customer service and employee expertise.

- •

Successful integration of acquisitions (e.g., CSK Auto).

- •

Well-balanced revenue from both DIY and professional customers.

Weaknesses

- •

Less international presence compared to GPC.

- •

Brand may not have the same historical resonance with older mechanics as NAPA.

- •

Faces intense competition on both the DIY and DIFM fronts simultaneously.

Differentiators

Superior logistics network with extensive hub-and-spoke system.

Strong emphasis on professional parts people.

- →

Advance Auto Parts, Inc.

Market Share Estimate:Significant

Target Audience Overlap:High

Competitive Positioning:Major player focused heavily on the professional (DIFM) market, especially after its Carquest acquisition.

Strengths

- •

Strong relationships with professional installers and repair shops.

- •

Owner of Worldpac, a leading distributor of original equipment (OE) import parts.

- •

Large store footprint and commercial delivery fleet.

Weaknesses

- •

Has faced significant operational and performance challenges in recent years.

- •

Lags behind AutoZone and O'Reilly in key financial metrics like sales growth and margins.

- •

E-commerce experience and integration have been areas of struggle.

Differentiators

Strong focus on the professional installer through Advance Pro and Carquest brands.

Worldpac provides a unique advantage in the import vehicle parts space.

- →

W.W. Grainger, Inc.

Market Share Estimate:Leading (in MRO)

Target Audience Overlap:High (for Motion Industries)

Competitive Positioning:High-service MRO distributor for businesses of all sizes, with a powerful e-commerce platform.

Strengths

- •

Best-in-class e-commerce platform with a vast 'endless assortment' of products.

- •

Strong brand reputation for reliability and service.

- •

Effective multi-channel model combining digital, sales reps, and branch network.

- •

Serves a very broad range of industries and customers.

Weaknesses

- •

Higher price point compared to some competitors.

- •

Less focus on providing deep technical services and fabrication compared to Motion.

- •

Large, complex catalog can be challenging for smaller customers to navigate.

Differentiators

Digital leadership in the MRO space.

High-touch, high-service customer model.

- →

Fastenal Company

Market Share Estimate:Significant (in MRO)

Target Audience Overlap:Medium

Competitive Positioning:On-site industrial distributor focused on becoming part of the customer's supply chain.

Strengths

- •

Unique and highly successful network of industrial vending machines and on-site locations.

- •

Deeply integrated into customer workflows, creating high switching costs.

- •

Strong focus on fasteners and safety supplies, dominating this niche.

- •

Efficient decentralized network of stores.

Weaknesses

- •

Less comprehensive offering in power transmission and fluid power compared to Motion Industries.

- •

Business model is dependent on securing physical space at customer locations.

- •

Brand is not as synonymous with general MRO as Grainger.

Differentiators

On-site and vending machine-based inventory management.

'Closer to the customer' physical presence.

Indirect Competitors

- →

Amazon (and Amazon Business)

Description:Global e-commerce giant offering a massive selection of automotive parts (DIY focus) and industrial supplies (MRO focus) with fast, convenient shipping.

Threat Level:High

Potential For Direct Competition:Already a direct competitor in many product categories, but lacks the specialized services, immediate availability for complex repairs, and deep B2B relationships of incumbents.

- →

RockAuto

Description:A pure-play online retailer of automotive parts known for its vast catalog and highly competitive pricing. Appeals to price-sensitive, knowledgeable DIY customers.

Threat Level:Medium

Potential For Direct Competition:A major force in the online DIY space, but its model does not serve the professional installer's need for speed, delivery, and local support.

- →

Original Equipment Manufacturers (OEMs)

Description:Vehicle and equipment manufacturers (e.g., Ford, Caterpillar) that sell their own branded replacement parts through dealer networks and directly.

Threat Level:Medium

Potential For Direct Competition:Always a competitor, especially for newer vehicles under warranty. The 'Right to Repair' movement could impact their control over the aftermarket.

- →

Large Retailers (e.g., Walmart, The Home Depot)

Description:Mass-market retailers that carry a limited selection of high-volume, simple automotive and industrial maintenance items (e.g., oil, wipers, basic tools).

Threat Level:Low

Potential For Direct Competition:Unlikely to expand into complex parts and services. They compete on price and convenience for basic maintenance items.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Diversification Across Automotive and Industrial Sectors

Sustainability Assessment:Provides a hedge against downturns in any single industry, creating financial stability.

Competitor Replication Difficulty:Hard

- Advantage:

NAPA's Hybrid Model of Company-Owned and Independent Stores

Sustainability Assessment:Combines the benefits of corporate scale with the agility and community integration of local owners, creating a wide and deep market penetration.

Competitor Replication Difficulty:Hard

- Advantage:

Vast Physical Distribution Network

Sustainability Assessment:Enables rapid parts availability ('hot shot' delivery), a critical factor for professional customers that is difficult for online-only players to replicate.

Competitor Replication Difficulty:Hard

- Advantage:

Strong Brand Equity and Trust with Professionals (NAPA AutoCare)

Sustainability Assessment:Built over decades, the NAPA brand represents quality and reliability to a loyal base of professional mechanics, creating a significant moat.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'Existing Inventory of Internal Combustion Engine (ICE) Parts', 'estimated_duration': '5-15 years, declining as the vehicle fleet electrifies.'}

Disadvantages

- Disadvantage:

Threat from Vehicle Electrification

Impact:Critical

Addressability:Difficult

- Disadvantage:

Lagging E-commerce User Experience vs. Digital-Native Competitors

Impact:Major

Addressability:Moderately

- Disadvantage:

Complexity of Managing a Hybrid Corporate/Independent Store Network

Impact:Minor

Addressability:Difficult

Strategic Recommendations

Position GPC as the indispensable, high-service distribution partner for the entire vehicle and industrial lifecycle, from ICE to EV and from simple MRO to complex automation, leveraging its physical network as a key differentiator for speed and expertise.

Differentiate through superior technical expertise, training (for mechanics and industrial clients), and unparalleled last-mile logistics, creating a service-oriented moat that pure-play e-commerce competitors cannot easily replicate.

Quick Wins

- Recommendation:

Optimize B2B online ordering portals for mobile-first use by mechanics in the garage.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Launch targeted marketing campaigns showcasing NAPA's EV parts availability and training programs to AutoCare centers.

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Invest aggressively in cataloging, sourcing, and stocking a comprehensive range of EV aftermarket parts.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Expand Motion Industries' digital services to include predictive maintenance and IoT solutions for industrial clients.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Acquire smaller, specialized distributors in high-growth areas like EV charging infrastructure or industrial automation.

Expected Impact:High

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Establish a leadership position in battery lifecycle management, including servicing, remanufacturing, and recycling.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Develop a unified data platform across all business segments to improve demand forecasting, cross-selling, and supply chain efficiency.

Expected Impact:High

Implementation Difficulty:Difficult

Whitespace Opportunities

- Opportunity:

Become the Leading Independent Provider of EV Aftermarket Training and Certification

Competitive Gap:There is a significant shortage of mechanics trained to service EVs. Competitors are not yet dominant in providing comprehensive training programs.

Feasibility:High

Potential Impact:High

- Opportunity:

Integrated Fleet Management for Mixed (ICE/EV/Industrial) Fleets

Competitive Gap:Few competitors can service the entire range of a commercial customer's fleet, from delivery vans (NAPA) to forklifts (Motion).

Feasibility:Medium

Potential Impact:High

- Opportunity:

Develop a Strong, Branded Remanufacturing and Sustainability Program

Competitive Gap:While remanufacturing exists, no competitor has effectively marketed a comprehensive, ESG-focused program to environmentally-conscious consumers and fleet managers.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Specialized Parts and Services for Advanced Driver-Assistance Systems (ADAS)

Competitive Gap:ADAS calibration and repair is a complex, high-margin service area that many independent shops are not yet equipped to handle. GPC can be the key supplier and training partner.

Feasibility:Medium

Potential Impact:High

Messaging

Message Architecture

Key Messages

- Message:

We Keep the World Moving.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero, Sustainability Report, Careers Page

- Message:

A leading global service provider of automotive and industrial replacement parts and value-added solutions.

Prominence:Secondary

Clarity Score:High

Location:Homepage, About Us, Press Releases

- Message:

Our local expertise and global scale ensure we deliver for our customers.

Prominence:Secondary

Clarity Score:High

Location:Careers Page, Investor Presentations

- Message:

We're committed to minimizing our environmental impact, fostering an inclusive culture, supporting our communities and operating with integrity.

Prominence:Tertiary

Clarity Score:High

Location:Sustainability Section, Annual Reports

The messaging hierarchy is clear and well-structured for a corporate website. The primary message, 'We Keep the World Moving,' is an aspirational and memorable tagline. This is appropriately followed by a more descriptive secondary message defining the business. Tertiary messages focus on key corporate pillars like ESG and scale, which are crucial for the target investor and partner audience.

Messaging is highly consistent across all corporate-level communications, including the website, press releases, and investor presentations. The core identity as a global, scaled distributor with a long history is reinforced in every major section.

Brand Voice

Voice Attributes

- Attribute:

Authoritative

Strength:Strong

Examples

Leading global distributor with scale and brand strength to capture market share.

We are the market leader serving both the automotive aftermarket and heavy vehicles.

- Attribute:

Formal

Strength:Strong

Examples

Genuine Parts Company Reports Second Quarter 2025 Results and Revises Full-Year Outlook.

The company has included reconciliations of this additional information to the most comparable GAAP measure in the appendix of this presentation.

- Attribute:

Stable & Established

Strength:Strong

Examples

- •

Established in 1928, Genuine Parts Company is a leading global service provider...

- •

For more than 95 years, we've built upon this foundation...

- •

Join our decades-long success story...

- Attribute:

Community-Oriented

Strength:Moderate

Examples

We have been making a difference in our communities for more than 95 years.

Our passionate teammates generously volunteer their time and resources...

Tone Analysis

Corporate & Financial

Secondary Tones

- •

Confident

- •

Responsible

- •

Historical

Tone Shifts

The tone shifts from strictly financial and operational on investor-focused pages to a more people-centric and purpose-driven tone on the 'Careers' and 'Sustainability' pages.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

To be a stable, growing, and globally diversified investment and partner, built on nearly a century of leadership in the essential automotive and industrial parts distribution markets.

Value Proposition Components

- Component:

Global Scale and Reach

Clarity:Clear

Uniqueness:Somewhat Unique

Examples

a vast network of over 10,700 locations spanning 17 countries

- Component:

Financial Stability and Shareholder Returns

Clarity:Clear

Uniqueness:Unique

Examples

History of consistent dividends

Focused on Maximizing Shareholder Value

- Component:

Operational Excellence and Expertise

Clarity:Clear

Uniqueness:Somewhat Unique

Examples

Leverage distribution expertise, efficiencies and shared services...

- Component:

Commitment to ESG

Clarity:Clear

Uniqueness:Common

Examples

Aligned to SASB and TCFD frameworks.

fostering an inclusive culture

GPC's differentiation is primarily rooted in its immense scale, long history (since 1928), and its status as a reliable dividend-paying company. While many companies claim operational excellence or ESG commitments, GPC's nearly 100-year history and vast physical footprint are tangible, hard-to-replicate differentiators. The messaging effectively leverages this heritage as a proxy for stability and reliability.

The messaging positions GPC as an established, blue-chip leader in its markets. It doesn't message as a disruptor or a high-growth tech company, but as a foundational pillar of the global automotive and industrial economies. This conservative and stable positioning is ideal for attracting long-term institutional investors, but less so for those seeking aggressive growth.

Audience Messaging

Target Personas

- Persona:

Investors & Financial Analysts

Tailored Messages

- •

Focused on Maximizing Shareholder Value.

- •

Strong balance sheet, cash flow, disciplined capital allocation...

- •

Revises 2025 Outlook: Revenue Growth of 1% to 3%...

Effectiveness:Effective

- Persona:

Corporate Talent & Potential Employees

Tailored Messages

- •

We are more than 63,000 teammates united by a commitment to our purpose...

- •

We champion safe, equitable and uplifting work environments...

- •

Join our decades-long success story to drive your career to new places.

Effectiveness:Somewhat Effective

- Persona:

Corporate Partners & Suppliers

Tailored Messages

- •

Be the Supplier of Choice.

- •

Be a Valued Customer.

- •

Our local expertise and global scale ensure we deliver for our customers.

Effectiveness:Effective

Audience Pain Points Addressed

- •

Investment Risk (addressed by emphasizing stability, history, and dividends)

- •

Supply Chain Complexity (addressed by highlighting global scale and distribution expertise)

- •

Market Volatility (addressed by focusing on the non-discretionary nature of replacement parts)

Audience Aspirations Addressed

- •

Seeking reliable, long-term investment growth

- •

Desire for stable career opportunities with a reputable company

- •

Need for a dependable, scaled global distribution partner

Persuasion Elements

Emotional Appeals

- Appeal Type:

Appeal to Security & Stability

Effectiveness:High

Examples

- •

Established in 1928...

- •

For nearly 100 years...

- •

History of consistent dividends.

- Appeal Type:

Appeal to Pride & Purpose

Effectiveness:Medium

Examples

- •

We Keep the World Moving.

- •

Our passionate teammates generously volunteer their time...

- •

it's our people at the heart of our success

Social Proof Elements

- Proof Type:

Longevity and History

Impact:Strong

Examples

Mention of 1928 founding date and 95+ year history.

- Proof Type:

Scale (Number of locations/employees)

Impact:Strong

Examples

more than 10,700 locations in 17 countries

more than 63,000 teammates

- Proof Type:

Brand Recognition (via subsidiaries)

Impact:Strong

Examples

sold primarily under the NAPA brand name, widely recognized for quality parts...

Motion Industries, a leading industrial distributor...

Trust Indicators

- •

Detailed financial reporting (SEC Filings, Annual Reports)

- •

Named executives and Board of Directors with bios

- •

Clear governance documents

- •

Adherence to reporting frameworks like SASB and TCFD

Scarcity Urgency Tactics

Not applicable for this type of corporate website.

Calls To Action

Primary Ctas

- Text:

View more

Location:Homepage (linking to Sustainability)

Clarity:Clear

- Text:

Download fact sheet

Location:About Us page

Clarity:Clear

- Text:

Email Alerts

Location:Main Navigation (under News & Events)

Clarity:Clear

- Text:

View Annual Report

Location:Investor-focused pages

Clarity:Clear

The CTAs are functional and appropriate for the primary audience of investors and analysts. They are direct, informational, and lead to deeper dives into data (reports, financials, alerts). There is no attempt at persuasive or sales-oriented CTAs, which is fitting for the site's purpose.

Messaging Gaps Analysis

Critical Gaps

There is limited forward-looking messaging about innovation and technology. The narrative is heavily weighted towards history and stability, with less focus on how GPC is adapting to future trends like vehicle electrification, IoT in industrial parts, and digital transformation in distribution.

Contradiction Points

No itemsUnderdeveloped Areas

The 'One GPC' narrative, mentioned in investor presentations, could be more prominently featured on the main website to better connect the parent company brand with its operating company brands (NAPA, Motion, etc.).

While the site is excellent for investors, the value proposition for top-tier technology talent is underdeveloped. The messaging doesn't strongly articulate why a data scientist or software engineer should choose GPC over a tech company.

Messaging Quality

Strengths

- •

Exceptional clarity and consistency in its core messaging for its primary investor audience.

- •

Effectively uses its long history and scale as powerful proof points for stability and market leadership.

- •

Brand voice is authoritative and professional, building credibility and trust.

- •

Clear separation of corporate messaging from the consumer-facing messaging of its subsidiary brands.

Weaknesses

- •

Over-reliance on historical achievements can make the brand feel conservative and slow-moving.

- •

Lack of a compelling, forward-looking innovation narrative.

- •

Messaging for non-investor audiences, particularly potential tech talent, is generic.

Opportunities

- •

Develop a dedicated 'Innovation' or 'Future of Distribution' section to showcase initiatives in EVs, data analytics, and supply chain tech.

- •

Create more integrated stories that show the 'One GPC' culture in action, linking the corporate entity's resources to successes at the operating company level.

- •

Craft a more compelling Employer Value Proposition (EVP) message that highlights the unique technological and logistical challenges GPC solves, making it attractive to problem-solvers in tech fields.

Optimization Roadmap

Priority Improvements

- Area:

Future Vision & Innovation Messaging

Recommendation:Create a new top-level section on the website titled 'Innovation' or 'Our Future'. Populate it with content about strategic investments in technology, initiatives for the EV market, and digital transformation of the supply chain. This will balance the historical narrative with a forward-looking one.

Expected Impact:High

- Area:

Talent Attraction Messaging

Recommendation:Revamp the 'Careers' section to include specific narratives about the complex, high-impact problems GPC is solving with technology. Create profiles of tech-focused employees and highlight the 'GPC Global Technology Center' more prominently.

Expected Impact:Medium

- Area:

Brand Architecture Storytelling

Recommendation:Integrate the 'One GPC' concept more visibly on the homepage and 'About Us' section. Use a graphic or interactive element to show how the parent company supports and unifies its diverse portfolio of brands like NAPA and Motion.

Expected Impact:Medium

Quick Wins

Add a 'Key Initiatives' module to the homepage that links to stories about innovation and ESG efforts, providing a better upfront balance to the financial data.

Re-title the main tagline on the careers page from a generic statement to something more compelling, like 'Move the World with Us. Solve the challenges of global distribution.'

Long Term Recommendations

Conduct a brand perception study among tech talent to identify key messaging gaps and opportunities for crafting a more powerful EVP.

Develop a content strategy that includes regular thought leadership pieces from executives on the future of the automotive and industrial aftermarkets, positioning GPC as a forward-thinking leader, not just a historical one.

The strategic messaging of genpt.com is a masterclass in targeted communication for a corporate holding company. The message architecture, brand voice, and value proposition are exceptionally well-aligned to serve its primary audience: investors, financial analysts, and corporate partners. The messaging framework is built on a foundation of stability, scale, and history, which effectively communicates reliability and low risk. The brand voice is authoritative, formal, and confident, reinforcing its position as an established market leader.

However, this singular focus creates strategic gaps. The messaging is significantly underdeveloped in conveying a forward-looking vision of innovation. The narrative is rooted in the past (founded in 1928) and the present (current financials), but the story of the future is largely absent. This poses a risk to brand perception, potentially positioning GPC as a legacy player rather than a forward-thinking leader adapting to trends like electrification and digitalization. Furthermore, this historical focus weakens its appeal to top-tier technology and innovation talent who are motivated by future challenges, not past successes.

To optimize, GPC must evolve its narrative to be bifocal—celebrating its storied history while simultaneously articulating a clear and exciting vision for the future of distribution. By creating dedicated content around innovation, better integrating the 'One GPC' story, and sharpening its employer value proposition, the company can broaden its appeal and solidify its position as not just a company that has kept the world moving, but one that will keep it moving for the next 100 years.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Dominant Market Presence: Operates over 10,700 locations in 17 countries, with NAPA Auto Parts being a leading brand in the highly fragmented automotive aftermarket.

- •

Established Customer Base: Serves a large, loyal base of professional (Do-It-For-Me) customers, which constitute about 80% of its automotive end-market sales.

- •

Brand Trust and Reputation: NAPA is recognized as the most trusted brand among auto parts retailers, a critical factor for both professional and DIY customers.

- •

Comprehensive Product Portfolio: Offers an extensive catalog of over 500,000 automotive parts and millions of industrial MRO parts, meeting diverse customer needs.

Improvement Areas

- •

Electric Vehicle (EV) Parts Catalog: Proactively build out a comprehensive portfolio of EV-specific replacement parts (e.g., batteries, thermal management systems, e-motors) to capture future demand.

- •

Digital Tools for Professionals: Enhance digital offerings for professional mechanics, including advanced diagnostic support, integration with shop management software, and B2B e-commerce platforms.

- •

Data-Driven Product Assortment: Utilize data analytics to optimize inventory and product assortment at a local level, catering to the specific vehicle parc and industrial base of each micro-market.

Market Dynamics

Automotive Aftermarket: 3-4% CAGR. Industrial (MRO) Distribution: ~4.6% CAGR.

Mature

Market Trends

- Trend:

Vehicle Electrification

Business Impact:Threat to traditional ICE parts revenue (engine, exhaust, fuel systems) but a major opportunity in new EV-specific components. Requires significant investment in new inventory, training, and services.

- Trend:

Digitalization and E-commerce

Business Impact:Intensified competition from online-only players (e.g., Amazon, RockAuto). Creates an urgent need to build a seamless omnichannel ('clicks-and-mortar') experience and robust B2B e-procurement platforms.

- Trend:

Industry Consolidation

Business Impact:Ongoing M&A activity presents opportunities for GPC to acquire smaller distributors to expand geographic reach and market share in both automotive and industrial segments.

- Trend:

Predictive Maintenance & IoT (Industrial)

Business Impact:Shifts the industrial parts business from reactive replacement to proactive, data-driven services, creating opportunities for higher-margin, value-added solutions.

Critical Inflection Point. The market is mature but undergoing fundamental technological (EVs) and channel (digital) shifts. Proactive investment now is essential to defend market leadership and capture future growth.

Business Model Scalability

Medium

High fixed costs associated with a vast physical footprint (distribution centers, stores) and inventory. Scalability is capital-intensive, often achieved through M&A rather than purely organic growth.

Moderate. Significant operating leverage can be achieved by increasing sales volume through the existing network, but expansion requires substantial upfront investment.

Scalability Constraints

- •

Dependence on physical store and distribution network.

- •

Legacy IT infrastructure and supply chain systems can hinder agility.

- •

Complexities of managing a global supply chain across diverse regulatory environments.

Team Readiness

Experienced leadership team accustomed to managing a large, complex, publicly-traded global enterprise. Recent strategic updates show a focus on modernization and digital initiatives.

Operates in two primary, largely distinct segments: Automotive (NAPA) and Industrial (Motion). This structure allows for focus but may create silos that prevent cross-segment synergies.

Key Capability Gaps

- •

Advanced Data Analytics: Need for deeper expertise in data science to drive predictive inventory management, dynamic pricing, and customer personalization.

- •

E-commerce and Digital Experience: Requires specialized talent in UX/UI design, digital marketing, and platform engineering to compete with digital-native retailers.

- •

Electric Vehicle Technology: Lack of deep, in-house technical expertise on EV components, diagnostics, and service requirements.

Growth Engine

Acquisition Channels

- Channel:

B2B Professional Sales (Automotive & Industrial)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Equip sales teams with better CRM and data analytics tools to identify cross-sell/upsell opportunities and predict customer needs.

- Channel:

Physical Retail Network (NAPA Stores)

Effectiveness:High

Optimization Potential:High

Recommendation:Transform stores into omnichannel hubs for BOPIS (Buy Online, Pickup In-Store), immediate returns, and expert advice, creating a key advantage over online-only competitors.

- Channel:

E-commerce (B2C & B2B)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Invest heavily in a unified, user-friendly e-commerce platform with robust part-lookup functionality, real-time inventory visibility, and personalized user experiences. Digital channels for Motion account for ~40% of sales, showing strong potential.

Customer Journey

The journey is bifurcated: Professionals rely on relationships and parts availability, while DIY customers are more price and convenience-sensitive. The online journey for both segments has significant room for improvement.

Friction Points

- •

Clunky or inaccurate online part search and vehicle fitment tools.

- •

Lack of network-wide, real-time inventory visibility for customers.

- •

Inconsistent last-mile delivery speeds compared to digital-native competitors.

Journey Enhancement Priorities

{'area': 'Online Search & Discovery', 'recommendation': 'Implement AI-powered search and visual search tools to dramatically improve the accuracy and ease of finding the correct part.'}

{'area': 'Omnichannel Integration', 'recommendation': 'Create a seamless experience where a customer can start an order online, get advice in-store, and have the part delivered or pick it up, all within a single transaction view.'}

Retention Mechanisms

- Mechanism:

NAPA AutoCare Center Program (B2B)

Effectiveness:High

Improvement Opportunity:Integrate value-added digital services, such as marketing support, diagnostic assistance, and access to telematics data, to increase stickiness.

- Mechanism:

Commercial Credit & Loyalty Programs

Effectiveness:High

Improvement Opportunity:Leverage purchasing data to offer personalized rebates and predictive reordering suggestions for commercial accounts.

- Mechanism:

Brand Trust & Warranty (B2C)

Effectiveness:High

Improvement Opportunity:Promote the NAPA brand's high trust score and reliable warranty more aggressively in digital marketing to counter low-price competitors.

Revenue Economics

Strong, based on global scale, purchasing power, and significant sales to high-LTV professional customers. However, margins are under pressure from online competition and rising operational costs.

Undeterminable externally, but likely very high for professional B2B clients and lower for opportunistic B2C customers.

Solid, but with declining efficiency in traditional channels. Digital channel efficiency needs significant improvement to drive future growth.

Optimization Recommendations

- •

Increase penetration of high-margin private label brands.

- •

Leverage data for dynamic pricing strategies in online channels.

- •

Optimize supply chain and inventory management to improve turnover and reduce carrying costs.

Scale Barriers

Technical Limitations

- Limitation:

Fragmented/Legacy IT Systems

Impact:High

Solution Approach:Adopt a phased modernization approach using an API-first architecture to connect legacy systems (ERP, WMS) with modern e-commerce and data analytics platforms.

- Limitation:

Lack of a Unified Data Platform

Impact:High

Solution Approach:Invest in a centralized data warehouse or data lake to consolidate information from sales, supply chain, and customer interactions, enabling advanced analytics and AI.

Operational Bottlenecks

- Bottleneck:

Last-Mile Delivery Logistics

Growth Impact:Directly impacts competitiveness against e-commerce giants offering same-day delivery.

Resolution Strategy:Leverage the distributed store network as micro-fulfillment centers. Partner with gig-economy delivery services for rapid local delivery.

- Bottleneck:

Inventory Management Complexity

Growth Impact:Balancing inventory to ensure high availability without excessive carrying costs across thousands of locations is a major challenge.

Resolution Strategy:Implement AI-driven demand forecasting and inventory optimization tools to improve stock levels and placement across the network.

Market Penetration Challenges

- Challenge:

Aggressive E-commerce Competition

Severity:Critical

Mitigation Strategy:Double down on the 'phygital' advantage: combine e-commerce convenience with the immediate availability, expert advice, and service offerings (e.g., tool rental, battery testing) of the physical store network.

- Challenge:

Technological Shift to EVs

Severity:Major

Mitigation Strategy:Become the leading aftermarket resource for EV service. This involves building the EV parts catalog, offering technician training programs through NAPA AutoCare, and potentially partnering with EV service startups.

Resource Limitations

Talent Gaps

- •

Digital Marketing & E-commerce Management

- •

Data Scientists & AI/ML Engineers

- •

EV Systems and Battery Technicians/Specialists

Significant capital will be required for technology modernization, supply chain upgrades, and potential strategic acquisitions in the EV or digital space. This appears manageable given the company's strong cash flow.

Infrastructure Needs

- •

Modern, scalable e-commerce platform.

- •

Upgraded warehouse management systems (WMS) and automation in distribution centers.

- •

EV battery handling and servicing capabilities in key locations.

Growth Opportunities

Market Expansion

- Expansion Vector:

EV Aftermarket Leadership

Potential Impact:High

Implementation Complexity:High

Recommended Approach:A multi-pronged strategy: 1) Secure supply chains for key EV components. 2) Develop and roll out EV maintenance and repair training for the NAPA AutoCare network. 3) Explore services like battery diagnostics and replacement.

- Expansion Vector:

Geographic Expansion (Industrial)

Potential Impact:Medium

Implementation Complexity:High

Recommended Approach:Continue strategic, bolt-on acquisitions of industrial distributors in target regions like Europe and Asia-Pacific to expand Motion's global footprint.

Product Opportunities

- Opportunity:

Data-as-a-Service (DaaS) for Repair Shops

Market Demand Evidence:Increasing vehicle complexity and connectivity generate vast amounts of diagnostic data. Independent shops lack the resources to analyze this effectively.

Strategic Fit:High

Development Recommendation:Develop a subscription-based service, offered through the NAPA network, that provides repair shops with access to aggregated repair data, diagnostic insights, and predictive maintenance alerts.

- Opportunity:

Remanufactured Parts for EVs

Market Demand Evidence:The high cost of new EV components (especially batteries and drive units) creates strong demand for cost-effective, sustainable remanufactured alternatives. The remanufacturing market is projected to grow significantly.

Strategic Fit:High

Development Recommendation:Invest in or partner with companies specializing in EV component remanufacturing to build a proprietary, high-quality offering.

Channel Diversification

- Channel:

Managed Marketplaces (e.g., Amazon Business)

Fit Assessment:Good for specific, high-volume parts and accessories, but risks channel conflict and margin erosion.

Implementation Strategy:Launch a curated selection of private-label or exclusive products on marketplaces to reach new customers without cannibalizing core B2B channels. Use it as a customer acquisition tool.

- Channel:

Direct-to-Fleet Service Solutions

Fit Assessment:Excellent fit, leveraging both automotive and industrial capabilities.

Implementation Strategy:Develop a comprehensive service offering for commercial and government vehicle fleets that bundles parts supply, inventory management (VMI), and predictive maintenance services.

Strategic Partnerships

- Partnership Type:

EV Technician Training & Certification

Potential Partners

- •

Technical colleges

- •

EV-specific training institutes (e.g., Weber State, SAE)

- •

EV manufacturers (for out-of-warranty service)

Expected Benefits:Positions NAPA as the go-to training provider for the independent repair industry, driving loyalty and ensuring the network is prepared for the EV transition.

- Partnership Type:

Fleet Management & Telematics Companies

Potential Partners

- •

Geotab

- •

Samsara

- •

Verizon Connect

Expected Benefits:Integrate telematics data to enable predictive parts ordering for fleet customers, creating a deeply embedded, high-switching-cost service.

Growth Strategy

North Star Metric

Share of Professional Wallet

This metric focuses on the core, high-LTV professional customer. Growth in this metric indicates success in deepening relationships, cross-selling new products (like EV parts), and integrating digital services, which are key to defending against competitors.

Increase share of wallet by 5% year-over-year by bundling parts, digital tools, and training.

Growth Model

Hybrid: Ecosystem & Retention-Led Growth

Key Drivers

- •

Deepening relationships with existing professional customers.

- •

Expanding the value proposition beyond parts to include training, software, and data services.

- •

Leveraging the physical network as a competitive moat against pure-play e-commerce.

- •

Strategic M&A to enter new markets or acquire new capabilities.

Focus on customer-centric initiatives that increase switching costs for professional clients. Build out the 'NAPA AutoCare' and 'Motion' brands as comprehensive service ecosystems, not just parts distributors.

Prioritized Initiatives

- Initiative:

Launch 'EV Ready' Program for NAPA AutoCare Centers

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 Months

First Steps:Establish a dedicated EV strategy team. Begin curriculum development with a training partner. Identify and secure suppliers for the top 50 EV replacement parts.

- Initiative:

Unified Omnichannel Platform Development

Expected Impact:High

Implementation Effort:High

Timeframe:24 Months

First Steps:Conduct a comprehensive audit of existing IT infrastructure. Define the customer journey map for both B2B and B2C users. Select a modern, API-first commerce platform.

- Initiative:

AI-Powered Supply Chain Optimization Pilot

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:12 Months

First Steps:Select a pilot region and product category. Partner with a data analytics firm to build and test demand forecasting models. Define key success metrics (e.g., inventory turnover, stock-out rate).

Experimentation Plan

High Leverage Tests

- Area:

Pricing

Experiment:A/B test dynamic vs. fixed pricing for specific B2C product categories online.

- Area:

Service Offering

Experiment:Pilot a 'Mobile Mechanic Supply' service in one city, offering guaranteed 1-hour delivery of parts directly to repair jobs.

- Area:

User Experience

Experiment:Test a VIN-based parts lookup vs. traditional year/make/model lookup to measure impact on conversion rate and order accuracy.

Utilize an A/B testing platform for digital experiments. Track key metrics such as conversion rate, average order value, customer satisfaction (NPS), and inventory turnover for operational pilots.

Run continuous digital A/B tests. Plan and execute larger operational pilots on a quarterly basis.

Growth Team

Establish a centralized 'Digital & Growth' Center of Excellence (CoE) that supports both the Automotive and Industrial segments. Embed dedicated digital product managers and analysts within each business unit to ensure alignment.

Key Roles

- •

Chief Digital Officer

- •

Head of EV Strategy

- •

Director of Data Science & Analytics

- •

Head of Omnichannel Customer Experience

A combination of hiring external digital-native talent and aggressively upskilling the existing workforce, particularly in areas of data literacy, digital marketing, and EV technology.

Genuine Parts Company (GPC) possesses a formidable growth foundation built on decades of market leadership, brand trust, and an extensive physical distribution network. Its position is strong, but it stands at a critical juncture defined by two powerful, disruptive forces: the automotive industry's generational shift to electric vehicles and the relentless rise of digital-first commerce. Continued success is not guaranteed by past performance; it requires a decisive pivot.

The primary barrier to GPC's future growth is not competition in the traditional sense, but inertia. Its scale, while an asset, can be a liability if legacy systems and processes hinder the agility needed to adapt. The company's most significant challenge is to transform its operational mindset from a traditional distributor to a digitally-enabled, service-oriented ecosystem.

The most compelling growth opportunities lie in leveraging its core strengths to address market shifts. GPC's physical network is not an anchor but a strategic asset that online-only competitors cannot replicate. By transforming its thousands of stores into omnichannel hubs for logistics, service, and expertise, it can create a powerful 'clicks-and-mortar' competitive advantage.

Strategic Recommendation:

The overarching growth strategy must be a deliberate, multi-year transformation focused on three pillars:

1. Embrace the Future of Mobility: Aggressively invest to become the undisputed aftermarket leader for Electric Vehicles. This is a defensive and offensive imperative, requiring strategic initiatives in parts sourcing, technician training, and new service development.

2. Win in a Digital World: Commit to a top-to-bottom digital transformation. This involves building a world-class, unified e-commerce platform and using data analytics to drive every aspect of the business, from supply chain optimization to customer personalization.

3. Evolve the Value Proposition: Shift from being a parts supplier to an indispensable service partner for professional customers. This means building an ecosystem of value-added services—data insights, diagnostic support, and business management tools—that create deep, lasting customer loyalty.

Executing this strategy will require significant investment in technology and talent, but it is the necessary path to secure another century of market leadership and truly 'Keep the World Moving' in a new era.

Legal Compliance

Genuine Parts Company

https://www.genpt.com

Automotive and Industrial Replacement Parts Distribution

Primarily a B2B distributor of automotive and industrial replacement parts, operating through a global network. As a publicly traded company (NYSE: GPC), this website serves as a key portal for investor relations and corporate communications.

The website provides a comprehensive 'Privacy Notice' accessible from the footer. It was last updated in February 2024, which is a good sign of active management. The policy is detailed, covering the types of personal information collected, sources of information, purposes for use, and categories of third parties with whom data is shared. It includes specific sections for residents of various jurisdictions, including the EEA/UK/Switzerland (GDPR), California (CCPA/CPRA), and other US states with privacy laws. It clearly outlines user rights such as access, correction, and deletion. The inclusion of contact details for data privacy inquiries is also a strength. However, the notice is lengthy and dense, which could impact readability for the average user.

A 'Terms of Use' document is accessible via the website footer. The terms are standard for a corporate website, covering intellectual property rights, acceptable use, disclaimers of warranties, and limitations of liability. It includes a section on 'Forward-Looking Statements,' which is a critical legal safe harbor for a publicly traded company's investor relations site. The terms also specify the governing law and jurisdiction (State of Georgia), which provides legal clarity. The document is clear and appears legally robust for its intended purpose of governing the use of the informational content on the site.

Upon visiting the site, a cookie consent banner appears. The banner provides 'Accept All' and 'Reject All' options, as well as a 'Cookie Settings' button for granular control, which is a strong practice aligned with GDPR. It correctly blocks non-essential cookies prior to user consent. The linked 'Cookie Policy' is part of the main Privacy Notice and details the types of cookies used (Strictly Necessary, Functional, Performance, Targeting). This implementation appears robust and compliant with modern data privacy standards that require explicit and informed consent.

Genuine Parts Company demonstrates a strong understanding of global data protection obligations. The Privacy Notice explicitly addresses the requirements of GDPR and CCPA/CPRA. For GDPR, it discusses the legal bases for processing data and data subject rights. For CCPA/CPRA, it details consumer rights and provides mechanisms to exercise them, including a 'Your Privacy Choices (Do Not Sell or Share My Personal Information)' link in the footer. This dedicated link is a key requirement under California law. The global approach to data protection is a significant strength, reducing the risk of non-compliance in key markets.

The website lacks a dedicated 'Accessibility Statement,' which is a missed opportunity to affirm its commitment to accessibility and outline compliance efforts. A manual check reveals some positive aspects, such as the use of 'Skip to main content' links. However, there are potential issues. For example, some interactive elements and data visualizations (like stock charts) may not be fully accessible to users with disabilities who rely on screen readers. Without a formal audit, it's difficult to assess full compliance with Web Content Accessibility Guidelines (WCAG) 2.1 AA, the common standard for ADA compliance in the digital realm. This represents a moderate legal risk, as plaintiffs' law firms actively target large corporations for ADA non-compliance.

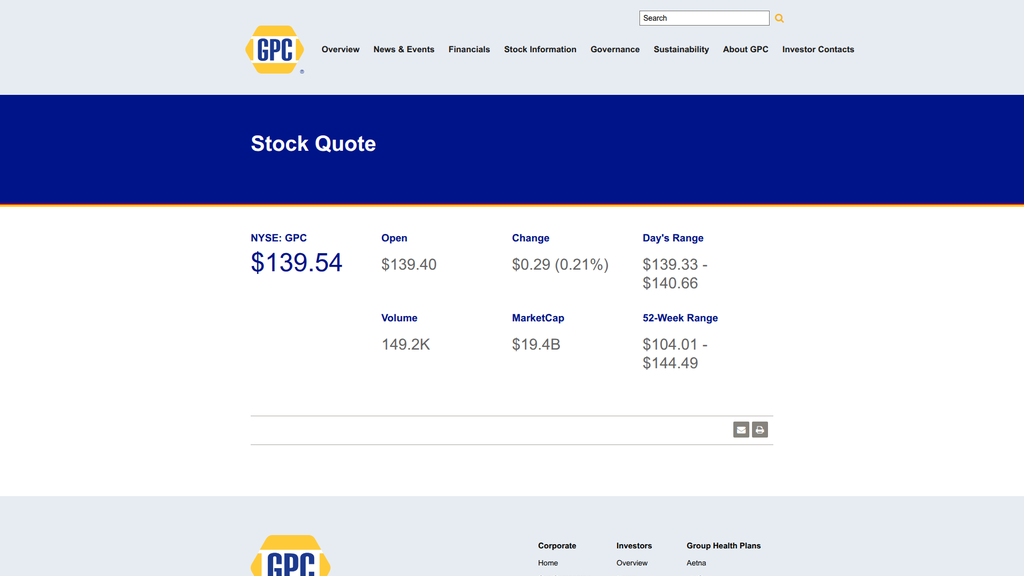

As an investor relations website for a NYSE-listed company, compliance with U.S. Securities and Exchange Commission (SEC) regulations is paramount. The site effectively manages this through several key features. The 'Terms of Use' include a 'Forward-Looking Statements' safe harbor provision. Financial data pages, like the 'Stock Quote' page, include necessary disclaimers about data delays ('Quote data delayed by at least 15 minutes'). The site provides easy access to SEC filings, annual reports, and quarterly earnings, consistent with Regulation FD (Fair Disclosure) principles, which aim to prevent selective disclosure of material information. This focus on transparent and compliant investor communication is a core strength.

Compliance Gaps

- •

Absence of a formal Accessibility Statement outlining commitment and compliance with WCAG/ADA standards.

- •

Interactive charts and financial data tools may not be fully accessible to users of assistive technologies.

- •

The privacy policy, while comprehensive, is very long and could be supplemented with a layered, more user-friendly summary to improve readability.

Compliance Strengths

- •

Robust and jurisdiction-specific Privacy Notice covering GDPR, CCPA/CPRA, and other regional laws.

- •

Implementation of a granular cookie consent mechanism that meets GDPR standards.

- •

Clear 'Terms of Use' with necessary legal safe harbors for forward-looking statements required by the SEC.

- •

Dedicated 'Do Not Sell or Share' link in the footer, demonstrating strong CCPA/CPRA compliance.

- •

Excellent adherence to SEC Regulation FD principles through timely and accessible financial reporting.

Risk Assessment

- Risk Area:

Web Accessibility (ADA)

Severity:Medium

Recommendation:Commission a formal WCAG 2.1 AA accessibility audit. Based on the audit, remediate identified issues and publish a formal Accessibility Statement on the website to mitigate legal risk and improve usability for all.

- Risk Area:

Data Privacy UX

Severity:Low

Recommendation:Improve the user experience of the Privacy Notice. Implement a layered notice with a high-level summary and links to more detailed sections to enhance transparency and user comprehension without removing the legally comprehensive text.

- Risk Area:

Third-Party Data Tools

Severity:Low

Recommendation:Review the accessibility compliance of third-party tools embedded on the site, such as the 'Interactive Analyst Center,' and ensure vendor contracts include accessibility compliance clauses.

High Priority Recommendations

- •

Conduct a Web Accessibility Audit: Immediately engage a third-party expert to audit https://www.genpt.com for compliance with WCAG 2.1 AA standards. This is the single most significant legal risk and should be prioritized to prevent potential ADA-related demand letters or litigation.

- •

Publish an Accessibility Statement: Following the audit, create and prominently link a public Accessibility Statement in the website footer. This statement should acknowledge the standards, describe the company's efforts, and provide a contact method for users to report accessibility issues.