eScore

hubbell.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Hubbell's digital presence is strong for a B2B manufacturer, with a well-structured site and good domain authority stemming from its long history. However, it primarily serves a bottom-of-funnel audience already familiar with the brand or specific product numbers. The SEO analysis reveals a significant gap in attracting top-of-funnel traffic through educational, problem-based content, an area where competitors are more aggressive. While having regional sites shows global reach, the lack of voice search optimization and a less prominent social media presence limits its overall digital intelligence.

The 'Competitor Cross Reference' tool is an excellent bottom-of-funnel asset that directly targets high-intent users looking for product alternatives.

Develop and launch a centralized 'Insights' or 'Resource Center' focused on thought leadership content (e.g., 'Grid Modernization,' 'Data Center Efficiency') to capture top-of-funnel organic traffic and build authority around key market trends.

The brand messaging is highly consistent and professional, effectively communicating its core value proposition of reliability and trust rooted in its long history. Audience segmentation is a clear strength, with tailored messaging for key verticals like Data Centers and Utilities. The primary weakness, as highlighted in the analysis, is an over-reliance on making claims without providing proof; there's a significant lack of case studies, customer testimonials, or quantifiable data to substantiate benefits like 'reduce operating costs.' This company-centric messaging ('We do this...') fails to fully resonate on an emotional or results-driven level.

Excellent audience segmentation on the homepage, with clear, tailored value propositions for each key market it serves, allowing different personas to quickly find relevant information.

Shift from 'claiming' to 'proving' by creating a 'Customer Success' section featuring case studies with quantifiable metrics (e.g., 'Reduced downtime by X%') for each key market segment.

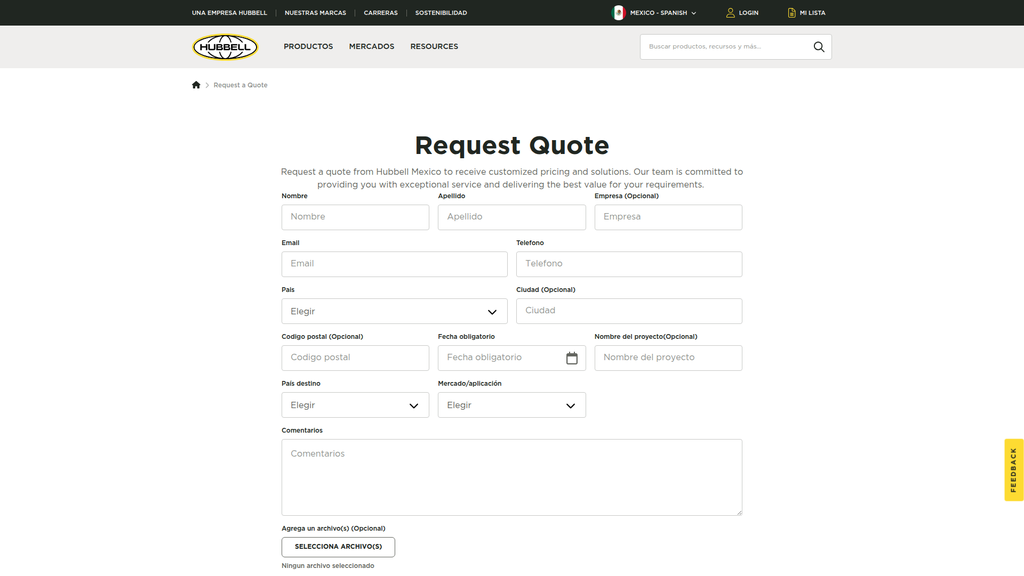

This is the weakest dimension for Hubbell's website, as the provided analysis details significant conversion friction. Key call-to-action buttons, such as the homepage CTA and the quote form submission, are low-contrast and lack visual prominence, directly inhibiting lead generation. The 'Request Quote' form itself is identified as a major barrier due to its length and high cognitive load. While the cross-device experience is functional, these fundamental flaws in the design of conversion-critical elements severely undermine the site's business effectiveness.

The information architecture is logical, effectively guiding users to relevant product categories and market segments once they decide to explore.

Immediately redesign all primary CTAs (especially 'CONTACT SALES' and form 'Submit' buttons) to use a solid, high-contrast background color (like the brand's yellow) to increase their visual weight and click-through rates.

Hubbell excels in establishing credibility, built upon a powerful foundation of its 135+ year history ('since 1888'). This is strongly reinforced by third-party validation, such as its recognition as one of the 'World's Most Ethical Companies'. The analysis of its legal framework shows robust compliance with privacy laws (GDPR, CCPA) and a best-practice cookie consent mechanism, which mitigates risk and builds trust. The primary minor weakness is the lack of customer success evidence (case studies, testimonials) which prevents the score from being higher.

Leveraging its founding date ('since 1888') and third-party awards ('World's Most Ethical Companies') as prominent trust signals builds immediate and powerful credibility.

Address the GDPR compliance gap by ensuring all marketing opt-in checkboxes on web forms are unchecked by default to align with affirmative consent requirements.

Hubbell's competitive advantages are deeply entrenched and sustainable. Its primary moats include a century-old brand reputation for reliability, an extensive and loyal distribution network, and a broad product portfolio that facilitates one-stop procurement for customers. These factors create high switching costs for clients who have specified Hubbell products into their systems. The main disadvantage noted is a slower pace of digitalization compared to rivals like Schneider Electric and Siemens, who are more aggressively positioning themselves as software and IoT leaders.

The deeply entrenched, multi-channel distribution network is a highly sustainable advantage that provides massive market reach and is extremely difficult for new entrants to replicate.

Accelerate a unified software and IoT strategy to embed intelligence into core products, preventing them from being commoditized by competitors' digital ecosystems.

Hubbell is extremely well-positioned for future growth due to powerful secular tailwinds in electrification, grid modernization, and data center expansion. The business model is proven and financially sound, with strong cash flow to fund strategic acquisitions and R&D. The analysis confirms its mature operational leverage and diverse revenue base across resilient markets. While manufacturing capacity and supply chain are potential constraints, the company's alignment with non-discretionary, long-term infrastructure spending gives it immense expansion potential.

Excellent alignment with powerful, long-term, non-discretionary market trends (grid modernization, electrification, data center growth) that provide a massive tailwind for growth.

Address the identified talent gap in software engineering and data science, possibly through targeted acquisitions ('acqui-hires'), to build the internal capability needed to capitalize on 'smart' infrastructure opportunities.

Hubbell operates a classic, highly coherent, and successful B2B manufacturing business model. Its value proposition of reliability and safety aligns perfectly with the needs of its risk-averse target audience in critical infrastructure. The model is fortified by a strong brand and an extensive distribution network. The primary weakness identified in the analysis is the heavy reliance on transactional product sales, with underdeveloped recurring revenue streams from services or software, which is a missed opportunity for future valuation and customer stickiness.

The business model shows exceptional alignment between its value proposition (reliability, quality) and the needs of its target markets (utilities, data centers), which are inherently risk-averse.

Develop and pilot service-based, recurring revenue offerings, such as 'Grid Automation-as-a-Service', to diversify from the purely transactional model and increase customer lifetime value.

As a major incumbent with a long history, Hubbell wields significant market power. Its strong brand and reputation for quality in critical applications grant it considerable pricing power and leverage with suppliers. The company holds a leading market share in several key product niches. The primary risk is not from direct feature-for-feature competition but from strategic repositioning by rivals like Eaton and Siemens, who are shaping the market narrative around digitalization and sustainability, potentially leaving Hubbell perceived as a traditional, less innovative player.

Strong brand reputation in critical, risk-averse industries allows for premium pricing and provides significant leverage with customers and partners.

Evolve market positioning from a 'trusted components manufacturer' to a 'provider of reliable, intelligent infrastructure solutions' to better compete with the digital-first narratives of rivals.

Business Overview

Business Classification

B2B Manufacturing & Engineering

Critical Infrastructure Solutions Provider

Electrical Equipment & Utility Systems

Sub Verticals

- •

Power & Utility

- •

Data Center

- •

Industrial Manufacturing

- •

Commercial Construction

- •

Renewables

- •

Telecommunications

- •

Water & Gas

- •

OEM

- •

Healthcare

Mature

Maturity Indicators

- •

Founded in 1888, demonstrating longevity and resilience.

- •

Publicly traded company (NYSE: HUBB) with a consistent history of dividend increases.

- •

Strong brand reputation for quality and reliability.

- •

Well-defined business segments (Utility Solutions and Electrical Solutions).

- •

Active portfolio management, including strategic acquisitions and divestitures.

- •

Focus on ESG, sustainability, and ethical company awards.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Product Sales via Distribution Channels

Description:Primary revenue driver is the sale of a broad portfolio of electrical and utility products through a multi-tiered distribution network, including electrical wholesalers, industrial suppliers, and retailers.

Estimated Importance:Primary

Customer Segment:Electrical Contractors, Industrial Maintenance Teams, Utility Companies, Construction Firms

Estimated Margin:Medium

- Stream Name:

Direct & Project-Based Sales

Description:Direct sales of specified products and integrated solutions to large enterprise customers, OEMs, and major utility providers for large-scale infrastructure projects.

Estimated Importance:Primary

Customer Segment:Large Utilities, Data Center Operators, Major Industrial Corporations, Government Entities

Estimated Margin:Medium-High

- Stream Name:

Value-Added Services

Description:Complementary services including technical support, training programs for contractors and distributors, and maintenance services that support product offerings.

Estimated Importance:Tertiary

Customer Segment:All B2B Segments

Estimated Margin:Medium

Recurring Revenue Components

- •

Repeat business from established B2B customer relationships

- •

Service and maintenance contracts on specialized equipment

- •

Long-term supply agreements with major distributors and OEMs

Pricing Strategy

Value-Based & Tiered Distribution Pricing

Mid-range to Premium

Opaque

Pricing Psychology

- •

Project-based quoting

- •

Volume discounts for distributors

- •

Bundled solution pricing

Monetization Assessment

Strengths

- •

Diverse revenue base across multiple resilient end-markets reduces cyclical risk.

- •

Strong brand equity allows for premium pricing on products known for reliability.

- •

Extensive distribution network creates a significant barrier to entry for new competitors.

Weaknesses

- •

High dependence on the economic health of construction and industrial sectors.

- •

Traditional B2B sales model may be slower to adapt to digital purchasing trends.

- •

Revenue is primarily transactional (product sales) with limited recurring service/software revenue streams.

Opportunities

- •

Expansion of 'smart' IoT-enabled products to create recurring revenue from data and analytics services.

- •

Developing a 'Product-as-a-Service' model for high-value equipment like grid automation systems.

- •

Capitalizing on high-growth secular trends such as grid modernization, data center expansion, and broad electrification.

Threats

- •

Supply chain disruptions and volatility in raw material costs impacting margins.

- •

Intense competition from large global players (e.g., Eaton, Schneider Electric) and nimble niche specialists.

- •

Risk of product commoditization in more mature product categories.

Market Positioning

A trusted provider of high-quality, reliable, and comprehensive solutions for critical electrical and utility infrastructure, built on a legacy of engineering excellence since 1888.

Market Leader in specific niches (e.g., 10.6% in Wiring Device Manufacturing), and a significant player across broader electrical and utility markets.

Target Segments

- Segment Name:

Electric Utility Operator

Description:Engineers, procurement managers, and field operators at investor-owned, municipal, and cooperative electric utilities responsible for power generation, transmission, and distribution.

Demographic Factors

- •

Technical background (engineering)

- •

Focus on long-term asset lifecycle

- •

Operates within a highly regulated environment

Psychographic Factors

- •

Highly risk-averse

- •

Values reliability, safety, and durability above all else

- •

Prefers established brands with a proven track record

Behavioral Factors

- •

Long sales cycles involving extensive testing and specification

- •

Purchasing based on total cost of ownership, not just initial price

- •

Relies on established distributor relationships and direct manufacturer support

Pain Points

- •

Aging grid infrastructure requiring modernization.

- •

Increasing grid instability from intermittent renewable energy sources.

- •

Need for improved grid monitoring and automation.

- •

Ensuring worker and public safety.

- •

Pressure to improve energy efficiency and reduce losses.

Fit Assessment:Excellent

Segment Potential:High

- Segment Name:

Data Center Facility Manager

Description:Professionals responsible for the design, construction, and operation of data centers, where power reliability and efficiency are paramount.

Demographic Factors

- •

Expertise in electrical and mechanical systems

- •

Manages significant capital and operational budgets

- •

Operates in a fast-paced, technologically advanced environment

Psychographic Factors

- •

Obsessed with uptime and reliability (99.999%+)

- •

Focused on energy efficiency (PUE) and reducing operational costs

- •

Seeks scalable, future-proof solutions

Behavioral Factors

- •

Specifies high-performance components

- •

Values partners who understand the unique demands of data center environments

- •

Rapid adoption of new technologies to improve performance

Pain Points

- •

Ensuring uninterrupted power to critical IT loads.

- •

Managing extreme power density and heat dissipation.

- •

Rapidly scaling infrastructure to meet demand.

- •

Reducing total cost of ownership (TCO).

- •

Need for enhanced connectivity and high-speed data transmission solutions.

Fit Assessment:Good

Segment Potential:High

Market Differentiation

- Factor:

Brand Heritage and Trust

Strength:Strong

Sustainability:Sustainable

- Factor:

Breadth of Product Portfolio

Strength:Strong

Sustainability:Sustainable

- Factor:

Extensive Distribution Network

Strength:Strong

Sustainability:Sustainable

- Factor:

Application-Specific Engineering Expertise

Strength:Moderate

Sustainability:Sustainable

Value Proposition

Hubbell provides high-quality, reliable electrical and utility solutions that enable customers to operate critical infrastructure safely, reliably, and efficiently.

Excellent

Key Benefits

- Benefit:

Operational Reliability & Minimized Downtime

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Brand history since 1888

- •

Focus on harsh and heavy industrial environments

- •

Use cases in critical markets like Healthcare, Data Centers, and Utilities

- Benefit:

Enhanced Safety & Regulatory Compliance

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

Products designed to meet stringent industry standards (e.g., UL, NEMA)

- •

Solutions for hazardous locations

- •

Emphasis on safety in marketing materials

- Benefit:

Comprehensive Portfolio for Simplified Procurement

Importance:Important

Differentiation:Unique

Proof Elements

- •

Extensive product catalog spanning multiple categories

- •

'Competitor Cross Reference' tool on website

- •

Market-specific solution guides

Unique Selling Points

- Usp:

End-to-end solutions for the entire energy ecosystem, from power source to meter.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A deep and established multi-channel sales network, providing broad market access and customer support.

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Modernizing an aging and unreliable electrical grid.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Ensuring power integrity and uptime in mission-critical facilities.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Sourcing a wide range of compatible and reliable electrical components from a single trusted vendor.

Severity:Major

Solution Effectiveness:Complete

Value Alignment Assessment

High

Hubbell's portfolio is directly aligned with major secular growth trends, including grid modernization, electrification, renewable energy integration, and the expansion of data-intensive industries.

High

The value proposition of reliability, safety, and quality resonates strongly with the risk-averse, technically-minded decision-makers in their core utility, industrial, and commercial segments.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Electrical Distributors (e.g., WESCO, Graybar)

- •

Engineering, Procurement, and Construction (EPC) Firms

- •

OEMs

- •

System Integrators

- •

Industry Standards Bodies (NEMA, IEEE)

Key Activities

- •

Research & Development

- •

High-Quality Manufacturing

- •

Supply Chain Management

- •

Channel Management & B2B Sales

- •

Technical Support & Engineering

Key Resources

- •

Manufacturing Facilities & Infrastructure.

- •

Intellectual Property (Patents & Trademarks)

- •

Strong Brand Reputation

- •

Experienced Engineering Talent

- •

Global Distribution Network

Cost Structure

- •

Cost of Goods Sold (Raw Materials, Labor)

- •

Selling, General & Administrative (SG&A) Expenses

- •

Research & Development (R&D) Investment

- •

Capital Expenditures for facilities and equipment.

Swot Analysis

Strengths

- •

Strong, century-old brand synonymous with quality and reliability.

- •

Diversified portfolio serving a wide range of resilient end markets.

- •

Deeply entrenched and loyal distribution channel.

- •

Strong financial performance with consistent cash flow generation.

- •

Strategic positioning to benefit from long-term trends like electrification and grid modernization.

Weaknesses

- •

Perception as a traditional, slower-moving incumbent compared to tech-focused startups.

- •

Revenue model is heavily reliant on transactional product sales.

- •

Complex portfolio across numerous brands could create internal inefficiencies.

Opportunities

- •

Lead the industry's digital transformation by integrating IoT and software into core products.

- •

Expand service-based and recurring revenue models (e.g., predictive maintenance, monitoring-as-a-service).

- •

Strategic acquisitions to enter high-growth adjacencies like EV charging infrastructure and energy storage solutions.

- •

Leverage data from smart devices to provide analytics and insights to utility customers.

Threats

- •

Economic downturns impacting construction and industrial capital spending.

- •

Intensifying competition from global conglomerates and agile niche players.

- •

Cybersecurity threats targeting 'smart' grid and connected infrastructure products.

- •

Disruption from new technologies or business models that bypass traditional distribution channels.

Recommendations

Priority Improvements

- Area:

Digital Customer Experience

Recommendation:Invest in a best-in-class e-commerce and digital specification platform. Go beyond the 'Request a Quote' form to provide engineers with advanced self-service tools, detailed product data, and online configuration options to streamline the design and procurement process.

Expected Impact:Medium

- Area:

Service Model Development

Recommendation:Pilot and scale service offerings around predictive maintenance and operational analytics for key product lines, particularly in the Utility Solutions segment. This shifts the relationship from transactional supplier to long-term operational partner.

Expected Impact:High

- Area:

Talent & Innovation

Recommendation:Launch a targeted initiative to attract software engineering, data science, and IoT talent to accelerate the development of 'smart' solutions. This may involve establishing innovation hubs in tech-centric locations, separate from traditional manufacturing sites.

Expected Impact:High

Business Model Innovation

- •

Develop a 'Grid-as-a-Service' offering for smaller utilities or large industrial clients, bundling hardware, software, and ongoing management into a subscription model.

- •

Create a data analytics platform that aggregates anonymized data from its installed base of smart devices to provide benchmarking and operational intelligence to customers.

- •

Establish a venture capital arm or strategic partnership program to invest in and collaborate with startups in emerging energy technology sectors.

Revenue Diversification

- •

Aggressively expand into the EV charging infrastructure market with a comprehensive suite of hardware and network management software.

- •

Develop integrated solutions for microgrids and distributed energy resources (DERs), combining components from across the Hubbell portfolio.

- •

Pursue strategic acquisitions in the field of grid-related software and cybersecurity services to build out a higher-margin, recurring revenue business line.

Hubbell Incorporated operates a robust and mature B2B manufacturing business model, deeply entrenched in the critical infrastructure of economies. Its core strength lies in its long-standing reputation for quality and reliability, a diverse product portfolio, and an extensive distribution network that creates a formidable competitive moat. The company is well-positioned to capitalize on significant, long-term secular tailwinds, including grid modernization, the proliferation of data centers, and the broad trend of electrification. Financial performance is strong, demonstrating consistent growth and healthy cash flow.

The primary strategic challenge and opportunity for Hubbell is the evolution from a traditional hardware manufacturer to an integrated hardware, software, and services provider. The current business model is predominantly transactional. Future growth and margin expansion will be driven by its ability to embed intelligence (IoT) into its products, generate recurring revenue from data and analytics, and develop service-based solutions. This requires a cultural and talent shift towards software engineering and data science. Strategic evolution should focus on digitizing the customer journey, innovating in service offerings, and aggressively pursuing opportunities in high-growth adjacencies like EV infrastructure and energy storage. By successfully navigating this transformation, Hubbell can solidify its market leadership and create new, sustainable avenues for growth in an increasingly connected and electrified world.

Competitors

Competitive Landscape

Mature

Moderately concentrated

Barriers To Entry

- Barrier:

High Capital Investment & Economies of Scale

Impact:High

- Barrier:

Established Distribution Channels and Relationships

Impact:High

- Barrier:

Brand Loyalty and Reputation

Impact:Medium

- Barrier:

Regulatory Compliance and Safety Standards

Impact:High

- Barrier:

Intellectual Property and Patents

Impact:Medium

Industry Trends

- Trend:

Electrification and Grid Modernization

Impact On Business:Drives demand for Hubbell's core utility and electrical products, especially those enabling smart grids and handling increased electrical loads from EVs and renewable energy integration.

Timeline:Immediate

- Trend:

Digitalization and IoT Integration

Impact On Business:Creates opportunities for smart, connected products (lighting, controls, meters). Requires investment in software and data capabilities to compete with rivals like Siemens and Schneider Electric who are strong in this area.

Timeline:Immediate

- Trend:

Sustainability and Energy Efficiency

Impact On Business:Increases demand for energy-efficient lighting, controls, and components that help customers meet their sustainability goals. Competitors like Schneider Electric are leveraging this as a key differentiator.

Timeline:Immediate

- Trend:

Renewable Energy Integration

Impact On Business:Boosts demand for specialized components for solar, wind, and energy storage projects, a key market segment for Hubbell.

Timeline:Near-term

- Trend:

Supply Chain Resilience

Impact On Business:Requires diversification of sourcing and manufacturing to mitigate disruptions. A resilient supply chain can be a significant competitive advantage.

Timeline:Immediate

Direct Competitors

- →

Eaton

Market Share Estimate:Significant, a top-tier global player

Target Audience Overlap:High

Competitive Positioning:A global power management company focused on energy-efficient solutions for electrical, hydraulic, and mechanical power.

Strengths

- •

Extremely broad and diversified product portfolio across electrical and industrial sectors.

- •

Strong focus on high-growth areas like data centers, electrification, and energy transition.

- •

Global manufacturing and distribution footprint.

- •

Significant investment in R&D and strategic acquisitions.

Weaknesses

- •

Large corporate structure may lead to slower decision-making compared to more focused competitors.

- •

Complexity of managing a highly diverse portfolio can strain resources.

- •

Potentially higher price points on some product lines due to brand premium.

Differentiators

- •

Holistic 'Power Management' approach, integrating electrical and industrial solutions.

- •

Deep expertise in UPS and power quality solutions for critical applications.

- •

Strong presence in the aerospace and eMobility sectors, providing cross-sector insights.

- →

Schneider Electric

Market Share Estimate:Significant, a top-tier global player

Target Audience Overlap:High

Competitive Positioning:Global specialist in energy management and digital automation, positioning itself as a leader in sustainability and efficiency.

Strengths

- •

Leader in digital transformation, with its EcoStruxure IoT platform integrating IT and OT.

- •

Strong brand association with sustainability and energy efficiency, a key market driver.

- •

Comprehensive portfolio for energy management, industrial automation, and infrastructure.

- •

Strong focus on software and services, creating recurring revenue streams.

Weaknesses

- •

Portfolio can be complex, requiring significant customer education.

- •

High reliance on digital solutions may be a barrier for less technologically mature customers.

- •

Premium pricing for integrated solutions.

Differentiators

- •

EcoStruxure architecture as a unifying platform for connected products.

- •

Strong 'Sustainability as a Service' consulting and solutions model.

- •

Deep focus on software-enabled solutions for specific end-markets like mining and data centers.

- →

Siemens

Market Share Estimate:Significant, a top-tier global player

Target Audience Overlap:High

Competitive Positioning:A technology powerhouse focused on connecting the real and digital worlds through its 'Smart Infrastructure' division.

Strengths

- •

Deep engineering expertise and a strong reputation for quality and reliability.

- •

Highly integrated portfolio for electrification, building automation, and grid control.

- •

Strong focus on software and digitalization to create intelligent infrastructure.

- •

Significant presence in large-scale infrastructure projects and government contracts.

Weaknesses

- •

Can be perceived as a complex and bureaucratic organization to deal with.

- •

Product portfolio is vast, potentially leading to a lack of focus in certain niche areas where Hubbell is strong.

- •

Solutions are often geared towards large, complex projects, potentially overlooking smaller customers.

Differentiators

- •

End-to-end portfolio from power generation to consumption.

- •

Emphasis on creating 'environments that care' through smart, adaptive infrastructure.

- •

Siemens Xcelerator platform for digital transformation.

- →

ABB

Market Share Estimate:Significant, a top-tier global player

Target Audience Overlap:High

Competitive Positioning:A global technology leader in electrification, robotics, automation, and motion.

Strengths

- •

Strong global presence in over 100 countries.

- •

Leader in industrial automation and robotics, which provides synergies with electrification.

- •

Technological expertise and heavy R&D investment.

- •

Growing momentum in high-demand sectors like data centers and utilities.

Weaknesses

- •

History of complex acquisitions that can be difficult to integrate.

- •

High capital investment requirements for its heavy industry focus.

- •

Vulnerability to cybersecurity threats due to increased digitalization.

Differentiators

- •

Pioneering technology in areas like DC fast charging for EVs.

- •

Strong combination of electrification products and industrial automation solutions.

- •

Focus on digital solutions under the ABB Ability™ platform.

- →

Legrand

Market Share Estimate:Strong competitor, particularly in building infrastructure

Target Audience Overlap:High

Competitive Positioning:A global specialist in electrical and digital building infrastructures.

Strengths

- •

Strong portfolio of brands in wiring devices, cable management, and lighting controls.

- •

Deep penetration in the commercial and residential building markets.

- •

Agile growth strategy through targeted acquisitions, especially in growth areas like data centers.

- •

Robust distribution network.

Weaknesses

- •

Less prominent in the heavy utility and industrial segments compared to Eaton or Siemens.

- •

Brand is more fragmented across its various acquisitions compared to monolithic brands like Siemens.

- •

Recent sales declines in the US market indicate vulnerability to construction market downturns.

Differentiators

- •

Strong focus and specialization on the building ecosystem.

- •

User-centric product design with an emphasis on ease of installation and aesthetics.

- •

Broad offering that spans from basic wiring devices to advanced digital lighting management.

Indirect Competitors

- →

Graybar

Description:A leading North American distributor of electrical, communications, and data networking products. They distribute products from Hubbell and its direct competitors.

Threat Level:Medium

Potential For Direct Competition:Low, but their influence on purchasing decisions is high. They could prioritize competitors' products or develop their own private-label brands.

- →

WESCO International

Description:A major distributor of electrical, industrial, and communications MRO and OEM products, construction materials, and advanced supply chain management services.

Threat Level:Medium

Potential For Direct Competition:Low, but as a key channel partner, their strategic decisions on which brands to promote heavily influence Hubbell's market access.

- →

Specialized Tech Companies (e.g., IoT, Smart Building Platforms)

Description:Companies that provide software platforms for building management, energy monitoring, or grid control. They may not manufacture hardware but their software dictates which hardware is compatible or preferred.

Threat Level:Medium

Potential For Direct Competition:Medium. They could partner exclusively with competitors or develop their own hardware, commoditizing the underlying electrical components.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Brand Heritage and Trust (Since 1888)

Sustainability Assessment:Highly sustainable, built over a century of reliability in critical infrastructure.

Competitor Replication Difficulty:Hard

- Advantage:

Broad Product Portfolio Across Utility and Electrical Segments

Sustainability Assessment:Sustainable, offering a one-stop-shop for many customers. However, competitors have similarly broad portfolios.

Competitor Replication Difficulty:Medium

- Advantage:

Established Distribution and Sales Channels

Sustainability Assessment:Highly sustainable, as these relationships with distributors and contractors are built over many years and are critical in the industry.

Competitor Replication Difficulty:Hard

- Advantage:

Strong Position in Niche Utility and Harsh Environment Markets

Sustainability Assessment:Sustainable due to specialized engineering and certifications required for these applications.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': 'Specific Patented Product Innovations', 'estimated_duration': '5-10 years, depending on patent life and speed of technological change.'}

Disadvantages

- Disadvantage:

Pace of Digitalization and Software Integration

Impact:Major

Addressability:Moderately

- Disadvantage:

Brand Perception as 'Traditional' vs. 'Innovative'

Impact:Minor

Addressability:Moderately

- Disadvantage:

Perceived Pricing and Customer Service Scores

Impact:Minor

Addressability:Easily

Strategic Recommendations

Quick Wins

- Recommendation:

Enhance Digital Marketing with Application-Specific Content

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Launch a Targeted Campaign Promoting the 'Competitor Cross Reference' Tool

Expected Impact:Medium

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Develop a Unified Software and IoT Strategy

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Expand Service Offerings Beyond Products

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Strategic Acquisitions in High-Growth Adjacencies

Expected Impact:High

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Establish a 'Hubbell Digital' Business Unit

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Invest in 'As-a-Service' Business Models

Expected Impact:High

Implementation Difficulty:Difficult

Evolve positioning from a 'trusted components manufacturer' to a 'provider of reliable, intelligent infrastructure solutions'. Emphasize the integration of Hubbell's robust hardware with modern digital capabilities to ensure safety, reliability, and efficiency in the new era of electrification.

Differentiate on the basis of 'Pragmatic Innovation and Unmatched Reliability'. While competitors focus heavily on complex, all-encompassing digital platforms, Hubbell can win by providing practical, easy-to-integrate smart solutions built on its century-old foundation of engineering excellence and product durability, especially for critical and harsh environments.

Whitespace Opportunities

- Opportunity:

Integrated Solutions for Mid-Sized Commercial and Industrial Facilities

Competitive Gap:Major competitors often focus on large enterprise-scale projects, leaving a gap for pre-engineered, easy-to-deploy, bundled solutions for medium-sized customers who lack deep engineering teams.

Feasibility:High

Potential Impact:High

- Opportunity:

Specialized Product Suites for Retrofitting and Upgrading Aging Infrastructure

Competitive Gap:There is a massive need to modernize existing grid and building infrastructure. Competitors are often focused on new builds. Hubbell can develop solutions specifically designed for the challenges of retrofitting.

Feasibility:High

Potential Impact:High

- Opportunity:

Training and Certification Programs for Contractors on Smart Technologies

Competitive Gap:The installer base is a key influencer but is often slow to adopt new technologies. By offering best-in-class training, Hubbell can build deep loyalty and accelerate the adoption of its newer, higher-margin products.

Feasibility:Medium

Potential Impact:Medium

- Opportunity:

Develop a Stronger Position in the EV Charging Infrastructure Component Market

Competitive Gap:While many companies offer charging stations, there is a significant market for the underlying, high-quality electrical infrastructure components (connectors, switchgear, controls) required for reliable deployments, a core Hubbell strength.

Feasibility:High

Potential Impact:High

Hubbell operates in a mature, moderately concentrated Electrical and Utility Solutions market, competing against global giants like Eaton, Schneider Electric, Siemens, and ABB. The industry is undergoing a significant transformation driven by electrification, digitalization, and sustainability. Hubbell's core competitive advantages are its long-standing brand reputation for reliability (since 1888), a comprehensive product portfolio, and deeply entrenched distribution channels. These are durable assets in an industry where trust and product availability are paramount.

The primary competitive threat comes from rivals who are more aggressively positioning themselves as digital and sustainability leaders. Companies like Schneider Electric and Siemens are successfully leveraging their IoT platforms (EcoStruxure, Xcelerator) to move beyond component sales into higher-margin integrated solutions and services. While Hubbell serves critical growth markets like renewables and data centers, it risks being perceived as a traditional hardware supplier rather than a strategic partner in digital transformation.

Direct competitors are well-capitalized, highly innovative, and possess global scale, making direct market share gains challenging. Indirect competition from powerful distributors like Graybar and WESCO represents a channel risk, while the rise of specialized software companies could commoditize the underlying hardware market.

Significant whitespace opportunities exist for Hubbell. The company can leverage its reputation for durability to target the massive market for retrofitting aging infrastructure, a segment less glamorous but larger than new builds. Furthermore, by focusing on integrated, easy-to-use solutions for the underserved mid-market and strengthening its position in the component supply chain for emerging areas like EV charging, Hubbell can carve out highly profitable niches. The strategic imperative is to thoughtfully integrate digital intelligence into its core products and reposition the brand as a provider of 'reliable, intelligent infrastructure solutions,' thereby bridging its legacy of trust with the demands of a connected future.

Messaging

Message Architecture

Key Messages

- Message:

Electrify & Energize

Prominence:Primary

Clarity Score:Medium

Location:Homepage hero banner, repeated lower on the homepage

- Message:

Trusted solutions for critical infrastructure since 1888

Prominence:Primary

Clarity Score:High

Location:Homepage hero banner sub-headline

- Message:

We create critical infrastructure solutions that electrify and energize our communities and economy.

Prominence:Secondary

Clarity Score:High

Location:Mid-page homepage section

- Message:

Sustainability is integral to everything we do at Hubbell.

Prominence:Secondary

Clarity Score:High

Location:Homepage feature card for Sustainability Report

- Message:

Hubbell’s innovative products and solutions enable our customers to operate critical infrastructure safely, reliably, and efficiently.

Prominence:Secondary

Clarity Score:High

Location:Headline for Products & Solutions section

The message hierarchy is logical but slightly repetitive. The primary tagline 'Electrify & Energize' is abstract and requires the secondary messages about 'critical infrastructure', 'safety', and 'reliability' to give it tangible meaning. The structure effectively flows from a high-level brand promise to market-specific value propositions and then to product categories.

Messaging is highly consistent across the homepage. The core concepts of electrification, energy, critical infrastructure, reliability, and safety are woven throughout all major sections, creating a unified and coherent narrative.

Brand Voice

Voice Attributes

- Attribute:

Established and Trustworthy

Strength:Strong

Examples

Trusted solutions for critical infrastructure since 1888

At Hubbell, we'll always be behind you

- Attribute:

Professional and Corporate

Strength:Strong

Examples

We help our customers build reliable, resilient, and renewable electrical and utility infrastructures...

Hubbell Recognized as One of the 2025 World's Most Ethical Companies

- Attribute:

Solution-Oriented

Strength:Moderate

Examples

We supply future-proof solutions...

We partner with healthcare facilities to provide solutions that reduce operating costs...

- Attribute:

Slightly Grandiose

Strength:Moderate

Examples

Electrify & Energize

We Electrify economies and Energize communities.

Tone Analysis

Authoritative

Secondary Tones

- •

Reassuring

- •

Formal

- •

Aspirational

Tone Shifts

The tone shifts to be more direct and functional in the 'Competitor Cross Reference' and product-level sections.

The 'Let's Work Together' careers section adopts a slightly more inspirational and inviting tone.

Voice Consistency Rating

Excellent

Consistency Issues

No itemsValue Proposition Assessment

Hubbell provides high-quality, reliable, and innovative electrical and utility solutions that ensure the safe and efficient operation of critical infrastructure, backed by over a century of industry leadership.

Value Proposition Components

- Component:

Reliability & Durability

Clarity:Clear

Uniqueness:Common

Examples

- •

Trusted solutions...

- •

reliable electrical solutions

- •

products that perform amidst the harshest of conditions

- Component:

Long-standing Expertise

Clarity:Clear

Uniqueness:Somewhat Unique

Examples

...since 1888

- Component:

Operational Efficiency for Customers

Clarity:Clear

Uniqueness:Common

Examples

- •

reduce operating costs, simplify maintenance

- •

minimize downtime

- •

reduced total cost of ownership

- Component:

Safety & Compliance

Clarity:Clear

Uniqueness:Common

Examples

operate safely

meet compliance regulations

- Component:

Sustainability Focus

Clarity:Somewhat Clear

Uniqueness:Common

Examples

2025 Annual Sustainability Report

contributing to a sustainable future

Hubbell's primary differentiator is its long history ('since 1888'), which serves as a powerful proxy for trust, reliability, and expertise. While competitors like Eaton and Schneider Electric also emphasize reliability and efficiency, Hubbell leans heavily on its heritage. The messaging around innovation ('future-proof solutions') is present but less emphasized than its legacy of trust.

The messaging positions Hubbell as a foundational, highly dependable stalwart of the industry. It's not positioned as the most cutting-edge disruptor but as the proven, reliable choice for critical applications where failure is not an option. The 'Competitor Cross Reference' tool is a tactical messaging choice that positions them as a direct, confident alternative to competitors.

Audience Messaging

Target Personas

- Persona:

Utility & Power Grid Operator

Tailored Messages

We ensure utility infrastructures operate safely, reliably, and efficiently from the power source to the meter.

Effectiveness:Effective

- Persona:

Industrial/Manufacturing Plant Manager

Tailored Messages

We help maximize production and minimize downtime with reliable electrical solutions.

Effectiveness:Effective

- Persona:

Data Center Manager

Tailored Messages

We supply future-proof solutions that enhance connectivity, reliability, and uptime for reduced total cost of ownership.

Effectiveness:Effective

- Persona:

Commercial Construction Specifier/Contractor

Tailored Messages

We add value to commercial construction by creating more efficient ways to build, manage, and maintain structures.

Effectiveness:Effective

- Persona:

Original Equipment Manufacturer (OEM)

Tailored Messages

We ensure original equipment manufacturers receive the highest-quality components to support their brands.

Effectiveness:Effective

Audience Pain Points Addressed

- •

Downtime and production loss

- •

High operating and maintenance costs

- •

Safety risks and compliance challenges

- •

Infrastructure unreliability

- •

Future-proofing investments

Audience Aspirations Addressed

- •

Building resilient and efficient infrastructure

- •

Ensuring operational continuity and uptime

- •

Contributing to a sustainable future

- •

Maintaining a safe working environment

Persuasion Elements

Emotional Appeals

- Appeal Type:

Security & Safety

Effectiveness:High

Examples

Trusted solutions...

operate critical infrastructure safely, reliably, and efficiently

- Appeal Type:

Pride & Legacy

Effectiveness:Medium

Examples

...since 1888

Hubbell Recognized as One of the 2025 World's Most Ethical Companies

- Appeal Type:

Altruism & Future-Building

Effectiveness:Medium

Examples

energize communities to create a brighter tomorrow

contributing to a sustainable future for our world

Social Proof Elements

- Proof Type:

Awards & Recognition

Impact:Strong

Examples

Hubbell Recognized as One of the 2025 World's Most Ethical Companies

- Proof Type:

Longevity & Heritage

Impact:Strong

Examples

since 1888

Trust Indicators

- •

Explicit mention of 'Trusted solutions'

- •

Founding date 'since 1888'

- •

Publication of Annual Reports and Sustainability Reports

- •

Recognition as 'World's Most Ethical Companies'

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

Explore Market

Location:Repeated for each market segment card

Clarity:Clear

- Text:

Explore Products

Location:Repeated for each product category card

Clarity:Clear

- Text:

Read More

Location:For reports and news items

Clarity:Clear

- Text:

Search Products

Location:Competitor Cross Reference tool

Clarity:Clear

- Text:

Explore Careers

Location:Hiring section callout

Clarity:Clear

The CTAs are clear, direct, and well-aligned with a user journey focused on exploration and information gathering. They effectively guide users from high-level market interests to specific product categories. However, there is a lack of lead-generation CTAs (e.g., 'Request a Consultation', 'Download a Whitepaper') on the homepage, with the 'Request a Quote' form located on a separate, less prominent page.

Messaging Gaps Analysis

Critical Gaps

- •

Lack of customer-centric storytelling. The site talks about what it does for markets but doesn't feature customer stories, case studies, or testimonials to prove its impact.

- •

Quantifiable outcomes are missing. The messaging claims benefits like 'reduce operating costs' and 'minimize downtime' but provides no data, metrics, or proof points to substantiate these claims.

- •

The 'how' behind the innovation is underdeveloped. While the site mentions 'innovative products', the messaging doesn't explain Hubbell's R&D process, engineering expertise, or what makes their solutions technologically superior.

Contradiction Points

No itemsUnderdeveloped Areas

Sustainability messaging. While a report is featured, the core narrative could more deeply integrate how Hubbell's products directly enable customers' sustainability goals (e.g., energy efficiency metrics, support for renewable energy grid connections).

Service and support messaging. The value of Hubbell's partnership, customer service, and technical support is not a prominent part of the core brand message.

Messaging Quality

Strengths

- •

Excellent message discipline and consistency around core themes of trust, reliability, and critical infrastructure.

- •

Clear and effective audience segmentation through the 'Serving Essential Markets' section, with tailored value propositions for each.

- •

Strong use of heritage ('since 1888') and social proof ('World's Most Ethical Companies') to build immediate trust and credibility.

- •

Professional, authoritative voice that aligns perfectly with a B2B audience making high-stakes purchasing decisions.

Weaknesses

- •

The primary tagline 'Electrify & Energize' is somewhat abstract and relies heavily on supporting copy for meaning.

- •

Messaging is very company-centric ('We do this...') rather than customer-centric ('You will achieve...').

- •

Over-reliance on claims without providing supporting evidence (case studies, data points).

- •

The homepage lacks prominent CTAs for sales engagement or lead capture.

Opportunities

- •

Develop a library of case studies for each key market, showcasing specific customer challenges and quantifiable results achieved with Hubbell solutions.

- •

Elevate the 'Competitor Cross Reference' tool as a key value proposition, framing it as a way to simplify procurement and provide superior alternatives.

- •

Create thought leadership content (whitepapers, technical guides) that addresses the pain points of key personas and ties them back to Hubbell's solutions, using CTAs to capture leads.

- •

Integrate the 'sustainability' message more directly into product and market messaging, moving it from a corporate report to a core customer benefit.

Optimization Roadmap

Priority Improvements

- Area:

Value Proposition Substantiation

Recommendation:Incorporate a 'Customer Success' or 'Projects' section featuring 3-5 detailed case studies with quantifiable metrics (e.g., 'Reduced downtime by X%', 'Achieved Y% in energy savings'). Feature these prominently on the homepage.

Expected Impact:High

- Area:

Lead Generation

Recommendation:Add a secondary, solution-focused CTA on the homepage, such as 'Talk to an Engineer' or 'Request a Needs Assessment', to capture high-intent leads earlier in their journey.

Expected Impact:High

- Area:

Audience Messaging

Recommendation:Rewrite key headlines and market descriptions to be more customer-centric. For example, change 'We help maximize production...' to 'Maximize Your Production and Minimize Downtime...'.

Expected Impact:Medium

Quick Wins

- •

Add logos of key customers or partners (if permissible) to the homepage as a form of social proof.

- •

Feature a specific, innovative product on the homepage to better substantiate the 'innovation' claim.

- •

Change the generic 'Read More' CTAs for reports to benefit-oriented language, like 'See Our Sustainability Impact'.

Long Term Recommendations

- •

Develop a comprehensive content strategy focused on thought leadership that addresses the evolving challenges of grid modernization, data center efficiency, and industrial automation.

- •

Invest in creating video testimonials with key customers to bring the value proposition to life.

- •

Overhaul the product pages to focus less on specifications and more on the application-specific problems they solve for the end-user.

Hubbell's strategic messaging is that of a quintessential industry leader: strong, stable, and deeply trustworthy. The website effectively communicates a core value proposition centered on reliability and safety for critical infrastructure, leveraging its 135+ year history as its most powerful differentiator. The message architecture is clear, and the brand voice is consistently professional and authoritative, which is well-suited for its risk-averse B2B audience. The explicit segmentation by market—from Data Centers to Utilities—is a major strength, allowing for targeted messaging that speaks directly to the unique pain points of each vertical, such as minimizing downtime for industrial clients or ensuring compliance for healthcare facilities.

However, the messaging exhibits a significant gap between making claims and proving them. While it repeatedly asserts benefits like efficiency and reliability, it lacks the customer-centric evidence (case studies, data points, testimonials) needed to substantiate these claims in a competitive market. The messaging is company-centric, focusing on what Hubbell does rather than what the customer achieves. Consequently, the brand feels more like a dependable component supplier than a strategic partner in solving complex problems.

To elevate its market position and drive business outcomes more effectively, Hubbell should shift its messaging strategy from 'claiming' to 'proving.' By developing and integrating customer success stories with quantifiable results, the company can transform its abstract promises of value into tangible, compelling proof. Furthermore, by making lead-generation calls-to-action more prominent and developing thought leadership content, Hubbell can better capitalize on its brand authority to capture and nurture qualified leads, directly impacting customer acquisition and solidifying its position not just as a historic leader, but as an indispensable partner for the future of critical infrastructure.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Established in 1888, demonstrating over 135 years of market presence and adaptation.

- •

Serves a wide array of critical and diverse B2B markets, including Utility, Commercial, Industrial, Data Center, Renewables, and Telecom.

- •

Comprehensive product portfolio across Power & Utilities, Lighting & Controls, Wiring & Electrical, and Datacom, indicating deep entrenchment in customer value chains.

- •

Achieved $5.6B in net sales in 2024, reflecting significant market demand and scale.

- •

Strategic acquisitions like Systems Control to enhance its utility solutions portfolio and align with grid modernization trends show proactive adaptation to market needs.

Improvement Areas

- •

Accelerate R&D for 'smart' IoT-enabled devices to transition from a component supplier to a solutions provider.

- •

Develop integrated product-service bundles, particularly for high-growth sectors like renewables and data centers.

- •

Enhance software and service capabilities to complement the hardware-centric portfolio, creating stickier customer relationships.

Market Dynamics

4-7% CAGR for the general electrical equipment market, with high-growth segments like renewables, data centers, and grid modernization exceeding 10%.

Mature

Market Trends

- Trend:

Electrification & Decarbonization

Business Impact:Massive tailwind for Hubbell, driving demand for grid infrastructure upgrades, renewable energy components (solar, wind), and EV charging solutions.

- Trend:

Grid Modernization & Hardening

Business Impact:Drives significant, long-term, non-discretionary demand for Hubbell's core utility products (e.g., transmission, distribution, automation) to improve reliability and integrate new energy sources.

- Trend:

Explosive Growth in Data Centers (driven by AI)

Business Impact:Creates surging demand for high-reliability power distribution, connectivity, and electrical components. Data center power demand is expected to triple by 2030.

- Trend:

Digitalization & IoT

Business Impact:Opportunity to embed intelligence into traditional products, creating higher-margin, data-driven solutions and services. Also a threat if competitors innovate faster in this space.

Excellent. Hubbell is well-positioned at the nexus of several powerful, long-term secular growth trends. The need for grid upgrades, renewable integration, and powering the digital economy is immediate and sustained.

Business Model Scalability

Medium

High fixed costs associated with manufacturing plants and R&D, but significant operating leverage once breakeven is met. Susceptible to raw material price volatility.

High. Increased production volume leads to significant margin expansion, as demonstrated by their price and productivity actions to offset cost inflation.

Scalability Constraints

- •

Manufacturing capacity and the capital expenditure required to expand it.

- •

Supply chain vulnerabilities and raw material availability/pricing (e.g., copper, steel).

- •

Talent acquisition for skilled manufacturing and specialized engineering roles.

- •

Integration of acquired companies to realize synergies.

Team Readiness

Experienced leadership team typical of a large, publicly-traded industrial company, with a demonstrated track record of M&A and portfolio shaping.

Likely a divisional structure based on its Utility Solutions and Electrical Solutions segments, which is appropriate for its diverse markets but may create silos that hinder cross-selling of integrated solutions.

Key Capability Gaps

- •

Agile software development and data science expertise to build out 'smart' product ecosystems.

- •

Digital marketing and e-commerce capabilities to supplement a traditional sales-led model.

- •

Solutions architecture and consultative selling skills to move up the value chain from components to integrated systems.

Growth Engine

Acquisition Channels

- Channel:

Distributor Networks / Wholesale

Effectiveness:High

Optimization Potential:Medium

Recommendation:Develop digital tools and training programs to empower distributors to sell more complex, integrated solutions. Implement a data-sharing program to improve demand forecasting.

- Channel:

Direct Sales Force (for large utility/industrial accounts)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Equip the sales force with consultative selling training focused on solving system-level problems (e.g., grid reliability, data center uptime) rather than selling individual components.

- Channel:

Specification Selling (Architects/Engineers)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Invest in developing comprehensive BIM/CAD libraries and online design/configuration tools to make it easier for engineers to specify Hubbell products early in the design phase.

- Channel:

Digital Lead Generation (Website 'Request Quote')

Effectiveness:Low

Optimization Potential:High

Recommendation:Optimize the online product catalog with better search and filtering. Implement a lead scoring and nurturing system to qualify inquiries for the sales team efficiently.

Customer Journey

Long and complex B2B journey involving awareness (trade press, events), consideration (website, spec sheets, distributor consultation), and decision (quote, negotiation). The 'Competitor Cross Reference' tool is a key asset in the consideration phase.

Friction Points

- •

Difficulty finding detailed technical specifications or compatibility information on the website.

- •

Slow response time to quote requests submitted online.

- •

Lack of transparent pricing for standard components, forcing reliance on distributors for all inquiries.

Journey Enhancement Priorities

{'area': 'Online Product Discovery', 'recommendation': 'Develop a best-in-class, mobile-friendly online catalog with faceted search, 3D models, and downloadable spec sheets.'}

{'area': 'Quote & Configuration', 'recommendation': 'Create a self-service online configuration tool for common product assemblies that provides instant budget estimates, reducing the burden on the sales team and speeding up the customer process.'}

Retention Mechanisms

- Mechanism:

Brand Reputation & Reliability

Effectiveness:High

Improvement Opportunity:Leverage its 135-year history in marketing campaigns to reinforce trust and differentiate from newer, less-proven competitors.

- Mechanism:

Distribution Channel Lock-in

Effectiveness:High

Improvement Opportunity:Launch a premier partner program for top distributors offering exclusive benefits, co-op marketing funds, and advanced training.

- Mechanism:

Product Specification

Effectiveness:Medium

Improvement Opportunity:Create a loyalty and education program for specifying engineers, offering certified training and early access to new product information.

Revenue Economics

As a mature manufacturer, Hubbell likely has strong unit economics characterized by solid gross margins, managed through procurement, manufacturing efficiency, and strategic pricing. They have demonstrated an ability to manage cost inflation through productivity and price actions.

Not Applicable (This is a B2B industrial model, not SaaS. The equivalent would be Customer Lifetime Value vs. Cost of Customer Acquisition, which is driven by long-term relationships and repeat business from large accounts).

High. The company demonstrates strong financial performance with double-digit growth in free cash flow and a focus on margin expansion, indicating an efficient revenue engine.

Optimization Recommendations

- •

Implement dynamic pricing strategies based on demand, raw material costs, and competitor pricing.

- •

Focus sales efforts on higher-margin, integrated solutions rather than commoditized individual components.

- •

Increase wallet share within existing large accounts through strategic cross-selling between the Utility and Electrical solutions segments.

Scale Barriers

Technical Limitations

- Limitation:

Legacy Manufacturing Systems

Impact:Medium

Solution Approach:Invest in 'Industry 4.0' technologies like automation, robotics, and predictive maintenance to increase factory output, improve quality, and reduce costs.

- Limitation:

Pace of R&D for Digital Solutions

Impact:High

Solution Approach:Establish separate, agile R&D pods focused on software and IoT. Consider acquiring smaller tech companies ('acqui-hiring') to rapidly bring in digital talent and IP.

Operational Bottlenecks

- Bottleneck:

Supply Chain Complexity & Volatility

Growth Impact:Can constrain production, delay revenue, and compress margins.

Resolution Strategy:Diversify supplier base, increase use of dual-sourcing for critical components, and invest in supply chain visibility software for better demand planning and risk mitigation.

- Bottleneck:

Acquisition Integration

Growth Impact:Failure to effectively integrate acquisitions like Systems Control can lead to unrealized synergies and operational disruption.

Resolution Strategy:Develop a standardized M&A integration playbook and a dedicated integration management office (IMO) to ensure smooth transitions of culture, systems, and processes.

Market Penetration Challenges

- Challenge:

Intense Competition

Severity:Critical

Mitigation Strategy:Compete on total cost of ownership, reliability, and integrated solutions rather than just price. Key competitors include Eaton, ABB, Schneider Electric, Legrand, and Rockwell Automation.

- Challenge:

Incumbent Relationships in a Mature Market

Severity:Major

Mitigation Strategy:Utilize the 'Competitor Cross Reference' tool aggressively. Target challenger accounts with disruptive solutions or superior service models. Focus on new projects and high-growth segments where relationships are less entrenched.

Resource Limitations

Talent Gaps

- •

Software Engineers and Data Scientists (for developing smart products)

- •

Cybersecurity experts (as products become more connected)

- •

Digital Marketers and E-commerce Specialists

Significant and ongoing capital required for R&D, manufacturing facility upgrades/expansion, and strategic acquisitions to maintain a competitive edge.

Infrastructure Needs

- •

Modernized, automated manufacturing facilities.

- •

A unified, modern ERP system to integrate operations across divisions and acquisitions.

- •

Advanced R&D labs for testing and developing next-generation grid and electrical technologies.

Growth Opportunities

Market Expansion

- Expansion Vector:

Deeper Penetration into Data Center Vertical

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Create a dedicated 'Data Center Solutions' team. Develop bundled offerings for hyperscalers and co-location providers. Partner with data center design and construction firms.

- Expansion Vector:

Full-Spectrum Renewable Energy Solutions

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Expand product lines beyond components to include integrated solutions for solar farms, wind turbines, and energy storage systems. Acquire companies specializing in grid-scale inverters or battery management systems.

- Expansion Vector:

International Market Expansion (Asia-Pacific)

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Establish a joint venture or strategic partnership with a local player to navigate regulatory hurdles and distribution channels. Focus initially on high-demand sectors like utility infrastructure in developing economies.

Product Opportunities

- Opportunity:

Grid Automation-as-a-Service

Market Demand Evidence:Utilities are increasingly looking to outsource non-core operations and adopt opex models. The grid optimization market is growing at over 9% annually.

Strategic Fit:High. Leverages existing expertise from the Systems Control acquisition and shifts from a one-time sale to recurring revenue.

Development Recommendation:Pilot a subscription-based model for substation monitoring and control with a select group of utility customers.

- Opportunity:

Smart Electrical Panels for Commercial Buildings

Market Demand Evidence:Growing demand for energy efficiency and smart building management. This aligns with trends in commercial construction and facility management.

Strategic Fit:High. A natural extension of their existing electrical components business, adding a layer of high-margin intelligence.

Development Recommendation:Partner with a building automation software company to co-develop a solution with an open API for easy integration.

Channel Diversification

- Channel:

Direct-to-Contractor E-commerce Portal

Fit Assessment:Good for smaller contractors and standard/repeat orders.

Implementation Strategy:Launch a pilot e-commerce site for a specific product line (e.g., residential wiring devices) to test the model before a broader rollout. Ensure it complements, rather than competes with, key distributors.

- Channel:

Partnerships with System Integrators

Fit Assessment:Excellent. System integrators are key influencers and channel partners for complex projects in industrial automation and smart buildings.

Implementation Strategy:Create a formal System Integrator partnership program with training, certification, dedicated technical support, and preferential pricing.

Strategic Partnerships

- Partnership Type:

Technology Integration

Potential Partners

- •

Siemens

- •

Honeywell

- •

Johnson Controls

- •

Major cloud providers (AWS, Azure, GCP)

Expected Benefits:Ensure Hubbell's hardware is seamlessly compatible with major building/grid management software platforms, increasing its specified-product pull-through.

- Partnership Type:

EV Charging Infrastructure

Potential Partners

- •

ChargePoint

- •

EVgo

- •

Electrify America

- •

Major automotive OEMs

Expected Benefits:Become a key supplier of electrical infrastructure components (switchgear, transformers, connectors) for the build-out of public and fleet EV charging networks.

Growth Strategy

North Star Metric

Share of Revenue from High-Growth Megatrends

This metric aligns the entire organization around the most critical long-term growth drivers (electrification, grid modernization, digitalization). It shifts focus from incremental gains in mature markets to capturing leadership in future-proofed segments.

Increase share of revenue from these segments (Data Centers, Renewables, Grid Automation, Electrification) from an estimated 30-35% to over 50% within 3-5 years.

Growth Model

Hybrid: Sales-Led & Ecosystem-Driven Growth

Key Drivers

- •

Strategic Account Management (Deepening relationships with top utilities and industrial clients)

- •

Channel Enablement (Empowering distributors and integrators to sell Hubbell solutions)

- •

Specification Wins (Getting Hubbell products designed into projects early)

- •

Strategic M&A (Acquiring capabilities and market access in high-growth areas)

Strengthen the core sales-led motion while building a dedicated partnership team to manage the ecosystem of distributors, integrators, and technology partners.

Prioritized Initiatives

- Initiative:

Launch 'Hubbell Grid Modernization Solutions' Bundle

Expected Impact:High

Implementation Effort:High

Timeframe:12-18 months

First Steps:Form a cross-functional team from the legacy utility business and the newly acquired Systems Control. Identify 3-5 key utility pain points and assemble an integrated hardware/software/service solution.

- Initiative:

Develop a 'Digital Toolkit' for Specifying Engineers

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:6-9 months

First Steps:Survey 100 specifying engineers to identify their biggest workflow challenges. Begin development of an online product configurator and BIM object library.

- Initiative:

Pilot an 'Industrial IoT' Sensor Product Line

Expected Impact:High

Implementation Effort:Medium

Timeframe:9-12 months

First Steps:Acquire or partner with a small IoT sensor company. Co-develop a simple, retrofittable sensor for a common industrial component (e.g., a motor connector) to monitor temperature and vibration.

Experimentation Plan

High Leverage Tests

{'test': 'Subscription Pricing Pilot', 'hypothesis': 'A subset of utility customers will prefer an opex-based subscription for substation monitoring over a large capex purchase.'}

{'test': 'Digital Self-Service Portal', 'hypothesis': 'Offering a self-service portal for small contractors to place standard orders will increase sales efficiency and customer satisfaction in this segment.'}

Use a combination of leading indicators (e.g., pilot customer engagement, portal sign-ups) and lagging indicators (e.g., recurring revenue booked, reduction in sales-per-transaction cost).

Quarterly review of in-flight pilots and launching of one new strategic experiment per half-year.

Growth Team

A centralized 'Strategic Growth Office' reporting to the CEO, tasked with identifying and incubating new growth vectors. This office would sponsor cross-functional 'Initiative Teams' for specific projects.

Key Roles

- •

Head of Strategic Growth

- •

Market Vector Lead (e.g., Head of Electrification)

- •

Director of Strategic Partnerships

- •

Business Development Manager (New Ventures)

A mix of internal upskilling (training existing product managers on solution selling), external hiring for key digital roles, and strategic acquisitions to rapidly onboard new capabilities.

Hubbell Incorporated is a well-established industrial stalwart with a strong foundation and an enviable position at the center of powerful secular tailwinds, including grid modernization, electrification, and the data-driven economy. Its product-market fit is undeniable, built over a century of reliability. The company's primary growth challenge is not survival but transformation: evolving from a high-quality component manufacturer into an integrated solutions provider that can capture more value from these macro trends.

The most significant growth opportunities lie in deepening its penetration into hyper-growth verticals like data centers and renewables, and by adding layers of software, intelligence, and services to its core hardware products. The recent acquisition of Systems Control is a strong strategic move in this direction, enhancing capabilities in the high-value grid automation space.

Key barriers are primarily internal and operational. The company must guard against complacency, accelerate its digital capabilities, and ensure its organizational structure can support the sale of complex, cross-divisional solutions. Intense competition from other large, well-capitalized players means that speed and innovation are critical.

The recommended strategy is to build upon its core strengths while systematically pursuing growth in adjacent, high-margin areas. This involves establishing a dedicated strategic growth function, focusing the entire organization on revenue from 'megatrend' markets as a North Star Metric, and prioritizing initiatives that bundle products into solutions, enhance the digital customer journey, and explore new business models like subscription services. Success will be defined by Hubbell's ability to innovate at the system level, leveraging its vast portfolio to solve bigger, more complex problems for its customers.

Legal Compliance

Hubbell's Privacy Policy is present and linked from key data collection points, such as the 'Request a Quote' form, which is a good practice. The policy clearly outlines the types of personal data collected, the purposes for processing, and the use of cookies and other tracking technologies. It also addresses the rights of data subjects under various global regulations, including GDPR and CCPA, by providing sections on 'Your Rights and Choices' and specific information for residents of California, the EEA, UK, Switzerland, and other regions. The consent mechanism on the Mexican 'Request a Quote' form explicitly links to the policy and terms before submission, which is a positive compliance step. However, the checkbox for marketing communications is pre-checked by default on some versions of their forms, which is not compliant with the GDPR's requirement for unambiguous, affirmative consent. The use of third-party services like Google reCAPTCHA is acknowledged, but the implications of data sharing with Google should be more explicitly detailed within their own privacy notice.