eScore

key.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Key.com demonstrates a sophisticated digital presence, particularly excelling in local search intent with dedicated, optimized pages for its loan officers. However, its broader content authority is challenged by national competitors and fintechs who dominate informational, top-of-funnel search queries. While the site is well-structured, a clear strategy for voice search optimization is not apparent, and its multi-channel presence appears standard without standout innovation.

Excellent execution of a 'phygital' (physical + digital) strategy, using hyper-local landing pages to capture high-intent geographic search traffic within its core markets.

Develop a robust, top-of-funnel content strategy around the 'Financial Wellness' theme to build authority and capture a wider audience for non-product-related financial queries, improving organic traffic and brand visibility.

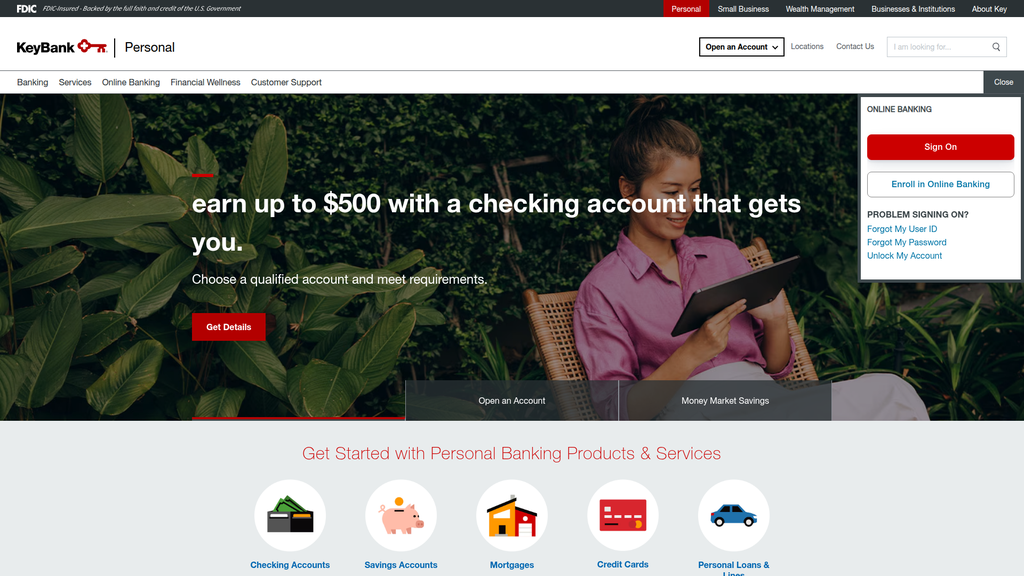

The website's messaging is clear and effective for specific audience segments, particularly those motivated by promotional offers. However, there is a significant disconnect between the brand's stated mission of 'financial wellness' and the homepage's heavy focus on transactional bonuses. This creates a conflicted brand narrative, weakening its unique positioning against competitors who use similar acquisition tactics.

Messaging for promotional offers is exceptionally clear and direct, effectively targeting and converting rate-sensitive customer personas with specific, high-value incentives.

Rebalance the homepage message hierarchy to lead with the aspirational 'financial wellness' brand promise, subordinating the transactional offers to support, rather than define, the primary value proposition.

The site employs a strong visual hierarchy and prominent, clear calls-to-action that guide users effectively toward conversion. However, the analysis identifies moderate cognitive load due to information density and friction points like lengthy application forms, which can hinder the completion of the user journey. While the cross-device experience is solid, enhancing secondary CTAs and streamlining forms would significantly boost conversion rates.

Primary calls-to-action are visually prominent, use clear, action-oriented language, and are logically placed at points of high user intent, creating an effective conversion funnel for motivated users.

Streamline the digital account opening process with a stated goal of 'under 5 minutes' by minimizing form fields, leveraging mobile-native features like ID scanning, and reducing overall cognitive load to decrease application abandonment.

As a major financial institution, KeyBank's website excels in demonstrating credibility and mitigating risk through meticulous legal and regulatory compliance. Trust signals such as FDIC membership, Equal Housing Lender logos, and clear privacy policies are prominently displayed and robust. The primary weakness is a lack of customer-centric social proof like testimonials or case studies, relying instead on institutional awards and credentials.

Meticulous and consistent use of required financial disclosures (e.g., TISA, TILA, NMLS) builds a powerful foundation of trust and significantly mitigates regulatory risk.

Incorporate customer testimonials and detailed case studies on the main product and service pages to complement institutional trust signals with relatable, peer-driven social proof.

KeyBank's competitive moat is built on the traditional banking strengths of brand trust, an integrated service model, and a physical branch network, which create high switching costs. However, these advantages are slowly eroding in the digital age, and the company is perceived as a slower innovator compared to fintech disruptors. Its most defensible advantage is its integrated capital markets division serving middle-market companies, a feature not easily replicated by regional peers.

The integrated Commercial and Investment Bank (KeyBanc Capital Markets) provides a unique, defensible advantage in serving middle-market clients that most regional competitors and fintechs cannot match.

Aggressively counter the perception of slow innovation by forming strategic partnerships with fintechs to rapidly integrate new technologies and enhance the digital user experience, turning a defensive position into a proactive one.

KeyBank demonstrates solid scalability through a strong deposit base and growing non-interest income streams. However, its growth potential is constrained by high fixed costs from its physical branch network and legacy technology systems. The acquisition and strategic pivot of Laurel Road into a national digital bank for healthcare professionals shows a clear and promising signal for market expansion beyond its traditional geographic footprint.

The strategic use of its Laurel Road brand as a national, digital-first bank targeting a specific high-value niche (healthcare professionals) provides a scalable and defensible vector for geographic and demographic expansion.

Accelerate the modernization of the core banking platform and invest in a centralized customer data platform to break down internal data silos, which is critical for enabling hyper-personalization and improving operational leverage for future growth.

KeyBank's business model is highly coherent and resilient, effectively balancing traditional net interest income with a diverse and growing portfolio of fee-based revenue from wealth management and capital markets. The company shows strong strategic focus on its target segments, particularly middle-market commercial clients where it has a distinct advantage. This diversified model is well-aligned with its value proposition of being a full-service, relationship-based financial partner.

The diversified revenue model, combining stable net interest income with high-margin, non-interest income from its capital markets and wealth management divisions, provides significant resilience against interest rate volatility.

Systematically develop and implement a data-driven program to deepen wallet share by more effectively cross-selling wealth management and other fee-based services into the existing mass-affluent retail customer base.

Within its 15-state footprint, KeyBank is a major player with significant market power and brand recognition. However, on a national scale, its influence is limited, and it faces intense pricing pressure from larger banks and nimble fintechs, reducing its overall pricing power. The company's strategy of focusing on specific client segments and leveraging fintech partnerships is a smart defensive move to maintain its position in a hyper-competitive market.

Holds a dominant or significant market share in its core regional markets, providing a stable foundation of client relationships and a strong deposit base.

Shift from competing on price (promotional bonuses) to competing on value by productizing its 'financial wellness' expertise into a tangible digital platform, thereby creating pricing power based on unique value rather than commoditized offers.

Business Overview

Business Classification

Diversified Financial Services

Bank Holding Company

Financial Services

Sub Verticals

- •

Retail Banking

- •

Commercial Banking

- •

Wealth Management

- •

Investment Banking & Capital Markets

Mature

Maturity Indicators

- •

Publicly traded (NYSE: KEY) with a history tracing back to 1825.

- •

Operates over 1,000 branches across 15 states.

- •

Manages a large, diversified asset base (approx. $187 billion as of June 2024).

- •

Offers a comprehensive suite of financial products for consumer, SMB, and corporate clients.

- •

Maintains a consistent dividend payment history.

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Net Interest Income

Description:The primary driver of revenue, representing the spread between interest earned on loans (mortgages, commercial loans, etc.) and interest paid on customer deposits and other borrowings.

Estimated Importance:Primary

Customer Segment:All Segments

Estimated Margin:Medium

- Stream Name:

Non-interest Income (Fee-based)

Description:A diverse and growing set of revenues including investment banking fees, wealth management fees, service charges on deposit accounts, card income, and commercial payment services. This stream is critical for mitigating interest rate volatility.

Estimated Importance:Secondary

Customer Segment:All Segments (especially Commercial and Wealth Management)

Estimated Margin:High

Recurring Revenue Components

- •

Interest income from loan portfolios

- •

Account maintenance and service fees

- •

Wealth management and asset management fees

- •

Trust services fees

Pricing Strategy

Interest Rate Spread & Fee-for-Service

Mid-range

Semi-transparent

Pricing Psychology

- •

Promotional Offers (e.g., '$300 Welcome Bonus', introductory 0% APR on credit cards)

- •

Tiered Pricing (e.g., higher savings rates for larger balances)

- •

Bundling (e.g., 'Relationship Benefits' offering discounts for multiple products)

Monetization Assessment

Strengths

- •

Diversified model with both net interest income and significant non-interest income streams.

- •

Strong deposit base provides a stable, low-cost source of funding.

- •

Growing fee-based businesses, particularly in investment banking and wealth management, offer higher margins and less interest-rate sensitivity.

Weaknesses

- •

Profitability is highly sensitive to macroeconomic conditions, especially interest rate fluctuations.

- •

Competition from larger national banks and agile FinTechs can compress margins on core products.

- •

Reliance on promotional offers to attract new customers can be costly and may not build long-term loyalty.

Opportunities

- •

Strategically grow high-fee businesses like wealth management and capital markets to further diversify revenue.

- •

Leverage digital platforms to cross-sell additional products to the existing 2 million+ retail customer base.

- •

Optimize the balance sheet to improve net interest margin (NIM), as indicated by recent strategic actions.

Threats

- •

A prolonged low-interest-rate environment would compress net interest margins.

- •

Increased competition from digital-only neobanks with lower cost structures.

- •

Heightened regulatory scrutiny and capital requirements for regional banks.

Market Positioning

Relationship-based super-regional bank focused on targeted client segments in specific industries and geographies, combining a physical branch network with advancing digital capabilities.

Major Super-Regional Bank. One of the largest bank-based financial services companies in the U.S., but a smaller player compared to bulge-bracket national banks like JPMorgan Chase or Bank of America.

Target Segments

- Segment Name:

Mass Market & Mass Affluent Consumers

Description:Individuals and households requiring a full range of personal banking services, from basic checking and savings to mortgages, credit cards, and personal loans.

Demographic Factors

Located within Key's 15-state footprint

All age ranges, with a focus on digitally-savvy younger customers and established older customers

Psychographic Factors

- •

Value convenience (digital + physical access)

- •

Seek a trusted, long-term financial partner

- •

Motivated by financial incentives and rewards (cash back, bonus interest)

Behavioral Factors

- •

Use online and mobile banking for daily transactions

- •

Visit branches for complex needs or problem resolution

- •

Likely to hold multiple products with one institution

Pain Points

- •

Feeling like just a number at larger national banks

- •

Difficulty getting personalized financial advice

- •

Navigating complex financial decisions like home buying

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

High-Net-Worth Individuals (Key Private Client)

Description:Wealthy individuals and families requiring sophisticated wealth management, investment advisory, trust, and private banking services.

Demographic Factors

High income and significant investable assets

Psychographic Factors

- •

Value personalized service and a dedicated advisory team

- •

Concerned with wealth preservation, growth, and legacy planning

- •

Seek exclusivity and specialized expertise

Behavioral Factors

High-touch relationship with a dedicated advisor

Utilize a complex array of investment and credit products

Pain Points

- •

Coordinating multiple financial professionals (accountants, lawyers, bankers)

- •

Finding unbiased, expert financial guidance

- •

Managing complex assets and estate planning

Fit Assessment:Good

Segment Potential:High

- Segment Name:

Middle Market Commercial Clients

Description:Mid-sized businesses in targeted industries (e.g., consumer, energy, healthcare, technology) needing commercial lending, treasury management, and capital markets access.

Demographic Factors

Businesses with significant annual revenue, typically within Key's geographic footprint or specific industry verticals

Psychographic Factors

Value industry-specific expertise from their banking partner

Seek a strategic advisor, not just a lender

Behavioral Factors

Require sophisticated cash management and payment processing solutions

Access capital markets for growth and acquisitions

Pain Points

- •

Securing growth capital

- •

Managing complex cash flow and payment systems

- •

Lacking access to sophisticated investment banking services typically reserved for large corporations

Fit Assessment:Excellent

Segment Potential:High

Market Differentiation

- Factor:

Integrated Commercial and Investment Bank (KeyBanc Capital Markets)

Strength:Strong

Sustainability:Sustainable

- Factor:

Targeted industry expertise in middle-market commercial banking.

Strength:Strong

Sustainability:Sustainable

- Factor:

Dense physical branch and ATM network in core markets.

Strength:Moderate

Sustainability:Temporary

- Factor:

Commitment to community investment and 'Outstanding' CRA rating.

Strength:Moderate

Sustainability:Sustainable

Value Proposition

To empower clients, colleagues, and communities to thrive by providing a comprehensive suite of relationship-based financial services, combining the reach and capabilities of a large bank with a commitment to personalized guidance and community focus.

Good

Key Benefits

- Benefit:

Full-Service Financial Partner

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

Wide range of products shown on website: Checking, Savings, Mortgages, Credit Cards, Investments, Private Client services.

- Benefit:

Digital Convenience & Accessibility

Importance:Critical

Differentiation:Common

Proof Elements

Online banking, mobile app with check deposit, Zelle for P2P payments.

- Benefit:

Relationship-Based Rewards

Importance:Important

Differentiation:Somewhat unique

Proof Elements

Mention of 'Relationship Rates and Benefits' and interest rate discounts on mortgages for clients.

- Benefit:

Personalized Guidance

Importance:Important

Differentiation:Somewhat unique

Proof Elements

Profiles of specific Mortgage Loan Officers, 'Key Private Client' services promising a dedicated team.

Unique Selling Points

- Usp:

Integrated Capital Markets capabilities for middle-market companies, a service not all regional banks offer at this scale.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A long-standing history (nearly 200 years) and deep community ties, supported by a 10-time 'Outstanding' CRA rating.

Sustainability:Long-term

Defensibility:Strong

- Usp:

Specific product offers like the 'unlimited 2% cashback' Key Cashback® credit card.

Sustainability:Medium-term

Defensibility:Moderate

Customer Problems Solved

- Problem:

Managing daily finances and payments efficiently.

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Securing financing for major life purchases (e.g., home).

Severity:Critical

Solution Effectiveness:Complete

- Problem:

Growing and managing personal wealth for the long term.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Accessing capital and sophisticated treasury services for business growth.

Severity:Critical

Solution Effectiveness:Complete

Value Alignment Assessment

High

KeyCorp's offerings align well with the core needs of the US banking market, providing essential deposit, credit, and investment services. Its dual focus on consumer and commercial banking allows it to capture a broad swath of the market.

High

The value proposition strongly aligns with its target segments. The emphasis on relationship banking and a full suite of services resonates with consumers and businesses seeking a primary financial partner, while the specialized Key Private Client and KeyBanc Capital Markets divisions cater directly to the distinct needs of high-net-worth and middle-market clients.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Payment Networks (Visa, Mastercard)

- •

FinTech Providers (e.g., Zelle)

- •

Credit Bureaus (Experian, Equifax, TransUnion)

- •

Scotiabank (Strategic Investor).

- •

Insurance Companies

Key Activities

- •

Deposit Taking & Lending

- •

Risk Management & Underwriting

- •

Payment Processing

- •

Investment & Wealth Management

- •

Regulatory Compliance

- •

Technology Development & Maintenance

Key Resources

- •

Banking License & Regulatory Charters

- •

Capital Base (CET1 Ratio).

- •

Physical Branch Network & Real Estate Assets

- •

Digital Banking Platform & IT Infrastructure

- •

Brand Reputation & Customer Relationships

- •

Employee Expertise (Bankers, Advisors, Analysts)

Cost Structure

- •

Interest Expense (paid on deposits)

- •

Employee Compensation & Benefits

- •

Technology & Infrastructure Costs

- •

Provision for Credit Losses

- •

Marketing & Customer Acquisition Costs

- •

Physical Branch Occupancy & Operational Costs

Swot Analysis

Strengths

- •

Diversified business model reduces reliance on any single revenue stream.

- •

Strong capital position provides strategic flexibility and resilience.

- •

Established brand and deep-rooted client relationships in core markets.

- •

Significant fee-generating capabilities from investment banking and wealth management.

Weaknesses

- •

Large physical branch network entails high fixed operational costs.

- •

Earnings are sensitive to interest rate cycles and macroeconomic trends.

- •

Pace of digital innovation may lag smaller, more agile FinTech competitors.

- •

Recent profitability metrics have been challenging, indicating potential operational inefficiencies.

Opportunities

- •

Leverage recent strategic investment from Scotiabank to accelerate growth and balance sheet repositioning.

- •

Deepen wallet share by cross-selling wealth management and capital markets services to existing commercial and retail clients.

- •

Invest in data analytics and AI to deliver hyper-personalized customer experiences and improve underwriting.

- •

Continued growth in fee-based income as a percentage of total revenue.

Threats

- •

Intensifying competition from larger national banks, non-bank lenders, and FinTechs.

- •

Cybersecurity threats and data privacy risks.

- •

Potential for increased regulatory capital requirements (e.g., Basel III endgame).

- •

An economic downturn leading to increased credit losses.

Recommendations

Priority Improvements

- Area:

Digital Customer Experience

Recommendation:Accelerate investment in the digital platform to create a more seamless, personalized, and proactive customer journey, integrating banking, lending, and investment views to compete with FinTech user experiences.

Expected Impact:High

- Area:

Operational Efficiency

Recommendation:Conduct a strategic review of the physical branch network to optimize footprint, potentially consolidating underperforming locations while investing in technology and advisory services in high-growth areas to reduce fixed costs.

Expected Impact:Medium

- Area:

Client Deepening

Recommendation:Develop and implement data-driven marketing and sales programs to systematically identify and pursue cross-sell opportunities, particularly converting mass affluent retail customers into wealth management clients.

Expected Impact:High

Business Model Innovation

- •

Explore 'Banking as a Service' (BaaS) partnerships with non-financial companies to embed Key's financial products into third-party ecosystems, creating new revenue channels.

- •

Develop digital-first, niche product offerings for underserved segments, such as freelancers or small e-commerce businesses, that are not well-served by traditional banking products.

- •

Integrate AI-powered financial wellness tools and advice into the retail banking platform to add value beyond basic transactions and increase customer stickiness.

Revenue Diversification

- •

Continue to aggressively expand the wealth and asset management business, as fee-based income is more stable and less capital-intensive than lending.

- •

Grow specialized commercial payment and treasury management solutions, which generate recurring fee revenue and create sticky client relationships.

- •

Investigate opportunities in adjacent financial services, such as insurance brokerage, either through acquisition or partnership, to offer a more holistic financial solution to clients.

KeyCorp (key.com) represents a mature, diversified super-regional bank with a robust and well-established business model. Its core strength lies in its diversified revenue streams, balancing traditional net interest income from a strong deposit and loan base with a growing and crucial non-interest income portfolio driven by its sophisticated KeyBanc Capital Markets and wealth management divisions. This structure provides resilience against the cyclical nature of interest rates. The company is well-positioned with its primary target segments—mass market consumers, high-net-worth individuals, and particularly middle-market commercial clients, where its industry-specific expertise and integrated investment banking capabilities serve as a significant differentiator.

The primary strategic challenge facing KeyCorp is navigating the digital transformation of the financial services industry. While possessing a valuable physical footprint and long-standing client relationships, it faces intense pressure from more agile, digitally-native FinTechs and larger national banks with massive technology budgets. The high fixed costs associated with its branch network pose a potential drag on efficiency. The business model's evolution must prioritize creating a seamless 'phygital' (physical + digital) experience that leverages its human, relationship-based advantage while delivering the digital convenience customers now expect.

Opportunities for strategic evolution are significant. The recent capital injection from Scotiabank provides the flexibility to reposition the balance sheet for improved profitability and to 'lean into' high-growth, fee-generating businesses. The path forward requires a dual focus: optimizing the traditional banking model for efficiency (e.g., branch network rationalization) and aggressively investing in digital capabilities, data analytics, and high-margin fee businesses. By deepening relationships with its existing client base and leveraging its unique middle-market capabilities, KeyCorp can build a sustainable competitive advantage and drive future growth.

Competitors

Competitive Landscape

Mature

Moderately Concentrated

Barriers To Entry

- Barrier:

Regulatory Compliance and Licensing

Impact:High

- Barrier:

High Capital Requirements

Impact:High

- Barrier:

Brand Trust and Customer Inertia

Impact:High

- Barrier:

Technology Infrastructure Investment

Impact:Medium

- Barrier:

Establishing a Physical Branch Network

Impact:Medium

Industry Trends

- Trend:

Digital Transformation and AI Integration

Impact On Business:Requires significant investment in mobile/online banking platforms, AI-driven personalization, and digital customer service to remain competitive.

Timeline:Immediate

- Trend:

Competition from Fintech and Neobanks

Impact On Business:Increased pressure on fees, deposit rates, and user experience. Creates opportunities for partnership but also threatens traditional revenue streams.

Timeline:Immediate

- Trend:

Focus on Customer Experience and Personalization

Impact On Business:Shifts focus from product-centric to customer-centric models. Success depends on leveraging data to offer tailored advice and financial wellness tools.

Timeline:Immediate

- Trend:

Cybersecurity and Data Privacy

Impact On Business:Growing threat landscape necessitates continuous investment in security infrastructure to maintain customer trust and comply with regulations.

Timeline:Immediate

- Trend:

Open Banking and API Integration

Impact On Business:Potential to create new revenue streams and integrated customer experiences through partnerships, but also introduces new competitive threats and data security challenges.

Timeline:Near-term

Direct Competitors

- →

PNC Financial Services Group

Market Share Estimate:Top 10 US Bank by assets.

Target Audience Overlap:High

Competitive Positioning:Positions itself as a mainstream bank with a strong regional presence and innovative digital tools like the Virtual Wallet.

Strengths

- •

Strong brand recognition and dense branch network in core markets.

- •

Diversified revenue streams across retail, corporate, and asset management.

- •

Robust digital platform with a focus on financial wellness tools.

- •

Consistently strong financial performance.

Weaknesses

- •

Less national brand recognition compared to the 'Big Four'.

- •

Efficiency ratio has historically been higher than some peers, indicating potential for cost control issues.

- •

Vulnerable to economic downturns due to significant loan portfolio.

Differentiators

Virtual Wallet® product suite for integrated checking, savings, and financial management.

Strong focus and market share in the Mid-Atlantic and Midwest regions.

- →

Huntington Bancshares

Market Share Estimate:Top 25 US Bank by assets.

Target Audience Overlap:High

Competitive Positioning:A super-regional bank focused on community engagement, customer-centricity, and a 'Welcome' philosophy.

Strengths

- •

Strong market position in the Midwest.

- •

Recognized leader in SBA 7(a) lending, indicating strong small business relationships.

- •

High customer satisfaction and multiple 'Best Bank' awards.

- •

Effective at growing revenue and net interest income.

Weaknesses

- •

Geographically concentrated in the Midwest, making it susceptible to regional economic performance.

- •

Smaller scale and marketing budget compared to national competitors.

- •

Brand recognition is low outside of its core operating states.

Differentiators

"Fair Play Banking" philosophy (e.g., 24-Hour Grace® for overdrafts).

Deep specialization and market leadership in small business banking.

- →

M&T Bank

Market Share Estimate:Top 25 US Bank by assets.

Target Audience Overlap:High

Competitive Positioning:A community-focused regional bank with a strong presence in the Eastern US, known for its conservative management and consistent profitability.

Strengths

- •

Strong and dense branch network in the Northeast and Mid-Atlantic.

- •

Conservative credit culture leading to stable performance through economic cycles.

- •

Diverse offerings across retail, commercial, and wealth management.

- •

Successful history of strategic acquisitions.

Weaknesses

- •

Digital offerings and user experience may lag behind more tech-focused competitors.

- •

Higher exposure to commercial real estate loans compared to some peers, posing a potential risk.

- •

Brand is not well-known nationally.

Differentiators

Deep community banking model with localized decision-making.

Strong focus on building long-term relationships, particularly with commercial clients.

Indirect Competitors

- →

Chime

Description:A leading US neobank offering fee-free mobile banking services, including checking and savings accounts, through a partner bank.

Threat Level:High

Potential For Direct Competition:Increasing, as it expands its product suite to rival traditional checking and savings offerings, primarily targeting younger and lower-income demographics.

- →

SoFi

Description:A digital personal finance company offering a suite of financial products including student loan refinancing, mortgages, personal loans, credit cards, investing, and banking via a national bank charter.

Threat Level:High

Potential For Direct Competition:Already a direct competitor in many product areas. Its all-in-one digital platform strategy directly challenges the traditional bank's relationship model.

- →

Rocket Mortgage

Description:The largest mortgage lender in the US, offering a streamlined, digital-first mortgage application and approval process.

Threat Level:Medium

Potential For Direct Competition:Low for full-service banking, but its dominance in the mortgage space directly threatens a key product line for KeyBank, eroding customer relationships at a critical life stage.

- →

PayPal / Venmo

Description:Digital payment platforms that facilitate peer-to-peer money transfers and online payments. Both have expanded to offer business services, credit/debit cards, and crypto trading.

Threat Level:Medium

Potential For Direct Competition:Increasing. By handling daily transactions and payments, they disintermediate banks from core customer interactions and are slowly adding more banking-like features.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Established Brand and Trust

Sustainability Assessment:The 'two centuries of service' heritage provides a foundation of trust that is difficult for new entrants to build. This is a durable advantage in an industry where security is paramount.

Competitor Replication Difficulty:Hard

- Advantage:

Integrated Financial Services Model

Sustainability Assessment:Offering a full suite of banking, lending, and wealth management services creates high customer switching costs and enables deeper client relationships.

Competitor Replication Difficulty:Medium

- Advantage:

Physical Branch Network

Sustainability Assessment:While less critical than before, branches still serve as a key channel for complex transactions, advisory services, and local brand presence, which digital-only competitors lack.

Competitor Replication Difficulty:Hard

Temporary Advantages

{'advantage': 'Promotional Interest Rates and Bonuses', 'estimated_duration': "3-6 months. These offers, like the '$300 Welcome Bonus' and high-yield savings rates, are effective for short-term customer acquisition but are easily matched or surpassed by competitors."}

Disadvantages

- Disadvantage:

Perception of Slower Innovation

Impact:Major

Addressability:Moderately

- Disadvantage:

Geographic Concentration

Impact:Minor

Addressability:Difficult

- Disadvantage:

Complex Fee Structures

Impact:Major

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Simplify and Prominently Display Digital Value Propositions on the Homepage

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Launch Targeted Digital Campaigns Highlighting Relationship-Based Rate Discounts

Expected Impact:Medium

Implementation Difficulty:Moderate

Medium Term Strategies

- Recommendation:

Invest in a Hyper-Personalized Financial Wellness Platform

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Develop Niche Lending Products for Underserved Segments

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Embrace Strategic Fintech Partnerships to Enhance Digital Offerings

Expected Impact:High

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Modernize Core Banking Infrastructure

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Geographic Expansion Through Digital-First Model

Expected Impact:High

Implementation Difficulty:Difficult

Reposition KeyBank as 'The Relationship Bank for a Digital Age.' This leverages the core strength of trust and full-service offerings while aggressively communicating a commitment to digital convenience and innovation. The message should be: get the best of both worlds—the security of an established institution and the seamless experience of a fintech.

Differentiate through 'Pragmatic Innovation and Financial Wellness.' Instead of competing on every feature with fintechs, focus on curating and integrating best-in-class digital tools that solve real financial problems for target client segments. Combine human-led advice (in-branch or remote) with powerful digital wellness tools to create a hybrid service model that neobanks cannot replicate.

Whitespace Opportunities

- Opportunity:

Holistic Financial Planning for the 'Mass Affluent' Segment

Competitive Gap:Large banks often reserve dedicated financial advisors for high-net-worth 'Private Client' tiers, while fintech robo-advisors lack a human touch. There is a large segment of customers who need more than an app but don't meet the threshold for private banking.

Feasibility:High

Potential Impact:High

- Opportunity:

Integrated Banking and Lending for Small-to-Medium Sized Businesses (SMBs)

Competitive Gap:SMBs are often forced to patch together solutions from different providers (e.g., a bank for checking, a fintech like Square for payments, another for loans). A seamless, integrated digital platform for SMBs that combines banking, payments, payroll, and lending is a significant opportunity.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Financial Products for the Gig Economy/Freelancers

Competitive Gap:Traditional banks struggle with products tailored to individuals with fluctuating incomes. This includes tools for automated tax savings, simplified expense tracking integrated with a business checking account, and more flexible credit underwriting.

Feasibility:Medium

Potential Impact:Medium

KeyBank operates as a significant super-regional bank within the mature and moderately concentrated US financial services industry. Its primary competitive set includes other large regional banks like PNC, Huntington, and M&T Bank, all of whom vie for market share through a combination of physical presence, product breadth, and increasingly, digital capabilities. The main competitive pressures, however, are bifurcated. From above, national giants like JPMorgan Chase and Bank of America apply pressure with massive marketing budgets and advanced, scaled technology platforms. From below, a growing cohort of agile neobanks and specialized fintech firms are unbundling the traditional banking relationship, acquiring customers with superior user experiences, low fees, and niche product offerings.

KeyBank's core sustainable advantage lies in its established brand trust, built over two centuries, and its integrated service model that fosters sticky, multi-product customer relationships. Its physical branch network remains a differentiator for certain demographics and complex service needs, something pure-play digital competitors cannot offer. However, the bank faces the critical challenge of being perceived as less innovative than both its larger and smaller competitors. While its website highlights modern features like Zelle and mobile deposits, its primary value propositions still lead with promotional rates and traditional product silos (Checking, Savings, Mortgages), rather than a holistic, customer-centric digital experience.

The most significant threat is disintermediation. Indirect competitors like Rocket Mortgage can capture a crucial product relationship (mortgage), while neobanks like Chime and payment apps like Venmo can take over the high-frequency daily banking relationship. This leaves KeyBank at risk of being a commoditized back-end utility holding deposits, rather than the primary financial partner for its clients.

The strategic imperative is to bridge the gap between its traditional strengths and the demands of the modern digital consumer. The whitespace opportunities lie not in trying to out-feature every fintech, but in leveraging its trusted advisor status. By creating a superior hybrid model that combines accessible human advice with a seamless, personalized digital wellness platform, KeyBank can occupy a valuable market position that is difficult for both mega-banks (often too impersonal) and neobanks (lacking holistic advisory services) to effectively challenge. This involves a strategic shift from product-led marketing to a solutions-oriented approach that addresses the financial journeys of specific customer segments, such as the mass affluent and small businesses.

Messaging

Message Architecture

Key Messages

- Message:

Earn up to $500 with a checking account that gets you.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Banner

- Message:

For every financial need, we'll meet you in the moment.

Prominence:Primary

Clarity Score:Medium

Location:Homepage Hero Banner

- Message:

The path to financial wellness starts here.

Prominence:Secondary

Clarity Score:High

Location:Homepage Footer / Brand Mission

- Message:

Put your life goals in motion. Let’s build your future together.

Prominence:Secondary

Clarity Score:Medium

Location:Homepage Body

- Message:

Expert guidance every step of the way.

Prominence:Tertiary

Clarity Score:High

Location:Mortgage Loan Officer Page

The message hierarchy is heavily skewed towards tactical, promotional offers (cash bonuses, high interest rates) in the most prominent, above-the-fold positions. The broader brand message about 'financial wellness' and 'meeting you in the moment' is present but secondary, creating a potential disconnect between the brand promise and the initial user experience, which is highly transactional.

Messaging is generally consistent in its focus on products and solutions across different pages. The personal homepage emphasizes acquiring new accounts with bonuses, while the mortgage officer page focuses on guidance and tools for a specific product. The underlying theme of providing financial tools for customer needs is consistent, though the tone can shift from promotional to advisory.

Brand Voice

Voice Attributes

- Attribute:

Promotional

Strength:Strong

Examples

- •

earn up to $500 with a checking account

- •

$300 Welcome Bonus

- •

unlimited 2% cashback. no expirations.

- Attribute:

Aspirational

Strength:Moderate

Examples

- •

put your life goals in motion.

- •

Let’s build your future together.

- •

your dream home just got more affordable.

- Attribute:

Helpful / Guiding

Strength:Moderate

Examples

- •

we'll meet you in the moment.

- •

we’ll help you navigate the road ahead.

- •

Expert guidance every step of the way.

- Attribute:

Conventional

Strength:Strong

Examples

- •

Get Started with Personal Banking Products & Services

- •

Open an Account

- •

Tips and How-To's

Tone Analysis

Transactional

Secondary Tones

Encouraging

Reassuring

Tone Shifts

Shifts from highly promotional ('$500 Bonus!') in the hero section to more aspirational ('put your life goals in motion') in the body.

The Mortgage Loan Officer page adopts a more personal and advisory tone ('I will work closely with you') compared to the main homepage.

Voice Consistency Rating

Good

Consistency Issues

The heavy emphasis on transactional offers on the homepage can overshadow the more relationship-focused 'financial wellness' voice mentioned in the brand mission.

Value Proposition Assessment

KeyBank offers a comprehensive suite of accessible banking products with competitive financial incentives, supported by digital convenience and the promise of guidance towards financial well-being.

Value Proposition Components

- Component:

Financial Incentives (Bonuses, High Rates)

Clarity:Clear

Uniqueness:Common

- Component:

Digital Convenience (Mobile/Online Banking)

Clarity:Clear

Uniqueness:Common

- Component:

Personalized Guidance & Financial Wellness

Clarity:Somewhat Clear

Uniqueness:Somewhat Unique

- Component:

Broad Product Portfolio

Clarity:Clear

Uniqueness:Common

KeyBank's primary differentiators in its messaging are the explicit focus on 'financial wellness' and the combination of a broad product suite with relationship benefits. However, the website's execution leads with common industry tactics like cash bonuses, which are not unique. Competitors like PNC and U.S. Bank also offer a wide range of products and digital tools. The 'financial wellness' angle is the most unique element but is not the most prominent message, reducing its differentiating power.

The messaging positions KeyBank as a direct competitor to other large national and regional banks like PNC, U.S. Bank, and Chase. The emphasis on welcome bonuses and competitive rates for specific products is a direct attempt to win customers in a crowded, mature market. The positioning is that of a large, stable, full-service bank that offers both modern digital tools and the benefits of a long-standing institution, but it struggles to carve out a uniquely compelling narrative from the homepage messaging alone.

Audience Messaging

Target Personas

- Persona:

Rate/Offer Shoppers

Tailored Messages

- •

earn up to $500 with a checking account

- •

earn 3.50% interest rate

- •

unlimited 2% cashback. no expirations.

Effectiveness:Effective

- Persona:

First-time Homebuyers / Refinancers

Tailored Messages

- •

your dream home just got more affordable.

- •

Get a 0.25% interest rate discount on mortgages.

- •

Expert guidance every step of the way.

Effectiveness:Effective

- Persona:

Digitally-savvy Consumers

Tailored Messages

- •

say hello to convenience.

- •

deposit checks wherever, whenever.

- •

send money in a snap.

Effectiveness:Effective

- Persona:

High-Net-Worth Individuals

Tailored Messages

- •

KEY PRIVATE CLIENT

- •

we’ll help you navigate the road ahead.

- •

Get personalized insights from a dedicated team.

Effectiveness:Somewhat

Audience Pain Points Addressed

- •

Feeling that banking is inconvenient

- •

Worrying about getting the best rate or offer

- •

Needing guidance for major financial decisions like buying a home

- •

Desire for secure and easy ways to manage money daily

Audience Aspirations Addressed

- •

Achieving life goals (e.g., homeownership)

- •

Building a secure financial future

- •

Making finances simpler and less stressful

- •

Maximizing returns on savings and spending (cashback, interest)

Persuasion Elements

Emotional Appeals

- Appeal Type:

Aspiration / Achievement

Effectiveness:Medium

Examples

put your life goals in motion.

your dream home just got more affordable.

- Appeal Type:

Security / Peace of Mind

Effectiveness:Medium

Examples

we’ll help you navigate the road ahead.

Let’s build your future together.

- Appeal Type:

Convenience / Ease

Effectiveness:High

Examples

say hello to convenience.

send money in a snap.

Social Proof Elements

- Proof Type:

Longevity and Stability

Impact:Moderate

Examples

two centuries of service... and counting.

- Proof Type:

Expertise

Impact:Moderate

Examples

The Mortgage Loan Officer page, which positions an individual as a dedicated expert.

Trust Indicators

- •

NMLS# 399797

- •

Equal Housing Lender

- •

Mention of being one of the nation's largest bank-based financial service companies

- •

Providing security articles on fraud prevention

Scarcity Urgency Tactics

Promotional offers for checking accounts and savings rates are implicitly time-sensitive, which encourages immediate action, although specific end dates are not listed in the provided content.

Calls To Action

Primary Ctas

- Text:

Get Details

Location:Homepage Hero Banners

Clarity:Clear

- Text:

Open an Account

Location:Homepage Hero Banner / Main Navigation

Clarity:Clear

- Text:

Apply Now

Location:Mortgage Loan Officer Page

Clarity:Clear

- Text:

Enroll Now

Location:Online Banking Section

Clarity:Clear

- Text:

Schedule an appointment now

Location:Footer / Contact Section

Clarity:Clear

The CTAs are clear, direct, and action-oriented. Their placement is logical, corresponding directly to the product or service being promoted. However, the sheer number of different CTAs on the homepage ('Get Details', 'Open an Account', 'Open our most popular account', 'Open Key Cashback® today', etc.) can dilute the focus and create decision fatigue for a new user without a specific goal.

Messaging Gaps Analysis

Critical Gaps

- •

A clear, compelling brand story that connects the company's 200-year history to the modern customer's need for 'financial wellness'. The connection is stated but not demonstrated through a narrative.

- •

Lack of customer testimonials or case studies on the personal banking homepage to provide social proof beyond the bank's own claims.

- •

A clear articulation of how KeyBank is different or better than its primary competitors beyond the current promotional offer.

Contradiction Points

The brand promise is to 'meet you in the moment' and guide 'financial wellness' (a relationship-based message), but the primary experience on the homepage is a series of transactional, product-based offers, which feels impersonal.

Underdeveloped Areas

The 'financial wellness' concept. It's mentioned as the goal ('The path to financial wellness starts here'), but the content doesn't fully build out what that means or how KeyBank uniquely delivers it beyond standard banking products and articles.

Messaging for the Key Private Client. It is presented as just another tile, lacking the premium feel or detailed value proposition needed to attract high-net-worth individuals.

Messaging Quality

Strengths

- •

Clarity of promotional offers is very high; users know exactly what they can get.

- •

Product categories are well-defined, making it easy for users with a specific need to find the right section.

- •

Messaging around digital tools effectively communicates convenience and ease of use.

- •

CTAs are direct and unambiguous.

Weaknesses

- •

Over-reliance on transactional messaging (cash bonuses) cheapens the brand and overshadows the more strategic 'financial wellness' message.

- •

The core brand narrative is weak and fails to differentiate KeyBank in a meaningful way from other large banks.

- •

The homepage message hierarchy is cluttered, presenting too many options and offers at once.

- •

Emotional connection is limited; the messaging is largely functional and promotional rather than relationship-building.

Optimization Roadmap

Priority Improvements

- Area:

Homepage Message Hierarchy

Recommendation:Restructure the homepage hero section to lead with the core brand promise of 'moving forward' or 'financial wellness,' using a primary aspirational message. Subordinate the transactional cash offers to a secondary position to establish brand value before product value.

Expected Impact:High

- Area:

Value Proposition Communication

Recommendation:Develop a dedicated content section or interactive experience that clearly defines 'Financial Wellness' from KeyBank's perspective. Showcase tools, success stories, and advisor expertise to make this abstract concept tangible and differentiating.

Expected Impact:High

- Area:

Audience-Message Fit

Recommendation:Create more distinct messaging pathways or landing experiences for different personas. For example, a user interested in 'building their future' should have a different journey than someone just chasing a '$300 bonus'.

Expected Impact:Medium

Quick Wins

- •

Simplify the homepage hero banner to focus on a single, primary call-to-action instead of a rotating carousel with multiple competing offers.

- •

Add customer testimonials or success snippets to the homepage to build social proof.

- •

Rewrite product headlines to be more benefit-oriented (e.g., 'Build Your Savings Faster' instead of 'Money Market Savings').

Long Term Recommendations

- •

Invest in a comprehensive brand storytelling campaign that connects KeyBank's 200-year history of stability with its modern mission of empowering financial progress.

- •

Conduct persona research to refine messaging that resonates more deeply with the emotional drivers of key segments, moving beyond purely financial incentives.

- •

Overhaul the site's information architecture to guide users based on their life stage or financial goal (e.g., 'Starting Out,' 'Buying a Home,' 'Planning for Retirement') rather than just by product category.

KeyBank's strategic messaging on its website is a functional but ultimately conflicted execution that prioritizes short-term customer acquisition tactics over long-term brand building. The core tension lies between its stated mission to 'empower... clients... to thrive' on a 'path to financial wellness' and a homepage that overwhelmingly communicates a transactional value proposition based on cash bonuses and interest rates. While this approach is effective at attracting rate-sensitive shoppers, it fails to build a durable brand preference or meaningfully differentiate KeyBank from its numerous competitors who employ identical tactics. The messaging architecture is cluttered, presenting a barrage of product offers that dilutes the potentially powerful, though underdeveloped, 'financial wellness' narrative. The brand voice is clear and professional but lacks a distinct personality, oscillating between promotional and generically encouraging tones. The greatest weakness is the messaging gap between the relational brand promise and the transactional user experience. The 'why' of choosing KeyBank is lost amidst the 'what' of its offers. To improve business outcomes, KeyBank must elevate its brand story. The optimization roadmap should focus on rebalancing the messaging hierarchy to lead with the aspirational goal of financial progress, substantiating this claim with tangible proof (tools, stories, expert advice), and only then presenting the products as the means to achieve that end. This strategic shift would better align messaging with the brand's mission, improve differentiation, and foster deeper, more valuable customer relationships beyond the initial promotional period.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Established for over two centuries, indicating a long-term, stable customer base and trusted brand.

- •

Comprehensive suite of financial products for personal, commercial, and wealth management clients, serving a wide range of market needs.

- •

Significant physical presence with branches and ATMs, complemented by mature online and mobile banking platforms.

- •

Recent financial reports show strong revenue growth (21% year-over-year in Q2 2025) and consistent profitability, demonstrating sustained market demand.

Improvement Areas

- •

Enhance the digital user experience to compete with agile fintech startups and neobanks, especially in mobile-first account opening and loan applications.

- •

Increase personalization of product recommendations and financial advice using AI/ML to better serve individual customer needs.

- •

Reduce friction in the customer journey between digital and physical channels for a seamless omnichannel experience.

Market Dynamics

US Retail Banking market projected to grow at a CAGR of 4.2% between 2024 and 2029.

Mature

Market Trends

- Trend:

Digital Transformation and Fintech Competition

Business Impact:Traditional banks are heavily investing in technology to compete with digital-first fintechs and neobanks that offer superior customer experiences and lower costs. Over half of banks are actively implementing digital transformation initiatives.

- Trend:

Hyper-Personalization through AI

Business Impact:AI is being used to deliver tailored financial advice, personalized product offerings, and proactive customer service, which can improve click-through rates by 5x and increase customer loyalty.

- Trend:

Emphasis on Omnichannel Experience

Business Impact:Customers expect a seamless, consistent experience across all channels, including mobile apps, websites, and physical branches. 70% of customers consider this essential when choosing a bank.

- Trend:

Embedded Finance and Open Banking

Business Impact:The integration of banking services into non-financial platforms creates new revenue streams but also threatens to disintermediate traditional banks from their customers.

Crucial. The banking industry is at an inflection point. While the market is mature, the rapid pace of technological change and evolving customer expectations create a significant opportunity for established players like KeyCorp to capture market share by accelerating digital transformation and innovation. Failure to adapt quickly poses a substantial threat from more agile competitors.

Business Model Scalability

Medium

High fixed costs associated with physical branch networks and legacy IT infrastructure limit scalability. Digital channels offer a more scalable, lower-cost model for growth.

Moderate. While digital services offer high leverage, the overall business model is weighed down by the operational costs of its physical footprint and complex regulatory compliance requirements.

Scalability Constraints

- •

Legacy core banking systems hinder rapid product development and integration with modern technologies.

- •

Regulatory and compliance overhead increases with scale and complexity.

- •

Dependence on a physical branch network for certain services and customer segments creates a drag on cost-effective expansion.

Team Readiness

Experienced executive team with a demonstrated focus on strategic growth, including investments in technology and front-line bankers. However, like many incumbent banks, there may be a challenge in fostering a sufficiently agile and innovative culture to compete with fintechs.

Traditional, likely siloed structure (Consumer Bank, Commercial Bank, etc.) which can slow down cross-functional initiatives critical for modern growth strategies like omnichannel customer experience.

Key Capability Gaps

- •

Agile Product Management: Need for teams that can rapidly iterate on digital products based on customer feedback.

- •

Data Science and AI/ML Engineering: Crucial for developing personalization engines, advanced fraud detection, and operational automation.

- •

User Experience (UX) Design: Deep expertise is required to create digital experiences that are on par with leading consumer technology apps.

Growth Engine

Acquisition Channels

- Channel:

Digital Advertising (Promotional Offers)

Effectiveness:High

Optimization Potential:High

Recommendation:Utilize AI-driven targeting to optimize ad spend on welcome bonuses and cashback offers. A/B test different offer structures to identify the most cost-effective acquisition campaigns.

- Channel:

Physical Branches

Effectiveness:Medium

Optimization Potential:Medium

Recommendation:Reposition branches from transactional hubs to advisory centers, focusing on high-value interactions like mortgage applications and wealth management consultations. Use data to optimize branch locations and formats.

- Channel:

Content Marketing & SEO

Effectiveness:Medium

Optimization Potential:High

Recommendation:Expand financial wellness content to attract organic traffic for high-intent keywords. Develop targeted content funnels that guide users from educational articles to relevant product pages.

- Channel:

Cross-Sell / Up-Sell

Effectiveness:Medium

Optimization Potential:High

Recommendation:Implement a 'next-best-product' recommendation engine using customer data to proactively identify and market relevant products (e.g., mortgages, investments) to existing checking/savings account holders.

Customer Journey

The primary digital conversion path is driven by prominent calls-to-action for opening an account, often tied to a specific monetary bonus. The path appears straightforward but likely involves complex application forms.

Friction Points

- •

Lengthy and complex online application forms for accounts and loans.

- •

Clunky identity verification processes that may require manual follow-up.

- •

Inconsistent experience when moving from a digital application start to needing in-person branch assistance.

Journey Enhancement Priorities

{'area': 'Digital Account Opening', 'recommendation': 'Streamline the online application to the bare minimum required fields, using data pre-fill and mobile-native features (e.g., ID scanning) to reduce completion time to under 5 minutes. '}

{'area': 'Omnichannel Handoff', 'recommendation': 'Create a system where a customer can start an application online and seamlessly schedule a branch appointment to finish, with the banker having all previously entered information available.'}

Retention Mechanisms

- Mechanism:

Relationship Benefits Program

Effectiveness:Medium

Improvement Opportunity:Increase the perceived value and personalization of benefits. Use data to offer proactive rate discounts or fee waivers based on customer behavior and relationship depth, rather than requiring customers to seek them out.

- Mechanism:

Digital Banking Platform (Mobile App)

Effectiveness:High

Improvement Opportunity:Integrate proactive financial wellness tools, personalized spending insights, and savings goal trackers to make the app an indispensable daily financial tool, thereby increasing stickiness.

- Mechanism:

Customer Service

Effectiveness:Moderate

Improvement Opportunity:Empower front-line staff with better technology and a 360-degree view of the customer to resolve issues more efficiently. Integrate AI-powered chatbots for instant answers to common questions, freeing up human agents for complex issues.

Revenue Economics

As a large regional bank, KeyCorp's economics are driven by Net Interest Margin (NIM) and non-interest income. Recent performance shows strong revenue and NIM growth. The high cost of customer acquisition (CAC) in banking ($200-$1500 per customer) necessitates a focus on maximizing customer lifetime value (LTV).

Likely healthy (targeting >3:1) for multi-product customers, but potentially marginal for single-product, low-balance customers acquired through expensive promotions. A key strategic goal is to convert the latter into the former.

Good, with recent reports indicating higher profitability than competitors. There is an ongoing strategic focus on growing non-interest income from areas like investment banking and wealth management to improve revenue diversity.

Optimization Recommendations

- •

Focus marketing spend on acquiring customers with a high propensity to adopt multiple products.

- •

Automate underwriting and processing for consumer loans to reduce operational costs and improve margins.

- •

Increase focus on fee-based services (wealth management, payments) which are less sensitive to interest rate fluctuations.

Scale Barriers

Technical Limitations

- Limitation:

Legacy Core Banking Platform

Impact:High

Solution Approach:Pursue a two-speed IT architecture: maintain the legacy core for stability while building an agile, API-driven layer on top for rapid development of new digital products and services. Plan a long-term, phased core modernization.

- Limitation:

Siloed Customer Data

Impact:High

Solution Approach:Invest in a centralized Customer Data Platform (CDP) to create a single, unified view of each customer across all product lines and channels, enabling true personalization.

Operational Bottlenecks

- Bottleneck:

Manual Underwriting and Onboarding Processes

Growth Impact:Slows customer acquisition, increases operational costs, and leads to a poor customer experience.

Resolution Strategy:Invest in AI and automation technologies to streamline credit decisioning for consumer and small business loans, and to automate back-office verification tasks.

- Bottleneck:

Fragmented Channel Management

Growth Impact:Creates inconsistent customer experiences and operational inefficiencies.

Resolution Strategy:Establish a dedicated Omnichannel Strategy team responsible for ensuring seamless integration of service, sales, and marketing across digital and physical touchpoints.

Market Penetration Challenges

- Challenge:

Intense Competition from Large National Banks and Fintechs

Severity:Critical

Mitigation Strategy:Differentiate on customer service and community focus, while investing aggressively in digital capabilities to achieve parity on user experience. Compete by offering a superior hybrid 'human + digital' model.

- Challenge:

Customer Inertia and High Switching Costs

Severity:Major

Mitigation Strategy:Overcome inertia with compelling, high-value acquisition offers (e.g., significant cash bonuses). Simplify the switching process with digital tools that help customers easily move direct deposits and recurring payments.

Resource Limitations

Talent Gaps

- •

Data Scientists & AI Specialists

- •

Cloud Infrastructure Engineers

- •

Digital Product Managers

- •

Cybersecurity Experts

Significant ongoing investment required for technology modernization and digital transformation, estimated to be in the hundreds of millions annually. KeyCorp plans to increase technology investments by nearly $100 million.

Infrastructure Needs

- •

Migration of more core systems to the cloud for enhanced scalability and efficiency.

- •

Modern API gateway to facilitate secure partnerships with fintechs.

- •

Upgraded data analytics and business intelligence platforms.

Growth Opportunities

Market Expansion

- Expansion Vector:

Demographic: Younger, Digital-Native Customers

Potential Impact:High

Implementation Complexity:Medium

Recommended Approach:Develop a distinct digital-first sub-brand or product suite with features tailored to this demographic (e.g., no overdraft fees, financial wellness tools, seamless mobile experience). This can capture a new segment without alienating the core customer base.

- Expansion Vector:

Niche Segments: Specialized Small Business Banking

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Develop industry-specific banking solutions (e.g., for healthcare practices, tech startups) that bundle specialized software, payment processing, and tailored lending products.

Product Opportunities

- Opportunity:

Embedded Finance / Banking-as-a-Service (BaaS)

Market Demand Evidence:Growing trend of non-financial companies wanting to offer financial products (e.g., point-of-sale lending, branded debit cards) to their customers.

Strategic Fit:Leverages KeyCorp's banking license and infrastructure to create a new, scalable B2B revenue stream.

Development Recommendation:Develop a modern API platform and form a dedicated partnership team to target large retailers, software platforms, and marketplaces.

- Opportunity:

Advanced Financial Wellness Platform

Market Demand Evidence:Increasing consumer demand for tools that help with budgeting, saving, and financial planning, an area where fintechs currently lead.

Strategic Fit:Deepens customer relationships, increases app engagement, and positions KeyBank as a trusted advisor rather than just a utility.

Development Recommendation:Acquire a small personal finance management (PFM) fintech or partner with one to integrate their technology directly into the KeyBank mobile app.

Channel Diversification

- Channel:

Fintech App Marketplaces

Fit Assessment:Good

Implementation Strategy:Partner with established fintech apps (e.g., budgeting, investing platforms) to offer KeyBank accounts or loans as a preferred funding source or product option directly within their ecosystems.

- Channel:

Workplace Banking Programs

Fit Assessment:Excellent

Implementation Strategy:Develop a dedicated sales team to partner with large corporations to offer KeyBank accounts, mortgages, and financial wellness seminars as an employee benefit, enabling bulk customer acquisition.

Strategic Partnerships

- Partnership Type:

Technology Co-development

Potential Partners

- •

Leading AI/ML firms (e.g., Palantir, DataRobot)

- •

Core banking modernization specialists (e.g., Mambu, Thought Machine)

- •

Cybersecurity firms

Expected Benefits:Accelerate development of critical capabilities like personalization, automation, and security without having to build everything in-house.

- Partnership Type:

Product Integration

Potential Partners

- •

Plaid

- •

Leading accounting software (e.g., QuickBooks, Xero)

- •

Vertical SaaS providers

Expected Benefits:Enhance the value of core banking products by seamlessly integrating them into the digital tools customers and businesses already use, thereby increasing stickiness and utility.

Growth Strategy

North Star Metric

Primary Checking Relationships

This metric focuses on the depth of the customer relationship, not just the quantity of accounts. A 'primary' relationship, often defined by recurring direct deposits, indicates that KeyBank is the customer's main financial institution, creating significant opportunities for cross-selling high-margin products like loans and investments.

Increase the percentage of new checking accounts that become 'Primary' within 90 days by 15%.

Growth Model

Acquire & Deepen Growth Model

Key Drivers

- •

High-value, low-friction digital acquisition offers.

- •

A seamless, fast digital onboarding experience.

- •

A data-driven, automated cross-sell engine.

- •

Proactive, personalized relationship management.

Focus marketing on a single, compelling entry product (e.g., high-bonus checking). Immediately after onboarding, trigger an automated, personalized communication flow that introduces and incentivizes the adoption of additional products based on the customer's profile and behavior.

Prioritized Initiatives

- Initiative:

Launch 'Express Onboarding' for Digital Accounts

Expected Impact:High

Implementation Effort:Medium

Timeframe:6-9 Months

First Steps:Map the current digital application journey to identify all points of friction. Form a cross-functional 'squad' of product, engineering, and compliance stakeholders to redesign the flow with a '5-minutes-to-open' goal.

- Initiative:

Develop a Personalized 'Next-Best-Product' Engine

Expected Impact:High

Implementation Effort:High

Timeframe:12-18 Months

First Steps:Consolidate customer data into a central repository. Develop an initial predictive model to identify customers most likely to need a mortgage or auto loan in the next 6 months. Test model effectiveness via a targeted email campaign.

- Initiative:

Pilot a Fintech Partnership Program

Expected Impact:Medium

Implementation Effort:Medium

Timeframe:9-12 Months

First Steps:Appoint a Head of Fintech Partnerships. Identify 2-3 key capability gaps (e.g., PFM, digital lending) and begin vetting potential fintech partners to integrate their solutions.

Experimentation Plan

High Leverage Tests

- Area:

Acquisition Offers

Test:A/B test a '$300 cash bonus' vs. a '4.50% APY for 6 months' offer to see which drives higher-quality customer acquisition.

- Area:

Onboarding Funnel

Test:Test a multi-page form against a single-page, conversational form to measure completion rate and drop-off.

- Area:

Cross-Sell Messaging

Test:Experiment with different channels (email, in-app notification, SMS) and timing for presenting a credit card offer to new checking account customers.

Utilize a combination of digital analytics tools (for conversion rates, drop-off), BI dashboards (for business KPIs like accounts opened, cross-sell ratio), and customer surveys (for satisfaction scores).

Run at least one high-leverage A/B test per quarter for major initiatives and maintain a continuous, bi-weekly cadence of smaller optimization tests on the website and mobile app.

Growth Team

A centralized Growth Team led by a Chief Growth Officer, with cross-functional pods dedicated to key stages of the customer lifecycle (e.g., Acquisition Pod, Onboarding Pod, Engagement & Retention Pod).

Key Roles

- •

Chief Growth Officer

- •

Product Manager, Growth

- •

Data Scientist, Growth Analytics

- •

Performance Marketing Manager

- •

Conversion Rate Optimization (CRO) Specialist

Foster a culture of experimentation by celebrating both successful and failed tests as learning opportunities. Provide ongoing training in agile methodologies, data analytics, and customer-centric design. Empower teams with the autonomy and tools to run experiments quickly.

KeyCorp is a well-established regional bank with a strong foundation, evidenced by its long history, comprehensive product suite, and solid financial performance. The company has a strong product-market fit within its traditional segments. However, it stands at a critical juncture where the primary threat and greatest opportunity are one and the same: the rapid digital transformation of the financial services industry. The market is mature but being aggressively disrupted by fintechs and neobanks who set a high bar for digital customer experience.

The company's primary growth engine relies on promotional offers for acquisition and a relationship-based model for retention. While effective, this engine can be significantly supercharged. The key to unlocking exponential growth lies in deepening customer relationships at scale through technology. The current 'Acquire & Deepen' model is sound but must evolve to be more automated, personalized, and proactive. The largest barriers to this evolution are internal: legacy technology platforms, siloed data, and an organizational structure that may inhibit the agility required for rapid digital innovation.

Key growth opportunities lie not in traditional geographic expansion, but in targeting new demographic segments (digital natives) and creating new revenue streams through technology (BaaS, embedded finance). Partnerships with fintechs are not just an option but a strategic necessity to accelerate the acquisition of critical technological capabilities.

Recommendations:

-

Prioritize Digital Onboarding: The single most impactful initiative is to create a best-in-class, sub-5-minute digital account opening process. This is the front door for new growth and must be as seamless as top fintech competitors.

-

Unify Customer Data: Aggressively pursue the creation of a single customer view. This is the foundational layer upon which all meaningful personalization and cross-selling efforts will be built.

-

Adopt a Pod-Based Growth Structure: Form a dedicated, empowered growth team with cross-functional expertise. This team's sole focus should be moving the North Star Metric of 'Primary Checking Relationships' through rapid experimentation.

KeyCorp's challenge is not a lack of opportunity but the speed and focus of its execution. By strategically investing in technology to enhance its digital customer experience and leverage its vast data assets, the company can successfully defend its market position and unlock significant, sustainable growth.

Legal Compliance

KeyBank provides a comprehensive 'KeyCorp Online Privacy Statement' that is centrally accessible through the website's footer and a dedicated 'Privacy & Security' page. The policy clearly outlines the types of Personal Information collected, how it's used, and with whom it's shared, including affiliates and third-party service providers. It explicitly states that Key does not sell personal information, a key tenet of modern privacy laws. The policy addresses specific rights under the California Consumer Privacy Act (CCPA)/CPRA, providing a link and a toll-free number for California residents to exercise their rights to access or delete their information. It also details how consumers can limit information sharing for marketing purposes among Key affiliates, which aligns with the requirements of the Gramm-Leach-Bliley Act (GLBA). The document distinguishes between the online privacy statement and the more detailed 'KeyCorp Privacy Notice' for consumer banking clients, which is a standard and compliant practice under GLBA. The policy's structure and content demonstrate a mature approach to privacy, tailored to the heavily regulated financial services industry.