eScore

lowes.comThe eScore is a comprehensive evaluation of a business's online presence and effectiveness. It analyzes multiple factors including digital presence, brand communication, conversion optimization, and competitive advantage.

Lowe's demonstrates a sophisticated digital presence with a dominant organic search footprint covering a vast range of DIY and product-related keywords. Its omnichannel strategy masterfully blends national brand authority with local store relevance, leveraging its physical locations for fulfillment and localized marketing. The company is actively investing in AI to enhance the online experience, from search and recommendations to customer service, indicating a forward-looking approach to digital intelligence. While its content authority for the DIY segment is exceptional, there's a recognized gap in tailored content for professional customers, which is a key area for development.

Exceptional integration of local and national SEO, using its ~1,700 physical stores as a strategic asset for local search visibility and buy-online-pickup-in-store (BOPIS) conversions.

Develop a dedicated content hub and voice search strategy specifically for the 'Pro' audience, addressing their unique search intents related to job site needs, bulk materials, and business management.

Lowe's brand communication is highly effective at driving transactions, with a clear, promotional, and urgent tone centered on savings and seasonal deals. This messaging is extremely clear for its core DIY audience but largely neglects the professional 'Pro' segment on primary digital assets like the homepage. While social proof through customer reviews is strong, the overall brand narrative lacks an emotional connection, focusing more on tactical promotions than the brand's mission. Recent marketing efforts have started to engage younger demographics through creator networks, showing an evolving strategy.

Unmistakable clarity and prominence of promotional and sales-driven messaging, effectively converting purchase intent for the DIY homeowner segment.

Create a segmented messaging strategy that prominently features a value proposition for 'Pro' customers on the homepage, highlighting services, reliability, and business tools over just price.

The website provides a highly optimized conversion path with a logical information architecture, intuitive navigation, and a frictionless checkout process. Its mobile experience is excellent, and the design is action-oriented, effectively guiding users toward purchase. The company is actively investing in enhancing the omnichannel experience with features like in-store pickup lockers to reduce friction further. Minor weaknesses include high content density on the homepage, which could increase cognitive load, and inconsistent CTA styling that presents a low but present risk of user hesitation.

A robust and efficient omnichannel fulfillment system, with over 60% of online orders picked up in-store, seamlessly bridging the digital and physical shopping experience.

A/B test a simplified homepage layout to reduce visual clutter and cognitive load, and elevate the visibility of the 'For Pros' section to streamline the journey for this key segment.

Lowe's has built substantial credibility through its strong brand recognition, comprehensive privacy policies, and clear terms of service that mitigate e-commerce risks. Trust signals are abundant, including the prominent display of a J.D. Power award for customer satisfaction and partnerships with well-known national brands. The company demonstrates transparency with a dedicated product recalls page and a portal for privacy requests. While its compliance framework is mature, medium risks exist in its cookie consent implementation and the potential for digital accessibility litigation, which require ongoing vigilance.

A centralized 'Privacy Request Portal' and a comprehensive, multi-state U.S. Privacy Statement that proactively addresses consumer data rights, building significant user trust.

Engage a third-party auditor to perform a full WCAG 2.1 AA audit of the main e-commerce site to proactively identify and remediate accessibility issues, mitigating a high-risk area for litigation.

Lowe's primary competitive advantage is its extensive omnichannel network, where its vast physical store footprint serves as a strategic asset for fulfillment and service, a moat that is difficult for online-only competitors to replicate. This is complemented by strong brand recognition, a growing portfolio of higher-margin private label brands, and an expanding ecosystem of installation services. However, its position as the number two player behind The Home Depot, particularly in the highly lucrative 'Pro' segment, indicates its moat is strong but not dominant in the industry. Strategic acquisitions of companies like FBM are a clear and aggressive move to shore up this key weakness.

The defensible moat created by its massive physical store network, which functions as a logistics and service hub for its integrated omnichannel strategy.

Accelerate the integration of recent acquisitions (like ADG and FBM) to build a truly differentiated, service-led value proposition for large professional contractors, which is the company's most significant competitive disadvantage.

Lowe's demonstrates high scalability, supported by strong unit economics and a business model with significant operational leverage. The company is strategically focused on scalable growth vectors, primarily by increasing its share of the Pro customer wallet and expanding its high-margin installation services business. While new store growth is modest (10-15 stores per year), the true expansion potential lies in deepening relationships with existing customers and leveraging technology and supply chain investments to improve efficiency and capture more of the total project value. The primary constraints are the complexity of last-mile logistics for bulky goods and the capital-intensive nature of supply chain modernization.

A clear and focused growth strategy ('Total Home Strategy') centered on increasing wallet share with the high-value 'Pro' customer segment through targeted services and strategic acquisitions.

Invest heavily in last-mile logistics and dedicated fulfillment solutions for bulky goods to directly address a major operational bottleneck and meet the critical job-site delivery needs of professional customers.

Lowe's operates a highly coherent and mature omnichannel retail model with a clear strategic focus on its 'Total Home Strategy'. This strategy effectively aligns its resources—from acquisitions and technology investments to loyalty program redesigns—toward the primary goals of winning the Pro customer and accelerating online sales. Revenue streams are well-diversified beyond product sales to include high-margin services, credit, and protection plans. The model's main vulnerability is its dependence on the cyclical housing market, but the strategic push into the more resilient Pro segment is a direct and logical hedge against this risk.

Exceptional strategic focus, demonstrated by the 'Total Home Strategy,' which aligns major capital investments, acquisitions, and operational initiatives toward the clear goal of gaining market share with the professional customer.

Resolve the channel conflict created by the website disclaimer that 'local stores do not honor online pricing', as it undermines the coherence of a seamless omnichannel brand promise.

As the #2 player in a duopolistic market, Lowe's exerts significant market power, though less than its primary competitor, The Home Depot. Its massive scale provides substantial leverage over suppliers, and its brand is a powerful force in shaping consumer trends in the DIY space. However, intense price competition from Home Depot limits its pricing power. The company's market share trajectory is stable with a clear strategic intent to grow by capturing a larger piece of the professional market, evidenced by major acquisitions like Foundation Building Materials.

Substantial leverage over its supply chain and partners due to its immense scale and purchasing volume, allowing it to negotiate favorable terms and build a portfolio of exclusive private-label brands.

Continue to aggressively execute its strategy to capture the 'Pro' market, as closing the gap with The Home Depot in this segment is the most direct path to increasing overall market share and influence.

Business Overview

Business Classification

Omnichannel Retail

Hybrid B2C & B2B

Home Improvement

Sub Verticals

- •

Appliances

- •

Building Materials & Lumber

- •

Tools & Hardware

- •

Lawn & Garden

- •

Home Decor & Furniture

- •

Paint

- •

Installation Services

Mature

Maturity Indicators

- •

Extensive physical store footprint (~1,700 stores)

- •

Strong brand recognition and established market position

- •

Focus on operational efficiency and supply chain optimization

- •

Stable, albeit competitive, market share

- •

Strategic acquisitions to target growth segments (e.g., Pro customers)

Enterprise

Steady

Revenue Model

Primary Revenue Streams

- Stream Name:

Product Sales (DIY & Pro)

Description:Core revenue driver from the sale of a wide range of home improvement products, including appliances, tools, building materials, and garden supplies, through both physical stores and eCommerce channels.

Estimated Importance:Primary

Customer Segment:DIY Homeowners & Professional Contractors

Estimated Margin:Medium

- Stream Name:

Installation & Home Services

Description:Fee-based services for the installation of products like flooring, kitchens, windows, and appliances. This 'Do-It-for-Me' (DIFM) model is a key part of the 'Total Home' strategy.

Estimated Importance:Secondary

Customer Segment:DIFM Homeowners

Estimated Margin:High

- Stream Name:

Lowe's Pro Services

Description:Targeted offerings for professional contractors, including bulk pricing, specialized product sourcing, and dedicated support services, which represent a significant and growing portion of sales (approx. 25-30%).

Estimated Importance:Secondary

Customer Segment:Professional Contractors

Estimated Margin:Medium

- Stream Name:

Credit Services

Description:Revenue generated through co-branded credit card programs, offering customers special financing options and discounts, which drives sales volume and customer loyalty.

Estimated Importance:Tertiary

Customer Segment:DIY Homeowners & Professional Contractors

Estimated Margin:Medium

- Stream Name:

Extended Protection Plans

Description:Sales of extended warranties and protection plans for major appliances and tools, providing a high-margin, recurring revenue opportunity.

Estimated Importance:Tertiary

Customer Segment:DIY Homeowners

Estimated Margin:High

Recurring Revenue Components

- •

Extended Protection Plans

- •

MyLowe's Rewards & Pro Loyalty Programs

- •

Potential for product subscriptions (e.g., filters)

Pricing Strategy

Competitive Pricing

Mid-range

Transparent

Pricing Psychology

- •

Promotional Pricing (e.g., Labor Day sales)

- •

Financing Offers (e.g., 0% APR)

- •

Volume Discounts (for Pro customers)

- •

Loyalty-Based Pricing (MyLowe's Rewards)

Monetization Assessment

Strengths

- •

Diversified revenue streams beyond core product sales (services, credit).

- •

Strong omnichannel integration capturing both online and in-store shoppers.

- •

Growing high-value Pro customer segment provides a buffer against DIY spending volatility.

- •

Private label brands (e.g., Kobalt, Allen + Roth) offer higher margin potential.

Weaknesses

- •

High dependence on the cyclical housing and home renovation market.

- •

Intense price competition from key rivals limits margin expansion.

- •

Historically lower penetration in the lucrative Pro segment compared to The Home Depot.

Opportunities

- •

Expansion of online marketplace model to increase product assortment without inventory risk.

- •

Further development of subscription-based services for recurring home maintenance needs.

- •

Leveraging AI for enhanced personalization, demand forecasting, and productivity.

- •

Growth in the 'Total Home' services, moving beyond installation to full project management.

Threats

- •

Intense competition from The Home Depot, Menards, and increasingly, online retailers like Amazon.

- •

Economic downturns reducing discretionary spending on home improvement projects.

- •

Supply chain disruptions impacting product availability and increasing costs.

- •

Shifting consumer preferences towards smaller, more specialized local hardware stores for convenience and expertise.

Market Positioning

A leading omnichannel home improvement retailer for both DIY and Pro customers, striving to be a 'one-stop shop' by integrating a wide product selection with comprehensive services and a customer-centric experience.

Second largest in the U.S. home improvement market (approx. 28% share), trailing The Home Depot (approx. 47% share).

Target Segments

- Segment Name:

DIY (Do-It-Yourself) Homeowners

Description:The traditional core customer base, comprising homeowners and renters who undertake home maintenance, repair, and decoration projects themselves. This segment accounts for approximately 75% of sales.

Demographic Factors

- •

Middle-to-upper income households

- •

Age range 30-60

- •

Suburban and rural homeowners

Psychographic Factors

- •

Value-conscious and seeks promotions

- •

Enjoys hands-on projects and learning new skills

- •

Seeks inspiration for home aesthetics and design

Behavioral Factors

- •

Project-based purchasing (e.g., weekend projects)

- •

Utilizes online resources (how-to guides, videos) for research

- •

Responsive to seasonal promotions (e.g., gardening in spring, holidays)

Pain Points

- •

Lack of knowledge or confidence to start a project

- •

Finding all necessary materials in one trip

- •

Budgeting for large-scale projects

- •

Transporting large or bulky items

Fit Assessment:Excellent

Segment Potential:Medium

- Segment Name:

Professional (Pro) Contractors

Description:A high-value, strategic growth segment consisting of small-to-medium sized businesses in trades such as general contracting, remodeling, property management, and landscaping. This segment accounts for 25-30% of sales and is a key focus of the 'Total Home Strategy'.

Demographic Factors

- •

Small business owners

- •

Primarily male

- •

Operates within a specific geographic area

Psychographic Factors

- •

Values relationships and reliability

- •

Time-sensitive and efficiency-focused

- •

Brand loyal to tools and materials that perform

Behavioral Factors

- •

Frequent, high-volume purchases

- •

Requires fast fulfillment (in-store pickup, jobsite delivery)

- •

Needs access to credit and business management tools

- •

Less price-sensitive than DIY, more focused on availability and convenience

Pain Points

- •

Product stockouts delaying projects

- •

Inefficient purchasing and checkout processes

- •

Managing expenses and invoices across multiple jobs

- •

Sourcing a wide variety of materials from different suppliers

Fit Assessment:Good

Segment Potential:High

Market Differentiation

- Factor:

Omnichannel Strategy

Strength:Strong

Sustainability:Sustainable

- Factor:

Private Label Brands (Kobalt, Allen + Roth)

Strength:Moderate

Sustainability:Sustainable

- Factor:

Focus on Home Decor & Style

Strength:Moderate

Sustainability:Temporary

- Factor:

Installation & Home Services Ecosystem

Strength:Strong

Sustainability:Sustainable

Value Proposition

Lowe's empowers homeowners and professionals to achieve their home improvement goals by providing a vast selection of products, value-added services, and expert guidance through a seamless omnichannel experience.

Excellent

Key Benefits

- Benefit:

Comprehensive Product Selection

Importance:Critical

Differentiation:Common

Proof Elements

Extensive online and in-store inventory across numerous categories

- Benefit:

Convenient Fulfillment Options

Importance:Critical

Differentiation:Somewhat unique

Proof Elements

- •

In-store pickup

- •

Same-day delivery

- •

Jobsite delivery for Pros

- Benefit:

Project Support & Expertise

Importance:Important

Differentiation:Somewhat unique

Proof Elements

- •

Online 'How-To' articles and guides

- •

In-store associate expertise

- •

Kids' DIY workshops

- Benefit:

Installation & Professional Services

Importance:Important

Differentiation:Unique

Proof Elements

Dedicated installation services for various product categories

Unique Selling Points

- Usp:

'Total Home Strategy' aiming to serve every aspect of home improvement needs for both DIY and Pro customers.

Sustainability:Long-term

Defensibility:Strong

- Usp:

A unified loyalty program ('MyLowe’s Rewards') for both DIY and Pro customers to create a single ecosystem.

Sustainability:Medium-term

Defensibility:Moderate

- Usp:

Strategic acquisitions (like FBM) to rapidly scale and integrate services for the Pro customer.

Sustainability:Long-term

Defensibility:Strong

Customer Problems Solved

- Problem:

Difficulty in sourcing all necessary products for a home improvement project from a single location.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Lack of skills or time to complete projects, requiring professional installation.

Severity:Major

Solution Effectiveness:Complete

- Problem:

Inefficient procurement and material management for professional contractors.

Severity:Critical

Solution Effectiveness:Partial

Value Alignment Assessment

High

The value proposition is well-aligned with the core needs of the large and stable home improvement market, addressing both product acquisition and project execution.

High

Lowe's effectively addresses the distinct needs of its two primary segments: value and guidance for DIYers, and efficiency and reliability for Pros. Strategic initiatives show a clear focus on improving alignment with the high-potential Pro segment.

Strategic Assessment

Business Model Canvas

Key Partners

- •

Product Manufacturers & Suppliers (e.g., Whirlpool, DeWalt, Scotts)

- •

Third-party Installation Contractors

- •

Logistics and Supply Chain Providers

- •

Financial Institutions (for credit services)

- •

Non-profit Organizations (e.g., Habitat for Humanity, Rebuilding Together)

Key Activities

- •

Merchandising and Inventory Management

- •

Retail Store & eCommerce Operations

- •

Supply Chain & Logistics Management

- •

Marketing & Sales (for both B2C and B2B)

- •

Customer Service & In-Store Support

- •

Management of Installation Services

Key Resources

- •

Extensive Network of Physical Stores

- •

Robust eCommerce Platform & Mobile App

- •

Distribution Centers & Logistics Infrastructure

- •

Strong Brand Equity & Customer Loyalty

- •

Portfolio of Private Label Brands

- •

Skilled Workforce (in-store associates, Pro specialists)

Cost Structure

- •

Cost of Goods Sold (COGS)

- •

Employee Wages & Benefits

- •

Store Operating Expenses (rent, utilities)

- •

Marketing & Advertising

- •

Technology & IT Infrastructure

- •

Supply Chain & Distribution Costs

Swot Analysis

Strengths

- •

Strong brand recognition and a vast physical store network across North America.

- •

Well-developed omnichannel capabilities integrating online and in-store experiences.

- •

Diversified customer base spanning DIY, DIFM, and Pro segments.

- •

Growing focus and investment in the high-margin Pro customer segment.

Weaknesses

- •

Lower market share and historically weaker penetration in the Pro segment compared to The Home Depot.

- •

High dependency on the North American market, particularly the U.S. housing cycle.

- •

Perception by some Pros as being more retail/DIY-focused than its primary competitor.

Opportunities

- •

Significant growth potential in the Pro market through targeted strategies and acquisitions.

- •

Expansion of online marketplace to broaden product selection without increasing inventory costs.

- •

Leveraging AI and data analytics to improve personalization, supply chain efficiency, and customer service.

- •

Growing the installation services business to capture more DIFM (Do-It-For-Me) customer spending.

Threats

- •

Intense and direct competition from The Home Depot, which has a larger scale and market share.

- •

Economic downturns that could reduce consumer spending on home improvement projects.

- •

Potential for continued supply chain disruptions and inflationary pressures on costs.

- •

Competition from online-only retailers (Amazon, Wayfair) and specialized trade suppliers.

Recommendations

Priority Improvements

- Area:

Pro Customer Experience

Recommendation:Accelerate the rollout of Pro-centric services such as dedicated fulfillment centers, advanced online tools for project and expense management, and specialized in-store support teams to close the competitive gap with The Home Depot.

Expected Impact:High

- Area:

Supply Chain Modernization

Recommendation:Continue investing in supply chain technology, such as AI-powered demand forecasting and the market delivery model, to improve in-stock rates, reduce delivery times for bulky items, and lower operational costs.

Expected Impact:High

- Area:

Digital Personalization

Recommendation:Utilize customer data and AI to deliver highly personalized online experiences, including project-specific recommendations, tailored promotions, and content that guides customers from inspiration to completion.

Expected Impact:Medium

Business Model Innovation

- •

Develop a 'Lowe's Home Services' subscription platform for recurring maintenance tasks (e.g., HVAC servicing, gutter cleaning, lawn care), creating a predictable, high-margin revenue stream.

- •

Launch a comprehensive project management service for large renovations, acting as a general contractor that coordinates trades and materials, thereby capturing a larger share of the total project value.

- •

Create a tool and equipment rental marketplace, allowing Pros to rent out their underutilized equipment to other Pros or DIYers through the Lowe's platform, taking a commission on each transaction.

Revenue Diversification

- •

Expand B2B offerings to target new professional segments like property management companies, hospitality, and institutional clients with tailored product assortments and services.

- •

Monetize the extensive 'How-To' content library through premium, in-depth digital workshops or paid one-on-one virtual consultations with project experts.

- •

Build out the online marketplace to include a wider array of home goods and services from third-party sellers, transforming Lowe's into a more holistic home ecosystem and generating revenue from commissions.

Lowe's operates a mature and robust omnichannel retail business model, firmly positioned as the second-largest player in the home improvement industry. Its core strength lies in its extensive physical and digital footprint, serving a broad customer base that spans from casual DIY enthusiasts to professional contractors. The company's 'Total Home Strategy' is a clear and logical framework for future growth, correctly identifying the professional (Pro) customer and the expansion of online sales and integrated services as the primary value-creation levers. The primary strategic challenge for Lowe's remains the intense competition with The Home Depot, which currently holds a dominant market share, particularly within the lucrative Pro segment. Lowe's is aggressively addressing this gap through strategic acquisitions (e.g., FBM) and a revamped Pro loyalty program, which are critical moves to build credibility and capture share. The business model's evolution hinges on transforming from a traditional retailer into a comprehensive home improvement ecosystem. Opportunities for innovation lie in creating recurring revenue through subscription services for home maintenance and expanding deeper into project management, thereby moving up the value chain. By successfully executing its strategy to better serve the Pro customer while defending its strong position with DIYers and leveraging technology to enhance efficiency and customer experience, Lowe's is well-positioned for steady, sustainable growth, though market share gains will be hard-fought.

Competitors

Competitive Landscape

Mature

Oligopoly

Barriers To Entry

- Barrier:

Economies of Scale

Impact:High

- Barrier:

Supply Chain & Logistics Network

Impact:High

- Barrier:

Brand Recognition & Customer Loyalty

Impact:High

- Barrier:

High Capital Investment (Real Estate & Inventory)

Impact:High

- Barrier:

Access to Distribution Channels

Impact:Medium

Industry Trends

- Trend:

Increased Focus on the Professional (Pro) Customer

Impact On Business:Lowe's is actively investing in its Pro offerings to capture a larger share of this lucrative and resilient market segment, which is crucial for growth as the DIY market slows.

Timeline:Immediate

- Trend:

Omnichannel Integration

Impact On Business:Seamless integration of online (website, app) and in-store experiences is critical. Customers research online and purchase in-store (or vice-versa). This requires robust digital tools and efficient fulfillment options like BOPIS (Buy Online, Pick-up In Store).

Timeline:Immediate

- Trend:

Rise of DIY and DIFM (Do-It-For-Me)

Impact On Business:While DIY surged post-pandemic, a shift towards DIFM requires retailers to offer robust installation and professional referral services to capture a wider range of projects.

Timeline:Near-term

- Trend:

Sustainability and Energy Efficiency

Impact On Business:Growing consumer demand for eco-friendly and energy-efficient products presents an opportunity for Lowe's to differentiate its product assortment and attract environmentally conscious customers.

Timeline:Near-term

- Trend:

AI and Technology Integration

Impact On Business:Leveraging AI for personalized recommendations, inventory management, and enhancing in-store associate tools is becoming a key competitive differentiator. Lowe's is actively investing in this area.

Timeline:Immediate

Direct Competitors

- →

The Home Depot

Market Share Estimate:Leading market share, approximately 17.1% of the total home improvement market.

Target Audience Overlap:High

Competitive Positioning:Market leader positioning itself as a one-stop-shop for both DIYers and professional contractors, with a very strong emphasis on the Pro customer.

Strengths

- •

Dominant market share and brand recognition.

- •

Highly successful and mature 'Pro Xtra' loyalty program that fosters deep relationships with contractors.

- •

Extensive and efficient supply chain and distribution network.

- •

Strong omnichannel capabilities and significant e-commerce sales.

- •

Higher revenue and sales generated from its Pro customer base (approx. 50% of sales).

Weaknesses

- •

Can be perceived as less focused on home decor and design-oriented DIY customers compared to Lowe's.

- •

Customer service can be inconsistent due to the vast scale of operations.

- •

Slightly lower customer satisfaction scores in some recent J.D. Power studies compared to Lowe's.

Differentiators

- •

Deeply entrenched ecosystem for the Pro customer, including dedicated services, credit options, and bulk pricing.

- •

Strong portfolio of exclusive brands like Ryobi and Husky that are popular with both Pros and consumers.

- •

Larger overall store footprint and sales volume.

- →

Menards

Market Share Estimate:Significant regional player, third-largest home improvement retailer in the U.S.

Target Audience Overlap:Medium

Competitive Positioning:Value-focused retailer known for its slogan 'Save Big Money,' primarily targeting budget-conscious DIY customers in the Midwest.

Strengths

- •

Strong regional brand loyalty in the Midwest.

- •

Effective 11% rebate program (often offered as in-store credit) which drives repeat business.

- •

Broad product assortment that extends beyond traditional home improvement to include groceries, pet supplies, etc.

- •

Vertically integrated manufacturing for some products, allowing for cost control.

- •

Highly rated for value and merchandise variety.

Weaknesses

- •

Limited geographic footprint, operating in only 14-15 states.

- •

Less sophisticated e-commerce and mobile app experience compared to Home Depot and Lowe's.

- •

Weaker penetration in the professional contractor market.

- •

Private ownership limits access to capital markets for expansion.

Differentiators

- •

Unique rebate program that fosters a loyal customer base.

- •

Hybrid model of a home improvement store and a general merchandiser.

- •

Strong portfolio of private-label brands like Masterforce and Dakota.

- →

Ace Hardware

Market Share Estimate:Large number of locations but smaller overall market share due to smaller store format.

Target Audience Overlap:Medium

Competitive Positioning:Positions itself as 'The Helpful Place,' focusing on convenience, customer service, and community presence for quick, smaller-scale projects.

Strengths

- •

Exceptional and consistently high-ranking customer service.

- •

Convenient neighborhood locations; ~75% of the U.S. population is within 15 minutes of a store.

- •

Retailer-owned cooperative model fosters strong local community ties and tailored product assortments.

- •

Strong brand reputation and customer loyalty.

Weaknesses

- •

Generally higher prices on individual items compared to big-box retailers.

- •

Limited product selection and inventory depth due to smaller store size.

- •

Less equipped to handle large-scale Pro projects and bulk orders.

- •

Fragmented online-to-offline experience across different independently-owned stores.

Differentiators

- •

Hyper-local, convenience-driven business model.

- •

Focus on knowledgeable, personal customer service as the primary value proposition.

- •

Cooperative structure where store owners are also shareholders.

Indirect Competitors

- →

Amazon

Description:Global e-commerce giant offering a vast selection of home improvement products, particularly tools, smart home devices, and home goods. Growing its presence in the category.

Threat Level:High

Potential For Direct Competition:Already a direct competitor in many categories; threat will grow as logistics for larger items improve. Amazon holds significant market share in online tool sales.

- →

Walmart

Description:Mass-market retailer competing in categories like paint, hardware, lawn & garden, patio furniture, and cleaning supplies, primarily on price.

Threat Level:Medium

Potential For Direct Competition:Unlikely to compete on core building materials, but will continue to erode share in adjacent categories.

- →

Wayfair

Description:A large, online-only retailer specializing in home goods, furniture, and decor, directly competing with Lowe's in categories like lighting, flooring, vanities, and patio.

Threat Level:Medium

Potential For Direct Competition:Already a direct competitor in home decor and furnishings. Unlikely to expand into raw building materials.

- →

Tractor Supply Company

Description:Retailer focused on the rural lifestyle, with significant product overlap in lawn and garden, outdoor power equipment, tools, and workwear.

Threat Level:Low

Potential For Direct Competition:Serves a niche but overlapping customer base. Competition will remain focused on specific 'rural' categories.

Competitive Advantage Analysis

Sustainable Advantages

- Advantage:

Extensive Omnichannel Network

Sustainability Assessment:The large footprint of physical stores serves as a strategic asset for fulfillment (BOPIS, returns) and customer service, which is difficult for online-only players to replicate.

Competitor Replication Difficulty:Hard

- Advantage:

Strong Brand Recognition and Trust

Sustainability Assessment:Lowe's is a household name with decades of brand equity. Recent J.D. Power awards for customer satisfaction reinforce this trust.

Competitor Replication Difficulty:Hard

- Advantage:

Established Pro-Customer Services

Sustainability Assessment:While trailing Home Depot, Lowe's has a significant and growing Pro business with dedicated services, credit, and loyalty programs that are being enhanced to increase stickiness.

Competitor Replication Difficulty:Medium

- Advantage:

Portfolio of Private Label Brands

Sustainability Assessment:Brands like Kobalt and Allen + Roth offer exclusive products, control over pricing, and higher potential margins. This creates a unique product assortment.

Competitor Replication Difficulty:Medium

Temporary Advantages

{'advantage': '#1 Ranking in J.D. Power Customer Satisfaction Study (2025)', 'estimated_duration': '1 year (until the next study is released). This is a powerful marketing tool for the current year. '}

{'advantage': 'Specific Seasonal Promotions and Sales', 'estimated_duration': 'Short-term. Competitors can and do quickly match promotional pricing on key items.'}

Disadvantages

- Disadvantage:

Secondary Position in the Pro Market

Impact:Critical

Addressability:Moderately

- Disadvantage:

Overall #2 Market Share Position

Impact:Major

Addressability:Difficult

- Disadvantage:

Vulnerability in Non-Core Categories

Impact:Major

Addressability:Moderately

Strategic Recommendations

Quick Wins

- Recommendation:

Aggressively Market J.D. Power #1 Ranking

Expected Impact:Medium

Implementation Difficulty:Easy

- Recommendation:

Optimize In-App 'Store Mode'

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Showcase Hyper-Local 'Top Sellers in Your Area'

Expected Impact:Low

Implementation Difficulty:Easy

Medium Term Strategies

- Recommendation:

Accelerate Enhancements to 'MyLowe's Pro Rewards'

Expected Impact:High

Implementation Difficulty:Moderate

- Recommendation:

Expand 'How-To' Content into Interactive Project Planning Tools

Expected Impact:Medium

Implementation Difficulty:Moderate

- Recommendation:

Forge Exclusive Partnerships with Emerging Smart Home and Sustainable Brands

Expected Impact:Medium

Implementation Difficulty:Moderate

Long Term Strategies

- Recommendation:

Develop a Scaled Installation Services Platform

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Invest in Last-Mile Logistics for Bulk Goods

Expected Impact:High

Implementation Difficulty:Difficult

- Recommendation:

Explore Small-Format Urban Store Concepts

Expected Impact:Medium

Implementation Difficulty:Difficult

Solidify Lowe's position as the premier destination for the modern homeowner and 'light' Pro, emphasizing a superior, less intimidating shopping experience, design inspiration, and technology. Differentiate from Home Depot's 'heavy-duty Pro' focus by being the smarter, more accessible choice for a broader range of home improvement projects.

Differentiate through a superior end-to-end customer experience, blending inspirational digital content and planning tools with best-in-class in-store service. Focus on a curated assortment in decor-forward categories (kitchen, bath, flooring, lighting) and build a reputation for being the leading retailer for smart home and sustainable living solutions.

Whitespace Opportunities

- Opportunity:

Integrated Digital Project Management Suite for Homeowners

Competitive Gap:No competitor offers a truly integrated digital tool that takes a homeowner from inspiration and budgeting, through product selection and purchase, to DIY guidance or professional installer connection.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Subscription Services for Maintenance Items

Competitive Gap:While Amazon offers 'Subscribe & Save,' no home improvement retailer has a dedicated, tailored subscription service for items like air/water filters, lawn treatments, salt, etc. This creates recurring revenue and customer lock-in.

Feasibility:High

Potential Impact:Medium

- Opportunity:

Pro-Focused Equipment Rental & Repair Services Hub

Competitive Gap:Home Depot has a strong tool rental program, but there is an opportunity to create a more comprehensive service hub for Pros that includes rental, repair, and maintenance services, positioning Lowe's as a true partner in maintaining their business.

Feasibility:Medium

Potential Impact:High

- Opportunity:

Curated Showrooms for Kitchen & Bath Design

Competitive Gap:While both retailers have displays, there is a gap for more immersive, design-centric showroom experiences that better compete with specialty kitchen/bath retailers and help customers visualize and plan major renovations.

Feasibility:Medium

Potential Impact:Medium

The home improvement retail market is a mature oligopoly, dominated by the duopoly of The Home Depot and Lowe's. Lowe's is firmly positioned as the second-largest player, facing intense competition on multiple fronts. The primary competitive battleground is for the lucrative professional (Pro) customer segment, where Home Depot has a substantial lead due to its long-standing focus, robust loyalty program, and deeply integrated services. Lowe's has correctly identified this as a critical growth area and is making significant investments to close the gap with its 'MyLowe's Pro Rewards' and other tailored services.

While competing for the Pro, Lowe's must also defend its traditional stronghold: the Do-It-Yourself (DIY) customer. Here, it differentiates by cultivating an image of being more design-focused and accessible, a perception bolstered by its recent J.D. Power award for #1 in customer satisfaction. This award is a significant, albeit temporary, competitive advantage that should be leveraged heavily in marketing. However, this DIY segment is under threat from indirect competitors. Pure-play e-commerce retailers like Amazon are aggressively capturing share in categories like tools and smart home devices, while specialty retailers like Wayfair compete directly in decor-heavy categories such as lighting, vanities, and furniture.

The key to Lowe's future success lies in a multi-pronged strategy. First, it must continue its aggressive pursuit of the Pro customer to create a more resilient, higher-volume business. Second, it must double down on its key differentiator for the DIY segment: a superior, inspirational customer experience that seamlessly blends digital planning tools with helpful in-store service. Third, it must innovate beyond traditional retail by exploring whitespace opportunities like integrated project management software and subscription services to build deeper, more durable customer relationships. The competitive landscape is stable but unforgiving; Lowe's has strong assets but must execute flawlessly on its Pro strategy while defending its core against both its primary rival and nimble digital disruptors.

Messaging

Message Architecture

Key Messages

- Message:

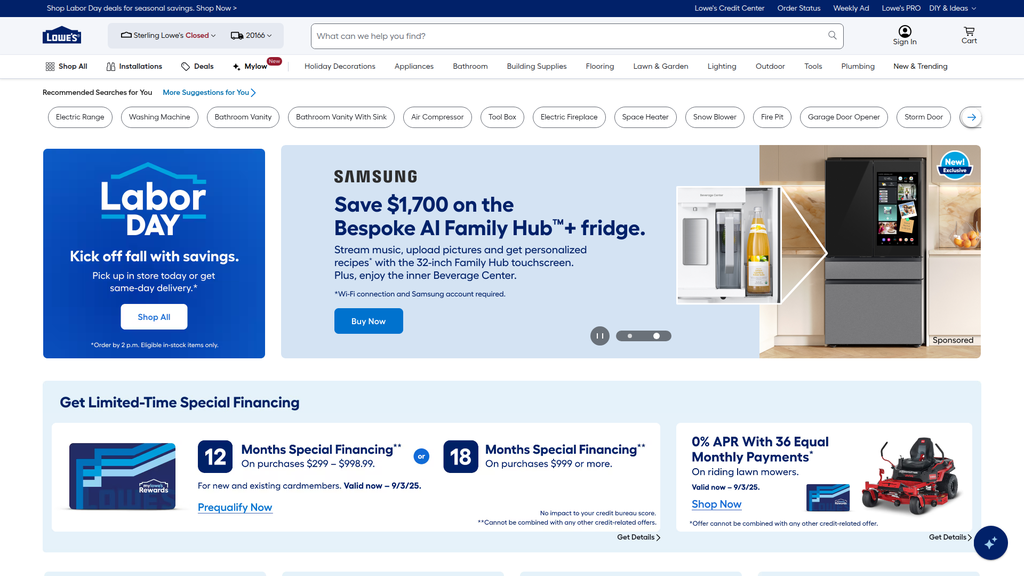

Labor Day. Kick off fall with savings.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Banner

- Message:

Pick up in store today or get same-day delivery.

Prominence:Primary

Clarity Score:High

Location:Homepage Hero Banner

- Message:

Up to 50% Off Select Patio Furniture and Accessories.

Prominence:Primary

Clarity Score:High

Location:Homepage Deals Section

- Message:

Shop. Earn. Save.

Prominence:Secondary

Clarity Score:High

Location:Homepage - Loyalty Program Section

- Message:

Learn More With Lowe’s (How-to guides and workshops)

Prominence:Secondary

Clarity Score:High

Location:Homepage - Content Section

- Message:

Lowe’s is number 1 in Customer Satisfaction Among Home Improvement Retailers.

Prominence:Tertiary

Clarity Score:High

Location:Homepage - Mid-page Banner

- Message:

We’re here to help the community, provide disaster relief and make an impact.

Prominence:Tertiary

Clarity Score:Medium

Location:Homepage - Mid-page Banner

The message hierarchy is overwhelmingly focused on immediate, transactional value. Primary messages are almost exclusively about sales, specific discounts, and financing offers. This effectively drives short-term sales but subordinates messages about brand value, expertise, and long-term customer relationships. Inspirational and educational content is present but holds a secondary position, serving to support the primary goal of driving purchases.

Messaging is highly consistent in its transactional focus. From the homepage to specific product pages, the emphasis is on price, deals, and product specifications. However, there's a tonal shift; the homepage attempts to be more inspirational and seasonal ('Kick off fall with savings'), while product and category pages are purely functional and utilitarian. The core message of 'savings' is the most consistent thread.

Brand Voice

Voice Attributes

- Attribute:

Promotional

Strength:Strong

Examples

- •

Up to 50% Off

- •

Buy 1, Get 1 FREE via Rebate

- •

Last Chance Offers

- •

Save 28%

- Attribute:

Helpful

Strength:Moderate

Examples

- •

Learn More With Lowe’s

- •

How to Build a Fire Pit

- •

We’re here to help the community

- •

Understanding your growing zone will help you...

- Attribute:

Urgent

Strength:Moderate

Examples

- •

Shop now.

- •

Last Chance Offers

- •

Valid now through 9/3/25

- Attribute:

Inspirational

Strength:Weak

Examples

- •

Reimagine Your Space

- •

Craft a Cozy Outdoors

- •

Set the Scene for Scares

Tone Analysis

Transactional

Secondary Tones

- •

Urgent

- •

Helpful

- •

Seasonal

Tone Shifts

Shifts from broad, inspirational seasonal messaging ('Kick off fall') to highly specific, urgent deal messaging ('Save 28%').

Moves from a helpful, project-focused tone ('How to Build a Retaining Wall') to a purely functional, technical tone on product pages ('1/4-in - 20 x 1-1/4-in Phillips/Slotted combination -Drive Machine screws').

Voice Consistency Rating

Good

Consistency Issues

The brand's higher-level mission ('make every home a better home') is almost entirely absent, creating a disconnect between corporate identity and the customer-facing voice, which is heavily tactical and price-focused.

Value Proposition Assessment

Lowe's offers a wide selection of home improvement products at competitive prices, with frequent sales and financing options to make projects more affordable, supported by helpful resources for the DIY customer.

Value Proposition Components

- Component:

Price & Savings

Clarity:Clear

Uniqueness:Common

- Component:

Convenience (Delivery & Pickup)

Clarity:Clear

Uniqueness:Common

- Component:

Project Support & Inspiration

Clarity:Clear

Uniqueness:Somewhat Unique

- Component:

Wide Product Selection

Clarity:Clear

Uniqueness:Common

- Component:

Customer Satisfaction

Clarity:Somewhat Clear

Uniqueness:Somewhat Unique

Lowe's attempts to differentiate itself from competitors like The Home Depot by emphasizing customer satisfaction, as evidenced by the J.D. Power award prominently displayed. While both giants compete fiercely on price and selection, Lowe's messaging leans slightly more towards the homeowner and DIYer with inspirational content and project guides, whereas Home Depot has historically had a stronger positioning with professional contractors. The value proposition of making projects happen via educational content is a key differentiator, though it is secondary to the primary price messaging.

The messaging positions Lowe's as a value-driven primary destination for DIY homeowners. It competes directly on price, promotion, and convenience. The focus on seasonal projects ('Fall Gardening Favorites', 'Halloween Tricks & Treats') and inspirational content ('Reimagine Your Space') aims to capture the discretionary spending of homeowners, positioning Lowe's as a partner in not just maintaining, but improving their lifestyle.

Audience Messaging

Target Personas

- Persona:

The DIY Homeowner

Tailored Messages

- •

Labor Day. Kick off fall with savings.

- •

Learn More With Lowe’s

- •

How to Build a Fire Pit

- •

Kids’ DIY Workshops

Effectiveness:Effective

- Persona:

The Professional Contractor ('Pro')

Tailored Messages

A small 'Business' toggle on the 'Shop. Earn. Save.' section.

Highly specific product pages (e.g., machine screws) that are functionally useful but not explicitly tailored with 'Pro' messaging.

Effectiveness:Ineffective

Audience Pain Points Addressed

- •

High cost of home projects (addressed by sales, discounts, and financing).

- •

Lack of knowledge or confidence for projects (addressed by 'How-To' articles and workshops).

- •

Inconvenience of shopping for large items (addressed by 'Pick up in store' and 'same-day delivery').

Audience Aspirations Addressed

- •

Creating a beautiful, comfortable home ('Reimagine Your Space').

- •

Enjoying seasonal activities with family and friends ('Craft a Cozy Outdoors', 'Tailgate in Style').

- •

Achieving a sense of accomplishment through completing a project ('Find Your Next Project').

Persuasion Elements

Emotional Appeals

- Appeal Type:

Financial Savings / Security

Effectiveness:High

Examples

- •

Up to 50% Off

- •

Save 28%

- •

0% APR With 36 Equal Monthly Payments

- Appeal Type:

Aspiration / Pride of Ownership

Effectiveness:Medium

Examples

Reimagine Your Space

Create a relaxing patio

- Appeal Type:

Seasonal Nostalgia & Excitement

Effectiveness:Medium

Examples

- •

Kick off fall with savings.

- •

Set the Scene for Scares

- •

Game Day Must-Haves

Social Proof Elements

- Proof Type:

Customer Reviews & Ratings

Impact:Strong

- Proof Type:

Third-Party Awards (J.D. Power)

Impact:Moderate

- Proof Type:

Purchase Volume Indicators ('1k+ bought last week')

Impact:Weak

Trust Indicators

- •

Recognizable national brand logos (Weber, Craftsman, Samsung)

- •

Third-party validation (J.D. Power award for customer satisfaction)

- •

Mention of community support and disaster relief efforts

Scarcity Urgency Tactics

- •

'Last Chance Offers'

- •

Time-limited financing deals ('Valid now through 9/3/25')

- •

Prominent use of 'Shop now' on all sale items

Calls To Action

Primary Ctas

- Text:

Shop now

Location:Homepage Banners and Deal Sections

Clarity:Clear

- Text:

Get Details

Location:Beneath financing offers and rebates

Clarity:Clear

- Text:

Add to Cart

Location:Product listings and product pages

Clarity:Clear

- Text:

Learn More

Location:Inspirational and How-To content sections

Clarity:Clear

The CTAs are extremely effective for their purpose: driving immediate clicks and transactions. They are clear, concise, and contextually relevant. 'Shop Now' is used for broad promotional categories, while 'Add to Cart' is for specific products. The language is simple and direct, leaving no ambiguity for the user.

Messaging Gaps Analysis

Critical Gaps

- •

Pro-Specific Messaging: The homepage is almost exclusively tailored to the DIY homeowner. There is a significant lack of prominent messaging, value propositions, or content streams specifically targeting the crucial professional contractor audience, despite this being a strategic growth area for the company.

- •

Brand Storytelling: Beyond a tertiary mention of community help, there is no narrative that communicates the Lowe's brand purpose or values. The messaging is tactical, not emotional or story-driven, failing to build a deeper brand connection beyond price.

- •

Service-Oriented Messaging: While products are featured heavily, services like installation and design consultation are not prominently messaged on the homepage, representing a missed opportunity to communicate a key differentiator.

Contradiction Points

Online vs. In-Store Pricing: The disclaimer 'Our local stores do not honor online pricing' at the top of the page creates immediate channel conflict and undermines the message of a seamless, convenient customer experience.

Underdeveloped Areas

Loyalty Program Value: The 'Shop. Earn. Save.' message is clear but lacks depth. The messaging could do more to explain the specific benefits and create a more compelling reason to join beyond generic points.

Sustainability Messaging: With sustainability being a growing trend in home improvement, there is a lack of messaging around eco-friendly products, sustainable practices, or how Lowe's can help customers create a more energy-efficient home.

Messaging Quality

Strengths

- •

Clarity of Promotions: Sale and discount messages are exceptionally clear, prominent, and easy to understand.

- •

Effective Use of Social Proof: The ubiquitous use of star ratings and review counts on every product powerfully leverages user validation to drive purchase confidence.

- •

Strong Link between Inspiration and Commerce: The website effectively connects inspirational content (like 'How to Build a Fire Pit') directly to the products needed to complete the project.

- •

Action-Oriented Language: The constant use of direct CTAs like 'Shop Now' and 'Add to Cart' creates a clear path to purchase.

Weaknesses

- •

Over-Reliance on Price: The brand's identity is almost entirely defined by promotions and price, making it vulnerable to price wars and diminishing brand loyalty.

- •

Neglect of the 'Pro' Audience: The messaging fails to adequately address the needs and motivations of professional contractors on the main customer touchpoint.

- •

Lack of Emotional Connection: The messaging is highly functional and transactional, missing opportunities to build a deeper, more emotional brand connection with customers.

- •

Potential for Message Fatigue: The sheer volume of competing offers and 'Shop Now' CTAs on the homepage can be overwhelming and lead to message blindness.

Opportunities

- •

Develop a 'Pro' Messaging Track: Create a dedicated and prominent content stream on the homepage that speaks directly to professional contractors, highlighting pro-specific services, loyalty benefits, and products.

- •

Integrate Brand Storytelling: Weave the 'why' behind Lowe's into the homepage narrative. Feature customer success stories or associate spotlights to humanize the brand.

- •

Highlight 'Done-For-You' Services: Elevate the messaging around installation and consultation services to capture customers who lack the time or skill for DIY projects.

- •

Emphasize Sustainable Solutions: Create a messaging pillar around energy-efficient products and sustainable home improvement to appeal to environmentally conscious and cost-savvy consumers.

Optimization Roadmap

Priority Improvements

- Area:

Audience Segmentation

Recommendation:Implement a personalized or segmented homepage view. Create a prominent, persistent banner or section targeting 'Pros' with messaging about the Pro loyalty program, job-site delivery, and bulk pricing.

Expected Impact:High

- Area:

Value Proposition

Recommendation:Balance promotional messaging with brand-building content. Elevate the 'Customer Satisfaction' and 'Helpful Expertise' pillars to be on par with 'Savings', rather than secondary mentions.

Expected Impact:Medium

- Area:

Brand Narrative

Recommendation:Launch a content series featuring real customer 'home transformations' that showcases products in an authentic, emotionally resonant context. This moves beyond 'how-to' and into 'here's what's possible'.

Expected Impact:Medium

Quick Wins

- •

A/B test the 'Shop. Earn. Save.' section with more benefit-oriented language detailing what 'MyLowe's Money' can be used for.

- •

Create a dedicated 'Sustainable Home' category link on the homepage under 'Popular Categories'.

- •

Feature a 'Pro Tip of the Week' on the homepage to start engaging that audience with minimal layout changes.

Long Term Recommendations

- •

Develop a cohesive omnichannel messaging strategy to resolve the online vs. in-store pricing conflict and promote a unified brand experience.

- •

Invest in a content marketing strategy that positions Lowe's as the definitive thought leader in home improvement, covering trends, home value, and sustainability, not just project tutorials.

- •

Overhaul the loyalty program messaging to create distinct value tracks for DIYers (focused on rewards for future projects) and Pros (focused on business benefits and time-saving features).

Lowe's website messaging is a highly optimized, transactional machine, strategically designed to drive short-term sales through a relentless focus on price, promotions, and urgency. Its key strengths lie in the clarity of its offers and its powerful use of social proof (reviews and ratings) to build purchase confidence at the product level. The messaging architecture correctly prioritizes time-sensitive deals, like the 'Labor Day' sale, which is effective for a mass-market retail strategy dependent on seasonal and holiday spending.

The primary brand voice is promotional and transactional, which, while effective for conversion, leaves little room for building a deeper emotional connection or brand loyalty beyond price. The website successfully addresses the core pain points of the Do-It-Yourself (DIY) homeowner—cost and project uncertainty—by pairing aggressive discounts with a robust library of helpful how-to content.

However, this singular focus on the DIY customer creates two significant strategic vulnerabilities. First, there is a critical messaging gap in addressing the professional contractor ('Pro') audience. This high-value segment is a stated area of strategic growth for Lowe's, yet the homepage—the brand's most important digital asset—fails to speak to them directly, ceding a clear messaging advantage to competitors like The Home Depot who have historically catered more to this base.

Second, the over-reliance on price-based messaging positions Lowe's as a commodity, making it susceptible to margin erosion and hindering the development of a distinct brand identity. The brand's mission of making 'every home a better home' is not communicated; instead, the implied message is 'get the cheapest stuff for your home.' A major point of friction is the explicit disclaimer that online prices are not honored in stores, which directly contradicts the seamless omnichannel experience modern consumers expect and could negatively impact customer satisfaction.

To evolve, Lowe's must develop a dual-track messaging strategy that maintains its strong promotional cadence for the DIY segment while creating a distinct, value-added communication stream for the Pro audience. Furthermore, it needs to elevate its brand narrative, weaving in stories of customer success and community impact to build a brand that customers are not just willing to buy from, but want to buy from.

Growth Readiness

Growth Foundation

Product Market Fit

Strong

Evidence

- •

Established as the #2 player in the ~$1 trillion US home improvement market, indicating deep market penetration and brand recognition.

- •

Reported total sales of $24.0 billion for Q2 2025, demonstrating a massive and consistent customer base.

- •

Serves a broad customer base, including both Do-It-Yourself (DIY) and Professional (Pro) customers, with a stated strategic goal to increase Pro penetration.

- •

Awarded #1 in Customer Satisfaction Among Home Improvement Retailers by J.D. Power, suggesting strong resonance with its target audience.

Improvement Areas

- •

Deepen wallet share with the lucrative Pro segment, where it currently lags behind its primary competitor, Home Depot.

- •

Enhance product and service offerings for larger, more complex renovation projects to move beyond smaller DIY tasks.

- •

Improve the value proposition for younger, first-time homeowners with curated, project-based solutions and digital design tools.

Market Dynamics

Modest (Projected at ~3.4% - 5.4% annually).

Mature

Market Trends

- Trend:

Intensifying Focus on Professional (Pro) Customers

Business Impact:The Pro market is more resilient and lucrative than the DIY segment. Capturing a larger share is the primary growth vector for Lowe's.

- Trend:

Rise of Omnichannel and Unified Commerce

Business Impact:A seamless experience across online (web, mobile app) and in-store is now a baseline expectation. Customers research online and purchase offline (ROPO), requiring integrated inventory, pricing, and customer service.

- Trend:

Integration of Smart Home Technology and Sustainability

Business Impact:Growing consumer demand for energy-efficient, eco-friendly, and connected-home products requires curated assortments and knowledgeable staff.

- Trend:

Demand for Installation and 'Do-It-For-Me' (DIFM) Services

Business Impact:Represents a significant revenue expansion opportunity beyond pure product sales, increasing customer lifetime value and loyalty.

Favorable for focused growth. While the overall market is mature, the shift toward professional services and omnichannel integration presents a timely opportunity for Lowe's to capture market share from competitors by executing its 'Total Home' strategy effectively.

Business Model Scalability

High

High fixed costs associated with a large physical store footprint and distribution network, but variable costs scale efficiently with sales volume.

High. Once fixed costs are covered, incremental sales from existing stores and e-commerce channels contribute significantly to profitability.

Scalability Constraints

- •

Physical store footprint saturation in North America.

- •

Complexity of last-mile logistics for bulky and heavy items.

- •

Labor availability and cost for in-store expertise and installation services.

- •

Supply chain complexity in managing hundreds of thousands of SKUs across multiple channels.

Team Readiness

Strong. The current leadership team has a clear vision with the 'Total Home Strategy' and has demonstrated a willingness to invest in growth through strategic acquisitions (e.g., Foundation Building Materials, Artisan Design Group).

Mature, but evolving to better integrate digital and physical retail operations and build out a dedicated Pro-focused organization.

Key Capability Gaps

- •

B2B sales and relationship management at scale to effectively court large professional contractors.

- •

Advanced data science and AI talent to optimize personalization, supply chain, and pricing.

- •

Product management and software engineering for developing a world-class B2B e-commerce platform.

Growth Engine

Acquisition Channels

- Channel:

Physical Stores

Effectiveness:High

Optimization Potential:Medium

Recommendation:Enhance the in-store experience for Pro customers with dedicated services, checkout areas, and parking. Continue to leverage stores as fulfillment hubs for online orders (BOPIS/Curbside).

- Channel:

Digital Marketing (SEO/SEM)

Effectiveness:High

Optimization Potential:Medium

Recommendation:Optimize for local, project-based keywords ('kitchen remodel near me'). Develop more robust 'how-to' content to capture top-of-funnel DIY traffic and establish authority.

- Channel:

Loyalty Programs (MyLowe's Rewards)

Effectiveness:Medium

Optimization Potential:High

Recommendation:Create a distinct, high-value loyalty tier specifically for Pro customers with benefits beyond simple discounts, such as dedicated support, business management tools, and priority delivery.

- Channel:

Traditional Media (TV/Print)

Effectiveness:Medium

Optimization Potential:Low

Recommendation:Shift budget towards more targeted digital video and social media campaigns focused on project inspiration and Pro business solutions.

Customer Journey

Predominantly omnichannel, with customers frequently using the website/app for research and inspiration before transacting in-store or using Buy-Online-Pickup-In-Store (BOPIS).

Friction Points

- •

Disconnect between online and in-store pricing and promotions, as stated on the website.

- •

Cumbersome online experience for Pro customers managing large, complex orders for multiple jobs.

- •

Inconsistent in-store expertise for complex product categories.

- •

Inventory visibility between online and the physical store can be inaccurate, leading to poor customer experiences.

Journey Enhancement Priorities

- Area:

Pro Customer Digital Experience

Recommendation:Develop a dedicated B2B portal or app for Pros with features like quote management, multi-user accounts, and integration with accounting software.

- Area:

DIY Project Planning

Recommendation:Invest in interactive online tools (e.g., AR visualizers, project cost estimators) that guide users from inspiration to a complete shopping list.

- Area:

Seamless Fulfillment

Recommendation:Improve real-time inventory tracking and offer more flexible delivery options, including scheduled delivery windows for large Pro orders.

Retention Mechanisms

- Mechanism:

MyLowe's Rewards Program

Effectiveness:Moderate

Improvement Opportunity:Tier the program to offer significantly more value to high-spending Pro customers, fostering loyalty and preventing multi-sourcing from competitors.

- Mechanism:

Lowe's Credit Card Offers

Effectiveness:High

Improvement Opportunity:Develop specialized credit and financing solutions for Pro businesses, such as extended payment terms or project-based credit lines.

- Mechanism:

Email & Content Marketing

Effectiveness:Moderate

Improvement Opportunity:Segment audiences more effectively (Pro vs. DIY, project type) and use data to deliver hyper-personalized project recommendations, maintenance reminders, and offers.

Revenue Economics

Strong. The business model benefits from a mix of high-margin private label brands and high-volume national brands. The key economic driver for growth is increasing the lifetime value of the Pro customer.

Healthy (Estimated). For a mature retailer, customer acquisition costs are relatively stable, while the lifetime value of a loyal Pro customer can be exceptionally high.

High, but with room for improvement in Pro segment profitability.

Optimization Recommendations

- •

Increase average order value (AOV) by bundling products and services for common projects.

- •

Drive higher purchase frequency from Pros through improved loyalty programs and dedicated services.

- •

Expand high-margin installation services to capture a larger share of the total project cost.

Scale Barriers

Technical Limitations

- Limitation:

Legacy IT Infrastructure

Impact:Medium

Solution Approach:Continue phased migration to a modern, cloud-based, microservices architecture to improve agility, data integration, and the omnichannel experience.

- Limitation:

Siloed Data Systems

Impact:High

Solution Approach:Invest in a unified customer data platform (CDP) to create a single view of the customer across all touchpoints, enabling true personalization for both DIY and Pro segments.

Operational Bottlenecks

- Bottleneck:

Last-Mile Delivery for Bulky Goods

Growth Impact:Limits e-commerce growth and competitiveness, especially for Pro customers needing job-site delivery.

Resolution Strategy:Expand the network of cross-dock terminals and fulfillment centers, and potentially partner with specialized logistics providers for job-site delivery.

- Bottleneck:

In-Store Pro Service Capacity

Growth Impact:A poor in-store experience can deter high-value Pro customers from making Lowe's their primary supplier.

Resolution Strategy:Invest heavily in dedicated, knowledgeable Pro Desk staff, implement Pro-only checkout and loading zones, and use technology to streamline order fulfillment.

Market Penetration Challenges

- Challenge:

Intense Competition from Home Depot

Severity:Critical

Mitigation Strategy:Differentiate by creating a superior, tailored experience for small-to-medium sized Pros and enhancing the 'Total Home' service offering, rather than competing solely on price or product assortment.

- Challenge:

Market Saturation in North America

Severity:Major

Mitigation Strategy:Focus on increasing share of wallet within the existing customer base rather than aggressive new store expansion. Growth will come from selling more services and solutions to current DIY and Pro customers.

Resource Limitations

Talent Gaps

- •

B2B E-commerce Specialists

- •

Data Scientists and AI/ML Engineers

- •

Skilled Trade Professionals for Installation Services

Significant but manageable. Continued investment required in supply chain modernization ($1.7B+), technology, and strategic acquisitions. Recent acquisitions show a clear willingness to deploy capital for growth.

Infrastructure Needs

- •

Expansion of market-based fulfillment and delivery centers.

- •

In-store technology upgrades (mobile POS for associates, self-service kiosks for Pros).

- •

Modernization of core IT systems to support a truly unified commerce model.

Growth Opportunities

Market Expansion

- Expansion Vector:

Increase Wallet Share with Small-to-Medium Pro Customers

Potential Impact:High

Implementation Complexity:High

Recommended Approach:Execute the 'Total Home Strategy' by integrating recent acquisitions like FBM and ADG to provide a one-stop-shop for Pros. Develop a dedicated B2B digital platform and enhance in-store services.

- Expansion Vector:

Target the Hispanic Pro and DIY Customer

Potential Impact:Medium

Implementation Complexity:Medium

Recommended Approach:Develop culturally relevant marketing campaigns, ensure bilingual staffing in key markets, and tailor product assortments to regional preferences.

Product Opportunities

- Opportunity:

Expansion of Installation & Repair Services ('Do-it-for-me')

Market Demand Evidence:The DIFM segment is large and growing, with many homeowners lacking the time or skills for complex projects.

Strategic Fit:High. Perfectly aligns with the 'Total Home' strategy, creating a recurring, high-margin revenue stream.

Development Recommendation:Build a managed marketplace of vetted, certified local contractors, integrated with Lowe's product ecosystem and project planning tools.

- Opportunity:

Growth of High-Margin Private Label Brands

Market Demand Evidence:Consumers are receptive to store brands that offer a strong value proposition (e.g., Kobalt, Allen+Roth).

Strategic Fit:High. Improves overall gross margin and creates product differentiation from competitors.

Development Recommendation:Continue to invest in R&D and marketing for private label brands, particularly in categories where Pros seek value and durability.

Channel Diversification

- Channel:

Dedicated B2B E-commerce Platform

Fit Assessment:Excellent. This is a critical missing piece to effectively serve the Pro customer at scale.

Implementation Strategy:Build or acquire a platform with features tailored to Pros: complex quoting, job account management, advanced delivery scheduling, and credit lines.

- Channel:

Enhanced Mobile App as an In-Store 'Co-Pilot'

Fit Assessment:Excellent. Bridges the gap between the digital and physical shopping journey.

Implementation Strategy:Integrate features like in-store product mapping, real-time inventory lookup by aisle, and associate chat for both DIY and Pro users.

Strategic Partnerships

- Partnership Type:

Home Builder & Property Management Alliances

Potential Partners

National and regional home builders

Large multi-family property management firms

Expected Benefits:Creates a recurring, large-volume sales channel for the Pro business, locking in customers at the source of new construction and MRO (Maintenance, Repair, and Operations) spend.

- Partnership Type:

Smart Home Ecosystem Integrations

Potential Partners

- •

Google Nest

- •

Amazon Alexa

- •

Apple HomeKit

- •

Major smart appliance manufacturers

Expected Benefits:Positions Lowe's as a central hub for the connected home, offering integrated product and service packages for smart home setup and installation.

Growth Strategy

North Star Metric

Pro Customer Share of Wallet

Growth is not just about acquiring more Pro customers, but becoming their primary supplier. This metric aligns the entire organization—from merchandising to supply chain to digital—on the goal of deepening relationships with the most valuable customer segment.

Increase Pro share of wallet from an estimated 25-30% to over 40% within three years.

Growth Model

Hybrid: Pro (Sales & Relationship-Led) + DIY (Omnichannel & Content-Led)

Key Drivers

Pro: Dedicated account managers, B2B digital platform, loyalty program value.

DIY: SEO-driven content marketing, in-app project guidance, personalized promotions.

Run two distinct but interconnected growth engines. The Pro engine focuses on LTV through service and solutions, while the DIY engine focuses on acquisition and AOV through inspiration and convenience.

Prioritized Initiatives

- Initiative:

Launch 'Lowe's Pro Hub' Digital Platform

Expected Impact:High

Implementation Effort:High

Timeframe:12-18 Months

First Steps:Appoint a Head of Pro Digital Products. Conduct in-depth interviews with 50+ small and medium-sized contractors to define the MVP feature set.

- Initiative:

Revamp Pro Loyalty Program to a Tiered, Value-Based System

Expected Impact:High

Implementation Effort:Medium

Timeframe:6-9 Months

First Steps:Analyze purchasing data of the top 10% of Pro customers to identify key value drivers beyond price (e.g., delivery speed, dedicated support).

- Initiative:

Scale 'Total Home' Installation Services

Expected Impact:Medium

Implementation Effort:High

Timeframe:18-24 Months

First Steps:Pilot a managed marketplace for 3 key service categories (e.g., flooring, roofing, HVAC) in two major metropolitan markets to refine the operational model.

Experimentation Plan

High Leverage Tests

- Area:

Pro Engagement

Test:A/B test different onboarding offers for new Pro loyalty members (e.g., upfront discount vs. future credit vs. free delivery).

- Area:

Omnichannel Conversion

Test:Experiment with personalized project starter kits on the website homepage based on browsing history.

- Area:

Service Monetization

Test:Pilot a premium 'Lowe's Pro+' subscription service offering unlimited delivery and dedicated phone support for a monthly fee.

Utilize cohort analysis to track the spending behavior and retention of newly acquired Pro customers. Measure omnichannel success by tracking the percentage of online sessions that involve an in-store action (e.g., checking local inventory, adding to list for pickup).

Bi-weekly sprint cycle for digital product teams; quarterly review of major strategic pilots.

Growth Team

Establish a dedicated 'Pro Growth' division with its own P&L, led by a General Manager reporting directly to the C-suite. This team would have embedded product, marketing, sales, and analytics functions.

Key Roles

- •

General Manager, Pro Business

- •

Director of B2B Digital Product

- •

Head of Pro Loyalty & Retention

- •

Lead Data Scientist, Pro Analytics

Acquire talent from B2B software and distribution industries. Develop an in-house training program ('Pro Academy') for store associates to better understand and serve the needs of professional contractors.

Lowe's has a strong foundation for growth, built on a powerful brand, extensive physical footprint, and a solid position in the mature home improvement market. The company's stated 'Total Home Strategy' correctly identifies the most critical growth vector: capturing a larger share of the lucrative Professional (Pro) customer segment, where it has historically lagged its main competitor. Recent strategic acquisitions confirm a serious commitment to this goal.

The primary challenge is one of execution. Lowe's must transition from a DIY-centric retailer to a true omnichannel partner for the Pro. This requires a fundamental shift in technology, operations, and culture. The current growth engine is effective for the DIY customer but creates friction for Pros who require a more sophisticated, B2B-centric experience. Operational bottlenecks in last-mile delivery and inconsistent in-store service for Pros are significant scale barriers that must be addressed urgently.

Growth opportunities are substantial but concentrated. The path to scalable growth lies not in geographic expansion, but in deepening the relationship with existing customers. Expanding high-margin installation services and building a best-in-class digital platform for Pros are the two most promising avenues. These initiatives will transform Lowe's from a product seller into a comprehensive project solutions provider, creating a durable competitive advantage.

Recommendation: The highest priority is to accelerate the development of a dedicated digital ecosystem for the Pro customer. This should be treated with the urgency of a company-defining mission. We recommend establishing an empowered, cross-functional 'Pro Growth' division. The North Star Metric should be 'Pro Customer Share of Wallet,' focusing the entire organization on becoming the primary supplier for this critical segment. By successfully executing this Pro-focused transformation while continuing to serve its core DIY base, Lowe's can unlock its next phase of significant, profitable growth and close the market share gap with its chief rival.

Legal Compliance