eScore

kellanova.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

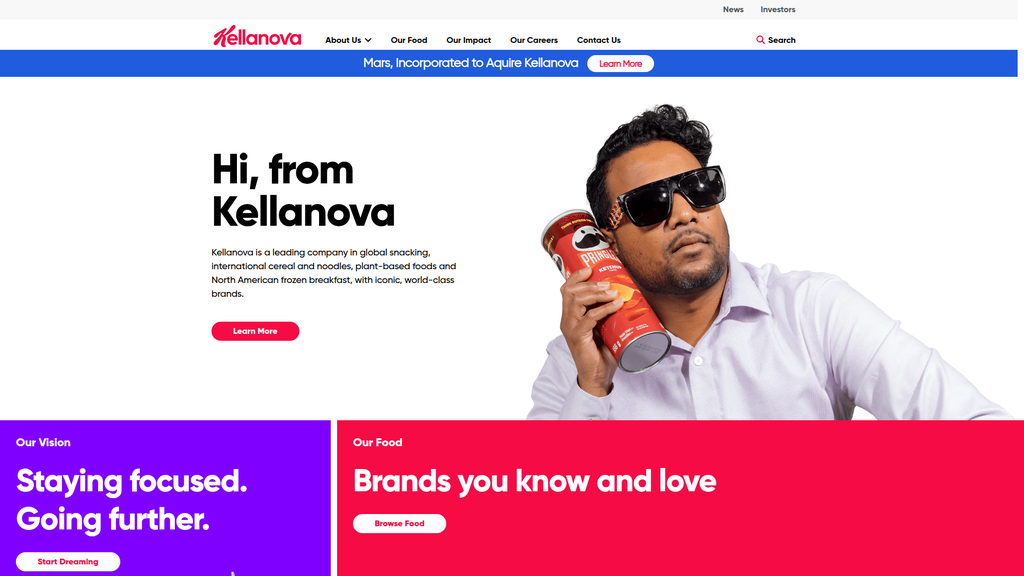

Kellanova's digital presence is defined by its corporate function, serving investors and media effectively, especially concerning the Mars acquisition. However, it lacks broader content authority and thought leadership on consumer or industry trends, a role delegated to its individual brands. The website is a well-designed global directory but has minimal localized content, and its search visibility is almost entirely dominated by M&A news, limiting organic reach on other strategic topics.

The website clearly communicates its global scale with a 'View by Region' functionality, effectively serving as a high-level corporate directory for its international operations.

Develop a dedicated content hub for 'The Future of Snacking' to establish thought leadership beyond corporate announcements, covering innovation, consumer trends, and sustainability in greater detail.

The messaging effectively leverages the immense equity of its iconic brands, which is a clear strength. However, the overall brand voice is inconsistent, shifting between formal corporate speak and ambiguous marketing phrases like 'Staying focused. Going further.' There's a significant gap in articulating a compelling, forward-looking value proposition for the new Kellanova entity, especially for investors and top talent, beyond its existing portfolio.

The brand consistently and effectively leverages the nostalgia and trust of its portfolio with the simple, powerful message 'Brands you know and love'.

Replace vague corporate messaging ('Start Dreaming') with concrete strategic pillars that clearly articulate the company's growth strategy and value proposition to key audiences like investors.

As a corporate site, its primary 'conversion' goal is stakeholder communication, not sales. The user experience features a clean design and low cognitive load, making information easy to find. However, the analysis highlights inconsistent CTA design and ambiguous copy (e.g., 'Let's Go Now'), creating a disjointed journey and diluting the effectiveness of guiding users to key information, which is a notable friction point.

The site's clean information architecture and logical navigation create a low-friction experience for users seeking specific corporate information like brand portfolios or career opportunities.

Standardize all primary call-to-action buttons to a single, high-contrast visual style and use clear, action-oriented copy to improve user guidance and click-through rates.

Kellanova demonstrates a mature approach to credibility and risk, with robust and transparent legal compliance features. The granular cookie consent manager, comprehensive privacy policies tailored to different jurisdictions, and clear terms of use are significant strengths. It also leverages the immense trust of its consumer brands and has received numerous third-party awards, solidifying its position as a credible global entity.

Implementation of a sophisticated, GDPR-compliant 'Privacy Preference Center' for cookie consent, which provides users with granular control and demonstrates a strong commitment to data privacy.

Incorporate a prominent 'Safe Harbor' disclaimer adjacent to all forward-looking statements, particularly those concerning the Mars acquisition, to mitigate securities litigation risk.

Kellanova's competitive advantage is exceptionally strong and sustainable, rooted in a portfolio of iconic, category-defining brands like Pringles and Cheez-It with deep cultural penetration. This brand equity is fortified by a massive global manufacturing and distribution network that creates significant economies of scale and high barriers to entry. The pending acquisition by Mars is set to amplify these advantages into a nearly insurmountable moat in the global snacking industry.

The portfolio of iconic, category-defining brands (Pringles, Cheez-It, etc.) represents a highly sustainable moat built on decades of brand loyalty and cultural relevance.

Address the portfolio's skew towards processed foods by accelerating innovation and acquisition in the 'better-for-you' space to defend against shifting consumer health trends.

The business model is inherently built for massive scale, with high operational leverage and a global manufacturing footprint. Kellanova is strategically positioned to capitalize on growth in emerging markets, a key pillar of its strategy. The impending integration with Mars will dramatically enhance scalability, combining distribution networks and opening new global markets for its iconic brands.

Excellent strategic timing, having spun off its slower-growth cereal business to align perfectly with the sustained, high-growth global snacking category.

Invest in a unified, cloud-based supply chain platform with AI/ML capabilities to modernize legacy systems and improve demand forecasting and end-to-end visibility.

The business model is highly coherent, with a clear focus on the high-growth snacking category following the strategic spin-off. Revenue streams are robust, and the company leverages its primary assets—iconic brands and global scale—effectively. The pending acquisition by Mars further validates the model's strength and aligns perfectly with the strategic goal of creating a global snacking powerhouse.

The strategic spin-off created a highly focused business model dedicated to the higher-growth snacking sector, unlocking significant shareholder value and strategic clarity.

Develop a direct-to-consumer (DTC) channel, even if just for niche brands or limited editions, to capture valuable first-party data and build direct customer relationships.

Kellanova holds significant market power, with brands that are leaders or strong challengers in their respective categories, affording it considerable pricing power. Its global distribution network provides substantial leverage with retailers. The ultimate testament to its market power is the $35.9 billion acquisition by Mars, which validates its immense brand equity and strategic value within the industry.

Demonstrated pricing power, with the ability to raise prices to protect margins against inflation without significant loss of market share due to strong brand loyalty.

Proactively counter the threat from high-quality private label brands by introducing 'fighter brand' variants or strategic pack sizes to compete at multiple price points.

Business Overview

Business Classification

Consumer Packaged Goods (CPG) Manufacturer

B2B Wholesale

Food & Beverage

Sub Verticals

- •

Salty Snacks

- •

Portable Wholesome Snacks

- •

Frozen Breakfast Foods

- •

Plant-Based Foods

- •

International Cereals & Noodles

Mature

Maturity Indicators

- •

Recent major corporate restructuring (spin-off from Kellogg Co. to form Kellanova and WK Kellogg Co).

- •

Portfolio of globally recognized, billion-dollar brands (e.g., Pringles, Cheez-It).

- •

Extensive global manufacturing and distribution footprint across 20+ countries.

- •

Pending acquisition by a larger multinational conglomerate (Mars, Incorporated) for $35.9 billion.

- •

Long-standing history and brand equity inherited from the 117-year legacy of Kellogg Company.

Enterprise

Steady (with potential for acceleration post-acquisition)

Revenue Model

Primary Revenue Streams

- Stream Name:

Global Snacking Product Sales

Description:Revenue generated from the sale of iconic snacking brands such as Pringles, Cheez-It, Pop-Tarts, and Rice Krispies Treats through global retail and foodservice channels. This is the largest and most growth-oriented segment, representing approximately 60% of net sales.

Estimated Importance:Primary

Customer Segment:Mass-Market Consumers (via Retailers)

Estimated Margin:Medium to High

- Stream Name:

North American Frozen Foods Sales

Description:Sales of frozen breakfast products (Eggo) and plant-based foods (MorningStar Farms). This segment holds strong market-leading positions in its respective categories within North America.

Estimated Importance:Secondary

Customer Segment:North American Consumers (via Retailers)

Estimated Margin:Medium

- Stream Name:

International Cereals & Noodles Sales

Description:Revenue from cereal and noodle brands sold outside of North America, including Kellogg's, Frosties, and Kellogg's Instant Noodles, with a strong focus on emerging markets like Mexico, India, Brazil, and Africa.

Estimated Importance:Secondary

Customer Segment:International Consumers (via Retailers)

Estimated Margin:Low to Medium

Recurring Revenue Components

Repeat consumer purchases driven by strong brand loyalty and household penetration.

Long-term supply contracts with major global retailers and foodservice distributors.

Pricing Strategy

Wholesale & Distributor Pricing

Mid-range to Premium

Opaque (Wholesale prices are not public; consumers see retail pricing set by partners)

Pricing Psychology

- •

Brand Value Perception: Pricing reflects the premium status of iconic brands.

- •

Promotional Pricing: Collaboration with retailers on sales, coupons, and multi-buy offers to drive volume.

- •

Value Sizing: Offering various package sizes (e.g., single-serve, family-size) to cater to different consumer needs and price points.

Monetization Assessment

Strengths

- •

Strong brand equity allows for premium pricing and resilient demand.

- •

Diverse portfolio across multiple categories and geographies mitigates risk.

- •

Significant pricing power demonstrated by raising prices to protect margins against inflation.

Weaknesses

- •

High dependency on third-party retailers (e.g., supermarkets) for distribution and sales.

- •

Vulnerability to price negotiations and margin pressure from large retail partners.

- •

Limited direct-to-consumer (D2C) revenue streams, reducing direct customer relationships and data.

Opportunities

- •

Post-acquisition by Mars, leverage combined distribution networks to expand market reach and reduce costs.

- •

Aggressively expand in high-growth emerging markets where snacking habits are increasing.

- •

Develop and scale D2C e-commerce platforms to capture higher margins and valuable consumer data.

Threats

- •

Intense competition from other CPG giants like PepsiCo and Mondelez, as well as private-label brands.

- •

Shifting consumer preferences towards healthier, less-processed snack options.

- •

Volatility in commodity prices for key ingredients (grains, oils, etc.) impacting cost of goods sold.

Market Positioning

A global, snacks-led powerhouse focused on brand differentiation, category leadership, and expansion in emerging markets.

Market Leader or a Strong No. 2 in key sub-verticals like crackers (Cheez-It) and stackable potato crisps (Pringles).

Target Segments

- Segment Name:

The Modern Family

Description:Households with children seeking convenient, reliable, and enjoyable food options for meals (breakfast) and on-the-go snacking occasions.

Demographic Factors

- •

Parents aged 30-50

- •

Middle to upper-middle income

- •

Suburban or urban households

Psychographic Factors

- •

Value convenience and time-saving solutions

- •

Seek trusted brands

- •

Balance indulgence with a desire for wholesome options

Behavioral Factors

- •

Bulk purchases at supermarkets/hypermarkets

- •

High brand loyalty

- •

Influenced by children's preferences

Pain Points

- •

Lack of time for meal preparation

- •

Finding snacks that appeal to the entire family

- •

Budget constraints vs. desire for quality brands

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Gen Z & Millennial Snackers

Description:Younger consumers (18-35) who snack frequently throughout the day and are highly influenced by social media, flavor innovation, and brand collaborations.

Demographic Factors

- •

Ages 18-35

- •

Students or young professionals

- •

Digitally native

Psychographic Factors

- •

Seek novelty and exciting flavors

- •

Value authenticity and brand personality

- •

Influenced by peer recommendations and online trends

Behavioral Factors

- •

Impulse purchases at convenience stores

- •

High engagement with digital marketing campaigns

- •

Open to trying new and limited-edition products

Pain Points

- •

Boredom with traditional snack options

- •

Desire for shareable, social-media-worthy food experiences

- •

Seeking brands that align with their personal values

Fit Assessment:Good

Segment Potential:High

- Segment Name:

Health-Conscious Consumers

Description:Individuals and households actively seeking healthier food alternatives, including plant-based, protein-rich, and organic options, without completely sacrificing taste and convenience.

Demographic Factors

- •

All ages, with a higher concentration in Millennials and Gen X

- •

Higher education levels

- •

Urban dwellers

Psychographic Factors

- •

Prioritize health and wellness

- •

Read nutritional labels carefully

- •

Environmentally and ethically conscious

Behavioral Factors

- •

Shop at natural food stores and supermarket health aisles

- •

Willing to pay a premium for perceived health benefits

- •

Early adopters of new health food trends

Pain Points

- •

Difficulty finding healthy options that are also convenient and taste good

- •

Skepticism towards health claims from large corporations

- •

Limited availability of plant-based options in mainstream stores

Fit Assessment:Fair to Good

Segment Potential:High

Market Differentiation

- Factor:

Iconic Brand Portfolio

Strength:Strong

Sustainability:Sustainable

- Factor:

Global Distribution Network

Strength:Strong

Sustainability:Sustainable

- Factor:

Product and Flavor Innovation

Strength:Moderate

Sustainability:Sustainable

- Factor:

Economies of Scale in Manufacturing

Strength:Strong

Sustainability:Sustainable

- Factor:

Integration into Mars, Inc. Ecosystem (Post-Acquisition)

Strength:Strong

Sustainability:Sustainable

Value Proposition

To provide a diverse portfolio of delicious, convenient, and trusted snacks and breakfast foods for every occasion, powered by iconic global brands.

Good

Key Benefits

- Benefit:

Brand Trust and Familiarity

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Decades of market presence

High levels of brand recognition and household penetration

- Benefit:

Convenience and Accessibility

Importance:Critical

Differentiation:Common

Proof Elements

Wide availability in all major retail channels

Portable packaging designed for on-the-go consumption

- Benefit:

Taste and Indulgence

Importance:Important

Differentiation:Somewhat unique

Proof Elements

Proprietary recipes and flavor profiles

Consistent product quality

- Benefit:

Variety and Innovation

Importance:Important

Differentiation:Somewhat unique

Proof Elements

Frequent launch of new flavors and limited-time offers

Brand collaborations and product mashups (e.g., Cheez-It & Taco Bell).

Unique Selling Points

- Usp:

A portfolio of globally recognized, category-defining brands like Pringles and Cheez-It.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Unmatched global scale in the snacking category, soon to be amplified by the Mars acquisition.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Strategic focus as a pure-play snacks-led company following the spin-off of the North American cereal business.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

The need for quick, easy, and satisfying food options for busy lifestyles.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Finding trusted and consistent food products that appeal to multiple family members.

Severity:Major

Solution Effectiveness:Complete

- Problem:

The desire for indulgent treats and flavor variety to combat snack boredom.

Severity:Major

Solution Effectiveness:Partial

Value Alignment Assessment

High

Kellanova's portfolio is well-aligned with the massive and growing global snacking market. The spin-off allows for a more focused strategy on this high-growth sector.

High

The company's core brands have exceptionally high penetration and loyalty among its primary target segments. There is a significant opportunity to better align with the values of the 'Health-Conscious Consumer' segment.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Global Retailers (e.g., Walmart, Tesco, Carrefour)

- •

Foodservice Distributors (e.g., Sysco)

- •

Raw Material Suppliers (Agricultural commodity providers)

- •

Co-Manufacturing & Packaging Partners

- •

Marketing & Advertising Agencies (e.g., Interpublic Group)

- •

Licensing & Brand Collaboration Partners (e.g., Taco Bell, Crocs).

Key Activities

- •

Brand Management & Marketing

- •

Product Innovation & R&D

- •

Large-Scale Manufacturing

- •

Global Supply Chain & Logistics Management

- •

Sales & Trade Marketing

- •

Mergers & Acquisitions (as exemplified by the Mars deal)

Key Resources

- •

Portfolio of Iconic Brands (Intellectual Property)

- •

Global Manufacturing Facilities

- •

Extensive Distribution Network and Retail Relationships

- •

Proprietary Product Formulations

- •

Human Capital (Brand managers, food scientists, supply chain experts)

Cost Structure

- •

Cost of Goods Sold (Raw materials, manufacturing labor, overhead)

- •

Selling, General & Administrative (SG&A) Expenses

- •

Marketing & Advertising Spend

- •

Logistics & Distribution Costs

- •

Research & Development Investment

Swot Analysis

Strengths

- •

Dominant portfolio of high-equity, globally recognized brands.

- •

Extensive and efficient global supply chain and distribution network.

- •

Increased strategic focus on the high-growth snacking category after the spin-off.

- •

Strong pricing power and proven ability to manage inflationary pressures.

- •

Significant presence and growth potential in emerging markets.

Weaknesses

- •

High reliance on traditional retail channels, which are subject to consolidation and margin pressure.

- •

Portfolio is heavily weighted towards indulgent snacks, facing headwinds from health and wellness trends.

- •

Declining earnings and revenue growth rates in recent years prior to the spin-off.

- •

Operational complexity associated with managing a global manufacturing footprint.

Opportunities

- •

Leverage Mars' resources and distribution channels post-acquisition to accelerate growth and achieve synergies.

- •

Expand the 'better-for-you' snack portfolio through innovation and acquisition to capture health-conscious consumers.

- •

Utilize AI and data analytics to personalize marketing and optimize the supply chain.

- •

Further penetrate high-growth emerging markets in Africa and Asia with tailored products.

- •

Grow the foodservice and away-from-home channels through strategic partnerships.

Threats

- •

Intensifying competition from CPG giants (PepsiCo, Mondelez) and agile private label brands.

- •

Sustained shifts in consumer preferences towards fresh, natural, and low-processed foods.

- •

Global supply chain disruptions and commodity price volatility.

- •

Increased regulatory scrutiny regarding food labeling, health claims, and marketing to children.

- •

Potential for brand fatigue and the need for constant innovation to maintain consumer interest.

Recommendations

Priority Improvements

- Area:

Post-Acquisition Integration

Recommendation:Establish a dedicated integration management office with Mars to aggressively pursue synergies in procurement, distribution, and back-office functions. Prioritize cultural alignment to retain key talent.

Expected Impact:High

- Area:

Portfolio Modernization

Recommendation:Accelerate R&D and M&A efforts in the 'better-for-you' snacking space. Reformulate existing products to reduce sodium, sugar, and artificial ingredients where feasible without compromising core brand identity.

Expected Impact:High

- Area:

Digital Transformation & D2C

Recommendation:Invest in a centralized data analytics platform to derive deeper consumer insights. Pilot and scale direct-to-consumer (D2C) initiatives for niche brands like RXBAR to build direct relationships and test innovations.

Expected Impact:Medium

Business Model Innovation

- •

Develop a personalized snacking subscription service based on consumer taste profiles and dietary needs.

- •

Create 'snacking occasion' platforms that bundle products with digital content or experiences (e.g., 'Movie Night Box' featuring Pop-Tarts and Pringles).

- •

Launch a corporate venture arm to invest in emerging food tech startups focused on sustainable ingredients and novel snack formats.

Revenue Diversification

- •

Expand brand licensing into adjacent consumer goods categories (e.g., apparel, housewares) to capitalize on brand equity.

- •

Aggressively build out the foodservice channel by developing customized products for restaurant partners (e.g., Cheez-It flavored coatings, Eggo waffle buns).

- •

Explore international expansion of the MorningStar Farms plant-based portfolio into Europe and Asia, leveraging Mars' existing cold-chain logistics.

Kellanova represents a strategic evolution from the legacy Kellogg Company, sharpening its focus to become a global snacks-led powerhouse. The 2023 spin-off of the North American cereal business was a pivotal move, unshackling the higher-growth snacking portfolio from the mature, slower-growing cereal division. The company's business model is anchored in the strength of its iconic brands—Pringles, Cheez-It, Pop-Tarts, and Eggo—which command significant market share, strong brand loyalty, and pricing power.

The core revenue model, based on high-volume wholesale to retail partners, is robust and highly scalable but also creates a dependency that limits direct consumer engagement and exposes the company to margin pressure from powerful retailers. Operationally, Kellanova is a mature, efficient enterprise with a formidable global manufacturing and distribution network. However, its greatest challenge and opportunity lies in adapting its indulgent-heavy portfolio to meet the accelerating consumer shift towards health and wellness.

The pending $35.9 billion acquisition by Mars, Incorporated is the single most important strategic factor defining Kellanova's future. This transaction is not merely a change in ownership but a fundamental shift in its competitive standing. The integration will create a dominant force in the global snacking industry, combining Mars' confectionery strength with Kellanova's savory snack leadership. The strategic imperatives for Kellanova are now inextricably linked to this integration. Success will be defined by the ability to realize significant cost and revenue synergies, leverage a combined R&D and distribution platform to accelerate innovation and market penetration, and effectively navigate the cultural integration of two CPG giants. The evolution from a newly independent public company to a critical division within a larger private entity dramatically alters its strategic horizon, prioritizing long-term, integrated growth over short-term public market pressures.

Competitors

Competitive Landscape

Mature

Moderately concentrated

Barriers To Entry

- Barrier:

Brand Equity & Loyalty

Impact:High

- Barrier:

Global Distribution Networks & Retail Relationships

Impact:High

- Barrier:

Economies of Scale in Manufacturing & Procurement

Impact:High

- Barrier:

Marketing & Advertising Spend

Impact:Medium

- Barrier:

Regulatory Compliance (Food Safety)

Impact:Medium

Industry Trends

- Trend:

Health & Wellness Focus

Impact On Business:Requires reformulation for lower sugar/sodium, addition of functional ingredients, and development of 'better-for-you' snack alternatives. Brands like RXBAR and MorningStar Farms are well-positioned, but legacy brands like Pop-Tarts face challenges.

Timeline:Immediate

- Trend:

Growth of Private Label Brands

Impact On Business:Increased price competition and pressure on margins as retailers like Walmart (Great Value) and Target (Good & Gather) offer high-quality, lower-cost alternatives, gaining significant consumer trust and market share.

Timeline:Immediate

- Trend:

Sustainability & Ethical Sourcing

Impact On Business:Consumers increasingly demand transparency in sourcing and eco-friendly packaging, requiring investment in supply chain visibility and sustainable materials to maintain brand reputation.

Timeline:Near-term

- Trend:

Convenience & On-the-Go Snacking

Impact On Business:Reinforces the strategic importance of Kellanova's core portfolio (Pringles, Cheez-It, Rice Krispies Treats) which are inherently convenient. Opportunity to innovate in packaging and formats for enhanced portability.

Timeline:Immediate

- Trend:

Digital Engagement & E-commerce

Impact On Business:Shift in marketing spend towards digital channels and the need to build robust direct-to-consumer (DTC) or e-commerce retail partnerships. Data analytics becomes crucial for understanding online consumer behavior.

Timeline:Near-term

Direct Competitors

- →

Mondelēz International

Market Share Estimate:Leading player in global snacking, particularly strong in biscuits and chocolate.

Target Audience Overlap:High

Competitive Positioning:A global snacking powerhouse with a focus on biscuits, chocolate, and candy, owning iconic brands like Oreo, Cadbury, and Toblerone.

Strengths

- •

Dominant market position in biscuits and chocolate.

- •

Extensive global distribution network and emerging markets presence.

- •

Strong brand portfolio with high consumer loyalty (e.g., Oreo).

- •

Significant investment in marketing and product innovation.

Weaknesses

- •

Less diversified in salty snacks compared to Kellanova or PepsiCo.

- •

Portfolio is heavily weighted towards indulgent, less healthy options.

- •

Susceptible to commodity price fluctuations, especially cocoa.

Differentiators

Deep expertise in the chocolate and biscuit categories.

Aggressive M&A strategy to acquire emerging, on-trend brands.

- →

PepsiCo (Frito-Lay North America)

Market Share Estimate:Dominant leader in the savory snacks category in North America.

Target Audience Overlap:High

Competitive Positioning:The undisputed leader in salty snacks, leveraging a massive scale and an unparalleled direct-store-delivery (DSD) system.

Strengths

- •

Market dominance with brands like Lay's, Doritos, and Cheetos.

- •

Exceptional DSD network providing significant shelf space advantage.

- •

Massive marketing budget and highly effective advertising campaigns.

- •

Synergies with its beverage division create powerful retail partnerships.

Weaknesses

- •

Primarily focused on salty, fried snacks which face health-related headwinds.

- •

Less presence in the sweet snacks/bakery and frozen breakfast categories.

- •

Innovation can be incremental, relying on flavor extensions of core brands.

Differentiators

Unmatched DSD logistics and supply chain efficiency.

Brand portfolio is synonymous with the savory snack category itself.

- →

General Mills

Market Share Estimate:Significant player in snack bars, cereal, and refrigerated dough.

Target Audience Overlap:High

Competitive Positioning:A diversified food company with strong positions in at-home food categories, including cereal, snack bars, and baking goods.

Strengths

- •

Iconic brands in various categories (Nature Valley, Betty Crocker, Pillsbury, Cheerios).

- •

Strong leadership in the snack bar segment with Nature Valley and Fiber One.

- •

Well-established retail relationships across the entire grocery store.

- •

Growing pet food division provides diversification.

Weaknesses

- •

Legacy portfolio heavily reliant on center-store categories facing slower growth.

- •

Less dominant in the high-growth salty snacks category.

- •

Can be perceived as a more traditional, slower-moving company.

Differentiators

Stronghold in the snack bar and refrigerated dough categories.

Brand portfolio that spans breakfast, baking, and snacking.

- →

Conagra Brands

Market Share Estimate:Notable player in meat snacks, popcorn, and frozen meals.

Target Audience Overlap:Medium

Competitive Positioning:A branded food company with a diverse portfolio across frozen, grocery, and snacks, known for revitalizing legacy brands.

Strengths

- •

Dominant position in specific niches like meat snacks (Slim Jim) and microwave popcorn (Orville Redenbacher's, ACT II).

- •

Strong portfolio of frozen brands (e.g., Birds Eye, Healthy Choice).

- •

Successful track record of modernizing acquired brands.

- •

Broad portfolio covering multiple meal occasions.

Weaknesses

- •

Smaller scale in global snacking compared to Kellanova, Mondelēz, and PepsiCo.

- •

Lacks a 'mega-brand' in the core cracker or chip categories with the scale of Pringles or Lay's.

- •

Portfolio includes many legacy brands that require significant investment to remain relevant.

Differentiators

Leadership in specific sub-categories like meat snacks and seeds.

Focus on the frozen food aisle provides a different competitive arena.

Indirect Competitors

- →

Private Label Brands (e.g., Walmart's Great Value, Costco's Kirkland Signature)

Description:Retailer-owned brands that offer similar snack products, often at a lower price point, directly competing for shelf space and consumer value perception.

Threat Level:High

Potential For Direct Competition:They are already direct competitors on the shelf. The threat is their increasing quality and brand perception, moving beyond just being a value option.

- →

Health & Wellness Snack Brands (e.g., Kind, Clif Bar, Hippeas)

Description:Companies focused on 'better-for-you' snacks, using clean labels, plant-based ingredients, and functional benefits to appeal to health-conscious consumers.

Threat Level:Medium

Potential For Direct Competition:High, as they erode market share from legacy brands and force large CPGs to either acquire them or innovate in the health and wellness space. Mars has already acquired Kind.

- →

Meal Kit Services (e.g., HelloFresh, Blue Apron)

Description:These services reduce overall grocery store trips and provide curated meal solutions, which can include snack and breakfast add-ons, thus bypassing traditional CPG channels.

Threat Level:Low

Potential For Direct Competition:Low, their business model is fundamentally different, but they compete for the same share of the consumer's stomach and food budget.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Iconic, Category-Defining Brands

Sustainability Assessment:Highly sustainable. Brands like Pringles, Cheez-It, Pop-Tarts, and Eggo have deep cultural penetration and brand loyalty built over decades, which is difficult and expensive to replicate.

Competitor Replication Difficulty:Hard

- Advantage:

Global Manufacturing & Supply Chain Scale

Sustainability Assessment:Highly sustainable. The established global footprint allows for significant economies of scale in sourcing raw materials and manufacturing, creating a cost advantage that is difficult for smaller players to match.

Competitor Replication Difficulty:Hard

- Advantage:

Extensive Retail Distribution Network

Sustainability Assessment:Sustainable. Long-standing relationships with global retailers ensure premium shelf space and widespread product availability. This is a significant barrier to entry for new brands.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'Post-Spinoff Focus as a Snacking Powerhouse', 'estimated_duration': '1-2 years. The 2023 split from the North American cereal business (WK Kellogg Co) allowed Kellanova to concentrate resources and strategy on its higher-growth snacking portfolio. This advantage of renewed focus will normalize as the strategy becomes business-as-usual.'}

{'advantage': 'Synergies from Mars Acquisition', 'estimated_duration': '2-5 years. The pending acquisition by Mars will create a global snacking behemoth. Initial advantages will come from combining distribution, cross-promoting products, and leveraging combined R&D, but competitors will adapt to the new market structure over time.'}

Disadvantages

- Disadvantage:

Portfolio Skewed Towards Processed Foods

Impact:Major

Addressability:Moderately

- Disadvantage:

Vulnerability to Private Label Competition

Impact:Major

Addressability:Difficult

- Disadvantage:

Slower to Innovate in Emerging Health Trends

Impact:Minor

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Launch 'Limited Time Offer' Flavor Collaborations

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Optimize Digital Shelf Presence

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Integrate & Leverage Mars' Assets Post-Acquisition

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Expand 'Better-for-You' Portfolio

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Invest in Supply Chain Agility & Data Analytics

Expected Impact:Medium

Implementation Difficulty:Difficult

Long Term Strategies

- Recommendation:

Establish a Dominant Position in Emerging Markets

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Lead in Sustainable Packaging Innovation

Expected Impact:Medium

Implementation Difficulty:Difficult

Post-acquisition, position the combined Mars-Kellanova entity as the 'Undisputed Global Leader in Snacking Moments,' spanning from indulgent treats (Mars chocolate) to savory crunch (Pringles, Cheez-It) and wholesome bites (RXBAR, Kind). The messaging should emphasize unparalleled variety, quality, and availability for any consumer occasion.

Differentiate through a 'Portfolio Powerhouse' strategy. No other single competitor will have the same breadth across chocolate, candy, savory crackers, chips, and snack bars. Leverage this unique diversity to create cross-category retail programs, bundled promotions, and consumer-facing campaigns that competitors cannot replicate.

Whitespace Opportunities

- Opportunity:

Premium, 'Better-for-You' Frozen Breakfast

Competitive Gap:While Eggo dominates the mainstream frozen breakfast space, there is a gap for premium, convenient options with clean labels, high protein, and functional ingredients, competing more with startups than with direct CPG rivals.

Feasibility:High

Potential Impact:Medium

- Opportunity:

Global Savory Snack Flavor Innovation Platform

Competitive Gap:While competitors often launch regional flavors, there is an opportunity to create a global platform (leveraging the Pringles brand) that systematically introduces and rotates international street food or gourmet flavors in major markets, creating a continuous news cycle and catering to adventurous palates.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Direct-to-Consumer (DTC) Customization

Competitive Gap:Major CPG competitors have limited DTC offerings. A whitespace exists for a DTC platform allowing consumers to create customized variety packs of snacks (e.g., a mix of Pringles, Cheez-It, and Rice Krispies Treats) or even personalized Pop-Tarts.

Feasibility:Medium

Potential Impact:Medium

Kellanova operates as a global snacking powerhouse, built on a portfolio of iconic, category-defining brands such as Pringles, Cheez-It, and Pop-Tarts. The strategic split from its North American cereal business in 2023 was a pivotal move to unlock growth by focusing on the more dynamic snacking sector. However, the competitive landscape is dominated by formidable, scaled competitors like Mondelēz in sweet snacks and PepsiCo/Frito-Lay in savory snacks, who possess immense brand equity and unparalleled distribution networks.

The most significant event shaping Kellanova's future is its pending acquisition by Mars, Incorporated, for approximately $35.9 billion, expected to close in 2025. This transaction will create a colossal entity in the food industry, combining Mars' strength in confectionery (M&M's, Snickers) and emerging health snacks (Kind) with Kellanova's dominance in crackers, salty snacks, and frozen breakfast. The combined portfolio will present a nearly unmatchable breadth of offerings for various snacking occasions, creating significant cross-promotional opportunities and strengthening its negotiating power with retailers.

Key industry trends present both opportunities and threats. The persistent consumer shift towards health and wellness puts pressure on Kellanova's legacy portfolio of processed foods, demanding innovation in 'better-for-you' alternatives and ingredient transparency. Simultaneously, the rise of high-quality private label brands is a major threat, eroding market share through compelling value propositions. Kellanova's primary sustainable advantages—its powerful brand equity, global scale, and extensive distribution—provide a robust defense. The integration with Mars is set to amplify these strengths significantly. Strategic imperatives for the newly combined company will be to harmonize operations, aggressively innovate in health and wellness categories, defend against private label encroachment through brand marketing and strategic pricing, and leverage its powerful new portfolio to gain a greater share of the global snacking market.

Messaging

Message Architecture

Key Messages

- Message:

Mars, Incorporated to Aquire Kellanova

Prominence:Primary

Clarity Score:Low

Location:Top Banner (Above Header)

- Message:

Kellanova is a leading company in global snacking, international cereal and noodles, plant-based foods and North American frozen breakfast, with iconic, world-class brands.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Section

- Message:

Advancing sustainable and equitable access to food.

Prominence:Secondary

Clarity Score:High

Location:Homepage 'Creating Better Days' Section

- Message:

Brands you know and love

Prominence:Secondary

Clarity Score:High

Location:Homepage 'Our Food' Section

- Message:

Staying focused. Going further.

Prominence:Tertiary

Clarity Score:Low

Location:Homepage 'Our Vision' Section

The messaging hierarchy is critically flawed due to a confusing and factually questionable banner about a Mars acquisition at the very top of the page, which overshadows all subsequent messaging. Below this, the hierarchy correctly prioritizes defining the new corporate entity and its scale. However, the ESG message ('Creating Better Days') is presented with more vigor and a stronger CTA than the core business vision, potentially skewing the perceived priorities of the company for an investor audience.

Messaging is inconsistent. The primary definition of the company is clear and professional, but it's preceded by a confusing banner and followed by a mix of vague corporate speak ('Staying focused. Going further.') and overly casual greetings ('Hi, from Kellanova'). This inconsistency creates a disjointed narrative about the new company's identity and focus.

Brand Voice

Voice Attributes

- Attribute:

Corporate

Strength:Strong

Examples

Kellanova is a leading company in global snacking, international cereal and noodles, plant-based foods and North American frozen breakfast...

Advancing sustainable and equitable access to food.

- Attribute:

Approachable

Strength:Moderate

Examples

Hi, from Kellanova

Brands you know and love

- Attribute:

Aspirational / Vague

Strength:Moderate

Examples

Staying focused. Going further.

Start Dreaming

- Attribute:

Mission-Driven

Strength:Strong

Examples

Let’s Do This!

Creating Better Days

Tone Analysis

Informative and professional

Secondary Tones

- •

Purposeful

- •

Casually friendly

- •

Ambiguous

Tone Shifts

A jarring shift from the alarming/confusing acquisition banner to the casual 'Hi, from Kellanova' greeting.

A shift from the straightforward business description to the vague, aspirational language of the 'Vision' section.

Voice Consistency Rating

Poor

Consistency Issues

The voice oscillates between a formal, multi-billion dollar corporation and a casual, friendly startup.

The energetic, action-oriented voice of the ESG section ('Let’s Do This!') contrasts sharply with the passive and unclear voice of the corporate vision section ('Start Dreaming').

Value Proposition Assessment

Kellanova's implied value proposition is being a new, more agile, and growth-focused global snacking powerhouse, built upon a legacy of iconic brands and a strong commitment to corporate social responsibility.

Value Proposition Components

- Component:

Market Leadership in Snacking

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Portfolio of Iconic Brands

Clarity:Clear

Uniqueness:Unique

- Component:

Commitment to ESG ('Better Days Promise')

Clarity:Clear

Uniqueness:Common

- Component:

Future Growth & Innovation (Post-Spinoff)

Clarity:Unclear

Uniqueness:Common

The messaging fails to clearly differentiate Kellanova from other global snacking giants like Mondelez or PepsiCo. While leveraging its iconic brands is a strength, the forward-looking growth story—the primary rationale for the spin-off—is not articulated. The ESG focus, while strong, is a common theme among large CPG companies and does not serve as a primary differentiator for investors or top talent.

The current messaging positions Kellanova as a legacy company with a new name, heavily reliant on its past successes and brand portfolio. It does not effectively position the company as a dynamic, forward-looking innovator in the snacking category, which was the strategic intent of separating from the slower-growth cereal business.

Audience Messaging

Target Personas

- Persona:

Investors / Financial Analysts

Tailored Messages

Kellanova is a leading company in global snacking...

Staying focused. Going further.

Effectiveness:Ineffective

- Persona:

Potential Employees / Talent

Tailored Messages

- •

Our Vision

- •

Creating Better Days

- •

Let’s Do This!

Effectiveness:Somewhat Effective

- Persona:

Corporate Partners / Media

Tailored Messages

Hi, from Kellanova

Kellanova around the globe

Effectiveness:Somewhat Effective

Audience Pain Points Addressed

For ESG-conscious stakeholders: The need for corporations to have a clear sustainability and social equity strategy.

Audience Aspirations Addressed

For potential employees: The desire to work for a purpose-driven company that has a positive global impact.

Persuasion Elements

Emotional Appeals

- Appeal Type:

Appeal to Legacy & Nostalgia

Effectiveness:High

Examples

Brands you know and love

- Appeal Type:

Appeal to Purpose & Altruism

Effectiveness:Medium

Examples

Creating Better Days

Advancing sustainable and equitable access to food.

Social Proof Elements

{'proof_type': 'Brand Recognition (Implied)', 'impact': 'Strong'}

{'proof_type': 'Global Scale (Implied)', 'impact': 'Moderate'}

Trust Indicators

Leveraging the equity of well-known, trusted food brands.

Scarcity Urgency Tactics

No itemsCalls To Action

Primary Ctas

- Text:

Learn More

Location:Top Banner (Acquisition)

Clarity:Unclear

- Text:

Learn More

Location:Homepage Hero Section

Clarity:Clear

- Text:

Start Dreaming

Location:Homepage 'Our Vision' Section

Clarity:Unclear

- Text:

Let’s Do This!

Location:Homepage 'Creating Better Days' Section

Clarity:Somewhat Clear

- Text:

Browse Food

Location:Homepage 'Our Food' Section

Clarity:Clear

CTA effectiveness is low. The most prominent CTAs are either confusing ('Learn More' on the acquisition banner links to a competitor's site), ambiguous ('Start Dreaming'), or navigational ('Browse Food'). The most compelling CTA ('Let’s Do This!') is tied to the ESG initiative, not the core investment or corporate thesis, which misdirects audience motivation.

Messaging Gaps Analysis

Critical Gaps

- •

A clear, compelling investor proposition. The 'why invest in Kellanova now?' message is absent.

- •

Articulation of the growth strategy. The website explains what Kellanova is but not where it is going or how it will win.

- •

Leadership voice and vision. There is no clear message from the CEO or leadership team on the homepage to frame the new company's direction.

- •

Employee value proposition. Beyond the general ESG mission, there is no clear message on why top talent should join Kellanova specifically.

Contradiction Points

The most significant contradiction is the top banner stating Mars is acquiring Kellanova, which recent news indicates is a major corporate event, while the rest of the site introduces Kellanova as a new, independent entity. The banner's link to Mondelez's website further deepens the confusion and damages credibility instantly.

Underdeveloped Areas

The 'Our Vision' section is generic and lacks substance. 'Staying focused. Going further.' needs to be substantiated with strategic pillars or concrete goals.

The narrative connecting the spin-off to future value creation is completely missing.

Messaging Quality

Strengths

- •

Effectively leverages the immense brand equity of its product portfolio ('Brands you know and love').

- •

Clearly and prominently communicates its commitment to ESG, which is important for a key stakeholder segment.

- •

The core definition of the company's business areas is concise and easy to understand.

Weaknesses

- •

Catastrophic lack of clarity at the top of the page due to the erroneous/confusing acquisition banner.

- •

Inconsistent brand voice that undermines the establishment of a clear corporate identity.

- •

Absence of a sharp, differentiated value proposition for investors and potential top talent.

- •

Over-reliance on vague, uninspired corporate jargon ('Staying focused. Going further.').

Opportunities

- •

Develop a powerful narrative around the 'new beginning' post-spin-off, focusing on agility, innovation, and growth.

- •

Create tailored messaging tracks for key audiences (Investors, Talent, Partners) accessible from the homepage.

- •

Use the 'Our Food' section to tell stories of innovation within the brands, not just showcase the portfolio.

- •

Feature leadership messaging to instill confidence and provide a clear strategic vision.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Top Banner

Recommendation:Immediately remove the inaccurate and confusing banner regarding a Mars acquisition. This is a critical trust and credibility issue that must be resolved instantly.

Expected Impact:High

- Area:

Homepage Headline & Value Proposition

Recommendation:Replace 'Hi, from Kellanova' with a powerful, forward-looking headline that captures the core value proposition. Example: 'A New Era of Snacking: Legacy Brands, Future Growth.' Explicitly state the investor thesis.

Expected Impact:High

- Area:

Brand Voice

Recommendation:Unify the brand voice to be consistently professional, confident, and forward-looking. Eliminate overly casual or vague language. The voice should reflect a 100+ year-old company embarking on a new, dynamic chapter.

Expected Impact:Medium

- Area:

Vision Section

Recommendation:Substantially revise the 'Our Vision' section. Replace 'Staying focused. Going further.' with specific strategic pillars (e.g., 'Driving Growth Through Differentiated Innovation,' 'Expanding Our Global Reach,' 'Powering Our Future with Top Talent'). Change the CTA 'Start Dreaming' to something tangible like 'See Our Strategy'.

Expected Impact:Medium

Quick Wins

- •

Remove the 'Mars to Aquire' banner immediately.

- •

Change the 'Hi, from Kellanova' headline to something more substantial.

- •

Change the 'Start Dreaming' CTA to 'Learn About Our Vision'.

Long Term Recommendations

- •

Develop distinct messaging journeys for key audience personas (Investor, Talent, Media) with clear navigation from the homepage.

- •

Integrate proof points for growth and innovation throughout the site, such as case studies of recent product successes or market expansions.

- •

Build out a robust 'Leadership' section with executive bios and video messages that clearly articulate the company's strategic direction and vision for the future.

Kellanova's strategic messaging is in a state of critical identity crisis. As a new corporate entity spun off from a century-old company, its primary communication goal should be to establish a clear, confident, and forward-looking identity, particularly for the investor and financial communities that prompted its creation. However, the website's message is fundamentally undermined by a shocking lack of clarity at the highest level—an inexplicable top banner announcing an acquisition by Mars that immediately destroys credibility.

Beyond this critical flaw, the messaging fails to articulate a compelling reason for Kellanova's existence. It rests heavily on the legacy of its well-known brands and a robust but generic ESG platform ('Better Days Promise'). While these are valuable assets, they are historical and table-stakes, respectively. The core strategic narrative—how this new, snack-focused company will unlock growth and outperform competitors like Mondelez and PepsiCo—is entirely absent. The brand voice is schizophrenic, shifting between the gravitas of a global leader and the awkward informality of a startup, further confusing its identity.

Ultimately, the website successfully explains what Kellanova is—a portfolio of famous brands. It completely fails to communicate why Kellanova was created and why its key audiences should invest their capital, careers, or confidence in its future. The messaging supports brand awareness but does not drive the strategic business objectives of a newly independent, publicly-traded company aiming to prove its value in the market.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Inherited a portfolio of iconic, world-class brands with deep consumer familiarity and multi-generational loyalty, including Pringles, Cheez-It, Pop-Tarts, and Eggo.

- •

Net sales for 2024 were approximately $13 billion, indicating massive market acceptance and demand.

- •

Dominant retail placement and category leadership in key snacking segments like salty snacks and crackers.

- •

Following the split from Kellogg Company, Kellanova was strategically designed to be a growth-oriented entity focused on the high-performing snacking and emerging markets categories.

Improvement Areas

- •

Accelerate innovation in the 'better-for-you' sub-segment of existing brands to capture health-conscious consumers.

- •

Strengthen brand relevance with younger demographics (Gen Z, Gen Alpha) through targeted digital marketing and culturally resonant product innovations.

- •

Enhance the appeal and market penetration of smaller, high-potential brands like RXBAR and MorningStar Farms.

Market Dynamics

Global snack food market projected to grow at a CAGR of 5-6.4%. Plant-based food market growing at a CAGR of 12-25%. Frozen breakfast market growing at a CAGR of 6-8%.

Mature

Market Trends

- Trend:

Health and Wellness Focus

Business Impact:Increasing consumer demand for snacks that are low-sugar, high-protein, plant-based, and have clean labels. This necessitates reformulation of existing products and innovation of new, healthier lines.

- Trend:

Convenience and On-the-Go Consumption

Business Impact:Busy lifestyles are driving the 'snackification' of meals, creating demand for portable and single-serve packaging formats. This is a core strength for Kellanova's portfolio.

- Trend:

E-commerce and Direct-to-Consumer (DTC) Growth

Business Impact:The shift to online grocery shopping requires a strong digital shelf presence and sophisticated e-commerce logistics, a significant operational shift for traditional CPG companies.

- Trend:

Sustainability and Ethical Sourcing

Business Impact:Consumers are increasingly prioritizing brands with eco-friendly packaging and transparent, responsible sourcing of ingredients, impacting supply chain and brand reputation.

Excellent. Kellanova's strategic pivot to a snacks-led powerhouse aligns perfectly with sustained growth in the global snacking category and rising demand in emerging markets.

Business Model Scalability

High

High fixed costs associated with manufacturing plants, global supply chains, and brand marketing. Variable costs include raw materials and distribution. Model is built for massive scale.

High. Once fixed costs are covered, the marginal cost to produce and sell additional units is relatively low, leading to significant profit potential with increased volume.

Scalability Constraints

- •

Supply chain complexity and vulnerability to disruptions (geopolitical, climate-related).

- •

Volatility in raw material and commodity prices impacting cost of goods sold.

- •

Manufacturing capacity constraints for high-demand products, requiring significant capital investment for expansion.

Team Readiness

Experienced leadership team with a clear strategic vision for transforming Kellanova into a 'snacks-led powerhouse' post-spinoff.

Reorganized post-spinoff to be more agile and focused on growth drivers: snacks and emerging markets. However, large corporate structures can still face challenges with speed and agility compared to smaller disruptors.

Key Capability Gaps

- •

Deep expertise in data science and AI to optimize supply chains and personalize marketing.

- •

Agile product development and R&D talent focused on rapid innovation in health/wellness and plant-based foods.

- •

Direct-to-Consumer (DTC) e-commerce channel management and digital marketing specialists.

Growth Engine

Acquisition Channels

- Channel:

Retail Distribution (Grocery, Mass, Convenience)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Utilize advanced data analytics to optimize shelf placement, trade spend, and promotional strategies by retailer. Develop retailer-exclusive product variations to strengthen partnerships.

- Channel:

Brand Marketing (Digital, TV, Social)

Effectiveness:High

Optimization Potential:High

Recommendation:Shift a greater portion of marketing spend towards performance-based digital channels. Use AI and consumer data to deliver hyper-personalized marketing messages to specific consumer segments.

- Channel:

E-commerce (Amazon, Walmart.com, etc.)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Invest heavily in 'digital shelf' optimization, including content, imagery, and search rankings. Master platform-specific advertising to win keyword bids and drive impulse online purchases.

- Channel:

Food Service & Vending

Effectiveness:Medium

Optimization Potential:High

Recommendation:Expand presence in high-traffic locations like airports, universities, and corporate campuses with tailored product formats and vending solutions.

Customer Journey

Primarily an offline, impulse-driven journey: Awareness (Advertising) -> Consideration (In-store shelf) -> Purchase. The online journey is growing but is less mature.

Friction Points

- •

Out-of-stock situations on retail shelves leading to brand switching.

- •

Price sensitivity, especially in inflationary environments, where consumers may opt for private-label alternatives.

- •

Lack of product availability in high-growth online or international channels.

Journey Enhancement Priorities

{'area': 'Online Discovery', 'recommendation': "Invest in SEO and content marketing around snacking occasions (e.g., 'best snacks for movie night') to capture high-intent search traffic."}

{'area': 'Point of Sale (In-Store)', 'recommendation': 'Leverage data-driven planograms and secondary placements (e.g., end-caps) to increase visibility and drive impulse buys during key seasonal periods.'}

Retention Mechanisms

- Mechanism:

Brand Loyalty & Habit

Effectiveness:High

Improvement Opportunity:Reinforce emotional connection through brand storytelling and purpose-driven marketing (e.g., sustainability initiatives).

- Mechanism:

Product Innovation (New Flavors, Limited Editions)

Effectiveness:High

Improvement Opportunity:Use social listening and data analytics to more quickly identify flavor trends and launch targeted limited-time offers (LTOs) that create buzz and drive repeat purchases.

- Mechanism:

Consistent Quality and Taste

Effectiveness:High

Improvement Opportunity:Implement smart manufacturing and IoT sensors to ensure stringent quality control across the global supply chain, maintaining the taste consumers expect.

Revenue Economics

Strong. As a mature CPG, Kellanova operates on a model of high volume and established margins. Profitability is driven by manufacturing scale, supply chain efficiency, and premium brand pricing.

Not Applicable (This is a B2C CPG metric, not SaaS. The equivalent is Return on Ad Spend - ROAS, which is strong for established brands but varies by campaign).

High. The company demonstrates strong ability to convert its massive operational scale into revenue and profit, with 2024 organic net sales growing 5.6% and adjusted operating profit up 17.3%.

Optimization Recommendations

- •

Implement dynamic pricing strategies in e-commerce channels to optimize margins.

- •

Continue aggressive pursuit of productivity improvements and supply chain efficiencies to combat inflation.

- •

Shift portfolio mix towards higher-margin products and brands, such as premium snacks and differentiated plant-based offerings.

Scale Barriers

Technical Limitations

- Limitation:

Legacy Supply Chain Technology

Impact:Medium

Solution Approach:Invest in a unified, cloud-based supply chain platform with AI/ML capabilities for end-to-end visibility, demand forecasting, and inventory optimization.

Operational Bottlenecks

- Bottleneck:

Supply Chain Volatility

Growth Impact:Disruptions in raw material sourcing and logistics can lead to stock-outs, delaying revenue and damaging retailer relationships.

Resolution Strategy:Diversify supplier base geographically to reduce single-source dependency. Build a more agile and flexible supply chain that can adapt to market shifts.

- Bottleneck:

Manufacturing Agility

Growth Impact:Inability to quickly retool production lines for new products or packaging formats can slow down innovation and response to market trends.

Resolution Strategy:Invest in flexible manufacturing lines and smart factory technologies (IoT, digital twins) to accelerate new product introductions.

Market Penetration Challenges

- Challenge:

Intense Competition

Severity:Critical

Mitigation Strategy:Focus on differentiating through brand equity and rapid innovation. Aggressively defend shelf space and invest in marketing to maintain top-of-mind awareness. Key competitors include Mondelez, PepsiCo, and Nestlé.

- Challenge:

Shifting Consumer Preferences

Severity:Major

Mitigation Strategy:Establish a robust consumer insights engine leveraging AI and data analytics to anticipate trends in health, wellness, and sustainability, and proactively innovate the product portfolio.

- Challenge:

Rise of Private Label Brands

Severity:Major

Mitigation Strategy:Justify premium pricing through superior quality, innovation, and strong brand marketing. Introduce 'fighter brand' variants or pack sizes to compete at different price points.

Resource Limitations

Talent Gaps

- •

Data Scientists & AI/ML Engineers

- •

E-commerce & Digital Marketing Experts

- •

Food Scientists specializing in plant-based and 'clean-label' formulations

Significant and ongoing capital required for manufacturing capacity expansion (especially in emerging markets), supply chain modernization, and potential strategic acquisitions.

Infrastructure Needs

Upgraded digital infrastructure for data analytics and AI.

Expanded manufacturing and logistics facilities in key emerging markets like Mexico, India, and Brazil.

Growth Opportunities

Market Expansion

- Expansion Vector:

Geographic Expansion in Emerging Markets

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Prioritize markets with a growing middle class and increasing demand for convenience snacks (e.g., Southeast Asia, India, Brazil). Adapt flavors and marketing to local tastes while leveraging global brand power.

Product Opportunities

- Opportunity:

Premiumization of Core Brands

Market Demand Evidence:Consumers are willing to pay more for indulgent, high-quality, or gourmet versions of familiar snacks.

Strategic Fit:High. Leverages existing brand equity and manufacturing capabilities.

Development Recommendation:Launch 'Pringles Reserve' with gourmet flavors or 'Cheez-It Signature Collection' with artisanal cheeses. Test in select markets before global rollout.

- Opportunity:

Expansion of 'Better-for-You' and Plant-Based Lines

Market Demand Evidence:The plant-based market is forecasted for double-digit growth, and health-conscious snacking is a major trend.

Strategic Fit:High. Aligns with corporate mission and captures a rapidly growing consumer segment.

Development Recommendation:Invest in R&D to improve taste and texture of MorningStar Farms products. Launch baked, reduced-sodium, or protein-fortified versions of major snack brands like Pringles and Rice Krispies Treats.

Channel Diversification

- Channel:

Direct-to-Consumer (DTC) E-commerce

Fit Assessment:Medium. Challenging for low-price, high-volume goods but offers invaluable first-party data.

Implementation Strategy:Launch a DTC platform focused on exclusive product bundles, limited editions, and subscription boxes for super-fans. Use it as a data-gathering and brand-building tool rather than a primary sales channel.

- Channel:

Strategic Vending and Micro-Markets

Fit Assessment:High. Aligns perfectly with on-the-go consumption trends.

Implementation Strategy:Partner with major vending operators to secure placement in offices, hospitals, and transit hubs. Develop specific product SKUs optimized for vending machine formats.

Strategic Partnerships

- Partnership Type:

Ingredient & Food Tech Collaboration

Potential Partners

- •

AI-powered flavor development companies

- •

Sustainable packaging startups

- •

Leading plant-protein suppliers

Expected Benefits:Accelerate R&D for healthier and more sustainable products, reduce time-to-market for innovation, and gain access to cutting-edge technology.

- Partnership Type:

Entertainment & IP Licensing

Potential Partners

- •

Major film studios (Disney, Universal)

- •

Video game publishers (Nintendo, Epic Games)

- •

Streaming services (Netflix)

Expected Benefits:Drive sales and brand relevance through co-branded products and promotions tied to major cultural events, particularly targeting younger consumers.

Growth Strategy

North Star Metric

Global Snacking Occasions per Household

This metric shifts focus from simply selling units to becoming an integral part of consumers' daily lives. It measures both market penetration (households) and consumption frequency (occasions), directly reflecting brand habit and loyalty.

Increase by 5-7% annually by expanding into new consumption moments (e.g., morning snack, post-workout) and increasing purchase frequency.

Growth Model

Hybrid: Brand + Distribution + Innovation

Key Drivers

- •

Massive brand-building investment to maintain mental availability.

- •

Securing and optimizing physical and digital shelf space.

- •

A continuous pipeline of product innovations (flavors, formats, new lines) to drive excitement and incremental sales.

Continue to operate as a brand-led CPG but embed agile, data-driven 'growth pods' within brand teams to accelerate innovation and channel optimization.

Prioritized Initiatives

- Initiative:

Launch 'Cheez-It' in Key European Markets

Expected Impact:High

Implementation Effort:High

Timeframe:18-24 months

First Steps:Conduct deep market research on local cracker preferences and competitor landscape. Develop a market entry plan starting with the UK and Germany.

- Initiative:

Develop a 'Better-for-You' Platform Across Power Brands

Expected Impact:High

Implementation Effort:Medium

Timeframe:12 months

First Steps:Establish clear nutritional guardrails (e.g., sodium/sugar reduction targets). Launch pilot projects for 'Baked Pringles' and 'Rice Krispies Treats with Protein'.

- Initiative:

Implement an AI-Powered Demand Forecasting System

Expected Impact:Medium

Implementation Effort:High

Timeframe:24 months

First Steps:Partner with a leading AI/ML solutions provider. Integrate disparate data sources (sales, marketing, weather, economic indicators) to build a predictive model.

Experimentation Plan

High Leverage Tests

{'test': 'Digital marketing creative and messaging A/B testing for different consumer segments.', 'hypothesis': 'Personalized ads will yield a higher ROAS than generic brand advertising.'}

{'test': 'In-market pilot of a new sustainable packaging format for Pringles in a specific region.', 'hypothesis': 'Consumers will respond positively to eco-friendly packaging, leading to a measurable lift in sales and brand perception.'}

Utilize a combination of metrics including incremental sales lift, Return on Ad Spend (ROAS), brand sentiment analysis, and consumer purchase intent surveys.

Run digital marketing tests on a weekly/bi-weekly basis. Conduct in-market product/packaging tests on a quarterly basis.

Growth Team

A centralized 'Growth Center of Excellence' providing data analytics, e-commerce, and consumer insights expertise to de-centralized, brand-focused growth teams within each major business unit.

Key Roles

- •

Head of Growth Analytics & Insights

- •

Director of Global E-commerce

- •

Innovation Strategy Manager

Invest in continuous training for marketing and sales teams on data analysis, digital marketing tools, and agile methodologies. Actively recruit talent from tech and DTC industries.

Kellanova's strategic transformation into a snacks-led powerhouse is well-timed and built on an exceptionally strong foundation of iconic brands with deep market penetration. The company's product-market fit is undeniable, and its business model is designed for global scale. The primary growth vectors are clear: aggressive expansion in emerging markets, capturing the rapidly growing health and wellness segment, and innovating on core brands to maintain relevance and drive premiumization.

The most significant barriers to growth are external market pressures and internal operational complexity. Intense competition from agile global players like Mondelez and PepsiCo, coupled with shifting consumer tastes toward healthier options and private labels, creates a challenging landscape. Internally, the primary challenge lies in transforming a legacy CPG supply chain into a digitally-enabled, agile, and resilient operation capable of weathering global disruptions and responding quickly to market trends.

To accelerate growth, Kellanova must adopt a three-pronged strategy:

1. Innovate Aggressively: Double down on R&D for 'better-for-you' alternatives across all power brands and expand the plant-based portfolio. This is not just an opportunity but a defensive necessity against market trends.

2. Expand Intelligently: Prioritize geographic expansion for proven brands like 'Cheez-It' into untapped but receptive markets, adapting to local tastes while leveraging global brand power.

3. Digitize the Core: Make significant investments in technology, particularly AI and data analytics, to create a truly predictive and efficient supply chain and to deliver the personalized marketing required to win in an omnichannel world.

By successfully executing on these fronts, Kellanova can fully leverage its powerful brand portfolio to achieve its vision of becoming the world's best-performing snacks company, delivering consistent and sustainable long-term growth.

Legal Compliance

Kellanova provides a comprehensive and globally-aware 'Consumer Privacy Notice,' last updated in February 2025. The policy is easily accessible from the website footer. It clearly outlines the types of personal information collected, the purposes for its use (including marketing and site functionality), and data retention periods. Crucially, it specifies different data controllers based on user location (e.g., Kellogg Europe Trading Limited for the EEA), demonstrating a sophisticated understanding of jurisdictional requirements under GDPR. The policy details user rights such as access, portability, revision, and deletion, and provides multiple contact methods for exercising these rights, including a dedicated privacy portal, email, a toll-free number, and a physical mailing address. This layered approach is a best practice. The notice also specifically addresses residents of various US states with distinct privacy laws, indicating compliance with CCPA/CPRA and others.

The 'Terms of Use' are present and linked in the site footer. They are clearly written and explicitly state they are governed by U.S. law, with Kellanova's offices in the United States controlling the site. A key strength is the prominent notice at the top, which highlights the presence of an arbitration agreement, and waivers for jury trials and class actions. This strategically positions the company to manage legal disputes efficiently. The terms cover essential areas such as intellectual property rights, user conduct, and limitations of liability. They are robust and appear enforceable for their intended purpose as a corporate website's governing document.

Kellanova's website deploys a sophisticated cookie consent banner upon initial visit. This banner provides users with clear choices beyond a simple 'accept all' button. Users can click on 'Cookie Preferences' to access a detailed 'Privacy Preference Center.' This center allows for granular control, enabling users to opt-in or out of specific categories of cookies, such as 'Performance Cookies,' 'Functional Cookies,' and 'Targeting Cookies,' while correctly noting that 'Strictly Necessary Cookies' are always active. This granular consent mechanism is a strong indicator of compliance with GDPR and ePrivacy Directive standards, which require specific and informed consent before loading non-essential trackers. The clear link to the Privacy Notice within the cookie banner is also a positive feature.

Kellanova's overall data protection posture is mature and reflects the legal obligations of a multinational corporation. The combination of a detailed, jurisdiction-specific privacy notice, a granular cookie consent manager, and a dedicated privacy portal for data subject requests establishes a strong compliance framework. The privacy notice explicitly mentions processing data to prevent and investigate fraudulent or illegal activity and to comply with legal processes, which aligns data protection with broader business risk management. The separate 'Job Applicant Privacy Notice' further demonstrates a segmented and organized approach to handling different categories of personal data, which is a hallmark of a well-designed data governance program.

The website demonstrates a strong commitment to digital accessibility. An 'Accessibility' link is consistently present in the site footer. The site's code includes features like 'skip to main content' links, which are a fundamental requirement for users of screen readers. Furthermore, public statements and initiatives, such as the use of NaviLens technology on packaging, show a corporate-level commitment to accessibility that extends beyond the website. This holistic approach to accessibility serves as a significant brand differentiator and mitigates legal risk under laws like the Americans with Disabilities Act (ADA).

As a major food company, Kellanova's corporate site faces scrutiny over its marketing and corporate social responsibility (CSR) claims. The 'Creating Better Days' and 'Better Days Promise' sections make ambitious environmental and social commitments, such as advancing sustainable access to food for 4 billion people by 2030. These claims create a risk of 'greenwashing' if not properly substantiated. Kellanova mitigates this by publishing detailed policy documents and methodologies on its 'Better Days Promise' site, providing a degree of transparency. The most significant industry-specific factor is the pending acquisition by Mars, Inc. The website's announcement of this event is a forward-looking statement and carries significant legal weight under SEC regulations. The lack of an explicit 'Safe Harbor' disclaimer accompanying this announcement on the homepage is a notable gap in managing securities litigation risk.

Compliance Gaps

- •

No explicit 'Safe Harbor' disclaimer for forward-looking statements directly on the homepage or news release regarding the Mars acquisition.

- •

The 'Terms of Use' are explicitly designed for U.S. users, which could create ambiguity for international corporate stakeholders or investors accessing the site from other jurisdictions.

- •

While CSR claims are backed by some documentation, the high-level marketing language ('A day where our planet thrives') could still be targeted as vague or overly broad under FTC Green Guides scrutiny.

Compliance Strengths

- •

Excellent, granular cookie consent mechanism ('Privacy Preference Center') that aligns with GDPR best practices.

- •

Comprehensive, globally-aware Privacy Notice that addresses specific rights and data controllers for different jurisdictions (e.g., GDPR, CCPA/CPRA).

- •