eScore

homedepot.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

The Home Depot exhibits a dominant digital presence, masterfully blending its extensive physical store network with a powerful e-commerce platform. Its content strategy effectively captures users across the entire purchasing funnel, from high-level DIY project research to specific product searches. The company's massive domain authority and sophisticated omnichannel features, like Buy Online, Pick-up In Store (BOPIS), create a formidable digital footprint that is difficult for competitors to replicate.

Exceptional omnichannel integration that uses the website and app to drive both online sales and highly profitable in-store traffic, creating a seamless customer journey.

Implement greater personalization on the website and app to create distinct experiences for the 'DIY' and 'Pro' customer segments, surfacing more relevant tools, content, and offers upon entry.

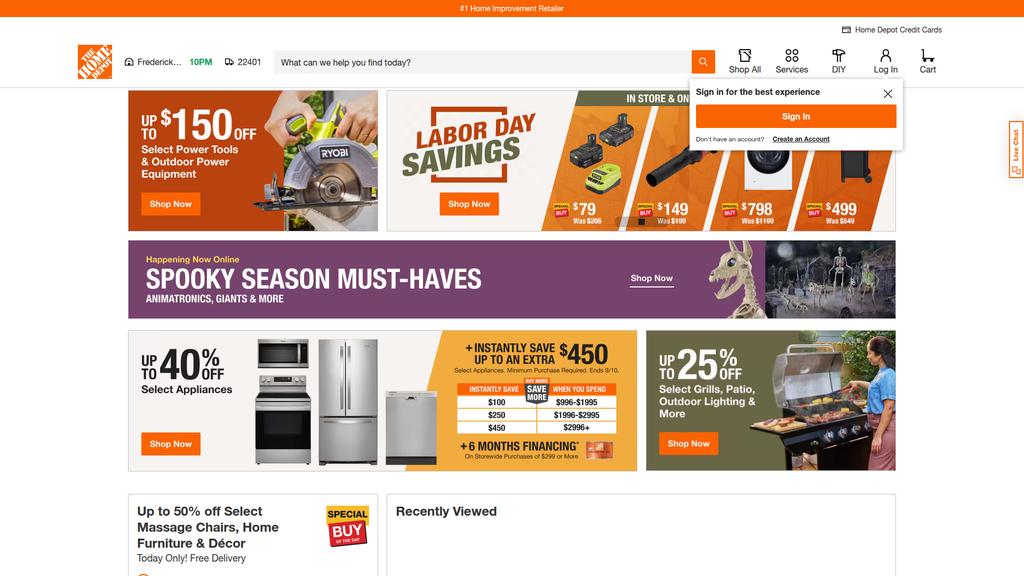

The brand's core message, 'How doers get more done™,' is strong and consistently reinforced through action-oriented and empowering language. Communication is exceptionally clear regarding transactional value, with a heavy emphasis on promotions and savings that resonates with its price-conscious audience. While highly effective at driving sales, this transactional focus sometimes overshadows the more inspirational and project-success narratives that could build a deeper emotional connection.

Unmatched clarity in communicating price, value, and promotions, which effectively drives a sense of urgency and transactional behavior.

Balance the overwhelming number of promotional messages on the homepage with more inspirational, narrative-driven content that showcases successful project outcomes to build a stronger brand connection beyond price.

The website is a highly functional, mature e-commerce platform designed to handle a massive catalog and complex user journeys effectively. Navigation is intuitive, and primary conversion elements like 'Add to Cart' are prominent and clear. However, the homepage suffers from visual clutter and a high density of competing offers, which increases cognitive load and can lead to choice paralysis for users without a specific goal.

A robust and logical information architecture, featuring a comprehensive mega menu and prominent search bar that allows users to efficiently navigate millions of SKUs.

Streamline the homepage by reducing the number of competing promotional banners and calls-to-action to create a more focused user experience and increase the impact of primary offers.

As the market leader, The Home Depot enjoys immense inherent credibility and brand trust. Trust signals for its high-consideration 'Home Services' are strong, explicitly detailing contractor vetting processes like background checks and license verification. However, the provided analysis and recent legal history reveal strategic vulnerabilities in digital accessibility (ADA compliance) and data privacy consent practices, which present both legal and reputational risks.

A comprehensive and transparent vetting process for its third-party service providers, which builds significant trust for its high-margin 'Do-It-For-Me' offerings.

Implement a prominent, GDPR-style cookie consent banner on the US website to require affirmative opt-in for non-essential tracking, mitigating risks from evolving state privacy laws.

The Home Depot's competitive advantages are deeply entrenched and highly sustainable, forming a wide economic moat. Its massive economies of scale grant significant purchasing power over suppliers, while its sophisticated, integrated supply chain is a key differentiator that pure-play e-commerce retailers cannot match. The most defensible advantage is the mature ecosystem built for the 'Pro' customer, which fosters intense loyalty and creates high switching costs.

A deeply integrated ecosystem for Professional (Pro) customers that combines loyalty programs, specialized services, credit offerings, and a dedicated supply chain, creating powerful switching costs.

Aggressively expand digital tools for Pro customers to include business management and workflow software, transforming from a supplier into an indispensable business partner.

The business model is highly scalable, leveraging high fixed costs across an enormous sales volume. The company has clearly identified its primary growth vectors in the underserved professional market and the high-margin 'Home Services' segment. Strategic acquisitions (like SRS Distribution) and investments in dedicated 'Pro' distribution centers demonstrate a clear and actionable strategy for future expansion and capturing greater market share.

A clearly defined and well-funded strategy to capture a larger share of the massive Professional (Pro) market, which is growing faster than the DIY segment.

Address the growing shortage of skilled trade labor by creating partnerships with vocational schools and trade programs to cultivate the next generation of professional customers and service providers.

The Home Depot operates a highly coherent and synergistic omnichannel model where each part reinforces the others. The core retail business (both physical and digital) is complemented by high-margin, diversified revenue streams from services, rentals, and credit offerings. The strategic focus is exceptionally clear, with resources being decisively allocated towards the 'Pro Ecosystem' and 'Do-It-For-Me' services, aligning perfectly with identified market growth opportunities.

Excellent alignment between a diversified revenue model and a clear strategic focus on growing the high-value Pro and 'Do-It-For-Me' customer segments.

Develop and pilot subscription-based 'Home-as-a-Service' models for recurring maintenance needs to create predictable, recurring revenue streams and reduce dependency on economic cycles.

As the dominant market leader with a market share around 64%, The Home Depot exerts significant power over the home improvement industry. Its immense scale provides substantial leverage over suppliers, allowing it to achieve favorable pricing and terms. This translates into competitive pricing for customers while maintaining healthy margins, demonstrating clear pricing power and market influence that competitors struggle to match.

Dominant market share and massive economies of scale, which provide superior negotiating power with suppliers and the ability to win on both price and selection.

Proactively counter the threat from service marketplaces like Angi and Thumbtack by investing in a superior, more integrated digital experience for booking and managing 'Home Services'.

Business Overview

Business Classification

Omnichannel Retail

Services Marketplace

Home Improvement

Sub Verticals

- •

Building Materials

- •

Tools & Hardware

- •

Lawn & Garden

- •

Home Appliances

- •

Decor & Furniture

- •

Installation & Repair Services

Mature

Maturity Indicators

- •

Market leader with significant market share (~51% in Home Improvement Stores).

- •

Well-established brand with high recognition and customer loyalty.

- •

Consistent financial performance and dividend payouts.

- •

Focus on operational efficiency, supply chain optimization, and strategic acquisitions for growth.

- •

Extensive physical store footprint across North America.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Product Sales (Retail & E-commerce)

Description:Core revenue driver from the sale of a wide range of home improvement products, including building materials, decor, hardware, and garden supplies, through physical stores and homedepot.com. This is split between DIY and Professional customer segments.

Estimated Importance:Primary

Customer Segment:DIY Homeowners & Professional Contractors

Estimated Margin:Medium

- Stream Name:

Pro/Contractor Services

Description:Sales and services tailored to professional contractors, builders, and maintenance crews. This includes bulk pricing, dedicated support staff, a tiered loyalty program (Pro Xtra), and specialized fulfillment options. This segment accounts for approximately half of all sales.

Estimated Importance:Primary

Customer Segment:Professional Contractors

Estimated Margin:Medium-High

- Stream Name:

Home Services (Installation & Repair)

Description:Acts as a managed marketplace connecting customers with vetted, third-party local professionals for a wide array of installation and remodeling services (e.g., HVAC, electrical, flooring). Home Depot manages the project and derives revenue from service fees.

Estimated Importance:Secondary

Customer Segment:DIFM (Do-It-For-Me) Homeowners

Estimated Margin:High

- Stream Name:

Tool & Equipment Rental

Description:Rental services for professional-grade tools and equipment, from small power tools to large machinery like excavators and trucks, serving both DIY customers for single projects and Pros for ongoing needs.

Estimated Importance:Tertiary

Customer Segment:DIY Homeowners & Professional Contractors

Estimated Margin:High

- Stream Name:

Financial Services & Credit

Description:Revenue generated through co-branded consumer and commercial credit cards, offering financing options, and other financial products. This drives sales and enhances customer loyalty.

Estimated Importance:Tertiary

Customer Segment:DIY Homeowners & Professional Contractors

Estimated Margin:High

Recurring Revenue Components

Pro Xtra Loyalty Program, which drives repeat business from high-value professional customers.

Potential for maintenance and service contracts tied to Home Services installations.

Pricing Strategy

Value-Based & Promotional Pricing

Mid-range

Transparent

Pricing Psychology

- •

Promotional Pricing (e.g., 'Labor Day Savings', 'Special Buy of the Day')

- •

Volume Discounts (for Pro customers)

- •

Price Matching Guarantee

- •

Financing Offers (e.g., '6 Months Everyday Financing')

Monetization Assessment

Strengths

- •

Diversified revenue streams beyond simple product retail.

- •

High-margin services and rental businesses complement core retail.

- •

Strong monetization of the high-value Pro customer segment through tailored services and loyalty programs.

- •

Omnichannel integration (e.g., Buy Online, Pick Up In Store) increases average transaction value.

Weaknesses

- •

High dependency on the health of the North American housing market and overall economic conditions.

- •

Intense price competition from rivals like Lowe's and online retailers like Amazon.

- •

Operational complexity in managing both product sales and a vast services marketplace.

Opportunities

- •

Further expansion of the Pro ecosystem through strategic acquisitions and technology investments to deepen wallet share.

- •

Growth of the high-margin Home Services marketplace by adding more service categories and improving the digital experience.

- •

Introduction of subscription-based models for home maintenance and repair services.

- •

Leveraging data analytics for more personalized pricing and promotions for Pro and DIY segments.

Threats

- •

Economic downturns reducing consumer discretionary spending on large renovation projects.

- •

Market saturation and increasing competition from both big-box rivals and smaller, more nimble players.

- •

A persistent shortage of skilled trade labor could constrain the growth of the 'Do-It-For-Me' (DIFM) services segment.

- •

Shifting consumer preferences towards smaller, more convenient store formats could challenge the large warehouse model.

Market Positioning

Market Leader and One-Stop Shop

Dominant (Approx. 51-52% of the US Home Improvement store market).

Target Segments

- Segment Name:

DIY (Do-It-Yourself) Homeowner

Description:Individuals or families who own or rent their homes and prefer to undertake home improvement, repair, and maintenance projects themselves. This segment ranges from beginners to experienced 'Weekend Warriors'.

Demographic Factors

- •

Ages 30-65

- •

Middle to upper-middle-class income

- •

Homeowners

Psychographic Factors

- •

Value self-reliance and accomplishment.

- •

Enjoy learning new skills.

- •

Seek value and affordability.

- •

Motivated by improving their living space.

Behavioral Factors

- •

Purchases are often project-based and seasonal.

- •

Conducts online research before visiting a store.

- •

Responsive to promotions and DIY workshops.

- •

Buys in smaller quantities compared to Pros.

Pain Points

- •

Lack of knowledge or confidence to start/complete a project.

- •

Finding the right tools and materials.

- •

Staying within budget.

- •

Transporting large or heavy items.

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Professional Contractor (Pro)

Description:A critical and high-value segment comprising professional contractors, remodelers, builders, property managers, and tradespeople (plumbers, electricians). They rely on Home Depot as a key supplier for their business operations.

Demographic Factors

Primarily male, though this is changing.

Owns or operates a small to medium-sized business.

Psychographic Factors

- •

Value efficiency, reliability, and relationships.

- •

Profit-driven and time-sensitive.

- •

Brand loyal if service is consistent and reliable.

Behavioral Factors

- •

Frequent, high-volume purchases.

- •

Requires fast and flexible fulfillment options (in-store pickup, job site delivery).

- •

Leverages loyalty programs (Pro Xtra) and credit lines.

- •

Values dedicated support and specialized services.

Pain Points

- •

Inventory stockouts delaying projects.

- •

Inefficient purchasing and expense tracking.

- •

Time wasted in-store.

- •

Access to competitive, consistent pricing.

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

DIFM (Do-It-For-Me) Customer

Description:Homeowners who prefer to hire professionals to complete home improvement projects. They use Home Depot to find and hire trusted installers for services ranging from simple installations to major renovations.

Demographic Factors

Varies widely, but often includes busy professionals or those lacking DIY skills/desire.

Psychographic Factors

- •

Prioritizes convenience and quality over cost.

- •

Seeks trust and peace of mind from a reputable brand.

- •

Risk-averse regarding project outcomes.

Behavioral Factors

- •

Initiates projects through the Home Services portal or in-store consultation.

- •

Less frequent, but very high-value transactions.

- •

Decision-making based on trust, reviews, and financing options.

Pain Points

- •

Finding reliable and skilled contractors.

- •

Managing project scope, budget, and timeline.

- •

Uncertainty about project quality and guarantees.

Fit Assessment:Good

Segment Potential:High

Market Differentiation

- Factor:

Integrated Pro Ecosystem

Strength:Strong

Sustainability:Sustainable

- Factor:

Omnichannel Supply Chain & Logistics

Strength:Strong

Sustainability:Sustainable

- Factor:

Brand Recognition & Trust

Strength:Strong

Sustainability:Sustainable

- Factor:

Breadth of Product Assortment

Strength:Strong

Sustainability:Sustainable

- Factor:

Home Services Marketplace

Strength:Moderate

Sustainability:Sustainable

- Factor:

Exclusive Brands (e.g., Ryobi, Husky, Behr)

Strength:Moderate

Sustainability:Temporary

Value Proposition

To be the #1 destination for home improvement, empowering both DIYers and Professionals with the broadest selection of products, competitive prices, and the expert support and services needed to get any project done right.

Excellent

Key Benefits

- Benefit:

One-Stop Shopping Convenience

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Vast product categories listed on the website.

Combination of product sales, tool rental, and installation services.

- Benefit:

Expert Support & Resources

Importance:Important

Differentiation:Somewhat unique

Proof Elements

- •

In-store expert staff (carpenters, plumbers).

- •

Online DIY project guides and calculators.

- •

Free in-store kids workshops.

- Benefit:

Specialized Services for Professionals

Importance:Critical

Differentiation:Unique

Proof Elements

- •

Pro Xtra loyalty program with tiered benefits.

- •

Dedicated Pro desks in stores.

- •

Bulk pricing and job site delivery options.

- Benefit:

Trusted Installation & Home Services

Importance:Important

Differentiation:Somewhat unique

Proof Elements

- •

Vetting process for service providers (background checks, license verification).

- •

Wide range of services from electrical to full kitchen remodels.

- •

Backed by The Home Depot brand.

Unique Selling Points

- Usp:

The industry's most comprehensive, interconnected ecosystem for Professionals, integrating specialized products, logistics, loyalty rewards, and business management tools.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A highly efficient, omnichannel supply chain that enables fast and flexible fulfillment (BOPIS, job site delivery) at a massive scale.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A trusted, nationwide platform for Do-It-For-Me services, removing the friction of finding and managing contractors for homeowners.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Project Complexity & Lack of Know-How (DIY)

Severity:Major

Solution Effectiveness:Complete

- Problem:

Inefficiency & Unreliable Supply (Pro)

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Finding Trusted Contractors (DIFM)

Severity:Critical

Solution Effectiveness:Partial

- Problem:

Access to a Wide Variety of Products in One Place

Severity:Major

Solution Effectiveness:Complete

Value Alignment Assessment

High

The value proposition directly addresses the core needs of the growing home improvement market, which includes trends in DIY, professional services, and smart home integration.

High

The company has successfully bifurcated its value proposition to cater specifically to the distinct needs of its two primary audiences: DIYers who need guidance and value, and Pros who need efficiency and reliability.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Product Suppliers & Manufacturers (Global and Domestic)

- •

Third-Party Service Providers & Contractors (for Home Services)

- •

Logistics & Freight Companies

- •

Financial Institutions (for credit services)

- •

Technology Partners (e.g., Google Cloud for AI innovation).

Key Activities

- •

Merchandising & Inventory Management

- •

Supply Chain & Logistics Optimization

- •

In-Store & Online Retail Operations

- •

Marketing & Customer Relationship Management (especially for Pros)

- •

Vetting & Management of Service Professionals

Key Resources

- •

Extensive Network of Physical Stores

- •

Advanced Distribution & Fulfillment Centers

- •

Strong Brand Equity & Customer Trust

- •

Pro Xtra Loyalty Program & Pro Customer Data

- •

E-commerce Platform & Mobile App

Cost Structure

- •

Cost of Goods Sold (COGS)

- •

Store Operating Expenses (Labor, Rent, Utilities)

- •

Supply Chain & Logistics Costs

- •

Sales, General & Administrative (SG&A) Expenses

- •

Marketing & Advertising Spend

- •

Technology & E-commerce Infrastructure Investment

Swot Analysis

Strengths

- •

Dominant market leadership and brand recognition.

- •

Highly efficient, scaled omnichannel supply chain.

- •

Deeply entrenched relationship with the high-value Professional customer segment.

- •

Diversified revenue streams including services and rentals.

- •

Strong financial health and ability to make strategic acquisitions.

Weaknesses

- •

High dependency on the North American housing market and macroeconomic cycles.

- •

Large physical store format may be less convenient for some consumers compared to smaller, local competitors.

- •

In-store customer service can be inconsistent due to the scale of operations.

- •

The business model is largely imitable by its primary competitor, Lowe's.

Opportunities

- •

Massive growth potential in the fragmented Professional market through acquisitions (like SRS) and building a deeper ecosystem.

- •

Expansion of the Home Services marketplace to capture a larger share of the DIFM segment.

- •

Leveraging AI and data analytics to further personalize the customer experience and optimize operations.

- •

Growth in sustainability and eco-friendly products as a key consumer trend.

- •

Limited international presence presents long-term expansion opportunities.

Threats

- •

Intense competition from Lowe's, Amazon, and specialized retailers.

- •

An economic downturn, high-interest rates, or a housing market slowdown could significantly reduce consumer spending.

- •

Ongoing supply chain disruptions and inflation impacting costs and margins.

- •

Shortage of skilled labor could limit the growth of the professional and services segments.

- •

Shifting consumer behavior and expectations for convenience and delivery speed.

Recommendations

Priority Improvements

- Area:

Pro Customer Digital Experience

Recommendation:Invest further in the Pro digital platform to offer advanced features like project management tools, customized pricing engines, and seamless integration with accounting software to become an indispensable business partner.

Expected Impact:High

- Area:

Home Services Integration

Recommendation:More deeply integrate the Home Services offering into the core retail journey, using in-store and online interactions to proactively suggest relevant installation services, creating a truly seamless 'product + service' purchase path.

Expected Impact:High

- Area:

Data Analytics & AI

Recommendation:Accelerate the use of AI for predictive inventory management to mitigate stockouts for Pros, and leverage customer data to create hyper-personalized marketing and product recommendations for the DIY segment.

Expected Impact:Medium

Business Model Innovation

- •

Develop a 'Home-as-a-Service' subscription model offering homeowners annual packages for routine maintenance, inspections, and repairs, creating a recurring revenue stream.

- •

Launch a B2B platform targeting commercial and property management clients, expanding beyond the residential Pro segment.

- •

Create a dedicated in-house design and build consultancy service for large-scale renovation projects, capturing more value than the current referral-based model.

Revenue Diversification

- •

Aggressively expand the tool and equipment rental business, potentially through smaller, standalone rental locations in urban areas.

- •

Build out a B2B supply business for municipalities and large enterprises, leveraging the existing supply chain.

- •

Expand financial services to include project loans and contractor-specific financing products, capturing more of the project value chain.

The Home Depot operates a mature and highly successful omnichannel retail business model, fortified by a services marketplace. Its strategic position as the market leader is built on a foundation of immense scale, brand trust, and a world-class supply chain. The company's most significant competitive advantage and future growth driver lies in its deeply integrated ecosystem for the Professional (Pro) customer segment. This 'Pro Ecosystem'—combining specialized products, a tiered loyalty program, dedicated fulfillment, and business tools—creates high switching costs and differentiates it from competitors who are less focused on this lucrative market.

The primary strategic evolution for Home Depot is the transition from being a product retailer to a comprehensive platform manager for all home improvement needs. This involves a deliberate shift to grow its higher-margin, less cyclical revenue streams like Home Services, Rentals, and Pro-specific offerings to buffer against the volatility of the housing market. While facing significant threats from macroeconomic uncertainty and intense competition, Home Depot's opportunities for growth are substantial. The key to unlocking this potential will be deepening its digital integration, particularly for the Pro segment, and successfully scaling its Home Services marketplace to capture the growing 'Do-It-For-Me' consumer trend. Future innovation should focus on creating recurring revenue models, such as maintenance subscriptions, to further insulate the business from economic cycles and solidify its role as an indispensable partner for homeowners and professionals alike.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Economies of Scale

Impact:High

- Barrier:

Brand Recognition and Loyalty

Impact:High

- Barrier:

Supply Chain and Logistics Networks

Impact:High

- Barrier:

High Capital Investment

Impact:High

- Barrier:

Prime Real Estate Locations

Impact:Medium

Industry Trends

- Trend:

Omnichannel Integration (BOPIS, Ship-to-Store)

Impact On Business:Critical for maintaining market share by providing seamless online and offline customer experiences.

Timeline:Immediate

- Trend:

Increased Focus on Professional (Pro) Customers

Impact On Business:Significant revenue growth opportunity, requiring tailored services, loyalty programs, and inventory.

Timeline:Immediate

- Trend:

Growth in Do-It-For-Me (DIFM) Segment

Impact On Business:Requires expansion of installation and professional services to capture a larger share of home renovation projects.

Timeline:Near-term

- Trend:

Demand for Sustainable and Eco-Friendly Products

Impact On Business:Growing consumer preference necessitates sustainable sourcing and offering a wider range of 'green' products.

Timeline:Near-term

- Trend:

Smart Home Technology Integration

Impact On Business:Opportunity to become a central hub for smart home devices and installation services.

Timeline:Near-term

Direct Competitors

- →

Lowe's Companies, Inc.

Market Share Estimate:Approx. 27-28%

Target Audience Overlap:High

Competitive Positioning:Positions itself as a friendly, customer-centric retailer with a strong appeal to DIY customers and a growing focus on professionals.

Strengths

- •

Strong brand recognition and customer loyalty.

- •

Well-developed omnichannel capabilities.

- •

Leads in the major appliances market segment.

- •

Effective marketing to DIY and female customers.

- •

Robust private-label brand portfolio (e.g., Kobalt, Craftsman).

Weaknesses

- •

Historically perceived as weaker in serving professional contractors compared to Home Depot.

- •

Slightly smaller store footprint and overall market share.

- •

Dependence on the US market makes it vulnerable to domestic economic shifts.

- •

Inconsistent in-store experience across different locations can be a challenge.

Differentiators

- •

Store layout often perceived as brighter and more organized.

- •

Strong focus on home decor and design inspiration.

- •

Exclusive partnerships with certain brands and designers.

- →

Menards

Market Share Estimate:Significant regional player, but smaller nationally

Target Audience Overlap:Medium

Competitive Positioning:Positions itself as the 'Save Big Money' low-price leader, with a vast, one-stop-shop product assortment that includes groceries and other general merchandise.

Strengths

- •

Strong reputation for low prices.

- •

High customer loyalty in its core Midwestern market, driven by its rebate program.

- •

Broad product mix beyond traditional home improvement.

- •

Vertically integrated manufacturing for some products, which helps control costs.

Weaknesses

- •

Limited geographic presence, primarily in the Midwest.

- •

Less sophisticated e-commerce and mobile app experience compared to Home Depot and Lowe's.

- •

Brand recognition is low outside of its core operating region.

- •

Lower penetration with professional contractors.

Differentiators

- •

Unique 11% rebate program (in-store credit).

- •

In-store grocery and general merchandise sections.

- •

Distinctive, jingle-based advertising.

- →

Ace Hardware

Market Share Estimate:Smaller than big-box retailers, but extensive reach through independent stores

Target Audience Overlap:Medium

Competitive Positioning:Positions itself as 'The Helpful Place,' focusing on convenience, personalized customer service, and community connection through its cooperative of locally-owned stores.

Strengths

- •

High marks for customer service and expertise.

- •

Convenient neighborhood locations for quick trips.

- •

Strong community involvement and local ownership model builds loyalty.

- •

Brand trust and longevity.

Weaknesses

- •

Higher price points on many items compared to big-box stores.

- •

Limited product selection, especially for large-scale projects.

- •

Inconsistent store layouts and inventory due to the cooperative model.

- •

Cannot compete on large contractor or builder supply needs.

Differentiators

- •

Cooperative business model of franchisee-owned stores.

- •

Focus on convenience and small project needs.

- •

Emphasis on personal, helpful service.

Indirect Competitors

- →

Amazon

Description:Global e-commerce giant offering a vast selection of tools, home goods, smart home devices, and maintenance supplies with fast delivery.

Threat Level:High

Potential For Direct Competition:Already a direct competitor in many product categories; potential to expand into services and building materials is high.

- →

Walmart

Description:Mass-market retailer offering a growing range of home improvement, garden, and decor products at low prices.

Threat Level:Medium

Potential For Direct Competition:Increasingly competing in categories like paint, tools, and outdoor living, but unlikely to challenge in heavy building materials.

- →

Local & Specialty Retailers

Description:Includes local hardware stores, plumbing and electrical supply houses, flooring showrooms, and garden nurseries.

Threat Level:Medium

Potential For Direct Competition:Highly specialized and relationship-driven, they compete effectively in niche categories and with professional customers.

- →

Angi / Thumbtack

Description:Online marketplaces that connect homeowners directly with independent contractors and service professionals for home projects.

Threat Level:Medium

Potential For Direct Competition:Directly competes with Home Depot's 'Do-It-For-Me' installation services by disintermediating the retailer from the service transaction.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Brand Equity and Market Leadership

Sustainability Assessment:Highly sustainable due to decades of investment and market presence, creating strong consumer trust.

Competitor Replication Difficulty:Hard

- Advantage:

Economies of Scale and Purchasing Power

Sustainability Assessment:As the market leader, Home Depot's massive scale allows for superior pricing negotiations with suppliers, a durable cost advantage.

Competitor Replication Difficulty:Hard

- Advantage:

Integrated Supply Chain and Logistics Network

Sustainability Assessment:A sophisticated network of distribution centers, including those for pro customers, provides efficiency and speed that is difficult to match.

Competitor Replication Difficulty:Hard

- Advantage:

Strong Pro Customer Ecosystem

Sustainability Assessment:Deeply embedded relationships with professional contractors through loyalty programs, dedicated services, and credit offerings create high switching costs.

Competitor Replication Difficulty:Medium

- Advantage:

Omnichannel 'Interconnected Retailing' Strategy

Sustainability Assessment:The seamless integration of a vast physical store footprint with a robust digital platform is a powerful, long-term advantage.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'Exclusive Product Lines (e.g., Ryobi, Behr)', 'estimated_duration': 'Medium-term (2-5 years), as exclusivity agreements can change.'}

{'advantage': 'Promotional Pricing and Sales Events', 'estimated_duration': 'Short-term, as competitors can easily match prices.'}

Disadvantages

- Disadvantage:

Vulnerability to Pure-Play E-commerce Disruption

Impact:Major

Addressability:Moderately

- Disadvantage:

Inconsistent In-Store Customer Service

Impact:Minor

Addressability:Moderately

- Disadvantage:

Perception as being less design/decor-focused than Lowe's

Impact:Minor

Addressability:Easily

Strategic Recommendations

Quick Wins

- Recommendation:

Launch targeted digital campaigns highlighting the value of 'Pro Xtra' loyalty program to capture smaller, independent contractors.

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Enhance in-app features to include project-based shopping lists and 'how-to' video integration directly on product pages.

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Optimize website and app for 'Do-It-For-Me' service inquiries, simplifying the process of getting a quote and scheduling an appointment.

Expected Impact:High

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Develop a subscription-based service for recurring home maintenance needs (e.g., HVAC filters, water filters, lawn care supplies).

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Expand partnerships with smart home technology companies to offer bundled product and installation packages.

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Invest in AR/VR tools that allow customers to visualize projects (e.g., paint colors, flooring, kitchen remodels) in their own homes.

Expected Impact:Medium

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Build out a more robust 'circular economy' program, including tool rentals, used tool marketplaces, and material recycling services.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Vertically integrate into installation services by acquiring or building regional service providers to ensure quality and capture more margin.

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Establish formal partnerships with vocational schools and trade programs to cultivate loyalty with the next generation of professional customers.

Expected Impact:Medium

Implementation Difficulty:Moderate

Solidify the position as the authoritative, end-to-end project partner for both serious DIYers and professional contractors, moving beyond just product sales to a fully integrated solution provider.

Differentiate through superior expertise and an unmatched, integrated ecosystem of products, services, and support for the Pro and complex project customer, while improving the online experience to be more inspirational for the decor-focused consumer.

Whitespace Opportunities

- Opportunity:

Personalized Project Planning & Management Platform

Competitive Gap:No competitor offers a truly integrated digital tool that guides a customer from project inspiration through planning, purchasing, and execution, tailored to their skill level and budget.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Home Maintenance Subscription Services

Competitive Gap:The market for automated, recurring delivery of essential home maintenance items (filters, salt pellets, etc.) is fragmented and not owned by a major home improvement retailer.

Feasibility:High

Potential Impact:Medium

- Opportunity:

Pro-Focused Financial and Business Management Tools

Competitive Gap:Competitors offer credit and loyalty programs, but there's a gap in providing integrated software solutions for pros to manage bidding, invoicing, and material ordering directly through Home Depot.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Certified Green/Sustainable Home Renovation Services

Competitive Gap:Growing consumer interest in sustainable living is not yet met by a dedicated, branded service that offers certified eco-friendly home improvement projects (e.g., energy efficiency audits, sustainable material installation).

Feasibility:Medium

Potential Impact:Medium

The Home Depot operates as the clear market leader in the mature and highly concentrated home improvement retail industry. The market structure is an oligopoly, with Lowe's being the only competitor of comparable scale. This dynamic creates intense price competition and a continuous drive for operational efficiency. Home Depot's most sustainable competitive advantages are its immense scale, which provides significant purchasing power, a sophisticated and integrated supply chain, and powerful brand equity built over decades. Furthermore, its deeply entrenched relationship with the high-value professional (Pro) customer segment serves as a significant competitive moat that is difficult for rivals to penetrate.

The primary direct threat, Lowe's, competes fiercely across all product categories and has made significant strides in its omnichannel strategy and appeal to DIY customers. However, Home Depot maintains a lead in market share and a stronger perception among professional contractors. Regional players like Menards compete effectively on price in their core markets, while cooperative models like Ace Hardware differentiate through convenience and personalized service.

The most significant emerging threats are from indirect and digital competitors. Amazon's vast logistics network and massive product selection pose a continuous threat to commodity product sales. Additionally, service marketplaces like Angi challenge Home Depot's growing 'Do-It-For-Me' business by connecting consumers directly with contractors. To maintain its leadership, Home Depot must continue to leverage its primary differentiator: the seamless integration of its physical and digital assets. Strategic opportunities lie in deepening the ecosystem for the Pro customer beyond products to include business management tools, expanding into subscription-based services for recurring maintenance needs, and leveraging technology like AR to simplify the customer's project planning journey. The key to future growth is to transition from being a product retailer to an end-to-end project solutions partner.

Messaging

Message Architecture

Key Messages

- Message:

Sales and Savings (e.g., 'Labor Day Savings', 'Up to 50% off')

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Banner, Promotional Modules

- Message:

How doers get more done™

Prominence:Secondary

Clarity Score:Medium

Location:Footer, Brand Tagline

- Message:

Comprehensive Product Selection

Prominence:Primary

Clarity Score:High

Location:Navigation, 'Shop By Category' section

- Message:

Professional Installation & Services

Prominence:Secondary

Clarity Score:High

Location:Homepage Module, Services Pages

- Message:

1 Home Improvement Retailer

Prominence:Tertiary

Clarity Score:High

Location:Header (subtle)

The message hierarchy is overwhelmingly focused on immediate, transactional outcomes. Price and promotions are the most prominent messages, clearly designed to drive short-term sales. Core brand messages like 'How doers get more done™' are present but take a backseat to deals. Messaging for services and professional support is visible but secondary to product sales, indicating a clear prioritization of the retail e-commerce function over service booking on the homepage.

Messaging is generally consistent in its transactional and value-driven focus. The 'savings' and 'deals' language is ubiquitous. However, there's a noticeable tonal shift between the high-urgency homepage and the more reassuring, trust-focused 'Services' pages. The latter appropriately slows down the pace to build confidence for a higher-consideration purchase (like installation), which is an effective, if not entirely consistent, approach.

Brand Voice

Voice Attributes

- Attribute:

Promotional

Strength:Strong

Examples

- •

Up to 50% off Select Massage Chairs, Home Furniture & Décor

- •

Was $203.94 Save $124.94 (61%)

- •

Shop Today's Specials

- Attribute:

Action-Oriented

Strength:Strong

Examples

- •

How doers get more done™

- •

Get the job done right

- •

Shop All

- •

Apply Now

- Attribute:

Authoritative

Strength:Moderate

Examples

- •

1 Home Improvement Retailer

- •

Trusted pros at your Fingertips

- •

Background Checked

- •

License Verification

- Attribute:

Helpful

Strength:Moderate

Examples

- •

DIY Projects and Ideas

- •

Project Calculators

- •

Helpful Buying Guides

Tone Analysis

Urgent & Transactional

Secondary Tones

- •

Empowering

- •

Reassuring

- •

Informational

Tone Shifts

Shifts from high-urgency promotional messaging on the homepage to a more measured, trust-building tone on the 'Services' pages.

Moves from a product-focused tone to an educational one in the 'DIY Projects and Ideas' section.

Voice Consistency Rating

Good

Consistency Issues

The brand's core empowering message ('How doers get more done') is sometimes drowned out by the sheer volume of promotional shouting on the homepage, creating a slight disconnect between the brand promise and the primary user experience.

Value Proposition Assessment

To be the ultimate one-stop shop for home improvement, offering the widest selection of products at competitive prices, supported by the tools, resources, and professional services needed to complete any project successfully.

Value Proposition Components

- Component:

Price & Value

Clarity:Clear

Uniqueness:Common

Examples

- •

Explicit 'Was/Save' pricing

- •

Constant promotional events ('Labor Day Savings')

- •

Special Buy of the Day

- Component:

Vast Selection

Clarity:Clear

Uniqueness:Somewhat Unique

Examples

- •

Exhaustive navigation with dozens of product categories

- •

Shop by Category section

- •

Explicit mission statement: 'the broadest selection of products'

- Component:

Convenience & Accessibility

Clarity:Clear

Uniqueness:Somewhat Unique

Examples

- •

Omnichannel offerings like 'Free Delivery' and in-store pickup.

- •

Home Depot Rental services

- •

'Download Our App' for mobile access

- Component:

Project Support & Expertise

Clarity:Somewhat Clear

Uniqueness:Unique

Examples

- •

'DIY Projects and Ideas' section

- •

In-store Kids Workshops

- •

Professional installation services with 'Trusted pros'

Home Depot differentiates itself through its immense scale, brand authority as the '#1 retailer', and a balanced appeal to both DIY enthusiasts and professional contractors. While competitors like Lowe's may focus more on the consumer DIY market, Home Depot's messaging for 'Pro Services' and the breadth of its installation services signal a stronger commitment to the professional segment. Its tagline, 'How doers get more done™,' effectively encapsulates this dual focus on empowerment and results, which is a key differentiator.

The messaging positions Home Depot as the undisputed market leader and the default choice for any home improvement need. By emphasizing vast selection and competitive pricing, it competes directly with other big-box retailers and online giants like Amazon. The inclusion of 'Home Services' and 'Pro Services' messaging carves out a defensible niche against purely online retailers by leveraging its physical footprint and contractor relationships.

Audience Messaging

Target Personas

- Persona:

The DIY Homeowner

Tailored Messages

- •

'DIY Projects and Ideas' to provide inspiration and guidance.

- •

Promotional messages like 'Labor Day Savings' appealing to budget-consciousness.

- •

'Free In-Store Kids Workshops' to engage families and build future brand loyalty.

- •

'How doers get more done™' to empower them with a sense of capability.

Effectiveness:Effective

- Persona:

The 'Do-It-For-Me' (DIFM) Customer / Homeowner seeking services

Tailored Messages

- •

'Leave Your Next Project to Us'

- •

'Professional Installation & Services'

- •

Trust-building messages on the Services page: 'Background Checked,' 'License Verification,' 'Insurance Requirements'.

- •

Extensive list of specific installation services (e.g., 'Ceiling Fan Installation', 'Generator Installation').

Effectiveness:Effective

- Persona:

The Professional Contractor ('Pro')

Tailored Messages

- •

'Pro Services & Contractor Supply' link in the header.

- •

Messaging around credit services and bulk purchasing.

- •

Availability of professional-grade brands like Milwaukee and DeWalt featured prominently in sales.

Effectiveness:Somewhat Effective

Audience Pain Points Addressed

- •

High cost of home projects (addressed by constant sales and financing offers).

- •

Lack of knowledge or skills for a project (addressed by 'DIY Projects and Ideas').

- •

Difficulty finding a trustworthy contractor (addressed by 'Home Services' with vetted pros).

- •

Needing a wide variety of items for a single project (addressed by vast product selection).

Audience Aspirations Addressed

- •

Achieving a successful project outcome and the pride that comes with it.

- •

Making one's home more comfortable, beautiful, and functional.

- •

Saving money by doing it yourself.

- •

Increasing home value through improvements.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Sense of Accomplishment/Empowerment

Effectiveness:High

Examples

'How doers get more done™'

'Engaging Activities for Your Future Doers'

- Appeal Type:

Financial Security/Savviness (Saving Money)

Effectiveness:High

Examples

'Save $174.00 (50%)'

'Get $5 off when you sign up for emails'

- Appeal Type:

Peace of Mind/Trust

Effectiveness:Medium

Examples

'Get the job done right—The Home Depot adds peace of mind to all your projects'

'Trusted pros at your Fingertips'

Social Proof Elements

- Proof Type:

Product Ratings and Reviews

Impact:Strong

Examples

Displaying star ratings and high review counts directly on product listings, e.g., 'RYOBI ONE+ 18V... (4.8 / 13267)'

- Proof Type:

Claim of Market Leadership

Impact:Moderate

Examples

'#1 Home Improvement Retailer'

Trust Indicators

- •

Explicit vetting process for service providers: 'Background Checked', 'License Verification', 'Insurance Requirements'.

- •

Prominent display of customer service contact information ('Need Help?').

- •

Association with major, trusted brands (e.g., RYOBI, Milwaukee, GE).

- •

Clear terms and conditions for financing offers.

Scarcity Urgency Tactics

Time-limited offers: 'Today Only! Free Delivery'

Countdown timers: 'Ends in 12 hrs 06 mins'

Calls To Action

Primary Ctas

- Text:

Shop Today's Specials

Location:Homepage, below hero banner

Clarity:Clear

- Text:

Register Now

Location:Kids Workshops module

Clarity:Clear

- Text:

Learn More

Location:Professional Installation & Services module

Clarity:Clear

- Text:

Apply Now

Location:Home Depot Credit Cards module

Clarity:Clear

The CTAs are exceptionally clear, direct, and action-oriented. Their effectiveness lies in their simplicity and frequent placement. However, the sheer volume of competing CTAs on the homepage ('Shop Now', 'Apply Now', 'Learn More', etc.) could create choice paralysis for users without a specific goal, slightly diminishing the impact of any single CTA.

Messaging Gaps Analysis

Critical Gaps

Lack of inspirational, narrative-driven content on the homepage. The experience is almost entirely transactional, missing an opportunity to connect with the 'why' behind a project (e.g., 'creating your family's dream backyard' vs. 'shop patio furniture').

The 'Pro' customer journey is not clearly distinct from the consumer journey on the homepage. Pro-specific value propositions are buried behind a single navigation link.

Contradiction Points

The heavy emphasis on deep discounts and 'low price' can subtly undermine the messaging of high-quality, trusted professional installation services, which is a premium offering.

Underdeveloped Areas

Community-building messaging. While there are workshops, the website doesn't effectively showcase a community of 'doers' sharing their projects and successes, which would strongly reinforce the brand promise.

Sustainability messaging. While Home Depot has sustainability initiatives, this value-driven message is absent from the primary homepage content, a growing area of importance for consumers.

Messaging Quality

Strengths

- •

Unmatched clarity in communicating price, value, and promotions.

- •

Effectively communicates an immense breadth of product offerings through well-organized navigation.

- •

Strong use of social proof (ratings/reviews) at the product level to drive conversion.

- •

Clear and persuasive trust-building messages for its 'Home Services' offerings.

Weaknesses

- •

Over-reliance on transactional messaging can de-emphasize the brand's more emotional, empowering aspects.

- •

The homepage can feel cluttered and overwhelming due to the density of offers.

- •

Weak narrative or storytelling elements to build a deeper brand connection beyond price.

Opportunities

- •

Integrate user-generated content (customer project photos/stories) onto the homepage to provide authentic inspiration and social proof.

- •

Develop a more personalized homepage experience that surfaces different messages and offers for identified 'Pro' versus 'DIY' customers.

- •

Create more content around project outcomes and lifestyle benefits, not just the products themselves, to build a stronger emotional connection.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Content Strategy

Recommendation:Balance the promotional modules with a dedicated 'Project Inspiration' or 'Doer Spotlight' module. Feature a high-quality visual story of a customer's completed project, linking to the products and guides used. This shifts focus from 'what we sell' to 'what you can achieve'.

Expected Impact:High

- Area:

Audience Segmentation

Recommendation:Implement a simple persistent toggle or use behavioral data to create distinct homepage views for 'Homeowner' and 'Pro' segments. The 'Pro' view should prioritize bulk pricing, credit services, and pro-grade tool offers over general home decor.

Expected Impact:High

- Area:

Brand Narrative

Recommendation:Weave the 'How doers get more done' narrative more actively into the customer journey. For example, change category headlines from 'Shop Tools' to 'Tools to Get It Done' and frame 'DIY Guides' as 'Your Project Playbook'.

Expected Impact:Medium

Quick Wins

- •

A/B test benefit-oriented CTA language (e.g., 'Start Your Project') against action-oriented language ('Shop Now').

- •

Add a 'Trending Projects' section to the homepage that links to popular DIY guides and associated products.

- •

Feature the 'Background Checked' and 'License Verification' trust badges more prominently on the homepage's 'Home Services' module.

Long Term Recommendations

- •

Invest in a robust content marketing hub that goes beyond simple DIY guides to include video series, designer interviews, and deeper storytelling about the impact of home improvement.

- •

Develop a loyalty program that rewards project completion and engagement with educational content, not just purchases, to reinforce the 'doer' identity.

- •

Integrate sustainability messaging more authentically into product categories and brand storytelling to align with evolving consumer values.

The Home Depot's website messaging is a masterclass in driving transactional e-commerce for the home improvement sector. Its architecture is built around two core pillars: showcasing an unparalleled breadth of product selection and creating a high-urgency environment through relentless promotions. This strategy is highly effective for its primary audience of price-conscious DIY homeowners and professionals who know what they need. The brand voice is direct, action-oriented, and promotional, leaving no ambiguity about the desired user action: to shop and to save.

Where the strategy shows opportunity for growth is in balancing this transactional efficiency with deeper brand building. The powerful tagline, 'How doers get more done™,' promises empowerment and project success, but this narrative is largely secondary to the 'Special Buy' of the day on the homepage. The site successfully caters to two distinct audiences—the DIYer and the DIFM (Do-It-For-Me) customer—by creating a clear tonal shift. While the homepage shouts deals to the DIYer, the 'Services' section speaks in a reassuring, trust-focused voice to the DIFM customer, highlighting vetted professionals and peace of mind. However, the 'Pro' contractor audience is underserved by the current generalist messaging, representing a significant opportunity for personalization.

The key strategic challenge is to evolve the messaging from being a mere 'supplier of things' to a 'partner in project success.' This involves elevating inspirational and educational content, celebrating the outcomes of projects (not just the tools used), and building a stronger sense of community. By weaving its empowering brand narrative more deeply into the user experience, The Home Depot can fortify its market leadership beyond price and selection, creating a more resilient brand connection that drives long-term loyalty.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Dominant market share in the home improvement retail sector, significantly larger than its closest competitor, Lowe's.

- •

Consistently high revenue, reporting $152.7 billion in fiscal 2023, demonstrating massive market acceptance.

- •

Broad appeal to two distinct, large customer segments: Do-It-Yourself (DIY) consumers and Professional (Pro) contractors.

- •

Extensive physical footprint with over 2,300 stores, which also serve as fulfillment hubs for a sophisticated omnichannel strategy.

- •

Comprehensive product and service offerings, covering everything from simple hardware to complex home installation services, catering to the full spectrum of home improvement needs.

Improvement Areas

- •

Deepen the ecosystem for Pro customers beyond transactions to include business management and workflow tools.

- •

Enhance personalization for DIY customers, moving from product recommendations to project-based guidance and support.

- •

Further develop the 'Home Services' platform to improve the customer experience and quality control of third-party contractors.

Market Dynamics

Projected at 3.4% to 5.5% for 2025, with long-term growth expected to reach a market size of ~$688 billion by 2029.

Mature

Market Trends

- Trend:

Growing Professional (Pro/DIFM) Market

Business Impact:The Pro/Do-It-For-Me (DIFM) market is growing faster than the DIY segment, representing a massive ~$475 billion addressable market and Home Depot's largest growth opportunity.

- Trend:

Integrated Omnichannel Experience

Business Impact:Customers expect a seamless journey between online research, mobile app usage, and in-store purchasing (BOPIS - Buy Online, Pick-up In Store). A strong omnichannel strategy is a key differentiator and revenue driver.

- Trend:

Smart Home and Sustainability

Business Impact:Increasing consumer demand for energy-efficient, sustainable, and connected-home products creates new high-margin product categories and service opportunities.

- Trend:

Economic Headwinds and Housing Market Influence

Business Impact:High interest rates can soften demand for large, financed renovation projects, while a resilient housing market and rising home equity can fuel spending.

Favorable. While facing macroeconomic pressures, the market has stable long-term fundamentals. The current focus on capturing the underserved Pro market and expanding the services ecosystem is exceptionally well-timed.

Business Model Scalability

High

High fixed costs associated with physical stores and distribution centers are leveraged effectively through high sales volume. The model scales by increasing sales per square foot and expanding digital and service offerings which have lower marginal costs.

High. Investments in supply chain, technology, and Pro-focused capabilities are designed to handle significant increases in volume with less than proportional increases in cost.

Scalability Constraints

- •

Supply chain complexity and vulnerability to disruption (e.g., material shortages, shipping delays).

- •

Dependence on skilled labor, both for in-store expertise and for the network of service providers.

- •

Physical store footprint is nearing saturation in the North American market, requiring growth to come from existing assets and new channels.

Team Readiness

Strong. The executive team has a clear, publicly communicated strategy focused on the interconnected retail experience and capturing the Pro market.

Mature and robust, but requires ongoing adaptation to break down silos between digital, in-store, and Pro-focused divisions to deliver a truly seamless omnichannel experience.

Key Capability Gaps

- •

Advanced Data Science & AI Talent: Deeper expertise needed to optimize supply chain, personalize customer experiences at scale, and develop sophisticated financial/project management tools for Pros.

- •

Software Product Management: To build out the digital ecosystem for Pro customers, competing with specialized B2B software providers.

- •

Service Provider Network Management: Scaling the 'Home Services' offering requires robust capabilities in vetting, managing, and ensuring the quality of a vast network of independent contractors.

Growth Engine

Acquisition Channels

- Channel:

Physical Stores & Brand Recognition

Effectiveness:High

Optimization Potential:Medium

Recommendation:Transform stores from mere points of sale into experiential hubs for DIY education (workshops) and Pro relationship management, further integrating them into the omnichannel journey.

- Channel:

Search Engine Optimization (SEO) & Content Marketing

Effectiveness:High

Optimization Potential:Medium

Recommendation:Expand 'how-to' and project-based content to cover more complex Pro-level tasks and emerging areas like smart home integration and sustainable building practices.

- Channel:

Paid Digital Advertising (SEM/Social)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Implement more sophisticated targeting and personalization, especially for high-value Pro customers, using data from loyalty programs to inform ad spend and creative.

- Channel:

Pro Customer Outreach & Sales

Effectiveness:Medium

Optimization Potential:High

Recommendation:Invest heavily in building a dedicated B2B sales force with 'wholesaler-like capabilities' to manage relationships and secure larger, planned purchases from top-tier contractors.

Customer Journey

A complex, non-linear omnichannel path. Customers frequently use the website/app for research and price comparison, visit stores to see products, and utilize BOPIS for convenience.

Friction Points

- •

Disconnect between online project planning and in-store execution.

- •

Inconsistent experience and quality in the 'Home Services' marketplace.

- •

Navigating massive stores to find specific items can be challenging for less experienced customers.

Journey Enhancement Priorities

{'area': 'Mobile App In-Store Mode', 'recommendation': 'Enhance the mobile app with advanced in-store navigation, product locators, and project-specific checklists that guide a customer through the store.'}

{'area': 'Pro Customer Digital Tools', 'recommendation': 'Develop a unified digital platform for Pros to manage quotes, orders, job site deliveries, and credit lines seamlessly across mobile and desktop. '}

Retention Mechanisms

- Mechanism:

Pro Xtra Loyalty Program

Effectiveness:High

Improvement Opportunity:Evolve from a rewards-based program to a full-fledged business services ecosystem, offering exclusive access to financial products, project management software, and priority service.

- Mechanism:

Consumer Credit Card & Special Financing

Effectiveness:Medium

Improvement Opportunity:Offer more personalized financing options based on project size and customer history to encourage larger basket sizes and repeat projects.

- Mechanism:

DIY Workshops & Educational Content

Effectiveness:Medium

Improvement Opportunity:Create a more structured online learning path for homeowners, building skills and confidence, which leads to more ambitious (and higher-spend) future projects.

Revenue Economics

Strong. The business model benefits from immense economies of scale in purchasing, logistics, and marketing, allowing for competitive pricing while maintaining healthy margins.

High for Pro customers; Moderate for DIY customers. The key to growth is converting DIY customers into lifelong homeowners who tackle multiple projects and increasing the wallet share from highly loyal Pro customers.

High, evidenced by strong revenue per store and steady growth in online sales as a percentage of total revenue.

Optimization Recommendations

- •

Increase average order value by bundling products and services for common projects.

- •

Improve margins by further expanding high-quality private label brands (e.g., Husky, Ryobi, Glacier Bay).

- •

Capture higher-margin revenue through the expansion and improved monetization of the 'Home Services' platform.

Scale Barriers

Technical Limitations

- Limitation:

Legacy IT Infrastructure

Impact:Medium

Solution Approach:Continue strategic investment in cloud-based platforms and APIs (e.g., partnership with Google Cloud) to unify data and create a more agile, integrated system for inventory, customer data, and supply chain management.

Operational Bottlenecks

- Bottleneck:

Supply Chain & Logistics for Pro Customers

Growth Impact:Ability to reliably deliver large, complex orders directly to job sites is a critical bottleneck to capturing more Pro wallet share.

Resolution Strategy:Continue building out flatbed distribution centers and investing in logistics technology to separate Pro fulfillment from the retail store network, improving efficiency and reliability for large orders.

- Bottleneck:

In-Store Labor Allocation

Growth Impact:Balancing expert assistance for complex sales with efficient checkout and fulfillment for simple transactions.

Resolution Strategy:Invest in employee training and technology (e.g., employee-facing apps) to empower associates, while optimizing store layouts to streamline BOPIS and quick-trip purchases.

Market Penetration Challenges

- Challenge:

Intense Competition

Severity:Major

Mitigation Strategy:Differentiate through a superior ecosystem for the Pro customer and a more integrated, supportive experience for the DIYer, rather than competing solely on price.

- Challenge:

Market Saturation in North America

Severity:Major

Mitigation Strategy:Focus on increasing 'wallet share' from existing customers, particularly Pros, rather than solely on acquiring new customers. This involves expanding into adjacent services and becoming an indispensable business partner.

Resource Limitations

Talent Gaps

- •

B2B Sales Professionals with industry expertise.

- •

Data Scientists and Machine Learning Engineers.

- •

Supply Chain and Logistics Technology Specialists.

Low. The company generates substantial free cash flow, sufficient to fund strategic initiatives, investments, and acquisitions.

Infrastructure Needs

Continued investment in market-specific distribution and fulfillment centers dedicated to Pro customers.

Modernization of in-store technology to better support an omnichannel experience.

Growth Opportunities

Market Expansion

- Expansion Vector:

Deepen Wallet Share with Professional Customers

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Build a comprehensive ecosystem of products, services, credit, delivery, and software tools that make Home Depot an indispensable partner for contractors' businesses. Strategic acquisitions like SRS Distribution are a key part of this approach.

Product Opportunities

- Opportunity:

Expansion of 'Home Services' Marketplace

Market Demand Evidence:The Do-It-For-Me (DIFM) market is a significant and growing segment of the home improvement industry.

Strategic Fit:High. Leverages existing brand trust and customer base to capture revenue from the installation and service side of the products it sells.

Development Recommendation:Invest in a more robust digital platform for service booking, project management, and quality control. Consider a tiered 'Pro-Certified' installer program to ensure quality and reliability.

- Opportunity:

Turnkey Renovation Project Management

Market Demand Evidence:Consumers, especially less-experienced Millennial homeowners, desire simpler, all-in-one solutions for complex projects like kitchen and bath remodels.

Strategic Fit:Medium. A significant step beyond current offerings, but a logical extension of their product and service ecosystem.

Development Recommendation:Pilot a full-service renovation offering in select markets, acting as the general contractor that coordinates all products, labor, and timelines for a fixed price.

Channel Diversification

- Channel:

Enhanced B2B Digital Platform

Fit Assessment:High. This is not a new channel, but a necessary evolution to serve Pro customers who expect wholesale-like digital capabilities.

Implementation Strategy:Acquire or build a dedicated e-commerce platform for Pros with features like personalized pricing, quote management, multi-user accounts, and integration with accounting software.

Strategic Partnerships

- Partnership Type:

Technology & Software Integrations

Potential Partners

- •

Construction project management software companies (e.g., Procore, Houzz Pro)

- •

Accounting software (e.g., QuickBooks)

- •

Interior design and visualization platforms

Expected Benefits:Embed The Home Depot's procurement and product catalog directly into the workflow of Pro customers, creating high switching costs and increasing loyalty.

- Partnership Type:

Home Builder & Real Estate Alliances

Potential Partners

- •

Large national home builders

- •

Property management companies

- •

Real estate brokerages

Expected Benefits:Establish Home Depot as the preferred supplier for new construction, multi-family property maintenance, and post-sale homeowner projects.

Growth Strategy

North Star Metric

Pro Customer Wallet Share

This metric directly measures success in the company's largest identified growth opportunity. It shifts focus from transactional volume to the depth of the customer relationship and lifetime value of the most lucrative segment.

Increase average spend per Pro customer by 15% over the next 24 months.

Growth Model

Ecosystem-Led Growth

Key Drivers

- •

Depth of Pro-specific services (delivery, credit, tools).

- •

Seamlessness of the interconnected DIY customer journey.

- •

Breadth and quality of the 'Home Services' installer network.

Focus on building a network effect where more Pros attract more suppliers and better services, which in turn attracts more customers (both Pro and DIY) to the platform. The goal is to make Home Depot the indispensable operating system for home improvement.

Prioritized Initiatives

- Initiative:

Develop 'Pro Business-in-a-Box' Digital Platform

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 months

First Steps:Form a dedicated product development team. Conduct deep user research with various contractor segments to map out essential features for a minimum viable product (MVP).

- Initiative:

Launch a 'Home Depot Certified' Installer Program

Expected Impact:High

Implementation Effort:Medium

Timeframe:12 months

First Steps:Define certification criteria (licensing, insurance, quality standards). Pilot the program in 3-5 key markets to refine the vetting and project oversight process.

- Initiative:

Implement AI-Powered Project Planner for DIY Customers

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:12-18 months

First Steps:Leverage existing 'how-to' content and sales data to build a recommendation engine. Develop a user-friendly interface on the website and app that guides users from idea to a complete, shoppable project list.

Experimentation Plan

High Leverage Tests

{'test': "Subscription-based service for Pros (e.g., 'Pro Prime') offering free delivery, dedicated support, and software access.", 'hypothesis': 'A subscription model will increase loyalty and average annual spend among small to mid-size contractors.'}

{'test': 'Dynamic pricing and bundling for project-based purchases.', 'hypothesis': "Offering a small, automated discount for buying all recommended items for a project (e.g., 'The Complete Deck Project' bundle) will increase average order value."}

Utilize A/B testing platforms for digital initiatives. For operational changes (like new delivery options), use matched-market testing to compare performance of test stores vs. control stores.

Continuous bi-weekly sprints for digital experiments; quarterly reviews for larger in-store and operational pilot programs.

Growth Team

A hub-and-spoke model. A central 'Growth Strategy' team sets the vision and allocates resources. Dedicated, cross-functional 'Growth Pods' are embedded within key business units: 'Pro Ecosystem,' 'DIY Journey,' and 'Home Services'.

Key Roles

- •

Head of Pro Growth (Product & GTM leadership)

- •

Lead Data Scientist (Personalization & Logistics)

- •

Senior Product Manager (Digital Experience)

- •

Head of Service Provider Partnerships

A combination of aggressive external hiring for specialized tech and data roles, coupled with an internal upskilling program to enhance the commercial and analytical capabilities of existing business leaders.

The Home Depot exhibits a powerful growth foundation, characterized by dominant product-market fit in a mature, yet resilient, industry. Its business model is highly scalable, and its leadership team has correctly identified the primary growth vector: deepening its relationship with the Professional (Pro) customer. The company's growth engine, built on a successful omnichannel strategy, is robust but requires further evolution to fully cater to the distinct needs of its two core customer segments—DIY and Pro.

The most significant barriers to scale are not capital, but operational complexity and market saturation. Overcoming these requires a strategic shift from a product retailer to an ecosystem provider. The supply chain must be re-engineered to provide wholesale-level service to Pros, and the digital experience must evolve into a comprehensive toolkit for managing their business.

The greatest opportunities lie in capturing a larger 'share of wallet' from the massive Pro market and expanding the high-margin 'Home Services' business. This involves moving beyond selling products to managing entire projects and becoming an integrated partner in a contractor's daily workflow.

To achieve this, the recommended growth strategy is to build an 'Ecosystem-Led' model. The North Star Metric should be 'Pro Customer Wallet Share,' focusing the entire organization on increasing the lifetime value of its most crucial segment. Prioritized initiatives should center on building a 'Business-in-a-Box' digital platform for Pros, certifying a reliable network of installers for a superior DIFM experience, and using AI to simplify the journey for DIY customers. By successfully executing this ecosystem strategy, The Home Depot can create a powerful competitive moat and unlock the next significant phase of its growth.

Legal Compliance

The Home Depot provides a comprehensive 'Privacy and Security Statement' that is easily accessible. It details the categories of personal information collected (e.g., purchase history, location, financial information), the sources (directly from users, service providers, marketing companies, social media), and the purposes for collection (order fulfillment, marketing, analytics). The policy clearly states that it does not apply to Home Depot Canada or Mexico, providing separate links for their respective policies, which is a good practice for jurisdictional clarity. It explicitly mentions the use of tracking technologies like cookies and in-store cameras. The policy also outlines with whom data is disclosed, including service providers, financial services companies, and advertising partners, and notes that it may be compensated for sharing information that does not directly identify a user with third parties for marketing. This level of detail is crucial for compliance with laws like the CCPA/CPRA.