eScore

grainger.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Grainger demonstrates a sophisticated digital presence, anchored by a powerful e-commerce platform that drives the majority of its sales. The company excels at search intent alignment through its massive long-tail catalog and the expert-driven 'KnowHow' content hub, capturing users at all stages of the buying funnel. Its multi-channel presence is robust, integrating online, mobile, sales reps, and physical branches into a cohesive omnichannel strategy. The site's content authority is high, built on decades of industry leadership and specialized technical content that competitors like Amazon Business cannot easily replicate.

Exceptional long-tail SEO strategy, capturing high-intent searches for millions of specific MRO products, which is a core pillar of its customer acquisition strategy.

Further enhance voice search optimization by structuring 'KnowHow' content into direct question-and-answer formats to capture more featured snippets for conversational queries related to MRO challenges.

Grainger's messaging clearly positions it as a premium, value-added partner rather than a low-cost supplier. It effectively tailors messages to different personas, such as facilities managers and safety officers, by highlighting relevant services like 'KeepStock' and safety solutions. The brand voice is consistently professional, expert, and reliable, which aligns perfectly with its B2B audience. However, the analysis indicates a significant gap in leveraging customer social proof, relying more on its own heritage for credibility than on testimonials or case studies.

The 'Grainger KnowHow®' platform is a masterclass in content marketing that effectively communicates deep expertise, differentiating the brand from purely transactional competitors.

Systematically incorporate customer testimonials and quantifiable case studies into the website to move from self-proclaimed trust signals ('For over 90 years...') to third-party validation, which would strengthen conversion messaging.

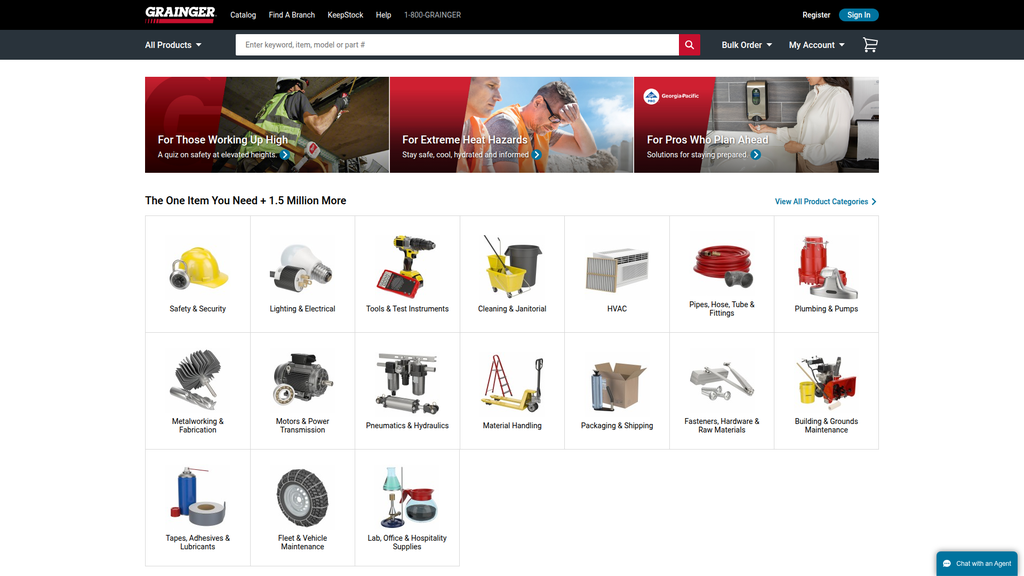

The website is highly optimized for its task-oriented B2B audience, featuring a prominent search bar and logical information architecture that minimizes cognitive load. The user flow from discovery to purchase is clear and efficient, catering to professionals who value speed. While the overall experience is strong, there are minor friction points, such as understated calls-to-action in hero banners and a dense footer that could be better organized. The platform's mobile adaptation is good, and the site is generally accessible, though a formal accessibility statement would be a best practice.

The task-oriented design, with a powerful, centrally located search function and clear category navigation, allows professional users to find and purchase products with maximum efficiency.

Enhance primary hero banners by converting subtle arrow links into high-contrast, action-oriented CTA buttons (e.g., 'Shop Safety Solutions') to improve click-through rates and guide users more effectively.

Grainger's credibility is exceptionally high, built on over 90 years of operation and a strong reputation for reliability. The company provides numerous trust signals, including technical support, 24/7 customer service, and deep supplier relationships. It mitigates customer risk through value-added services like inventory management and providing critical compliance documents like Safety Data Sheets (SDS). While the company excels at demonstrating its own expertise, it could further bolster credibility by featuring more third-party validation like customer success stories or industry awards more prominently.

Robust industry-specific compliance, such as the easy-to-access Safety Data Sheet (SDS) lookup tool, which is a critical trust signal and necessity for its B2B customers.

Increase transparency and build further trust by developing and featuring a dedicated section for customer case studies with quantifiable ROI, moving beyond implied success to documented proof.

Grainger's competitive moat is wide and sustainable, rooted in its immense scale and sophisticated logistics network, which are incredibly difficult and capital-intensive to replicate. Services like 'KeepStock' create high switching costs by deeply embedding Grainger into customer operations, a significant advantage over transactional marketplaces. While its product breadth is being challenged by Amazon Business, its curated industrial-grade supply chain and technical expertise provide a strong defense. The primary vulnerability is a perception of higher prices, which the company actively counters by focusing on total cost of ownership.

The integrated 'KeepStock' inventory management service acts as a powerful moat, creating high switching costs and shifting the customer relationship from transactional to a deeply embedded operational partnership.

Invest in developing and promoting a proprietary data analytics platform for customers, offering predictive insights on their MRO spend and maintenance needs, creating a new, highly defensible competitive advantage.

The business model is highly scalable, demonstrated by the dual 'High-Touch' and 'Endless Assortment' strategies that effectively target different market segments. The extensive distribution network and advanced e-commerce platform provide significant operational leverage, allowing the company to handle increased volume efficiently. The Endless Assortment segment, in particular, shows high-teens growth potential. While there are high fixed costs, the company's strong financial position and focus on automation and data analytics position it well for continued market share gains and international expansion.

The dual business model ('High-Touch Solutions' and 'Endless Assortment') provides a robust framework for scalable growth, allowing Grainger to efficiently capture both large, complex enterprise accounts and the long tail of the SMB market.

Accelerate investment in data science and AI talent to build predictive models for cross-selling, up-selling, and supply chain optimization, unlocking further capital efficiency and scalability.

Grainger's business model is exceptionally coherent and strategically sound. The dual 'High-Touch' and 'Endless Assortment' models allow the company to address distinct market segments with tailored value propositions, minimizing channel conflict and maximizing market coverage. Resource allocation is clearly focused on strategic growth drivers like digital capabilities and supply chain superiority. The company demonstrates a strong strategic focus on its core MRO market while innovating with value-added services, showing excellent alignment between its revenue model, customer needs, and competitive strengths.

The strategic clarity of the dual business model, which allows Grainger to defend its high-service, high-margin enterprise business while simultaneously competing for growth in the price-sensitive SMB segment, is a masterstroke of market segmentation.

Further integrate service offerings into the digital product purchasing journey, for example, by prompting a customer buying safety equipment with information about a managed safety program, to improve the coherence between product sales and service revenue.

As a market leader in a fragmented industry, Grainger commands significant market power, holding an estimated 7% share in the U.S. MRO market. This scale provides considerable leverage with suppliers and allows for pricing power, especially within its 'High-Touch' solutions for large customers who prioritize reliability over price. The company's market share trajectory is positive, with a stated goal of outgrowing the market by 400-500 basis points annually. While facing intense competition from Amazon Business on price, Grainger effectively influences the market by setting standards for service, reliability, and integrated solutions.

Significant pricing power within the 'High-Touch' segment, where its value proposition of reliability, technical support, and inventory management allows it to command premium prices from customers who prioritize reducing operational downtime.

Launch targeted marketing campaigns that explicitly contrast Grainger's supply chain reliability and expert support with the weaknesses of marketplace models, thereby proactively shaping the market narrative around 'total cost' instead of 'unit price'.

Business Overview

Business Classification

B2B eCommerce & Industrial Distribution

Value-Added Services

Maintenance, Repair, and Operations (MRO)

Sub Verticals

- •

Safety & Security

- •

HVAC

- •

Material Handling

- •

Tools & Test Instruments

- •

Cleaning & Janitorial

- •

Fleet & Vehicle Maintenance

Mature

Maturity Indicators

- •

Over 90 years of operating history

- •

Publicly traded company (NYSE: GWW) with a significant market capitalization.

- •

Extensive distribution network with numerous distribution centers and branches.

- •

Deeply entrenched relationships with a large, diversified customer base of over 4.5 million.

- •

Significant investment in eCommerce, with a large percentage of sales coming through digital channels.

- •

Established brand reputation for reliability and a broad product offering

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

High-Touch Solutions (Product Sales)

Description:The core business, representing the majority of revenue, involves the distribution of a wide range of MRO products to large and mid-sized customers with complex needs. This is supported by a dedicated sales force, technical support, and physical branches.

Estimated Importance:Primary

Customer Segment:Large and Mid-sized Enterprises

Estimated Margin:Medium

- Stream Name:

Endless Assortment (eCommerce)

Description:A higher-growth, online-focused model (Zoro.com, MonotaRO.com) targeting smaller businesses with less complex needs through a streamlined digital purchasing experience.

Estimated Importance:Secondary

Customer Segment:Small to Medium Businesses (SMBs)

Estimated Margin:Low to Medium

- Stream Name:

Value-Added & Inventory Management Services (KeepStock®)

Description:Fee-based and contract services that go beyond product sales, including vendor-managed inventory (VMI), onsite services, safety consulting, and energy services. These services are designed to reduce customers' total cost of ownership.

Estimated Importance:Tertiary

Customer Segment:Large and Mid-sized Enterprises

Estimated Margin:High

Recurring Revenue Components

- •

KeepStock® Inventory Management service contracts.

- •

Managed Safety Program contracts

- •

Onsite service agreements

Pricing Strategy

Contract & Transactional Pricing

Mid-range to Premium

Semi-transparent

Pricing Psychology

- •

Volume-based discounts

- •

Contract pricing for large accounts

- •

Bundled solutions (product + service)

Monetization Assessment

Strengths

- •

Diversified revenue across two major business models (High-Touch and Endless Assortment) catering to different market segments.

- •

High customer retention driven by deep integration into customer workflows.

- •

Growing, high-margin services business (KeepStock®) that increases customer stickiness.

- •

Strong pricing power due to scale and ability to ensure product availability.

Weaknesses

- •

High overhead costs associated with the High-Touch model's physical footprint and sales force.

- •

Margin pressure from the lower-margin, high-growth Endless Assortment segment.

- •

Susceptibility to price competition from purely digital players like Amazon Business.

Opportunities

- •

Further expansion of the fee-based services portfolio, which offers higher margins and recurring revenue potential.

- •

Leveraging data from customer purchases to offer predictive maintenance services.

- •

Deeper integration of service offerings into the eCommerce platform to drive adoption.

- •

International market expansion, particularly in high-growth industrial regions.

Threats

- •

Intensifying competition from digital-native B2B marketplaces (e.g., Amazon Business) that can compete aggressively on price.

- •

Economic downturns that reduce industrial output and MRO spending by key customer segments.

- •

Supply chain disruptions that can impact product availability and increase costs.

- •

Shifting customer preferences towards self-service, purely online procurement models.

Market Positioning

Value-added, high-service industrial partner for complex MRO needs, differentiating through reliability, expertise, and integrated supply chain solutions.

Major Player (Approx. 6-7% of the highly fragmented North American MRO market).

Target Segments

- Segment Name:

Large Industrial & Manufacturing Enterprises

Description:Companies with complex operations, multiple sites, and a critical need for operational uptime. They require a strategic partner for MRO procurement, not just a supplier.

Demographic Factors

- •

>500 employees

- •

Multiple plant/facility locations

- •

High MRO spend

Psychographic Factors

- •

Value reliability and risk reduction over lowest price

- •

Seek to consolidate suppliers

- •

Focused on total cost of ownership (TCO)

Behavioral Factors

- •

Engage in long-term contract pricing

- •

Utilize vendor-managed inventory (VMI) services

- •

Require technical support and compliance services

Pain Points

- •

Unplanned equipment downtime

- •

High inventory carrying costs

- •

Complex supply chain management

- •

Ensuring safety and regulatory compliance

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Government & Public Institutions

Description:Federal, state, and local government agencies, as well as educational and healthcare institutions, with formal procurement processes.

Demographic Factors

Public sector entities

Often require specific procurement vehicles (e.g., GPOs)

Psychographic Factors

Value compliance and process adherence

Budget-conscious but require reliability

Behavioral Factors

Respond to RFPs and government contracts

Purchase from pre-approved vendor lists

Pain Points

- •

Navigating complex procurement rules

- •

Supplier diversity requirements

- •

Budgetary constraints

Fit Assessment:Good

Segment Potential:Medium

- Segment Name:

Small-to-Medium Businesses (SMBs) & Contractors

Description:Smaller businesses, workshops, and trade contractors (electricians, plumbers, HVAC techs) who need a wide range of products with quick, convenient access.

Demographic Factors

- •

<100 employees

- •

Single or few locations

- •

Tradespeople and small business owners

Psychographic Factors

Value convenience and speed

Price-sensitive but brand loyal if service is good

Behavioral Factors

- •

Primarily use online channels (Zoro.com)

- •

Transactional, less frequent purchases

- •

Need immediate product availability for specific jobs

Pain Points

- •

Lack of a dedicated procurement function

- •

Wasting time sourcing parts from multiple suppliers

- •

Project delays due to lack of part availability

Fit Assessment:Good

Segment Potential:High

Market Differentiation

- Factor:

Integrated High-Touch Service & Product Model

Strength:Strong

Sustainability:Sustainable

- Factor:

Extensive Distribution & Supply Chain Network

Strength:Strong

Sustainability:Sustainable

- Factor:

Technical Expertise and Customer Support

Strength:Moderate

Sustainability:Sustainable

- Factor:

Broad Product Assortment (over 1.7 million products)

Strength:Strong

Sustainability:Temporary

Value Proposition

For businesses that need to maintain operations, Grainger is the indispensable partner for MRO supplies and services, ensuring you have the right products and solutions when you need them, backed by a robust supply chain and deep technical expertise to keep your world working.

Excellent

Key Benefits

- Benefit:

Comprehensive Product Access

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Catalog of approx. 2 million products in High-Touch, over 14 million on Zoro.

Partnerships with thousands of trusted suppliers.

- Benefit:

Operational Uptime & Reliability

Importance:Critical

Differentiation:Unique

Proof Elements

Extensive distribution network for fast, next-day delivery.

KeepStock® services to prevent stock-outs of critical parts.

- Benefit:

Reduced Total Cost of Ownership

Importance:Important

Differentiation:Unique

Proof Elements

Inventory management services reduce customer carrying costs.

Supplier consolidation simplifies procurement processes

- Benefit:

Expertise and Problem Solving

Importance:Important

Differentiation:Unique

Proof Elements

24/7 customer service and technical support

Specialized safety and facility services consultants

Unique Selling Points

- Usp:

A dual business model that serves both large, complex customers (High-Touch) and small, transactional customers (Endless Assortment) effectively.

Sustainability:Long-term

Defensibility:Strong

- Usp:

The KeepStock® vendor-managed inventory (VMI) solution, which deeply integrates Grainger into its customers' operational workflows.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A resilient, scaled supply chain infrastructure that provides a competitive advantage in product availability and delivery speed.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Minimizing costly operational downtime due to lack of a critical part.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Managing the complexity and overhead of procuring and stocking thousands of MRO items.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Ensuring workplace safety and navigating complex regulatory requirements.

Severity:Major

Solution Effectiveness:Partial

- Problem:

Sourcing specialized or hard-to-find items quickly and efficiently.

Severity:Minor

Solution Effectiveness:Complete

Value Alignment Assessment

High

Grainger's model directly addresses the MRO market's core needs for reliability, product breadth, and operational efficiency, especially as trends move toward predictive maintenance and supply chain resilience.

High

The dual 'High-Touch' and 'Endless Assortment' models allow Grainger to tailor its value proposition effectively to both large enterprises seeking strategic partners and SMBs seeking convenience.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Over 5,000 MRO product suppliers and manufacturers (e.g., 3M, Milwaukee, Honeywell).

- •

Logistics and freight carriers (e.g., FedEx, UPS)

- •

Technology partners (e.g., SAP, Salesforce, Microsoft Azure).

- •

Local service and installation contractors.

Key Activities

- •

Sourcing and Procurement

- •

Supply Chain and Logistics Management

- •

eCommerce Platform Management

- •

Sales and Customer Relationship Management

- •

Inventory Management Service Delivery (KeepStock®)

Key Resources

- •

Extensive Distribution Center network.

- •

Sophisticated eCommerce technology platform

- •

Strong brand reputation and customer trust built over 90+ years

- •

Experienced sales force and technical support staff.

- •

Deep supplier relationships

Cost Structure

- •

Cost of Goods Sold (COGS)

- •

Logistics, freight, and warehouse operating costs

- •

Sales, General & Administrative (SG&A) expenses, including sales force compensation

- •

Investment in technology and eCommerce infrastructure

- •

Marketing and advertising expenses.

Swot Analysis

Strengths

- •

Established brand recognition and reputation for reliability.

- •

Superior supply chain and distribution network enabling high service levels.

- •

Deeply integrated customer relationships, especially with the High-Touch model and KeepStock® services.

- •

Strong financial position with robust cash flow generation.

- •

Effective dual business model serving distinct customer segments.

Weaknesses

- •

Higher cost structure compared to pure-play online competitors.

- •

Potential for channel conflict between High-Touch and Endless Assortment models.

- •

Perception of being higher-priced, making it vulnerable in transactional sales.

Opportunities

- •

Accelerate growth in higher-margin, recurring revenue services.

- •

Leverage data analytics for predictive maintenance and personalized customer offerings.

- •

Further penetration of the large and fragmented SMB market via the Zoro platform.

- •

Strategic acquisitions to expand into new geographies or service capabilities.

- •

Increased focus on sustainability and ESG-related products and services.

Threats

- •

Aggressive price competition and market share erosion from Amazon Business.

- •

Macroeconomic slowdowns impacting industrial customer spending.

- •

Disintermediation by manufacturers selling directly to end-users.

- •

Rapid technological changes requiring continuous significant investment.

- •

Global supply chain disruptions impacting costs and product availability.

Recommendations

Priority Improvements

- Area:

Digital Experience Personalization

Recommendation:Invest heavily in AI-driven personalization on Grainger.com and Zoro.com to provide proactive product recommendations, anticipate reordering needs, and create a more consultative digital experience to counter the transactional nature of competitors.

Expected Impact:High

- Area:

Service and Product Integration

Recommendation:Seamlessly integrate service offerings (e.g., KeepStock®, Safety Consulting) into the product purchasing journey. For example, when a customer buys safety gloves, digitally prompt them with information about a managed safety service.

Expected Impact:Medium

- Area:

SMB Value Proposition

Recommendation:Enhance the value proposition for the Endless Assortment (Zoro) segment beyond just price and selection by adding simple, value-added digital tools like basic inventory tracking or compliance checklists for small businesses.

Expected Impact:Medium

Business Model Innovation

- •

Develop a 'Predictive Maintenance as a Service' (PMaaS) offering by analyzing customer purchasing data to predict equipment failure and proactively suggest replacement parts, creating a new high-margin, subscription-based revenue stream.

- •

Launch a curated third-party marketplace for highly specialized, long-tail MRO products, expanding assortment without inventory risk and capturing commission-based revenue.

- •

Create a subscription-based 'Grainger Prime' for businesses, offering benefits like guaranteed delivery times, premium technical support, and access to exclusive training content from 'Grainger KnowHow®'.

Revenue Diversification

- •

Expand the scope of consulting services to include sustainability/ESG reporting and optimization for facilities, leveraging their product expertise in energy-efficient lighting, HVAC, and waste management.

- •

Monetize the 'Grainger KnowHow®' platform through certified training programs and paid workshops for safety, maintenance, and facility management professionals.

- •

Offer 'MRO-in-a-box' subscription kits for specific industries or business types (e.g., a 'New Restaurant Starter Kit' or a 'Small Machine Shop Monthly Supply Box').

W.W. Grainger's business model is a masterclass in strategic evolution within a mature industry. The company has successfully navigated the shift from a traditional, catalog-based distributor to a sophisticated, dual-model B2B powerhouse. Its core strength lies in its 'High-Touch Solutions' model, which builds a deep, defensible moat around large enterprise customers through integrated services like KeepStock®, effectively moving the competitive basis from price to total cost of ownership and operational reliability. This model is capital and labor-intensive but generates loyal, high-value relationships that pure-play eCommerce competitors struggle to replicate.

The strategic development of the 'Endless Assortment' model (Zoro) was a critical and prescient move to compete directly with digital-native disruptors like Amazon Business. It allows Grainger to capture the price-sensitive SMB segment without diluting the premium, service-oriented value proposition of its core brand. The primary strategic tension and opportunity lie in managing these two models. While the Endless Assortment segment drives growth, it also exerts pressure on overall margins.

Future evolution must focus on leveraging Grainger's primary strategic asset: data. With insight into the MRO purchasing habits of millions of businesses, Grainger is uniquely positioned to transition from a reactive supplier to a proactive, predictive partner. The greatest opportunity for strategic transformation is to build a recurring revenue ecosystem on top of its transactional product sales. By developing and scaling data-driven services like predictive maintenance, ESG consulting, and advanced inventory analytics, Grainger can further cement its role as an indispensable operational partner, ensuring its continued market leadership and profitable growth in an increasingly competitive and digitized industrial landscape.

Competitors

Competitive Landscape

Mature

Moderately concentrated

Barriers To Entry

- Barrier:

Extensive Logistics & Distribution Network

Impact:High

- Barrier:

Capital for Broad & Deep Inventory

Impact:High

- Barrier:

Established Supplier Relationships

Impact:High

- Barrier:

Brand Reputation and Customer Trust

Impact:Medium

- Barrier:

Technological Infrastructure (e-commerce, ERP)

Impact:Medium

Industry Trends

- Trend:

Digital Transformation & E-commerce Adoption

Impact On Business:Requires continuous investment in the online platform, user experience, and digital marketing to compete with digital-native players like Amazon Business.

Timeline:Immediate

- Trend:

Demand for Value-Added Services

Impact On Business:Shifts focus from pure product distribution to integrated solutions like inventory management (VMI), safety consulting, and repair services, creating stickier customer relationships.

Timeline:Immediate

- Trend:

Supply Chain Resilience & Diversification

Impact On Business:Customers prioritize reliable supply, creating an advantage for distributors with robust, diversified supply chains and advanced inventory management capabilities.

Timeline:Near-term

- Trend:

Data & Analytics for Predictive Maintenance

Impact On Business:Opportunity to leverage sales data and customer insights to offer predictive ordering and maintenance solutions, creating a new revenue stream and deeper integration.

Timeline:Long-term

- Trend:

Sustainability and ESG Initiatives

Impact On Business:Growing customer demand for sustainable products and transparent reporting requires curation of green product lines and sustainable operational practices.

Timeline:Near-term

Direct Competitors

- →

MSC Industrial Supply Co.

Market Share Estimate:Significant, a key publicly traded competitor

Target Audience Overlap:High

Competitive Positioning:Solutions-oriented partner for the industrial sector, particularly strong in metalworking.

Strengths

- •

Strong position in the metalworking and manufacturing sectors.

- •

Value-added services including inventory management and technical expertise.

- •

Large sales force with deep industry knowledge.

- •

Robust e-commerce platform.

Weaknesses

- •

Less brand recognition among the general public compared to Grainger.

- •

Historically perceived as more focused on metalworking than as a general MRO supplier.

- •

Fewer physical branch locations than Grainger or Fastenal.

Differentiators

Deep expertise and product selection for metalworking applications.

Focus on providing technical expertise and solutions, not just products.

- →

Fastenal Company

Market Share Estimate:Major player, especially in fasteners and on-site solutions

Target Audience Overlap:High

Competitive Positioning:Local service and supply chain solutions provider, emphasizing proximity to the customer.

Strengths

- •

Vast network of over 3,000 local branches providing 'last-mile' service.

- •

Leader in industrial vending (VMI) solutions with thousands of on-site machines.

- •

Strong focus on fasteners and safety supplies.

- •

Highly effective local sales and service model.

Weaknesses

- •

Broad MRO product offering is less comprehensive than Grainger's.

- •

Online e-commerce experience and catalog search can be less intuitive.

- •

Brand is heavily associated with fasteners, potentially limiting perception as a broad-line MRO supplier.

Differentiators

On-site inventory management solutions (vending and bins).

Hyper-local presence through its extensive branch network.

- →

Applied Industrial Technologies

Market Share Estimate:Niche leader

Target Audience Overlap:Medium

Competitive Positioning:Specialized distributor and solutions provider for industrial motion and flow control.

Strengths

- •

Deep technical expertise in bearings, power transmission, and fluid power.

- •

Strong engineering and fabrication service capabilities.

- •

Loyal customer base in heavy industry and manufacturing.

- •

Network of service centers for repairs and maintenance.

Weaknesses

- •

Much narrower product scope than Grainger; not a one-stop-shop for general MRO.

- •

Lower brand awareness outside of its core industrial segments.

- •

Digital platform is less sophisticated than larger competitors.

Differentiators

Value-added technical services and engineering support.

Specialization in critical industrial components.

Indirect Competitors

- →

Amazon Business

Description:The B2B marketplace arm of Amazon, offering a massive selection of MRO products from various sellers with the convenience of Prime shipping and a familiar user interface.

Threat Level:High

Potential For Direct Competition:Is already a direct competitor and is rapidly gaining share, especially in the 'spot buy' and less-technical MRO categories.

- →

The Home Depot Pro / HD Supply

Description:The professional services division of The Home Depot, targeting contractors, property managers, and institutional customers with a range of MRO, janitorial, and construction supplies.

Threat Level:High

Potential For Direct Competition:Already a direct competitor, particularly for customers in facilities maintenance, trades, and smaller business segments. The acquisition of HD Supply significantly strengthened its MRO capabilities.

- →

Lowe's For Pros

Description:Lowe's B2B program that offers products, credit solutions, and services tailored to construction and maintenance professionals.

Threat Level:Medium

Potential For Direct Competition:A direct competitor for smaller businesses and trade professionals, though with less emphasis on the heavy industrial MRO segment compared to Grainger.

- →

WESCO International

Description:A major distributor of electrical, communications, and utility products. Following its merger with Anixter, it has a massive scale in its specialized domains.

Threat Level:Medium

Potential For Direct Competition:Competes directly on electrical, safety, and other related MRO categories, but not across the full breadth of Grainger's catalog. Poses a threat by being the preferred specialist vendor for certain categories.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Scale and Logistics Infrastructure

Sustainability Assessment:Highly sustainable due to the immense capital investment and time required to replicate a national distribution network with millions of square feet of warehouse space.

Competitor Replication Difficulty:Hard

- Advantage:

Brand Equity and Trust

Sustainability Assessment:Sustainable. Over 90 years in business has built significant trust and reliability, which is critical for customers who cannot afford downtime.

Competitor Replication Difficulty:Hard

- Advantage:

Integrated Value-Added Services

Sustainability Assessment:Moderately sustainable. Services like KeepStock® inventory management and safety consulting create high switching costs and embed Grainger into customer operations.

Competitor Replication Difficulty:Medium

- Advantage:

Breadth of Product Catalog

Sustainability Assessment:Moderately sustainable. While vast, this is being challenged by marketplace models like Amazon Business. The advantage lies in the curated, reliable industrial-grade supply chain behind the products.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'Exclusive Distribution Rights for Niche Products', 'estimated_duration': '1-3 years, depending on supplier contracts.'}

Disadvantages

- Disadvantage:

Price Perception

Impact:Major

Addressability:Moderately

- Disadvantage:

Legacy Business Model Overhead

Impact:Major

Addressability:Difficult

- Disadvantage:

Digital User Experience vs. Digital Natives

Impact:Major

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted digital marketing campaigns highlighting technical support and supply chain reliability, directly contrasting with Amazon Business's weaknesses.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Optimize on-site search functionality for technical and colloquial terms to improve product discovery for skilled trades.

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Prominently feature 'Click-and-Collect' / branch pickup options throughout the checkout process to leverage the physical network advantage.

Expected Impact:High

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Develop a tiered 'Grainger Pro' service for small-to-medium businesses, offering a simplified digital experience, bundled services, and competitive pricing to counter Home Depot Pro and Amazon Business.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Expand high-margin service offerings, particularly in ESG consulting, energy efficiency audits, and IoT-enabled predictive maintenance.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Invest in personalizing the digital experience, using customer data to provide tailored recommendations, re-ordering prompts, and relevant content from the 'KnowHow' center.

Expected Impact:Medium

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Invest in a proprietary data analytics platform that offers customers insights into their MRO spend, predicts parts failure, and optimizes inventory levels, solidifying Grainger as an indispensable partner.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Explore a curated third-party marketplace model to strategically expand product selection in non-core categories without taking on inventory risk.

Expected Impact:Medium

Implementation Difficulty:Difficult

Evolve positioning from a 'distributor of products' to an 'indispensable partner for operational excellence.' Emphasize reliability, total cost of ownership, and expert solutions that keep businesses running, leveraging the combination of digital convenience and physical presence/expertise.

Hyper-focus on a hybrid 'clicks-and-mortar' strategy. Differentiate by providing a best-in-class digital experience that is seamlessly integrated with the physical branch network and human expertise, offering a level of service and reliability that pure-play e-commerce and traditional branch-based models cannot match.

Whitespace Opportunities

- Opportunity:

Develop a comprehensive sustainability/ESG solutions package for mid-sized industrial clients.

Competitive Gap:Competitors are focused on selling 'green' products, but few offer a holistic service that includes compliance reporting, energy audits, and waste reduction consulting.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Targeted MRO solutions for emerging high-tech industries (e.g., EV manufacturing, biotech labs).

Competitive Gap:Traditional distributors may lack the specialized product knowledge and sourcing for these new industries. Amazon Business lacks the required technical vetting and support.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Offer 'MRO-as-a-Service' subscription models for smaller businesses.

Competitive Gap:No major competitor offers a predictable, subscription-based model for common MRO supplies and services, which would appeal to businesses looking to simplify procurement and manage cash flow.

Feasibility:Low

Potential Impact:High

- Opportunity:

Enhanced training and certification content via Grainger KnowHow®.

Competitive Gap:While competitors offer some content, creating a premium or certified online training portal for safety, skilled trades, and maintenance could create a new revenue stream and a deeply engaged audience.

Feasibility:High

Potential Impact:Medium

W.W. Grainger operates in the mature and moderately concentrated MRO distribution industry. Its competitive landscape is defined by a multi-front battle against traditional broad-line distributors like MSC and Fastenal, and increasingly, against disruptive digital and retail giants like Amazon Business and The Home Depot Pro.

Grainger's core sustainable advantages are its immense physical logistics network, established brand trust, and deep integration into large customer operations via value-added services. These create a significant moat that is difficult and expensive for competitors to replicate. However, the company faces considerable challenges. Its primary disadvantages are a perception of higher prices and the high overhead costs of its legacy model, which make it vulnerable to more agile, lower-cost digital competitors. The user experience of Amazon Business, familiar to millions of consumers, sets a high bar that Grainger must continually strive to meet.

Direct competitors like Fastenal and MSC differentiate through focused strategies: Fastenal with its hyper-local service and on-site vending solutions, and MSC with its deep expertise in the metalworking sector. The most significant threat comes from indirect competitors who are now direct threats. Amazon Business leverages its e-commerce supremacy and logistics prowess to capture transactional, 'spot-buy' purchases, while The Home Depot Pro's acquisition of HD Supply makes it a formidable force in the facilities maintenance space.

Strategic whitespace for Grainger exists where digital convenience intersects with deep industry expertise. The key opportunity is not to out-Amazon Amazon, but to leverage its unique hybrid assets. This means creating a seamless omnichannel experience where the digital platform is the easy entry point, but is backed by the reliability of its supply chain, the immediate availability of products at local branches, and the value of its expert technical support. Future growth will be driven by moving further up the value chain—from a supplier of parts to a provider of data-driven operational intelligence and specialized solutions in areas like sustainability and advanced manufacturing.

Messaging

Message Architecture

Key Messages

- Message:

Grainger is the comprehensive source for MRO products.

Prominence:Primary

Clarity Score:High

Location:Footer Text ('Grainger offers over a million products...')

- Message:

We provide expert-driven solutions and resources, not just products.

Prominence:Primary

Clarity Score:High

Location:Homepage Sections ('Grainger KnowHow®', 'Services and Solutions')

- Message:

Grainger is a trusted, reliable partner with a long history of service.

Prominence:Secondary

Clarity Score:High

Location:Footer Text ('America’s trusted source for MRO supplies', 'For over 90 years...')

- Message:

Our solutions are organized around your professional needs and challenges.

Prominence:Secondary

Clarity Score:Medium

Location:Homepage Banners ('For Those Working Up High', 'For Pros Who Plan Ahead'), Product Collections Section

- Message:

Access our products and services anytime, anywhere through modern digital platforms.

Prominence:Tertiary

Clarity Score:High

Location:Footer Text ('...online features and a mobile app...')

The messaging hierarchy is strategically sound for a B2B e-commerce leader. The homepage effectively balances transactional needs (product categories, search bar) with brand-building, value-added content ('KnowHow', 'Services and Solutions'). This structure correctly prioritizes product discovery for visitors with immediate needs, while simultaneously funneling other users towards content that establishes Grainger as an expert partner, justifying a premium position over pure transactional competitors.

Messaging is highly consistent across the analyzed sections. The central themes of professionalism, expertise, and comprehensive solutions are woven through product marketing, content marketing, and service descriptions. The tagline 'We Keep the World Working®' aligns perfectly with the problem/solution-oriented messaging seen in homepage banners and the supportive tone of the service descriptions.

Brand Voice

Voice Attributes

- Attribute:

Professional

Strength:Strong

Examples

- •

For Pros Who Plan Ahead

- •

technical support from experts

- •

MRO supplies and industrial products

- Attribute:

Expert

Strength:Strong

Examples

- •

Grainger KnowHow ®

- •

News, inspiration and resources to help you get the job done.

- •

deep knowledge of MRO tools and products

- Attribute:

Reliable

Strength:Strong

Examples

- •

America’s trusted source

- •

For over 90 years...

- •

24/7 customer service

- Attribute:

Supportive

Strength:Moderate

Examples

We’re here for you – find out how we can help.

How can we help you?

Tone Analysis

Informative

Secondary Tones

- •

Professional

- •

Supportive

- •

Reassuring

Tone Shifts

The tone shifts from transactional/informative in the product categories to educational/inspirational within the 'Grainger KnowHow®' section.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

Grainger is the definitive, reliable partner for MRO professionals, providing a comprehensive selection of products backed by expert support, value-added services, and deep industry knowledge to ensure your operations run safely and efficiently.

Value Proposition Components

- Component:

Vast Product Selection

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Expert Technical Support and Resources

Clarity:Clear

Uniqueness:Unique

- Component:

Managed Services (e.g., Inventory Management)

Clarity:Clear

Uniqueness:Unique

- Component:

Reliability and Longevity

Clarity:Clear

Uniqueness:Somewhat Unique

Grainger's messaging effectively differentiates it from commodity e-commerce platforms like Amazon Business by emphasizing high-touch, value-added services such as 'KeepStock® Inventory Management' and 'Managed Safety Programs'. The 'Grainger KnowHow®' content hub is a significant differentiator that builds authority and positions them as a strategic partner, not just a supplier. Against traditional competitors like Fastenal or MSC Industrial, the differentiation hinges on the breadth of their online offering and the accessibility of their expertise.

The messaging positions Grainger as a premium, full-service MRO solutions provider. It justifies its market position by focusing on the total value delivered—through expertise, reliability, and services—rather than competing solely on price. This is a classic 'solutions selling' approach aimed at customers where the cost of downtime or a safety incident far outweighs any potential savings on individual product costs.

Audience Messaging

Target Personas

- Persona:

Facilities/Maintenance Manager

Tailored Messages

- •

KeepStock® Inventory Management

- •

Building & Grounds Maintenance

- •

Solutions for staying prepared.

Effectiveness:Effective

- Persona:

Safety Officer / EHS Manager

Tailored Messages

- •

For Those Working Up High

- •

A quiz on safety at elevated heights.

- •

Managed Safety Programs

- •

Safety and Health Solutions Center

Effectiveness:Effective

- Persona:

Procurement Professional

Tailored Messages

America’s trusted source for MRO supplies

over a million products from thousands of trusted MRO suppliers

Effectiveness:Somewhat Effective

Audience Pain Points Addressed

- •

Risk of safety incidents ('Stay safe, cool, hydrated')

- •

Operational downtime ('help you get the job done')

- •

Inventory management challenges ('KeepStock®')

- •

Emergency unpreparedness ('Solutions for staying prepared')

Audience Aspirations Addressed

- •

Running an efficient, well-maintained facility

- •

Ensuring a safe and compliant work environment

- •

Being seen as a proactive professional ('For Pros Who Plan Ahead')

Persuasion Elements

Emotional Appeals

- Appeal Type:

Security & Peace of Mind

Effectiveness:High

Examples

- •

Solutions for staying prepared.

- •

Stay safe, cool, hydrated and informed

- •

America's trusted source

Social Proof Elements

- Proof Type:

Appeal to Authority & Longevity

Impact:Moderate

Examples

For over 90 years, we’ve built a tradition...

America’s trusted source...

Trust Indicators

- •

Longevity ('For over 90 years')

- •

Scale ('over a million products', 'thousands of trusted... suppliers')

- •

24/7 Customer Service & Technical Support

- •

Emphasis on 'trusted source'

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

Product Category Links (e.g., 'Safety & Security', 'Lighting & Electrical')

Location:Homepage, below banner

Clarity:Clear

- Text:

Implicit: The Search Bar

Location:Header (prominently)

Clarity:Clear

- Text:

Engagement Links (e.g., 'For Those Working Up High')

Location:Homepage Banners

Clarity:Clear

- Text:

Chat with an Agent

Location:Pop-up / Footer

Clarity:Clear

The CTAs are highly effective for their intended purposes. Transactional CTAs (search, product categories) are clear and guide users with high purchase intent. Engagement CTAs (links to 'KnowHow' content) successfully draw users deeper into the Grainger ecosystem to build brand affinity and demonstrate expertise. However, there is a lack of a prominent, high-level business development CTA for new, large customers, such as 'Request a Business Consultation' or 'Explore Enterprise Solutions'.

Messaging Gaps Analysis

Critical Gaps

- •

Lack of Customer Social Proof: The site relies heavily on its own heritage for trust. There are no customer testimonials, case studies, or logos of well-known clients, which is a significant missed opportunity to build credibility.

- •

Absence of Quantifiable Outcomes: The messaging explains what Grainger does but rarely what impact it has. There are no metrics or benefit-driven statements like 'Reduce inventory costs by up to X%' or 'Improve safety compliance with...'.

- •

Limited Messaging for Procurement Persona: While the site serves procurement professionals, the messaging does not explicitly address their key drivers, such as total cost of ownership (TCO), supplier consolidation benefits, or procurement process efficiency.

Contradiction Points

No itemsUnderdeveloped Areas

Storytelling: The brand story is limited to its history. There is an opportunity to tell customer success stories that illustrate how Grainger's products and expertise solved a real-world, high-stakes problem.

Industry-Specific Messaging: While there is an 'Industries' link under 'Product Collections', the homepage messaging is very general. Tailoring messaging to key verticals like healthcare, manufacturing, or government could be more impactful.

Messaging Quality

Strengths

- •

Excellent Brand Positioning: The messaging clearly and consistently positions Grainger as a value-added partner, not just a distributor.

- •

Strong Voice and Tone: The professional, expert voice is perfectly aligned with the target audience and builds confidence.

- •

Effective Content Marketing Integration: The 'KnowHow' platform is seamlessly integrated into the messaging, serving as a powerful tool for demonstrating expertise and building trust.

- •

Clarity and Simplicity: The language is direct, easy to understand, and focused on the professional user.

Weaknesses

- •

Over-reliance on Self-Proclaimed Trust: The brand relies on its own claims of being 'trusted' and its '90-year' history, rather than leveraging third-party validation from customers.

- •

Too Rational, Not Enough Emotion: The messaging is highly logical. While appropriate for a B2B audience, incorporating more storytelling could forge a stronger emotional connection and brand preference.

- •

Generic Homepage for All Audiences: The homepage experience is largely one-size-fits-all, missing an opportunity to direct different personas (e.g., a safety manager vs. a buyer) to more tailored content paths.

Opportunities

- •

Feature a rotating 'Customer Spotlight' or 'Problem Solved' section on the homepage.

- •

Create and promote downloadable industry guides or whitepapers based on 'KnowHow' content in exchange for lead information.

- •

Develop a clear 'Why Grainger?' value proposition summary near the top of the homepage to immediately frame the brand against competitors.

Optimization Roadmap

Priority Improvements

- Area:

Social Proof & Trust Building

Recommendation:Incorporate a 'Trusted By' section with logos of key enterprise customers. Develop and feature 3-5 concise, powerful video testimonials or written case studies that highlight quantifiable business outcomes.

Expected Impact:High

- Area:

Value Proposition Clarity

Recommendation:Add a dedicated section on the homepage titled 'The Grainger Advantage' that visually communicates the three core pillars: Comprehensive Product Access, On-Demand Expertise, and Operational Solutions. This will quickly orient new visitors.

Expected Impact:High

- Area:

Audience Segmentation

Recommendation:Develop tailored messaging and content for the procurement persona, focusing on ROI, TCO, and efficiency gains. Create a dedicated landing page or content hub for 'Procurement Professionals'.

Expected Impact:Medium

Quick Wins

- •

Incorporate benefit-oriented subheadings in the 'Services and Solutions' section (e.g., 'KeepStock® Inventory Management: Reduce Carrying Costs & Eliminate Stockouts').

- •

Add customer quotes or star ratings (if available) to the homepage banners.

- •

Test a more prominent CTA for business inquiries, such as 'Get a Custom Quote' or 'Talk to a Specialist'.

Long Term Recommendations

Invest in a robust content strategy built around customer success stories, transforming the 'KnowHow' section from a helpful resource into a powerful sales-enablement tool.

Develop personalized homepage experiences based on user data (e.g., industry, past purchases, or role) to surface the most relevant products, services, and content.

W.W. Grainger's website messaging is a masterclass in B2B brand positioning for a market leader. The strategy successfully elevates the company from a simple distributor of MRO products to an indispensable business partner. The message architecture is intelligently designed, balancing the immediate, transactional needs of repeat customers with the strategic priority of communicating its deeper value proposition through services and expertise ('KnowHow®', 'KeepStock®'). The professional, expert, and reliable brand voice is flawlessly consistent and perfectly aligned with the expectations of its target personas in maintenance, safety, and operations.

The core strength lies in its differentiation from the growing threat of low-cost, purely transactional e-commerce players. By consistently foregrounding its human expertise, managed services, and solution-oriented approach, Grainger builds a defensible moat based on value, not just price. However, the strategy reveals a significant opportunity for evolution. Its reliance on self-proclaimed trust signals ('90 years', 'trusted source') is a relic of legacy marketing. The modern B2B buyer, even in traditional industries, expects peer validation. The near-total absence of customer testimonials, case studies, or quantifiable success metrics is the single largest messaging gap. By failing to translate its value proposition into the proven success of its customers, Grainger is leaving its most powerful persuasive tool untapped. The optimization roadmap should, therefore, be laser-focused on sourcing and strategically deploying this social proof to evolve the narrative from 'what we do' to 'what our customers achieve with us'.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Established 90+ year operating history and strong brand reputation as a market leader in the MRO industry.

- •

Serves a massive, diversified customer base of over 4.5 million businesses worldwide.

- •

Extensive product catalog with millions of SKUs, effectively serving as a one-stop shop for MRO needs.

- •

High percentage of revenue (70% in High-Touch Solutions) originates through digital channels, indicating strong adoption of its e-commerce platform.

- •

Development of value-added services like KeepStock® Inventory Management and technical support shows an evolution beyond product sales to meet complex customer needs.

Improvement Areas

- •

Enhance digital user experience with advanced personalization and AI-driven product recommendations to compete with digital-native players.

- •

Deepen vertical-specific expertise and product bundling for key growth sectors like healthcare, government, and technology manufacturing.

- •

Improve the integration and user experience between the 'High-Touch' (Grainger.com) and 'Endless Assortment' (Zoro.com) models for a more seamless customer journey.

Market Dynamics

Steady growth, with the global MRO Distribution market projected to grow at a CAGR of ~4.6% and the North American market at ~2.6%.

Mature

Market Trends

- Trend:

Digital Transformation (Industry 4.0)

Business Impact:Increasing customer expectation for seamless B2B e-commerce experiences, real-time data, and automated procurement processes. This is both a threat from digital-native competitors and an opportunity for Grainger to leverage its scale.

- Trend:

Demand for Value-Added Services

Business Impact:Shift from transactional product sales to integrated solutions. Customers seek inventory management, predictive maintenance insights, and sustainability consulting, creating opportunities for higher-margin, recurring revenue streams.

- Trend:

Supply Chain Resilience & Optimization

Business Impact:Businesses are prioritizing reliable and efficient MRO supply to minimize operational downtime, increasing the value of dependable partners like Grainger with robust logistics networks.

- Trend:

Rise of B2B Marketplaces

Business Impact:Intensified competition, particularly from Amazon Business, which creates pricing pressure and challenges traditional distributor relationships, especially with smaller, price-sensitive customers.

Excellent. The market is actively rewarding scaled, tech-enabled distributors. Grainger's ongoing investments in digital capabilities and supply chain position it well to capture share in a market undergoing significant technological change.

Business Model Scalability

High

Significant fixed costs in its extensive distribution network (distribution centers, branches), but this infrastructure provides operating leverage as volume increases. The e-commerce model has lower variable costs per transaction.

High. The established distribution network and digital platforms can handle significant increases in sales volume with incremental cost, leading to higher profitability.

Scalability Constraints

- •

Physical logistics and supply chain complexity associated with managing millions of SKUs.

- •

Dependence on a large sales and service team for the 'High-Touch' business model, which scales less rapidly than pure-play e-commerce.

- •

Potential for legacy IT systems to hinder agile development and integration of new technologies.

Team Readiness

Strong. As a publicly-traded, long-established industry leader, the company possesses an experienced executive team accustomed to managing complexity and scale.

Segmented structure ('High-Touch Solutions' and 'Endless Assortment') allows for focused strategies on different customer types. However, this could create silos that hinder a unified customer experience.

Key Capability Gaps

- •

Agile software development and product management talent to accelerate digital innovation.

- •

Data science and AI/ML expertise to drive personalization, demand forecasting, and supply chain optimization.

- •

Vertical-specific solutions experts who can combine product knowledge with deep industry process understanding.

Growth Engine

Acquisition Channels

- Channel:

Digital (SEO, SEM, E-commerce Platform)

Effectiveness:High

Optimization Potential:High

Recommendation:Invest in programmatic SEO for millions of product pages, leverage AI for SEM bid optimization, and implement advanced personalization on the website to increase conversion rates.

- Channel:

Direct Sales Force

Effectiveness:High

Optimization Potential:Medium

Recommendation:Equip the sales team with better data analytics tools and CRM integrations to identify cross-sell/upsell opportunities and focus on acquiring high-value accounts. Continue strategic expansion of the sales force.

- Channel:

Content Marketing (Grainger KnowHow®)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Develop more targeted, industry-specific content (e.g., white papers, webinars) tied to specific product solutions and use it for lead generation and nurturing in an account-based marketing (ABM) framework.

Customer Journey

Primarily a self-service e-commerce path for smaller orders and a sales-assisted path for large, complex B2B procurement involving contracts and system integrations.

Friction Points

- •

Navigating and filtering through millions of SKUs can be overwhelming for users without precise product knowledge.

- •

Complex checkout and approval workflows required by large B2B customers can be cumbersome if not perfectly integrated with their e-procurement systems.

- •

Lack of a unified view or journey for customers who might be served by both Grainger.com and Zoro.com.

Journey Enhancement Priorities

{'area': 'On-Site Search & Discovery', 'recommendation': 'Implement an AI-powered semantic search engine that understands technical specifications, industry jargon, and user intent to deliver more accurate results.'}

{'area': 'B2B Procurement Integration', 'recommendation': 'Deepen integrations with major e-procurement platforms (e.g., SAP Ariba, Coupa) to further streamline the purchasing process for large enterprise customers.'}

Retention Mechanisms

- Mechanism:

KeepStock® Inventory Management

Effectiveness:High

Improvement Opportunity:Integrate IoT sensors and predictive analytics into KeepStock solutions to automate reordering based on actual usage and predict maintenance needs, further embedding Grainger into customer operations.

- Mechanism:

Dedicated Sales & Service Reps

Effectiveness:High

Improvement Opportunity:Leverage customer data to provide proactive, consultative advice on cost savings, product consolidation, and safety compliance, transitioning reps from order-takers to strategic partners.

- Mechanism:

eProcurement & System Integration

Effectiveness:High

Improvement Opportunity:Develop APIs and standardized integration packages to make it easier and faster for mid-sized companies to connect their purchasing systems with Grainger's platform.

Revenue Economics

Strong. As a large-scale distributor, Grainger benefits from significant purchasing power and logistical efficiencies, though margins are under pressure from digital competition.

Likely high for the 'High-Touch' segment due to long-term contracts and embedded services, creating high switching costs. More variable for the 'Endless Assortment' transactional customers.

High, evidenced by consistent profitability and operating margins around 15%.

Optimization Recommendations

- •

Increase the penetration of high-margin private label products.

- •

Expand the portfolio of recurring-revenue services (e.g., safety consulting, managed inventory) to increase customer lifetime value.

- •

Utilize dynamic pricing algorithms to optimize margins on non-contractual, spot-buy purchases.

Scale Barriers

Technical Limitations

- Limitation:

Legacy Enterprise Systems

Impact:Medium

Solution Approach:Adopt a two-speed IT architecture, maintaining stable core ERP systems while building a flexible, microservices-based layer for customer-facing applications to enable faster innovation.

Operational Bottlenecks

- Bottleneck:

Supply Chain Complexity & Disruptions

Growth Impact:Disruptions can lead to stockouts, delayed deliveries, and damaged customer trust, directly impacting revenue and retention.

Resolution Strategy:Invest in advanced supply chain visibility platforms, diversify the supplier base, and utilize predictive analytics to better forecast demand and position inventory proactively.

- Bottleneck:

Inventory Management at Scale

Growth Impact:Carrying millions of SKUs ties up significant working capital and increases the risk of obsolescence.

Resolution Strategy:Implement multi-echelon inventory optimization (MEIO) software to strategically position inventory across the network based on demand patterns, improving service levels while reducing overall stock.

Market Penetration Challenges

- Challenge:

Intense Competition from Digital-Native Players

Severity:Critical

Mitigation Strategy:Compete not just on price or assortment, but on value-added services, technical expertise, and supply chain reliability. Differentiate through a superior, consultative 'High-Touch' service model that digital-only players cannot replicate.

- Challenge:

Market Fragmentation

Severity:Major

Mitigation Strategy:Continue to take share from smaller, regional distributors by leveraging national scale, a superior digital experience, and robust inventory management solutions that smaller players cannot offer.

Resource Limitations

Talent Gaps

- •

Data Scientists and AI/ML Engineers

- •

Digital Product Managers with B2B expertise

- •

Vertical Industry Solutions Architects

Sustained high capital expenditure is required for supply chain automation, digital platform development, and potential strategic acquisitions.

Infrastructure Needs

Continued investment in distribution center automation (robotics, AGVs) to increase efficiency and throughput.

Upgrades to the core data infrastructure to support real-time analytics and AI applications.

Growth Opportunities

Market Expansion

- Expansion Vector:

Deeper Vertical Penetration (e.g., Healthcare, Government, Data Centers)

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Create dedicated cross-functional teams for each target vertical. Develop tailored product assortments, specialized content, and service bundles (e.g., compliance services for healthcare) to address unique industry needs.

- Expansion Vector:

International Market Growth

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Focus on expanding the 'Endless Assortment' digital model in mature e-commerce markets (e.g., Europe) and pursue strategic acquisitions or partnerships to enter new high-growth regions.

Product Opportunities

- Opportunity:

Predictive Maintenance as a Service (PMaaS)

Market Demand Evidence:The MRO industry is trending towards predictive maintenance to reduce downtime.

Strategic Fit:Strong. Leverages existing product knowledge and customer relationships, moving up the value chain.

Development Recommendation:Partner with industrial IoT sensor and analytics companies to co-develop a service offering. Pilot with key 'High-Touch' customers.

- Opportunity:

Sustainability & ESG Solutions

Market Demand Evidence:Increasing customer focus on sustainability goals and regulatory reporting.

Strategic Fit:Excellent. Aligns with corporate responsibility and provides a new dimension of value to customers.

Development Recommendation:Develop a suite of services including energy efficiency audits, sustainable product sourcing, and waste management consulting. Bundle these services with relevant product sales.

Channel Diversification

- Channel:

Enhanced Mobile Application

Fit Assessment:Strong. Maintenance professionals are increasingly mobile and need on-the-go access to order parts, check specs, and manage inventory.

Implementation Strategy:Develop features beyond simple purchasing, such as visual search (photo-to-part), access to technical manuals, and integration with KeepStock inventory scanning.

Strategic Partnerships

- Partnership Type:

Technology & Software Integrations

Potential Partners

- •

CMMS (Computerized Maintenance Management System) providers

- •

Industrial IoT platform companies

- •

E-procurement software vendors

Expected Benefits:Deeper integration into customer workflows, creating higher switching costs and enabling data-driven service offerings.

- Partnership Type:

Specialized Service Providers

Potential Partners

- •

Engineering consulting firms

- •

Specialized industrial cleaning services

- •

Safety training and certification bodies

Expected Benefits:Expand Grainger's service portfolio without needing to build all capabilities in-house, offering a more comprehensive solution to customers.

Growth Strategy

North Star Metric

Customer Share of Wallet

This metric focuses on deepening relationships and increasing the value of each customer, aligning perfectly with the strategy of cross-selling products and adding high-margin services. It shifts the focus from purely customer acquisition to customer growth and retention.

Increase share of wallet by 15% within key customer segments over the next 24 months.

Growth Model

Hybrid: Sales-Led Growth (SLG) for High-Touch & Product-Led Growth (PLG) for Endless Assortment

Key Drivers

- •

Sales team effectiveness and coverage (SLG)

- •

Value-added service penetration (SLG)

- •

Digital user experience and self-service capabilities (PLG)

- •

Search engine visibility and conversion rate (PLG)

Empower the direct sales force with data-driven tools to expand large accounts. Simultaneously, invest heavily in the digital platform's UX, personalization, and self-service features to efficiently acquire and serve the long tail of the market.

Prioritized Initiatives

- Initiative:

Develop & Launch Vertical Solution Bundles

Expected Impact:High

Implementation Effort:Medium

Timeframe:9-12 months

First Steps:Form a pilot team for the 'Healthcare' vertical. Conduct customer discovery interviews to identify unmet needs and map out a bundled product/service offering.

- Initiative:

AI-Powered E-commerce Personalization Engine

Expected Impact:High

Implementation Effort:High

Timeframe:12-18 months

First Steps:Hire a lead Data Scientist for e-commerce. Begin with a pilot project to personalize product recommendations on the homepage for logged-in users.

- Initiative:

Expansion of IoT-Enabled Inventory Management

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:6-9 months

First Steps:Identify a technology partner for IoT sensors and platform. Select 20 strategic customers to participate in a pilot program for the next-generation KeepStock solution.

Experimentation Plan

High Leverage Tests

{'test': 'Dynamic Pricing Models', 'hypothesis': 'Implementing dynamic pricing for non-contract customers based on demand, inventory levels, and competitor pricing will increase gross margin without significantly impacting conversion rate.'}

{'test': 'Service Subscription Tiers', 'hypothesis': "Offering tiered subscription plans for services (e.g., 'Safety Compliance Basic' vs. 'Premium') will create predictable, recurring revenue streams and increase service adoption."}

Utilize an A/B testing platform for all digital experiments. Measure initiatives against key metrics including Customer Lifetime Value (LTV), Gross Margin Return on Investment (GMROI), and Customer Retention Rate.

Bi-weekly sprint cycle for digital product experiments. Quarterly review cycle for major strategic initiatives.

Growth Team

A centralized 'Growth Strategy' team that sets direction, combined with decentralized, cross-functional 'Growth Pods' focused on specific objectives (e.g., 'Mid-Sized Customer Acquisition', 'Vertical Market Penetration').

Key Roles

- •

Head of Growth Strategy

- •

Data Scientist (Customer Analytics)

- •

Vertical Market Manager

- •

Digital Product Manager (B2B Experience)

Establish a dedicated budget for growth experimentation. Create a 'Growth Guild' for internal knowledge sharing and training on topics like data analytics, experimentation design, and agile methodologies.

W.W. Grainger possesses a formidable growth foundation built on decades of market leadership, a massive customer base, and a robust physical and digital infrastructure. Its product-market fit is undeniable in the mature MRO industry. The primary growth vector lies not in simple expansion, but in a strategic transformation from a product distributor to a tech-enabled solutions partner. The market is ripe for this shift, as trends like digital transformation and supply chain optimization push customers to seek more than just parts; they need integrated solutions that improve their operational efficiency.

The company's growth engine is strong but faces significant pressure from nimble, digital-native competitors like Amazon Business. While Grainger's 'High-Touch' model for large enterprises remains a powerful competitive advantage, the key to accelerating growth is to infuse it with technology and scale its value-added services. Opportunities in predictive maintenance, sustainability solutions, and deeper vertical integration are substantial and align perfectly with market needs.

The most significant barriers to scale are not external market access but internal complexities: managing a vast supply chain, overcoming potential legacy system inertia, and acquiring top-tier digital talent. The primary strategic challenge is to balance the needs of the established, sales-led 'High-Touch' business with the agile, product-led 'Endless Assortment' model.

Recommendations are centered on a three-pronged strategy: 1) Deepen Customer Integration by evolving from a supplier to an indispensable operational partner through technology and services like IoT-enabled inventory management. 2) Sharpen Vertical Focus by creating tailored product and service bundles that solve the specific, complex problems of high-value industries. 3) Accelerate Digital Innovation by investing heavily in AI-driven personalization and a seamless B2B user experience to defend and grow market share among all customer segments. By adopting 'Customer Share of Wallet' as its North Star, Grainger can align the entire organization around a strategy of creating deeper, more profitable, and more defensible customer relationships.

Legal Compliance

Grainger maintains a comprehensive privacy posture, evidenced by its detailed Business Conduct Guidelines and specific policies addressing global privacy laws. The company's 2022 ESG report explicitly mentions implementing solutions to facilitate data subject requests under GDPR, CCPA, and PIPEDA, demonstrating a proactive approach to transparency and individual data rights. The policy outlines the collection, use, and sharing of Personally Identifiable Information (PII) and commits to protecting it based on globally recognized principles. Training is provided to employees on handling PII, reinforcing the company's commitment. The policy is accessible via the website footer, ensuring transparency for users and business partners.

Grainger's terms are robust and tailored for a B2B environment. Multiple documents, including the 'Supplier Agreement' and 'Purchase Order Terms', govern relationships. These documents clearly define key commercial terms such as product cost, payment terms (e.g., 2% 10 NET 30), electronic data interchange for business documents, and procedures for product returns. The return policy allows for returns within 30 days for most items, with clear exceptions for custom-ordered or hazardous materials. The terms establish a strong legal framework that manages expectations and liabilities effectively in complex B2B transactions. These terms are clearly designed to be enforceable and specify the conditions of sale, risk, and title transfer.

The website demonstrates a solid approach to cookie compliance. Upon visiting, a clear cookie banner appears, offering options to 'Accept' or view the Privacy Policy. The site also provides a 'Privacy Preference Center' which allows for granular control over different cookie categories, such as Strictly Necessary, Performance, Functional, and Targeting cookies. This level of user control is aligned with the stringent requirements of regulations like GDPR. Non-essential cookies appear to be blocked pending user consent, which is a key compliance indicator.